This paper analyses the influence of family members’ social capital on non-family members’ social capital in family firms. It tests the impact of one type of social capital on another type of social capital using structural equation modelling techniques. The sample consists of 172 Spanish family firms in which at least two family members and two non-family members work in each firm. Data analysis shows that family social capital has a direct and positive influence on non-family social capital and the relationships between some of the social capital dimensions in each group. This research provides family firms with insights on which aspects of their members’ relationships are important to creating an ideal environment in the firm for generating social capital. It shows that relationships between all family members are key to increasing non-family social capital. This is the first study to analyse the effects of relationships between family members on those of non-family members. This work examines both the influence of the various social capital dimensions within each group and between the two groups in family firms, using an integrated model.

El propósito de este artículo es analizar la influencia que el capital social de los familiares que trabajan en la empresa familiar tiene sobre el capital social de los empleados no familiares. El impacto del capital social familiar sobre el no familiar ha sido comprobado a través de un modelo de ecuaciones estructurales. La muestra consiste en 172 empresas familiares españolas que tienen al menos 2 miembros familiares y 2 miembros no familiares trabajando en la empresa. El análisis de los datos muestra que el capital social familiar tiene un efecto directo y positivo sobre el capital social no familiar, así como las relaciones entre algunas de las dimensiones de cada grupo. Esta investigación permite a las empresas familiares conocer qué aspectos de las relaciones de los miembros de su organización son importantes para tener un buen ambiente de trabajo en la empresa. Esto muestra que las relaciones entre todos los empleados familiares son claves para incrementar el capital social no familiar. Este es el primer estudio que analiza los efectos de las relaciones entre miembros familiares y no familiares. Este trabajo tiene por objeto combinar la influencia de las dimensiones del capital social en cada grupo y entre los 2 principales grupos de una empresa familiar (miembros familiares y miembros no familiares), y utiliza un modelo integrado para llevar a cabo este objetivo.

Family businesses differ from other types of firms (Chua, Chrisman, & Sharma, 1999); they have idiosyncratic resources and capabilities (Habbershon & Williams, 1999) such as a family language, which allows them to communicate more efficiently and exchange more information with greater privacy (Tagiuri & Davis, 1996); motivation; loyalty; and trust, to name a few, which enables them to outperform non-family firms in some aspects (Anderson & Reeb, 2003).

In this way, Moores (2009) says that the basic characteristic that distinguishes family firms from other types of businesses is the influence of familial relationships, which operate as a collective good within family firms. Habbershon, Williams, and MacMillan (2003) refer to this characteristic as ‘familiness’, a construct which encompasses the idiosyncratic bundle of resources and capabilities possessed by family firms resulting from the familial interactions. This construct is distinct to research on family businesses (Pearson, Carr, & Shaw, 2008).

Research on family businesses has been done from several theoretical perspectives, which include agency and stewardship theories (Chrisman, Chua, Kellermanns, & Chang, 2007; Miller, Le Breton-Miller, & Sholnick, 2008). However, some scholars have also used the resource-based view (RBV) of the firm to explain the familiness construct (Barney, 1991; Habbershon & Williams, 1999). Nevertheless, the RBV is criticised for a general lack of specificity and for not clarifying why this competitive advantage exists in family firms (Hoopes, Madsen, & Walker, 2003).

In this sense, to overcome these limitations in the organisational literature, increasing importance should be attached to social capital or assets embedded in relationships that contribute to the creation of valued outcomes (Coleman, 1988; Leana & Van Buren, 1999). Recently, some scholars have proposed that social capital theory can offer a unique position from which to study family firms (Arregle, Hitt, Sirmon, & Very, 2007; Pearson et al., 2008), with the goal of providing a clearer picture of some of the unique characteristics of family businesses. The ‘familiness’, which results from relationships between family members in family businesses, is fairly well known. However, the impact of family relationships on relationships among non-family members in the family firm is not yet known.

The literature on social capital has grown enormously over the last two decades, demonstrating the important role of social capital especially in the context of family firms (Kontinen & Ojala, 2012). However, according to Chuang, Chen, and Chuang (2012), the conditions which encourage and support the organisational social capital (in this case, the family firm internal social capital or FFISC) have received little attention and the related literature is still growing. The scientific community has made even less contribution to the study of social capital in family firms, perhaps with the exception of works by Arregle et al. (2007), Hoffman, Hoelscher, and Sorenson (2006), Pearson et al. (2008), and Sorenson, Goodpaster, Hedberg, and Yu (2009). Consequently, research on social capital in family firms is lacking, and even more so on FFISC, which takes into account not only relationships between family members but also relationships among non-family members.

The vast majority of researchers in this area say that for many family firms, the social capital residing in familial relationships (familiness) is an important element of their capability to create a competitive advantage (Arregle et al., 2007; Hoffman et al., 2006; Mustakallio & Autio, 2001; Pearson et al., 2008; Sorenson et al., 2009). Based on this line of thinking, we adopt social capital theory to identify the specific behaviour and social resources within the family firm. More concretely, we follow the perspective of Nahapiet and Ghoshal (1998, p. 243), who defined social capital as ‘the sum of the actual and potential resources embedded within, available through, and derived from the network of relationships possessed by an individual or social unit’, and limit our study to relationships in family firms. In other words, we adopt an internal view of social capital like Arregle et al. (2007), Chuang et al. (2012), Dess and Shaw (2001), Leana and Van Buren (1999), and Pearson et al. (2008), in the process combining Pearson et al.’s (2008) work on the development of a construct of social capital in family firms, with Arregle et al.’s (2007) work on the development of social capital flow to business systems.

