The important role played by Portuguese tax professionals in the tax system motive the analyses of their perception of tax complexity and its relation with their tax noncompliant behaviours. Data collected in 2013 by questionnaire allowed to perform it and this paper presents the results. Firstly, it analyses the main areas of tax complexity pointed out by tax professionals and secondly summarizes the fourteen areas of tax complexity, into three indices, by using the principal component analyses. Thus, an index of legislative tax complexity and two indices of administrative tax complexity (in professionals’ and tax authority's context) were constructed. Data suggest that could be possible to measure the level of tax complexity by using indices. We verify that there is a relation between tax professionals’ perceptions of tax complexity, measured through the indices, and some of their tax noncompliant behaviours, in particular the unintentional ones.

The increased sophistication of business dealings and the globalisation of markets have given rise to more complex and refined mechanisms of tax evasion. Furthermore, tax authorities have passed more complex anti-abuse regulations. However, tax complexity created to serve as a barrier against tax fraud, tax evasion and other ways of reducing or entirely avoiding one's commitment to pay taxes, ultimately often becomes a springboard for the realization of these same schemes of tax noncompliance, by exploiting the ambiguities and loopholes that tax complexity provides. This is a vicious circle, in which tax noncompliance and tax complexity nowadays frequently emerge as cause and effect of one other.

The perception of tax complexity has also been increasing largely because of the adoption of the self-assessment system in many countries (Loo, McKerchar, & Hansford, 2009). This system transfers tax compliance tasks to taxpayers instead of tax administrations. This trend, in general, occurs without previous preparation of the taxpayers, supporting an increased perception of tax complexity and its consequences in terms of tax compliance (Evans & Tran-Nam, 2010; McKerchar, Meyer, & Karlinsky, 2008).

As a result of the taxpayers’ perception of tax complexity, it has shifted the paradigm in the relationship between tax administrations and taxpayers and a new “player” has been introduced into the “equation”: the tax professionals (Erard, 1993). Tax professionals are the tax preparers, tax practitioners, tax agents, tax accountants, tax consultants, tax advisors, tax intermediaries and certified accountants to which taxpayers resort in order to comply with their tax obligations. The effect of the work of these professionals on tax (non)compliance, particularly in an aggressive tax planning context, by dealing with tax complexity, came to be recognized by the OECD [Organization for Economic Co-operation and Development], in 2006, in the Seoul Declaration1 (OECD, 2008).

In Portugal, the tax system is based on self-assessment and is known to be very complex, with a high level of tax law ambiguity and “volatility”. According to the World Bank, Portugal is ranked as a leading country for tax complexity and bureaucracy (World Bank, 2011a, 2011b, 2013a, 2013b). In connection with this, the OECD (2010) also classifies as problematic the increasing levels of tax system complexity, in Portugal, caused, particularly by the frequent changes in tax laws.

In addition, in Portugal, tax professionals, the certified accountants,2 comply with business and individual tax obligations and the corresponding taxes are charged mostly through them. Thus, in Portugal, tax professionals, more than taxpayers, experience the issue of tax complexity, since their activity comprises the resolution of different tax problems for their clients, or employers. Therefore, the perspective of tax professionals could play an important role in the future design of Portuguese tax policy.

In the international literature, we observe that although tax complexity have been analysed in several studies, a consensual definition is still needed. As stated by Tran-Nam (2004), there is no precise theoretical framework about tax complexity. There is not also a consensus in relation to the better way to measure it and its perception.

Therefore, in this paper we analyse a different way to measure tax complexity's perception, in the perspective of tax professionals, through the construction of indices of tax complexity. In addition, we try to understand the impact of tax complexity perceived by tax professionals, measured by the indices, on their unintentional tax noncompliant behaviours (errors, mistakes and omissions) and on their propensity for intentional tax noncompliant behaviours (under reporting of income, over reporting of expenses, deliberate misclassification of income, and other ways to entirely avoid or reduce pay taxes).3

To achieve those objectives, in 2013, a questionnaire survey was sent to assess the Portuguese tax professionals’ views regarding their tax complexity's perception and their tax compliance. This paper presents some findings of that survey, by reporting the conclusions of 994 questionnaires.

This paper is divided into five parts, apart from this introduction: literature review, drawing of research hypotheses, research methodology, analyses of data and discussion of results. Finally, we state our main conclusions and suggest further lines of research.

2Literature reviewFrom the late 1980s some researchers, such as Ayres, Jackson, and Hite (1989), Hite and McGill (1992) and Erard (1993), detected a knowledge gap in the area of tax noncompliance. They noted that academic studies regarding “[…] tax compliance did not consider the potential impact of the tax preparer on the compliance decision.” (Hite & McGill, 1992, p. 390), despite the growing importance of the activity of those professionals in tax compliance and in dealing with tax complexity (Ayres et al., 1989).

After that, the academia started the study of the impact of paid tax professionals’ role in tax systems, firstly in the US [United States], later extending to other countries, particularly to the Anglo-Saxon ones: Australia, New Zealand and UK [United Kingdom]. Although three decades have now beyond, this issue remains pertinent.

The tax issues related to tax professionals that are most analysed in international tax literature, during those three decades, are the complexity of the tax systems and their perception about it, the use of their tax knowledge, the burden and the effect of penalties on their activity, and the consequences of tax complexity for their tax compliance tasks (Ayres et al., 1989; Bloomquist, Albert, & Edgerton, 2007; Cuccia, 1994; Green, 1994; Long & Swingen, 1987; McKerchar, 2005; O’Donnell, Koch, & Boone, 2005; OECD, 2008; Reckers, Sanders, & Wyndelts, 1991; Samelson & Schloemer, 2001).

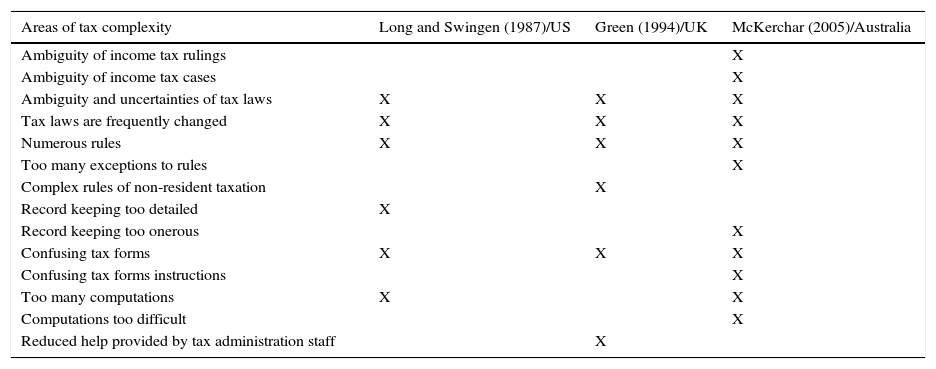

Table 1 shows the main areas of tax complexity perceived by those tax professionals in the US, UK and Australia.

