To examine technological innovation performances of international new ventures (INVs), this study investigates how and under what conditions insider and institutional ownership might matter. Building on the perspective of multiple principal conflicts, we theoretically and empirically address this central question by developing an understanding of how insider and institutional ownership could improve and hinder technological innovation performances of INVs. We also examine the influence of INV founding entrepreneurs’ experience to determine whether their prior professional and startup-founding experience could constrain or enhance innovation performance implications of insider and institutional ownership. Empirical results obtained from a sample of 219 Korean INVs demonstrate that insider ownership and institutional ownership can differentially affect INVs’ technological innovation performances by providing positive and negative innovation contributions, respectively. We also found that founders’ prior experience was an important aspect of enhancing the technological innovation of INVs. Specifically, prior professional experience and startup-founding experience of INVs’ founders were found to negatively and positively affect the contribution of institutional ownership to technological innovation performances of INVs, respectively. By contrast, we discovered that the contribution of INVs’ insider ownership to technological innovation performances of INVs had no relationship with their founders’ experience. We ultimately draw meaningful contributions to the literature by examining roles of corporate governance structure of INVs and their founders’ experience in explaining innovation performances of INVs.

Although engaging in international trade has traditionally required substantial resources, advances in technology and communications have made it much easier for young and small businesses to enter overseas markets (Riding et al., 2012). The emergence of small and medium-sized enterprises (SMEs) with significant network capabilities, learning capabilities, and entrepreneurial capabilities in international markets has attracted scholarly attention of international business (IB) researchers (Cavusgil & Knight, 2015; Gerschewski et al., 2018; Zander et al., 2015). Those entrepreneurial enterprises are typically SMEs with an innovative mindset and a global awareness, implying that they not only consider their domestic market as a product outlet, but also consider the entire globe to be an immense store with vast sales possibilities (Mudambi & Zahra, 2018). In this regard, international new ventures (INVs)—i.e., SMEs that have entered the international market early in their existence—have emerged as a noteworthy topic in the IB research realm. Despite contributions made by previous literature, there has been a dearth of studies examining multiple principal issues in INVs and how they affect technological innovation performances to this point (Baum et al., 2011; Lahr & Mina, 2016; Schwens & Kabst, 2011). Multiple principal problems can be defined as “multiple collective action problems” that firms encounter when they must balance interests of multiple shareholders under corporate governance (Voorn et al., 2019, p. 671). Arthurs et al. (2008) have proposed insiders’ preference for long-term investment and institutional investors’ underwriting by considering the purpose of various investment periods between principals, leading to the occurrence of multiple principal problems in the IPO process of venture companies. Each principal's interest in technological innovation differs. While insider owners of ventures are interested in protecting and advancing technological innovations for the benefit of themselves and long-term shareholders, institutional investors are more interested in leveraging and monetizing present values of those technologies.

This study examines INVs setting wherein multiple principal problems and technological innovation issues for long-term performance are salient. Traditional agency theory examines conflicts of interest between a principal and agents. Considering multiple principal viewpoints is an approach that can be used to address conflicts of interest among multiple principals when at least one of them has a disparate interest in the firm's long-term performance, resulting in a collective action dilemma (Arthurs et al., 2008; Ward & Filatotchev, 2010). Under these circumstances, there is a risk of discordant behavior among multiple principal groups and existence of a situation where each principal might be faced with contradictory decisions about whose interests should be reflected in long-term decision making (Voorn et al., 2019; Young et al., 2008). Therefore, applying multiple principal perspectives into INVs settings can extend insight and additionality into issues that might arise between insider and institutional owners (Florin, 2005; Hsu, 2007; Popov & Roosenboom, 2012).

Mutual consent within INVs regarding technological innovation as long-term corporate performance can only be accomplished when information asymmetry between insider owners (i.e., the founders, the founders’ family members and relatives, and employees) and institutional investors (i.e., venture capitals and angel investors) is minimized (Amit et al., 1990; Gompers, 1995; Shane & Cable, 2002). However, insider owners and institutional investors are inevitably confronted by multiple principal issues due to incompatibility of their respective stances regarding long-term performance of INVs (Arthurs et al., 2008; Choi et al., 2012). Specifically, insider owners of INVs with rapid knowledge accumulation and ability to adapt are often willing to make long-term investments in technological innovation to overcome liabilities of newness and smallness that inevitably arise from resource deficiencies relative to indigenous incumbents in the international market (Buccieri et al., 2021; Djupdal & Westhead, 2015; Lundan & Li, 2019; Mathews & Zander, 2007; Prashantham & Floyd, 2012; Sapienza et al., 2006). Meanwhile, although institutional investors—including venture capitalists (VCs)—can help INVs overcome certain flaws in market competitiveness and ensure organizational legitimacy (Fisher et al., 2017; Hellmann & Puri, 2000), they also desire short-term returns to guarantee their investor profits (Arthurs et al., 2008; Nofsinger & Wang, 2011). Resulting multiple principal issues caused by such asymmetric information might lead to serious conflicts regarding decision making for long-term investments (Young et al., 2008). Nonetheless, there have been few studies examining effects of multiple principals on INVs' investment in technological innovation.

To fill in the research gap described above, the multiple principal problem has emerged as a theoretical lens for understanding the asymmetric information conflict by which insider and institutional ownership can coexist to achieve long-term mutual goals in INVs. Compared to institutional investors, insiders have a more in-depth understanding of information and knowledge about developing new technologies by embedding extant technologies that an INV has accumulated (Deligianni et al., 2020). By contrast, institutional investors have a lot of experience in quickly maximizing the value of an INV's latest technology through exit or IPO (initial public offering) (Callen & Fang, 2013). However, there has been a lack of research into how the information asymmetry problem caused by each principal's knowledge differs and affects long-term technological innovation performance of an INV. In this regard, the background of our study consists of multiple principal problems that arise between owners in terms of technological innovation performances of Korean INVs. INVs have grown tremendously in Korea to the point of becoming a central pillar of economic development. Their technological innovation has contributed substantially to various sectors. Accordingly, there have recently been increasing empirical studies using Korean ventures as samples. For example, Kim (2020) has found that R&D subsidies for ventures could influence firms’ technological innovation depending on output additionality through subcontracting. Lee et al. (2022) have verified that VCs have positive impact when information asymmetry between investors and ventures is reduced and that independent VCs—rather than governmental VCs—can improve corporate innovation. Using ICT startups as a sample, Chung et al. (2022) have examined the ownership structure of ventures as a critical factor in innovation and performance for technology-based startups that are facing difficulty accumulating the necessary capital. As such, several issues concerning Korean ventures are being discussed. Among them, ownership—which refers to the decision-making group that could affect technological innovation—has emerged as a central discourse. The theoretical lens that focuses on multiple principal problems through this research setting enriches our interpretation of founders’ human capital as a moderator of issues arising in Korean INVs and information asymmetry between principals.

By examining the INVs setting through the lens of multiple principal problems, we delineate how a founder's human capital in terms of learning (i.e., professional and startup experience) influences technological innovation performance in this work. Founders of INVs who rely excessively on their past professional experience may have limited market dynamism. Thus, they might not accept feedback in a new environment (Carr et al., 2010; Nadkarni et al., 2011). Given the importance of flexibility for the survival of INVs in a dynamic and complex environment, myopic learning based on previous experiences might be detrimental to technological innovation performance (Zettinig & Benson-Rea, 2008; Zuzul & Tripsas, 2020). Meanwhile, founders of INVs with startup familiarity might be well-suited to weathering uncertainties by reducing information asymmetry through the use of entrepreneurial orientation, efficient investment management, and proactiveness at the investment stage (Dencker & Gruber, 2015; Frese et al., 2020; Hsu, 2007), thus granting persuasive awareness for insiders and institutional investors regarding long-term investments.

