Sustainable product innovation is a key issue facing agri-food companies to maintain and increase their competitiveness. Based on a sample of 320 international agri-food companies for the period 2002–2017, this paper analyzes the role that ownership structure and capital structure play with regard to sustainable product innovation as well as whether these financing decisions differ depending on the firm's ownership structure. The results indicate that family-owned firms show an aversion to this type of eco-innovation projects, regardless of their source of financing. On the contrary, ownership by cross-holdings favors investment in sustainable product innovation projects, showing a greater preference for the use of debt financing versus auto-financing to fund them.

In a globalized environment characterized by high competition in all sectors, further exacerbated by the drop in demand caused by the recent global crisis, knowledge and innovation constitute an important source of competitive advantages for companies to maintain and increase their competitiveness on a global scale (De Massis, Frattini, Pizzurno, & Cassia, 2015; De Medeiros, Ribeiro, & Cortimiglia, 2014; Hsu, Huang, Massa, & Zhang, 2014; López-Cabarcos, Srinivasan, & Vázquez-Rodríguez, 2020). The above is especially valid in the case of agri-food companies (Finco, Bentivoglio, & Bucci, 2018).

Although traditionally the agri-food sector has been considered as not being especially innovative compared to other manufacturing sectors (Costa & Jongen, 2006; Grunert et al., 1997; Török, Tóth, & Balogh, 2019), the loss of competitiveness caused by low labor costs in less developed countries has led agri-food companies to adopt a strategic focus (Rama, 2008), turning their attention to innovation as a way to increase the quality of their products and the efficiency of their processes as well as diversify risks (Avermaete, Viaene, Morgan, & Crawford, 2003; Batterink, Wubeen, Klerkx, & Omta, 2010; García-Álvarez-Coque, Mas-Verdu, & Sánchez-García, 2014).

Additionally, changes in lifestyles and greater consumer awareness for the protection of the environment and respect for human rights have drastically modified the population's demands (Borsellino, Schimmenti, & El Bilali, 2020), making innovation in sustainable products increasingly important to agri-food companies (Mol & Oosterveer, 2015). As a result, the development of sustainable product lines (e.g., organic, bio, CO2 neutral, fair trade) for a broad array of commodities (such as tea, coffee, sugarcane, cocoa, soy, fruit, milk, meat, etc.) has been boosted in recent decades.

These innovations aim to reduce the environmental impact through the rational use of natural resources, proper waste management, or the use of renewable energy; ensure respect for human rights; and ensure ethical treatment of animals, both those destined for production and experimentation, representing a radical break with conventional processes in the agri-food sector (El Bilali, 2018). In addition, they require investing greater resources in the short term, whereas their results tend to materialize in the very long term (Bartoloni, 2013; Berrone, Fosfuri, Gelabert, & Gómez-Mejia, 2013), which raises the need to consider the economic and financial viability of these investments, given that the resources necessary to carry out innovation projects in sustainable products could be used for other projects that entail fewer costs and risks for the company (Cai & Li, 2018).

In this sense, considering that a firm's capital and ownership structure have been basic determinants of the degree of innovation in other business sectors (Bayona, Cruz, García, & Sánchez, 2013; Decker & Günther, 2017; Karantininis, Sauer, & Furtan, 2010), it is worthwhile analyzing the role they play in the agri-food sector (Capitanio, Coppola, & Pascucci, 2010). Thus, in this paper we aim to analyze the role that ownership and capital structure play with regard to investment in sustainable product innovation projects in agri-food companies.

The effect of ownership structure on firm innovation has attracted research attention (Hoskisson, Hitt, Johnson, & Grossman, 2002; Lee & O'Neill, 2003), examining the influence of both qualitative structure (i.e., the nature/type of ownership) and quantitative structure (i.e., ownership concentration) on a firm's propensity toward innovation. In the case of the agri-food sector, although family ownership dominates among agri-food companies (Faccio & Lang, 2002), it is being increasingly controlled by business groups (Almeida & Wolfenzon, 2006; Tleubayev, Bobojonov, Gagalyuk, García-Meca, & Glauben, 2021). Both types of ownership have distinctive characteristics, which can favor or hinder investment in research, development, and innovation (R&D&i) (Hsu et al., 2014; Tleubayev et al., 2021; Zahra, Neubaum, & Larrañeta, 2007).

Although ownership structure can play a catalyzing role by boosting innovation (Chen, Li, Shapiro, & Zhang, 2014; I.M. García-Sánchez, Aibar-Guzmán, & Aibar-Guzmán, 2020b), its development depends highly on the firm's financial resources availability (Acosta-Prado, Longo-Somoza, & Lozano, 2017; Lin, Zeng, Qi, Ma, & Tam, 2014). Prior studies have shown that the existence of financial constraints conditions innovation activity (Alsharkas, 2014; Hall, 2002). Consequently, the study of how firms finance eco-innovation projects is a pertinent research question. Specifically, we analyze the role that self-financing and external financing play with regard to sustainable product innovation, which allows us to contrast the dilemma of preference for independence versus financial profitability. Later, we analyze whether these financing decisions differ depending on the firm's ownership structure associated with the existence of two types of ultimate owner, family firms or business groups.

The results obtained for a sample made up of 320 international agri-food companies for the period 2002–2017 indicate that family-owned firms show an aversion to this type of eco-innovation projects, regardless of their capital structure. On the contrary, ownership by cross-holdings favors investment in sustainable product innovation projects, showing a greater preference for the use of debt financing versus auto-financing to fund them.

Our study contributes to literature in several ways. First, our study links three important elements that have hardly been empirically investigated in unison (i.e., sustainable product innovation, ownership structure, and capital structure) focusing the analysis on a sector that must address relevant environmental and social challenges and, however, has received lesser research attention than other manufacturing sectors. Thus, our research extends prior literature by examining the effect of ownership structure and capital structure on sustainable product innovation as well as the moderating effect of ownership structure on financing decisions regarding sustainable product innovation.

