A major concern in financial reporting is the extent to which managers engage in earnings management. This paper analyses a specific strategy of earnings management, income smoothing, whose purpose is to reduce income variability over time and it is mentioned in the literature as a rational behaviour that allows accomplishing several purposes in the long term. The aim of this paper is to identify income smoothing practices in a sample of companies listed on the Euronext Lisbon, gathered from SABI database, over a five-year period (2001-2005). The methodology employed, common among Anglo-Saxon studies, differs considerably from those that have been used in Portugal to analyse such practices. It consists of computing several income smoothing measures that use accruals as an earnings management instrument, some of them requiring the estimation of accruals models to obtain its discretionary component. Since this is a preliminary study, these measures were only applied to a particular activity sector — the construction sector. The results of this study provide some insight on the accounting nature of income smoothing, particularly on the use of accruals to report earnings with an artifi cially reduced variability.

1. Introduction

The presence of information asymmetries between management and third parties relating to the company creates the need for a measure that is able to summarize the activity of the company, which may be used, among other purposes, to assess the management's action or as a source of information about the company's ability to generate future cash flows. The accounting income is, in fact, the most commonly used variable as such summary measure. Income is used, for example, as a reference to set the management's variable remuneration, to analyse the situation of the company by creditors or to make purchasing and/or selling decisions by investors.

However, users of financial information that use the accounting income as a basis for decision making are faced with a magnitude that is easily manipulated, given the flexibility inherent to accounting standards, in considering diverse options to reflect on a particular event, or the need to make certain estimates, aspect that has some underlying subjectivity and uncertainty, and that opens, also, the way to manipulation. In fact, literature (e.g., Fern et al., 1994) usually acknowledges that companies are encouraged to select accounting policies, in the latitude allowed by accounting standards and generally accepted accounting principles, which closely reflect their reporting needs, so published earnings and the financial position of the companies are, to some extent, the result of discretionary choices. The fact is that, if financial statements reflect a desired image by management, it represents a serious problem for the many users that make their decisions based on the information produced by the accounting system.

These aspects, combined with the spiral of financial scandals that, with cases such as the Italian multinational Parmalat, do not seem restricted to the North American context, triggered a great interest in earnings management practices, not only in academia but in society in general, being one of the lines of accounting research to which much attention has been devoted in recent decades.1

According to the literature (e.g., Monterrey, 1998; Albornoz, 2003), it is possible to identify three earnings management strategies:

— Aggressive accounting policies, aimed at improving income;

— Conservative accounting policies, aimed at reducing income; and

— Income smoothing policies, aimed at increasing income in some fi scal exercises and at decreasing it in others, in order to minimize its long-term fluctuations.

According to Albornoz (2003), research carried out within the scope of the first two strategies focuses, generally, on very specific business circumstances that generate incentives for management to change the reported income, either in ascending or descending direction, as are the cases of the change of management bodies, processes such as acquisitions or mergers, takeovers, etc. (e.g., Porciau, 1993; Perry & Williams, 1994; Teoh et al., 1998). When that does not occur, that is, when the company does not go through special circumstances that force management to adopt accounting policies that increase or reduce income in a continuous basis, the third strategy set out, income smoothing, seems more rational on the long-term (Chaney et al., 1998). Thus, unlike the other hypotheses of earnings management, income smoothing is a general strategy that can be tested in samples of heterogeneous companies, without requiring the presence of strong incentives to manipulate in a specific direction, being, therefore, the study object of the present paper.

Generally, to smooth income, managers create "reserves" in periods of good performance, in order to use them to increase earnings in periods of poor performance, making, hence, the reported earnings actually less variable than the true company's economic performance (Leuz et al., 2003). Managers can use both accruals2 and cash flows for income smoothing purposes. However, given the high costs resulting from cash flows manipulation, and since their manipulation is much more visible than the accruals manipulation, it is expected that managers prefer to use accruals to normalize the reported earnings series (Peasnell et al., 2000). Furthermore, from the researcher's standpoint, the use of accruals as an accounting manipulation instrument offers the advantage of aggregating in a single figure the net effect on income of numerous accounting policies (Healy, 1985; Watts & Zimmerman, 1990). Thus, measures based on accruals are currently widely adopted in the test of earnings management hypotheses, among which is the hypothesis of income smoothing (e.g., Tucker & Zarowin, 2006; Myers et al., 2007; Huang et al., 2009; Athanasakou et al., 2010).

Therefore, the aim of this paper is to identify income smoothing practices using accruals as an accounting manipulation instrument, within the scope of a sample of companies listed on Euronext Lisbon, as a result of: (i) firstly, the widespread adoption of smoothing measures which focus on accruals as a potential instrument available to the discretion of those responsible for preparing the financial statements; and (ii) secondly, the fact that research conducted in Portugal on income smoothing, in particular Ferreira et al. (2003) and Mendes & Rodrigues (2006), uses only smoothing measures based on the work of Ronan & Sadan (1981) and Iñiguez & Poveda (2004),3 respectively, which shows the relevance of assessing whether the previous evidence remains using alternative methodologies. It is, thus, to the best of our knowledge, the first approach in our country to this issue from this angle, which should be understood as a still preliminary version.4

The remainder of this paper is organised as follows. In section 2 a brief summary of the literature related to the subject under study is carried out. The process of sample selection, the methodologies employed and the results are presented in section 3. Finally, in section 4, the main conclusions are presented, along with suggestions for future research to be developed within the scope of this topic, in face of certain constraints underlying the study.

2. Previous literature and hypothesis definition

2.1. Positive accounting theory

Watts & Zimmerman (1978) developed the positioning of the Positive Accounting Theory (PAT) oriented towards organizations. These authors developed PAT based on the agency theory and on the idea that all stakeholders in the agency relationship act to their own advantage, seeking to maximize their wealth. Thus, this theory introduced in the analysis the so-called contract costs and political costs to explain the companies' accounting choices, assisting, in parallel, the understanding of income smoothing practices.

In fact, notwithstanding the existence of different contracts aiming at reducing agency costs, the manager has some latitude to act in accordance with his/her interests, given that the contracts or the targets set in those contracts are often defined by reference to the accounting figures, which he/she can, to some extent, manipulate. Thus, in a contractual perspective, research in accounting has devoted mainly to analysis of the contracts negotiated within the company and their consequences on the behaviour of the several contracting parties. In this context, the remuneration contracts that bind the manager to shareholders (bonus plan hypothesis), as well as the contracts that reflect the shareholders/creditors relationships (debt covenant hypothesis), may constitute a factor explaining income smoothing practices. Likewise, the relationships involving the company with the public authorities can encourage the manager to pursue an income smoothing goal (political costs hypothesis).