Taken together, results of this study extend multiple principal relationships to INVs by identifying potentially competing motivations of two actors (i.e., those of insider owners and institutional investors), thus contributing to the literature by examining how multiple principal problems affect technological innovation performance for long-term growth and how such problems can be addressed. Our contributions are primarily three-fold. First, through multiple principal perspectives in INVs, we discern that insider owners who monitor other principals and institutional investors representing agents providing capital could disagree over long-term decisions about technological investment. Although multiple principal problems concerning innovative performance do not arise in cases where the insight or discernment of institutional investors can be helpful for INVs in the short term, there might still be an incongruity between strategic orientations of institutional and insider owners in the long term due to their different investment purposes. Our second contribution to multiple principal perspectives is our finding that, given principals’ opposing motives for investing in technological innovations, founders having more professional experience can exacerbate the information asymmetry problem due to their myopic learning, resulting in harmful long-term investments. Our third contribution is that multiple principal problems for technological innovation investment are more likely to be addressed as the founder has increasing previous startup experience. To sum up, we contribute to existing studies by showing that INVs with experienced founders are successful in competition by reducing conflicts of interest between principals. Such organizational learning can positively impact INVs’ long-term goals and innovative performances.

The rest of this study is organized as follows. In the theory and hypotheses section, multiple principal problems and learning theory occurring in the context of INVs are explained and each hypothesis is presented. In the methods section, background explanations are presented for Korean INVs (our sample) and measurement of explanatory variables is demonstrated. In the section of analyses and empirical results, verification results and their significance are demonstrated. Lastly, the discussion and conclusion section reports key findings and presents discussions of unsupported hypotheses, theoretical and managerial implications, and limitations and directions for future research.

Theory and hypothesesMultiple principals and learning theory in the context of INVsThis paper includes INVs in which both insider owners (e.g., founder) and institutional investors (e.g., venture capitalists) coexist and cooperate to achieve mutual interests. In this situation, both entities possess asymmetric information regarding venture operations such that the insider owner is more aware of what the venture is doing (Organisation for Economic Co-operation and Development, 2000). Under these circumstances, institutional investors will monitor behaviors, management styles, and philosophies of insider owners. This relationship is often referred to as so-called the multiple principal problem or multiple accountability problem (Voorn et al., 2019). The insider owner commonly acts to meet expectations of all stakeholders and shareholders rather than any single one. Once multiple principals are brought in, governance becomes increasingly complicated, leading to serious multiple principal problems (Young et al., 2008). Multiple principal problems are particularly likely to occur when an institutional investor pursues enhanced short-term performance to swiftly retrieve its investment. In other words, since principals’ interests are often not identical, a conflict between pursuing one's own individual interests and mutual interests is common (Young et al., 2008). As a result, although both insider owner and institutional investors generally aim to guide INVs in the right direction, it becomes increasingly complex and difficult to establish governance that aligns interests of one given principal with those of other principals. However, the status quo can subside in the presence of reciprocal trust accumulated by them.

According to explanations given by learning theory (Argote, 2011; Dixon, 2017; Senge, 1990), one example situation that can lead to shared reliability is when institutional investors trust the management and business capabilities of the insider owner. Such management and business capabilities can possibly be obtained by attaining adequate knowledge and relevant experiences (Park, 2010, 2011) that we can nutshell it simply as ‘learning.’ As illustrated by Levitt & March (1988, p. 320), learning enables firms to encode “inferences from history into routines that guide behavior.” This definition is perhaps particularly true for INVs in that entry into foreign markets typically denotes challenges for small organizations and venture firms because they suffer from a lack of internal resources relatively more than conglomerates. That is, entry into foreign markets (i.e., internationalization) causes INVs to face unfamiliarity in the institutional environment residing in host countries and overcome liabilities of foreignness (Gerschewski et al., 2018; Park et al., 2022). Gerschewski et al. (2018) have pointed out that prior learning through relevant business and founding experiences can function as valuable knowledge to trigger the development of new products and reformation of R&D, thus facilitating internationalization activities and promoting performance (Yli-Renko et al., 2002). Briefly, learning can ease the development and evolution of capabilities in INVs (Zahra, 2005).

