Entrepreneurial orientation (EO) is associated with superior performance, although the mechanisms through which EO translates into an advantageous market position are still poorly understood. Drawing on EO and resource-based theory (RBT) literature, this study highlights the role of a systemic bundle of firms' capabilities in channelling the effect of EO on performance. The components of EO – innovativeness, risk-taking, and proactiveness – are analysed hierarchically to better understand how the entrepreneurial process builds within the firm and facilitates the development of idiosyncratic capabilities. The results, based on a sample of firms operating in rapidly evolving markets, suggest that innovativeness, as part of the organizational culture, contributes to risk-taking and proactiveness. Proactiveness enables firms to seize new market opportunities and foster innovation capability, directly and indirectly, through networking and market learning. Innovation capability is the ultimate driver of a firm's performance, in terms of enhancing its customer equity and business growth.

Entrepreneurial orientation (EO) represents the organizational adoption of key practices, management philosophies, and behaviours that are entrepreneurial in nature (Anderson, Covin & Slevin, 2009). EO is considered a cornerstone of the corporate or firm-level entrepreneurship literature (Wales, Gupta & Mousa, 2013; Kuratko, 2017) that embodies ‘the policies and practices that provide a basis for entrepreneurial decisions and actions’ (Rauch, Wiklund, Lumpkin & Frese, 2009: 763). After decades of prolific theoretical and empirical work, it is widely accepted that EO is associated with superior firm performance, not only in small start-up ventures, but also in well-established companies (Lampe, Kraft & Bausch, 2020). Paradoxically, although many studies investigate the EO-firm performance relationship, it seems that the mechanisms through which EO affects performance are still poorly understood (Putniņš & Sauka, 2020). In other words, the variables that may intervene in EO-outcome relationships are seldom modelled and, in this way, the reasons why EO is important for a firm to grow and outperform its rivals remain underexplored (Gupta, Niranjan & Markin, 2020). Therefore, the advancement of knowledge within the EO domain requires investigating models that reflect EO's immediate outcomes and thus how the EO effect is translated into an advantageous market position (Covin & Wales, 2019). Accordingly, this study examines the EO-performance relationship to identify the fundamental variables that drive EO's effect on performance (Landström, Åström & Harirchi, 2015; Ahmadi & O'Cass, 2018; Covin & Wales, 2019).

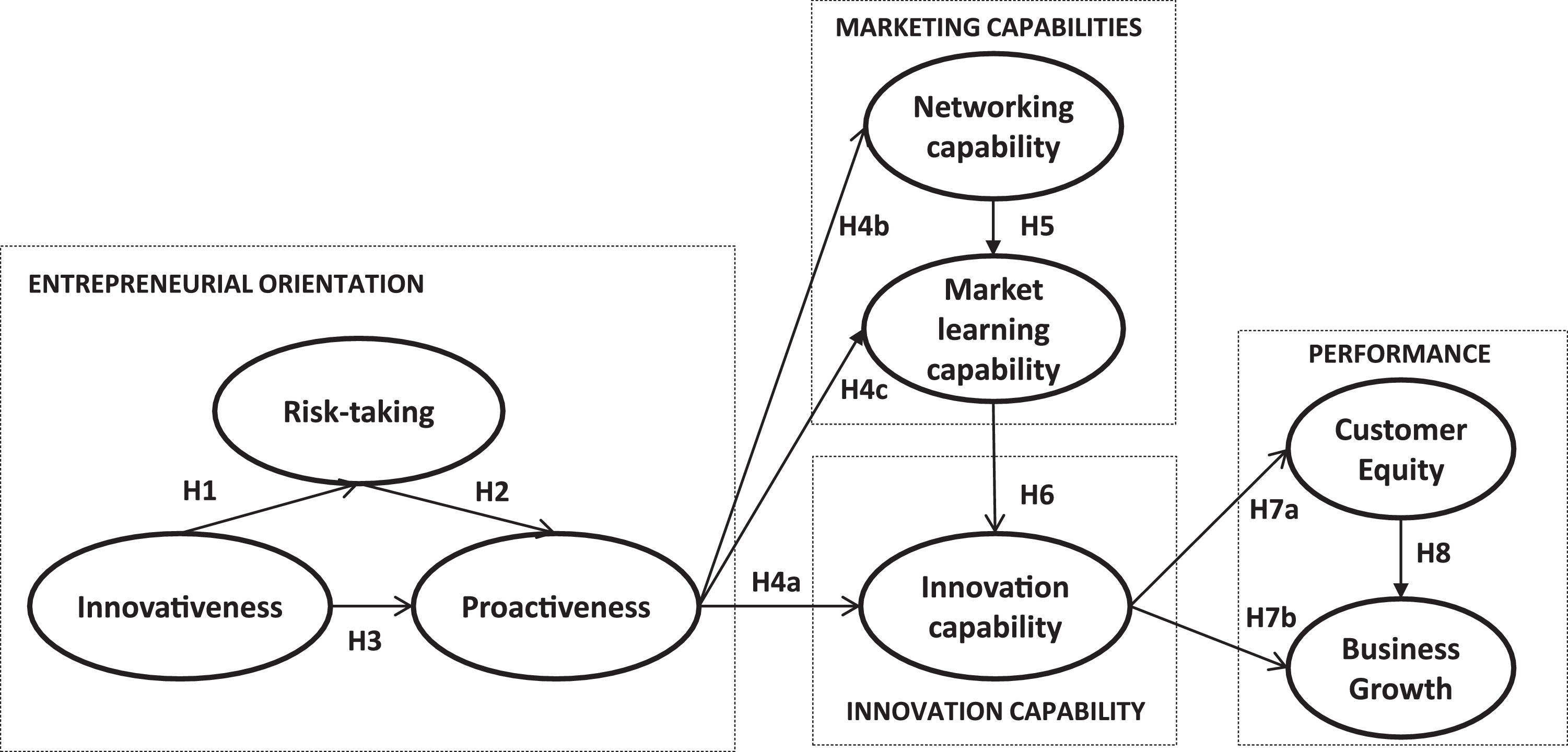

Previous studies have analysed either the aggregate role of different organizational capabilities as the missing link between EO and performance (Falahat, Lee, Soto-Acosta & Ramayah, 2021) or the individual role of some specific capabilities, such as innovation ambidexterity (Zhang, Edgar, Geare & O'Kane, 2016), organizational learning (Gupta et al., 2020; Karami and Tang, 2019), and operational marketing capabilities (Ahmadi & O'Cass, 2018). However, simultaneous analysis of a firm's innovation and marketing capabilities in the EO-performance relationship has barely been addressed. In this context, the resource-based theory (RBT) of competitive advantage (Barney, 1991) ‘can provide a helpful theoretical lens through which to understand how and why EO influences firm performance’ (Wales, Kraus, Filser, Stöckmann & Covin, 2021: 575). The RBT points to the systemic nature of organizational capabilities (Grant & Bakhru, 2016). Hence, identifying the key capabilities that channel EO into performance should go hand in glove while establishing relationships amongst them. This aspect, however, has been largely neglected in previous studies. To address this literature gap, this study focuses on the systemic role of firms’ innovation capability and architectural marketing capabilities (market learning and networking) as key drivers that channel the effect of EO into superior performance (Fig. 1).

Over the years, several renowned researchers have underlined the need to broaden our understanding of how EO is built within the organisation or to study the potential interrelationships between the dimensions of EO to provide models with greater conceptual precision and managerial relevance (Wales et al., 2013; Gupta & Dutta, 2018). The analysis of these relationships is a substantive issue that has received little attention in the literature despite its benefits for understanding how the entrepreneurial process is articulated and continues towards the development of marketing and innovation capabilities (Schindehutte, Morris & Kocak, 2008). As a result, a secondary goal of this research is to conduct an in-depth examination of the links between the EO dimensions and to present a new disaggregated hierarchical model of EO dimensions (Fig. 1).

