This study examines the impact of digital integration on the environmental sustainability of European companies from 2016 to 2022, focusing on emissions reduction, environmental innovation, and resource efficiency. Using a two-stage system generalized method of moments (GMM) model and quantile regression with instrumental variables on panel data, we investigate how digital technologies influence corporate sustainability practices. Descriptive statistics reveal significant variation in digital technology adoption and environmental performance among the 22 European countries studied. Pearson's correlation matrix and variance inflation factor analyses confirm the absence of multicollinearity among the variables. The empirical results from the two-stage GMM model demonstrate that digital integration positively affects emissions reduction, environmental innovation, and resource efficiency. These findings are consistent across different quantiles, indicating that digital integration benefits companies regardless of their initial sustainability levels. However, the impact is more pronounced for companies with lower initial performance. The Hansen test validates the instruments used, and the absence of second-order serial correlation supports the robustness of our GMM model estimations. The positive relationship between past and current sustainability performance underscores the dynamic nature of corporate environmental practices. Our study highlights the crucial role of digital integration in promoting sustainable business practices and offers significant implications for policymakers and business managers. Companies are encouraged to assess their digital environmental footprints, invest in sustainable technologies, and adopt green innovations. Policymakers should support the development of digital industries and facilitate their integration into traditional sectors to enhance overall sustainability. The findings contribute to understanding how digital transformation can drive environmental sustainability, providing a foundation for future research on the intersection of digital technologies and corporate sustainability practices.

Big data, artificial intelligence, and cloud computing are examples of digital technology driving society and the economy into the digital era, along with the swift advancement of information technology (Ji et al., 2023). “Industry 4.0” describes this fourth industrial revolution, defined by a steady transition to digital technology via networks connecting different kinds of goods, value chains, and business models. The fusion of highly intelligent, networked, and self-sufficient physical and digital technologies such as the Internet of Things (IoT), robotics, autonomous vehicles, and 3D printing opens up new opportunities for innovation, expansion of commercial activities, and development of an information society in the era of Industry 4.0 (Gembali et al., 2022; Małkowska et al., 2021). The phrase “information society” originated in the 1970s with Alvin Toffler, a distinguished American sociologist and futurist, and his well-known technological wave theory (Toffler, 1980).

The COVID-19 epidemic, trade disputes, and geopolitical unrest have created a more complex and demanding economic climate. Improving an organization's sustainability has constantly emerged as the most effective way to deal with the unstable outside world (Ji et al., 2023). Academics typically use “sustainable development” or “sustainability” to refer to the coexistence of the ecological environment and economic progress. Specifically, corporate sustainable development (SD) is defined as a multifaceted concept encompassing social, economic, and environmental development and as a business approach that aims to meet current needs without impeding future growth, considering ecological and natural resource-related concerns (Klimek, 2020). Society 4.0 and Economy 4.0 are critical areas of European Union (EU) development (Kwilinski et al., 2023). The EU's “Digital Europe Program,” for instance, aims to establish a sophisticated, intelligent, twenty-first-century economy that should make Europe the most productive, inventive, and “green” economic power in the world (Misuraca et al., 2012).

The constant acceleration of technical advancements is a necessary component of the digital transformation of European nations. However, the strategy to digitize the European economy needs more than roaming restrictions and free wireless internet access for everyone. The digitization of the European economy, which includes manufacturing automation and robotization, creates previously unheard-of economic prospects. Furthermore, even governments understand that having digital strategies is crucial. For instance, the EU presented its digital strategy in February 2020, stating that “everyone is experiencing the digital transformation in their life” and emphasizing that a digital strategy will benefit every European, EU business, and even the entire globe (European Commission, 2020b).

Governments and media outlets worldwide now prioritize emission reductions because they are essential to protect the environment. There is increasing global pressure to substantially reduce carbon emissions from industrial energy use, specifically focusing on heavily emitting enterprises in countries such as China and the United States (Karlilar et al., 2023). Given that domestic and international policies and legislation continually emphasize reducing emissions, business owners must consider how to help combat climate change.

Humans face enormous issues that need action from all parties, including businesses, governments, and the general public. In the face of climate change and resource shortage, a new growth paradigm that guarantees SD is required. According to the World Commission on Environment and Development, SD can satisfy present needs without endangering subsequent generations. The main focuses of SD are the preservation of the environment, economic growth, and social inclusion (Marinakis & White, 2022).

It is challenging to distinguish between the direct and indirect effects of information and communication technology (ICT) due to the growth of digitalization in enterprises, homes, and the financial sector. Globalization unquestionably influences digital technology adoption (Skare & Riberio Soriano, 2021) and how ICT affects the environment (Danish et al., 2018). The scientific community has, in turn, taken an interest in this issue, and there is a significant amount of recent work on this novel approach to problem-solving. For instance, Ahmed et al. (2021) find that globalization and ICT favor CO2 emissions, even though expansion and urbanization harm different layers of the biosphere. Virtual practices, goods, and services that save on energy and emissions are replacing conventional practices, goods, and services. Travel and the resulting emissions are lower thanks to e-commerce, e-banking, virtual meetings, and online education (Adeleye et al., 2021). The impact of robotization, digitization, and innovation on workplace productivity and employment has also received new research attention (Ballestar et al., 2021). Several studies provide evidence of manufacturing process advancements that result in more efficient work teams and more efficient use of resources (Al-Omoush et al., 2020; Bai et al., 2021; Klimant et al., 2021). Digital transformation at all levels also ensures sustainable production, consumption, and business continuity in any scenario, including pandemics.

Studying how the digital revolution affects the environment is still in its early stages. For example, Chen and Hao investigate how board structure enhances environmental performance in digital transformation (Chen & Hao, 2022). Another study finds that new energy-efficient technologies can reduce carbon dioxide production (Cheng et al., 2021). In addition, research shows that digitizing nondecomposable waste substantially increases waste reduction (up to 65 %), according to Kurniawan (2022). Nevertheless, firm-level empirical research finds scant support for the notion that digital paradigms improve environmental performance. The lack of in-depth research into the correlation between digital transformation and green sustainability hinders a comprehensive understanding of the challenges businesses face in the digital age. Furthermore, comprehensively examining the intricacies of the interdependence between digital technology and pollution has the potential to facilitate strategies aimed at enhancing environmental performance (Wang et al., 2022).

Four recent studies are based on various survey results from China. Li et al. (2020) measure environmental performance via decreases in air pollutants, wastewater, and solid waste, as well as improvements in firm environmental status (Li et al., 2023). Three criteria assess environmental status: whether the business measures its impact on the environment, whether promoting environmental sustainability is one of the company's key aims, and whether employees support environmental protection (EP) measures (Li, 2022; Zhou & Liu, 2023). In a poll, we use the following statement to gauge EP: “Our business eliminates waste (air, water, and solid) emissions, the consumption of poisonous and hazardous materials, and the frequency of environmental mishaps and energy use.”

This empirical research sheds light on and assesses how digital integration influences European businesses’ attempts to reduce their emissions. This study also reveals the relationship between digital integration and environmental innovation in European companies. Finally, the study unveils how digital integration influences resource efficiency.

This study answers three research questions. First, how does digital integration contribute to emissions reduction in European companies? Second, what is the relationship between digital integration and environmental innovation in European companies? Third, how does digitization affect European companies’ resources?

This study uses a Thomson Reuters sample of an average of 1,738 ESG (environmental, social, and governance)-listed European companies from 2017 to 2022. In addition, we use a sophisticated generalized method of moments (GMM) with a dynamic panel model that simultaneously considers unobserved heterogeneity, serial correlation, endogeneity problems, and reverse causality (Wintoki et al., 2012). We use Powell's (2016) IV-QRPD panel data model with nonadditive fixed effects, allowing us to estimate quantile-specific effects; this describes the influence of explanatory variables on the central tendency and the tails of the conditional outcome distribution.

