The analysis of productivity performance of the Mexican Northern Border offers an interesting case study for that objective. This is because it combines mobile growth factors due to regional reallocation of economic activity and, on the other hand, the fact that factors that are considered immobile in the literature such as education, infrastructure and specialization were initially localised in Central Mexico. We show that, throughout this period, in the Northern Border the accumulation of immobile factors and the efficiency in its advantage have been determining factors in its economic growth.

En este artículo analizamos la dinámica y los determinantes del desempeño de la productividad laboral de los estados de la Frontera Norte después de 20 años de liberalización comercial de México con Estados Unidos a fin de contribuir a la identificación de los hechos estilizados de este proceso en la literatura de crecimiento económico regional. El análisis del desempeño productivo en la Frontera Norte mexicana ofrece un interesante caso para ese objetivo mientras combina los factores de crecimiento móviles debido a la reasignación de actividad económica y, por otro lado, el hecho de los factores que en la literatura se consideran relativamente inmóviles, tales como educación, infraestructura y especialización, que inicialmente se localizaban en el centro del país. Como conclusión, mostramos que a lo largo del periodo, en la Frontera Norte, la acumulación de factores relativamente inmóviles de crecimiento y la eficiencia en su aprovechamiento han sido determinantes en su crecimiento económico.

How does trade liberalization affect productivity growth across regions through time? How much is the outcome affected by the immobility of localized growth factors or technological externalities due to reallocation of economic activity? How efficiently are regions taking advantage of growth factors localized in their territories? In this article, we study the effects of trade integration with the United States on productivity growth in Mexican manufacturing across states after 20 years within the framework provided by the new growth empirics and economic geography.

That international trade causes an increase in productivity growth in sectors or firms involved in trade is a basic insight in economics, at least since the classic Smith's Wealth of Nations, as noted here: “By means of [foreign trade], the narrowness of the home market does not hinder the division of labor in any particular branch of art or manufacture from being carried to the highest perfection. By opening a more extensive market for whatever part of the produce of their labor may exceed the home consumption, it encourages them to improve its productive powers.” (Smith, 1776, vol. 1, p. 413, quoted from Skott & Ros, 1997).