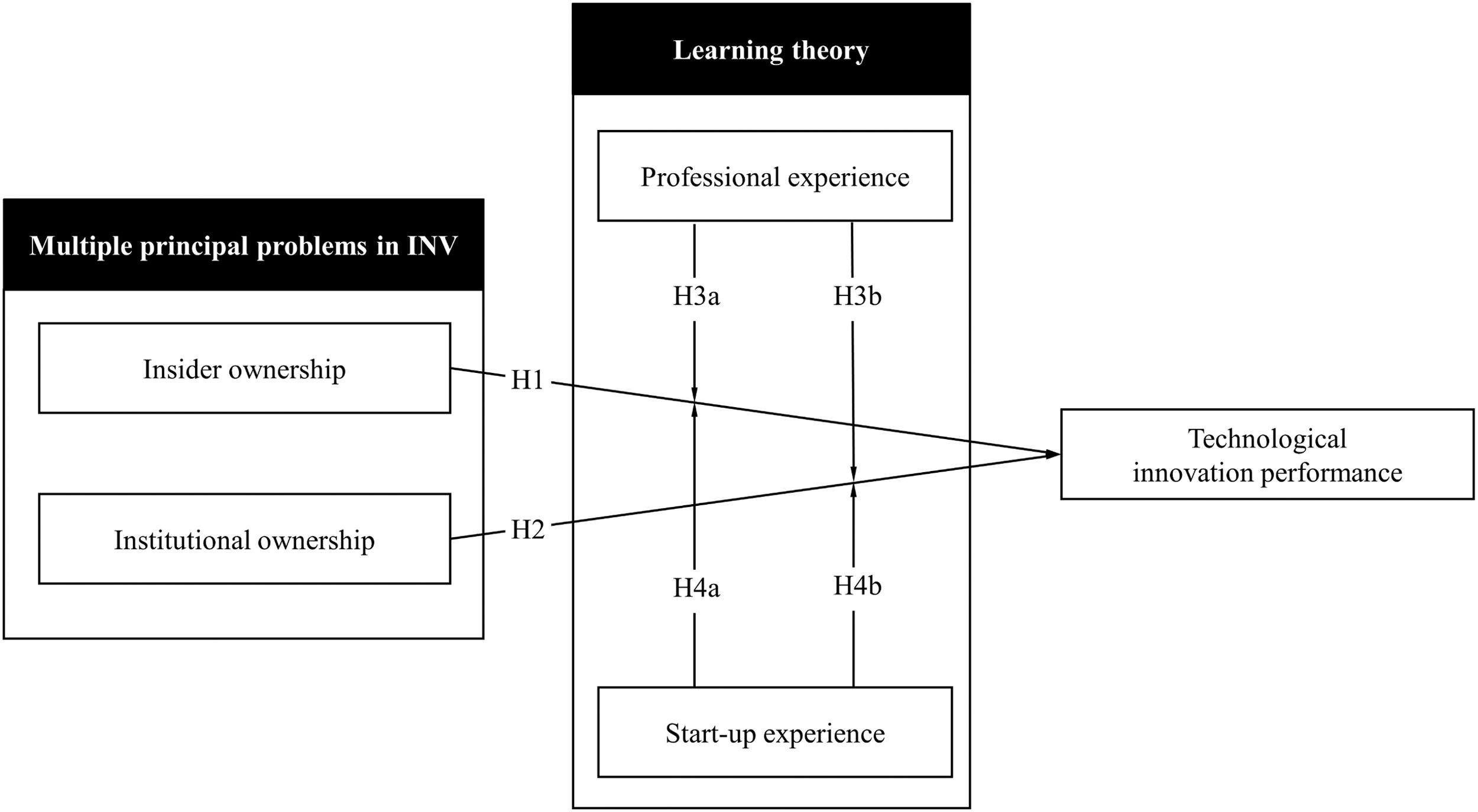

The reason why we choose to shed light on ‘learning’ in the context of INVs is that it is a critical conduit whereby INVs can create and develop their competitiveness (Schwens & Kabst, 2011). In the case where the internal owner (CEOs and/or founder) has various types of experience, INVs do not shirk continuous learning. Instead, they seek knowledge development. Logically, those INVs should be in a better position to pursue opportunities that are available in global markets than other INVs which do not seek knowledge development. Thus, the former are better positioned to adequately handle uncertainties and surmount any risks encountered in alien environments (Sapienza et al., 2006). In other words, learning theory posits that human beings can augment their creative capacity by having greater experiences and know-how obtained from such experiences. It can be expected that INVs armed with such top managements possessing various prior experiences will survive in the competitive international battlefield better than those suffering from the lack of such a capability. Zhang (2011) has verified that the founder's start-up experience forms learning by social connection and attracts attention from venture capitalists. With evidence from Japanese startups, Kato et al. (2015) have validated that founders’ experiential capital matters for innovation. Dencker & Gruber (2015) have explored how types of experiences a founder exploits influence a venture's performance. Gifford et al. (2021) have found that a founder's multifaceted experience can increase his/her understanding of innovation and make a substantial contribution to a venture's survival. Taken together, these findings indicate that learning may influence INVs’ financial, objective (i.e., survival and stability), and innovative performance, even in uncertain atmospheres, which are common in international markets. In the next section, we will develop and introduce sets of hypotheses on how insider and institutional ownership influence technological innovation performances of INVs and how the INV founding entrepreneurs’ prior professional and startup-founding experience could moderate innovation performance implications of insider and institutional ownership. Fig. 1 summarizes our conceptual framework.

Multiple principals of INVs and technological innovation performanceIn this study, INVs are defined as companies that generate more than 20% of their total sales overseas during the three years after their founding (Zhou et al., 2010) with attempt to achieve radical globalization based on an innovative nature and global mindset (Khan & Lew, 2018). Compared to multinational businesses and indigenous firms, international start-ups often have lower levels of organizational legitimacy, vertical integration, and small scale (Shrader et al., 2000). Since INVs aim to globalize swiftly despite being start-ups, they have a relatively high likelihood of failure in the process of internationalization. Since enterprises that embrace a more sequential entry mode have a 26% internationalization failure rate, the internationalization failure rate of INVs cannot be ignored (Mudambi & Zahra, 2018). As a result, start-up founders seek to increase the feasibility of their business plans by augmenting their limited business experience and establishing organizational legitimacy with the help of VCs and institutional investors who can coach and fund startups to achieve successful exits (i.e., IPO or acquisition).

However, VCs and institutional investors operate from a self-interest perspective (Fisher et al., 2017; Hellmann & Puri, 2000). Personal capitalism is the primary economic perspective of VCs, which is dominated by professional logic (Fisher et al., 2017). VCs gain credibility through their investing track record. They exert authority through equity percentages and a straightforward hierarchy. That is, both VCs and institutional investors share a common investment purpose of creating economic profits for themselves and their fund investors. Meanwhile, insiders—including the start-up founder—aim to create a sustainable enterprise while pursuing economic profit. Therefore, it takes a long time to acquire managerial and leadership skills and develop the organization (Picken, 2017). Accordingly, conflicts of interest among principals of INVs might lead to multiple principal problems.

To grow and thrive in international markets, INVs must cultivate innovative competencies to deal with their liabilities of smallness, newness, and foreignness (Zahra, 2005). To that end, INVs mainly employ differentiated or niche strategies to provide unique products and services to local customers. As technology continues to develop, INVs also require persistent technological development to secure a sustainable competitive advantage. However, since radical innovation is quite resource-consuming, firms including INVs must make steady efforts to pursue innovation to achieve continuous growth (Buccieri et al., 2020; Shahzad et al., 2022). The proclivity of INVs for enhancing technologies to new markets to expand revenue potential is likely to benefit from insider owners’ innovative motivation. Therefore, insider owners can strive for continuous technological innovation to survive and eventually develop into long-term companies. Through interviews with representatives from eight Pakistani INVs, Gerschewski et al. (2018) have found that founders’ entrepreneurial orientations and continual innovation in products and work environments are critical for INVs to survive the 2000 dot-com crisis and the 2008 global financial crisis.

Since INVs must be able to adapt to changes in the business environment after successfully introducing new products into overseas markets, insider owners who fail to quickly recognize technological needs of foreign markets risk bad performance. Ramos-Hidalgo et al. (2022) have examined the effect of innovation on sustainable growth of 243 Spanish INVs and found that R&D investments play an indispensable role in their competitiveness and technological progress (Booltink & Saka-Helmhout, 2018). For example, innovative patents that protect core competence and maintain sustainable competitiveness were found to positively affect international performances of INVs. In a study considering American-born-global companies, Knight & Cavusgil (2004) have investigated impacts of innovative culture, knowledge, and capacities on international and entrepreneurial firms and discovered that the ability to adapt innovation resources is critical to INVs' long-term success.

Prior research has also shown that insider owners (i.e., founders, their families, and employees) can positively affect technological performance by reducing agency costs (Choi et al., 2012). The same argument can be extended to performances of INVs in terms of technological innovation. Founders of INVs are incentivized to alter their portfolios based on forecasts of future success because they are likely to have exclusive information about a firm's technological trajectory (Fuerst & Zettinig, 2015). Founders’ families in INVs are also likely to value long-term goals achieved through the firm's solidity over short-term financial gains. Results of a study linking employee earnings and wealth to company performance have shown that employees in INVs exhibit boosted productivity and performance by reducing labor-management friction and increasing individual commitment, cooperation, and information sharing (Martin et al., 2020). Therefore, technological innovation is a crucial aspect of long-term growth of INVs. The present work proposes that insider ownership can positively affect technological innovation performances of INVs with the following hypothesis:

Hypothesis 1 (H1): Insider ownership has a positive relationship with technological innovation performances of INVs.

Although previous studies have shown that institutional investors generally can improve firm innovation performance by providing business portfolio consultations (Popov & Roosenboom, 2012), capital investment (Hall, 2002), and proactive monitoring (Rong et al., 2017), caution is needed before directly applying such reasoning to INVs. Since R&D projects of INVs—relative to those of normal corporations—involve higher uncertainty and require increased consideration of potential risks and even international investment stages, concerns about technology investment failure may hinder founders' willingness to invest in R&D. Thus, to achieve high R&D performance, insiders in INVs are likely to tolerate some extent of innovation failure and pursue long-term success (Aghion et al., 2013; Manso, 2011).

However, institutional investors are generally more interested in short-term returns than in long-term success of investee companies (Callen & Fang, 2013). VCs may put pressure on managers, including founders, to achieve high short-term performance, thus causing them to avoid risky long-term projects (Stein, 1988). When facing pressure from incentives and job security, managers are pressured to give up R&D projects and instead solely aim to improve short-term performance (Bushee, 1998, 2001a). For example, Lahr & Mina (2016) have investigated the effect of VCs’ investments on the patents of investee companies in US and UK companies and found insignificant or rather opposite impacts.