After controlling for sector and time effects, the results indicate that digital integration significantly impacts emissions reduction, environmental innovation, and corporate resource efficiency. The theoretical contributions of these positive impacts bring new perspectives regarding how digital technologies may promote corporate sustainability and environmental responsibility nationally. These findings may be relevant in guiding public policies, business strategies, and future research to foster a more sustainable economy.

The convergence of digital transformation and ESG practices presents an intriguing area of research. However, our study aims to address significant gaps in the literature. While digital transformation is advancing rapidly, its direct impact on corporate sustainability remains inadequately explored, particularly within nonfinancial European companies and under the umbrella of ESG criteria. Existing studies often overlook the specific contributions and challenges faced by sectors outside of finance, which play pivotal roles in sustainability efforts. This neglect limits our understanding of how digital integration influences sustainability practices across diverse sectors and overlooks sector-specific dynamics crucial for effective policy and business strategy formulation. The existing research methodologies’ temporal dynamics and endogeneity concerns pose substantial challenges. Many studies fail to account for these factors adequately, potentially skewing causal inferences about the effects of digital technologies on sustainability outcomes. Our study aims to mitigate these methodological gaps by utilizing robust panel data spanning 6 years and employing advanced econometric techniques like the system generalized method of moments (SGMM) and instrumental variable quantile regression panel data (IV-QRPD). These methods enable us to explore the relationships and capture the varying impacts of digital integration on ESG performance across different quantiles of sustainability, thereby contributing methodological advancements to the field. Ultimately, our research seeks to deepen theoretical insights and provide actionable insights for policymakers and businesses striving to integrate digital technologies effectively into sustainable practices across Europe.

The research on the relationship between digital integration and ESG performance provides theoretical insights into how digital technologies can drive sustainable business practices. We contribute to the literature by demonstrating that digital transformation is a technological advancement and a significant enabler of corporate sustainability.

The subsequent sections of this paper are structured as follows: The first section presents an introduction, and the second section presents the theoretical framework. The third section develops the hypotheses. The fourth section discusses the results and corresponding discussions. Finally, we conclude by addressing the implications of this research for researchers, managers, and policymakers.

Theoretical frameworkThe effects of integrating digital technology into company sustainability strategies are multifaceted and encompass many interdependent interactions. To gain a holistic and in-depth understanding, we approach different aspects of digital integration and environmental sustainability by combining different theories. The resource-based view (RBV) theory focuses on companies’ internal resources; the technological innovation theory focuses on adopting new technologies; and the institutional theory analyzes institutional pressures. Stakeholder theory considers stakeholder expectations, while green IT and sustainable business theories focus specifically on the environmental practices of digital businesses.

Resource-based viewFor a long time, one of the most significant conceptual frameworks in academics has been the RBV. This approach asserts that companies’ unique, hard-to-reproduce resources and skills form the basis of their competitive advantage and excess returns, thus explaining the disparities in performance among different organizations (Barney, 2000). Resources and new competencies are required to build a lasting competitive edge in the digital age (Liu et al., 2011).

Due to a fast-paced climate where gaining and maintaining a sustained competitive edge, even for limited periods, has become more challenging, firms today face rising unpredictability and complexity. Embracing the ongoing industrial revolution, primarily digital, and adjusting to technological improvements is one of the greatest difficulties facing organizations today. This is particularly true for companies that did not start digitally or globally but are eager to expand internationally to capture a larger market. Digital transformation is a crucial and economical strategy for these companies to obtain a competitive edge. Expanding into new overseas markets through digital exports or e-commerce is one of the most efficient ways to accomplish this goal (Kehinde et al., 2022; Pergelova et al., 2019).

Abu Hasan et al. (2022) find that companies can use tangible and intangible resources to create a competitive edge. On the other hand, the literature on strategic management is not yet clear about the extent to which enterprise resources and talents contribute to competitive advantages through the integration of digital technology. Researchers claim that the capability for innovation and integrated technology increasingly influences the viability of small- and medium-sized firms (Abu Hasan et al., 2022). According to the RBV, a firm's resources can improve performance and sustainability. These include individual tactics, corporate resources, and particular internal characteristics (Lockett et al., 2009).

Many researchers claim that the influence of digital advances on eco-friendly practices remains uncertain (Diófási-Kovács & Nagy, 2023). On the one hand, the proliferation of ICT tools and digital technologies, along with their capability and performance growth, raises energy demand. At the same time, the significant environmental damage caused by electronic waste draws attention to the adverse effects of technology life cycles (Chen et al., 2020). Conversely, using digital technology and subsequently enhancing the productivity of businesses and industrial processes may enable us to reduce our energy consumption, waste, pollution, and workload (Li et al., 2023).

Additionally, IT facilitates the coordination of product design and manufacturing, enhancing the impact of environmental practices (Gimenez et al., 2015). Corporate social responsibility (CSR) reporting is a highly complex process requiring storing, processing, and analyzing large amounts of data. This is an area where digital technologies can make significant progress. Quantitative and qualitative data can help evaluate company performance, and the sustainability perspective adds a layer of complexity that necessitates cutting-edge technology (Lindfors, 2021). According to Broccardo et al. (2023), advancing digital technologies helps environmental management methods become more successful.

The implications of digital transformation on environmental performance are curvilinear (Li et al., 2023). A rebound effect can happen when handling data, which negatively impacts the environment (by using more energy, contributing to e-waste, etc.). Initially, EP increases in the early stages of digital transformation (by using technologies to optimize and manage resource use). According to the RBV, a firm's performance and competitive advantage are significantly influenced by its capabilities and resources. Businesses can gain and maintain competitive advantage by using resources that are valuable, rare, inimitability, and non-substitutable (VRIN). Digital integration can be seen as a strategic tool that improves a company's environmental management capacities. By investing in digital technologies, businesses can create distinctive capabilities for resource efficiency, carbon reduction, and environmental innovation. This is consistent with the RBV's focus on utilizing internal resources to attain higher performance levels.

Technological innovation theoriesIntroducing new technology signals a shift in economic systems. Although digitization is a fast-evolving sector of national concern, particularly regarding long-term economic viability, it has benefits and drawbacks. The search for variables affecting economic growth in the socioeconomic sector has changed as research trends in the business sector have evolved. Along with societal advancement, rising industrialization, environmental deterioration, and other independent variables, the business sector is fast changing (Xu et al., 2022). For example, Maiurova et al. (2022) examine the environmental effects of digitalization in two German cities. They assert that digitalization is revolutionary in reducing municipal solid waste and greenhouse gas emissions, conserving raw materials, creating jobs, and improving energy and machinery efficiency. Although existing research indicates that using conventional fossil fuels is directly related to increased emissions (Abbasian Fereidouni & Kawa, 2019), financial innovation and digitization support the production and use of renewable energy, thereby lowering emissions (Maiurova et al., 2022).

Several studies in the most recent literature find evidence that digitalization influences environmental quality. For instance, empirical research shows that digitalization improves environmental quality by reducing carbon, greenhouse gas, and other pollution emissions (Xu et al., 2022). Digitalization also improves technical innovation, which in turn increases energy efficiency, reduces the demand for energy (fossil fuels), and, as a result, reduces emissions and other pollution. Additionally, digitalization supports green globalization, energy efficiency, green export values, and a reduction in polluting businesses, according to Xu et al. (2022).