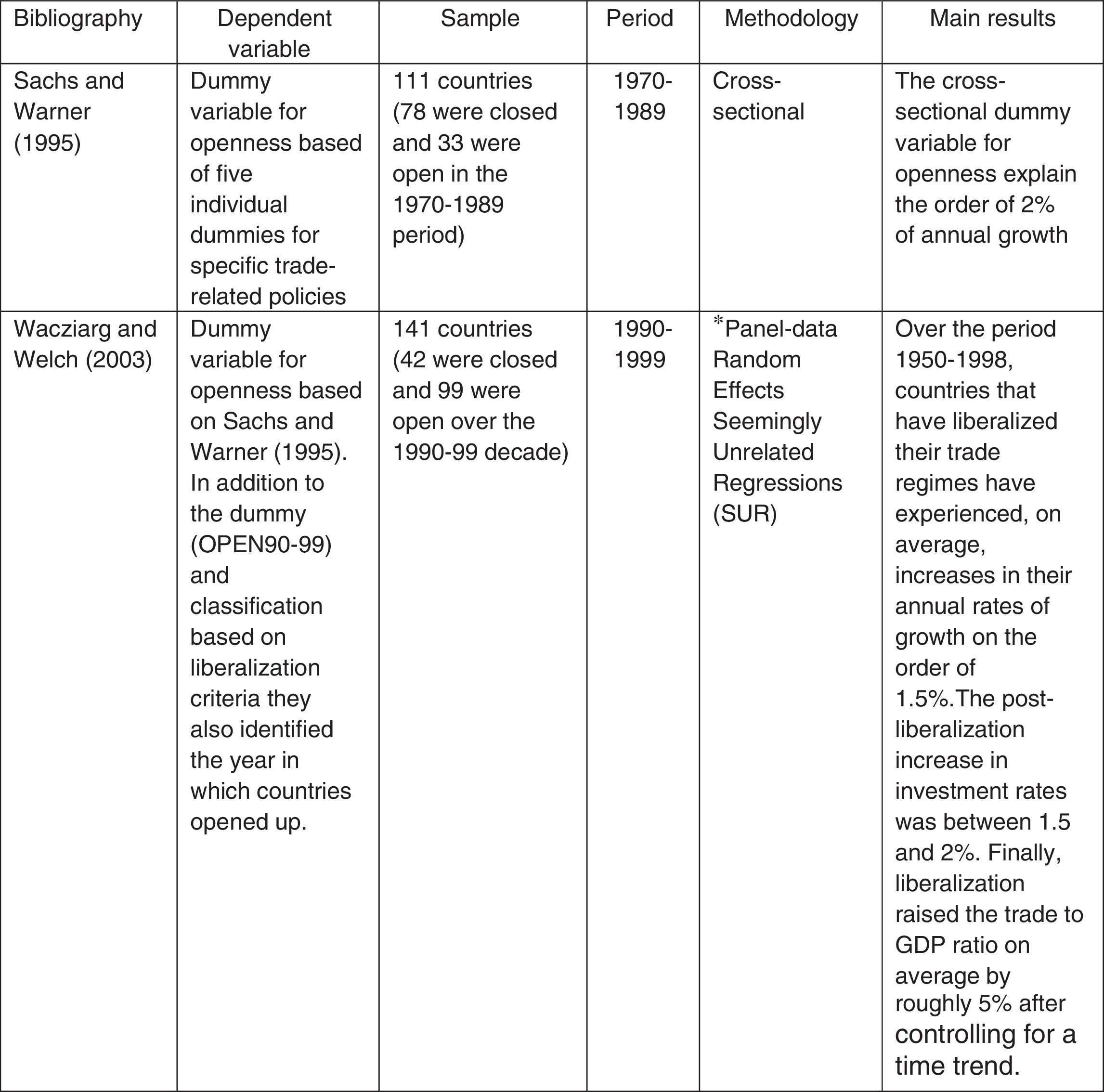

In this perspective, economic analysis has shown that the relationship between productivity growth and trade liberalization is mediated by conditional factors. Posterior research has identified the conditional factors through which trade liberalization encourage productivity growth. For relevant research see, for instance, Sachs and Warner (1995), Rodrıguez and Rodrik (2000) and Wacziarg and Welch (2003). However, while this research has generated relevant findings through cross-country and country-specific studies, the analysis of the effect of trade on productivity in regions is still on developing while related mostly to endogenous growth and new economic geography factors, as well as the interactions of these factors through time and space. In particular, economists continue paying closer attention to regional economic growth patterns in order to understand how the transition to an open economy affects local economic growth in medium and long term.

The basic theme of one strand of the regional economic growth literature has been that externalities are related to the productivity of firms in a location in two ways: (i) to the easiness for acquiring knowledge or skills due to the extension of the market, and (ii) to the previous/current local accumulation of resources related to productivity growth. According to the type of growth factors involved in these externalities, following de León (2003), we call the first type of effect, “trade-induced-growth-factors”, and the second ones “localized endogenous growth factors”.

Here, we also continue the Ohlin (1933:2)’s observation: “As a matter of fact, the geographical distribution of productive factors is important…It is true that some of the factors are, under certain conditions, freely mobile, but some are not, and all those placed in the group called ‘nature’ are completely immobile”

The trade-induced-growth-factors are the most familiar kind of factors that underlie the explanation of the positive effect of trade on productivity growth. For more explanations on economic growth and trade liberalization, taking into account internal and external externalities, see Romer (1986, 1990), Grossman and Helpman (1991), and Young (1991) who have become the classical recent references in the literature. In most of these explanations, growth is related to market extension. If geography is introduced in this literature then distance to the open new market become relevant.

Localized endogenous growth factors (LEGF) are related to factors that “complement” physical capital, such as human capital, public infrastructure, local knowledge spillovers as well as specialization that generate a technological externality that affects productivity growth positively. In the new economic geography literature, in general, these factors are considered as having low spatial mobility while related to historical agglomeration of these factors.