Once synthesized, within PAT's scope, certain business features of the company, or related to the environment in which it operates as possible explanatory factors of the income smoothing behaviour, the null (H0) and alternative (H1) hypotheses underlying our study are the following:

— H0: Absence of an income smoothing strategy (in the construction sector).

— H1: Existence of an income smoothing strategy (in the construction sector).

2.2. Research approaches in income smoothing identification

it is possible to identify in literature different approaches to analyse the existence (or absence) of income smoothing practices. Among the most common, the following are to be highlighted:

1. The Classical Approach. The "Classical Approach", so denominated by Albrecht & Richardson (1990), consists of analysing the relationship between the choice of a smoothing variable (or instrument) and its effect on the reported income. However, this methodology is widely criticized by Eckel (1981), mainly for three reasons. Firstly, to measure the incidence of income smoothing, these studies generally define a model for estimating the income considered as normal or expected (expectancy model), although that model (e.g., linear, first-difference model) may not adequately specify the earnings generation process. Secondly, many of these studies measure income smoothing without making the aggregation of the effects of several potential smoothing variables, focusing on a single accounting variable likely to smooth income. Indeed, the aggregation of variables is important, because, as suggested by Zmijewski & Hagerman (1981), companies select accounting procedures not independently, but rather on the basis of their overall expected effects on income. Thirdly, some studies consider the effects of the smoothing variable in just a period, not considering the intertemporal effects. According to Eckel (1981), in order to be sure when making inferences regarding the income smoothing behaviour, we implicitly refer to a pattern of behaviour over time, and not just one single period; hence, empirical tests about such behaviour should be multi-period. A number of studies fall into this methodology, such as, for example, the works of Cushing (1969), Dascher & Malcolm (1970), White (1970, 1972), Ronen & Sadan (1975), Ronen & Sadan (1981), Moses (1987), given the presence of some of the aforementioned features.

2. The Income Variability Approach. This method, introduced by Imhoff (1977) and developed by Eckel (1981), relies on the idea that sales are the real component of a company's economic activity and, therefore, when real income smoothing exists, it is reflected in sales. Thus, assuming that sales can only be intentionally smoothed by real smoothing and that the level of earnings is dependent, to some extent, from the level of sales, Eckel expects that a change in sales produces a relatively large effect on income; hence, if the specifi ed measure of variability of income is lower than the same measure of variability of sales, it may be concluded that income was smoothed artificially or through accounting. The work of Eckel (1981) stands out as a pioneering study in this fi eld, although many have been his followers, replicating and extending his methodology, namely Albrecht & Richardson (1990), Ashari et al. (1994), Chalayer (1994), Booth et al. (1996), Carlson & Bathala (1997), Michelson et al. (1995, 2000), Bao & Bao (2004), Iñiguez & Poveda (2004), Habib (2005), Daske et al. (2006), Tseng & Lai (2007).

3. The Sector Approach. A rather peculiar analysis consisted of assessing the propensity of companies to smooth earnings by adopting the dualist perspective of economy suggested by Averitt (1968) and Bluestone et al. (1973).5 This perspective divides the industrial structure into two distinct sectors: the core sector and the periphery sector. According to the referred scholars (in particular the latter), the core sector is composed of large companies, with intensive capital use, high productivity, high profit margins, located in concentrated markets with high monopolist incidence, with strong labour unions presence, and usually all of these factors are associated with high wages. Conversely, the periphery sector is characterised by smaller firms, intensive in hand labour, with reduced profits and productivity, located in highly competitive markets, with low presence of labour unions, which have no assets, size and political power to take advantage from economies of scale or to spend large amounts on research and development activities, and, typically, have lower wages. As examples of studies adopting this dual approach of economy in income smoothing analysis stand out Belkaoui & Picur (1984), Albrecht & Richardson (1990), Kinnunen et al. (1995) and Breton & Chenail (1997), although the evidence obtained has not always been conclusive, that is, there was not always evidence that the opportunities and the willingness for income smoothing are significantly higher in companies from the core sector than in companies operating in a more peripheral sector of the economy and vice versa.

4. The Accruals Approach. The last group of studies uses discretionary accruals to detect income smoothing behaviours. Accruals models were developed in literature on earnings management (see next section) and, in recent decades, they began to be used in income smoothing studies, such as in the investigation of anticipatory income smoothing, which establishes as hypothesis that managers smooth earnings considering not only current performance but also future performance (e.g., Fudenberg & Tirole, 1995; DeFond & Park, 1997; Ahmed et al., 2000; Albornoz & Alcarria, 2003; Belkaoui, 2003; Elgers et al., 2003). Other studies use discretionary accruals to obtain the pre-managed income (or simply use the total accruals) on their income smoothing measures, as described in section 2.4. These measures correspond to the adopted in the present study.

2.3. Accruals as an earning management instrument

Accruals are generally defined as the difference between the reported income and the cash flow, that is, they represent the cumulative effect derived from introducing the accrual basis in the conventional accounting model. Hence results the following expression of the total or observed accruals (TAC) for company i in period t:

However, the accounting standards of many countries does not require companies to report consistently the Cash Flows Statement (Wysocki, 2005), precluding the TAC calculation as described in (1) (refer red to as cash flow statement approach). Thus, several researchers usually calculate TAC indirectly, using information available in other financial statements (referred to as balance sheet approach).

Accruals comprise two components: (1) a component of short-term or working capital accruals (STAC), which corresponds to the variation of the working capital; and (2) a component of long-term (LTAC), which corresponds to the depreciation and amortization expense of the period. Accordingly, the total accruals of a firm i in period t can also be calculated by the following expression (e.g., Dechow et al., 1995; Wysocki, 2005):

Where:

TACit = total accruals in period t for firm i;

ΔCAit = change in current assets in period t from period t-1 for firm i;

ΔCashit = change in cash and cash equivalents in period t from period t-1 for firm i;

ΔCLit = change in current liabilities in period t from period t-1 for firm i;

ΔSTDit = change in short-term debt included in current liabilities in period t from period t-1 for firm i;

DEPit = depreciation and amortization expense in period t for firm i.

