Small and medium-sized enterprises (SMEs) in Taiwan have made undeniable contributions to the rapid economic development of Taiwan over the last decades. In Taiwan's economic system, over 90% of businesses are SMEs. However, with the increasingly severe problems of population aging, labor demands, and talent development falling far below expectations, all small and medium-sized family businesses in Taiwan will face succession difficulties in the coming decade. In view of this, this study was mainly to discuss the issue of business succession, focus on the status of business successors, and analyze the impact of successor knowledge and succession willingness on corporate sustainable innovation and successful business succession. Moreover, this study also noted that leader approval would affect the relationship between business successor and sustainable innovation. In other words, the leadership positions of family businesses in Taiwan are generally held by elders, and they are often not willing to delegate their powers, thus, leader's willingness to delegate their power to and approval of the successor would be crucial to the successor's willingness to succeed in the family business.

According to the statistical data released by the Ministry of Economic Affairs in 2018, SMEs account for 25.05% of the businesses with 10–20 years of operations in Taiwan, and for 21.96% of the businesses with more than 20 years of operations (Ministry of Economic Affairs, 2012). In addition, according to the statistical data of Taiwan businesses in 2017, as set out in the 2018 SMEs White Paper, a total of 1,331,182 SMEs accounted for 97.64% of the overall number of businesses (Chen & Wang, 2018). Therefore, SMEs are currently a very hot research topic. According to the Global Family Business Survey 2018, only 5% of family businesses in Taiwan had relatively clear succession planning in place, which was far below the global average level at 16%, and few SMEs were able to complete succession smoothly (De Massis, Frattini, Majocchi, & Piscitello, 2018). Moreover, SMEs in Taiwan have inherent difficulties in completing succession, and thus, have greater difficulties in completing succession smoothly.

Family businesses in Taiwan have their particularity and representativeness, as the promotion of employees in Taiwan businesses is measured mainly according to employee loyalty to the business, and not their performance, which is also an essential difference between Taiwan and other countries, in particular European and American countries, regarding the treatment of human resources. In other words, employees who have worked in a business for more years could be promoted, which incurs the issue of succession and inheritance that contemporary Taiwanese SMEs have to cope with. As these senior entrepreneurs/leaders have been in high positions for long periods, and are reaching the age of retirement, it leads to the issue of the aging of the senior management of businesses as a whole. At this moment, whether the founders would let their family members, or persons other than family members, take over the businesses or even appoint professional management to manage the businesses will not only affect the key areas of the future operations of the businesses, it will also affect the key driver for the economic development of Taiwan in the future.

Literature review found that most research on business successors focused on the key conditions and factors for the succession of successors (Nuthall & Old, 2017), including tacit knowledge transfer (Henry, Erwee, & Kong, 2013), succession planning (Kansal, 2012), successor selection criteria (Perricone, Earle, & Taplin, 2010), qualities of successors (Dou & Li, 2013), successor training modules (Lansberg & Astrachan, 2010), successor development methods (Michel & Kammerlander, 2015), etc. However, there is currently little research regarding the relation between business successor and sustainable innovation. In addition, in the research of business successor and sustainable innovation, most scholars focused on discussing interview-based qualitative research, and ignored quantitative research. In view of the above, the purposes of this study are to conduct an in-depth discussion of the relationship between Taiwan's SMEs successors and sustainable innovation, fill the theoretical gap in the academic community, and provide relevant suggestions for business succession.

Literature review and hypothesisSustainable innovationSustainability has been defined as maintaining the existence of the human species, intergenerational welfare, and the productivity and resilience of economic systems (Tisdell, 1991: 164); as well as maintaining capital stocks – including “natural capital stocks” (Costanza, Daly, & Bartholomew, 1991) and the regenerative capacity of the environment (Hueting, Bosch, & De Boer, 1992). The concept of sustainable innovation in relation to business management has only emerged in recent years. The Brundtland Commission researched the correlation between environment and development, and created the term “sustainable development”, which it defined as “sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (World Commission on Environment and Development, 1987a, 1987b). In view of the above, for purpose of this study, sustainable innovation is defined as SMEs in Taiwan safeguarding the inherent values of business and giving full play to business vitality through suitable successors.

SuccessorThe concept of “successor” originated in the 1950s and 1960s, and was originally called “Replacement Planning”, which referred to early preparation for the case of the accidental loss of business leadership or senior management (Leibman & Bruer, 1994). Succession can also be called inheritance, which refers to the current decision makers of organizations having certain control over the concept of inheritance (Gephart, 1978). Lansberg (1988) believed that succession is more than the nominal inheritance of the leadership position of a business, it also includes changes in interpersonal relationships, power relationships, etc. in relation to this position; it was stated that succession is a process of inheritance, i.e., the transfer of power from the previous generation to the next generation, referring to replacement and handing over. Garman and Glawe (2004) suggested that succession is a structural process of reserving potential candidates for successors in pursuit of new roles. Hall (1986) defined “successor” as the planning of business for cultivating candidates for senior management positions in the upcoming years for the purpose of ensuring the continuity of the key positions of the business; specifically, potential persons are to be selected from all levels of the business organization, as based on the assessment and performance of personnel for implementing replacement planning. In brief, it is the process of replacing key roles in the organization of business.