In this context, permanent changes in Mexico's trade policy have made the country, in particular its Northern Border, an ideal case study of the interaction of those two kinds of factors that, taking into consideration the geography, affect productivity growth. In 1985, after four decades of import-substitution industrialization, Mexico began to open its economy to trade. The government enacted reform swiftly, eliminating most trade barriers in the following three years. After the signing of a free trade agreement between Canada, Mexico, and the U.S., in 1994, Mexico's location in North America has made trade liberalization equivalent to economic integration with the United States.

Even more, for Mexican firms, proximity to foreign markets means proximity to the U.S. market. Yet, Mexico's closed-economy main industrial centers were located far from the United States. Since the 1950s, manufacturing capacity has been concentrated in the country's interior around the largest manufacturing areas such as Distrito Federal and the state of Mexico. Foreign-market access began to lure firms to the Mexico-U.S. border. Then, the existing spatial pattern of economic activity that has been identified as Northern Border states increased their employment and output's share while Mexico City (including Distrito Federal and the state of Mexico) has been showing a lower share. But what was happening with productivity growth?

In fact, the conclusion in de León (2003) was that manufacturing spatially close to the United States did not show a better performance in economic growth than the rest of states as expected and that previous accumulated growth factors in Central Mexico regions, such as education, learning by doing, local knowledge spillovers, and infrastructure were still relevant in explaining productivity growth across state manufacturing in Mexico. In that study, de León considered certain immobility of LEGF. He was a kind of pessimist while he anticipated that Northern states, although close to the U.S., and having limited access to LEGF would show a lower productivity growth than the old central region.

Ten years after that study and 20 since NAFTA, some general evidence shows a faster productivity growth (regarding the Mexican economy) in Northern states as a group. In this article, we explore if such productivity growth could be explained by a relocation of LEGF from the interior (where those factors were located in the beginning of trade liberalization process) and/or the level of efficiency of the exploitation of LEGF in Northern states in relation to the relevance of those factors in the interior.

In Section 2 we review the analytical context of growth theory, trade theory and new economic geography related to the main topic of this article. Section 3 then describes the empirical framework. In Section 4, we empirically evaluate the role of LEGF and trade induced factors in Mexico's Northern Border Region taken municipalities as observation units, while Section 5 presents the conclusions of the article.

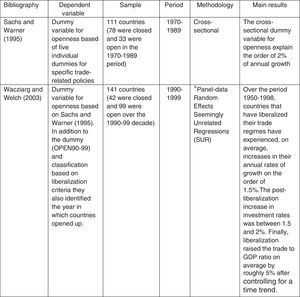

2Literature reviewRegarding the recent analytical and empirical analysis of the impact of trade liberalization on economic growth, this has been developed mostly through cross-country approach following Sachs and Warner (1995, henceforth, SW) and the posterior contribution of Rodriguez and Rodrik (2000, henceforth RR) who identify in SW, problems in measuring openness, statistically sensitive specifications, the collinearity of protectionist policies with other “bad” policies, and other econometric difficulties. Taking RR's critique into consideration, Wacziarg and Welch (2003, henceforth WW) presented an updated results of SW with more precise classification of the variable “open/closed” countries and extending their data on trade policy openness to year 2000. WW also estimated the within-country response of trade liberalization on economic growth, controlling for time invariant country characteristics. WW results confirmed that SW's cross sectional results were sensitive to openness classification in the 1970–1989 period and they no longer hold for the 1990s. In contrast to cross-country findings, they found that new results based on within-country variation suggest that the effects of increased openness policy within countries through time are positive, economically large and statistically significant. However, when WW (2003:3) examine a subsample of 24 developing countries, the following lessons are identified: “First, there is a vast amount of heterogeneity across countries in the extent to which growth rose after trade reforms. While the average effect obtained in the large sample is positive, roughly half of the countries experienced zero or even negative changes in growth post-liberalization. Second, generalizations about the factors that may explain these differences are difficult to draw. The preexisting institutional environment of countries, the extent of political turmoil, the scope and depth of economic reforms, and the characteristics of concurrent macroeconomic policies all seem to have a role to play” WW (2003:3).