Areas of tax complexity in tax professionals’ context.

| Areas of tax complexity | Long and Swingen (1987)/US | Green (1994)/UK | McKerchar (2005)/Australia |

|---|---|---|---|

| Ambiguity of income tax rulings | X | ||

| Ambiguity of income tax cases | X | ||

| Ambiguity and uncertainties of tax laws | X | X | X |

| Tax laws are frequently changed | X | X | X |

| Numerous rules | X | X | X |

| Too many exceptions to rules | X | ||

| Complex rules of non-resident taxation | X | ||

| Record keeping too detailed | X | ||

| Record keeping too onerous | X | ||

| Confusing tax forms | X | X | X |

| Confusing tax forms instructions | X | ||

| Too many computations | X | X | |

| Computations too difficult | X | ||

| Reduced help provided by tax administration staff | X |

Long and Swingen (1987), in the US, Green (1994), in the UK, and McKerchar (2005), in Australia, have found that the majority of tax professionals perceive high levels of tax complexity in the tax systems of their countries. In Table 1, we highlight the following areas of tax complexity, which are common to all the reviewed studies: “Ambiguity and uncertainties of tax laws”; “Tax laws frequently change”; “Numerous rules” and “Confusing tax forms”. Tax professionals relate tax complexity mainly to the ambiguity and excessive changes in tax laws, as well as to the excessive burden of the need to comply. Thus, there seem to be two dimensions of tax complexity: the legislative and the compliance one.

The literature review points out three main types of difficulties caused by high levels of tax complexity: (i) tax professionals spend more time in tax updating; (ii) tax professionals are more likely to commit mistakes and omissions in tax matters; (iii) tax professionals have greater opportunities for exploiting the ambiguity of the tax laws in taxpayers’ favour (GAO, 2006; Green, 1994; Laffer, Winegarden, & Childs, 2011; McKerchar, 2005; OECD, 2008). Moreover, the role of tax complexity in the creation of opportunities to use the ambiguities and loopholes in the tax laws is related to the use that tax professionals make of their tax knowledge (O’Donnell et al., 2005; Stephenson, 2007).

Do tax professionals use their tax knowledge in order to resolve ambiguity and uncertainties in tax law created by tax complexity, contributing positively to tax compliance, or does the opposite occur?

There is some research which studies this relationship in tax professionals’ perspective: tax knowledge, perception of tax complexity, and tax compliance. It concludes about three category of relations: (i) positive, i.e. a higher level of professionals’ tax knowledge affords them a better capacity to deal with tax complexity in order to comply; moreover, a higher level of tax knowledge gives them a better perception of the probability of detention and severity of punishment for taxpayers and for themselves; (ii) negative, i.e. the greater tax professionals’ tax knowledge is, the better they know the more complex points and the ambiguities of tax laws and the better use they can make of these in favour of their customers, or employers, (which can results in more tax intentional noncompliant decisions); (iii) a combination of both (i) and (ii), i.e. as regards less complex and ambiguous tasks, professionals use their higher level of tax knowledge to deal with tax complexity, in order to comply more strictly with the tax laws. However, as regards more complex and ambiguous subjects, they use their higher level of tax knowledge to deal with tax complexity in favour of their customers, or employers, to comply less (Christian, Gupta, Weber, & Willis, 1994; Cuccia, 1994; Erard, 1993; Klepper, Mazur, & Nagin, 1991; Mills, Erickson, & Maydew, 1998; Newberry, Reckers, & Wyndelts, 1993; O’Donnell et al., 2005; Reckers et al., 1991; Stephenson, 2007).

In this paper we analyse the relation between tax complexity and tax noncompliance (unintentional and intentional) in the perspective of Portuguese tax professionals. Thus, in the following sections, we set out the research questions and hypotheses and the used methodology. Then, we present and discuss the results of our empirical study, and compare them with the results of the international tax literature.

3Research questions and hypothesesTaking into account the literature review and our objective, we draw up the following research questions:

- 1.

Does the perception of tax complexity influence tax professionals’ attitudes towards tax compliance in Portugal?

- 2.

Can the perception of tax complexity be measured through the indices of tax complexity?

Basing our study on the international tax literature review, and taking into account our research questions, we set out our research hypotheses, as follows.

According to Long and Swingen (1987), Green (1994), McKerchar (2005) and McKerchar, Ingraham, and Karlinsky (2005), there are areas of tax complexity, which can be grouped into dimensions of tax complexity, the legislative and the compliance dimensions, and which reflect tax professionals’ perception of the complexity of the tax system. We need to consider the possibility that their perception of these dimensions of tax complexity can increase or reduce their perception of tax system complexity as a whole. It is also important, to simplify the study of tax complexity's impact on the tax system, to understand if we can use indices of tax complexity to measure the complexity of the tax system as a whole. In this regard the hypotheses to be tested are as follows:H1 There is a relation between tax professionals’ legislative tax complexity index and their perception about tax system complexity as a whole. There is a relation between tax professionals’ compliance4 tax complexity index and their perception about tax system complexity as a whole.

In tax professionals context, GAO (2006), Bloomquist et al. (2007) and Laffer et al. (2011)5 report that in addition to intentional tax noncompliance, which opportunity can be provided by tax complexity (in its link to tax knowledge), tax professionals also make unintentional errors and omissions due to tax complexity. GAO (2006) and Laffer et al. (2011) refer clearly that tax complexity provides opportunities for both voluntary and involuntary tax noncompliance, from a tax preparer's perspective; i.e. it increases his/her chances to be tax aggressive (intentional tax noncompliance) and the probability to engage in unintentional tax noncompliance situations. Consequently, our next research hypothesis is:H3 Tax professionals’ perception of tax system complexity, measured by its indices, is related to their unintentional tax noncompliant behaviours and their tax aggressiveness.