Our study contributes to the extant literature in two ways. First, it develops a framework to explain how EO fosters a systemic bundle of innovation and marketing capabilities that reinforces the firm's competitiveness. In this study, innovation capability is defined as a firm's ability, relative to competition, to adopt or implement more new products or services with a greater degree of incorporated novelty (Mendoza-Silva, 2021). Although entrepreneurial firms are innovative in nature, empirical examination of the effect of EO on firms’ innovation capability has scarcely been addressed in previous research (Aljanabi, 2018). This gap originates from the common practice of EO research. The EO construct has been mainly measured considering the three dimensions identified by Covin and Slevin (1989): innovativeness, risk-taking, and proactiveness, using the nine-item scale developed by these authors (Wales et al., 2013; Wales, 2016). Thus, researchers measure the innovativeness dimension of EO as the number of products or services marketed by the firm (innovation intensity) and the intensity of changes in product or service lines (innovation novelty). Therefore, when using Covin and Slevin's (1989) EO scale, construct overlap should prevent the introduction of innovation capability in the conceptual model (Covin & Wales, 2019). However, in this study, following Matsuno, Mentzer and Özsomer (2002), Zhou, Barnes and Lu (2010), Martin and Javalgi (2016), and Arshi, Burns, Ramanathan and Zhang (2020), innovativeness is conceptualised as a cultural input of the innovation process, that is, as a pro-innovation corporate culture. In this way, we can use firms’ innovation capability as a distinct factor in the EO-performance relationship and expand previous empirical evidence mainly focused on the impact of EO on the number of new products developed (Arunachalam, Ramaswami, Herrmann & Walker, 2018), or the degree of novelty or success of the new products (Alegre & Chiva, 2013; Kocak, Carsrud & Oflazoglu, 2017).

Furthermore, we focus on two essential marketing capabilities identified in the literature to compete in modern, overcompetitive, and rapidly changing markets: networking capability (Mitrega, Forkmann, Zaefarian & Henneberg, 2017; Mu, Thomas, Peng & Di Benedetto, 2017) and market learning capability (Kaleka & Morgan, 2017; Varadarajan, 2020). Networking and market learning can be considered architectural marketing capabilities, that is, higher-order processes required to efficiently develop marketing mix tasks, whereas specialised capabilities refer to operational marketing mix skills (Vorhies, Morgan & Autry, 2009). Previous studies have analysed how EO enhances specialised or operational marketing capabilities (Martin & Javalgi, 2016; Ahmadi & O'Cass, 2018) or the moderating role of architectural capabilities in the relationship between EO and innovation output or the number of new products commercialised (Arunachalam et al., 2018). In this study, however, we analyse the specific role of EO in developing architectural marketing capabilities and their contribution to strengthening the firm's central innovation capability, the ultimate driver of the firm's performance.

Zhao (2005) stated that a combination of entrepreneurship and innovation is vital to organizational success in dynamic and changing environments. Our approach amplifies and clarifies this idea, particularly highlighting the systemic nature of marketing and innovation capabilities that create a sustainable competitive advantage (Feng, Morgan & Rego, 2017) and channel EO into performance. The following quote from Forbes CommunityVoice translates these systemic relationships into simple business jargon: ‘Think of marketing and innovation like a pair of gears that work together to move your entrepreneurial success engine forward’ (Young Entrepreneur Council, 2014).