Then WW recommended further analysis to identify those factors that account for heterogeneity in the growth effects of trade reform. Also, Kneller, Morgan, and Kanchanahatakij (2008, henceforth KMK) who reviewed a sample of 37 “liberalizing countries” in a cross-section analysis, and after exploring different measurement of trade liberalization as well a different conditional variables such as human capital, natural barriers and institutional quality, found that heterogeneity in results cannot be explained, and with Pritchett (2001) and Bhagwati and Srinivasan (2002), they suggest that “case study evidence may offer greater returns than further cross-country analysis”.

For a summary of previous referred literature, see Fig. 1.

From here, there is an extensive field of research in this approach which has focused to specific group of countries and individual countries. The literature is immense, just to mention a few representative cases, see Paus, Reinahardt, and Robinson (2003) on Latin America, Chand and Sen (2002) on India, Cavalcanti and Rossi (2003) on Brazil, and Iregui, Melo, and Ramírez (2007) on Colombia, and de León (2009) on Mexico, among others.

In the empirical analysis on trade liberalization and growth, Mexico could be considered an interesting case study, while its economic growth performance has been remarkably low, despite its deep and extended degree of trade liberalization. See, for instance KMK, who in their estimated results for 37 countries, according to the variables included in the model, Mexico, should be the country with the highest rate of economic growth in the post-liberalization context.

In this article, while we analyze the relationship between trade liberalization and productivity growth, we propose to complement that literature with some findings across new economic geography and endogenous growth theory in a regional approach.

In particular, there are some studies which have initiated the merging of the fields of endogenous growth and new economic geography (or geographical economics) such as Martin and Ottaviano (1999) and Baldwin, Martin, and Ottaviano (1998). This literature combined the insights of the endogenous growth literature and new geography model of first generation where all the elements of the new economic geography core models were present, except for labor mobility between regions. If knowledge spillovers are localized, agglomeration of firms can stimulate growth in the core region, therefore, the process of cumulative causation is enhanced in a growth model.

More recently, Baldwin and Forslid (2000) provided the first endogenous growth version of the core model of geographical economics that included labor mobility between regions. They presented a model where long-run growth and industrial location are jointly endogenous by introducing innovation growth à la Romer (1990) into a core-periphery model à la Krugman. The model thus gave an explanation of the interaction among economic integration, for example through a fall in transport costs, the location of manufacturing activity, and economic growth. The model incorporated the fact that economic growth affects location and location affects economic growth. More precisely, the technological externalities or knowledge spillovers that are the driving force behind endogenous growth theories are related to the distribution of manufacturing activity across space.

An interesting result of the Baldwin and Forslid (2000) model is that one out of the three stable long-run equilibria resulting in the model, the distribution of the manufacturing workforce which remains stable over time, is the even spreading of manufacturing activity across the two regions and convergence in economic growth between the two regions. For similar results in models which merges new economic geography and endogenous growth, see also Baldwin, Martin and Ottaviano (2001) and chapter 11 in Fujita and Thisse (2013).

Brakman, Garretsen, and Van Marrewijk (2009) suggests that the Baldwin-Forslid model can be extended, among other settings, by combining endogenous growth with simulation dynamics from geographical economics. Here, we take a different approach and explore the relationship between endogenous growth and geography through an empirical approach.

Here, it is relevant to note that much of the recent regional science make emphasis in the immobility of specialization, skills and tasks. In this respect, Baldwin and Evenett (2015: 31) noted that:

“In contrast [to the extent that…chase for lower cost production location], high levels of productivity, specialization advantages, and innovation resulting from the agglomeration of skills and tasks imply that no every activity creating value is at risk of migrating across borders”. Also, Baldwin and Everett (2015: 48) observed that:

“Falling tariffs and low transportation costs have revealed that many tasks that do remain in high-wage economies are ones that are supported by dynamics that provide strong individual disincentives to relocated abroad. Where productivity levels and growth are supported by co-location, that is, when a firm has to locate in a certain place to obtain the benefits of thick labor markets, substantial tacit knowledge flows, high quality infrastructure, strong university-business linkages, and so on, then ‘good’ jobs and any rents associated with them are viscid”.

In this approach, Piras, Postiglioni, and Aroca (2011) found evidence that technological progress in one region is not only a function of the productivity growth rate in that region, but also of capital accumulation in other (spatial continual) regional economies. Although the increased diversification of economic activities and the rapid development of new technologies, have reduced the role of location as determinant of economic growth.

