This paper studies the allocation of the functions and responsibilities of prudential supervision on public authorities, including the central bank. In particular, it is argued that there are interdependencies in the design of institutions; political decisions on the supervisory structure are not taken in isolation. Analyzing a panel data set of prudential supervision regimes in 98 countries over the period from 1999 to 2010, I find that central banks play a smaller role in supervision and tasks are more decentralized if the central bank is independent and transparent. Measures of firm and fiscal decentralization are typically associated with a greater centralization of supervisory functions outside of the central bank.

En el presente ensayo se estudia la asignación de funciones y responsabilidades de supervisión prudencial en autoridades públicas, entre las que se incluye el banco central. En concreto se aduce que existen interdependencias en el diseño de las instituciones; las decisiones políticas acerca de la estructura de supervisión no se toman de manera aislada. Mediante el análisis de un panel de datos sobre regímenes de supervisión prudencial en 98 países durante período entre 1999 y 2010 se encuentra que los bancos centrales desempeñan un papel menor en la supervisión y que las tareas se descentralizan más si el banco central es independiente y transparente. Las medidas de descentralización corporativa y fiscal se asocian típicamente con una mayor centralización de las funciones de supervisión fuera del banco central.

Over the last few years, there has been a growing interest in the institutional design of financial supervision. For policy-makers, the setting up, structuring and monitoring of prudential supervision has become a key priority since, at the latest, the global financial crisis.2 For economists, the mandate, organization and effects of newly established or enlarged financial supervision authorities have the potential to add to an already extensive literature on the optimal design of central banks.

Empirical research on financial supervision authorities has mainly taken one of the following two routes. In one set of papers, the effect of financial supervision on outcomes (such as the stability of the banking sector) is examined. Examples include Masciandaro, Pansini, and Quintyn (2011), Dincer and Eichengreen (2012) and Caprio, D’Apice, Ferri, and Puopolo (2014). Another set of papers puts measures of financial supervision on the left-hand side of the regression equation, aiming to explore the determinants of a country's supervisory structure.

In this short paper, I examine empirically the institutional design of financial supervision. While previous studies often focus on macroeconomic and institutional country variables, typically including an ad hoc list of (potential) determinants, I focus on one specific country characteristic, the organizational structure of institutions. Specifically, I argue that political decisions concerning the specialization, subordination, delegation and coordination of financial supervision are heavily shaped by actual country experiences of organizing public and private activities. As a result, the design of prudential supervision should not be assessed in isolation but is interdependent with other relevant institutions.

I explore this hypothesis using a panel data set that covers 98 countries over the period from 1999 to 2010. The panel allows to study differences in the regulatory framework both across countries and over time.3 A frequent challenge for the empirical analysis of financial supervision is the definition of measures of the institutional design of prudential supervision. In practice, the supervisory architecture can be assessed along various dimensions, including the role of the central bank, the allocation of various types of supervision across institutions, and the features of those institutions, among others. I define variables that focus explicitly on the functions and responsibilities taken over by the central bank.

The remainder of the paper is structured as follows: the next section briefly discusses the relevant literature, followed by a description of the methodology and data. The heart of the paper is Section 4 which presents and discusses the empirical results. Finally, a short summary concludes.

2LiteratureThe empirical literature on the architecture of prudential supervision, dating back to Goodhart and Schoenmaker (1995) and sizably extended with a number of notable contributions by Donato Masciandaro, has grown considerably in magnitude over recent years. Instead of summarizing all empirical findings, I briefly focus on a few relevant studies.

In an early analysis, Luna Martinez and Rose (2003) provide descriptive evidence, derived from a survey in 15 countries, on experiences in integrated financial sector supervision. They find, for instance, that there are differences in the perception of integration; practically all countries believe they have achieved a higher degree of harmonization in the regulation and supervision of banks and securities companies than between banks and insurance firms. They also identify advantages and disadvantages of establishing unified supervisory agencies.

Dincer and Eichengreen (2012) examine empirically determinants of supervisory arrangements. Based on a sample of 89 countries, they examine the role of the central bank in prudential supervision, but they explore only a limited set of explanatory variables and do not focus explicitly on other institutional arrangements.

In similar fashion, Melecky and Podpiera (2013) analyze various determinants of institutional structures of prudential and business conduct supervision of financial services. While their sample of regressors is large, including governance and central bank autonomy, their analysis is primarily exploratory.

The paper that is perhaps most closely related to my analysis is Dalla Pellegrina, Masciandaro, and Pansini (2013). They study whether central bank independence and monetary policy arrangements can jointly influence the likelihood of policy-makers assigning banking supervision to central banks. They find some effects (e.g., stronger operational independence implies lesser supervisory powers). However, while their analysis is exclusively confined on institutional monetary settings (including the central bank), I take a much broader approach.

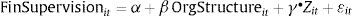

3Methodology and dataTo examine whether the management and organization of (public) activities has an effect on the structure of financial supervision, I estimate regressions of the form:

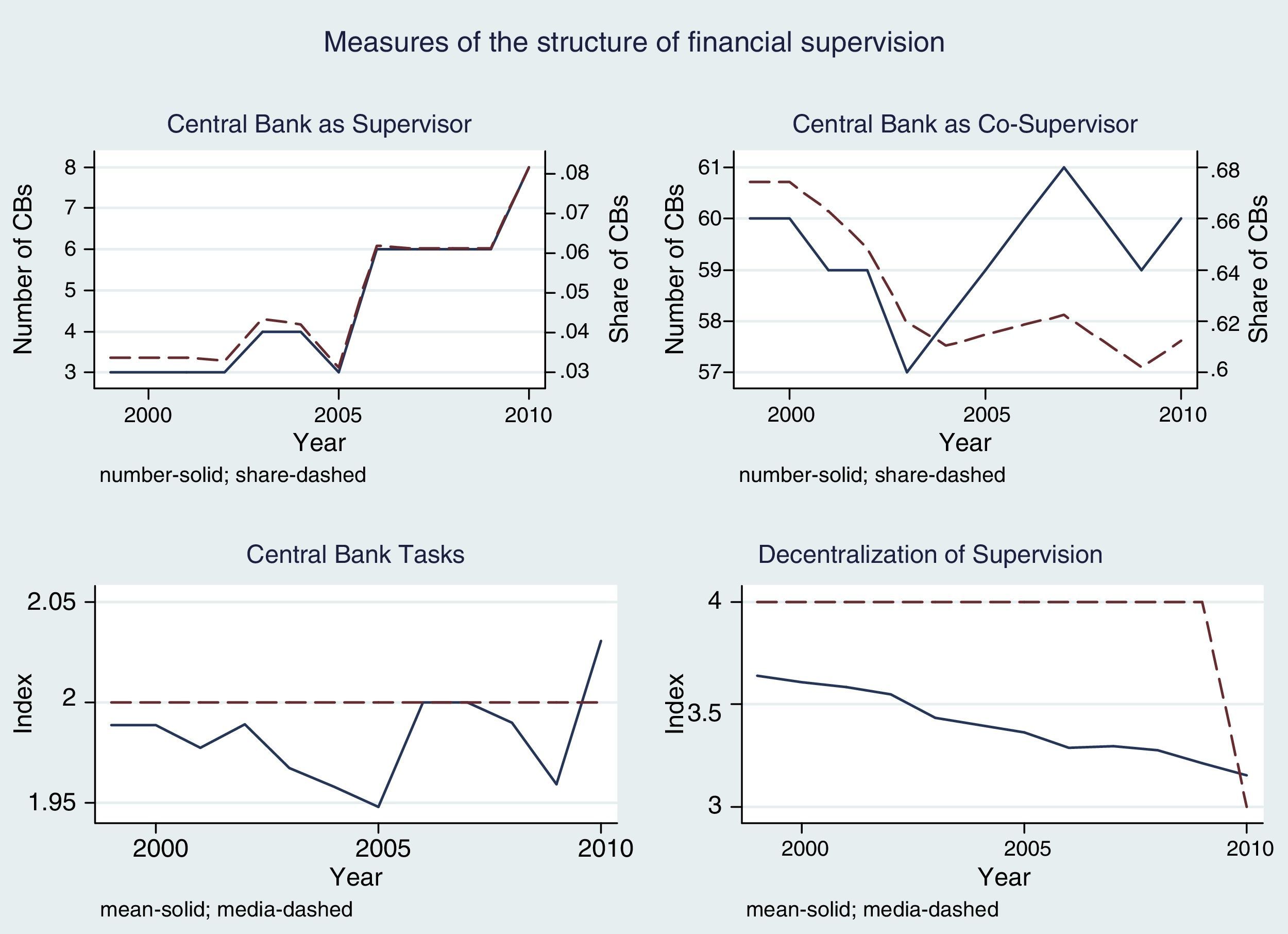

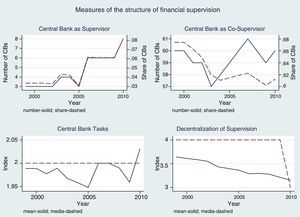

where FinSupervisionit is a measure of the supervisory architecture in country i at time t, OrgStructure is a measure of the country's organizational structure outside supervision, Z denotes a vector of auxiliary conditioning variables, and ¿it is the residual. The coefficient of interest to me is β, which represents the partial effect of existing structures on supervision, ceteris paribus; consequently, to the extent that there is an association between a country's broader organizational principles and its choice of arrangements for financial supervision is identifiable, the estimates of β can take different signs, depending on the relationship (and the definition of the variable) that is analyzed.4The data are taken from standard sources. Detailed information on the organizational structure of financial sector supervision are obtained from the World Bank; this data differentiates supervision by the type of intermediary (i.e., banks, insurances, or the capital market).5 Based on this data, I construct four different measures that aim to describe (and capture various aspects of) the role of the central bank in financial supervision (FinSupervision). A first measure, central bank as supervisor, is a binary dummy variable that takes the value of one if all supervisory tasks are allocated exclusively to the central bank (and zero otherwise); the supervisory functions are fully centralized in the central bank.6 The second measure offers a broader, somewhat more encompassing definition. This variable, central bank as co-supervisor, is again a binary dummy variable; it takes the value of one if at least some supervisory tasks are allocated to the central bank (and zero otherwise). In a third approach, I compute an index, central bank tasks, that reflects the number of supervisory tasks assigned to the central bank. This index ranges from 1 to 4, with a low value of 1 indicating that all functions are organized outside of the central bank, while a high value of 4 means that the central bank alone is responsible for prudential supervision. Finally, I compute an index, decentralization of supervision, that captures the extent to which the supervisory tasks are distributed across different authorities. This index takes values from 1 (concentration of responsibilities inside the central bank) to 5 (establishment of separate institutions for banking, insurance and securities supervision).

Fig. 1 plots the evolution of these measures over time. As shown, the role of the central bank in prudential supervision has, if anything, decreased until 2005; most notably, the range of functions and responsibilities assigned to the central bank has gradually declined. Since then, however, the trend has reversed, and central banks have again gained in importance. In contrast to this U-shaped pattern of central bank involvement, there has been a continuous tendency toward concentration of tasks in financial supervision, as shown in the graph in the lower right corner of Fig. 1.

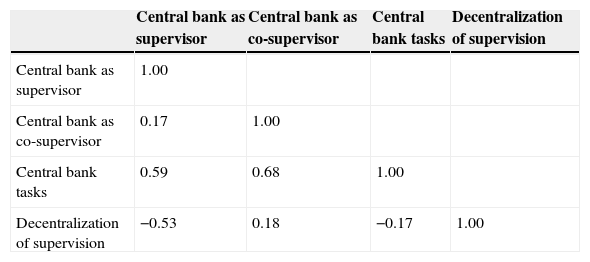

Table 1 presents a correlation matrix of the measures of interest. The table shows that the correlation coefficients vary sizably, suggesting that the different measures indeed capture various aspects of the countries’ supervisory architectures.

