This study examines the determinants of voluntary disclosure, and its different categories, in the annual reports of Portuguese and Spanish listed companies. We studied the relations between corporate characteristics, corporate governance variables and voluntary disclosure. We built a voluntary disclosure index based on the information firms provided in their annual reports. The results show that the score for strategy is significantly higher than for marketing and human capital. The analysis of the multiple regression models indicated that disclosure decisions are a complex process and are affected by interrelated factors. The results indicate that the main determinants of voluntary disclosure are the variables related with firm size, growth opportunities, organizational performance, board compensation and the presence of a large shareholder.

1. Introduction

The focus of our study is examining empirically the determinants of voluntary disclosure, and its different categories, in the annual reports of Iberian Peninsula listed companies. The voluntary disclosure of information is seen in the literature as motivated, in the first place, by its effects on the capital market perception level of the value of the organizations. There are major market incentives to disclose information voluntarily and managers' attitudes to voluntary disclosure change according to the perceived relationship of the costs and benefits involved (e.g. Gray et al., 1990; Healy & Palepu, 1995).

The agency theory, initially developed by Jensen & Meckling (1976), is based on the conflict of interest between owners (the principal) and the managers of these (the agent), in situations where there is a separation between the ownership and management or in situations where one person delegates a task to another or the management of certain interests. As a result of asymmetric information and interests, the principal should have reasons to not trust the agent. In this sense, certain mechanisms are put in place to align the interests of agents with those of the principal, thus reducing the possibility of information asymmetry, as well as opportunistic behaviours (ICAEW, 2005).Thus, revealing more information will result in a reduction of agency costs. According to Leventis & Weetman (2000: 5) "a voluntary disclosure may serve as a way of reducing the adverse effects of "moral hazard" and "adverse selection". Voluntary disclosure can also strengthen the confidence of external investors in relation to management, reducing equally the costs of the agency. Several studies provided the framework for linking disclosure to corporate governance. On the corporate governance side, most of the research focuses on ownership structure and board structure (in a broad sense, governance rules). According to Denis and McConnell (2003: 2) "the internal corporate governance mechanisms of primary interest are the board of directors and the equity ownership structure of the firm".

To analyse the level of voluntary disclosure we built an index through a list of items, within six categories. We employed multivariate regressions to examine the determinants of voluntary disclosure and its different categories. In our work an important aspect is the definition of "voluntary disclosure". Consistently with prior definitions in different regulatory national environments (Cooke 1989b; Raffournier, 1995; Meek et al., 1995; Depoers, 2000; Allegrini & Greco, 2011), we consider voluntary disclosure as the information released to the outside deriving from management's insider knowledge of the company, which are not required to be published in regulated reports. Voluntary disclosure is, therefore, produced by a management's reporting decision (Meek et al., 1995; Healy & Palepu, 2001). We analysed the information disclosed by Iberian Peninsula non-financial listed companies, concerning the year of 2007. In this sense, we analysed the information disclosed few time after the obligation of following International Financial Reporting Standards (IFRS) as endorsed by the European Union. Furthermore, in Spain, the Unified Good Governance Code, applicable from 2007 onwards, provided a common standard for the good governance practices of all listed firms. In Portugal, the recommendations on Corporate Governance were implemented in 2001, continuing to regularly improve its legislative framework through a process of bi-annual amendments. We hope that this research and the results obtained have contributed to the perception of the practices of governance and dissemination adopted by Iberian Peninsula companies. Furthermore, the results of this study may be useful to investors, company managers, and other researchers interested in the information disclosed on the market by companies and their determining factors.

This paper is organized as follows. In the next section, section 2, we present the main arguments found in the literature for each of the developed hypotheses. The research design is described in section 3. Analysis and results are discussed in Section 4. Finally, section 5 summarizes and concludes the study.

2. The determinants of voluntary disclosure: Development of hypothesis.

2.1. Relation between ownership structure and voluntary disclosure

Eng & Mak (2003) argue that when managerial ownership is low, there is a greater agency problem, meaning that managers have greater incentives to consume shareholders wealth, and reduced incentives to maximize organizational performance. Eng & Mak (2003) also argue that monitoring by outside shareholders increases costs of the firm. However, monitoring by outside shareholders may be reduced if managers can provide voluntary disclosure. That is, voluntary disclosure is a substitute for monitoring. More recently, Baek et al. (2009) find that, for firms with low levels of managerial ownership, there is a negative relationship between the level of managerial ownership and the level of disclosure.

H1a: Voluntary disclosure is negatively related to managerial ownership.

In a greater number of countries the government has a capital participation in some companies that are of strategic importance to the state. These companies are run like other private commercial enterprises, but may have to look beyond pure profit goals and consider goals related to the interests of the nation. These goals may conflict with the commercial objectives of the enterprise (Mak & Li, 2001). Eng & Mak (2003) and Wang et al. (2008) find a positive relationship between government ownership and disclosure. Because of the government's interest in these companies and the conflicting objectives faced by these firms, there may be a greater need for communication with other shareholders of the firm.

H1b: Voluntary disclosure is positively related to government ownership.

In cases of ownership dispersion, investors don't have first-hand access to information, and this may lead to increased demands for organizational information that can be used to monitor management (Gelb, 2000). For Lopes & Rodrigues (2006) if a shareholder owns a large stake in a company, the dependence on public disclosure is likely to be smaller, because he can directly monitor management. Furthermore, the ownership structure may have a significant impact on the adoption of rules of good governance which, in turn, will affect corporate disclosure (Arcay & Vázquez, 2005). As suggested by Wymeersch (2002) compliance with the recommendations of codes of good governance is more difficult when a significant proportion of a firm's equity is held by a majority shareholder.

H1c: Voluntary disclosure is negatively related to with a presence of a large shareholder.

2.2. Relation between directors' and supervisors' structures and voluntary disclosure

Lefwich et al. (1981) and Fama & Jensen (1983) argue that the larger the proportion of independents on the board, the more effective it will be in monitoring management acts, and companies can be expected to have more voluntary disclosures. According to several authors, independent directors are supposed to mitigate the agency confl icts between large controlling shareholders and minority outsider shareholders (Anderson & Reeb, 2004; Park & Shin, 2004; Patelli & Prencipe, 2007). Chen & Jaggi (2000), Arcay & Vázquez (2005) and Patelli & Principe (2007) empirical results show a positive correlation between the proportion of independent directors on the board and the amount of voluntary information disclosed by the companies.

H2a: Voluntary disclosure is positively related to the proportion of non-executives and independents on the board.

Vafeas (2000) argues that investors place higher value on earnings information when provided by firms with smaller boards. Some authors argue that larger boards may be beneficial because, for example, they increase the pool of expertise and resources available, namely, to monitor the managers' actions (e.g. Dalton et al., 1999). Di Pietra et al. (2008) argue that in firms with ownership concentration and high insider shareholders representation in the board, larger boards do not necessarily imply less effective governance structures. A larger board can offer "more knowledge and expertise, as well as more capacity for monitoring and sharing the workload" (Larmou & Vafeas, 2010, p. 62). Larger boards could better contribute to mitigate distributional conflicts among insider and minority outsider owners (Allegrini & Greco, 2011).

H2b: Voluntary disclosure is related to the size of the board (with no predicting sign).

Empirical evidence indicates that voluntary disclosure is positively related to the functioning of an audit committee (e.g. Ho & Wong, 2001; Arcay & Vázquez, 2005; Allegrini & Greco, 2011). Dominance of a board by executives and insiders can deter the creation of active and independent audit committees (Klein, 1998; Méndez & García, 2007). In addition to the audit committee, firms can voluntarily establish an internal audit function. Davidson et al. (2005) argue that this function can improve the effectiveness of governance procedures. Several studies argue that the big audit firms risk damage to the value of their reputation if they are associated with clients whose reporting practices are perceived as lower quality. Hence, they encourage clients to disclose more information (Hossain et al., 1994; Raffournier, 1995; Chau & Gray, 2002; Camfferman & Cooke, 2002). Wang et al. (2008) show that the level of voluntary disclosure is positively related to the reputation of the engaged auditor.

H2c: Voluntary disclosure is positively related with the existence of monitoring and control structures.

Nagar et al. (2003) argue that general stock-priced-based incentives represent an effective mean of encouraging both good and bad news disclosures. These authors report a positive association between corporate disclosure and the proportion of CEO compensation affected by stock price. Arcay & Vázquez (2005) also find that directors' stock option plans are positively related to voluntary disclosure. The study of Shleifer & Vishny (1997) pointed out that a remuneration contract with a strong benefit plan will cause management's interest to be consistent with those of the investors. As a result, management's actions will work to benefit investors.

H2d: Voluntary disclosure is positively related to management incentives.

Fama (1980) and Fama & Jensen (1983) argue that the market for directors serve as an important source of incentives for them to be good monitors because being directors of well-run companies signals value to the external market, which rewards them with additional directorships. Despite this, Shivdasani & Yermack (1999) suggest that the benefits of outside directorship may be non-linear, declining for the highest directorship levels as busy directors have less available time to monitor management properly. There is evidence for the costs associated with serving on multiple boards. These studies suggest that too many directorships may lower the effectiveness of directors as corporate monitors. In contrast, Ferris et al. (2003) claim that busy boards are as effective as non-busy boards at monitoring and find no relation between the average number of directorships held by outside directors and the firm's market-to-book ratio.

