Spanish family businesses have undertaken a major process of internationalisation, creating business groups with companies in emerging countries, such as Morocco. Morocco is the principal destination for Spanish investment in Africa. This paper analyses the impact of factors related to ownership, management and organisational culture on the performance of business groups created by Spanish and Moroccan companies. Therefore we also examine the possible moderating effect of the family nature of the Spanish company. In total, 252 business groups are analysed, of which 124 were created by Spanish family firms and 128 by Spanish non-family firms. The information was obtained through a survey conducted in 2013.

The results, obtained by linear regression, show that performance, measured by profitability, is enhanced when there is a higher proportion of ownership by the Spanish family business, when there is a larger number of Moroccan managers, when the management approach is results-oriented and when decision taking is centralised. Moreover, the family nature of the Spanish company has a moderating effect on the relationship between business group profitability and two of the variables analysed, namely the percentage of ownership and the centralisation of decision taking.

The results of this study could help to clarify an issue of some significance in professional and academic circles. Both owners and managers of family businesses can use these research findings to better understand how certain characteristics of business group management could affect their performance and the success of the internationalisation process.

Las empresas familiares españolas están llevando a cabo un importante proceso de internacionalización mediante la creación de grupos empresariales con empresas de países emergentes. Específicamente, Marruecos es el principal destino de la inversión española en África. En este artículo se analiza la repercusión de factores relacionados con la propiedad, la gestión y la cultura organizativa en el rendimiento de grupos empresariales creados por empresas españolas y marroquíes. Además, se examina el posible efecto moderador de la naturaleza familiar de la empresa española en estas relaciones. Se han analizado 252 grupos empresariales; de ellos, 124 han sido creados por empresas españolas de carácter familiar y 128 por empresas españolas no familiares. La información se ha obtenido a través de una encuesta realizada en el año 2013.

Los resultados, aplicando regresión lineal, muestran que el rendimiento del grupo empresarial, medido por la rentabilidad, aumenta cuando hay mayor proporción de propiedad de la empresa familiar española, cuando hay mayor número de gerentes marroquíes, cuando el enfoque de gestión se orienta a los resultados y cuando la toma de decisiones está centralizada. Además, el carácter familiar de la empresa española tiene un efecto moderador en la relación de la rentabilidad del grupo empresarial con dos de las variables analizadas, concretamente, el porcentaje de propiedad española y la centralización de la toma de decisiones.

Los resultados de este estudio podrían ayudar a aclarar una cuestión de importancia en el ámbito profesional y académico. Tanto los propietarios como los gerentes de empresas familiares pueden usar los resultados de esta investigación para entender mejor cómo ciertas características de la gestión de grupos empresariales pueden afectar a su rendimiento y, consecuentemente, al éxito del proceso de internacionalización.

Family firms are important social and economic institutions in both developed and emerging economies. In most countries around the world, family businesses comprise 70–95% of all business entities (European Family and Business, 2012). In Europe, the majority of SMEs are family owned and form the backbone of the economy (Botero, Cruz, De Massis, & Nordqvist, 2015).

In the process of their internationalisation, the formation of business groups plays an important role. According to IFRS 10, the term business groups refers to all businesses where a company, called the parent entity, controls one or more other entities, called the subsidiaries (International Accounting Standards Board, 2011). When a business group is controlled by a family firm, it is known as a family business group (FBG), a form of business organisation that is present in many economies around the world (Cheung, Haw, Tan, & Wang, 2014; Della Piana, Vecchi, & Cacia, 2012). FBGs are often created by companies in developed economies as a means of entering markets in emerging economies (Lien, Teng, & Li, 2016), as is the case in Morocco.

Previous studies of the internationalisation of small-medium sized family firms have examined the question from different perspectives, usually paying more attention to how and why they expand abroad (Banalieva & Eddleston, 2011; Bhaumik et al., 2010; Fernández & Nieto, 2006; Gómez-Mejia et al., 2010; Kraus, Mensching, Calabrò, Cheng, & Filser, 2016; Sciascia, Mazzola, Astrachan, & Pieper, 2013). However, there exists a research gap concerning the factors that may benefit the performance of the business group created, and therefore its survival – which, obviously, is an important goal for family owners (Le Breton-Miller & Miller, 2013). Therefore, in view of the possibly significant influence on the results obtained by the FBG, the fact that its partners are family businesses, and as little is known about this question, the present study aims to contribute to a better understanding of the issues involved.

Family involvement can affect business results (Basco, 2014; Holt, Pearson, Carr, & Barnett, 2017). In recent years corporate governance has become an issue of major importance in family businesses (Del Giudice, 2017) and in response, areas such as ownership and governance have been analysed in research studies (Short, Sharma, Lumpkin, & Pearson, 2016). Business performance may be affected by the family nature of a company, especially by its ownership structure and corporate strategies (Pindado & Requejo, 2015). In this sense, governance and resources of family firms are key determinants of outcomes such as the continuation of family involvement and firm survival (Chrisman, Sharma, Steier, & Chua, 2013). The competitive advantages of a family firm arise from its system of corporate governance (Carney, 2005). In addition, organisational culture can affect the results obtained (Vallejo, 2011) and therefore analysing business management from an organisational standpoint can underpin a company's future development (Del Giudice, 2017). However, in the field of FBGs, these factors require more research since previous studies have mainly focused on how ownership and governance-related questions may affect the performance of family firms in developed countries or in companies listed in emerging markets (Sánchez-Ballesta and García-Mecca, 2007; Wang & Shailer, 2015, 2017).

