In this study, we construct a new measurement of a firm's trade risk expectation. We investigate how exporters’ innovation strategies respond to trade protection and their risk expectation by studying the global anti-dumping investigations against China. Specifically, using information on targeted products, we identify the trade risk level of each firm. We then develop a theoretical model to analyze how a multi-product firm adjusts its innovation strategies by its trade risk expectation when affected by anti-dumping measures, and the spillover effects of trade risk expectation on the firm's innovation strategies. This model predicts that first, affected firms will increase their R&D investment and innovation output in response to the increase of trade risk. Second, firms are more likely to choose high-quality innovation when their trade risk expectations increase. Third, for unaffected firms, an increase in trade risk expectation will lead to a growth in their innovation outputs. These predictions are aligned with the Chinese data, which are matched with an anti-dumping dataset from the Global Anti-dumping Database and several firm-level datasets. After changing the definition of trade risk expectation, excluding the cases also affected by countervailing measures and those with a zero anti-dumping tax rate, our results remain constant. This gives us further confidence that exporters with higher trade risks are more responsive to trade protection.

Under the World Trade Organization (WTO) rules, anti-dumping is the most common form of temporary trade barriers. In addition, since 1995, China has become the most frequently targeted country. According to statistics from the Ministry of Commerce of China, 1571 anti-dumping investigations were conducted of China from 1995 to 2022, 25.9 % of the total global anti-dumping investigations over the same period. Furthermore, final duties were imposed for 1172 of these anti-dumping investigations, 28.4 % of the total anti-dumping duties worldwide. According to the 2021 Report to Congress on China's WTO Compliance, which was submitted by the United States Trade Representative in February 2022, the US is likely to adopt more non-tariff than tariff measures against China in the future, especially anti-dumping, countervailing, and safeguard measures. This means trade remedy measures would become the most common trade protection tools for other countries against China.

There is considerable literature on the economic impacts of anti-dumping measures. Most analyses focus on the effects of these measures on domestic firms and industries, although relatively few examine the corresponding impacts on affected foreign exporters. Besides the impacts on exporters’ pricing behavior, exporting behavior, and foreign direct investment strategies (e.g., Blonigen, 2002; Blonigen & Park, 2004; Bown & Crowley, 2007; Crowley et al., 2018; Lu et al., 2013), few studies explore the effects of anti-dumping measures on exporters’ innovations (Huang et al., 2024; Meng et al., 2020; Xie et al., 2020). In addition, to our knowledge, no studies consider the heterogeneous innovation responses of exporters with different trade risk expectation, and none use theoretical models to describe the mechanism of this issue. Therefore, understanding whether affected exporters adjust their innovation strategies according to their trade risk expectations in response to the negative shocks generated by anti-dumping measures is important in fully grasping market competition between domestic firms and foreign exporters.

Thus, in this study, we attempt to fill the gap in the literature using China as our research example, which is the world's largest exporter and the most frequently targeted country of anti-dumping measures worldwide. We address the following research questions: Do affected exporters adjust their innovation strategies? What innovations do they choose? Do their innovation strategies change when they have different trade risk expectations? Is there a spillover effect on unaffected exporters with trade risks?

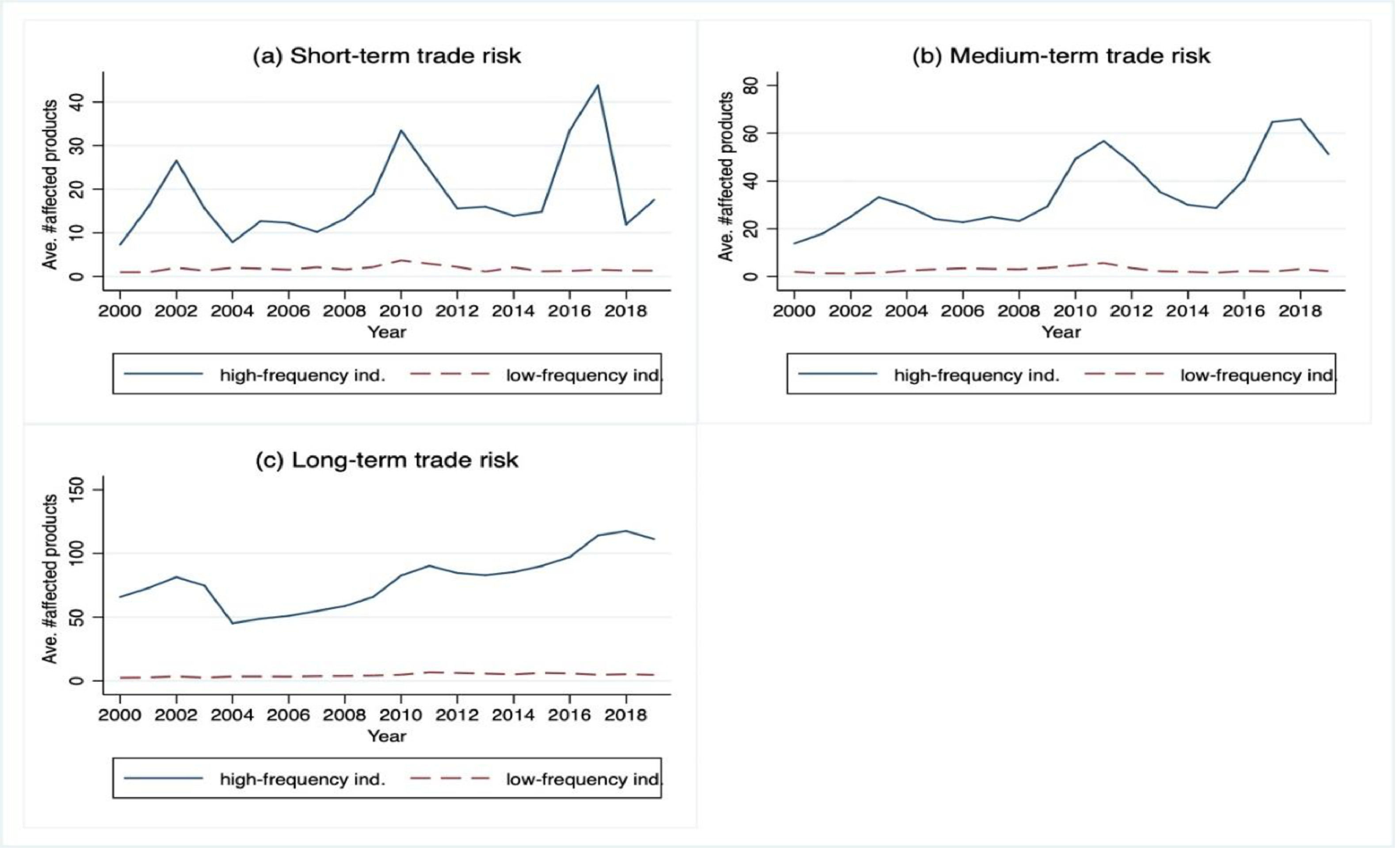

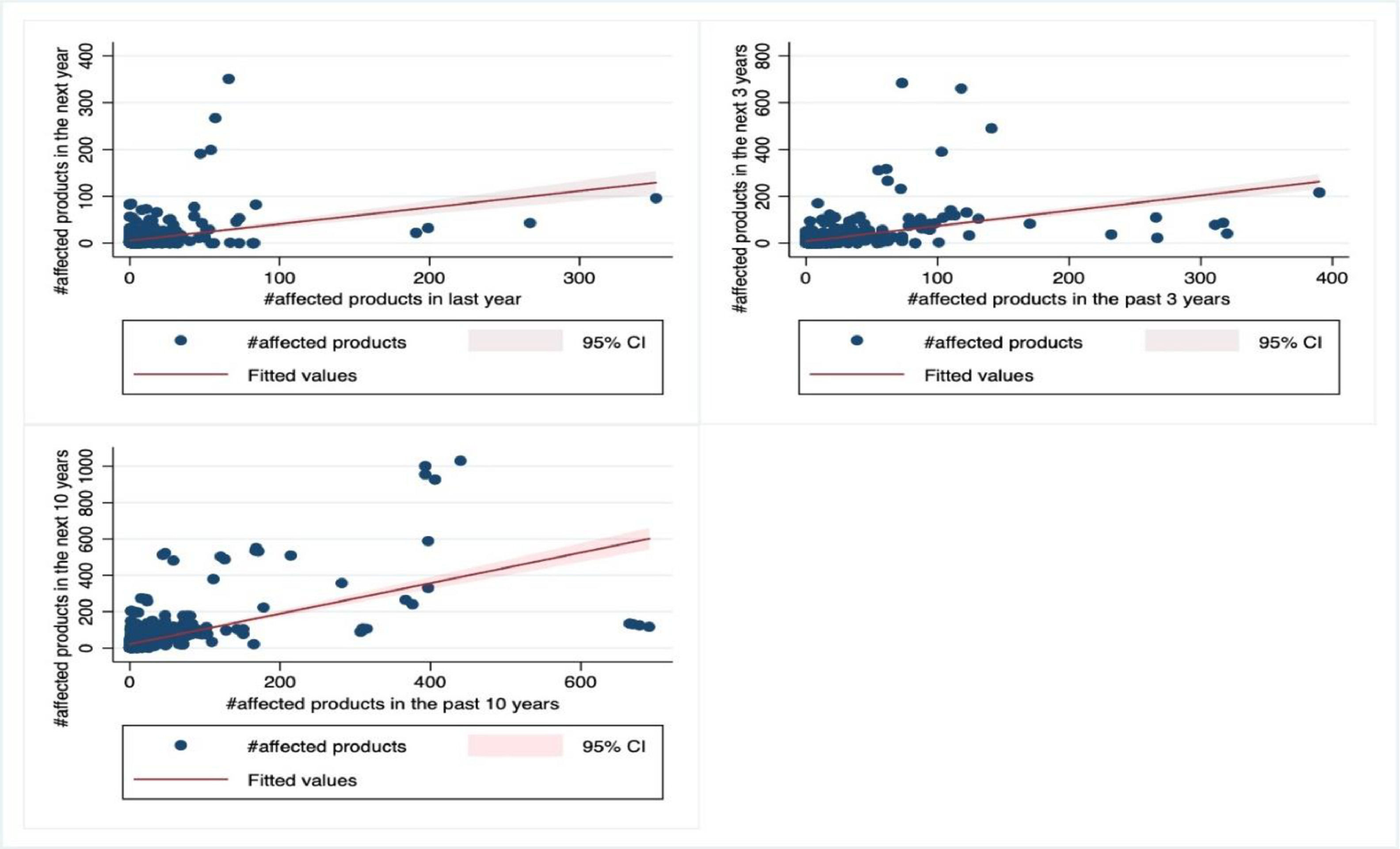

Identifying the trade risk expectation of each firm is challenging. Therefore, using the Global Anti-dumping Database of the World Bank (Bown et al., 2020), we employ the number of targeted products to measure the trade risk at the industry level. Based on this, we delineate the industries into two groups—high-frequency and low-frequency industries—with respect to the median of the number of targeted products by year. We find that for low-frequency industries, the average number of targeted products is stable from short- to long-term trade risks. However, for high-frequency industries, the average number of targeted products fluctuates greatly under short- and medium-term trade risks, and they demonstrate a growth trend under long-term trade risks.

To understand how multi-product firms develop innovation strategies according to trade risk expectations when affected by anti-dumping measures, we construct a theoretical model to analyze the mechanism. We start the analysis with sufficient innovation resources and expand it to a case with resource constraints. To further identify the mechanism, we analyze the spillover effects of trade risk expectations on a firm's innovation strategies. This model predicts that in response to increasing trade risk expectations, affected firms will increase their R&D investments, which leads to more innovation outputs. With limited resources, affected firms are more likely to choose high-quality innovation when their risk expectations increase. For unaffected firms, an increase in trade risk expectations will increase their innovation outputs. To clarify the significance of trade protection effects, we test the predictions of the model using firm-level data from China for the period 2000–2013, which are matched with data from the Global Anti-dumping Database (GAD) and several micro-datasets. The empirical results are consistent with our model predictions.

The paper is organized as follows. The next section provides an overview of the related literature, and Section 3 develops the theoretical model. Section 4 presents the data, measurement of trade risk, and empirical specifications. Section 5 describes the empirical results for each prediction from the model and the robustness checks. Finally, Section 6 highlights the conclusions of the study.

Literature reviewThis study builds on and contributes to several strands of the literature. First, it expands the literature on the effects of temporary trade barriers such as anti-dumping duties. Most studies empirically clarify the impacts of temporary trade barriers on bilateral trade. Reportedly, the most direct impact is the restriction on exports from foreign sellers, termed “trade destruction”. Many studies have demonstrated this issue at the macro- or micro-levels. They show that anti-dumping measures significantly reduced imports from a targeted country (Felbermayr & Sandkamp, 2020; Sandkamp, 2020; Vandenbussche & Zanardi, 2008) or that of targeted products (Brambilla et al., 2012), which benefits domestic firms, especially the least productive producers (Jabbour et al., 2019). Lu et al. (2013) find that American anti-dumping investigations decreased the number of exporters, not the export volume per exporter. Some studies indicate that the US-China trade war reduced exports from China (Jiang et al., 2023), but also caused a significant decline in the real income and trade of the US in the short term (Amiti et al., 2019; Fajgelbaum et al., 2020). In turn, this effect increased targeted goods imports from other countries, or a “trade diversion”. However, only a few studies address this effect. For example, Brenten (2001) provides evidence at the country level, and Durling and Prusa (2006) for a specific sector. Furthermore, several studies examine the effects of anti-dumping measures on domestic sales in targeted countries, termed “trade depression”, such as Bown and Crowley (2007) who focused on Japan. These studies imply that anti-dumping measures increase the domestic sales of targeted goods in targeted countries, which decreases imports from other countries. Another effect of anti-dumping is “trade deflection”, which deals with how exports respond to trade protection. Here, affected countries increase their exports of targeted goods to other countries (Bown, 2010; Bown & Crowley, 2007; Chandra, 2016; Crowley et al., 2018). Some literature focuses on the product spillover effect of anti-dumping measures. For example, Lu et al. (2018) indicate that Chinese exporters imposed with anti-dumping duties by the US reduce their overall export scope and concentrate on fewer more successful products. Long et al. (2018) also show that American-imposed anti-dumping duties against China led to a significant increase in the export value and quantities of non-targeted goods sold by affected firms to the US. While the overall impact on trade is well documented, the literature has not yet explored the effects of non-tariff measures according to firms’ different trade risk expectations. Using insights from this literature, we fill this gap by theoretically and empirically investigating the role of anti-dumping measures according to firms’ trade risk expectations.

Second, this paper is related to the literature on the effects of temporary trade barriers on productivity and innovation. Recent research shows that the final anti-dumping duties have significant negative impacts on foreign firms’ productivity (Chandra & Long, 2013). In the domestic arena, laggard companies have productivity gains, while frontier firms experience productivity losses during the protection of anti-dumping (Kongings & Vandenbussche, 2008). Some literature regarding the effects of anti-dumping measures on innovation indicates that due to the competition caused by anti-dumping, domestic firms will tend to use new technology earlier than foreign ones and invest more in R&D (Avsar & Sevinc, 2019; Crowley, 2006). However, less is known about the corresponding impacts on Chinese targeted firms, and few studies examine the heterogeneous effects on types of innovation (Huang et al., 2024; Meng et al., 2020; Xie et al., 2020). In particular, Meng et al. (2020) argue that Chinese firms tend to upgrade the quality of their exports of targeted products in affected markets, especially those with ex ante higher product quality. Huang et al. (2024) show that US anti-dumping duties significantly increase the innovation of Chinese targeted firms, especially substantive innovation. Following the context of heterogeneous innovation inputs in Aghion and Howitt (2009), we contribute to this literature by developing a model of firms’ innovation strategies and anti-dumping measures according to its trade risk expectation and by identifying the effects through a firm-level analysis.