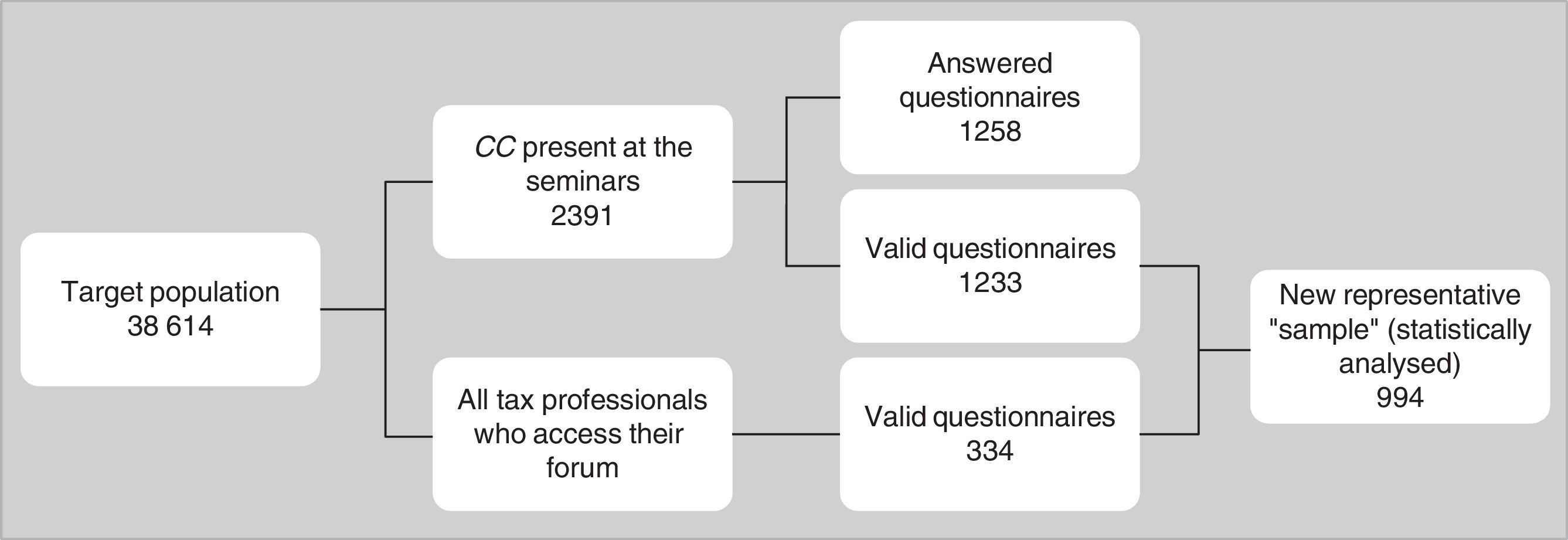

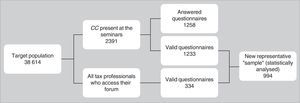

In order to collect the data, following the suggestion of Raupp and Beuren (2006), we have used a quantitative approach, collecting data through survey in the form of a questionnaire, addressed to Portuguese certified accountants6 in active service (the only tax professionals authorized by Portuguese tax administration). Our target population amounts to 38,614 members.7 To implement our questionnaire in paper format, we used the members present in their regulatory authority's8 tax seminars of February 2013. Furthermore, we put the same questionnaire online (in tax professionals’ forum). We have collected 1258 questionnaires answered on paper and 334 answered online, amounting to a total of 1567 valid questionnaires.

To apply our survey, we used a convenience sample. In order to turn it into a representative sample, based on the aspects of the target population, we performed “post survey adjustments” to the sample, using tables of random numbers to obtain a smaller, but stratified “random” sample. Fig. 1 presents an overview of the collecting process, which resulted in the 994 questionnaires statistically analysed.

The response rate, regarding the professionals present in the tax seminars, was about 52% and 4.1% concerning all the professionals in active service. In terms of international tax research it is an acceptable response rate, as stated for instance by Green (1994), who had a response rate of 25% and by McKerchar (2005) with 1%.9

The questionnaire survey points out a set of questions aimed at obtaining information on the following (see Appendix A):

- (i)

To make a socio-demographic, professional and technical characterization of the respondents (questions 1, 2, 3, 4, 5, 6, 7, 9, 10 and 20).

- (ii)

To evaluate their perception relatively to Portuguese tax system complexity (questions 11, 12, 13, 14, 15, 16, 19 and 22).

- (iii)

To understand the impact of tax complexity on tax professionals’ unintentional tax noncompliant behaviours (questions 23, 24, 25 and 26).

- (iv)

To evaluate the impact of tax complexity on tax professionals’ propensity to participate in intentional schemes of tax noncompliance (questions 27 and 28).

The following section presents and discuss the results of tax complexity perception, in the perspective of Portuguese tax professionals.

5Results and discussion of results5.1Descriptive statisticsThe data concerning Portuguese tax professionals’ perception of tax system complexity lead us to the conclusion that they generally regard the Portuguese tax system as being highly complex, with 89.1% of respondents considering it as either complex or very complex.

These results are in line with those of the World Bank (2011a, 2011b, 2013a, 2013b), which ranks Portugal as a leading country in terms of tax bureaucracy in Europe, only surpassed by Italy and some Eastern European countries.