Our study contributes to the family business literature in three ways. First, this paper presents evidence on how the ownership structure, management and organisational culture affect the performance of the FBG. Second, we examine whether the family nature of the company has a moderating effect on these relationships, in the view that it is important to investigate both family and non-family representation at different governance levels in family firms (Binacci, Peruffo, Oriani, & Minichilli, 2016). Third, this study focuses on the FBGs promoted by Spanish family businesses in Morocco, an area that has, to date, received little research attention. As regards the Spanish economy, Morocco is the principal destination for Spanish investment in Africa, and successive governments have encouraged Spanish firms to enter this emerging market by establishing commercial relations with Moroccan companies (Economic and Commercial Office of Spain in Rabat, 2010). Moreover, Morocco can serve as a platform for foreign firms to enter new markets and is of strategic value for international comparisons and in the analysis of contextual factors (Cox, Estrada, Lynham, & Motii, 2005).

The rest of this paper is organised as follows: first, we review the existing literature and formulate the research hypotheses. In the next section we describe the research methodology applied, and then set out and discuss the results obtained. Finally, we present the main conclusions drawn.

Theoretical background and hypothesesFamily businesses differ from other companies in terms of their values, goals and strategic behaviour (Bona Sánchez et al., 2007; Chrisman, Chua, Pearson, & Barnett, 2012; Kotlar & De Massis, 2013; Poza, 2007), and the particular characteristics of these businesses mean that their internationalisation is not as straightforward as for others (Arregle, Naldi, Nordqvist, & Hitt, 2012; Gómez-Mejia, Makri, & Larraza-Kintana, 2010; Kuo, Kao, Chang, & Chiu, 2012). Studies of family businesses have shown that family involvement, through company management and ownership, makes this business form unique, and that the company's governance structure is a key aspect in the process of internationalisation (Arregle et al., 2012). Specifically, previous research has shown that family firms seem to internationalise later, more slowly and in a particular way, reflecting their traditionally conservative approach, and seeking to avoid the risks inherent to the process of internationalisation (Mitter, Duller, Feldbauer-Durstmüller, & Kraus, 2014).

There is no single definition of family business, and perhaps there never will be (Chrisman et al., 2012). Chen et al. (2008: 499–500) define it as “a firm where members of the founding family continue to hold positions in top management, are on the board, or are blockholders of the company”. Other authors emphasise the family-control nature of the company (Berrone, Cruz, & Gomez-Mejia, 2012). Among direct measures of family involvement are ownership control or active participation in corporate governance (Anglin, Reid, Short, Zachary, & Rutherford, 2017). Two theories are often proposed to explain the actions of family businesses: agency theory and stewardship theory.

Researchers in the field of corporate governance apply agency theory to explain the behaviour resulting from the separation between company ownership and management (Del Giudice, 2017). Agency theory tends to focus on the (contractual) relationship between a business's owners (principals) and its managers (agents) (Jensen & Meckling, 1976). According to this theory, the principal and the agent have conflicting goals, and this divergence creates additional costs for the company, in that the principal must review the agent's work, while the latter may behave in an opportunistic way (Del Giudice, 2017). Such agentic actions could be taken to favour the interests of the dominant family at the expense of the firm's long-term overall performance (Bertrand & Schoar, 2006; Morck, Percy, Tian, & Yeung, 2005).

The stewardship theory interprets the relationship between principal and agent as not necessarily conflicting, but believes that management acts as steward for the investor, and pursues the creation of shareholder value as a basic objective in the management of the company's resources. Hence, there is no conflict between shareholder and management. A partnership between the parties is established in order to increase the corporate value of the company (Del Giudice, 2017).

Thus, there is a debate about whether the family firm operates under stewardship (due to the potentially positive characteristics associated with its altruistic, communal and long-term nature) or as an agency (due to its exploitative and nepotistic nature) (Dodd & Dick, 2015). According to Madison, Holt, Kellermanns, and Ranft (2016), who reviewed the literature on agency and stewardship theories with respect to family firms, these two theories have been considered as opposites, but in fact they can complement each other, insofar as both address the same phenomena: the individual-level behaviours and firm-level governance mechanisms that predict organisational outcomes. In this field, too, Neubaum, Thomas, Dibrell, and Craig (2017) made use of stewardship theory to explain the performance of family firms and showed that it is increasingly applied in this area.