However, accruals are not entirely discretionary, so that a part of them depends on a number of factors beyond the management control, such as the accounting standards or changes in economic conditions of the company (Healy, 1985; Kaplan, 1985). Therefore, in total accruals, it is necessary to distinguish two components (Albornoz, 2003)6:

a) a non-discretionary component or non-discretionary accruals (NDAC), which corresponds to adjustments made to the cash flow, resulting from the application of accounting standards in a rational manner and considering the evolving economic conditions of the company;

b) a discretionary component or discretionary accruals (DAC), which corresponds to adjustments made to the cash flow, selected by management in accordance with its interests in terms of earnings.

The second component is considered an aggregate measure of management discretion and has been used in numerous studies to detect the presence of earnings management. However, only the total accruals are observable, so researchers face the problem of separating the non-discretionary and discretionary components of TAC. Thus, the methodology used by most studies to isolate both TAC components is to establish a set of assumptions about the normal behaviour of accruals in the absence of incentives to manipulate the income and, based on them, set models to estimate their normal or non-discretionary component. Therefore, once the normal component of the accruals (NDAC) is estimated, it is compared with the observed accruals (TAC), extracting by difference their discretionary component (DAC).

Notwithstanding constant developments that have followed the initial work of Healy (1985), and despite the emergence of more sophisticated models in econometric terms, the classical models continue to predominate on the empirical research, namely the Jones (1991) model and its versions.7 Jones breaks with the assumption that the non-discretionary component of accruals is constant in time and proposes a model to estimate the non-discretionary accruals that controls the effect of changes in the company's economic circumstances, in line with the proposal put forward by Kaplan (1985). For that purpose, the model states that TAC are a function of the change in revenues and of the level of gross property, plant, and equipment.

2.4. Income smoothing measures

2.4.1. Measures that use accruals models

The models of accruals estimation (e.g., Jones, 1991) can be used to calculate the pre-managed earnings, which may be used as a proxy of the real ones whenever they are well specifi ed. Thus, some studies, within the scope of income smoothing, work with the earnings before discretionary accruals, calculated as the difference between the reported income and the discretionary accruals, which is supposed to be a variable exempt from accounting discretion.

At this level, literature suggests two income smoothing measures (e.g., Tucker & Zarowin, 2006; Grant et al., 2008; Huang et al., 2009; Athanasakou et al., 2010): (1) correlation between the annual change in discretionary accruals (ΔDAC) and the annual change in pre-discretionary income (ΔPDI), ρ(ΔDAC, ΔPDI); (2) standard deviation of reported income divided by the standard deviation of pre-discretionary income, σI / σPDI.

These measures assume that there is an underlying pre-managed income series and that managers use discretionary accruals to smooth the reported income series. A greater degree of smoothing is evidenced by a more negative correlation (that is, closer to -1) between ΔDDAC and ΔPDI. In addition, a smaller relative variation of the reported income compared to the pre-discretionary income (that is, a lower σI / σPDI ratio) indicates a higher degree of smoothing.

2.4.2. Alternative measures

Empirical research also use other income smoothing measures that, although using accruals as a smoothing instrument, do not require the estimation of accruals models for obtaining its discretionary component, relying solely on measures of total accruals, cash flows from operations and reported income.

A first measure, widely used in previous studies (e.g., Bhattacharya et al., 2003; Leuz et al., 2003; Daske et al., 2006; Myers et al., 2007; Cahan et al., 2008; Grant et al., 2008), is the correlation between the annual change in total accruals (ΔTAC) and the annual change in cash flows from operations (ΔCFO), ρ(ΔTAC, ΔCFO). A lower value of this measure (that is, a more negative value) indicates a greater use of accruals to offset fluctuations in cash flows, thus smoothing income series. In fact, as emphasized by Leuz et al. (2003), management may use its accounting discretion to conceal economic shocks in the company's operating cash flows. For example, it may accelerate the recognition of future profits or delay the recognition of current losses to hide poor current performance. Equally, it may not disclose a strong current performance with the intention of creating reserves for the future. In both cases, accounting accruals attenuate cash flows' oscillations and result in a negative correlation between changes in TAC and CFO. Nevertheless, a negative correlation is the natural product of the accrual basis of accounting, whereas large magnitudes in this correlation indicate, ceteris paribus, smoothing of reported earnings (Leuz et al., 2003).

Another related measure, used, for example, in the works of Subramanyam (1996), Leuz et al. (2003), Gassen et al. (2006), Myers et al. (2007) and Grant et al. (2008), is the standard deviation of reported income divided by the standard deviation of cash flows from operations, σI / σCFO. A lower value of this ratio, that is, a higher volatility of the CFO, has an underlying higher degree of smoothing, meaning that accruals are being used to compensate for the CFO oscillations.

Both measures, like in the previous section, allow inferring the existence of accounting or artificial income smoothing, more specifically intertemporal smoothing.

3. Study of earnings management practices: Income smoothing

Following the theoretical framework of the issue under study, this section aims at analysing the income smoothing behaviour within the scope of a sample of Portuguese companies listed on the stock market. Thus, after defining the methodology and describing the process of sample selection, the presentation of the results of the empirical study is put forward, in particular the results of the accruals models' estimation and of the income smoothing measures applied.

3.1. Methodology

The methodological approach adopted in this study consists of two complementary phases, in line with the research objective previously outlined (that is, to identify income smoothing practices using accruals as an accounting manipulation instrument).

In a first phase, aiming at obtaining an estimate for the abnormal component of accruals, often used as a proxy for management accounting discretion, the estimation of accruals models is undertaken, in particular the estimation of the Jones (1991) model. The choice of the original Jones model is based on its popularity in the literature on earnings management, given that, having elapsed nearly two decades after its inception, this model and some versions of it continue to dominate empirical research in this field. 8 Moreover, the fact that it is a first approach to this issue (that is, within the scope of income smoothing and for Portugal) also justifies the implementation of this model in the analysis developed.

In the second phase, in order to ascertain whether or not the Portuguese companies listed on the stock market manipulate accruals aiming at ensuring the stabilization of reported earnings, different income smoothing measures are calculated, which have been adopted, in the international context, in previous studies. Additionally, some variants of these income smoothing measures are also calculated for control purposes. Thus, some of the measures used employ the results obtained in the first phase of the study, that is, the estimated discretionary accruals, whereas others rely solely on measures of total accruals, cash flows and reported income, not requiring, therefore, the estimation of accruals models to obtain their discretionary component. The ρ(ΔDAC, ΔPDI1), the ρ(ΔDAC, ΔPDI2), the σOI / σPDI1 and the σNI / σPDI2 fall within the first group, whereas the ρ(ΔTAC, ΔCFO), the σOI / σCFO and theσNI / σCFT fall within the second one (which description is given in Table 3).