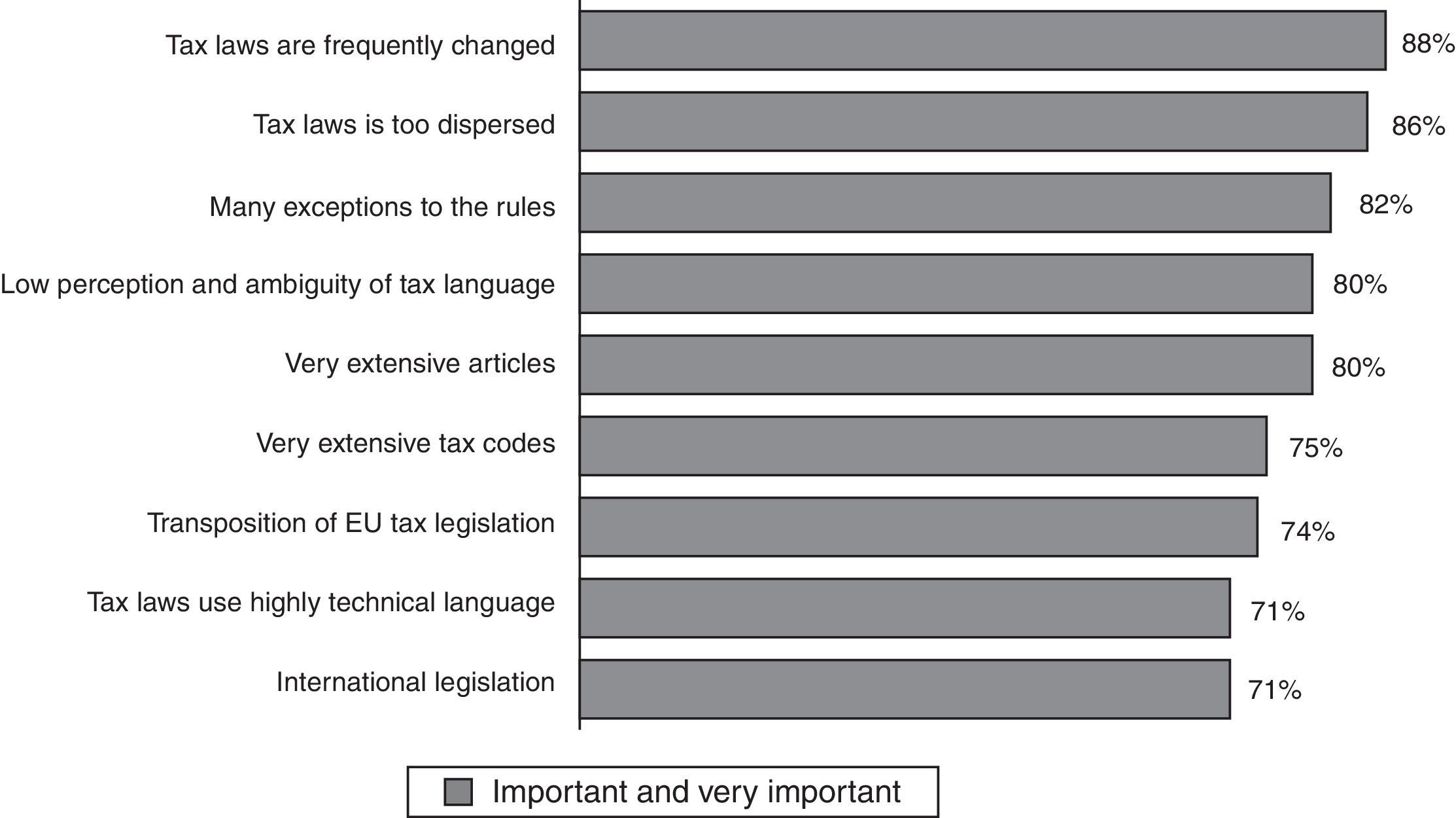

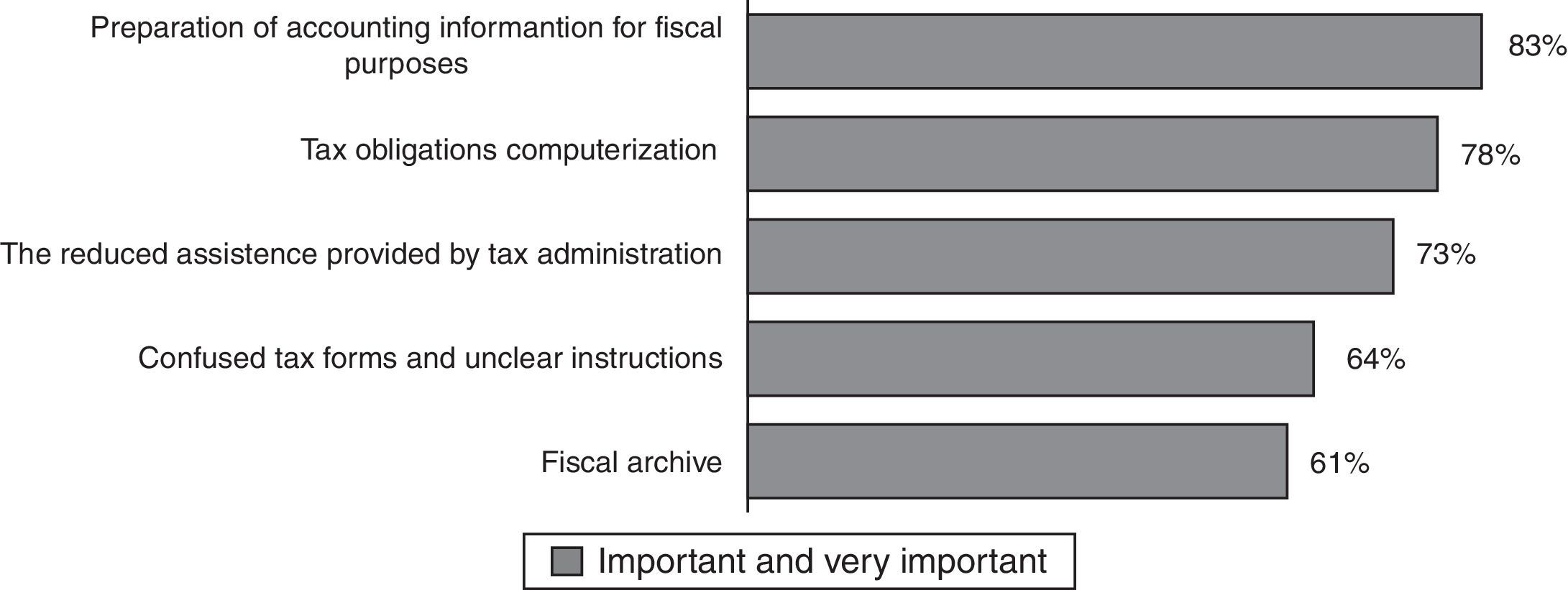

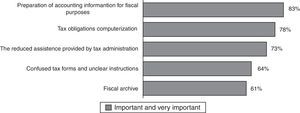

In relation to the areas of tax complexity, Figs. 2 and 3 represent, in ascending order of importance from the professionals’ perspective, the several determinants (areas) of legislative and compliance tax complexity. There are, in tax professionals’ context, fourteen determinants, or manifest variables, of tax complexity's perception.

Concerning legislative tax complexity (see Fig. 2), tax professionals assign a high level of relevance to all areas, in special to tax laws changes, with 88%, and to tax laws dispersion, with 86%.

As can be observed in Fig. 3, in the context of compliance tax complexity, Portuguese tax professionals assign a high level of importance to all areas, in particular to preparation of accounting information for fiscal purposes (83%) and to tax obligation informatization (computerization) (78%). Moreover, the reduced help (assistance) provided by tax administration staff captured our attention because it presents a mode of 5 (i.e.: very important in tax complexity context). These data are in line with those obtained by Lopes (2009) about the costs of time within the companies in the areas of tax complexity. They also corroborate the conclusions achieve by Long and Swingen (1987), Green (1994) and McKerchar (2005).

Based on the results obtained in the descriptive statistics, in the following section we present the construction of tax complexity indices.

5.2The Construction of tax complexity indicesIn order to simplify the statistical analysis of the effect of tax complexity's perception on tax (non)compliance, in tax professionals’ perspective, we will use three indices, or constructs, replacing the fourteen manifest variables (presented in Figs. 2 and 3). In addition, the construction of these indices will, in future, allow us to monitor the evolution of the phenomena and to compare the trends with other groups’ perception of tax complexity, namely the taxpayers.

This work is in line with the construction of an index of tax complexity in the UK, by a team of investigators from the Office of Tax Simplification; they developed an additive weighted index (Whiting, Sherwood, Rice, & Jones, 2014). The indices constructed in this paper have the advantage of the robustness of the statistical technique used.

In relation to the areas of tax complexity, we also intend to identify the number of dimensions of tax complexity perceived by tax professionals, in the Portuguese tax system. Firstly, based on a preliminary exploratory study, we define the number of indices (dimensions): three, and the variables which belong to each dimension.

Then, we construct the three synthetic indices, which represent the dimensions of tax complexity's perception for Portuguese tax professionals. To build those indices we use the principal component analyses [PCA], retaining a single factor. The individuals’ scores are formed from the respective factorial scores (standardized).

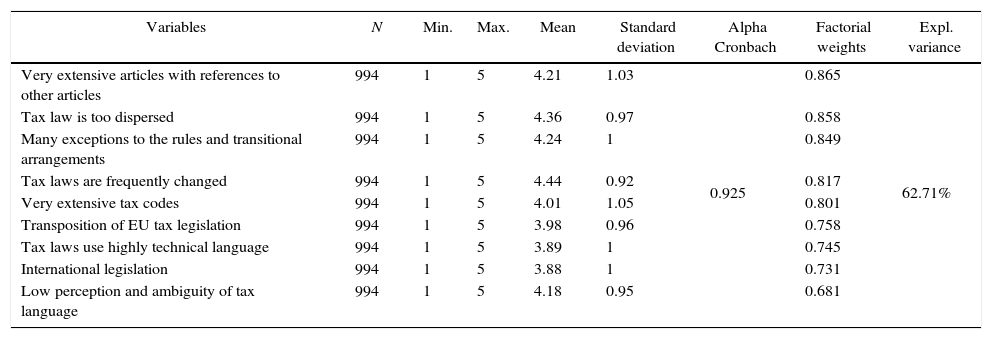

5.2.1Indices construction: legislative tax complexity indexThe first index is the “legislative tax complexity index”.