Candidates for successors are generally classified into two types: first, family successors by inheritance; second, appointment of professional management; both types have advantages and disadvantages. While it seems easy for family successors to assume positions due to their familiarity with the business, they may be unable to adapt to or address abrupt market situations. While professional management with adequate knowledge and experience would generally be able to provide new ideas and creative visions to help a business grow and thrive, as nonfamily members, professional management may lack an understanding of the knowledge and culture of the business (Palacios, Martínez, & Jiménez, 2013); for example, Ahrens, Landmann, and Woywode (2015) found that, a succession event in a family has positive significant impact on the business promotion performance of the business. The succession of a CEO by a non-family member has a greater business promotion performance, as compared with that of a family member. In addition, based on the disturbance variable of a special quality (education level) for the succession of a CEO, high education level has significant positive interference effect, while low education level has significant negative interference effect. Similarly, Alshanty and Emeagwali (2019) also proposed knowledge capability will create the firm core competence of sustainable innovation.

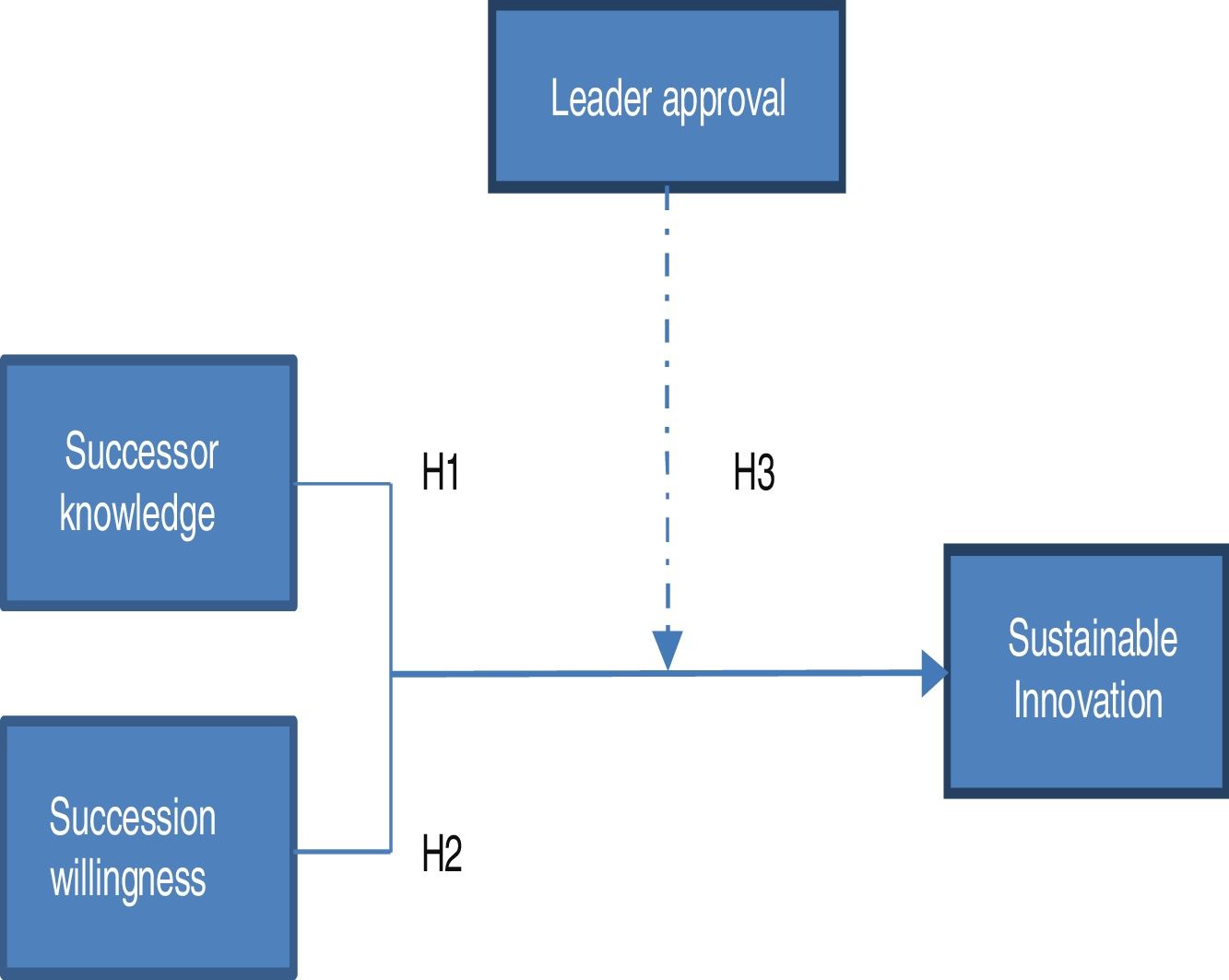

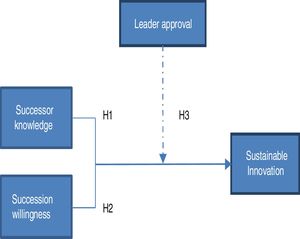

In view of the above, succession is a four-step process: the needs of the succession event, developing successor selection criteria, determining candidates for successor, and selecting a candidate for succession. Therefore, the overall succession process can be regarded as the founder transferring power to the successor and the successor realizing the innovation and sustainable development of the business by leveraging this power (Welsh, Memili, & Kaciak, 2016). In addition, in the process of power transfer, the successor will inductive the theory knowledge, continuously develop their management and decision making capabilities building sustainable innovation business model and consolidate their status (Allal & Bidan, 2017), thus, the following research hypothesis is proposed:H1 Successor knowledge is positively correlated to corporate sustainable innovation.

The replacement of leadership would result in power restructuring among the internal members of the business, which will have material impact on the strategies and structure of the business in the future (Weese, 1996), and is also of symbolic significance to external consumers, shareholders, suppliers, and the government (Kesner & Sebora, 1994); moreover, changes in the leadership of business from time to time will also lead to fights and conflicts within the business, which will further affect the operation and performance of the business (Rowe, Rankin, & Gorman, 2005). Lieberson and O’Connor (1972) stated that the impact of a successor's personal willingness for operating performance is below the impact of the industry and the business regarding operating performance; however, Day and Lord (1998) considered time lag (approximately 3 years) and reanalyzed the research data of Lieberson and O’Connor (1972), and found that the impact of successor's personal willingness on operating performance is higher than the impact of the industry and the business on operating performance. Thereafter, Nan and Mahoney (1981) also stated that a successor will have considerable impact on operating performance.

