The auditor profession has always faced the problem of the audit expectation gap. These differences of expectations emerge from the perception society has in relation to: the quality of the audit work, the performance of the auditors, the result of their work and their objectives; in comparison with what is expected from these professionals. The objective of this study is to evaluate if, in Portugal, the teaching of audit courses reduces, or not, the audit expectation gap. The authors questioned students in higher education courses of management and accounting, before and after having audit courses, to find out if these influenced their perception on the responsibilities, the duties and limitations of the auditor work. The authors concluded that audit education does not reduce these differences in all the points analyzed, however, it alters the students’ perception regarding the auditor's responsibility regarding prevention and detection of errors, frauds and illegal acts.

The concept of differences of expectations in auditing (audit expectation gap) was initially introduced in the literature by Liggio in 1974, who defined it as being the differences between the idealized levels of performance, either by the auditors in relation to their work, or by financial statements users in relation to the auditors’ work. According to Guy and Sullivan (1988) and McEnroe and Martens (2001), the expectation gap between financial statements users and the auditors derive from distinct points of view regarding auditors’ responsibilities, mainly in what concerns the financial statements and their purpose. Many investors believe that the auditors have the responsibility and the duty to verify all documents with the aim to detect any error or fraud that may have occurred, (Louwers, Ramsay, Sinason, Strawser, & Thibodeau, 2011; Messier, Glover, & Prawitt, 2011). In Portugal, the definition of “expectation gap” we most identify with is the one Almeida (2005) cites, attributing to Guy and Sullivan (1988) and to Wolf, James, and Gregory (1999):

“Difference between what the public and the users of the financial information believe to be the responsibilities of the auditors and what the auditors think their own responsibilities are”.

The theme of the expectation gap has been greatly studied, both by academics and by public organizations or auditors’ associations. These studies mainly aim at understanding the nature, the origin and the perception of society regarding the work, the function, and the responsibilities of auditors.

In 1974, with the objective of determining if there was a gap in the expectations, the American Institute of Certified Public Accountants (AICPA) created the Cohen Commission. The results obtained by this commission suggest the existence of a gap in the expectations of financial statements users in relation to the auditors’ responsibilities and duties and, apparently, the problem would be due to the lack of their capacity to react and evolve quickly enough to meet social expectations.

Nair and Rittenberg (1987) proved, in a study carried out in the United States, the existence of different perceptions between bankers and the certified public accountants regarding the auditors’ opinion. Epstein and Geiger (1994) study concluded that nearly half of the investors expected the auditors to detect relevant distortions related to non-intentional errors and more than 70% wished that auditors actively investigated fraud evidence, although they admitted that these are difficult to detect. In their turn, Anderson, Lowe, and Reckers (1993) show that the expectation gap in auditing is also perceived by the North America judges.

Humphrey, Moizer, and Turley (1993) detected evidence of the audit expectation gap in England. The gap derives from factors such as the auditor's role in the detection of frauds, the auditor's responsibility in the analysis of the financial statements, the threats to the auditor's independence and the auditor's capacity to deal with risk and uncertainty. The authors also add that, “if any theme may be qualified as the heart of the debate of the expectation gap in auditing, it is the question of independence of the auditor”. This way the authors place the independence at the center of the questions related to the expectation gap.

However, the expectation gaps were not only a reality in the Anglo-Saxon countries, where auditing is a market demand and the scrutiny on auditors is greater. Indeed, Salehi, Mansoury, and Azary (2009) in Iran, Lin and Chen (2004) in China, Best, Buckby, and Tan (2001) in Singapore, Dixon, Woodhead, and Sohliman (2006) in Egypt, Sidami (2007) in Lebanon Saha and Baruha (2008) in India, show that this issue is transversal to all societies, and that the expectation gap come from the public's perception of independence and the auditors’ responsibilities in relation to the detection of errors and frauds.

Almeida (2012) concluded that there is also an audit expectation gap in Portugal and that it is mainly based in the detection of errors and frauds, and in the detection of illegal acts. This researcher also enhances that the factor which most contributes to the dissatisfaction of financial statements users, in relation to the auditing work, is the auditor's poor performance.

2Auditing in PortugalThe Lei 140/2015 de 7 de September, states that are proper and exclusive acts of the auditors: statutory audit, voluntary review of accounts and related services, the exercise of any functions which by law require the intervention of an auditor, as well as any other functions of public interest which the law confers.

To become an auditor the candidates are required to take an admittance exam. The examination is organized with a view to ensure the necessary level of theoretical knowledge in the fields relevant to audit and certify the ability to apply such knowledge in practice, and is currently comprised of four written tests. Applicants who have been approved in all the written exams will undergo an oral exam which will consist in the presentation of a subordinate work to a theme drawn from among a set of proposed topics by the examining board.

