The purpose of this paper is to explore the concept of orientation towards international markets (OIM) for born global firms (BG) and present a measurement scale of OIM specifically designed for these firms. We propose a scale of OIM based on the literature review and a qualitative study. This proposal is then tested by means of a quantitative research design. The final scale not only considers three constructs of the market orientation concept: customer orientation, competitor orientation and interfunctional coordination; but also incorporates another construct related to the innovation capability of the firm (innovativeness and technological capability). This proposed measurement scale shows invariance across younger and older BG firms and, therefore, constitutes a useful measurement tool to be considered by future research analyzing the impact of OIM of BG firms on their performance.

El objetivo de este trabajo es explorar el concepto de orientación hacia los mercados internacionales (OIM) para empresas Born Global (BG) y presentar una escala de medición de OIM diseñada específicamente para este tipo de empresas. Proponemos una escala de OIM en base a la revisión de la literatura y de un estudio cualitativo. Esta propuesta se testa por medio de una investigación cuantitativa. La escala final considera tres constructos del concepto orientación al mercado: orientación al cliente, orientación a los competidores y coordinación interfuncional; y también incorpora un constructo relacionado con la capacidad de innovación de la empresa (capacidad de innovación y capacidad tecnológica). La escala de medición propuesta es invariante entre las empresas BG más jóvenes y las más maduras y, por lo tanto, constituye una herramienta de medición útil para ser considerada en investigaciones futuras que analicen el impacto de la OIM de las empresas BG en sus resultados.

The purpose of this paper is to explore the concept of orientation towards international markets (OIM) for Born Global (BG) firms and present a measurement scale of OIM specifically designed for this type of early and rapidly internationalizing ventures.

Numerous empirical and conceptual studies on BGs have been conducted since the nineties (Apselund & Moen, 2005; Coviello & Munro, 1997; Freeman, Edwards, & Schroder, 2006; Freeman, Hutchings, Lazaris, & Zyngier, 2010; Freeman, Hutchings, & Chetty, 2012; Hashai & Almor, 2004; Kim, Basu, Naidu, & Cavusgil, 2011; Knight & Cavusgil, 2005; Knight, Madsen, & Servais, 2004; Knight, 1997; McDougall & Oviatt, 1996; McDougall, Shane, & Oviatt, 1994; Moen & Servais, 2002; Oviatt & McDougall, 1994; Rennie, 1993; Spence, Orser, & Riding, 2011). However, the vast majority of the studies have focused on the early internationalization stages of the BG companies, with a few notable exceptions (Blesa, Ripollés, & Monferrer, 2009; Hashai & Almor, 2004; Jones & Coviello, 2005; Kuivalainen, Sundqvist, & Servais, 2007; Luostarinen & Gabrielsson, 2006; Moen, 2002; Monferrer, Blesa, & Ripollés, 2013; Peiris, Akoorie, & Sinha, 2012). In fact, the role of orientation towards international markets in early internationalized firms has not been focused upon in previous born global literature. Peiris et al. (2012) point out that scholars have developed integrative models representing the core concepts and constructs in the entrepreneurial internationalization process. Nevertheless, they see an opportunity to extent research by focusing on those aspects leading to sustainable competitive advantage and higher performance of the firm. In this line, Efrat and Shoham (2012) note that the impact of external and internal factors on the BGs’ performance has hardly been analyzed (Almor & Hashai, 2004; Knight & Cavusgil, 2004), while both internal and external performance drivers have been studied previously with regard to gradually globalizing firms (GGs) (Cavusgil & Zou, 1994; Root, 1994; Sarkar & Cavusgil, 1996; Sousa, Martínez-López, & Coelho, 2008; Styles & Ambler, 1994; Zou & Stan, 1998).

Accordingly, we focus this study on one internal driver that firms, in general, and BGs specifically could exploit for obtaining superior performance: the orientation towards international markets (OIM). From our perspective, this orientation should be related to the market orientation (MO) concept, but its content must be broader due to the international dimension of the concept. Therefore, we believe, and that is part of the interest of this research, that the development of the OIM could initially consider the components of the MO concept, but likely should also incorporate other components that allow firms to extend this market orientation to international markets. In some sense, the type of discussion we present here is similar to the one proposed by Covin and Miller (2014) when they raise the question of “whether Entrepreneurial Orientation (EO) and International Entrepreneurial Orientation are treated as distinct constructs within the International Entrepreneurship (IE) literature or, alternatively, whether international is simply a context in which EO research has been pursued” (p. 13). Taking into account one of the approaches that some IEO research employ, as Covin and Miller (2014) mention, we assume that OIM share the core elements of the MO construct yet includes a additional distinguishing elements–namely, an “international” emphasis.

The concept of MO, understood as “the organization-wide generation of market intelligence, dissemination of the intelligence across departments and organization-wide responsiveness to it” (Kohli & Jaworski, 1990, p. 3) has been increasingly considered an essential driver for achieving superior business performance around the world (Chan & Ellis, 1998; Ellis, 2006; Farrell, 2000; Kirca, Jayachandran, & Bearden, 2005; Lado, Maydeu-Olivares, & Rivera, 1998; O'Sullivan & Butler, 2009). However, despite its reported importance for business performance in general, and for SME performance in particular (Collinson & Houlden, 2005; Kara, Spillan, & DeShields, 2005; Li, Zhao, Tan, & Liu, 2008), the concept of MO has rarely been explored in the context of BGs (Gabrielsson & Kirpalani, 2012; Madsen, Sorensen, & Torres-Ortega, 2015). Efrat and Shoham (2012) indicate that the three aspects of MO identified by Narver and Slater (1990) – customer orientation, competitor orientation and interfunctional coordination – should be encompassed in firms’ marketing capabilities to create a solid foundation for competitive advantage.

Cadogan, Diamantopoulos, and Pahud de Mortanges (1999) developed the “export market orientation” (EMO) scale as a measurement of MO for exporting firms because “the shift from a domestic to an export setting suggests that “merely modifying existing measures by ‘internationalizing’ their terminology is unlikely to be sufficient. Additional items will most probably be required which are qualitatively very different from those occurring in domestic markets” (Cadogan & Diamantopoulos, 1995, p. 51)” (p. 690–691). Our work wants to contribute to this stream of academic research because it is focused on what could stimulate a company to orientate itself towards international markets, and specifically when this intention is very close to its inception. Therefore, further with the organization-wide generation of market intelligence, dissemination of the intelligence across departments and organization-wide responsiveness to it, we believe that something else should be considered to understand the orientation towards international markets of some companies. In this sense, the orientation of the company towards innovation, and its interest of providing international markets with novelties could be a good complement of the original MO components for understanding the orientation towards international markets. That is exactly what we want to disentangle with this research: what other component/s should be considered, if any, besides the traditional market orientation components for understanding the orientation towards international markets of BG firms, and how we can measure this latter orientation.

Precisely, the fact of being focused on this type of companies justifies than EMO has not been directly adopted: first, BG firms may simultaneously use multiple internationalization modes, not only exports. Besides, these firms are small and entrepreneurial in terms of ownership and organization (Almor & Hashai, 2004; Melén & Nordman, 2009), which renders their mode of functioning essentially different from that of traditional gradual exporters. Moreover, EMO was developed based on the MARKOR scale, which did not measure the construct of customer orientation, which is considered a key factor for BGs (Aspelund & Moen, 2001; Kim et al., 2011). These are the reasons why we do not propose to use EMO for measuring OIM for BG firms and we will work on a new scale for OIM based on the conceptualization of MO.