For the organizational structure of countries (OrgStructure), I borrow a wide range of measures from the literature. I start with central bank characteristics, for which I use central bank independence and central bank transparency; updated measures have been recently provided by Dincer and Eichengreen (2014). Next, I explore differences in the organization of firms across countries. Specifically, I apply the firm decentralization measure compiled by Bloom, Sadun, and Van Reenen (2012). I also experiment with Hofstede's (2001) power distance rankings, which measure the perceptions of and the preferences for hierarchical relationships in a country. Finally, I use measures of fiscal decentralization, compiled by Arzaghi and Henderson (2005).

For the additional conditioning variables, I refer to the analysis in Dincer and Eichengreen (2012). In particular, I consider three types of controls. For macroeconomic conditions, I use the (log of) GDP per capita (in constant international prices) and the average of CPI inflation in the previous ten years, both taken or constructed from the World Bank's World Development Indicators. A country's institutional background is captured by dummy variables for the origin of the legal code, taken from La Porta, Lopez-De-Silanes, and Shleifer (2008). I also follow Dincer and Eichengreen's (2012) approach in controlling for measures from the World Bank's Worldwide Governance Indicators database, although the individual variables are typically highly correlated.

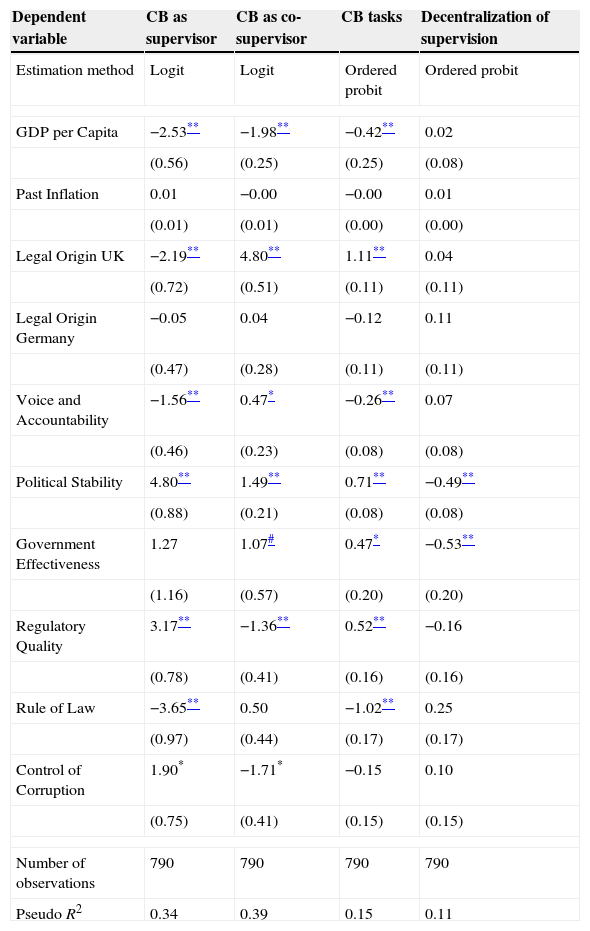

4Empirical resultsIn the empirical analysis, I proceed stepwise. I begin with an analysis of standard country determinants of financial supervision. In particular, I review the set of explanatory variables that are proposed and used in Dincer and Eichengreen (2012). Table 2 presents the results. There are four columns; each column reports the result of a separate regression. Specifically, I tabulate separate estimation results for each of my four measures of the supervisory architecture as dependent variable. Since the categorical structure of the regressand differs, I also vary the estimation method. I use multinomial logit estimation for the first two regressands (which are binary dummy variables), while I apply an ordered probit estimator for the remaining two measures.7

Standard determinants of financial supervision.

| Dependent variable | CB as supervisor | CB as co-supervisor | CB tasks | Decentralization of supervision |

|---|---|---|---|---|

| Estimation method | Logit | Logit | Ordered probit | Ordered probit |

| GDP per Capita | −2.53** | −1.98** | −0.42** | 0.02 |

| (0.56) | (0.25) | (0.25) | (0.08) | |

| Past Inflation | 0.01 | −0.00 | −0.00 | 0.01 |

| (0.01) | (0.01) | (0.00) | (0.00) | |

| Legal Origin UK | −2.19** | 4.80** | 1.11** | 0.04 |

| (0.72) | (0.51) | (0.11) | (0.11) | |

| Legal Origin Germany | −0.05 | 0.04 | −0.12 | 0.11 |

| (0.47) | (0.28) | (0.11) | (0.11) | |

| Voice and Accountability | −1.56** | 0.47* | −0.26** | 0.07 |

| (0.46) | (0.23) | (0.08) | (0.08) | |

| Political Stability | 4.80** | 1.49** | 0.71** | −0.49** |

| (0.88) | (0.21) | (0.08) | (0.08) | |

| Government Effectiveness | 1.27 | 1.07# | 0.47* | −0.53** |

| (1.16) | (0.57) | (0.20) | (0.20) | |

| Regulatory Quality | 3.17** | −1.36** | 0.52** | −0.16 |

| (0.78) | (0.41) | (0.16) | (0.16) | |

| Rule of Law | −3.65** | 0.50 | −1.02** | 0.25 |

| (0.97) | (0.44) | (0.17) | (0.17) | |

| Control of Corruption | 1.90* | −1.71* | −0.15 | 0.10 |

| (0.75) | (0.41) | (0.15) | (0.15) | |

| Number of observations | 790 | 790 | 790 | 790 |

| Pseudo R2 | 0.34 | 0.39 | 0.15 | 0.11 |

Notes: Standard errors are in parentheses.