After being approved in oral exam the candidate will go on an internship. The internship aims to give the candidate an adequate training and practice in the exercise of professional activities, so that you can play the auditor role competently and with responsibility, particularly in its technical and ethical aspects. The probationary period has duration of three years, with a minimum of seven hundred hours per year.

In 2014, the European legal framework on the audit has been revised, with the approval of Directive 2014/56/EU of the European Parliament and of the Council of 16 April 2014 and Regulation (EU) No 537/2014 of the European Parliament and of the Council of 16 April 2014, related to specific aspects of the statutory audit of public interest entities.

This European framework was incorporated in Portuguese law with the approval of the Lei n° 140/2015 of 7 September (Portuguese Auditors Statutes) and with the Lei n° 148/2015 of 9 September (Auditing Supervision Law). These laws deepened the requirements applicable to public oversight system that now covers the approval and registration of the ROC and SROC, the adoption of standards on professional ethics and control of internal quality of SROC, continuing education, as well as quality control systems and inspections and penalties for ROC and SROC. They also institute that International Auditing Standards will be applicable in auditing's starting in 2016.

3Review of literatureThere are various studies that have analyzed the difficulty in eliminating the expectation gap regarding the auditor's work, (Gloeck and Jager, 1993; Sikka, Puxty, Willmott, & Cooper, 1992). Sweeney (1997) and Gray and Stuart (2001), pointed out that the reduction of the expectation gap is the only way the auditors have to maintain and preserve the independence and the credibility they are supposed to have in the public eye. Therefore, the answer given by the auditors can take two distinct approaches: one that is defensive and another that is constructive.

The first approach instructs and clarifies financial statements users on the auditors’ competences, the responsibilities, and the limitations; the second approach advises the expansion of the function and the extension of the audits. Lee, Azham, and Kandasamy (2008) refer some methods that may help reduce these differences: the education of financial statements users (defensive approach); the expansion of the audit report, the restructuring of audit methodologies, the expansion of responsibilities and performance of auditors (constructive approach).

Almeida (2002), adds that the changes to reduce these differences cannot be conceived only from the perspective of the auditor, or only from the perspective of the audited and should primarily go through the framework of the external audit as an integral element of society, that contributes to our well-being.

It may be a utopian idea to eliminate these differences, but the fact that they may be reduced can be considered a great step forward. This seems to be Sikka et al. (1992) understanding, they state that the nature of the components of the expectation gap are difficult to eliminate, and that the perception of the auditors’ performance is a factor which is not only difficult to measure but changes constantly, and therefore it is possible to reduce, but not completely eliminate the audit expectation gap.

Innes, Brown, and Hatherly (1991) concluded that expanding the audit reports and including information about the type and the depth of the auditor's work, may reduce the expectation gap between financial statements users and auditors. Even before the study mentioned above, the Auditing Research Foundation, in 1989, also identified the auditor's report as the main cause of the problem, and argued that the expectation gap should be dealt starting from these reports and the way they were written.

In the same way, in 1992, the Irish Institute of Chartered Accountants concluded that the existing misunderstanding in society regarding the auditors and the auditing work is greatly due to the reports, suggesting therefore that the expansion of these reports, adding more information, could contribute to narrow the financial statements users and auditors’ viewpoints. As a result of the studies carried out by the Commission McDonald (1988), it was recommended that, apart from the more extensive and explicit audit report, the inclusion of a management representation letter, acknowledging their responsibility for the financial statements, should be presented annually to the shareholders by the audit commission. This measure was adopted and has become compulsory in the auditing work.

It is clear that the reports are actually an important tool in narrowing the expectation gap. Other studies, Gramling, Schatzberg, and Wallace (1996), Hussain (2003) and Monroe and Woodliff (1993), have also demonstrated the importance of the auditor's experience, level of knowledge and skill in the reduction of the expectation gap.

Furthermore, the existing literature reveals the presence of an evident misunderstanding between financial statements users and auditors regarding the functions, duties and role that auditors have in society, called the comprehension gap. This gap comprises not only the legal issues related to the auditors’ role and responsibilities (deficiency patterns), but also their performance in the light of the legislation and standards by which they are governed (deficient performance).

According to Robinson and Lyttle (1991) and Porter (1993), this comprehension gap is not limited to the financial information users, but in fact, it also contributes to the poor performance and to the auditors’ deficient interpretation of the audit standards (Porter, 1993). Boyle and Canning (2005), Darnill (1991), suggest that, in general, the auditors’ work is so complex and uninteresting in the public eyes that it leads to a lack of efficiency in the teaching of these subjects as a way of reducing the expectation gap. However, these authors suggest that teaching and disseminating these subjects among the financial statements users could be considered a mechanism for decreasing the expectation gap.