To achieve the purpose of this paper, we, like Chuang et al. (2012), follow Dess and Shaw (2001) and Leana and Van Buren (1999) in conceptualising organisational social capital, and Arregle et al. (2007) and Pearson et al. (2008) in conceptualising family firms’ social capital as a resource which reflects the social relationships within the firm, which pertains to the concept of internal social capital (Adler & Kwon, 2002; Leana & Pil, 2006). In short, for the purpose of this study, relationships within the firm do not include individuals outside the firm or other organisations.

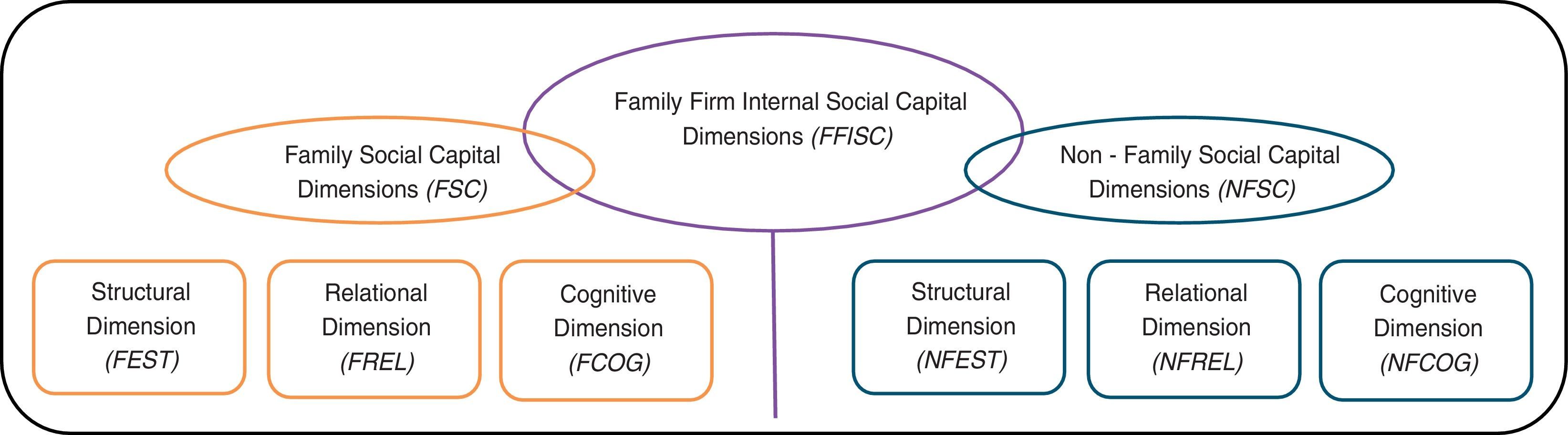

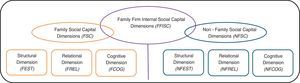

From Nahapiet and Ghoshal's (1998) framework and Salvato and Melin's (2008) work in which they distinguish two kind of networks in family firms, we can conclude that family firms are not a homogeneous group: on the one hand, there is a network of family members (family group), and on the other hand, there is a network of non-family members (non-family group). The FFISC focuses on relationships within family firms, which include relationships between family members and relationships between non-family members in the family firm. In this paper, as we say above we focus on relationships only inside family firms, that is, on FFISC, which is built by relationships in the two groups inside family firms. We examine family members’ relationships with each other (familiness), non-family members’ relationships with each other, and how family members’ relationships influence non-family members’ relationships. We study ‘familiness’ to test the hypothesis that good relationships among family members create an ideal environment in which to create social capital (Coleman, 1988). We also study non-family members’ relationships to test the hypothesis that weak ties in a family firm are also beneficial to creating social capital (Burt, 1992).

Our first goal is to propose that FFISC is formed by social capital which emerges from relationships between family members (FSC) and by social capital which emerges from relationships between non-family members (NFSC), and that each type of social capital has its own characteristics. In this way, we apply the social capital concept to compare and contrast different types of relationships (Inkpen & Tsang, 2005), something which has not been done often in the literature. We analyse two different groups (family members and non-family members) addressing both viewpoints, internal to the family group (familiness) and internal to the non-family group.

Social capital is a complex multidimensional construct (Koka & Prescott, 2002) with three different but interrelated dimensions: structural, relational, and cognitive (Nahapiet & Ghoshal, 1998; Tsai & Ghoshal, 1998). However, there are relatively few studies which have investigated all the dimensions of social capital together. Therefore, following Bolino, Turnley, and Bloodgood's (2002) and Nordqvist's (2005) suggestions, and following Payne, Moore, Griffis, and Autry (2011), who say that the concept of social capital offers enormous potential for better understanding multi-level management and organisational phenomena, in this study, we propose a conceptual model for better understanding the antecedent factors and consequences of investments in different forms of FFISC. Thus, our second goal in the current study, following Adler and Kwon (2002), is to explore the two forms of FFISC (i.e. relationships between family members and between non-family members) to know how each form is built in family firms, and consequently, show that both forms have its own dimensions, namely, structural, relational, and cognitive. These two forms of social capital combine to build FFISC (Arregle et al., 2007). We follow Adler and Kwon's (2002) model, which considers both forms of social capital simultaneously. Finally, based on social capital theory, our third goal is to explore how FSC influences on NFSC.

All in all, in this paper, we seek to address some gaps in the literature. First, we aim to contribute to the literature on family firms and social capital. Second, we aim to identify avenues for future research on FSC and NFSC. Finally, we aim to clarify family firms’ distinctive resources.

The rest of the paper is organised as follows. First, we provide a theoretical background on social capital and describe its dimensions and forms in general. Next, we explain the influence of FSC on NFSC by developing and then testing a model. Finally, we summarise the findings and implications, identify the paper's limitations, and suggest avenues for future research.

Conceptual frameworkTo sum up much of the conventional wisdom regarding social capital, we underline two works: that by (a) Nahapiet and Ghoshal (1998, p. 252), who said ‘who you know affects what you know’, and by (b) Woolcock and Narayan (2000, p. 225) who said ‘social capital it is not what you know, it is who you know’.