For providing validation to the proposed OIM construct and its measurement scale for BG firms, and constituting another trait of this study, the proposed OIM measure will be analyzed considering two groups of BGs, formed according to their age. Ripollés and Blesa (2012), referring to Lippman and Rumelt (1982), recognize that: “Younger organizations as opposed to mature ones have less knowledge about markets and customers; they may engage in inefficient practices until they learn; they may need time to forge relationships with external partners, including customers and channel members; and may also not know about what they can do or should do” (p. 280). Therefore, although Pennings, Lee, and van Witteloostuijn (1998) claim that: “Age is a rather crude proxy for the firm-specific knowledge that comes with organizational learning” (p. 439), we focus on firm age for analyzing the OIM measure in BGs with different levels of time-based experience and experiential knowledge. Hence, the fact of considering different BGs adds the current research to the line of work of some authors who consider different BG groups according to their age such as Moen (2002), Hashai and Almor (2004), Jones and Coviello (2005), Luostarinen and Gabrielsson (2006), Kuivalainen et al. (2007) and Peiris et al. (2012).

For accomplishing the mentioned objectives, this research is organized as follows: first, a review of the literature on BGs and MO is presented. Subsequently, we show the results of a qualitative study in which the concept of OIM and the traditional scales for measuring MO have been assessed by managers of BGs. Through this qualitative study, we are able to propose the scale for measuring OIM and determine the measurement instrument to be validated through quantitative research in the “Assessing the instrument through quantitative research” section. In the final section, we provide the final scale for measuring the OIM of BG firms.

Literature reviewBorn global firmsIn the BG context, four salient characteristics have been detected by numerous researchers as crucial for characterizing this type of entrepreneurial ventures: the speed of internationalization from inception, the percentage of exports, the foreign market scope and the firm size. First, regarding speed, the time lag between the foundation of a BG and the first foreign sale is typically three years or less (Luostarinen & Gabrielsson, 2004; Oviatt & McDougall, 1994). Second, the threshold of export intensity (percent of foreign sales) of these firms is usually fixed in at least twenty-five percent (Knight & Cavusgil, 1996; Knight, 1997; Servais, Zucchella, & Palamara, 2007). The third characteristic is their market scope, which refers to the number of countries or even continents in which the BGs operate (Hashai, 2011). Finally, the fourth characteristic of BGs is their size: the literature suggests that these firms are typically small and medium enterprises (Rennie, 1993; Moen & Servais, 2002; Rialp, Rialp, & Knight, 2005). In this study, we adopt these four features for defining a firm as BG, in line with previous research (Madsen, 2013).

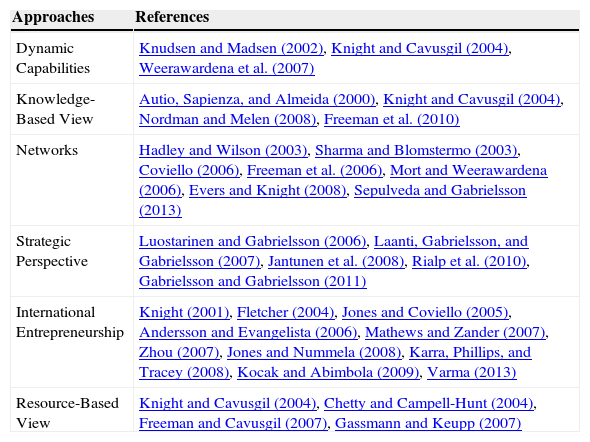

Earlier contributions considering BGs have focused upon explaining the phenomenon adopting different theoretical bases. According to our literature review, there are at least six traditional approaches related to BGs (see Table 1).

BG approaches.

Considering the literature review, many aspects have been suggested to be important for the internationalization process of BGs. These aspects include their characteristics (Knight & Cavusgil, 1996; Oviatt & McDougall, 1994), factors influencing their internationalization process (Knight et al., 2004; Rialp et al., 2005), the market knowledge (Shook, Priem, & McGee, 2003), financing conditions (Gabrielsson, Sasi, & Darling, 2004; Kocak & Abimbola, 2009), innovation and technology (Freeman et al., 2006; Zahra, Duane, & Hitt, 2000; Zhang & Dodgson, 2007), and finally the role of managers (Moen, 2002). Some authors have specifically considered the influence of dynamic capabilities on internationalization in BGs (Weerawardena, Sullivan Mort, Liesch, & Knight, 2007), other studies have incorporated the knowledge-based view (Grant, 1996) and, according to Sharma and Blomstermo (2003), the internationalization process can also depend on the networks in which a company operates. According to Rialp, Galván, and Suarez (2010), the BG phenomenon has become a subject of study in a wide variety of disciplines, thereby leading to the combination of approaches of schools in strategic management and international entrepreneurship. Karra et al.’s (2008) study is also focused upon understanding the process of early internationalization under the strategy-making process. Finally, Chetty and Campell-Hunt (2004) emphasized the importance of including the resource-based view to more comprehensively explain the non-path-dependent behaviour of BGs.

According to the dynamic capabilities paradigm, firm's capabilities are determinant in creating and maintaining competitive advantage that leads towards superior performance (Dierickx & Cool, 1989; Teece, Pisano, & Shuen, 1997). This approach is innovative in the way it views firms’ accumulated knowledge as a foundation for development of capabilities (Zander & Kogut, 1995) and it refers to internationalization as an interaction between internal and external factors, which makes internationalization a push–pull process (Mathews & Zander, 2007). According to the dynamic capabilities perspective, firms can achieve performance-enhancing advantages by strategically managing their capabilities in terms of adaptation, integration, and re-configuration, in light of a changing environment (Teece et al., 1997). Since such capabilities are based on the knowledge developed within firms, they have greater relevance in firms where such knowledge is created on a regular basis, such as BGs. Being small and flexible, BGs lack the path dependence routines and bureaucracies that tend to hinder innovation within other types of firms. Given their strong technological orientation and the unique dynamic conditions associated with their environment, Knight and Cavusgil (2004) and Weerawardena et al. (2007) concluded that dynamic capabilities are perhaps the most appropriate perspective for studying BGs.

Market orientationZou and Myers (1999) identified marketing, R&D/technology and production capabilities as key performance drivers. In fact, market orientation (MO) is recognized in the marketing literature to be one of the most relevant capabilities driving higher performance (Foley & Fahy, 2004).

Hunt and Morgan (1995) described MO as a valuable, rare, socially complex, and causally ambiguous resource available to firms. Until the end of the 1990s, the MO concept was connected to marketing philosophy and understood as an implementation of this philosophy, and the studies were focused on determinants of its implementation.

The literature on MO has focused on various research objectives. Early contributions in this field have attempted to provide different conceptualizations of MO (e.g., Horng & Chen, 1998; Ruekert, 1992), but most studies (f. e. Wren, Souder, & Berkowitz, 2000) are based on the conceptualizations offered by Narver and Slater (1990) as well as Kohli, Jaworski, and Kumar (1993). Narver and Slater (1990) defined MO as a construct consisting of three behavioural dimensions of customer orientation, interfunctional coordination and competitor orientation. The conceptualization of Kohli and Jaworski (1990) focused more on MO as a process with three stages: intelligence generation, intelligence dissemination and responsiveness. Then, according to Kohli and Jaworski (1990) a firm exhibiting market orientation engages in the generation of market intelligence, disseminates this intelligence throughout the organization and develops effective strategies in response to this information. On the other hand, Narver and Slater (1990) characterize market orientation as being more culturally embedded, demonstrating an orientation towards customers, competitors, and interfunctional coordination.

Different views of MO (namely, the cultural, behavioural and system-based perspectives) have also been presented (González & González, 2005; Helfert, Ritter, & Walter, 2002; Lafferty & Hult, 2001). However, regarding the measurement scales of MO, the most widely used scales are MKTOR, which was developed by Narver and Slater (1990), and MARKOR, developed by Kohli et al. (1993). We think it is worth emphasizing that these two original measures were created and developed to be used, at least initially, in domestic environments. In fact, the international activity of the company is not inherent to any item of these scales. Actually, the majority of MO studies had examined its determinants and effects in a domestic setting. Chan and Ellis (1998) observed that the strongest MO impact on performance was typically found in USA firms. Other studies showing positive effects have been recorded in a variety of settings, including Spain (Lado et al., 1998), Australia (Farrell, 2000) and Ireland (O'Sullivan & Butler, 2009), among others (see reviews by Ellis, 2006; Kirca et al., 2005).