Education as an instrument to overcome the audit expectation gap was reinforced by Gramling et al. (1996) in a study carried out with American university students, in auditing courses, and with auditors, with the aim to compare both views regarding the audit work. They concluded that there are areas where the differences fade way and others areas where the differences remain. However, they point out that, even after concluding the audit degree, there are some differences between the auditing professional and the auditing students. The authors’ justification for these remaining differences is that the auditors’ experience could enhance the dissimilarities between them and the students, since the auditors have a greater knowledge of the world of business, the environment, the companies, as well as the economic implications of the cost/benefit effect that affects the auditing practice.

Hussain (2003) replicates and enlarges the study of Gramling et al. (1996) referring that the increase of training in auditing positively affects the expectation gap. This means that the students who attend subjects addressing issues related to auditing may change preconceived ideas they have regarding the profession of auditor.

Ferguson, Richardson, and Wines (2000) compared the vision of auditors and of two types of students: those who only had been in contact with audit issues in their academic training; and those who, apart from their academic background, did their professional training with auditors. They concluded that the professional training in auditing is a decisive factor in the decrease of the expectation gap. However, they enhance that this decrease is considerably higher when the students have a more practical contact with audit issues, bringing their perception of the audit functions and role closer to the views the auditors. In the same way Lee, Azham, and Mohamad (2008) studied the effect of education on the reduction of the expectation gap in Malaysia, and concluded that education contributes to the fading of these differences. Nevertheless, the results of the study indicate a significant and more consistent effect when the students have a practical contact with audit fieldwork.

Lee and Azham (2008) refer that various studies point out that the audit expectation gap is reduced through teaching subjects related to audit. They state that education significantly improves the comprehension of the financial statements users regarding the financial statements, as well as the auditor's functions.

Monroe and Woodliff (1993) explored the results obtained through questionnaires given to groups of students in auditing and marketing degrees, at the beginning and at the end of their degrees. They concluded that the point of view of the auditing students regarding the responsibility and the reliability of the financial statements changed considerably at the end of the course. The opinion of these students became that the auditors, in fact, took on less responsibility than they initially thought. On the other hand, marketing students, despite some changes regarding audit work, the overall results are substantial less positive in comparison to the result obtain by the students in audit degrees.

Bailey, Bylinski, and Shields (1983) and Epstein and Geiger's (1994) studies suggest that the financial statements users with more qualifications tend to assign less responsibilities to auditors than those who have less academic training. Following this line of thought, Lee, Azham, and Kandasamy (2008) state that “… education improves the level of understanding of financial statements users regarding the functions and processes of auditing”.

4MethodologyThe audit expectation gap exists in Portugal according to Almeida (2012), the factors which mostly influence these differences are focused on the detection of errors and frauds and illegal acts. This reality greatly limits the auditor's role because it goes well beyond these restricted aspects.

Audit standards define the obligation of the auditors to consider the plan their work so that material errors or frauds should be detected, but they also clarify that the auditor is not and cannot be made responsible for the prevention and detection of errors (this obligation is assigned to management). While addressing this issue, the auditor should act with reinforced skepticism.

The studies mentioned indicate some ways and solutions to minimize this problem, since it is very difficult to be solved, and this, itself, justifies and motivates our study contribution so that solutions can be point out in Portugal to minimize the audit expectation gap.

Humphrey, Moizer, and Turley (1997) hoped that the problem would fade way in time. However, the recurring occurrence of polemic cases involving auditor's role and companies frauds exacerbated the problem. We concluded therefore that the research around this subject is not only imperative but must be deepened and amplified.

With the objective of studying this subject, in 2011 we distributed to the students in the areas of management and accounting in three schools of higher education – The Instituto Politécnico de Tomar (IPT) in two degrees: management and auditing; the Instituto Superior de Contabilidade e Administração de Coimbra (ISCAC) in the accounting and auditing degree; and in the Escola Superior de Tecnologia e Gestão de Oliveira do Hospital (ESTGOH), in the Administration and Finance degree – a questionnaire before the beginning of the theoretical and practical subjects of auditing (pre) that was responded by 82 students, and after attending these subjects (post), that was answered by 63 students. These three degrees have the audit course in the final year (3rd year) or in the 2nd semester of the 2nd year, after having, financial accounting, cost accounting, taxation and enterprise law courses.

Following the research lines of Monroe and Woodliff (1993), Gramling et al. (1996) and Ferguson et al. (2000), we tried to find out in what way the students’ perception of the auditing role is altered with the knowledge they acquire on the subjects. Thus, we drew up a questionnaire, based on the questionnaire used by the authors mentioned above, to study this theme. The questionnaire was distributed in 2011 to the students of the schools mentioned above, before (pre) starting the theoretical and practical auditing subjects, and after (post) attending these subjects.