Although several studies have analyzed the relationship between innovation and ownership structure (Chen & Hsu, 2009; Chen et al., 2014; De Massis et al., 2015; Decker & Günther, 2017; Deng, Hofman, & Newman, 2013; I.M. García-Sánchez et al., 2020b; Hsu et al., 2014; Matzler, Veider, Hautz, & Stadler, 2015) and between innovation and capital structure (Alsharkas, 2014; Bartoloni, 2013; Hall, 1992; O'Brien, 2003), to the best of our knowledge, no previous study has analyzed the moderating effect of ownership structure on financing decisions regarding innovation and, specifically, on sustainable product innovation. In this sense, by drawing attention to the interplay between ownership structure and corporate capital structure with respect to sustainable product innovation, we show that both factors are closely related.

Furthermore, we consider two types of ownership with a high weight in the agri-food sector (i.e., family ownership and cross-holding ownership), the effect of which on eco-innovation as well as on the financing sources used to fund it have not been researched enough. To date, there are few studies on this subject and most of them are focused on agri-food cooperatives (Chen, Joshi, Cheng, & Birthal, 2015). Thus, our research complements prior studies by analyzing new factors, such as family ownership of agri-food companies or their affiliation to business groups, which can help to explain the keys to business success in the agri-food sector.

Regarding innovation strategies, despite the abundant literature in this field, there are few studies that focus exclusively on the agri-food sector and, moreover, they are biased towards some countries (e.g., the United Kingdom, the United States, and Asian countries), without offering comparisons internationally (El Bilali, 2018; Finco et al., 2018; Tleubayev et al., 2021). We adopt an international approach encompassing 320 international agri-food companies, which contributes to the generalization of our findings. Additionally, we stress the breadth of our sample (4878 observations) and the long analysis period (2002–2017).

Theoretically, we complement the pecking order theory by incorporating a resource-based perspective to provide a more solid framework for studying the individual and joint effect of ownership structure and corporate capital structure on sustainable product innovation. O'Brien (2003) showed that the extent to which a firm follows the pecking order theory depends on its business strategy (specifically, whether such a firm pursues a strategy of innovation). We extend his results by showing that ownership structure also affects the hierarchy of financing sources preferred by a firm.

This paper contains six sections. After this introduction, the next section briefly addresses innovation in sustainable products in the agri-food sector. The third section presents the theoretical framework on which our research hypotheses are formulated. The fourth section sets out the empirical framework of the study, after which we present and discuss the main results. Finally, in section six, the main conclusions of the study are drawn, the implications of our findings are discussed, the limitations of the study are acknowledged, and some topics for future research are suggested.

Innovation in sustainable products in the agro-food sectorThe agri-food industry is a key sector in the international economy. In the case of the European Union, the agri-food industry represents 2.1% of GAV and 19% of total exports, generating employment for more than 4.72 million workers (Food Drink Europe, 2019). Given its importance in the economy, innovation and progress in this sector represent a source of excellence contributing to socioeconomic development (Acosta-Prado et al., 2017). Thus, nowadays innovation constitutes a key source to obtain sustainable competitive advantages for agri-food companies (Acosta-Prado et al., 2017; Capitanio et al., 2010), which have focused their innovation efforts on process improvement (Archibugi, Cesaratto, & Sirilli, 1991), applying technologies from other sectors.

At the same time, the agri-food sector generates an important percentage of global green gas (GHG) emissions (Food and Drink Europe, 2019). As a result, ethical and environmental issues have gained growing importance and an increasing number of agri-food firms embrace them (El Bilali, 2018; Mol & Oosterveer, 2015; Schimmenti, Migliore, Di Franco, & Borsellino, 2016), becoming a key driver of innovation in the agri-food sector (Food & Drink Europe, 2019). Sustainable innovation can be defined as “the creation of novel and competitively priced goods, processes, systems, services, and procedures designed to satisfy human needs and to provide a better quality of life for everyone with a life-cycle minimal use of natural resources (materials including energy and surface area) per unit output, and a minimal release of toxic substances” (Reid & Miedzinski, 2008, p. 2). Overall, it is divided into four generic categories: product, process, market, and organizational innovation (El Bilali et al., 2018).

As regards sustainable product innovation, it refers to the development of new characteristics to reduce the negative environmental impacts that a product generates throughout its life cycle (Maxwell & van der Vorst, 2003; Xie, Huo, & Zou, 2019). The initiatives for developing sustainable products include eco-design, a more efficient use of energy and raw materials, compositional changes to eliminate toxic materials, and environmental-friendly packaging, among other product characteristics (Aibar-Guzmán & Somohano-Rodríguez, 2021; Dangelico & Pujari, 2010; Kam Sing Wong, 2012).

The development of sustainable products in the agri-food industry has been driven by several factors both internal and external to the companies (De Medeiros et al., 2014; Hojnik & Ruzzier, 2016). To a large extent, external drivers involve regulations and customer demands (Guoyou, Saixing, Chiming, Haitao, & Hailiang, 2013; Ilg, 2019; Lin et al., 2014), whereas internal drivers refer to the motivation and ability (resources and capabilities) of a firm to design, produce, and sell sustainable products, and include financial and human resources, technological competences, knowledge, managerial concerns, and organizational culture, among others (De Medeiros et al., 2014; Hilmersson & Hilmersson, 2021; Lin et al., 2014).

Theoretical framework and research hypothesesOwnership structure and sustainable product innovationPrior research has shown that ownership structure influences business strategies and decision-making (Le Breton-Miller & Miller, 2008; Matzler et al., 2015) as well as corporate outcomes (Decker & Günther, 2017). It provides “an important mechanism by which firms can assemble and direct resources for innovation” (Chen et al., 2014, p. 1).

As stated earlier, a distinctive feature of the agri-food sector is the predominance of family ownership (Faccio & Lang, 2002). Given the importance and weight of family-owned firms in the economy worldwide (De Massis et al., 2015; Decker & Günther, 2017), and considering their distinctive characteristics (De Massis et al., 2015; Matzler et al., 2015; Zahra, Hayton, & Salvato, 2004), several studies have looked at the influence of family ownership on firm innovation (Acosta-Prado et al., 2017).