In de León (1999, 2003, 2007, 2009) there was a review of the literature on economic growth which had been developed in explaining differences in productivity growth among cities or regions before and under trade liberalization and some implications for the Mexican case were explored. More specifically, de León (2003) explored how differences in urban economic growth can be affected, taking into consideration transportation costs and variables related to endogenous growth models. In the Mexican case, it was argued that since economic growth is based on specific urban characteristics that are created over time in cities, history matters when an economy is opened.

Specifically, what are the regional productivity implications when a previously closed economy is opened by trade tariff reductions? If trade liberalization implies, in regional terms, relocation or moving of the central market for “national” firms, from the “interior” to the “foreign” market, new geographical economics anticipates that technological externalities would promote some productivity growth in places close to the new market. This idea can be easily illustrated in the Mexican urban manufacturing case. Under import substitution industrialization (ISI), as the internal market was to be promoted, the central market was where the people were. As it has been the case with others countries under ISI, these locations were the largest central cities. Under trade liberalization, because the internal market is no longer protected, and because of export promotion strategies, the central market is now located closer to the “foreign” market, in Mexico's case, in its Northern states.

However, productivity growth in geographical dimension is not only determined by market extension but also for other factors such as education, learning by doing, infrastructure and so on. In the literature, these factors are localized in certain places and may show certain spatial immobility.

In particular, taking into consideration these two kinds of growth determinants, de León (2003) has empirically examined the growth effects of trade liberalization in Mexico. He focused on the role of human capital, local knowledge spillovers, learning by doing, and infrastructure that encourage growth of pre-existing manufacturing centers and the locations with good access to foreign markets, which encourages the growth of cities along the Mexican border. He compared productivity growth in Mexican urban manufacturing before and after trade liberalization. Consistent with the argument that productivity growth in the new areas (Northern cities) is restricted by the unavailability of non-physical capital in those areas, he found that manufacturing in the Northern cities shows poor performance in productivity growth.

The empirical results described then the general features of the post-trade reform pattern of productivity growth in Mexican urban manufacturing. Under trade liberalization, there was not a northward shift in productivity growth. Mexico's closed-economy manufacturing centers around the largest cities have not diminished in importance in terms of productivity growth as firms relocate their activities to cities in Northern Mexico where they have better access to foreign markets. The implementation of the North American Free Trade Agreement, which should reinforce the motivation for firms to locate near the United States, had not been promoting a higher rate of productivity growth.

In the following section, we will empirically identify the implications of this reallocation of economic activity in terms of economic growth for Mexico along the last 20 years with emphasis in the Northern states.

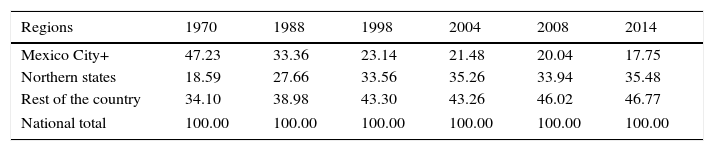

3Empirical frameworkTaking into consideration the relevant literature presented in the previous section and in order to evaluate the consistence of the former argument along the last 20 years, we expand the data initially presented at the state level in de León (1999, 2003) to municipalities and longer time period. This data still confirms Livas and Krugman (1992)’s and Hanson (1994)’s findings based on employment and output growth but not on productivity levels and growth rates. Table 1, confirms these results at state manufacturing level; the manufacturing employment share in relation to the national total, for Mexico City manufacturing Area (DF and the Mexico state), decreased from 47.23 to 17.75 percent between 1970 and 2014. At the same time, Northern states, those that are close to the border1 with the U.S., such as Baja California, Coahuila, Chihuahua, Nuevo Leon, Sonora and Tamaulipas as a whole show an increasing share of total employment, from 18.59 to 35.48 percent. We now turn to the analysis of the performance of both groups of states in terms of productivity levels and rate of growth. Selected years correspond to the availability of data according to the date of census.