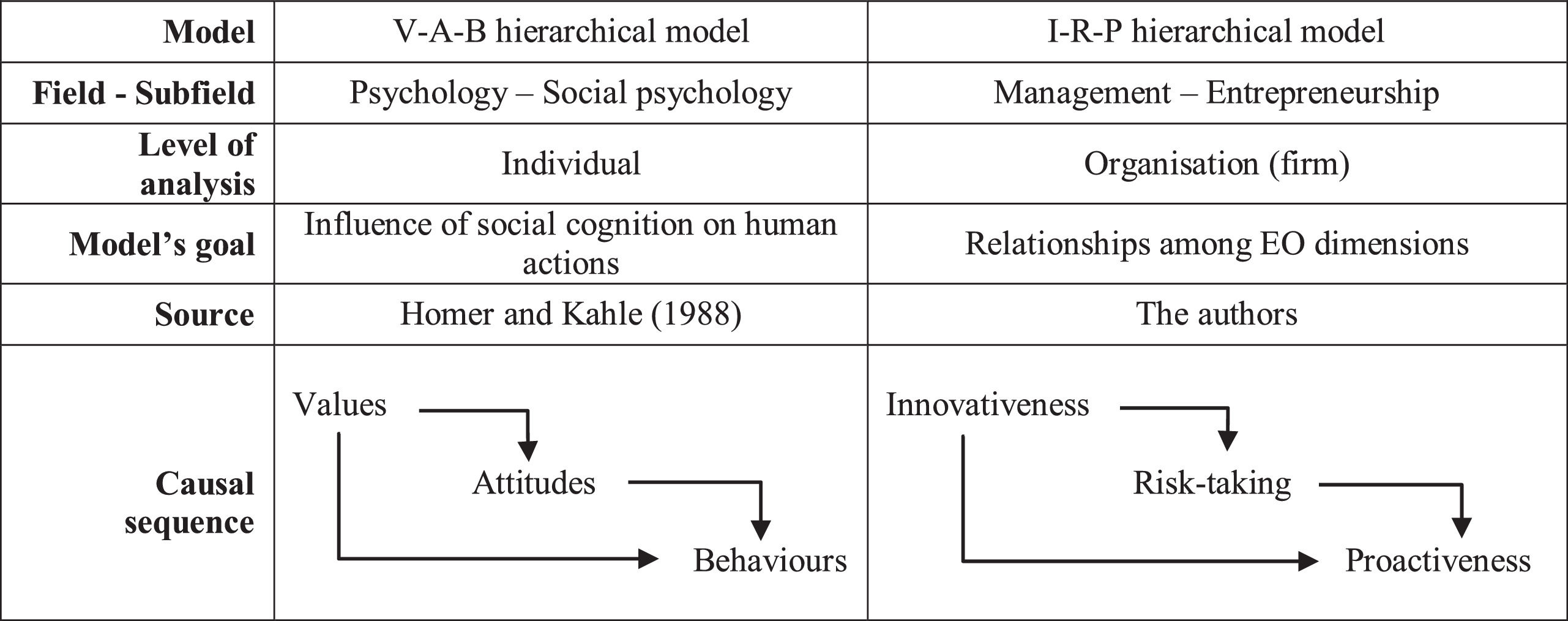

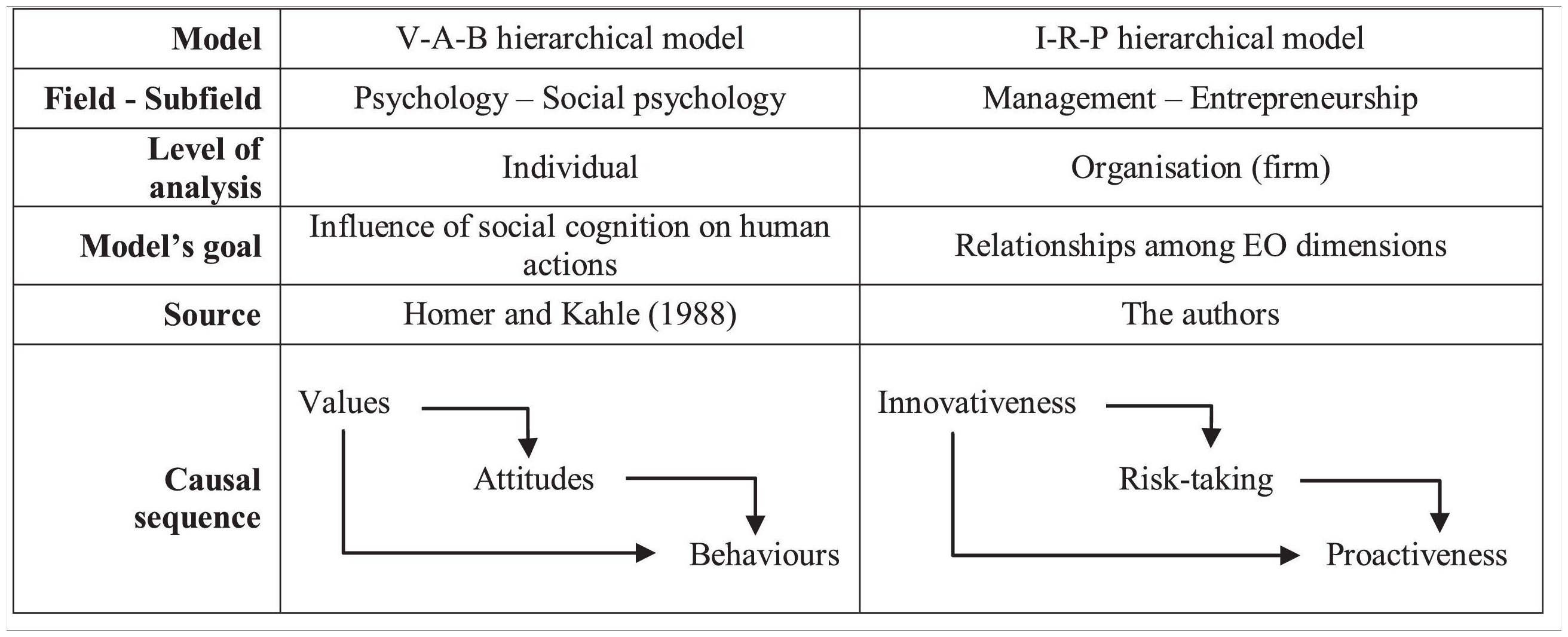

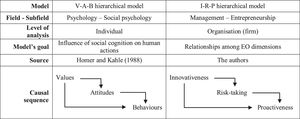

The second contribution of this study responds to the call of Wales et al. (2013) and Gupta and Dutta (2018) to examine the relationships amongst individual EO dimensions. The analysis of the causal relations amongst the EO dimensions can help to broaden our understanding of EO as an interdependent process and the logic underlying entrepreneurial behaviour. However, few studies have adopted this approach so far (Tang, Kreiser, Marino, Dickson & Weaver, 2009; Pérez-Luño, Wiklund & Cabrera, 2011; Joshi, Das & Mouri, 2015; Putniņš & Sauka, 2020; Hurtado-Palomino, De La Gala-Velásquez, & Merma-Valverde, 2021). Therefore, we propose an original disaggregated model of the relationships amongst the three dimensions of EO, inspired by Homer and Kahle's (1988) Value-Attitude-Behaviour (V-A-B) model, to achieve two important objectives: (i) to develop a more comprehensive view of EO as an interdependent process (Gupta & Dutta, 2018), and (ii) to provide valuable insights on EO's contribution to the development of firms’ capabilities and performance. In other words, by disaggregating the EO construct, we open the black box of how EO builds within the organization (Joshi et al., 2015) and we can illuminate how EO facilitates the development of key organizational capabilities to compete in modern markets. In this study, innovativeness, as a part of organizational culture (Arshi et al., 2020), is the primary factor that affects proactiveness, both directly and indirectly, through risk-taking. Proactiveness, in turn, is deemed the key process by which entrepreneurial firms seize new market opportunities through the development of innovation and marketing capabilities.

Literature reviewEO dimensions revisitedAlthough the dimensionality of EO has been the subject of intense academic debate, the three dimensions identified by Miller (1983) and Covin and Slevin (1989) have been the dominant approach for modelling this firm-level strategic posture (Wales et al., 2013).

Innovativeness is a firm's willingness to nurture creativity and experimentation; that is, its tendency to engage in and support new ideas, technological leadership, novelty, R&D, and other innovation activities to develop new products, services, and processes (Lumpkin & Dess, 1996; Hughes & Morgan, 2007). The empirical literature, primarily based on Covin and Slevin's (1989) popular scale, tends to measure innovativeness as an output – the number of products or services marketed (innovation intensity) and changes in product or service lines (innovation novelty). However, Linton (2019) and Arshi et al. (2020) claimed that redefining the innovativeness component of EO as input would improve the clarity of the dimension and make it more congruent with EO's conceptualisation. Knight and Cavusgil (2004) pointed to the organisational culture roots of EO. Therefore, innovativeness as input has been defined as an internal environment favourable for innovation (Rubera & Kirca, 2012); that is, innovativeness represents openness to new ideas as a trait of a firm's culture (Hult, Hurley & Knight, 2004). This reconceptualization of innovativeness as a cultural trait has been used in the EO literature by Matsuno et al. (2002), Zhou et al. (2010), and Martin and Javalgi (2016). Therefore, from our conceptual approach, entrepreneurial firms are receptive to new products, services, and/or process proposals and undertake the necessary activities to create a favourable environment for innovation, whereas innovation capability is a consequence of entrepreneurial behaviour.

Risk-taking reflects a managerial attitude favouring strategic actions that have uncertain outcomes. It is generally associated with a tendency to accept bold actions, such as entering unknown new markets and/or committing a large portion of resources to risky ventures (Lumpkin & Dess, 1996). Entrepreneurial firms consider risk-taking as a potential source of value creation in modern markets, in which consumers continuously demand change. Meanwhile, risk-taking is considered as an effective means of preventing inertia, inaction, and even adherence to traditions in more consolidated firms (Hughes & Morgan, 2007).

Proactiveness is a forward-looking perspective in which firms actively seek to take the initiative by anticipating future demand and pursuing new opportunities. For example, by introducing new products ahead of the competition or by participating in emerging markets, companies attempt to obtain first-mover advantages and create change and lead rather than follow (Lumpkin & Dess, 1996; Hughes & Morgan, 2007). Proactiveness, therefore, reflects firm behaviour that recognises and seizes market opportunities quickly, taking the initiative to be the first to market. Thus, proactive firms can lead and generate new businesses, thereby shaping the market (Forsman, 2011).

Relationships amongst the EO dimensionsTwo salient conceptualisations of EO coexist in the literature, with each approach providing unique insights. The unidimensional perspective focuses on the commonalities of the set of EO dimensions and models it as an aggregate composite or gestalt construct. On the contrary, the multidimensional perspective assesses dimensions as independent constructs. Under this disaggregated conception, EO is a label for different dimensions considered collectively (Covin & Lumpkin, 2011).

After Covin and Slevin's (1989) contribution, and for more than a decade, the unidimensional approach was the mainstream framework. As the field has been refined, the multidimensional perspective based on Lumpkin and Dess (1996) has gained momentum, ‘indicating greater acceptance of the notion that EO dimensions may manifest unique contributions to firm outcomes’ (Wales et al., 2013: 370). However, beyond isolating these unique influences of different EO dimensions on other dependant variables, the disaggregated conceptualisation also allows exploring possible causal relationships amongst the EO dimensions to understand how the entrepreneurial process builds. For instance, Wales et al. (2013: 375) advised researchers to ‘examine the relationships between the EO dimensions to explore whether some dimensions influence others when investigating EO as a multidimensional phenomenon’. Gupta and Dutta (2018: 165–166) asserted that ‘the inter-relationships between the dimensions (of EO) is a key theoretically substantive issue that has gone relatively unnoticed’. When discussing the path ahead for strategic orientation research, Cadogan (2012: 343) underlined that ‘modelling a strategic orientation as a single aggregated composite may not be so beneficial: if the dimensions… have different magnitude relationships with performance… or interact with each other…, since real relationships may be hidden’. He specifically called for the construct to be viewed in a variety of disaggregated ways to develop models with greater conceptual precision and managerial relevance.

Despite this gap, to the best of our knowledge, only five studies have examined the nature of the hierarchical causal relationships between EO dimensions. Tang et al. (2009) pioneered the disaggregated hierarchical approach. In their model, proactiveness was the primary factor in encouraging the other dimensions of EO, risk-taking and innovativeness. Putniņš and Sauka (2020) also identified proactiveness as a driver of risk-taking, while innovativeness moderates the relationship between risk-taking and performance. Hurtado-Palomino, De La Gala-Velásquez, & Merma-Valverde, 2021 almost inverted the order of the causal link: risk-taking is the driver of proactiveness, and innovativeness moderates the relationship between proactiveness and performance. Joshi et al. (2015) and Pérez-Luño et al. (2011) explored other hierarchical relationships, sharing the view that both proactiveness and risk-taking may influence innovativeness. Nevertheless, the five studies mentioned above measure innovativeness as an innovation output rather than as an input to the innovation process.

To develop a new theoretical perspective, we also opt for a disaggregated model. We then rely on social psychology to provide a useful analogy for theory building on the relationships amongst EO dimensions. Homer and Kahle (1988) formulated the influential Value-Attitude-Behaviour (V-A-B) hierarchical model to explain individual actions. Values are considered high-level abstractions, a type of social cognition that facilitates adaptation to the environment. Values then serve as inputs for shaping midrange attitudes and specific behaviours. The underlying assumption is that values can influence behaviours, both directly and indirectly, through attitudes. This conceptual framework can be applied at the organizational level, mutatis mutandis, to develop a novel model of the relationships amongst the three dimensions of EO – the Innovativeness–Risk-taking–Proactiveness (I-R-P) hierarchical model (Table 1). Innovativeness (organizational culture or values) is at the top of the hierarchy and influences proactiveness (entrepreneurial behaviours), both directly and indirectly, through risk-taking (managerial attitudes).

According to Tushman and O'Reilly (1997), organizational culture lies at the heart of innovation. Therefore, innovativeness is considered the initial variable in the causal sequence of the EO construct. One might reasonably suppose that openness to new ideas encourages risk-related attitudes and abilities. On one hand, a culture that supports innovation should foster managerial risk-taking attitudes and mitigate risk aversion. For instance, Koberg and Chusmir (1987) demonstrated that the presence of an innovative culture is positively related to managers’ propensity for risk-taking. On the other hand, a sustainable innovation-friendly environment requires risk management abilities. Innovative firms are expected to assess the degree of risk and respond appropriately given the degree of such risk. Based on this discussion, we have formulated the first hypothesis.

