Development in electrical energy storage has attracted several researches due to its solutions multiplicity. The research focus of this study was to identify the main features of battery global value chain for urban light electric vehicle in South Korea and Japan. The global value chain is utilized to analyze company core competencies to achieve cost reduction and product differentiation, thereby increasing productivity and profits, and finally, the macroeconomic growth of a country. Interviews, to obtain primary data, have performed overseas at Japanese and South Korean companies, involved in the production and sales of batteries. From the data analysis, it can be inferred that there are global integration prospects of the value chain with the production of some components out of these Asian countries and Brazil as a potential participant. This exploratory research has mixed methods of data gathering, i.e., triangulation. With regards to data collection, documents available from companies were analyzed; plants and R&D centers were visited to performing interviews with executives. Within the global value chain, ensuring lithium supply has become priority for companies. Thus, lithium mining could be a path for Brazil to become part in the battery global value chain. This argument is justified in two ways. First, Brazil has technology and experience in mining provided by the Vale Company. Large lithium reserves are in neighboring countries in South America. Second, Argentina is a MERCOSUL member and it could be beneficial to both countries to extract lithium for batteries. The main technical challenges faced by electric vehicle are the battery lifetime as well as the need for a specific charging infrastructure. Furthermore, Brazil will face challenges and opportunities in developing high-value activities within battery global value chain. The public policy suggested is to map the components from battery global value chain and highlighting those that can or should be produce in Brazil for strategic technology development.

Although oil prices have presented a downward trend, more than 712,000 electric vehicles were sold worldwide in 2015, mainly in the United States, Japan, China, South Korea and Germany. In Brazil, until the end of 2015, just over 840 electric and hybrid vehicles were licensed (ANFAVEA, 2016, p. 61).

The alternative development for internal combustion engine, either for purely electric or hybrid vehicle, has attracted the Brazilian researchers’ attention. However, outside of Brazil, the issue about electric vehicle development is well known. Thereby, Chan states that the successful production and marketing of electric vehicle depends on overcoming many challenges, including availability of products with displacement of autonomy at an affordable cost; availability of efficient and easy to use infrastructure; availability of business model to leverage the cost of battery (Chan, 2011).

Aside from these challenges, scientific articles are constantly reporting new progress in this area. For example, Xinghu (2010) from the introduction of electric vehicles in China analyzed the shortcomings in the energy sector. Du, Ouyang, and Wang (2010) studied business solutions for the mass penetration of electric vehicles first generation in China. Kudoh and Motose (2010) studied the preferences of Japanese consumers in the use of electric vehicles.

Thus, for these authors the traditional mobility based on fossil fuel is going to end. The transition to electric vehicles is a revolution in mobility standard and it represents the trend for the future. About that trend, the former Saudi Arabia Oil Minister in the 1970s, Sheik Ahmed Zaki Yamani, said: “The Stone Age did not end for lack of stone, and the Oil Age will end long before the world runs out of oil” (The Economist Group Limited, 2003).

The Japanese, South Korean, Chinese and German automotive industry, have shown increasing concern about oil fueled mobility. Japanese and South Korean industries are more experienced in the production and marketing of light electric vehicles on a large scale. Thus, studying the electric vehicle global value chain and Brazil's potential participation in this chain becomes important topic for Brazilian researchers.

Within this context, the adoption and development of technologies for electric vehicles should not ignore Brazil, the eighth largest consumer of automobiles in the world (OICA, 2016). Thus, Brazil needs to clearly understand where it can explore opportunities in this new global value chain. The research problem of this study can be stated as: What are the main features of battery global value chain in Japan and South Korea?

The research focus is to identify the main features of battery global value chain for urban light electric vehicle version in South Korea and Japan. These two countries, unlike other countries, have met the challenges of mass production and sales of electric vehicles for over two decades. In addition, their researches provide some insights into the potential participation of Brazil in this value chain. The study aims to verify the main technological challenges concerning battery value chain for electric mobility.