Founders of traditional business expect their successors to be equipped with management skills to lead the business to enter a higher level of development (Dyck, Mauws, Starke, & Mischke, 2002). Higher readiness of the successor will lead to higher mutual trust between the family and the business; when the business has improved tax savings and wealth transfer plans, the succession process will be smoother (Morris, Williams, Allen, & Avila, 1997). Accordingly, Sharma, Chrisman, and Chua (2003) stated that the leadership's inheritance willingness and the successor's succession willingness, as well as their recognition of their respective roles in the succession process and improved succession planning, will contribute to the smooth completion of the succession process. Venter, Boshoff, and Maas (2010) also found that the successor's succession willingness and readiness, as well as the relation between the successor and the predecessor, have significant positive impact on performance in the process of succession. Moreover, Woodfield and Husted (2017) stated that, generally, only 30% family businesses in Asia can be successfully handed over to the second generation for operation, and only 10% of such businesses can be successfully handed over to the third generation. It was also found that it is considerably difficult to successfully complete family business succession, thus, the following research hypothesis is proposed:H2 Successor's succession willingness is positively correlated to corporate sustainable innovation.

Goldberg and Wooldridge (2010) considered the successor's leadership experience, capabilities, and qualities, as based on the group decision-making model, and selected the best successor to guarantee the operating performance of a business. Accordingly, Cabrera-Suárez and Martín-Santana (2012) proposed succession planning practices, including that succession planning should maintain the metabolism of the organization; succession planning should have preplanning; candidate selection should be implemented properly; and supplementary measures should be provided. Each step of knowledge reserves, as well as the relevant training and development of successors for SMEs, are very important and closely related. The entire process, from talent selection to subsequent talent utilization and development, can be implemented through a system of a set of clear successor training modules, including five steps, i.e., positioning, defining, talent selection, talent development (training), and performance validation (Ling, Baldridge, & Craig, 2012).

Moreover, Chung and Luo (2013) discussed the development method of the second generation successor of business, as based on small and medium-sized family businesses in Taiwan, and found that successors who studied abroad since childhood may be unable to adapt to the typical paternalism of their fathers, such as powerful authority, centralized control, discipline and instruction, maintaining distance from subordinates, the requirement of absolute obedience and allegiance, and a leadership style without clear expression of intent. Moreover, they may be unable to adapt to the cultural atmosphere of the business, meaning that they are unable to obey and depend on the leadership, revere the leadership, and being subjected to the words of the leadership, hence, they may give up their succession training and return abroad. However, successors that have grown up in the environment of the family business can easily build the recognition and sense of belonging required for holding a position in a family business in the future. The external training and experience of offspring is generally unrelated to their family business; therefore, if they voluntarily join the family business as early as possible, most of them can independently undertake the responsibilities in the future through their internal training in the business. If offspring are willing to follow and learn from their parents and go through a long succession preparation period, but the parents are unwilling to delegate their powers, the two generations still need to cooperate with each other till the offspring ultimately becomes the de facto responsible persons, thus, the following research hypothesis is proposed:H3 Leader's approval has positive interference in the relation between the successor and corporate sustainable innovation.