However, these studies have obtained mixed results. Some authors document a positive effect of family ownership on innovation (Deng et al., 2013; Hsu et al., 2014; Lodh, Nandy, & Chen, 2014), whereas others report a negative (Chen & Hsu, 2009; Chrisman & Patel, 2012; Classen, Carree, Van Gils, & Peters, 2014; Munoz-Bullon & Sanchez-Bueno, 2011) or no significant impact (Matzler et al., 2015). These results, however, have been explained arguing that the distinctive, unique characteristics of family-owned firms may both hamper and foster innovation (Hsu et al., 2014; Wang, Lo, & Weng, 2019; Zahra et al., 2007).

From a theoretical viewpoint, researchers have resorted to several theories to explain the influence of family ownership on firm innovation (Acosta-Prado et al., 2017), agency theory and the resource-based view being the most frequently used (Matzler et al., 2015). According to agency theory (Jensen & Meckling, 1976), family ownership creates specific agency costs that negatively affect innovation. Conversely, the resource-based view (Barney, 1991) poses that family ownership confers unique, idiosyncratic resources and capabilities to businesses (e.g., human and relational capital, better alignment between ownership and management) that can favor innovation (De Massis et al., 2015; Deng et al., 2013; Hsu et al., 2014; Zahra et al., 2004).

Family ownership is associated with a long-term orientation (Sharma, Chrisman, & Chua, 1997), which boosts a more strategic (less myopic) focus, looking at increasing the firm's long-term value (De Massis et al., 2015; Hoskisson et al., 2002; Hsu et al., 2014) and consequently positively affects a firm's propensity to innovate. Furthermore, because of the strong links between family owners and their local communities as well as reputation concerns (Fuller & Tian, 2006; Memili, Fang, Koc, Yildirim-Oktem, & Sonmez, 2018), family ownership is commonly associated with an enhanced level of corporate social responsibility (CSR) (Uhlaner, Berent, Jeurissen, & de Wit, 2010).

Therefore, it can be expected that the long-term orientation and CSR awareness associated with family ownership outweigh the negative effects of risk aversion and nepotism in such a way that the resulting net effect of family ownership on eco-innovation is positive. In this regard, I.M. García-Sánchez et al. (2020b) found a positive association between family ownership and eco-innovation.

Agri-food companies present a feature that has not been properly studied in literature, that is their affiliation to business groups. According to Claessens, Fan, and Lang (2006), p. 4), a business group can be described as “a corporate organization where a number of firms are linked through stock-pyramids and cross-ownership”. From a resource-based perspective (Barney, 1991), business group affiliation provides companies with competitive advantages (Choi, Lee, & Williams, 2011) by mobilizing financial, human, and technological resources among the firms belonging to the group.

In this sense, coordination and vertical integration can lead to significant benefits for the weakest links in the production process (Dries, Germenji, Noev, & Swinnen, 2009; Hilmersson & Hilmersson, 2021). Furthermore, business group affiliation allows companies to share risks and take advantage of the group's connections and reputation. Thus, business group affiliation gives agri-food companies better access to financing (Almeida & Wolfenzon, 2006; Tleubayev et al., 2021).

As a result, business group affiliation can enhance a firm's innovation capability and reduce uncertainty inherent to the innovation process (Bartoloni, 2013; Lodh et al., 2014). Several authors document a positive effect of business group affiliation on innovation (Chang, Chung, & Mahmood, 2006; Choi et al., 2011; Lodh et al., 2014), due to the generation of financial and operative synergies within the group (Bartoloni, 2013). As regards eco-innovation, I.M. García-Sánchez et al. (2020b) found a positive association between ownership by cross-holdings and eco-innovation, which could be explained by considering that business group members can benefit from the intra-group reallocation of technological, human, and financial resources (Belenzon, Berkovitz, & Rios, 2013).

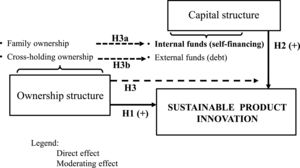

Based on the above arguments, we posit that the nature of agri-food business ownership affects investment in sustainable product innovation and, specifically, both family and cross-holding ownership will be positively related to sustainable product innovation. Accordingly, the following hypothesis has been stated:

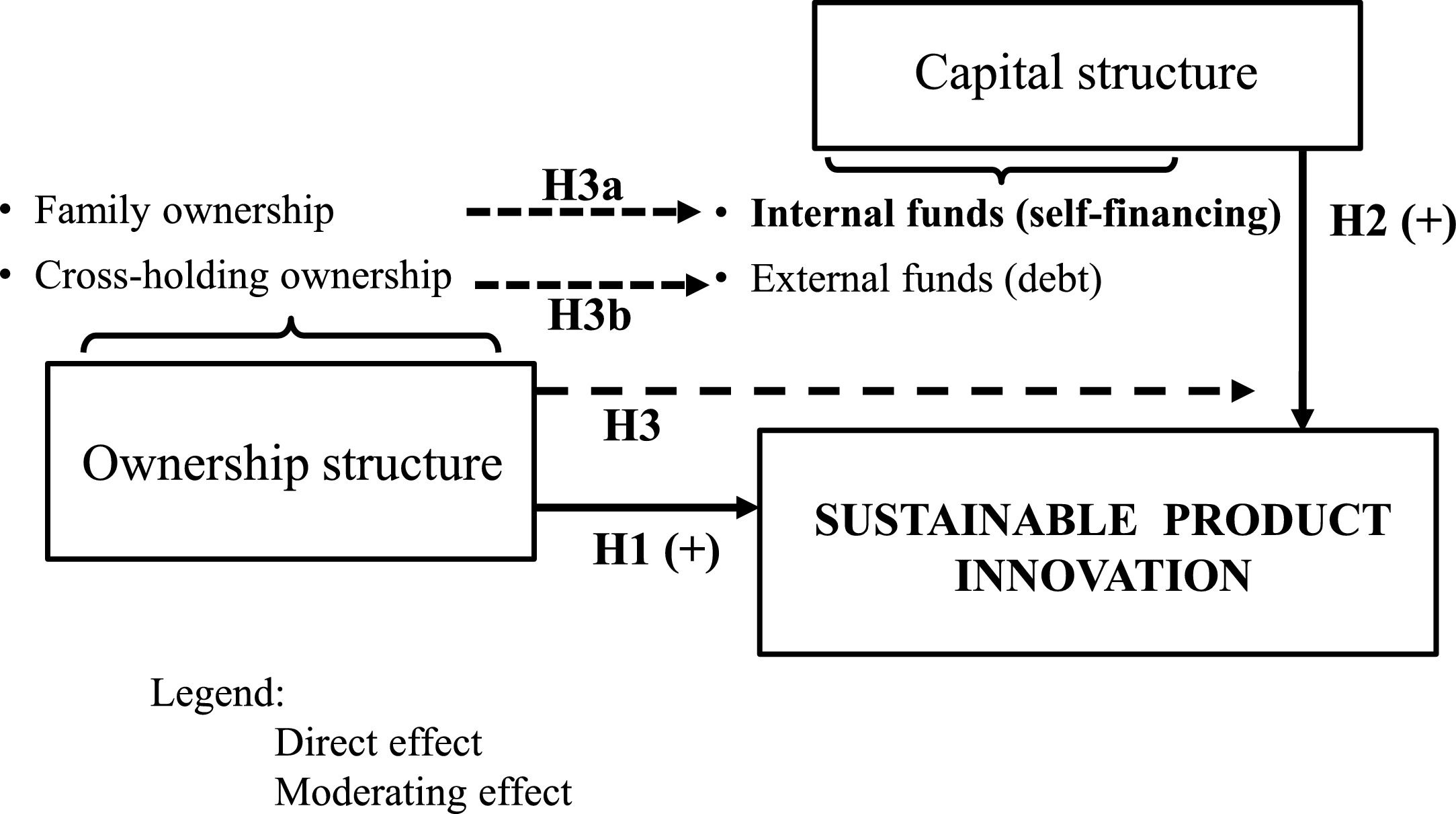

H1 : There is a positive association between family ownership and ownership by cross-holdings and sustainable product innovation projects.

As stated earlier, engaging in sustainable product innovation requires more than simply being motivated (Dangelico & Pujari, 2010), resource availability is a key factor influencing this type of investment decisions (Alsharkas, 2014; Lin et al., 2014). Sustainable product innovation often requires investing greater financial resources in the short term while returns, if they occur, will be obtained in the long term (Bartoloni, 2013; Berrone et al., 2013; I.M. García-Sánchez et al., 2020b).

The existence of a link between the firm's investment and financing decisions was firstly recognized by Jensen and Meckling (1976). Since then, many researchers have analyzed such a relationship, observing that the array of viable investments for a firm depends on its capital structure (O'Brien, 2003). From a theoretical viewpoint, corporate financing decisions have been explained drawing on three main theories: the pecking order theory, the trade-off theory and agency theory (Manos, Murinde, & Green, 2007). The first one, proposed by Myers and Majluf (1984), establishes a hierarchy of financing sources. Thus, firms tend to prioritize internal sources of financing and, only when these are not enough to cover their financial needs, firms resort to external sources of financing, preferring, first, debt financing and, as the last option, equity.

Several studies provide empirical support for the pecking order theory in the case of innovation funding (Capizzi, Giovannini, & Pesic, 2011; O’ Brien, 2003). Hall (1992) analyzed the relationship between capital structure and research and development (R&D) investment and found a negative relationship between R&D investment and debt financing, which suggests that R&D activities are financed by using internally generated funds. Vicente-Lorente (2001) also documented a negative association between R&D investment and debt financing. In a similar line, Bartoloni (2013) found that Italian innovative firms prefer to use internal funds and only resort to external financing when their innovative efforts increase and internal financial resources are not enough.

From this perspective, the pecking order theory's arguments would be applicable to financing decisions regarding investments in sustainable product innovation. Given the risky and uncertain nature of such investments, creditors are often reticent to finance them (Hsu et al., 2014) and tend to apply higher borrowing costs and require collateral (Bartoloni, 2013; Capizzi et al., 2011). As a result, companies will be less willing to resort to debt financing to fund sustainable product innovation projects and will prefer self-financing.

Consequently, it can be expected that agri-food companies will resort to external financing to fund innovation projects in sustainable products only when internally generated financial resources are insufficient (Bartoloni, 2013; Capizzi et al., 2011). Thus, the following hypothesis can be stated:

H2 : Agri-food companies are more likely to resort to internally generated resources (self-financing) rather than external funds (debt) to finance sustainable product innovation projects.

Some firm characteristics (such as size, age, reputation, activity sector or geographical location) as well as institutional factors affect credit conditions (Alsharkas, 2014; Capizzi et al., 2011; Hall, 2002) and, consequently, a firm's financing decisions and capital structure. Ownership structure can also affect financing decisions related to sustainable product innovation projects, although, in some cases, there are conflicting interpretations regarding its influence.

In relation to family ownership, it affects the firm's capital structure as, to maintain control over the company, family owners tend to prefer to use internal financial resources (self-financing) over external financing to avoid the monitoring and interventionist role that lenders could play (Hsu et al., 2014; Matzler et al., 2015). Indeed, self-financing would allow family firms to address their innovation strategies with greater independence, especially when investments require long periods of time to provide adequate performance (De Massis, Audretsch, Uhlaner, & Kammerlander, 2018).

In this sense, due to the family owners’ desire to maintain independence and control of firm management –independence effect– (Wang et al., 2019), family-owned firms will tend to be reluctant to resort to external sources of financing to fund innovation projects (Le Breton-Miller & Miller, 2008). As a result, it can be expected that family-owned firms follow a pecking order of financing sources to fund sustainable product innovation projects and rely mainly on internal sources of financing.