Thus, discussions about the feasibility of Brazil automotive industry development based on electric propulsion are expected. In Brazil, other global value chains have been subject of foreign researchers. For example, the study by Sturgeon, Gereffi, Guinn, and Zylberberg (2013) about Brazilian industry participation in the global value chain of following industries: aerospace, electronics and medical equipment. None about electric vehicles global value chain study was found.

It is justified the need to generate more understanding of this economic sector, because a preliminary review of the national literature on the subject, has produced few Brazilian papers result. A search with key words “electric car” and “electric vehicles” in traditional database (Web-of-Science, 2015) highlighted the low involvement of Brazilian Academy in the knowledge creation on that subject. Therefore, this seems to confirm that many researchers are involved in traditional automotive industry studies and they have not yet turned their attention to electric vehicles.

Theoretical framework: battery global value chainAccording to Porter (1998), value chain is the relationship among the company and its suppliers upstream and downstream. That value chain approach is utilized to analyze the company core competencies to achieve cost reduction and differentiation. There are two types of value chains: primary activities, including inbound logistics, operations, distribution logistics, marketing, sales and service; and support activities, such as infrastructure, human resource management, technology development and acquisition.

This approach has been extended to global value chain analysis based on global supply and logistics. In recent years, many industries have become distributed geographically in networks with global supply activities in various countries. Within these networks, some sites may be specialized in certain activities and, the value added to them can be distributed among several locations, i.e., they may cover among several countries and companies. Thus, it is defined the concept of GVC, Global Value Chain (Sturgeon et al., 2013).

The Global Value Chain is utilized to analyze company core competencies to achieve cost reduction and product differentiation, thereby increasing productivity and profits, and finally, the macroeconomic growth of a country. An intervention that responds to chain deficiencies (e.g., non-compliance with established technology standards) moves the company to more sophisticated capital niche with intensive qualification.

Fournier, Hinderer, Schmid, Seign, and Baumann (2011) state that in the electric vehicle industry, batteries and its electronic components stand out in the value chain as result of significant technological challenges. Besides that, batteries have less durable components, requiring constant replacement. According to Castro and Ferreira (2013), there are four types of batteries that competing to establish a standard for the electric vehicle industry: PbA (lead acid); lithium-ion battery; NiMH (nickel metal hydride) and sodium, also known as ZEBRA, Zero Emission Battery Research Activity, fully recyclable and tending to be cheaper than lithium batteries.

The history of batteries is related to the history of electric cars – the mid-nineteenth century. It was in 1859 that the Belgian Planté held the demonstration of the first lead-acid battery, used by many electric vehicles developed from the early 1880s in France, UK and USA. Shortly afterwards, in 1885, Benz demonstrated the first internal combustion engine. In 1901, Thomas Edison, interested in the potential of electric vehicles, developed the nickel-iron battery, with storage capacity 40% greater than the lead acid battery. However, the cost of production was much higher. The nickel–zinc and zinc–air emerged in the late nineteenth century (Hoyer, 2007).