Reviewing the results, three findings appear particularly notable. First, of the two macroeconomic variables, only a country's per capita income measurably affects the supervisory structure. Interestingly, the estimated coefficient takes a significantly negative value, indicating that richer countries tend to transfer supervisory functions and responsibilities from the central bank to other authorities; Dincer and Eichengreen (2012), in contrast, report a positive effect of per capita income on central banks with supervisory functions. Second, for the remaining institutional and governance measures, the findings differ sizably across columns, both in magnitude and significance, possibly due to multicollinearity. Finally, the standard determinants largely fail to reasonably explain the extent of decentralization of supervisory tasks. Perhaps in line with intuition, greater political instability and less effective governments are associated with a wider distribution of supervisory tasks across authorities. In the following, I will use these controls as nuisance variables, focusing exclusively on the variables of interest.

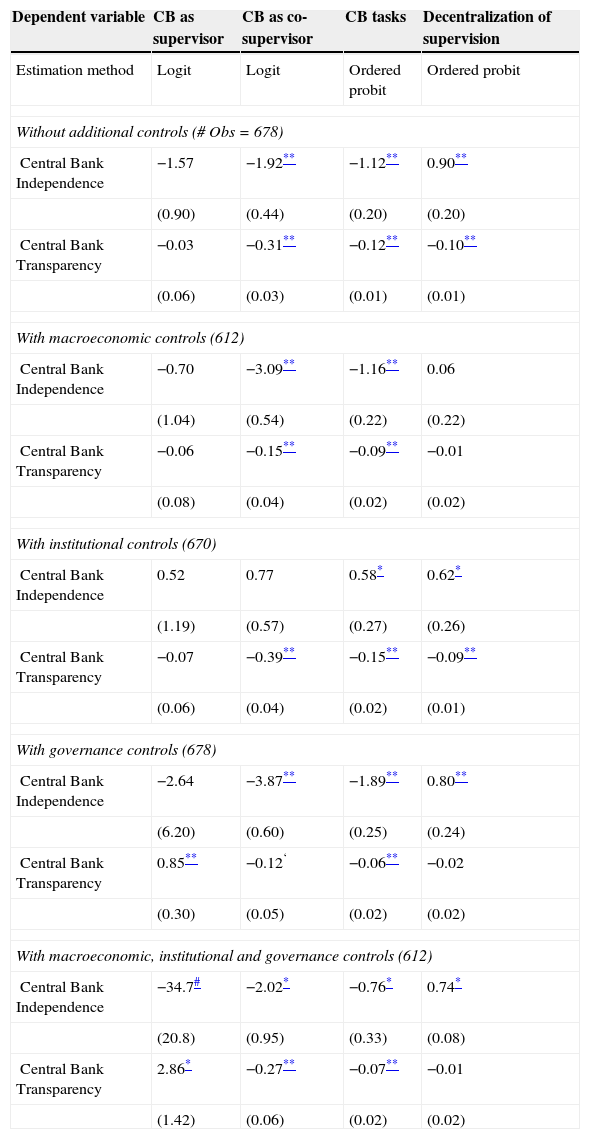

In a first exercise, I examine the effect of central bank characteristics on the structure of financial supervision. In the empirical implementation, I explore two newly compiled index measures on the independence and transparency of central banks from Dincer and Eichengreen (2014). The results are reported in Table 3. As before, I tabulate estimation results for different measures of financial supervision across columns. I also experiment with various combinations of the control variables (gradually moving from the most parsimonious specification without any additional controls in the first panel to more demanding specifications in the lower panels), but for the sake of brevity I only report the coefficients of interest.

Financial supervision and central bank characteristics.

| Dependent variable | CB as supervisor | CB as co-supervisor | CB tasks | Decentralization of supervision |

|---|---|---|---|---|

| Estimation method | Logit | Logit | Ordered probit | Ordered probit |

| Without additional controls (# Obs=678) | ||||

| Central Bank Independence | −1.57 | −1.92** | −1.12** | 0.90** |

| (0.90) | (0.44) | (0.20) | (0.20) | |

| Central Bank Transparency | −0.03 | −0.31** | −0.12** | −0.10** |

| (0.06) | (0.03) | (0.01) | (0.01) | |

| With macroeconomic controls (612) | ||||

| Central Bank Independence | −0.70 | −3.09** | −1.16** | 0.06 |

| (1.04) | (0.54) | (0.22) | (0.22) | |

| Central Bank Transparency | −0.06 | −0.15** | −0.09** | −0.01 |

| (0.08) | (0.04) | (0.02) | (0.02) | |

| With institutional controls (670) | ||||

| Central Bank Independence | 0.52 | 0.77 | 0.58* | 0.62* |

| (1.19) | (0.57) | (0.27) | (0.26) | |

| Central Bank Transparency | −0.07 | −0.39** | −0.15** | −0.09** |

| (0.06) | (0.04) | (0.02) | (0.01) | |

| With governance controls (678) | ||||

| Central Bank Independence | −2.64 | −3.87** | −1.89** | 0.80** |

| (6.20) | (0.60) | (0.25) | (0.24) | |

| Central Bank Transparency | 0.85** | −0.12‘ | −0.06** | −0.02 |

| (0.30) | (0.05) | (0.02) | (0.02) | |

| With macroeconomic, institutional and governance controls (612) | ||||

| Central Bank Independence | −34.7# | −2.02* | −0.76* | 0.74* |

| (20.8) | (0.95) | (0.33) | (0.08) | |

| Central Bank Transparency | 2.86* | −0.27** | −0.07** | −0.01 |

| (1.42) | (0.06) | (0.02) | (0.02) | |

Notes: Standard errors are in parentheses.