Research framework demonstrated in Fig. 1.

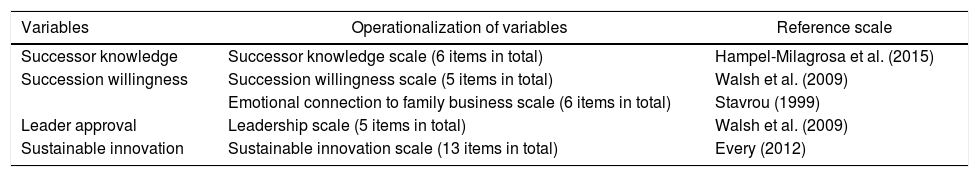

Research samples and methodsQuestionnaire and variablesThis study is divided into 4 variables: “successor knowledge”, “succession willingness”, “leader approval”, and “sustainable innovation”. As defined by prior scholars, the operational summary of the variables is shown in Table 1.

Operationalization of variables.

| Variables | Operationalization of variables | Reference scale |

|---|---|---|

| Successor knowledge | Successor knowledge scale (6 items in total) | Hampel-Milagrosa et al. (2015) |

| Succession willingness | Succession willingness scale (5 items in total) | Walsh et al. (2009) |

| Emotional connection to family business scale (6 items in total) | Stavrou (1999) | |

| Leader approval | Leadership scale (5 items in total) | Walsh et al. (2009) |

| Sustainable innovation | Sustainable innovation scale (13 items in total) | Every (2012) |

In this study, a questionnaire survey was applied to understand the relation between business successor and corporate sustainable innovation. The senior management of 128 companies in Taiwan were used as research samples. Statistical analysis was further conducted after organizing and summarizing the original questionnaire data recovered. This study was conducted from April 2018 to December 2018 on the senior management of small and medium-sized family businesses in Taiwan. The questionnaire survey in this study was divided into two stages, a pilot questionnaire and a formal questionnaire, and analyzed and described, as follows:

Pre-testThe pilot questionnaire of this study was dispatched to a total of 36 senior management persons of SMEs in Taiwan from April 2018 to June 2018, and a total of 30 valid pilot questionnaires were recovered.

Formal questionnaireIn this study, data were collected by means of dispatching printed questionnaires. In order to acquire the required information to validate the various research hypotheses, specific items were determined by inductive and deductive means; a Likert 5-point scale was implemented for item measurement indicators, from Strongly disagree (1) to Strongly agree (5); the higher the score, the higher degree of the agreement of the respondent. The lower the score, the weaker the relation between the second-generation business successor and corporate sustainable innovation. In addition, before dispatching the formal questionnaires of this study, the purpose and requirements of this study were explained to the respondents on the phone, and their consent was sought. Moreover, relevant personnel in the surveyed businesses were entrusted to assist in dispatching, recovering, and urging questionnaire completion, in order to ensure the truthfulness and validity of the questionnaires; this stage lasted from June 2018 to October 2018. After removing 22 incomplete and invalid questionnaires, a total of 128 valid questionnaires were recovered.

Statistical analysis of sample characteristicsThe table of statistical analysis shows that male respondents account for the largest proportion (60.2%), which indicates that most family businesses in Taiwan were founded or succeeded by males. Regarding age, respondents aged 41–50 account for the largest proportion (43.8%), and most successors are the eldest sons in the families (37.5%), followed by respondents who are the second sons in the families, (33.6%), which also represents a large proportion. Moreover, family businesses successfully inherited to the second generation account for 44.5% of the total number of family businesses in Taiwan, which indicates that most businesses in Taiwan are in the stage of handing over between the second generation and the third generation, and most of them have not yet completed succession, which is also the reason that partially contributed to the fact that less than 10% businesses in Asia have been inherited to the third generation. In addition, entrepreneurs in Taiwan account for 37.5% of the total number, which indicates that the structures of family businesses in Taiwan are dominated by first-generation entrepreneurs and second-generation successors. Regarding education background and level, most successors graduated from universities in Taiwan and have joined the family businesses for 6–10 years (35.9%). It should be noted that the scale of family businesses in Taiwan involving replacement planning is generally larger than that of SMEs in Taiwan. Family businesses with a total capital exceeding more than NT$ 10,000,000 account for 57.8% of the total number of businesses. In other words, family businesses with a larger scale are more likely to implement replacement planning for business succession as early as possible. Finally, the industrial structure in Taiwan is still dominated by manufacturing; family businesses engaged in manufacturing account for 59.4% and their leadership members are generally aged 60–69 years old (39.1%).

