The crowdfunding movement has created opportunities for entrepreneurs to overcome financial barriers and initiate innovative projects that can alter consumer behaviour towards more sustainable consumption practices, particularly mindful consumption. Mindful consumption involves incorporating acquisitive, repetitive and aspirational behaviours and purchasing decisions that consider the impact on ecosystems and communities. While previous research has identified success factors such as project descriptions, financing goals, social capital and innovation, their influence on crowdfunding success through the lens of mindful consumption could be less determinant. The entire concept of what success entails can also be redefined and, with it, the impact of startups. This study fills this research gap by determining the factors that contribute to the success of environmental projects in reward-based crowdfunding and understanding how such projects also promote consumers’ sustainable consumption practices. The study employs fuzzy-set qualitative comparative analysis on a sample of 210 Kickstarter projects in the environmental category to identify the necessary conditions for crowdfunding success and unravel the complex factors at play between success and mindful consumption. The results are consistent with previous literature finding that integrating monetary-related keywords alone is not enough for crowdfunding success, indicating that the overall understanding of startup success should be revisited to include social capital. Identifying the necessary conditions for redefining success also contributes to the formation of guidelines to assure sustainable innovation for new ventures in reward-based crowdfunding platforms such as Kickstarter.

Highlights

Redefining Success in Crowdfunding Through the Lens of Sustainable Innovation: This study contributes to a deeper understanding of how crowdfunding platforms like Kickstarter can serve as catalysts for sustainable innovation, emphasising the role of backers’ mindful consumption in shaping the future of entrepreneurial success.

Mindful Consumption is a Significant Predictor of Environmental Crowdfunding Success: The study reveals how incorporating mindful consumption practices and sustainability cues into project narratives positively influences crowdfunding outcomes, signalling a shift towards value-driven consumer engagement.

Social Capital and Sustainability Keywords are Vital for Crowdfunding Engagement and Success: The results underscore the significance of social capital and the strategic use of sustainability-related language for enhancing backer support, offering new insights into the dynamics of successful crowdfunding campaigns.

Empirical Analysis Unveils Key Factors for Crowdfunding Success Beyond Financial Metrics: This study uses fuzzy-set qualitative comparative analysis to examine the complex interplay between project success and the promotion of mindful consumption, challenging traditional metrics of success in environmental crowdfunding on Kickstarter.

The emergence of the crowdfunding movement has unlocked new avenues for entrepreneurial initiatives, allowing them to flourish and overcome financial limitations. This development has significantly fostered innovation, particularly in ventures that might otherwise have yet to commence. Within this realm, a surge of projects dedicated to facilitating sustainable transitions have been introduced (Böckel et al., 2021). However, despite their significance in proposing alternative modes of consumption, the success of crowdfunded projects still seems to rely on traditional measures for economic success such as purely financial factors. This concern prompts the primary research question of this study, which is to identify the factors that contribute to the success of crowdfunded projects through the lens of sustainable consumption and to analyse whether current crowdfunding projects have succeeded in achieving this aim.

When investigating contemporary entrepreneurial dynamics, particularly in the context of reward-based crowdfunding, mindful consumption is a pivotal element (Fehrer & Nenonen, 2020; Fischer et al., 2021). Sheth et al. (2011) define mindful consumption as ‘temperance in acquisitive, repetitive and aspirational consumption at the behaviour level, ensuing from and reinforced by a mindset that reflects a sense of caring toward self, community, and nature’ (p. 30). Mindful consumption encompasses acquisitive (buying beyond one's needs), repetitive (buying, discarding and buying again) and aspirational (an upwards shift in aspirations, which is a form of conspicuous consumption) behavioural categories. Individuals who practice mindful consumption consciously avoid such behaviours and are motivated by increased awareness and a thoughtful attitude spurred by a mindful perspective to care for self, community and nature; factors that can have significant entrepreneurial and marketing impact. However, research exploring these impacts is limited (Kumar & Agrawal, 2023).

In the context of crowdfunding, which is defined as ‘the process of raising money to help turn promising ideas into business realities by connecting investees with potential supporters’ (Ramsey, 2012, p. 54), the crowd's role as potential consumers and supporters is crucial. This is particularly true for reward-based crowdfunding, where individuals donate to a project or business expecting to receive a non-financial reward in return such as goods or services at a later stage if the project is successful. Traditionally, the transition from potential consumers to supporters primarily hinges on a crowdfunding projects’ descriptions and financial goals. Nevertheless, additional factors may be influential when focusing on mindful consumption behaviours, particularly since opting to support such projects implies not buying later, given the implicit reward for their backing. This is of considerable significance given the economic rise of impact startups, that prioritise financial returns as well as social and environmental outcomes (Iizuka & Hane, 2021). To this end, research has examined related areas of knowledge—primarily green knowledge management and green technological innovation (Khan et al., 2024); however, the focus has largely been on companies and not consumers, while the extent to which socio-environmental entrepreneurship has impacted the adoption of alternative modes of consumption remains unexplored (Khan et al., 2024). Therefore, understanding how successful projects promote social and environmental awareness to increase conscious consumption in the context of reward-based crowdfunding offers a promising opportunity for research.

Previous research has pinpointed project description, financing goals, social capital and innovation as vital success factors for crowdfunding campaigns. Engaging and concise project descriptions tailored to potential backers’ interests significantly influence success (Liang et al., 2020). Similarly, sustainability-focused language resonates with consumers who value sustainability, which attracts more backers (Berns et al., 2022). Nonetheless, sustainability terms only partially determine success, as they align more with potential backers’ concerns than the core objectives of venture projects (Mollick, 2014).

Setting realistic financial goals is another crucial success factor. Projects that overshoot funding requirements or fail to detail an execution plan can seem unrealistic, resulting in a lack of financial support. Transparency in financial information is crucial in this regard (Alhammad et al., 2022). Projects that effectively communicate financial needs often surpass monetary goals; a phenomenon that has been observed on platforms such as Kickstarter (Huang et al., 2021; Kaartemo, 2017).

Social capital, which is indicated by the number of backers, also has a significant role. Projects with a high backer count typically reflect greater engagement and support, which can lead to funding success (Mollick, 2014). This factor underscores the importance of strong community and network support in entrepreneurial ventures (Defazio et al., 2021), which is a cornerstone of this study's focus on engaging determinants.

Innovation is a pivotal success factor for promoting sustainable economies through mindful consumption behaviours (Horne & Fichter, 2022). Projects that offer incremental improvements rather than radical innovations tend to be more successful (Bargoni et al., 2024). This distinction is vital for impact startups that focus on growth and make significant contributions to sustainable transitions (Anand et al., 2021).

Notably, calls have been made for a deeper understanding of how motivational factors might affect consumer behaviour in crowdfunding (Buttice et al., 2017) as well as the influence of specific crowdfunding platforms such as Kickstarter (Shneor & Vik, 2020). A systematic literature review revealed that previous research has not deeply examined backers’ motivations concerning crowdfunding success towards the promotion of mindful consumption, and has not considered Kickstarter, which is arguably one of the leading platforms for reward-based projects, nor has it thoroughly explored the factors behind the impact of startups and their influence on consumer behaviour. Therefore, further exploration of campaign descriptions and the influence of the community have been suggested (Kaartemo, 2017; Stiver et al., 2015). Therefore, investigating these aspects, alongside innovation adoption and product characteristics, presents a notable research opportunity (Jáki et al., 2022; Shneor & Vik, 2020).