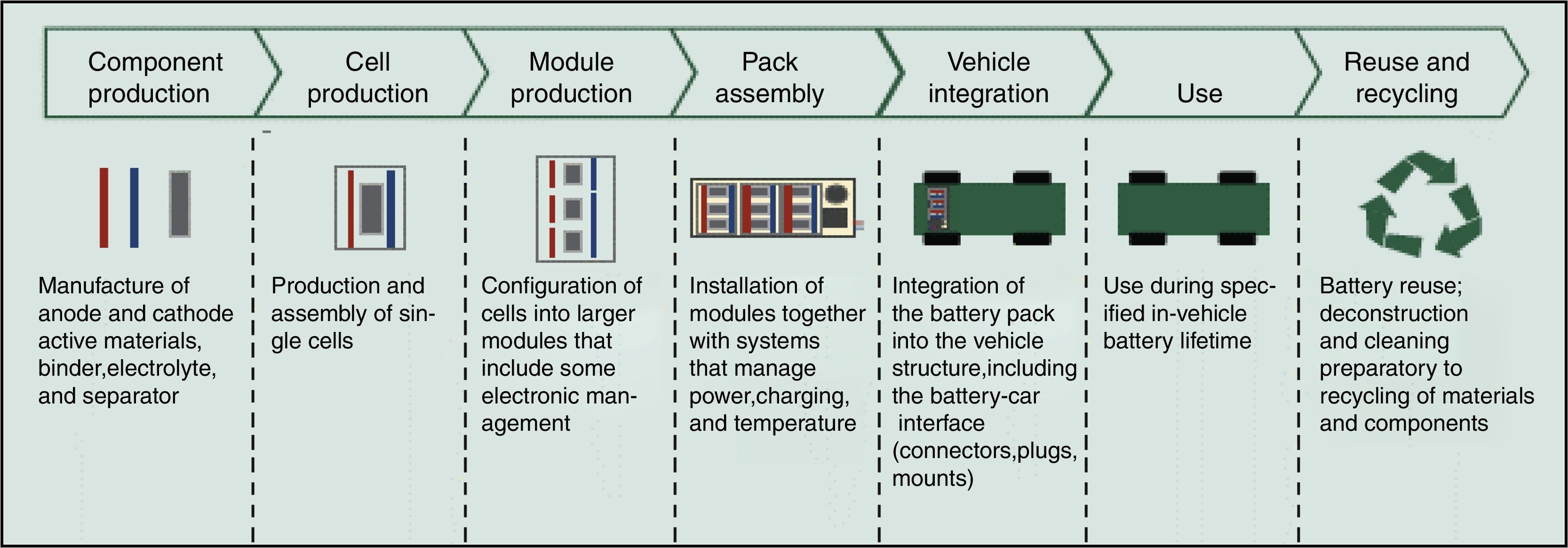

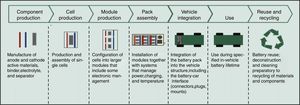

Batteries have different durability according to the technology used, the type of usage and storage conditions. The factors that affect battery durability are extreme temperatures, recharge overage and full battery discharge. Manufacturers estimate useful battery life at 150,000km and 5 years of durability. With regard to lithium-ion battery, Dinger et al. (2010) explore the value chain stages, as shown in Fig. 1.

Fig. 1 presents the relationships complexity involving global value chain. The process involves the development of activities, production, marketing and distribution scattered around the world, e.g., production stages shared between different firms in different countries. The central focus of this study proposal is to identify the main features of the battery production global value chain for electric mobility. Thus, it is intended to verify the possibilities for Brazilian participation in this value chain.

Research methodologyThis exploratory research has mixed methods of data gathering, i.e., data triangulation. According to Patton (2002), the concept of data triangulation relates several methods, data and theories in the study of a common phenomenon. Despite the use of different data sources, one must analyze the data obtained together, and draw conclusions based on the whole (Davidson, 2005).

Regarding to data collection, documents available from companies were analyzed; plants and R&D centers were visited to perform interviews with executives. The interviews had the objective to verify different aspects that influence the investment of financial resources in the production of the electric vehicles, and identifying technical aspects considered important in the global value chain for lithium-ion batteries.

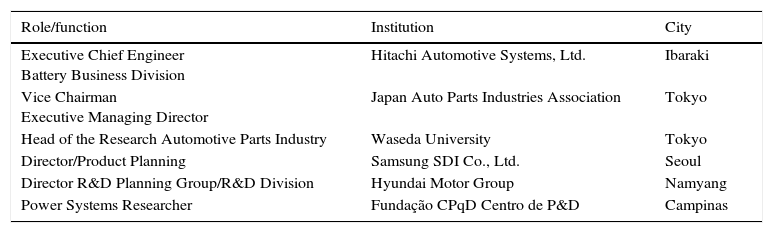

Semi-structured interviews were utilized to obtain primary data. The interviews lasted about 90min and were performed over the months of April and May 2015 at Japanese and South Korean companies, that were involved in the production and sales of batteries. Furthermore, there were dialogs with Brazilian researcher in energy sector from CPqD. In Chart 1 it is presented information about respondent role or function, company name and city where the interviews took place.