The social capital concept was developed by sociologists, including James Coleman, Ronald Burt, and Robert Putnam, who have made large contributions to the recent development of the construct. Coleman (1990, p. 302) defines social capital as ‘some aspect of social structure that facilitates certain actions of individuals within the structure’. Burt (1992, p. 9) defines social capital as relationships with others, namely ‘friends, colleagues, and more general contacts through whom you receive opportunities to use your financial and human capital’. According to Putnam (1993, p. 167), social capital refers to ‘features of social organisation, such as trust, norms, and networks’.

Social capital theory has been expanded to explain a variety of outcomes, including industry creation (Aldrich & Fiol, 1994), firm growth (Chuang et al., 2012; Habbershon et al., 2003; Ostgaard & Birley, 1994), career success (Seibert, Krainer, & Linden, 2001), group effectiveness (Oh, Chung, & Labianca, 2004; Oh, Labianca, & Chung, 2006), knowledge transfer (Weber & Weber, 2011), and strategic choice (Houghton, Smith, & Hood, 2009). In other words, the study of social capital has entered almost every field in the social sciences over the last decades. In other words, social capital has become a powerful concept which encompasses many areas including that of family firms.

The application of social capital theory in organisational settings was proposed initially by Nahapiet and Ghoshal (1998, p. 243), who define it as ‘the sum of the actual and potential resources embedded within, available through, and derived from the network of relationships possessed by an individual or social unit’. This definition highlights the importance of networks of strong, cross-cutting personal relationships that develop over time and which provide the basis for trust. Adler and Kwon (2002, p. 23) define this construct as ‘the goodwill available to individuals or groups. Its source lies in the structure and content of the actor's social relations. Its effects flow from the information, influence, and solidarity it makes available to the actor’.

Social capital theory was founded on the premise that a network provides value to its members by allowing them access to the social resources embedded within the network (Bourdieu, 1985; Seibert et al., 2001). Therefore, social capital is the network of relationships possessed by an individual or social group that facilitates action and creates value (Adler & Kwon, 2002; Bourdieu, 1985; Nahapiet & Ghoshal, 1998). Social capital has been defined in a variety of ways by numerous researchers in the social and organisational sciences (Adler & Kwon, 2002; Borgatti & Foster, 2003; Lin, 2001; Zheng, 2010); however, all these definitions share at least two common elements: (1) social capital arises from the structure of relationships between and among actors in a network (Burt, 1992) and (2) an actor has the ability to access this network or its social–structural benefits (Coleman, 1988). Thus, the basic idea of social capital is that a person constitutes an important asset, one which can be called on in a crisis, enjoyed for its own sake, and leveraged for material gain (Davidsson & Honig, 2003). In other words, social capital comprises both structural aspects as well as cultural aspects (Van Deth, 2003).

Networks of relationships constitute or lead to resources which can be used for the good of the individual or the collective (Dakhli & De Clercq, 2004). Hence, the concept of social capital with long-term relationships engenders trust and goodwill between the transaction partners to decrease opportunistic behaviour (Adler & Kwon, 2002; Bubolz, 2001; Nahapiet & Ghoshal, 1998; Uzzi, 1996); reduce transaction costs (Lazerson, 1995; Van Deth, 2003); solve problems of coordination (Lazega & Pattison, 2001; Lin, 2001); make collective work easier (Putnam, 1993); enhance access to markets, complementary resources, and technological knowledge (Hitt, Ireland, Camp, & Sexton, 2001, 2002); enhance reputation, increase rule understanding, give privileged access to information and knowledge (Inkpen & Tsang, 2005); and facilitate information transfer (Larson, 1992; Uzzi, 1996).

Cohen and Levinthal (1990) say that the more informationally rich a venture's social network is, the more knowledge it will be able to assimilate, value, and apply. With greater flow of information, the transaction cost for the organisation is to recruit ‘better’ (be it in skill, or technical or cultural knowledge). Individual embeddedness in one network enables individuals to extract otherwise unavailable resources (Flap, 1988) from their social structures, networks, and memberships (Lin, Vaughn, & Ensel, 1981; Portes, 1998). Social capital also contributes directly to a venture by allowing it to acquire better human and financial resources, and indirectly through its ability to leverage productivity (Florin, Lubatkin, & Schulze, 2003). All these benefits, together with managerial capability, predict a venture's performance (Lee, Lee, & Pennings, 2001).

The main idea of social networks is that persons and groups with more and better social capital will be better able to realise their goals (Schutjens & Völker, 2010) because social capital acts as glue which binds people together in social relationships. It also acts as a lubricant which makes social interactions in social relationships easier (Anderson & Jack, 2002). This means investment in social relationships yields returns.

Arregle et al. (2007) say that the social capital construct can be examined from two perspectives: (a) a process perspective and (b) a content perspective. According to Nahapiet and Ghoshal (1998), from a process perspective, four dynamic factors influence the development of social capital: stability (time), interaction, interdependence, and closure. Meanwhile, from the latter perspective, three dimensions comprise social capital: structural (the mere existence of these network connections between actors in the organisation), relational (the nature and quality of connections between individuals in the organisation), and cognitive (people within a social network share a common perspective or understanding) (Bolino et al., 2002; Nahapiet & Ghoshal, 1998; Yli-Renko, Autio, & Sapienza, 2001).

Social capital integrates processes occurring at individual, group, and organisational levels (Klein & Kozlowski, 2000; Leana & Van Buren, 1999). In this study, we analyse social capital at the group level (family and non-family) and the influence of FSC on NFSC.