3.2. Sample selection

The sample was gathered from the SABI database and includes, initially, all Portuguese companies listed on Euronext Lisbon, available for the period 2000-2005.9

The option for a 6 years period is justifi ed by the fact that literature recognizes, generally, that smoothing practices should be analysed in extended time horizons (e.g., Copeland, 1968; Eckel, 1981; Moses, 1987). For example, in their study on income smoothing, Tucker & Zarowin (2006) develop their analysis in a time horizon of 5 years.

It should be noted, however, that financial institutions were excluded from the analysis due to their specific accounting features, which cause for their accruals structure to be significantly different from other activity sectors (Moreira & Pope, 2006). Furthermore, it should be emphasized that some variables of the analysis are calculated in terms of variation and all of them are scaled by lagged total assets, hence, no model can be estimated during the 2000 fiscal year.

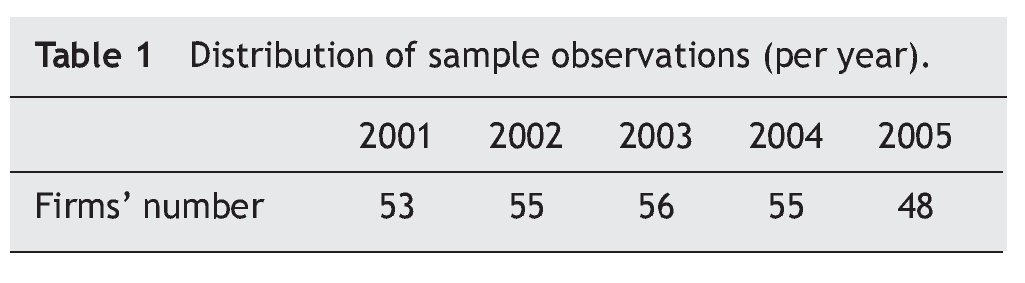

Thus, the selection procedure described above leads to a final sample of 267 firm-year observations, for the 2001-2005 period, which corresponds, at most, to 56 companies. The distribution of the sample observations, per year, is presented in Table 1, which corresponds to the sample used in the estimation of DAC (per year).

3.3. Results

3.3.1. Accruals models' estimation

As stated above, the model used to estimate the normal component of the accruals is Jones (1991) model, for the reasons previously mentioned. According to the tendency adopted by recent literature (e.g., Peasnell et al., 2000; Tucker and Zarowin, 2006; Athanasakou et al., 2010), the model is estimated in its cross-section version, that is, it is estimated in each fi scal year using data available from the companies listed on the stock market comprising the sample, rather than estimating it for each company using the time series data. Thus, the model is estimated separately for each year (5 years), within listed companies, by the Ordinary Least Squares Method. To note that the estimation of models in the cross-section version (as opposed to the time series estimation) assumes that companies are grouped by sectors and that a cross-sectional estimation of the models by year and sector is made. It should be referred, however, that this study did not divide the sample by sector for the purpose of estimating the accruals models due to poor sector representation, which would exclude diverse companies from the analysis. This estimation of the discretionary accruals without undertaking a sector division may, nevertheless, have some infl uence in the models results, notwithstanding the fact that companies also differ structurally within the sector itself (Peasnell et al., 2000). Indeed, in a recent study, Di Narzo et al. (2010) consider that achieving improvements in detecting earnings management practices may not only come from the definition of new models, but also from the definition of new methodologies to estimate the parameters of the accruals models. In fact, traditional estimation methods — time series and cross-section — are based on the assumption of homogeneity of the accrual generating process (AGP), which is often violated within various sectors. Moreover, both estimation methods are not readily applicable, in their original version, in several capital markets due to insufficient number of observations. Based on these arguments, the authors propose a new estimation method, which they call mixture approach, 10 although it has not yet been validated by the academic community.

Regarding the model specification, all variables, except the independent term, are deflated by the beginning-of-year total assets (Ait-1), in order to avoid heteroscedasticity problems. It should also be noted that in the estimated accruals models, where necessary, heteroscedasticity has been corrected using the White test.

The discretionary accruals estimated in each fiscal year, required for the second phase of this study, correspond to the residuals of the model's estimation, that is to say, correspond to the difference between the observed accruals and the estimation of their non-discretionary component, EST (NDACit/Ait-1). The sample used in the estimation of DAC (per year), as mentioned before, is shown in Table 1.

Table 2 provides descriptive statistics (mean, median, and standard deviation) for the 5 regressions estimated. The mean/median of the coefficient of the variable change in revenues (ΔREV) is positive and proved to be consistent with the results obtained in previous literature (e.g., Jones, 1991; Jeter & Shivakumar, 1999; Peasnell et al., 2000).11 Similarly, as expected, the mean/median associated to the coefficient of the variable gross property, plant, and equipment (PPE) is negative, because an increase of the PPE has an underlying increase in the depreciation expense, which is a negative component of the total accruals (Jones, 1991). Furthermore, to note that the model is globally significant (mean/median p-value associated with the F<0.10 statistic), with a mean (median) adjusted R2 of 0.10 (0.09). Given that the model explains an acceptable portion of the variation in total accruals, it was considered feasible to continue the analysis (second phase), using the DAC (i.e., the «it) as a measure of the manipulation level. To emphasize, however, as referred previously, that the moderate values obtained in diverse parameters of the model may be a consequence of the fact that the estimation made did not group companies by sector. Additionally, the Jones (1991) model is applied to a context which is different from the one where it originally emerged (Anglo-Saxon context), which may also influence the results attained (see, for instance, the work of Albornoz, 2003 and Ferreira, 2010, where the evidence obtained in some cases is similar to the present study). Indeed, some empirical studies (e.g., Paulo, 2007) provide evidence that accruals estimation models vary in their predictive power when assessed in dissimilar environments, given the differences between countries regarding accounting systems, economic performance, institutional features and social, legal and political environment that affect financial data.

3.3.2. Income smoothing measures

This section assumes the calculation of income smoothing measures for each of the companies from the sample. However, this being, as noted previously, a preliminary study, the measures are only applied to a particular activity sector. Thus, the "construction" sector has been selected, with the two-digit Economic Activities Classification (CAE) 45, since it has a minimum number of observations, in this case 3, with information available for the entire period under analysis (2001-2005). The studied companies are the following:

— Conduril — Construtora Duriense, S.A.;

— Imobiliária Construtora Grão-Pará, S.A.;

— Teixeira Duarte — Engenharia e Construções, S.A.