Studies have shown that most firms in emerging economies are family controlled (Lien et al., 2016), i.e. the family is the majority owner and predominates on the board (Filatotchev, Strange, Piesse, & Lien, 2007). From the agency standpoint, the popularity of family-controlled companies in emerging markets is due to the inadequate protection of investor rights by the legal system (La Porta, Lopez-de-Silanes, & Shleifer, 1999). However, according to the stewardship theory, family altruism can be an incentive for the family to preserve the value of the company for the following generations (Salvato & Melin, 2008) and so the family will adopt a long-term perspective in its strategic decisions for the company (Schulze, Lubatkin, Dino, & Buchholtz, 2001). Both agency theory and stewardship theory assume a positive relationship between family domination and performance (Miller & Le Breton-Miller, 2006).

However, family firms present considerable complexity, and thus Pindado and Requejo (2015), in a review of 350 empirical studies of family-firms, observed no clear consensus on whether family ownership was beneficial or detrimental to firm performance. This is a topic of great interest, especially regarding FBGs with companies from different countries, as research findings are scarce in this respect. The existence of partners of different nationalities within FBGs means that the ownership structure adopted is of fundamental importance (Delios & Beamish, 1999). The proportion of capital held by each partner reflects its ability to influence decision-making and company management (De Miguel, Pindado, & De la Torre, 2004; Thomsen, Pedersen, & Kvist, 2006). A higher concentration of ownership may provide benefits, in the sense that decision-making can be controlled (Geringer & Hebert, 1989), that partners’ roles and responsibilities can be assigned, and that agency conflicts motivated by opportunistic behaviour can be prevented (Chen, Chen, & Chung, 2006). In short, through greater control, performance can be enhanced (Perrini, Rossi, & Rovetta, 2008).

In any company, governance structures are a determining factor in value creation, which is affected in particular ways when the firm's owners are family members (Kammerlander, Sieger, Voordeckers, & Zellweger, 2015; Sitthipongpanich & Polsiri, 2015). Specifically, family members may fear that the internationalisation of the company will provoke ownership and management changes that reduce their decision-making power and restrict their ability to achieve their business goals. One such goal is that of long-term continuity, as one of the main priorities of family firms is to maintain their legacy for later generations (Sund, Melin, & Haag, 2015). Therefore, if there is a higher percentage of ownership in the FBG by the Spanish family business, this will enhance the performance of the business relationship, by enabling the family to retain control of the new company. Therefore, we propose the following hypothesis:

Hypothesis 1: A higher percentage of FBG ownership by a Spanish family firm is related to better business performance.

Aspects such as the characteristics and actions of the management team are very important to the performance of this business association. The presence of family members in management positions and on the board is considered positive for the company (Binacci et al., 2016). However, when there are both family and non-family members, discrepancies may arise. Differences in family status, social origin, education and previous experience can lead to tensions that impair the integration of management, and produce a negative impact on business performance (Chua, Chrisman, & Sharma, 2003; Minichilli, Corbetta, & MacMillan, 2010).

In addition, family managers often feel more attached to the company and pursue, in addition, socioemotional goals, whereas non-families may be driven by more financial-related outcomes (Berrone et al., 2012; Gomez-Mejia et al., 2007), feeling more strongly that they are part of the business, and less a part of the family system (Eddleston & Kellermanns, 2007).

Therefore, it is important to obtain a deeper understanding of the influence of family and non-family representation at different levels of governance (Binacci et al., 2016; Hoffmann, Philipps, & Stubner, 2016; Sharma, Chrisman, & Gersick, 2012; Stewart & Hitt, 2012; Yu, Lumpkin, Sorenson, & Brigham, 2012). This research gap is especially evident in the case of FBGs, where the management structure is influenced by the existence of partners of different nationalities (Shenkar & Zeira, 1992).

Although a foreign manager (i.e., one from the Spanish company) may contribute new knowledge and experience to the FBG, there are factors that favour the employment of local administrators. In particular, local control helps overcome possible cultural barriers, especially in contexts where they are known to exist (Mohedano-Suanes & Benavides-Espinosa, 2012). Furthermore, local managers have a network of relationships in the country, together with good knowledge of institutions and business practices (Choi & Beamish, 2004).

Family businesses are traditionally viewed as companies with conservative attitudes and a great aversion to risk taking. They are often characterised as organisations that are lacking in openness and professionalisation, and which do not wish to delegate management responsibilities elsewhere (Kuo et al., 2012; Yabushita & Suehiro, 2014). However, Woods, Dalziel, and Barton (2012) observed that the delegation of management tasks to local managers can avoid overloading the responsibilities of family members, or situations such as managers persisting in unsuccessful strategies and attempting to justify previous erroneous decisions. In addition, the need for success in the internationalisation process can facilitate the entry of local managers into the team, thus helping the FBG identify successful strategies and solutions in the context of the emerging country in which it is trading.

Accordingly, we hypothesise that when there is a higher proportion of Moroccan managers in the management team of the FBG, this will increase its performance. Thus, we propose the following hypothesis:

Hypothesis 2: The presence of a higher proportion of Moroccan managers in the FBG is related to better performance.

Organisational culture has been defined as the beliefs, values and assumptions that are shared by members of an organisation (Schein, 1985). It plays a key role in determining work climate, leadership style, strategy formulation and organisational behaviour and processes (Saffold, 1988). It has been observed that the culture permeating an organisation is what makes it different (O’Reilly & Chatman, 1996). In the context of relations between two companies, the choice of a particular organisational culture may influence their basic management practices (Damanpour, Devece, Chen, & Pothukuchi, 2012; Pothukuchi, Damanpour, Choi, Chen, & Park, 2002) and consequently their performance (Vallejo, 2011).

