We study the role of directors appointed by banks and those appointed by investment funds in the informativeness of accounting earnings in a low investor protection environment with a high presence of institutional directors. Results suggest that the monitoring role of directors appointed by banks and funds improves investor protection and increases market confidence in accounting information. The paper has interesting academic and policy implications for the debate on the proper degree of institutional involvement in corporate governance, noting that when analyzing the role of institutional investors, researchers must take into account investors’ participation in other mechanisms of corporate control such as the board of directors. We contribute to the literature by showing that, in a weak regulatory and low investor protection environment, one of the ways in which institutional investors play a monitoring role is through influencing earnings quality when they are both shareholders and board members.

Estudiamos el papel de los consejeros que representan a las entidades bancarias y los fondos de inversión en la capacidad informativa de los resultados contables en un entorno con una baja protección de los inversores y con una alta presencia de consejeros institucionales. Los resultados sugieren que el control ejercido por los consejeros que representan los intereses de las entidades bancarias y de los fondos de inversión mejora la protección de los inversores e incrementa la credibilidad de la información contable divulgada. El artículo posee interesantes implicaciones políticas y académicas en el contexto del debate relativo al nivel de implicación de los inversores institucionales en el gobierno corporativo, apuntando la necesidad de que los investigadores tomen en consideración el papel de los inversores institucionales en otros mecanismos de control corporativo, como es el consejo de administración. Contribuimos a la bibliografía mostrando que, en un entorno de débil protección de los accionistas, una de las formas a través de las cuales los inversores institucionales desempeñan un papel de control es mediante su influencia en la calidad de la información contable cuando son, al mismo tiempo, consejeros y accionistas de la empresa.

Boards of directors can play a significant role in controlling agency problems. From an agency perspective, the ability of the board to act as an effective monitoring mechanism depends on its independence of management (Beasley, 1996). Independent directors do not appear to be really efficient in Communitarian countries, however, and some authors highlight that the supervising role in these environments is not played by independent directors, as UK-and US-based research suggests, but by directors appointed by institutional investors (García-Osma & Gill de Albornoz-Noguer, 2007; López-iturriaga, García-Meca & Tejerina-Gaite 2015; Sánchez-Ballesta & García-Meca, 2007).

The presence of directors appointed by institutional investors (we call them institutional directors) on the board is increasing across all OECD countries, and accordingly, institutions are becoming more influential in the corporate governance of bank-dominated countries. Although prior research has provided significant insights into the relationship between institutional investors and reporting quality (Ahmed, Hossain, & Adams, 2006; Bona-Sánchez et al., 2013; Chung, Firth, & Kim, 2002; Lobo & Yang, 2001; Siregar & Utama, 2008), the available evidence is mixed and has failed to consider the role of these shareholders as directors. Nevertheless, directors representing institutional investors make up an important part of the boards in some European countries. Thus, according to (Struggles, 2011), directors appointed by institutional investors account for 40% of directorships in Spain, 22% in France and 13% in Italy. In contrast, they only account for 2% of British firms’ directorships. As this report shows, the presence of institutional directors is also highly different among continental countries, as characterized by the importance of financial intermediaries as resource providers, high ownership concentration and banks as relevant shareholders (e.g., the proportion of institutional directors in German boards is only 8%). Unlike the Anglo-Saxon environment, the role exercised by institutional investors when they are board members enables them to be part of the internal decision-making process (e.g., Weinstein & Yafeh, 1998). Because its institutional investors are simultaneously core shareholders and highly represented directors, Spain represents a unique scenario to analyze how the presence of institutional directors on the board affects the quality of reported earnings. Therefore, we analyze the role of institutional directors in the informativeness of accounting earnings in a sample of Spanish listed firms between 2004 and 2010. In addition, although agency theory has dominated research about board of directors, we use other theoretical approaches such as resource theory, stewardship theory, and resource dependency theory to provide insights regarding the role of institutional directors.

No previous study has considered how directors appointed by institutional investors affect the properties of accounting earnings in a low investor protection environment with a high presence of institutional directors. Therefore, our paper seeks to fill this gap in the literature by studying the influence of directors appointed by different types of institutional investors on earnings informativeness. Accordingly, we make a distinction between directors appointed by banks and those appointed by investment funds. We think that they may have differences in their incentives and an ability to monitor managers and alleviate asymmetric information problems, and that these differences may have an effect on the properties of accounting earnings.

In this respect, institutional investors should not be considered as a homogeneous group, because they can have different levels of influence and ability to exercise control in corporate decision making (Almazan, Hartzell, & Starks, 2005; Chen, Elder, & Hsieh, 2007; López-iturriaga et al., 2016). According to the literature, depending on their investment horizons and business ties, institutional investors can either encourage short-term managerial behavior (Bhide, 1993; Froot, Scharfstein, & Stein, 1992) or actively monitor firms, thus constraining managerial discretion (Bushee, 1998). The literature also underlines that some institutional investors choose to monitor firms and exert influence on managers, whereas others focus on information gathering and short-term trading profits (Elyasiani, Jia, & Mao, 2010).

The results in this paper suggest that directors appointed by banks and funds improve investor protection and increase market confidence in accounting information.