H2e: Voluntary disclosure is related to management expertise (with no predicting sign).

2.3. Relation between firm characteristics and voluntary disclosure

Profitability ratios are usually used in empirical research on voluntary disclosure (Raffournier, 1995; Meek et al., 1995; Ahmed & Courtis, 1999; Ho & Wong, 2001; Camfferman & Cooke, 2002; Petersen & Plenborg, 2006). The positive relation between disclosure and firm performance is implied by theoretical models of voluntary disclosure in the face of adverse selection. According to Meek et al. (1995) companies that are performing well tend to voluntarily disclose more information. In general, these papers predict that, in the presence of disclosure costs, firms whose performance exceeds a certain threshold will disclose, while those below the threshold will not. According to Wang et al. (2008) as the firm's earnings increase, managers have incentives to supply more information to the market in order to signal quality.

H3a: Voluntary disclosure is positively related to companies' performance.

A higher level of debt could lead to higher levels of agency costs, which could be eliminated by higher levels of disclosure. However, several studies support a negative relationship between the level of debt and disclosure practices, as is the case of Zarzeski (1996), Abd-Elsalam & Weetman (2003). The argument is sustained by the so-called signalling factors that support that companies with high leverage ratio belong to the bank,oriented financial system, where capital markets are no longer seen as the main source of finance and corporate information becomes more private than public. To Jensen & Meckling (1976) companies with a high level of debt try to reduce monitoring costs by disclosing more information. Wang et al. (2008) and Allegrini & Greco (2011) predict a positive relation between debt and voluntary disclosure.

H3b: Voluntary disclosure is related to the level of companies' debt (with no predicting sign).

Literature find evidence that larger firms disclose more information (e.g. Cooke, 1989a,b; Meek et al., 1995; Hossain et al., 1995; Camfferman & Cooke, 2002; Eng & Mak, 2003; Arcay & Vázquez, 2005; Wang et al., 2008; Allegrini & Greco, 2011). Also Beattie et al. (2004) find a positive relation between the size and the reporting of British companies. Hope (2003) emphasizes the need of increasing the quality of accounting information available abroad due to high demand of this information. To Jensen & Meckling (1976) large companies face greater agency costs because they require large volumes of external capital to finance their investments. Watts & Zimmerman (1990) also argue that the political costs are greater in large organizations. Consequently, large firms tend to disclose more information to reinforce confidence and to reduce such costs.

H3c: Voluntary disclosure is positively related with the size of the company.

Hossain et al. (2005) argue that high growth firms need external equity to stimulate their growth and equity providers require oriented information for the estimation of equity risks. Consistent with this argument, some studies document that disclosure is associated with a lower cost of equity (Botosan, 1997; Healy et al.,1999; Lang & Lundholm, 2000; Botosan & Plumlee, 2002) and with a lower cost of debt (Sengupta, 1998), which in turn stimulates firms' growth opportunities through the availability of finance to fund their acquisition and development.

H3d: Voluntary disclosure is positively related with growth opportunities.

3. Research design

3.1. Sample

Our sample consists of 140 listed firms from the Iberian Peninsula. Portugal has 38 firms included in this study, which represents 27,14% of our total sample and Spain has 102 firms included which represents 72,86%. The sample of our work consists of non-financial Iberian companies listed in the market, in the year of 2007. The consolidated accounts of the selected companies are analysed, when these companies are required to consolidate. The accounting and market data used in the research were collected from the Thomson Datastream database, as well as from the analysis of reports and accounts of the companies and the information disclosed by companies in their official sites.

3.2. Construction of the disclosure Index

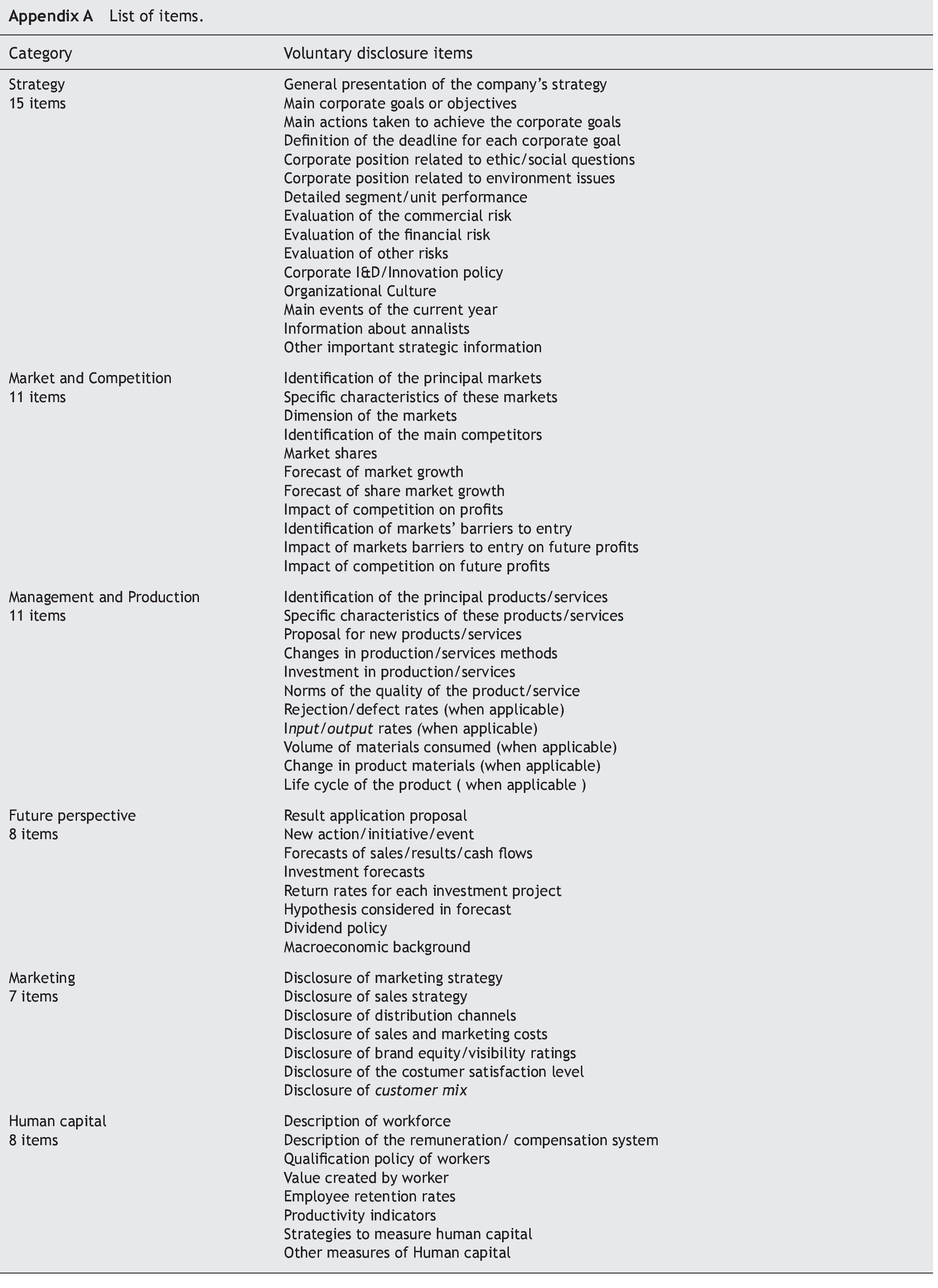

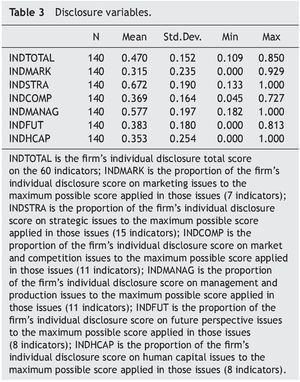

The disclosure index is based on the information firms provide in their annual reports to shareholders. The index is similar to that in Eng & Teo (1999), Eng et al. (2001), Eng & Mak (2003) and Peterson & Plenborg (2006). The design of the index is inspired by earlier studies and reports as, for example, Botosan (1997),1 AICPA (1994), the PwC Value Reporting (1999) and CICA (2008). Common to these studies is that they focus on investors' needs. Our disclosure index is based on the following six categories: strategy, market and competition, management and production, marketing, future perspective and human capital. A scoresheet was designed for scoring firms on the amount and the level of detail of disclosures. A total of 60 indicators within the six groups have been identified (see Appendix A). We read the annual reports of 2007 for the sample firms and assessed each annual report on the six disclosure categories. The disclosure index is unweighted as it assumes that each indicator of each disclosure category is equally important (Gray et al., 1995). Despite that, we use a scale, of zero to two, to score the level of detail of the information disclosed about each indicator inside the six categories. The firms' score was zero if the company did not disclose anything about that indicator, the score was one if the company has disclosure without detail and, finally, the score was 2 if the company disclosure has detail. We proceed to the validation of our voluntary disclosure index, following Botosan (1997), based on the following points: comparison with similar studies using voluntary disclosure indexes; positive statistically significant correlations between the number of analysts and the voluntary disclosure scores; an accepted value for the Cronbach's alpha coefficient; and similar results with previous studies of the correlation between the voluntary disclosure level and firm characteristics.