The results in Table 3 turn out to be remarkably robust across the various specifications. Greater independence and transparency seem to be consistently associated with fewer supervisory functions for the central bank; the estimates of β take a significantly negative sign for most specifications in the first three columns of the table. A reasonable explanation for this finding is that governments have a preference for greater control of supervisory activities. The finding that dependent and opaque central banks are, on average, associated with greater decentralization of tasks is generally in line with this interpretation (column 4).

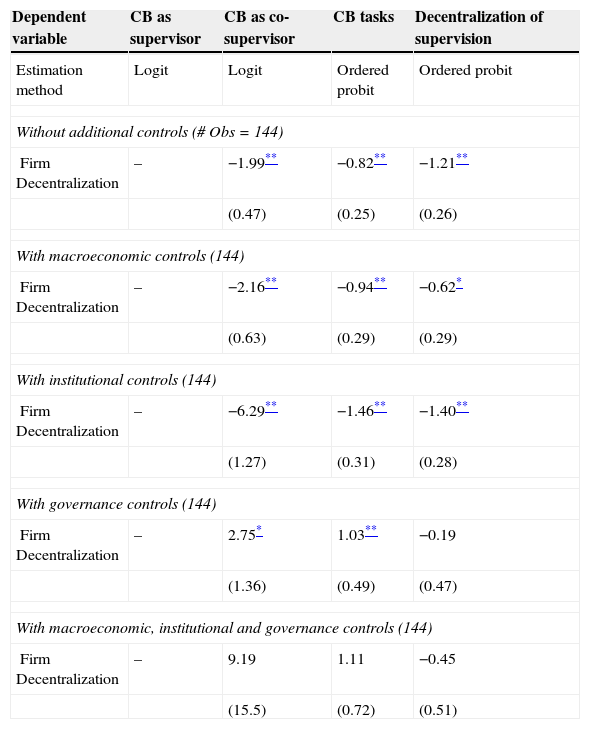

Next, I explore the effect of the organization of firms in the private sector on the allocation of supervisory functions. Bloom, Sadun, and Van Reenen (2012) have collected data on the decentralization of investment, hiring, production, and sales decisions from corporate headquarters to local plant measures based on interviews. Unfortunately, however, this measure is available for only 12 countries; in none of these countries, the central bank alone is responsible for prudential supervision.

Table 4 presents the results. Again, the β estimates are often negative and statistically significant for measures of central bank responsibilities as regressand, indicating that decentralization at the firm level is associated with an allocation of supervisory functions outside the central bank. In principle, this finding may suggest that there is decentralization in both the private sector and the public sectors. For the measure of decentralization of prudential supervision, however, the estimated coefficient also takes a negative value, suggesting the opposite relationship, although the estimation results turn out to be not particularly robust.

Financial supervision and firm organization.

| Dependent variable | CB as supervisor | CB as co-supervisor | CB tasks | Decentralization of supervision |

|---|---|---|---|---|

| Estimation method | Logit | Logit | Ordered probit | Ordered probit |

| Without additional controls (# Obs=144) | ||||

| Firm Decentralization | – | −1.99** | −0.82** | −1.21** |

| (0.47) | (0.25) | (0.26) | ||

| With macroeconomic controls (144) | ||||

| Firm Decentralization | – | −2.16** | −0.94** | −0.62* |

| (0.63) | (0.29) | (0.29) | ||

| With institutional controls (144) | ||||

| Firm Decentralization | – | −6.29** | −1.46** | −1.40** |

| (1.27) | (0.31) | (0.28) | ||

| With governance controls (144) | ||||

| Firm Decentralization | – | 2.75* | 1.03** | −0.19 |

| (1.36) | (0.49) | (0.47) | ||

| With macroeconomic, institutional and governance controls (144) | ||||

| Firm Decentralization | – | 9.19 | 1.11 | −0.45 |

| (15.5) | (0.72) | (0.51) | ||

Notes: Standard errors are in parentheses.

Fig. 2 provides a scatter plot of the decentralization of supervision functions and firm decentralization in the year 2006 (the year the Bloom, Sadun, and Van Reenen survey was taken), illustrating the negative relationship. The empirical estimate is affected by Japan (and the United States) as outlier(s).

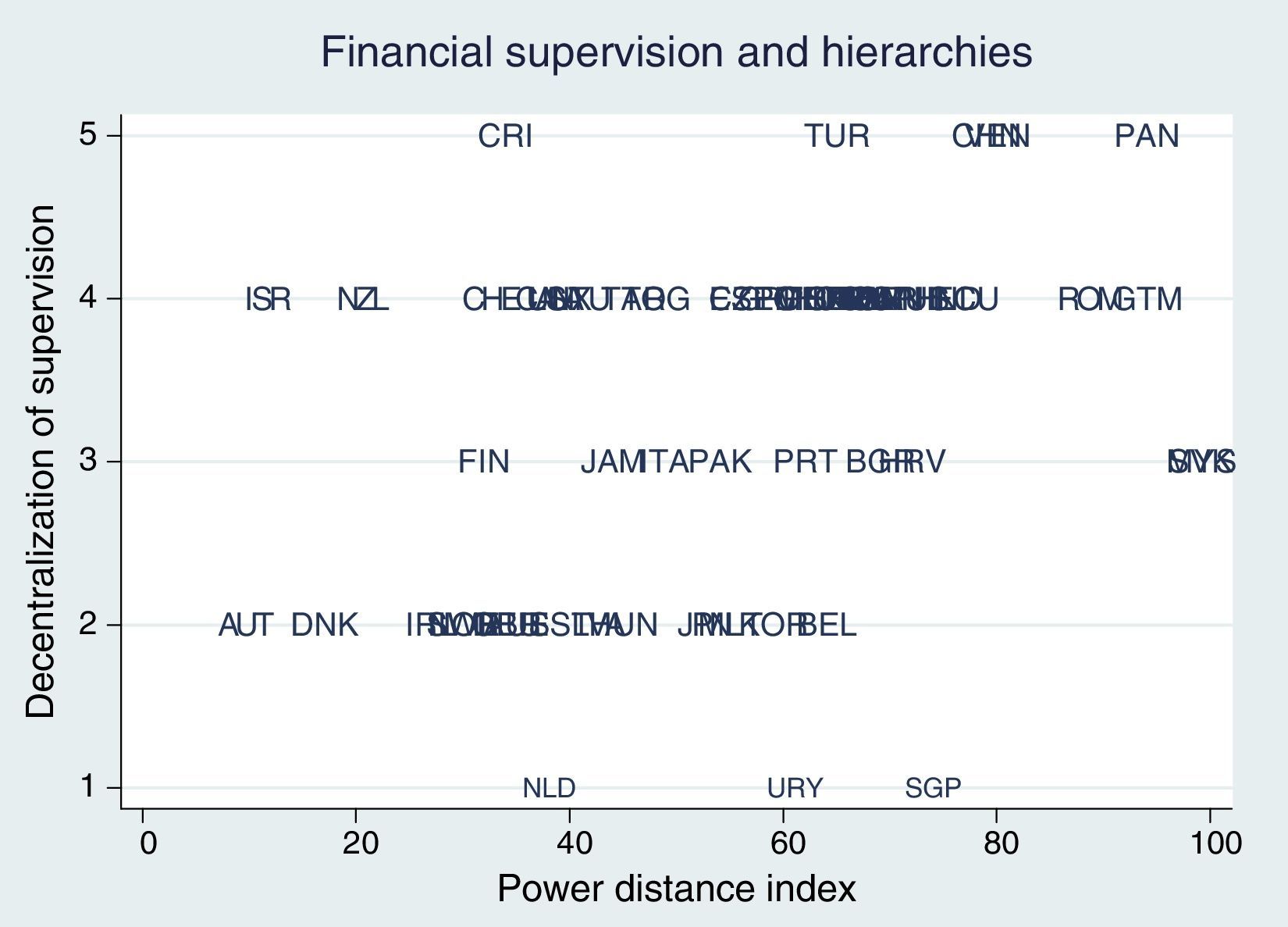

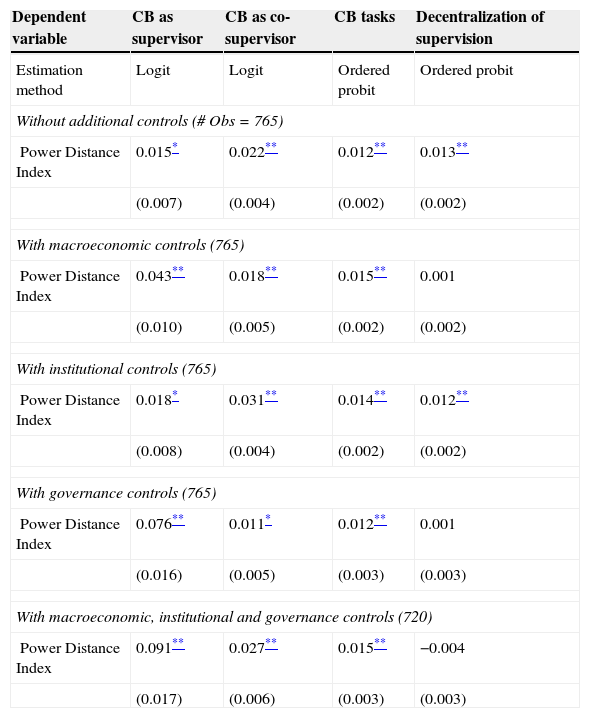

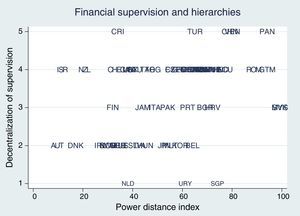

In Table 5, I explore an alternative measure of firm organization, Hofstede's (2001) power distance index. This index is defined to measure the extent to which the less powerful members of organizations and institutions accept and expect that power is distributed unequally. It is available for a much larger set of countries, but unlike the Bloom, Sadun, and Van Reenen (2012) measure it is defined such that low values reflect self-determination. As a result, the positive estimates of β confirm previous findings; greater power distance (and, therefore, organizational hierarchies) is associated with supervisory tasks in the hands of the central bank. As before, Fig. 3 provides an accompanying scatter plot.

Financial supervision and hierarchical structures.

| Dependent variable | CB as supervisor | CB as co-supervisor | CB tasks | Decentralization of supervision |

|---|---|---|---|---|

| Estimation method | Logit | Logit | Ordered probit | Ordered probit |

| Without additional controls (# Obs=765) | ||||

| Power Distance Index | 0.015* | 0.022** | 0.012** | 0.013** |

| (0.007) | (0.004) | (0.002) | (0.002) | |

| With macroeconomic controls (765) | ||||

| Power Distance Index | 0.043** | 0.018** | 0.015** | 0.001 |

| (0.010) | (0.005) | (0.002) | (0.002) | |

| With institutional controls (765) | ||||

| Power Distance Index | 0.018* | 0.031** | 0.014** | 0.012** |

| (0.008) | (0.004) | (0.002) | (0.002) | |

| With governance controls (765) | ||||

| Power Distance Index | 0.076** | 0.011* | 0.012** | 0.001 |

| (0.016) | (0.005) | (0.003) | (0.003) | |

| With macroeconomic, institutional and governance controls (720) | ||||

| Power Distance Index | 0.091** | 0.027** | 0.015** | −0.004 |

| (0.017) | (0.006) | (0.003) | (0.003) | |

Notes: Standard errors are in parentheses.