Our study contributes to the literature on the effect of board composition on earnings quality in several ways. First, we provide evidence of the link between directors appointed by institutional investors and earnings quality in a way that is difficult to capture in the US or UK context, where this type of director is less prevalent. The higher number of institutional directors in countries as Spain allows us to examine their effects on financial and economic variables and even to study differences between them according to their objectives. Second, the results do not support differences between both types of directors regarding objectives, stability, scrutiny and visibility, suggesting that in institutionally controlled firms both types of directors representing banks and funds improve earnings quality. Overall, our results confirm that board characteristics have an important influence on earnings informativeness, and cover a relevant research question, due to the lack of previous evidence and the important role of institutional investors in Spanish boards. The findings also support the importance of the monitoring function of non-executive directors on the board, with no distinctions.

Institutional settingSpain is a civil-law country with a bank-oriented financial system in which banks play an active role regarding the markets. Spanish companies are characterized by a one-tier board system, where there is a distinction between three main categories of directors: internal directors (executive) and external directors (institutional and independent). These institutional directors (called consejeros dominicales) represent a significant proportion of the board and are usually large banks and investment funds (Heidrick & Struggles, 2011). Therefore, in Spain there are controlling shareholders who usually sit on boards to represent the interests of institutional investors and who have an important role as controlling shareholders, members of their boards and creditors. The high proportion of these institutional directors on boards, explained by the high ownership concentration of Spanish firms, favors a sense of board stability that gives institutional directors large opportunities to engage in financial decisions (Elyasiani et al., 2010). Additionally, these directors play an outstanding role and maintain close ties with the governance of non-financial firms, maintaining frequent involvement in management decisions (Bona et al., 2013).

As in other Continental European countries, these controlling shareholders mitigate the conflict between management and minority shareholders, but lead to other conflicts between controlling shareholders and minority shareholders. This is due to large controlling shareholders frequently own substantially more control rights than cash flow rights, what gives them a high expropriation potential (López Iturriaga and Tejerina Gaite, 2014).

In Spain there are several codes of Corporate Governance that recommend the compliance of corporate governance regulations. The first official Code of Good Governance (the Olivencia Code) was issued in Spain in 1998. After the Aldama report (2002), in 2006 the Unified Code of Corporate Governance (CUBG, 2006) was issued, whose main purpose was to improve business management and return transparency to the Spanish system. This code was confined to companies whose shares are traded on the Stock Exchanges, and under the “comply or explain” principle, these companies had to state their degree of compliance with the Code's 58 recommendations, indicating whether they comply or not with them. Recently, in 2015, the Good Governance Code was issued and introduced several improvements, especially regarding new recommendations concerning corporate social responsibility issues and more transparency regarding board compensation.

Background and hypotheses developmentThe effect of the board composition on the properties of accounting earnings has been considered extensively in previous literature because corporate boards are responsible for monitoring the information contained in financial reports (Beasley, 1996). Fama and Jensen (1983) highlight the importance of board members in carrying out the board's decision control function. Thus, as earnings management misleads investors by giving them false information about a firm's true operating performance, boards may have a role in improving earnings informativeness.

In an effort to enhance the effectiveness of the board, there is a tendency to require the presence of a majority of outside directors (Park & Shin, 2004). By being independent of management's influence, outside directors are thought to be in a better position than insiders to protect shareholder interests from managerial opportunism. According to Peasnell, Pope, and Young (2005) the likelihood of managers’ making income-increasing abnormal accruals to avoid reporting losses and earnings reductions is negatively related to the proportion of outsiders on the board. Similarly, as Cravens and Wallace (2001) argue, financial statement fraud is less likely to appear in firms with outside dominated boards.

Monks and Minow (2011), however, argue that directors become effective not only because they have no economic ties to the company beyond their job as directors but also because they are significant shareholders. In this sense, when directors have a significant interest in the company that they serve, directors’ self-interests and the best interest of the company become inextricably intertwined. According to this perspective, outside directors may become effective monitors only if they have proper incentives. Outside directors are thus likely to be uninterested directors in those countries where they have only token ownership interest, if any, in the firms that they serve. Supporting this view, for a sample of Spanish quoted companies from 1999 to 2001, García-Osma and Gill de Albornoz-Noguer (2007) show that the main role in constraining earnings management practices is played by institutions and not by independent directors. According to Sánchez-Ballesta and García-Meca (2007), this is probably due to the greater presence of controlling shareholders and as well as the lack of a proper measure of board independence, especially in Communitarian studies, where there are many fears that board members are not independent of those who nominate them.

According to the stewardship theory, directors representing institutional investors may behave as good stewards due to their large stakes and the need to protect the interest of the investors they represent. Because the main interest of directors appointed by institutional investors is to create the maximum level of return for their beneficiaries, appointed institutional directors may seek to extend their influence to the decision-making board committees, given that increased share value resulting from direct supervision can compensate for any supervisory costs that may be directly incurred. Supporting this view, some papers have found a significant effect of institutional directors on reducing leverage and retributions (López-iturriaga et al., 2015) and on improving audit opinions (Pucheta-Martinez & Garcia-Meca, 2014). Therefore, if earnings informativeness provides governance benefits, these directors are more likely to understand and value such benefits and, as a result, demand higher earnings quality from managers.

On the other hand, institutional investors on boards may be interested in less informative earnings in order to expropriate minority shareholders. This expropriation is one of the main concerns in the governance of Spanish firms, since controlling shareholders possess significant voting rights. These institutional directors may also influence managers to provide lower quality accounting information to the market in order to protect them from competitors and from the scrutiny of minority shareholders.