Table 2 resumes the results from the construction of this index. As can be seen in Table 2, with regard to this first index, the component matrix KMO [Kaiser–Meyer–Olkin]=0.898 (between 0.8 and 0.9) and p=0.000 (<0.001), which indicates the suitability of a good sample, consequently the PCA is adequate. Moreover, the Bartlett's test of sphericity, with χ2(36)=6036.756 and p=0.000 (p<0.001), demonstrates the suitability of the PCA for the population. In addition, Cronbach's alpha presents a value of 0.925, i.e. bigger than 0.9, which demonstrates an excellent reliability of the index. Thus, we justify the extraction of one component by the Kaiser criterion, and we concluded that the explained variable is acceptable, because it presents a value of 62.71%. We can conclude that this index with one dimension is adequate.

Construction of the legislative tax complexity index.a

| Variables | N | Min. | Max. | Mean | Standard deviation | Alpha Cronbach | Factorial weights | Expl. variance |

|---|---|---|---|---|---|---|---|---|

| Very extensive articles with references to other articles | 994 | 1 | 5 | 4.21 | 1.03 | 0.925 | 0.865 | 62.71% |

| Tax law is too dispersed | 994 | 1 | 5 | 4.36 | 0.97 | 0.858 | ||

| Many exceptions to the rules and transitional arrangements | 994 | 1 | 5 | 4.24 | 1 | 0.849 | ||

| Tax laws are frequently changed | 994 | 1 | 5 | 4.44 | 0.92 | 0.817 | ||

| Very extensive tax codes | 994 | 1 | 5 | 4.01 | 1.05 | 0.801 | ||

| Transposition of EU tax legislation | 994 | 1 | 5 | 3.98 | 0.96 | 0.758 | ||

| Tax laws use highly technical language | 994 | 1 | 5 | 3.89 | 1 | 0.745 | ||

| International legislation | 994 | 1 | 5 | 3.88 | 1 | 0.731 | ||

| Low perception and ambiguity of tax language | 994 | 1 | 5 | 4.18 | 0.95 | 0.681 |

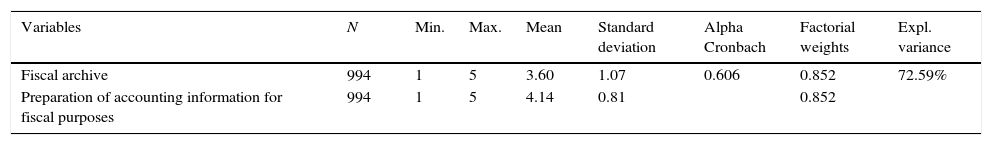

The second index is the Compliance tax complexity index in tax professionals’ context.

Table 3 presents the results from the construction of this index. In relation to this index, the component matrix KMO=0.500 (between 0.5 and 0.6) and p=0.000 (<0.001), which indicates that the quality is not good; although, given the particularity of the measure in Likert scales of five points, the PCA is acceptable. Additionally, Bartlett's test of sphericity, with χ2(1)=219.505 and p=0.000 (p<0.001), demonstrates the suitability of the PCA for the population.

Construction of the compliance tax complexity index in tax professionals’ context.a

| Variables | N | Min. | Max. | Mean | Standard deviation | Alpha Cronbach | Factorial weights | Expl. variance |

|---|---|---|---|---|---|---|---|---|

| Fiscal archive | 994 | 1 | 5 | 3.60 | 1.07 | 0.606 | 0.852 | 72.59% |

| Preparation of accounting information for fiscal purposes | 994 | 1 | 5 | 4.14 | 0.81 | 0.852 |

As can be observed in Table 3, additionally Cronbach's alpha presents a value of 0.606 (between 0.6 and 0.7), which demonstrates a questionable reliability index, although as we have already mentioned, given the particularity of the measure in Likert scales of five points, the index's reliability is acceptable. Therefore, we justify the extraction of one component by the Kaiser criterion, and we conclude that the explained variable is acceptable, because it presents a value of 72.59%. Therefore this index with one dimension is adequate.

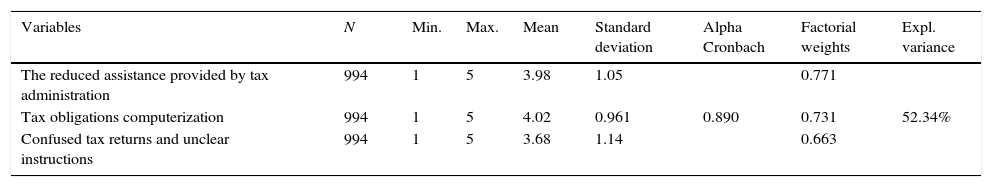

5.2.3Indices construction: compliance tax complexity index in tax administration's contextThe third index is the Compliance tax complexity index in tax administration's context.

Table 4 resumes the results of the construction of the third index. This index presents the component matrix KMO=0.606 (between 0.6 and 0.7) and p=0.000 (<0.001), which indicates that the quality is reasonable. However, given the particularity of the measure in Likert scales of five points, the PCA is acceptable. Additionally, Bartlett's test of sphericity, with χ2(3)=218.498 and p=0.000 (p<0.001), shows the suitability of the PCA for the population.

Construction of the compliance tax complexity index in tax administration's context.a

| Variables | N | Min. | Max. | Mean | Standard deviation | Alpha Cronbach | Factorial weights | Expl. variance |

|---|---|---|---|---|---|---|---|---|

| The reduced assistance provided by tax administration | 994 | 1 | 5 | 3.98 | 1.05 | 0.890 | 0.771 | 52.34% |

| Tax obligations computerization | 994 | 1 | 5 | 4.02 | 0.961 | 0.731 | ||

| Confused tax returns and unclear instructions | 994 | 1 | 5 | 3.68 | 1.14 | 0.663 |

As can be seen in the data of Table 4, Cronbach's alpha presents a value of 0.890 (between 0.8 and 0.9), which demonstrates a very good reliability of the index. Consequently, we justify the extraction of one component by means of the Kaiser Criterion, and we conclude that the explained variable is acceptable, because it presents a value of 52.34%. Therefore, this index with one dimension is adequate.