4. Analysis and results

4.1. Descriptive statistics

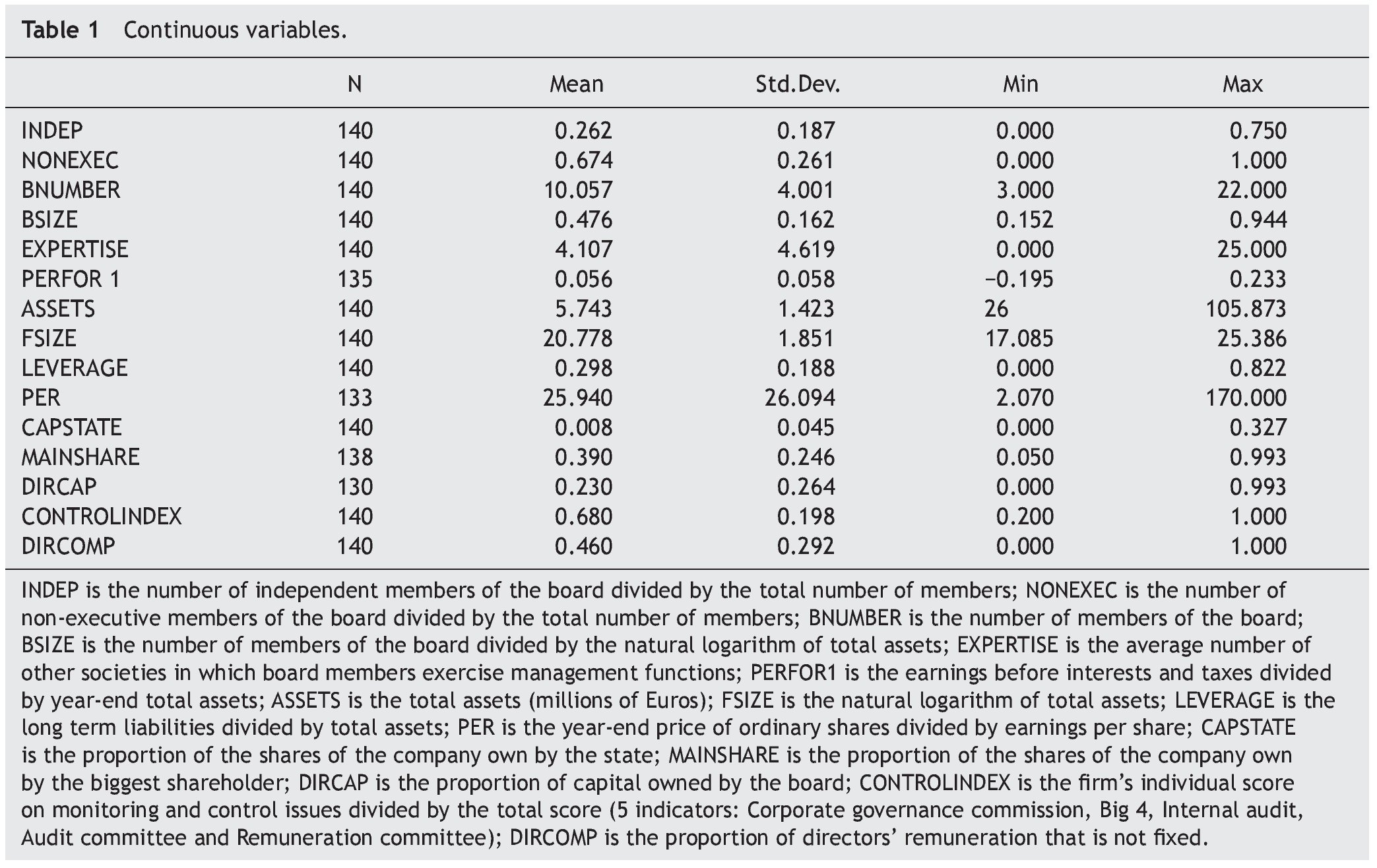

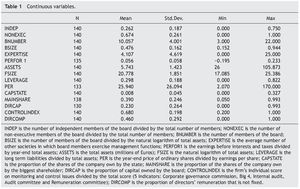

In Table 1 we show the descriptive statistics of the continuous variables, in Table 2 of the dichotomous variables and in Table 3 of the disclosure variables. Descriptive statistics of the continuous variables show that companies in our study are widely distributed regarding to corporate size. The results show us that the part of the remuneration that is not fi xed present a mean of 46% of the total board remuneration. The average board has approximately 10 members and includes a mean of 67% of non-executives, but only 26% are considered independent2. In our sample, 4 is the average number of other societies in which board members exercise management functions.

The analysis of ownership structure through the continuous variables showed us that the proportion of shares owned by the state have a low average of 0.8%, being the biggest participation in 32% of the company's shares.

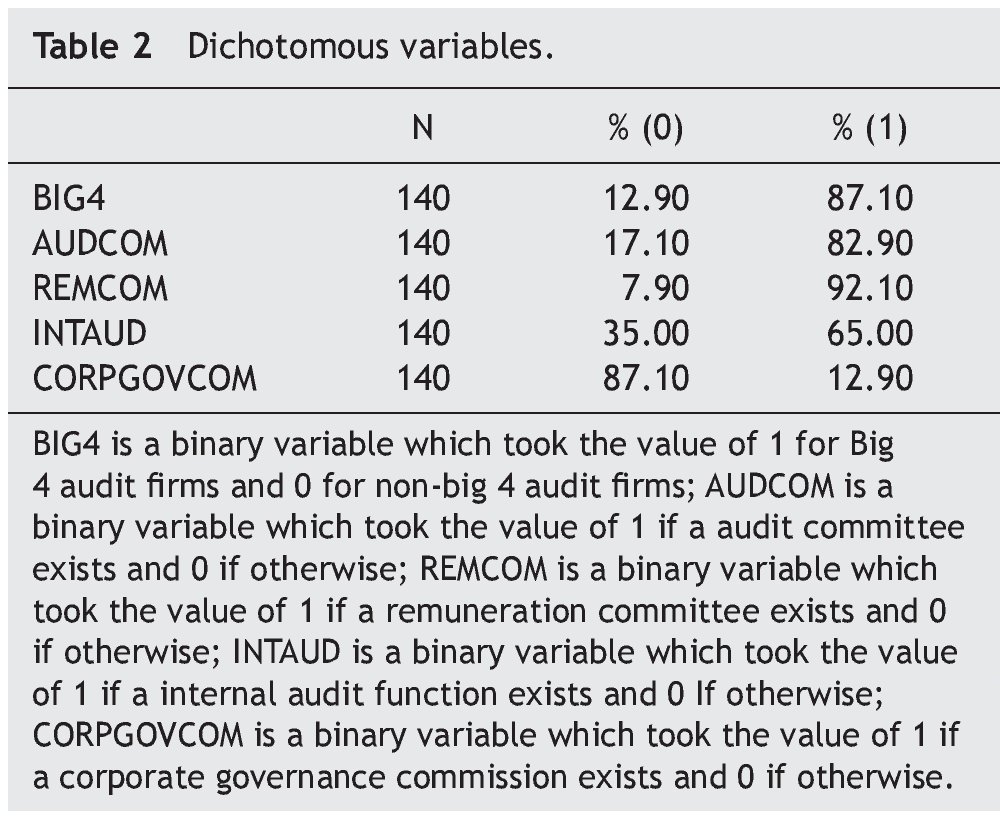

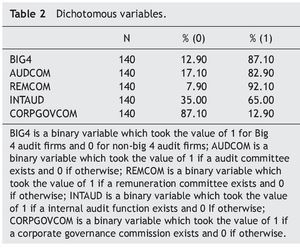

The mean level of ownership concentration, studied by the proportion of the shares of the company owned by the biggest shareholder, is 39%, with a minimum of 5% and a maximum of 99%. The management ownership has a mean of 23%, but it is also widely distributed. By the analysis of the dichotomous variables we can conclude that the majority of companies in our study have an audit committee, a remuneration committee, an internal audit function and have one of the Big 4 external auditors. Otherwise, the majority of companies don't have a corporate governance commission.