The objectives of this study are threefold. First, it explores how crowdfunding projects can effectively drive consumer behaviour towards more sustainable practices, contributing to the broader goal of transitioning to a sustainable economy. Second, it investigates the role of crowdfunding in promoting sustainable development through mindful consumption, ultimately questioning the notion of success and the assessment of impact startups. Finally, this study uses fuzzy-set qualitative comparative analysis (fsQCA) as the methodological backbone to examine the intricacies of backers’ support for projects underpinned by the ethos of mindful consumption. Despite this methodology quickly gaining interest among researchers, its use to empirically examine crowdfunding success remains limited (Colombo, 2021; Kraus et al., 2018; Mattke et al., 2022). Using fsQCA allows for a thorough exploration of a complex set of conditions that lead to crowdfunding success through mindful consumption. This methodology offers a nuanced analysis that complements traditional techniques like descriptive statistics or regression analysis that are used to examine the role of monetary, material, energy, sustainability, water and innovation keywords in project descriptions (Vis, 2012). Therefore, this study also addresses this research gap by using fsQCA qualitative analyses.

The main question that guides this research—What conditions foster crowdfunding projects’ success in promoting mindful consumption behaviours and how?—aims to fill these gaps using qualitative and content analysis to examine the relationship between reward-based crowdfunding and mindful consumption by selecting backers as a primary focus and examining potential motivational factors linked to mindful consumption. The study also considers the financial health and team composition of projects, given their noted influence on success. We analyse this support to identify factors indicative of higher backer support, which is our proxy measure for social capital. This analysis also integrates an exploration of whether factors signalling higher backer support also indicate projects that promote mindful consumption.

Using novel approaches, this study contributes to re-evaluating the traditional measures of successful crowdfunding projects through the lens of mindful consumption. This study also contributes to research on the growth of impact startups, which is crucial for promoting sustainable innovation and transforming our economy towards sustainable development. The role of these startups aligns with the United Nations Sustainable Development Goals (SDGs), creating synergies necessary for transformative change (Iizuka & Hane, 2021; Van Zanten & Van Tulder, 2021) in the form of sustainable entrepreneurship, which has been identified as a significant gap in previous research and a critical target for crowdfunding platforms (Muñoz & Cohen, 2018; Rosário et al., 2022).

Therefore, this study expands the understanding of the transformative role of startups as sustainability enablers (Fichter et al., 2023). Since transforming consumer behaviours is crucial for advancing a sustainable economy (Mi & Coffman, 2019), the influence of crowdfunding in promoting consumer practices that respect ecosystem health and community well-being becomes vital. Therefore, crowdfunding projects must include their effectiveness in altering consumer behaviour as a critical success criterion.

This is an endeavour that applies across all industries. Whereas a proposal for crowdfunding initiatives might be context-specific, the overarching factors of effectiveness, in terms of success (e.g. project description), could be generalised across domains. This evidence has recently been supported by implementing machine learning models in this analysis (Elitzur et al., 2024; Feng et al., 2024). Therefore, the contribution of our study is further emphasised as successful crowdfunding strategies to foster sustainable consumption behaviours could be generally applicable.

The remainder of this paper proceeds as follows. Section 2 presents a literature review on reward-based crowdfunding success factors and introduces a conceptual framework that centres on mindful consumption. Section 3 details the study's methodology (fsQCA) and the signals and propositions used in the research. Section 4 analyses the results, clearly identifying the necessary conditions for success in the presence and absence of such conditions. Section 5 presents a discussion of the theoretical implications of the findings and implications for management. Finally, section 6 includes conclusions, study limitations and suggestions for future crowdfunding success, particularly on platforms like Kickstarter.

Theoretical framework and propositionsThe theoretical foundation of this enquiry is anchored in social capital and signalling theory (Bafera & Kleinert, 2023; Colombo, 2021), offering a novel lens to scrutinise the multi-faceted impact of funding decisions. This approach not only empowers backers with insights regarding their contributions but also provides entrepreneurs with a pre-launch evaluation framework to pre-assess projects’ potential societal and environmental impacts. This dual focus aligns with the broader objectives of mindful consumption, where consumer choices resonate with everyday decisions and sustainable entrepreneurship, which is fundamentally about crafting products and services that address contemporary socio-environmental challenges (Muñoz & Cohen, 2018; Rosário et al., 2022).

The emphasis on scrutinising entrepreneurs’ business propositions before market entry enhances the legitimacy of such ventures. This enhanced legitimacy could benefit all three stakeholders: the entrepreneur, the backer and the crowdfunding platform. Nevertheless, despite the recognised utility of platforms such as Kickstarter in bolstering social entrepreneurial endeavours, a lack of consensus on whether the most successful projects are those that contribute significantly to social and environmental welfare remains (Bento et al., 2019; Neumann, 2021).

To further address these concerns, this study conducted a comprehensive systematic literature review, following the Preferred Reporting Items for Systematic Reviews and Meta-Analysis (PRISMA) methodology (Page et al., 2021). The results of the search string (‘crowdfunding success’ AND ‘social capital’ AND ‘review AND Kickstarter’) yielded 100 results. Following the screening process, 40 studies were included to analyse the factors of success of crowdfunding projects with a particular focus on the exploring of social capital (the PRISMA flow diagram is presented in Appendix A).

The findings revealed that scholarly work on crowdfunding has focused extensively on the elements that guarantee project success (particularly on Kickstarter), regardless of whether ventures promoted alternative modes of consumption. Therefore, previous research has demonstrated that early contributions significantly accelerate success, independent of campaign length or targeted funding goals, which surprisingly do not correlate with success (Dalla Chiesa et al., 2022). Notably, shorter campaigns often witness a genuine surge in funding, especially as the deadline nears (Alhammad et al., 2022). An exception to this trend has been observed in the case of serial crowdfunders, who, benefitting from accumulated social capital, often achieve funding success more swiftly and find repeated success on the platform (Jáki et al., 2022). Furthermore, a negative correlation has been noted between the number of backers and the total amount pledged. Nevertheless, this factor positively impacts projects’ later market performance, suggesting that projects with more backers are generally more sustainable from a business perspective (Hörisch and Tenner, 2020).

Some studies have also focused on the terms used in project descriptions to understand which terms are most likely to lead to success. The use of terms related to sustainability such as ‘green’ and ‘eco-friendly’ were found to positively correlate with project success (Böckel et al., 2021; Kaartemo, 2017). Indeed, green factors have been shown to significantly affect crowdfunding success, particularly when combined with other qualitative indicators in comments, concluding that crowdfunding helps scale up sustainable innovations developed by environmental entrepreneurs in Indiegogo (Tang et al., 2024). In contrast, the use of monetary terms (‘promotion’, ‘discount’ and ‘% reduction’, among others) tends to have a negative impact, reducing funding contributions and engagement (Chan et al., 2021; Berns et al., 2022). Financial considerations also have an influence on determining the mindfulness of a project's design. Research has demonstrated that discrepancies between the financial goals of a project and the actual funds raised can adversely affect backers’ support. This misalignment is often perceived as a marker of unreliability (Bargoni et al., 2024); a phenomenon that deserves further exploration in the context of mindful consumption projects.

Although our study focuses on Kickstarter, previous research has also highlighted that social capital and project descriptions, among other factors (e.g. social media messages) significantly drive success for sustainable projects (see Alhammad et al., 2022 for a review). To this end, a strong community and clear messages are particularly beneficial in terms of social and environmental impact. Therefore, crowdfunded platforms should prioritise the inclusion of functionalities that allow social interactions to further nurture these factors.

These insights into crowdfunding success factors are crucial for understanding the dynamics of mindful consumption in the context of crowdfunding. To further understand the intricacies of mindful consumption for new ventures, this study next explores this concept.

Mindful consumptionMindful consumption is a behavioural paradigm characterised by moderation in previously described acquisitive and aspirational consumption patterns that is underpinned by a conscientious mindset towards self, community and the natural world (Sheth et al., 2011). This behavioural aspect is particularly salient in venture projects that rely on backers’ support for social impact. Behavioural models such as the Theory of Planned Behaviour (Ajzen, 1991) and the value-belief-norm theory (Stern et al., 1999) suggest that personal attitudes and beliefs about sustainability can be translated into increased support for crowdfunding initiatives and intentions to become a social entrepreneur (Maheshwari et al., 2023). However, the exploration of mindful consumption within the crowdfunding sphere remains limited, with insufficient research addressing this intersection (Akbari et al., 2022). Moreover, recent calls have addressed the need for further research exploring social capital in promoting entrepreneurship ventures, particularly crowdfunding initiatives (Nielsen & Binder, 2021; Kukurba et al., 2021).