Nevertheless, the proliferation of studies on social capital has led some researchers to decry the overexpansion of the concept (Houghton et al., 2009). Thus, social capital is a double-edged sword (Westlund, Rutten & Boekema, 2010). Woolcock (1998) said that social capital can provide a range of valuable services for community members, but it can also have a negative effect on a firm, such as poor performance (Portes, 1998), exclude outsiders, put excessive demand on group members, restrict individual freedoms, and downward levelling norms (Portes & Landolt, 1996). Some scholars have acknowledged the potential downside of social capital (Kontinen and Ojala, 2012; Leana & Pil, 2006; Maurer & Ebers, 2006; Portes, 1998; Uzzi, 1997). However, the less social capital a firm has, the more it is exposed to opportunistic behaviour (Walter, Lechner, & Kellermanns, 2007).

This lack of agreement about social capital reinforces the importance of developing a social capital model for family firms. Thus, in this paper, we examine organisational social capital from the same perspective as Chuang et al. (2012) and Dess and Shaw (2001), who in turn based their studies on Leana and Van Buren (1999, p. 540), who described social capital at the organisational level as ‘a resource reflecting the character of social relations within the organisation, realised through members’ levels of collective goal orientation and shared trust’. Likewise, we follow Arregle et al. (2007) in examining the interactions between family members, interactions between non-family members, and the influence of FSC on NFSC. In doing so, we take into account the resource dependence perspective (Pfeffer & Salancik, 1978), which states that FFISC depends not only on the relationships between family members, but also on the relationships between non-family members.

In this paper, we also follow the definition of social capital by Oh et al. (2004, 2006) in introducing the group social capital concept. Group social capital emerges from a group, within which networks of relationships and consequently social capital exist, although some empirical studies have shown that networks do not automatically constitute social capital (Labianca & Brass, 2006; Portes, 1998). Finally, we adopt the content perspective of social capital to build the social capital construct (which has structural, relational, and cognitive dimensions).

On the one hand, we have the FSC construct, which refers only to relationships between family members, to better understand the effects of family relationships on the development of family firm social capital, that is, family social capital within the family firm. In a family, all members are interconnected by emotionally intense links and by ties which are stronger, more intense, and more enduring. Thus, in family firms whose proprietors view their businesses as vehicles for the security, reputation, and intergenerational benefits of their kin, the connections between these owners and their organisations are often unusually close (Arregle et al., 2007; Miller et al., 2008; Zahra, Hayton, & Salvato, 2004). FSC builds on internal cohesiveness and solidarity within a collective or unit such a as a family, business, or local community (Montemerlo & Sharma, 2010). Thus, FSC is found in dense networks, which in turn helps build trust, internal cohesiveness, and solidarity in the pursuit of common goals (Coleman, 1988).

FSC leads to a quicker convergence of individual goals towards a collective goal within family businesses. This form of capital also enables norms of ‘generalised reciprocity’ and binds units in the pursuit of collective goals by generating trust and discouraging malfeasance (Granovetter, 1985; Uzzi, 1997). Moreover, with FSC, interests, norms, and values are shared and a common identity emerges, leading to efficiencies enabled by lower monitoring costs, higher commitment, prevention of accumulated grievances and grudges, combined with faster dispute resolution (Nelson, 1989; Ouchi, 1981).