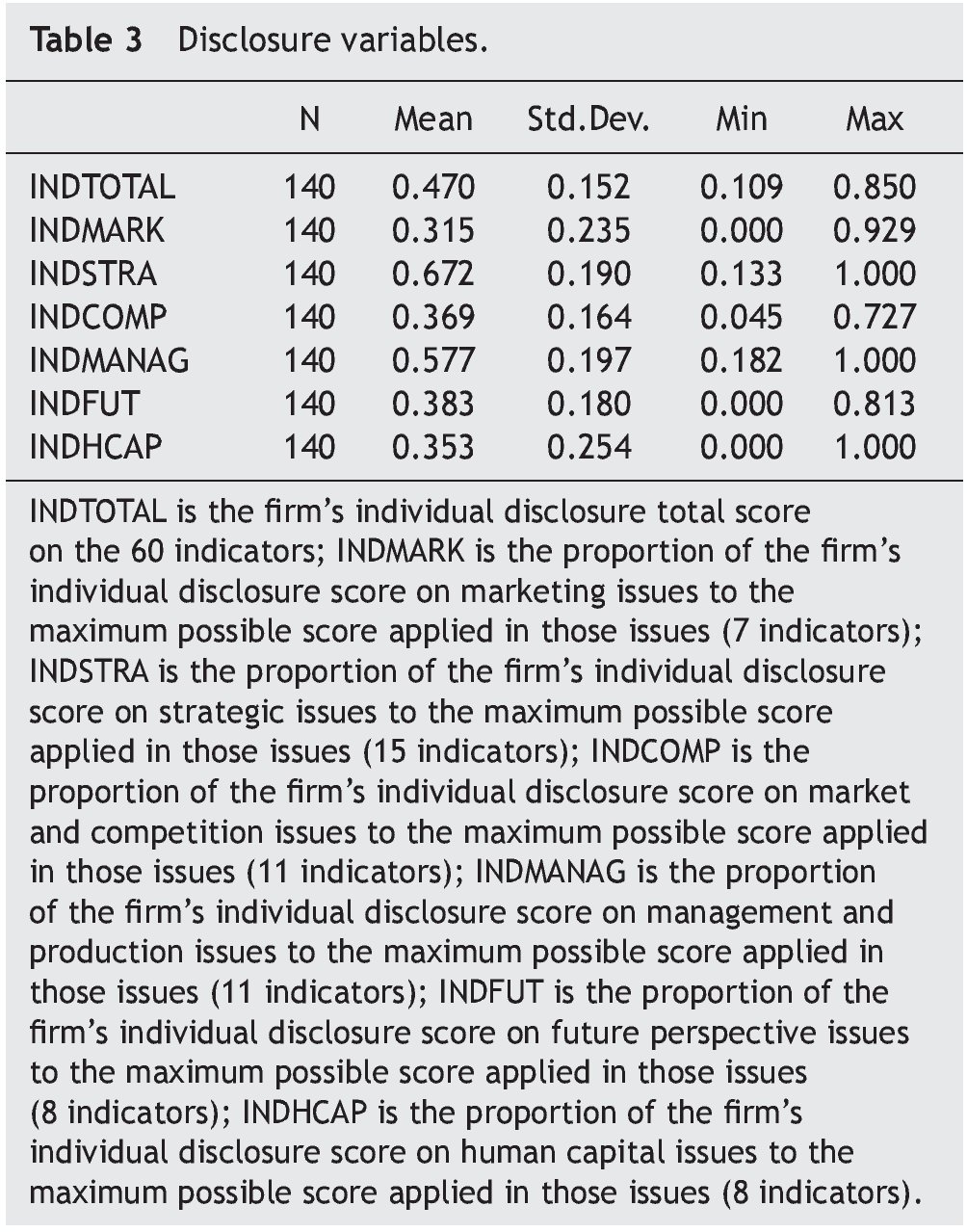

The score for strategy and management and production categories is significantly higher than that for marketing and human capital categories. The score for strategy is the highest score, suggesting that management considers strategy information an important issue.

Our results are consistent with the work of Meek et al. (1995). The authors analysed the factors influencing voluntary annual report disclosures by United States, United Kingdom and Continental European multinational companies. They concluded that the disclosure of strategic information seems to reflect national or regional influences. Specifically, Continental European companies voluntarily disclose more of this type of information than either American or British companies. The authors refer that, in general, the measurement practices in most Continental European countries are conservative and often tax-determined. In this sense, Meek et al. (1995, p. 566) argue that "perhaps these companies view disclosures of strategic information as a way to overcome a conservative bias in their measurement practices". Also Domínguez et al. (2010) state that, within the information voluntarily disclosed by companies, strategic stands out. In this sense, we can state that this information can be distinguished by its capacity to differentiate the companies that act on the market. Marketing is the category with the lowest score.

4.2. Multiple regression analysis

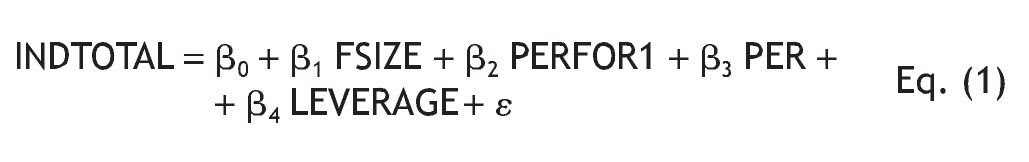

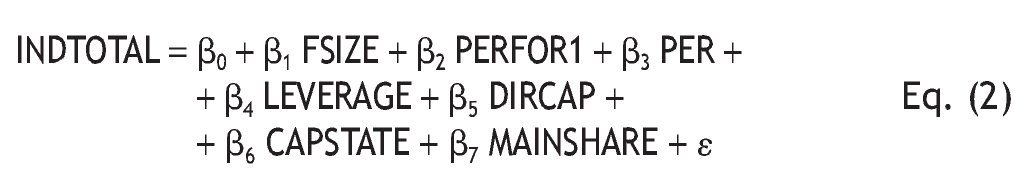

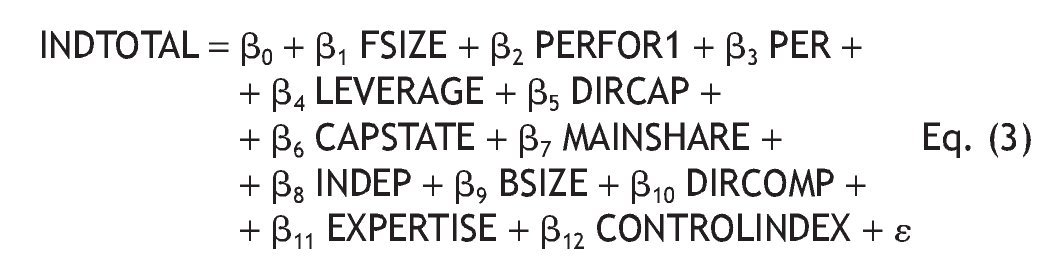

We studied the determinants of voluntary disclosure using, firstly, the total voluntary disclosure index as the dependent variable and, secondly, we made the same analysis using the six categories of the voluntary disclosure index. In the estimation of the model we used the method Enter (Standard Multiple Regression) through the SPSS 17.0.

4.2.1. Dependent variable: Total voluntary disclosure index

4.2.1.1. Model 1

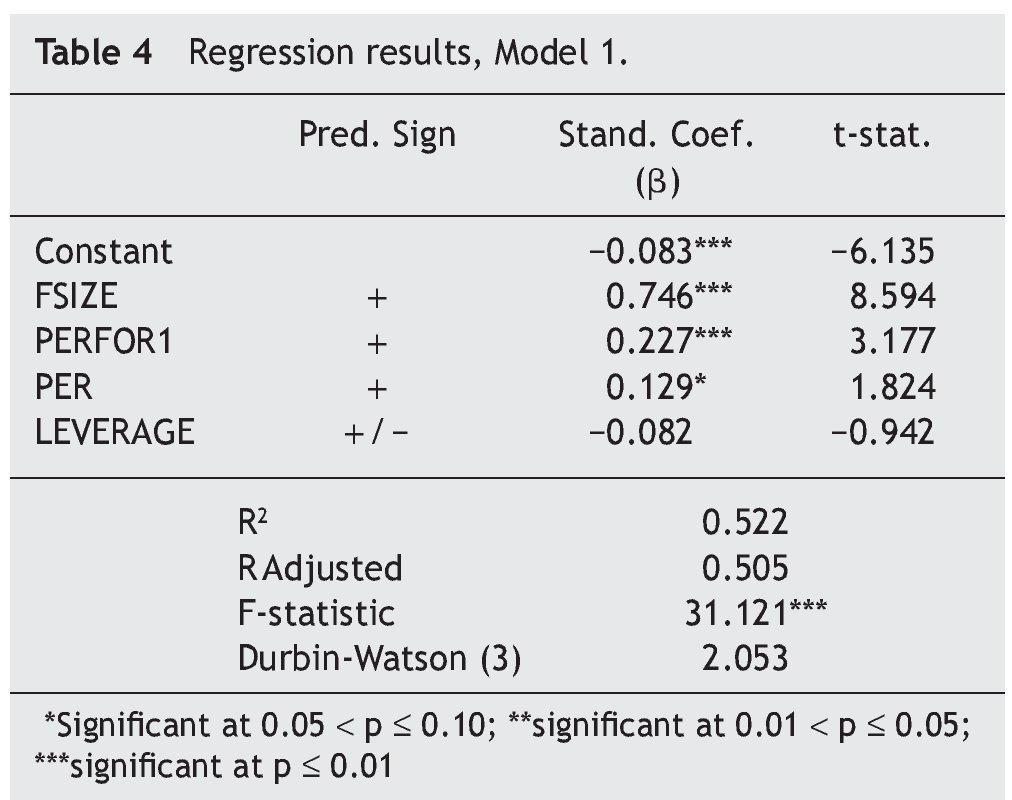

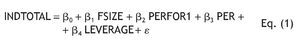

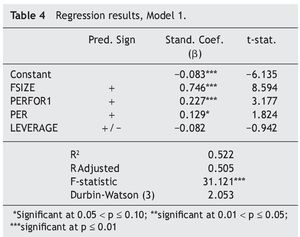

This model pretends to explain the impact of variables related with firm characteristics, such as firm size, performance, leverage and growth opportunities. Table 4 present the regression results.