These considerations were underlined by Kandula (2006), who observed that the key to good performance is a strong culture. Accordingly, it is necessary to determine the relationship between components of organisational culture and performance management practices. Moreover, in FBGs, the culture factor has a positive impact. In this sense, the special characteristics of a family firm can be said to depend on its organisational culture, i.e., the reflection of the values and attitudes inherent to the family nature of the business (Fuentes, Vallejo, & Martínez, 2007; Vallejo, 2011).

According to previous research, the organisational culture can be characterised by various independent dimensions (Hofstede, Neuijen, Ohayv, & Sanders, 1990; Pothukuchi et al., 2002). In general, these dimensions are related to firms’ internal organisation, to their management style and to diverse aspects of human resource management, such as how staff hiring is conducted or the degree of involvement by employees in company activity. Taking into account that organisational culture has been identified as one of the essential factors determining company performance (Alas, Kraus, & Niglas, 2009; Vallejo, 2011), the following hypotheses are proposed:

Hypothesis 3a: When a FBG encourages staff involvement, this has a positive effect on its performance.

Hypothesis 3b: When the results of the FBG are its priority goal, this has a positive effect on its performance.

Hypothesis 3c: When the FBG practices selective staff hiring, this has a positive effect on its performance.

Hypothesis 3d: When the FBG centralises its management procedures, this has a positive effect on its performance.

Finally, we consider the extent to which the relations addressed in the above hypotheses would be maintained in the case of business groups constituted by non-family Spanish companies or whether, on the contrary, they would be moderated by the family nature of Spanish companies. Given the importance of family participation within family firms (Chua, Chrisman, & Sharma, 1999) and the general consensus among researchers that family businesses differ from other SMEs, mainly in terms of their intertwining of the family and the business (Chrisman, Chua, & Sharma, 2005; Chrisman et al., 2012; Laforet, 2016), we inquire whether the family-owned nature of a company might moderate the effect exerted by each variable on the group's performance. Accordingly, we propose the following study hypotheses:

Hypothesis 4a: The family nature of the Spanish business plays a moderating role in the relation between ownership and FBG performance.

Hypothesis 4b: The family nature of the Spanish business plays a moderating role in the relation between management and FBG performance.

Hypothesis 4c: The family nature of the Spanish business plays a moderating role in the relationship between organisational culture and FBG performance.

Research methodologyAccording to information provided by the Moroccan Ministry of Foreign Trade (2010), there were currently 812 business groups with Spanish participation in the ownership. However, some of these business groups had ceased trading or their contact details were not available. Accordingly, these groups were eliminated from the study population analysed, which finally contained 771 valid business groups. For this study, conducted in February 2013, a structured questionnaire was sent to the CEOs,1 who were addressed in the assumption that they would be able to provide a reliable view of the position of the company (Ghobadian and O’Regan 2006). Subsequently, 252 valid survey responses were obtained for this research, a response rate of 32.68%. Of these, 124 were from FBGs, i.e., those of a family-owned Spanish entity, while the remaining 128 questionnaires were answered by the CEOs of non-FBGs, i.e. those whose Spanish entity was not family-owned. The analysis made, therefore, is cross-sectional.

In this paper, by ‘family owned’, we refer to a company in which the family has strategic control over its resources and business processes (Barbera & Moores, 2013), through its management of the major activities of the company, such as operational policies, investment and financing decisions and senior management appointments. In order to identify the FBG whose Spanish entity was family-owned, a question to this effect was included in the questionnaire.

In addition, 31 respondents who had declined to answer the full questionnaire did agree to respond to selected questions. We compared the differences between the means of the main sample for these items and those corresponding to the respondents who answered only a selection of the questions, and found that the differences were not statistically significant. Therefore, the non-response bias in this survey is not considered a serious problem that would affect the conclusions drawn.

As indicated above, the questionnaires were sent to the CEOs. As these CEOs could come from either the Spanish or the Moroccan partner, it was necessary to test for possible bias, due to the country of origin of the CEO, in the answers to the issues raised. Application of the Mann–Whitney U test showed that there were no significant differences in the responses made.

VariablesPerformanceMost studies of large companies have focused on objective measures of financial performance, such as profitability, growth and costs (Damanpour et al., 2012; Geringer & Hebert, 1991). Return on Assets (ROA) is the most commonly used variable in the context of family firms (Basco, 2013; Mazzi, 2011). Previous studies have concluded that the performance of family business is best measured according to ROA (Wagner, Block, Miller, Schwens, & Xi, 2015) because this parameter is less influenced than alternative measures by the firm's financial structure. In institutional contexts such as those of emerging countries (as is the case of Morocco), in which there is generally no legal obligation to disclose financial information, this magnitude is difficult to obtain. Therefore, to calculate this variable, the questionnaire inquired about the result of the financial year and the value of the assets. From these data, the ROA for each business group was calculated.

