Amidst rapidly evolving market conditions, relying solely on internal information and knowledge for innovation has proven inadequate. The emergence of the digital economy injected renewed vitality into enterprise innovation. However, existing studies have predominantly concentrated on the digital transformation intrinsic to enterprises, neglecting the impact of partners' digital transition on enterprises’ innovation performance. From the perspective of supply chain spillovers, this study evaluates the influence of digital transitions in upstream and downstream enterprises on the innovation activities of midstream enterprises. The results show that the digital transformation of enterprises within the supply chain exhibits a transmission effect, and the digital transformation of upstream and downstream enterprises significantly promotes the innovation performance of midstream enterprises. The mechanistic analysis revealed that the digital transformation of upstream and downstream enterprises mainly enhances the resilience of the supply chain by improving its efficiency, optimizing the match between supply and demand, and stabilizing the relationship between supply and demand, thus promoting the innovation level of midstream enterprises. Further analysis shows that improvements in the innovation output of midstream enterprises are reflected in the quality of innovation. When the upstream and downstream firms belong to the same industry, the supply chain spillover effect of digital transformation is more evident, and simultaneously, the digital collaboration of the supply chain can promote the innovation of midstream enterprises.

With the vigorous development of mobile internet, cloud computing and intelligent technology, digital technology has become a key factor in promoting economic development, improve the competitiveness in various fields of the economy, create emerging markets, and ensure comprehensive and sustainable growth. In recent years, digital transformation of China's enterprises has accelerated. According to the report of China Information and Communication Research Institute, the digital transformation of China's enterprises has entered the deepening stage from the primary stage, and the digital penetration rate of enterprises has exceeded 70%. Digital transformation is not only a strategic decision of a single enterprise, but also inevitably affects or is influenced by the upstream and downstream enterprises. This mutual influence and correlation form the customer contagion effect of digital transformation in the industrial chain, that is, the innovative behavior of digital transformation is transmitted and spread throughout the industrial chain, which in turn affects the innovative development of midstream enterprises.

Many countries have recognized the importance of digital transformation and formulated corresponding strategic policies. For instance, the European Commission initiated the "Digital Europe Industrial Action Plan" as a part of its ongoing Digital Single Market strategy, strategically advancing Industry 4.0 and smart industries. In its "National Advanced Manufacturing Strategy," the United States emphasizes the digitization of production through the collection and distribution of information required for manufacturing via digital design and manufacturing. Japan's "Digital New Deal" and "Semiconductor and Digital Industry Strategy" aim to advance industry digitization and digital industrialization through hardware investments, soft environment development, various research and development investments in digital technology, and the promotion of new infrastructure construction to drive digital economic development. China's "14th Five-Year National Informatization Plan," calls for synergistically promoting digital industrialization and industrial digital transformation, accelerating the pace of building a digital society, and elevating the level of digital government construction. In summary, the study of digitalization in industrial chains is both a strategic necessity for nations and an imperative for scholarly exploration.

Early research on digitalization primarily focused on the development and application of information technology and its implications for business operations and management. Nof (2009) comprehensively updated the technical and engineering aspects of automation. Marković (2008) delved into the management of organizational change and culture in the globalization era, underscoring the significance of continuous learning in the new knowledge economy. However, with the rapid advancement of digital technologies, the focal point of research has shifted toward the integration of digital transformation and the real economy. At the macro-level, Brechko (2021) identified digital transformation as a primary way to ensure balanced national economic growth. Samiilenko et al. (2021) highlighted the profound impact of digital transformation on the current state of digital technology implementation in Ukraine and globally, against the backdrop of information economy development. At the micro level, Chen et al. (2022) discovered that urban digital economies’ growth significantly enhances the Environmental, Social, and Governance) performance of Chinese enterprises. Zhang et al. (2022) explored the influence of digital transformation on Chinese enterprises’ production efficiency. Digital transformation is recognized as a pivotal element in modern enterprise development, exerting a profound influence on business innovation. Peng and Tao (2022) posited that digital transformation can stimulate enterprise innovative momentum. Through resource integration, enterprise digitalization further empowers open innovation (Wu et al., 2022). However, these studies primarily focused on theoretical frameworks and the direct relationships between digitization and corporate innovation, neglecting an in-depth exploration of specific mechanisms and the impact of digital transformation in upstream and downstream partners on innovation in midstream enterprises. The existing research indicates a close relationship among corporate innovation, resource acquisition, and external support, particularly for supply chain partners. (Hao et al., 2022). Earlier international literature from the perspective of supply chain management and social capital suggested that enterprises are more likely to benefit from external knowledge procurement, potentially driving enhanced new market supplies for businesses (Roper et al., 2008). Recent studies show that open innovation in small and medium enterprises (SMEs) necessitates acquiring expertise from suppliers along traditional value chains, offering valuable insights into how supply chain partners influence business innovation (Brunswicker & Vanhaverbeke, 2015). Therefore, this study explores the following questions: Does the digital transformation of upstream and downstream enterprises affect midstream innovation in the supply chain? What mechanisms facilitate the impact of the digital transformation from upstream and downstream enterprises on midstream firm innovation?

Thereby, using data on supply chain companies disclosed by listed companies in China, this study investigates the direct impact of digital transformation of upstream and downstream enterprises on the innovation of midstream enterprises and empirically tests the impact of digital transformation of upstream and downstream enterprises on the innovation of midstream enterprises from supply chain resilience perspective (improving supply chain efficiency, optimizing supply and demand matching, and maintaining supply and demand relationships). Finally, the innovation types of digital transformation are analyzed in detail; the spillover effects of digital transformation belonging to the same industry in the upper, middle, and lower reaches are distinguished; and the influence of digital collaboration on midstream enterprises’ innovation is analyzed.

This study's contributions encompass three aspects: (1) Existing research on enterprise digital transformation predominantly focuses on the impact of internal digitalization on factors such as production efficiency and stock liquidity. However, the digital transformation of supply chain partners exerts significant driving effects that influence innovation in other enterprises. This study emphasizes the crucial role of digital transformation in upstream and downstream enterprises in driving innovation in midstream enterprises, thus broadening the scope of research on digital transformation. (2) Regarding supply chain resilience, the transmission mechanism through which the digital transformation of upstream and downstream enterprises drives the innovative growth of midstream enterprises is discussed, providing a new theoretical explanation for the spillover effects and innovation improvement mechanisms of enterprises’ digital transformation. Further research is required on how digital transformation leads to spillover effects. Regarding supply chain resilience, clarifying how digital transformation depends on changes in the supply and demand relationships in vertical markets is helpful. (3) Determine whether upstream and downstream digitally driven innovation improves innovation efficiency or innovation quality; distinguish whether midstream companies and upstream and downstream companies in the same industry significantly improve innovation level; and further explore the innovation-enhancing effect of digital collaboration.

Theoretical analysis and literature reviewDigital transformation and innovationDigital transformationWithin the field of organizational studies, digital transformation is regarded as a fundamental change in organizational attributes instigated by the integration of information, computation, communication, and connectivity technologies. This transformation mainly aims to optimize and enhance organizational processes through digital means (Bharadwaj et al., 2013). Early research in this domain primarily focused on the digitization of computers and technological attributes, delving deeply into the definition, essence, and primary content of digital transformation from a technological perspective. This study further elucidated the strategies and antecedent processes of these transformations (Kane et al., 2015). However, as research perspectives have expanded, an increasing number of scholars have begun to examine digital transformation's impact on macroeconomic entities and microenterprises, especially its contribution to enhancing the economic benefits for businesses. Consistent research findings indicate that digital transformation has extensive and profound effects on enterprise management, change, and innovation. These impacts manifest in various forms, such as improving information transparency; identifying and meeting customer needs; achieving market segmentation; aiding decision-making; and driving business models, products, and service innovations (Berman, 2012).

Furthermore, Chen et al. (2020) adopted a perspective transitioning from "empowering" to "enabling" and further summarized the typical characteristics of enterprise operations in a digital environment. They successfully constructed a theoretical framework and system for enterprise operations management in a digital context. Although digital transformation offers numerous advantages to enterprises, they face several challenges during the transformation process, including transformation costs and uncertainties (Vial, 2021). Some studies suggest that enterprises can effectively reduce connectivity costs and optimize resource allocation by adopting digital forms, such as information technology, internet development, and data management, thereby significantly enhancing their productivity (Hess et al., 2016). Moreover, such transformations enhance enterprises’ overall capabilities, drive the development of new products, and improve innovation performance. The digital transformation of enterprises in the capital market can significantly enhance stock liquidity (Fitzgerald et al., 2014). These empirical studies provide crucial theoretical support and practical evidence for understanding and exploring the impact of enterprises’ digital transformation.

Enterprises innovationInnovation is characterized by complexity, creativity, and openness and is accompanied by randomness, irregularity, and chaos (Pietronudo et al., 2022). Traditional enterprises engaging in innovation activities must invest substantial resources in market research and analysis to acquire the information necessary to make informed innovation decisions. However, constrained by factors such as, finances and time, these decisions often rely on the intuition of managers and decision makers, who inherently carry a high degree of uncertainty, potentially rendering expenditures on research and development (R&D) experiments as sunk costs (Salles, 2006). Damanpour (1991) categorized innovation into radical and incremental types, in which radical innovation is achieved through continuous, gradual, and successive minor innovations, ultimately fulfilling the innovation objective. Conversely, incremental innovation is rapid and dramatic, significantly impacting existing systems, and is characterized by a high degree of innovation over a short duration, typically completed within a brief period. Griliches (1990) posited that patent statistics serve as an economic indicator that reflects the speed and direction of technological progress, with the number of patents and their citations representing the quantity and quality of innovation, respectively. Acs et al. (2002) underscored the importance of the number and quality of patents in measuring regional innovation capacity, indicating that these dimensions are crucial for understanding and promoting economic development. Therefore, segmenting innovation output into efficiency and quality is vital for thoroughly analyzing corporate innovation activities, optimizing innovation management strategies, and fostering technological advancement and economic growth.

Digital transformation in upstream and downstream enterprises and innovation in midstream enterprisesThe industrial supply chain characteristics are increasingly emphasized in the digital era (Verhoef et al., 2021; Gong & Ribiere, 2021), inevitably leading to the spillover effects of digital transformation in upstream and downstream enterprises on innovation in midstream enterprises through the linkage of the industrial and supply chains. Examining the directions of digital transformation:

- (1)

Product digitization primarily involves digitized upgrading of existing products or developing new digital products. When undergoing product digitization transformation, upstream enterprises may develop new digital technologies or integrate existing technologies into products to enhance their functionality and performance. These technological innovations can be transmitted directly or indirectly to midstream enterprises, inspiring them to assimilate new technologies and innovate products. Additionally, the demand for digital technologies and intelligent products from downstream enterprises serves as a market signal, providing feedback to midstream enterprises, and driving them to develop new products or services to meet these demands (Boudreau, 2012).

- (2)

Process digitization involves applying digital technologies to enhance the efficiency of enterprise operational processes such as procurement, research and development, design, manufacturing, storage, and sales (Chen et al., 2020; Kitsios & Kamariotou, 2021). Downstream enterprises improve their operational process efficiency through digitization, such as by implementing precision marketing, requiring midstream enterprises to exhibit higher flexibility and adaptability in their products and services. Therefore, midstream enterprises may innovate their production and supply chain processes to adapt better to these changes. The process digitization of upstream enterprises, such as the digitization transformation of procurement and manufacturing processes, can enhance product quality and delivery speed, thereby driving midstream enterprises to optimize their operational processes and product design (Ingaldi & Klimecka-Tatar, 2022).

- (3)

The digitization of organizational management involves integrating existing organizational structures and management models with digital technologies to reshape management methods and functions, enhancing communication, collaboration, and decision-making efficiency. This facilitates the transition from an "industrial management model" to a "digital management model" (Park et al., 2020). By implementing management systems such as ERP, MES/DCS, and PLM, upstream and downstream enterprises efficiently manage their internal resources, creating a demonstrative effect on midstream enterprises. This inspires them to adopt similar digital management tools, thereby improving their management efficiency and innovation capabilities. Additionally, the digitization of organizational management in upstream and downstream enterprises improves communication, collaboration, and decision-making efficiency. These advancements are transmitted to midstream enterprises through supply chain collaboration, and foster innovation through internal and external cooperation.

- (4)

The digitalization of business models refers to enterprises leveraging digital technologies to change their methods of value creation and acquisition, thereby altering existing business models or developing new ones (Yoo et al., 2012). Upstream and downstream enterprises change their business models through digital technology, such as by participating in digital platforms. This may require midstream enterprises to adjust their business models to adapt to these changes, for example, by developing products or services suitable for these platforms. The digital transformation of business models also implies a change in the ways of creating and acquiring value, presenting challenges and opportunities for midstream enterprises, and stimulating innovation in products, services, and market strategies. Accordingly, this study proposes the following hypothesis:

H1 The digital transformation of upstream and downstream enterprises promotes innovation in midstream enterprises.

The digital transformation of upstream enterprises, employing advanced data analytics, automated production, and real-time supply chain monitoring technologies, not only optimizes their own production processes, and improves efficiency and output quality but also renders the supply chain more transparent and predictable (Guo et al., 2023). Through more accurate demand forecasting and inventory management, upstream enterprises can reduce excess production and inventory backlogs, lower costs, and enhance their responsiveness to market changes. The digital transformation of downstream enterprises primarily focuses on customer relationship management, market analysis, and personalized services (Rasool et al., 2022). By understanding and responding to end-market demand, downstream enterprises can provide faster and more accurate feedback on changes in market demand and consumer preferences throughout the supply chain. In such an environment, midstream enterprises face strong impetus from both upstream and downstream.

H2 The digital transformation of upstream and downstream enterprises, by enhancing the efficiency of the entire supply chain, provides the necessary impetus and opportunities for innovation in midstream enterprises.

The core of optimizing supply and-demand matching lies in the efficient circulation and processing of information. By leveraging technologies such as big data analytics, cloud computing, and artificial intelligence, upstream enterprises can monitor market dynamics in real-time and accurately predict demand trends. The efficient circulation of information facilitated by these technologies reduces information asymmetry issues in traditional supply chains, helping to avoid the "bullwhip effect" (Cachon et al., 2007), and amplify demand fluctuations in the supply chain transmission process. Progress in the collection and analysis of consumer data from downstream enterprises provides more accurate demand forecasts for the entire industrial chain. These data directly guide midstream enterprises to adjust production plans, optimize inventory management, reduce resource wastage, and motivate them to innovate products and services to better meet market demands. In this process, midstream enterprises must enhance their flexibility and responsiveness by adapting to upstream and downstream digitization processes. The application of digital technology enables midstream enterprises to quickly adapt to market changes, such as efficiently responding to demand fluctuations from upstream and downstream through advanced manufacturing technologies (e.g., automation and intelligent production lines) and supply chain management tools (e.g., real-time supply chain monitoring systems). Furthermore, the digital transformation of upstream and downstream enterprises has created new opportunities and business models for midstream enterprises. By sharing data with upstream enterprises, midstream enterprises can gain better insights into the characteristics and performance of raw materials and components, thereby facilitating innovation in product design. Close connections with downstream enterprises help midstream enterprises to better understand market trends and consumer preferences, foster product innovation, and adjust to market strategies. Accordingly, this study proposes the following hypothesis:

H3 The digital transformation of upstream and downstream enterprises drives the optimization of supply and demand matching, leading to increased productivity in upstream enterprises.

Against the backdrop of digital transformation, upstream and downstream enterprises have effectively improved supply-demand relationships by reducing information asymmetry and transaction costs in the industry and supply chains (Chiu & Lin, 2022). This enhancement creates a favorable external environment for innovation activities in midstream enterprises. In their quest for suitable suppliers and customers, upstream and downstream enterprises face high search costs. Once partners are identified, the costs related to contract signing, supervision, and control arise. Failure to fulfill contracts on time results in additional costs related to breaches, communication coordination, price negotiations, and costs associated with changing suppliers or customers. However, the application of digital management within organizations, such as information storage and dissemination technologies, significantly aids in the efficient screening of qualified suppliers or customers. This minimizes contractual relationships with potentially unethical or inadequately capable partners (Shan et al., 2023). Furthermore, digital transformation enables upstream and downstream enterprises to establish immediate dynamic connections with partners through technologies such as the internet, big data, and cloud computing. This reduces negotiation and consultation costs during the contract signing process, and lowers moral risks and monitoring costs due to incomplete contracts. Therefore, after utilizing digital technology to select optimal suppliers or customers, upstream and downstream enterprises tend to maintain stable supply-demand relationships. This stability is advantageous for midstream enterprises because it helps reduce the coordination costs associated with customer or supplier maintenance and transitions. It diminishes transaction uncertainty and enhances operational efficiency as well as reduces the inclination of enterprises to invest in specialized assets, mitigating opportunistic behaviors and issues related to excessive pricing. Consequently, it creates a favorable operational environment for the entire industry and supply chains (Jiang et al., 2022). Accordingly, this study proposes the following hypothesis:

H4 The digital transformation of upstream and downstream enterprises maintains the stability of supply-demand relationships, thereby driving innovation in midstream enterprises.

This study selects supply chain relationship data for the top five suppliers and customers of Shanghai and Shenzhen A-share listed companies from 2011 to 2022 as the research sample. The supply chain data, digital transformation index, and enterprise financial data used are from China Stock Market & Accounting Research and hand-sorted. The enterprise patent data used were from the China Research Data Service Platform. First, following Yang et al. (2022), the data set of “Year-Upstream Enterprises-Midstream Enterprises-Downstream Enterprises” is constructed. For example, the midstream enterprise (A) may correspond to multiple upstream enterprises (X) and downstream enterprises (Y) in 2019, then “2019-A-X” is constructed. In this study, we perform (1) Sample selective processing: the enterprises that conducted initial public offering, listed ST, and were delisted during the sample period and enterprises with serious data loss are eliminated. (2) Data processing: logarithmic processing and tail reduction are used as indicators.

Variable definition and measurement- (1)

Digital Transformation of Enterprises: Existing literature measures enterprise digital transformation from aspects such as investment in software and hardware information equipment under new fixed investments and the frequency of key terms related to digital technology applications. Considering the existing literature, this study constructs a framework for the enterprise digital transformation index system from the following five aspects and calculates the level of enterprise digital transformation:

Digital Strategy: Based on Python, this study extracts the frequency of digital innovation terms from the management discussion sections of listed company annual reports (Antons et al., 2020). This is combined with the presence of positions such as Chief Information Officer and Chief Data Officer in the executive teams of listed companies.

Digital Technology: Measured by the frequency of key terms such as technology empowerment, artificial intelligence technology, blockchain technology, cloud computing technology, and big data technology.

Organizational Management: Measured by digital capital investment, human capital investment, construction of digital infrastructure, and establishment of technological innovation bases.

Digital Application: Measured by the frequency of key terms such as technological innovation, process innovation, and business innovation.

The entropy weighting method is used to attribute weights to the five delineated indicators. Subsequently, a comprehensive index of corporate digital transformation is determined through calculations based on the weighted values of the respective indicators. This approach ensures a methodologically robust quantification of digital transformation efforts within the corporate context.

- (1)

Corporate Innovation (Patent). Corporate innovation, encapsulated through patent activities, necessitates a multifaceted assessment because of the inherent uncertainties and bureaucratic intricacies associated with patent granting, notably the requirements for examinations and annual fee settlements (Tan et al., 2014). Recognizing the potential immediate impact of patent technology on corporate performance during the application phase, this study utilizes patent application volume as a stable, reliable, and prompt indicator of innovation levels.

Innovation is not merely about increasing the number of patents or outputs from R&D; its essence is significantly defined by the substantive quality of innovation or its actual impact on the market and society. When enterprises exhibit high innovation efficiency but low innovation quality, this suggests that despite the rapid production of numerous innovative outcomes, there is room for improvement in their technological depth and market applicability. Conversely, if an enterprise demonstrates high innovation quality but relatively low efficiency, it must consider optimizing R&D processes and resource allocation to enhance the speed and efficiency of innovation. To understand an enterprise's innovation capabilities comprehensively and in-depth and provide crucial guidance for formulating innovation strategies and optimizing resource allocation, this study draws upon Cao and Zhang (2020) by measuring innovation efficiency and quality both quantitatively and qualitatively. Innovation efficiency (Patentud) is quantified as the ratio of patent applications to R&D investments using the Patent/ln(1+RD) calculation. Concurrently, innovation quality (Patenti) is gauged following the conceptual framework of Akcigit et al. (2016), employing the Herfindahl-Hirschman Index logic at a broad classification echelon for weighted analysis, following the 1−∑α2 formula, where α signifies the proportional presence of each principal category in the patent classification schema. After determining the knowledge breadth metrics at the patent echelon, a median aggregation methodology is applied to amalgamate this breadth into a corporate-level indicator. An elevated patent knowledge breadth value signifies enhanced diversity among principal patent categories, which indicates heightened patent quality.

- (1)

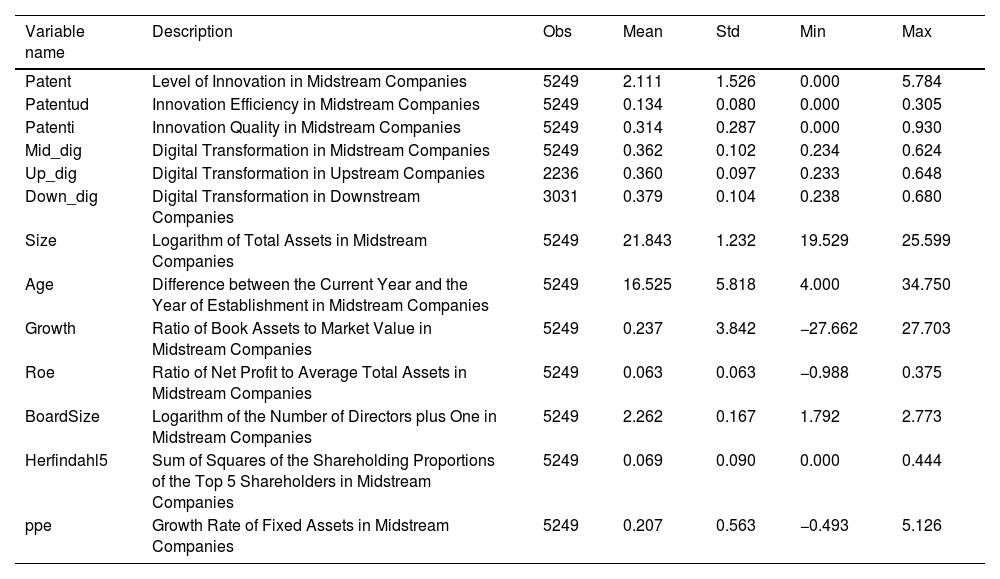

Control Variables: This study selects a series of factors that have been proven to affect the innovation level of enterprises in the literature as controls (Table 1). These include midstream companies’ digital transformation (Mid_Dig), enterprise age (Age), enterprise size (Size), growth (Growth), profitability (Roe), board size (BoardSize), equity concentration (Herfindahl5), and fixed asset growth rate (ppe).

Table 1.Definition of main variables.

The regression equation for this study is defined as follows:

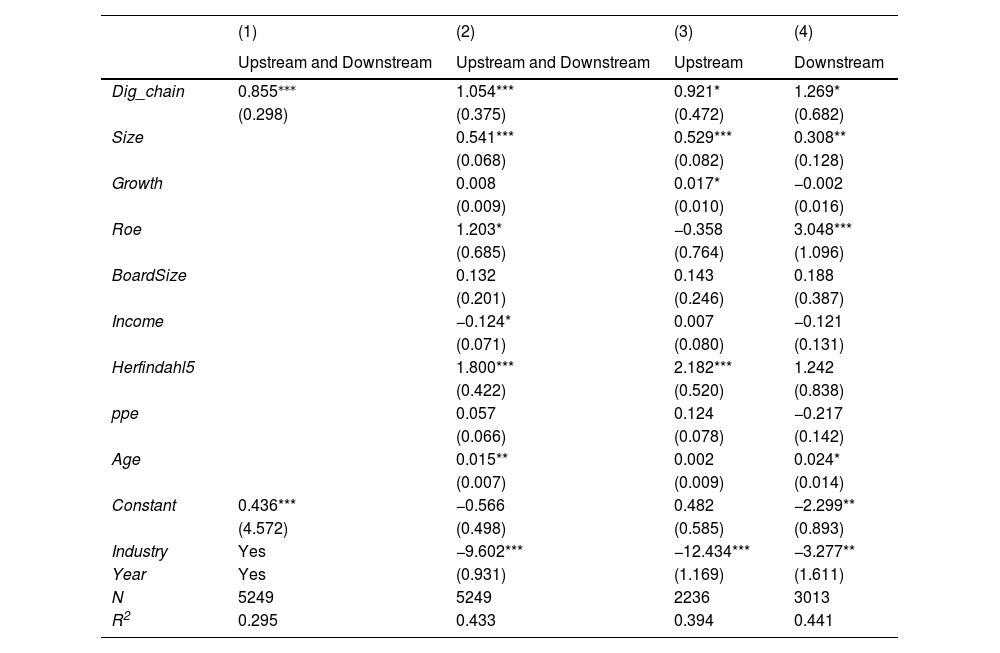

where Dig_chaini,t represents the digital transformation value of the upstream and downstream enterprises i in year t. Patent denotes the level of innovation for focal enterprise i in year t, encompassing strategic innovation (Patentud) and substantive innovation (Patenti). Controls refers to a series of control variables. Industryi is the industry dummy variable. Yeart is the year dummy variable. εi,t is the random error term.Empirical resultsBaseline regressionThe results of the baseline regression test presented in Table 2 indicate that the digital transformation of upstream and downstream enterprises (Dig_chain) consistently exerts a significant positive impact on focal enterprises’ innovation performance across all four models.

Baseline regression results.

Note: (1) ***, **, and * respectively denote significance levels at 1 %, 5 %, and 10 %. (2) The value in parentheses is standard error.

Specifically, in the models in Columns (1) and (2), the influence of digital transformation on the innovation level (Patent) and strategic innovation (Patentud) of the focal enterprise both reach a significance level of 1 %, with coefficients of 0.770 and 1.018, respectively. Moreover, in the models in Columns (3) and (4), digital transformation's impact on substantive innovation (Patenti) and strategic innovation (Patentud) of the focal enterprise also achieves significance levels of 1 % and 5 %, with coefficients of 1.157 and 0.756, respectively. This suggests a pronounced positive relationship between the digital transformation of upstream and downstream enterprises and innovation level as well as both strategic and substantive innovations of the focal enterprise. The baseline regression results support the digital collaborative innovation hypothesis, which posits that the digital transformation of upstream and downstream enterprises can enhance information fluidity and collaborative efficiency, thereby promoting the focal enterprise's innovative activities. This process aids the focal enterprise in bolstering its market competitiveness, and facilitates a shift from traditional modes of innovation, ultimately leading to enhanced innovative performance.

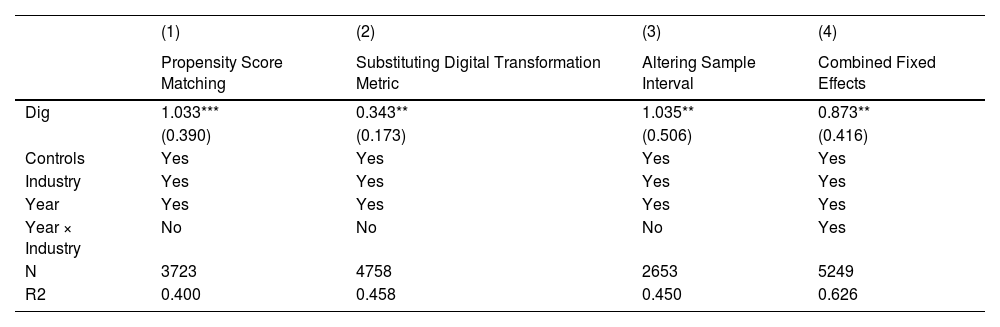

Robustness tests- (1)

Propensity Score Matching (PSM) Robustness Test. This study employs PSM to test for robustness. For matching, we select variables such as the previously mentioned industry digital transformation level, corporate governance level, R&D investment, human capital, capital structure, and management costs. Propensity scores are calculated using the logit model, and a 1:3 nearest neighbor matching method is applied to the samples. After matching, regression is conducted on the valid observations. Column (1) of Table 3 lists the results of the PSM robustness test. After controlling for industry and year fixed effects, the coefficient of the explanatory variable Dig_chain is 1.033, which is significant at the 1 % level. This result reaffirms our research hypothesis, suggesting a significant positive impact of the digital transformation of upstream and downstream enterprises on focal firms’ innovation. This conclusion remains robust under stringent statistical testing.

Table 3.Robustness tests.

Note: (1) *** and ** respectively denote significance levels at 1 % and 5 %. (2) The value in parentheses is standard error.

- (2)

Substituting the Metric for Digital Transformation. This study introduces an alternative metric for digital transformation to facilitate robustness assessment. Following Zhang et al. (2021), this study employs the proportion of the year-end value of intangible assets pertinent to the digital economy relative to aggregate intangible assets as a surrogate indicator, effectively supplanting the initial digital transformation measurement. As shown in Column (2) of Table 3, the empirical findings underscore that digital transformation within both the upstream and downstream sectors contributes substantially to the enhancement of innovation within midstream enterprises.

- (3)

Modification of the Sample Interval. To bolster the robustness validation of the study, the sample is recalibrated, specifically focusing on the period after 2015, which aligns with the rapid evolution phase of China's digital economy. Column (2) of Table 3 presents the outcomes of this robustness examination. After adjusting for the fixed effects pertinent to industry and year, the coefficient associated with Dig_chain was 0.742, attaining statistical significance at the 10 % threshold. This finding corroborates the substantive influence of digital transformation endeavors in both upstream and downstream enterprises on midstream firms’ innovation propensities. Accordingly, the principal inferences of this study demonstrate their validity, even within the recalibrated sample interval, underscoring their resilience in the face of more rigorous analytical conditions.

- (4)

Adjustment for Spatio-Temporal "Time × Industry" Joint Fixed Effects. Following Moser and Voena (2012), we rigorously incorporate controls for joint fixed effects attributable to time and industry intersections. This measure is instrumental in circumventing the estimation biases potentially induced by industry-specific perturbations across various temporal contexts. Column (4) of Table 3 reveals that the coefficient of digital transformation steadily retains its positive significance at the 1 % confidence interval. This consistency emphasized the robustness and reliability of the estimated outcomes.

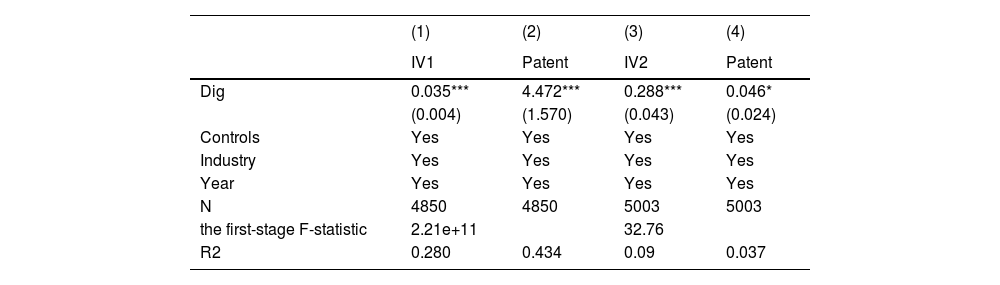

To further mitigate endogeneity, this study employs an instrumental variable approach. Following Nunn and Qian (2014), this study designates the interaction between the one-year lagged data of national internet penetration rates and the number of fixed telephones in the region in 1984 as the instrumental variable for the degree of digital transformation in enterprises. Additionally, based on the construction concept of the Bartik instrument (Goldsmith-Pinkham et al., 2020; Shen & Yuan, 2020), this study utilizes the product of the initial share (exogenous variable) of the analysis unit and the overall growth rate (common shock) to simulate the estimated values for successive years. These estimated values are highly correlated with the actual values yet uncorrelated with the residual terms. Specifically, this study employs the product of the average degree of digital transformation of other enterprises in the same two-digit industry as the sample company in the preceding year (2002) and the growth rate of internet users nationwide (excluding the province in which the enterprise is located) as the instrumental variable for digital transformation.

Table 4 presents the results of the two-stage least-squares regression with instrumental variables. Columns (1) and (2) of Table 4 report the regression results for the first instrumental variable, while Columns (3) and (4) present the results for the second instrumental variable. The results indicate that the first-stage F-statistics exceed 10, suggesting that the chosen instrumental variables do not suffer from weak instrument problems. In the second-stage regression results, the coefficient of the digital transformation variable for upstream and downstream enterprises was significantly positive. This reinforces the robustness of the finding that digital transformation in upstream and downstream enterprises significantly promotes innovation among midstream companies.

Robustness tests.

Note: (1) *** and * respectively denote significance levels at 1 % and 10 %. (2) The value in parentheses is standard error.

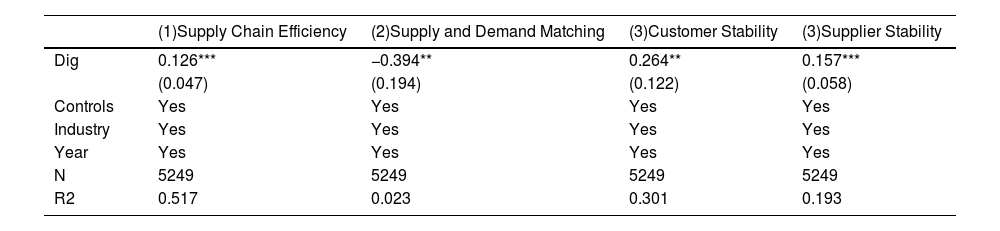

Previous research shows that digital transformation in upstream and downstream enterprises significantly enhances innovation in midstream enterprises. However, what channels and mechanisms underlie this effect? This section aims to preliminarily address this question from the perspectives of supply chain efficiency, optimization of supply and-demand matching, and stabilization of supply and demand relationships. This approach facilitates a more profound understanding of the externalities caused by the digital transformation of upstream and downstream enterprises. The impact of digital transformation in these enterprises on the mechanism variables is formulated as follows:

where M represents the mechanism variable and the interpretations of the remaining variables are consistent with those delineated in Eq. (1).Enhancing supply chain efficiencySupply chain efficiency emphasizes the enhancement of dialogue frequency and trade interactions between upstream and downstream enterprises, which manifests as a smooth cycle of product and service turnover. Recent research employs work-in-progress inventory as a representative indicator of supply chain efficiency (Wang et al., 2022). However, representing supply chain efficiency solely by the stock level overlooks the factor fluidity between enterprises at different nodes of the supply chain. Hence, this study builds on corporate inventory levels and employs inventory turnover days to reflect supply chain efficiency, calculated as ln(365/inventory turnover rate). This metric is chosen because of two considerations. First, the number of days of inventory turnover effectively mitigates the measurement errors in supply chain efficiency caused by companies retaining safety stock. Second, inventory turnover days reflect the frequency of dialogue and trade interactions between enterprises upstream and downstream of the supply chain, indicating supply chain flexibility and response speed. This is particularly pertinent in the context of the current challenges of overcapacity. Fewer turnover days signify faster inventory liquidation and higher efficiency of logistics, information flows, and capital flows among enterprises in the supply chain nodes.

Table 5 presents the regression results. Column (1) of Table 5 examines the impact of digital transformation in upstream and downstream enterprises on the supply chain efficiency of midstream companies. The estimated coefficient of Dig is significantly positive at the 1 % level, indicating that digital transformation in upstream and downstream enterprises can enhance the supply chain efficiency of midstream companies. This suggests that digital transformation in upstream and downstream enterprises enables midstream enterprises to optimize their supply chain management by achieving higher data transparency, more accurate demand forecasting, more efficient resource allocation, and quicker response times. Consequently, this leads to reduced inventory costs and production delays, enhances adaptability to market changes, and stimulates the development of new products, innovation in production processes, and the reform of business models, ultimately enhancing the overall innovative capacity of midstream enterprises.

Mechanism examination.

Note: (1) *** and ** respectively denote significance levels at 1 % and 5 %. (2) The value in parentheses is standard error.

The cost of coordinating supply and demand during supply chain collaboration is challenging to measure directly. Hence, this study quantifies the precision of supply and-demand matching in the supply chain by measuring the deviation of production fluctuations from demand fluctuations, thereby depicting the cost of supply and demand coordination within the supply chain. Drawing upon Cachon et al. (2007), this study constructs an index of supply-demand deviation defined as follows:

where σ(•) denotes the standard deviation of the variable, with the numerator and denominator representing the volatility of the enterprise's production and demand, respectively. The enterprise's production volume, Production, is calculated using Eq. (4), where Cost refers to the enterprise's operating costs and Inv signifies the net value of the enterprise's year-end inventory. The enterprise's demand, Demand, is proxied by its operating costs, Cost. Greater deviations in supply and demand in the supply chain indicate lower precision in supply-demand matching, leading to higher costs for coordinating supply and demand within the enterprise's supply chain. The regression results are presented in Column (2) of Table 5, which shows that the coefficient of Dig is negative and significant at a minimum level of 5 %. This implies that digital transformation in upstream and downstream enterprises can reduce the costs of supply demand coordination in midstream enterprises. This demonstrates that digital transformation in upstream and downstream enterprises reduces the time and resource costs for midstream enterprises in coordinating raw material supply and product demand by enhancing information sharing and communication efficiency within the supply chain. Consequently, midstream enterprises can respond more effectively to market changes and consumer demands, thereby allocating more resources and flexibility toward innovation in products and services and enhancing their adaptability and innovative capacity in highly competitive markets.Stabilizing supply and demand relationshipsDigital transformation in upstream and downstream enterprises enhances supply chain stability (including the stability of suppliers and customers) and creates a more predictable environment conducive to long-term planning and innovation in midstream enterprises. Such stability reduces operational risks and fosters bolder experimentation and innovation in midstream enterprises’ products and services. In line with the previously defined stability of supply and demand relationships, this study, drawing upon existing literature, delineates the stability of supply and demand relationships between upstream and downstream enterprises in the supply chain. Stability in customer-supplier relationships implies long-term and ongoing supply and sales relationships. Therefore, this study, inspired by Sun and Wang (2021), measures the stability of supplier/customer relationships (Stable) by dividing the number of the top five suppliers/customers in the current year that also appeared in the previous year by five.

Columns (3) and (4) of Table 5 present the regression results. Columns (3) and (4) examine the impact of digital transformation in upstream and downstream enterprises, respectively, on the stability of supplier/customer relationships in midstream enterprises. The coefficient of Dig is significantly positive, indicating that digital transformation in upstream and downstream enterprises strengthens the stability of supply and demand relationships. These results suggest that digital transformation in upstream and downstream enterprises enhances supply chain resilience by maintaining stable supply and demand relationships, thereby driving innovation in midstream enterprises, thereby validating H4.

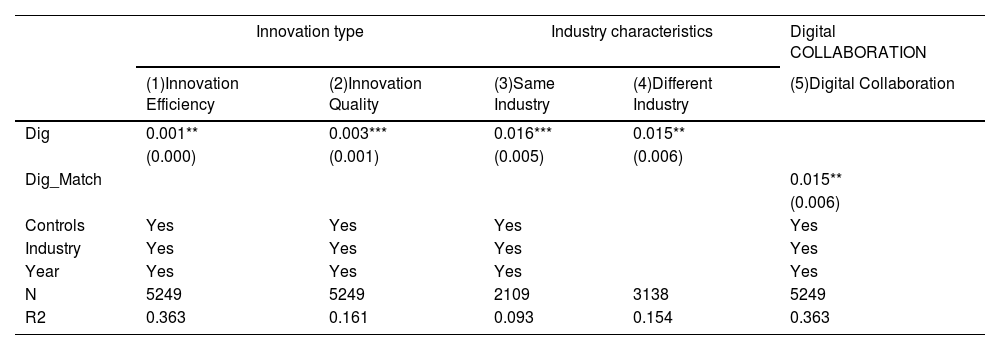

Further analysisEnhancing innovation efficiency or improving innovation qualitySince the country proposed an innovation-driven strategy, although the innovation level of enterprises has significantly improved, many problems remain. In achieving high-quality development, innovation is facing the test of "quantity" and "quality.” Enterprises can neither just increase investment in innovation, nor fall into the "trap" of high innovation efficiency and be complacent. To reveal how to balance the effective use of resources and the in-depth promotion of innovation achievements during digital transformation, and how to pay attention to the quality and influence of innovation achievements while pursuing speed and quantity, this study further refines the innovation output into two dimensions: innovation efficiency and innovation quality. As Columns (1) and (2) of Table 6 show, the regression results for innovation efficiency in Column (1) reveal that the coefficient of Dig is 0.001, significantly positive at the 5 % level. The results for innovation quality in Column (2) indicate that the coefficient of Dig is 0.003, significantly positive at the 1 % level. This suggests that digital transformation in upstream and downstream enterprises enhances innovation level in midstream enterprises, not only in terms of innovation output but also in terms of efficiency and quality. However, compared with a mere increase in innovation efficiency, digital transformation in upstream and downstream enterprises profoundly affects the innovation quality in midstream enterprises. Through improved market understanding, supply chain collaboration, data-driven decision-making, and risk management, midstream enterprises can achieve higher quality and more profound innovation.

Further analysis.

Note: (1) *** and ** respectively denote significance levels at 1 % and 5 %. (2) The value in parentheses is standard error.

Midstream enterprise innovation is influenced by the spillover effects of digital transformation in upstream and downstream enterprises within their supply chains, fostering shared knowledge, mutual understanding, and co-creation of value (Selnes & Sallis, 2003). Enterprises across different segments transcend corporate, industrial, and regional boundaries to achieve a synergistic effect that surpasses the sum of their individual contributions. The sample included in this study is segmented into same-industry and different-industry groups based on whether the upstream and downstream enterprises belong to the same industry as the midstream enterprise and group-specific tests are conducted. Column (3) of Table 6 presents the regression results for the same industry group, where the coefficient of Dig is 0.016, significant at the 1 % level. The regression results for the different-industry group, as shown in Column (4), indicate that the coefficient of Dig is positive, significant at the 5 % level. These empirical findings suggest that when midstream enterprises and their upstream and downstream counterparts belong to the same industry, the impact of digital transformation on innovation in midstream enterprises is more pronounced. This can be attributed to shared industry knowledge and technology, close supply chain collaboration, rapid market feedback, shared experiences in risk management and quality control, consistency in industry standards, and the applicability of customized solutions, which make the influence of digital transformation on innovation in midstream enterprises more significant within the same industry.

Digital collaboration between upstream and downstream enterprises and innovation in midstream enterprisesThe primary pathways through which digital collaboration between upstream and downstream enterprises impacts innovation in midstream enterprises include the effective utilization of complementary resources and reduction of transaction costs to stimulate innovation. The digital transformation collaboration between midstream enterprises and their upstream and downstream counterparts facilitates the efficient use of these complementary resources. This enables seamless information sharing and business synchronization, thereby constructing a more efficient supply chain. Significant digital disparities between upstream and downstream enterprises can create a "digital divide," leading to increased transaction costs. Therefore, to minimize transaction costs and ensure efficient resource utilization, digital collaboration between midstream enterprises and their upstream and downstream counterparts is pivotal for fostering innovation in midstream enterprises.