As regards business groups, as stated earlier, affiliation to business groups allows companies to obtain funds from other group companies at lower costs (Almeida & Wolfenzon, 2006; Bartoloni, 2013; Lodh et al., 2014). As noted by Manos et al. (2007), ownership by cross-holdings may have some implications for the pecking order theory: on the one hand, they often have better access to external financing (Chang & Hong, 2000) and, on the other, by creating “virtual (or internal) capital markets” (Manos et al., 2007, p. 446) cross-holdings allow financially constrained firms to obtain financial resources (Bartoloni, 2013; Choi et al., 2011; Claessens et al., 2006), lessening the necessity for obtaining external financing.

Nevertheless, cross-holding ownership has a more economic and short-term orientation (I.M. García-Sánchez et al., 2020b), which, along with the higher agency costs derived from the existence of nonaligned interests, lead companies to pursue short-term gains. Thus, business groups will favor the use of debt financing to benefit from the leverage effect on financial profitability (return on equity – ROE – effect). However, ownership by cross-holdings could pose contradictory effects on financing decisions related to sustainable product innovation projects due to the ROE effect. Although a high ROE reflects that the firm has enough internal financial resources and, therefore, according to the pecking order theory, it would be willing to fund sustainable product innovation by using its internally generated financial resources instead of restoring to external funding (Myers & Majluf, 1984), a high value of ROE allows firms to obtain more favorable credit conditions and benefit from the leverage effect on financial profitability, which would incline them to use debt financing. Considering that innovation processes require a long period of time to generate returns and the short-term orientation of cross-holding ownership, the latter effect will prevail, and business groups can be expected to prefer debt to the use of their own self-financing.

Based on the above discussion, we posit that ownership structure affects financing decisions regarding sustainable product innovation so that, in the case of family ownership, the independence effect outweighs other considerations and therefore family firms will be more likely to rely on internally-generated resources rather than external funds to finance innovation projects in sustainable products, whereas, conversely, cross-holding ownership leans towards a preference for external funds rather than internally-generated resources to finance such projects. Accordingly, the following hypothesis is stated:

H3 : Ownership structure affects financing decisions related to sustainable product innovation projects

Considering the two types of ownership considered in this study, this hypothesis can be split into two sub-hypotheses

H3a : Family agri-food companies are more likely to resort to internally generated resources (self-financing) rather than external funds (debt) to finance sustainable product innovation projects (independence effect).

H3b : Agri-food companies affiliated to business groups are more likely to rely on external funds (debt) rather than internally generated resources (self-financing) to finance sustainable product innovation projects (ROE effect).

The following figure (Fig. 1) depicts the overall model of our study.

METHODSampleIn order to test the research hypotheses, we used a sample made up of 320 international agri-food companies for the period 2002–2017, whose economic-financial and sustainability information is available in the Thomson Reuters and EIKON databases. The sample companies configure an unbalanced data panel made up of 4878 observations, although the time distribution is practically homogeneous. The sample companies are located in 44 countries with different institutional and economic settings, existing a geographical bias in favor of the United States.

Models and variablesEquation 1 depicts the model proposed to test the research hypotheses.

SustProdInnoi,t = φ0 + φ1 Self_Financingi,t + φ2 Debti,t + φ3 CrossHoldingi,t + φ4 CrossHolding*Self-Financingi,t + φ5 CrossHolding*Debti,t + φ6 Familyi,t + φ7 Family*Self_Financingi,t + φ8 Family*Debti,t + φ9 Sizei,t + φ10 ROAi,t + φ11 Cashi,t + φ12 Dividendi,t + φ13 ForeignSalesi,t + φ14 CAPEXi,t + φ15 NonCAPEXi,t + φ16 FirmAgei,t + φ17 NCSRPIi + φ18 Crisist + φ19 Countryi + φ20 Yeart + εit + ηi [Equation 1]

In this equation, the dependent numerical variable (SustProdInno) was extracted from the ESG database available in EIKON. It corresponds to a score that reflects the degree of sustainable product innovation in each business in relation to the firms that operate in its sector. This score is the product innovation associated with the fact that the firm has implemented eco-innovation and eco-design strategies, as well as clean technologies in its production process.

The independent variables refer to a firm's capital structure and ownership structure. As regards the former, Self_Financing and Debt determine the availability of self-financing (own resources generated without considering capital contributions with respect to total assets) and the level of debt (proportion of debt that a company supports with respect to total assets), respectively. Regarding ownership structure, the variables related to the presence of cross-holdings and family groups in a firm's ownership structure are represented by CrossHolding and Family, respectively. They are measured by the voting rights that cross-holdings and families own when their participation exceeds 5% in the stock capital of the firm (I.M. García-Sánchez et al., 2020b). The individualized impact of these variables on the dependent variable will determine these owners’ attitude towards to sustainable product innovation projects. The effect of their interaction with the variables Self_Financing and Debt will allow us to determine the preference that each type of owner shows in relation to the financial sources used to fund sustainable product innovation projects. These interactions are calculated by using the centered variables to avoid multicollinearity problems in the model.