Companies and executives interviewed.

| Role/function | Institution | City |

|---|---|---|

| Executive Chief Engineer Battery Business Division | Hitachi Automotive Systems, Ltd. | Ibaraki |

| Vice Chairman Executive Managing Director | Japan Auto Parts Industries Association | Tokyo |

| Head of the Research Automotive Parts Industry | Waseda University | Tokyo |

| Director/Product Planning | Samsung SDI Co., Ltd. | Seoul |

| Director R&D Planning Group/R&D Division | Hyundai Motor Group | Namyang |

| Power Systems Researcher | Fundação CPqD Centro de P&D | Campinas |

Before the interviews, a collaborative pre-test toward performing the validation concerning the script of issues was applied to operations management specialist at the Mercedes-Benz Ltda Company.

Research resultsBattery power in an internal combustion vehicle is utilized for starting the engine and other functions such as electronic fuel injection, ignition of lights and air conditioning. Besides these functions, battery power in electric vehicle is also responsible for supplying power to the electric engine that will move the vehicle, i.e., the lithium-ion battery will replace the fuel tank.

According to Rosolem (2012), as lithium is a small and light element, lithium batteries have higher power level and energy per mass unit. In addition, for those applications where size and weight are important requirements, the lithium-ion batteries are suitable.

Batteries currently account for about 40% of the electric vehicle's weight and make up approximately 50% of the final price. Its energy efficiency gives electric vehicle a range of up to 150km on average, reaching 120km/h and can withstand up to 2000 recharge cycles (approximately 5 years). After this period, the batteries may be used in other places, such as in machinery industry, replacing the current lead-acid batteries. This expansion of the economic useful life of the battery will positively affect the residual value and, consequently, the total cost of ownership of the vehicle (Jussani and Albertin, 2013).

The lithium battery is fully recyclable and there are factors that may increase its price: such as a shortage in global supply of lithium and rare earth material, political problems in countries with high production. On the other hand, besides the increase in the global supply of lithium and rare earth element, other factors that may reduce the price are improvements in battery technology and large-scale production (Burke, Jungers, Yang, & Ogden, 2007).