Manufacturing employment share in relation to the national total. Mexico: 1970–2014. (Percentage points).

| Regions | 1970 | 1988 | 1998 | 2004 | 2008 | 2014 |

|---|---|---|---|---|---|---|

| Mexico City+ | 47.23 | 33.36 | 23.14 | 21.48 | 20.04 | 17.75 |

| Northern states | 18.59 | 27.66 | 33.56 | 35.26 | 33.94 | 35.48 |

| Rest of the country | 34.10 | 38.98 | 43.30 | 43.26 | 46.02 | 46.77 |

| National total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

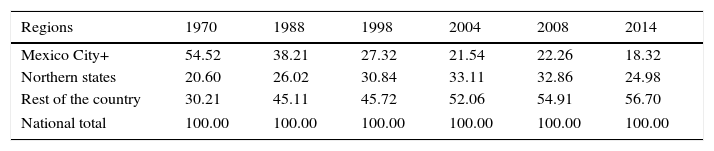

In terms of output, see Table 2, Mexico City share decreases from 54.52 to 18.32 percent. Northern states increase from 20.60 to 24.98 percent.

Manufacturing output share in relation to the national total. Mexico: 1970–2014. (Percentage points).

| Regions | 1970 | 1988 | 1998 | 2004 | 2008 | 2014 |

|---|---|---|---|---|---|---|

| Mexico City+ | 54.52 | 38.21 | 27.32 | 21.54 | 22.26 | 18.32 |

| Northern states | 20.60 | 26.02 | 30.84 | 33.11 | 32.86 | 24.98 |

| Rest of the country | 30.21 | 45.11 | 45.72 | 52.06 | 54.91 | 56.70 |

| National total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

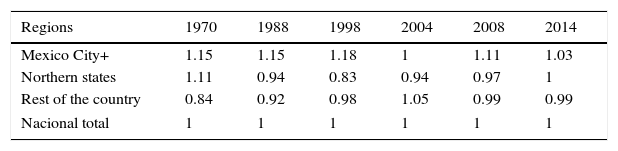

If we observe the behavior of labor productivity for the same states during the same period, our perception about the performance of each set of states changes. Table 3 presents the level of output per worker, labor productivity, for those selected states from 1970 to 2014. The Mexico City region has kept, with some variations, their productivity steadily above in relation to the national level. At the same time, Northern states have seen their labor productivity level lower than the national average, although there is an increment from 1998 to 2014. The data is reported in comparative terms in order to “isolate” variations observed at the national level. In any case, our interest is in observing comparative performance across states.

Manufacturing output per worker share in relation to the national total. Mexico: 1970–2014.

| Regions | 1970 | 1988 | 1998 | 2004 | 2008 | 2014 |

|---|---|---|---|---|---|---|

| Mexico City+ | 1.15 | 1.15 | 1.18 | 1 | 1.11 | 1.03 |

| Northern states | 1.11 | 0.94 | 0.83 | 0.94 | 0.97 | 1 |

| Rest of the country | 0.84 | 0.92 | 0.98 | 1.05 | 0.99 | 0.99 |

| Nacional total | 1 | 1 | 1 | 1 | 1 | 1 |

From Tables 1–3 is clear that there are other regional changes that may be of interest to identify, such as, the increment in labor, output and productivity in some states in Central and Central West Mexico. However, in this paper we only analyze the case of Northern Mexico because its relevance in terms of the implications of some themes in new geographical economics and endogenous growth models.

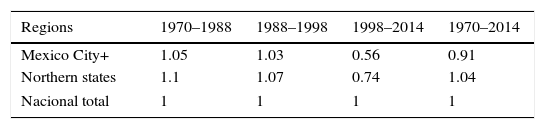

Table 4 presents labor productivity growth data for three periods, 1970–1988, 1988–1998, and 1998–2014 following the fact that 1988 was the year when trade liberalization initially consolidated. For the first period, Mexico City+ grew lower than the national growth rate and Northern states even lower than the national growth rate. But for the second and third period, 1988–1998, that is, consolidated trade liberalization; labor productivity in the Northern states grew faster than Mexico City. As a result, for the long period, 1970–2014, labor productivity for Mexico City shows a rate lower than national average and Northern states lightly above.