The questionnaire is divided in three sections related to the following aspects: (I) the auditors and the auditors process, (II) the role that should be played by auditors (III) the groups to whom the auditor should be accountable, with a total of 25 questions. All the questionnaires were answered under confidentiality, using a seven points Lickert scale where “1” indicates total disagreement and “7” indicates total agreement. Only the questionnaires which were fully completed were considered.

Our main objective is to find out if education in auditing changes the perception of the auditing students, we considered the following study hypotheses:H1

The students have different perceptions of the auditors’ role and the responsibilities before and after they receive training in auditing.

H2Training in auditing contributes to alter the perception about auditors and the auditing process;

H3Training in auditing contributes to alter the students’ perception of the role auditors should play;

H4Training in auditing contributes to alter the perception of the users of the financial information to whom the auditor should be accountable for.

The answers to these four hypotheses may help to draw conclusions on the effective contribution that training in auditing makes to the reduction of the expectation gap in Portugal on the major areas of auditing responsibilities, auditing process, role and accountability.

A secondary question, but not of minor importance, will allow us to understand which areas of the training made a greater or a lesser contribution to the change in the perceptions.

To analyze these hypotheses it will be considered the sum of the total number of questions and the sums of the three separate sections of the questionnaire, obtaining four scores, comprising the total understanding of the responsibilities, of the auditing process, of the role of the auditor and of the accountability of the auditor. Changes on the value of these scores will demonstrate a different student perception as a result of training. The questionnaires were analyzed using the IBM-SPSS Statistics (version 21).

As the data of this study is deductive, it leads to a study of hypotheses, which is the analysis of the statistical significance of the tendencies of the answers, that is, the differences of perception apparent in the answers of the students before (pre) and after (post) the training in auditing. These differences were studied using the test t to evaluate the significance of the differences in the answers to all the sections of the questionnaire in the pre and post phase, to determine whether there are differences in the students’ answers regarding the various themes under study in the different sections.

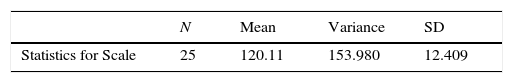

Initially we ran a test of internal consistence of the data using the Cronbach's Alpha according with Gliem and Gliem (2003) and we concluded that there is internal consistence; see Table 1:

Item-analysis from SPSS output Cronbach's Alpha – reliability statistics.

| N | Mean | Variance | SD | |

|---|---|---|---|---|

| Statistics for Scale | 25 | 120.11 | 153.980 | 12.409 |

| Mean | Minimum | Maximum | Range | Max/Min | Variance | |

|---|---|---|---|---|---|---|

| Item means | 4.804 | 2.097 | 6.201 | 4.104 | 2.957 | 1.144 |

| Item variances | 1.744 | 1.051 | 2.724 | 1.673 | 2.591 | .139 |

| Inter-item correlations | .106 | −.355 | .841 | 1.196 | −2.371 | .041 |

| Item total statistics | Scale mean if item deleted | Scale variance if item deleted | Corrected item total correlation | Square multiple correlation | Cronbach's Alpha if item deleted |