The interdependence of sustainable development goals (SDGs) is evident. Sustainable practices use synergies that lessen the effects of climate change. For instance, low-carbon energy systems can track and predict climate and biodiversity changes over time with highly effective renewable energy integration, thanks to digitalization and artificial intelligence. Additionally, climate research relies on multi-spatial-temporal climatic data to understand climate variability and future projections. Forecasting has changed due to the digitalization of historical climate data and the availability of real-time climate data. This has also given rise to a framework for understanding climate events and their implications for biodiversity. Also, the IoT has dramatically improved real-time, extensive data analysis and data-collection techniques, which could make implementation easier. Multi-spatial-temporal climatic data are a starting point in climate research for analyzing weather conditions and projections. Digitizing historical and current climate data has altered extreme weather prediction and the creation of prevention and adaptation strategies (Murugesan, 2008). Without a doubt, digitizing collection-based research thus facilitates the compilation and evaluation of biological baselines for estimating the effects of climate change, changes in land use (physical and biological qualities of land), land cover (human use of land), invasive species, and consequences of human activity on species diversity (Hedrick et al., 2020).

Institutional theoryAccording to institutional theory, an organization must adhere to societal norms, rules, and expectations to become legitimate and endure in its surroundings. This theory strongly emphasizes how external factors—such as legal requirements and social norms—shape organizational behavior. The institutional theory of organizations places institutions at the center of examining the formation and operation of organizations. Organizations, in this perspective, are regional instantiations of larger institutions. Institutions shape organizational forms, design elements, accepted beliefs, regulations, and conventions. Following established rules gives an organization legitimacy, reduces uncertainty, and makes its actions and operations more understandable (Berthod, 2016).

According to recent literature, institutional frameworks support a national and international organizations’ structure. They introduce social conduct, moral standards, and conventions that produce important rules (Bitektine et al., 2018). Institutional theory explains organizational behavior, particularly conduct that is environmentally friendly. This behavior includes business methods for conserving energy, environmental management, and ecological responsiveness (Qian et al., 2015). According to institutional theory, the institutional environments in which a corporation operates significantly affect its performance (both in terms of economic and environmental factors). Firms function like open systems, where interactions with the environment, which comprises laws and norms, normative views, and social values, happen regularly (Latif et al., 2020). Businesses tend to conform to institutional settings to better fit into the environment because they seek the legitimacy of conforming to societal and regulatory regimes (Colwell & Joshi, 2013). We go into detail on how businesses embrace digital technologies to increase environmental sustainability because of institutional pressures. Governments, consumers, investors, and other stakeholders are putting more and more pressure on businesses to act responsibly toward the environment. By integrating digitally, businesses can better fulfill these demands and adhere to environmental regulations.

Stakeholder theoryStakeholder theory states that companies strengthen their ties to stakeholders to ensure sustainable performance and competitive advantages (Abdullah et al., 2016). In addition, stakeholder theory postulates that stakeholder engagement increases performance while reducing environmental uncertainty and costs. Several authors claim that reducing environmental uncertainties can help organizations better manage their products and services, hire and retain quality people, improve their reputations, foster greater consumer loyalty, maintain competitive advantages, and minimize risk (Zailani et al., 2019). Furthermore, improved Environmental Management Accounting (EMA) practices can decrease environmental uncertainty, enhancing how organizations use tangible and intangible resources to safeguard the environment and economic performance (Hofer et al., 2012).

Green IT and sustainable business modelsBusiness model innovation (BMI) has been well-known in recent corporate practice and research (Bianchini et al., 2023). According to several studies, a BMI shift can lead to (Evans et al., 2017) and help incorporate sustainability in business development (Schaltegger et al., 2012). Sustainable business model innovation (SBMI) is officially part of BMI, and it is obvious how BMI contributes to the growth of sustainable consumption and production (SCP) (Geissdoerfer et al., 2018).

Even though conventional innovation activities significantly harm the environment but produce rapid material advancement, researchers and businesses are becoming more interested in green innovation, especially with the advent of new technologies and materials. Green technology innovation (GTI), however, was not a hot topic for scholars until 2007, primarily because of the unrest at the United Nations Climate Change Conference that year and the U.S. government's dramatic signing of the Bali Road Map at the end of the conference (Haller et al., 2024). Since 2008, industrialized and developing nations have strongly emphasized achieving emissions neutrality, and developing green, low-carbon technologies is now a common concern for combating climate change and global warming (Zhou et al., 2023).

In contrast, Shi and Lai find that rich countries are more interested in GTI than developing ones based on the growth rate of overall publications (Shiu & Yang, 2017). Second, GTI is a worldwide phenomenon, and in recent years, research on GTI in emerging economies has drastically grown. The Chinese government's announcement at the 15th International Climate Change Conference, held in Copenhagen in 2009, regarding its increased global responsibility for low-carbon economic development and its commitment to the United Nations for its emission reduction targets, is one possible explanation. China is rated among the world's top nations regarding green technical innovation relating to the environment compared to other nations and areas (Zhou et al., 2023).

Hypotheses developmentSince the 1990s, environmental and social issues have become increasingly important for all enterprises at both operating and strategic levels. Further, COP 23—the Conference of Parties to the United Nations Framework Convention on Climate Change—emphasizes the urgent need to control their business impact across the entire production value chain (United Nations, 2017). Sustainability pillars must integrate with a company's strategy, planning, and organizational culture. Sustainability should, therefore, be embedded in the organization, both at a strategic and an operating level, in line with a holistic and pervasive goal of maximizing benefits and improving financial performance.

Unfortunately, the ways companies interpret and implement sustainability principles and translate goals into actions are not homogeneous due to dissimilarity in industry features or internal features, such as size, age, or organizational structure. Different tools should support this implementation, including programs for sustainability reporting, monitoring systems, specific digital technologies, business process reengineering, and sustainable product designs (Broccardo et al., 2023).

A firm's ability to manage urgent environmental and social challenges is crucial to its success because doing so is essential for generating new value (Breton, 2015). The literature indicates that sustainability has particular strategic importance for businesses and various stakeholders (Nekhili et al., 2017); a comprehensive understanding of sustainability is thus necessary to balance economic growth, environmental preservation, and social protection (Bergman et al., 2018). Managing sustainability effectively is crucial to maintaining its significance and providing value to stakeholders (Lee & Raschke, 2020). Businesses thus spend more on sustainability for various reasons, including commercial success, legitimacy, or internal development (Mohapatra, 2023; Windolph et al., 2014). External market pressure, legal frameworks, and stakeholder expectations may also strengthen a company's commitment to sustainability (Testa et al., 2016).

The benefits of an innovation-spurring digital economy on a low-carbon trajectory may have historically been overstated. According to one study, since China started its carbon emission trading pilot program, the digital economy has considerably assisted the establishment of low-carbon enterprises (Zhang et al., 2022). Also, some researchers find that the development level of the digital economy (DLDE) has a favorable effect on the reduction of CO2 emissions; they also use interprovincial panel data to find a notable impact on regional diffusion (Hao et al., 2022).

Jing Dong (JD) Company in China is an example of an effective CER utilizing digital economy technologies. JD's data center employs energy-saving technology, including indirect evaporative cooling and frequency conversion. Economic management gradually reduced the data center's average yearly power use, making it more environmentally friendly. Additionally, JD Group entered into a business alliance with Didi Taxi to promote car-sharing among employees, reducing CO2 emissions by around 270,000 kg. JD uses recyclable shipping boxes and looks for green models for product packaging (Meng et al., 2023). In addition, JD launched a digital collective supply chain to promote collaborative efforts among companies to achieve sustainable growth.

Streamlining the utilization of data and informational assets within the digital economy may be a more effective way to reduce the costs of allocating human and material resources. Additionally, streamlining the utilization of data and informational assets can foster innovation and convergence to improve economic transactions’ efficacy and better manage energy resource consumption. This significantly lowers carbon emissions by creating an open, shared, and symbiotic ecology. This leads us to the following:

Hypothesis 1 Digital integration increases emissions reduction efforts.