In summary, we predict a positive relationship between directors appointed by institutional investors and earnings informativeness. This leads us to our first unsigned assumption:H1 There is a positive effect of institutional directors on earnings informativeness.

In spite of their influence, however, not all institutional directors are equally willing or able to serve their function. Some prior studies note that blockholding levels, investment strategies and investment durations are found to be valid driving forces for the constraint of accruals management by institutional investors (Wang, 2014). Therefore, differences among institutional investors are not only legal or regulatory but also vary in terms of investment strategy and their incentives and resources to gather information and engage in corporate governance (Bennett, Sias, & Starks, 2003). As a result, various authors note that the presence or absence of business relationships can condition the institutional investor's levels of influence. Almazán et al. (2005), Brickley, Lease, and Smith (1988), Bushee (1998), Ferreira and Matos (2008), Hartzell and Starks (2003), and Ramalingegowda and Yu (2012) have shown that certain, but not all, types of institutional investors exert influence on antitakeover amendments, R&D investment decisions, CEO compensation, profitability, and earnings conservatism. López-Iturriaga et al. (2015) also show that institutional directors have a variety of incentives to engage in corporate governance, noting different effects on the cost of debt depending on the type of institutional director.

Consistent with this heterogeneity across institutional investors, we distinguish between directors appointed by banks and directors appointed by investment funds.1

The influence of institutional directors on earnings quality can be viewed from different theories. According to the resource-dependence theory, institutional directors representing banks may be more interested in improving earnings informativeness in order to give the firm easier access to financial resources. From the stewardship perspective, these banks on boards can also bring experience and skills that improve the quality of financial statements due to their benefits in the strategic course of the company (García-Meca, López-Iturriaga & Tejerina-Gaite, 2015). Additionally, and consistent with the agency theory, institutional directors representing banks may monitor managerial behavior to lower the risk faced by lenders (Cabedo & Beltrán, 2016). In this line, Fama (1985) suggests that banks’ monitoring costs can be lower than the monitoring costs of the other intermediaries (e.g., fund investment companies). According to Cau and Stacchini (2010), sitting on a firm's board is also an obvious way for a lender to screen borrowers, observe the outcomes of financed projects and discourage their potential opportunistic behaviors. Consistent with this view, Hadlock and James (2002) report that long-term relationships between banks and nonfinancial firms reduce asymmetric information and allow banks to control firms’ investment decisions. Thus, they diminish adverse selection and moral hazard problems. Similarly, Ramalingegowda and Yu (2012), note that the institutions that have long investment horizons and independence from management are most likely to monitor managers, finding a positive relationship with conservative financial reporting. Koh (2003) also found a negative relationship between long-term oriented investors and earnings management, i.e., large long-term oriented investors monitor management and, in this way, limit earnings manipulation. Similarly, Bona-Sánchez et al. (2013) note that when a bank is the firm's dominant owner, increasing the ownership stake beyond the minimum level needed for effective control provides an alignment of interest between the bank and minority shareholders, which positively affects earnings informativeness.

On the other hand, directors appointed by investment funds represent institutional investors that only maintain an investment relationship with firms whose shares they own (García-Meca et al., 2015). Their position in the firm is more independent, and therefore, they could be less interested than banks that actively engage in corporate governance. Bushee (1998) finds that transient institutional investors overweight near-term earnings while underweighting long-run value, and so induce mispricing. The excessive focus on current earnings by such institutional investors creates incentives for earnings management (e.g., Graves & Waddock, 1990) that may decrease earnings informativeness (e.g., Bona-Sánchez et al., 2013). Thus, we pose the following hypothesis:H2a Directors appointed by banks have a positive influence on earnings informativeness. Directors appointed by investment funds have a negative influence on earnings informativeness.

The initial sample comprises all non-financial firms listed on the Spanish stock exchange at the end of 2010 (105 firms). The exclusion of the firms that do not have full accounting data in the Osiris database reduces our sample to 90 firms. We also apply the method developed by Hadi (1992) to eliminate outliers, which represent 8% of the sample. As a result, we obtain an unbalanced panel of 454 firm-year observations over the 2004 to 2010 period. Our sample period starts in 2004, one year after a law designed to increase the transparency of financial reporting was passed. This law requires that Spanish listed firms provide, among other things, information on the members of the board in their annual corporate governance reports.

Variables and modelsAccording to Scott (1997) “the information content of reported net income can be measured by the extent of security price change or, equivalently, by the size of the abnormal market returns, around the time the market learns the current net income” (p. 117). Following this argument, Petra (2007) posits that investors who find earnings informative are likely to revise their beliefs about future returns, affecting to investor's buying and selling decisions. In this context, previous literature about earnings quality and corporate governance measure the informativeness of accounting earnings by examining the earnings response coefficient (ERC) from a regression of cumulative abnormal stock returns (CAR) on net income (e.g., Ahmed et al., 2006; Fan & Wong, 2002; Francis, Schipper, & Vincent, 2005; Imhoff & Lobo, 1992; Teoh & Wong, 1993; Warfield et al., 1995; Yeo, Tan, Ho, & Chen, 2002):

where CARit is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period ending three months following the end of the fiscal year; NIit is net earnings in year t divided by the market value of equity at the beginning of year t; ¿it is the error term for firm i in year t.We expect a positive and significant coefficient on χ1, suggesting that earnings have an information role; that is, the stock market incorporates earnings credibility into the price formation process.

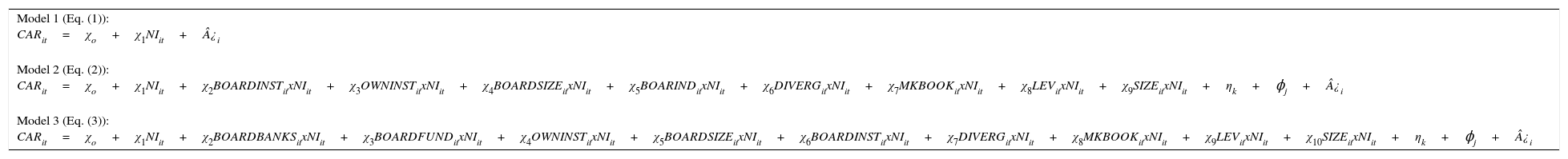

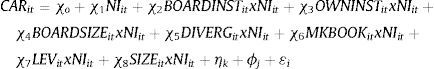

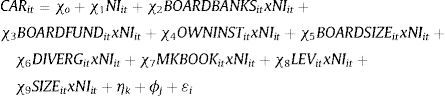

To analyze the effect of our hypotheses on earnings informativeness, we expand the ERC model in Eq. (1) by including interactions between our variables and NIit in Eqs. (2) and (3):

In Eq. (2), BOARDINSTit is the percentage of institutional members on the board of directors, measured as institutional members divided by total members on the board. The variable OWNINSTit is the percentage of ownership (ownership concentration) in the hands of institutional owners; BOARDSIZEit is the size of the board, measured as the natural logarithm of the members on the board; DIVERGit measures the degree of divergence between the dominant owner's voting and cash flow rights as previous studies have shown that divergence affects earnings informativeness (e.g., Bona-Sánchez et al., 2013; Fan & Wong, 2002; Francis et al., 2005; Lee, 2007; Martín, Sánchez, & Alemán, 2007). To identify a firm's dominant owner and measure its voting and cash flow rights, we follow La Porta, Lopez-de-Silanes, and Shleifer (1999) and use the control chain methodology. To control for the effect of other variables that could potentially affect earnings informativeness, we include the value of the equity ratio at the end of the year (MKBOOKit,), measured as the market value divided by the book value of shares; leverage (LEVit), measured as total debt in year t divided by total assets at the beginning of the year t; and size (SIZEit), measured as the natural logarithm of the market value of equity.2 We also include dummy variables φj and ηk to control for industry and year effects, respectively.

In Eq. (3), we separately include BOARDBANKit and BOARDFUNDit instead of BOARDINSTit. The variable BOARDBANKit is the percentage of directors appointed by banks, measured as directors appointed by banking institutions divided by total directors. BOARDFUNDit, is the percentage of directors appointed by mutual funds, measured as directors appointed by mutual funds divided by total directors.

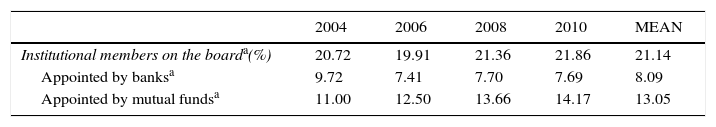

Empirical resultsDescriptive statisticsTable 1 reports the percentage of institutional members on the board in Spanish companies. As we can see, on average, 21.14% of board members are appointed by institutional investors (8.09% by banking institutions and 13.05% by mutual funds). Over the period from 2004 to 2010, we appreciate a scarce increase in the percentage of institutional members on the board, rising from 20.72% in 2004 to 21.14% at the end of 2010. Analyzing the evolution of the different type of directors appointed by institutional investors, we see a decrease in the percentage of directors appointed by banks (from 9.72% in 2004 to 8.09% in 2010) as well as an increase in the percentage of directors appointed by mutual funds (from 11% in 2004 to 13.05%) in 2010.

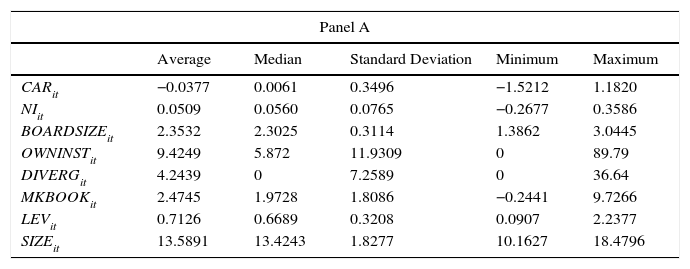

Table 2 (Panel A) presents descriptive statistics for the other variables. The average (median) return (CARit) is −0.0377 (0.0061). The average net income (NIit) is 0.0509 (median 0.0560), while the average (median) divergence between voting and cash flow rights (DIVERGit) is 4.2439%, indicating that the dominant owner possesses, on average, 4.2439% more voting rights than cash flow rights. Table 2 (Panel B) reports correlations among the variables and suggests that multicollinearity does not affect subsequent regressions.3 Nevertheless, we conduct a formal test to ensure that multicollinearity is not present in our regressions. In particular, we calculate the Variance Inflation Factor (VIF) for each independent variable included in the estimated model. The highest VIF for our models is well below 5 (the threshold value indicating that multicollinearity might not be present) (Studenmund, 2006). We therefore conclude that multicollinearity is not a problem in our sample.

Descriptive Statistics.

| Panel A | |||||

|---|---|---|---|---|---|

| Average | Median | Standard Deviation | Minimum | Maximum | |

| CARit | −0.0377 | 0.0061 | 0.3496 | −1.5212 | 1.1820 |

| NIit | 0.0509 | 0.0560 | 0.0765 | −0.2677 | 0.3586 |

| BOARDSIZEit | 2.3532 | 2.3025 | 0.3114 | 1.3862 | 3.0445 |

| OWNINSTit | 9.4249 | 5.872 | 11.9309 | 0 | 89.79 |

| DIVERGit | 4.2439 | 0 | 7.2589 | 0 | 36.64 |

| MKBOOKit | 2.4745 | 1.9728 | 1.8086 | −0.2441 | 9.7266 |

| LEVit | 0.7126 | 0.6689 | 0.3208 | 0.0907 | 2.2377 |

| SIZEit | 13.5891 | 13.4243 | 1.8277 | 10.1627 | 18.4796 |

| Panel B. Correlation Matrix | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CARit | NIit | BOARDSIZEit | BOARDINSTit | _BOARDBANKit | OWNISTit | BOARDFUNDit | DIVERGit | MKBOOKit | LEVit | |

| NIit | 0.2473 | 1.0000 | ||||||||

| BOARDSIZEit | 0.0525 | 0.1972 | 1.0000 | |||||||

| BOARDINSTit | −0.0775 | −0.0750 | 0.3206 | 1.0000 | ||||||

| OWNINSTit | 0.0781 | 0.0670 | 0.2738 | 0.0670 | ||||||

| BOARDBANKSit | −0.0377 | 0.0349 | 0.3951 | 0.4151 | 1.0000 | 0.4052 | ||||

| BOARDFUNDit | −0.0603 | 0.1029 | 0.1006 | 0.8235 | −0.1744 | −0.0193 | 1.0000 | |||

| DIVERGit | 0.0315 | 0.0373 | 0.1586 | −0.0074 | −0.0842 | −0.0262 | 0.0445 | 1.0000 | ||

| MKBOOKit | 0.1003 | 0.1295 | 0.0070 | −0.0556 | −0.0520 | 0.0465 | −0.0278 | 0.0500 | 1.0000 | |

| LEVit | 0.1587 | 0.0993 | 0.2624 | 0.0741 | 0.0489 | −0.0136 | 0.0497 | 0.0332 | 0.1745 | 1.0000 |

| SIZEit | 0.2341 | 0.3020 | 0.6011 | −0.0475 | 0.1978 | 0.2184 | −0.1747 | 0.1332 | 0.0332 | 0.2549 |

CARit is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period ending three months following the end of the fiscal year. NIit is net earnings in year t divided by the market value of equity at the beginning of year t. BOARDINSTit is the percentage of institutional members on the board of directors, measured as institutional members divided by total members on the board. OWNINSTit is the percentage of voting rights in the hands of the institutional owners. BOARDBANKit is the percentage of directors appointed by banks, measured as directors appointed by banking institutions divided by total directors. BOARDFUNDit, is the percentage of directors appointed by mutual funds, measured as directors appointed by mutual funds by total directors. BOARDSIZEit is the size of the board, measured as the natural logarithm of the members on the board. DIVERGit measures the degree of divergence between the dominant owner's voting and cash flow rights. MKBOOKit is the value of equity ratio at the end of the year. LEVit is total debt in year t divided by total assets at the beginning of year t; SIZEit is the natural logarithm of the market value of equity.

We estimate all the regressions using a panel data procedure, namely, fixed-effects and Generalized Method of Moments (GMM). Unlike cross-sectional analysis, panel data allow us to control for individual heterogeneity. This property is crucial in our study because earnings informativeness is very closely related to the firm specificity. Thus, to address this source of endogeneity,4 we control for this heterogeneity by modeling it as an individual effect, which is then eliminated by using the average variables (fixed effects) or taking first differences of the variables (GMM). Additionally, the GMM estimator allow us to address another source of endogeneity, simultaneity, that arises when at least one of the explanatory variables is determined simultaneously along with the dependent variable (Wooldridge, 2002). Therefore, all GMM models have been estimated by using instruments. Particularly, we have used all the right-hand-side variables in the models lagged twice and six times as instruments; the only exceptions are the year-effects variables, which are considered exogenous. The original Arellano and Bond (1991) approach can perform poorly, however, if the autoregressive parameters are too large or the ratio of the variance of the panel-level effect to the variance of the idiosyncratic error is too large. Drawing on Arellano and Bover (1995), Blundell and Bond (1998) develop a system GMM estimator that addresses these problems by expanding the instrument list to include instruments for the levels equation. In this paper, we use the system GMM approach to estimate our models.5

The consistency of GMM estimates depends on both an absence of second-order serial autocorrelation in the residuals and the validity of the instruments. To check for potential model misspecification, we use the Hansen statistic of over-identifying restrictions. We next examine the m2 statistic developed by Arellano and Bond (1991) to test for the absence of second-order serial correlation in the first-difference residual. Finally, we conduct three Wald tests, specifically, a Wald test of the joint significance of the industry dummies (z1), a Wald test of the joint significance of the time dummies (z2) and a Wald test of the joint significance of the reported coefficients (z3).

Model 1 in Table 3 presents results on the basic relationship between earnings and returns. As expected, χ1 is positive and statistically significant, suggesting that earnings have an information role (Fan & Wong, 2002) in Spain. Models 2 and 3 in Table 3 report the incidence of institutional members on boards of directors on earnings informativeness. In particular, Model 2 shows a positive and statistically significant effect of the percentage of institutional members on the board of directors on earnings informativeness, with χ2=1.83, supporting hypothesis H1. These results also support some papers noting that institutional participation on boards of directors may help to empower managers to formulate and implement strategy, reduce complexity, and facilitate cooperation and coordination among stakeholders (Cuevas-Rodríguez, Gomez-Mejia, & Wiseman, 2012; Pugliese et al., 2009).

Institutional members on the board and earnings informativeness.

| Model 1 (Eq. (1)): CARit=χo+χ1NIit+¿i |

| Model 2 (Eq. (2)): CARit=χo+χ1NIit+χ2BOARDINSTitxNIit+χ3OWNINSTitxNIit+χ4BOARDSIZEitxNIit+χ5BOARINDitxNIit+χ6DIVERGitxNIit+χ7MKBOOKitxNIit+χ8LEVitxNIit+χ9SIZEitxNIit+ηk+ϕj+¿i |

| Model 3 (Eq. (3)): CARit=χo+χ1NIit+χ2BOARDBANKSitxNIit+χ3BOARDFUNDitxNIit+χ4OWNINSTitxNIit+χ5BOARDSIZEitxNIit+χ6BOARDINSTitxNIit+χ7DIVERGitxNIit+χ8MKBOOKitxNIit+χ9LEVitxNIit+χ10SIZEitxNIit+ηk+ϕj+¿i |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| NIit | 1.31*** (50.38) | 1.84*** (3.06) | 2.00*** (3.12) |

| BOARDINSTit×NIit | 1.83*** (2.71) | ||

| BOARDBANKit×NIit | 3.78*** (3.26) | ||

| BOARDFUNDit×NIit | 2.35*** (3.23) | ||

| OWNINSTit×NIit | 0.06*** (8.33) | 0.03*** (3.66) | |

| BOARDSIZEit×NIit | −2.71*** (−6.83) | −2.39*** (−6.50) | |

| DIVERGit×NIit | −0.04** (−2.61) | −0.002 (−1.40) | |

| MKBOOKit×NIit | 0.006*** (6.87) | 0.002* (1.69) | |

| LEVit×NIit | 1.70*** (7.25) | 1.02*** (3.04) | |

| SIZEit×NIit | 0.29*** (3.90) | 0.23*** (2.65) | |

| Constant | −0.10*** (−51.78) | −0.02 (−1.35) | −0.03 (−1.59) |

| Year effect | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes |

| Hansen | 84.14 (0.99) | 52.20 (0.98) | 64.01 (0.98) |

| Test m2 | 0.20 (0.84) | 0.39 (0.69) | 0.44 (0.66) |

| Test z1 | 6.73*** | 6.41*** | |

| Test z2 | 53.07*** | 38.35*** | |

| Test z3 | 66.68*** | 70.74*** | |

Statistically significant at 1 percent.

In parentheses, t-statistics based on robust standard errors.

CARit is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period ending three months following the end of the fiscal year. NIit is net earnings in year t divided by the market value of equity at the beginning of year t. BOARDINSTit is the percentage of institutional members on the board of directors, measured as institutional members divided by total members on the board. BOARDBANKit is the percentage of directors appointed by banks, measured as directors appointed by banking institutions divided by total directors. BOARDFUNDit, is the percentage of directors appointed by mutual funds, measured as directors appointed by mutual funds by total directors. OWNINSTit is the percentage of voting rights in the hands of the institutional owners. BOARDSIZEit is the size of the board, measured as the natural logarithm of the members on the board. DIVERGit measures the degree of divergence between the dominant owner's voting and cash flow rights. MKBOOKit is the value of equity ratio at the end of the year. LEVit is total debt in year t divided by total assets at the beginning of year t; SIZEit is the natural logarithm of the market value of equity. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. z1, Wald test of the joint significance of the industries dummies. z2, Wald test of the joint significance of the time dummies. z3, a Wald test of the joint significance of the reported coefficients.

Moreover, Model 3 shows that the positive effect remains when we consider the different types of institutional directors. Thus, the incidence on earnings informativeness of directors appointed by both banks and mutual funds are positive and statistically significant (χ2=3.78 and χ3=2.35, respectively), so that we confirm our H2a and reject H2b. Consequently, although most researchers find differences between institutional investors on earnings informativeness (e.g., Bona Sánchez, Pérez Alemán, & Santana Martín, 2013), these differences are not observed when we focus on the role of these institutional investors as directors. When institutional directors are board members, they contribute to earnings informativeness without distinction. Therefore, because earnings quality provides governance benefits, directors appointed by both banks and investment funds are likely to understand and value such benefits and, as a result, demand earnings quality from managers. In addition, the results would be in line with those suggesting that the effect of transient institutions (e.g., funds) on aggressive accruals management is not systematic across all firms and may not be as severe as previously posited (Koh, 2007). Moreover, although investment funds are characterized by a short-term focus and are less likely to discipline managers (Cornett, Marcus, Saunders, & Tehranian, 2007), this evidence suggests that when they become directors, these differences with banks and other pressure-sensitive directors disappear and both of them influence earnings quality in a positive way. Regarding the control variables, the results in Table 3 (Models 2 to 7) show that the greater the size of the board, the greater the earnings informativeness, in line with other authors (e.g., Bona-Sánchez et al., 2013). Moreover, models show that the greater the divergence in the dominant owner's voting and cash flow rights, the lower the earnings informativeness (the coefficient on DIVERGitxNIit is negative and significant in Models 2 to 7). This result is consistent with previous literature (e.g., Bona Sánchez et al., 2013; Fan & Wong, 2002; Francis et al., 2005; Lee, 2007; Martín et al., 2007), showing that as the divergence between the dominant owner's voting and cash flow rights increases, the dominant owner's incentives to expropriate minority shareholders also increase, which negatively affects earnings informativeness. Finally, the models show positive coefficients on NIitxSIZEit, NIitxLEVit and NIitxMKBOOKit, indicating that the greater the level of each variable, the greater the earnings informativeness. These results are consistent with prior studies that focus on other geographic contexts (Fan & Wong, 2002; Francis et al., 2005).

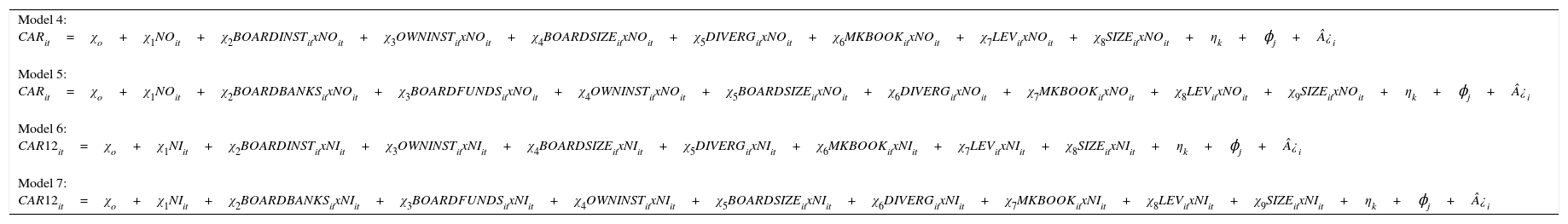

Sensitivity analysisIn this section, we first extend our analysis by considering an alternative measure of accounting earnings, namely, net operating income (NO) instead of net income (NI). The results are reported in Table 4 (Models 4 and 5). The results are not different from those obtained in Table 3 and thus provide further evidence in support of our hypotheses.

Institutional members on the board and earnings informativeness. Sensitivity analysis.

| Model 4: CARit=χo+χ1NOit+χ2BOARDINSTitxNOit+χ3OWNINSTitxNOit+χ4BOARDSIZEitxNOit+χ5DIVERGitxNOit+χ6MKBOOKitxNOit+χ7LEVitxNOit+χ8SIZEitxNOit+ηk+ϕj+¿i |

| Model 5: CARit=χo+χ1NOit+χ2BOARDBANKSitxNOit+χ3BOARDFUNDSitxNOit+χ4OWNINSTitxNOit+χ5BOARDSIZEitxNOit+χ6DIVERGitxNOit+χ7MKBOOKitxNOit+χ8LEVitxNOit+χ9SIZEitxNOit+ηk+ϕj+¿i |

| Model 6: CAR12it=χo+χ1NIit+χ2BOARDINSTitxNIit+χ3OWNINSTitxNIit+χ4BOARDSIZEitxNIit+χ5DIVERGitxNIit+χ6MKBOOKitxNIit+χ7LEVitxNIit+χ8SIZEitxNIit+ηk+ϕj+¿i |

| Model 7: CAR12it=χo+χ1NIit+χ2BOARDBANKSitxNIit+χ3BOARDFUNDSitxNIit+χ4OWNINSTitxNIit+χ5BOARDSIZEitxNIit+χ6DIVERGitxNIit+χ7MKBOOKitxNIit+χ8LEVitxNIit+χ9SIZEitxNIit+ηk+ϕj+¿i |

| Model 4 | Model 5 | Model 6 | Model 7 | |

|---|---|---|---|---|

| NIit | 2.18*** (3.20) | 2.16*** (2.98) | ||

| NOit | 2.20*** (4.64) | 2.32*** (4.22) | ||

| BOARDINSTit×NIit | 3.61*** (5.09) | |||

| BOARDBANKit×NIit | 2.89*** (2.77) | |||

| BOARDFUNDit×NIit | 2.36*** (3.33) | |||

| BOARDISNTit×NOit | 1.66*** (4.44) | |||

| BOARDBANKit×NOit | 2.22** (2.60) | |||

| BOARDFUNDit×NOit | 2.60*** (6.24) | |||

| OWNINSTit×NIit | 0.08*** (3.66) | 0.07*** (8.26) | ||

| OWNINSTit×NOit | 0.03*** (6.65) | 0.10*** (5.18) | ||

| BOARDSIZEit×NIit | −2.90*** (−7.91) | −2.53*** (−6.16) | ||

| BOARDSIZEit×NOit | −3.66*** (−8.84) | −2.99*** (−6.03) | ||

| DIVERGit×NIit | −0.02* (−1.79) | −0.006* (−1.82) | ||

| DIVERGit×NOit | −0.007 (−1.33) | −0.003* (−1.18) | ||

| MKBOOKit×NIit | 0.01*** (5.20) | 0.003*** (4.66) | ||

| MKBOOKit×NOit | 0.002*** (4.29) | 0.003* (1.82) | ||

| LEVit×NIit | 3.67*** (8.49) | 2.00*** (6.42) | ||

| LEVit×NOit | 1.34*** (8.47) | 1.79*** (8.17) | ||

| SIZEit×NIit | 0.30*** (3.18) | 0.22*** (5.16) | ||

| SIZEit×NOit | 0.45*** (9.33) | 0.74*** (6.74) | ||

| Constant | −0.10 (−4.34) | −0.022 (−0.23) | −0.01 (−0.32) | −0.08(−0.31) |

| Year effect | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes |

| Hansen | 67.02 (0.99) | 60.8592 (0.89) | 69.69 (0.80) | 70.08 (0.90) |

| Test m2 | 0.35(0.72) | 0.30 (0.66) | 0.42 (0.60) | 0.43 (0.58) |

| Test z1 | 11.60*** | 15.98*** | 15.67*** | 52.26*** |

| Test z2 | 137.51*** | 218.63*** | 43.98*** | 82.65*** |

| Test z3 | 143.33*** | 72.89*** | 102.66*** | 78.23*** |

Statistically significant at 1 percent.

In parentheses, t-statistics based on robust standard errors.

CARit is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period ending three months following the end of the fiscal year. CAR12it is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month ending on December 31st (fiscal year). NIit is net earnings in year t divided by the market value of equity at the beginning of year t. NOit is net operating income at year t divided by market value of equity at the beginning of year t. BOARDINSTit is the percentage of institutional members on the board of directors, measured as institutional members divided by total members on the board. BOARDBANKit is the percentage of directors appointed by banks, measured as directors appointed by banking institutions divided by total directors. BOARDFUNDit, is the percentage of directors appointed by mutual funds, measured as directors appointed by mutual funds by total directors. OWNINSTit is the percentage of voting rights in the hands of institutional owners. BOARDSIZEit is the size of the board, measured as the natural logarithm of the members on the board. DIVERGit measures the degree of divergence between the dominant owner's voting and cash flow rights. MKBOOKit is the value of equity ratio at the end of the year. LEVit is total debt in year t divided by total assets at the beginning of year t; SIZEit is the natural logarithm of the market value of equity. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. z1, Wald test of the joint significance of the industries dummies. z2, Wald test of the joint significance of the time dummies. z3, a Wald test of the joint significance of the reported coefficients.

Next, to check whether our results are sensitive to the definition of CARit, which considers a 12-month period ending three months following the end of the fiscal year, we redefine the variable considering the fiscal year (a 12 month period ending December 12th). The results are reported in Table 4 (Models 6 and 7). Overall, our findings are consistent with previous results in Table 3.

Finally, we extend our analysis in two ways. First, by measuring the institutional board presence using dummy variables. Second, by adding all the variables without interactions with NI. Untabulated results show that the effect of institutional board members on earnings informativeness is still positive (some control variables are not significant in some regressions).6

Concluding remarksThe role exercised by institutional investors when they are board members in continental countries enables them to be part of the internal decision-making process. Because institutional investors are simultaneously core shareholders and highly represented directors, Spain represents a unique opportunity to analyze how the presence of institutional directors on the board affects the quality of reported earnings. The objective of this paper is thus to analyze the role of institutional directors in the informativeness of accounting earnings in a sample of Spanish listed firms between 2004 and 2010. We also study the different roles of directors appointed by banks and those appointed by investment funds.

The results show that the focus on the monitoring role of directors appointed by banks and funds is a fruitful way to improve investor protection and increase market confidence in accounting information. These results suggest that institutional participation on boards of directors may help to empower managers to formulate and implement strategy, reduce complexity, and facilitate cooperation and coordination among stakeholders. Nevertheless, the results do not support the differences among the two types of directors regarding objectives, stability, scrutiny and visibility, suggesting that in institutionally controlled firms, directors representing both banks and funds improve earnings quality. When institutional directors are board members, they contribute to earnings informativeness with no distinction between the types of directors. These results suggest that although investment funds are characterized by a short-term focus and are less likely to discipline managers, when they become directors, these differences with banks and other pressure-sensitive directors disappear and both influence earnings quality in a positive way.

The paper contributes to the literature by showing that, in a weak regulatory and low investor protection environment, one of the ways in which institutional investors play a monitoring role is by influencing earnings quality when they are both shareholders and board members. In addition, the paper has interesting academic and policy implications for the debate on the proper degree of institutional involvement in corporate governance, noting that when analyzing the role of institutional investors, researchers must take into account investors’ participation in other mechanisms of corporate control, such as the board of directors.

Conflicts of interestThe authors have no conflicts of interest to declare.

Spain has a bank-based financial system in which financial intermediaries perform a wide range of financial services, as they have traditionally played an important role in the governance of nonfinancial firms. Nevertheless, the development of the financial markets has enabled another type of institution, the investment fund, to break into the Spanish market and occupy important positions as shareholders.

For a discussion justifying the inclusion of these variables see Fan and Wong (2002).

The correlation between BOARDINSTit and BOARDBANKit and the correlation between BOARDINSTit and BOARDFUNDit are not a concern in our study because these variables are never in the same model.

According to Wooldridge (2002), we define endogeneity bias broadly as any situation where the disturbance term of the structural equation is correlated with one or more independent variables.

More precisely, we use the two-step system GMM estimation included in the xtabond2 stata routine written by Roodman (2009). The two-step estimation estimates the regression with heteroskedasticity-robust standard errors.