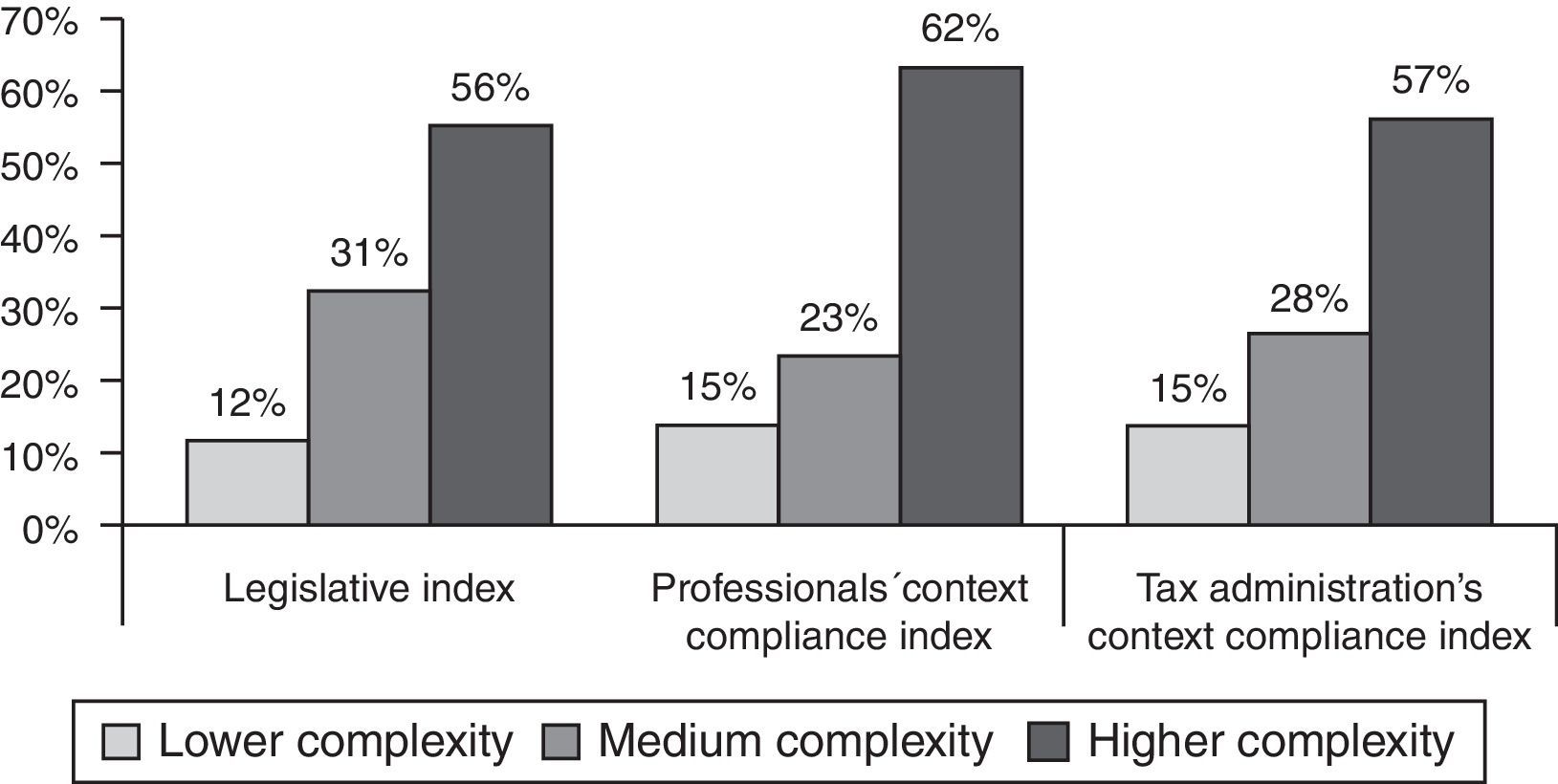

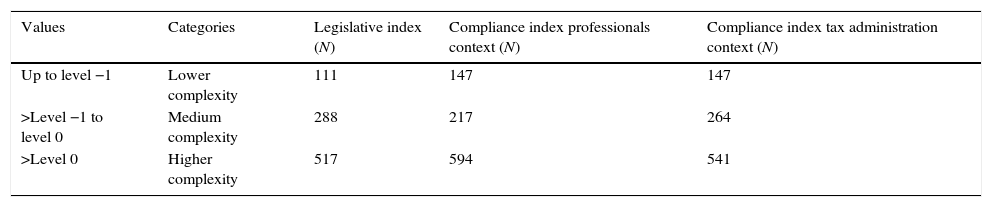

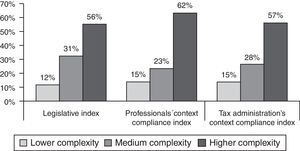

5.2.4Indices construction: classification of respondentsIn order to improve the statistical treatment of the indices results, we transformed each index in a variable with three categories; in ascending order of tax complexity (see Table 5).The results, from the distribution of tax professionals across the three categories of the indices, are summarized in Fig. 4.

Transformation of the three indices of tax complexity in categories.

| Values | Categories | Legislative index (N) | Compliance index professionals context (N) | Compliance index tax administration context (N) |

|---|---|---|---|---|

| Up to level −1 | Lower complexity | 111 | 147 | 147 |

| >Level −1 to level 0 | Medium complexity | 288 | 217 | 264 |

| >Level 0 | Higher complexity | 517 | 594 | 541 |

From the analysis of data in this Figure, we can observe a high level of perception of tax complexity, among Portuguese certified accountants, in all the dimensions (the dimensions are represented by the three indices). In the three indices the high complexity has always more than 50%.

At this point, it is necessary to analyse if tax professionals’ perception of tax complexity is related with their tax noncompliant behaviours. Thus, in the next section we test our research hypothesis.

5.3Testing the research hypothesesIn order to test our research hypotheses, we will test the relationship between the explicative and the dependent variables.

Due to the characteristics of our data we use nonparametric tests: χ2 and the Kruskal Wallis Test. To measure the strength and direction of the relation between variables we use the Spearman Correlation (Pestana & Gageiro, 2000). The adoption of nonparametric tests, rather than parametric tests, is justified by the lack of data normality, as well as by the using of nominal and ordinal variables on the five point Likert scales of the questionnaire.