H1: Innovativeness is positively associated with risk-taking.

Furthermore, the risk-taking dimension is deemed a reasonable antecedent of a firm's proactiveness (Hurtado-Palomino, De La Gala-Velásquez, & Merma-Valverde, 2021). A constructive risk-taking attitude generates bias for opportunity-seeking behaviour, that is, exploration and exploitation (Lumpkin & Dess, 1996; Hughes & Morgan, 2007). Moreover, risk-taking managers usually seize opportunities and commit resources before fully understanding the actions that need to be taken (Covin & Slevin, 1991). Organizational studies may provide valuable insights into the micro-foundations of entrepreneurial attitudes and behaviours in established firms. Caldwell and O'Reilly (2003) analysed the role of workgroup norms in high-technology organisations. According to their results, when risk-taking is both accepted and encouraged, and mistakes are expected when trying new ideas, new and creative solutions to problems are likely to emerge. Similarly, Sethi, Smith and Park (2001) showed that encouraging cross-functional product development teams to take risks leads to more innovative behaviour. In summary, when managers assess and seek to manage their firm's risks, they are more likely to take the initiative and proactively address market challenges (Bromiley, McShane, Nair & Rustambekov, 2015). Therefore, the second hypothesis of this study is as follows.

H2: Risk-taking is positively associated with proactiveness.

The direct influence of innovativeness on proactiveness is included in the model, as extant literature emphasises the importance of creating a supportive organisational culture that enables people to behave proactively (Rubera & Kirca, 2012). Crant (2000) proposed that organisational culture directly affects proactive behaviour. From a marketing perspective, Nasution, Mavondo, Matanda and Ndubisi (2011) observed that innovative cultures enable employees to be more proactive towards customer needs. More importantly, Thomas, Whitman and Viswesvaran (2010) suggested that innovativeness could lead to the emergence of proactive norms that transcend the passive tendencies of individual employees. Brettel, Chomik and Flatten (2015) showed that non-hierarchical cultures play a significant role in determining the degree of proactiveness amongst small and medium enterprises. In a fine-grained analysis using Schein's multi-layered model of organisational culture (Schein, 1992), Hogan and Coote (2014) demonstrated that innovation-orientated cultural elements – values, norms, and artefacts – support the innovative behaviours of law firms. In other words, an innovative culture is conducive for being proactive. These arguments lead to the third hypothesis.

H3: Innovativeness is positively associated with proactiveness.

Capability is an intermediate transformation ability between the resources (inputs) and objectives (outputs). Deploying innovation capability involves a constant search for change, which drives new and improved products and processes (Breznik & Hisrich, 2014). Although capabilities are difficult to observe, they can be measured in a relative sense by benchmarking them against competition (Teece, Peteraf & Leih, 2016). Building on these ideas, we define innovation capability as the ability to commercialise, relative to competition, a higher rate of new products or services with a higher degree of incorporated novelty (Mendoza-Silva, 2021). Innovation intensity and innovation novelty, from a benchmarking perspective, constitute the two fundamental pillars of innovation capability.

Although some authors have envisaged that EO could be a significant driver of firms’ innovation capability (Saunila, 2020), empirical examination of this relationship has been poorly addressed in the literature. Previous research has mainly focused on the impact of EO, conceptualised as an aggregated construct, on product innovation novelty (Kocak et al., 2017) rather than innovation capability. Researchers have also focused on the effect of EO on product innovation success (Alegre & Chiva, 2013) and the number of new products developed annually by the firm (Arunachalam et al., 2018).

Moving a step further, our disaggregated EO model disentangles the development of innovation capability. In our analysis, proactiveness is considered to be the specific dimension of EO through which entrepreneurial firms seize new market opportunities via innovation. Proactiveness allows market inefficiencies to be identified and mitigated in advance, and creates new opportunities to redefine the market (Kreiser, Marino, Kuratko & Weaver, 2013). Therefore, proactiveness is expected to enhance a firm's innovation capability. The scant empirical literature on disaggregated configurations for EO does not explore this causal relationship: in previous studies proactiveness is mainly associated to firms’ innovation output, rather than innovation capability (Joshi et al., 2015; Pérez-Luño et al., 2011; Tang et al., 2009). Therefore, the following hypothesis is proposed.

H4a: Proactiveness is positively associated with the firm's innovation capability.

Marketing capabilities represent complex processes that involve combining market knowledge and available organisational resources to scan and track the market in pursuit of new opportunities, to better adapt to changing market conditions and, therefore, define, develop, and deliver superior market value (Morgan, Vorhies & Mason, 2009; Varadarajan, 2020). Vorhies et al. (2009) identified two distinct sets of marketing capabilities: (i) architectural capabilities, which help organisations acquire market knowledge and use their internal and external networks to build resources and better understand their clients; in this way, architectural capabilities help firms to be the first to identify and seize market opportunities; and (ii) specialised capabilities, which are linked to the tactical activities required to design and commercialise the firm's offer, such as communication, personal selling, pricing, and distribution. In this study, networking and market learning represent architectural marketing capabilities.

Networking capability is a firm's ability to initiate, maintain, and utilise relationships with various external partners, such as customers, suppliers, or competitors (Mitrega et al., 2017). Networking capability indicates a firm's ability to manage inter-firm relationships, find suitable network partners, and cooperate with them regularly (Mu et al., 2017). Networking activities allow firms to acquire relevant market information, identify new technologies critical for their long-term competitiveness in advance, and be ready for change (Covin, Eggers, Kraus, Cheng & Chang, 2016). In increasingly competitive and sophisticated modern markets, it is difficult for firms to achieve their objectives in isolation. Therefore, a firm's networking capability largely determines its ability to create value and enhance its chances of succeeding in the marketplace (Ford, Verreynne & Steen, 2017). Proactive firms seek to be the first to develop new strategic approaches in existing markets or to enter and develop new markets (Covin et al., 2016). In doing so, they may find it increasingly helpful to count on a solid network of partners to share resources during the innovation process and successfully develop new businesses (Forkmann, Henneberg & Mitrega, 2018; Santos-Vijande; López-Sánchez, & Rudd, 2016). In other words, it is reasonable to assume that proactive firms will be interested in and favour resource pooling and sharing with their network of partners as a mechanism to explore and/or exploit new market opportunities ahead of competition (Brettel et al., 2015). Based on this we propose the following hypothesis.

H4b: Proactiveness is positively associated with the firm's networking capability.

Market learning capability is conceptualised as the learning activities undertaken by firms that aim to collect, disseminate, and assimilate relevant marketplace information regarding changes in customer preferences, latent customer needs, and competitor actions to be used for commercial purposes (Varadarajan, 2020). Market learning also seems to be a critical activity in entrepreneurial firms as they are heavily interested in collecting relevant information about market opportunities to anticipate and understand customer needs and preferences. Thus, the proactiveness dimension of EO focuses on identifying and acting on new market opportunities, and sometimes even creating new markets. In this way, this dimension expands a firm's learning scope (Mu et al., 2017). Accordingly, proactiveness may result in an increased level of market intelligence (Matsuno et al., 2002), which can be processed to develop new knowledge and insights that facilitate sensing and acting on events and trends in the marketplace (Lisboa, Skarmeas & Lages, 2011). Consequently, the proactive dimension of EO is expected to be conducive to a more robust market-learning capability. Therefore, we propose the following hypothesis.

H4c: Proactiveness is positively associated with the firm's market learning capability.

As previously mentioned, RBT highlights the systemic nature of organisational capabilities (Grant & Bakhru, 2016; Feng et al., 2017). To the extent of our knowledge, the relationship between networking capability and market learning capability has not been analysed in the literature. In our conceptual model, a firm's ability to interact with other market agents is deemed to foster the ability to learn from the market. To substantiate this reasoning, we need to acknowledge that firms operate in highly interconnected and complex market settings, where partnerships become increasingly necessary to face the markets’ growing threats and challenges (Mu et al., 2017; Varadarajan, 2020). In this context, a firm's boundaries become blurred to incorporate other market partners’ knowledge, experience, and resources. This blurring means, in practice, that ‘learning becomes increasingly dependant on inter-organizational collaborations’ (Storbacka & Nenonen, 2015: 75). Thus, it is reasonable to assume that a firm's ability to develop and cooperate regularly with a network of valuable partners will facilitate its ability to learn from this network and gain more accurate market insights. In this respect, Covin et al. (2016: 5626) pointed out that ‘networking suggests the presence of an openness capability’. Therefore, a firm's networking capability may help it acquire new information about customer tastes and preferences, new technologies, and know-how for new products and services, and allow the firm to be well informed about critical changes in the industry. Therefore, we propose the following hypothesis.