In the broader context of the sharing economy, crowdfunding initiatives have been heralded as catalysts for a more decentralised, equitable and sustainable economic model (García-Flores & Madero, 2020). This paradigm shift necessitates a departure from structured (sometimes rigid) organisational structures that are typical of startups towards more agile and transformative models that can reshape consumer behaviour. Trust and reputation, which emerge from diverse factors such as narrative construction, social capital and strategic insight, have critical influence on this transformation (Gupta & Srivastava, 2024). While new ventures have been acknowledged as engines of social change, with shared economies superseding ownership-centric models in driving sustainability, the environmental impact of these ventures must be adequately explored in the context of consumer participation in sharing activities. This gap in understanding warrants further investigation in the crowdfunding context (Dinh et al., 2024). Additionally, the response of the sharing economy to institutional challenges such as the attainment of SDGs still needs to be explored, meriting further academic attention (Faraji et al., 2023).

When investigating the mindful consumption–crowdfunding nexus, it is essential to consider the broader landscape of crowdfunding success factors. Related research has highlighted the impact of information and communication strategies on consumer behaviour. For instance, sustainability cues such as eco-labelling and green marketing have been scrutinised for their influence on consumer choices and encouraging more environmentally conscious decisions (Ottman et al., 2006). Complementing these strategies are regulatory measures designed to reinforce sustainable consumer practices (Fischer et al., 2021). Furthermore, the influence of social networks and peer dynamics in shaping sustainable purchase decisions is noteworthy. These social drivers can foster an environment in which sustainability is valued, promoting responsible consumption. Within the crowdfunding milieu, the concept of social capital, which is manifested through the support of numerous backers, has been identified as a crucial success factor influenced by external determinants of consumer behaviour (Buttice et al., 2017; Cai et al., 2019).

In summary, previous research has offered valuable insights into the determinants of consumer behaviour and sustainable consumption (Thøgersen, 2006). Building upon this foundation, the promotion of mindful consumption behaviours can be informed by a deeper understanding of information strategies and social capital on existing crowdfunding platforms such as Kickstarter.

Social capital and crowdfundingAsserting that crowdfunding support can be a prominent factor for substantiating a venture idea and shaping future consumers’ mindful consumption, this study uses the number of backers as the measure of social capital. Referencing Bourdieu (1986), social capital includes value and benefits that are cultivated through connections within an individual's social network. This perspective is particularly relevant in the context of crowdfunding as it indicates the potential for social entrepreneurs to attract backers by achieving trust and credibility, which is essential for increasing social capital (Hörisch & Tenner, 2020).

Supporting this assumption, previous literature has emphasised how backers’ support triggers reciprocity and a sense of belonging to a community with mutual interests (Buttice et al., 2017). This shared identification subsequently cultivates increased support for reshaping individual behaviours, reinforcing an inner motivation to transition to mindful consumption practices. To this end, cognitive (e.g. shared narratives), structural (e.g. social networks) and relational (e.g. trust) dimensions of social capital have been identified as predictors of financial support for venture initiatives (Park & Loo, 2022).

This study examines the concept of cognitive social capital within the crowdfunding domain; a topic that has received limited attention in scholarly literature. Cognitive social capital refers to the support extended by backers, which can be predicated by the use of shared language and narratives (Parhankangas & Renko, 2017). A shared linguistic framework has been demonstrated to foster a common understanding that can attract potential backers and facilitate the dissemination of common practices (Cai et al., 2019). Furthermore, shared language can intricately shape the storytelling of venture ideas and significantly influence how backers interpret information, which can subsequently improve crowdfunding initiatives’ performance and is instrumental for mitigating financing uncertainties (Colombo, 2021).

In previous explorations of the factors that drive successful crowdfunding initiatives, signalling theory has been used as a robust framework (Bafera & Kleinert, 2023; Colombo, 2021; Huang et al., 2021). As explained in the next section, signalling theory is a valuable framework for understanding what makes crowdfunding campaigns successful.

Signalling theory and crowdfundingAccording to the signalling theory, entrepreneurs (the signallers) can enhance the attractiveness of their initiatives by sending selected signals to potential backers (the receivers). This study explores how entrepreneurs describe projects (the signals), and how backers interpret this information to offer social support, providing a novel perspective for understanding the nuances of the delivery of project information for gaining backers’ support.

Previous research has identified the signals that can boost the success of crowdfunding initiatives (Belleflamme et al., 2014; Cai et al., 2019; Colombo, 2021; Connelly et al., 2011; Mollick, 2014). The findings have demonstrated that quality signals and information asymmetry are critical factors that can convey the viability of a project to potential backers and determine how well backers are informed about a project's quality. Belleflamme et al. (2014) emphasised how providing clear financial information can mitigate asymmetry and promote a sense of trust to attract social capital. According to Mollick (2014), project descriptions should instil trust and confidence so that backers are confident that their financial support will be rewarded, which has also been supported in other studies (Colombo, 2021). Furthermore, not only do monetary words contribute to establishing a sense of trust, but teams of entrepreneurs rather than solo founders also seem to be preferred. Entrepreneurial teams convey a set of knowledge and skills to navigate ventures’ complexities, which increases the probability of success (Bernardino et al., 2021).

Other authors (Belleflamme et al., 2014; Connelly et al., 2011) have asserted that information quality increases external support, particularly social proof, which can be measured through growth, which is measured as the difference between the money pledge and the goal achieved. The extent to which a project receives increasing support could drive the motivation of future backers, and detailed information should be assiduously conveyed in project descriptions.

In addition to monetary words, team composition and growth rate, signalling theory has been used to examine consumers’ purchasing process in crowdfunding (Turan, 2021). The findings indicate that backers often struggle to assess the true potential of crowdfunding projects based on the information provided in project descriptions. As a result, and in the context of this study, backers might rely on signals such as sustainability cues and/or the perceived degree of innovation based on personal experience.

Signals as conditions for crowdfunding successThe proposed signals and characteristics identified in previous research regarding successful Kickstarter projects in the context of this study include monetary, sustainability and innovation keywords (extracted from the project description) and growth rate and team composition. Previous empirical research concerning these signals is next assessed to provide a solid rationale for the constructing related hypotheses. In fsQCA, such hypotheses are presented as propositions.

Financial health signalsPrevious research on the use of monetary keywords in project narratives has been contradictory. One study demonstrated that using monetary-related keywords significantly influences the success of crowdfunding projects (Majumdar & Bose, 2018), wherein words related to the cost-effectiveness, affordability, savings or smart consumption are used in the project descriptions. Such language conveys a positive perception of a project's feasibility and can drive potential backers’ motivation. Subsequent positive assessments can also influence perceptions of the trustworthiness and legitimacy of crowdfunding projects.

In contrast, using monetary-related terms (e.g. discounts, promotions, savings) has also been found to negatively correlate to funding contributions. A previous study of 80,000 campaigns on Kickstarter confirmed the potential negative consequences of using monetary-related terms in project descriptions, and this effect was minimised for sustainability-related projects, which is examined in this research (Chan et al., 2021). Furthermore, non-financial factors such as team size, rather than financial keywords, were found to significantly influence crowdfunding success (Shneor & Vik, 2020).

This contradictory evidence suggests the need for a multi-faceted approach to examine crowdfunding strategies, including relational factors and community engagement, rather than solely relying on economic factors (Buttice et al., 2017; Cai et al., 2019). This holistic approach can also promote mindful consumption. By leveraging relational and community engagement factors, crowdfunding projects can foster a sense of collective awareness among backers (Gazzola et al., 2022).

Therefore, we argue that while acknowledging that conveying financial feasibility is essential for crowdfunding initiatives’ success, it should not be the only factor that drives crowdfunding projects, let alone a mindful consumption project. Therefore, this study presents the first proposition.