The role of MO in the international business environment was initially explored by the seminal research of Cadogan et al. (1999). Drawing on traditional exporting firms, these authors developed a measure scale called “export market orientation” (EMO) based in the original Jaworski and Kohli's (1993) scale, and introduced the following new constructs in the export context: export intelligence generation, export intelligence dissemination and export intelligence responsiveness. In this sense, the EMO scale has been empirically tested in the context of exporting firms (Boso, Cadogan, & Story, 2013; Cadogan, Cui, & Li, 2003; Chi & Sun, 2013; Chung, 2012; Murray, Yong Gao, & Kotabe, 2011).

In addition to traditional exporting firms, other type of firms has demonstrated the influence of MO in an international context: new entrepreneurial ventures (Brettel, Engelen, & Heinemann, 2009), new export ventures (Evers, 2011) and export ventures (Balas, Colakoglu, & Gokus, 2012). These empirical studies have used the MARKOR, MKTOR or EMO scales.

As noted above, only a relatively small number of empirical works have expanded MO research to include international new ventures (INVs) and BGs (Ripollés, Blesa, & Monferrer, 2012; Wood et al., 2011). For instance, Ripollés et al. (2012) highlighted the influence of the international learning effort of INVs through their international MO. Other studies address the role of MO as a strategy that influences the success of INVs combined with entrepreneurial orientation and learning orientation (Frishammar & Andersson, 2009; Ruokonen & Saarenketo, 2009; Ripollés et al., 2012). Although past studies have made significant progress towards understanding MO in early internationalizing firms, conceptual and measurement issues for BGs require further exploration (Blesa, Monferrer, Ripollés, & Nauwelaerts, 2008; Knight & Cavusgil, 2004).

As previously mentioned, BG firms have to confront risks and uncertainties associated with the foreignness of their target markets without having accumulated the experience and resources needed for internationalization. Efrat and Shoham (2012) justify why prior international experience of BG's founders cannot completely substitute organizational experience, although such experience can be used to reduce the liability of foreignness associated with internationalization. Furthermore, BG firms may simultaneously use not only multiple internationalization modes, but also exports, and their mode of functioning is different from that of traditional exporters. That is the reason why we do not adopt directly the traditional scales for measuring MO for dealing with the orientation towards international markets by BG firms and propose the OIM concept for these firms, as well as we believe the suitability of the components of current MO scales for its measurement should be assessed.

The OIM concept for BG firmsThe need to examine how OIM could be understood by BGs justifies the use of the case study method first (Eisenhardt, 1989; Yin, 2003). Yin (2003) suggested that case studies are appropriate when the research investigates “how” and “why” questions regarding a contemporary set of events.

Consistent with the guidelines recommended by Yin (2003), the sampling strategy first follows the literal replication technique, which refers to produce the same results in the selected cases; second, theoretical replication is aimed at producing contrasting results but predictable reasons within the investigated cases. In this study, theoretical replication was achieved by selecting companies with different products and strategies. Regarding the literal replication involved, BGs were selected according to the following criteria:

- 1.

Firms should be SMEs: according the definition of the European Commission for establishing the size of a firm, the number of employees must be considered: SMEs have between 10 and 249 employees.

- 2.

Firms should have commenced international activity within three years after inception to be considered BGs (Knight & Cavusgil, 2004).

- 3.

Firms must be exporting minimum 25% of their sales (Knight & Cavusgil, 1996; Knight, 1997; Madsen, Rasmussen, & Servais, 2000).

- 4.

Firms must be exporting at least in two different continents (Hashai, 2011).

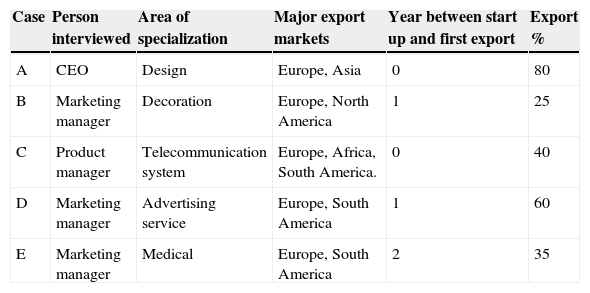

The characteristics of the firms that participated in the qualitative study are shown in Table 2. Spanish companies are considered here because an important number of studies about MO and BG have been performed in Spain and, more relevant, the studies developed in Spain about MO and BGs have hardly shown country idiosyncratic differences (Blesa et al., 2009; Mazaira, González, & Avendaño, 2003; Pla Barber & Cobos Caballero, 2002; Polo Peña, Jamilena, & Molina, 2012; Rialp & Rialp, 1996).

BGs participating in the qualitative study.

| Case | Person interviewed | Area of specialization | Major export markets | Year between start up and first export | Export % |

|---|---|---|---|---|---|

| A | CEO | Design | Europe, Asia | 0 | 80 |

| B | Marketing manager | Decoration | Europe, North America | 1 | 25 |

| C | Product manager | Telecommunication system | Europe, Africa, South America. | 0 | 40 |

| D | Marketing manager | Advertising service | Europe, South America | 1 | 60 |

| E | Marketing manager | Medical | Europe, South America | 2 | 35 |

In-depth interviews were conducted following the key informant approach, which is a common practice in international marketing and BGs research (Diamantopoulos & Souchon, 1999; Evers & Knight, 2008). In addition to in-depth interviews, we utilized different sources to collect information about the firms (Yin, 2003), such as annual reports, information on company Web sites and a large firm database (SABI).

We developed the interview protocol for collecting information related to the orientation towards international markets of the company and the level of familiarity with the MO concept and measurement. More precisely, respondents were asked to provide information regarding the role of international operations in their firms, the international experience of management and the percentage of international sales; their level of agreement with the MO concept (as suggested by Hou (2008): “Market orientation involves creating a competitive advantage through a customer-focused enterprise, in which customer values are created” (p. 1251)); how they evaluated the orientation towards international markets of their firms and to assess MARKOR and MKTOR scales, more specifically to determine the suitability of each constructs and items.