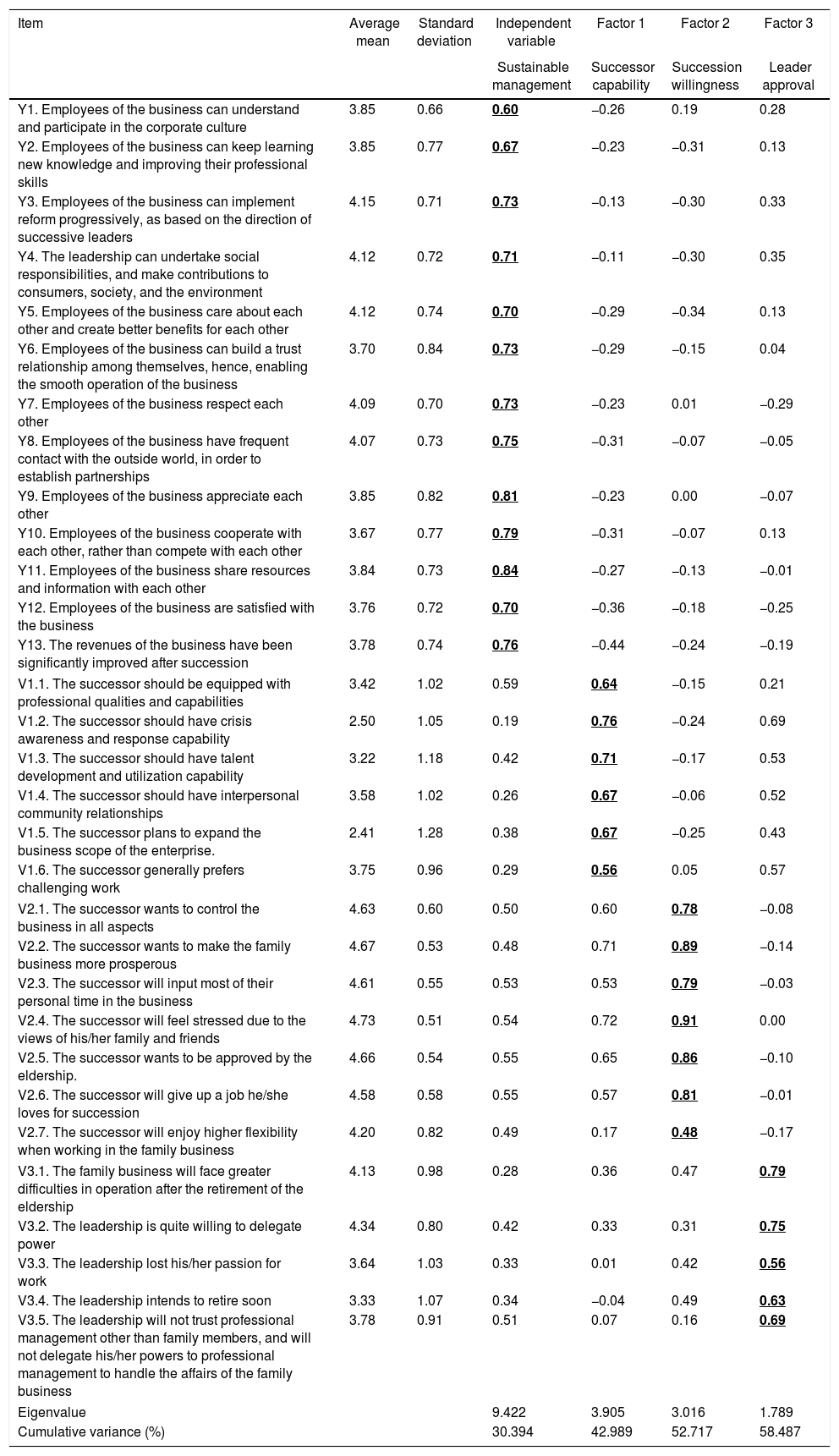

Reliability and validityThe above samples (a total of 128 samples) were used in this study for Exploratory Factor Analysis (EFA), which consisted of 31 items in total after the removal of 4 cross-loading items. The number of factors was determined on the basis of whether or not the eigenvalue was larger than 1; and 31 items were divided into 3 factors with reference to the line trend of the screening plot (Table 2).