H5: Networking is positively associated with the firm's market learning capability.

Although a firm's R&D ability constitutes a significant trigger for internally driven innovation, the ability to obtain market insights also represents a valuable starting point for innovation (Alegre & Chiva, 2013). Thus, even pure technology-push innovations require the effective development of different marketing capabilities (Adams, Freitas & Fontana, 2019). An adequate understanding of the evolving needs of the market allows a firm to take advantage of emerging opportunities. Similarly, firms that monitor the market and interiorise the relevant data achieve a shared interpretation and build a fruitful stock of knowledge to nurture and develop innovation whenever required; whereas a lack of market information and knowledge inhibits this process (Storbacka & Nenonen, 2015; Alshanty & Emeagwali, 2019). Market learning capability involves close tracking of competitors’ strategies and actions, including their successes and failures, which also improves the firm's understanding of market prospects and strengthens its ability to innovate (Calantone, Cavusgil & Zhao, 2002; Varadarajan, 2020). Moreover, any learning process involves questioning the firm's pre-established mental models about itself and its environment, as well as its commonly accepted problem-solution approaches (Storbacka & Nenonen, 2015). Thus, firms go beyond adaptation and gain higher-level learning, which is essential for developing radical innovation (Baker & Sinkula, 2007). In this line of reasoning, market learning capability has been shown (i) to reinforce the firm's ability to be aware of market opportunities and innovate at a higher rate than its competitors, that is, to foster organizational innovation intensity (Nasution et al., 2011) and (ii) to favour the firm's innovation originality or the degree of novelty of its new products and services, that is, to promote organizational innovation novelty (Kaleka & Morgan, 2017). Accordingly, we propose the following hypothesis.

H6: Market learning is positively associated with the firm's innovation capability.

Innovation is mainly acknowledged by researchers and practitioners as an organizational instrument crucial for adapting to the ongoing evolution of market needs and sustaining firms’ long-term growth (Crossan & Apaydin, 2010). Thus, innovation is a cornerstone in determining firms’ profitability and growth potential and achieving a sustained competitive advantage (Mendoza-Silva, 2021). Additionally, the ability to innovate involves a certain degree of tacit knowledge that cannot be easily imitated or appropriated by competitors, which constitutes an isolating mechanism for a firm's advantage (Teece et al., 2016).

Extant literature suggests the convenience of using different performance indicators to closely examine the effects of firms’ innovation capabilities (Mendoza-Silva, 2021). In this study, we consider two performance measures: business growth as it represents the main objective of entrepreneurial organisations, and customer equity as an intermediate step in achieving business growth (Matsuno, Zhu & Rice, 2014). Previous research stresses the role of customer performance as an indicator of market success in the relationship between innovation capability and firm performance, assuming that customer satisfaction, loyalty, and value-added perceptions constitute a necessary intermediate step to achieving improved performance relative to competition (Calantone et al., 2002). A firm's innovation capability constitutes the main organisational instrument that provides a unique value experience to the customer base by adapting and reformulating the product and service portfolio in line with market expectations and latent needs (Prahalad & Krishnan, 2008). Therefore, a firm's innovation capability represents a vital organisational ability to meet current and future market demands and increase customer satisfaction, loyalty, and long-term value, that is, customer equity. A firm's innovation capability also allows it to enter new markets, serve new market segments, and seize new market opportunities; thus, the firm can increase its sales, profits, and market share, that is, business growth. Accordingly, we hypothesise as follows.

H7: Firms’ innovation capability is positively associated with (a) customer equity and (b) business growth.

Undoubtedly, loyal customers who are aware of the added value they receive from the firm must be reflected in improved business growth (Matsuno et al., 2014). Even when a firm shapes customers’ expectations through radical or lead-the-customer innovation, the innovation advantage from the market viewpoint is a key requisite for success. Thus, the final hypothesis is as follows.

H8: Customer equity is positively associated with business growth.

We accessed a database of 987 Spanish manufacturing and service firms provided by a private foundation devoted to the study and promotion of organizational innovation. Such firms typically operate in rapidly evolving markets. Fieldwork was conducted during the second half of 2018. Managing directors were considered in the best position to provide critical insights into a firm's strategic orientation, processes, and outcomes; therefore, they were selected as key informants in each sampling unit (Hughes & Morgan, 2007; Covin & Wales, 2019). They received an email explaining the primary purpose of the research, guaranteeing the anonymity of the study, and including a link to the online platform where the questionnaire was hosted. When necessary, first and second follow-up reminders were sent. In total, 190 eligible questionnaires were received, generating a response rate of 19.25%. More than 50% of the respondent firms had between 10 and 49 employees, and 54.7% operated in the service sector. We compared the mean differences between early and late respondents to check for non-response bias, and no significant differences were found (Armstrong & Overton, 1977).

We also controlled for common method variance (Podsakoff, MacKenzie & Podsakoff, 2012) through the study design, including the following ex-ante remedial procedures. First, respondents were allowed to remain anonymous while participating in the study. Second, we emphasised the importance of honestly answering survey questions. Third, we established a psychological separation between the predictor and criterion variables to avoid inducing respondents to conceive of causal relationships between the variables under study. Additionally, we used two statistical remedies as ex post remedial procedures. We performed Harman's one-factor test and found no evidence that one factor accounted for the majority of the variance. Recent studies have asserted that such a method is meaningful for identifying common method variances (Babin, Griffin & Hair, 2016).

Furthermore, we conducted a modified test based on Lindell and Whitney's (2001) marker variable technique, as we did not measure an unrelated construct ex ante to economise the survey items. In this regard, as a weakly related construct, we employed a life satisfaction element (Simmering, Fuller, Richardson, Ocal & Atinc, 2015), represented by the item ‘I am satisfied with life’. We included the marker variable in the structural equation model and no significant increase in the variance of dependant variables was identified. Additionally, the average correlation between the constructs of the structural model and the marker variable was 0.019, and the average significance was 0.564, which exceeded the lower limit of 0.05 (bilateral) and 0.01 (bilateral) needed to be considered significant. In conclusion, the procedural remedies and statistical tests performed in this study show that common method variance was not a problem.

Measurement scalesThe theoretical constructs in the conceptual model were measured using multi-item scales (see Table 2). All items were scored on a 7-point Likert scale anchored by ‘strongly disagree’ (1) and ‘strongly agree’ (7). The innovativeness scale is sourced from Hult et al. (2004). The scales for risk-taking and proactiveness are inspired by the Covin and Slevin (1989) EO scale and the studies of Martin and Javalgi (2016) and Mu et al. (2017). The measurement scales for market learning and networking capabilities were based on Forsman (2011). To operationalise a firm's innovation capability, we measured the intensity and novelty of the innovations commercialised by the sampled firms relative to their major competitors in the industry over the last 3 years (Mendoza-Silva, 2021).

Measurement model: Psychometric properties of the first-order measurement scales.

| Latent variables and indicators | Loadingsa | AVE | α (Composite reliability index) |

|---|---|---|---|

| Innovativeness (INNOVAT) | 71.5% | 0.87 (0.91) | |

| Our firm willingly accepts innovation proposals | 0.790 | ||

| Management actively seeks innovative ideas | 0.868 | ||

| Management nurtures and supports innovative thinking, experimentation, and creativity | 0.825 | ||

| Innovation is a fundamental part of our company culture | 0.896 | ||

| Risk-Taking (RISK-T) | 73.7% | 0.82 (0.89) | |

| Adoption of a non-conservative posture in order to maximize the probability of exploiting potential opportunities | 0.817 | ||

| Willingness to take high-risk projects | 0.925 | ||

| Readiness to manage bold risks | 0.829 | ||

| Proactiveness (PROACT) | 82.2% | 0.89 (0.93) | |

| Ability to recognize and address first new market opportunities | 0.902 | ||

| Capability to seize new opportunities being first to market with new products and services | 0.924 | ||

| Emphasis on exploiting first new opportunities for generating new profitable business | 0.894 | ||

| Networking Capability (NETW) | 81.5% | 0.89 (0.93) | |

| Ability to create a network of relationships with valuable external partners | 0.897 | ||