Proposition 1

The absence of financial health signals (monetary keywords) is a necessary condition for a mindful consumption project type.

Sustainability signalsRegarding sustainability cues, words related to circular economy business models are also drivers of backers’ support and attract the attention of backers that prioritise ethical and mindful consumption. Therefore, sustainability keywords should be included in associated project descriptions (Bansal et al., 2019; Cai et al., 2019). Projects that use words that refer to eco-friendly materials, renewable energy and/or water savings might receive higher support from backers (Böckel et al., 2021; Liang & Chen, 2021; Neumann, 2021). Previous research has argued that emphasising such attributes could resonate with environmentally aware consumers amidst growing public awareness of sustainable consumption practices. The inclusion of such terms attracts like-minded backers based on alignment with their ethical and sustainable values (Bansal et al., 2019; Dinh et al., 2024).

The overriding question for potential backers is whether the cues included in project descriptions presented in crowdfunding platforms solely intend to attract consumers’ attention (greenwashing) or are genuine factors of new ventures’ business purposes. To this end, Mollick (2014) stressed enhancing the quality and the transparency of project description to reduce such perceptions. To verify this issue further, this study presents following proposition.

Proposition 2

Sustainability signals are a necessary condition for mindful consumption projects.

Innovation signalsIn terms of innovation, information in project descriptions concerning the degree and form of innovation can convey identity-building signals (Colombo, 2021), particularly since consumers that back new venture ideas expect to be seen as innovators themselves, and active prosumers can drive other consumers’ motivations (see Shah et al., 2020 for a review). Additionally, including innovative components within a project description might convey a strong signal of a project's potential impact in terms of sustainability. When a project contributes to alternative modes of consumption (mindful consumption in this case), these identity-building signals could accelerate the transformation of consumers’ behaviours towards more sustainable practices when they support forward-thinking and mindful ventures.

Solutions that can be considered unique and creative are perceived as solidly grounded, reducing uncertainty. Moreover, serial crowdfunders’ success is closely linked to the intrinsic innovation of funded projects (Buttice et al., 2017; Mollick, 2014). In addition, innovative projects are essential for addressing the complex challenges of sustainability (Bansal et al., 2019). Therefore, we present the following proposition:

Proposition 3

Innovation signals are a necessary condition of mindful consumption projects.

Team composition and growth rate signalsThrough these propositions, this study challenges and re-evaluates what constitutes success for a Kickstarter project, without questioning the main objective of the platform to provide alternative funding options that nurtures entrepreneurship and ensures that promising projects succeed under more favourable conditions than standard project funding (e.g. venture capital funding). While previous studies have linked crowdfunding success to factors such as entrepreneurs’ credibility, alliances, and the quality of the crowdfunding project page (Huang et al., 2021), this study argues that financial success alone is not a valid indicator of success for mindful consumption projects. Therefore, alignment between the nature of a project and its impact on consumers’ transition to a more sustainable lifestyle, measured by sustainability and innovation cues, are essential and such signals should be considered prerequisites of success.

To this end, given the significance of relational factors that require a holistic approach to crowdfunding initiatives from the perspective of mindful consumption, other overlooked factors have also been analysed (Buttice et al., 2017; Cai et al., 2019; Gazzola et al., 2022). Therefore, whether a project is proposed by a solo founder or a team of entrepreneurs and the project's growth rate (measured as the difference between the money pledged and the goal achieved) are also predictors of social capital, which leads us to the final proposition:

Proposition 4

Team composition and growth rate have not been given enough attention as potential necessary conditions of mindful consumption projects; however, success cannot be guaranteed without them.

Formulation of propositionsAfter articulating signalling theory as the theoretical framework for assessing the extracted Kickstarter project information, we construct a model to quantify the link between each signal and the number of backers to examine mindful consumption projects, as shown in Fig. 1.

Water, energy, materials and sustainability keywords indicate the presence of sustainability cues within project descriptions. We also identify the type of innovation from the projects’ narratives, and financial health is assessed using the presence of monetary keywords in descriptions and the difference between the amount of money sought (goal) and the amount finally achieved (pledge). The influence of collaboration is measured by whether a project is represented by a group or brand or a single individual.

By examining financial feasibility, sustainability cues, collaboration and the degree of innovation, this analysis can uncover patterns and relationships that contribute to shaping sustainable ventures that contribute to consumers’ adoption of mindful consumption behaviours and facilitate future research. Including these specific conditions in a fuzzy-set analysis will provide a nuanced understanding of the factors that influence Kickstarter crowdfunding success. Additionally, by employing a fuzzy-set analysis to examine these theoretical frameworks and propositions, future researchers can assess the conditions that promote mindful consumption practices and contribute to a deeper understanding of how individuals, businesses and crowdfunding platforms can foster and promote mindful consumption.

MethodologyFuzzy-set qualitative comparative analysis (fsQCA)We take two approaches to address our research question: what conditions foster crowdfunding projects’ success in promoting mindful consumption behaviours and how? First, we identify the patterns that enable entrepreneurs to achieve success and focus on efforts using the dimensions analysed to examine the role of dimensions such as financial attractiveness (monetary keywords), sustainability and innovation. Second, we analyse which patterns lead to failure (i.e. a low level of focus on some dimensions or combinations) and prevent success.

We propose two hypotheses behind both phenomena. First, the existence of complex causality based on the logical relationships between the study's dimensions and possible combinations. Second, equifinality, in which results can be achieved through different routes, with no single cause attributable to both phenomena. The fulfilment of the aforementioned objectives and the validation of these hypotheses will provide valuable insights for entrepreneurs to establish strategic approaches to maximise the probability of crowdfunding success.

Qualitative comparative analysis with continuous data using fsQCA is selected to address these two approaches, given its adequacy for determining different degrees for categorising the factors and conditions considered. Qualitative comparative analysis can combine quantitative and qualitative approaches to identify patterns and casual relationships across a sample of cases, even when samples are small (Ragin, 2008; Schneider & Wagemann, 2012). The purpose of the method, which was proposed by Ragin (1987), is to establish the causal or necessary conditions that make it possible to obtain a specific result. More specifically, and in relation to the aforementioned propositions, fsQCA makes it possible to identify the extent to which the proposed conditions (team composition, growth rate and monetary, sustainability, water, innovation, material and energy keywords) facilitate success, which is indicated by a high number of backers.

Previous studies using this methodology have refined its implementation (Bafera & Kleinert, 2023; De Crescenzo et al., 2022; Kraus et al., 2018). Referencing these authors, fsQCA is preferred for this study over other methodologies as it can reveal complex configurations of factors to enhance the understanding of the interplay between multiple conditions. Moreover, although it can be applied with large samples (Vis, 2012), as noted above, it is also suitable for working with small and medium-sized samples (Fiss, 2007). This is particularly convenient when exploring emerging topics such as those addressed in this study.

The purpose of fsQCA is to determine the causes (called conditions) either individually or through combinations (configurations) that are sufficient to achieve a target outcome (a high number of backers, in this case) (Ragin, 1987). When applying this method, it is essential to consider one of its primary assumptions, which is related to the hypotheses; that is, asymmetry, referring to the conditions that allow a specific outcome to be achieved (a high number of backers) when they occur in inverse form (presence or absence) not necessarily causing the opposite outcome (i.e. a low number of backers) (Rubinson et al., 2019).

Finally, fsQCA identifies conditions as either necessary or sufficient. A condition is necessary if it is present when the outcome occurs, indicating that the outcome cannot occur if the condition is absent. A condition is sufficient if its presence guarantees the outcome, even if the outcome can be achieved in other ways (Ragin, 2008). Furthermore, core (high relationship with the outcome) and peripheral (low average level) conditions are also identified (Ferrer et al., 2023).

Finally, we propose two types of models. The first model seeks to identify how different degrees of focus on the conditions can achieve a high number of backers, which is called as the presence model. The second model, called the absence model, reveals how a high or low level of effort in the conditions can prevent achieving the result (a high number of backers).