Exploratory factor analysis of the measurement indicators for business succession and sustainable innovation.

| Item | Average mean | Standard deviation | Independent variable | Factor 1 | Factor 2 | Factor 3 |

|---|---|---|---|---|---|---|

| Sustainable management | Successor capability | Succession willingness | Leader approval | |||

| Y1. Employees of the business can understand and participate in the corporate culture | 3.85 | 0.66 | 0.60 | −0.26 | 0.19 | 0.28 |

| Y2. Employees of the business can keep learning new knowledge and improving their professional skills | 3.85 | 0.77 | 0.67 | −0.23 | −0.31 | 0.13 |

| Y3. Employees of the business can implement reform progressively, as based on the direction of successive leaders | 4.15 | 0.71 | 0.73 | −0.13 | −0.30 | 0.33 |

| Y4. The leadership can undertake social responsibilities, and make contributions to consumers, society, and the environment | 4.12 | 0.72 | 0.71 | −0.11 | −0.30 | 0.35 |

| Y5. Employees of the business care about each other and create better benefits for each other | 4.12 | 0.74 | 0.70 | −0.29 | −0.34 | 0.13 |

| Y6. Employees of the business can build a trust relationship among themselves, hence, enabling the smooth operation of the business | 3.70 | 0.84 | 0.73 | −0.29 | −0.15 | 0.04 |

| Y7. Employees of the business respect each other | 4.09 | 0.70 | 0.73 | −0.23 | 0.01 | −0.29 |

| Y8. Employees of the business have frequent contact with the outside world, in order to establish partnerships | 4.07 | 0.73 | 0.75 | −0.31 | −0.07 | −0.05 |

| Y9. Employees of the business appreciate each other | 3.85 | 0.82 | 0.81 | −0.23 | 0.00 | −0.07 |

| Y10. Employees of the business cooperate with each other, rather than compete with each other | 3.67 | 0.77 | 0.79 | −0.31 | −0.07 | 0.13 |

| Y11. Employees of the business share resources and information with each other | 3.84 | 0.73 | 0.84 | −0.27 | −0.13 | −0.01 |

| Y12. Employees of the business are satisfied with the business | 3.76 | 0.72 | 0.70 | −0.36 | −0.18 | −0.25 |

| Y13. The revenues of the business have been significantly improved after succession | 3.78 | 0.74 | 0.76 | −0.44 | −0.24 | −0.19 |

| V1.1. The successor should be equipped with professional qualities and capabilities | 3.42 | 1.02 | 0.59 | 0.64 | −0.15 | 0.21 |

| V1.2. The successor should have crisis awareness and response capability | 2.50 | 1.05 | 0.19 | 0.76 | −0.24 | 0.69 |

| V1.3. The successor should have talent development and utilization capability | 3.22 | 1.18 | 0.42 | 0.71 | −0.17 | 0.53 |

| V1.4. The successor should have interpersonal community relationships | 3.58 | 1.02 | 0.26 | 0.67 | −0.06 | 0.52 |

| V1.5. The successor plans to expand the business scope of the enterprise. | 2.41 | 1.28 | 0.38 | 0.67 | −0.25 | 0.43 |

| V1.6. The successor generally prefers challenging work | 3.75 | 0.96 | 0.29 | 0.56 | 0.05 | 0.57 |

| V2.1. The successor wants to control the business in all aspects | 4.63 | 0.60 | 0.50 | 0.60 | 0.78 | −0.08 |

| V2.2. The successor wants to make the family business more prosperous | 4.67 | 0.53 | 0.48 | 0.71 | 0.89 | −0.14 |

| V2.3. The successor will input most of their personal time in the business | 4.61 | 0.55 | 0.53 | 0.53 | 0.79 | −0.03 |

| V2.4. The successor will feel stressed due to the views of his/her family and friends | 4.73 | 0.51 | 0.54 | 0.72 | 0.91 | 0.00 |

| V2.5. The successor wants to be approved by the eldership. | 4.66 | 0.54 | 0.55 | 0.65 | 0.86 | −0.10 |

| V2.6. The successor will give up a job he/she loves for succession | 4.58 | 0.58 | 0.55 | 0.57 | 0.81 | −0.01 |

| V2.7. The successor will enjoy higher flexibility when working in the family business | 4.20 | 0.82 | 0.49 | 0.17 | 0.48 | −0.17 |

| V3.1. The family business will face greater difficulties in operation after the retirement of the eldership | 4.13 | 0.98 | 0.28 | 0.36 | 0.47 | 0.79 |

| V3.2. The leadership is quite willing to delegate power | 4.34 | 0.80 | 0.42 | 0.33 | 0.31 | 0.75 |

| V3.3. The leadership lost his/her passion for work | 3.64 | 1.03 | 0.33 | 0.01 | 0.42 | 0.56 |

| V3.4. The leadership intends to retire soon | 3.33 | 1.07 | 0.34 | −0.04 | 0.49 | 0.63 |