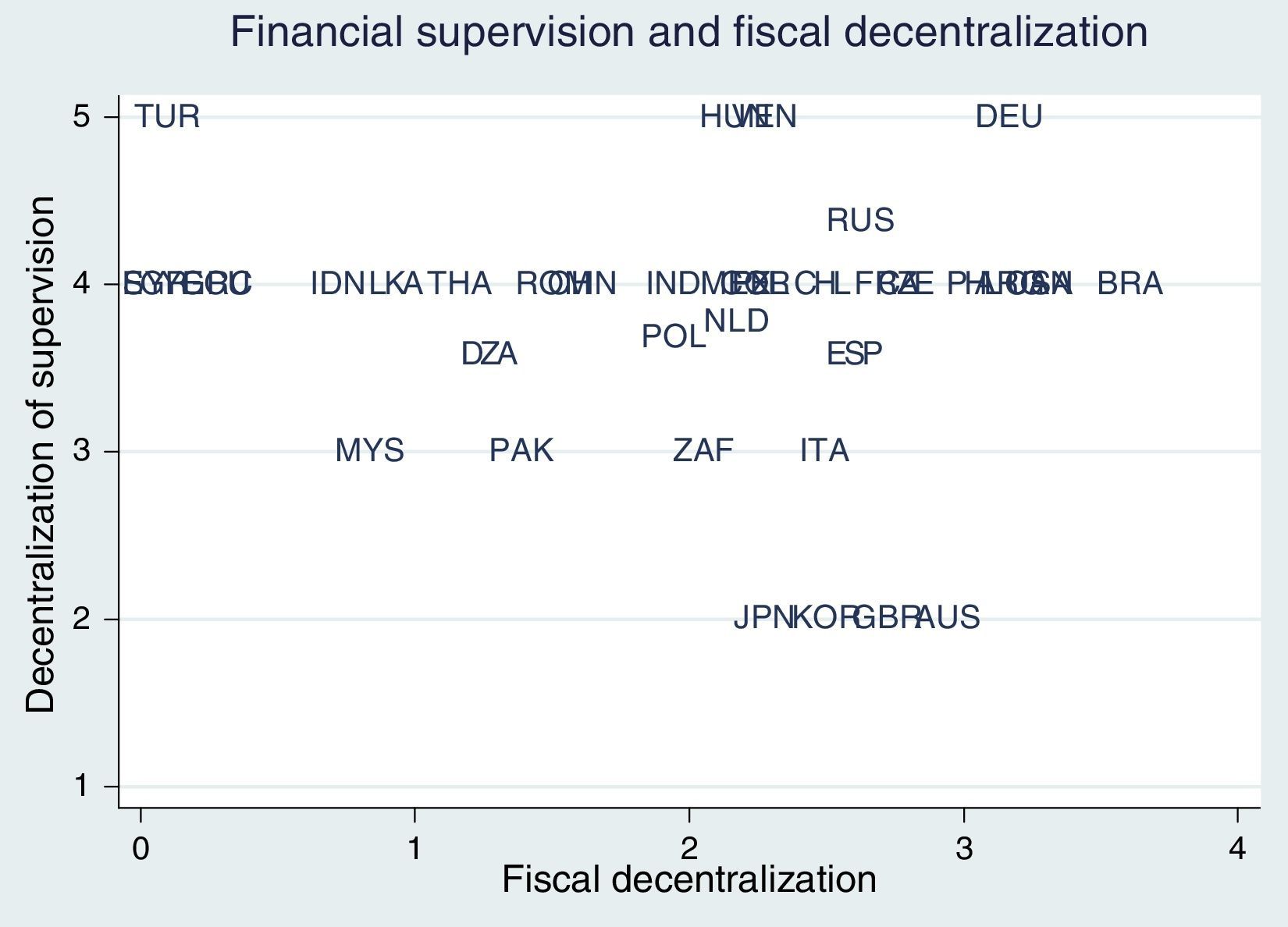

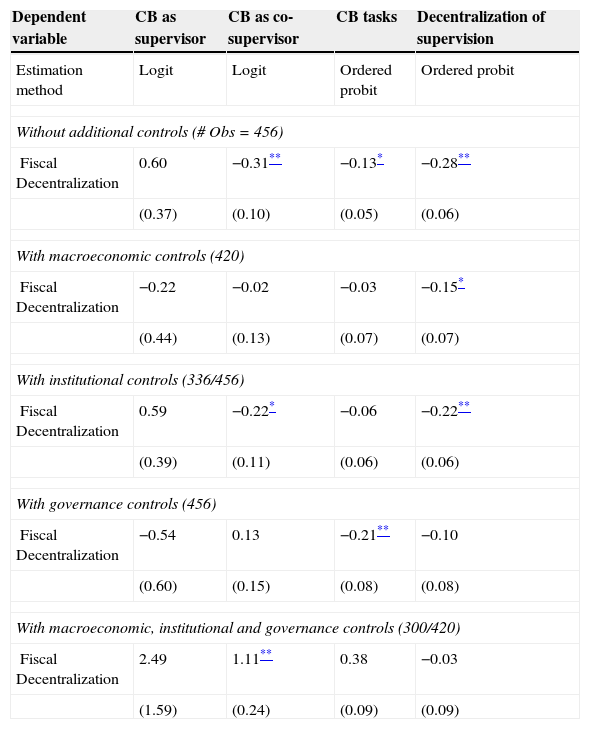

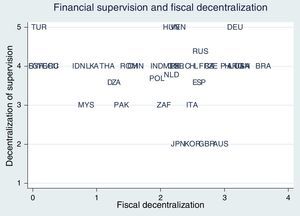

In a final exercise, I examine the effect of fiscal decentralization on the structure of financial supervision. Arzaghi and Henderson (2005) construct a federalism index, based on nine indicators, that varies from zero to four. For this measure, however, the findings vary across measures and specifications, as shown in Table 6. While some estimation results seem to suggest that fiscal decentralization is associated with greater dispersion of supervisory functions across authorities, the β coefficient switches its sign in the most demanding regression specification (with all nuisance controls). Interestingly, the association between fiscal decentralization and decentralization of supervision is, if anything, negative. For illustration, Fig. 4 plots both decentralization measures.