Growth rate of labor productivity in relation to the national total. Mexico 1970–2014. (Percentage annual average growth rate).

| Regions | 1970–1988 | 1988–1998 | 1998–2014 | 1970–2014 |

|---|---|---|---|---|

| Mexico City+ | 1.05 | 1.03 | 0.56 | 0.91 |

| Northern states | 1.1 | 1.07 | 0.74 | 1.04 |

| Nacional total | 1 | 1 | 1 | 1 |

At this point, it is clear that even though new geographical economics conclusion applies to labor and output levels, the implications in the long run in terms of productivity remain to be seen. How, then, can a better story be told?

Krugman's inclusion of dynamic externalities has certainly extended the analysis of the impact of trade on regional growth. However, his analysis is limited, since he observes externalities related exclusively to market size and not to the specific conditions that promote productivity growth or regional competitiveness.

In the next section, we introduce the sources that promoted productivity as a whole for regional and urban areas according to endogenous growth theories. Introducing these sources will be seen to have relevant implications for the impact of trade on regional growth differences.

As shown in de León (1999), new economic growth models had analyzed the kinds of urban characteristics that are the relevant sources of endogenous growth. In this research, we have considered: education, as the engine of growth, local knowledge spillovers, learning by doing, and infrastructure. Because economic growth is promoted by local characteristics related to growth factors that are created over time in cities, history may matter once an economy is opened. In particular, if this is the case, trade liberalization should make proximity to the foreign market important, as suggested by Krugman and others, but it does not necessarily weaken other externalities generated in some regions or cities. In other words, mere agglomeration of economic activity is not the only source of externalities. Specific characteristics related to variables identified in endogenous growth models in each location must also be considered. Moreover, if state characteristics related to variables tied to recent growth models are relevant, the outcome, in terms of regional growth patterns under trade liberalization, cannot be determined solely by considering such variables as transportation costs. If this is the case, adjustment away from the closed-economy growth pattern is likely more protracted. Trade makes proximity to the new central market (the U.S. market, in the Mexican case), more important, but it does not directly weaken the externalities generated by factors related to endogenous growth. Moreover, the sectoral reallocation of economic activity that trade brings may cause some closed-economy centers to grow in the short or medium term. As specialization redirects activities from some industries to others, the relevance of these state characteristics makes specific industrial centers, all else being equal, the ones more likely to benefit.

Then, in this article, we analyze which are the sources of recent faster economic growth in the Northern states. In particular, we explore if during the last 20 years, there has been a faster accumulation of LEGF in Mexico's Northern states with respect to the rest of the country and evaluate how efficiently the LEGF are used in the Northern states in respect to the rest of the country.

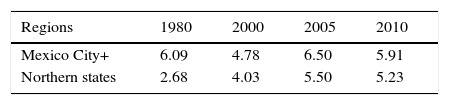

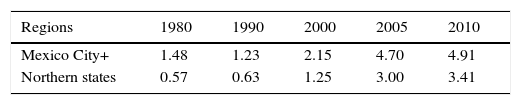

4Empirical analysis of the role of localized endogenous growth factors in Mexico's Northern Border statesIn the following, we present data regarding the accumulation of LEGF in Northern states as aggregated and Mexico City. Regarding working-age population with completed elementary education (primaria) in Table 5 we see an increment in Northern states which goes from 2.68 in 1980 to 5.23 percent in 2010. Also in completed secondary education (secundaria), Table 6, in Northern states there is a remarkable increment that goes from 0.57 percent in 1980 to 3.41 in 2010.

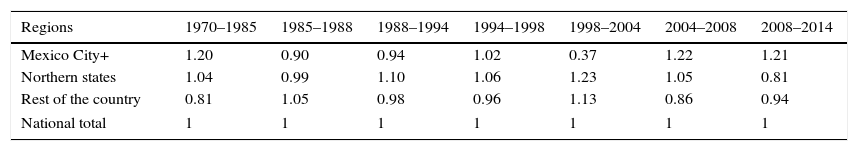

In the framework developed in this article, we related increase in the rate of capital accumulation to learning by doing as defined before. In Table 7, we present the rate of growth of capital assets respect to national growth rate for Northern states, here, we see that capital accumulation has grown faster since 1988 and faster than Mexico City.