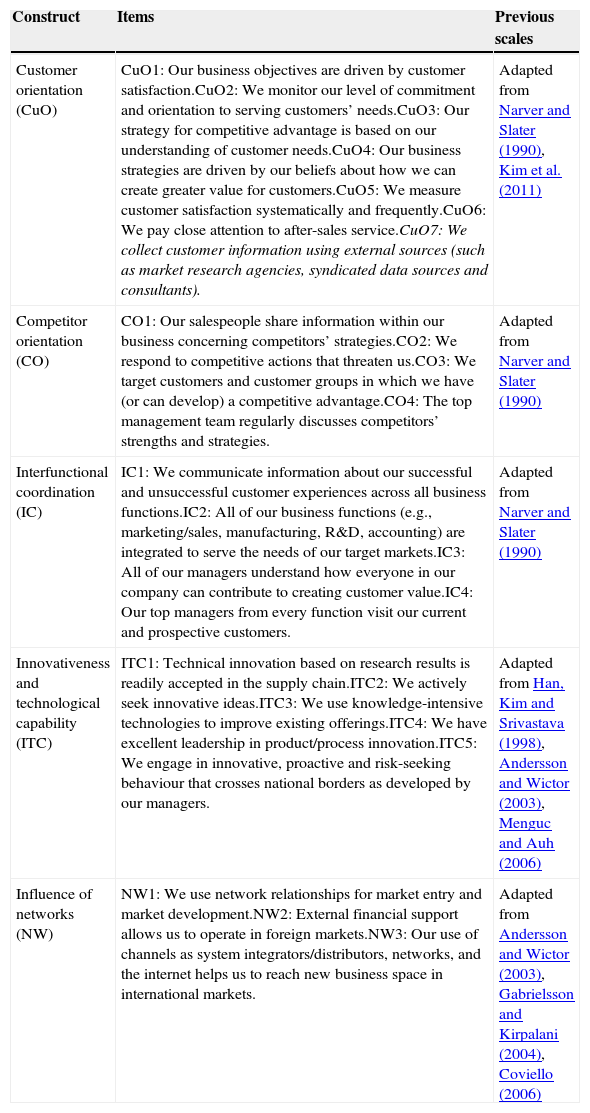

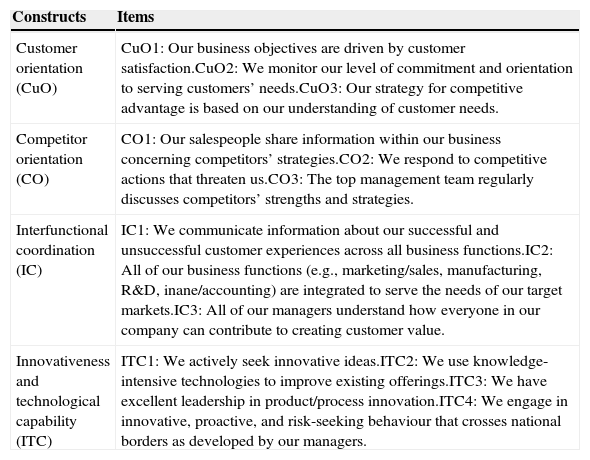

The results from this qualitative study allowed us to develop the content of OIM for the BGs context following the recommendations of Churchill (1979). In this sense, all respondents highly agreed with the MO concept being presented and its adequacy for international markets, and the managers of four BGs preferred the use of the scale from Narver and Slater (MKTOR) to capture the MO of their firms in foreign markets (only one manager considered both scales equally useful). This is because most BGs tend to have a high level of customer orientation (Kim et al., 2011) and the MARKOR scale does not measure this construct, which is considered a key factor for BGs (Aspelund & Moen, 2001; Kim et al., 2011). Likewise, our qualitative study also indicates that managers require the addition of a couple of constructs to the MKTOR scale, as well as one new item added to the customer orientation construct (CuO7 in Table 3), when orientation towards international markets is considered. The two new constructs are the influence of networks and the role of innovativeness and technological capability (see Table 3).

The proposed scale for measuring the OIM of BGs.

| Construct | Items | Previous scales |

|---|---|---|

| Customer orientation (CuO) | CuO1: Our business objectives are driven by customer satisfaction.CuO2: We monitor our level of commitment and orientation to serving customers’ needs.CuO3: Our strategy for competitive advantage is based on our understanding of customer needs.CuO4: Our business strategies are driven by our beliefs about how we can create greater value for customers.CuO5: We measure customer satisfaction systematically and frequently.CuO6: We pay close attention to after-sales service.CuO7: We collect customer information using external sources (such as market research agencies, syndicated data sources and consultants). | Adapted from Narver and Slater (1990), Kim et al. (2011) |

| Competitor orientation (CO) | CO1: Our salespeople share information within our business concerning competitors’ strategies.CO2: We respond to competitive actions that threaten us.CO3: We target customers and customer groups in which we have (or can develop) a competitive advantage.CO4: The top management team regularly discusses competitors’ strengths and strategies. | Adapted from Narver and Slater (1990) |

| Interfunctional coordination (IC) | IC1: We communicate information about our successful and unsuccessful customer experiences across all business functions.IC2: All of our business functions (e.g., marketing/sales, manufacturing, R&D, accounting) are integrated to serve the needs of our target markets.IC3: All of our managers understand how everyone in our company can contribute to creating customer value.IC4: Our top managers from every function visit our current and prospective customers. | Adapted from Narver and Slater (1990) |

| Innovativeness and technological capability (ITC) | ITC1: Technical innovation based on research results is readily accepted in the supply chain.ITC2: We actively seek innovative ideas.ITC3: We use knowledge-intensive technologies to improve existing offerings.ITC4: We have excellent leadership in product/process innovation.ITC5: We engage in innovative, proactive and risk-seeking behaviour that crosses national borders as developed by our managers. | Adapted from Han, Kim and Srivastava (1998), Andersson and Wictor (2003), Menguc and Auh (2006) |

| Influence of networks (NW) | NW1: We use network relationships for market entry and market development.NW2: External financial support allows us to operate in foreign markets.NW3: Our use of channels as system integrators/distributors, networks, and the internet helps us to reach new business space in international markets. | Adapted from Andersson and Wictor (2003), Gabrielsson and Kirpalani (2004), Coviello (2006) |

We believe the addition of these new components allow us to pass from the general market orientation concept to the orientation towards international markets concept. Innovativeness and technological capability has been previously identified in the BG literature as one of the factors highly influencing the BG internationalization process (Freeman et al., 2006; Zahra et al., 2000; Zhang & Dodgson, 2007). Furthermore, Kim et al. (2011) analyze the relationship between BG's customer orientation, one of the traditional components of the MO scale, with innovativeness and technological capability for customer relationship management (CRM) and external customer information management.

On the other hand, the previous literature has also identified financial conditions and the networks in which companies operate as factors heavily influencing the BGs internationalization process (Gabrielsson et al., 2004; Kocak & Abimbola, 2009; Sharma & Blomstermo, 2003). In this regard, some authors also relate MO and networks, as for example Cadogan et al. (2003) or Ellis (2010). Cadogan et al. (2003) included network capabilities in the scale they developed to measure firm's marketing capabilities.

Therefore, based on the literature review and the qualitative study, 23 items were considered to measure the 5 components of the proposed scale for measuring OIM.

Assessing the instrument through quantitative researchData collection and sampleThe sample for developing the quantitative part of the research collects information from three European countries: Denmark, Finland and Spain. These countries were selected because BGs have been recognized as an important phenomenon in all of them (Gabrielsson & Kirpalani, 2004; Madsen & Servais, 1997; Ripollés et al., 2012).

We collected contact details for international firms from different databases: Danish BGs (a database developed from previous studies conducted at the University of Southern Denmark (Madsen, 2013)), Kohdistamiskone (a database that contains information on Finnish companies), and ICEX (Spanish Institute for Foreign Trade). A Web-based survey was distributed by e-mail from March 2012 to January 2013 to the firms selected under the following three criteria: (1) firms with less than 250 employees, (2) firms with international activity, and (3) active independent companies. A total of 6489 companies were identified meeting these criteria and contacted; 955 completed questionnaires were collected, which represents a response rate of 15%. Of these valid answers, it is possible to identify 216 BGs (23% of the total sample) considering the criteria previously mentioned. A non-response bias check was conducted comparing early responses and late responses (Oppenheim, 1966). This tactic has been used commonly in other research as a proxy of non-response bias check when direct data of non-responses is not obtainable (Datta, Guthrie, & Wright, 2005). No significant differences were detected between early and late respondents.

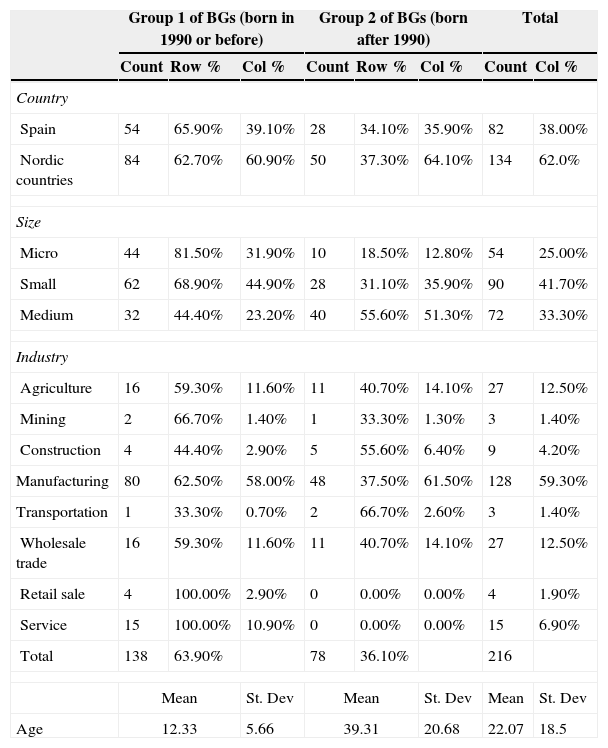

Looking for external validity of the proposed scale, we employed this sample to analyze the OIM scale between two different groups of BGs attending their age. As 22 years old is the average age of the firms in the sample, and given that the information was collected primarily in 2012, one group is formed by those BG firms founded in 1990 or before, and the second group included those BGs founded after 1990. Considering our sample of BGs, 78 BGs (36.1%) were in the first group, and 138 (63.9%) in the second group of BGs. Table 4 presents descriptive information regarding these BGs. More precisely, we provide information regarding the age of these companies, their size and their industries.