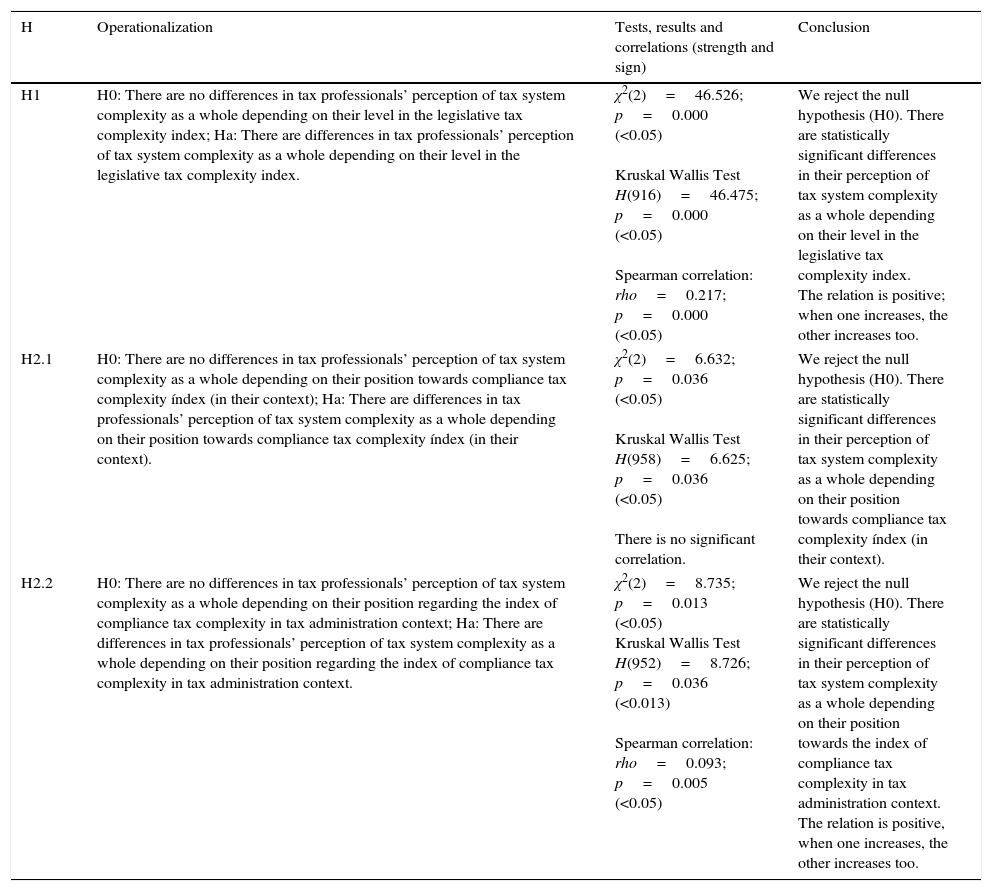

Table 6 presents the effects of each indices of tax complexity on tax professionals’ perception of tax system complexity as a whole.

Effects of the indices of tax complexity on tax professionals’ perception of tax system complexity.

| H | Operationalization | Tests, results and correlations (strength and sign) | Conclusion |

|---|---|---|---|

| H1 | H0: There are no differences in tax professionals’ perception of tax system complexity as a whole depending on their level in the legislative tax complexity index; Ha: There are differences in tax professionals’ perception of tax system complexity as a whole depending on their level in the legislative tax complexity index. | χ2(2)=46.526; p=0.000 (<0.05) Kruskal Wallis Test H(916)=46.475; p=0.000 (<0.05) Spearman correlation: rho=0.217; p=0.000 (<0.05) | We reject the null hypothesis (H0). There are statistically significant differences in their perception of tax system complexity as a whole depending on their level in the legislative tax complexity index. The relation is positive; when one increases, the other increases too. |

| H2.1 | H0: There are no differences in tax professionals’ perception of tax system complexity as a whole depending on their position towards compliance tax complexity índex (in their context); Ha: There are differences in tax professionals’ perception of tax system complexity as a whole depending on their position towards compliance tax complexity índex (in their context). | χ2(2)=6.632; p=0.036 (<0.05) Kruskal Wallis Test H(958)=6.625; p=0.036 (<0.05) There is no significant correlation. | We reject the null hypothesis (H0). There are statistically significant differences in their perception of tax system complexity as a whole depending on their position towards compliance tax complexity índex (in their context). |

| H2.2 | H0: There are no differences in tax professionals’ perception of tax system complexity as a whole depending on their position regarding the index of compliance tax complexity in tax administration context; Ha: There are differences in tax professionals’ perception of tax system complexity as a whole depending on their position regarding the index of compliance tax complexity in tax administration context. | χ2(2)=8.735; p=0.013 (<0.05) Kruskal Wallis Test H(952)=8.726; p=0.036 (<0.013) Spearman correlation: rho=0.093; p=0.005 (<0.05) | We reject the null hypothesis (H0). There are statistically significant differences in their perception of tax system complexity as a whole depending on their position towards the index of compliance tax complexity in tax administration context. The relation is positive, when one increases, the other increases too. |

According to our analysis, there is a statistically significant relationship between the perception of tax complexity and the legislative and compliance dimensions of tax complexity, represented by their indices. Thus, we can conclude that we can measure the level of complexity of the tax system, in tax professionals’ perspective, by using their indices of tax complexity.

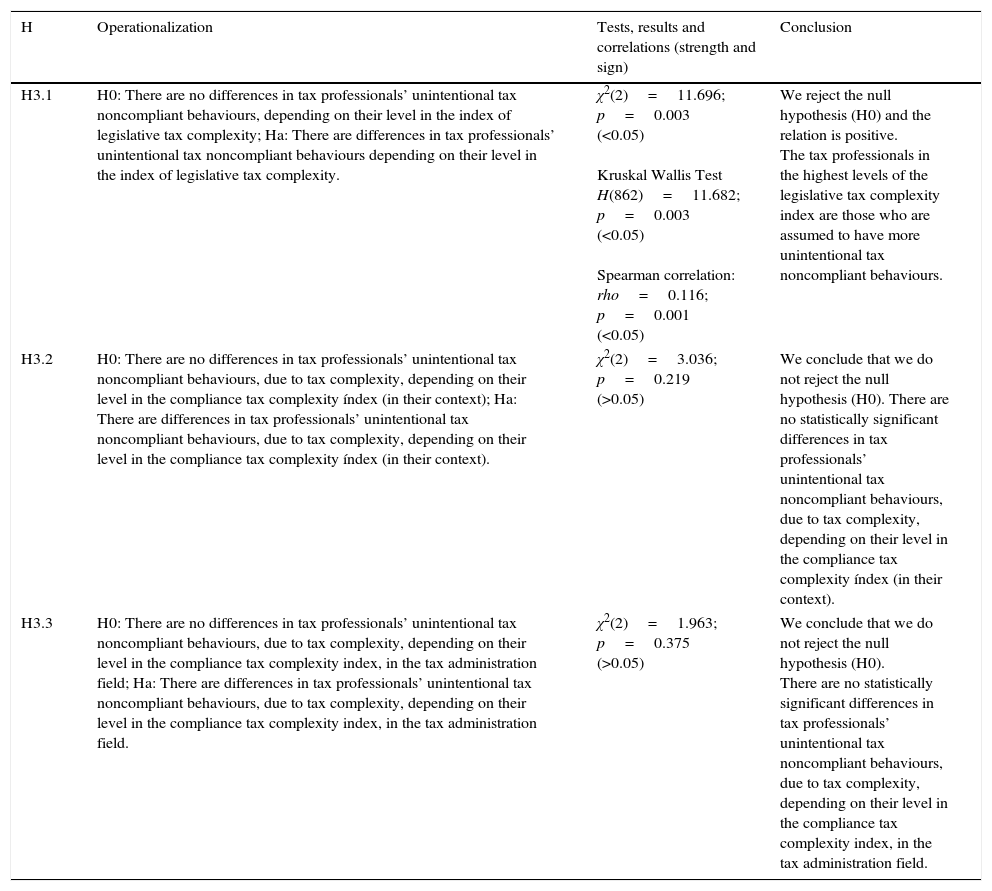

Table 7 presents the relation between the dimensions (indices) of tax professionals’ complexity and their unintentional tax noncompliant behaviours.

