Crowdfunding represents an alternative way of funding entrepreneurial ventures – and is attracting a high amount of interest in research as well as practice. Against this background, this paper analyzes reward-based crowdfunding campaign strategies and their communication tools. To do this, 446 crowdfunding projects were gathered and empirically analyzed. Three different paths of successful crowdfunding projects could be identified and are described in detail. Practical implications of crowdfunding strategies are derived, and are dependent on the required sales effort and the project added value. The terms communicator, networker and self-runner are created for this crowdfunding strategy and filled with practical examples. This paper contributes to the literature in different ways: first, it sheds more light on the developing concept of crowdfunding, with an overview of current academic discussions on crowdfunding. Furthermore, the analysis of success factors for crowdfunding initiatives adds to an emerging area of research and allows entrepreneurs to extract best practice examples for increasing the probability of successful crowdfunding projects under consideration of the key influencing factors of communication.

El crowdfunding representa un modo alternativo de financiar proyectos empresariales – y está atrayendo un gran interés tanto en el ámbito de la investigación como en la práctica. En este contexto, este artículo analiza las estrategias de campañas de crowdfunding de recompensa y sus herramientas de comunicación. Con este fin, se han reunido y analizado empíricamente 446 proyectos de crowdfunding. Se han podido identificar tres formas diferentes de proyectos con éxito de crowdfunding, que son descritos en detalle. Las implicaciones prácticas de las estrategias de crowdfunding son obtenidas y dependen del sales effort requerido y del valor añadido del proyecto. Los términos comunicador, networker y self-runner son creados para esta estrategia de crowdfunding y explicados con ejemplos prácticos. Este artículo contribuye a la literatura en diferentes formas. En primer lugar, aclara el concepto en desarrollo de crowdfunding al proporcionar una visión general de las discusiones académicas actuales de en esta materia. Además, el análisis de los factores de éxito para las iniciativas de crowdfunding es valioso para esta área emergente de investigación y permite a los emprendedores extraer ejemplos de las mejores prácticas para así aumentar la probabilidad de éxito en proyectos de crowdfunding bajo la consideración de factores influyentes de comunicación clave.

Facing the problems of insufficient cash flows and an information asymmetry with investors about the venture's quality, the greatest challenge for entrepreneurs is to attract outside funding for their venture, especially in the beginning of their entrepreneurial activity (Cosh, Cumming, & Hughes, 2009). A lack of operating history and/or proven track record contributes to the challenges of obtaining credit (Stemler, 2013). Entrepreneurs therefore often turn to a variety of external capital sources, including venture capitalist funds, banks, leasing firms, as well as private individuals (Cosh et al., 2009) such as the entrepreneur's friends and family (Agrawal, Catalini, & Goldfarb, 2014). The use of internal financing through personal funds, family and friends, also called bootstrapping (Belleflamme, Lambert, & Schwienbacher, 2014; Brush, Carter, Gatewood, Greene, & Hart, 2006; Ebben & Johnson, 2006; Sannajust, Roux, & Chaibi, 2014; Winborg & Landström, 2001), remains one of the most used options. However, many ventures are not successful in attracting sufficient capital due to failed attempts to convince investors, a lack of sufficiently large sums from investors in general, and a lack of concrete specification of industries or what capital is needed for (Lambert & Schwienbacher, 2010). A new form of funding for small entrepreneurs has however recently emerged: entrepreneurs turn to a large number of individuals, the crowd, to raise funds (Agrawal, Catalini, & Goldfarb, 2013; Kleeman, Voß, & Rieder, 2008; Unterberg, 2010). So-called crowdfunding, which describes a large number of investors’ contributions of finances to projects, products, or business ideas (Wenzlaff, Gumpelmaier, & Eisfeld-Reschke, 2012), has emerged as an alternative possibility for individuals to receive funding in different ways (Tomczak and Brem, 2013).

The concept of mobilizing funding in small pieces is not new, and traditionally occurs in almost every corporation (Fiedler & Horsch, 2014; Harrisson, 2013; Zademach & Baumeister, 2013). Contrary to typical financial investments, crowdfunding is fundamentally open to everyone (Blohm, Leimeister, Wenzlaff, & Gebert, 2013; Wenzlaff et al., 2012). The concept originally gained prominence with the financing of artists or creative projects and then spread across further sectors (Bradford, 2012; Meinshausen, Schiereck, & Stimeier, 2012). Initiatives in journalism, software, and fashion constitute examples of the ongoing spread of this funding concept (Schwienbacher & Larralde, 2010).

The remainder of this paper will first see a literature review discussing several alternative definitions of crowdfunding, clarifying the main concepts of this type of funding, including different models and actors. This part sets a common understanding of crowdfunding. The methodology section then defines key variables, analyzes the prior-defined dataset, and describes the approach taken to answer the research question “What factors are responsible for a successful crowdfunding campaign?”. Third, a discussion of findings provides the reader with greater insights into relevant factors that determine the success of crowdfunding initiatives. The conclusion summarizes key thoughts and theories, discusses limitations of this study, and points to future research directions.

BackgroundDefinitionsCrowdfunding has evolved from the concept of crowdsourcing and represents one dimension of this phenomenon that includes crowdvoting and crowdcreation (e.g. Leimeister & Zogaj, 2013; Leimeister, 2012; Richter, Seidler-de Alwis, & Jötten, 2014). The term originally comes from Howe (2006a, 2006b, 2008), who defined crowdsourcing in an online article in 2006: “The act of taking a job traditionally performed by a designated agent (usually an employee) and outsourcing it to an undefined, generally large group of people in the form of an open call.” – (2006a, p.1; 2006b, p.1)

This definition to date remains the most prominent scientific one, which we will therefore follow (Brabham, 2009; Starbird, 2012). The term crowdsourcing stems from “crowd” and “outsourcing,” pointing to the meaning to outsource specific functions to a group of external persons (Kleeman et al., 2008). Entrepreneurs and companies not only can obtain feedback and creative solution to business problems, but can also tap into individuals’ excess capacities, such as their financial resources (Zheng, Li, Wu, & Xu, 2014).

In addition to crowdfunding's embeddedness in crowdsourcing (Lehner, 2013; Zheng et al., 2014), it also borrows concepts from micro finance (Mollick, 2014); crowdfunding is in fact closely connected to micro lending (Vitale, 2013), a concept that refers to the idea of funding individuals who do not have access to conventional financing from credit institutions (Armendariz & Morduch, 2010).

Similar to crowdsourcing, crowdfunding finds itself in a juvenile state of scientific research (Howe, 2008; Mollick, 2014). This is why various definitions of crowdfunding exist, none of which have received overall scientific acceptance (e.g. Belleflamme et al., 2014; Tomczak & Brem, 2013; Bouncken, Komorek, & Kraus, 2015). Upon close examination of the various definitions, some reoccurring patterns include: crowdfunding focuses on raising financial funding from the public, represented by a group of people, using specific internet-based platforms (e.g. Mazzola & Distefano, 2010; Ribiere & Tuggle, 2010; Yang, Adamic, & Ackerman, 2008).

Crowdfunding as a two-sided marketCrowdfunding is typically a two-sided market, tying “together two distinct groups of users in a network” (Eisenmann, Parker, & Van Alstyne, 2006, p. 2). Two-sided networks have a subsidy-side and a money-side. The subsidy-side consists of a group of investors, the funders or “backers” that contribute to the money-side, that is, the founder. Intermediaries, usually online platforms such as Kickstarter, charge fees to fundraisers while funders are not required to pay fees to the platform (e.g. Indiegogo, 2014; Kickstarter, 2014; Osterwalder & Pigneur, 2010).

Crowdfunding modelsThe dimensions of crowdfunding differ in terms of the allocation of resources and the return to investors (e.g. Moritz & Block, 2014; Tomczak & Brem, 2013; Zhang, 2013). Individuals composing the crowd generally receive rewards in different ways: material compensation, often in the form of monetary rewards (Vukovic, Mariana, & Laredo, 2009), or immaterial compensation in the form of social acknowledgment (Kazai, 2011) are the most prominent. In the case of material compensation, the reward can consist of monetary payments when the project initiators agree to refund the paid amount directly. This can also occur indirectly with rewards composed of products or services (Pelzer, Wenzlaff, & Eisfeld-Reschke, 2012). Overall, scholars divide crowdfunding into four models, as displayed in Fig. 1: donation-based crowdfunding, reward-based crowdfunding, crowdlending, and equity-based crowdfunding (e.g. Beck, 2012; Giudici, Nava, Rossi Lamastra, & Verecondo, 2012; Leimeister, 2012).

The following briefly outlines the four options for the sake of completeness:

The donation-based crowdfunding model refers to a classic fundraising objective, with the difference that the donations arrive via Web 2.0 and in most cases through a specific intermediary. Investors do not expect material rewards in exchange for their contribution (Giudici et al., 2012), but a social reward instead (e.g. acknowledgements) (Leimeister & Zogaj, 2013). The reward model offers both material as well as immaterial compensation and is currently the most prevalent crowdfunding model (Mollick, 2014). On the one hand, funders can benefit from pre-selling or pre-ordering, thereby receiving the financed project or product before publication or market entrance, often at a better price (Hemer, Schneider, Dornbusch, & Frey, 2011; Röthler & Wenzlaff, 2011) or even only at the price of an acknowledgment or plug (Belleflamme, Lambert, & Schwienbacher, 2013; Kortleben & Vollmar, 2012). The most cited, analyzed, and one of the oldest and largest crowdfunding platforms, Kickstarter, is a reward-based community (Frydrych, Bock, Kinder, & Koeck, 2014; Kuppuswamy & Bayus, 2014). Reward-based projects are often non-profit organizations, for example a registered association (this is an “e.V.” in Germany). Based on earlier research, they tend to be more successful than other organizational forms of crowdfunding (Belleflamme et al., 2013).

In the lending model, investors provide funds through small loans (Allison, Davis, Short, & Webb, 2015; Bruton, Khavul, Siegel, & Wright, 2015). In this type of crowdfunding, funders can earn an interest payment that was contractually agreed upon before the loan was made (Giudici et al., 2012). These kinds of contracts can either be between private persons, so called peer-to-peer lending (Hemer et al., 2011; Kaltenbeck, 2011; Kortleben & Vollmar, 2012), or between private persons and companies (Barasinka & Schäfer, 2010; Mach, Carter, & Slattery, 2013).

The equity-based crowdfunding model treats project funders as investors by making them equity stakeholders in return for their support (Mollick, 2014) with the goal of profit sharing in the future (Beck, 2012; Brem & Wassong, 2014). Here, the crowd buys shares of the fundraised company. In the German-speaking realm, this type of crowdfunding is often referred to as crowdinvesting, crowdlending (e.g. Brem, Jovanovic, & Tomczak, 2014; Hornuf & Klöhn, 2013; Leimeister & Zogaj, 2013) or investment crowdfunding (Barnett, 2013, p. 1).

Literature reviewAcademic literature on factors determining the success of a crowdfunding project is rather limited. However, a few authors have in fact made initial attempts at analyzing some characteristics of successful crowdfunding projects.

The literature review has two parts: literature on success factors in the preparation of the crowdfunding project and success factors during the crowdfunding project.

Starting with the success factor in the preparation time, Belleflamme, Lambert, & Schwienbacher, 2010 for example find that the type of project has an effect on the success rate. In fact, projects that are part of non-profit organizations are more successful than other organizational forms. The authors see the reason for this in the argument made by Glaeser and Shleifer (2001) who suggest that due to the reduced focus on profits, non-profit organizations find it easier to attract outside capital. In addition, Mollick (2014) examines the underlying dynamics of project success and failure and concludes that social network size as well as the project's quality relates to project success. The author further suggests that geography has an influence on project success, reasoning that founders’ proximity to project supporters results in more successful projects. Colombo, Franzoni, and Rossi-Lamastra (2015) empirically investigate the relationship between the early contributions shortly after the launch and the success of the crowdfunding campaign. Cholakova and Clarysse (2015) investigate the motivation of investing in crowdfunding, but not the specific factors of a project. Mollick (2014) argues that potential funders are more likely to select realistic funding goals, as project goals that are too high or too low are not likely to lead to a successful funded project.

The second part of the literature review observes success factors during the crowdfunding project. This observes in detail web presence, the amount of supporters/backers, updates and blog entries, rewards/incentives, and the number of comments.

The following section subsumes different aspects, hereafter called web presence, a term that consists of videos and pictures in the project presentation, a personal picture of the project owner, the existence of a separate Facebook page, or websites.

Wheat, Wang, Byrnes, and Ranganathan (2013) describe the video as the most important part of the funding appeal to potential project backers. Videos should touch the heart of backers and tell a real story about the own project. Mollick identifies the lack of a video as extremely negative, stating how “producing a video is a clear signal of at least minimum preparation” (2014, p. 8). Wheat et al. (2013) make another important point: the video is an opportunity to introduce the project owner or team. Cholakova and Clarysse (2015) describe how backers recognizing a project owner in the video have no positive influence on the project's success. They found out that a personal, emotional relationship between the project owner and the backers is not positively related to the investment in a crowdfunding project (Cholakova & Clarysse, 2015, p. 160).

Zheng et al. (2014) encourage the use of information about the project through various media to improve the communication and the understanding between the entrepreneurs and the backers (sponsors). According to Boeuf, Darveau, & Legoux, 2014, announcements of personal information about the entrepreneur (project owner) including personal pictures are considered positive due to the higher trust and serious support this achieves from the backers. Colombo et al. (2015) point out that crowdfunding platforms are a social environment, and therefore a picture of the project owner underlines the social capital component and boosts the probability of successful projects.

Mollick (2014) points to the increasingly important role of social networks in funding new ventures. Further, authors such as Belleflamme et al. (2014) highlight the importance of Web 2.0 and social networks to facilitate founders’ access to the crowd. A link to the founder's or project's Facebook page, visible on the project description page or the founder's profile, facilitates access to the project's social network page. Interested backers can gain more information on the founder and the project and can easily create awareness of it through liking and sharing the page. The availability of a direct link to the founder's Facebook page is documented in a dichotomous variable that will be used in the models later in this study. Due to the importance of Web 2.0 in crowdfunding (Belleflamme et al., 2014), the existence of a website supplying more information to potential funders should have an effect on project success. Furthermore, Frydrych et al. (2014) argue that information on the founder or the founding organization adds legitimacy to the project, attracting more funders as a result. Hence, the availability of a link to the project's website on the founder's profile or the project description page is coded into a dichotomous variable that functions as an independent variable in this study. Belleflamme et al. (2014) state that strong engagement in social networking activities does not raise the funding amount. On the other hand, Lu, Xie, Kong, and Yu (2014) argue that social networking, especially in the early stage of the project, can strongly raise the probability of a successful project funding. Byrnes, Ranganathan, Walker, and Faulkes (2014) highlight e-mailing to social networks as a driver of successful projects.

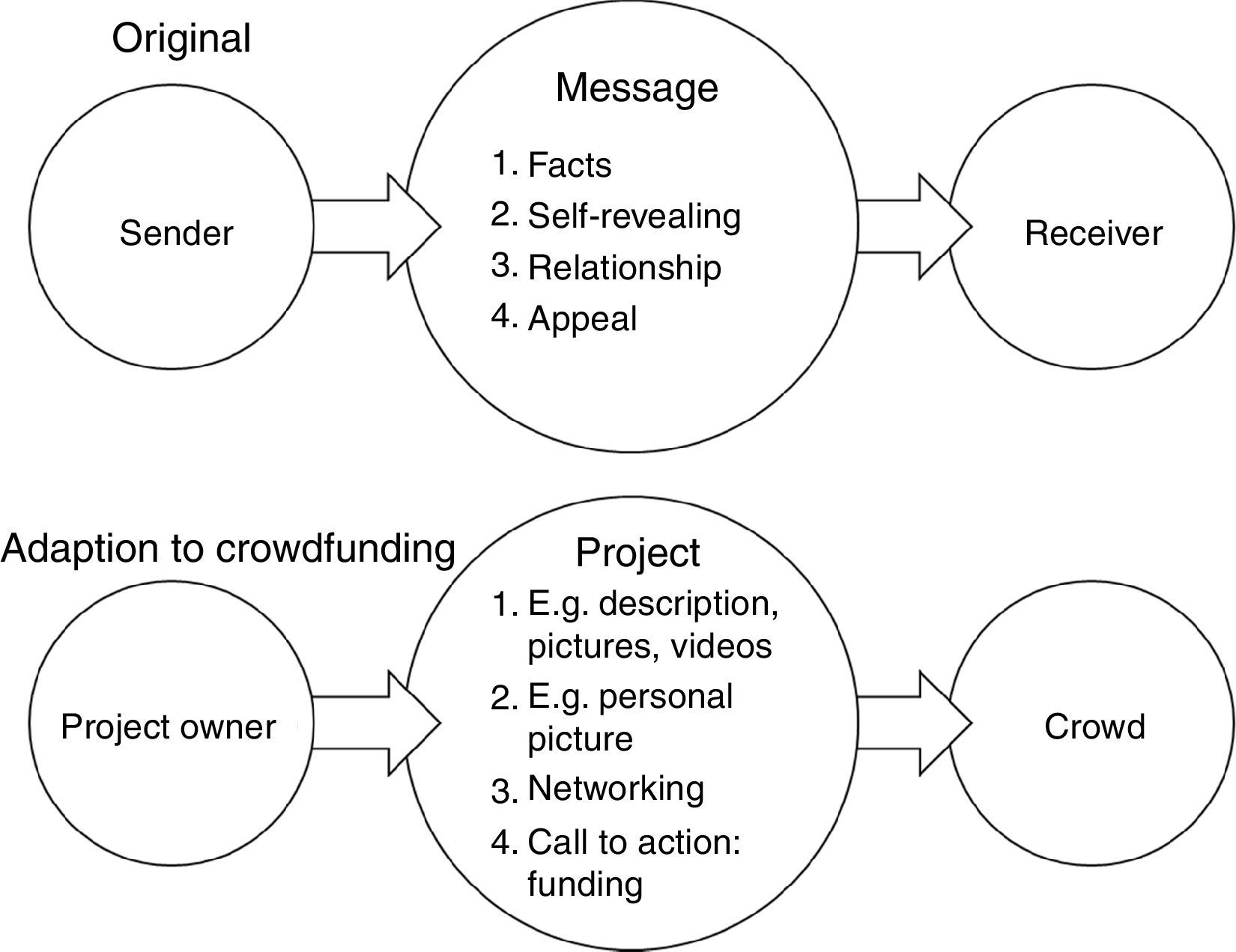

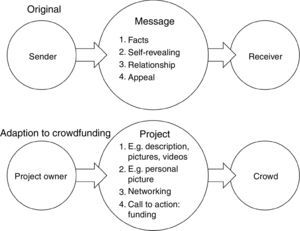

Finally, considering the high relevance of the communication between the project owner and the crowd, the classical theory of communication is also important. In his four-sided model, Schulz von Thun (2000) reveals that every piece of information between the sender (in our case the project owner) and the receiver (crowd) consists of four facets: facts, self-revealing, relationship, and appeal. Applying this theory to crowdfunding, challenges in communication can lead to poor funding results (see Fig. 2). Therefore, the transmission of a mix of facts, personal information, customer relationship, and the call to action itself are the fundamental duty of the project owner and determine the success of projects (e.g. Hui, Greenberg, & Gerber, 2014; Wu, Wang, & Li, 2015).

Theory of communication by Schulz von Thun (2000) and the adaption to crowdfunding.

Colombo et al. (2015) underlines the importance of strong support by backers in the early stage of the project, especially when the quality of the product is unclear. Whenever potential backers recognize that funding has already taken place, they are more encouraged to donate. The information about the amount of backers and the money collected are clear indicators of interest and are therefore highlighted by the platforms. According to Kuppuswamy and Bayus (2014), backers typically join projects in the very early stages and in the end.

Xu et al. (2014) underline the importance of updates and blog entries. The tendency here is clear: updates are crucial. Projects with frequent updates can almost double the probability of successful funding (32.6% vs. 58.7%) in their specific cases. Xu et al. compare the importance of updates with the initial presentation of the project on the platform. An intensive communication between the project creator and the community is “more predictive of success than the representation of the project page” (Xu et al., 2014, p. 9). Kuppuswamy and Bayus (2014) discover that recent updates, especially in the final stage of the crowdfunding project, have a positive influence on achieving the project goal in how they awaken emotions and excitement from backers.

In the different dimensions of crowdfunding, backers can receive either material rewards (Vukovic et al., 2009) or immaterial rewards through social acknowledgment (Kazai, 2011). Recording the number of rewards backers receive in gratitude for supporting a project allows conclusions about backers’ motivation for participation. Steinberg (2012) denotes the incentives as the most important motivation for participating; it is therefore the all-important aspect for a successful project. Wheat et al. (2013) shows how incentives are expected and should have a personal connection to the project. According to Wheat, public acknowledgment without material rewards is the most promising pathway. The least promising form on the other hand is not offering any incentives, while a middle way is offering material incentives. Colombo et al. (2015) underlines the importance of incentives, especially for generating backers in the very early stage of the project.

The number of comments on a project matter as well. Antonenko, Lee, and Kleinheksel (2014) point out that intensive communication positively impacts successful projects on the project website, as well as reacting promptly to questions, posting own questions, and providing frequent status updates.

MethodologyResearch approachReward-based crowdfunding is the dominant type of crowdfunding when it comes to the funds raised and number of projects (Wilson & Testoni, 2014). Against this background, this paper focuses on empirical evidence about what factors are responsible for a successful crowdfunding campaign, and has the basis of a reward-based crowdfunding approach. For this, we analyze a platform which focuses on the reward-based approach in Germany. As part of our project, we received data from VisionBakery, a German online platform and service for crowdfunding. A rewarded-based community, VisionBakery is a suitable model of study, thanks to its similar approach to and structure of the worldwide market leader Kickstarter (Boeuf et al., 2014). It has also been in operation since 2011 (Sixt, 2014). VisionBakery considers itself as the first supporter and first funding partner for project owners. Intensive consultancy is part of this relationship, with the common experience of the project and the common will of improvement uniting the platform and the project owner. VisionBakery stands for social interaction and the aim to generate and share practical implications for project success for the next generation of projects (VisionBakery, 2015), making it a qualified research project.

The data set from VisionBakery comes from all projects since its launch in 2011. There are 446 projects from this date until the end of 2014; canceled projects and not-launched projects were eliminated.

An empirical approach analyzes the data in an effort to answer the research question on success factors of crowdfunding. The applied fuzzy set qualitative comparative analysis (fsQCA) is a new analytic form in frequent use in scientific work in the fields of marketing, innovations and entrepreneurship (e.g. Huang & Huarng, 2015; Tóth, Thiesbrummel, Henneberg, & Naudé, 2015; Wu & Huarng, 2015). The selected analyses represent an innovation model to reach advanced empirical analyses, and are a state-of-the-art research approach for entrepreneurship and innovation (e.g. Mas-Verdú, Ribeiro-Soriano, & Roig-Tierno, 2015; Wu & Huarng, 2015). fsQCA is a suitable approach for this study because it identifies and assesses different paths as well as key success factors. Another important factor for choosing fsQCA is that QCA includes the skill that combinations of factors explain a certain outcome, in our case successful crowdfunding projects. This is the opposing position to the linear causal additivity that conventional variable-oriented methods are based upon (Aus, 2009). It follows the approach by Katz and Kahn (1978) that “a system can reach the same final state, from different initial conditions and by a variety of different [or multiple] paths.”

Object of analysisEvery founder needs to indicate a target level of funds that a project should achieve. Similar to the Kickstarter model, VisionBakery allows founders access to the money raised provided that the funding goal has been reached. Otherwise, backers receive their funding back via bank transfer. The structure of the websites Kickstarter and VisionBakery is, as mentioned above, very similar to each other. In the center of the project website are videos (Kickstarter) and pictures (VisionBakery). The key information about the project is identical: the amount of backers, and the amount of pledged funding including the funding goal and the remaining time for funding. Kickstarter offers more details about the project owner than VisionBakery. The look and feel as well as the structure are very similar, and the project information and rewards offered appear in the exact same structure. An interesting difference is the updates feature. While Kickstarter has an own section just for updates in the description of an ongoing project, VisionBakery updates directly appear in the project description, with the amount of updates only counted in the database. And while Kickstarter has only the comments section, VisionBakery additionally offers the features of blog, questions, and backers, presenting the comments at the end of the website.

VariablesThe following section describes the key variables in this study:

Web presence: VisionBakery allows founders to post a video, offering more detail about themselves and their project's aim on the project's description page. Here, founders can include several pictures in the explanation of their project. Photos of the project, the rewards, and the founder can provide additional information to interested funders and increase the project's credibility. Founders have the option of including a profile picture of themselves, or in case the founder is an organization, its logo. Profile pictures can add a level of personalization to the project and help potential backers identify with the founder or the founding organization. A link to the founder's or project's Facebook page, visible on the project description page or the founder's profile, facilitates access to the project's social network page. Interested backers can gain more information about the founder and the project and can easily create awareness of it through liking and sharing the page. In this article, these relevant individual aspects merge together into the term web presence.

Backers: The number of backers indicates the amount of people that have supported the project through its duration.

Updates and blog entries: VisionBakery encourages project founders to post and share updates about their project. Potential funders with an interest in the project and existing funders can gain more insight into the development of the project along with new information about project developments. Another option for interaction between the project owner and the backers is the blog. Experiences gained, news, and moods can be communicated by the project owner. The number of blog entries is recorded as well as the amount of updates.

Rewards/incentives: The number of different rewards/incentives backers receive as a way of saying thanks for support is part of the analysis.

Comments: Funders, potential funders, the founder, as well as administrative and support staff from the VisionBakery website can post comments about the project on the bottom of the description page. This then records the number of negative and positive comments, with the difference being comments from founders. The resulting continuous variable serves as an input for various statistical analyses in this study.

Analysis procedureThe following section describes the procedure of the analysis. Ragin (2008a) proposes that set relations in social research are central to social science theorizing, making analyses of set relations critically important to social research. As a result, the new fuzzy set qualitative comparative analysis method (fsQCA) has received significant attention from academics and practitioners (e.g. Bell, Filatotchev, & Aguilera, 2014; Chang & Cheng, 2014; Fiss, 2011; Misangyi & Acharya, 2014; Tóth et al., 2015; Woodside, 2013; Woodside & Zhang, 2011). Fiss (2011) has suggested that fsQCA is based on the analysis of set-theoretic relationships rather than linear relationships between variables, and that it can handle significant levels of causal complexity based on a configurational understanding of how causes combine and contribute to an outcome. Most researchers have employed a set-theoretic approach based on fsQCA and focused on categorizing relevant antecedents (e.g. web presence or updates and blog entries in our specific case) into causal recipes for achieving high outcomes such as performance, profit, satisfaction or, in our case, the probability of successful crowdfunding projects.

Accordingly, this study employs a set-theoretic approach to explore how causal conditions (i.e. web presence, backers, updates and blog entries, rewards/incentives, number of comments) combine to contribute to an outcome (i.e. realized funding in percentage) by following Ragin's fsQCA guide (Ragin, 2008b) step by step. First, to transform ordinary data into fuzzy sets, this study follows Ragin (2008a, 2009) and Misangyi and Acharya (2014) to specify fuzzy set full membership (95%), cross-over anchors (50%), and full non-membership (5%). This study specifically sets the original values of the 95th percentile, 50th percentile, and 5th percentile from ordinary data to respectively correspond to full membership (fuzzy score=.95), cross-over anchors (fuzzy score=.5), and full non-membership (fuzzy score=.05).

In the second step, this study follows Chang and Cheng (2014), Fiss (2011), Misangyi and Acharya (2014), and Ragin (2008b) to construct a data matrix known as a truth table with 32 (i.e. 25) rows, where 5 is the number of causal conditions in this study. To construct the truth table, we set the frequency and consistency threshold. In terms of the frequency threshold, Ragin (2008a, 2008b) indicates that the frequency the researchers specified should have at least 75–80% of the cases included in the analysis. In terms of the consistency threshold, Fiss (2011) suggests that the acceptable consistency should be above the minimum recommended threshold of .75, and Misangyi and Acharya (2014) proposed that minimum raw consistency was .80. In line with this literature, this study specifies the frequency threshold as 10 and the consistency threshold as .85.

While specific analysis and standard analysis are two possibilities for each analysis, Ragin (2008a, 2008b) strictly recommends standard analysis because this is the only way to generate the intermediate solution (partial logical remainders are incorporated into the solution). In standard analysis, there are three solutions (i.e. complex solution, parsimonious solution, and intermediate solution) for each analysis. Ragin (2008a, 2008b) further suggests that these solutions are based on a different treatment of the remainder combinations (i.e. there is no logical remainder used in the complex solution, although all logical remainders are allowed in the parsimonious solution without any evaluation of their plausibility), recommending the intermediate solution. This study thus attempts to combine relevant conditions into various causal recipes for exploring the configurations to achieve high realized funding in percentage based on intermediate solutions.

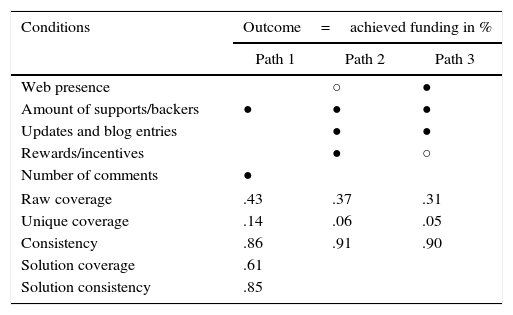

ResultsTable 1 displays the intermediate result produced from fsQCA. Note that the parsimonious result is exactly the same as the intermediate one, indicating that the conditions of the causal paths in Table 1 are central conditions rather than peripheral (see details in Fiss, 2011).

Causal configurations sufficient for achieving funding in percentages.

| Conditions | Outcome=achieved funding in % | ||

|---|---|---|---|

| Path 1 | Path 2 | Path 3 | |

| Web presence | ○ | ● | |

| Amount of supports/backers | ● | ● | ● |

| Updates and blog entries | ● | ● | |

| Rewards/incentives | ● | ○ | |

| Number of comments | ● | ||

| Raw coverage | .43 | .37 | .31 |

| Unique coverage | .14 | .06 | .05 |

| Consistency | .86 | .91 | .90 |

| Solution coverage | .61 | ||

| Solution consistency | .85 | ||

Notes: Black circles (●) indicate the presence of causal conditions (i.e. antecedents). White circles (○) indicate the absence or negation of causal conditions. The blank cells represent “don’t care” conditions.

Three causal configurations are found to be sufficient for high achieved funding in percentage with acceptable consistency levels. The consistency index serves as significance (Ragin, 2008a) and supports an argument of sufficiency (Ragin, 2009). In addition, the unique coverage for each causal path recognizes that each path offers a unique contribution to the explanation of the crowdfunding success. Coverage, like strength, measures the extent to which the configuration accounts for the outcome (Ragin, 2008a). In short, these three solutions constitute a high consistency (.85) and explain over 60% of the outcomes.

The solutions in Table 1 indicate that the amount of backers is evidently the most important condition for high achieved funding in percentage. This is a necessary condition regardless of how other conditions combine. Put more specifically, more backers represent more cash flow. The amount of backers and the number of comments jointly constitute a causal path to successful crowdfunding without regard to other conditions (i.e. path 1). The comments can be regarded as the public statements from a brand's spokesperson, and thus function as a marketing tool for influencing the potential backers’ perceptions of respective projects. Founders can also update information on their projects via comments. Accordingly, path 1 with the highest unique coverage signifies that the breadth and the depth of the crowd's interest are sufficient to achieve funding. While the amount of backers denotes how many people show interest in the projects (i.e. the breadth), the number of comments represents how much attention people can pay to the projects (i.e. the depth).

However, when the number of comments is not taken into account, founders’ updates and blog entries become more significant (see path 2 and path 3). In other words, founders need to maintain the crowd's interest by updating relevant information about the projects on their blogs. Web tools such as videos, pictures, and Facebook appear to play an important role in updating information and keeping the crowd's interest. Again, when founders lack these tools, they need to design an incentive plan for backers to enhance their interest (path 2). On the other hand, when founders are incapable of offering rewards or incentives to potential backers, they have to effectively utilize web tools in order to grab the crowd's attention (path 3).

Furthermore, a comparison of path 2 and path 3 shows that these configurations involve a pattern of substitution. Web presence and rewards/incentives here appear to substitute for each other. Simply put, the presence of one of the conditions combined with the absence of another constitutes a part of causal conditions. While the web presence represents an intangible pull for attracting the crowd's interest, the incentive plan acts as a tangible motivation for encouraging the potential backers to take action. These two conditions cannot be present simultaneously when achieving successful crowdfunding.

A comparison across all solutions also reveals that the number of comments can substitute for the portfolio of web presence, updates and blog entries, and rewards/incentives. Because founders can also market their projects or update information by posting comments, this means that they have no need to focus on marketing their projects by using web tools, updating information, or designing the incentive plan when they frequently post comments. In sum, these solutions indicate that these conditions are critical factors, even though founders should appropriately combine these conditions to achieve funding.

DiscussionThe following discussion comes from the two-part literature review of success factors in preparation of and during the crowdfunding project and the insights gained through our analysis.

Crowdfunding is fundamentally changing the way new projects access funding. In daily business, the focus is very much on equity-based crowdfunding projects. However, reward-based campaigns have quickly become the dominant type of crowdfunding all over the world. In 2012, 14% of funding volumes were reward-based, compared to 4% of equity-based crowdfunding (Wilson & Testoni, 2014). Part of this high growth can be attributed to the agile nature of reward-based campaigns, where the return on the contribution – be it a product, service, or acknowledgment – is clear and defined a priori, not bound by the exit liquidity concerns of an equity investment.

In answer to the research question, it is important to remember that success factors during the projects are multi-layered. Mollick (2014) finds that social network size as well as the project's quality relates to project success. Hence, communication of crowdfunding projects appears to be a key element for their success. We find that videos, pictures, blogs, and other online elements in many cases play an important role, as expected by the analysis of earlier research. However, the relationship to the crowdfunding campaigns’ success is not automatically positive, and sometimes is even negative: in path 1, there is no influence; in path 2, it is an inhibiting factor, while in path 3, it is a main argument for success.

So depending on the causal configuration of realized projects, it does not always make sense to use all available communication instruments. This is in several cases contradictory to earlier research: Wheat et al. (2013) and Mollick (2014) found the lack of a video to be negatively related to crowdfunding success. Boef et al. (2014) as well as Colombo et al. (2015) point out that a picture of the project owner boosts the probability of successful projects. Belleflamme et al. (2014) highlight the importance of Web 2.0 and social networks, while Antonenko et al. (2014) research that successful projects are positively affected by intensive communication on the project website, reacting promptly to questions, posting own questions, and giving frequent status updates. The importance of updates is supported by Xu et al. (2014): projects with frequent updates can almost double the probability of successful funding. Regarding the use of social media, earlier research reveals different directions as well. Belleflamme et al. (2014) note that social networking activities do not raise the funding amount. On the other hand, Lu et al. (2014) argue that social networking, especially in the early stage of the project, can strongly raise the probability of successful project funding. Byrnes et al. (2014) highlight e-mailing to social networks as a driver for successful projects.

When it comes to incentives, we can only partly support Steinberg (2012) and Colombo et al. (2015) who identify incentives as the key elements of a successful crowdfunding project. We even find all three possible variants: rewards can be key for success (path 2), can have no influence (path 1), or can even be harmful (path 3). This might be explained in general by the fact that incentives are expected in any case by those involved (Wheat et al., 2013). Especially in the case of path 3, it might be just too much to do extensive communication with videos, pictures, social media, updates, blogs, etc. when supporters are sufficient in the first place.

The only constant success factor for crowdfunding success is the number of supporters and backers, who may receive either material rewards (Vukovic et al., 2009) or immaterial rewards in the form of social acknowledgment (Kazai, 2011). This supports the research done by Colombo et al. (2015). This support is considered to be a key success factor in all of the paths.

With the three different paths for successful crowdfunding projects in mind, this strongly confirms the adapted communication theory of crowdfunding based on the original theory of communication by Schulz von Thun (2000). The heterogeneity of the crowd requires a broad information approach. As a result, renouncing one of the four elements (detailed description of the project including pictures or videos; personal information about the project owner; networking; and a call for action) may undermine the success of a project.

It finally is important to remember that earlier research did not have such a broad approach when it came to analyzing crowdfunding success. So this might be the reason why their results differ in individual sections.

Implications for practiceReward-based campaigns provide funders the opportunity to pre-purchase a product or service, and the reward structure often also includes the option to support the project through a donation without actually pre-purchasing any product or service. This different reward structure offers options to founders to establish different relationships with their audience: some funders fit well into the potential customer profile, while others take the profile of a fan or project supporter. While the pre-purchasing customer profile might behave in accordance with new product launch marketing theory, the additional source of variation introduced by the fans of a project (regardless of whether they are pre-purchasing or not) changes the dynamics of the crowdfunding campaign evolution, modifying what would otherwise be a classic marketing plan for a new product or service.

Based on prior research on crowdfunding dynamics, we expect to see campaign success determined by whether there was a strong (funding) wave as the project started (Etter, Grossglauser, & Thiran, 2013), together with the surge of a high (social) networking effect – virality of the project – that would drive the project funding through to completion (Mollick, 2014). What we find is that the crowdfunding campaign dynamics are far more complex, especially in terms of the influence of crowdfunding communication approaches, which the last section of this paper discusses.

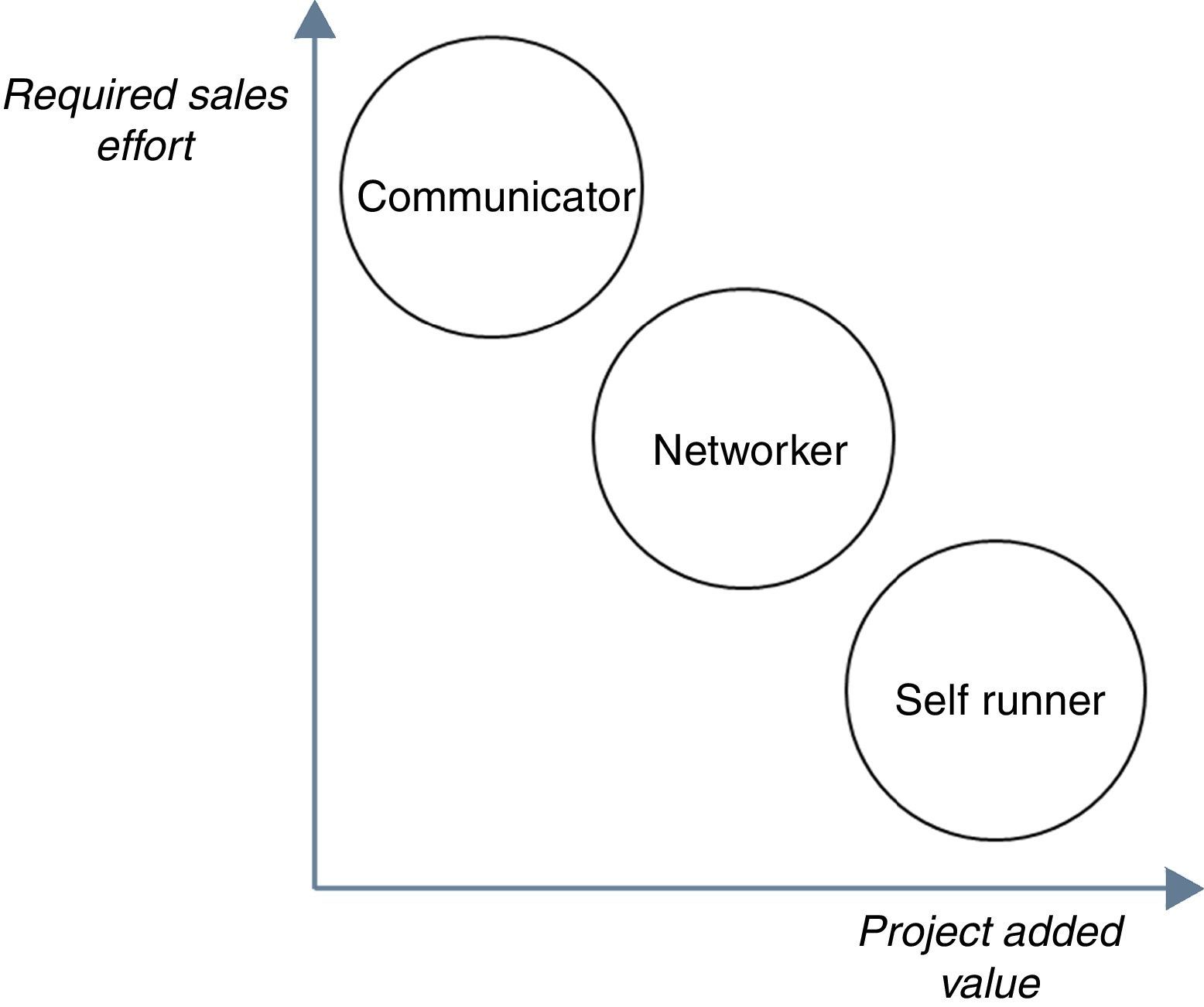

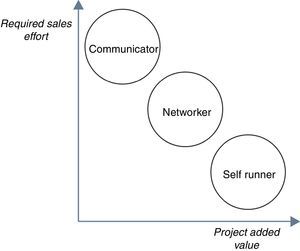

With our results in mind, we propose a typology of crowdfunding campaigns for future consideration:

- (a)

Communicator: this type yields a strong social network and fans, using online marketing and public relations. It helps the project to “turn heads.” Nevertheless, a lackluster product or service keeps visits-to-contributions ratios low, and most of the funds come from symbolic contributions and/or reward offerings. Put another way, the communicator is rewarded for his/her strong effort as part of a rather weak project. This strategy comes from path 3 identified in our research.

- (b)

Networker: funders start building virality through their personal network and their community, and the project gradually draws more attention as founders manage to fit their offering to what ticks with their audience through blogs and updates. Summarizing the networker, the focus is on already-known potential founders and the intensive work with them, keeping the information flow running and offering attractive rewards. This approach can be referred to as path 2.

- (c)

Self-runner: an attractive product is the driver of virality with an active community of backers; the success of the launch gets media attention, a high number of comments, and brings additional fans to the project in addition to the potential customers. It appears here that the product is simply outstanding, and therefore no self-determined online activity is needed to lead the project to a successful funding. The work for this kind of project appears complete before the crowdfunding project starts, with the campaign seen as given. Here, path 1 serves as a basis.

It is therefore important before starting a crowdfunding project to consider which strategy fits best with the idea, and the founder or the founding team in particular. A distinctive use of communication tools like social media, pictures, rewards, etc. is achieved based on this decision.

The chart below (Fig. 3) summarizes the findings in this article, and serves as a basis for practical guidelines which are useful for the choice of a strategy. The axes are required sales effort and project added value.

The following practical guidelines for future project owners can be derived based on this threefold division:

Start creating new projects with the simple goal of generating added value for third parties, not for the project owner. Added value can be multi-layered, and include everything from knowledge, entertainment, experiences, emotion, or quality of life.

Get a feeling for the project. Start discussing the idea in a very early stage with your close peer group in an effort to identify market demand and optimize the project. Do this, and it will be easy to recognize a “Wow!” project and a “tough” project.

Keep the desire for continuous development, for example with the help of sample through-runs, fixed feedback routines, pre-testing, or re-designing the project if needed. Consequently re-examine the project. Most of the hard work comes before the crowdfunding project is even online.

Win the crowd before starting the project online. Start the communication with family, friends, and colleagues early – they are crucial for the first stage of the campaign and therefore for the degree of attention to the whole project. If you feel strong restraints, invest time and effort in offering attractive rewards and setting up online tools.

Create constant updates about optimization, news, innovation, experiences, and feedbacks – the crowd will show their appreciation for improvements and a consistent work ethic via their funding.

Limitations and further researchAs with every research, our approach has some limitations. First, we focus our analysis on a reward-based platform. If the same analysis examines another platform, for example with an equity-based or donation-based focus, results might differ. Applying our approach to other types of crowdfunding platforms, especially in an international and interdisciplinary context, might bring new insights into the topic of crowdfunding success. To be sure, this is the main shortcoming the authors see with this research, as equity-based crowdfunding investors will definitely have different motivations to invest than people interested in reward- or donation-based projects. Another point is that we only have objective data available, that is, observations from VisionBakery's website. Participants however could state why they choose to invest in specific projects. Here, additional qualitative research, for instance interviews with investors and companies, is a good idea. Our findings are generalizable to a limited degree because the data collection stems from a single website and its research focus is set on Germany. Comparisons with platforms from other European countries might contribute to a better understanding of the link between crowdfunding motivation and the local economic situation. In any case, the shortcomings here ultimately offer interesting avenues for future research.