Sample and calibrationThe use of fsQCA requires an adequate sample, ensuring that the cases in the sample are similar in terms of context and outcomes, but also have a certain degree of heterogeneity in terms of the absence or presence of conditions, i.e. the degree to which they exhibit the five dimensions of impact (Rawhouser et al., 2017).

Kickstarter's crowdfunding platform was chosen as it is considered to be the largest crowdfunding platform with international recognition (Mollick & Nanda, 2015). We first collected a dataset of 212 Kickstarter projects included in the environmental category. This category was chosen to increase the probability that the pursuit of alternative modes of consumption was present in project descriptions. Constructing the environmental projects dataset required extracting the contents related to the signals included in this study, which was described in the online project page of each crowdfunding campaign. This thorough work was performed in September 2023. Referencing previous research (Du et al., 2015), and given that project descriptions, creators and money pledged and goal achieved (growth rate) are clearly presented in project pages, the data were easily extracted. We then coded the dataset to identify the keywords that conveyed monetary, sustainability and innovation signals.

In addition, the criteria for projects’ selection were based on funding success, including only those with minimum pledge amounts of 50,000€. Notably, a successful project in the Kickstarter platform does not necessarily guarantee that the project will be launched in the market. Some entrepreneurs use Kickstarter as a testing ground before a final project is conceived (Mollick, 2014). For the purpose of this study, this should not be considered a limitation but an advantage, given that it reveals insights into current and future market demand. After sorting the dataset by the number of backers, two outliers were removed from the final selection. Therefore, 210 projects were included in the final sample.

As previously described, the outcome defined in this study (number of backers) is used as a proxy for social capital; therefore, the question of projects’ monetary success is not the main objective of this analysis but is instead defined as strong support from the community of backers. This means that a low backer ratio even when the crowdfunding project was successful, indicates that it did not drive strong support, whereas projects with a high number of backers are considered to shape consumers’ future mindful consumption practices. To define the conditions that best determine strong social support and might best describe whether a supported project promoted mindful consumption behaviours, we selected six conditions from the project descriptions: financing goals (monetary keywords), sustainability cues (materials, energy, water and sustainability keywords) and innovation keywords in addition to creator (team composition) and growth rate (money pledged versus goal achieved). These conditions constitute the narrative and storytelling approaches chosen by entrepreneurs as the factors that might lead to success based on experience and informed by previous successful projects on the platform.

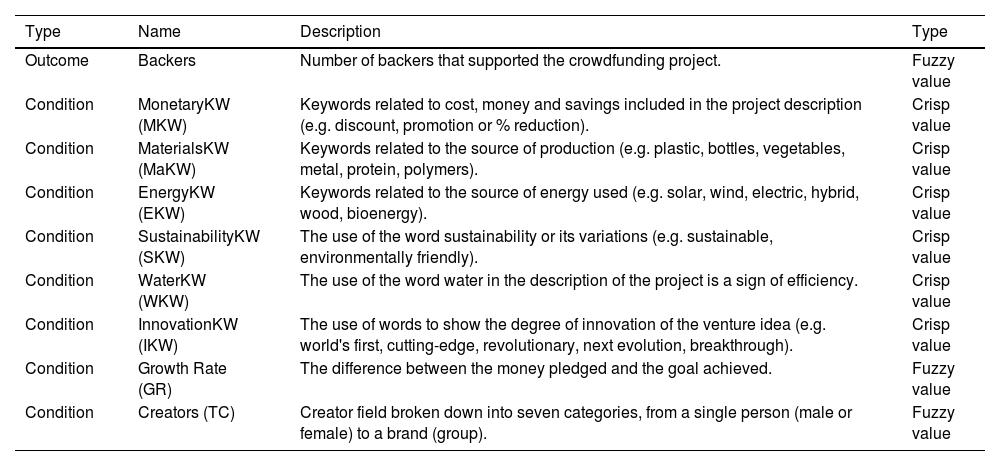

Based on the above, and referencing Ragin's approaches (1987, 2008), we identified two types of conditions. First, conditions that have continuous values and variations with a wide range of values are identified as fuzzy values. Second, dichotomous conditions that show the presence (1) or absence (0) of the keywords in the description are called crisp values (Table 1).

Outcome and Conditions: Description and Type.

| Type | Name | Description | Type |

|---|---|---|---|

| Outcome | Backers | Number of backers that supported the crowdfunding project. | Fuzzy value |

| Condition | MonetaryKW (MKW) | Keywords related to cost, money and savings included in the project description (e.g. discount, promotion or % reduction). | Crisp value |

| Condition | MaterialsKW (MaKW) | Keywords related to the source of production (e.g. plastic, bottles, vegetables, metal, protein, polymers). | Crisp value |

| Condition | EnergyKW (EKW) | Keywords related to the source of energy used (e.g. solar, wind, electric, hybrid, wood, bioenergy). | Crisp value |

| Condition | SustainabilityKW (SKW) | The use of the word sustainability or its variations (e.g. sustainable, environmentally friendly). | Crisp value |

| Condition | WaterKW (WKW) | The use of the word water in the description of the project is a sign of efficiency. | Crisp value |

| Condition | InnovationKW (IKW) | The use of words to show the degree of innovation of the venture idea (e.g. world's first, cutting-edge, revolutionary, next evolution, breakthrough). | Crisp value |

| Condition | Growth Rate (GR) | The difference between the money pledged and the goal achieved. | Fuzzy value |

| Condition | Creators (TC) | Creator field broken down into seven categories, from a single person (male or female) to a brand (group). | Fuzzy value |

Finally, it is necessary to conduct a data calibration process before applying the fsQCA. This requires 2k combinations (Ragin, 2008), where k is the number of conditions, i.e. this study includes 28 = 256 combinations of focus (high or low) in the eight dimensions identified.

It has been recommended that the calibration process be based on external knowledge to minimise the use of sample characteristics (Ragin et al., 2008). However, when data are collected through questionnaires, the use of positional measures such as the median as a point of maximum ambiguity is a widely accepted solution (Russo & Confente, 2019). More concretely, referencing Misangyi and Acharya (2014) and Fiss (2011), we consider a project to belong to a set (fully in) when it is included in the 90th percentile of condition or outcome scores representing that set, while projects that do not belong to a set (fully out) are those with condition and/or outcome scores that are below the 10th percentile, with the median constituting the point of maximum ambiguity. The results of this process are presented in Table 2.

Threshold value calibration.

| Full membership | Crossover point | Full non-membership | |

|---|---|---|---|

| Backers | 5046.0 | 1105.5 | 339.3 |

| Creators | 3.0 | 1.0 | 1.0 |

| Growth_Rate | 2871.9 | 486.7 | 11.6 |

| MonetaryKW | 1 (monetary); 0 (no monetary) | ||

| MaterialsKW | 1 (materials described); 0 (no materials described) | ||

| EnergyKW | 1 (sources of energy described); 0 (no sources of energy described) | ||

| SustainabilityKW | 1 (sustainability keywords); 0 (no sustainability keywords) | ||

| WaterKW | 1 (water keywords); 0 (no water keywords) | ||

| InnovationKW | 1 (innovation keywords); 0 (no innovation keywords) | ||

Table 3 presents the descriptive statistics.

ResultsTo ensure the validity of our results, we next assess the quality and validity of the models obtained, which depends on an indicator called consistency, which ranges from 0 to 1. Consistency measures the existence of a possible necessary or sufficient relationship between a condition or a set of conditions and an end result. According to Ragin (2017) and Scheneider and Wagemann (2010), a necessary relationship is valid if the indicator is equal to or greater than 0.9. In cases of one condition or combination of conditions, consistency must be equal to or higher than 0.75. This threshold assesses the model's validity. In addition to consistency, the coverage indicator expresses the degree to which a condition or combination of conditions explains the outcome.