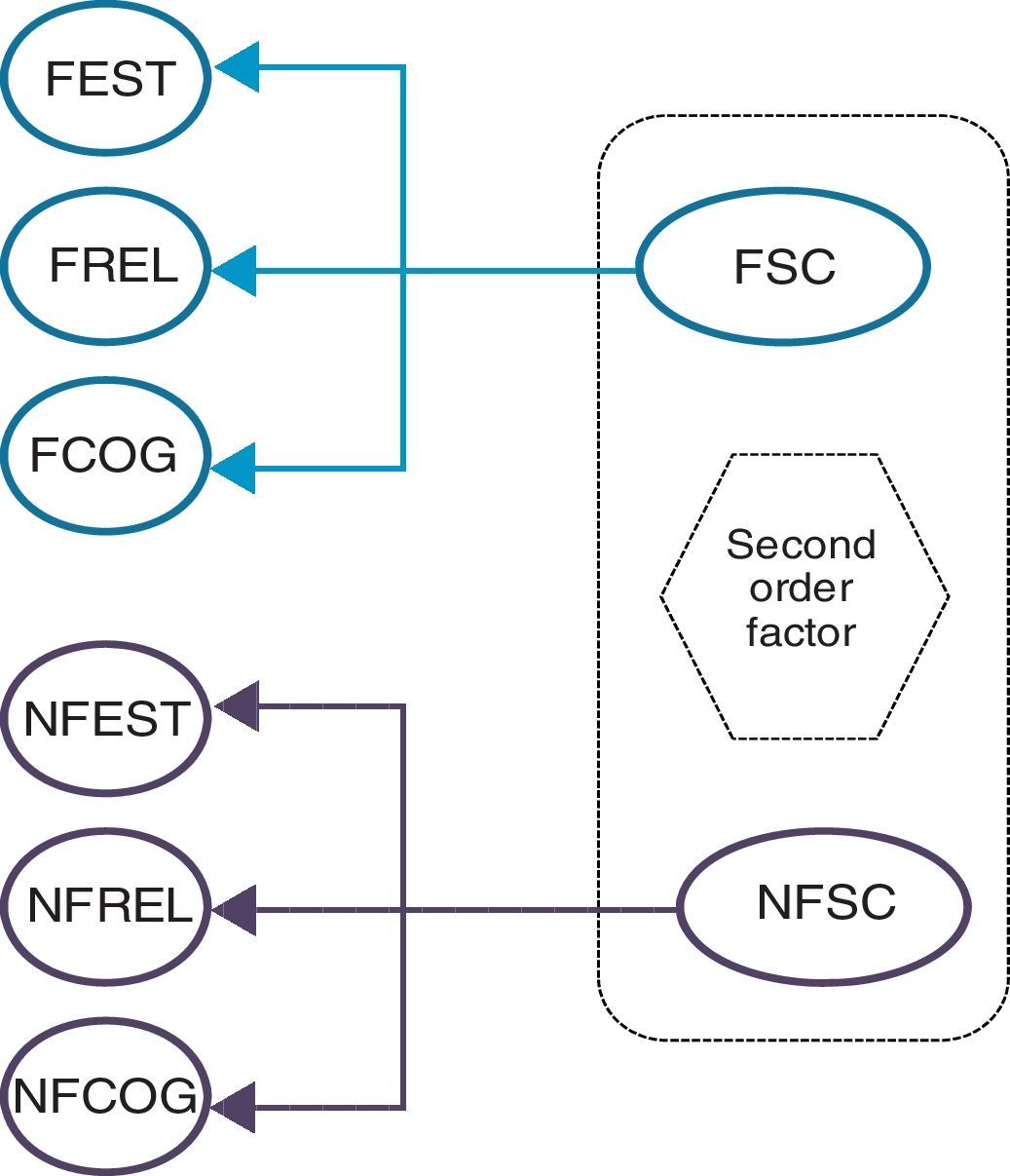

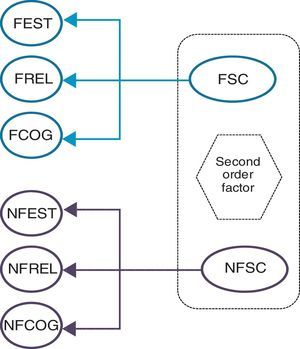

As we have already mentioned, following Nahapiet and Ghoshal's (1998) framework, we propose that FSC has its own structural, relational, and cognitive dimensions; its strength is in these distinct dimensions residing within familiness. Following Arregle et al. (2007), Leana and Pil (2006), Pearson et al. (2008), and Tsai and Ghoshal (1998) among others, who suggest exploring the dimensions of FSC, we analyse each dimension of the structural, relational, and cognitive dimensions of FSC (see Figs. 1 and 2).

However, an over-reliance on the family can constrain business development. Therefore, while FSC provides some advantages, it could also be limiting because the group is not necessarily the best source of information, and could inhibit a ‘break-out’. While a family offers benefits of resource leverage and strong levels of support and trust, it also provides redundant information (Portes, 1998). A family firm needs to seek more diversity and heterogeneous information and advice. According to Cook and Whitmeyer (1992), the more personal resources one has, the more attractive weak ties become, and thus, a network which is less dense and has weak ties (i.e. social capital from non-family members) is needed to overcome these limitations because it brings other resources or knowledge to the firm (Adler & Kwon, 2002; Arregle et al., 2007; Bubolz, 2001; Granovetter, 1973, 1985; Hagel & Singer, 1999; Jack, 2005; Miller & Le Breton-Miller, 2005; Nahapiet & Ghoshal, 1998).

On the other hand, we also examine the NFSC concept because family firms often need more than family members due to the complexities and environmental hazards the firms face. This concept focuses primarily on how non-family members contribute to the realisation of a firm's goals and objectives. Linkages to unconnected units (structural holes) enable efficient goal achievement, lead to greater informational benefits, and enable identification of fruitful opportunities, favourable negotiations, and placement in positions of power and influence (Burt, 1992; Granovetter, 1973; Jack, 2005). Thus, NFSC is social capital which emerges from the relationships of non-family members in a family firm.

The benefits of NFSC can be far-reaching and can include increased ability to gather information, ability to gain access to power or better placement within the network, and ability to better recognise new opportunities (Adler & Kwon, 2002). That is, non-family members generate social capital by supplying the firm with resources and knowledge, which can strengthen and stabilise the business, and stretch its capabilities (Adler & Kwon, 2002; Arregle et al., 2007; Bubolz, 2001; Granovetter, 1973, 1985; Hagel & Singer, 1999; Jack, 2005; Miller & Le Breton-Miller, 2005; Nahapiet & Ghoshal, 1998). Hence, in this way, non-family members enable family firms to generate social capital (Nam, 2002) by obtaining information which would otherwise be unavailable or costly to locate (Davidsson & Honig, 2003) and help to survive during the tough times (Miller, Lee, Chang, & Le Breton-Miller, 2009).

In family firms, there are more structural holes among non-family members because they do not have the same cohesive group structure that family members have. Thus, in principle, NFSC is richer in structural holes than FSC.

As we have mentioned, following Nahapiet and Ghoshal's (1998) framework, we propose that NFSC has its own structural, relational, and cognitive dimensions; its strength is in these distinct dimensions residing among non-family members. Following Arregle et al. (2007), Leana and Pil (2006), Pearson et al. (2008), and Tsai and Ghoshal (1998), among others, who suggest exploring the dimensions of family firm social capital, we analyse the structural, relational, and cognitive dimensions of NFSC emerging from non-family members in a family firm (see Figs. 1 and 2).

Oh et al. (2004) view a group as both a whole unit and a collection of individuals, considering individuals as embedded simultaneously in the social structure of a group and an overall organisation (Firebaugh, 1980; Manson, 1993). Oh et al. (2004) also state that in group social capital, a group itself has a social structure and must be considered both as a whole and as an aggregate of its parts, focusing on the configuration of social ties (or conduits) which make resources available to a person or group (Adler & Kwon, 2002; Seibert et al., 2001). In addition, different types of groups are appropriate for different purposes (Casson & Giusta, 2007). From a structuralist perspective, the configuration of group members’ social ties within and outside a group affects the extent to which the members connect to individuals who can convey needed resources, have the opportunity to exchange information and support, have the motivation to treat each other in positive ways, and have the time to develop trusting relationships which might improve their tasks, and consequently, the group's effectiveness (Bantel & Jackson, 1989; Krackhardt, 1992), because they have the time to develop working routines and understandings. This reduces the transaction cost for all group members, as well as between groups, generating benefits for all (Oh et al., 2006).