| Capability to collaborate with our partners on a regular basis | 0.885 | ||

| Capability to manage and exploit networks in business | 0.926 | ||

| Market Learning Capability (MKT-L) | 84.1% | 0.91 (0.94) | |

| Ability to identify the relevant market knowledge | 0.906 | ||

| Capability to internalize the new market knowledge | 0.930 | ||

| Capability to exploit new knowledge for innovations | 0.915 | ||

| Innovation Capability (INNCAP) | 85.2% | 0.96 (0.97) | |

| Our products and services are more innovative than those of our competitors | 0.888 | ||

| Our clients perceive many of our new products and services as state-of-the-art | 0.908 | ||

| We launch innovations with more novel features than our competitors | 0.945 | ||

| We launch more innovations than our competitors | 0.942 | ||

| We have the ability to develop more new products and services than our competitors | 0.911 | ||

| Our firm innovates at a higher rate than its competitors | 0.944 | ||

| Customer Equity (CUST-E) | 67.3% | 0.88 (0.91) | |

| Improved customer satisfaction | 0.876 | ||

| Increased customer loyalty | 0.823 | ||

| Improved customer value creation by the firm's offering | 0.874 | ||

| Increased communication flows with customers | 0.827 | ||

| Reduction in number of complaints | 0.700 | ||

| Business Growth (BUS-G) | 88.8% | 0.94 (0.96) | |

| Sales growth | 0.950 | ||

| Market share growth | 0.937 | ||

| Profit growth | 0.940 |

AVE average variance extracted, CR composite reliability.

The criteria employed in PLS-SEM to consider an indicator to be suitable for a measurement scale is that of Hair et al. (2017a).

Customer equity refers to customer satisfaction, loyalty or retention, superior value provided to customers, improved communication with customers, and reduced customer complaints (Matsuno et al., 2014). To measure business growth, we consider items commonly referred to in the literature (Vorhies et al., 2009): sales, market share, and profits. Business growth was assessed in relative terms, that is, compared with the major competitors in the industry, to minimise the industry effect and decrease the subjectivity of the response by establishing a point of reference for comparison. We also introduced a temporal reference to the last 3 years to provide a deeper understanding of how EO and a firm's innovation capability contribute to attaining long-term competitive advantages (Baker & Sinkula, 2007). We also include the usual control variables for firm size: the natural logarithm of the number of employees and sales.

ResultsThe hypothesised relationships in the conceptual model were examined using partial least squares for structural equation modelling (PLS-SEM) (Ringle, Wende, & Becker, 2015). To reinforce confidence in our findings, we conducted a post hoc power analysis using G*Power 3, which revealed that the power value for the structural model was above the accepted cut-off of 0.80. SmartPLS 3 software was employed to examine the measurement model results a priori and then proceed with the structural model analysis. The level of statistical significance for the associated t-statistic was computed using a bootstrap resampling method of 5000 subsamples, with the same number of cases as in the original sample (Hair, Hult, Ringle & Sarstedt, 2017a).

Measurement modelTable 2 shows the psychometric properties of the measurement model (reliability, convergent validity, and discriminant validity). All item loadings are above the threshold of 0.7, and the associated t-statistic is statistically significant (Anderson & Gerbing, 1988), which suggests that all items are accurate indicators of the latent variables. As shown in Table 2, Cronbach's alpha and the composite reliability index (CR) values exceed the recommended threshold value of 0.7, indicating construct reliability. The average variance extracted (AVE) values range between 0.673 and 0.888, which are above the recommended value of 0.50, indicating convergent validity. The discriminant validity was tested by computing the heterotrait-monotrait ratio of correlations (HTMT), which is below the conventional threshold level of 0.85 (see Table 3), showing that the square root of the AVE of all constructs is larger than all other cross-correlations. The means and standard deviations of the latent variables in the conceptual model are also presented in Table 3.

Descriptive statistics: Inter-correlations and discriminant validity of the latent variables.

| INNOVAT | RISK-T | PROACT | MKT-L | NETW | INNCAP | CUST-E | BUS-G | TURN | EMPL | |

|---|---|---|---|---|---|---|---|---|---|---|

| INNOVAT | 0.846 | 0.552 | 0.675 | 0.655 | 0.516 | 0.696 | 0.491 | 0.436 | 0.101 | 0.166 |

| RISK-T | 0.465 | 0.858 | 0.644 | 0.610 | 0.548 | 0.486 | 0.422 | 0.504 | 0.224 | 0.088 |

| PROACT | 0.599 | 0.552 | 0.907 | 0.672 | 0.588 | 0.552 | 0.498 | 0.572 | 0.097 | 0.062 |

| MKT-L | 0.584 | 0.526 | 0.609 | 0.917 | 0.717 | 0.532 | 0.438 | 0.336 | 0.080 | 0.138 |

| NETW | 0.454 | 0.466 | 0.523 | 0.642 | 0.903 | 0.504 | 0.383 | 0.262 | 0.054 | 0.036 |

| INNCAP | 0.639 | 0.431 | 0.513 | 0.501 | 0.465 | 0.923 | 0.527 | 0.472 | 0.033 | 0.018 |

| CUST-E | 0.448 | 0.371 | 0.452 | 0.401 | 0.349 | 0.507 | 0.820 | 0.550 | 0.084 | 0.097 |

| BUS-G | 0.396 | 0.442 | 0.525 | 0.313 | 0.240 | 0.451 | 0.524 | 0.942 | 0.350 | 0.184 |

| TURN | −0.093 | 0.204 | 0.091 | −0.074 | −0.051 | 0.030 | 0.053 | 0.338 | – | 0.424 |

| EMPL | −0.153 | 0.080 | 0.058 | −0.129 | −0.034 | 0.017 | 0.018 | 0.178 | 0.424 | – |

| Mean | 5.65 | 5.29 | 5.45 | 5.28 | 5.16 | 4.91 | 5.59 | 4.81 | 2.24 | 1.460 |

| S.D. | 1,16 | 1,01 | 1,00 | 1,09 | 1,31 | 1,44 | 0.91 | 1,55 | 0.75 | 0.548 |

The square root of the average variance extracted (AVE) is in italics on the diagonal. The correlations are below the diagonal. All correlations were considered statistically significant at p < 0.05. The HTMT ratios are above the diagonal.

Key: S.D. = standard deviation INNOVAT = innovativeness RISK-T = risk-takingPROACT = proactiveness.

MK-L = market learning capability NETW = networking capability INNCAP = innovation capability.

CUST-E = customer equity BUS-G = business growth TURN = sales turnover EMPL = number of employees.

The coefficient of determination (R2) and the Stone–Geisser criterion (Q2) were obtained to verify the explanatory power and predictive relevance of the model. The R2 for each of the latent dependant variables is above 0.10 (Falk & Miller, 1992; Hair et al., 2017a; Hair, Sarstedt, Ringle & Gudergan, 2017b). For the full sample, the R2 values range from 0.259 to 0.534, which is acceptable. The results of PLS-SEM blindfolding procedure show that all Q2 values are greater than 0 and range from 0.151 to 0.418, confirming the predictive relevance of the model (Chin & Newsted, 1999). Structural model testing also involves assessing path coefficients and their significance values. We used a bootstrap resampling method (5000 samples, 190 cases) to produce t-statistics and standard errors (Hair et al., 2017a). Table 4 provides a summary of the findings, showing the standardised coefficients and significance of the specified paths.

Structural model.

| Model relationships | Standardized coefficient | t-value bootstrap | Results |

|---|---|---|---|

| H1: Innovativeness is positively associated with risk-taking | 0.495 | 6.898*** | Supported |

| H2: Risk-taking is positively associated with proactiveness | 0.321 | 4.535*** | Supported |

| H3: Innovativeness is positively associated with proactiveness | 0.467 | 7.277*** | Supported |

| H4a: Proactiveness is positively associated with the firm's innovation capability | 0.322 | 4.033*** | Supported |

| H4b: Proactiveness is positively associated with the firm's networking capability | 0.532 | 9.589*** | Supported |

| H4c: Proactiveness is positively associated with the firm's market learning capability | 0.394 | 6.049*** | Supported |

| H5: Networking is positively associated with the firm's market learning capability | 0.430 | 6.261*** | Supported |

| H6: Market learning is positively associated with the firm's innovation capability | 0.310 | 3.503*** | Supported |

| H7a: Firms’ innovation capability is positively associated with customer equity | 0.506 | 8.466*** | Supported |

| H7b: Firms’ innovation capability is positively associated with business growth | 0.248 | 3.203*** | Supported |

| H8: Customer equity is positively associated with business growth | 0.381 | 5.255*** | Supported |

| Latent variables | R2 | Q2 | |

| Risk-taking | 0.280 | 0.182 | |

| Proactiveness | 0.465 | 0.354 | |

| Networking capability | 0.284 | 0.217 | |

| Market learning capability | 0.534 | 0.418 | |

| Innovation capability | 0.321 | 0.250 | |

| Customer equity | 0.259 | 0.151 | |

| Business growth | 0.419 | 0.345 |

Key: n.s. = non-significant. *** p<0.01; ** p<0.05; * p<0.10.