Descriptive information for the total sample of BGs and the two subsamples.

| Group 1 of BGs (born in 1990 or before) | Group 2 of BGs (born after 1990) | Total | ||||||

|---|---|---|---|---|---|---|---|---|

| Count | Row % | Col % | Count | Row % | Col % | Count | Col % | |

| Country | ||||||||

| Spain | 54 | 65.90% | 39.10% | 28 | 34.10% | 35.90% | 82 | 38.00% |

| Nordic countries | 84 | 62.70% | 60.90% | 50 | 37.30% | 64.10% | 134 | 62.0% |

| Size | ||||||||

| Micro | 44 | 81.50% | 31.90% | 10 | 18.50% | 12.80% | 54 | 25.00% |

| Small | 62 | 68.90% | 44.90% | 28 | 31.10% | 35.90% | 90 | 41.70% |

| Medium | 32 | 44.40% | 23.20% | 40 | 55.60% | 51.30% | 72 | 33.30% |

| Industry | ||||||||

| Agriculture | 16 | 59.30% | 11.60% | 11 | 40.70% | 14.10% | 27 | 12.50% |

| Mining | 2 | 66.70% | 1.40% | 1 | 33.30% | 1.30% | 3 | 1.40% |

| Construction | 4 | 44.40% | 2.90% | 5 | 55.60% | 6.40% | 9 | 4.20% |

| Manufacturing | 80 | 62.50% | 58.00% | 48 | 37.50% | 61.50% | 128 | 59.30% |

| Transportation | 1 | 33.30% | 0.70% | 2 | 66.70% | 2.60% | 3 | 1.40% |

| Wholesale trade | 16 | 59.30% | 11.60% | 11 | 40.70% | 14.10% | 27 | 12.50% |

| Retail sale | 4 | 100.00% | 2.90% | 0 | 0.00% | 0.00% | 4 | 1.90% |

| Service | 15 | 100.00% | 10.90% | 0 | 0.00% | 0.00% | 15 | 6.90% |

| Total | 138 | 63.90% | 78 | 36.10% | 216 | |||

| Mean | St. Dev | Mean | St. Dev | Mean | St. Dev | |||

| Age | 12.33 | 5.66 | 39.31 | 20.68 | 22.07 | 18.5 | ||

As explained in “The OIM concept for BG firms” section, based on the traditional scales for measuring MO and the qualitative study focused on 5 Spanish BGs, we obtained a theoretical OIM scale for BG firms with 5 constructs and 23 items (see Table 3). Likert scales with 7 choices (1 for “strongly disagree”; 7 for “strongly agree”) were used to measure the various items.

Following the approach of other researchers in marketing (e.g., Joshi & Sharma, 2004), to assess whether a common method bias posed a threat to our data we performed the Harman's one-factor test on the items. If there is a substantial amount of common method variance, then either a single factor will emerge from the factor analysis, or one general factor will account for the majority of the covariance among the variables (Podsakoff & Organ, 1986).

In our case, common method bias was not a concern. The factor analysis considering all BG firms in the sample resulted in 6 factors with eigenvalue greater than 1 (accounting for 65.05% of the total variance); the first factor accounted for 33.3% of the variance. The same analysis for BGs in the first group resulted in 7 factors with eigenvalue greater than 1 (accounting for 67.65% of the total variance); the first factor accounted for 28.6% of the variance. Finally, the factor analysis for the second group of BGs resulted in 5 factors with eigenvalue greater than 1 (accounting for 64.85% of the total variance) and the first factor accounted for 35.7% of the variance. Thus, common method bias does not pose threat to our data.