The results of the 7 smoothing measures used are summarized in Tables 3, 4 and 5, for each of the companies designated, respectively.

Concerning the company "Conduril — Construtora Duriense, S.A.", results are consistent with the income smoothing hypothesis. Indeed, in Panel 1 of Table 3, there is an almost perfect negative correlation, statistically significant (p-values <0.05 and 0.01, Panel 3, measures 1 and 2), between the annual change in discretionary accruals (ΔDAC) and the annual change in pre-discretionary income (ΔPDI1 and 2), suggesting that, on the basis of the pre-managed income, managers use discretionary accruals to make the reported income series smooth (that is, if the pre-managed income is below (above) the desired level, managers use DAC that increase (reduce) the reported income). Likewise, ratios σOI / σPDI1 and σNI / σPDI2 have values less than 1 and close to zero, which means that the reported earnings have a lower variability than the underlying pre-managed earnings, validating the previous findings. It should be noted, however, that in the measures using the net income (measures 2 and 4), it shows to be more smoothed than the ordinary income (measures 1 and 3), which might suggest that the extraordinary items are also being used to normalize the reported income streams. The measures set out in Panel 2 also corroborate the income smoothing hypothesis. In particular, a significant and close to -1 correlation [ρ(ΔTAC, ΔCFO)], and values less than 1 and close to zero for the ratios σOI / σCFO and σNI / σCFT, suggest a strong use of accruals by management in order to compensate for fluctuations in cash flows, reducing, thus, the volatility of earnings. Also in this case, a higher smoothing of the net income (measure 7), compared to the ordinary income (measure 6), is to be noted.

Regarding the company "Imobiliária Construtora Grão-Pará, S.A.", evidence of income smoothing is not as strong as in the previous case, although, in face of the measures presented in Panels 1 and 3 of Table 4, the presence of such practices may also be concluded. Thus, given the negative (Panel 1) and significant correlation coefficients (p-values <0.10, Panel 3), and the ratios σOI / σPDI1 and σNI / σPDI2 with values below 1 and close to zero, evidence of income smoothing is again supported, albeit with much lower intensity. In fact, the measures listed in Panel 2 point towards this direction (lower smoothing degree), with a non significant correlation coefficient [ρ(ΔTAC, ΔCFO)] and values closer to 1 for ratios σOI / σCFO (0.578) and σNI / σCFT (0.727). Furthermore, it should be mentioned that, in this case, the combined analysis of all measures suggests higher smoothing of the ordinary income level.

Finally, with regard to the company "Teixeira Duarte — Engenharia e Construções, S.A.", the results presented in Table 5 are not consistent with the income smoothing hypothesis, given that none of the analysed correlations, although negative, is statistically significant (Panel 3), and ratios, with the exception of measures 3 and 4, are closer to 1.

Given the above, if the choice was the conception of separate categories (ranks) of income smoothing, sorted, for instance, in descending order, in category 1 would be companies with a high smoothing, in category 2 companies with intermediate smoothing and in category 3 non smoothing companies, that is, companies "Conduril — Construtora Duriense, S.A.", "Imobiliária Construtora Grão-Pará, S.A." and "Teixeira Duarte — Engenharia e Construções, S.A.", respectively.

However, it ought to be stressed that the results attained in this study do not allow assessing whether the smoothing practices developed are of an opportunistic or efficient type. Indeed, although the majority of earnings management practices are seen in an opportunist perspective of the pursuit of individual goals by management, deteriorating the quality of financial information provided by the company, the same does not always apply in relation to income smoothing. Literature acknowledges that one of the goals of smoothing, by reducing the variability of earnings over time, may also be to efficiently communicate private information about the company's future earnings, that is, to signal to stakeholders of financial statements the pattern of the company's long-term earnings (which enhances stakeholders' ability to predict future profitability), and there is some empirical evidence in this direction (e.g., Subramanyam, 1996; Hunt et al., 2000; Tucker & Zarowin, 2006; Cahan et al., 2008).

4. Conclusions

An important issue in financial reporting is the extent to which managers manipulate the reported earnings. In this sense, this work fits into the line of research on earnings management that, in recent decades, has been concerned with the use that management makes of the discretion it has in the process of preparing financial statements and, in particular, in determining the accounting income, a variable that is commonly used as a summary measure of the company's performance by users of financial statements (Albornoz, 2003). More particularly, a specific strategy of earnings management, the income smoothing, is studied. This strategy, according to literature, is a logical and rational behaviour that allows the achievement of numerous long-term objectives (e.g., reduce the perceived risk, increase the value of the company, facilitate projections, maintain good work relationships, facilitate reaching retributive goals), unlike other earnings management strategies that, as aforementioned, take place in very specific business circumstances and in specific moments.

With the aim of identifying income smoothing practices, within a sample of Portuguese companies listed on the stock market, several income smoothing measures using accruals as an accounting manipulation instrument were used, in line with the research being developed in the international context, most of which has not yet been applied, to the best of our knowledge, to the Portuguese business setting. Results suggest the existence of smoothing practices within companies listed on Euronext Lisbon, particularly in the analysed economic activity sector — the construction sector —, highlighting the accounting nature of income smoothing (also named artificial smoothing), by showing that managers manipulate a set of accounting instruments available to them (in this case, accruals) with the purpose of ensuring the stabilization of reported earnings. To note also that these results are consistent with those achieved in previous works, developed in our country, on the phenomenon of income smoothing, also within the companies listed on the stock market, albeit with considerably different methodologies, in particular Ferreira et al. (2003), in the banking sector, and Mendes & Rodrigues (2006), in a heterogeneous sample of companies that excludes financial companies.