| V3.5. The leadership will not trust professional management other than family members, and will not delegate his/her powers to professional management to handle the affairs of the family business | 3.78 | 0.91 | 0.51 | 0.07 | 0.16 | 0.69 |

| Eigenvalue | 9.422 | 3.905 | 3.016 | 1.789 | ||

| Cumulative variance (%) | 30.394 | 42.989 | 52.717 | 58.487 | ||

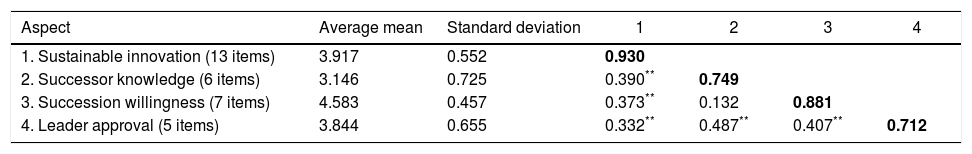

In this study, the independent variable Y is “sustainable innovation”, which is measured according to a total of 13 items, an eigenvalue of 9.422, and an explained variance of 30.394%; among the independent variables, Factor 1 is “successor knowledge”, which is measured according to a total of 6 items, an eigenvalue of 3.905, and an explained variance of 12.595%; Factor 2 is “succession willingness”, which is measured according to a total of 7 items, an eigenvalue of 3.016, and an explained variance of 9.728%; Factor 3 is “leader approval”, which is measured according to a total of 5 items, an eigenvalue of 1.789, and an explained variance of 5.77%. The cumulative explained variance of the three factors is 58.487%. Regarding internal consistency testing, Cronbach's alpha value is 0.930 for sustainable innovation, 0.749 for successor knowledge, 0.881 for succession willingness, and 0.712 for leader approval, which satisfies the requirement for Cronbach (Nunnally, 1978). The items for Cronbach testing were selected based on the following standard: removing an item contributed to improving the overall Cronbach Alpha value; and removing an item with a small Corrected Item-Total Correlation value after removal of the preceding item; while items with an Item to total (Corrected Item Total Correlation) greater than 0.3 were retained (Nunnally, 1978). It was found that each item in the model was greater than 0.3; therefore, all the items were retained. The correlation degree among items ranging from 0.132 (successor willingness factor and successor knowledge factor) to 0.487 (leader approval factor and successor knowledge factor) were considered as having moderate correlation (Table 3).

Cronbach analysis of measurement indicators for business succession and sustainable innovation, as well as the correlation among aspects.

| Aspect | Average mean | Standard deviation | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|---|

| 1. Sustainable innovation (13 items) | 3.917 | 0.552 | 0.930 | |||

| 2. Successor knowledge (6 items) | 3.146 | 0.725 | 0.390** | 0.749 | ||

| 3. Succession willingness (7 items) | 4.583 | 0.457 | 0.373** | 0.132 | 0.881 | |

| 4. Leader approval (5 items) | 3.844 | 0.655 | 0.332** | 0.487** | 0.407** | 0.712 |

Note: The diagonal line is Cronbach's alpha value (alpha).

** p<0.05.

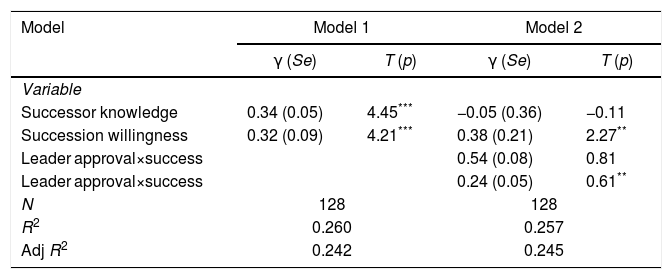

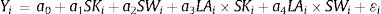

In order to understand the impact of successor and inheritor on corporate sustainable innovation, two models were designed in this study for estimating the results. Model 1 shows the impact of successor knowledge and succession willingness on corporate sustainable innovation; Model 2 shows the interference effect of leader approval on successor. In this study, the average score of the items of each aspect was obtained based on the results of Exploratory Factor Analysis, hence, the measurement of the dependent variable “sustainable innovation”, and the independent variables of “successor knowledge”, “succession willingness”, and “leader approval”, as well as the regression equations for Model 1 and Model 2, were further obtained, as follows:

where SKi refers to the questionnaire score of the ith respondent in the successor knowledge aspect; SWi refers to the questionnaire score of the ith respondent in the succession willingness aspect; LAi refers to the questionnaire score of the ith respondent in the leader approval aspect; LAi×SKi and LAi×SWi refer to the interference effect of leader approval on successor knowledge and succession willingness, respectively. Specific analysis results are shown in Table 4.Regression analysis of business succession and inheritance.

| Model | Model 1 | Model 2 | ||

|---|---|---|---|---|

| γ (Se) | T (p) | γ (Se) | T (p) | |

| Variable | ||||

| Successor knowledge | 0.34 (0.05) | 4.45*** | −0.05 (0.36) | −0.11 |

| Succession willingness | 0.32 (0.09) | 4.21*** | 0.38 (0.21) | 2.27** |

| Leader approval×success | 0.54 (0.08) | 0.81 | ||

| Leader approval×success | 0.24 (0.05) | 0.61** | ||

| N | 128 | 128 | ||

| R2 | 0.260 | 0.257 | ||

| Adj R2 | 0.242 | 0.245 | ||

Note:

*Refers to p-value<0.1.