|---|---|---|---|---|---|

| Item 1 | 114.72 | 145.810 | .287 | .427 | .739 |

| Item 2 | 114.75 | 146.728 | .239 | .409 | .741 |

| Item 3 | 116.54 | 153.709 | −.047 | .243 | .760 |

| Item 4 | 116.10 | 149.111 | .088 | .289 | .752 |

| Item 5 | 118.01 | 159.128 | −.212 | .434 | .768 |

| Item 6 | 117.10 | 151.658 | .013 | .458 | .757 |

| Item 7 | 117.72 | 157.570 | −.164 | .357 | .760 |

| Item 8 | 114.77 | 147.578 | .154 | .291 | .747 |

| Item 9 | 114.61 | 143.202 | .308 | .407 | .737 |

| Item 10 | 115.25 | 144.728 | .206 | .353 | .744 |

| Item 11 | 114.93 | 138.499 | .428 | .380 | .729 |

| Item 12 | 115.00 | 142.917 | .316 | .402 | .737 |

| Item 13 | 114.08 | 141.911 | .357 | .528 | .734 |

| Item 14 | 114.21 | 137.069 | .496 | .672 | .725 |

| Item 15 | 114.30 | 139.098 | .517 | .603 | .726 |

| Item 16 | 114.84 | 139.171 | .310 | .393 | .737 |

| Item 17 | 114.87 | 135.330 | .485 | .497 | .724 |

| Item 18 | 115.16 | 132.544 | .549 | .552 | .718 |

| Item 19 | 115.22 | 135.378 | .481 | .545 | .724 |

| Item 20 | 114.54 | 139.949 | .425 | .426 | .730 |

| Item 21 | 113.91 | 142.699 | .341 | .375 | .735 |

| Item 22 | 115.07 | 139.612 | .442 | .533 | .729 |

| Item 23 | 115.79 | 141.355 | .332 | .798 | .735 |

| Item 24 | 115.34 | 138.573 | .452 | .630 | .728 |

| Item 25 | 115.81 | 141.807 | .297 | .828 | .738 |

| Cronbach's Alpha | Standardized item Cronbach's Alpha | |

|---|---|---|

| Reliability coefficients | 0.864 | 0.876 |

Table 1 shows the item-analysis output from SPSS for the multi-item scale of student perceptions of auditors responsibilities. George and Mallery (2003) argue that over 0.8 it is has good consistency. To test the hypotheses, it will be considered the significance level of α=0.05. To analyze the change on student perception pre and post the Wilcoxon test is used both for items and for the scores. Since the number of students is less than 100 and data is ordinal the nonparametric test Wilcoxon is used because it does not assume normality in the data and it is used to compare two sets of scores that come from the same participants, for instance scores from one time point to another.

4.1Section IUnivariate analysis is done only to understand, as a pedagogical point of view, which perceptions are more affected by training. That constitutes a motivation for further analysis.

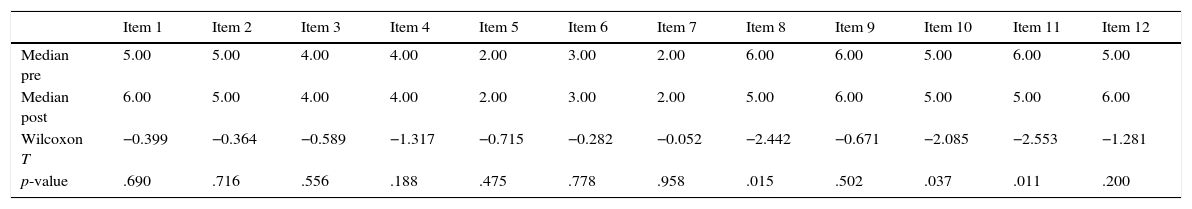

The statistical processing regarding the first section resulted in Table 2.

Medians of items 1–12 of pre and post observations.

| Item 1 | Item 2 | Item 3 | Item 4 | Item 5 | Item 6 | Item 7 | Item 8 | Item 9 | Item 10 | Item 11 | Item 12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Median pre | 5.00 | 5.00 | 4.00 | 4.00 | 2.00 | 3.00 | 2.00 | 6.00 | 6.00 | 5.00 | 6.00 | 5.00 |

| Median post | 6.00 | 5.00 | 4.00 | 4.00 | 2.00 | 3.00 | 2.00 | 5.00 | 6.00 | 5.00 | 5.00 | 6.00 |

| Wilcoxon T | −0.399 | −0.364 | −0.589 | −1.317 | −0.715 | −0.282 | −0.052 | −2.442 | −0.671 | −2.085 | −2.553 | −1.281 |

| p-value | .690 | .716 | .556 | .188 | .475 | .778 | .958 | .015 | .502 | .037 | .011 | .200 |

An issue with more agreement among the students, both in the pre and post phase, was question 9 (the auditors must identify procedures that may help the companies’ administration to make management more efficient), which shows that the students give the auditor a function that goes beyond the traditional issue of opinion about the financial statements. The auditor is seen as an active partner in the management of the companies, who should advise the administration on the course followed and on the future strategy of the company.

The issue with less agreement, with the lowest mean and with the lowest median, is question 5 (the companies benefit little with an audit) which shows that the students give the auditor a great social responsibility and that they see auditing as a positive thing for the company. This situation shows that even before the students have a formal contact with the subjects of auditing, they already understand the benefits of doing audits. This fact may result from the knowledge of subjects related to management that students have come across with during their course, even before they had a formal contact with auditing, or, this is in fact the perception society has.

From the analysis of Table 2 we can see that there are statistically significant alterations in questions: 8 (the existence of auditors decreases the occurrence of frauds), 11 (the fact that the auditing committee comprises non-executive members improves the auditors’ independence) and 10 (the auditors must report the issues related to the management efficiency to the shareholders). In the first three questions the answers showed less agreement, in the last two they showed greater agreement. Except for question 11, all the others are in consonance with the results obtained by Ferguson et al. (2000), which means the students consider that the profession is adequately controlled, that the fact the company is audited does not imply there are no frauds, that the management efficiency must be subject to the opinion of the auditor and that imprecise accounting norms do not affect the auditing process.

Students think that apart from the auditors’ role of reporting on the financial statements, they should also report on the management practices, that is, they are in favor of an expansion of the range and the scope of auditing beyond its traditional niche.