However, this study has some limitations to remind when interpreting the results. These limitations result in some suggestions for future research to be developed in this area of knowledge. Firstly, notwithstanding the fact that empirical studies often use measures of discretionary accruals in tests of earnings management, and despite the fact that Jones (1991) model continues to be widely adopted in literature to separate the discretionary and the non-discretionary components of accruals, it is not exempt from criticism (e.g., Dechow et al., 1995; Guay et al., 1996). Hence, in further analysis, it would be interesting to verify whether the results obtained are maintained using alternative accruals models. Secondly, the smoothing measures calculated only refer to an activity sector; therefore, it is important to extend the analysis to all sectors that comprise the sample, so as to be possible to extrapolate results to the universe of listed companies. Moreover, once such a calculation for the entire sample was made, it would be interesting to create different categories of income smoothing and to analyse the factors that explain its higher or lower incidence. Thirdly, the analysis conducted, as noted previously, does not allow concluding whether the purpose of management, by carrying out these practices, is of an opportunistic or efficient type; hence, future research in this line could contribute significantly to the ongoing debate "uniformity versus flexibility" in the definition of accounting standards. In fact, obtaining evidence consistent with an improved communication about the company's performance (efficient manipulation) would be a reason in favour of allowing some flexibility in accounting standards, when it is often highlighted, and also as a result of disclosed financial scandals, that managers wrongly take advantage of such ability to distort the information they disseminate to financial users (opportunistic manipulation).

Notwithstanding the limitations outlined, the present work has two main contributions. On the one hand, and to our knowledge, it is the first study of income smoothing practices in the Portuguese context that uses discretionary accruals as a smoothing instrument. On the other hand, the evidence obtained may be of interest at several levels, not being restricted to the academic community, particularly for users of financial statements, accounting standards setting bodies and at the level of audit work.

Acknowledgements

The authors gratefully acknowledge to Bureau van Dijk and FCT (Fundação para a Ciência e a Tecnologia).

1. Schipper (1989), Healy & Wahlen (1999), among others, define earnings management as any practice undertaken deliberately by management to alter reported earnings, with the purpose of obtaining some specific gain. However, it should be stressed that, when performing these practices, there is not necessarily an intention to "mislead" on the part of the management. Indeed, there are two perspectives about the earnings management practices: one efficient and other opportunistic. On the one hand, when management uses discretion to provide information to the market on its expectations about the future of the company, such discretion is seen as something positive (efficient manipulation) (e.g., Ronen & Sadan, 1981; Chaney & Lewis, 1995; Tucker & Zarowin, 2006; Cahan et al., 2008). On the other hand, if the management's incentives to develop these practices aims at achieving individual goals, at the expense of other parties related to the company, such as shareholders or creditors, the discretion is perceived negatively (opportunistic manipulation) (e.g., Bhattacharya et al., 2003; Leuz et al., 2003).

2. The term "accruals" corresponds to the earnings' component that does not generate cash flows (see section 2.3).

3. Ronen & Sadan (1981) propose linear regression analyzes to determine intertemporal and classificatory smoothing. Iñiguez & Poveda (2004) propose an income smoothing index, based on the calculation of coefficients of variation, in line with the Eckel's (1981) initial proposal.

4. It should be stressed, however, that some of the smoothing measures adopted in this study were also applied to Portugal in a number of recent international studies, which analyse differences in the incidence of earnings management practices between countries (in particular measure 5, ρ(ΔTAC, ΔCFO), described in Table 3, applied in Bhattacharya et al., 2003; Leuz et al., 2003; Burgstahler et al., 2006; Daske et al., 2006 and Cahan et al., 2008). These analyzes are, however, developed at a country-level, rather than a firm-level, unlike what happens in the present study.

There is also a number of national studies (e.g., Moreira, 2006a; Moreira, 2006b; Moreira & Pope, 2006; Borralho, 2008; Marques, 2008; Góis, 2009; Martins & Moreira, 2009; Ferreira, 2010) that, although examining accruals as an accounting manipulation instrument, do not deal specifically with the adoption of income smoothing strategies in Portugal.

5. Both quoted by Belkaoui & Picur (1984) and Albrecht & Richarson (1990).

6. In the present paper, the terms "non-discretionary", "normal" or "expected" accruals are used indistinctively, and the same occurs regarding "discretionary", "abnormal" or "unexpected" accruals (cf. Peasnell et al., 2000).

7. See, in this regard and for a critical review of some of the models, the works of Dechow et al. (1995), Kang & Sivaramakrishnan (1995), Guay et al. (1996), Shivakumar (1996), Garza-Gómez et al. (1999), Hansen (1999), Jeter & Shivakumar (1999), Kang (1999), Young (1999), Bartov et al. (2000), Jones (2000), Peasnell et al. (2000), Thomas & Zhang (2000), Ye (2007) and Stubben (2009).

8. Recent studies on income smoothing (e.g., Gu & Zhao, 2006; Lapointe-Antunes et al., 2006; Tucker & Zarowin, 2006; Athanasakou et al., 2008; Huang et al., 2009) continue to adopt models based on Jones (1991) proposal.

9. SABI, or Iberian Balance Sheet Analysis System, is a database of Bureau van Dijk and includes financial information on Portuguese and Spanish companies. To note that the period of analysis chosen reflects the availability of existing information in the database reported to the date on which data was collected.

10. This method is not based on the sector classification of companies, but in a statistical procedure that admits K AGPs, and companies are classifi ed into K estimation samples. Companies are grouped in order to reduce the heterogeneity in the estimation samples, the latter being determined by an automatic algorithm which optimizes the goodness-of-fit criterion.

11. However, the expected sign for this variable coefficient is not predefined, since a positive change in the revenues level can cause variations in items affecting both positively and negatively the working capital, such as accounts receivable and accounts payable, respectively.

Received 21 September 2011; accepted 20 March 2012

* Corresponding author.

E-mail address:

cmendes@ipca.pt (C. Araújo Mendes).

References

Ahmed, A. S., Lobo, G. J., & Zhou, J. (2000). Job security and income smoothing: An empirical test of the Fudenberg and Tirole (1995) model. SSRN Working Paper Series, October version.

Albornoz, B. G. (2003). Alisamiento del beneficio y manipulación de ajustes por devengo: Análisis empírico en el contexto español. Accounting Research Award "José M.ª Fernández Pirla" (XI Edición), Instituto de Contabilidad y Auditoría de Cuentas, Madrid.

Albornoz, B. G., & Alcarria, J. J. (2003). Analysis and diagnosis of income smoothing in Spain. European Accounting Review, 12, 443-463.

Albrecht, W. D., & Richardson, F. M. (1990). Income smoothing by economy sector. Journal of Business Finance and Accounting, 17, 713-730.

Ashari, N., Koh, H. C., Tan, S. L., & Wong, W. H. (1994). Factors affecting income smoothing among listed companies in Singapore. Accounting and Business Research, 24, 291-301.

Athanasakou, V., Strong, N., & Walker, M. (2010). The association between classificatory and inter-temporal smoothing: Evidence from the UK's FRS 3. The International Journal of Accounting, 45, 224-257.