The results show that a firm's innovative culture triggers its risk-taking capability (H1: path coefficient = 0.495; t-statistic = 6.898; p < 0.01) and the ability to behave proactively (H3: path coefficient = 0.467; t-statistic = 7.277; p < 0.01), which is further reinforced by its risk-taking practices (H2: path coefficient = 0.321; t-statistic = 4.535; p < 0.01). In turn, proactiveness exerts three types of effects. First, as expected, it has a direct impact on innovation capability (H4a: path coefficient = 0.322; t-statistic = 4.033; p < 0.01); that is, proactiveness is positively related to a firm's ability to innovate to a greater extent and with a higher level of novelty than its main competitors. Second, proactiveness fosters an organisation's ability to build and exploit a suitable partner network (H4b: path coefficient = 0.532; t-statistic = 9.589; p < 0.01). Specifically, this is the strongest direct effect produced by proactiveness in our conceptual model, which suggests that firms that seek to anticipate and enact new market opportunities rely strongly on building a network of valuable partners to collaborate. Third, the expected effect of proactiveness on market-focused learning capability is also confirmed (H4c: path coefficient = 0.394; t-statistic = 6.049; p < 0.01). Thus, firms must be able to identify, internalise, and exploit market knowledge to be ahead in the market.

As expected, networking capability reinforces the firm's market-focused learning capability (H5: path coefficient = 0.430; t-statistic = 6.261; p < 0.01), which proves that market partners are valuable resources to learn about the market. A firm's market learning capability also directly affects the intensity and novelty of the firm's innovation effort or capability (H6: path coefficient = 0.310; t-statistic = 3.503; p < 0.01). This effect is slightly lower than that of proactiveness on innovation capability. Additionally, the results indicate that a firm's innovation capabilities strengthen customer equity (H7a: path coefficient = 0.506; t-statistic =8.466; p < 0.01) and business growth relative to its main competitors in terms of sales, market share, and profit growth (H7b: path coefficient = 0.248; t-statistic = 3.203; p < 0.01). Finally, as expected, customer equity reinforces business growth (H8: path coefficient = 0.381; t-statistic = 5.255; p < 0.01).

The analysis of the indirect effects in the research model (available from the authors upon request) highlights that the indirect effect of innovativeness on a firm's innovation capability through proactiveness is positive and significant: 0.150 (t-statistic = 3.070; p < 0.01) and that the indirect effect of risk-taking on a firm's innovation capability through proactiveness is even higher: 0.166 (t-statistic = 4.230; p < 0.01). Therefore, proactiveness is a type of impeller that pushes innovative culture and risk-taking practices towards a firm's innovation capability.

Second, innovativeness and risk-taking also contribute indirectly to the development of a firm's networking and market-learning capabilities. These findings, in addition to the direct effect of proactiveness on these variables, extend prior research (Keh, Nguyen & Ng, 2007; Martin & Javalgi, 2016), highlighting the role of EO in the development of architectural marketing capabilities.

Third, innovativeness exerts a positive and significant total indirect effect on (i) firms’ innovation capability (0.322; t-statistic = 5.639; p < 0.01), (ii) customer equity (0.163; t-statistic = 4.675; p < 0.01), and (iii) business growth (0.142; t-statistic = 3.762; p < 0.01). These data address recent concerns in the literature to generate further empirical evidence on how organisational culture influences innovation and firm performance (Hogan & Coote, 2014; Tian, Deng, Zhang & Salmador, 2018) and strengthen the usefulness of an innovative culture to foster firm competitiveness. Fourth, the effect of a firm's innovation capability on customer equity is noticeably greater than that on business growth, even after considering the total effect (direct + indirect) of innovation capability on business growth (0.248 + 0.193 = 0.441; t-statistic = 6.805; p < 0.01). This result supports the idea that innovative behaviour plays a major role in helping organisations build goodwill, engagement, and confidence amongst its customer base (Matsuno et al., 2014).

Additional checksWe performed additional analyses to complement the main findings of our study. First, we briefly examined the potential direct influence of architectural marketing capabilities on performance. To this end, we include the direct effects of architectural marketing capabilities on customer equity and business growth in the original structural model. In this way, only one of the four new causal relationships considered is significant. Explained in more detail, we find that the direct effect of networking capability on both customer equity (path coefficient = 0.059; t-statistic = 0.615) and business growth (path coefficient = −0.048; t-statistic = 0.614) is non-significant. For market learning capability, we observe that, while there is a significant effect on customer equity (path coefficient = 0.172; t-statistic = 2.090; p < 0.05), this is not the case for business growth (path coefficient = 0.116; t-statistic = 1.476; non-significant). It was identified that the two capabilities have different direct influences on performance. Market learning seems to be the most influential of the two capabilities, but only when it impacts customer equity as its direct effect is not significant on business growth. Networking capability has no significant direct influence on performance, customer equity or business growth. These results promote future investigations into whether these impacts are stable over time and in different contexts.

Second, we checked the following specific indirect effects in the original structural model: (i) networking capability → market learning capability → innovation capability → customer equity (path coefficient = 0.067; t-statistic = 2.476; p < 0.05) and (ii) networking capability → market learning capability → innovation capability → business growth (path coefficient = 0.033; t-statistic = 2.001; p < 0.05). We observe that there are indirect effects that should be formally hypothesised and tested in the future to gain deeper knowledge of the influence of architectural marketing capabilities on performance using these routes of indirect effects. It is important to understand that this is the first attempt to shed light on the role of architectural marketing capabilities in this context and we have emphasised a direct effects structural equation model guided by theory and logic. Moreover, this is the first study in which the sequence of the constructs and the causal relationships are the result of the formulated hypotheses and their relationships are developed with the theory (Brown, 1977; Bunge, 1973).

Third, EO was assessed as a unidimensional, higher-order latent variable. This higher-order latent variable was included in the structural model following the repeated indicators approach (Hair et al., 2017a, 2017b). All indicators of the three first-order latent variables (innovativeness, risk-taking, and proactiveness) are considered to specify the second-order latent variable EO. The AVE and CR for the second-order latent variable is 0.525 and 0.916, respectively. The loadings of the first-order latent variables to the second-order latent variable are above 0.7, and the related t-statistic is significant. That is, the EO measure can be considered reliable, as it is within the thresholds of acceptance.

Furthermore, we examined the following specific indirect effects within the original structural model and considering EO as a second-order latent variable:

(i) EO → networking capability → market learning capability → innovation capability → customer equity (path coefficient = 0.011; t-statistic = 0.980; non-significant).

(ii) EO → networking capability → market learning capability → innovation capability → business growth (path coefficient = 0.006; t-statistic = 0.948; non-significant).

EO → market learning capability → innovation capability → customer equity (path coefficient = 0.027; t-statistic = 1.094; non-significant).

(iv) EO → market learning capability → innovation capability → business growth (path coefficient = 0.013; t-statistic = 1.065; non-significant).

(v) EO → innovation capability → customer equity (path coefficient = 0.290; t-statistic = 5.314; p < 0.01; significant).

(vi) EO → innovation capability → business growth (path coefficient = 0.142; t-statistic = 2.702; p < 0.01; significant).

These empirical results reveal that the indirect effects of EO as a unidimensional higher-order latent variable are significant through innovation capability when customer equity and business growth are the final dependant variables. More complex indirect effect paths involving architectural marketing capabilities do not have a significant influence. These results invite further study of the indirect impacts of these architectural marketing capabilities in other contexts and types of firms. Furthermore, they show that innovation capability can be understood as the ultimate driver of our research's performance.

Thus, the empirical results provide additional insights into our conceptual model and hypotheses, considering the limitations that are always present in studies based on cross-sectional data. Finally, thinking in terms of mediation, or even indirect effects, from a theoretical and logical perspective would have meant formulating and conceptually developing the hypotheses from a different perspective which would have resulted in a set of hypotheses diverging from the one proposed in this study.

DiscussionThe analysis of the relationship between EO and performance has been a vivid research question in recent decades (Wales et al., 2021). However, Covin and Wales (2019) called for further research on the mechanisms that translate EO into performance. Therefore, our study models and tests the central role of a systemic bundle of marketing and innovation capabilities in channelling the effect of EO towards superior customer equity and business growth.