The hypothesis H3a predicted a positive relation between companies' performance and voluntary disclosure. Our result supports the previous hypothesis. This result suggests that companies that are performing well tend to voluntarily disclose more information. The positive statistical significant relation between organizational performance and the voluntary disclosure index also corroborate the argument of Meek et al. (1995) and of Petersen & Plenborg (2006). Also according to Wang et al. (2008) as the firm's earnings increase, managers have incentives to supply more information to the market in order to signal quality.

On the other hand, voluntary disclosure helps investors to differentiate the high quality stocks. Furthermore, we can also analyse this result in light of the legitimacy theory. In this sense, companies with good performance feel persuaded by the social contract to perform voluntary reporting of their activities and results. According to the signalling theory, it was expected that managers of companies that are performing well disclose more information about their present situation, in order to send signs to the market about the quality of the companies they manage.

The hypothesis H3c predicted a positive relation between companies' size and voluntary disclosure. Our result supports the previous hypothesis. The firm size has been found to be significantly and positively correlated with disclosure level in a number of studies, suggesting that larger companies disclose more information, either mandatory or voluntary, than smaller companies (Cooke 1989 a, b; Meek et al., 1995; Hossain et al., 1995; Camfferman & Cooke, 2002; Ho & Wong, 2001; Eng & Mak, 2003; Wang et al., 2008; Allegrini & Greco, 2011).The argument rely on the fact large firms tend to have more voluntary disclosure because they need more financing capital than smaller firms. Furthermore, large firms are closely watched by investors and have the ability to absorb extra costs for broader disclosure. This positive statistical significant result between the firm size and the voluntary disclosure can be also explained by the fact that larger firms make a more extensive use of the capital markets and have a greater number of analysts following them (Lang & Lundholm, 1993). These facts make the companies willing to provide more information to the market. Also the agency theory suggests that larger firms will have higher agency costs compared to smaller firms which require them to voluntarily disclose more information to mitigate this agency problem (Jensen & Meckling, 1976). The extent of the result also shows that the firm size can be considered a major determinant of voluntary disclosure. Also Arcay & Vázquez (2005, p. 323) state that their findings "reveal that corporate size is a significant determinant of corporate disclosure". Furthermore, this result also shows that companies are worried about their legitimacy. Companies that feel more observed tend to increase the level of disclosure to keep their reputation and ensure their survival.

The hypothesis H3d predicted a positive relation between companies' growth opportunities and voluntary disclosure. Our result supports the previous hypothesis. For a company with growth opportunities, mandated disclosure might be insufficiently to produce low information asymmetry. These companies need external finance and, generally, have high litigation, and proprietary costs. In this sense, these companies will improve their voluntary disclosure of information. Furthermore, according to the signalling theory, companies will disclose information in order to send signs to the market. Finally, the hypothesis H3b predicted a relation between companies' debt and voluntary disclosure (with no predicted sign). Our result doesn't support the previous hypothesis. The level of debt does not provide an explanation for the level of voluntary disclosure. Our result is similar to Raffournier (1995), Wang et al. (2008) and Allegrini & Greco (2011). This result is not very surprising as evidence from earlier studies is mixed.

4.2.1.2. Model 2

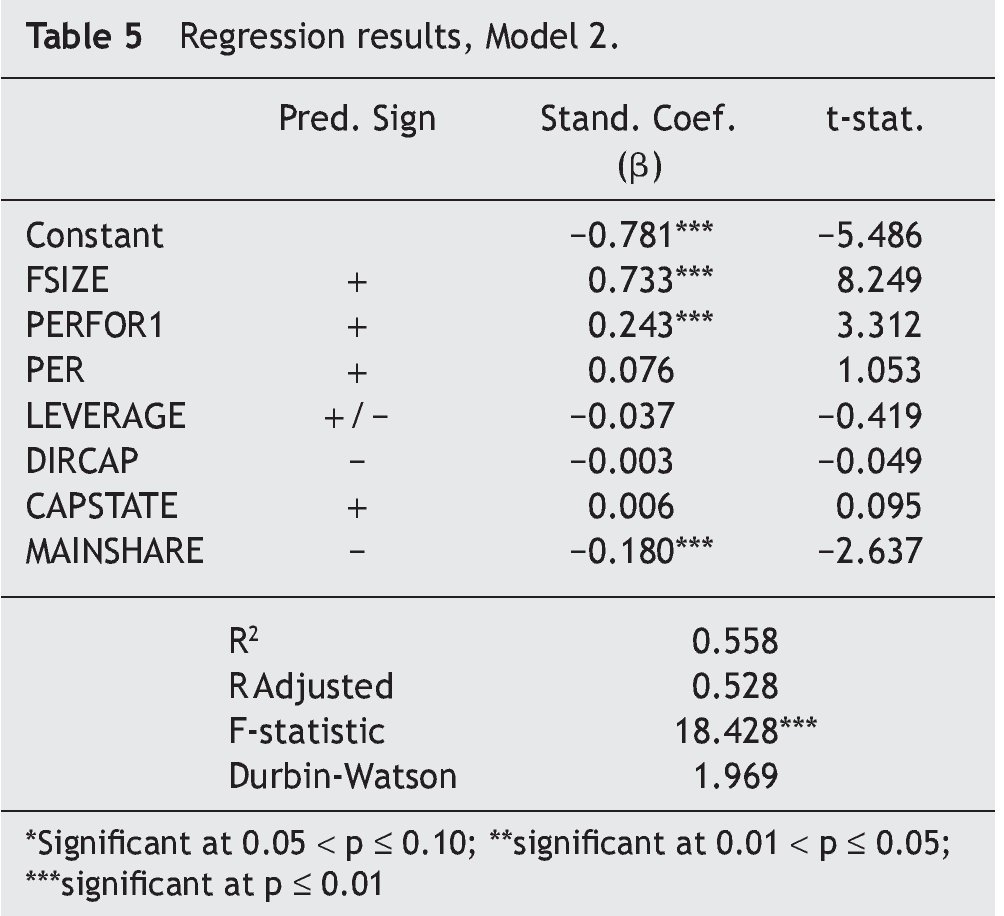

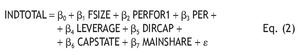

The second version of the model incorporates explanatory variables associated to ownership structure. This model intends to measure the impact of variables such as management ownership, state ownership and the presence of a large shareholder. Table 5 present the regression results.

The hypothesis H1c predicted a negative relation between the presence of a large shareholder and voluntary disclosure. Our result supports the previous hypothesis. There is a negative statistical significant (at 0,01 level) association between the level of voluntary disclosure and the presence of a large shareholder (-0,180). In the presence of a large shareholder, the owner has significant involvement in the firm's management and has unlimited access to information. This fact restrains the voluntary disclosure of information to outside.

Our result is also consistent with the result achieved by Arcay & Vázquez (2005) for spanish companies. Their findings showed that the highest mean disclosure index corresponds to firms with widely dispersed ownership.

The hypothesis H1a predicted a negative relation between managerial ownership and voluntary disclosure. Our result doesn't support the previous hypothesis. The relation of voluntary disclosure and management ownership is statistically non-significant, but revealed the expected negative sign. The hypothesis H1b predicted a positive relation between government ownership and voluntary disclosure. Our result doesn't support the previous hypothesis. The relation is statistically non-significant, but also with the expected positive sign. As we can see, despite the statistical non-significance, the signs are in line with the predicted hypotheses and with previous findings. For example, Eng & Mak (2003) find that lower managerial ownership and significant government ownership are associated with increased disclosure. Despite this, in both cases, our results show that the beta coefficients are very near to zero, which give us the idea that neither of this variables have a relevant influence in what concerns to corporate disclosure decisions for Iberian Peninsula listed companies. In fact, Leech & Manjón (2002, p. 164) state that, in Spain, "the typically highly concentrated ownership is the central ingredient in corporate governance practices, namely the disclosure ones". A similar conclusion can be taken for Iberian Peninsula companies, having in account the results presented for the variables of ownership structure.

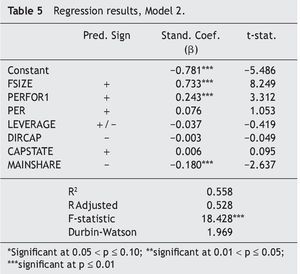

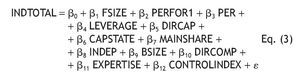

4.2.1.3. Model 3

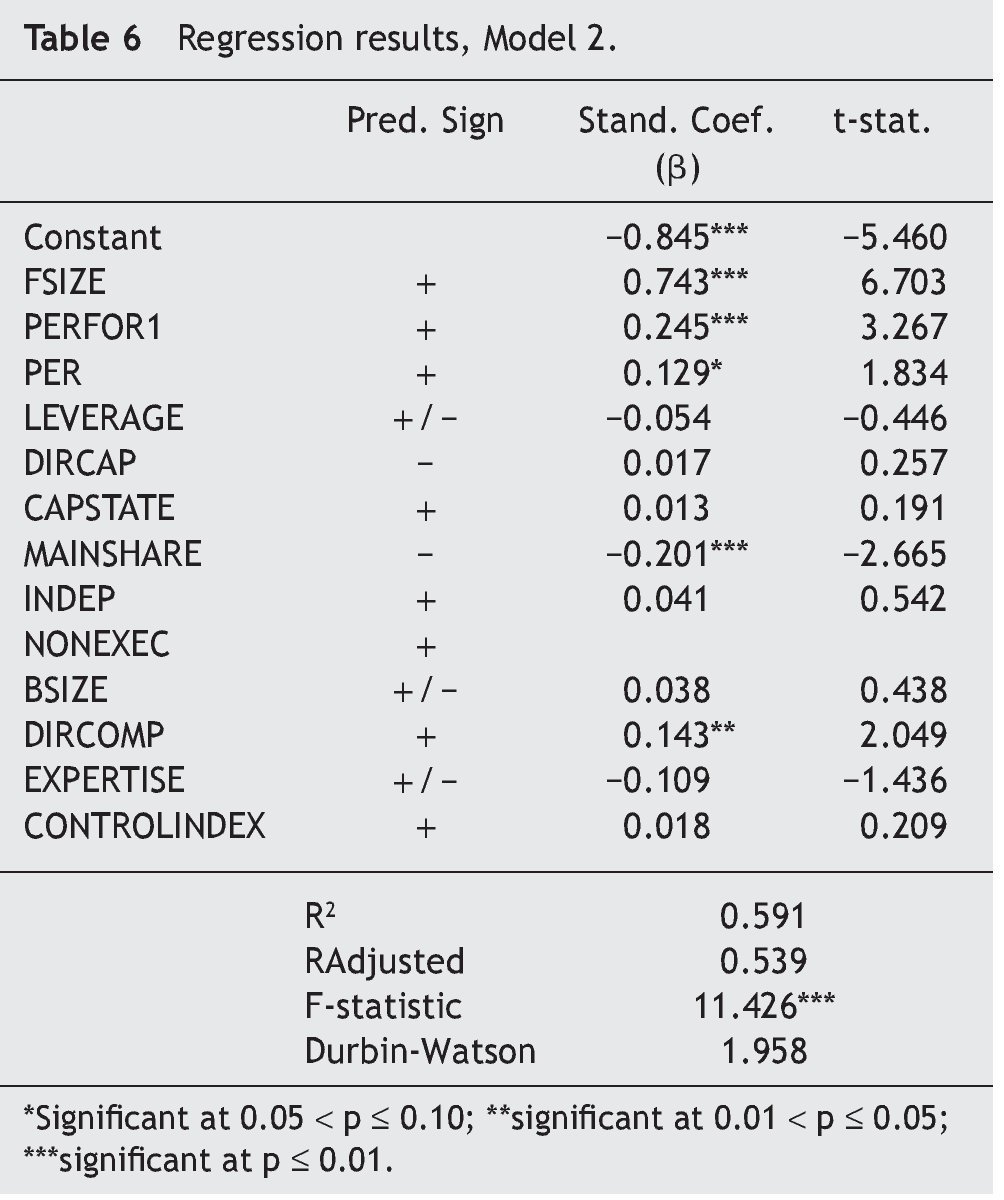

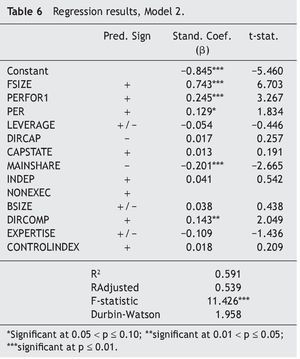

The third version of the model incorporates explanatory variables associated to directors' and supervisors' structures. In this sense, regression equation3 introduces variables such as the proportion of independent directors on the board, size of the board, board compensation, board expertise and existence of monitoring and control structures. In Table 6 we present the regressions results.

The hypothesis H2d predicted a positive relation between management incentives and voluntary disclosure. Our result supports the hypothesis H2d. We find a positive statistical significant relation (p<0,05) between the variable DIRCOMP, measured by the proportion of directors' remuneration that is not fixed and the voluntary disclosure index. This result supports the association between management incentives and voluntary disclosure practices by Iberian Peninsula companies. Arcay & Vázquez (2005) found a similar result for Spanish companies. The authors showed that the mean disclosure index is significantly higher for companies that have established a stock option plan as a mean of director remuneration.

We do not find a statistical significant association between board independence, board size or the existence of monitoring structures and the voluntary disclosure index, but the coefficients are positive. In this sense, our results don't support the hypotheses H2a,H2b,H2c. Maybe the most surprising result is the one related to board independence, presented as one of the main flags of the new philosophy of transparency and rigour of the information disclosed by listed companies. The true is that literature provides us with mixed results. For example, Lopes & Rodrigues (2006), when analysing the determinants of disclosure level in the accounting for financial instruments of Portuguese listed companies, find no relation between the proportion of independent directors and disclosure. However, the work of Arcay & Vázquez (2005), for Spanish companies, showed that the disclosure index is significantly higher for companies with higher proportion of independent directors on the board.

The board expertise, with a negative sign, did not show statistical significance. So, our result doesn't support the hypotheses H2e. The statistical non-significance may be, in part, consistent with the claim of Ferris et al. (2003) that busy boards are as effective as non-busy boards at monitoring, but the negative sign is not consistent with the previous correlations' results.

The value obtained for the R square of the model 3 was 0.591. This tells us how much of the variance in the dependent variable (total voluntary disclosure index) is explained by the model. Given these results, we conclude that the variables considered in the model largely explain the voluntary disclosure of companies.

4.2.2. Dependent variable: Category of voluntary disclosure index

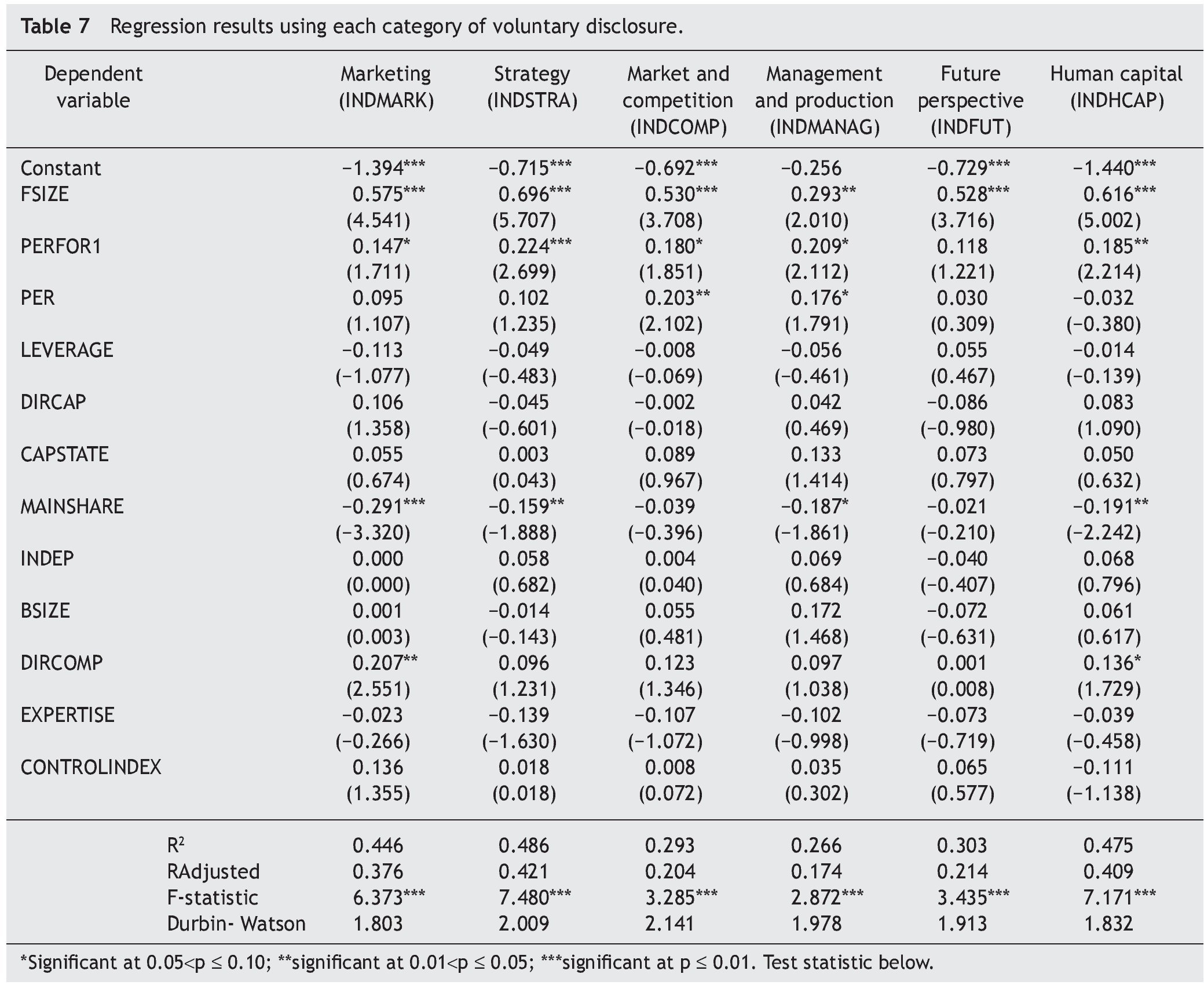

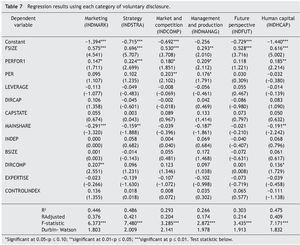

Table 7 provides the results of the regression models for each category. A first analysis allows us to conclude that we have less statistical significant determinants for each voluntary disclosure category than the ones resulting from the previous analysis of the total voluntary disclosure score. These determinants are also related with board compensation, ownership concentration, firm size, growth opportunities and organizational performance.

The firm size shows a positive statistical significant relation with all the categories of voluntary disclosure. As noted by Foster (1986, p. 44) "the variable most consistently reported as significant in studies examining differences across firms in their disclosure policy is firm size". This result confirms that firm size is significantly related to the level of information voluntarily disclosed by listed Iberian Peninsula companies. Growth opportunities show a positive statistical significant relation with the disclosure of information about market and competition (0.203) and about management and production (0.176). Organizational performance shows a positive statistical significant relation with all the voluntary disclosure categories, exception made to the future perspective category. This last category presents no more than the firm size as the major determinant. The presence of a large shareholder shows a negative statistical significant relation with the disclosure of information on strategy category (-0.159), management and production (-0,187), on marketing category (-0.291) and on human capital category (-0.191).

Finally, an interesting result is the positive statistical significant relation between the board compensation and the disclosure of information on marketing category (0.207) and human capital category (0.136). Nagar et al. (2003) argue that stock price-based incentives reduce managerial reluctance to disclose private information. Their results suggest that stock price-based compensation plays a role in providing managers with an incentive to improve price informativeness through disclosure.

5. Concluding remarks

We empirically examined the determinants of voluntary disclosure, and its different categories, on the annual reports of Iberian Peninsula listed companies. The results indicate that the main determinants of voluntary disclosure are the variables related with firm size, growth opportunities, organizational performance, board compensation and the presence of a large shareholder. The extent of the result showed that the firm size can be considered a major determinant of voluntary disclosure. We also found a negative association between the level of voluntary disclosure and the presence of a large shareholder in Iberian Peninsula companies. In an agency setting featured by ownership concentration, large insider shareholder take advantage of the benefits of private control and has direct access to information. Our results show that this characteristic of the Iberian Peninsula ownership structure have a significant impact on the adoption of rules of good governance which, in turn, affect the corporate disclosure. Compensating board members by aligning their interests with the firm's performance suggest that the linkage of management compensation to performance results in a transfer of risk to management and acts as an impeditive of opportunistic behaviour. We plotted several multiple regressions using as the dependent variable each one of the six categories of the voluntary disclosure index and concluded that we have less statistical significant determinants for each voluntary disclosure category than the ones resulting from the previous analysis of the total voluntary disclosure score. Despite this, in general, we have the same major corporate governance determinants. An interesting result was the positive relation between the board compensation and the disclosure of information on marketing category and human capital category.

Our results highlight the importance of corporate disclosures under concentrated ownership structures. The results in our study are consistent with the agency theory explanation of the complementary relationship between governance rules and voluntary disclosure, in a setting featured by large controlling shareholders. We hope that this research has contributed to draw conclusions on voluntary disclosure practices, adopted by Iberian Peninsula listed companies and the determinants of these practices. Furthermore, most of the previous research studied the effect of one single corporate governance attribute and very few of them examined different governance attributes in a single study. In this study we examined, simultaneously, several corporate governance mechanisms, assuming that the different mechanisms interact with each other.

Our voluntary disclosure index was based on the information provided by the firms in their annual reports or in public websites. As a result any disclosures those firms provided in analysts meetings, conference calls and in other circumstances are not included in the final result of our index. We analysed the corporate governance determinants of voluntary disclosure and we are aware of the existence of other factors that can have influence and that were not included in the model. For future work it would be interesting to explore the interactions among the several information sources, namely the relations between firm's voluntary disclosure policies, mandatory disclosure requirements and the information produced by analysts.

1. Botosan (1997) provide a discussion about the advantages and disadvantages of using AIRM disclosure index versus a self constructed disclosure index.

2. Anderson et al. (2004) reported, for a sample of US firms from 1993 to 1998, approximately 12 directors, 57% of whom were independent. Asbaugh-Skaife et al. (2006), who study US firms in 2002, reported a mean of 10 board members and 70% of independent directors. In contrast, Morales et al. (2010) also reported a average board of 10 members but only 29.64% of independent directors, for a sample of Spanish non-financial listed firms during 2004-2007. CMVM (2008) reported, for Portuguese listed companies in the year of 2007, 19.2% of independents members on the board. CNMV (2008) reported, for Spanish listed companies in the year of 2007, 28.32% of independents. These data confirm that low independence is a predominant characteristic of Iberian Peninsula listed companies.

3. Durbin Watson test analyse if the residuals are independent (with values near 2 autocorrelation of residue don't exist).

Received 10 January 2012; accepted 25 June 2012

* Corresponding author.

E-mail address:

helena.alves@ipleiria.pt (H. Alves).

References

Abd-Elsalam, O., & Weetman, P. (2003). Introduction international accounting standards to an emerging capital market: relative familiarity and language effect in Egypt. Journal of International Accounting, Auditing and Taxation, 12, 63-84.

Ahmed, K., & Courtis, J. (1999). Associations between corporate characteristics and disclosure levels in annual reports: A meta-analysis. British Accounting Review, 31, 35,61.

AICPA (1994). Improving business reporting-A customer focus: Meeting the information needs of investors and creditors, comprehensive report of the special committee on financial reporting (the Jenkins report). American Institute of Certifi ed Public Accountants.

Allegrini, M., & Greco, G. (2011). Corporate boards, audit committees and voluntary disclosure: evidence from Italian Listed Companies. Journal of Management and Governance, Online FirstTM. Available from: http://www.springerlink.com/ content/32720028107 w4746 [accessed 2011 Feb 24].

Anderson, R., & Reeb, D. (2004). Board composition: Balancing family influence in S&P 500 firms. Administrative Science Quarterly, 49, 209,237.

Anderson, R., Mansi, S., & Reeb, D. ( 2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics. 37, 315-342.

Arcay, M., & Vázquez, M. (2005). Corporate characteristics, governance rules and the extent of voluntary disclosure in Spain. Advances in Accounting, 21, 299-331.

Ashbaugh-Skaife, H., Collins, D., & LaFond, R. (2006). The effects of corporate governance on firm's credit ratings. Journal of Accounting and Economic, 42, 203-243.

Baek, H., Johnson, D., & Kim, J. (2009). Managerial Ownership, Corporate Governance and Voluntary disclosure. Journal of Business and Economic Studies, 15, 44-61.

Beattie, V., McInnes, B., & Fearnley, S. (2004). A Methodology for analysing and evaluating narratives in annual reports: a comprehensive descriptive profi le and metrics for disclosure quality attributes. Accounting Forum, 28, 205-236.

Botosan, C. (1997). Disclosure level and the cost of equity capital. The Accounting Review, 72, 323-349.

Botosan, C., & Plumlee, M. (2002). A re-examination of disclosure level and expected cost of equity capital. Journal of Accounting Research, 40, 2-40.

Camfferman, K., & Cooke, T. (2002). An analysis of disclosure in the annual reports of UK and Dutch companies. Journal of International Accounting Research, 1, 3-30.

Chau, G., & Gray, S. (2002). Ownership structure and corporate voluntary disclosure in Hong Kong and Singapore. The International Journal of Accounting, 37, 247-265.

Chen, C., & Jaggi, B. (2000). Association between independent non-executive directors, family control and financial disclosures in Hong Kong. Journal of Accounting and Public Policy, 19, 285-310.