Bao, B., & Bao, D. (2004). Income smoothing, earnings quality and firm valuation. Journal of Business Finance and Accounting, 31, 1525-1557.

Bartov, E., Gul, F., & Tsui, J. (2000). Discretionary accruals models and audit qualifications. Journal of Accounting and Economics, 30, 421-452.

Belkaoui, A. (2003). Anticipatory income smoothing and the investment opportunity set: An empirical test of the Fudenberg and Tirole (1995) model. Review of Accounting and Finance, 2, 99-117.

Belkaoui, A., & Picur, R.D. (1984). The smoothing of income numbers: Some empirical evidence on systematic differences between core and periphery industrial sectors. Journal of Business Finance and Accounting, 11, 527-545.

Bhattacharya, U., Daouk, H., & Welker, M. (2003). The world price of earnings opacity. The Accounting Review, 78, 641-678.

Booth, G. G., Kallunki, J. P., & Martikainen, T. (1996). Post-announcement drift and income smoothing: Finnish evidence. Journal of Business Finance and Accounting, 23, 1197-1211.

Borralho, J. (2008). A associação entre a manipulação dos resultados contabilísticos e a opinião dos auditores. Jornal de Contabilidade, 379, 326-336.

Breton, G., & Chenail, J. P. (1997). Une étude empirique du lissage des bénéfices dans les entreprises canadiennes. Comptabilité — Contrôle — Audit, 3, 53-67.

Burgstahler, D. C., Hail, L., & Leuz, C. (2006). The importance of reporting incentives: Earnings management in european private and public firms. The Accounting Review, 81, 983-1016.

Cahan, S. F., Liu, G., & Sun, J. (2008). Investor protection, income smoothing, and earnings informativeness. Journal of International Accounting Research, 7, 1-24.

Carlson, S.J., & Bathala, C.T. (1997). Ownership differences and firms' income smoothing behaviour. Journal of Business Finance and Accounting, 24, 179-196.

Chalayer, S. (1994). Identification et motivations des pratiques de lissage des résultats comptables des entreprises françaises cotées en Bourse. PhD Thesis in Management Science, University of Saint-Etienne.

Chaney, P. K., Jeter, D. C., & Lewis, C. M. (1998). The use of accruals in income smoothing: A permanent earnings hypothesis. Advances in Quantitative Analysis of Finance and Accounting, 6, 103-135.

Chaney, P.K., & Lewis, C.M. (1995). Earnings management and firm valuation under asymmetric information. Journal of Corporate Finance, 1, 319-345.

Copeland, R. M. (1968). Income smoothing. Journal of Accounting Research, Empirical Research in Accounting, Selected Studies, 6, (Supplement), 101-116.

Cushing, B. E. (1969). An empirical study of changes in accounting policy. Journal of Accounting Research, (Autumn), 196-203.

Dascher, P. E., & Malcom, R. E. (1970). A note on income smoothing in the chemical industry. Journal of Accounting Research, (Autumn), 253-259.

Daske, H., Gebhardt, G., & Mcleay, S. (2006). The distribution of earnings relative to targets in the European Union. Accounting and Business Research, 36, 137-167.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. The Accounting Review, 70, 193-225.

Defond, M. L., & Park, C. W. (1997). Smoothing income in anticipation of future earnings. Journal of Accounting and Economics, 23, 115-139.

Di Narzo, A. F., Freo, M., & Mattei, M. M. (2010). Improving the power of accrual models in Europe: The mixture approach. SSRN Working Paper Series, September version.

Eckel, N. (1981). The income smoothing hypothesis revisited. Abacus, 17, 28-40.

Elgers, P. T., Pfeiffer, R. J., & Porter, S. L. (2003). Anticipatory income smoothing: A re-examination. Journal of Accounting and Economics, 35, 405-422.

Fern, R. H., Brown, B. C., & Dickey, S. W. (1994). An empirical test of politically-motivated income smoothing in the oil refining industry. Journal of Applied Business Research, 10, 92-100.

Ferreira, A. (2010). Motivações do gestor e instrumentos contabilísticos utilizados na gestão dos resultados: O caso das autarquias locais. PhD Thesis in Accounting, University of Aveiro.

Ferreira, A., Carmo, C., Cravo, D. J., & Alves, S. (2003). A problemática do alisamento dos resultados: Um estudo empírico no sector bancário português. Revisores & Empresas, 21, 7-14.

Fudenberg, D., & Tirole, J. (1995). A theory of income and dividend smoothing based on incumbency rents. Journal of Political Economy, 103, 75-93.

Garza-Gómez, X., Okumara, M., & Kunimura, M. (1999). Discretionary accrual models and the accounting process. SSRN Working Paper Series, October version.

Gassen, J., Fülbier, R. U., & Sellhorn, T. (2006). International differences in conditional conservatism — The role of unconditional conservatism and income smoothing. European Accounting Review, 15, 527-564.

Góis, C. (2009). Financial reporting quality and corporate governance: The portuguese companies evidence. Paper presented at the "XV Congreso AECA", September, Valladolid.

Grant, J., Markarian, G., & Parbonetti, A. (2008). CEO risk-related incentives and income smoothing. SSRN Working Paper Series, December version.

Gu, Z., & Zhao, J. Y. (2006). Accruals, income smoothing and bond ratings. SSRN Working Paper Series, March version.

Guay, W. R., Kothari, S. P., & Watts, R. L. (1996). A market-based evaluation of discretionary accrual models. Journal of Accounting Research, 34, (Supplement), 83-105.

Habib, A. (2005). Firm-specific determinants of income smoothing in Bangladesh: An empirical evaluation. Advances in International Accounting, 18, 53-71.

Hansen, G.A. (1999). Bias and measurement error in discretionary accrual models. Working Paper, Pennsylvania State University.

Healy, P. M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7, 85-107.

Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13, 365-383.

Huang, P., Zhang, Y., Deis, D. R., & Moffitt, J. S. (2009). Do artificial income smoothing and real income smoothing contribute to firm value equivalently? Journal of Banking and Finance, 33, 224-233.

Hunt, A., Moyer, S., & Shevlin, T. (2000). Earnings volatility, earnings management, and equity value. Working Paper, University of Washington.

Imhoff, E. A. (1977). Income smoothing — A case for doubt. TheAccounting Journal, 1, 85-100.

Iñíguez, R., & Poveda, F. (2004). Long-run abnormal returns and income smoothing in the spanish stock market. European Accounting Review, 13, 105-130.