Analysis of necessary conditionsThis analysis endeavours to identify whether a high degree of focus on one of the dimensions analysed is necessary to generate success in the project, which is represented by a high number of sponsors. For both models, the question is whether one dimension alone is sufficient to achieve high impact or whether a lack of focus on a single dimension would prevent the result from being achieved (Ruozzi & Vicente, 2021). The consistency values presented in Table 4 reveal that only the low level of focus on the monetary keyword dimension exceeds 0.9 in both cases of presence or absence, indicating that the absence of keywords related to monetary considerations is, by itself, a condition to achieve a high level of backers. This finding is relevant given that authors such as Ragin (2008) have argued that it is extremely rare to find necessary conditions in typical social science contexts where phenomena are characterised by complexity and multi-causality.

Analysis of necessary conditions.

| Model 1. Achieves high number of backers | Model 2. Fails to achieve high number of backers | |||

|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | |

| TCC | 0.793453 | 0.603737 | 0.764263 | 0.662816 |

| ∼TCC | 0.556854 | 0.674525 | 0.543093 | 0.749815 |

| GRC | 0.735271 | 0.773750 | 0.421333 | 0.505361 |

| ∼GRC | 0.529954 | 0.445520 | 0.811376 | 0.777454 |

| MonetaryKW | 0.089565 | 0.439500 | 0.100215 | 0.560500 |

| ∼MonetaryKW | 0.910428 | 0.470263 | 0.899791 | 0.529737 |

| SustainabilityKW | 0.314243 | 0.422466 | 0.376902 | 0.577534 |

| ∼SustainabilityKW | 0.685751 | 0.491241 | 0.623104 | 0.508759 |

| WaterKW | 0.211228 | 0.609706 | 0.118631 | 0.390294 |

| ∼WaterKW | 0.788766 | 0.439829 | 0.881375 | 0.560171 |

| InnovationKW | 0.185244 | 0.550909 | 0.132488 | 0.449091 |

| ∼InnovationKW | 0.814749 | 0.451751 | 0.867518 | 0.548249 |

| MaterialKW | 0.270428 | 0.428065 | 0.317005 | 0.571936 |

| ∼MaterialKW | 0.729565 | 0.483784 | 0.683001 | 0.516216 |

| EnergyKW | 0.146932 | 0.465161 | 0.148222 | 0.534839 |

| ∼EnergyKW | 0.853061 | 0.467709 | 0.851784 | 0.532291 |

Source: Author's elaboration based on 2023 Kickstarter data. Calculations were conducted using fsQCA 4.0 software.

Note: The necessary condition is in bold. KW = keywords; GRC = Growth rate; TCC = Team composition. The symbol (∼) indicates the absence of the condition, which is intended as a lower degree of impact on the pillar representing the condition.

fsQCA allows comparative assessments to be conducted among different configurations of conditions, resulting in an enriched examination of the relationships related to a given outcome. This analysis determines the extent to which the simultaneous presence or absence of several conditions (configurations) is sufficient for achieving the result. A configuration is valid when two conditions are met. First, the model must have a consistency equal to or higher than 0.75 (Ragin, 2008). Second, overall coverage must be higher than 0.25 (Fiss et al., 2013), ranking between 0.25 and 0.65, although coverage values are deemed unimportant for conditions with high consistency (Table 5).

Sufficiency analysis.

| Model 1. Achieves high number of backers | |||||||

|---|---|---|---|---|---|---|---|

| Conditions | Conf. 1a | Conf. 1b | Conf. 1c | Conf. 1d | Conf. 1e | Conf. 1f | Conf. 1 g |

| TCC | • | • | • | • | • | • | • |

| GRC | • | • | • | • | • | ○ | • |

| MonetaryKW | ○ | ○ | ○ | ○ | ○ | ○ | |

| SustainabilityKW | ○ | ○ | ○ | ○ | ○ | ○ | |

| WaterKW | ○ | ○ | ○ | ○ | • | ||

| InnovationKW | • | ○ | ○ | • | |||

| MaterialKW | • | ○ | ○ | ○ | ○ | ||

| EnergyKW | • | ○ | ○ | ○ | ○ | ○ | • |

| Consistency | 0.872 | 0.859 | 0.895 | 0.865 | 0.856 | 0.781 | 0.939 |

| Raw Coverage | 0.239 | 0.247 | 0.088 | 0.153 | 0.232 | 0.067 | 0.008 |

| Unique Coverage | 0.035 | 0.041 | 0.011 | 0.010 | 0.089 | 0.066 | 0.008 |

| Overall Consistency | 0.857 | ||||||

| Overall Coverage | 0.480 | ||||||

| Model 2. Fails to achieve a high number of backers | |||||||

| Conditions | Conf. 2a | Conf. 2b | Conf. 2c | Conf. 2d | Conf. 2e | Conf. 2f | |

| TCC | • | • | • | • | • | • | |

| GRC | ○ | • | ○ | ○ | |||

| MonetaryKW | ○ | ○ | • | ○ | • | ○ | |

| SustainabilityKW | ○ | ○ | • | ○ | • | ||

| WaterKW | ○ | ○ | ○ | ○ | ○ | ○ | |

| InnovationKW | ○ | ○ | ○ | • | • | ||

| MaterialKW | • | ○ | • | ○ | ○ | ||

| EnergyKW | ○ | ○ | ○ | • | • | ||

| Consistency | 0.877 | 0.773 | 0.869 | 0.986 | 0.988 | 1 | |

| Raw Coverage | 0.418 | 0.077 | 0.012 | 0.067 | 0.007 | 0.006 | |

| Unique Coverage | 0.297 | 0.008 | 0.012 | 0.016 | 0.007 | 0.006 | |

| Overall Consistency | 0.841 | ||||||

| Overall Coverage | 0.467 | ||||||

Source: Author's research based on 2023 Kickstarter data. Calculations were conducted using fsQCA 4.0 software, including the Quine–McClusky algorithm for the reduction of primary implicants.

Note: • and ○ respectively denote the presence/absence of the condition.

A theoretical relationship can only be considered absent when values are lower than 0.75 in the absence model (Fiss et al., 2013). Additionally, the analysis reveals three solutions: (a) a complex solution, which reduces the number of combinations assuming that the case configurations do not produce the outcome; (b) a parsimonious solution, which minimises the combinations assuming that the combinations without cases produce the outcome; and (c) an intermediate solution, which minimises the combinations assuming that only some of the combinations without cases produce the outcome. It is convenient to consider that two types of conditions in which the core conditions show parsimonious and intermediate solutions and indicate a strong causal relationship with the outcome, whereas peripheral conditions that only appear in the intermediate solution indicate a weaker causal relationship with the outcome (Ferrer et al., 2023).

We analyse the intermediate solution in this study, which aligns with the complex solution. Table 5 shows the results of the complex, parsimonious and intermediate solutions, where large circles indicate central conditions (strong causal relationship with the outcome), small circles denote peripheral conditions and the absence of circles indicates that the condition has a low influence on the outcome. Different configurations are analysed to identify the key factors that contribute to successful crowdfunding campaigns and how they are aligned with mindful consumption. Descriptive statistics are also analysed to further examine the results.

Unlike complex solutions, parsimonious solutions incorporate the logical residuals in an attempt to minimise the number of configurations but without incorporating a prior assessment by the researcher as to whether a sufficiency relationship is possible. Intermediate solutions offer a middle way, where the logical remainders are incorporated or not depending on the researcher's expectations in which logical remainders have been used in the derivation of the parsimonious solution (Thiem & Dusa, 2013). The intermediate solution is presented, although in the case of this study, the complex and intermediate solutions produce identical results. As such, the simpler, parsimonious solution is not included in the intermediate solution. This may be attributable to many of the 256 possible configurations not having at least one case.

The coverage of the configurations in both models indicates the proportion of cases explained by the configuration. Low coverage may be a consequence of equifinality, i.e. the presence or absence of a high-impact score can occur in multiple ways or the existence of necessary or present conditions in all configurations (Rubinson et al., 2019). In that sense, the overall coverage of the models is also slightly below the typical threshold of 0.60 (Mattke et al., 2022), suggesting that the results should be generalised with caution given the small number of configuration cases or consider the relevance of necessary conditions such as monetary keywords for the success model or those that are present in all configurations such as TCC.