On the contrary to what happened with the study of Ferguson et al. (2000), the Portuguese students do not think that the auditor's independence is reinforced by the fact that the auditing commission is constituted by non-executive members. This conclusion may be based on what is stated by Cohen, Gayner, Krishnamoorthy, and Wright (2011), who, when analyzing the members of the auditing committees (in Portugal designated by auditing commission), concluded that the nomination is done between people with whom the management body has had previous professional or personal contacts, which suggests therefore that the supervising body is not totally independent from the management body and that its monitoring activity is conditioned.

4.2Section IIIn this section the students express their degree of agreement to 9 statements related to the auditor's role. The first 3 questions are related to the auditor's responsibility regarding the financial statements issued by the company, and in the other 6 questions, to the auditor's responsibilities regarding the audited entity.

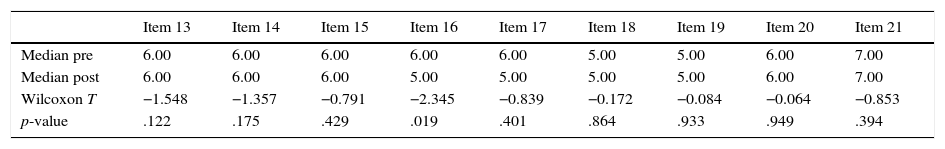

Table 3 shows the results obtained in the second section according to the opinions collected. Once more, the methodology used was the one described and applied in the previous point.

Medians of items 13–21 of pre and post observations.

| Item 13 | Item 14 | Item 15 | Item 16 | Item 17 | Item 18 | Item 19 | Item 20 | Item 21 | |

|---|---|---|---|---|---|---|---|---|---|

| Median pre | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 5.00 | 5.00 | 6.00 | 7.00 |

| Median post | 6.00 | 6.00 | 6.00 | 5.00 | 5.00 | 5.00 | 5.00 | 6.00 | 7.00 |

| Wilcoxon T | −1.548 | −1.357 | −0.791 | −2.345 | −0.839 | −0.172 | −0.084 | −0.064 | −0.853 |

| p-value | .122 | .175 | .429 | .019 | .401 | .864 | .933 | .949 | .394 |

From the analysis of Table 3 we conclude that the question with greater agreement in the pre phase and the post phase is question 21 (the financial statements present a truthful and appropriate image of the company). The question with less agreement, with the lowest mean and with the lowest median, is question 18 (the continuity of the company does not present any doubts).

Regarding the first three questions related to the auditor's responsibility for the financial statements issued by the company, we noticed that the alterations are not statistically significant, which may indicate that before starting the auditing module the students already assume that the financial statements must be done according to the principles and the accounting norms, it must be accepted, and it must be in accordance with the materiality concept. This is not surprising due to the fact that they have already been in contact with the terminology, namely in the accounting subjects.

Regarding the questions related to the auditor's responsibilities toward the audited entity, we noticed that question 16 (all fraud is detected) presents statistically significant alterations, although the average value still indicates a level of agreement for this statement. In fact, a significant number of students do not see the auditor as responsible for detecting all types of frauds. This change is in line with the study made by Lee, Azham, and Kandasamy (2008) and Ferguson et al. (2000). We can therefore say that education is a mean to clarify the auditor's responsibilities regarding fraud, and bring together the students’ perceptions of the auditing norms (ISA 240) which refer that the auditor has the responsibility of obtaining a reasonable assurance that the financial statements, as a whole, are free of material misstatement.

In relation to the other questions we can see that, except for question 8 (the regulating entities were informed of any irregularities of the companies), the averages point to a decrease – although the differences have no statistical significance – which may indicate that the acquired knowledge during the training in relation to the auditor's role and functions has not significantly decreased the perception of their responsibilities, but it may induce the notion that these should be imputed firstly the those who are responsible for preparing and drawing up the financial statements. One of the contributing facts was a greater knowledge of the auditing norms and processes.

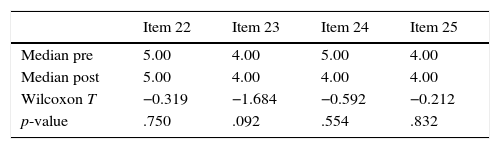

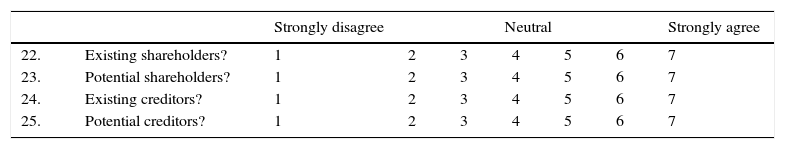

4.3Section IIIIn this section the students express their degree of agreement with 4 questions related to the group of people interested in the auditor's work and to whom they may have to answer to for losses due to poor auditing service. The methodology is identical to the one previously used.

In this section we intend to understand the opinion of the students regarding financial statements users who they may have to answer to for possible losses due to poor performance in the evaluation of the financial statements of the entity and the subsequent issue of an unqualified opinion.