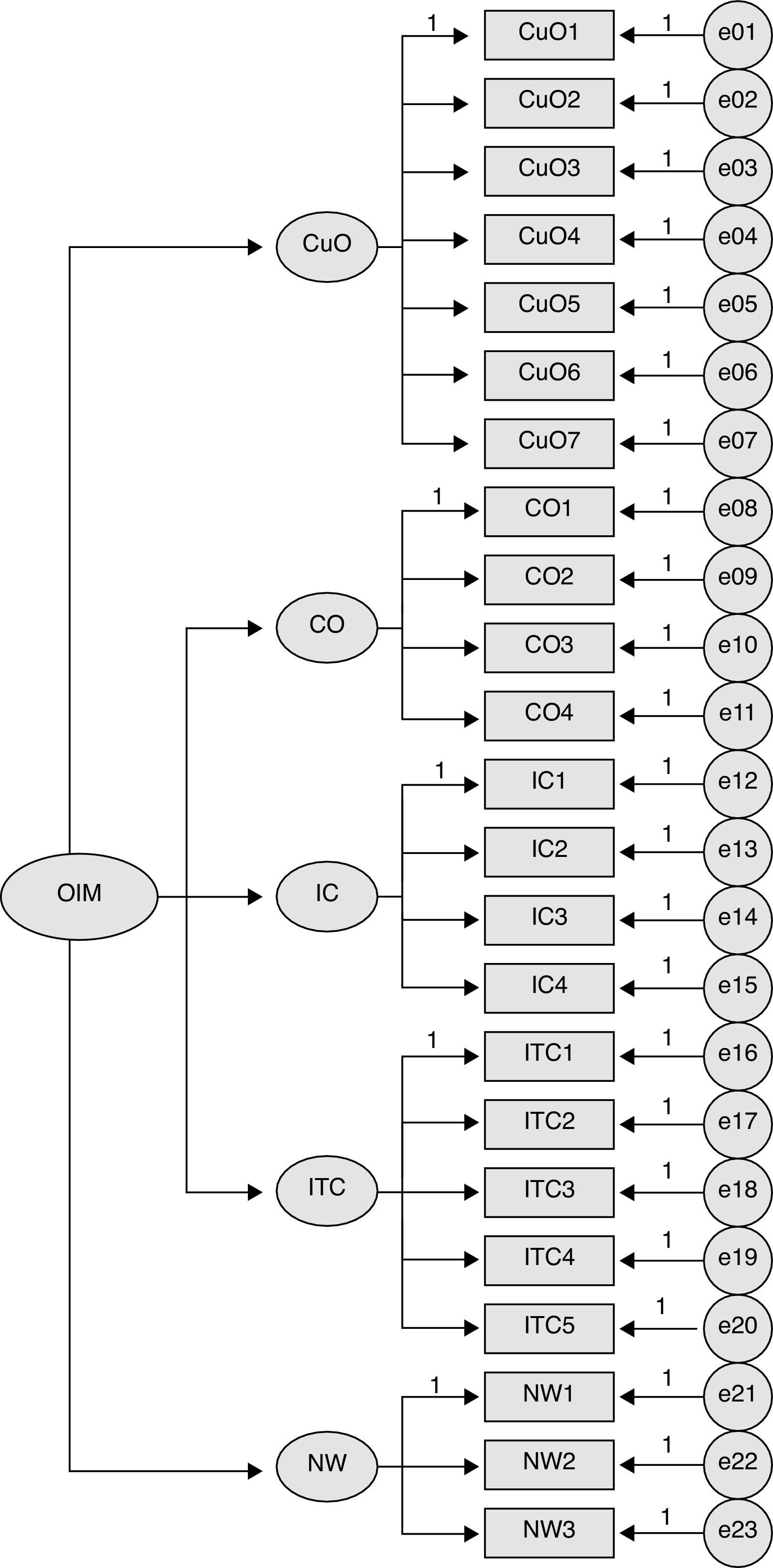

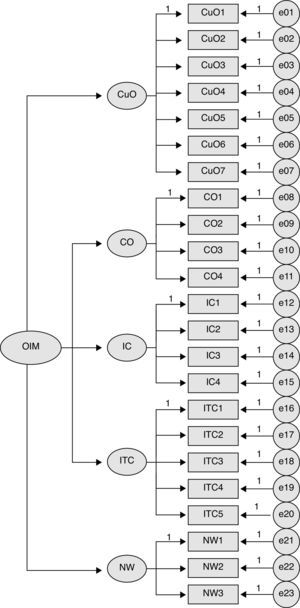

Measurement modelThere is an extensive debate regarding the reflective vs. formative nature of observed measures and models in the literature (f.e. the Journal of Business Research special issue (61/12) covers controversy about formative versus reflective model specification). We propose OIM being a reflective second order construct measured by five reflective first order dimensions (Customer Orientation (CuO), Competitor Orientation (CO), Interfunctional Coordination (IC), Innovativeness and Technological Capability (ITC) and Influence of Networks (NW)) because variation in the level of OIM leads to variation in its indicators, and also because those indicators are presumed to be interrelated (Judge & Kammeyer-Mueller, 2012). Therefore, we suggest a Type 1 model in Jarvis, MacKenzie, and Podsakoff (2003) terminology (“first-order latent factors with reflective indicators and also that these first-order factors are themselves reflective indicators of an underlying second-order construct” (p. 204)).

To analyze the proposed model (see Fig. 1), a multi-group confirmatory factor analysis (CFA) was used, considering one of the dominant focal points for analyzing multi-group data (Hair, Black, Babin, Anderson, & Tatham, 2006). An analysis of the validity and reliability of the scales employed in our model was performed by means of CFA. Inasmuch as the scale development was founded on the review of the most relevant literature and the qualitative research performed, the content validity of the measurement instruments seem to be guaranteed.

To confirm the existence of multidimensionality in the OIM scale, an alternative model strategy was developed (Anderson & Gerbing, 1988; Hair et al., 2006). Thus, we compared a second-order model in which various dimensions measured the multidimensional construct under consideration with a first-order model in which all items weighed on a single factor (Steenkamp & Van Trijp, 1991). The results showed that the second-order model had a much better fit than the first-order model. These results enabled us to conclude that the OIM concept demonstrated a multidimensional nature.

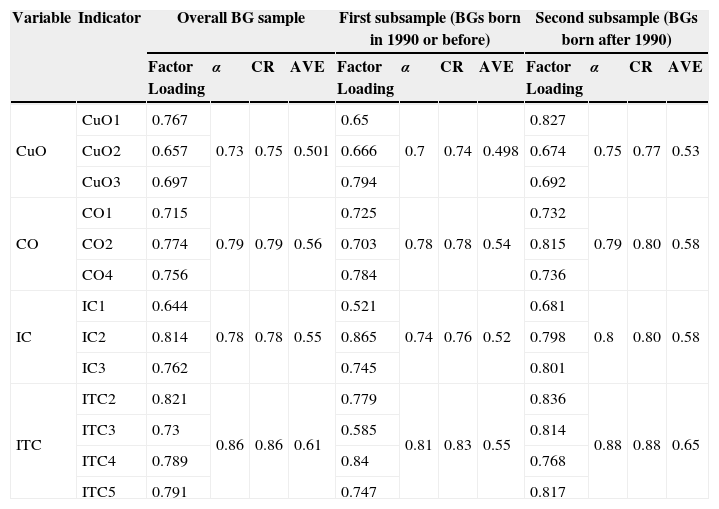

To analyze the reliability of the constructs, we first conducted an exploratory factor analysis (EFA). The consideration of multiple items for each construct increases construct reliability (Terblanche & Boshoff, 2008). Using EFA and considering the different items for each construct, we found that only one dimension appeared for all constructs, except for CuO in the general sample as well as in both subsamples of BGs. An analysis of the factor matrix allowed us to identify that the last item (“We collect customer information using external sources”) was not related to the remainder of the items that measured CuO; thus, this item was eliminated from the CuO construct measurement. After this item was eliminated, the exploratory factor analyses confirmed the unidimensionality of the 5 constructs considered for measuring OIM in the general sample and in both samples of BGs.

The item-total correlation, which measures the correlation of each item with the sum of the remaining items that constitute the scale, is above the minimum of 0.3 recommended by Nurosis (1993) for all constructs in the samples used. Cronbach's alpha (α) exceeded the recommendation of 0.70 suggested by Nunnally and Bernstein (1994), except for the NW construct in the general sample (0.6) and in the first group of BGs (0.4).

Then, we conducted confirmatory factor analysis (CFA) for all constructs in the model, with the aim of assessing the measurement reliability and validity, using the statistics package AMOS 20. First thing to consider is the normality of the available data. The normality test performed on the available items indicates that we cannot accept the assumption of normality neither in the total sample nor in both subsamples. In fact, for various items, the critical values exceeded +2.00 or −2.00, which indicates statistically significant degrees of non-normality. AMOS also reports the joint multivariate kurtosis value and its associated critical ratio. Small multivariate kurtosis values (e.g., less than 1.00) are considered negligible, whereas values ranging from one to ten often indicate moderate non-normality. Values that exceed ten indicate severe non-normality. In our case, for the total sample and the subsamples the values indicate severe non-normality. One method to correct for non-normality is to use the Bollen-Stine p-value rather than the usual maximum likelihood-based p-value to assess overall model fit.

The scale refinement process followed applying the three criteria proposed by Jöreskog and Sörbom (1993): (1) weak convergence requiring the elimination of indicators that did not have a significant factorial regression coefficient for Student's t distribution>2.58 (p=0.01); (2) strong convergence forcing the elimination of those indicators that were not substantial, i.e., those whose standardized coefficient (λ) was less than 0.5; and (3) a selective elimination of indicators that least contributed to the explanation of the model, given the cut-off point of R2<0.3. Following all these recommendations, we eliminated three items from the CuO scale (CuO4, CuO5 and CuO6), one item from the CO scale (CO3), one item form the IC scale (IC4), one item from ITC (ITC1) and the construct NW. We would like to point out that the elimination of this construct was unexpected because the literature, from our perspective, provides arguments for justifying its consideration as a component of the orientation towards international markets (as we have already mentioned, some research show how networks are factors heavily influencing the BGs internationalization process (Gabrielsson et al., 2004; Kocak & Abimbola, 2009; Sharma & Blomstermo, 2003)). As we mention in the “Discussion” section, we believe more research is needed on this construct, especially in the items that could be use for measuring it.

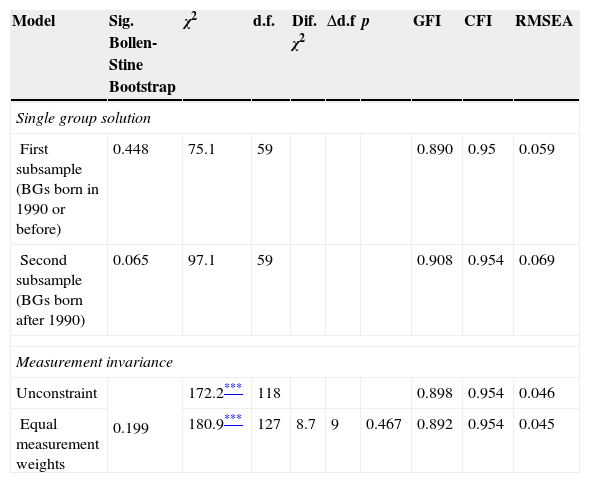

The Bollen-Stine bootstrap for the total sample of BGs enabled us to accept the final measurement model (p value is 0.284). Likewise, the Bollen-Stine bootstrap also enabled us to accept the model for both subsamples (p value is 0.448 and 0.065, respectively). The results of the final CFA are reported in Table 5 for the entire sample, for BGs constituted in 1990 or before, and for BGs constituted after 1990.