This short-term performance orientation of institutional investors might be more pronounced for INVs in emerging countries. Rong et al. (2017) have assumed the existence of a positive relationship between institutional ownership and corporate innovation in advanced economies. They found that the relationship was different in emerging countries when activity and intensity of institutional investors were low. Moreover, while mutual funds had a positive effect on the innovation performance of a company, domestic institutional investors had no significant effect. Chinese VCs, which are less interested in long-term development of venture firms, are more focused on realizing profits faster and therefore wary of risky and uncertain projects (White et al., 2005). These findings imply that institutional investors acting as speculators with little interest in an INV's long-term profitability might intensify managerial short-termism. Venture financing is linked to a tendency to considerably reduce the time to bring a product to market, particularly for innovations (Hellmann & Puri, 2000). Based on patterns of investment in INVs by institutional investors who are less interested in long-term technological innovation performance due to their short-term “rent-seeking” tendency, we postulate the following hypothesis:

Hypothesis 2 (H2): Institutional ownership has a negative relationship with technological innovation performance of INVs.

Moderation role of founder's learning experiencePrior professional experienceAlthough most previous studies assume that the experience of startup founders as human capital plays a vital role in enhancing innovation performance, such as by executing corporate R&D, developing new products, and seizing market opportunities (Kato et al., 2015; Marvel et al., 2020; Shepherd & DeTienne, 2005), we attempt to assert that a founder's extensive professional experience might not necessarily have positive effects on innovative performance. The presence or absence of a founder/manager's professional background experience may determine the degree to which a company invests in the R&D that is essential for technological innovation (Barker III & Mueller, 2002). This causal association has been convincingly shown in small electronics and software companies (Romijn & Albaladejo, 2002). However, Bacon-Gerasymenko (2019) have argued that, although managers in venture firms can learn from their past successes, their learning propensity declines after a certain amount of experience because they may gradually come to rely on heuristics and mental short-cuts, which hinders new learning. Venture firms are likely to learn from recent accomplishments, whereas insights from bygone or obsolete experiences may harm future performance. Miller (1991) has suggested that, because CEOs’ prolonged tenure limits their ability to strategically and structurally match the new environment with their own companies, they will not be able to keep up with the changing environment, resulting in poor company performances. In other words, since the founder's professional knowledge is closely related to the firm's technological innovation, technological innovation performance might be reduced when path-breaking changes are not sought while path-dependency is bolstered.

Prior professional experience of founders might have a side effect of slowing capture of new technological opportunities. This may not be able to suppress investment-recovery opportunism among institutional investors (Lee et al., 2020; Zhang et al., 2019). Although institutional investors may hamper R&D activities for technological innovation by thwarting founders' long-term risk-taking decisions and applying continuous pressure to only pursue short-term results, founders caught in the inertia of their own professional experience may not fully comprehend the foci of the execution of such decisions (Stein, 1988; Zuzul & Tripsas, 2020).

From an institutional investor's rent-seeking perspective, additional investment can be facilitated for INVs' technology innovation performance when there is a need for more resources with considerable confidence in their success (Florin, 2005; Zhang et al., 2019).

However, asymmetric information problems in such long-term decision-making processes between institutional investors and founders may mainly arise from the founder's obsession with reliance on past professional experience, resulting in no additional funding (Amit et al., 1990; Gompers, 1995; Shane & Cable, 2002). Although the prior professional experience of the founder has been shown to be effective to some extent in the initial stage, its value deteriorates in investors' importance list beginning from the second funding round (Ko & McKelvie, 2018). Rich professional experience of founders of INVs with an advantage of significantly reducing the cost for trial attempts to arrive at optimal solutions could increase one's self-confidence by causing them to undervalue their past failure experiences and overvalue successful ones due to potential myopia (Baum et al., 2011; Levinthal & March 1993; Marvel et al., 2020). Since this cognitive myopia is likely to cause overconfidence, it may be difficult to expect progressive learning effects from professional experience (Welch & Welch, 2009). Even in cases of international survival, the narrow mindset generated by domestic learning can make old firms more likely to ignore, misinterpret, or reject valuable information they receive from foreign markets, all of which are inappropriate behaviors in which INVs should never engage (Carr et al., 2010; Nadkarni et al., 2011). Based on the above discussion of how founders’ myopic learning attitude and overconfidence caused by professional experience can narrow the perspective of insider owners in terms of technological opportunities in the market, therefore causing them to not sufficiently convince institutional investors, we put forth the following hypotheses:

Hypothesis 3a (H3a): Founder's prior professional experience negatively moderates the relationship between insider ownership and technological innovation performance of INVs.

Hypothesis 3b (H3b): Founder's prior professional experience negatively moderates the relationship between institutional ownership and technological innovation performance of INVs.

Prior start-up experienceFounders with a learning perspective that allows them to recognize the importance of technology investment through startup experience exhibit a more positive attitude toward innovation performance (Newbert et al., 2007). Such startup experience among founders provides insider owners with information on the direction of technological trajectory (Baum et al., 2014), which can help INVs effectively manage complicated and long-term innovation outcomes (Choi & Shepherd, 2004; Dencker & Gruber, 2015). D'Angelo & Presutti (2019) have unveiled a positive moderating effect of a founder's prior experience with a start-up by fostering a learning perspective regarding effects of entrepreneurial orientation and learning orientation on growth of Italian SMEs (Fernández-Mesa & Alegre, 2015). Hsu (2007) has found that entrepreneurs with many start-up experiences are fully aware of public relations, social networks, and industry dynamics that are necessary for each investment stage. Such awareness allows them to raise extra external funds with experiential learning. In other words, founders with substantial start-up experience in INVs can adapt to resource-limited conditions and solve likely problems, which further reduces uncertainty about long-term investment for insider owners by developing skills and abilities within them to deal with inherent problems (Dencker & Gruber, 2015; Tietz et al., 2021).

In addition, founders with startup experience can help enhance the firm's understanding and responsiveness to the market by acquiring investment techniques optimized for INVs and corporate resource expansion strategies (Deligianni et al., 2020; Newbert et al., 2007; Zhang, 2011). Since prior start-up experience allows founders to more easily reach solutions to acquire opportunities in the market and utilize their technological capabilities for long-term investment outcomes, such successes and failures can furnish insider owners with a broader range of opportunities and higher probability than past attempts (Dencker & Gruber, 2015). This prior start-up experience of a founder can further enhance communication, network, and information competencies within INVs, all of which can help overcome the liability of smallness, thus providing them with first-hand insight into how to utilize and coordinate limited resources (Wales et al., 2013). Therefore, startup experience of the founder can help insider owners avoid past mistakes to achieve long-term investment purposes, thus helping INVs achieve desirable technological innovation performances (Farmer et al., 2011).

We argue that learning perspectives of founders acquired through startup experience can help alleviate the negative relationship between institutional investors and INV's technological innovation performance. Founders with venture-backed start-up expertise are believed to have developed ties with venture capitalists. These foundrs not only have experience working with venture capitalists, but also are likely to know the group of experts who work closely with venture capitalists. By contrast, founders with no start-up experience are less likely to have built such relationships with venture capitalists (Zhang, 2011). In a study examining factors influencing access to external financing for 1869 startups in 27 countries, Nofsinger & Wang (2011) have found that institutional investors thoughtfully consider the degree of investor protection when deciding to invest in startups with the aim of preventing moral hazards such as information asymmetries and the misuse/misallocation of funds for personal benefit. Since the survivability of a business and the usage of previously obtained funds are difficult to secure and ascertain during the initial fundraising stage, a start-up in its early stage heavily relies on informal financing sources (e.g., the founder's relatives, friends, and neighbors) (Vos et al., 2007). In terms of technological innovation investments between an experienced founder with prior start-up experience and institutional investors, VCs are highly likely to regard founders as having a deepened acumen of investor protection, while such experiences are considered to be a substantial signal to reduce the extent of moral hazards. Therefore, the startup experience of founders in INVs can also help them fathom the ecosystem of VCs. It is valuable to elucidate at what time, how, and with whom long-term plans (e.g., technological R&D) should be discussed. Thus, we have the following hypotheses:

Hypothesis 4a (H4a): Founder's prior start-up experience can positively moderate the relationship between insider ownership and technological innovation performance of INVs.