When there is a poor performance on the auditors’ part, they may be prosecuted by the clients or by any other person interested in the financial information.

Based on the results presented in Table 4, we can see that all items in both periods present an average superior to 4, which reveals a tendency to agree with the statements in the section analyzed. We also want to enhance that when the results obtained in each item of the two periods are compared, there are no statistically significant differences, in view of the levels of significance already used. We infer that the students consider the auditors responsible toward all these interested groups. Given that the highest medium value is the one regarding the current shareholders, we can easily conclude that are them, according to the students, who have greater right to hold the auditors responsible, which shows the students’ perception that in effect the creditors are the interested part in the financial situation of the entity.

However, with regards to the investors and future creditors, the agreement revealed by the students in both phases is slightly less pronounced, which indicates that the students, especially in the pre phase, do not consider that the auditors are so responsible toward future investors or future creditors. Although not very significantly, this changes slightly in the post phase, the students seem to consider that somehow the auditors’ work will be a decisive element for the both groups.

This data is contradictory to the one found by Ferguson et al. (2000), where students considered that the auditors would have less responsibility toward the potential shareholders/creditors. The Portuguese students’ answers are justified by the fact that they consider auditors must have an active role in the management of companies by supporting the management body and reporting to the shareholders matters related to the management of the companies. This vision is not in accordance with the current auditing work, in fact students consider that the current auditor's role should be widened to include elements that until now were out of their field of action (e.g. give their opinion on the prospective financial statement), or they consider that the auditor should also be a consultant/advisory of the company, which raises independence problems.

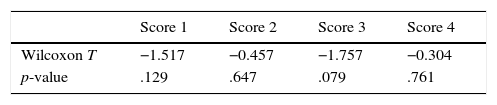

To test the hypotheses listed, we calculated the composite indicators of the whole questionnaire for the first hypothesis, for the second hypothesis the indicators of the first section, for the third hypothesis the indicators of the whole second section, and for the fourth hypothesis the indicators of the whole third section.H1

Training in auditing contributes to alter the perception about auditors’ role and responsibilities;

Corresponding to the statistical hypothesis:

Ho1: the sum of the scale items of the phase pre is equal to the phase post

H11: the sum of the scale items of the phase pre is different to the phase post

Training in auditing contributes to alter the perception about auditors and the auditing process;

Corresponding to the statistical hypothesis:

Ho2: the sum of the section 1 items of the phase pre is equal to the phase post

H12: the sum of the section 1 items of the phase pre is different to the phase post

Training in auditing contributes to alter the students’ perception of the role auditors should play;

Corresponding to the statistical hypothesis:

Ho3: the sum of the section 2 items of the phase pre is equal to the phase post

H13: the sum of the section 2 items of the phase pre is different to the phase post

Training in auditing contributes to alter the perception of the users of the financial information to whom the auditor should be accountable for.

Corresponding to the statistical hypothesis:

Ho4: the sum of the section 2 items of the phase pre is equal to the phase post

H14: the sum of the section 2 items of the phase pre is different to the phase post

After analyzing the results presented in Table 5, we noted that training only induces some significant change in relation to the auditors’ role (H3 value-p<0.1).

5ConclusionThe solution to minimize this difference of expectations may be to deepen the knowledge, and subsequent understanding, of the auditors’ real role, as well as their responsibilities, through a greater and better offer in audit education. When analyzing the authors mentioned above, it seems evident that a greater knowledge in subjects related to auditing may contribute to the reduction of the differences of perspectives between society and auditors by clarifying what are the real responsibilities of the auditor. Today students will be the ones who will evaluate tomorrow, so if their knowledge about auditing is sufficient and structured in the limitations of audit work, as well in the clear perception about what is reasonable to auditors’ to accomplish, they will also contribute to a change in opinions and mentalities in the future.

It is essential to develop the skills and the knowledge of the auditors and financial statements users. However, this is only possible if we determine the causes of these differences, in order to decide the solutions that may mitigate them. It is also important to prepare society, and the future and current financial statements users, to the fact that implementation of the measures mentioned above aims to reduce the differences of perspectives between them and the auditor's. To do so, it will be necessary to commit to teaching subjects who involve the auditors and their work.

Has a limitation of our study we can point out the small sample, so for future research we would suggest a larger sample, with more students and universities involved, and also an international comparison with other countries.