Internal consistency and convergent validity.

| Variable | Indicator | Overall BG sample | First subsample (BGs born in 1990 or before) | Second subsample (BGs born after 1990) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Factor Loading | α | CR | AVE | Factor Loading | α | CR | AVE | Factor Loading | α | CR | AVE | ||

| CuO | CuO1 | 0.767 | 0.73 | 0.75 | 0.501 | 0.65 | 0.7 | 0.74 | 0.498 | 0.827 | 0.75 | 0.77 | 0.53 |

| CuO2 | 0.657 | 0.666 | 0.674 | ||||||||||

| CuO3 | 0.697 | 0.794 | 0.692 | ||||||||||

| CO | CO1 | 0.715 | 0.79 | 0.79 | 0.56 | 0.725 | 0.78 | 0.78 | 0.54 | 0.732 | 0.79 | 0.80 | 0.58 |

| CO2 | 0.774 | 0.703 | 0.815 | ||||||||||

| CO4 | 0.756 | 0.784 | 0.736 | ||||||||||

| IC | IC1 | 0.644 | 0.78 | 0.78 | 0.55 | 0.521 | 0.74 | 0.76 | 0.52 | 0.681 | 0.8 | 0.80 | 0.58 |

| IC2 | 0.814 | 0.865 | 0.798 | ||||||||||

| IC3 | 0.762 | 0.745 | 0.801 | ||||||||||

| ITC | ITC2 | 0.821 | 0.86 | 0.86 | 0.61 | 0.779 | 0.81 | 0.83 | 0.55 | 0.836 | 0.88 | 0.88 | 0.65 |

| ITC3 | 0.73 | 0.585 | 0.814 | ||||||||||

| ITC4 | 0.789 | 0.84 | 0.768 | ||||||||||

| ITC5 | 0.791 | 0.747 | 0.817 | ||||||||||

Overall Sample: Bollen-Stine bootstrap p=0.284; GFI=0.948; CFI=0.982; RMSEA=0.040.

First subsample: Bollen-Stine bootstrap p=0.448; GFI=0.89; CFI=0.95; RMSEA=0.059.

Second subsample: Bollen-Stine bootstrap p=0.065; GFI=0.908; CFI=0.954; RMSEA=0.069.

Composite reliability (CR) represents the shared variance among a set of observed variables measuring an underlying construct (Fornell & Larcker, 1981). Generally, a composite reliability of at least 0.60 is considered desirable (Bagozzi & Yi, 1988). This requirement is fulfilled for every factor. The average variance extracted (AVE) was also calculated for each construct; the resulting AVE values were greater than 0.50, except for CuO with an AVE value of 0.498 (Fornell & Larcker, 1981). Therefore, the four constructs demonstrated acceptable levels of reliability.

Convergent validity was verified by analyzing the factor loadings and their significance. The scores obtained for the coefficients in Table 5 indicate that all factor loadings were significant (p<.001). Furthermore, the size of all of the standardized loadings were higher than 0.50 (Steenkamp & Geyskens, 2006). These findings provide evidence supporting the convergent validity of the indicators (Anderson and Gerbing, 1988).

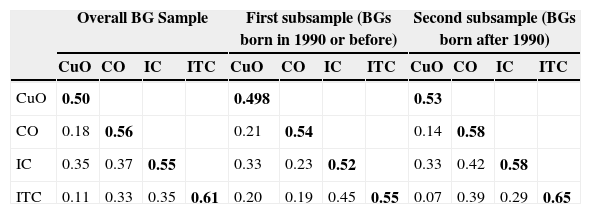

Evidence of the discriminant validity of the measures is provided in Table 6 for the overall sample and for the two subsamples. The shared variance between pairs of constructs was always less than the corresponding AVE (Fornell & Larcker, 1981).

Discriminant validity of the theoretical construct.

| Overall BG Sample | First subsample (BGs born in 1990 or before) | Second subsample (BGs born after 1990) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CuO | CO | IC | ITC | CuO | CO | IC | ITC | CuO | CO | IC | ITC | |

| CuO | 0.50 | 0.498 | 0.53 | |||||||||

| CO | 0.18 | 0.56 | 0.21 | 0.54 | 0.14 | 0.58 | ||||||

| IC | 0.35 | 0.37 | 0.55 | 0.33 | 0.23 | 0.52 | 0.33 | 0.42 | 0.58 | |||

| ITC | 0.11 | 0.33 | 0.35 | 0.61 | 0.20 | 0.19 | 0.45 | 0.55 | 0.07 | 0.39 | 0.29 | 0.65 |

The diagonal represents the AVE, while the values below the diagonal indicate the shared variance (squared correlations).

On the basis of these criteria, we concluded that the measure in the study provided sufficient evidence of reliability as well as convergent and discriminant validity. Thus, the revised measurement model was retained as the study's final measurement model for measuring OIM in BGs.

Measurement invarianceAfter the validity and reliability of the scale was confirmed, the measurement invariance of the measurement instrument to compare the two groups had to be assured (Hair et al., 2006). In our case, the differences that could exist between the ratings given by the scales in the two subsamples could be either the result of real differences between the companies or of systematic errors produced by the manner in which people in different companies responded to certain items. As Horn (1991) proposed, “without evidence of invariance of the measurement instrument, the study conclusions would be weak” (p. 119).

To analyze the invariance of the measurement instrument, we followed three steps that correspond to the three invariance levels with which we must comply.

STEP 1: First, we evaluate the loose cross-validation or single group solution. In other words, we employ the least demanding equivalence form in estimating the CFA for each one of the two samples separately. A good fit in both samples is required.

When we evaluated the validity and reliability of the model the CFA fit was good for both samples (summarized at the bottom of Table 5).

STEP 2: The following step involved confirming that the factorial structure (number of factors) is the same in the two samples, which is called equal form, factor structure or configural invariance. The method is similar to the previous method, but rather than estimating the model of each sample separately, a multi-group estimation is conducted. In other words, the model is estimated simultaneously in the two groups. This model serves as a basis for determining whether the restrictions that are incorporated affect the adjustment negatively.

We observe how the chi-squared value and the degrees of freedom are the sum of the two previous values (see Table 7), and although they remain significant, the remainder of the indicators shows that it is reasonable to assume the same factorial structure in both samples (GFI=0.898; CFI=0.954; RMSEA=0.046).

Measurement invariance test.

| Model | Sig. Bollen-Stine Bootstrap | χ2 | d.f. | Dif. χ2 | Δd.f | p | GFI | CFI | RMSEA |

|---|---|---|---|---|---|---|---|---|---|

| Single group solution | |||||||||

| First subsample (BGs born in 1990 or before) | 0.448 | 75.1 | 59 | 0.890 | 0.95 | 0.059 | |||

| Second subsample (BGs born after 1990) | 0.065 | 97.1 | 59 | 0.908 | 0.954 | 0.069 | |||

| Measurement invariance | |||||||||

| Unconstraint | 0.199 | 172.2*** | 118 | 0.898 | 0.954 | 0.046 | |||

| Equal measurement weights | 180.9*** | 127 | 8.7 | 9 | 0.467 | 0.892 | 0.954 | 0.045 | |

STEP 3: In this step, we must determine the invariance of the factorial loadings (also known as equal factor loadings or metric invariance), which implies that it is reasonable to assume that in the two subsamples, the factorial loadings that join each factor with its indicator are the same. In other words, we ensured that the concepts have been measured in the same way in both cases. Thus, it is necessary to compare the chi-squared value from the second (equal form) and third (equal factor loadings) steps to verify that the fit of the new model is not significantly worse. Therefore, we determined that the difference of the chi-squared is 8.7, which is not significant (see Table 7).

Thus, we can conclude that imposing restrictions on the equality of factorial loadings does not significantly and negatively influence the fit (p=0.467); therefore, such restrictions are plausible and the factorial invariance of the measurement instrument is confirmed.

Summary and discussionThis study explored the concept of OIM for BG firms and contributes the BG literature by presenting a measurement scale of OIM specifically designed for this type of firms following the widely accepted scale development procedure (see Table 8). A total of 5 constructs and 23 items were initially identified, and their reliability and validity were tested. Finally, with 4 constructs and 13 items, all alpha coefficients for the data exceeded the minimum standard for reliability, suggesting a high level of internal consistency for each construct. Both convergent validity and discriminate validity were satisfactory, suggesting that all measurement items closely represent conceptually meaningful constructs.