Third, some work explores the effects of import competition and policy uncertainty on firms’ innovation. According to Bloom et al. (2016), Chinese import competition led to increased technical change in European firms and the reallocation of employment between firms to more technologically advanced firms. Akcigit et al. (2018) confirm that globalization through diminished trade barriers boosts domestic innovation through induced international competition. Analyzing China's accession to the WTO in 2001, Liu and Ma (2020) find that trade liberalization may significantly encourage firms’ patent applications through the reduction of trade policy uncertainties. In contrast, Liu and Qiu (2016) indicate that the input tariffs cut by accession to the WTO decreased the innovation of Chinese firms. Similarly, Liu et al. (2021) show that import competition induced by China's accession to the WTO reduced firm innovations, especially those in industries experiencing greater tariff reduction after this accession. In addition, Hao et al. (2022) confirm that a rise in policy uncertainty negatively impacts firms’ innovation. Here, we expand this literature by including non-tariff trade regulation, innovation, and patenting in our study. However, our approach is different, as it focuses on the adjustments of firms’ innovation strategies rather than the overall impacts on their innovation.

Fourth, different from the literature focusing only on the anti-dumping measures imposed by a single country or region against China, such as the US (Chandra & Long, 2013; Huang et al., 2024; Lu et al., 2013, 2018) and EU (Felbermayr & Sandkamp, 2020; Jabbour et al., 2019), we use information on all anti-dumping cases against China by 25 economies during our whole sample period to explore these effects. Furthermore, we access the monthly customs data in China, which enable examining exporters’ responses to anti-dumping investigations (i.e., before final duties are imposed) and duties. This approach renders our estimation results more general and comprehensive.

Theoretical modelIn this section, we build a theoretical model to analyze how a multi-product firm adjusts its innovation strategies according to its trade risk expectations when affected by anti-dumping measures. First, in Section 3.1, we describe how a firm determines its trade risk expectations. To simplify the analysis, following the context of heterogeneous innovation inputs in Aghion and Howitt (2009), in Section 3.2, we assume that firms have sufficient innovative resources to support them in different types of innovation simultaneously. Therefore, we discuss the problem of firm innovation input strategies. Next, in Section 3.3, we analyze the effects of trade risk expectations on firms’ innovation output. In Section 3.4, based on the types of firm innovation, we expand the model to a case with resource constraints and discuss how firms develop heterogeneity innovation strategies. Finally, we analyze the spillover effects of trade risk on firm's innovation strategies in Section 3.5.

Firms’ trade risk expectationsSuppose the probability of a representative firm's trade risk is p, then this firm's trade risk expectation can be denoted by E(p). In this study, p means the probability of a representative firm affected by anti-dumping measures. Thus, E(p) depends on both the anti-dumping measures imposed on the firm and that on that firm's industry. First, E(p) depends on whether the firm was affected by an anti-dumping investigation or duties before, noted as Iinv and Iduty, respectively. If the firm was affected by anti-dumping investigations before, then Iinv=1, and 0 otherwise. Similarly, if the firm was affected by anti-dumping duties before, then Iduty=1, and 0 otherwise. Second, E(p) depends on the probability of the industry affected by anti-dumping measures, which includes the probability of the industry affected by an anti-dumping investigation. This is measured by p¯inv. The probability of the industry affected by an anti-dumping duty is represented by p¯duty. In this context, firms’ trade risk expectations can be delineated as individual and industrial trade risks, with the weight of χ and 1−χ, where 0≤χ≤1. Hence, firms’ trade risk expectations can be denoted as:

or equivalently as:Specifically, there are three cases: (1) If a firm has not been affected by an anti-dumping investigation before, then its trade risk expectation is E(p|Iinv=0,Iduty=0)=p¯invp¯duty. (2) If a firm was only affected by an anti-dumping investigation, but not by anti-dumping duties, then its trade risk expectation is E(p|Iinv=1,Iduty=0)=p¯invp¯duty+χp¯duty(1−p¯inv). (3) If a firm was affected by anti-dumping duties, then its trade risk expectation is E(p|Iinv=1,Iduty=1)=p¯invp¯duty+χ(1−p¯invp¯duty). These three cases satisfy E(p|Iinv=1,Iduty=1)>E(p|Iinv=1,Iduty=0)>E(p|Iinv=0,Iduty=0).

Firms’ innovation investment decisions under trade protectionWe now analyze how a firm makes innovation investment decisions under trade protection. If the success rate of innovation type j (i.e., high-quality or low-quality innovation) is μj, let π0 denote the initial export profit of the representative firm. At the end of the period, a firm's export profit π1j is affected by two factors: The first is whether anti-dumping measures were imposed on its export products, and the second is whether its innovation is successful or not.

Specifically, π1j is relevant in four cases: First, if the firm was not affected by anti-dumping measures and its relevant innovation failed in the current period, then its ending export profit remained, i.e., π1j=π0. Second, if the firm was affected by anti-dumping measures in the current period, but its innovation failed, then its ending profit decreased rapidly with the reduction rate δ∈(0,1]. In this case, π1j=(1−δ)π0. Third, if the firm was not affected by anti-dumping measures in the current period, but its innovation was successful, or the firm has never been affected by anti-dumping duties, then its profit growth is induced by innovation with the share γj, where γj∈(0,1), i.e., π1j=(1+γj)π0. If a firm has been affected by anti-dumping duties, in addition to the increase in ending profit, the innovation can also fill previous losses by δγjπ0, i.e., π1j=(1+γj)π0+δγjπ0. In the final case, the firm was affected by anti-dumping duties with successful relevant innovation in the current period. Although its ending profit decreased rapidly, it can employ innovation to cover the losses by exporting new products, as well as the losses caused by previous anti-dumping duties. In this case, a firm's profit is π1j=(1−δ+θj)π0+(δθjIduty)π0, where θj∈(0,1) is the growth rate induced by innovation, which satisfies θj>γj.1 To sum up, we have the following:

If the real probability of anti-dumping p could be known, then the expected profit is E(π1j)=(1−pδ)π0+μj(1+δIduty)[(1−p)γj+pθj]π0. In fact, we cannot accurately know the probability of anti-dumping ex-ante. Thus, a firm's expected ending profit can only be expressed by the trade risk expectation E(p), i.e.,

E[E(π1j)]=[1−E(p)δ]π0+μj(1+δIduty){[1−E(p)]γj+E(p)θj}π0.

As mentioned, to innovate, firms must invest in R&D activities, and know that innovations are characterized by uncertainty. Following the model insights in new growth theory (Aghion & Howitt, 2009), a higher innovation success rate means more investment in R&D activities, i.e., the success rate μjincreases with investment in innovation Rj, which satisfies the following research equation: μj=ϕ(Rj). For simplicity, we assume that a firm's innovation follows the Cobb-Douglas function: μj=λjRjσ, where λj reflects the efficiency of R&D activities, and σ is the elasticity, which satisfies σ∈(0,1).2 Regardless of whether the innovation is successful, the representative firm will always invest Rj for R&D activities. Given the assumptions above, the representative firm will choose Rj to maximize its expected net profit of R&D:

The optimal R&D investment Rj satisfies the first order condition, or the “research arbitrage equation”:

λjσRjσ−1(1+δIduty){[1−E(p)]γj+E(p)θj}π0=1.

This yields the optimal R&D investment and optimal innovation successful rate are:

Finally, this innovation investment choice leads to the maximized expected net profit of R&D (substituting Eq. (2) into Eq. (1)):

Impact of increased trade risk expectations on firms’ innovationRecall that the successful rate of innovation μj increases with R&D investment Rj. However, what is the relationship between trade risk and innovation output? To address this, differentiating Eq. (2) with respect to E(p) yields:

For any types of innovation, firms’ innovation investment and success rate increase alongside trade risk expectations. According to the Law of Large Numbers, an increase in the innovation success rate will increase innovation outputs. Thus, we propose the following:

Proposition 1

Firms will increase their R&D investment when the trade risks are expected to rise. This in turn leads to more innovation outputs.

According to Eq. (3), when comparing the optimal success rate of firms only affected by anti-dumping investigations (with Iinv=1 and Iduty=0) and unaffected firms (with Iinv=0 and Iduty=0), we have:

Here, when the representative firm is affected by an anti-dumping investigation, its trade risk expectations increase. Therefore, the firm will increase its innovation investment to develop new products to cover the possible losses of profit caused by anti-dumping duties. Thus:

Corollary 1.1

Compared with unaffected firms, firms only affected by an anti-dumping investigation tend to engage in more R&D activities and their innovation outputs increase.

Comparing the optimal innovation success rate of firms affected by anti-dumping duties (with Iinv=1 and Iduty=1) and that of unaffected firms (with Iinv=0 and Iduty=0), we have the following:

Eq. (7) indicates that firms affected by anti-dumping duties will also increase their innovation investment, which leads to a higher innovation success rate. In this case, anti-dumping duties negatively impact firms’ exports and profits. To reduce losses and create additional benefits, these firms are more motivated to innovate. Therefore, they have more innovation outputs. Therefore:

Corollary 1.2

Compared with unaffected firms, firms affected by anti-dumping duties tend to engage in more R&D activities and their innovation outputs continue to increase.

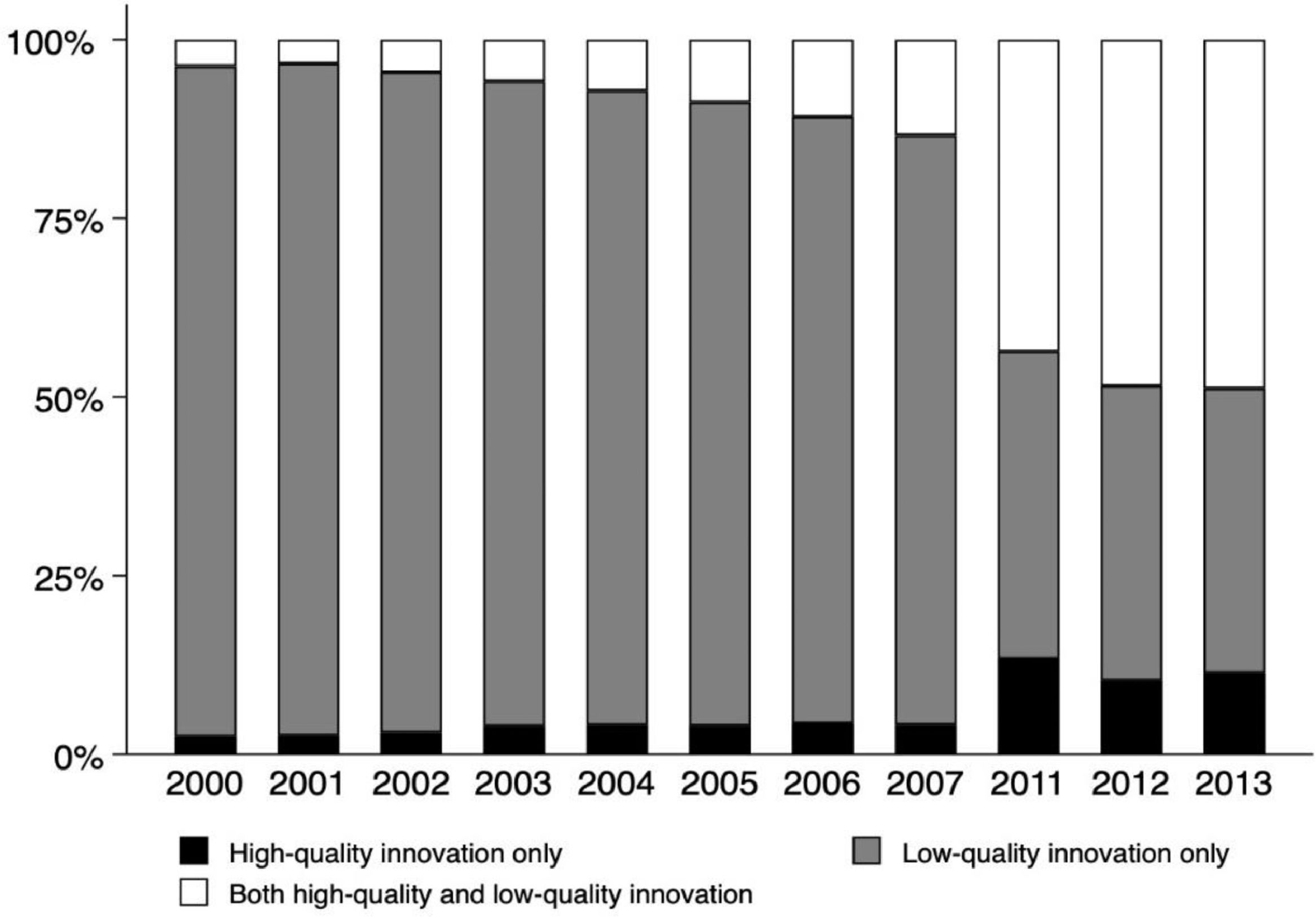

Innovation strategies of firms with resource constraintsThus far, we have discussed firms’ innovation strategies depending on their trade risk expectations with unlimited resources. However, not all firms can conduct different types of innovation activities simultaneously due to resource constraints. Although we cannot provide direct evidence to prove this argument, we can use the distribution of firms with different innovation outputs to support it. In the next section, we use the number of patent applications as an index of innovation. The latest Patent Law of the People's Republic of China (hereafter abbreviated as Patent Law) identifies three types of patents: invention, a utility model, and design. According to Patent Law (Chapter I: Article 2), “Invention means any new technical solution proposed for a product, a process or the improvement thereof.” It stipulates the requirements of novelty, inventiveness, and practical use, and requests a substantive examination after the patent application. Furthermore, a utility model and design only need a preliminary examination after the patent application.3 In general, invention patents are high-quality innovations that drive technological progress, while utility models and design patents are low-quality innovations with minor improvements. Hence, the cost and technological level of an invention is usually higher than that of a utility model and design. In this study, we consider an invention a “high-quality innovation” and a utility model and design a “low-quality innovation”. Fig. B1 in the Appendix shows that the proportion of firms with all types of innovation significantly increased during the sample period. The share of firms with only high-quality innovation (i.e., invention patent) slowly increased, and that of firms with only low-quality innovation (i.e., utility model and design patent) decreased. This indicates that a large share of firms does not have enough resources for multiple innovations. Therefore, how firms with limited resources develop their innovation strategies needs consideration.

Under the constraint of innovative resources, a representative firm must make decisions on the type of innovation and R&D investment sequentially based on its trade risk expectations. First, it must decide on the firm's innovation choice, namely high- or low-quality innovation. Second the firm's R&D investment decision is made regarding the amount of innovative input after it identifies its innovation type.

Suppose that cost and revenue are the key differences between high-quality innovation H and low-quality innovation L. Since the cost of high-quality innovation is higher than for low-quality innovation, high-quality innovation has a lower efficiency of R&D activities with the same innovative resources, namely λL>λH. This shows the innovation success rate response for firms with different innovation resources. In addition, the growth rate of profit γj and θj satisfy γH>γL and θH>θL, showing that the increase of export profit induced by high-quality innovation is higher than that for low-quality innovation. However, resource constraints mean that some firms can only choose a single type of innovation.