OwnershipThis variable was measured according to the percentage of ownership by the Spanish family firm in the business group.

Moroccan managementThe management structure was determined by the percentage of Moroccan managers in the top management team in the business group.

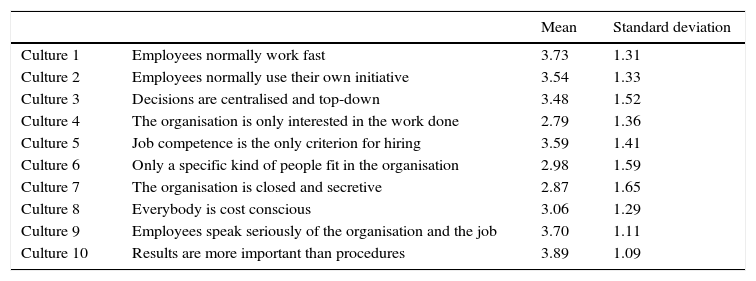

Organisational cultureTo determine the organisational culture of these business groups, we used a scale similar to those employed in previous studies (Hofstede et al., 1990; Pothukuchi et al., 2002) (Table 1), with questionnaire items measured on a 5-point Likert scale, where 1 means total disagreement and 5 means total agreement with the statement offered.

Organisational culture: items initially considered.

| Mean | Standard deviation | ||

|---|---|---|---|

| Culture 1 | Employees normally work fast | 3.73 | 1.31 |

| Culture 2 | Employees normally use their own initiative | 3.54 | 1.33 |

| Culture 3 | Decisions are centralised and top-down | 3.48 | 1.52 |

| Culture 4 | The organisation is only interested in the work done | 2.79 | 1.36 |

| Culture 5 | Job competence is the only criterion for hiring | 3.59 | 1.41 |

| Culture 6 | Only a specific kind of people fit in the organisation | 2.98 | 1.59 |

| Culture 7 | The organisation is closed and secretive | 2.87 | 1.65 |

| Culture 8 | Everybody is cost conscious | 3.06 | 1.29 |

| Culture 9 | Employees speak seriously of the organisation and the job | 3.70 | 1.11 |

| Culture 10 | Results are more important than procedures | 3.89 | 1.09 |

Exploratory factor analysis was applied to the questions relating to organisational culture, using principal component analysis with varimax rotation. The Bartlett sphericity test produced a significance level of 0.000 and the Kaiser–Meyer–Olkin index was 0.662 for FBGS (the corresponding values were 0.000 and 0.608 for non-FBG), greater than 0.5, which confirmed the existence of a correlation between the original variables. Thus, we presumed the existence of an underlying structure and, consequently, that multivariate analysis could be applied.

Four components were found to have an eigenvalue greater than one, with the cumulative variance reaching almost 69% for FBGs (77% for non-FBG). Observation of the factor loading matrix confirmed the existence of four cultural dimensions within both FBGs and non-FBGs.

The first factor, identified as ‘Staff involvement’, was positively correlated with four variables, which from different perspectives measure the involvement of employees with the firm. A firm in which the workforce is involved is one in which employees take initiatives, are aware of the costs faced by the firm, speak seriously of the organisation and work fast.

The second factor, ‘Interest in results or in procedures’, was positively correlated with three variables concerning the orientation of the organisational management: when results are judged to be more important than the procedures employed, when the organisation is closed and secretive and when managers are only interested in the work carried out.

The third factor, identified as ‘Selective or arbitrary hiring’, was positively correlated with two variables: the type of people who adapt well to the organisation and the recruitment criteria applied. Selective hiring would refer to an organisation where only a particular class of person would fit in well, and where recruitment is conducted on the basis of workers’ competence.

The fourth factor, ‘Centralised or decentralised decision taking’ was positively correlated with the variable concerning decision-making. When decisions are mainly taken by the managers, the process is said to be centralised.

Finally, Cronbach's alpha was used to assess the internal consistency of the factors obtained. The values obtained for the FBGs were 0.754, 0.788, 0.725 and 1 (as there is just one item in the fourth factor, there is total consistency in this respect). For the non-FBG, the corresponding values were 0.837, 0.793, 0.876 and 1 (as there is just one item in the fourth factor, there is total consistency). Since all of these values exceed 0.7, they can be considered acceptable, according to George and Mallery (2003).

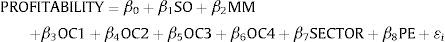

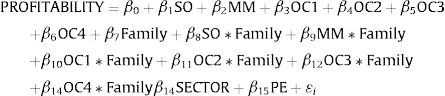

Statistical analysisThe hypotheses were tested by linear regression, by which the relationship can be modelled between a dependent variable and one or more explanatory variables (or independent variables). Specifically, to test hypotheses H1, H2, and H3 the following linear regression model (model 1) is proposed:

Model 2 tests the moderating effect of the family nature of the Spanish company on the relationships presented in model 1 (hypotheses H4a, H4b, H4c), as follows:

where SO, Spanish ownership; MM, Moroccan management; OC1, staff involvement; OC2, interest in results or in procedures; OC3, selective or arbitrary hiring; OC4, centralised or decentralised decisions; PE, previous experience; ¿i, non-observable random error associated with each observation of the dependent variable (profitability).The analysis also includes two control variables: sector and previous experience. The sector variable was measured via a discrete variable determined by 2-digit SIC codes. This classification is a standard approach in the literature (Amor-Tapia & Tascón-Fernández, 2014). Previous experience (PE) was measured by a dichotomous variable that took the value 1 if the partners had participated in a business group previously, and the value 0 otherwise (Chen, Park, & Newburry, 2009; Teng and Das, 2008).