Greater group social capital makes for more effective groups (in terms of quality of work, quantity of work, initiative, cooperation with other groups, ability to complete work on time, and ability to respond quickly to problems) because these groups have greater access to important resources necessary to maintain and improve their performance, and to quickly respond to challenges which arise (Oh et al., 2004). Groups themselves are heterogeneous, and family firm social capital is affected by the existence of groups (Duncan, 1974; Thomas & McDaniel, 1990).

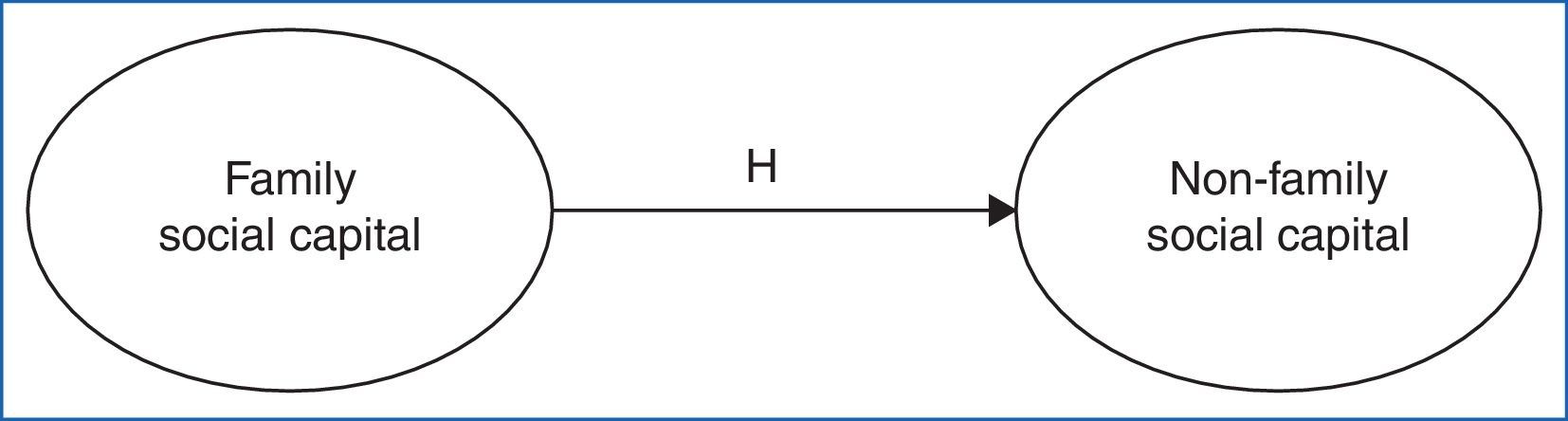

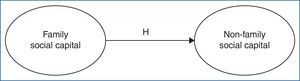

Thus, based on Salvato and Melin (2008), who say that family social capital is higher in families because of their stronger social ties, and on Arregle et al. (2007), who say that the family firms’ interactions, communications, and relationships make it possible to obtain resources from other groups, we propose the following hypothesis, which is illustrated in Fig. 3. H: Family social capital (social capital which arises from relationships between family members in family firms) has a positive influence on non-family social capital (social capital which arises from relationships between non-family members in family firms).

We conducted this study on Spanish firms included in the Iberian Balance Sheet Analysis System (SABI) database for January 2013. We used certain criteria to obtain a sample that is representative of the population. We eliminated companies affected by special situations such as insolvency, winding-up, liquidation, zero activity, and those with less than 50 employees. We also looked for companies with more than one family member employee and more than one non-family member employee. Finally, we looked for companies that provided financial information in the last five years.

In this study, a family firm is a firm which meets two conditions: (a) have a substantial level of common stock held by the founder or family members, which allows them to exercise control over the firm and (b) have family members who participate actively in monitoring the firm. As per Arosa, Iturralde, and Maseda (2010), Voordeckers, Van Gils, and Van de Heuvel (2007), and Westhead and Howorth (2006), we established 50% as the minimum percentage of a firm's equity considered as a controlling interest. To determine compliance with these two conditions, we conducted an exhaustive review of shareholding structures (percentage of common stock) and composition (names and surnames of shareholders). We obtained these data from the SABI database, but our aim was to corroborate the classification of family firms by through a questionnaire survey.

The original sample used in this study was a random sample of 1122 firms. After mailing reminders to the firms or contacting them by phone, 232 family firms responded to the questionnaire survey and provided data on their members’ relationships. From these 232 family firms, 172 responded as having both family and non-family employees, 28 only family employees, and 32 only non-family employees. Our sample's response rate was high, and the set of respondents is representative of the different employee groups across the various business areas and geographic locations in Spain.

Data collectionA questionnaire was used to obtain information that is unavailable or difficult to obtain for non-listed firms. Data were collected by means of telephone interviews, a method which ensures a high response rate. To guarantee the highest possible number of replies, managers were made aware of the study in advance by mailing them a letter indicating the purpose and importance of the research. To encourage participation, a date and time was arranged in advance for telephone interview. 232 (20.70%) family firms responded to the questionnaire; however, from these, 15.30% responded having both family and non-family employees, 2.50% responded having only family employees and 2.90% responded having only non-family employees. The interviewees were persons responsible for management of the firms (among the family employees who responded, 50.50% were CEOs, and among non-family employees, 38.20% were financial managers).

The questionnaire collected information on the variables required for the study, including information regarding the relationships between family employees and between non-family employees.