Firms choose their optimal innovation type by comparing the net profits brought by different innovations. If the net profit of high-quality innovation is higher than that for low-quality innovation, then the firm will choose high-quality innovation and vice versa. Thus, if there is no difference between the two innovations, then the non-arbitrage condition is:

This yields the expected probability of the net profit, rendering the two innovations indifferent:

where p^∈(0,1). For simplicity, for unaffected firms, we assume that the relative advantage of low-quality innovation in R&D efficiency is greater than the relative advantage of high-quality innovation in improving the export profit, i.e., λL/λH>γH/γL. For affected firms, we assume that θH/θL is large enough and satisfies θH/θL>λL/λH, which reflects that the relative advantage of high-quality innovation in the export growth of new products is larger than the relative advantage of low-quality innovation in R&D efficiency. In this context, when E(p)>p^, high-quality innovation will be chosen, as it induces higher net profit. When E(p)Proposition 2

Firms are more likely to choose high-quality innovation when their trade risk expectations are higher.

Since firms’ trade risk expectations relate to individual and industrial trade risks, we now focus on the impact of the probability of the industry affected by anti-dumping investigationp¯invon firm innovation strategy, which yields the following four cases:

- i.

If E(p|Iinv=1,Iduty=1)>E(p|Iinv=1,Iduty=0)>E(p|Iinv=0,Iduty=0)>p^, then all firms tend to choose high-quality innovations when p¯inv is large enough.

- ii.

If E(p|Iinv=1,Iduty=1)>E(p|Iinv=1,Iduty=0)>p^>E(p|Iinv=0,Iduty=0) with relatively high p¯inv, then firms affected by anti-dumping investigations tend to choose high-quality innovations, while unaffected firms tend to choose low-quality innovations.

- iii.

If E(p|Iinv=1,Iduty=1)>p^>E(p|Iinv=1,Iduty=0)>E(p|Iinv=0,Iduty=0) with relatively low p¯inv, then firms affected by anti-dumping duties tend to choose high-quality innovations, while firms only affected by anti-dumping investigations and unaffected firms tend to choose low-quality innovations.

- iv.

If p^>E(p|Iinv=1,Iduty=1)>E(p|Iinv=1,Iduty=0)>E(p|Iinv=0,Iduty=0), then all firms tend to choose low-quality innovations when p¯inv is low enough.

More generally, the innovation strategies of firms with high industrial trade risks are closer to the first two cases, while the innovation strategies of firms with low industrial trade risks are similar to the latter two cases. Based on this:

Corollary 2.1

In industries with high trade risks, firms affected by anti-dumping measures are more likely to choose high-quality innovations.

Corollary 2.2

In industries with low trade risks, firms affected by anti-dumping measures are more likely to choose low-quality innovations.

Spillover effects of trade risks on firms’ innovation strategiesIn the previous analysis, we compared the innovation strategies of firms affected by anti-dumping measures with unaffected firms with different trade risk levels. Note that anti-dumping measures have not been imposed on some industries. Thus, compared with no-risk firms, will other unaffected firms in affected industries prepare to deal with possible anti-dumping investigations in advance? In other words, does a spillover effect on unaffected firms with trade risks exist? Is this spillover effect related to the level of firms’ trade risk expectations?

Based on the above, we now analyze the spillover effects of trade risk on firms’ innovation strategies. According to Eq. (2), the optimal R&D investment of an unaffected firm is:

Differentiating Eq. (10) with respect to p¯inv yields:

As the probability of the industry affected by anti-dumping investigation p¯inv increases, the trade risk expectations of unaffected firms also increase. Hence, these firms’ R&D investment responses must be positive, which lead to a higher innovation successful rate. These firms will then have more innovation outputs. Thus, we propose the following:

Proposition 3

For unaffected firms, an increase in trade risk expectations leads to an increase in their innovation outputs.

This proposition then yields:

Corollary 3.1

Compared with no-risk firms, unaffected firms in industries with low trade risk tend to have more innovation outputs.

Corollary 3.2

Compared with industries with low trade risk, unaffected firms in industries with high trade risk tend to have more innovation outputs.

Data, measurement of trade risk and empirical strategyDataOur data come from multiple sources, the most important being the anti-dumping dataset from the Global Anti-dumping Database (GAD) of the World Bank by Bown et al. (2020). This includes information on all anti-dumping cases imposed by around 51 countries (or regions) in the period 1981–2020, such as the country (or region) who imposed the anti-dumping investigation, initiation date, final determination date and year each anti-dumping case was revoked, final anti-dumping duties, and product information (name, HS code).

The second dataset we used is Chinese customs data from the General Administration of Customs of China. This dataset contains detailed information on each firm's export transactions, including the company name, product identification (i.e., product name, HS code), export volume, export value, and destination country. For the period 2000–2006, this dataset provides monthly export transactions at the firm-product level. After 2007, it only includes annual data for each firm's export product. To identify the firm affected by an anti-dumping policy, we match targeted products in the GAD with this dataset using the HS 6-digit code, country name, and year.4

We use a patent as the index of innovation in this study, which we obtained from the State Intellectual Property Office (SIPO) dataset of China. This dataset contains detailed information on each patent filing since 1985, including the official name and address of the applicant, name of the patent, date of filing, and patent type (i.e., invention, utility model, or design).

We obtained other firm-level data from the Annual Survey of Industrial Firms (ASIF) published by the National Bureau of Statistics (NBS) of China. Until 2007, this data includes all state-owned enterprises (SOEs) and other ownership types with annual turnovers above 5 million RMB. After 2007, SOEs with annual turnovers below 5 million RMB are excluded from this data. From 2011 onward, the survey only covers manufacturing firms with annual turnovers above 20 million RMB. This dataset contains rich information at the firm level, including the company name, address, postal code, ownership type, employment, and complete information on the three major accounting statements (balance sheet, profit and loss account, and cash flow statement).

We link firms in the Customs dataset with the SIPO dataset and industrial firm data using the firm name, postal code, and year. Since we only have firm-level information for the period 2000–2013, we only include anti-dumping investigations or duties against China before 2013 in the analysis below. For this period, we collected 1042 anti-dumping cases against China imposed by 25 countries (or regions) for 1562 targeted products (at the HS 6-digit level). Following Liu and Qiu (2016), we exclude unreasonable observations in ASIF. To better identify the mechanism, we also exclude the years greatly affected by the global financial crisis (i.e., 2008–2010). Thus, our sample is a panel dataset from 2000 to 2007 and 2011–2013, which includes 368,831 observations and information on 120,407 unique firms.

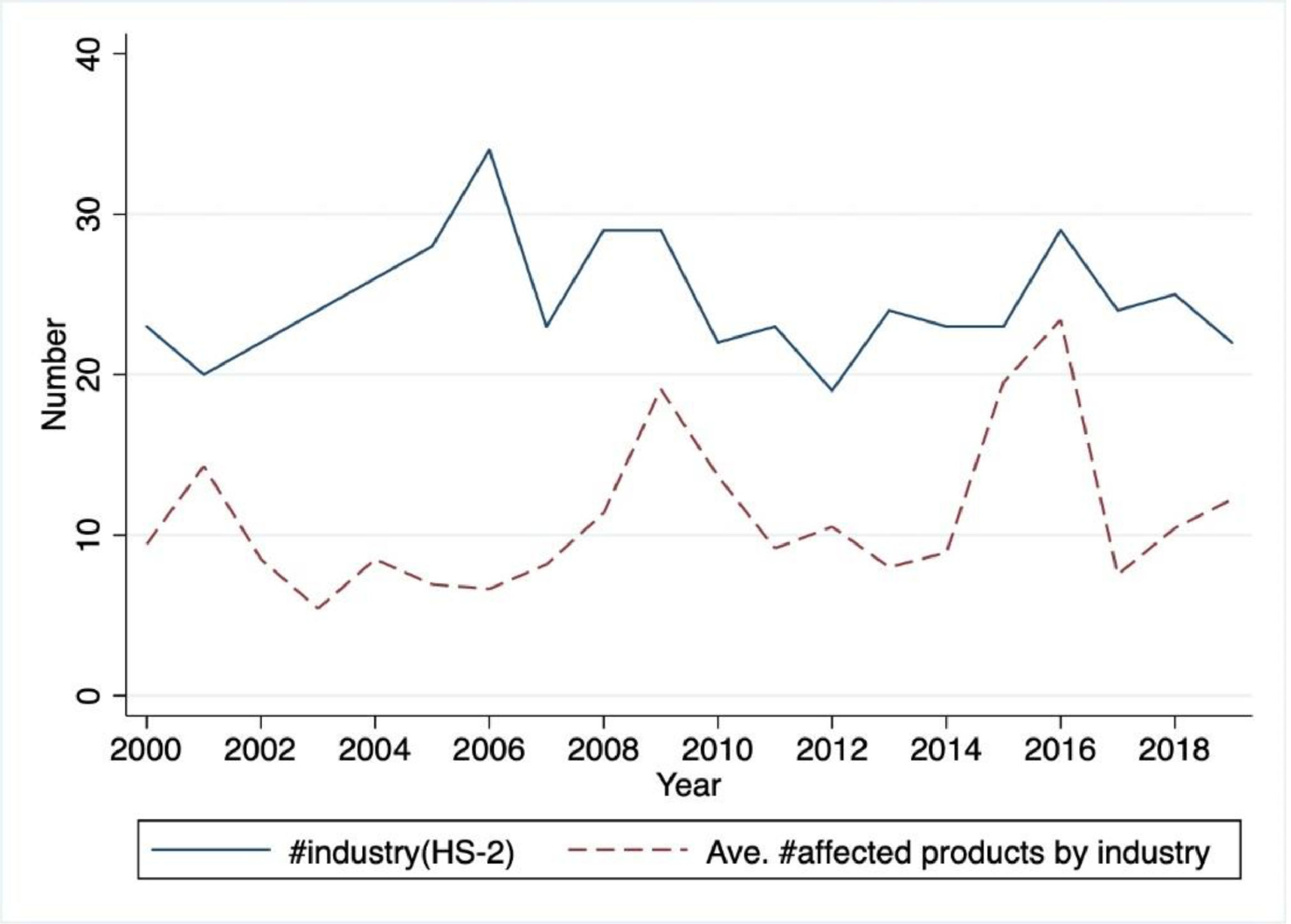

Measurement of trade riskMeasuring trade riskAmong all anti-dumping investigations against China, some industries (at the CIC 2-digit level) were frequently targeted, including chemical raw materials and products, metal products, and steel, with 290, 278, and 177 cases, respectively. These account for 47.45 % of all cases against China during the period 1995–2022. However, the number of targeted industries varies each year, and the number of targeted products in each case differs as well. Fig. B2 in the Appendix plots the number of targeted industries (at the HS 2-digit level) and average number of targeted products by industry during the period 2000–2019. The trends of these two curves differ, showing that in some years, the number of targeted industries was high with a low average number of targeted products. In this context, the number of targeted products must be considered when measuring the trade risk at the industry level.

In this study, we assume that if an industry has been frequently targeted before, then this industry faces high trade risk. Note that the risk lasts longer if we consider anti-dumping cases over a longer prior period. Thus, to simplify the analysis, we assume that if an industry was frequently targeted last year, then it faces a short-term trade risk in the current year. Similarly, if an industry was frequently targeted in the past three years or last decade, then it has a medium- or long-term trade risk in the current year. Thus, we divide the sample into two groups—the high-frequency industry and low-frequency industry—with respect to the median of the number of targeted products for each industry (at the HS 2-digit level) last year (past three years, or last decade). Fig. B3(a), Fig. B3(b), and Fig. B3(c) in the Appendix show the average number of targeted products for the high- and low-frequency industries for the short-, medium-, and long-term trade risk, respectively. For short-, medium-, and long-term trade risk, the average number of targeted products is stable for the low-frequency industry. However, in the high-frequency industry, the average value fluctuates significantly for short- and medium-term trade risk, and demonstrates a growth trend for long-term trade risk.5

Empirical strategyWe now describe our empirical strategy. To identify the effects of trade risk expectations induced by trade protection on firm innovation, we explore the anti-dumping policy to conduct a difference-in-difference (DD) analysis. The process of an anti-dumping case includes four stages: the initial investigation, preliminary determination, final determination, and termination of measures. Therefore, some firms are only affected by the anti-dumping investigation, and not by anti-dumping duties. In this context, we compare the trajectories of the innovation of Chinese exporters facing only an anti-dumping investigation or anti-dumping duties with those of companies without anti-dumping measures during the entire sample period. The DD regression specification is as follows:

where yit measures the innovation for firm i in year t, which is the number of patent applications in this study.6 We construct two differential variables in the benchmark analysis. One is ADinvestonlyit, which denotes whether firm i was only subject to anti-dumping investigations in year t. Another is ADimposedit, which indicates whether firm i was subject to anti-dumping duties in year t. Specifically, ADinvestonlyit can be considered an interaction of two dummy variables, i.e., ADinvestonlyit=diinvest·dt1, where diinvestrepresents whether firm i was only subject to anti-dumping investigations, andt1is the year this firm was first subjected to an anti-dumping investigation, with diinvest=1 if t>t1, and 0 otherwise. Similarly, ADimposedit can be rewritten as an interaction of two dummy variables, i.e., ADimposedit=diimposed·dt2, where diimposed indicates whether firm i was subject to anti-dumping duties, and t2 is the year this firm was first subjected to an anti-dumping duty, with diimposed=1 if t>t2, and 0 otherwise. Hence, we construct two treatment groups, where the first with ADinvestonlyit equals 1, and 0 otherwise, and the second with ADimposedit equals 1, and 0 otherwise.To isolate the effects of an anti-dumping policy, we include firm fixed effects αi, which captures all time-invariant firm heterogeneity such as ownership and unobservable factors. Time fixed effects αt are included to capture yearly shocks common to all firms, such as exchange-rate fluctuations and macro policies. Referring to Chandra and Long (2013), we also include a vector of time-varying controls Xit, which include labor productivity (lp), i.e., value-add per capita; employment (employ), and the operation years (age) of the firm. All these variables are in the logarithm.