Final scale for measuring the OIM of BGs.

| Constructs | Items |

|---|---|

| Customer orientation (CuO) | CuO1: Our business objectives are driven by customer satisfaction.CuO2: We monitor our level of commitment and orientation to serving customers’ needs.CuO3: Our strategy for competitive advantage is based on our understanding of customer needs. |

| Competitor orientation (CO) | CO1: Our salespeople share information within our business concerning competitors’ strategies.CO2: We respond to competitive actions that threaten us.CO3: The top management team regularly discusses competitors’ strengths and strategies. |

| Interfunctional coordination (IC) | IC1: We communicate information about our successful and unsuccessful customer experiences across all business functions.IC2: All of our business functions (e.g., marketing/sales, manufacturing, R&D, inane/accounting) are integrated to serve the needs of our target markets.IC3: All of our managers understand how everyone in our company can contribute to creating customer value. |

| Innovativeness and technological capability (ITC) | ITC1: We actively seek innovative ideas.ITC2: We use knowledge-intensive technologies to improve existing offerings.ITC3: We have excellent leadership in product/process innovation.ITC4: We engage in innovative, proactive, and risk-seeking behaviour that crosses national borders as developed by our managers. |

Our findings show that the proposed measurement scale for measuring OIM in BG firms is both reliable and valid. Given the four dimensions identified, the findings are consistent with previous research on the MO construct. For instance, the seminal work of Narver and Slater (1990) highlighted the importance of three of the dimensions: customer orientation, competitor orientation and interfunctional coordination.

For BGs acting in different foreign markets, the business objectives should be driven by customer satisfaction; their strategy for obtaining competitive advantage should be based on their understanding of all of their customer needs. Accordingly, these firms should monitor their level of commitment and orientation to serve customer needs. However, in addition to monitoring, the management team must communicate information regarding successful and unsuccessful customer experiences across all business functions. In this manner, it will be possible to integrate all business functions (e.g. R&D, manufacturing, marketing, sales, accounting) to serve the needs of the target markets. All managers can understand how everyone in the firm can contribute to creating customer value. Moreover, top management should regularly discuss competitors’ strengths and strategies and respond to competitive actions by competitors that threaten them. Hence, salespeople must share information with the entire organization in relation to competitor strategies because these individuals are likely to be the first to encounter such strategies.

The last dimension of the scale (innovativeness and technological capability) was previously identified in the BG literature as one of the factors influencing the BG internationalization process (Freeman et al., 2006; Zahra et al., 2000; Zhang & Dodgson, 2007). Furthermore, as previously mentioned, Kim et al. (2011) analyze the relationship among BG's customer orientation with innovativeness and technological capability for CRM and external customer information management. To engage in innovative, proactive, and risk-seeking behaviour that is developed by a firm's managers, to continuously seek innovative ideas that use knowledge-intensive technologies to improve existing offerings, and ultimately to become a leader in product and process innovation will undoubtedly enable such a firm to become oriented towards international markets, independently of the distance from the target foreign market/s to the domestic market.

Based on the quantitative study for validating the scale, it was determined that one of the constructs that had been identified through the qualitative analysis (influence of networks) should not be a component of the OIM scale. We believed that the external financial support that allows firms to operate in foreign markets and the use of networks for entering and developing in international markets could form part of the OIM construct as previous literature identified both factors influencing the BGs internationalization process (Gabrielsson et al., 2004; Kocak & Abimbola, 2009; Sharma & Blomstermo, 2003). However, the data did not suggest internal consistency for the construct. That is the reason why more research to identify the relevant items for measuring the construct as well as to fully understand the connection among networks and the OIM of BGs is required.

The results of this study provide relevant theoretical implications. This study provides a comprehensive view of the OIM of BGs by developing a measurement of OIM for these firms, which constitute an important type of international entrepreneurial organization. Given the scarcity of relevant information on the OIM of BGs, the measurement developed in the current study could thus serve as a platform for future studies. The findings of this study could also function as a reference for research investigating the internationalization of firms focused on BGs and performance. The analysis of the literature regarding BGs and performance revealed that high emphasis has been placed on assessing the export performance (Kocak & Abimbola, 2009), organizational performance (Liu & Fu, 2011), international performance (Jantunen, Nummela, Puumalainen, & Saarenketo, 2008; McDougall & Oviatt, 1996) and financial performance (Gleason & Wiggenhom, 2007) of BGs. However, despite the increased number of these studies, more research is necessary to explain the drivers of the growth and performance of these firms (Sharma & Blomstermo, 2003). In response to this concern, the results of this research enabled us to propose an OIM measurement scale specifically for BGs.

This study may help to stimulate further empirical research on the relationship between OIM and the performance of BGs. Hence, the scale proposed in this study will provide a useful reference for future investigations on this important topic.

Managerial relevanceManagers are aware that the MO of their companies is a sustainable source of competitive advantage that they strive to develop. With a stronger focus on return on investment and restricted budgets, it is more important than ever an effective OIM of the company. However, until the date, the managers of BG firms lacked the necessary tool that would allow them to measure this relevant intangible asset in their firms. The development of a valid and reliable OIM tool can assist managers in better understanding the reality of foreign markets and in developing effective strategies to attract and retain customers in different markets overseas. Consequently, this study makes an important contribution towards harmonizing the measurement of this relevant intangible asset by providing an empirically valid measurement scale of OIM for BG firms.

Furthermore, this measurement scale allows for an item-based prioritization. For marketing managers in particular, an application of the items of the scale can provide detailed information on marketing activities to meet the needs and expectations of customers. As a consequence, the OIM scale provides managers of BG firms with important means for taking actions, not only to increase their firms’ OIM but also to effectively manage the consequences of OIM such as customer satisfaction of their expectations. Finally, a relevant trait of the proposed measure is that it is useful for managers of BGs of different ages, becoming as a consequence a stable tool to be adopted.

LimitationsOur research is not free of limitations, which provide promising avenues for future research. We relied on a sample of BG firms of different ages from tree different countries, which is convenient for dealing with external validity aspects. Unfortunately, the sample sizes for Spain and the Nordic countries did not allow us to compare the two subsamples we have handled in the different contexts; therefore, the results of this research should be considered only as a first step in the context of developing a OIM for BG firms. Accordingly, future research should focus on validating the results of this study in different economic and geographical settings. Likewise, the assessment of this scale for those companies following a gradual internationalization process would allow us, if the scale is also valid for this type of firms, to provide a scale for measuring orientation towards international markets no matter the internationalization pattern followed by the company.

Another limitation is related to the reliance placed on perceptions of managers. As Rong and Wilkinson (2011) argue, studies that rely on perceptual information from managers may tell us only about sense-making by managers. Likewise, Uncles (2011) points out that a manager might believe the organization is market sensing, but wonders if customers or other stakeholders (suppliers, shareholders, analysts or competitors) would think the same. Although in line with Uncles (2011), we believe that having multiple respondents from each company to reflect the perspectives of managers with varied roles, functions, experiences and life stages, and not simply rely on one senior manager as key informants, is one option for overcoming this limitation, in this research it was not a possible alternative due to the available information being managed.

Finally, future research could compare the OIM scale presented in this study for BG firms with the scale that could be obtained following the C-OAR-SE procedure, based on content validity, established by expert agreement after pre-interviews with target raters (Rossiter, 2002). In doing so, researchers could use different instruments to assess OIM and its components avoiding possible bias when the purpose is to determine performance consequences. However, any study that aims to validate the impact of OIM on BG firms’ international performance would have to surmount the considerable challenges of data availability, which also hindered their inclusion in the current study.

Conflict of interestThe authors declare no conflict of interest.

The authors gratefully acknowledge the support provided by the Spanish Ministry of Education and Science for its financial support via the research project (ECO2010-16760).