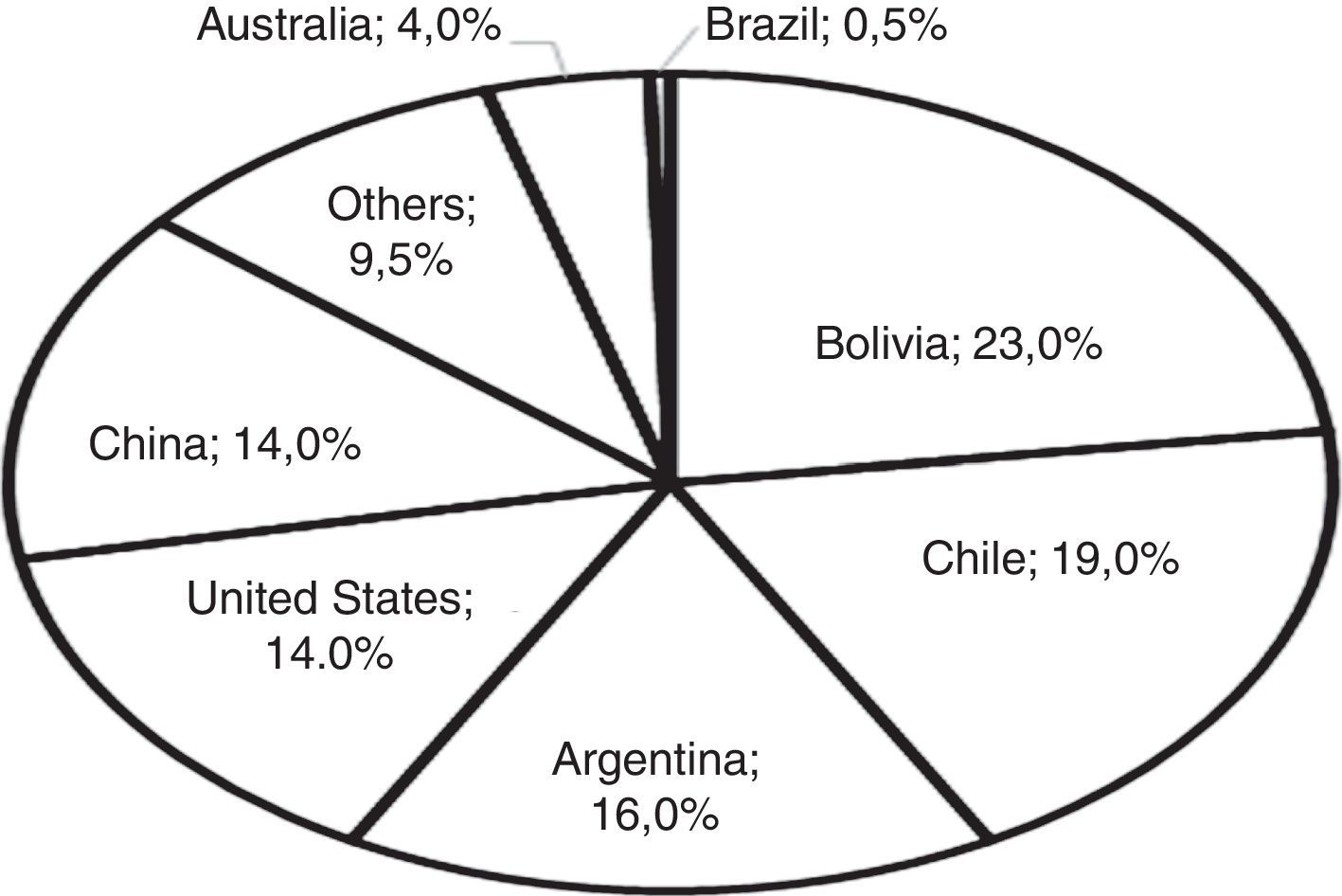

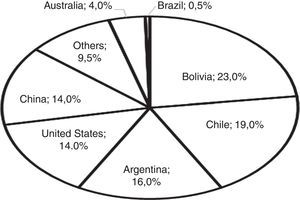

The rechargeable battery is the product that has the largest growth potential of lithium compounds – it is not an abundant ore and its reserves are concentrated in a few countries. In Fig. 2, approximately 60% of lithium reserves are concentrated in South America in Argentina, Chile and Bolivia. Brazil has 0.5% of the lithium world reserves (US Geological Survey, 2016).

Within the global value chain, ensuring lithium supply has become priority for battery companies in Asia. Respondents stressed the importance of strategic alliances and joint ventures among lithium exploration companies, battery suppliers and vehicle manufacturers. For example, GM Korea utilizes LG Chem battery at Spark EV 2015 model, and i-MiEV Mitsubishi model has chosen battery from GS Yuasa Japanese provider. Samsung SDI, company in South Korea, has been contracted by BMW to supply batteries for its i3 pure electric model and i8 hybrid (Jussani & Albertin, 2014).

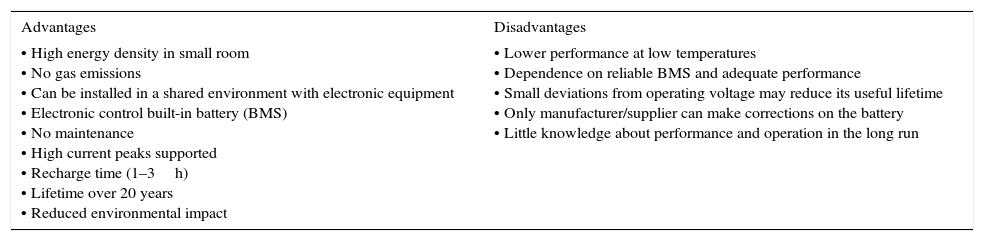

As lithium is recyclable, an increase in recycling industry of this type of battery is expected, as suggested by Dinger et al. (2010) in battery value chain. Thus, low performance traction batteries could be reutilized as power storage at homes. Chart 2 summarizes advantages and disadvantages of lithium-ion batteries. That chart is based on respondents responsible for electric vehicle projects in Japan and South Korea. Brazilian researcher in energy sector also has contributed.