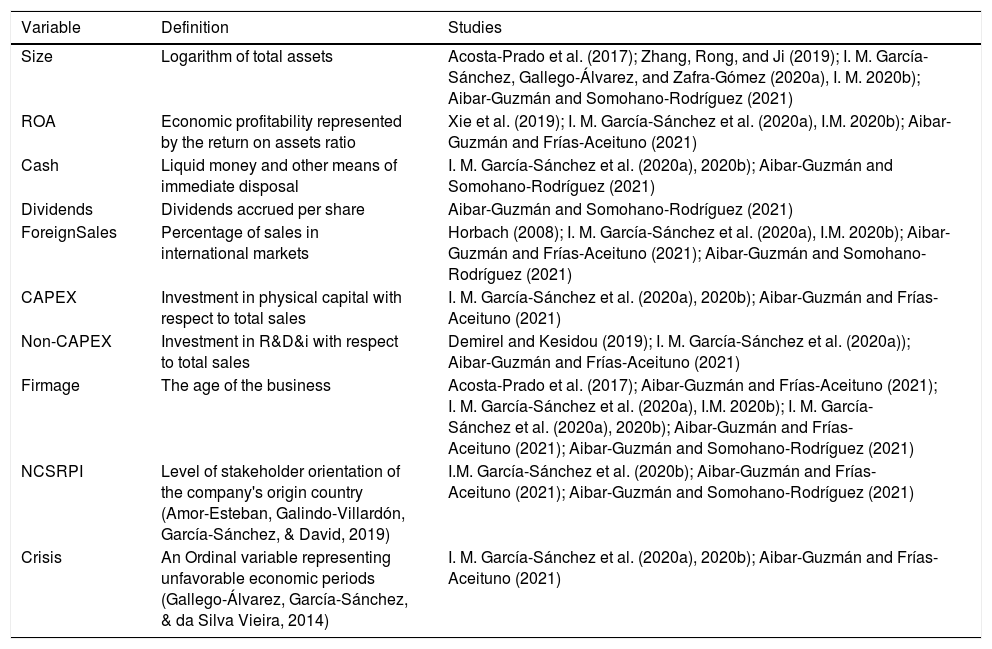

Equation 1 also incorporates ten control variables that represent firm capabilities and resources as well as institutional pressures. These variables avoid biased results due to the impact they have on the implementation of different proactive environmental strategies. In addition, ‘Country’ and ‘Year’ are also included as control variables. Table 1 summarizes a description of the control variables.

Control Variables definition.

Equation 1 also incorporated εit, the error term, which is divided into η and μ, in order to control the unobservable heterogeneity and represents the traditional random perturbation.

Analysis techniqueWe use econometric models for panel data, which allows us to disaggregate the error term into an individual effect, a temporary effect, and the random disturbance itself, avoiding the risk of obtaining unbiased estimates of the decisions made by agri-food companies in relation to innovation in sustainable products. In addition, panel data methodology allows us to address the problem of endogeneity, which is also important given that agri-food companies make decisions with continuous interaction with the market, which means that decisions are made based on variables that are determined simultaneously, causing a clear problem of endogeneity. Specifically, we use the generalized method of moments, the estimator proposed by Arellano and Bond (1991).

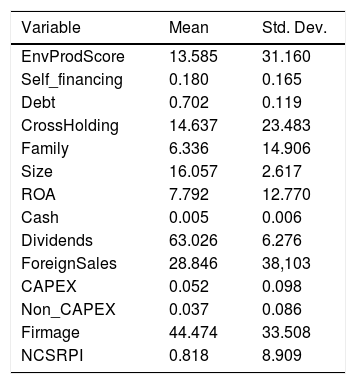

RESULTSDescriptive statistics and correlationsTable 2 shows the descriptive statistics for the variables included in the model. Agri-food companies show an average level of innovation in sustainable products of 13.585, presenting a high variability, 31.160. The voting rights of business groups in agri-food companies are 14.637% of their stock capital, whereas in the case of family firms the family owner has 6.336% of voting rights. Furthermore, agri-food companies have an economic profitability (ROA) of 7.792%.

Descriptive statistics.

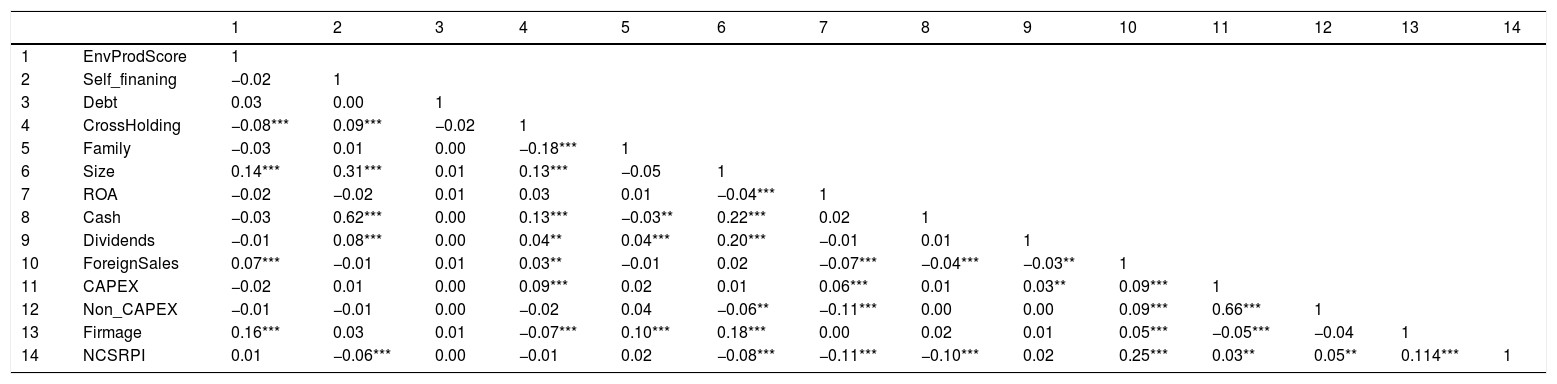

Table 3 show the bivariate correlations between the variables. It can be noticed that there are no multicollinearity problems among them.

Bivariate Correlations.

*, ** and *** indicate significance at a 1%, 5% and 10% level, respectively.