The configurations of the presence (model 1) and absence (model 2) models show that TCC is the most relevant element since it is present in all models, which could indicate that the variable should be re-examined and its removal should be considered for both models. In the case of the presence model, the growth variable stands out as it is present in all but one of the configurations. In the absence model, the water variable stands out as its absence prevents the objective from being achieved in all six configurations. With this in mind, a more detailed comparison between the configurations is needed (Fiss et al., 2013; Mattke et al., 2022). Seven configurations are identified for the success model.

- •

Configuration 1a. Requires including four dimensions: TCC, GRC and management of innovation and energy keywords. Considering these four criteria, project managers can omit monetary and sustainability keywords.

- •

Configuration 1b. Requires including TCC and GRC dimensions and monetary, sustainability, water and energy keywords can be omitted.

- •

Configuration 1c. Requires including TCC and GRC as well as material keywords, and it is unnecessary to include monetary, sustainability and energy keywords.

- •

Configuration 1d. In addition to the focus on TCC and GRC, keywords other than monetary language can be omitted or included.

- •

Configuration 1e. Similar to 1d, success can be achieved by focusing on TCC and GRC and including sustainability keywords. The inclusion of other keywords is at the discretion of the project manager as it will have no impact on the result.

- •

Configuration 1f. Unlike the other configurations, this approach only requires the inclusion of TCC and innovation keywords.

- •

Configuration 1g. This is the most complex dimension as it requires the inclusion of TCC, GRC and keywords related to water, innovation and energy.

In the case of the absence model, the six identified configurations are detailed below.

- •

Configuration 2a. Requires focus on TCC, the absence of GRC and including material and sustainability keywords prevents achieving success.

- •

Configuration 2b. TCC and material keywords and the absence of keywords in the rest of the dimensions will prevent the achievement of a large number of sponsors.

- •

Configuration 2c. Focusing efforts only on TCC, GRC and monetary keywords implies that the project will not attract a high number of sponsors.

- •

Configuration 2d. Success cannot be achieved if the project manager works only on TCC and sustainability and material keywords and ignores other keywords.

- •

Configuration 2e. Including TCC and monetary, water and material keywords will not achieve a high number of sponsors.

- •

Configuration 2f. In addition to 2e, this is the most complex configuration in the absence model as it includes four conditions present (TCC and sustainability, innovation and energy keywords) and four absent (GRC and monetary, water and material keywords).

No central condition occurs in either of the models (they are all peripheral), although the presence of the TCC pillar in all configurations stands out. This is an indication of the adequacy of the work that project managers must do to convey this dimension, combined with the elimination of monetary keywords (necessary condition) to attract a high number of sponsors.

DiscussionWe next discuss the proposed models referencing the results (see Table 6 for a summary). In this study, the absence of monetary keywords is found to be a necessary condition (Proposition 1) and a requirement for either high or low backers’ support. This means that for environmental projects to be successful at gaining social capital, monetary keywords should be avoided. In practical terms, this means not adding words that are related to money to the project descriptions such as discounts, promotions and reductions. This result sheds light on previous contradictory evidence. Despite studies having demonstrated that monetary keywords are critical for success (Majumdar & Bose, 2018), later work revealed a negative correlation, even if the effect was minimised in sustainable projects (Chan et al., 2021).

Evaluation of propositions.

| Proposition 1: The absence of financial health signals (monetary keywords) is a necessary condition for a mindful consumption project type. | Accepted |

| Proposition 2: Sustainability signals are a necessary condition for mindful consumption projects. | Partially accepted |

| Proposition 3: Innovation signals are a necessary condition for a mindful consumption project. | Rejected |

| Proposition 4: Team composition and growth rate have not been given enough attention as potential necessary conditions for mindful consumption projects; however, success cannot be guaranteed without them. | Accepted |

Our proposition that sustainability keywords are a necessary condition for greater social capital (Proposition 2) is partially accepted. This substantiates the role of social signals and community support for successful crowdfunding campaigns. In the cases with either high or low backers’ support, their absence does not constitute a measure of social capital in and of itself. This supports most recent literature finding that green factors have significant effects on crowdfunding success, particularly in conjunction with qualitative measures such as comments between backers and creators (Tang et al., 2024), suggesting that sustainability cues should be reinforced by community interaction to achieve higher backers’ support.

Given the co-creative nature of crowdfunding (Nielsen & Binder, 2021), it is perhaps not surprising to find that innovation keywords are not relevant or necessary in any of the cases (Proposition 3), meaning that they do not encourage or deter success. This result contradicts previous research findings that projects offering incremental improvements rather than radical innovations tend to be more successful (Bargoni et al., 2024). Based on our results, innovation should be conveyed differently for environmental projects to gain social capital through reward-based crowdfunding and promote mindful consumption practices. Disruptive ideas are particularly essential when impact startups aim to make significant contributions to sustainable transitions (Anand et al., 2021).

Finally, the proposition that best reflects what constitutes a mindful consumption project with excellent backers’ support is Proposition 4 as the presence of the TCC pillar stands out in all configurations. Matching this with the necessary condition of eliminating monetary keywords will attract a higher number of sponsors. This result aligns with previous evidence emphasising the benefits of entrepreneurial teams’ knowledge and skills as a factor of success (Bernardino et al., 2021).

This study achieved its aim of understanding the conditions that determining how startups impact sustainable transitions by promoting mindful consumption practices. Consequently, the concepts of crowdfunding projects’ success and sustainable entrepreneurship are re-evaluated. Therefore, based on this analysis, we next propose some practical implications for the success of mindful consumption projects with excellent backers’ support.

Theoretical implicationsThis research contributes significantly to reward-based crowdfunding literature in several ways. First and foremost, it integrates the novel concept of mindful consumption with crowdfunding success factors, extending the theoretical understanding of how crowdfunding can catalyse sustainable development through consumer behaviour change. This is an important inquiry since consumers decide which projects best fit their mindful consumption mindset through backing projects in relation to self, community and nature. Considering the nature of the database, this is particularly true in the case of self and nature. Notably, identifying team composition as a crucial aspect of successful outcomes also sheds light on the community factor, and the findings add to the debate regarding the influence of monetary keywords for successful crowdfunding projects.

In addition, the idea that mindful consumption can be a success factor in itself is a novel perspective for evaluating crowdfunding success that enriches the current research on sustainable consumer behaviour. Previous studies have highlighted the important influence of personality traits (agreeableness, openness and conscientiousness) on sustainable crowdfunder behaviour, particularly in the context of crowdfunding for SDGs, wherein backers with traits such as sympathy for others (community) are more likely to support sustainability projects (Dinh et al., 2024). The empirical evidence underscores the importance of integrating aspects of mindful consumption to promote sustainable behaviour through crowdfunding.

Furthermore, fsQCA methodology offers a notable theoretical contribution by showcasing its utility for exploring the complex causal relationships in crowdfunding research. Although this is not a new approach, its application to explore mindful consumption in the crowdfunding context represents a significant leap forward, providing a theoretical toolbox that can be useful for crowdfunding researchers and project designers.

Managerial implicationsThe interdisciplinary nature of this research, intersecting innovation, sustainability and crowdfunding offers extremely practical insights for social and environmental entrepreneurs who are inclined to launch projects on reward-based crowdfunding platforms, particularly Kickstarter. As note previously, our results demonstrate that financial concerns are not linked to success, indicating it is not necessary for promoting mindful consumption and acts as a deterrent. Therefore, environmental project creators should be extremely cognizant that using words such as promotion, discount or reduction to attract backing could backfire. Creators should consider using the limited space in project descriptions to introduce other mindful consumption signals and prioritise sustainability cues (e.g. eco-friendly and ocean saving) over less relevant financial indicators. We consider to be as a crucial managerial implication since it urges entrepreneurs to be exceptionally strategic with project descriptions when entering the environmental category, where sustainability-focused language and innovation are crucial factors for attracting support.