Financial supervision and fiscal decentralization.

| Dependent variable | CB as supervisor | CB as co-supervisor | CB tasks | Decentralization of supervision |

|---|---|---|---|---|

| Estimation method | Logit | Logit | Ordered probit | Ordered probit |

| Without additional controls (# Obs=456) | ||||

| Fiscal Decentralization | 0.60 | −0.31** | −0.13* | −0.28** |

| (0.37) | (0.10) | (0.05) | (0.06) | |

| With macroeconomic controls (420) | ||||

| Fiscal Decentralization | −0.22 | −0.02 | −0.03 | −0.15* |

| (0.44) | (0.13) | (0.07) | (0.07) | |

| With institutional controls (336/456) | ||||

| Fiscal Decentralization | 0.59 | −0.22* | −0.06 | −0.22** |

| (0.39) | (0.11) | (0.06) | (0.06) | |

| With governance controls (456) | ||||

| Fiscal Decentralization | −0.54 | 0.13 | −0.21** | −0.10 |

| (0.60) | (0.15) | (0.08) | (0.08) | |

| With macroeconomic, institutional and governance controls (300/420) | ||||

| Fiscal Decentralization | 2.49 | 1.11** | 0.38 | −0.03 |

| (1.59) | (0.24) | (0.09) | (0.09) | |

Notes: Standard errors are in parentheses.

This paper studies the allocation of the functions and responsibilities of prudential supervision on public authorities, including the central bank. In particular, it is argued that there are interdependencies in the design of institutions; political decisions on the supervisory structure are not taken in isolation. Analyzing a panel data set of prudential supervision regimes in 98 countries over the period from 1999 to 2010, I find that central banks play a smaller role in supervision and tasks are more decentralized if the central bank is independent and transparent. Measures of firm and fiscal decentralization are typically associated with a greater centralization of supervisory functions outside of the central bank.

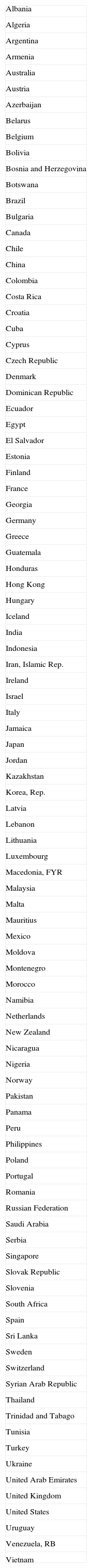

| Albania |

| Algeria |

| Argentina |

| Armenia |

| Australia |

| Austria |

| Azerbaijan |

| Belarus |

| Belgium |

| Bolivia |

| Bosnia and Herzegovina |

| Botswana |

| Brazil |

| Bulgaria |

| Canada |

| Chile |

| China |

| Colombia |

| Costa Rica |

| Croatia |

| Cuba |

| Cyprus |

| Czech Republic |

| Denmark |

| Dominican Republic |

| Ecuador |

| Egypt |

| El Salvador |

| Estonia |

| Finland |

| France |

| Georgia |

| Germany |

| Greece |

| Guatemala |

| Honduras |

| Hong Kong |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iran, Islamic Rep. |

| Ireland |

| Israel |

| Italy |

| Jamaica |

| Japan |

| Jordan |

| Kazakhstan |

| Korea, Rep. |

| Latvia |

| Lebanon |

| Lithuania |

| Luxembourg |

| Macedonia, FYR |

| Malaysia |

| Malta |

| Mauritius |

| Mexico |

| Moldova |

| Montenegro |

| Morocco |

| Namibia |

| Netherlands |

| New Zealand |

| Nicaragua |

| Nigeria |

| Norway |

| Pakistan |

| Panama |

| Peru |

| Philippines |

| Poland |

| Portugal |

| Romania |

| Russian Federation |

| Saudi Arabia |

| Serbia |

| Singapore |

| Slovak Republic |

| Slovenia |

| South Africa |

| Spain |

| Sri Lanka |

| Sweden |

| Switzerland |

| Syrian Arab Republic |

| Thailand |

| Trinidad and Tabago |

| Tunisia |

| Turkey |

| Ukraine |

| United Arab Emirates |

| United Kingdom |

| United States |

| Uruguay |

| Venezuela, RB |

| Vietnam |

Web: http://www.vwl2.wi.tu-darmstadt.de.

I thank Peter Claeys, Pierre Siklos, Jan Weidner, an anonymous referee, and conference participants at the 2014 ESPE/Banco de la República de Colombia Conference for helpful comments.

Frankel (2013) illustrates the widespread ignorance in (European) policy circles toward issues of financial regulation when discussing the fundamental problems of European monetary integration. He notes (p. 3): “Banking supervision was at best mentioned in passing in the 1990s. Almost no thought was given to the possibility of moving deposit insurance, supervision, or bank resolution, to the ECB level.”

While institutional arrangements often turn out to be remarkably robust, it should be noted that countries have performed frequent adjustments on their supervisory structure over the sample period. At one extreme, the United Kingdom transferred competencies from the Bank of England (BoE) to a newly established Financial Services Authority (FSA) in 1998, while the majority of the FSA's responsibilities were taken over by the BoE and two new regulators in 2013; see Ferran (2011) for details. Parenthetically, I note that both of these switches are just outside my sample period. Masciandaro and Quintyn (2009) provide an extensive and more detailed assessment of reforms in supervisory regimes; see also Masciandaro, Quintyn and Taylor (2008).

An obvious concern in this type of literature is potential endogeneity. However, given the timing structure of the analysis, where financial supervision structures have been formally established only in recent years while a country's organizational principles are likely to be relatively persistent, endogeneity is perhaps less of an issue here.

The data are available online at http://econ.worldbank.org/WBSITE/EXTERNAL/EXTDEC/EXTGLOBALFINREPORT/0,,contentMDK:23267422∼pagePK:64168182∼piPK:64168060∼theSitePK:8816097,00.html.