Lithium-ion batteries advantages and disadvantages.

| Advantages | Disadvantages |

|---|---|

| • High energy density in small room • No gas emissions • Can be installed in a shared environment with electronic equipment • Electronic control built-in battery (BMS) • No maintenance • High current peaks supported • Recharge time (1–3h) • Lifetime over 20 years • Reduced environmental impact | • Lower performance at low temperatures • Dependence on reliable BMS and adequate performance • Small deviations from operating voltage may reduce its useful lifetime • Only manufacturer/supplier can make corrections on the battery • Little knowledge about performance and operation in the long run |

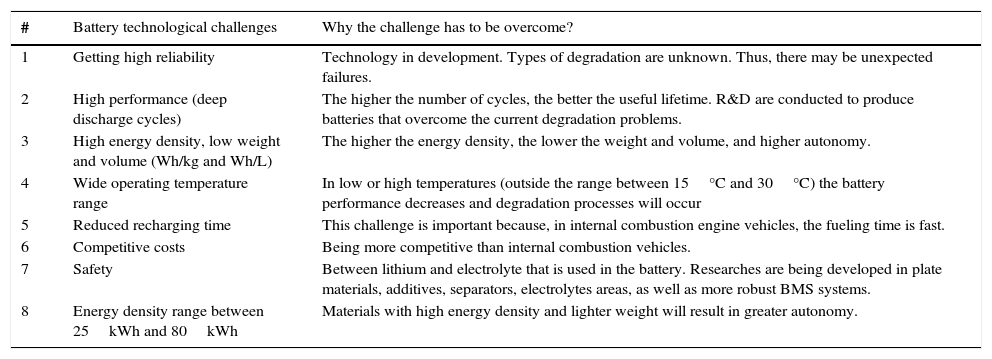

In the lithium-ion battery production, one of the difficulties faced is the usage of clean rooms and high purity components. Building the factory from Greenfield investment is expensive because the equipment is automated. Therefore, the method for cells production, modules and packs, may interfere with battery performance. Thus, it is verified the value chain importance in production of cells, modules and packs that was suggested by Dinger et al. (2010). Chart 3 presents battery technological challenges for electric vehicles.

Lithium-ion battery technological challenges.

| # | Battery technological challenges | Why the challenge has to be overcome? |

|---|---|---|

| 1 | Getting high reliability | Technology in development. Types of degradation are unknown. Thus, there may be unexpected failures. |

| 2 | High performance (deep discharge cycles) | The higher the number of cycles, the better the useful lifetime. R&D are conducted to produce batteries that overcome the current degradation problems. |

| 3 | High energy density, low weight and volume (Wh/kg and Wh/L) | The higher the energy density, the lower the weight and volume, and higher autonomy. |

| 4 | Wide operating temperature range | In low or high temperatures (outside the range between 15°C and 30°C) the battery performance decreases and degradation processes will occur |

| 5 | Reduced recharging time | This challenge is important because, in internal combustion engine vehicles, the fueling time is fast. |

| 6 | Competitive costs | Being more competitive than internal combustion vehicles. |

| 7 | Safety | Between lithium and electrolyte that is used in the battery. Researches are being developed in plate materials, additives, separators, electrolytes areas, as well as more robust BMS systems. |

| 8 | Energy density range between 25kWh and 80kWh | Materials with high energy density and lighter weight will result in greater autonomy. |

These challenges lead to the ideal stage that lithium-ion battery need to achieve. For example, in Chart 3, Section 7, the electrolyte operates at a well-defined voltage range. If the range limit is exceeded, it may result in adverse reactions. The outcome could burn the battery.