Jeter, D. C., Shivakumar, L. (1999). Cross-sectional estimation of abnormal accruals using quarterly and annual data: Effectiveness in detecting event-specific earnings management. Journal of Accounting and Business Research, 29, 299-319.

Jones, C. L. (2000). An analysis of the effectiveness of discretionary accrual measures. Working Paper, George Washington University.

Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29, 193-228. Kang, S. H. (1999). A conceptual and empirical evaluation of accrual prediction models. Working Paper, George Washington University.

Kang, S. H., & Sivaramakrishnan, K. (1995). Issues in testing earnings management and an instrumental variable approach. Journal of Accounting Research, 33, 353-367.

Kaplan, R. S. (1985). Comments on Paul Healy: Evidence on the effect of bonus schemes on accounting procedure and accrual decisions. Journal of Accounting and Economics, 7, 109-113.

Kinnunen, J., Kasanen E., & Niskanen J. (1995). Earnings management and the economy sector hypothesis: Empirical evidence on a converse relationship in the finnish case. Journal of Business Finance and Accounting, 22, 497-520.

Lapointe-Antunes, P., Cormier, D., Magnan, M., & Gay-Angers, S. (2006). On the relationship between voluntary disclosure, earnings smoothing and the value-relevance of earnings: The case of Switzerland. European Accounting Review, 15, 465-505.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69, 505-527.

Marques, M. (2008). A manipulação de resultados induzida pelo planeamento fi scal: O caso das pequenas e médias empresas portuguesas. Master Dissertation in Accounting and Auditing, University of Minho.

Martins, O. R., & Moreira, J. A. (2009). Endividamento bancário e qualidade da informação financeira: Um estudo para o caso português. Jornal de Contabilidade, 388, 217-231.

Mendes, C. A., & Rodrigues, L. L. (2006). Factors affecting income smoothing practices among listed companies on the portuguese stock market: Further evidence. Revista de Gestão e Economia, 11, 33-51.

Michelson, S. E., Jordan-Wagner, J., & Wootton, C. W. (1995). A market based analysis of income smoothing. Journal of Business Finance and Accounting, 22, 1179-1193.

Michelson, S. E., Jordan-Wagner, J., & Wootton, C. W. (2000). The relationship between the smoothing of reported income and risk-adjusted returns. Journal of Economics and Finance, 24, 141-159.

Monterrey, J. (1998). Un recorrido por la contabilidad positiva. Revista Española de Financiación y Contabilidad, 27, 427-467. Moreira, J. A. (2006a). Discretionary accruals: The measurement error induced by conservatism. Portuguese Journal of Management Studies, 11, 115-125.

Moreira, J. A. (2006b). Manipulação para evitar perdas: Impacto do conservantismo. Contabilidade e Gestão, 3, 33-63.

Moreira, J. A., & Pope, P. F. (2006). Piecewise linear accrual models: Do they really control for the asymmetric recognition of gains and losses? Working Paper, Faculty of Economics from Oporto University, January version.

Moses, O. D. (1987). Income smoothing and incentives: Empirical tests using accounting changes. The Accounting Review, 62, 358-377.

Myers, J. N., Myers, L. A., & Skinner, D. J. (2007). Earnings momentum and earnings management. Journal of Accounting, Auditing and Finance, 22, 249-284.

Paulo, E. (2007). Manipulação das informações contábeis: Uma análise teórica e empírica sobre os modelos operacionais de detecção de gerenciamento de resultados. PhD Thesis in Accounting, University of São Paulo.

Peasnell, K. V., Pope, P. F., & Young, S. (2000). Detecting earnings management using cross-sectional abnormal accruals models. Journal of Accounting and Business Research, 30, 313-326.

Perry, S. E., & Williams, T. H. (1994). Earnings management preceding management buyout offers. Journal of Accounting and Economics, 18, 157-179.

Porciau, S. (1993). Earnings management and non-routine executive changes. Journal of Accounting and Economics, 16, 317-336.

Ronen, J., & Sadan, S. (1975). Classificatory smoothing: Alternative income models. Journal of Accounting Research, 13, 133-149.

Ronen, J., & Sadan, S. (1981). Smoothing income numbers: Objectives, means, and implications. Massachusetts, Addison-Wesley Publishing Company.

Schipper, K. (1989). Commentary on earnings management. Accounting Horizons, 3, 91-102.

Shivakumar, L. L. (1996). Estimating abnormal accruals for detection of earnings management. Working Paper, Vanderbilt University.

Stubben, S. R. (2009). Discretionary revenues as a measure of earnings management. SSRN Working Paper Series, July version.

Subramanyam, K. R. (1996). The pricing of discretionary accruals. Journal of Accounting and Economics, 22, 249-281.

Teoh, S. H., Welch, I., & Wong, T. J. (1998). Earnings management and the long-run market performance of initial public offerings. Journal of Finance, 53, 1935-1974.

Thomas, J., & Zang, X. (2000). Identifying unexpected accruals: A comparison of current approaches. Journal of Accounting and Public Policy, 19, 347-376.

Tseng, L. J., & Lai, C. W. (2007). The relationship between income smoothing and company profitability: An empirical study. International Journal of Management, 24, 727-733.

Tucker, J. W., & Zarowin, P. A. (2006). Does income smoothing improve earnings informativeness? The Accounting Review, 81, 251-270.

Watts, R. L., & Zimmerman, J. L. (1978). Towards a positive theory of the determination of accounting standards. The Accounting Review, 53, 112-134.

Watts, R. L., & Zimmerman, J. L. (1990). Positive accounting theory. A ten year perspective. The Accounting Review, 65, 131-156.

White, G. E. (1970). Discretionary accounting decisions and income normalization. Journal of Accounting Research, (Autumn), 260-273.

White, G. E. (1972). Effects of discretionary accounting policy on variable and declining performance trends. Journal of Accounting Research, (Autumn), 351-358.

Wysocki, P. D. (2005). Assessing earnings and accruals quality: U.S. and international evidence. Working paper, MIT, October version.

Ye, J. (2007). Accounting accruals and tests of earnings management. SSRN Working Paper Series, July version.

Young, S. (1999). Systematic measurement error in the estimation of discretionary accruals: An evaluation of alternative modelling procedures. Journal of Business Finance and Accounting, 26, 833-862.

Zmijewski, M. E., & Hagerman, R. L. (1981). An income strategy approach to the positive theory of accounting standard setting/choice. Journal of Accounting and Economics, 3, 129-149.