Theoretical and empirical contributionsThe disaggregated analysis of EO components allowed us to explore the connections amongst them and explain how EO builds within the firm. Our Innovativeness–Risk-taking–Proactiveness (I-R-P) model precisely mirrors the widely accepted Value–Attitude–Behaviour (V-A-B) hierarchy of Homer and Kahle (1988); see Soininen, Puumalainen, Sjögrén, Syrjä and Durst (2013) and Fis and Cetindamar (2021) for other applications of the V-A-B model in the EO field. Central to our proposal is the reconceptualisation of innovativeness as an input (Arshi et al., 2020): a pro-innovation corporate culture (Matsuno et al., 2002; Zhou et al., 2010; Martin & Javalgi, 2016) that influences proactiveness both directly and indirectly through risk-taking. This theoretical model helps us understand the logic underlying entrepreneurial behaviour and expand previous proposals of disaggregated causal configurations (Tang et al., 2009; Pérez-Luño et al., 2011; Joshi et al., 2015; Putniņš & Sauka, 2020; Hurtado-Palomino, De La Gala-Velásquez, & Merma-Valverde, 2021). As an organisational culture that challenges the status quo, innovativeness leads a firm to accept uncertainty, tolerate risk (Hogan & Coote, 2014), and develop the ability to assess and manage the firm's risk. We also found that risk-taking is a mechanism that enhances proactiveness. Firms that take risks have an improved ability to calculate risk (Hogan & Coote, 2014), which puts them in a position to actively recognise new market opportunities, seize them first, create new business opportunities, and shape the market (Forsman, 2011). Our findings reveal that innovativeness also promotes proactiveness; that is, the firm's willingness to support creativity and experimentation allows it to anticipate future demands, attain first-mover advantages, and generate new business (Hult et al., 2004; Brettel et al., 2015). Finally, proactiveness represents the behavioural dimension that facilitates EO deployment through organisational capabilities.

The study also provides ample evidence on the prominent role of proactiveness (Kusa, Duda & Suder, 2021) and, more specifically, on how this individual dimension of EO directly favours the development of two architectural marketing capabilities, networking (Ford et al., 2017) and market learning (Kaleka & Morgan, 2017), as well as the firm's innovation capability. Thus, our findings support the view that proactiveness encourages networking, an ability that is particularly necessary to foresee and attend to future demand in modern hypercompetitive markets. Inter-firm collaborations constitute a key mechanism to obtain valuable information from markets, be informed of new technologies necessary for long-term success, and allow resource pooling and sharing when required to develop a new market offering. Furthermore, proactiveness enhances the materialisation of a firm's collection of relevant information by focusing on expanding its learning scope as well as sensing and acting on new market opportunities. Likewise, proactiveness fosters organisational innovation capability. As expected, a firm's ability to pursue new opportunities and mitigate market inefficiencies affects its ability to innovate with a higher level of incorporated novelty to keep ahead of its main competitors (Adams et al., 2019).

Our findings also point to the systemic nature of the relationships amongst marketing and innovation capabilities to reinforce a firm's competitiveness (Feng et al., 2017), a clear example of the RBT conceptualisation of the firm as a bundle of capabilities. We have demonstrated that the cooperation of interconnected valuable partners regularly provides opportunities to learn from the network, acquire new market insights, and identify critical changes in the marketplace. Empirical evidence concerning the effect of networking on market learning is scarce and we provide an early step in this direction (Forkmann et al., 2018). Moreover, our findings also suggest that firms can gather, internalise, and exploit new insights from the market to develop a stronger ability to innovate to address market needs. These results adhere to recent research that seeks to deepen our understanding of the effects and implications of market learning capabilities on long-term success (Varadarajan, 2020).

Finally, this study uncovers a hidden step that channels the effects of EO into performance. According to Gupta et al. (2020: 1126), ‘theory development in EO would benefit from deep incisive probes into the intermediate steps between EO and firm performance’. Our conceptual model provides a novel approach based on RBT to address the ongoing EO-performance debate (Wales et al., 2021). The RBT contends that neither a resource nor an EO can be directly translated into superior performance. To gain a competitive advantage, firms need to develop successful idiosyncratic capabilities from their resource bases, seconded or driven by their strategic orientations (Monteiro, Soares & Rua, 2019). We articulated a causal model that includes networking, market learning, and innovation capabilities, and seeks to expand its explanatory power to avoid construct overlap between EO and innovation capabilities measures (Covin & Wales, 2019). The empirical results show that innovation capability has a direct positive effect on performance variables. Overall, the integration of EO and a strategic capability perspective of competitive advantage transforms the stale traditional EO-performance debate into a higher value strategic entrepreneurship research topic (Simsek, Heavey & Fox, 2017).

Practical implicationsThis study has important implications for managers in entrepreneurial firms: it opens the EO black box, illustrating a valuable sequence for building EO within the firm (Gupta & Dutta, 2018) and it also clarifies the apparent causal ambiguity between EO and performance (Gupta et al., 2020).

First, managers interested in developing strong EO should understand that the starting point is the firm's innovative culture or innovativeness. High levels of innovativeness are the basis for developing risk tolerance and proactively taking advantage of market opportunities (Ling, López-Fernández, Serrano-Bedia & Kellermanns, 2020). Therefore, entrepreneurial managers must ensure openness to new ideas, enable creativity and tolerance for failure as a means to prevent inertia, and foster the organisational commitment of resources to risky but potentially profitable new ventures. Managers must also understand that innovativeness fosters proactive behaviour by individuals and allows leveraging value creation in rapidly evolving markets. The positive effect of innovativeness on proactiveness is reinforced by risk-taking. Accordingly, managers should support innovative thinking and discovery, and encourage bold actions as a key means of effectively pursuing new opportunities and obtaining first-mover advantages.

Second, managers must recognise that EO's beneficial effects on performance occur through an interwoven bundle of organisational capabilities. More precisely, managers need to be aware that proactiveness, the key process through which entrepreneurial firms seize new market opportunities, leads to the development of marketing and innovation capabilities that do not operate as isolated mechanisms but are rather interrelated. Thus, our findings suggest that proactiveness helps develop a firm's networking and market learning capabilities to gain knowledge and insights from other market partners. Similarly, proactiveness develops a firm's innovation capability to prevent the obsolescence of product offerings. However, the key message is that marketing and innovation capabilities constitute a system for propelling customer equity and business growth. Given the benefits of networking on learning capability which in turn benefits innovation capability to achieve performance, it is important for managers to internalise the need to monitor and support these capabilities. In this respect, managers must consider that complex and systemic interrelationships protect the firm from imitation, but these interdependencies also make the firm vulnerable in the case of misalignment (Le Breton-Miller & Miller, 2015). Thus, nurturing and aligning a synergetic chain of marketing and innovation capabilities appears to be an essential prerequisite for success.

Third, our findings suggest that a firm's innovation capability promotes not just business growth, but also customer equity, which further improves business growth. Accordingly, managers in entrepreneurial enterprises need to recognise that innovation efforts should focus on customer performance (satisfaction, perceived value, and loyalty) as a valuable instrument to reinforce overall performance.

Limitations and future research directionsThis study, like many other empirical studies in the literature, has limitations. First, we used a single-informant approach as a data source. In future studies, gathering corroborating information from multiple respondents would reinforce the reliability of the results. Second, this was a cross-sectional study and, therefore, we could not assess the dynamic effects. Using longitudinal data would be helpful for understanding the complex interrelationships that variables may have over time. Third, we used perceptual data to measure dependant and independent variables. Future research would benefit from the inclusion of objective performance measures to diminish potential social desirability bias and strengthen the rigour of the insights provided. Finally, the generalisability of the results requires caution, as it is not possible to confirm that the causal relationships identified in the model hold for different types of firms and countries.

As far as future research is concerned, an analysis of EO's long-term financial performance (return on investments) could provide a measure of how an entrepreneurial firm transforms its resources into profits and meets investors’ expectations (Matsuno et al., 2014). Second, further attention should be paid to growth via customer retention as it is an indicator of a firm's ability to maintain an ongoing relationship with customers and an antecedent of financial return. Third, the additional checks provided in this study show that it is necessary to continue investigating whether the potential direct impacts of architectural marketing capabilities on performance are stable over time and in different contexts to attain additional insights on this matter. Finally, the inclusion of collaborative innovation and the profile of collaborative partners in the EO-performance relationship could offer further insights into the EO and innovation research domains.

This research received financial support from the Ministry of Science and Innovation of Spain during the 2016–2019 Call for R&D Projects (PID2019–105726RB-I00).