Components and data analysisWe tested the model presented in Fig. 3 using structural equation modelling (SEM). Steenkamp and Baumgartner (2000) highlighted two main advantages of this technique. First, structural equation models explicitly incorporate measurement errors and analyse their influence on the degree of fit. Second, unlike multiple regressions, SEM enables the study of relationships between model variables simultaneously because several dependent variables can be considered in the same model and the same variable can be both endogenous and exogenous at the same time relative to the other variables in the model.

The hypothesised structural equation model was tested using EQS 6.2 (Bentler, 1995), with the raw data as input. Raw data screening showed evidence of non-normal distribution (Mardia's coefficient normalised estimate=12.21). Although other estimation methods have been developed for use when the normality assumption does not hold, the recommendation of Chou, Bentler, and Satorra (1991) and Hu, Bentler, and Kano (1992) of correcting the statistics rather than using a different estimation model was followed. In this way, robust statistics were provided (Satorra & Bentler, 1988).

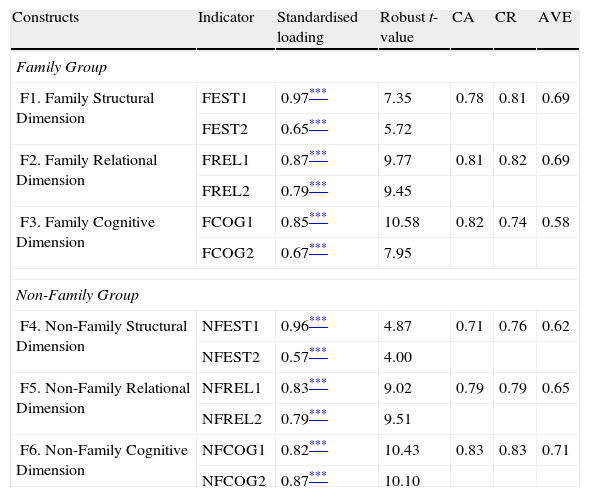

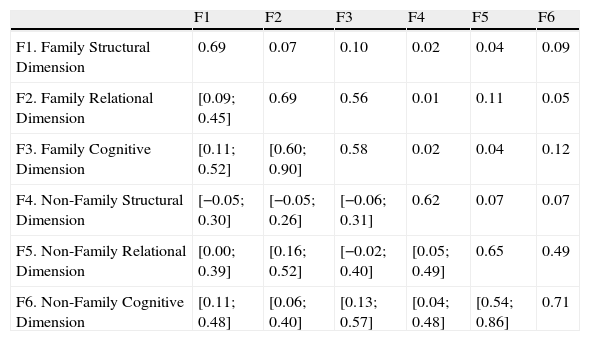

Validity of the scalesBefore we tested the hypothesis, although the validity of the scales have been tested in previous studies, we validated the measurement model again for this study because the constructs used in our study were adapted from previous studies (Tsai & Ghoshal, 1998) and were measured by multiple-item five-point Likert-type scales. Thus, we performed a confirmatory factor analysis (CFA) to validate the measurement model (Fig. 2). Table 1 displays the standardised loadings, robust t-values, reliability measured by Cronbach's (1951) α (CA), composite reliability (CR), and average variance extracted criteria (AVE). The final measurement model is reliable because all the CAs are above the recommended value of 0.70 (Churchill, 1979), and the CR indexes are higher than 0.70 (Fornell & Larcker, 1981). No evidence of a lack of discriminant validity is found, either from applying the confidence interval criterion (Anderson & Gerbing, 1988) or the AVE (Fornell and Larcker, 1981), as can be seen in Table 2. Nomological validity is assured because the difference between the measurement model and the theoretical model (structural model), x2s, is not significant (Anderson & Gerbing, 1988; Hatcher, 1994).

Validation of the final measurement model – reliability and convergent validity.

| Constructs | Indicator | Standardised loading | Robust t-value | CA | CR | AVE |

| Family Group | ||||||

| F1. Family Structural Dimension | FEST1 | 0.97*** | 7.35 | 0.78 | 0.81 | 0.69 |

| FEST2 | 0.65*** | 5.72 | ||||

| F2. Family Relational Dimension | FREL1 | 0.87*** | 9.77 | 0.81 | 0.82 | 0.69 |

| FREL2 | 0.79*** | 9.45 | ||||

| F3. Family Cognitive Dimension | FCOG1 | 0.85*** | 10.58 | 0.82 | 0.74 | 0.58 |

| FCOG2 | 0.67*** | 7.95 | ||||

| Non-Family Group | ||||||

| F4. Non-Family Structural Dimension | NFEST1 | 0.96*** | 4.87 | 0.71 | 0.76 | 0.62 |

| NFEST2 | 0.57*** | 4.00 | ||||

| F5. Non-Family Relational Dimension | NFREL1 | 0.83*** | 9.02 | 0.79 | 0.79 | 0.65 |

| NFREL2 | 0.79*** | 9.51 | ||||

| F6. Non-Family Cognitive Dimension | NFCOG1 | 0.82*** | 10.43 | 0.83 | 0.83 | 0.71 |

| NFCOG2 | 0.87*** | 10.10 | ||||

Notes: S-B χ2 (39 df)=43.46 (p=0.29); BBNFI=0.93; BBMMFI=0.99; CFI=0.99; IFI=0.99; MFI=0.99; RMSEA=0.026; Cronbach=0.76.

CA=Cronbach's α; CR=composite reliability; AVE=average variance extracted.