The identifying assumption of this DD estimation requires that the treatment and control groups are comparable before the first anti-dumping investigation occurs. Specifically, based on Lu et al. (2013), to check whether there is any difference in time trends between the treatment and control groups before the initiation of an anti-dumping investigation, we include the additional regressor Pretimeit in Eq. (12). Where Pretimeit=diinvest·dt0, where dt0=1 if t0=t1−1, and 0 otherwise. This indicates that the anti-dumping investigation occurred one year before the first anti-dumping investigation. Now, the regression specification becomes:

To identify the difference between a high-risk and low-risk industry, we implement two interaction terms to conduct a difference-in-difference-in-difference (DDD) analysis:

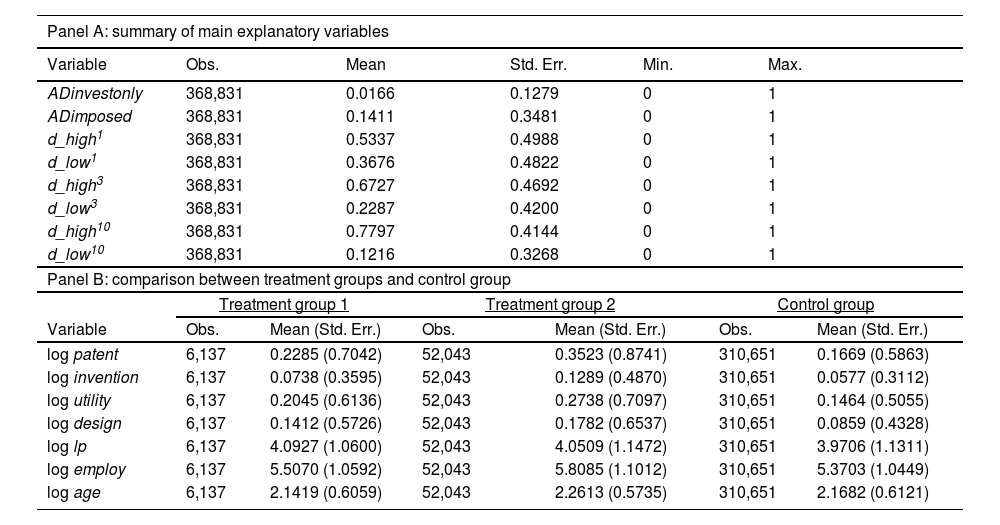

where d_highitn indicates whether a firm belongs to a high-risk industry. If firm i ever exported a product that belongs to a high-risk industry in year t, then d_highitn=1, and 0 otherwise. Furthermore, n∈{1,3,10} is the time interval that identifies short-, medium-, and long-term trade risks. To identify the spillover effects of trade risks on firm innovation, we focus on Chinese exporters who have never been imposed with anti-dumping investigations during our sample period, and use an OLS regression to explore these effects. The regression specification is as follows:where d_highitn is the same as in Eq. (14), and d_lowitn denotes whether a firm belongs to a low-risk industry. If firm i ever exported a product that belongs to a low-risk industry in year t, then d_lowitn=1, and 0 otherwise. If firm i did not export any targeted products in year t, then d_highitn=0, and d_lowitn=0.The summary statistics are shown in Table 1. Panel A summarizes the main explanatory variables, and Panel B compares the dependent and control variables of two treatment groups and the control group. First, in the whole sample, 1.66 % of the observations are of firms only affected by anti-dumping investigations, and 14.11 % are of firms affected by anti-dumping duties. Second, the ratio of samples with trade risk is around 90.13 %, with an increase in the proportion of high-risk samples and decrease in that of low-risk samples as trade risks last longer. Third, compared with unaffected firms (control group), those only affected by anti-dumping investigations (treatment group 1) or by anti-dumping duties (treatment group 2) have more patent applications, with more inventions, utility models, and design. Furthermore, these firms are usually more productive, larger, and have longer years of operation.

Summary statistics.

| Panel A: summary of main explanatory variables | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Obs. | Mean | Std. Err. | Min. | Max. | |||||

| ADinvestonly | 368,831 | 0.0166 | 0.1279 | 0 | 1 | |||||

| ADimposed | 368,831 | 0.1411 | 0.3481 | 0 | 1 | |||||

| d_high1 | 368,831 | 0.5337 | 0.4988 | 0 | 1 | |||||

| d_low1 | 368,831 | 0.3676 | 0.4822 | 0 | 1 | |||||

| d_high3 | 368,831 | 0.6727 | 0.4692 | 0 | 1 | |||||

| d_low3 | 368,831 | 0.2287 | 0.4200 | 0 | 1 | |||||

| d_high10 | 368,831 | 0.7797 | 0.4144 | 0 | 1 | |||||

| d_low10 | 368,831 | 0.1216 | 0.3268 | 0 | 1 | |||||

| Panel B: comparison between treatment groups and control group | ||||||||||

| Treatment group 1 | Treatment group 2 | Control group | ||||||||

| Variable | Obs. | Mean (Std. Err.) | Obs. | Mean (Std. Err.) | Obs. | Mean (Std. Err.) | ||||

| log patent | 6,137 | 0.2285 (0.7042) | 52,043 | 0.3523 (0.8741) | 310,651 | 0.1669 (0.5863) | ||||

| log invention | 6,137 | 0.0738 (0.3595) | 52,043 | 0.1289 (0.4870) | 310,651 | 0.0577 (0.3112) | ||||

| log utility | 6,137 | 0.2045 (0.6136) | 52,043 | 0.2738 (0.7097) | 310,651 | 0.1464 (0.5055) | ||||

| log design | 6,137 | 0.1412 (0.5726) | 52,043 | 0.1782 (0.6537) | 310,651 | 0.0859 (0.4328) | ||||

| log lp | 6,137 | 4.0927 (1.0600) | 52,043 | 4.0509 (1.1472) | 310,651 | 3.9706 (1.1311) | ||||

| log employ | 6,137 | 5.5070 (1.0592) | 52,043 | 5.8085 (1.1012) | 310,651 | 5.3703 (1.0449) | ||||

| log age | 6,137 | 2.1419 (0.6059) | 52,043 | 2.2613 (0.5735) | 310,651 | 2.1682 (0.6121) | ||||

Notes: Treatment group 1 is the sample of firms only affected by anti-dumping investigations; Treatment group 2 is the sample of firms affected by anti-dumping duties; Control group is the sample of unaffected firms.

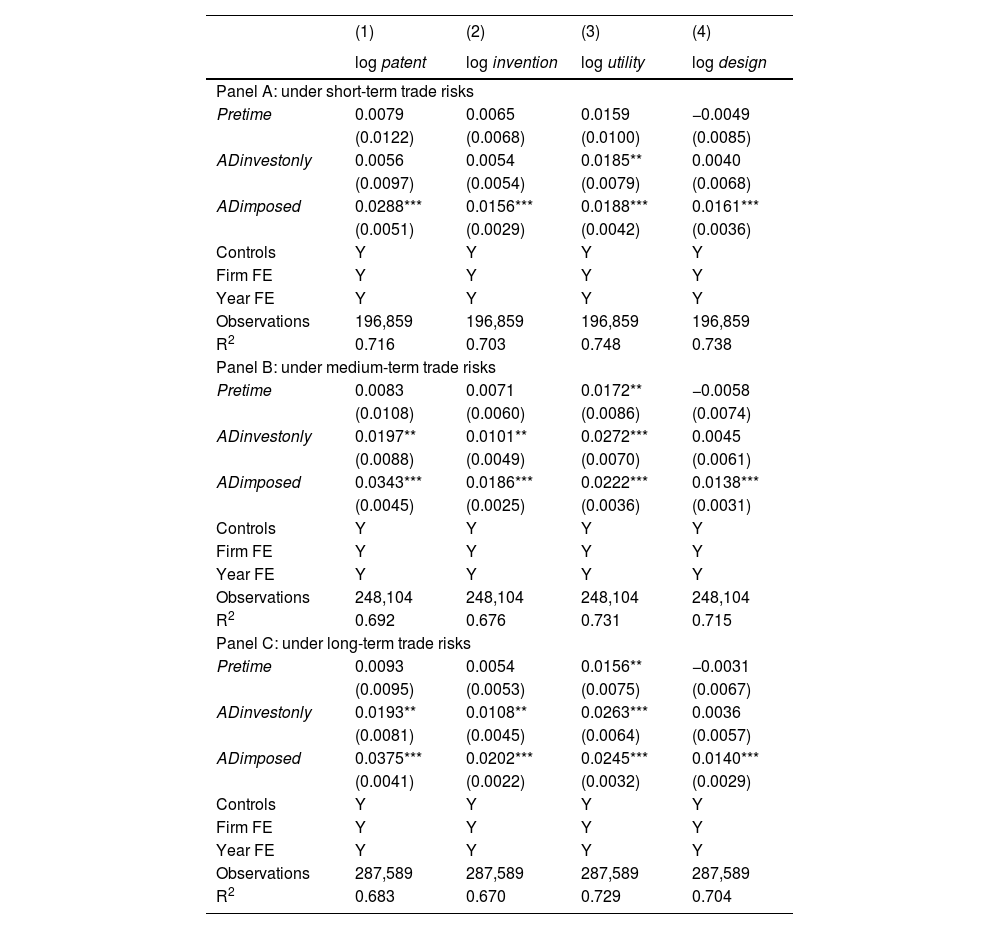

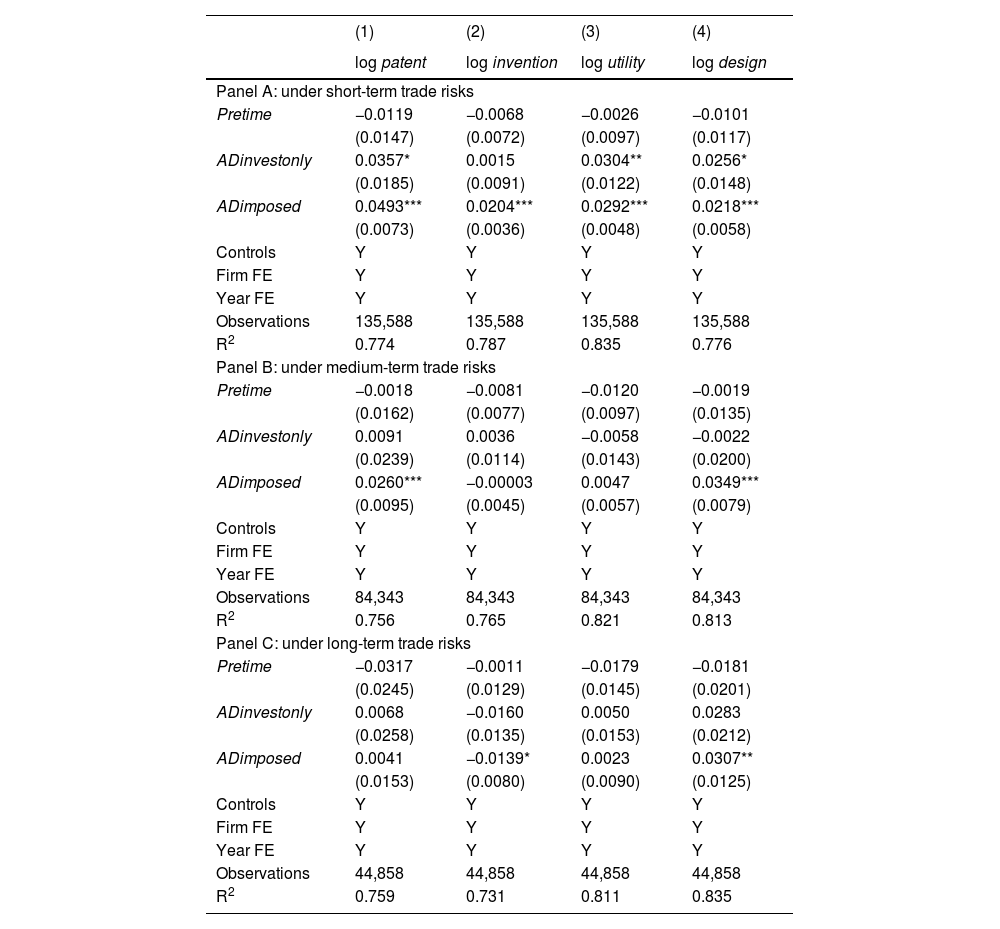

We start by analyzing how Chinese exporters’ innovation strategies respond to anti-dumping investigations or duties when they have different trade risk expectations. To explore these effects, we examine the high-risk and low-risk sample separately. Before providing our baseline results, we must confirm if the treatment and control groups are comparable. The estimation results from Eq. (13) are reported in Tables A1, A2 in the Appendix. Table A1 shows the results for the high-risk sample. As shown in Panel A, there is no evidence of any time trends between the treatment and control groups before the initiation of an anti-dumping investigation under short-term trade risk. For medium- and long-term trade risk, there is no difference for patent applications, inventions, and design between the treatment and control groups before an anti-dumping investigation was initiated. However, the treatment group had significantly more applications for utility models than the control group (Panel B and Panel C). Regardless, these results are no need for concern. On one hand, in column (3) of Panel B and Panel C of Table A1, the coefficient of Pretimeit is smaller than that of ADinvestonlyit and ADimposedit, and is only significant at the 5 % level. This means the similar trends before the anti-dumping investigation are smaller than the trends after the investigation. On the other, the similar trends might be caused by spillover effects, which we discuss in Section 5.3. Thus, these results do not affect the effectiveness of our results. Table A2 shows the results for the low-risk sample. Clearly, for this sample, there is no difference between the treatment and control groups before an anti-dumping investigation was initiated, thereby supporting the validity of our DD estimations.

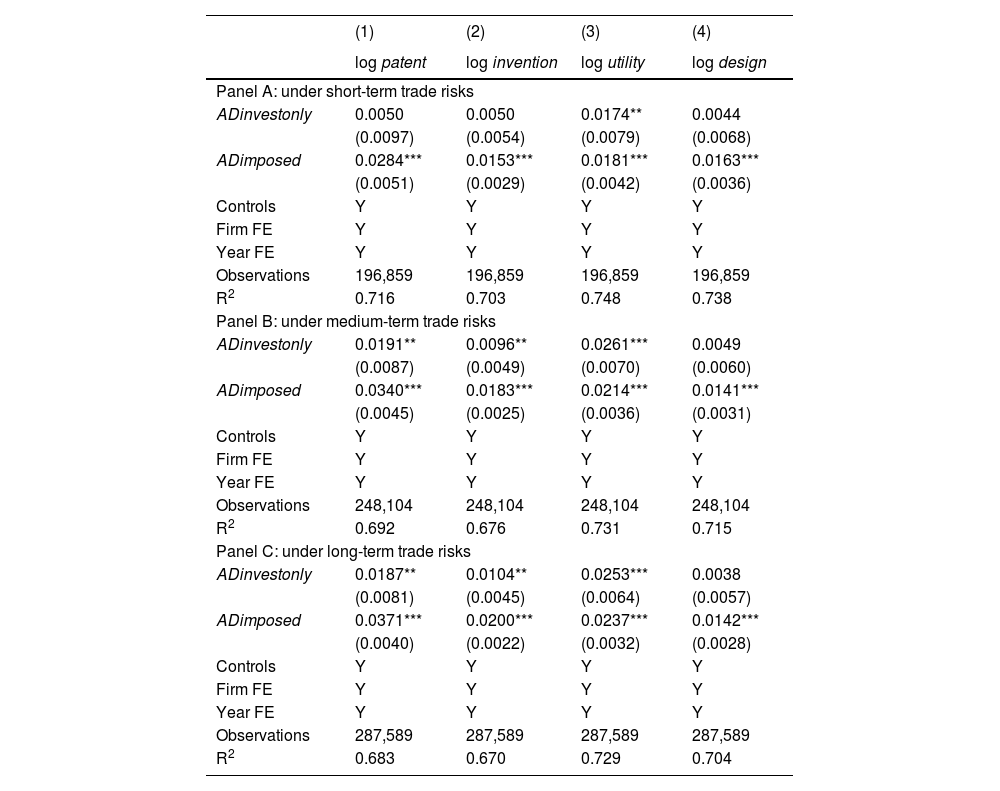

Table 2 reports the estimation results of the DD Eq. (12) for the high-risk sample. Panels A, B, and C estimate Eq. (12) for short-, medium-, and long-term trade risk, respectively. For this sample, firms’ trade risks are expected to increase from the short to long term (i.e., the risk expectation increases from Panel A to Panel C). The results in column (1) show that firms with high trade risks are more likely to increases their innovation outputs when affected by anti-dumping investigations or duties, and the coefficients of ADinvestonly and ADimposed increase from the short- to long-term risk expectation, which is aligned with Proposition 1.