Digitalization is a significant economic and social change agent in the EU (Ha, 2022). Its effects on the environment appear through various mediums. For example, the enhanced collection and recycling of electronic trash and the reuse of materials contribute to developing a circular economy, all made possible by technology (European Commission, 2020a). Digital solutions can solve several environmental challenges, including solid waste, e-waste, food waste, and agricultural waste. Additionally, several researchers have studied these systems (Hung et al., 2023). There are also numerous ways in which digital technologies may help to promote biodiversity (Ha, 2022). Visualizing and disseminating biological data, such as ICT, can boost policy effectiveness and public understanding.

Additionally, digitalization can create economic models that aid in halting biodiversity decline (Ha & Thanh, 2022). Other significant routes exist, such as environmental preservation, sustainable agriculture, and urban sustainability. However, digital technologies can help manage problems with air and water pollution caused by heavy and chemical industries. Digital technology can also help solve environmental issues such as air pollution, greenhouse gas emissions, wastewater treatment, and climate change (Feroz et al., 2021). Digital technology in manufacturing can implement green energy, energy savings, or renewable energy (Ha & Thanh, 2022).

Furthermore, companies can reduce operating costs and improve worker safety by introducing cleaner and more sustainable processes (Zhang et al., 2017). Sustainable production can also reduce resource consumption and degradation (Roy & Singh, 2017). We can address resource shortages, traffic congestion, and air pollution by introducing digital technologies such as big data, cloud computing, and artificial intelligence (Wu et al., 2021).

The literature also studies the connection between digitalization and “conventional” innovation. ICTs and cloud computing investments are facilitators of innovation, according to the OECD Digital Economy Outlook 2020. We propose that digital integration fosters innovation by providing firms with advanced tools and capabilities to develop green technologies. This aligns with the RBV's focus on using unique capabilities to drive innovation and competitive advantage.

Hence,

Hypothesis 2 Digital integration increases environmental innovation.

Increased resource efficiency in manufacturing enterprises is intimately linked to increased digitalization for effective business administration and establishing a control hub to preserve and allocate resources (Vazhenina et al., 2023). Resources, capabilities, and organization are the main elements influencing operational effectiveness (Li & Jia, 2018). Aligned with the core tenets of the resource-based perspective, the cultivation of competitive advantages necessitates procuring resources that are valuable, rare, difficult to replicate, and essential (Barney, 1991). Thus, in addition to land, capital, and labor, digital resources have become important for developing a digital economy. By enabling businesses to implement intelligent production, operations, and management, they can significantly increase productivity, value, and competitiveness (Chaudhuri et al., 2022).

The widespread integration of artificial intelligence, cloud computing, blockchain, and other recent technologies into traditional manufacturing processes is also helping businesses optimize processes, reduce operating expenses, boost production efficiency, create efficient and adaptable operational frameworks, and consolidate the quality of organizational planning, among other things (Mikalef & Pateli, 2017). Also, the efficient exchange of internal information in a digital setting mitigates the principal–agent problem, which enhances the company's internal controls and capacity for resource allocation (Frynas et al., 2018). Through digital transformation, enterprises can establish a fresh operational paradigm and organizational management framework (Konopik et al., 2022).

The institutional-based view (IBV) contends that a critical determinant of an organization's size is its capacity to respond to changes in the external institutional environment (Patnaik et al., 2022). Notably, digital transformation now involves enterprises upstream and downstream in the industrial chain (Li, 2020), fostering an ongoing exchange with competing firms, online services, and governmental organizations to acquire information, technology, and money (Teece, 2018). This occurs because the industrial system continuously expands, and the division of labor is more specialized. Consequently, digital transformation allows businesses to not only master additional digital resources but also to establish closer links with and acquire other economic actors.

Businesses can use this knowledge to gain a competitive edge. For example, web-based platforms enable businesses to combine mass customization and personalization seamlessly, achieving distinction and cost reduction simultaneously (Mourtzis et al., 2014). Digital technology can hasten information diffusion and dissemination, which benefits business communication and lowers search costs (Malone et al., 1987). As a result, organizations can better assess their competitive positions and connect with more upstream and downstream firms. Also, businesses that undergo digital transformation can better allocate their internal and external resources and boost operations, management, and production efficiency, strengthening their ability to maintain their corporate sustainability programs. Therefore, we hypothesize that digital integration, as a valuable resource, enables firms to implement more efficient processes and technologies, leading to reduced emissions. This hypothesis is grounded in the RBV's emphasis on leveraging internal resources for performance improvement.

Hypothesis 3 Digital integration increases resource efficiency.

Our study focuses on European ESG-listed companies between 2017 and 2022, corresponding to the growing awareness of digital transformation and ESG initiatives among policymakers worldwide. This time frame spans 6 years, providing valuable panel data to address potential endogeneity concerns in our model specifications.

Sample selectionWe followed a structured methodology to create a representative European sample of companies. The selection process took place in several stages to guarantee the robustness and representativeness of our sample:

Initial population: Our initial study population consisted of 2575 companies listed on European stock exchanges and included in the Thomson Datastream and ASSET4 databases.

Sector exclusions: The financial sector, which includes financial institutions, insurance companies, and real estate firms, was excluded from our sample due to its distinct activities and regulatory environment. This sector differs considerably from the other sectors in organizational and conceptual terms, which could introduce heterogeneity into our analysis.

Data completeness: Companies with missing data for dependent or explanatory variables during the sampling period were excluded to ensure a well-balanced panel. This step was crucial to maintaining the integrity of the statistical analysis and avoid bias caused by incomplete data.

After these exclusions, our final sample comprises 1,738 nonfinancial companies from 22 European countries, representing nine sectors: basic materials, consumer goods, consumer services, oil and gas, healthcare, industrial products, technology, telecommunications, and utilities. This comprehensive data set covers 6 years and includes 12,166 observations.

Data collection processThe data collection for our study was based on three primary sources:

Thomson datastream: This database provided us with financial and market information for the companies in our sample. Datastream is renowned for its extensive coverage and reliability, which guarantee the accuracy of the financial data used in our analysis.

Refinitiv Eikon database: This source provides detailed data on companies’ ESG performance. ASSET4 is recognized for its comprehensive ESG indicators, enabling a precise assessment of companies’ sustainability practices and digital integration.

European Commission: We supplemented our dataset with relevant policy and regulatory information from the European Commission. This information is crucial to understanding the regulatory framework influencing ESG practices and the digital transformations of companies in Europe.

The data has been systematically extracted and verified to ensure consistency and reliability. Integrating these different sources has resulted in a comprehensive and robust dataset covering the financial, ESG, and regulatory aspects of the companies in our sample.

By following this rigorous data collection process, we aim to provide an in-depth and reliable analysis of the relationship between digital transformation and the ESG practices of European nonfinancial companies.

The measurement of the variables. The measurement of variables, which encompasses the characteristics of a set of values that can be numerically quantified, follows a classical approach. It involves a dependent variable along with independent and instrumental variables. Furthermore, we incorporate control variables to ensure an unbiased estimation of the parameter of interest.

Dependent variables: corporate sustainabilityCorporate sustainability is the dependent variable in our econometric model and is measured using the environmental pillar of the Refinitiv ESG index. Investors widely use this pillar to measure corporate behavior in environmental, social, and governance contexts (Issa & Hanaysha, 2023; Konadu et al., 2022; Serafeim, 2015). The environmental pillar of the Refinitiv ESG Index is based on three categories: resource use, emissions, and innovation.