Hypothesis 4b (H4b): Founder's prior start-up experience can positively moderate the relationship between institutional ownership and technological innovation performance of INVs.

MethodsData and sampleTo empirically test the hypotheses proposed in this study, we utilized a dataset of Korean INVs. Korea has a valuable research setting in which innovation performance implications of INVs could be explored for the following reasons: Korea represents one of the most successful economies in terms of having carried out market liberalization and promoting international expansion of their firms. More importantly, new ventures have formed the backbone of Korean economic development over the past several decades. According to the business statistics released by Korean Ministry of SMEs and Startups, there are roughly 3.5 million new ventures (i.e., SMEs) in Korea, accounting for about 99.9% of all Korean firms and contributing to 83% and 34% of total employment and exports, respectively. Korea is also one of the most innovative economies in the world. According to a report released by the World Intellectual Property Organization (WIPO), Korea has become one of the world's leading innovative players, ranking fifth in the WIPO's Global Innovation Index 2021, even placing ahead of Singapore and Japan. In the last eight years, the number of new ventures increased from 28,193 to 39,101 and the average number of patents per venture rose from 3.5 to 5.3. A total of 817,000 people were newly hired by these ventures, which was more than the number of people newly hired by the total of four major conglomerates (i.e., Samsung, SK, Hyundai, and LG) in 2021. The average R&D cost of Korean ventures was 325 million Korean won, accounting for 5.5% of sales, which was substantially higher than those of SMEs (0.7%) and conglomerates (1.5%). This indicates that ventures are actively investing in technology development. INVs from Korea are currently playing a pivotal role in driving the innovative national competitiveness and responding to the rapidly changing global technological environments.

Our data were derived from the 2019 Survey Database for New Ventures in Korea, which was conducted by the Korean Ministry of SMEs and Startups and Korea Venture Business Association in December 2019. This database consisted of more than 30,000 Korean new venture firms commonly defined as SMEs according to Korea's Act on Special Measures for the Promotion of Venture Businesses. Given the objective of this study, which was to explore the topic of technological innovation performance in the context of INVs, we intentionally selected the final sample of firms from the survey database based on a series of specific screening criteria. First, the final sample for our analysis was limited to new ventures that could undertake innovative activities. Firms that were unable to satisfy this criterion were excluded from final data analysis (e.g., delisted and capital impairment). Second, sample firms intended to be included in our final analysis ware new ventures that were actively engaging in international expansion through exporting or other international marketing activities. We also limited our analysis to relatively young and small new ventures that made at least 20% of their total sales from international markets within three years of their inception (Zhou et al., 2010). In doing so, we excluded some firms that were no longer engaged in international activities or that made less than 20% of their total sales from international markets. This selection criteria allowed us to primarily focus on INVs that rapidly undertook international expansion in the early stage and to better understand and address important issues related to the role of corporate governance and founder competencies in explaining their variations in innovation performance.

Variables and measurementsAll variables used in our analysis were measured based on the approach developed in prior related research. Table 1 presents a description of each variable of interest.

Definitions of variables.

Consistent with prior studies (Spencer, 2003), we conceptualized technological innovation performance as an INV's ability to develop technological advances and protect related intellectual property. To measure the quality of an INV's technological advances, we measured technological innovation performance based on the total number of registered patents (Phene & Almeida, 2008; Shan et al., 1994; Shin et al., 2016).

Independent variablesThe ownership structure of a firm has considerable implications for its ability to create technological advances and develop patented products or services that are technologically viable. It is therefore important to fully capture the relationship between an INV's ownership structure and its technological innovation performance. To measure an INV's ownership structure, we included two independent measures of the INV's ownership structure: insider ownership and institutional ownership. The measure of insider ownership describes ownership by insider investors. Following prior related studies (Bethel & Liebeskind, 1993; Chaganti & Damanpour, 1991; Kacperczyk, 2009), we measured the degree of insider ownership of the INV as the stock owned by the INVs’ insiders, including the founder(s), family and relative owners, and employees. Consistent with findings of prior research (Knippen et al., 2019; Musteen et al., 2009), we captured the degree of institutional ownership of each INV as the percentage of total outstanding common shares held by all institutional investors.

Moderating variablesTo explore individual-level moderating effects explained by INV founders’ characteristics, we examined the role played by INV founders’ prior professional and start-up experiences. Following the approach taken in existing studies (Protogerou et al., 2017; Symeonidou & Nicolaou, 2018), we measured prior professional experience as INV founders’ prior work experience before founding the current INV in number of years. Moreover, following prior literature (Delmar & Shane, 2006; Symeonidou & Nicolaou, 2018; Uy et al., 2013), we conceptualized prior start-up experience as prior firm-founding experience, which was computed as the total number of firms established by INV founders before they established the current INV.

Control variablesTo rule out alternative explanations for INVs’ technological innovation performance, we included a range of control variables: firm size, R&D intensity, leverage, profitability, sales growth, and founder age. As large firms might have more resources and knowledge that can be used to make greater contributions to technological innovation performance, we controlled for firm size, which was measured as the natural logarithm of the total number of each firm's employees (Laursen & Salter, 2006; Yanadori & Cui, 2013). Since R&D intensity reflects a firm's inputs to technological innovation, we controlled for such technology input. We then measured R&D intensity as R&D expenditure divided by net sales (Laursen & Salter, 2006; Yayavaram & Chen, 2015). As financial conditions might reflect a firm's risk-bearing capability and a firm's capability to acquire financing from external institutions and spare resources for innovation, we included the leverage ratio measured as the INV's total debt divided by total assets to control for financial leverage effects (Chang & Rhee, 2011; Deng et al., 2018). Because a firm's motivation to innovate might be influenced by the firm's financial performance (Cassiman & Valentini, 2016; Cyert & March, 1963; Yanadori & Cui, 2013), we included an INV's financial performance measured by return on assets (ROA) calculated as the net income divided by total assets as well as sales growth measured as annual percentage in total sales. To control for industry-specific effects on technological innovation performance, we included a dummy variable, which was coded “1″ for a manufacturing industry and as “0″ for a non-manufacturing industry (Adomako et al., 2019; Khavul et al., 2010). Finally, following prior studies (Chatterji et al., 2019; Eesley et al., 2014), we controlled for individual-level general knowledge and experience by including INV's founder age measured as the focal founder's age in number of years at the time of the INV's founding.

Analyses and empirical resultsResults of descriptive analysis and correlation coefficients of major variables are shown in Table 2. Correlation coefficients were under 0.66, indicating no evidence of multicollinearity. We also calculated average variance inflation factor (VIF) values in models. They were below 2.1, further confirming that multicollinearity was less likely to affect the analysis of this study. Nevertheless, we followed procedures suggested by Aiken et al. (1991) and created interaction terms by centering all independent and moderating variables included in interaction terms. To empirically test our hypotheses, we used Poisson regression models because the dependent variable—technological innovation performance—was measured in the present work by the number of patents. As our dependent variable followed a distribution centered at zero, we estimated technological innovation performance using a Poisson regression model commonly used in previous studies explaining patent counts (Baum et al., 2000; Hall & Helmers, 2019; Reitzig & Wagner, 2010).1

Descriptive statistics and correlations.

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Technological innovation performance | 11.78 | 14.65 | 1.000 | |||||||||||

| 2. Manufacturing | 0.82 | 0.38 | 0.125 | 1.000 | ||||||||||

| 3. Firm size | 3.42 | 1.13 | 0.130 | −0.062 | 1.000 | |||||||||

| 4. Return on assets (ROA) | −0.01 | 0.32 | −0.028 | 0.004 | 0.088 | 1.000 | ||||||||

| 5. Sales growth | 0.25 | 1.21 | −0.041 | −0.032 | −0.101 | 0.086 | 1.000 | |||||||

| 6. Leverage | 0.66 | 0.97 | −0.024 | −0.102 | −0.173* | −0.468* | 0.012 | 1.000 | ||||||

| 7. R&D intensity | 0.44 | 2.32 | −0.044 | −0.050 | −0.188* | −0.354* | 0.079 | 0.551* | 1.000 | |||||

| 8. Founder age | 3.13 | 0.91 | 0.084 | 0.118 | −0.064 | −0.091 | −0.036 | 0.003 | 0.065 | 1.000 | ||||

| 9. Insider ownership | 80.60 | 24.50 | 0.129 | −0.198* | 0.271* | −0.208* | −0.060 | −0.097 | 0.032 | 0.070 | 1.000 | |||

| 10. Institutional ownership | 6.47 | 14.52 | 0.017 | −0.169* | 0.161* | −0.294* | −0.016 | −0.061 | 0.049 | 0.048 | 0.661* | 1.000 | ||

| 11. Professional experience | 11.64 | 8.73 | 0.019 | 0.082 | −0.006 | 0.025 | 0.112 | −0.038 | −0.095 | 0.373* | 0.016 | −0.012 | 1.000 | |

| 12. Startup experience | 0.89 | 0.60 | 0.178* | 0.054 | 0.117 | 0.043 | 0.050 | 0.052 | 0.024 | 0.034 | −0.063 | 0.031 | 0.030 | 1.000 |

Notes: N = 219.

Table 3 presents Poisson regression results of main and interaction effects with standardized coefficients we used to test our hypotheses. Model 1 of Table 3 reports results of the baseline model with only control variables included. Model 2 of Table 3 present results of testing our two baseline hypotheses regarding main effects of two ownership-specific parameters on INVs’ technological innovation performance. Hypothesis 1 proposes that insider ownership can increase technological innovation performances of INVs. Corroborating Hypothesis 1, the effect of insider ownership on INVs’ technological innovation performance in Model 2 was found to be statistically significant and positive (β = 0.016, p < 0.001). In contrast to the positive effect of insider ownership, Hypothesis 2 proposes that institutional ownership will be negatively associated with INVs’ technological innovation performances. As we hypothesized, the effect of institutional ownership in Model 2 was found to be significant and negative (β = −0.010, p < 0.001), providing support for Hypothesis 2. These results therefore provide evidence supporting the view that insider ownership and institutional ownership have different effects on INVs’ technological innovation performance enhancement, specifically by positively and negatively contributing to INVs’ technological innovation performance, respectively.

Results of regressions for INV's technological innovation performance.

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Manufacturing | 0.011⁎⁎⁎ | 0.013⁎⁎⁎ | 0.013⁎⁎⁎ | 0.014⁎⁎⁎ | 0.013⁎⁎⁎ |

| (0.062) | (0.063) | (0.063) | (0.064) | (0.063) | |

| Firm size | 0.010⁎⁎⁎ | 0.007⁎⁎⁎ | 0.005⁎⁎ | 0.006⁎⁎⁎ | 0.004⁎⁎ |

| (0.019) | (0.019) | (0.020) | (0.020) | (0.020) | |

| Return on assets (ROA) | −0.004⁎⁎ | −0.004* | 0.001 | 0.002 | 0.004* |

| (0.058) | (0.068) | (0.065) | (0.076) | (0.071) | |

| Sales growth | −0.003 | −0.002 | −0.003 | −0.003 | −0.004* |

| (0.022) | (0.022) | (0.023) | (0.023) | (0.025) | |

| Leverage | −0.001 | 0.001 | 0.003 | 0.004 | 0.004 |

| (0.034) | (0.034) | (0.033) | (0.034) | (0.033) | |

| R&D intensity | −0.004 | −0.006⁎⁎ | −0.005* | −0.005* | −0.004* |

| (0.013) | (0.014) | (0.013) | (0.013) | (0.013) | |

| Founder age | 0.006⁎⁎⁎ | 0.005⁎⁎⁎ | 0.004⁎⁎ | 0.005⁎⁎⁎ | 0.004⁎⁎ |

| (0.023) | (0.024) | (0.024) | (0.024) | (0.024) | |

| Professional experience | −0.002 | −0.003* | −0.003 | −0.004⁎⁎ | −0.002 |

| (0.002) | (0.002) | (0.009) | (0.002) | (0.009) | |

| Startup experience | 0.012⁎⁎⁎ | 0.014⁎⁎⁎ | 0.014⁎⁎⁎ | 0.031⁎⁎⁎ | 0.019* |

| (0.031) | (0.031) | (0.031) | (0.186) | (0.190) | |

| H1: Insider ownership | 0.016⁎⁎⁎ | 0.012⁎⁎⁎ | 0.012⁎⁎⁎ | 0.012⁎⁎ | |

| (0.001) | (0.002) | (0.002) | (0.002) | ||

| H2: Institutional ownership | −0.010⁎⁎⁎ | −0.026⁎⁎⁎ | 0.010* | −0.014⁎⁎ | |

| (0.002) | (0.003) | (0.004) | (0.005) | ||

| H3a: Insider ownership×Professional experience | 0.008 | 0.009 | |||

| (0.000) | (0.000) | ||||

| H3b: Institutional ownership×Professional experience | −0.022⁎⁎⁎ | −0.021⁎⁎⁎ | |||

| (0.000) | (0.000) | ||||

| H4a: Insider ownership×Startup experience | 0.013 | 0.002 | |||

| (0.002) | (0.002) | ||||

| H4b: Institutional ownership×Startup experience | 0.022⁎⁎⁎ | 0.013⁎⁎ | |||

| (0.004) | (0.004) | ||||

| Pseudo R2 | 0.071 | 0.096 | 0.125 | 0.106 | 0.130 |

| Chi2 | 270.649⁎⁎⁎ | 366.285⁎⁎⁎ | 478.952⁎⁎⁎ | 404.774⁎⁎⁎ | 499.291⁎⁎⁎ |

| AIC | 3576.252 | 3484.615 | 3375.949 | 3450.126 | 3359.609 |

| BIC | 3610.142 | 3525.284 | 3423.396 | 3497.573 | 3413.834 |

| N | 219 | 219 | 219 | 219 | 219 |

Notes: Reported values denote standardized regression coefficients with standard errors in parentheses. AIC = Akaike information criterion, BIC = Bayes information criterion.

Model 3 presents results for Hypotheses 3a and 3b regarding negative moderating effects of prior professional experience of INV founders. As shown in Model 3, the interaction term between insider ownership and INV founders’ prior professional experience was found to be positive but statistically insignificant (β = 0.008, n.s.). This result did not provide support for Hypothesis 3a. By contrast, the interaction term between institutional ownership and INV founders’ prior professional experience was found to be negative and statistically significant (β = −0.022, p < 0.001), thus providing support for Hypothesis 3b. In Model 4, we tested positive moderating effects of INV founders’ prior startup founding experience on respective contributions of insider ownership and institutional ownership to INVs’ technological innovation performances. Results of Model 4 indicated that, while the interaction term between insider ownership and prior startup founding experience was positive but insignificant (β = 0.013, n.s.), the interaction term between institutional ownership and prior startup founding experience was positive and statistically significant (β = 0.022, p < 0.001). These results provide strong empirical evidence regarding the importance of prior startup founding experience of INV's founders in weakening the negative contribution of institutional ownership to the INV's technological innovation performance, thus supporting Hypothesis 4b. However, the statistically insignificant interaction coefficient between insider ownership and prior startup founding experience did not support Hypothesis 4a. Overall, results shown in Models 3 and 4 indicate that INV founders’ prior professional experience and startup founding experience are important for INVs’ technological innovation performance by negatively and positively interacting with institutional ownership, respectively. These results strongly support Hypotheses 3b and 4b, respectively. However, rejections of Hypotheses 3a and 3b shown in Models 3 and 4, respectively, demonstrate that the link between INVs’ insider ownership and their technological innovation performances is independent of their founders’ prior professional and startup founding experience. Finally, Model 5 provides results of the full model that includes all main and interaction effects. As shown in Model 5, all main and interaction effects are highly consistent with and robust to results of separate models. In the following section, we will present results, provide possible reasons for the unsupported hypothesis, and offer relevant theoretical and managerial implications.

Discussion and conclusionThe purpose of this study was to verify primary factors influencing investment in technological innovation under the unique corporate governance of INVs compared to that of traditional incumbents with formal governance consisting of dispersed ownership. Existing studies have highlighted R&D investment (Ramos-Hidalgo et al., 2022), dynamic capabilities (Buccieri et al., 2021), and network resources (Gerschewski et al., 2018) as key long-term investments for the survival of INVs. However, based on the traditional agency theory, this study ascertains the effect of multiple principal issues arising from conflicting interests among multiple principals in INVs on technological innovation and proposes a moderating effect of founder's human capital through learning (i.e., professional and startup experience). Results of hypothesis testing indicated that insider ownership could positively affects technological innovation of INVs, whereas institutional ownership had a negative effect. While founder's learning-professional and startup experiences both had insignificant interactions with insider ownership, their entrepreneurial learning could strengthen INVs' technological investment through interactions with institutional investors (Frese et al., 2020).

The technological innovation performance of INVs, which is an indispensable factor in enhancing future competitiveness and survival that necessitates ample resources and persistent endeavors, might cause information asymmetry problems among multiple principals, namely insider owners and institutional investors (Arthurs et al., 2008; Buccieri et al., 2020). Since insider owners are oriented toward continuous growth of INVs from a long-term perspective (Picken, 2017), we proposed in H1 a positive causal relationship of insider ownership on investment in technological innovation, which was found to be significantly supported. In H2, we proposed that institutional investors' short-term rent-seeking tendencies (Callen & Fang, 2013)—unlike insider owners’ longstanding endurance—could negatively affect investment in technological innovation, which was also significantly supported.

Learning by the entrepreneurial orientation of founders can be subdivided into professional experience related to fields and experience with establishing startups specifically (Frese et al., 2020). H3 presumes that founder's prior professional experience could negatively interact with insider and institutional ownership, two groups where multiple principal problems on technological innovation investment have arisen. The possibility of myopic perception caused by founder's prolonged learning by prior professional experience could increase self-confidence, lead to distorted interpretations of past successes and failures, and foster an obsession with reliance on past know-how (Amit et al., 1990; Baum et al., 2011; Gompers, 1995; Levinthal & March, 1993; Marvel et al., 2020; Shane & Cable, 2002). In particular, the vulnerable feeling that investors might not highly esteem founders' prior professional experience in the subsequent funding round led to significant support for H3b (Ko & McKelvie, 2018). However, H3a was rejected. H4a and H4b suggest that a founder with start-up experience can effectively strategize about an INV's investment round using proficient social networks and public relations as well as prove viable usage of obtained funds with a property guarantee (Hsu, 2007; Nofsinger & Wang, 2011). With multifaceted strengths of the founder's previous startup experience, the rationale that the liability of smallness could be overcome by efficiently utilizing limited resources is statistically significant (Wales et al., 2013). However, H4a was rejected while H4b was supported.

Regarding the moderating effect of the founder's learning orientation, neither professional (H3a) nor startup experience (H4a) were found to significantly interact with insider ownership. For this insignificance of moderation, we suspect homophily between founder's prior experience and insider ownership. Homophily, which refers to an affinity in sociodemographic and behavioral domains in personal social networks, occurs more often with people with similar characteristics than in people with dissimilar characteristics (McPherson et al., 2001). In the establishment of an INV, the most influential members among insiders—after the founders—are informal investors who are entrepreneurial co-decision-makers who are typically close or extended family members and friends. Benefiting from the spillover knowledge effect from peer groups, informal investors make investment decisions even when their entrepreneurial capital is insufficient (Qin, Mickiewicz, & Estrin, 2022). For example, Nofsinger & Wang (2011) have examined determinants of the initial startup financing of entrepreneurial firms in 27 countries and found that informal investors with social ties to founders do not value their startup experience since they already know relevant private information such as abilities, characteristics, and network resources. In sum, we conjecture that insider owners in INVs would not be exceptionally drawn to founders’ prior experience in decision making on technological innovation due to their similar shared social background and private trust in entrepreneurial capital (i.e., the homophily effect). Moreover, when comparing results, the negative effect of institutional owners on technological innovation performance was found to be negatively moderated by founder's professional experience (H3b) and positively moderated by his/her startup experience (H4b). VCs might have more negative perceptions of long-term investment because they expect that the value of the current technology will decrease further when the founders are arrogant/conceited about their professional history (Nofsinger & Wang, 2011; Qin, Mickiewicz, & Estrin, 2022). However, since founders with start-up experience have faced various challenges, failures, and/or successes in their professional history, VCs tend to highly appreciate the potential of INVs’ technological innovation (Kato et al., 2015; Marvel et al., 2020).

Theoretical implicationsThis study developed a theory that could be used to assess the situation involving the occurrence of conflicting voices between insider owners and institutional investors in INVs for technological innovation performance and how problems could be relieved by a founder's prior experiences. We believe that multiple principal perspectives are well suited for clarifying this issue because of discordant objectives of bilateral principals involved in INVs’ long-term decision-making. Therefore, this study contributes to existing research examining technological innovation performance of INVs by presenting multiple principal issues and founder's prior experience as key factors.

First, this study extends prior literature showing that fundamental principals’ contrasting perspectives on technological investment by embracing multiple principal difficulties in INVs might cause them to have different ideas about short-term and long-term decision-making. Since new ventures grow at the initial stage of establishment through informal sources such as family and friends and require support from VCs to secure more funding and corporate credibility and visibility, previous studies have mainly focused on the relationship between founder and VCs as a reciprocally complementary relationship from a resource point of view, wherein VCs furnish several resources (e.g., management know-how and investment networks) to help assemble efficient governance mechanisms that startups lack (Cavallo et al., 2019; Freear et al., 1994, 2002, 1994). However, for technological innovation investment as a driver of long-term performance with high uncertainty, founders are willing to take risks and give weight to the survival and growth of INVs (Tang et al., 2016), while institutional investors expect to recover their investment and profits in a short period (Bushee, 2001b; Callen & Fang, 2013), leading to conflicts between the two principals. Although previous studies on agency problem have suggested the possibility of conflicting opinions between principal and agent due to information asymmetry or goal conflict from a risk aversion perspective (Eisenhardt, 1989), we put forth the idea that vulnerability of technology investment as a driver of long-term performance in INVs might also intensify such issues (Arthurs et al., 2008; Lahr & Mina, 2016).

Second, this study employed the learning theory of founders’ human capital to suggest that professional experience could negatively affect the stance taken by the institutional investors regarding technological innovation performance. A founder's prior professional experience attesting to the quality and competence of managerial teams could result in reduced investment uncertainty of institutional investors and less monitoring of INVs’ decision-making process (Hisrich & Jankowicz, 1990; Rock, 1987; Sapienza & Gupta, 1994). However, since learning by prior professional experience is more likely to lead to acquisition of inferences and incremental gains through references to central elements of past environments, learners (i.e., founders) repeatedly only partake in more habituated and capable activities, thus weakening their other knowledge bases and exacerbating their risk of being immersed in myopic learning. Furthermore, experiences that are successful in the short run might cause failure in the long run due to confidence formed from past successes, thus generating biased memories that are misleading compared to factual records (Levinthal & March, 1993). Altogether, this may indicate that institutional investors in INVs could negate or even devalue the founder's abundant prior professional experience in technological innovation investment decision-making (Ko & McKelvie, 2018).

Third, this study uncovered that a founder's previous startup experience known to play a narrowing role in information asymmetry between institutional investors and insider owners in INVs could enlighten multiple principal problems related to technological innovation investment (Gifford et al., 2021). Serial founders who have sequentially run multiple businesses are more realistic about failure than novice founders. They accordingly adjust their expectations based on their experiences. Among outcomes of experience, serial founders are more inclined to collect evidence that can help INVs have an optimistic mindset rather than dwelling on reasons for failure by obsessing over negative results (Hsu, 2007; Zhang, 2011). Our findings are consistent with those of Ucbasaran et al. (2011), which underscored that institutional capitalists should consider the past startup experiences of serial entrepreneurs before making investment decisions. The founder's previous startup experience grants institutional investors with confidence about the learning background and eases information asymmetry and unrest for INVs’ technological innovation performance.

Managerial implicationsThis study proffers the following managerial implications that can provide guidance to managers of INVs. First, it is important to prepare a bargaining logic that prevents insider owners and institutional investors from falling into a deadlock for INVs to achieve high technological innovation performance. For INVs, technological innovation is an essential method to succeed in the global market and secure future competitiveness. However, it also requires a lot of resources and time (Buccieri et al., 2020; Manso, 2011; Zahra, 2005). Since stakeholders of INV with their own interests can react in various ways to the idea of investing in long-term and uncertain projects such as R&D projects (Bushee, 1998; Martin et al., 2020), INV managers need to regularly signal toward, monitor, and convince both insider owners and institutional investors to minimize multiple principal problems, leading to investment in R&D projects (Callen & Fang, 2013; Young et al., 2008).

Second, the advantage of having institutional investors is indispensable for INVs to achieve their innovative capabilities and succeed in the international market. We confirmed that aggravation of multiple principals in INVs was plausible and that founders' professional experiences could negatively affect technological innovation. This therefore indicates that it is desirable for INV managers to develop situational agility that allows for flexible responses that can provide faith to institutional investors without relying on past professional experience (Bacon-Gerasymenko, 2019; Miller, 1991). Therefore, INV managers should place reduced emphasis on past professional experience for technological innovation while remaining wary of inertia and securing a broad perspective to show situational agility to institutional investors (Nadkarni & Herrmann, 2010; Zuzul & Tripsas, 2020).

Third, we advise founders lacking startup experience to compensate for that lack of experience with knowledge absorption through indirect learning using personal networks. Learning through boundary spanning is an essential competency for managers of organizations operating in an internationalized environment. Thus, the founder's experience in startups is an important source of networks (Yli-Renko et al., 2002). Since human-capital network resources provide INV managers with various opportunities for new ideas, market shifts, and technological innovations to acquire diverse knowledge (Bhagavatula et al., 2010; Grichnik et al., 2014; Laursen et al., 2012), it is worthwhile for managers to indirectly learn through personal networks, which may provide them with helpful clues when they are faced with new technology challenges (Almeida & Kogut, 1999; Biemans, 1991; Conway, 1995; Davidsson & Honig, 2003).

Limitations and future researchDespite these implications, our study has some limitations. First, we focused on founder's learning experiences and multiple principal governance problems to better understand INV's technological innovation performance. Future research should single out potential related to the board of directors’ composition and socioeconomic background since directors and outside directors of INVs can be organized differently than those of traditional firms. Second, to delineate technological innovation performances of INVs in a comparative context, future studies should incorporate how compositions and characteristics of the board of directors interact with the ownership structure in developed/emerging countries into their models (Adomako et al., 2019). Third, risk preferences have long been regarded as essential elements of entrepreneurship (Al-Mamary & Alshallaqi, 2022). Each firm might have different risk preferences, implying that those components might also influence INVs’ technological innovation performance. However, we did not consider them. Thus, future studies should consider impacts of CEO characteristics, environmental uncertainties, and so on. Fourth, we struggled to understand the moderating role of founders’ learning experiences as adjusting multiple principal problems in INVs. However, founders' other ability-related moderating factors (e.g., educational attainment, high-tech industry experience, and foreign experience) might affect technological innovation performances of their INVs (Protogerou et al., 2017). Indeed, since startup experience can enhance understanding of technology trajectory according to our findings, we envision that technology-based experiences of founders (or directors) will become an increasingly crucial aspect of long-term growth of INVs. Further, the lack of longitudinal information prevented us from conducting a dynamic analysis of factors that might contribute to technological innovation performances of INVs over time. Therefore, another avenue for future research is to assess longitudinal performance implications of INVs’ corporate governance and their founders’ characteristics using a longitudinal research design. Finally, we used only quantitative data. We believe that additional utilization of qualitative information, the so-called employment of triangulation, can enrich empirical findings.

Data availability statementsData available on request from the authors

FundingThis research received no external funding.

This work was supported by the Soonchunhyang University Research Fund and Sookmyung Women's University Research Grants. This work was partially supported by Hankuk University of Foreign Studies Research Funds.

Dr. Taewoo Roh is currently an Associate Professor of International Business and Strategy at Global Business School, Soonchunhyang University, Asan-si, Korea. His research interests center on environmental sustainability, green management, global strategy, knowledge and innovation, and business ethics. He has published in such journals as Journal of Business Ethics, Technological Forecasting and Social Change, Journal of Environmental Management, Journal of Cleaner Production, Journal of Retailing and Consumer Service, Business Research Quarterly, Managerial and Decision Economics, Electronic Commerce Research, and Telematics and Informatics. Publications are available at: http://www.researchgate.net/profile/Taewoo-Roh.

Dr. Byung Il Park is a Professor in International Business at the College of Business, Hankuk University of Foreign Studies (South Korea). His-research focuses on Asian emerging-market MNCs, MNC strategy, and corporate social responsibility of MNCs and MNC corruptions. He has published in such journals as the Journal of World Business, Journal of International Management, Management International Review, International Business Review, International Marketing Review, Corporate Governance: An International Review, International Small Business Journal, and Asia Pacific Journal of Management etc. In addition, has also handled various special issues, for example, for Journal of World Business, International Marketing Review, Thunderbird International Business Review, and European Journal of International Management.

Dr. Shufeng (Simon) Xiao is currently an Associate Professor of International Business at the Division of Business Administration, Sookmyung Women's University, Seoul, Korea. He is currently serving as Editor-in-Chief for International Journal of Multinational Corporation Strategy. His research interests center on emerging multinational enterprises, management of Chinese organizations, institutional theory in strategic management, entrepreneurship and innovation, foreign subsidiary management in emerging markets, with a particular focus on China and India, digital transformation, and international business in the digital economy, with a focus on technology innovation within and between platform ecosystems. His research has appeared in the Journal of Business Research, Journal of International Management, International Business Review, Management International Review, International Journal of Human Resource Management, Asian Business & Management, Business Research Quarterly, Thunderbird International Business Review, and other major journals.

For robustness check of Poisson regression results, we also conducted analyses using negative binominal regression models and zero-inflated Poisson regression with corrected Vuong test (ZIPCV) estimations. Results of regression analyses using negative binominal regression and ZIPCV estimations are qualitatively similar to results obtained using Poisson regression models. Due to space constraints, we chose to only report results of Poisson regression models. Results of our robustness checks are available upon request.