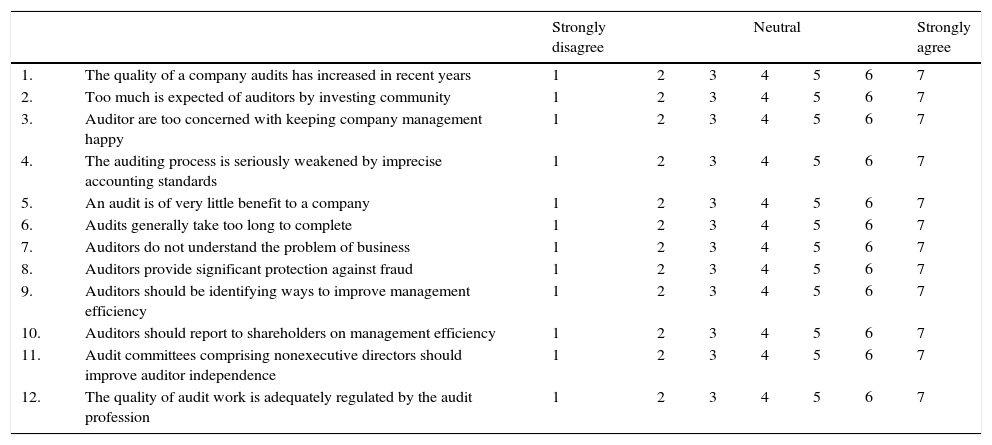

This questionnaire is designed to gather information regarding the role and contribution of audit to business activity. The questionnaire seeks to discover the beliefs that are held about the work of auditors. The eventual aim of the research is to promote greater consistency between the services provided by auditors and what is expected and valued the broader business community.

Is must be emphasized that the information you provide will be treated in the strictest confidence. Only the total results of the survey will be published, no individual details will be divulged.

Your cooperation in this project is vital to its success and we would be grateful if you would agree to complete the questionnaire.

Thank you for your help.

I. The following statements have been made about auditors and the auditors process. Please circle a number for each statement to indicate the extent of your agreement.

| Strongly disagree | Neutral | Strongly agree | ||||||

|---|---|---|---|---|---|---|---|---|

| 1. | The quality of a company audits has increased in recent years | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 2. | Too much is expected of auditors by investing community | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 3. | Auditor are too concerned with keeping company management happy | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 4. | The auditing process is seriously weakened by imprecise accounting standards | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 5. | An audit is of very little benefit to a company | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 6. | Audits generally take too long to complete | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 7. | Auditors do not understand the problem of business | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8. | Auditors provide significant protection against fraud | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 9. | Auditors should be identifying ways to improve management efficiency | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 10. | Auditors should report to shareholders on management efficiency | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 11. | Audit committees comprising nonexecutive directors should improve auditor independence | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 12. | The quality of audit work is adequately regulated by the audit profession | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

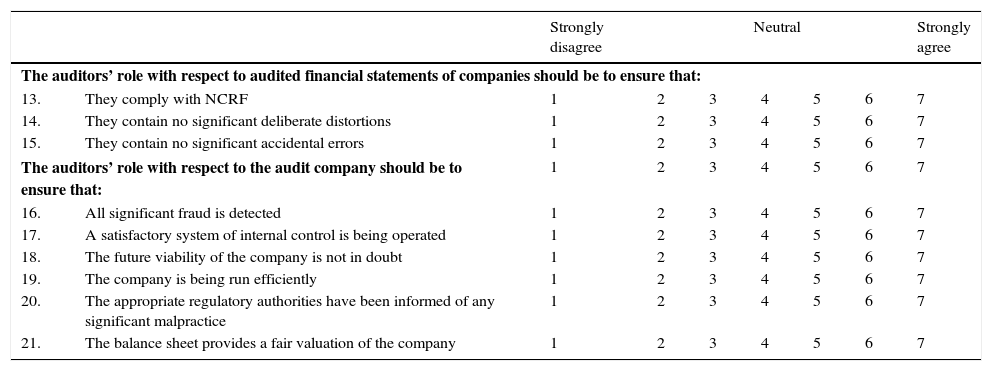

II. The following propositions relate to the role that should be played by auditors. Please circle a number for each proposition to indicate the extent you agree or disagree with it.

| Strongly disagree | Neutral | Strongly agree | ||||||

|---|---|---|---|---|---|---|---|---|

| The auditors’ role with respect to audited financial statements of companies should be to ensure that: | ||||||||

| 13. | They comply with NCRF | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 14. | They contain no significant deliberate distortions | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 15. | They contain no significant accidental errors | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| The auditors’ role with respect to the audit company should be to ensure that: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 16. | All significant fraud is detected | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 17. | A satisfactory system of internal control is being operated | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 18. | The future viability of the company is not in doubt | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 19. | The company is being run efficiently | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 20. | The appropriate regulatory authorities have been informed of any significant malpractice | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 21. | The balance sheet provides a fair valuation of the company | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

III. The following questions relate to the groups to whom auditors should be responsible. Please circle a number for each group, to indicate your views.

If a company's audited financial statements are significantly misstated and the audit report fails to disclose the true position, to what extended do you agree that the company's auditors should have a legal responsibility to the following groups for any loss arising from their reliance on audited financial statements: