The present study has been framed to analyze relationship between customer value perception and their technology adoption behaviour with reference to banking customers in India. Being primary in nature by employing multistage stratified sampling approach, the study has included a sample of 1201 banking customers residing in 12 different cities of India. Further, the relationship between customer value perception and technology adoption has been examined through the development of a model named Integrated Technology Adoption model by applying structural equation modelling approach. The results of the study highlight behavioural intentions towards technology adoption as the strongest predictor of value perception of the customers followed by their personal disposition towards technology adoption, perceived usefulness and perceived ease of use. Based on the findings of the study, probable courses of actions have been suggested to the banks for enhancing value perception of the customers regarding the latest banking technologies, thereby, ensuring long-term profitability and sustainability.

Customer value is emerging as one of the focal points that facilitate organizations to sustain the pressure of competition and differentiate them from the other competitors (Hamid, 2012). Considering the imperative role of customer value banking sector has also started framing strategic moves directed towards enhancing value perception of the customers regarding the products/services offered by banks (Al-Shbiel & Al-Olimat, 2016; Yadav & Suvarna, 2013). Among such moves, one of the promising initiatives taken by the banks is introduction of new and improved technologies into banking operations (Bajaber, AlQulaity, & Zafar, 2016; Kumar, Saxena, Suvarna, & Rawat, 2016). Introduction of latest technologies (such as internet banking (IB), mobile banking (MB), etc.) allow customers to carry out their banking transactions on anytime-anywhere basis, thereby, attempting to enhance value proposition of the customers regarding services offered by banks with the use of latest available technologies.

Since the rationale of introducing latest technologies into the banking operations is to provide convenience to customers with the ultimate aim of enhancing their value perception, it becomes imperative for the banks to explore impact of such technologies on value perception of the customers. The exploration of such kind will enlighten banks regarding the facets of technology adoption behaviour of the customers that affect their value perception regarding latest technologies. However, available research in this field indicates that the phenomenon of customer value and technology adoption has been hardly studied in its entirety and comprehensively with reference to banking customers in India, though the concept has received substantial acknowledgement from distinct researchers (Bhatt & Bhatt, 2016; Karthikeyan & Soniya, 2016; Noori, 2015; Rao & Budde, 2015). Therefore, with the aim to prepare a novel and path-breaking contribution to the existing literature, the present research work has been framed to examine relationship between customer value and their technology adoption behaviour with reference to banking customers in India. Accordingly, Integrated Technology Adoption (ITA) model has been developed and proposed in the present study.

The next part of the study has attempted to explore literature pertaining to the phenomenon of customers value and its relationship with technology adoption behaviour of the customers. Further, the present contribution includes elaboration of the research methodology followed by discussion regarding the results and conclusions emanating from the present study along with probable business implications for the banking sector.

2Review of literature2.1Customer value perception and technology adoption behaviourTechnology adoption behaviour of customers play a significant role in shaping their value perception regarding the technology (Rajagopal, 2006). Technological innovations in banking services induce customers to adopt technology by enhancing their convenience level and this eventually leads augmented value perception of customers towards using banking technologies. Similarly, Bhatt and Bhatt (2016) have stated that providing assistance regarding adoption mobile banking technology to the customers add to their value perception. Similarly, features of technology including ease with which technology can be operated; effectiveness and efficiency involved in operating the banking technologies (Chen, 2013; Laukkanen, 2007; Peppers & Rogers, 2004).

Further, Ho and Ko (2008) and Khadem and Mousavi (2013) uncovered that the customers, who perceive internet banking useful, easy-to-use, cost-effective and possess readiness to use technology, are willing to adopt internet banking and have high value perception regarding internet banking. Also, Hamprecht and Brunier (2011) stated that customers across all generations, are looking for services that are consistent, customized as well as useful and this belief of the customers has also been found to affect their value perception. Further, Yieh, Chen, and Wei (2012) have also unveiled significant relationship between technology readiness and customer value perception. Similarly, researchers, such as Loureiro, Kaufmann, and Rabino (2013), Hung, Chang, Eng, and Woing (2013), Hamid (2012), Wachter, Kim, and Kim (2012); also highlighted significant role of technology adoption decision of the customers and various facets related to it, such as perceived usefulness, optimism, etc. on the value perception of the customers.

2.2Technology adoption behaviour of customersThe phenomenon of value perception of the customers towards technology is difficult to understand in entirety without shedding light on their technology adoption phenomenon (Ho & Ko, 2008). Among such research contributions, the renowned attempts include Technology Readiness Index (TRI) developed by Parasuraman (2000); Technology Adoption Model (TAM) (Davis, Bagozzi, & Warshaw, 1989); Innovation diffusion theory (IDT) (Rogers, 1995); Theory of Reasoned Action (TRA) (Fishbein & Ajzen, 1975); Theory of Planned Behaviour (TPD) (Ajzen, 1991); The Unified Theory of Acceptance and Use of Technology Model (UTAUT) (Venkatesh, Morris, Davis, & Davis, 2003); Technology Adoption Propensity (TAP) index (Ratchford & Barnhart, 2011), etc. Broadly, three categories of technology adoption facets exhibiting significant impact on technology adoption behaviour of the customers have been highlighted. The three categories include personal disposition of customers towards technology adoption manifested through personal traits, namely, optimism, innovativeness, risk taking propensity, discomfort, self-efficacy, psychological resilience, social influence, habit, etc.; technology attributes, namely, perceived usefulness, perceived ease of use, performance expectancy, effort expectancy, relative advantage, etc. and facilitating condition available. Based on these models, distinct researchers at different points of time and with reference to different technologies have either validated the aforesaid models or considered different technology adoption facets in their studies. For instance, TAM has been validated with reference to different technologies including e-banking, e-learning, 3G mobile services, mobile banking, etc. in different economies, such as Korea, USA, Japan, Singapore, etc. (Akturan & Tezcan, 2012; Al-Shbiel & Al-Olimat, 2016; Fathema, Shannon, & Ross, 2015; Qteishat, Alqatawna, & Al-Ma’aitah, 2013). Likewise, TRI has also been validated in different settings and with reference to different technologies, including e-banking, e-insurance, e-learning system, self-service technologies, e-shopping, etc. (Chen, Chen, & Chen, 2009; Gupta & Garg, 2015; Ling & Moi, 2007; Taylor, Celuch, & Goodwin, 2002) in nations. Further, the significant role of various other facets, such as self-efficacy, risk social influence, habit, psychological resilience, facilitating conditions, etc. in technology adoption decision of the customers have been explored (Al-Haderi, 2013; Al-Qeisi & Al-Abdallah, 2013; Bakker, Gierveld, & Rijswijk, 2006; Compeau & Higgins, 1995; Farzianpour, Pishdar, Shakib, & Toloun, 2014; Limayem & Hirt, 2003; Venkatesh & Davis, 2000; Venkatesh et al., 2003; Venkatesh, Thong, & Xu, 2012; Verhoef et al., 2009; Vinayek & Jindal, 2011). Besides, different studies found in the literature have also shown varied results. Aboelmaged and Gebba (2013) highlighted statistically significant impact of perceived usefulness on behavioural intentions but statistically insignificant role of perceived ease of use on the behavioural intentions among mobile banking customers. Conversely, Maditinos, Chatzoudes, and Sarigiannidis (2013) and Akturan and Tezcan (2012) have found significant role of perceived usefulness and insignificant role of perceived ease of use in the adoption of mobile banking technology. Besides, some studies have depicted statistically significant but indirect impact of the four constructs of TRI (Parasuraman, 2000) on decision of the individuals towards technology adoption (e.g. Elliott, Meng, & Hall, 2008; Walczuch, Lemmink, & Streukens, 2007, etc.) instead of direct impact. Adding more, various socio-economic characteristics of the customers have also been found to exhibit significant impact on technology adoption behaviour of the customers (Amin & Territory, 2010; Gan, Clemes, Limsombunchai, & Weng, 2006; Pikkarainen, Pikkarainen, Karjaluoto, & Pahnila, 2004) in different contexts.

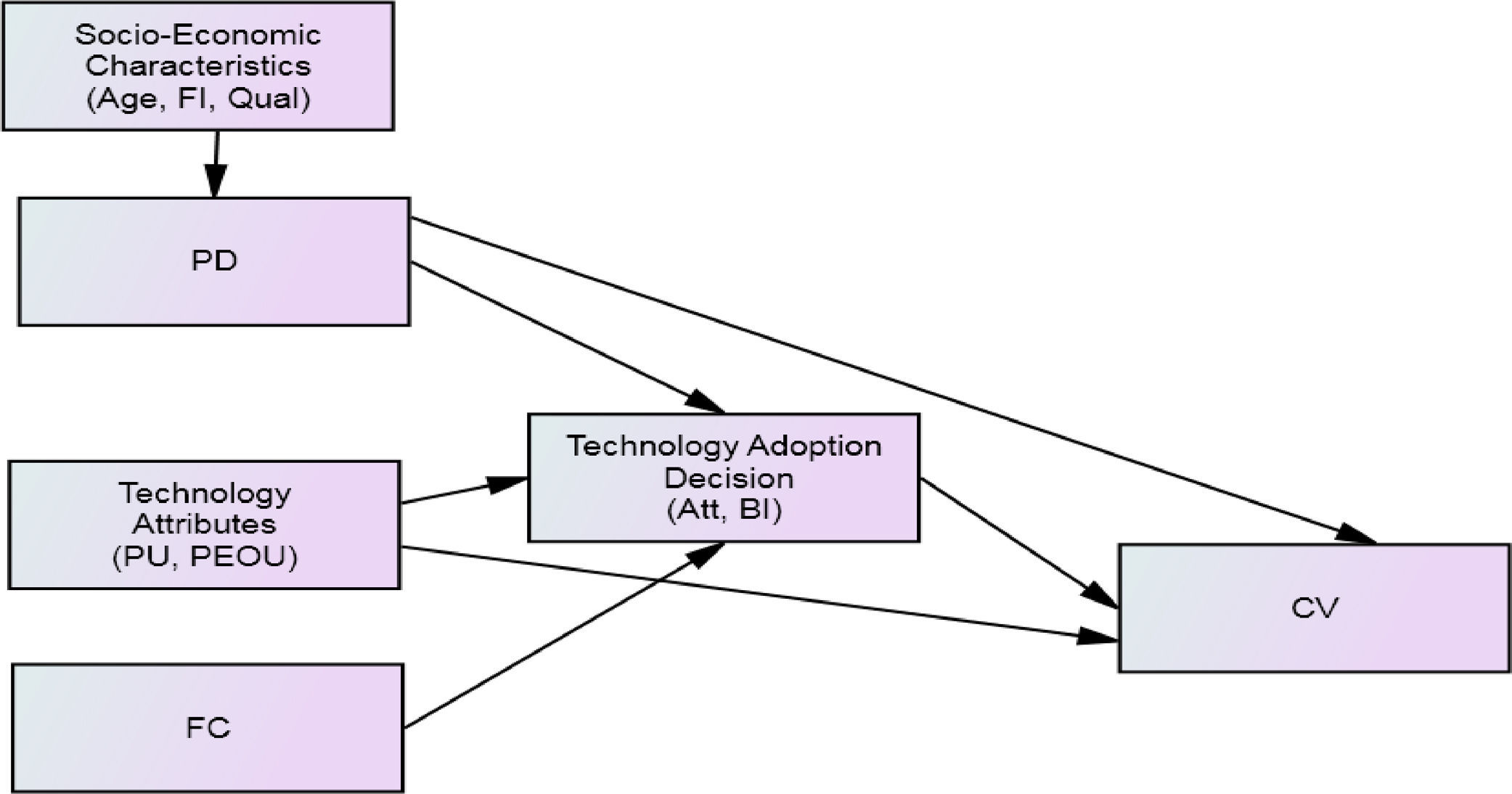

An in-depth analysis of the literature has made it evident that numerous studies have been carried out to explore and measure the dynamics of technology adoption among banking customers in different parts of the world and at different points of time. However, no substantial literature has been found with reference to countries like India (Chauhan, 2012; Gupta & Garg, 2015; Sharma & Govindaluri, 2014). Further, among the sparse existing relevant literature found with reference to the banking sector in India, studies are found to be either region specific or technology specific (e.g. Bhatt & Bhatt, 2016; Murali & Mallikarjuna, 2014; Paul, 2014, etc.). While, majority of the existing limited studies are also found to explore technology adoption phenomenon from single perspective, i.e., based on either technology attributes or personal traits of the customers, etc. (e.g., Kesharwani & Bisht, 2012; Tavishi & Kumar, 2013, etc.). Besides, researchers, such as Bhatt and Bhatt (2016), Hamprecht and Brunier (2011), etc. have recognized that one of the prime objectives of the banks for introducing new and improved technologies into the banking operations is to provide superior value to the customers. But, the literature has been found to fall short in providing substantial empirical evidence depicting relationship between technology adoption behaviour of the customers and their value perception regarding the technologies. Taking all the aforesaid issues into contemplation, the development of ITA model, in the present endeavour, aimed at analyzing the phenomenon of customer value perception and their technology adoption behaviour comprehensively from different angles with reference to the latest technological developments offered by the banking sector in India.

Accordingly, the hypothesis set for the present study is:H0.1 Customer value has no significant impact of technology adoption behaviour of the customers.

Since the focus of the present research was on the end users of the technology offered by banks, i.e., customers, a decision to consider representative sample of the banking customers in India had been taken. Accordingly, multistage stratified sampling approach has been applied, wherein, all the twenty-nine states of the Indian Union had been ranked based on per capita net state domestic product (PCNSDP) at factor cost (constant prices) for the year 2012–13 (published by Central Statistical Office, GOI). Thereafter, all the states had been categorized into four categories with seven states each in the first three categories and eight states in the fourth category. From each category, three states had been chosen randomly out of which the city with highest gross domestic product, from each of the selected state, was chosen. Accordingly, 110 responses from each of the twelve selected cities, namely, Mumbai, Hyderabad, Lucknow, Delhi, Gurgaon, Bhopal, Jammu, Shimla, Bhubaneswar, Agartala, Imphal and Itanagar had been collected. The selection of the customers and banks was based on convenience sampling approach and the collection of responses was self-administered and personal interviews were conducted by one of the authors (i.e. corresponding author). While collecting responses, due diligence has been made to the fact that the responses of the customers, having their own active bank accounts for a period not less than six months should only be taken. Therefore, the questionnaire designed to serve the purpose of the present study has explicitly asked whether the respondent himself or herself is holding bank account and if yes, since how long the bank account is being operated by the respondent.

Accordingly, a total of 1320 number of responses of the customers had been collected during the period November 2013 to May 2014. Primarily, the entire data of 1320 respondents had been scrutinized against outliers, missing responses and incomplete responses, thereby, reducing the size of the useable data to 1201 responses.

Further, an outlook to the socio-economic characteristics of the sampled respondents has indicated that majority of the respondents were males with an average age of 34 years and average family income (monthly) equals to ₹ 1,43,273 (Indian Currency). Further, maximum number of the respondents was found to be either graduates or under-graduates and was related to the employees class.

3.2MeasuresThe present primary data based study has been conducted through the development of a well-structured pretested questionnaire. The preliminary draft of questionnaire was pilot tested on 40 banking customers holding bank accounts in commercial banks (namely, State Bank of India, Axis Bank, HDFC Bank and Punjab National Bank) in Jammu and Delhi districts of India. On the basis of the responses, final draft of the questionnaire was prepared.

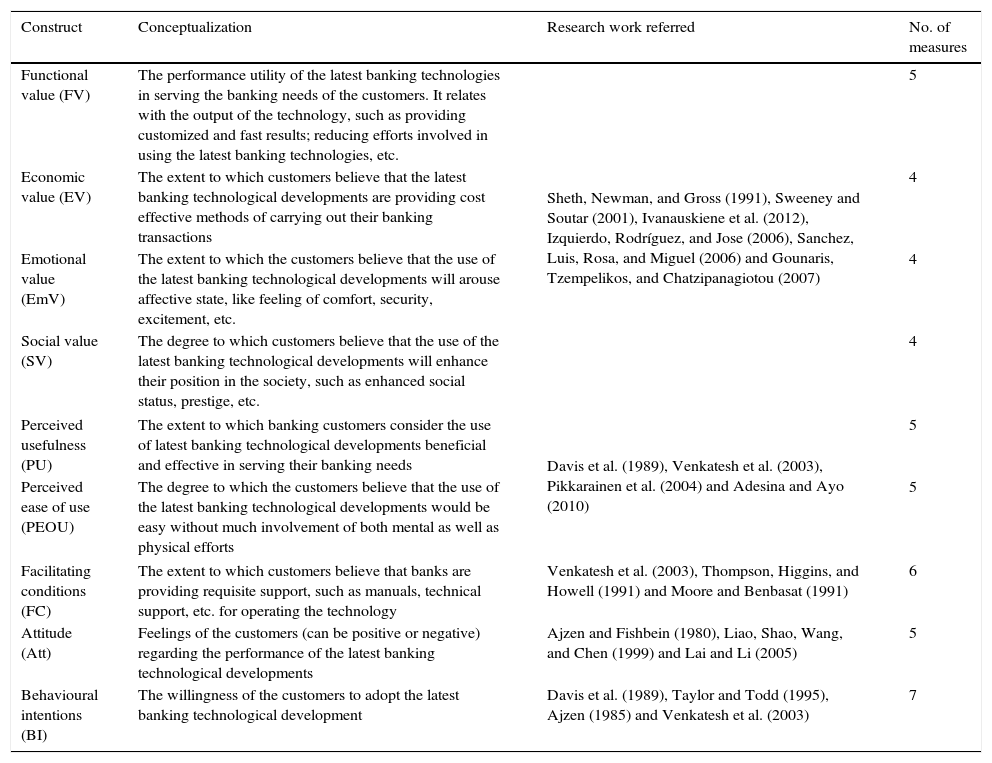

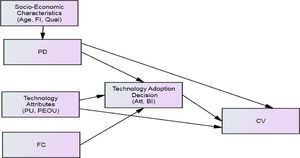

3.2.1Major theoretical paradigms of ITA modelThe focal point of the present composition is the value perception of customers towards the latest technological developments offered by banking sector. In the present study, customer value (CV) has been conceptualized as a measure of overall evaluation of the utility derived by the customers from using the latest banking technological developments. Further, CV is considered to be multi-dimensional in nature (Ho & Ko, 2008; Ivanauskiene, Auruskeviciene, Skudiene, & Nedzinskas, 2012; Roig, Garcia, & Tena, 2009). Thus, CV has been assessed through four sub-values, namely, functional value (FV), economic value (EV), emotional value (EmV) and social value (SV). In the present contribution these four values have been considered appropriate in context to the banking sector (Ivanauskiene et al., 2012). A detail description is given in Appendix I.

Further, the technology adoption decision of the customers has been assessed through two constructs, namely, attitude towards technology adoption (Att) and behavioural intentions towards technology adoption (BI). Studies, like Venkatesh et al. (2003, 2012) have stated that in cases, where the data pertaining to the actual usage of technology are not available, BI along with Att should be utilized to explore the technology adoption decision of the customers. In the present contribution also, the actual technology usage data were not accessible owing to which BI and Att have been considered.

Further, an insight into the phenomenon of technology adoption and customer value perception is considered to be deficient until and unless such analysis is accompanied by in-depth comprehension of the technology adoption behaviour of the customers. Accordingly, the three categories of technology adoption facets, namely, personal disposition towards technology adoption (PD); technology attributes and facilitating conditions (FC) have also been incorporated in the present study as these three categories are found to affect the technology adoption decision of the customers.

With reference to the present context, PD has been conceptualized as readiness of the customers towards technology adoption manifested through the personal traits of the customers. Thus, a forty seven-measure inventory (The use of the latest technologies gives me more control over my day to day personal and professional affairs; Other people come to me for advice on the usage and benefits of the latest technologies, etc.) has been developed after piercing the existing literature with respect to diverse personal traits which may have probable impact on the technology adoption decision of the customers. This inventory comprised of seven personal traits, namely, optimism, innovativeness, self-efficacy, risk taking propensity, habit, psychological resilience and social influence with 12, 5, 11, 5, 4, 4 and 6 measures of each trait, respectively. All these seven personal traits have been found to exhibit significant role in shaping the technology adoption behaviour of the customers in different contexts and settings. The research work referred to develop the said inventory includes research work by Ratchford and Barnhart (2011), Smith et al. (2008), Windle, Markland, and Woods (2008), Kim, Malhotra, and Narasimhan (2005), Venkatesh et al. (2003), Limayem and Hirt (2003), Parasuraman (2000), Venkatesh and Davis (2000), Agarwal and Prasad (1998), Compeau and Higgins (1995), Ajzen (1991), Davis et al. (1989), and Fishbein and Ajzen (1975). The responses of all the 47 measures have been taken on five-point scale ranging from 1 to 5, wherein, 1 indicates ‘Never’ and 5 indicates ‘Always’.

Furthermore, the review of relevant literature has highlighted both perceived usefulness (PU) and perceived ease of use (PEOU) as robust technology attributes, while analyzing technology adoption behaviour of the customers (Eriksson, Kerem, & Nilsson, 2005; Raza & Hanif, 2011). Thus, both PU and PEOU have been considered, in the present study, for the development of ITA model under the category of technology attributes. Besides, facilitating conditions (FC) have also been considered in the present composition as the relevant literature have highlighted that the environment within which the technology has to be operated also affects the technology adoption decision (Venkatesh et al., 2003). The conceptualization as well as development of PU, PEOU, FC, Att and BI have been summarized in Appendix I.

3.3Data adequacy tests of constructsAll the aforesaid constructs, namely, CV, PD, PU, PEOU, FC, Att and BI have been scrutinized against the normality assumptions. Accordingly, an outlook to the values of standard deviation, skewness and kurtosis have been found to establish data normality as all the values fall within the prescribed limit as suggested by Hair, Black, Babin, Anderson, and Tatham (2012), Curran, West, and Finch (1996) and West, Finch, and Curran (1995).

Further, internal consistency of all the aforementioned constructs has been assessed employing Cronbach's α statistics. Accordingly, the measured values of Cronbach's α are reported to fall in range between 0.860 to 0.972 for the constructs, namely, CV (i.e., FV, EV, EmV and SV), PD (optimism, innovativeness, risk taking propensity, habit, psychological resilience and social influence), PU, PEOU and BI which is above the prescribed limit of 0.70 as suggested by Hair et al. (2012), Tavakol and Dennick (2011) and Donio, Massari, and Passinate (2006). While, the constructs of self-efficacy, Att and FC have been purified on the basis of ‘if item deleted criterion’ and the resultant values are found to be above the prescribed norms. Also, the composite values for the construct, namely, PD and CV are found to be above 0.70, thereby, reinforcing internal consistency of these two constructs.

Further, the dimensionality of all the aforesaid constructs utilized in the development of ITA model has been examined employing Exploratory Factor Analysis (EFA) approach. Accordingly, the values of KMO statistics (ranging from 0.627 to 0.959) and Bartlett's test of sphericity (all values are statistically significant at 1 per cent level of significance) are found to meet the norms prescribed by Hair et al. (2012), Williams, Brown, and Onsman (2012) and Beaumont (2012), thereby, substantiating the statistical fitness of the data for employing EFA approach. Also, the values of communality statistics and factor loadings are found to meet the prescribed norms as suggested by Hair et al. (2012), i.e., value of each of the measures assessing the constructs, namely, PD, PU, PEOU, Att and BI are reported to be above 0.50. While in case of FC, value of communality statistics of a measure is found to be below the prescribed aforesaid limit, thereby, calling for refinement in FC inventory. Consequently, the said measure has been dropped from the inventory of FC. Thereafter again, EFA has been applied to the four-measure FC construct and all the four values of communality statistics are found to be above the prescribed norm of 0.50. Adding more, the application of EFA with principal component analysis and varimax rotation has yielded single factor solution in case of all the constructs, namely, PD, PU, PEOU, FC, Att and BI and the percentage of variance is found to fall in the range between 64.50 per cent to 86.84 per cent in case of all the aforesaid constructs.

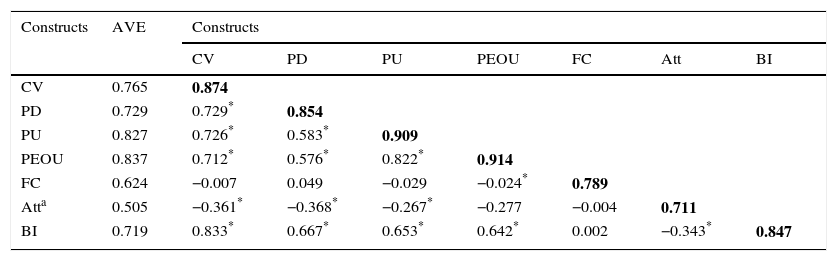

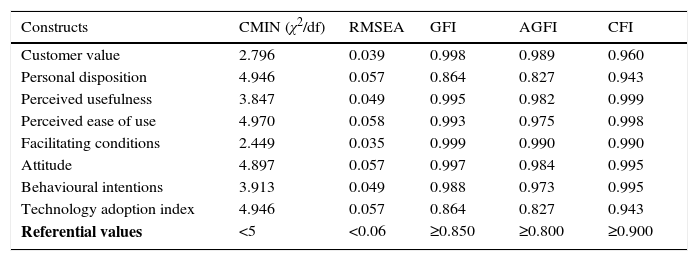

Besides, all the constructs used in the present composition have also been scrutinized for analyzing their structural validity by employing Confirmatory Factor Analysis (CFA) approach. Accordingly, the results of construct validity and reliability are found to be in compliance with the prescribed norms of 0.50 and 0.70, respectively as suggested by Hair et al. (2012), Hu and Bentler (1999), and Lei and Wu (2007). Also, the results of model fit indices have confirmed structural validity of the constructs (refer Appendix II). Further, the correlation statistics among all the aforesaid constructs have also been examined in order to detect the problem of multicollinearity. Accordingly, all the correlation coefficients (refer Table 1) are found (ranging from 0.002 to 0.833) below the threshold limit of 0.85 as suggested by Zainudin (2015) and Lei and Wu (2007). Thus, no problem of multicollinearity has been expected among the constructs. Adding to the point, discriminant validity of all aforesaid constructs has also been examined. The same can be done in two ways. In this regards, Hammer et al. (2011) and Saade and Bahli (2005) have suggested that the values of squared inter-construct correlation should be compared with the values of Average Variance Extracted (AVE) and the latter values should be greater than the former values for establishing Discriminant Validity (DV) of the constructs. Also, Fornell and Larcker (1981) have suggested that the square root of AVE should be higher than the values of correlation coefficient for establishing discriminant validity of the constructs and the same method has been used to analyze discriminant validity in the present study. As shown in Table 1, all the values of square root of AVE (diagonal elements) are found to be greater than that of correlation coefficients (off-diagonal elements), thereby, establishing discriminant validity of the constructs.

Inter-construct correlation matrix.

| Constructs | AVE | Constructs | ||||||

|---|---|---|---|---|---|---|---|---|

| CV | PD | PU | PEOU | FC | Att | BI | ||

| CV | 0.765 | 0.874 | ||||||

| PD | 0.729 | 0.729* | 0.854 | |||||

| PU | 0.827 | 0.726* | 0.583* | 0.909 | ||||

| PEOU | 0.837 | 0.712* | 0.576* | 0.822* | 0.914 | |||

| FC | 0.624 | −0.007 | 0.049 | −0.029 | −0.024* | 0.789 | ||

| Atta | 0.505 | −0.361* | −0.368* | −0.267* | −0.277 | −0.004 | 0.711 | |

| BI | 0.719 | 0.833* | 0.667* | 0.653* | 0.642* | 0.002 | −0.343* | 0.847 |

Note: Diagonal elements (bold figures) represent square root of AVE. Off diagonal elements are the values of correlation among the constructs.

The review of literature has depicted that the value perception of the customers depends on their technology adoption decision (reflected through BI and Att) which, in turn, depends on three categories of facets, namely, PD, technology attributes and FC. Based on the existing review of literature, ITA model has been theoretically framed and the same has been depicted in Fig. 1. Further, the theoretical ITA model has been empirically analyzed by employing structural equation modelling (SEM) approach, since this technique has been considered as one of the effective techniques for analyzing web of relationships between different variables simultaneously by drawing casual inferences (Hair et al., 2012; Lei & Wu, 2007). For same, $Z$-scores (where mean=1 and SD=1) of the aggregate of each of the constructs, namely, CV, PD, PU, PEOU, FC, Att and BI have been taken. Further, the socio-economic characteristics, namely, family income (FI) (monthly) and age have been assessed through $Z$-scores of the absolute values. While, educational qualification (Qual) of the customers has been assessed through dummy variable approach, wherein, 1 has been assigned to the category of the customer possessing qualification above graduation and 0 otherwise (i.e., qualification≤graduation).

Initially, the results of SEM have indicated statistically insignificant critical ratios in three cases, i.e., impact of PU on Att; impact of FC on Att and impact of FC on BI. This depicts that there exists no statistically significant path in these cases, thereby, indicating the need to modify the model. Further, model fit indices have also been examined in order to confirm the need for modifications in the model as recommended by Hair et al. (2012), Lei and Wu (2007), Hu and Bentler (1999) and Anderson and Gerbing (1984). The values of model fit indices, namely, GFI (0.963), AGFI (0.918) and CFI (0.962) are found to comply with the referential values. Whereas, the values of CMIN (χ2/df=10.377) and RMSEA (0.088) are reported to be above the minimum referential criterion values (Hair et al., 2012; Lei & Wu, 2007), thereby, substantiating the need for modifications in the model. Thus, the aforesaid three relationships have been dropped from the model. Thereafter again, results for the improved model have been estimated through SEM approach and critical ratios, parameter estimates & model fit indices have been examined. For the improved model, the values of critical ratios as well as parameter estimates are found to be statistically significant. But the values of model fit indices, i.e., CMIN and RMSEA are not registered to be in compliance with the referential criterion values. This signifies that the model still requires modifications for a good fit.

For the purpose of further modifications in the model, the criteria recommended by Hair et al. (2012), Lei and Wu (2007), Hu and Bentler (1999), and Anderson and Gerbing (1984) has been followed. The said criteria states that the theoretical background of the measures should be examined in order to explore the measures which may infer same meaning to the respondents and error terms of such measures should be co-varied if the same is supported by values of modification indices (in cases where the results of parameter estimates and CR are statistically significant). Accordingly, the error terms of age and FI have been found co-varied and again, SEM technique has been employed to analyze improvements in the model. After the said co-variation, the values of parameter estimates and critical ratios remain unaltered and unaffected. While the results of model fit indices indicate model fitness as all the values are found to meet referential criterion values, i.e., CMIN (χ2/df=4.54)<5; RMSEA (0.054)<0.06; GFI (0.979)≥0.85; AGFI (0.959)≥0.80 and CFI (0.984)≥0.90. Since all the above said values reflecting model fitness are found to meet the recommended criterion values, this further improved model has been considered as the statistically appropriate model and for this reason, it has been denoted as final ITA model in the present composition.

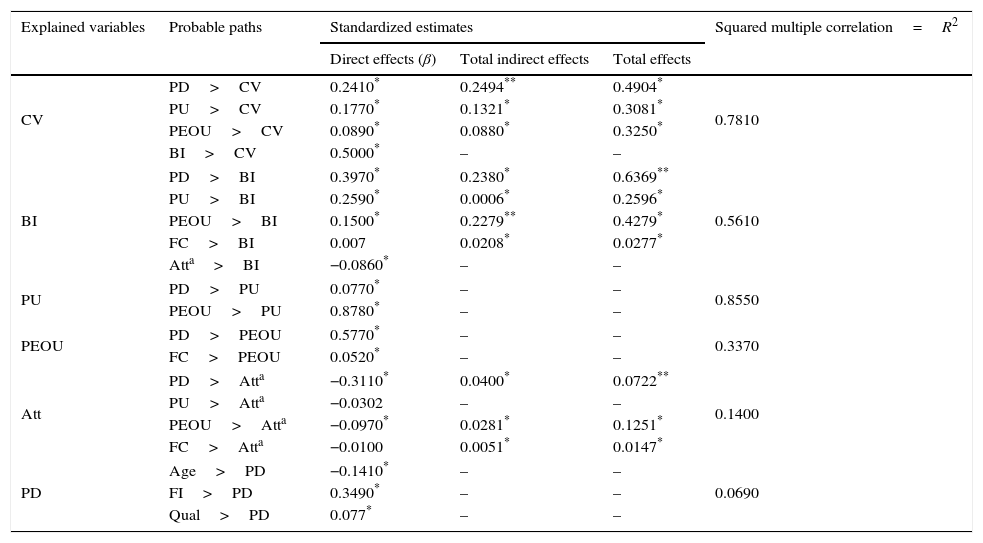

4.2Structural results of ITA modelThe results (refer Table 2) have depicted that value perception of the customers depends on PD, PU, PEOU and BI. Since all the probable facets (PD, PU, PEOU and BI) found to have significant impact on CV, H0.1 has been rejected and it has been inferred that CV has significant impact of the technology adoption behaviour of the customers. The significant positive coefficient values depict that increase in PD, PU, PEOU and BI would lead towards enhancing CV. Further, the value of squared multiple correlation, which explains total variation in the explained variable due to the explanatory variables, indicates that jointly, PD, PU, PEOU and BI accounts for 78 per cent variation in CV (refer Table 2). Indeed, the magnitude of relationships (values of direct estimates) has uncovered BI (β=0.5000; p<0.01) as the strongest predictor of CV followed by PD (β=0.2410; p<0.01), PU (β=0.1770; p<0.01) and PEOU (β=0.0890; p<0.01). These results implicate that the value perception of the customers, regarding the latest banking technologies, depends primarily on their behavioural intentions towards technology adoption followed by their personal disposition towards technology adoption. Further, belief of the customers regarding the usefulness of the latest banking technological developments in serving their banking needs and the effortlessness involved in operating the latest banking technologies are also found to affect value perception of the customers regarding the use of latest banking technological developments.

Structural results of ITA model.

| Explained variables | Probable paths | Standardized estimates | Squared multiple correlation=R2 | ||

|---|---|---|---|---|---|

| Direct effects (β) | Total indirect effects | Total effects | |||

| CV | PD>CV | 0.2410* | 0.2494** | 0.4904* | 0.7810 |

| PU>CV | 0.1770* | 0.1321* | 0.3081* | ||

| PEOU>CV | 0.0890* | 0.0880* | 0.3250* | ||

| BI>CV | 0.5000* | – | – | ||

| BI | PD>BI | 0.3970* | 0.2380* | 0.6369** | 0.5610 |

| PU>BI | 0.2590* | 0.0006* | 0.2596* | ||

| PEOU>BI | 0.1500* | 0.2279** | 0.4279* | ||

| FC>BI | 0.007 | 0.0208* | 0.0277* | ||

| Atta>BI | −0.0860* | – | – | ||

| PU | PD>PU | 0.0770* | – | – | 0.8550 |

| PEOU>PU | 0.8780* | – | – | ||

| PEOU | PD>PEOU | 0.5770* | – | – | 0.3370 |

| FC>PEOU | 0.0520* | – | – | ||

| Att | PD>Atta | −0.3110* | 0.0400* | 0.0722** | 0.1400 |

| PU>Atta | −0.0302 | – | – | ||

| PEOU>Atta | −0.0970* | 0.0281* | 0.1251* | ||

| FC>Atta | −0.0100 | 0.0051* | 0.0147* | ||

| PD | Age>PD | −0.1410* | – | – | 0.0690 |

| FI>PD | 0.3490* | – | – | ||

| Qual>PD | 0.077* | – | – | ||

Not only direct, PD, PU and PEOU also exhibit statistically significant indirect and total effect on CV. The statistically significant values of the indirect path from PEOU to CV, i.e., PEOU>BI>CV (0.076); PEOU>PU>Att>BI>CV (0.00030); PEOU>PU>Att>CV (0.00022); PEOU>PU>BI>CV (0.01150) uncover PU, BI and Att as significant mediating factors affecting the said relationship. But the examination of the four indirect paths depicts the path, i.e., PEOU>BI>CV as the most effective path (as indicated by relatively higher value of indirect estimate=0.0760). Likewise, the relationship between PU and CV is found to be significantly mediated by Att and BI. Two indirect paths from PU to CV, i.e., PU>Att>BI>CV (0.00034); PU>BI>CV (0.13183) have been identified, wherein, the latter path divulges as more effective path (reflected from relatively higher value of indirect effect in the case of latter path=0.1318). This describes BI not only as significant direct determinant of CV but also a significant mediator that affects the relationship of CV with PU and PEOU. From these results, it can be inferred that the customers, perceiving the use of the technology beneficial and hassle free, develop favourable intentions towards technology adoption which ultimately shape their value perceptions regarding the latest banking technological developments.

Further, PD has also been estimated to demonstrate statistically significant indirect and total effect on the assessment of the customers regarding the utility obtained from using the latest banking technological developments. At disaggregate level, the results have highlighted seven indirect paths from PD to CV, i.e., PD>PU>Attitude>BI>CV (0.00002); PD>PU>Attitude>CV (0.00017); PD>PU>BI>CV (0.00092); PD>PEOU>PU>Att>BI>CV (0.00017); PD>PEOU>PU>BI>CV (0.06690); PD>PEOU>CV (0.13690); PD>PEOU>BI>CV (0.04413). Among these seven paths, the most effective path identified is PD>PEOU>CV (based on the relatively higher value of indirect effect in this case. i.e., 0.1369). It indicates that as PD enhances, customers start perceiving technology easy to use, which in turn, enhances their value perception regarding the latest banking technological developments. Besides, at aggregate level, i.e., considering total indirect effects (refer Table 2), the statistically significant results unveil PU, PEOU, Att and BI as significant mediators in the relationship between PD and CV.

Alongwith exploring value perception of the customers towards technology, the phenomenon of technology adoption decision of the customers has also been examined in the present study. While analyzing antecedents of BI, PD (0.397; p>0.05) has been highlighted as the strongest predictor of BI followed by PU, PEOU and Att. These results indicate that the customers with favourable personal disposition towards technology adoption and having belief that the technology is useful and easy to use, develop willingness towards technology adoption. Further, FC has been found to exhibit statistically significant indirect impact on BI enrouted through PU, PEOU and Att. Adding more, it has also been found that PD, PU, PEOU and Att accounts for 56 per cent variation in BI. Further, a glance at the model reflects PEOU (0.878; p>0.01) as stronger antecedent of PU followed by PD. The positive correlation coefficient values indicate that when customers perceive the technology is easy to use and develop personal disposition towards technology adoption, they tend to believe that the technology is useful in serving their banking needs. While analyzing antecedents of PEOU, both PD and FC are found to account for 33 per cent variation in PEOU with PD (β=0.5770) being unveiled as stronger predictor than FC (β=0.0520) and both the aforesaid antecedents exhibit statistically significant direct impacts on PEOU. The results depicted that the presence of FC, such as technical support, manual support, etc. facilitate customers in operating the technology owing to which the use of the technology will no longer remains difficult for the customers. Further, it has also been found that the customers with favourable PD tend to learn hard regarding the new and improved technologies which, in turn, make the use of the technology hassle free for them, thereby, explaining the rationale for the significant relationship between PEOU and PD.

Further, the ITA model has also highlighted statistically significant direct as well as indirect impact of PD and PEOU on Att. Indeed, PD (β=0.3110; p<0.01) has been divulged as stronger antecedent of Att in comparison with PD. It seems that the personal disposition of the customers towards technology adoption and the ease with which technology can be operated affect the belief of the customers regarding the technology. Moreover, PU and FC have shown statistically insignificant direct but statistically significant indirect and total effect on the attitude of the customers regarding technology and its outcome. Also, it has been found that PD and PEOU accounts for 14 per cent variation in Att. Furthermore, Age, FI and Qual have been found to exhibit statistically significant impact on PD. The negative coefficient value depicting relationship between PD and Age concludes that as the age of the customers increases their disposition towards technology adoption tends to decrease. Further, positive coefficient values depicting relationship of PD with FI and Qual confirm that PD enhances with advancement in the family income and qualification of the customers. Indeed, FI has been highlighted as the stronger predictor of PD (0.349; p>0.01) than Qual (0.077; p>0.01). Besides, it has been found that as the qualification of the customers enhance, their PD also upgrade. Further, age, FI and Qual have been found to account for 6 per cent variation in PD.

5DiscussionThe dimensions of customer value perception with reference to technology adoption behaviour of the customers have put forth the efforts to integrate different taxonomies of customer value as well as technology adoption phenomenon among the customers. This integration will be helpful in understanding different aspects of value perception of the banking customers in a more parsimonious way. Indeed, the analysis of such kind constitutes keystone to continue with the study focusing on the relationship between customer value and technology adoption dynamics from applied perspective. The results of the study are found to be aligned with the studies conducted in past in different contexts (Chen, 2013; Ho & Ko, 2008; Laukkanen, 2007; Peppers & Rogers, 2004; Yieh et al., 2012), wherein, it has been highlighted that value perception of the customers turn out to be favourable when customers develop favourable behavioural intentions towards technology adoption; favourable personal disposition towards technology adoption, they believe that the technology is useful in serving their banking needs and is easy to use.

Besides, the present ITA model has also highlighted various other relationships, such as impact of socio-economic characteristics (age, family income and qualification) on personal disposition towards technology adoption; impact of perceived ease of use on perceived usefulness, impact of facilitating conditions on perceived ease of use, etc. In this context, personal disposition towards technology adoption, perceived usefulness, perceived ease of use and attitude towards technology adoption found to have statistically significant impact on behavioural intentions, thereby, converging with the earlier research works carried out by Al-Ajam and Nor (2013), Kaur and Gupta (2012), Kesharwani and Bisht (2012), etc. Further, facilitating conditions have been found to exhibit statistically significant indirect impact on behavioural intentions routed through perceived usefulness, perceived ease of use and attitude towards technology adoption. The presence of facilitating conditions make use of technology easier for the customers owing to which customers perceive the technology useful; easy to use and develop positive feeling towards performance of the technology and this, in turns, shape their intentions towards the adoption of the technology (Micheni, Kanampiu, Njue, & Mburu, 2013; Yu, 2012). The present composition also highlights significant impact of perceived usefulness and perceived ease of use on personal disposition towards technology adoption, thereby, supporting the earlier research work such as Maditinos et al. (2013), Walczuch et al. (2007), etc.

Likewise, the present composition has also unveiled significant impact of personal disposition towards technology adoption and facilitating conditions on perceived usefulness. The rationale can be the same as stated by Nath, Bhal, and Kapoor (2013), Zare and Yazdanparast (2013), Walczuch et al. (2007), i.e., when the customers perceive the technology easy to use and have favourable personal disposition towards technology adoption, they tend to perceive the technology useful in serving their intended needs. Further, the present composition also highlighted significant impact of personal disposition and perceived ease of use on attitude, thereby, supporting Khurshid, Rizwan, and Tasneem (2014), Saibaba and Murthy (2013), Aboelmaged and Gebba (2013) and Chen et al. (2009). These results infer that the customers with favourable personal disposition towards technology adoption and with the belief that the technology is easy to use have positive attitude towards technology adoption. Furthermore, age has been found to exhibit negative impact on personal disposition of customers towards technology adoption. This can be due to the fact that with the enhancement of age, customers are less favourable towards adopting new and improved technologies due to their strong belief system and reluctance to change their routines (Lau & Yuen, 2013; Yu, 2012). Further, the results of the study also corroborate with the conclusions of Xue, Hitt, and Chen (2011), Kim et al. (2005), wherein, it has been highlighted that individuals with high-income group always attempt to find new and improved technologies which facilitate them in carrying out their activities with more ease and comfort, thereby, enhancing, their tendency towards technology adoption. These could be the plausible reasons for significant impact of family income on personal disposition of the customers towards technology adoption in the present composition also. Adding more to the point, the significant positive impact of qualification on personal disposition towards technology adoption also support the literature (Karjaluoto, Mattila, & Pento, 2002; Nayak, Priest, & White, 2010; Tater, Tanwar, & Murari, 2011; Tommi & Mika, 2008) with one of the plausible reasons that qualification of the customers keep the customers aware regarding recent developments in the field of technology owing to which they might show more favourable personal deposition towards technology adoption. Moreover, qualification also enhances self-confidence of the customers in operating the technology on their own due to which customers develop favourable personal disposition towards technology adoption.

6ImplicationsBased on the aforesaid findings, banks are suggested with various ways for enhancing the value perception of the customers regarding the banking technologies. Accordingly, one of the implications can be that banks should focus on explaining the benefits of the latest banking technologies to the customers on regular basis. This can be done through various methods, such as organizing camps, etc. at various local places, playing short films, road shows, etc. Indeed in order to make the benefits of the latest technologies more apparent, the focal point of the banks should be on explaining the benefits of the latest banking technological developments over and above the traditional technologies. Doing so will increase the perceived usefulness of the latest banking technologies, thereby, adding to the overall utility of the latest banking technologies among the customers.

While focusing on perceived ease of use, banks are advised to provide hands-on-training to customers regarding the usage of latest banking technologies. Banks should also focus on providing requisite facilitating conditions to the customers for operating the latest banking technologies in order to enhance their behavioural intentions towards technology adoption, thereby, targeting value perception of the customers indirectly. Accordingly, banks should adopt measures, such as providing manuals written in regional languages with list of some common mistakes and their remedies; audio-visual demonstrations regarding the usage procedure of technology, etc. Moreover, banks may also appoint on-field complaint officer(s) whose task involves addressing the issues of customers pertaining to usage of latest banking technological developments at their respective places. Doing so will ease the operation of the technology, thereby, eventually leading towards enhancing value perception of customers towards the adoption of latest banking technologies.

Also, the relationship between personal disposition of the customers towards technology adoption and customer value has depicted significant role of seven personal traits in shaping customer value perception. The identification of seven personal traits, namely, optimism, innovativeness, self-efficacy, risk taking, habit, psychological resilience and social influence would enable the banks in framing strategies to enhance personal disposition of the customers towards technology adoption. For instance, banks are suggested to shape the belief of the customers that the technology gives them more control over their banking activities (i.e., banks need to enhance optimism level of the customers towards technology adoption). In this regards, one of the practices can be that the banks should provide more customized solutions to the customers, like, changing passwords, adding third party for banking transactions, getting transaction rights, etc. instantly without visiting banks or waiting for hours. Doing so will frame positive belief regarding the technology, thereby, enhancing their personal disposition towards technology adoption. Similarly, personal disposition has also been found to be manifested by risk taking propensity, thereby, indicating the need to focus on it. The same can be done through measures like providing risk insurance to the customers for the losses which are beyond the control of the customers. Further, banks should increasingly adopt measures that make the use of the latest banking technological developments more habitual for the customers, like, allowing customers to apply for loan through internet banking mode only, etc. Although some of the aforesaid practices have been initiated by many banks presently, yet these practices should be rigorously used by the banks in order to enhance the personal disposition of the customers towards technology adoption with underlying focus on enhancing their value perception.

7Future direction of researchThe present research work has attempted to analyze associated aspects of technology adoption and its association with value perception of the customers regarding the latest banking technological developments. However, while interpreting results of the present study, challenges as well as limitations of the study must be taken into account. The responses in the present study are taken on self-reported questionnaires, thereby, increasing the chances of common method variance (Fairbrother & Warn, 2003) though all precautions and checks for the same were made. Additionally, the present study has measured subjective perception of the customers regarding different facets of technology adoption, such as perceived usefulness, behavioural intentions, attitude, etc. which may be influenced by psychosomatic state of mind of the customers at the time of providing responses. Further in future, use of the Integrated Technology Adoption Model can be extended in assessing the technology adoption behaviour of the users in mandatory settings also. The study can also be planned to extend the Integrated Technology Adoption model with reference to specific banking technologies or with reference to other technologies, such as e-learning, e-commerce, etc. for analyzing the adoption phenomenon of such technologies among the customers. Furthermore, the Integrated Technology Adoption model can also be extended to diagnose dissimilarities in the technology adoption behaviour of the customers belonging to distinct regions/areas, etc. Also, the impact of time on the dynamism of technology adoption and customer value perception may add more useful insight into the phenomenon of technology adoption behaviour of the banking customers with the help of pooled or panel data using cross-section data for different period of time.

| Construct | Conceptualization | Research work referred | No. of measures |

|---|---|---|---|

| Functional value (FV) | The performance utility of the latest banking technologies in serving the banking needs of the customers. It relates with the output of the technology, such as providing customized and fast results; reducing efforts involved in using the latest banking technologies, etc. | Sheth, Newman, and Gross (1991), Sweeney and Soutar (2001), Ivanauskiene et al. (2012), Izquierdo, Rodríguez, and Jose (2006), Sanchez, Luis, Rosa, and Miguel (2006) and Gounaris, Tzempelikos, and Chatzipanagiotou (2007) | 5 |

| Economic value (EV) | The extent to which customers believe that the latest banking technological developments are providing cost effective methods of carrying out their banking transactions | 4 | |

| Emotional value (EmV) | The extent to which the customers believe that the use of the latest banking technological developments will arouse affective state, like feeling of comfort, security, excitement, etc. | 4 | |

| Social value (SV) | The degree to which customers believe that the use of the latest banking technological developments will enhance their position in the society, such as enhanced social status, prestige, etc. | 4 | |

| Perceived usefulness (PU) | The extent to which banking customers consider the use of latest banking technological developments beneficial and effective in serving their banking needs | Davis et al. (1989), Venkatesh et al. (2003), Pikkarainen et al. (2004) and Adesina and Ayo (2010) | 5 |

| Perceived ease of use (PEOU) | The degree to which the customers believe that the use of the latest banking technological developments would be easy without much involvement of both mental as well as physical efforts | 5 | |

| Facilitating conditions (FC) | The extent to which customers believe that banks are providing requisite support, such as manuals, technical support, etc. for operating the technology | Venkatesh et al. (2003), Thompson, Higgins, and Howell (1991) and Moore and Benbasat (1991) | 6 |

| Attitude (Att) | Feelings of the customers (can be positive or negative) regarding the performance of the latest banking technological developments | Ajzen and Fishbein (1980), Liao, Shao, Wang, and Chen (1999) and Lai and Li (2005) | 5 |

| Behavioural intentions (BI) | The willingness of the customers to adopt the latest banking technological development | Davis et al. (1989), Taylor and Todd (1995), Ajzen (1985) and Venkatesh et al. (2003) | 7 |

| Constructs | CMIN (χ2/df) | RMSEA | GFI | AGFI | CFI |

|---|---|---|---|---|---|

| Customer value | 2.796 | 0.039 | 0.998 | 0.989 | 0.960 |

| Personal disposition | 4.946 | 0.057 | 0.864 | 0.827 | 0.943 |

| Perceived usefulness | 3.847 | 0.049 | 0.995 | 0.982 | 0.999 |

| Perceived ease of use | 4.970 | 0.058 | 0.993 | 0.975 | 0.998 |

| Facilitating conditions | 2.449 | 0.035 | 0.999 | 0.990 | 0.990 |

| Attitude | 4.897 | 0.057 | 0.997 | 0.984 | 0.995 |

| Behavioural intentions | 3.913 | 0.049 | 0.988 | 0.973 | 0.995 |

| Technology adoption index | 4.946 | 0.057 | 0.864 | 0.827 | 0.943 |

| Referential values | <5 | <0.06 | ≥0.850 | ≥0.800 | ≥0.900 |

Note: df=Degrees of Freedom; CMIN=chi-square; RMSEA=Root Mean Square Residual; GFI=Goodness of Fit Index; AGFI=Adjusted Goodness of Fit Index; CFI=Comparative Fit Index.