DD estimation for high-risk sample.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| ADinvestonly | 0.0050 | 0.0050 | 0.0174** | 0.0044 |

| (0.0097) | (0.0054) | (0.0079) | (0.0068) | |

| ADimposed | 0.0284*** | 0.0153*** | 0.0181*** | 0.0163*** |

| (0.0051) | (0.0029) | (0.0042) | (0.0036) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 196,859 | 196,859 | 196,859 | 196,859 |

| R2 | 0.716 | 0.703 | 0.748 | 0.738 |

| Panel B: under medium-term trade risks | ||||

| ADinvestonly | 0.0191** | 0.0096** | 0.0261*** | 0.0049 |

| (0.0087) | (0.0049) | (0.0070) | (0.0060) | |

| ADimposed | 0.0340*** | 0.0183*** | 0.0214*** | 0.0141*** |

| (0.0045) | (0.0025) | (0.0036) | (0.0031) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 248,104 | 248,104 | 248,104 | 248,104 |

| R2 | 0.692 | 0.676 | 0.731 | 0.715 |

| Panel C: under long-term trade risks | ||||

| ADinvestonly | 0.0187** | 0.0104** | 0.0253*** | 0.0038 |

| (0.0081) | (0.0045) | (0.0064) | (0.0057) | |

| ADimposed | 0.0371*** | 0.0200*** | 0.0237*** | 0.0142*** |

| (0.0040) | (0.0022) | (0.0032) | (0.0028) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 287,589 | 287,589 | 287,589 | 287,589 |

| R2 | 0.683 | 0.670 | 0.729 | 0.704 |

Notes: (1) In columns (1) to (4), dependent variables are the logarithm of all patent application (log patent), the logarithm of invention (log invention), the logarithm of utility model (log utility) and the logarithm of design (log design), respectively. The independent variables, ADinvestonly and ADimposed, which represent the effects of anti-dumping investigation and anti-dumping duties, are interactions of the treatment group dummy and a post-affected by antidumping policy indicator. (2) Regressions include the logarithm of firm's labor productivity (log lp), the logarithm of employment (log employ), the logarithm of firm's operation years (log age), firm fixed effect, and year fixed effect. (3) The sample using in Panel A includes 84,140 firms with 196,859 observations; the sample using in Panel B includes 94,443 firms with 248,104 observations; the sample using in Panel C includes 101,021 firms with 287,589 observations. (4) Standard errors are reported in parentheses. (5) ***, **, and * represent significance at the 1 %, 5 %, and 10 % level, respectively.

Under short-term trade risks (Panel A), the coefficient of ADinvestonly is not statistically significant but positive, while an anti-dumping investigation increases the number of all patent applications of firms in high-risk industries by 1.93 % and 1.89 % under medium- or long-term trade risks, respectively (Panel B and Panel C). These results are consistent with the findings for Corollary 1.1. We also found a positive estimated coefficient for the shocks induced by anti-dumping duties (ADimposed), confirming the pattern in Corollary 1.2.7 If firms were affected by anti-dumping duties, then their total patent applications continue to increase by 2.88 %, 3.46 %, and 3.78 % under short-, medium-, and long-term trade risks, respectively. In other words, firms’ trade risks increase when affected by anti-dumping measures. In this case, they increase their R&D investment, which increases innovation outputs.

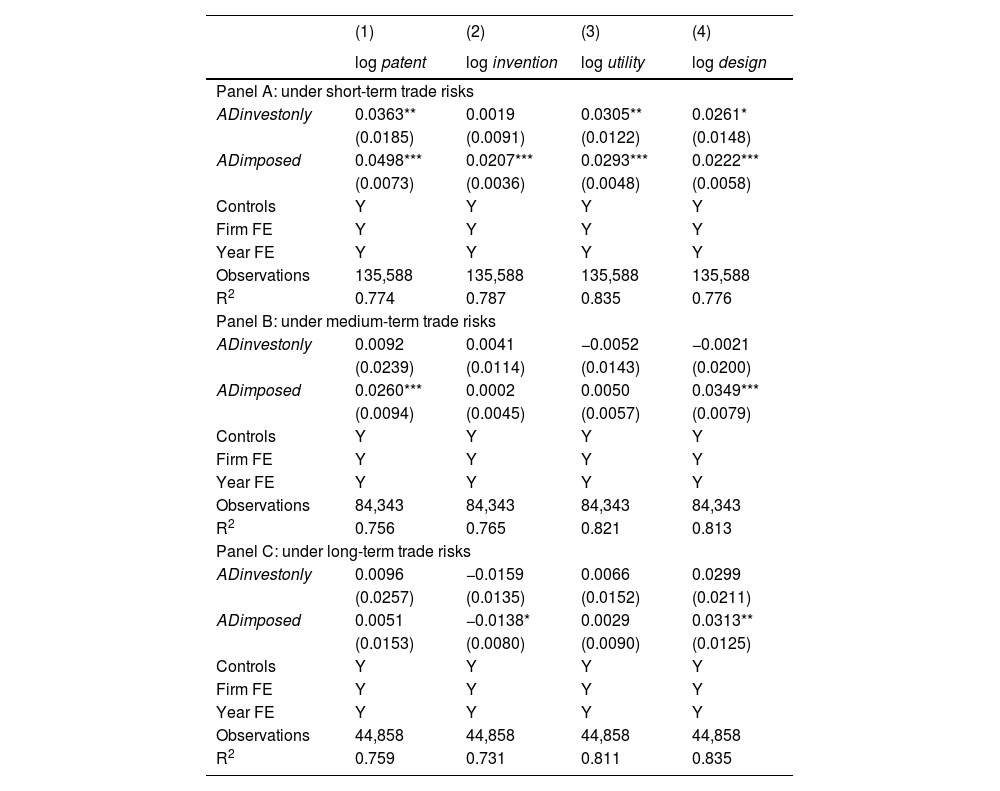

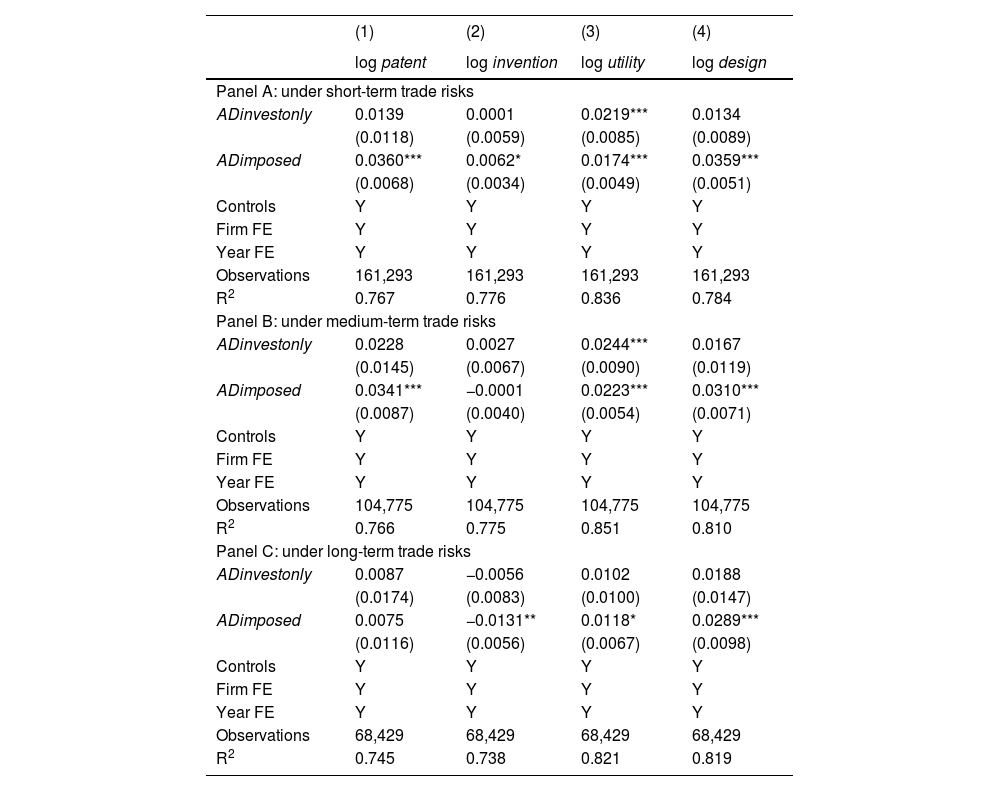

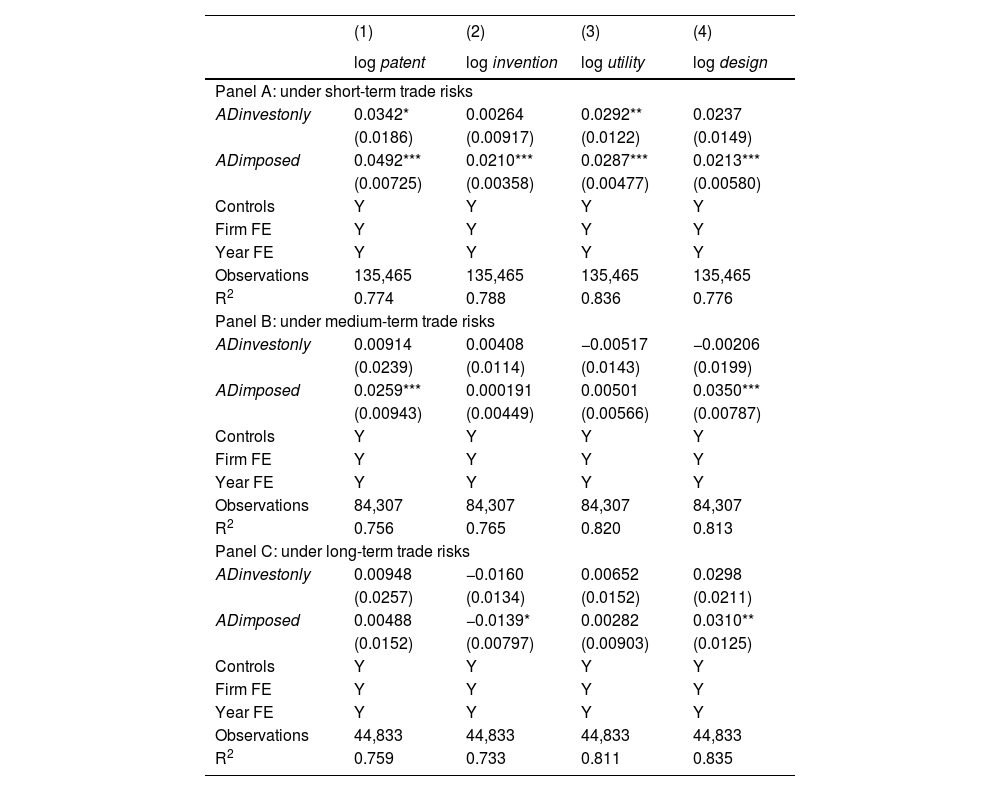

The results of the DD Eq. (12) for the low-risk sample are presented in Table 3. The dependent variable is the number of all patent applications in column (1). Different from the high-risk sample, for this one, firms’ trade risks are expected to decrease from the short to long term (i.e., the risk expectation decreases from Panel A to Panel C). The coefficients of ADinvestonly and ADimposed are positive, but not always statistically significant, and become smaller when trade risk expectation decreases. In the low-risk sample, we only find some positive estimated coefficients of the impacts caused by an anti-dumping investigation or anti-dumping duties under short- or medium-term trade risks. Compared with unaffected firms, an anti-dumping investigation increases the number of all patent applications of firms by 3.70 % under short-term trade risks. Furthermore, the number of patent applications of firms affected by anti-dumping duties continues to rise by 5.11 % and 2.63 % (Panel A and Panel B), while the coefficient of ADimposed is not statistically significant but positive under long-term trade risks (Panel C). These results confirm Proposition 1, Corollary 1.1, and Corollary 1.2.

DD estimation for low-risk sample.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| ADinvestonly | 0.0363** | 0.0019 | 0.0305** | 0.0261* |

| (0.0185) | (0.0091) | (0.0122) | (0.0148) | |

| ADimposed | 0.0498*** | 0.0207*** | 0.0293*** | 0.0222*** |

| (0.0073) | (0.0036) | (0.0048) | (0.0058) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 135,588 | 135,588 | 135,588 | 135,588 |

| R2 | 0.774 | 0.787 | 0.835 | 0.776 |

| Panel B: under medium-term trade risks | ||||

| ADinvestonly | 0.0092 | 0.0041 | −0.0052 | −0.0021 |

| (0.0239) | (0.0114) | (0.0143) | (0.0200) | |

| ADimposed | 0.0260*** | 0.0002 | 0.0050 | 0.0349*** |

| (0.0094) | (0.0045) | (0.0057) | (0.0079) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 84,343 | 84,343 | 84,343 | 84,343 |

| R2 | 0.756 | 0.765 | 0.821 | 0.813 |

| Panel C: under long-term trade risks | ||||

| ADinvestonly | 0.0096 | −0.0159 | 0.0066 | 0.0299 |

| (0.0257) | (0.0135) | (0.0152) | (0.0211) | |

| ADimposed | 0.0051 | −0.0138* | 0.0029 | 0.0313** |

| (0.0153) | (0.0080) | (0.0090) | (0.0125) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 44,858 | 44,858 | 44,858 | 44,858 |

| R2 | 0.759 | 0.731 | 0.811 | 0.835 |

Notes: (1) In columns (1) to (4), dependent variables are the logarithm of all patent application (log patent), the logarithm of invention (log invention), the logarithm of utility model (log utility) and the logarithm of design (log design), respectively. The independent variables, ADinvestonly and ADimposed, which represent the effects of anti-dumping investigation and anti-dumping duties, are interactions of the treatment group dummy and a post-affected by antidumping policy indicator. (2) Regressions include the logarithm of firm's labor productivity (log lp), the logarithm of employment (log employ), the logarithm of firm's operation years (log age), firm fixed effect, and year fixed effect. (3) The sample using in Panel A includes 67,741 firms with 135,588 observations; the sample using in Panel B includes 41,767 firms with 84,343 observations; the sample using in Panel C includes 24,107 firms with 44,858 observations. (4) Standard errors are reported in parentheses. (5) ***, **, and * represent significance at the 1 %, 5 %, and 10 % level, respectively.

Now that we have documented the stimulating effects of anti-dumping measures on innovation outputs, we examine the innovation strategies of firms with resource constraints. Specifically, we first show the heterogeneity of treatment effects across patent types. Regarding the high-risk sample, the regression results corresponding to Eq. (12) are presented in columns (2)–(4) of Table 2. The results in column (2) show that firms with high trade risks are more likely to increase their high-quality innovation when affected by anti-dumping measures. The coefficients of ADinvestonly and ADimposed become larger and more significant when their risk expectation increases from the short to long term. The results for low-quality innovations are reported in column (3) and column (4). These firms only choose low-quality innovations (i.e., utility models) when only affected by anti-dumping investigations, and increase their utility models and design when impacted by anti-dumping duties. In other words, firms in industries with high trade risks are more likely to choose both high-quality and low-quality innovations when they expect their trade risk to rise. These results preliminarily confirm Proposition 2 and Corollary 2.1.

The heterogeneity results for the low-risk sample are reported in columns (2)–(4) of Table 3. We find similar effects of anti-dumping measures on firms’ innovation strategies under short-term trade risks (Panel A): affected firms will first choose to increase low-quality innovation when only affected by anti-dumping investigations, and will increase high-quality innovation when anti-dumping duties are imposed. Different from the results for the high-risk sample, when they expect their risk to fall, affected firms in the low-risk sample only choose low-quality innovation (Panel B and Panel C), with an increase of design by 3.55 % and 3.18 % (column (4)). They may also reduce high-quality innovation under long-term trade risks (Panel C), with a decrease of inventions of 1.39 % evident. These results are consistent with Proposition 2 and Corollary 2.2.

To conclude, the innovation strategies of firms with different risk expectations differ when affected by anti-dumping measures. First, for the high-risk sample, firms are more likely to choose high-quality innovation when their risk is expected to rise from the short to long term, especially when affected by anti-dumping duties. Second, for the low-risk sample, firms will choose to increase some low-quality innovation when affected by anti-dumping measures, and may even reduce high-quality innovation when their risk expectations decrease. Third, under short-term trade risk, the innovation strategies of firms in the high- and low-risk samples are similar. Firms are more likely to choose low-quality innovation when only affected by anti-dumping investigations, and turn to high-quality innovation when anti-dumping duties are imposed. However, their innovations are different under medium- and long-term trade risk.

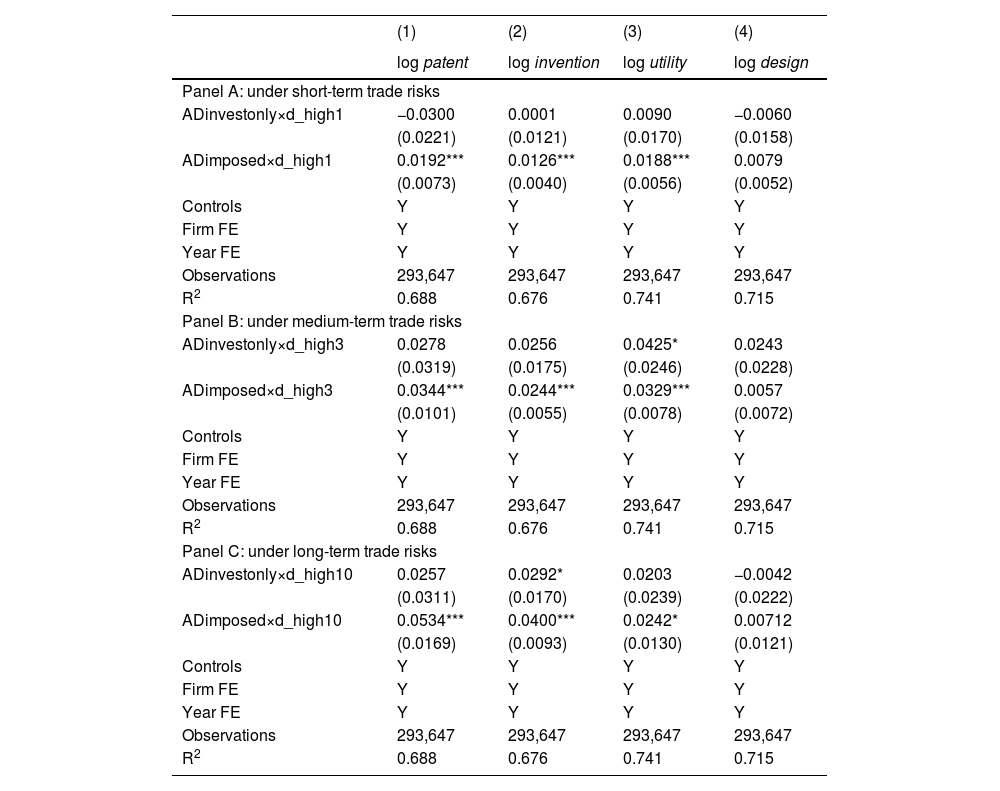

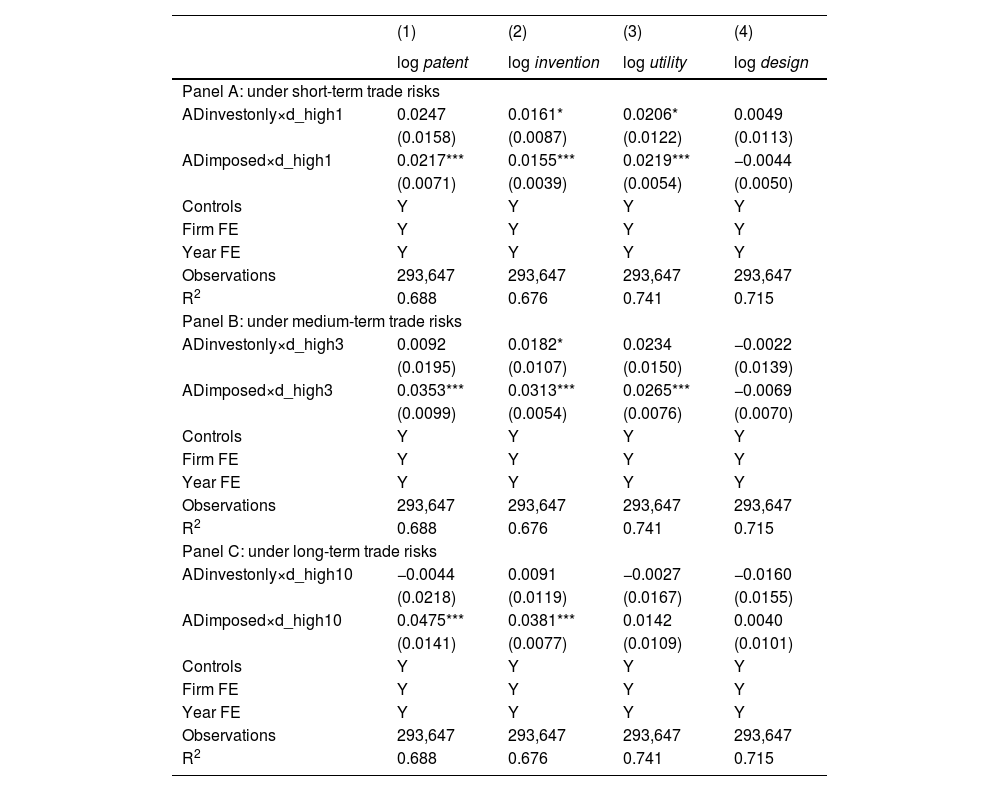

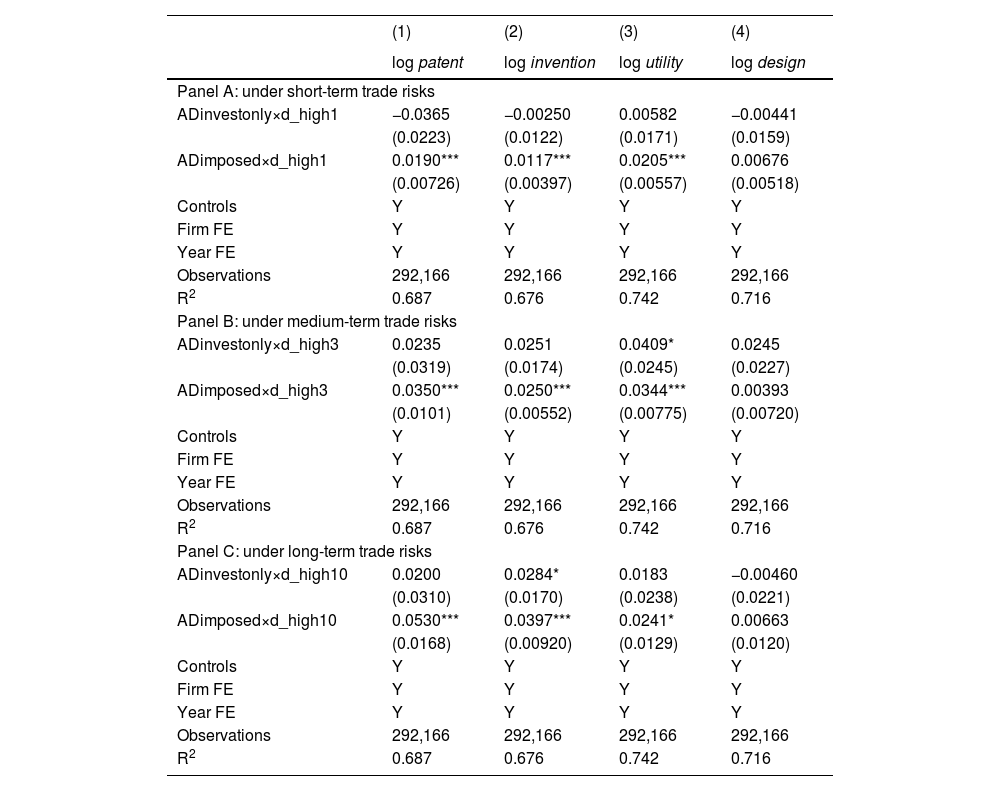

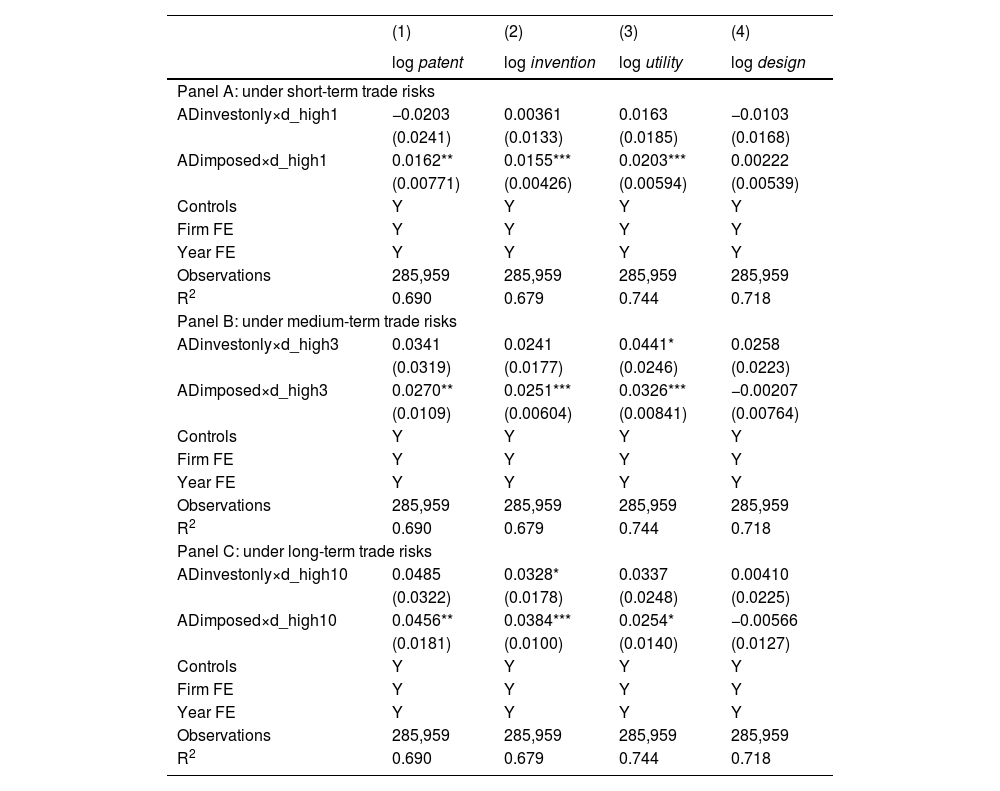

Although these results are aligned with Proposition 2, Corollary 2.1, and Corollary 2.2, we need to further examine whether the differences between the high- and low-risk samples are statistically significant. For this, we first combine both samples, which include 103,185 unique firms with 293,647 observations. The regression results from the DDD Eq. (14) are reported in Table 4. Panels A, B, and Panel C estimate the effects under short-, medium-, and long-term trade risk, respectively. First, none of the estimated coefficients of ADinvestonlyit×d_highitn (n = 1, 3, 10) for the number of all patent applications are statistically and economically significant, while the positive effects of anti-dumping duties on firms’ total innovations are larger for high-risk industries. This is shown by the positive and statistically significant coefficient on ADimposedit×d_highitn (n = 1, 3, 10) in column (1). Second, regarding the different types of innovation (columns (2)–(4)), there are almost no different innovation strategies between the high- and low-risk samples when firms are only affected by anti-dumping investigations. Anti-dumping duties lead high-risk firms to choose more high-quality innovation under short-, medium-, and long-term trade risks, as seen in an increase in inventions of 1.27 %, 2.47 %, and 4.08 %, respectively. In addition, high-risk firms will choose to have more utility models when affected by anti-dumping duties under short-, medium-, and long-term trade risks, while the difference in design between the high- and low-risk samples is not statistically significant.

Difference between high-risk sample and low-risk sample.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| ADinvestonly×d_high1 | −0.0300 | 0.0001 | 0.0090 | −0.0060 |

| (0.0221) | (0.0121) | (0.0170) | (0.0158) | |

| ADimposed×d_high1 | 0.0192*** | 0.0126*** | 0.0188*** | 0.0079 |

| (0.0073) | (0.0040) | (0.0056) | (0.0052) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 293,647 | 293,647 | 293,647 | 293,647 |

| R2 | 0.688 | 0.676 | 0.741 | 0.715 |

| Panel B: under medium-term trade risks | ||||

| ADinvestonly×d_high3 | 0.0278 | 0.0256 | 0.0425* | 0.0243 |

| (0.0319) | (0.0175) | (0.0246) | (0.0228) | |

| ADimposed×d_high3 | 0.0344*** | 0.0244*** | 0.0329*** | 0.0057 |

| (0.0101) | (0.0055) | (0.0078) | (0.0072) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 293,647 | 293,647 | 293,647 | 293,647 |

| R2 | 0.688 | 0.676 | 0.741 | 0.715 |

| Panel C: under long-term trade risks | ||||

| ADinvestonly×d_high10 | 0.0257 | 0.0292* | 0.0203 | −0.0042 |

| (0.0311) | (0.0170) | (0.0239) | (0.0222) | |

| ADimposed×d_high10 | 0.0534*** | 0.0400*** | 0.0242* | 0.00712 |

| (0.0169) | (0.0093) | (0.0130) | (0.0121) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 293,647 | 293,647 | 293,647 | 293,647 |

| R2 | 0.688 | 0.676 | 0.741 | 0.715 |

Notes: (1) In columns (1) to (4), dependent variables are the logarithm of all patent application (log patent), the logarithm of invention (log invention), the logarithm of utility model (log utility) and the logarithm of design (log design), respectively. The two independent variables, ADinvestonly×d_highn and ADimposed×d_highn (n = 1, 3, 10), which represent the difference between high-risk sample and low-risk sample under short-term, medium-term and long-term trade risks when firms were only affected by anti-dumping investigation or affected by anti-dumping duties. (2) Regressions include the logarithm of firm's labor productivity (log lp), the logarithm of employment (log employ), the logarithm of firm's operation years (log age), ADinvestonly, ADimposed, d_high1 (Panel A), d_high3 (Panel B), d_high10 (Panel C), firm fixed effect, and year fixed effect. (3) Standard errors are reported in parentheses. (4) ***, **, and * represent significance at the 1 %, 5 %, and 10 % level, respectively.

This finding implies that for the high-risk sample, the urgency of firms’ innovation strategies improves from short-term to long-term trade risks, meaning that the difference in innovation strategies between the high- and low-risk sample would be larger when their risk expectations last longer. In other words, due to resource constraints, firms in the high-risk sample prefer more high-quality innovation than those in the low-risk sample when trade risk expectations gradually increase. These results further address Proposition 2 and its corollaries.

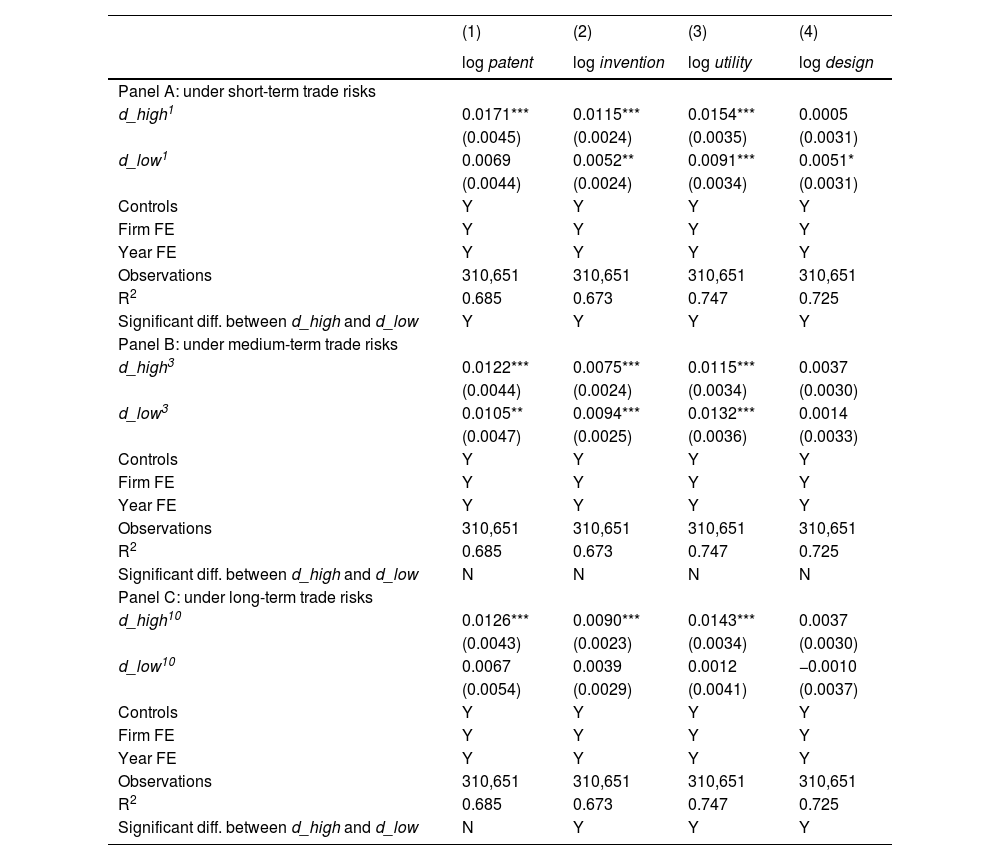

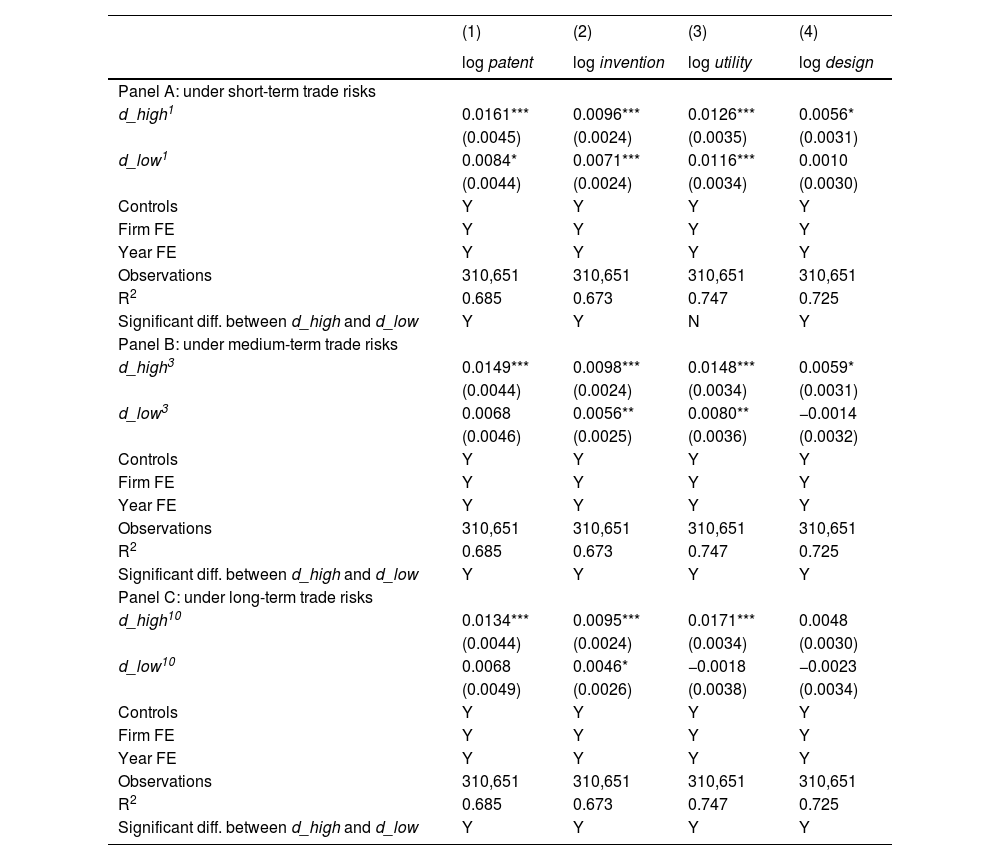

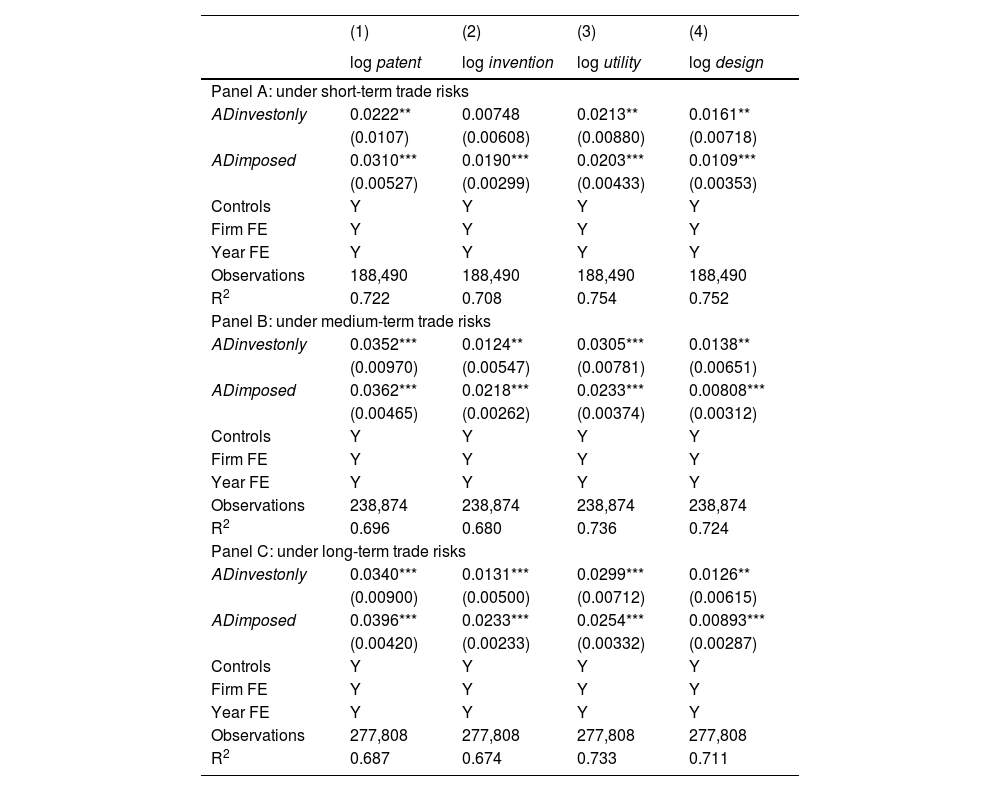

Spillover effects of trade risk on firms’ innovation strategiesTo further clarify firms’ innovation responses to trade risks caused by anti-dumping measures, in this section, we examine the heterogeneity impacts of trade risks on unaffected firms’ innovation strategies their risk expectations differ. Specifically, we use the sample of unaffected firms during our sample period, which includes 110,448 firms with 310,651 observations. The regression results from OLS Eq. (15) are reported in Table 5. Panels A, B, and C estimate the effects under short-, medium-, and long-term trade risk, respectively.

The spillover effects.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| d_high1 | 0.0171*** | 0.0115*** | 0.0154*** | 0.0005 |

| (0.0045) | (0.0024) | (0.0035) | (0.0031) | |

| d_low1 | 0.0069 | 0.0052** | 0.0091*** | 0.0051* |

| (0.0044) | (0.0024) | (0.0034) | (0.0031) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 310,651 | 310,651 | 310,651 | 310,651 |

| R2 | 0.685 | 0.673 | 0.747 | 0.725 |

| Significant diff. between d_high and d_low | Y | Y | Y | Y |

| Panel B: under medium-term trade risks | ||||

| d_high3 | 0.0122*** | 0.0075*** | 0.0115*** | 0.0037 |

| (0.0044) | (0.0024) | (0.0034) | (0.0030) | |

| d_low3 | 0.0105** | 0.0094*** | 0.0132*** | 0.0014 |

| (0.0047) | (0.0025) | (0.0036) | (0.0033) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 310,651 | 310,651 | 310,651 | 310,651 |

| R2 | 0.685 | 0.673 | 0.747 | 0.725 |

| Significant diff. between d_high and d_low | N | N | N | N |

| Panel C: under long-term trade risks | ||||

| d_high10 | 0.0126*** | 0.0090*** | 0.0143*** | 0.0037 |

| (0.0043) | (0.0023) | (0.0034) | (0.0030) | |

| d_low10 | 0.0067 | 0.0039 | 0.0012 | −0.0010 |

| (0.0054) | (0.0029) | (0.0041) | (0.0037) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 310,651 | 310,651 | 310,651 | 310,651 |

| R2 | 0.685 | 0.673 | 0.747 | 0.725 |

| Significant diff. between d_high and d_low | N | Y | Y | Y |

Notes: (1) In columns (1) to (4), dependent variables are the logarithm of all patent application (log patent), the logarithm of invention (log invention), the logarithm of utility model (log utility) and the logarithm of design (log design), respectively. The independent variables, d_highn and d_lown (n = 1, 3, 10) are a group of dummy variables, which represent whether the firms are belong to high-risk or low-risk industries under short-term, medium-term and long-term trade risks, respectively. (2) Regressions include the logarithm of firm's labor productivity (log lp), the logarithm of employment (log employ), the logarithm of firm's operation years (log age), firm fixed effect, and year fixed effect. (3) We use t-test to examine whether there is a significant difference between high-risk firms and low-risk firms. (4) Standard errors are reported in parentheses. (5) ***, **, and * represent significance at the 1 %, 5 %, and 10 % level, respectively.

First, regarding the number of all patent applications (column (1)), we find little spillover effects on unaffected firms with low-risk expectations, which only increases their patent applications by 1.06 % under medium-term trade risks. Furthermore, we find statistically significant and positive estimated coefficients for d_highn (n = 1, 3, 10), confirming Proposition 3, Corollary 3.1, and Corollary 3.2. For magnitude, on average, unaffected firms with high-risk expectations increase their innovation outputs by 1.72 %, 1.23 %, and 1.27 % under short-, medium-, and long-term trade risks, respectively. In other words, compared with no-risk firms, a significant spillover effect exists on unaffected firms with trade risks, especially those with high-risk expectations.

Next, regarding different types of innovation (columns (2)–(4)), first, compared with no-risk firms, those who are unaffected and have low-risk expectations increase their inventions, utility models, and design under short-term trade risks. For the difference in magnitude, unaffected firms with high-risk expectations have a larger estimated coefficient for inventions and utility models than low-risk ones, suggesting that the former are more sensitive to possible anti-dumping investigations than the latter (Panel A). Second, despite the level of risk expectations, we find a similar effect on unaffected firms under medium-term trade risks, i.e., unaffected firms with trade risks will increase their inventions and utility models under medium-term trade risks (Panel B). Third, under long-term trade risks, only unaffected firms with high-risk expectations will choose more innovation, increasing their inventions and utility models. None of the estimated coefficients for inventions, utility models, and design for unaffected firms with low-risk expectations are statistically significant (Panel C).

These findings imply that first, even if export firms are not affected by anti-dumping measures, they are more likely to innovate when they have higher trade risk expectations, and they prefer to perform more high-quality innovation. This finding is consistent with Proposition 3, and further confirms Proposition 1 and Proposition 2 at the industry level. Second, when unaffected firms are exposed to a high-risk environment for a long time, they are more sensitive to possible anti-dumping investigations and respond significantly to the negative trade shocks by engaging in more innovation. In contrast, when unaffected firms are exposed to a low-risk environment for a long time, their innovation strategies are closer to those of no-risk firms. This finding again confirms Proposition 1.

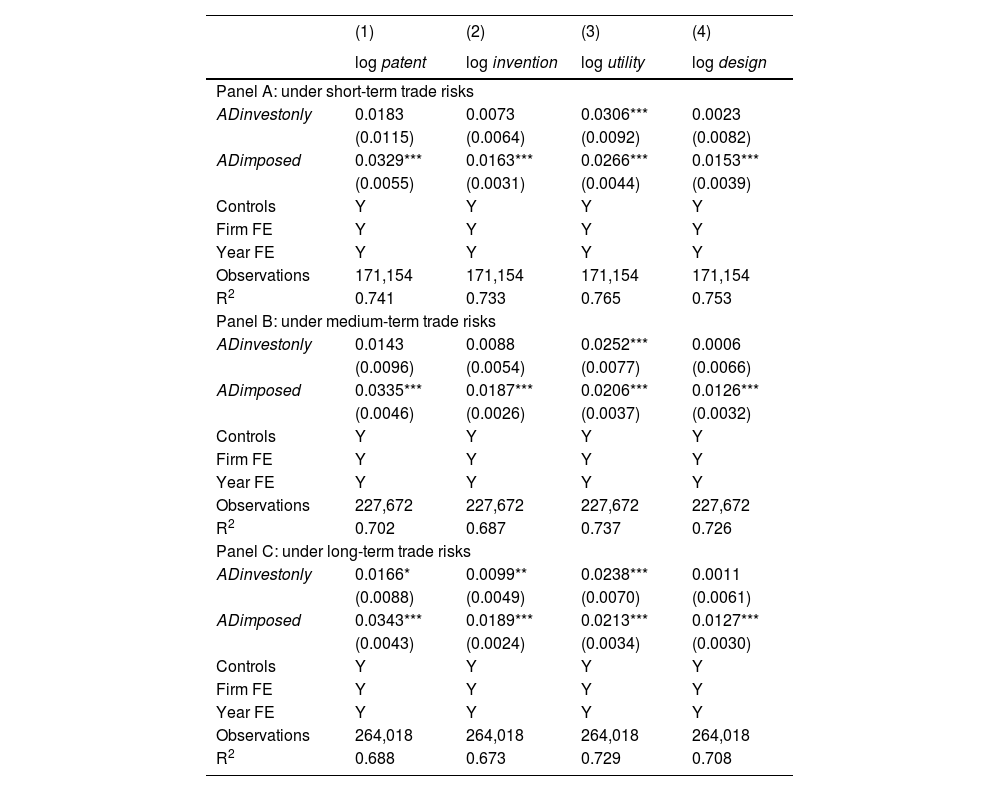

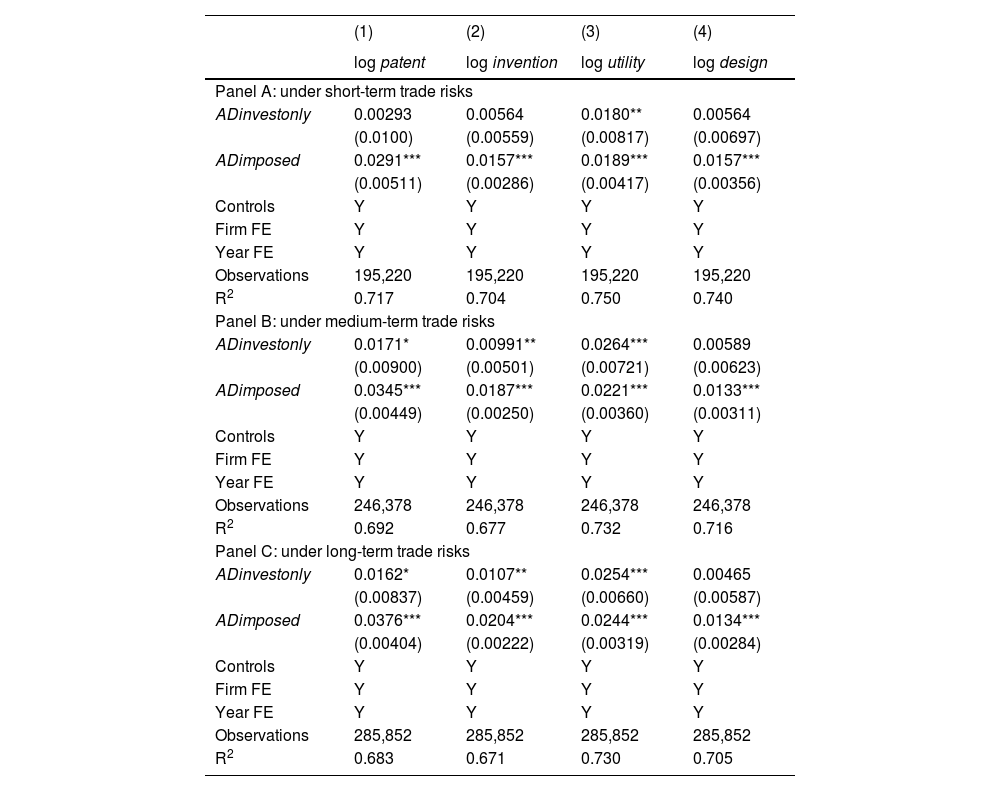

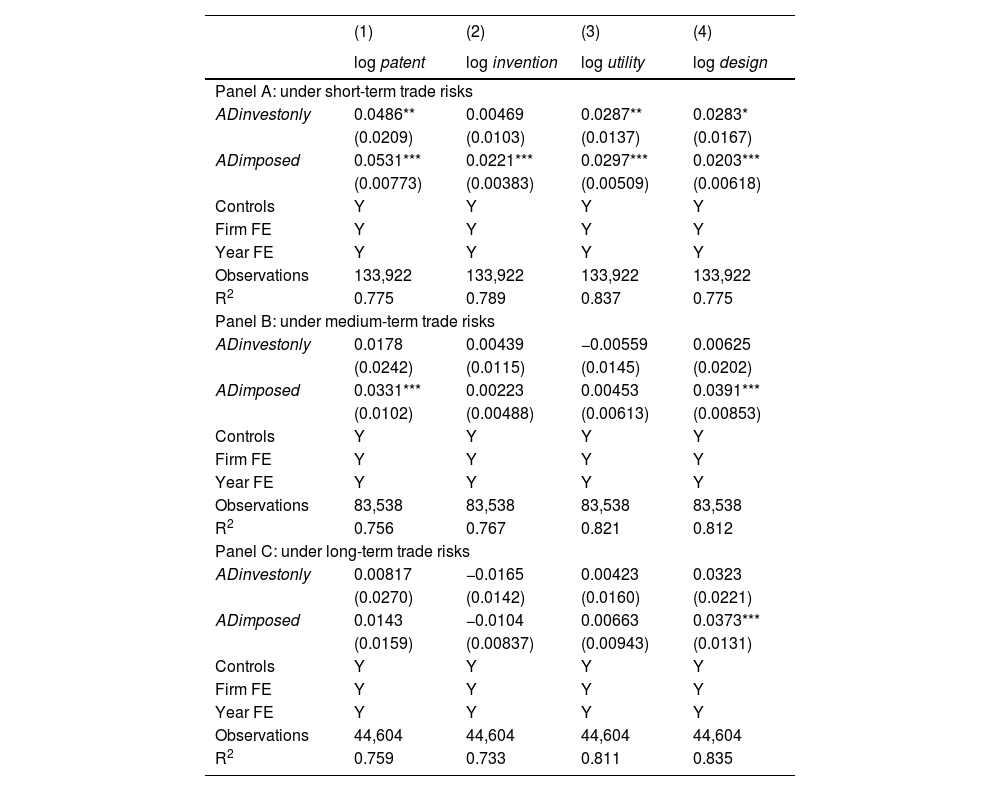

Robustness checksWe conduct a series of robustness checks on the aforementioned estimation results for all relevant outcomes examined in Sections 5.1–5.3. First, we use a different measure of trade risk level—the number of products imposed with final anti-dumping duties—to define high-frequency and low-frequency industries. Second, to exclude the possibility that our results are driven by cases affected by other non-tariff measures, we drop firms that were also imposed with countervailing measures. Finally, we exclude firms affected by zero anti-dumping taxes to eliminate the potential bias caused by “non-punishment” measures.8

Alternative measures of the level of trade riskIn this study, we focus on exploring export firms’ innovation strategies in response to anti-dumping measures based on their risk expectations. Therefore, how to measure the level of trade risk is an important issue. In the aforementioned analysis, we use the number of products affected by anti-dumping investigations to define high-frequency and low-frequency industries. However, some cases were not imposed with final anti-dumping duties, which means the affected firms did not need to pay anti-dumping taxes. According to statistics from the Ministry of Commerce of China, only 1172 of all 1571 cases were imposed with final duties from 1995 to 2022. Compared with anti-dumping duties, the message to firms brought by anti-dumping investigations is not strong enough.

To alleviate concerns that this measurement of the level of trade risk biases our estimates, we construct another measure thereof by counting the number of products imposed with final duties at the industry level by year. We then classify industries into high-frequency industries based on the number of products affected by anti-dumping duties above the sample median, and low-frequency industries according to the number of products affected by anti-dumping duties below the sample median. We also use cases imposed with final duties last year, the past three years, and the last decade to define short-, medium-, and long-term trade risks, respectively. The results are reported in Table A3, Table A4, Table A5, and Table A6 in the Appendix. We find that the overall message remains robust when using these alternative measures.

Excluding cases imposed with countervailing measuresIn addition to the anti-dumping investigations, some countries or regions simultaneously imposed countervailing measures against China. The first case with both anti-dumping and countervailing measures against China was imposed by Canada in 2004. According to statistics from the Ministry of Commerce of China, 153 cases against China included both anti-dumping and countervailing measures, accounting for 12.84 % of total anti-dumping cases during the period 2004–2022, mostly by the US, Australia, and Canada. If a firm was imposed with both at the same time, it paid more taxes as well. Thus, the impacts of both measures on firms’ innovation strategies would likely be greater than those of an anti-dumping policy alone. Therefore, our pervious results could be overestimated.

To address this concern, we collect these cases for our sample period9 and exclude firms affected by both anti-dumping and countervailing measures simultaneously. The results of the DD estimation are reported in Tables A7 and A8, and the results of the DDD estimation in Table A9 in the Appendix. Although the coefficients change slightly, these results do not alter our main findings, providing additional support that anti-dumping measures positively impact firms’ innovation outputs, and affected firms adjust their innovation strategies based on their trade risk expectations.

Excluding cases with a zero anti-dumping tax rateFor simplicity, in the previous analysis, we do not exclude firms who responded successfully, namely those that proved they were not dumping and thereby, obtained a zero tax rate. Because responding is costly, with a low success rate and a complicated process, few firms choose to respond. However, once firms successfully respond, they do not need to pay anti-dumping taxes, meaning they are not affected by anti-dumping duties. Therefore, they have less motivation to innovate than other affected firms. This might underestimate our results in Sections 5.1 and 5.2.

To rule out the possibility that our results are affected by these cases, we collect those with a zero tax rate during our sample period10 and exclude affected companies. The results, reported in Table A10, Table A11, and Table A12 in the Appendix, again confirm the positive impact of anti-dumping measures on firms’ innovation strategies, especially on those with high-risk expectations.

ConclusionsMost studies highlighted the impacts of non-tariff measures on bilateral trade (e.g., Bown & Crowley, 2007; Crowley et al., 2018; Lu et al., 2013), while very few investigated the effects of temporary trade barriers on exporters’ innovation (Huang et al., 2024; Meng et al., 2020; Xie et al., 2020). The literature has also not yet explored the effects of non-tariff measures based on different trade risk expectations, and theoretical models have not been applied to describe the mechanism. Using the insights of the literature, this study examined how affected exporters’ innovation strategies change in response to trade protection policies according to their trade risk expectations. This was based on the global anti-dumping investigations against China. Specifically, we first identified the trade risk level of each firm, and then developed a theoretical model to analyze the mechanism of how a multi-product firm develops innovation strategies according to its trade risk expectations when affected by anti-dumping measures. We also employed DD, DDD, and OLS estimation strategies to test the predictions of the model using firm-level data from China during the period 2000–2013.

Our model predicted that first, affected firms increase their R&D investment and innovation output in response to increased trade risk. Second, affected firms are more likely to choose high-quality than low-quality innovation when their trade risk expectations increase. Finally, for unaffected firms, an increase in trade risk expectations leads to an increase in innovation outputs, especially high-quality innovation. The empirical results were consistent with our model predictions. In addition, we conducted robustness checks of the estimation results from the previous analysis. After using a different measure of trade risk level to define high-frequency and low-frequency industries, and excluding firms also affected by countervailing measures and those with a zero anti-dumping tax rate, our results remain constant. This gives us further confidence that exporters with higher trade risks are more responsive to trade protection.

Due to the limitations of the firm-level data after 2013, some new features were likely ignored in our analysis. However, we believe our findings are still meaningful for understanding how firms respond to trade protectionism through innovation. These findings imply that: First, instead of choosing common countermeasures such as obtaining a separate tax rate or changing export destinations, affected firms can use innovations as a response to anti-dumping measures, which can reduce production costs or gain new export products. Second, based on information on existing anti-dumping cases in various industries, firms can assess their trade risks and make innovation decisions. Firms with higher short-term risk can choose low-quality innovation to quickly adjust their export products. firms with higher long-term risk can perform high-quality innovation to reduce production costs and improve productivity, which can make up possible losses from anti-dumping measures. Third, unaffected firms should be vigilant, especially those in high-risk industries. These firms can perform innovation in advance to ensure they can respond in time to avoid the negative impacts of anti-dumping measures.

Both authors contributed equally to the manuscript. This work was supported by the National Natural Science Foundation of China [grant numbers 72203241, 72103067].

Validity of DD estimation for high-risk sample.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| Pretime | 0.0079 | 0.0065 | 0.0159 | −0.0049 |

| (0.0122) | (0.0068) | (0.0100) | (0.0085) | |

| ADinvestonly | 0.0056 | 0.0054 | 0.0185** | 0.0040 |

| (0.0097) | (0.0054) | (0.0079) | (0.0068) | |

| ADimposed | 0.0288*** | 0.0156*** | 0.0188*** | 0.0161*** |

| (0.0051) | (0.0029) | (0.0042) | (0.0036) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 196,859 | 196,859 | 196,859 | 196,859 |

| R2 | 0.716 | 0.703 | 0.748 | 0.738 |

| Panel B: under medium-term trade risks | ||||

| Pretime | 0.0083 | 0.0071 | 0.0172** | −0.0058 |

| (0.0108) | (0.0060) | (0.0086) | (0.0074) | |

| ADinvestonly | 0.0197** | 0.0101** | 0.0272*** | 0.0045 |

| (0.0088) | (0.0049) | (0.0070) | (0.0061) | |

| ADimposed | 0.0343*** | 0.0186*** | 0.0222*** | 0.0138*** |

| (0.0045) | (0.0025) | (0.0036) | (0.0031) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 248,104 | 248,104 | 248,104 | 248,104 |

| R2 | 0.692 | 0.676 | 0.731 | 0.715 |

| Panel C: under long-term trade risks | ||||

| Pretime | 0.0093 | 0.0054 | 0.0156** | −0.0031 |

| (0.0095) | (0.0053) | (0.0075) | (0.0067) | |

| ADinvestonly | 0.0193** | 0.0108** | 0.0263*** | 0.0036 |

| (0.0081) | (0.0045) | (0.0064) | (0.0057) | |

| ADimposed | 0.0375*** | 0.0202*** | 0.0245*** | 0.0140*** |

| (0.0041) | (0.0022) | (0.0032) | (0.0029) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 287,589 | 287,589 | 287,589 | 287,589 |

| R2 | 0.683 | 0.670 | 0.729 | 0.704 |

Notes: (1) In columns (1) to (4), dependent variables are the logarithm of all patent application (log patent), the logarithm of invention (log invention), the logarithm of utility model (log utility) and the logarithm of design (log design), respectively. The independent variables, Pretime, which represents the difference between treatment group and control group a year before the first anti-dumping investigation. ADinvestonly and ADimposed which represent the effects of anti-dumping investigation and anti-dumping duties, are interactions of the treatment group dummy and a post-affected by antidumping policy indicator. (2) Regressions include the logarithm of firm's labor productivity (log lp), the logarithm of employment (log employ), the logarithm of firm's operation years (log age), firm fixed effect, and year fixed effect. (3) The sample using in Panel A includes 84,140 firms with 196,859 observations; the sample using in Panel B includes 94,443 firms with 248,104 observations; the sample using in Panel C includes 101,021 firms with 287,589 observations. (4) Standard errors are reported in parentheses. (5) ***, **, and * represent significance at the 1 %, 5 %, and 10 % level, respectively.

Validity of DD estimation for low-risk sample.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| log patent | log invention | log utility | log design | |

| Panel A: under short-term trade risks | ||||

| Pretime | −0.0119 | −0.0068 | −0.0026 | −0.0101 |

| (0.0147) | (0.0072) | (0.0097) | (0.0117) | |

| ADinvestonly | 0.0357* | 0.0015 | 0.0304** | 0.0256* |

| (0.0185) | (0.0091) | (0.0122) | (0.0148) | |

| ADimposed | 0.0493*** | 0.0204*** | 0.0292*** | 0.0218*** |

| (0.0073) | (0.0036) | (0.0048) | (0.0058) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 135,588 | 135,588 | 135,588 | 135,588 |

| R2 | 0.774 | 0.787 | 0.835 | 0.776 |

| Panel B: under medium-term trade risks | ||||

| Pretime | −0.0018 | −0.0081 | −0.0120 | −0.0019 |

| (0.0162) | (0.0077) | (0.0097) | (0.0135) | |

| ADinvestonly | 0.0091 | 0.0036 | −0.0058 | −0.0022 |

| (0.0239) | (0.0114) | (0.0143) | (0.0200) | |

| ADimposed | 0.0260*** | −0.00003 | 0.0047 | 0.0349*** |

| (0.0095) | (0.0045) | (0.0057) | (0.0079) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 84,343 | 84,343 | 84,343 | 84,343 |

| R2 | 0.756 | 0.765 | 0.821 | 0.813 |

| Panel C: under long-term trade risks | ||||

| Pretime | −0.0317 | −0.0011 | −0.0179 | −0.0181 |

| (0.0245) | (0.0129) | (0.0145) | (0.0201) | |

| ADinvestonly | 0.0068 | −0.0160 | 0.0050 | 0.0283 |

| (0.0258) | (0.0135) | (0.0153) | (0.0212) | |

| ADimposed | 0.0041 | −0.0139* | 0.0023 | 0.0307** |

| (0.0153) | (0.0080) | (0.0090) | (0.0125) | |

| Controls | Y | Y | Y | Y |

| Firm FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Observations | 44,858 | 44,858 | 44,858 | 44,858 |

| R2 | 0.759 | 0.731 | 0.811 | 0.835 |