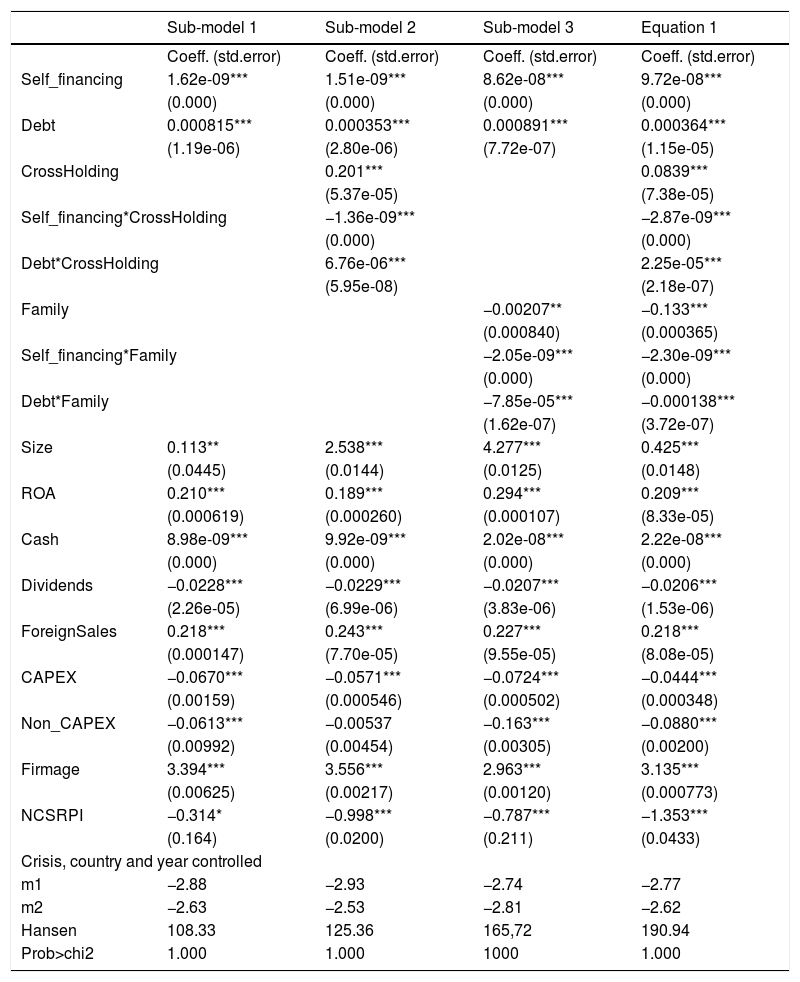

Table 4 summarizes the results obtained for Equation 1. Additionally, to test the robustness of the findings against different specifications of the model, estimates of the model are presented by stages so that the variables related to the firms’ ownership structure and their preferences regarding the sources of financing used to fund sustainable product innovation projects are successively incorporated.

Main results.

Notes:.

i) Heteroskedasticity-consistent asymptotic standard error in parentheses.

ii) *, ** and *** indicate significance at a 1%, 5% and 10% level, respectively.

iii) mi is a serial correlation test of order i using residuals in first differences, asymptotically distributed as N (0,1) under the null of no serial correlation.

vi) Hansen is a test of the over-identifying restrictions, asymptotically distributed as χ2 under the null of no correlation between the instruments and the error term, degrees of freedom in parentheses.

Focusing on the results of Equation 1, due to its robustness in relation to the other models, they allow us to accept the existence of a positive effect of ownership structure on sustainable product innovation stated by Hypothesis H1 only in the case of business groups. Indeed, ownership by cross-holdings favors investment in this type of innovation projects (CrossHolding: coeff. = 0.0839; p-value = 0.000), whereas, contrary to our expectations, in the case of agri-food companies family ownership is negatively related to sustainable product innovation (Family: coeff. = - 0.133; p-value = 0.000).

As regards Hypothesis H2, it can be seen in Table 4 that agri-food companies use both internal financial resources (Sel_financing: coef. = 9.72e-08; p-value = 0.000) and debt financing (Debt: coef. = 0.0003645; p-value = 0.000) to fund sustainable product innovation projects. Although previous findings indicate that, overall, firms are more likely to rely on self-financing rather than debt to finance innovation projects (Bartoloni, 2013; Hall, 1992), we found that sustainable product innovation by agri-food companies is funded by using both external and internal financial resources sources, which does not allow us to accept Hypothesis H2.

In relation to Hypothesis H3a, family firms show aversion to sustainable product innovation projects, regardless of whether they can fund them by using internal financial resources (Self_financing * Family: coeff = −2.30e- 09; p-value = 0.000) or have to resort to debt (Debt * Family: coeff = −0.000138; p-value = 0.000). Therefore, in the case of family firms, we cannot confirm the existence of a moderating effect of this type of ownership on financing decisions regarding sustainable product innovation in the terms posited by Hypothesis H3a and, accordingly, this hypothesis cannot be accepted.

Business groups do show a greater preference to use debt (Debt * CrossHolding: coeff = 2.25 e-05; p-value = 0.000) instead of internal financial resources (Self_financing * CrossHolding: coeff = −2.87e-09; p-value = 0.000) to fund sustainable product innovation projects. These results indicate the existence of a moderating effect of cross-holding ownership on financing decisions regarding sustainable product innovation, which is in line with what Hypothesis H3b posited. Accordingly, it can be accepted.

With regard to the control variables, in line with prior studies (Alsharkas, 2014; Finco et al., 2018; Hsu et al., 2014), we found that the oldest and largest companies, the most profitable and internationalized ones, as well as those with higher cash-flow are the most active regarding sustainable product innovation. On the contrary, the companies that have undertaken more investments in R&D and physical capital, and those that have adopted a more favorable dividend payment policy for investors show a low predisposition to carry out these sustainable innovation strategies.

DiscussionIn our first hypothesis (H1) we aimed to test whether qualitative ownership structure (i.e., the nature/type of ownership) affects sustainable product innovation. Specifically, we posited a positive effect of family ownership and cross-holding ownership on sustainable product innovation. This hypothesis was only accepted in the case of cross-holding ownership. In a capital-intensive industry as the agri-food sector, innovation requires large investments in capital and equipment, greater experience, and a better access to knowledge (García-Álvarez-Coque et al., 2014), affiliation to business groups can allow agri-food companies to overcome these constraints (Tleubayev et al., 2021). In this sense, our results confirm previous findings documenting a positive effect of business group affiliation on innovation both in other manufacturing sectors (Choi et al., 2011; Lodh et al., 2014) and in the agri-food sector (Hahlbrock & Hockmann, 2011; Tleubayev et al., 2021). We also confirm the results obtained by I.M. García-Sánchez et al. (2020b) regarding a positive association between ownership by cross-holdings and eco-innovation.