Model 1 was applied to the sample composed of 124 FBGs. Model 2 was tested by including both the FBGs and the non-FBGs.

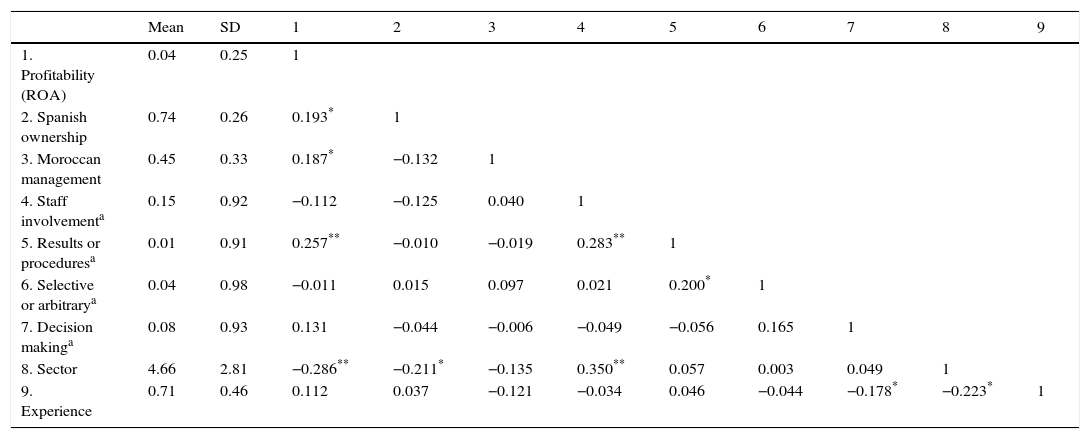

Results and discussionTable 2 shows the descriptive statistics and the correlations obtained between the FBG variables.

Descriptive statistics and correlation matrix.

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Profitability (ROA) | 0.04 | 0.25 | 1 | ||||||||

| 2. Spanish ownership | 0.74 | 0.26 | 0.193* | 1 | |||||||

| 3. Moroccan management | 0.45 | 0.33 | 0.187* | −0.132 | 1 | ||||||

| 4. Staff involvementa | 0.15 | 0.92 | −0.112 | −0.125 | 0.040 | 1 | |||||

| 5. Results or proceduresa | 0.01 | 0.91 | 0.257** | −0.010 | −0.019 | 0.283** | 1 | ||||

| 6. Selective or arbitrarya | 0.04 | 0.98 | −0.011 | 0.015 | 0.097 | 0.021 | 0.200* | 1 | |||

| 7. Decision makinga | 0.08 | 0.93 | 0.131 | −0.044 | −0.006 | −0.049 | −0.056 | 0.165 | 1 | ||

| 8. Sector | 4.66 | 2.81 | −0.286** | −0.211* | −0.135 | 0.350** | 0.057 | 0.003 | 0.049 | 1 | |

| 9. Experience | 0.71 | 0.46 | 0.112 | 0.037 | −0.121 | −0.034 | 0.046 | −0.044 | −0.178* | −0.223* | 1 |

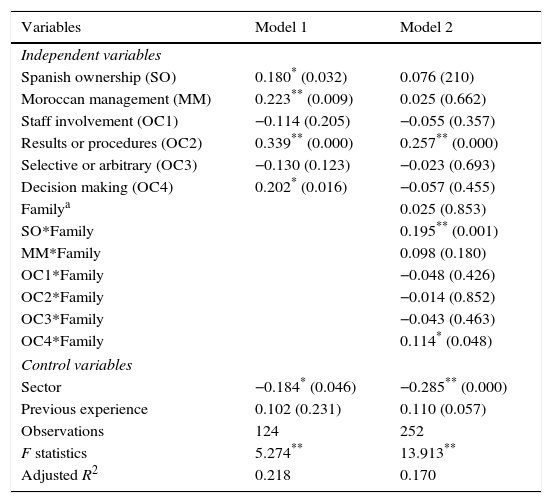

Table 3 shows the results obtained for models 1 and 2. To assess the degree of multicollinearity, we analysed the variance inflation factor (VIF) for all the variables in each model and no problem in this respect was observed. In both models, all VIF values were below the recommended threshold of 5 (Hair, Anderson, Tatham, & Black, 2006). A confirmatory factor analysis was performed. This analysis showed that there was no common latent factor that would determine shared common variance (Podsakoff, MacKenzie, & Podsakoff, 2012), and therefore this study presented no severe threat of common method bias.