This study normalizes the digital transformation indices of upstream and downstream enterprises and midstream enterprises to the [0,1] range. This study employs a modified coupling coordination degree model to assess the degree of coordination, D of digital transformation among enterprises at all three levels. Initially, the coupling degree C of the system is calculated as follows:

where, x=max(Up_Down_Dig,Mid_Dig), y=min(Up_Down_Dig,Mid_Dig). C represents the coupling degree of the system, illustrating the extent of the differences between the subsystems. This reflects the degree of interaction and influence among the systems or elements. However, there may exist what is termed as a "low-level coupling trap," where the interaction between systems might be at a lower level. Whereas, the system's coordination degree, can reveal whether different systems mutually promote each other at a high level or constrain each other at a low level. This indicated the degree of healthy coupling between the two systems. Hence, this study employs the system's degree of coordination to measure the matching degree of digital transformation among upstream, midstream, and downstream enterprises.where, T denotes the comprehensive coordination index of the system, α1=α2=0.5, implying that both systems possess equal importance. D represents the final calculated system coordination degree, indicative of digital collaboration.Column (5) of Table 6 presents the regression results for digital collaboration, where the coefficient of Dig_Match is 0.015, significant at the 5 % level. The degree of digital collaboration reflects the disparity between enterprises in terms of technology and resources, which affects the ability of midstream enterprises to efficiently utilize and absorb digital knowledge from upstream and downstream enterprises in the supply chain. Therefore, the smaller the digital gap between upstream and downstream enterprises and midstream enterprises–that is, the higher the level of digital collaboration–the more conducive it is to fostering innovation in midstream enterprises.

Conclusion and policy implicationsResearch conclusionsBy matching data from upstream, midstream, and downstream listed companies in China from 2011 to 2022, this study examines the impact of digital transformation in upstream and downstream enterprises on innovation in midstream enterprises from the perspective of supply chain resilience and its transmission mechanisms. The study finds that: (1) Digital transformation in upstream and downstream enterprises significantly fosters innovation in midstream enterprises. This conclusion holds true even after a series of endogeneity and robustness tests. (2) Digital transformation in upstream and downstream enterprises enhances supply chain resilience by improving supply chain efficiency, optimizing supply and demand matching, and stabilizing supply and demand relationships, leading to innovation in midstream enterprises. (3) The impact of digital transformation in upstream and downstream enterprises on innovation in midstream enterprises is reflected by significant increases in both innovation efficiency and innovation quality, with a more pronounced enhancement in innovation quality. Furthermore, when upstream and downstream enterprises belong to the same industry, the spillover effect of digital transformation becomes stronger. Digital collaboration within a supply chain can enhance innovation in midstream enterprises.

Policy recommendationsCurrent adjustments in the global division of labor and volatility in domestic and international markets have made the risk shocks faced by China's supply chain more complex and severe, necessitating urgent action from the government and enterprises to utilize digital technology innovations and applications to enhance the resilience and security of the supply chain. This study's findings have several policy implications.

First, optimizing digital transformation policies around external spillovers to enhance enterprise innovation throughout the supply chain is crucial. In the digital era, the characteristics of supply chains are increasingly emphasized, making enterprise innovation more influenced by the behaviors of upstream and downstream enterprises. However, a significant challenge in current digital transformation efforts is the prominent issue of "data silos," where enterprises focus on internal digital infrastructure while neglecting the external impacts, leading to the underutilization of digital technology's penetrative, collaborative, and external advantages. This study's findings indicate that enterprise innovation is influenced by the digital transformation of upstream and downstream enterprises. Therefore, digital transformation policies should focus on the entire supply chain process. Leveraging the vast market space in China, a series of digital application scenarios centered on end-user demand should be developed to define market demand as visual scenario opportunities that drive the digital transformation of market entities. Efforts should be made to deepen the digital transformation of the real economy throughout the entire supply chain; accelerate the digital transformation of R&D, design, production, management, and market services; and encourage upstream and downstream enterprises to strengthen digital technology innovation and application.

Second, reinforcing the role of digital transformation in upstream and downstream enterprises to enhance supply chain resilience should become the focal point of current digital transformation policies. Presently, digital transformation across an entire supply chain commonly faces issues of underdevelopment and structural imbalances. The fundamental reason for this is the relatively weak linkage effects and collaborative capabilities of the upstream and downstream enterprises. Thereby, this study's findings reveal that digital transformation in upstream and downstream enterprises can strengthen the resilience of industrial supply chains, and in turn, elevate the innovation levels of midstream and upstream enterprises. Accordingly, future digital transformation policies should focus on the digital transformation of upstream and downstream enterprises as a breakthrough point to promote the construction of supply chain collaboration mechanisms. Specifically, emphasis should be placed on enhancing supply chain linkages and collaborative effects across three levels: improving supply chain efficiency, optimizing supply and demand matching, and maintaining supply and demand relationships.

Third, formulating differentiated digital transformation policies to implement categorized and precise strategies for digital transformation is necessary. The effects of digital transformation differ significantly between industries and enterprises. This study's findings indicate that when midstream enterprises and their upstream and downstream counterparts belong to the same industry, the impact of digital transformation on innovation in midstream enterprises is more substantial. Moreover, the higher the level of digital collaboration within the supply chain, the more it contributes to promoting innovation in midstream enterprises. Digital collaboration and cooperation among enterprises in the same industry should be encouraged and promoted. By sharing industry-specific data and insights, upstream and downstream enterprises can support the innovation needs of midstream enterprises more effectively. Additionally, strengthening the level of digital collaboration among upstream, downstream, and midstream enterprises by establishing shared platforms to promote data- and knowledge-sharing is crucial. Simultaneously, training and resources should be provided to help enterprises upgrade their digital capabilities, particularly SMEs. Finally, supporting the establishment of industry-specific digital innovation platforms to promote the joint exploration of new technologies and processes by upstream and downstream enterprises and applying these innovations to enhance the quality of products and services is recommended.

Research limitations and prospectsEnterprise digitalization is a learning process. Future research should investigate and reveal how the digital transformation of upstream and downstream enterprises affects midstream enterprises’ innovation experiences. This study uses samples of listed companies to examine the effects of digital transformation on innovation in midstream enterprises and delves into the impact mechanisms from a supply chain resilience perspective. Future studies could select typical case enterprises, employ case study methodologies, or develop corresponding scales to further explore the spillover effects of enterprise digitalization within the supply chain and systematically study the digital learning mechanisms and logic between organizations.

FundingThis work was supported by the National Natural Science Foundation [Grant No. 72103067] and was supported by Fujian Province Humanities and Social Sciences Research Base—Quantitative Economics Research Center, Huaqiao University.

CRediT authorship contribution statementJiangying Wei: Conceptualization, Formal analysis, Writing – original draft, Writing – review & editing. Xiuwu Zhang: Data curation, Funding acquisition, Supervision. Takashi Tamamine: Methodology, Resources, Software.