CICA (2008). Corporate Reporting to Stakeholders. CICA Research Studies, Toronto: Canadian Institute of Chartered Accountants.

CMVM (2008). Relatório Anual sobre o Governo das Sociedades Cotadas em Portugal. Comissão do Mercado de Valores Mobiliários. http://www.cmvm.pt [accessed 2011 Dec 16].

CMVM (2008). Corporate Governance Report of Entities with Securities Admitted to Trading on Regulated Markets 2007. Comisión Nacional del Mercado de Valores. Available from: http://www.cnmv.es [accessed 2011 Dec 16].

Cooke, T. (1989a). Disclosure in the corporate annual reports of Swedish companies. Accounting and Business Research, 19, 113,124.

Cooke, T. (1989b). Voluntary corporate disclosure by Swedish companies. Journal of International Financial Management and Accounting, 1, 171-195.

Dalton, D., Johnson, J., & Ellstrand, A. (1999). Number of directors and financial performance: A meta-analysis. Academy of Management Journal, 42, 674-686.

Davidson, R., Goodwin-Stewart, J., & Kent, P. (2005). Internal governance structures and earnings management. Accounting and Finance, 45, 241-267.

Depoers, F. (2000). A cost benefit study of voluntary disclosure: some empirical evidence from French listed companies. European Accounting Review, 9, 245-263.

Denis, K., & McConnell, J. (2003). International Corporate Governance. Journal of Financial and Quantitative Analysis, 3, 1-36.

Di Pietra, R., Grambovas, C., Raonic, I., & Riccaboni, A (2008). The effects of board size and ''busy'' directors on the market value of Italian firms. Journal of Management and Governance, 12, 73,91.

Domínguez, L. Álvarez, I., & Sánchez, I. (2010). Determinantes de la divulgación voluntaria de información estratégica en internet: un estudio de las empresas españolas cotizadas. Revista Europea de Dirección y Economía de la Empresa, 19, 9-26.

Eng, L., Hong, K., & Ky, H. (2001). The relation between financial statement disclosures and the cost of equity capital of Singapore firms. Accounting Research Journal, 14, 35-48.

Eng, L., & Mak, Y. (2003). Corporate Governance and voluntary disclosure. Journal of Accounting and Public Policy, 22, 325-345.

Eng, L., & Teo, H. (1999). The relation between annual report disclosures, analysts' earnings forecasts and analyst following: evidence from Singapore. Pacific Accounting Review, 11, 219-239.

Fama, E. (1980). Agency problems and theory of the firm. Journal of Political Economy, 88, 288-307.

Fama, E., & Jensen, M. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325.

Ferris, S., Jagannathan, M., & Pritchard, C. (2003). Too busy to mind the business? Monitoring by directors with multiple board appointments. Journal of Finance, 58, 1087-1112.

Foster, G. (1986). Financial statement analysis. Englewood Cliffs, NJ: Prentice-Hall.

Gelb D. (2000). Managerial ownership and accounting disclosures: an empirical study. Review of Quantitative Finance and Accounting, 15, 169-185.

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: a review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing and Accountability Journal, 8, 47-77.

Gray, S, Radebaugh, L., & Roberts, C. (1990). International perceptions of cost constraints on voluntary information disclosures: a comparative study of UK and US multinationals. Journal of International Business Studies, Fourth Quarter, 597-622.

Healy, P., Hutton, A., & Palepu, K. (1999). Stock performance and intermediation changes surrounding sustained increases in disclosure. Contemporary Accounting Research, 16, 485-520.

Healy, P., & Palepu, K. (1995). The challenges of investor communications: the case of CUC International, Inc. Journal of Financial Economics, 38, 111-141.

Healy, P., & Palepu, K. (2001). Information asymmetry, corporate disclosure and capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 405-440.

Ho, S., & Wong, K. (2001). A study of the relationship between corporate governance structure and the extent of voluntary disclosure. Journal of International Accounting, Auditing and Taxation, 10, 139-156.

Hope, O. (2003). Disclosure Practices, Enforcement of Accounting Standards, and Analysts' Forecast Accuracy: An International Study. Journal of Accounting Research, 41, 235,273.

Hossain, M., Tan, M., & Adams, C. (1994). Voluntary Disclosure in an Emerging Capital Market: Some Empirical Evidence from Companies Listed on the Kuala Lumpur Stock Exchange. The International Journal of Accounting, 29, 334-351.

Hossain, M., Perrera, M., & Rahman, A. (1995). Voluntary disclosure in the annual reports of New Zealand Companies. Journal of International Financial Management and Accounting, 6, 69-87. Hossain, M., Ahmed, K., & Godfrey, J. (2005). Investment opportunity set and voluntary disclosure of prospective information: a simultaneous equations approach. Journal of Business Finance and Accounting, 32, 871-907.

ICAEW (2005). Information for Markets and Society. Institute of Chartered Accountants in Englands and Wales, London.

Jensen, M. & Meckling, W. (1976). Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360. Available from: http://ssrn. com/abstract=94043 [accessed 2011 Dec 16], 1-77.

Klein, A. (1998). Firm performance and board committee structure. Journal of Law and Economics, 41, 275-303.

Lang, M., & Lundholm, R. (2000). Voluntary Disclosure and Equity Offerings: Reducing Information Asymmetry or Hyping the Stock? Contemporary Accounting Research, 17, 623-662.

Larmou, S., & Vafeas, N. (2010). The relation between board size and firma performance in firms with a history of poor operating performance. Journal of Management and Governance, 14, 61-85.

Leech, D., & Manjón, M. (2002). Corporate Governance in Spain (with an Application of the Power Indices Approach). European Journal of Law and Economics, 13, 157-173.

Leftwich, R., Watts, R., & Zimmerman, J. (1981). Voluntary corporate disclosure: the case of interim reporting. Journal of Accounting Research, 19 (Supplement), 50-77.

Leventis, S. & Weetman, P. (2000). Exploring and Explaining Variations in Voluntary Disclosure in an European Emerging Capital Market: Evidence from the Athens Stock Exchange. Working Paper. University of Aberdeen.

Lopes, P., & Rodrigues, L. (2006). Accounting for financial instruments: an analysis of the determinants of disclosure in the Portuguese stock exchange. FEP, Working Paper nº 209. Universidade do Porto.

Mak, Y., & Li, Y. (2001). Determinants of corporate ownership and board structure: evidence from Singapore. Journal of Corporate Finance, 7, 235-256.

Meek, G., Roberts, C., & Gray, S. (1995). Factors influencing voluntary annual report disclosures by US and UK and continental European multinational corporations. Journal of international Business Studies, 26, 555-572.

Méndez, C., & García, R. (2007). The effects of ownership structure and board composition on the audit committee meeting frequency: Spanish evidence. Corporate Governance: An International Review, 15, 909,922.

Morales, C., Ballesta, J., & Meca, E. (2010). Exploring the relation between board and cost of debt: a study of the Spanish case. Facultad de Economia y Empresa, Working Paper. Universidad de Murcia.

Nagar, V., Nanda, D., & Wysocki, P. (2003). Discretionary disclosure and stock-based incentives. Journal of Accounting and Economics,34, 283-309.

Park, Y., & Shin, H. (2004). Board composition and earnings management in Canada. Journal of Corporate Finance, 10, 431,457.

Patelli, L., & Prencipe, A. (2007). The relationship between voluntary disclosure and independent directors in the presence of a dominant shareholder. European Accounting Review, 16, 5,33.

Petersen C., & Plenborg, T. (2006.) Voluntary disclosure and information asymmetry in Denmark. Journal of international Accounting, Auditing and Taxation, 15, 127-149.

PwC Value Reporting (1999). Forecasts 2000. PricewaterhouseCoopers.

Raffournier, B. (1995). The determinants of voluntary financial disclosure by Swiss listed companies. The European Accounting Review, 4, 261-280.

Sengupta, P. (1998). Corporate disclosure quality and the cost of debt. The Accounting Review, 73, 459-47.

Shivdasani, A., & Yermack, D. (1999). CEO involvement in the selection of new board members: An empirical analysis. Journal of Finance, 54, 1829-1854.

Shleifer, A., & Vishny, R. (1997). A Survey of Corporate Governance. Journal of Finance, 52, 737-783.

Vafeas, N. (2000). Board structure and the informativeness of earnings. Journal of Accounting and Public Policy, 19, 139-160.

Wang, K., Sewon, O., & Claiborne, C. (2008). Determinants and consequences of voluntary disclosure in an emerging market: Evidence from China. Journal of International Accounting, Auditing and Taxation, 17, 14-30.

Watts, R., & Zimmerman, J. (1990). Positive accounting theory: a ten year perspective. The Accounting Review, 65, 131,157.

Wymeersch, E. (2002). Convergence or divergence in corporate governance patterns in Western Europe? In McCahery, J. et al. (eds.), Corporate Governance regimes: Convergence and diversity. Oxford: Oxford University Press.

Zarzeski, M. (1996). Spontaneous Harmonization effects of culture and market forces on accounting disclosure practices. Accounting Horizons, 10, 18-37.