Results of regression analysis.

| Variables | Model 1 | Model 2 |

|---|---|---|

| Independent variables | ||

| Spanish ownership (SO) | 0.180* (0.032) | 0.076 (210) |

| Moroccan management (MM) | 0.223** (0.009) | 0.025 (0.662) |

| Staff involvement (OC1) | −0.114 (0.205) | −0.055 (0.357) |

| Results or procedures (OC2) | 0.339** (0.000) | 0.257** (0.000) |

| Selective or arbitrary (OC3) | −0.130 (0.123) | −0.023 (0.693) |

| Decision making (OC4) | 0.202* (0.016) | −0.057 (0.455) |

| Familya | 0.025 (0.853) | |

| SO*Family | 0.195** (0.001) | |

| MM*Family | 0.098 (0.180) | |

| OC1*Family | −0.048 (0.426) | |

| OC2*Family | −0.014 (0.852) | |

| OC3*Family | −0.043 (0.463) | |

| OC4*Family | 0.114* (0.048) | |

| Control variables | ||

| Sector | −0.184* (0.046) | −0.285** (0.000) |

| Previous experience | 0.102 (0.231) | 0.110 (0.057) |

| Observations | 124 | 252 |

| F statistics | 5.274** | 13.913** |

| Adjusted R2 | 0.218 | 0.170 |

FBG: Profitability was found to be positively affected, at a statistical significance of 5%, by the percentage of capital held by the Spanish family business, and therefore Hypothesis H1 is accepted. In line with the findings of previous research regarding family firms (Miller & Le Breton-Miller, 2007; Sciascia & Mazzola, 2008; Villalonga & Amit, 2006), we show for FBGs that the level of family participation influences business performance, and specifically that the FBG perceives greater profitability when the Spanish family business holds a higher proportion of the capital.

The percentage of Moroccan managers is statistically significant at 1%, with a positive sign. Thus, FBG profitability is greater when a larger number of Moroccan managers are included in the top management team. Therefore, Hypothesis H2 is accepted. This finding, in line with previous studies (Mohedano-Suanes & Benavides-Espinosa, 2012), might mean that the delegation of management responsibilities to the local partner avoids excessively loading the burden of responsibility onto family members (Woods et al., 2012). Furthermore, local managers have a better understanding of the institutions and the market in which the firm conducts its business activities, and also possess a network of relationships within the country (Choi & Beamish, 2004; Scarlata, Zacharakis, & Walske, 2016), which could help the business group overcome cultural barriers. Therefore, aspects related to the functional background diversity of non-family managers, as well as their knowledge and skills in the industry, are relevant to the performance of family companies (Binacci et al., 2016; Scarlata et al., 2016), and our results show that they can also influence the performance of the FBG.

The results obtained show that FBG profitability depends positively on two of the dimensions that characterise organisational culture, namely OC2 “Interest in results or in procedures” (significant at 1%) and OC4 “Centralised or decentralised decisions” (significant at 5%). FBG profitability is greater when management is results oriented and decision taking is centralised, and therefore hypotheses H3b and H3d are accepted. In this regard, it is important to take into account that Morocco presents certain characteristic management values (Forster & Fenwick, 2015), such as strong hierarchic patterns and performance-oriented procedures (House, Hanges, Javidan, Dorfman, & Gupta, 2004), and that group achievements are valued more highly than are those by individuals (Hofstede, 2001; House et al., 2004). In a related field, the GLOBE study (House et al., 2004) reported that Morocco scores comparatively poorly for gender egalitarianism, uncertainty avoidance and future orientation. This study also shows that Morocco achieves intermediate scores for performance orientation and human resource orientation. Finally, the GLOBE study scores Morocco highly on assertiveness.

Focusing management efforts on results may reduce conflicts within the organisation and thus contribute to improving its performance. In this respect, Fekete and Böcskei (2011) concluded that the presence of a results-oriented market culture will have a positive effect on the firm's performance.

Moreover, a more centralised decision making process will enable decisions to be taken more quickly, and this is consistent with the flexibility and speed in decision making that is characteristic of family firms (Poza, Alfred, & Maheshwari, 1997; Tsang, 2002). In addition, the way in which decisions are taken will affect the level of FBG profitability. Previous studies have shown that decision taking in family firms is usually centralised, a factor that poses an obstacle to their internationalisation (Fernández & Nieto, 2006). However, the present study reveals that once a FBG has been created, profitability is enhanced as a result of the more centralised decision-taking that is introduced, and thus the original nature of the family firm is maintained. The family nature of the Spanish company acts as a moderating factor in this relationship, thus strengthening the association between centralised decision-making and FBG profitability.

The remaining cultural factors (OC1 “Staff involved or not involved” and OC3 “Selective or arbitrary hiring”) do not present a statistically significant relationship with the profitability. Therefore, hypotheses H3a and H3c are not accepted.

Regarding the control variables, the industry variable is significant at 5%, which leads us to conclude that the sector in which the family firm operates affects the level of profitability. However, FBG profitability is not significantly influenced by previous participation or otherwise in a business group. This finding may be due, to a certain extent, to the fact that the question regarding this variable inquired about previous participation in a business group, without specifying whether this was in Morocco or elsewhere. Given the specific characteristics of this country, prior experience in this context could be particularly relevant. In addition, previous studies have shown that it is important that previous experience should have been with the same business partner (Rahman & Korn, 2010). Therefore, further research is needed to clarify the role played by this variable.