In the case of family ownership, Hypothesis H1 cannot be accepted as, in agri-food companies, family ownership is negatively related to sustainable product innovation. This negative effect can be explained by the fact that, according to agency theory, family ownership creates specific agency costs that negatively affect innovation. Firstly, family ownership is associated with non-financial objectives related to socio-emotional wealth (Gomez-Mejia, Haynes-Takács, Nuñez-Nickel, Jacobson, & Moyano-Fuentes, 2007) as well as conservatism and risk aversion (De Massis et al., 2015), which affects investment decisions because, beside economic factors, family-owned firms take non-economic ones into account. Thus, to the extent that family firms are concerned about preserving the continuity of the business and the family wealth (Chrisman & Patel, 2012; Claessens et al., 2006), they tend to avoid risky investments, such as those related to innovation, even when this involves sacrificing economic performance (De Massis et al., 2015; Matzler et al., 2015). Secondly, family firms may face financial constraints that hinder innovation (Hsu et al., 2014; Matzler et al., 2015), given that sometimes sustainable product innovation may imply duplicate investment in innovation (general innovation and eco-innovation). In this case, our results are in line with some prior studies (Acosta-Prado et al., 2017; Chen & Hsu, 2009; Classen et al., 2014; Matzler et al., 2015; Muñoz-Bullon & Sanchez-Bueno, 2011) that also document a negative effect of family ownership on innovation. Nevertheless, this result contradicts evidence obtained by I.M. García-Sánchez et al. (2020b) regarding a positive relationship between family ownership and eco-innovation.

In our second hypothesis (H2), we posited that, in line with the pecking order theory, agri-food companies are more likely to resort to internally generated resources rather than external funds to finance sustainable product innovation projects. However, our results indicate that they use both self-financing and debt to fund such projects. Thus, we can affirm that agri-food companies do not follow the hierarchy of financing sources established by the pecking order theory to fund sustainable product innovation projects. In this sense, our result is in line with those obtained by O'Brien (2003), who found that the extent to which a firm follows the pecking order theory depends on its business strategy.

As regards our third hypothesis (H3), we found that family firms’ aversion to sustainable product innovation projects is maintained regardless of the source of financing they use. However, as Hypothesis H3b posited, business groups show a greater preference for the use of debt instead of self-financing to fund these projects. In other words, there is a moderating effect of cross-holding ownership on financing decisions regarding sustainable product innovation. This is an important result as it indicates that business groups pursuing sustainable product innovation are less inclined towards following the pecking order model (Myers & Majluf, 1984) to finance such projects, indicating that ownership structure affects the hierarchy of financing sources preferred by the firm.

CONCLUSIONSAs Maxwell and van der Vorst (2003, p. 883) stress, “the requirement to develop sustainable products is one of the key challenges facing industry in the 21st century”. This statement is particularly true in the case of the agri-food sector, which must deal with a wide range of relevant issues to advance towards sustainable development. In this paper, we analyze the role that ownership structure and capital structure play in the agri-food sector with regard to sustainable product innovation as well as whether these financing decisions differ depending on a firm's ownership structure. The results obtained for a sample made up of 320 international agri-food companies for the period 2002–2017 indicate that family-owned firms show aversion to this type of eco-innovation projects, regardless of their capital structure. On the contrary, ownership by cross-holdings favors investment in sustainable product innovation projects, showing a greater preference for the use of debt financing rather than auto-financing to fund them.

The results derived from this research have both theoretical and practical implications. From a theoretical viewpoint, our results extend and complement related literatures (i.e., innovation literature, corporate governance literature, financial literature, and corporate social responsibility literature) by providing empirical evidence regarding whether and how ownership structure and capital structure affect sustainable product innovation. Specifically, our study complements the pecking order theory by incorporating a resource-based perspective to explain the moderating effect of ownership structure on corporate capital structure with regard to sustainable product innovation. Additionally, we broadened and updated the period considered in prior studies and used an international sample, which contributes to the generalization of our findings.

With regard to the study's practical implications, our results provide an orientation to policymakers in order to design strategies aimed at promoting innovation and competitiveness in a sector (the agri-food industry) that must address relevant environmental and social challenges. On the one hand, considering the positive effect of ownership by cross-holdings on sustainable product innovation by agri-food companies, innovation policies should boost business group affiliation in the agri-food sector. On the other hand, due to business groups tend to resort to external financing to fund sustainable product innovation projects, specific financial instruments could be devised to support them. Likewise, considering these results, firms could look for strategies to achieve the optimal ownership and capital structure to favor innovation and competitiveness.

Finally, it should be noted that this research is subject to some limitations, mainly related to the evolutionary nature of the factors that characterize the institutional context affecting the lending market and innovation, and their effects on financing decisions, which should be addressed in the future. In this sense, this research could be extended by considering the effect of the lending market's characteristics on the interplay among eco-innovation, ownership structure, and capital structure. Similarly, it would also be interesting to study how some firm characteristics (such as age, reputation, and location) and corporate governance mechanisms affect the individual and joint effect of ownership structure and corporate capital structure on sustainable product innovation in the agri-food sector.

Ministerio de Ciencia, Innovación y Universidades [Grant/Award Number: RTI2018- 093423- B- I00]; Consejería de Educación, Junta de Castilla y León [Grant/Award Number: SA069G18]; Universidad de Salamanca [Grant/Award Number: USAL2017- DISAQ]; Junta de Castilla y León y Fondo Europeo de Desarrollo Regional [Grant/Award No. CLU-2019-03 Unidad de Excelencia “Gestión Económica para la Sostenibilidad” (GECOS)]; and Xunta de Galicia [Grant/Award Number: 2020 GPC GI2016].