We use three specific corporate sustainability indicators: emissions reduction scores, environmental innovation scores, and resource efficiency scores, as explained in the Refinitiv ESG Index (Refinitiv Eikon Datastream, 2022):

Emissions score: This assesses a company's willingness and ability to reduce environmental emissions as part of its manufacturing and operating activities (Issa & Hanaysha, 2023; Refinitiv Eikon Datastream, 2022).

Environmental innovation score: This refers to innovative environmental technologies and processes, or ecologically designed goods, as well as the ability to minimize environmental costs and disadvantages for consumers, thereby opening up new business opportunities (Konadu et al., 2022; Refinitiv Eikon Datastream, 2022).

Resource use score: This reflects a company's ability to improve the use of materials, energy, water, and ecology through better supply chain management (Refinitiv Eikon Datastream, 2022; Serafeim, 2015).

These comprehensive sustainability indicators provide valuable information on the environmental practices and efficiency of the companies we evaluate. These measures are essential to understanding how companies integrate SD into their activities and their environmental impact. The detailed assessment of these variables enables a nuanced analysis of companies’ sustainability performance and its determinants.

Explanatory variables: integration of digital technology. Digital integration is a complex phenomenon with various dimensions, making it challenging to accurately establish precise parameters to measure its dynamics and changes.

To understand the relationship between digital transformation and business sustainability, we rely on the official European database for indicators of the Digital Economy and Society Index. One of these indicators, “Integration of Digital Technology,” pertains to using the latest technological advancements in business and e-commerce. It encompasses “business digitalization” and ”e-commerce,” as the European Commission explains (European Commission, 2020a).

The business digitalization category comprises four indicators that measure the percentage of companies utilizing electronic information sharing, social media platforms, big data analytics, and cloud solutions. The e-commerce segment includes three indicators: the percentage of companies engaged in online sales, the ratio of e-commerce revenue to total company revenue, and the percentage of companies conducting online sales internationally.

By utilizing these indicators, we gain valuable insights into the extent of digital technology adoption and its impact on sustainability.

Control variables. We carefully account for various factors in our analysis. To address the influence of company size, we use the natural logarithm of total assets at year-end, following previous studies (Marsat et al., 2021; Nirino et al., 2021). We measure financial performance via return on assets (ROA), the ratio of net income to total assets, consistent with previous research (Marsat et al., 2021; Nirino et al., 2021). We measure market performance with the market-to-book ratio, as in Marsat et al. (2021). Board size is the number of directors on the board, as in Yarram and Adapa (2021).

To measure board independence, we follow Yarram and Adapa (2021) and consider the percentage of independent directors on a board. Additionally, we incorporate two dummy variables—INDUSTRY DUMMY and Country DUMMY—to account for industry and country differences, thereby enhancing the comparability of our results. Furthermore, we introduce annual fixed effects (FE; YEAR DUMMY) to capture temporal variations in production, reflecting economic cycles and macroeconomic fluctuations (Nguyen et al., 2015).

By carefully accounting for these variables, we enhance the strength and validity of our analysis.

Instrumental variable. We evaluate each company's environmental management efficiency; specifically, we ask whether the company holds the ISO 14000 certification. This certification signifies the adoption of environmental management systems (EMS) based on standards established by the International Organization for Standardization (ISO) (Aba & Badar, 2013; Delmas & Montiel, 2008; Epstein & Roy, 1997). Among the ISO 14000 family of norms, ISO 14001 is the most significant, outlining EMS requirements that organizations can implement to enhance their environmental performance (Epstein & Roy, 1997). The ISO 14000 family also encompasses other elements such as environmental auditing, eco-labeling, and life cycle assessment. To capture this relationship effectively, we introduce a binary dummy variable that equals 1 if a company obtains the ISO 14000 certification in a given year and 0 otherwise (Refinitiv Eikon Datastream, 2022). This variable serves as our instrumental variable in the analysis.

Model specificationReverse causality and endogeneity issues are inherent in most studies concerning CSR (Aouadi, 2016; Habib & Bhuiyan, 2017). For instance, taking our case as an example, companies that demonstrate excellence in sustainability may choose to integrate digital technology into their strategic processes to enhance their environmental compliance. Ignoring this reverse causality could interfere with the actual effect of digital integration on firm sustainability.

In response to these pertinent concerns, we conduct a series of diagnostic tests, namely the Wooldridge test for autocorrelation, the Breusch-Pagan/Cook-Weisberg test for heteroskedasticity, and the Wooldridge test for strict exogeneity (Wooldridge, 2010). The results do not reject the Wooldridge strict exogeneity test, confirming that future values of our digital integration and control variables correlate with the current year's firm sustainability (Wintoki et al., 2012). This finding precludes using the traditional ordinary least squares and fixed effects estimation models. Following subsequent studies (see Girod and Whittington 2017, Koster and Pelster 2017), we employ a two-step SGMM estimation developed by Rellano and Bond (1991), following the model in Wintoki et al. (2012).

Additionally, we employ the IV-QRPD panel data model with Powell's (2016) nonadditive fixed effects, which exhibits greater robustness against outliers. Specifically, this model estimates quantile-specific effects, describing the influence of explanatory variables on the center and the tails of the conditional distribution of outcomes. We use the instrumental variable in the case of endogeneity. Using the IV-QRPD model, we can better understand the impact of digital integration on environmental sustainability, considering differences between companies and identifying specific effects at different levels of sustainability distribution. This gives us a more complete and nuanced view of the relationship between digital integration and corporate environmental sustainability. Therefore, we adopt the following equation:

In the above equation, Y(i,t) denotes one of the three sustainability indicators for each firm, such as the emission reduction score, environmental innovation score, or resource utilization score, over each year. X represents a vector of control variables, and εit is the error term. The i and t refer to individual firms in the sample and the respective periods. Hence, Y_ (i,t-1) captures the temporal dependence of sustainability for firm i. The inclusion of this term in our model is crucial to obtaining consistent estimates, as it helps to address issues such as omitted variable bias, reverse causality, and dynamic endogeneity, which are significant sources of endogeneity (Wintoki et al., 2012).

Empirical resultsThis section presents and analyzes the descriptive and empirical results of the study.

Descriptive statistics and Pearson's correlation matrix resultsTable 1 depicts the main descriptive statistics of the variables in our study. The average value of Digital Technology for the 22 European countries in the sample is 43.161 %. The average Emission Reduction value is 50.67 %, the average Environmental Innovations value is 28.06 %, and the average Efficient Use Resources value is 47.66 %.

. Descriptive statistics.

Note: S-W: Shapiro-Wilk test with Z-statistics. *** indicates significance at the 1 % level.

According to Mukherjee et al. (1998), data is usually distributed if the skewness value is close to 0 and the kurtosis value is less than 3. Table 1 shows that none of our variables have skewness close to 0 or kurtosis above 3, suggesting that the data is not symmetrically distributed and that there are extreme values. Additionally, the mean significantly differs from the median in many cases, implying that our data distribution is abnormal. Furthermore, we follow the approach of Razali and Wah (2011) to confirm our findings using the Shapiro–Wilk normality test.

As shown in Table 1, the assumption of a normal distribution for the variable must be rejected. Therefore, our variables do not perfectly meet the assumptions of normality and the absence of outliers.

Before conducting multivariate analyses, we examine the correlations between the independent variables to ensure no collinearity exists. We use a bivariate correlation matrix to test for the absence of perfect multicollinearity among the input variables, as shown in Table 2. Multicollinearity between two variables is “problematic” when the correlation coefficient exceeds the critical value of 0.8 (Gujarati & Porter, 2009). In our case, the intercorrelations between the explanatory variables range from –0.1388 to 0.4900, below the critical threshold of 0.8. Therefore, the correlation matrix indicates no collinearity among the explanatory variables in our model.

Correlation among all variables (Pearson coefficients).