Tests of research hypotheses about the relation between the indices of tax complexity and tax professionals’ unintentional tax noncompliant behaviours.

| H | Operationalization | Tests, results and correlations (strength and sign) | Conclusion |

|---|---|---|---|

| H3.1 | H0: There are no differences in tax professionals’ unintentional tax noncompliant behaviours, depending on their level in the index of legislative tax complexity; Ha: There are differences in tax professionals’ unintentional tax noncompliant behaviours depending on their level in the index of legislative tax complexity. | χ2(2)=11.696; p=0.003 (<0.05) Kruskal Wallis Test H(862)=11.682; p=0.003 (<0.05) Spearman correlation: rho=0.116; p=0.001 (<0.05) | We reject the null hypothesis (H0) and the relation is positive. The tax professionals in the highest levels of the legislative tax complexity index are those who are assumed to have more unintentional tax noncompliant behaviours. |

| H3.2 | H0: There are no differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity índex (in their context); Ha: There are differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity índex (in their context). | χ2(2)=3.036; p=0.219 (>0.05) | We conclude that we do not reject the null hypothesis (H0). There are no statistically significant differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity índex (in their context). |

| H3.3 | H0: There are no differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity index, in the tax administration field; Ha: There are differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity index, in the tax administration field. | χ2(2)=1.963; p=0.375 (>0.05) | We conclude that we do not reject the null hypothesis (H0). There are no statistically significant differences in tax professionals’ unintentional tax noncompliant behaviours, due to tax complexity, depending on their level in the compliance tax complexity index, in the tax administration field. |

As can be seen in Table 7, there is a statistically significant relationship between tax professionals’ unintentional tax noncompliant behaviours and their level on the legislative tax complexity index, and that relation is positive, i.e. more perception of legislative tax complexity more errors, mistakes and omissions. These results are in line with those of GAO (2006), Bloomquist et al. (2007) and Laffer et al. (2011). According to these authors, tax professionals make many unintentional errors due to tax complexity.

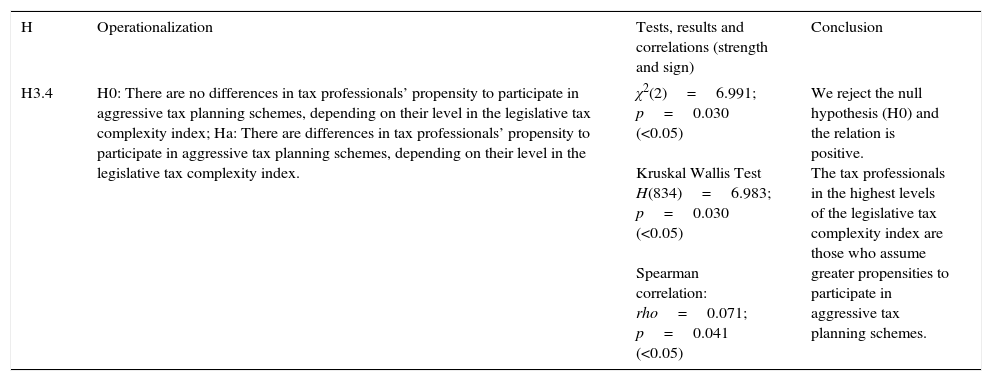

Table 8 presents the relation between the legislative dimension of tax complexity and tax professionals’ propensity for tax aggressiveness (intentional tax noncompliance), based on tax complexity.

Tests of research hypotheses as regards the relation between the legislative tax complexity index and tax professionals’ propensity for aggressive tax planning, based on tax complexity.

| H | Operationalization | Tests, results and correlations (strength and sign) | Conclusion |

|---|---|---|---|

| H3.4 | H0: There are no differences in tax professionals’ propensity to participate in aggressive tax planning schemes, depending on their level in the legislative tax complexity index; Ha: There are differences in tax professionals’ propensity to participate in aggressive tax planning schemes, depending on their level in the legislative tax complexity index. | χ2(2)=6.991; p=0.030 (<0.05) Kruskal Wallis Test H(834)=6.983; p=0.030 (<0.05) Spearman correlation: rho=0.071; p=0.041 (<0.05) | We reject the null hypothesis (H0) and the relation is positive. The tax professionals in the highest levels of the legislative tax complexity index are those who assume greater propensities to participate in aggressive tax planning schemes. |

According to the data shown in Table 8, there is a statistically significant relationship between tax professionals’ propensity for tax aggressiveness and their perception of legislative tax complexity (represented by the legislative tax complexity index), and the relation is positive, i.e. more perception of legislative tax complexity more tax aggressiveness in the tax professionals’ behaviours, choices and advices. These results are in line with those of GAO (2006), Bloomquist et al. (2007) and Laffer et al. (2011), they conclude that tax complexity provides opportunities to intentional tax noncompliance in tax professionals context, by taking advantages of tax laws ambiguities and their grey areas.

6ConclusionsTax professionals perceive the Portuguese tax system with a high level of complexity (89.1%). This result is in line with the international tax literature review (Green, 1994; Long & Swingen, 1987; McKerchar, 2005). The main determinants of tax complexity pointed out by Portuguese tax professionals are related to tax laws, such as: (i) “volatility” of tax laws (88%); (ii) tax laws dispersion (86%); (iii) preparation of accounting information for fiscal purposes (83%); (iv) many exceptions to the rules and transitional arrangements (82%); and (v) ambiguous language (80%).

We divide tax complexity into different dimensions, by grouping the 14 determinants of tax complexity, by using the technique of principal component analysis (PCA). The three dimensions (indices) are (i) the “Legislative tax complexity index”; (ii) the “Compliance tax complexity index in tax professionals’ context”; (iii) the “Compliance tax complexity index in tax administration's context”. This is a new and important result for tax research, since according to the international tax literature, tax professionals used to divide tax complexity in two dimensions: the legislative and compliance dimension; however the international literature does not present ways to measure those dimensions.

Regarding the impact of tax complexity, particularly in its legislative dimension, on tax professionals’ unintentional tax noncompliant behaviours and on their tax aggressiveness, tax system complexity appears as a critical problem, which increases tax professionals’ propensity to involuntary tax noncompliance and aggressive tax behaviours. This justifies the attention of policymakers, the tax authority, the regulatory authority of tax professionals and academia, in order to unite efforts to minimize its negative effects on tax professionals’ compliance activity, behaviours, choices and advices.

We propose some future lines of research – firstly, the study of the costs of the “volatility” of Portuguese tax laws for tax professionals, including, for instance, updates on professional software, knowledge updates and additional meetings with their customers. Secondly, we consider that it would be useful in future to undertake an update of the tax complexity indices, in order to measure their evolution within the Portuguese tax system. Finally, we propose the construction of those indices in other players’ context, namely, in the taxpayers’ and in the tax administration staff's.

This paper has benefited from valuable comments by participants at its presentation at the 38th Annual Congress of the European Accounting Association, at Scottish Exhibition and Conference Centre (SECC), Glasgow, Scotland (April, 2015).

Promoted by the FTA [OECD's Forum on Tax Administration].

In Portugal, certified accountants are the only professionals recognized by tax administration to comply with business obligations.

It is important to note that the study of tax noncompliance has a broader scope than tax evasion and tax fraud, tax avoidance, tax planning, shadow economy or tax gap, because tax noncompliance includes all those intentional behaviours, as well as the unintentional ones.

Or administrative complexity.

By referring to a 1996 study, from the Money Magazine.

CC – Contabilistas Certificados.

- Descargar PDF

- Bibliografía

- Material adicional