With respect to the moderating effect of the family nature of the Spanish parent company, the results for model 2 show that there exists a significant effect on the relationship between profitability and ownership, and between profitability and cultural factor OC4.

When the parent Spanish company is family owned, there is a stronger relation between the degree of ownership held by the Spanish company and FBG profitability, thus confirming hypothesis H4a. This may be due to the fact that, although, in general, the degree of participation by each partner in the business capital is an important factor in its control (Geringer & Hebert, 1989), in family businesses this aspect is of particular significance, especially when they internationalise towards emerging economies (Choi, Zahra, Yoshikawa, & Han, 2015). In this respect, a majority owner will be able to influence decision-taking and overall management of the organisation (De Miguel et al., 2004; Thomsen et al., 2006), thus heading off potential conflicts and preventing opportunistic behaviour (Chen et al., 2006), reducing agency conflicts and enhancing the possibility of achieving the goals that characterise traditional family businesses, one of which is its long-term continuity.

In relation to management, and contrary to initial expectations, the family nature of the company does not moderate the relation between the composition of the management team and the performance of the FBG, and therefore Hypothesis 4b is rejected. This finding might reflect the fact that while in general the delegation of management tasks to the local partner relieves family members of responsibility (Woods et al., 2012), as the organisations in question are newly created, within developing countries, the fact that local managers may persist in conducting actions that have proved unsuccessful in the past, seeking to justify these actions, could escape the notice of the parent company managers. Therefore, there would be no incentive to strengthen the presence of foreign managers in order to prevent such a situation.

Finally, the centralisation of decision taking affects the performance of the business group differently, depending on whether the Spanish parent company is family owned or not. However, this moderating effect is only apparent for one of the four dimensions of organisational culture analysed, and therefore hypothesis H4c is only partially accepted.

ConclusionsOne of the means by which family businesses can be internationalised is through the creation of business groups. The question of profitability with a newly-created business group can be crucial to the survival and development of these relations and, consequently, to the success of the internationalisation of a family business. When a family business located in a developed country decides to internationalise into an emerging economy through the creation of a FBG, a situation is created in which there is a new company, with partners of different nationalities and with different cultural backgrounds and management characteristics.

This paper, focused on FBGs created between Spanish and Moroccan companies, highlights the importance of ownership, management and organisational culture in the profitability. Furthermore, the family nature of Spanish businesses moderates the relationship between business group profitability and ownership and with the degree of centralisation of decision taking.

The model presented offers a useful tool to obtain more detailed knowledge of how a FBG is managed. Specifically, it can help owners, family members and professionals recognise the extent to which family participation in the business group may enhance its results, depending on the family's impact on company decision-making and on the organisational culture created in the business group. Knowledge of the factors affecting the performance of FBGs could help owners and managers, enabling them to better understand the company's organisation and management, and to focus on the characteristics requiring particular attention in order to improve performance. This question is highly relevant, as growing numbers of companies are becoming internationalised through the creation of FBGs with firms in emerging markets, which are expected to play a prominent role in driving the global economy (Bhaumik et al., 2010).

This study contributes in general to our understanding of the internationalisation of family businesses in the Spanish-Moroccan context, but in particular the conclusions drawn may help clarify the business relations that arise between developed countries and countries with emerging economies in North Africa and in other Arab countries which share cultural characteristics similar to those of Morocco. The findings reported are important in commercial and academic spheres. Given the special characteristics and needs of family firms, those responsible for public policy should pay special attention to these business structures, and consider facilitating their internationalisation through the creation of FBGs with companies in other countries. This could be achieved by fostering collaboration between the CEOs of different companies to exchange information and strengthen ties for future business groups.

This study presents certain limitations. The results, based on survey data, necessarily contain an element of subjectivity. However, this limitation has been addressed as far as possible through the use of generally accepted statistical tests, to maximise reliability. Moreover, our analysis is limited to a specific context, which makes it easier to obtain homogeneous data, but may restrict the generalisation of the results obtained. However, a certain heterogeneity has been observed regarding family firms, and so it would be useful to study the formation of groups within these organisations (Holt et al., 2017; Jaskiewicz & Dyer, 2017). Another valuable area for investigation would be to consider the relationship between business performance and variables such as company size, age, level of indebtedness, dispersion of property and generation.

Finally, taking into account that the creation of business groups represents an increasingly common means of enabling a firm to enter markets in emerging countries, we believe further research is necessary to study other aspects, such as socioemotional wealth, that may impact on the achievement or otherwise of the goals established.

Conflict of interestThe authors declare no conflict of interest.

This study was funded by the Spanish Agency for International Development, in its Programme for Inter-University Cooperation and Scientific Research between Spain and Algeria, Egypt, Jordan, Morocco and Tunisia (PCI-Mediterranean), Project No. A/021477/08. Another participant in this project was Houda Benghazi-Akhlaki, who was responsible for the translation of the questionnaire into Arabic and for establishing direct contacts with the groups of companies.