Note: ** and *** indicate significant relationships at the 5 % and 1 % levels.

Furthermore, we employ the variance inflation factor as a diagnostic test for multicollinearity. As a rule of thumb, Marquaridt (1970) and Gujarati & Porter (2009) suggest that a variance inflation factor greater than 10 indicates significant collinearity. According to Table 2, there are no issues with multicollinearity among the studied variables.

Empirical results of the two-stage SGMM dynamic models and IV-QRPDTo analyze the relationship between digital integration and corporate sustainability, including emissions reduction, environmental innovation, and resource efficiency, we employ a dynamic panel model known as the two-stage SGMM, following the approach in Arellano and Bond (1991). This econometric estimation method can capture variations among companies and over time while addressing the endogeneity bias of the explanatory variables. The endogeneity bias arises from digital integration and specific company characteristics that simultaneously influence sustainability. By utilizing the two-stage SGMM model, we mitigate this bias and enhance the robustness of our findings. Tables 3–5 display the parameter estimates and corresponding P-values derived from the two-stage SGMM model.

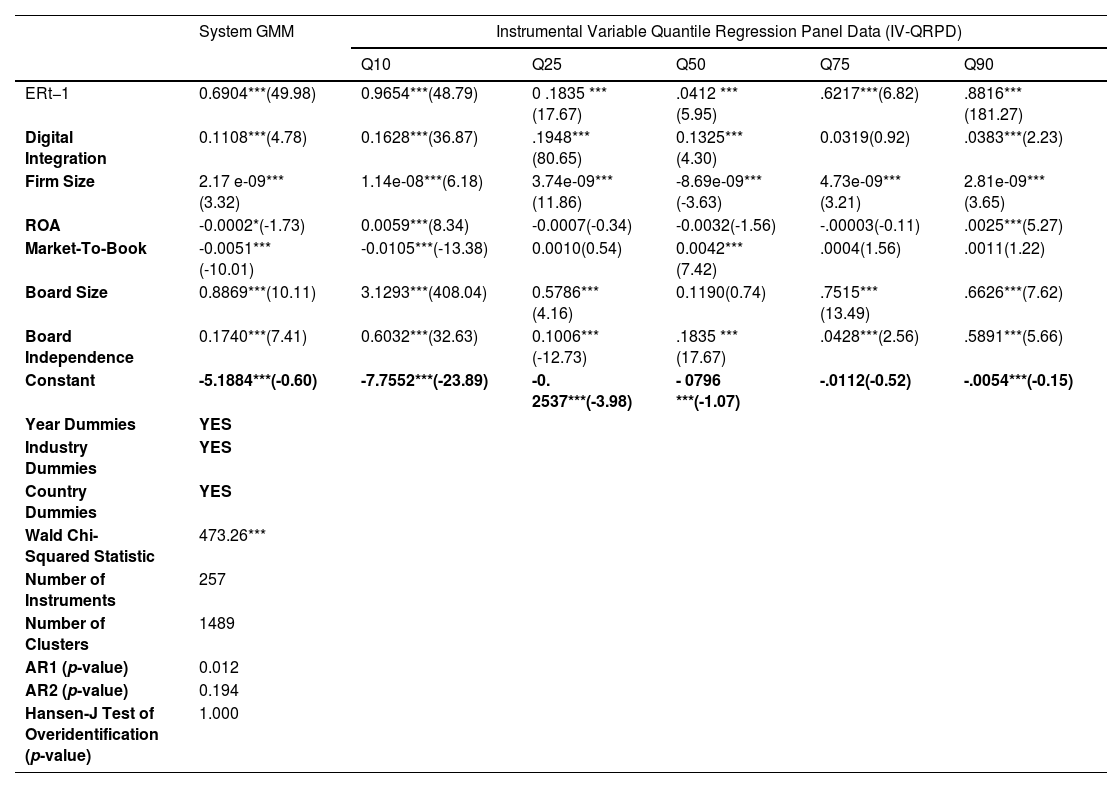

Digital Integration, Emissions Reduction, Two-Stage SGMM, and IV-QRPD The second column presents the results obtained using the two-step GMM approach. ***, **, and * denote significance at the 1 %, 5 %, and 10 % levels, respectively. The z-statistics of the two-stage GMM model are in parentheses and are based on Windmeijer-corrected standard errors (Windmeijer, 2005). For the IVQR, the instrumental variable is the binary variable for ISO 14000 certification, and the p-values are in parentheses. Dummy variables for year, industry, and country are not displayed.

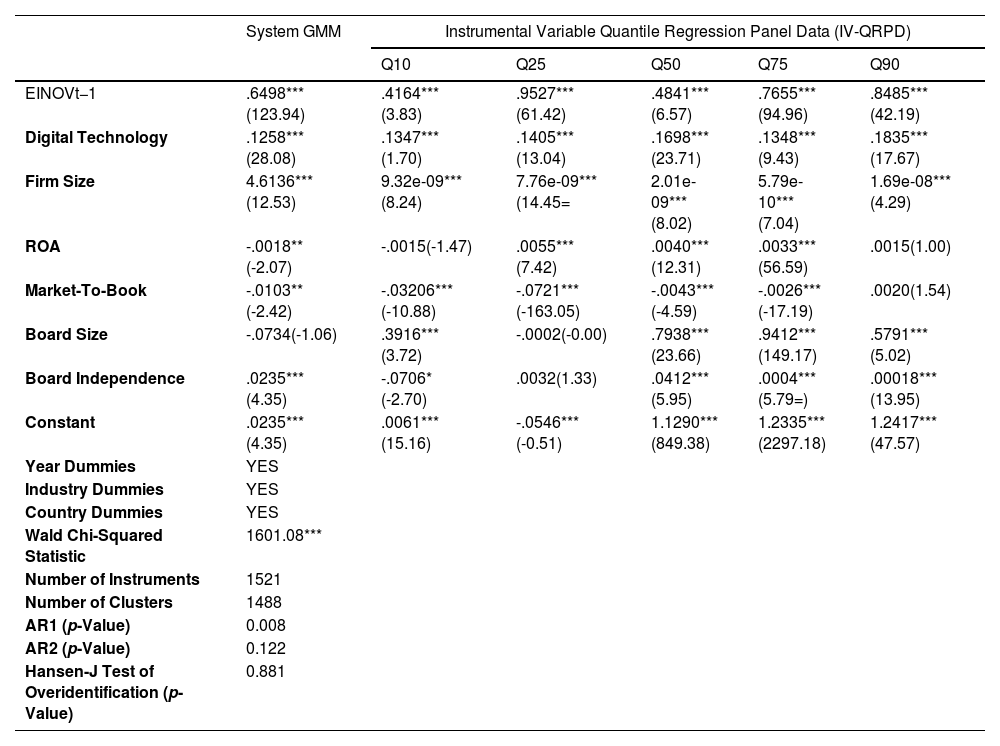

Digital Technology, Environmental Innovation, Two-Stage SGMM, and IV-QRPD The second column presents the results obtained using the two-step GMM approach. ***, **, and * denote significance at the 1 %, 5 %, and 10 % levels, respectively. The z-statistics of the two-stage GMM model are in parentheses and are based on Windmeijer-corrected standard errors (Windmeijer, 2005). For the IVQR, the instrumental variable is the binary variable for ISO 14000 certification, and the p-values are in parentheses. Dummy variables for year, industry, and country are not displayed.

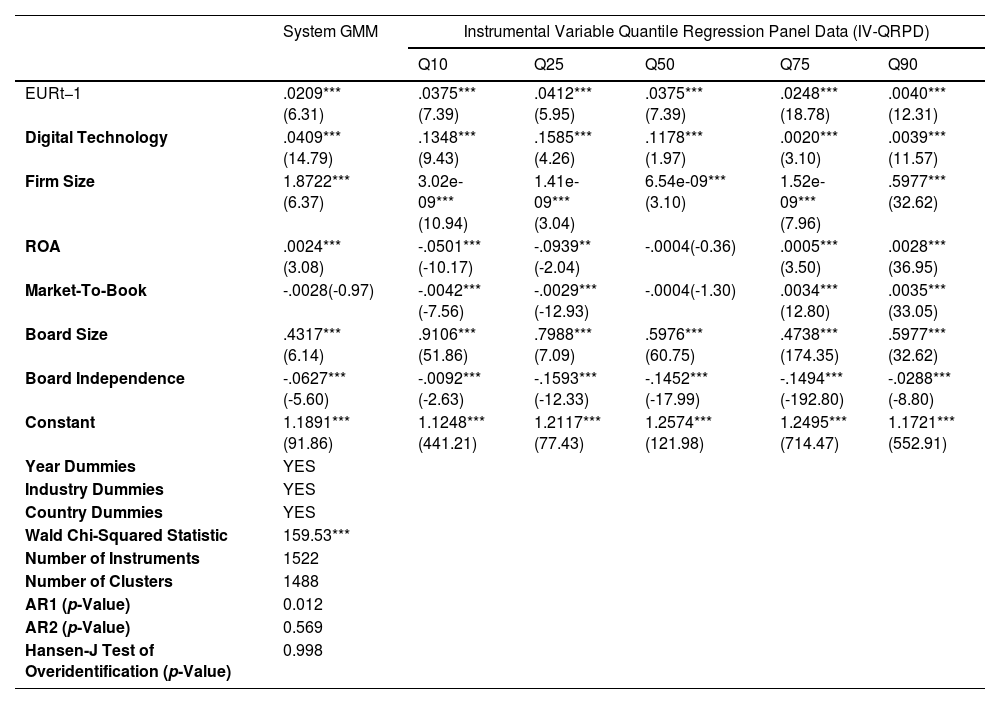

Digital Technology, Resource Efficiency, Two-Stage SGMM, and IV-QRPD The second column presents the results obtained using the two-step GMM approach. ***, **, and * denote significance at the 1 %, 5 %, and 10 % levels, respectively. The z-statistics of the two-stage GMM model are in parentheses and are based on Windmeijer-corrected standard errors (Windmeijer, 2005). For the IVQR, the instrumental variable is the binary variable for ISO 14000 certification, and the p-values are in parentheses. Dummy variables for year, industry, and country are not displayed.

In the context of regression using the GMM method, we apply the Hansen test to identify instruments and determine the validity of the specified instruments, following Roodman (2007). Additionally, we employ the Arellano & Bond (1991) test to identify first- and second-order autocorrelation (Arellano & Bover, 1995; Blundell & Bond, 1998).

The P-values from the Hansen test for the two-step GMM model are 1.000 (Table 3), 0.881 (Table 4), and 0.998 (Table 5), indicating excellent quality and validity of the instrumental variables in our estimations.

Consequently, the absence of second-order serial correlation in the error term, as indicated by the AR(2) values, confirms the validity of the GMM model estimation for the three analyzed models (Roodman, 2009). The lagged dependent variables also exhibit positive coefficients with high significance across all specifications, demonstrating the dynamic nature of the model's specification (Daher et al., 2015).

We observe a significant correlation (at the 1 % level) among the past values of Emissions Reduction (Table 3), Environmental Innovation (Table 4), Resource Efficiency (Table 5), and their current values for the company. This result is consistent with prior literature, suggesting that current managerial decisions and practices are strongly influenced by the company's past performance levels (Garcia-Castro et al., 2010). Therefore, past sustainability scores (Yt-1), such as emissions reduction, environmental innovation, and resource efficiency, play a crucial role in capturing the dynamic factors that affect it.

On the other hand, the results in Table 3 demonstrate a favorable and statistically significant association at the 1 % level of significance for the digital integration–emissions reduction relationship, confirming hypothesis 1. This suggests that digital integration positively affects efforts to reduce emissions. This positive correlation between digital integration and emissions reduction suggests that adopting digital technologies helps companies implement more environmentally friendly practices. By leveraging digital solutions, businesses can optimize their processes, reduce waste, and improve energy efficiency, resulting in lower emissions and a positive environmental impact.

Furthermore, to test hypothesis 2, Table 4 reveals a significant and favorable linkage, significant at the 1 % level, between Digital Integration and Environmental Innovation. This suggests that digital integration promotes environmental innovation, which in turn suggests that companies adopting digital technologies are more likely to develop and implement innovative and sustainable practices. Digital tools can facilitate research, development, and implementation of environmentally friendly technologies and processes, promoting continuous improvement in environmental performance.

Similarly, the results in Table 5 show a favorable and statistically significant relationship between Digital Integration and Resource Efficiency, as anticipated in hypothesis 3. Therefore, we accept hypothesis 3, which proposes that digital integration increases resource efficiency. By leveraging data analytics, artificial intelligence, and automation, companies can optimize resource allocation, reduce consumption, and minimize waste generation, thus improving overall resource efficiency.

The results of the two-stage GMM model provide a point estimate of the conditional mean effects of digital technology integration on companies’ environmental sustainability parameters. However, to enhance the robustness of our results, we use the IV-QRPD model. This technique solves the problems of endogeneity and heterogeneity and allows the regression parameters to vary over different quantiles of the firms’ environmental sustainability distribution.

The results in Tables 3 and 5 show that at distribution queues 10 and 25, digital technology integration has an enormously positive effect on emissions reduction and resource efficiency. This means that companies with the lowest levels of environmental sustainability benefit significantly from digital integration.

The impact remains for the 50th distribution level but may be less marked than at lower levels. This suggests that most already relatively sustainable companies continue to benefit from digital integration, but the effect is less pronounced.

Where distribution quotients are between 75 and 90, the impact of digital integration may be less significant or even insignificant. This may occur because the best-performing companies in terms of sustainability have already implemented advanced practices, and digital integration may have marginal effects on their already high environmental performance.

However, at distribution levels 10, 25, 50, 75, and 90, we observe digital integration's significant and positive impact on environmental innovation. This means that whatever their current environmental performance, companies that adopt digital technologies improve their capacity to develop innovative ecological practices and technologies.

At the lowest levels (10 and 25), there are companies with the lowest environmental performance. Here, digital integration plays a particularly crucial role in stimulating environmental innovation. These companies can benefit most from digital integration by adopting more environmentally friendly practices to improve their sustainability.

At the higher levels (50, 75, and 90), where companies already have higher environmental performance, digital integration continues to encourage environmental innovation. Sustainable companies can also improve their practices by integrating more advanced digital technologies.

The interpretation of the results at various levels reveals a complex relationship between digital integration and environmental sustainability in companies. Less efficient companies benefit most from digital integration; already sustainable companies may observe lesser effects. These findings have important practical implications for companies seeking to improve their environmental sustainability by integrating digital technologies. They also highlight the importance of tailoring the approach to each company's level of sustainability to achieve optimal environmental impact.

DiscussionResearchers and practitioners are increasingly interested in how digital technology can achieve energy and environmental sustainability, given that digital technology significantly affects energy consumption and environmental issues. The political-economic framework is the foundation for this study model, which looks at how digital technology affects energy and environmental sustainability.