Validation of the final measurement model – discriminant validity.

| F1 | F2 | F3 | F4 | F5 | F6 | |

| F1. Family Structural Dimension | 0.69 | 0.07 | 0.10 | 0.02 | 0.04 | 0.09 |

| F2. Family Relational Dimension | [0.09;0.45] | 0.69 | 0.56 | 0.01 | 0.11 | 0.05 |

| F3. Family Cognitive Dimension | [0.11;0.52] | [0.60;0.90] | 0.58 | 0.02 | 0.04 | 0.12 |

| F4. Non-Family Structural Dimension | [−0.05;0.30] | [−0.05;0.26] | [−0.06;0.31] | 0.62 | 0.07 | 0.07 |

| F5. Non-Family Relational Dimension | [0.00;0.39] | [0.16;0.52] | [−0.02;0.40] | [0.05;0.49] | 0.65 | 0.49 |

| F6. Non-Family Cognitive Dimension | [0.11;0.48] | [0.06;0.40] | [0.13;0.57] | [0.04;0.48] | [0.54;0.86] | 0.71 |

Notes: Diagonal represents the square root of the average variance extracted; while above the diagonal the shared variance (squared correlations) are represented. Below the diagonal the 95% confidence interval for the estimated factors correlations is provided.

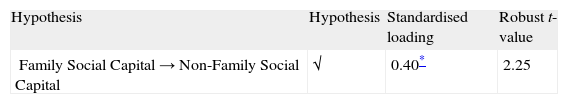

To test our hypothesis, we ran the SEM with all the hypothesised paths. Table 3 presents the results of the final structural models.

Hypothesis testing. Causal relation between family and non-family employees (second order factor).

| Hypothesis | Hypothesis | Standardised loading | Robust t-value |

| Family Social Capital→Non-Family Social Capital | √ | 0.40* | 2.25 |

Notes: S-B χ2 (47 df)=5915 (p=0.11); BBNFI=0.90; BBMMFI=0.97; CFI=0.98; IFI=0.98; MFI=0.97; RMSEA=0.039; Cronbach=0.76.

The FSC and NFSC measures were designed to reflect a second order factor structure, with the three internal social capital resource attributes (structure, relational, and cognitive) in each factor serving as latent indicators of the second order FSC and NFSC constructs. This second order conceptualisations are consistent with the majority of existing multidimensional constructs (Law, Wong, & Mobley, 1998), and it provides researchers with some flexibility in terms of breadth, width, and fidelity (Cronbach, 1951).

As Table 3 shows, and focusing in the second order factors, the results indicate that family members’ social capital influence non-family members’ social capital (λ=0.40; p<0.05).

The results obtained also indicate that both FSC and NFSC exist, and that both constructs are significant.

Discussion, conclusion, and implicationsThe purpose of this study was to develop, using a theoretical framework grounded on social capital theory, a model of internal social capital for family businesses, taking into account relationships between family employees and between non-family employees, and the influence of family group's social capital on non-family group's social capital.

This paper shows that each group in a family firm has distinct social capital, and that social capital is necessary to the life of an organisation (Leana & Van Buren, 1999). Yet, the concept seldom has been applied to compare and contrast different types of relationships. By addressing this deficiency in the literature, the paper has shown that social capital, in the form of both group and organisational social capital, is useful for distinguishing between different group types, because we have described two constructs, FSC and NFSC. The framework presented here indicates that FSC and NFSC contribute to the creation of the structural, relational, and cognitive aspects in each form of social capital. The model suggests that social capital, in turn, stimulates additional relationships between all of a family firm's members. The proposed model is a predictive one based on generally accepted theories from business administration and social psychology, applied to the specific case of family firms.

This paper makes several contributions to the existing research on social capital in family firms. First, although other studies have acknowledged social capital theory as being particularly relevant to the research on family firms (Arregle et al., 2007; Habbershon et al., 2003; Hoffman et al., 2006; Pearson et al., 2008), to the best of the authors’ knowledge this is the first to empirically test the relationships between family members in family firms (FSC). Second, this study also tests the relationships between non-family members in family firms (NFSC). Third, this study also explores the specificities which social capital theory could present regarding group dynamics in family firms, as well as their influence on the level of group cohesion. Finally, this study indicates that relationships between family members (FSC) have a significant and positive influence on non-family social capital (NFSC). In summary, the main contribution of this study is that it proposes and empirically verifies a model which integrates the influence of family group's social capital on non-family group's social capital in a family firm.

An important question future research could address is the practical implementation of this study's findings; in other words, the transferability of the study's findings to running real family businesses. The results of this research may be used as guidelines for consultants and advisors who are looking to improve the effectiveness of relationships between family members and between non-family members who run the family firm. Therefore, managers can use the findings to examine both formal and informal relationships (social capital) between all organisation members.

Although the study yielded significant findings, it also has limitations that need to be acknowledged. First, in this study, we focused on internal social capital. Although our decision to study FFISC was based on previous research, we could also have examined external social capital. A second potential limitation of this study is about the measures used. In previous studies on social capital, social network analysis has been used to assess the social capital of organisations. In addition, scholars such as Burt (2000) have argued for the superiority of network measures in research on social capital. However, in this study we did not use network measures, but rather developed our own approach, which is significantly less resource intensive and is more likely to result in higher response rates. Third, our research is based on Spanish family firms. Thus, the findings should be interpreted with caution, since the sample does not represent the situations in other countries. Further, our sample includes only family firms with at least 50 employees and private firms, so the results may not necessarily be generalisable to small firms and public firms. The study needs to be replicated with samples from other subpopulations to test for generalisability. Fourth, the study does not clarify the direction of causality of the relationship between FSC and NFSC because of the cross-sectional nature of the study.

Finally, having discussed the main conclusions and limitations, we now suggest some avenues for research which could further the current study. First, our measures of internal social capital should be validated against network measures, if possible, to better assess their validity. Second, it could be beneficial to study not only internal social capital but also external relationships to the family firm. Third, more data, particularly longitudinal data, could be collected in future investigations. Fourth, future research should certainly consider other observed measures such as innovation, performance (financial and non-financial measures), and employee commitment, motivation and satisfaction.

The authors thank Cátedra de Empresa Familiar de la UPV/EHU for financial support (DFB/BFA and European Social Fund). This research has received financial support from the UPV/EHU (Project UPV/EHU 12/22).