Since crowdfunding campaigns’ success is influenced by projects’ social capital, entrepreneurs should leverage their networks and engage early with potential backers to build momentum for campaigns. This is not a new suggestion; previous research has already demonstrated that serial crowdfunders tend to benefit from the social contacts with those who backed previous campaigns (Buttice et al., 2017; Defazio et al., 2021), and qualitative work has shown that direct interactions in terms of number of comments and number of updates shared with the community of backers (Kromidha & Robson, 2016) increase success by establishing an enhanced sense of ownership. Our research contributes to these findings and can be used by one-off or incumbent entrepreneurs to ensure success.

This evidence indicates that a re-evaluation of success in Kickstarter's projects is in the making. For ventures to succeed in the long term, financial feasibility should be complemented with social capital as key indicators for success. Furthermore, this social capital should be established under the premise of a contribution that transcends business goals and pursues a social and/or environmental benefit of some kind. Detailed project descriptions should be carefully designed to convey a real commitment to this endeavour to achieve tangible outcomes such as greater funding than expected. By doing so, project creators can more effectively communicate the impact of their projects, with greater success and impact. By pursuing tangible social and environmental impact, environmental Kickstarter projects cultivate the promotion of mindful consumption. In addition, individuals are encouraged to make other ethical choices such as reducing water use and choosing alternative materials or sources of energy.

Despite the evidence provided in this study, the potential of crowdfunding to promote sustainable innovations seems limited. Therefore, while crowdfunding eases the achievement of capital to finance sustainability endeavours, this capital can often fall short and funding for research and development needs remains insufficient (Mollick, 2014). As a consequence, achieving short-term goals driven by traditional modes of consumption could be favoured. This prevents the ideation of long-term solutions that are essential for sustainable innovations (Bansal et al., 2019).

In remaining cognizant of these considerations, social entrepreneurs should reassess the conditions under which impactful and innovative business ideas might contribute to the promotion of mindful consumption practices while benefitting individuals, their communities and the ecosystems that nurture their business ideas.

ConclusionsThis research is unique in that it is the first to address the relationship between mindful consumption and crowdfunding success using an interdisciplinary approach that intersects sustainability, entrepreneurship and co-creation. This study identifies the necessary conditions for success of projects on Kickstarter but has also demonstrates how the definition of success can be reinterpreted beyond financial measures, which is a critical consideration for its focus on mindful consumption. This study also provides a useful toolkit for creators and first-time entrepreneurs seeking support for environmental projects. Additionally, the findings contribute to research on entrepreneurship and enrich existing theories concerning success in crowdfunding, settling an important debate around the need to include specific information about functional benefits regarding financial concerns in projects’ descriptions.

This study has some limitations. The selection of projects within the environmental category to build the dataset might potentially bias the results given the predisposition of backers of this category towards sustainability projects. In future research, a more comprehensive sampling approach could be employed to cover a wider crowdfunding ecosystem, including other categories (Bansal et al., 2019). In addition, the choice of projects in the environmental category might limit the scope of research and its applicability to other project types. As the mindful consumption perspective also considers community, a suitable addition for future research could be to consolidate our findings using Kickstarter's social category. Moreover, platforms could integrate functionalities that further drive greater engagement such as networking opportunities and community events around backers’ and funders’ shared interests (Buttice et al., 2017).

While fsQCA offers an enriched interpretation of the relationships between different internal factors and a nuanced analysis of the conditions leading to crowdfunding success, it may limit the generalisability of our findings to broader contexts and should therefore be considered with some caution. In addition, the focus on configurations of conditions rather than isolated variables does not completely capture linear cause-and-effect relationships that other quantitative methods could reveal (e.g. regression). Likewise, we could also engage in more profound qualitative research to capture richer insights as to the sustainable mindset. This could be achieved through thematic content analysis, in-depth interviews or case studies of project creators and backers. This seems particularly pertinent in the environmental category when a successful brand is engaged in serial crowdfunding (e.g. Nebia). A deep dive into specific creators will add depth and granularity to our results.

Since Kickstarter is only one of many reward-based crowdfunding platforms, perhaps another avenue for future research would be to replicate the research with other competitors such as Indiegogo or Patreon, which could increase the theoretical relevance and the innovativeness of our research, since most academic researchers have predominantly focused on Kickstarter. To this end and to avoid short-term engagement, platforms could differentiate themselves by offering distinctive funding models, encouraging proposals for long-term initiatives (Bansal et al., 2019; Clark & Brennan, 2016). In this regard, the examination of different types of crowdfunding other than reward-based (e.g. donation-based or equity) could provide additional insights concerning the evidence offered here. Furthermore, to add transparency and promote environmental and social projects’ accountability, incorporating audited impact assessments and third-party certifications should be addressed on crowdfunding platforms (Horne & Fichter, 2022), which will facilitate projects’ alignment with the reinforcement of regulation (e.g. Green Claims Directive).

Finally, since this research endeavours to understand the extent to which mindful consumption is capable of changing consumer preferences and behaviour (Fischer et al., 2017), it would be interesting to incorporate some temporal dynamics. Our sample provides a snapshot in time, which does not allow us to examine the evolving nature of consumer behaviour or the impact of external factors such as regulatory changes and sustainable-focused laws on crowdfunding success. Comparing this dataset over time would allow us to further explore the evolution of mindful consumption, in alignment with previous work on eco-innovation (Dabbous et al., 2024). In addition, the inclusion of educational components or functionalities in project descriptions could help to raise awareness concerning the urgency of cultivating more mindful consumption and advancing sustainable development.

Funding sourcesThis research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

CRediT authorship contribution statementAna M. Gómez-Olmedo: Writing – review & editing, Writing – original draft, Validation, Supervision, Software, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. María Eizaguirre Diéguez: Writing – original draft, Data curation, Conceptualization. Jose Antonio Vicente Pascual: Visualization, Software, Methodology, Formal analysis.

Ana M. Gómez-Olmedo is a lecturer (since 2015) in the Marketing and Business Administration Department at ESIC University. She teaches undergraduate courses (such as Corporate Social Responsibility, Digital Marketing or Marketing Management). She is also the director of the Degree in Sustainability Management. Her research focuses on consumer behaviour research for the transition to mindful consumption behaviours and the benefits of mindfulness practice for this transition. In particular, regarding its application to marketing and education for sustainable development. She has also taken part in projects related to digital marketing.

María Eizaguirre Diéguez is currently Associate Professor in the Marketing and Business Administration Departments at ESIC University, where she teaches courses at both undergraduate (Relational Marketing, Agile Methodologies, Digital Client Management, Digital Client Experience) and graduate level (Direction of New Products and Services, Organizational Design). She is also the coordinator of the Master in Marketing Management. Before this position she was Academic Director of the IE Centre for Customer-Centricity at IE Business School and Director of the Innovation Lab of IE University, where she refocused her career from business to academia and started her academic research in the field of customer centricity and customer centric innovation, including co-creation.

José Antonio Vicente holds a Doctorate in Business Administration along with a Bachelor's degree in Market Research and Techniques, a diploma in Statistics, and an Executive MBA. Additionally, he possesses advanced proficiency in English. With over 18 years of experience, José Antonio has held leadership positions in strategic planning, marketing, sales, and market research, both in consultancy and staff roles. He has worked in multinational environments across diverse sectors such as tourism, insurance, banking, FMCG, retail, industrial, and pharmaceutical industries. He excels at identifying business opportunities and formulating, implementing, and overseeing strategic plans by effectively integrating analytical and business skills. As a Founding Partner at Descyfra Consulting, a specialized business consultancy in Marketing Science, he has contributed to over 50 projects focused on driving business growth for renowned companies including Coca-Cola, General Motors, Endesa, Santander, AXA, Diners Club, SSL Health, Carrefour, and TripAdvisor (eltenedor), among others. Furthermore, José Antonio is a respected lecturer in undergraduate and postgraduate programs at various universities and business schools.