Many organizations use more materials and energy than they produce, produce more pollution and waste, and generally contribute to the depletion of natural resources (Dyllick & Hockerts, 2002). The IT industry has also come under fire for harming the environment (Askarzai, 2011) via excessive energy use, greenhouse gas emissions, and hazardous waste disposal (Dwivedi et al., 2022). Smaller and more portable systems with fewer cooling, energy, and disposal requirements and advancements such as server virtualization and sensor technologies exist in response to these difficulties. In some instances, these operations have higher costs and make it more difficult for businesses to comply with legal obligations, such as those limiting carbon emissions. On the other hand, environmentally responsible organizations increase their credibility, gain a competitive edge (Zhao et al., 2019), and ensure the long-term sustainability of their operations and the environment around them.

Our study examines how national-level digital integration affects the environmental sustainability of European businesses between 2016 and 2022. We concentrate on emissions reduction, environmental innovation, and resource efficiency. We use a two-stage system GMM model and quantile regression with instrumental variables using panel data.

Our results imply that efforts to minimize emissions benefit from digital integration. Adopting digital technologies may also help businesses adopt eco-friendlier practices, according to this favorable association between digital integration and emissions reduction. Utilizing digital solutions may also help businesses streamline their operations, reduce waste, and boost energy efficiency, thus reducing emissions and positively influencing the environment. Our findings have significant practical consequences for businesses looking to increase their environmental sustainability through digital technologies. They also emphasize the significance of using strategies tailored to the organization's sustainability level when integrating these technologies for the greatest possible environmental impact.

Our research contributes to a better understanding of digital integration (Kusiak, 2017) and its function as a catalyst for business sustainability (Bechtsis et al., 2018). Digital integration, as expected, has a direct impact on the viability of the economy. The study thus confirms the findings in earlier studies that suggest digital integration can increase economic returns and decrease costs (Jänicke, 2012) by utilizing self-organizing production, assisting predictive and cooperative maintenance, intensifying transport planning, and accurately classifying retirement and disposal decisions (Hakeem, 2023; Tao et al., 2016). According to this finding, digital integration is essential for achieving economic sustainability.

According to our data, the influence of digital integration on climate preservation is entirely channeled through companies’ environmental preservation policies. According to this, digital integration influences corporate sustainability by motivating an organization to incorporate SD ideas into its daily operations. The findings imply that digital integration boosts the incorporation of SD concepts.

Company efficiency involves expanding the production frontier; the close resemblance between current and prospective outputs is a sign of increased efficiency (Jefferson, 1990). Information technologies can foster intelligent decision-making and management systems that boost the effectiveness of production, operations, and management processes from a digital transformation standpoint (Gölzer & Fritzsche, 2017). As a result, digital transformation can enhance the timeliness of internal communication and lower the coordination costs of production, transportation, storage, and other efforts (Fernandez & Nieto, 2006). We conclude that digital transformation expands the production frontier, increasing potential output while maintaining the same input levels and enhancing efficiency and corporate sustainability.

Additionally, digital transformation can help businesses become dynamic organisms rather than static organizations, respond swiftly and adapt to changing industry trends, enhance strategic stability and reliability, and attain profitable endeavors (Vial, 2019). Companies can use digitization in production supervision to gain immediate access to production, transport, and storage information. This facilitates the coordination of revisions and the supervision of manufacturing resources. Moreover, they can establish flexible supply chains by utilizing extensive data (big data) to capture and predict shifts in market demand ahead of time.

Enterprises can simulate their research and development processes, lowering trial-and-error expenditures and overall R&D costs (Vial, 2019). These simulations can be based on customer contentment, the digital transformation of diverse production factors, and comprehensive virtual experimentation. Integrating new technologies with old production variables through digital transformation enhances production and operation modes (Mikalef & Pateli, 2017), boosts management effectiveness (Frynas et al., 2018), and creates a competitive advantage. Therefore, digital transformation can enhance administration efficiency, research and development, and business activities, bringing actual production closer to the production scale.

This study also has crucial practical implications for companies in the European region. Companies must assess their digital environmental footprints to improve sustainability, invest in sustainable technologies, and adopt sustainable digital work practices. Using the IoT for resource management and implementing responsible e-waste management are also essential. Furthermore, encouraging green innovation, raising employee awareness, and collaborating with stakeholders are critical to achieving sustainability goals. By tracking progress and setting specific targets, companies can reduce their environmental impact while reaping the economic benefits of integrating digital technologies. All these measures strengthen their sustainability and resilience in the face of future environmental challenges.

There are also potential policy ramifications. Giving precedence to the advancement of the digital industry is of utmost importance. Governments should offer substantial support for technologies such as blockchain, big data, cloud computing, and other digital innovations. Furthermore, they should actively promote the seamless integration of the digital economy into urban planning, business operations, energy resource management, and environmental pollution control. As a result, the industrial structure improves, and digital technologies can enter old energy-intensive industries.

Second, we focus on the advantages of strengthening the industrial structure and green innovation capacity for CER. Several limitations are evident, including company variability and the influence of external factors. Future research should compare results among different companies, sectors, and countries. Involving key stakeholders to gain diverse perspectives is another crucial aspect of promoting more sustainable practices. Furthermore, external factors such as government policies, environmental regulations, economic fluctuations, etc., can influence results. Future research should also specifically differentiate the impact of digital technologies from these external influences.

ConclusionOur study concludes that digital integration significantly enhances corporate sustainability among European companies, mainly through emissions reduction, environmental innovation, and resource efficiency. Utilizing a two-stage system GMM model and quantile regression on panel data, the research establishes that digital technologies positively influence sustainability practices across varying performance levels. The robustness of the findings is supported by the Hansen test and the absence of second-order serial correlation, indicating the reliability of the results. Notably, companies with lower initial sustainability performance benefit more from digital integration, underscoring the critical role of adopting digital technologies for environmental improvement. Furthermore, the dynamic nature of corporate sustainability practices is highlighted, demonstrating that past performance substantially impacts current sustainability outcomes. Overall, the study underscores the vital contribution of digital integration to corporate sustainability and calls for increased adoption of digital technologies to drive environmental progress.

ImplicationsThe implications of this study are multifaceted, affecting corporate strategy, policymaking, research and development, and stakeholder engagement. For corporate strategy, the findings suggest that companies should prioritize digital integration to boost their environmental sustainability efforts, particularly for those with lower initial performance, as targeted digital investments can yield significant environmental benefits. Policymakers are encouraged to support developing and integrating digital technologies across traditional sectors to enhance overall sustainability, creating incentives for companies to adopt digital solutions. In the realm of research and development, this study lays the groundwork for future investigations into how specific digital tools and innovations can drive environmental performance, emphasizing the need for continued exploration. Stakeholder engagement is also crucial; raising awareness among investors and consumers about the positive impact of digital integration on sustainability can drive demand for greener products and services and encourage more companies to adopt sustainable practices.

RecommendationsCompanies should regularly assess their digital footprints to identify and mitigate environmental impacts and invest in green technologies that enhance emissions reduction and resource efficiency. Adopting industry best practices for digital integration can further maximize environmental benefits. Policymakers should facilitate digital adoption through financial incentives, subsidies, and grants and invest in the necessary digital infrastructure to support the integration of advanced technologies in traditional sectors. Additionally, regulatory support is essential to promote sustainable digital solutions and ensure compliance with environmental standards. Researchers should expand studies on specific digital technologies and their direct impact on sustainability, perform longitudinal analyses to understand the evolving relationship between digital integration and corporate sustainability, and conduct cross-sector analyses to identify best practices across different industries. Industry associations are encouraged to promote knowledge sharing by facilitating platforms for companies to exchange insights and best practices related to digital integration and sustainability and to develop training programs focused on implementing digital technologies for environmental sustainability. Implementing these recommendations can significantly enhance environmental sustainability and contribute to a greener, more sustainable future for Europe.

CRediT authorship contribution statementMajdi Anwar Quttainah: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Resources, Project administration. Imen Ayadi: Software, Methodology, Investigation, Formal analysis, Data curation, Conceptualization.