In order to address this challenge, the Japanese company Kuraray (2016) that produces battery separators (separates the anode from the cathode) is investing efforts in R&D to produce supercapacitors in activated carbon basis (it is one fifth of Li-ion mass). The goal is to deliver a safe charge of about 200km driving range (Waseda University, 2015).

Finally, one should note that lithium mining could be a path for Brazil to become a part in the battery global value chain, i.e., components production (Dinger et al., 2010). This argument is justified in two ways. First, Brazil has technology and experience in mining provided by the Vale Company. As shown, large lithium reserves are in neighboring countries in South America. Second, Argentina is a MERCOSUL member and it could be beneficial to both countries to extract lithium for traction batteries.

Final considerationsThe introduction of worldwide electric vehicle will be responsible for a deep rearrangement in the automotive industry and the outcome will be a disruptive innovation. For example, the electric vehicle maintenance frequency is less than an internal combustion vehicle, because an electric engine is simpler than an internal combustion engine, i.e., it does not have so many components such as gearbox, fuel pump and there is no need for lubricating oil, among other technological aspects. In this perspective, the adoption of the electric vehicle requires overcoming some obstacles, such as resistance of the consumers who demand for longer battery autonomy and more battery-charging infrastructure (Beeton & Meyer, 2015).

In this context, the main technical challenges faced by electric vehicle are the battery lifetime as well as the need for a specific recharging infrastructure. Nowadays, with existing technology, electric vehicle cannot obtain the same autonomy of an internal combustion vehicle, in competitive cost basis. One way to overcome this limitation is to install a battery-charging infrastructure in cities, roads and rural areas. The battery-recharging stations would have the same functions as today's gas stations, disseminated around the country.

Furthermore, Brazil will face challenges and opportunities in developing high-value added activities within electric vehicles global value chain. Uncertainties regarding public policies and industrial policies hinder the coming of foreign investment for electric vehicles development. Therefore, government efforts should aim to develop public policies toward to encourage the electric vehicles production like in the countries where electric vehicles can already be seen traveling on the streets and the avenues.

In a public policies context for developing battery global value chain, it is suggested to map the value chain of components and highlighting those that can or should be produced in Brazil for strategic technology development. The same procedure can be adopted with regards to manufacturing processes.

A strategy for automakers and initial purchasers is required to ensure in Brazil the electric vehicle deployment. In this way, the customers will become interested about electric vehicles (Velloso, 2010). Thus, there should be tax incentives from the government; incentives for technological development for companies; the maintenance of emission regulation process in order to bring new technological standards as result. That outcome takes into account the fuel production chain as well the vehicle production chain.

Despite the lack of investment by Brazilian vehicle manufacturers in this technology, power utilities indicate the possibility of investment together with the automotive industry, as seen with the Fiat automaker and the Itaipu Hydroelectric Power Plant (VE, 2016).

Finally, the results of this study should be considered in view of some restrictions. They occur from later findings out of the empirical data. It is important to highlight the research limitations, i.e., it was based on two Asian countries only. Certainly, the research results should not be over generalized and should not be extended to include a larger universe of countries and companies. If this research is repeat, the result might be different. The qualitative studies do not intend to generalize results (Cooper & Schindler, 2011).

Moreover, the qualitative interviews might present some distortions from interviewees understanding. Therefore, even if they have understood the questions, one should consider a bias in the answers, according to what the respondents really think.

Among suggestions for future research, it is propose a battery industry quantitative study in the light of Porter's five forces theory. Besides this suggestion, it would be interesting to repeat the same methodology for battery global value chain in other electric vehicles segment, such as electric bus.

These suggestions deserve detailed future studies since Brazil has an interesting opportunity that justifies mobilization efforts to develop a new automotive market.

Conflicts of interestThe authors declare no conflicts of interest.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.