Note:* p<0.1; ** p<0.05; *** p<0.01.

It can be found from the regression analysis results in Table 4 that, in Model 1, the multiple coefficient of determination R2 between the two independent variables of “successor knowledge” and “succession willingness” and the dependent variable “sustainable innovation” is 0.260, which indicates that successor knowledge and succession willingness can be used for explaining the variance of 26.0% of sustainable innovation. In addition, regression coefficients β are 0.34 and 0.32, respectively, which indicates that the two independent variables “successor knowledge” and “succession willingness” have positive impact on “sustainable innovation”, and P=0.00, referring to a significant impact level. Therefore, H1 and H2 are supported, i.e., successor knowledge and succession willingness are positively correlated to corporate sustainable innovation.

In Model 2, subject to the interference of leader approval with successor knowledge, the impact coefficient γ of successor knowledge on sustainable innovation is −0.05 (p=0.91), while the interference coefficient γ of leader approval with successor knowledge is 0.54 (p=0.42). Both results are insignificant, which indicate that leader approval has no significant impact on successor knowledge. Subject to the interference of leader approval, the impact coefficient of succession willingness increased by 0.06 (γ=0.38,p=0.02), as compared with Model 1; the interference coefficient γ of leader approval with succession willingness is 0.24 (p=0.05), which indicates a significant level. Therefore, H3 is partially supported; i.e., leader approval has significant positive impact on succession willingness, but has no significant impact on successor knowledge.

Conclusion and suggestionsConclusionThis study found that both successor knowledge and succession willingness have significant positive impact on sustainable innovation, which is also in line with the view of Herscovitch and Meyer (2002), meaning that in a family business, the successor will become more involved when they have a stronger sense of belonging. The empirical results show that successor knowledge shows more significant impact on corporate sustainable innovation than succession willingness, which indicates that the replacement planning of a family business attaches greater importance to the offspring's talents, and this also explains why “some family businesses will not let their offspring succeed to the businesses, and instead, they intend to appoint processional management to operate the businesses”, as indicated by Palacios et al. (2013). As Taiwanese families have many children and clan relatives, family members have a strong connection, and this blood tie tends to cause the succession willingness of a family successor to be ignored. In other words, both entrepreneurs and successors believe that family members should succeed the family business, and this is the responsibility and obligation of each family member.

Empirical study results show that leader approval has significant positive interference on successor's succession willingness; actually, leader approval is an affective commitment to the successor. The succession process where the successor becomes a competent manager capable of independently making decisions regarding the projects or affairs of the business through his/her efforts, and accumulating experience, is also the accumulation of capabilities. Therefore, higher leader approval will further motivate the successor's succession willingness. However, it should be noted that, the research findings show that leader approval has no direct significant impact on successor knowledge; successor's work capabilities are still accumulated through work and are not subject to the interference of leader approval.

In view of the above, while family business succession in Taiwan attaches more importance to the successor's capabilities, leader approval will also increase the successor's willingness to take over family business to some extent.

Managerial implicationsRegarding management practices in the current industrial structure in Taiwan, the depth of the technical environment and the width of the industrial environment are increased progressively due to the integration of the financial industry and technological industries; however, more than 90% of businesses are family businesses engaging in manufacturing, including many small and medium-sized manufacturers. Foreign investors are actively participating and investing in Taiwan's businesses, and even play a dominant role in Taiwan's market under the government's great efforts in promotion and development; however, such businesses are still constrained in the family business framework, and have simple form. Therefore, the pattern of nepotism and assertiveness will exist for years to come, and successors will undertake the important decision making responsibilities for the strategic layout of the family business. In this study, the impacts of the two key points in the replacement planning of family business, namely, the leadership and the successor, were discussed based on family business succession, in order to help business owners understand the core elements of family business succession, and allow family members to understand the importance of succession willingness and the interference of leader approval on the successor's succession willingness. Family business succession is not the obligation and responsibility of each family member, and not all family members want to take over the family business. This issue has been fully reflected in the research of Stavrou (1999), who pointed out that, in America, more than half of offspring do not want to succeed to the family business. Therefore, understanding the relationship between succession willingness, successor knowledge, and sustainable innovation will contribute to corporate sustainable innovation and succession.