Growth rate of the fixed assets in relation to the national total growth rate. Mexico: 1970–2014. (Percentage annual average growth rate).

| Regions | 1970–1985 | 1985–1988 | 1988–1994 | 1994–1998 | 1998–2004 | 2004–2008 | 2008–2014 |

|---|---|---|---|---|---|---|---|

| Mexico City+ | 1.20 | 0.90 | 0.94 | 1.02 | 0.37 | 1.22 | 1.21 |

| Northern states | 1.04 | 0.99 | 1.10 | 1.06 | 1.23 | 1.05 | 0.81 |

| Rest of the country | 0.81 | 1.05 | 0.98 | 0.96 | 1.13 | 0.86 | 0.94 |

| National total | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

Then, data showed in previous tables give evidence of a faster accumulation of LEGF in Northern Border under trade liberalization that could explain the correspondent increase in labor productivity of recent years (Table 8).

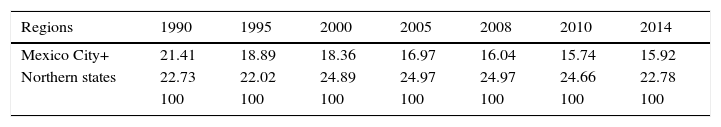

Share of electricity consumption by selected region in relation to the total national. Mexico 1990–2014. (Percentage points).

| Regions | 1990 | 1995 | 2000 | 2005 | 2008 | 2010 | 2014 |

|---|---|---|---|---|---|---|---|

| Mexico City+ | 21.41 | 18.89 | 18.36 | 16.97 | 16.04 | 15.74 | 15.92 |

| Northern states | 22.73 | 22.02 | 24.89 | 24.97 | 24.97 | 24.66 | 22.78 |

| 100 | 100 | 100 | 100 | 100 | 100 | 100 |

In the following, we explore the additional explanation about why productivity growth in Northern Border states has been growing faster, that is, how efficient the Northern states are in taking advantage of LEGF.

The recent work on growth empirics suggests a simple empirical approach for studying how regional productivity growth can be related to LEGF under trade liberalization. To the extent that market extension affects state/county (municipio) manufacturing performance, we expect trade liberalization to cause productivity growth in states that are located close to the U.S. To the extent that “localized factors” matter, we expect that states/counties (municipios) which have accumulated physical capital, as well as human capital and infrastructure, grow at higher rates in comparison to those which have not accumulated these factors.

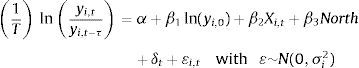

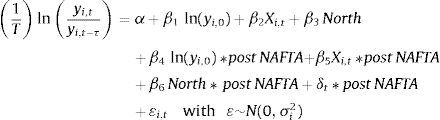

Our estimation will be based on the next equation. The new model to be estimated will have the following general form:

where Yit is the growth rate of added value per worker by municipality and year t, X and Z are matrices of explanatory variables by municipality, α is the common constant, η is a dummy-variable with one for municipalities localized in any of the Northern Border states; zero otherwise. This variable interacts with variables in matrix X and Z, ¿ are the residuals. Regarding the explanatory variables, matrix Z contains those variables other than our specific growth factors that potentially explain differences in productivity or long-term growth, such as output per worker at the beginning of the period. Matrix X includes the four types of factors related to endogenous growth models in this research: infrastructure, learning by doing, specialization, and human capital. See Table A.1, Appendix A, for definitions of variables and Table A.2 for their means and standard deviations. Here, we are taking municipalities as unit of observation, there are 12,285 observations in total in 6 manufacturing census (1988, 1993, 1998, 2003, 2008 and 2013) that corresponds to 2457 municipalities in Mexico for each census year. Again, these selected years correspond to the year when the censuses take place.In the following tables, we present the results of the model identified before by pooling the data for the five periods2 and the 2457 municipalities. The analysis is developed using a generalized least squares estimation model in order to considering a panel model with random effects, and correcting for heteroscedasticity. We have selected this model while this is the conventional model developed in similar studies. Table 9 shows the specific variables that are included for each regression.

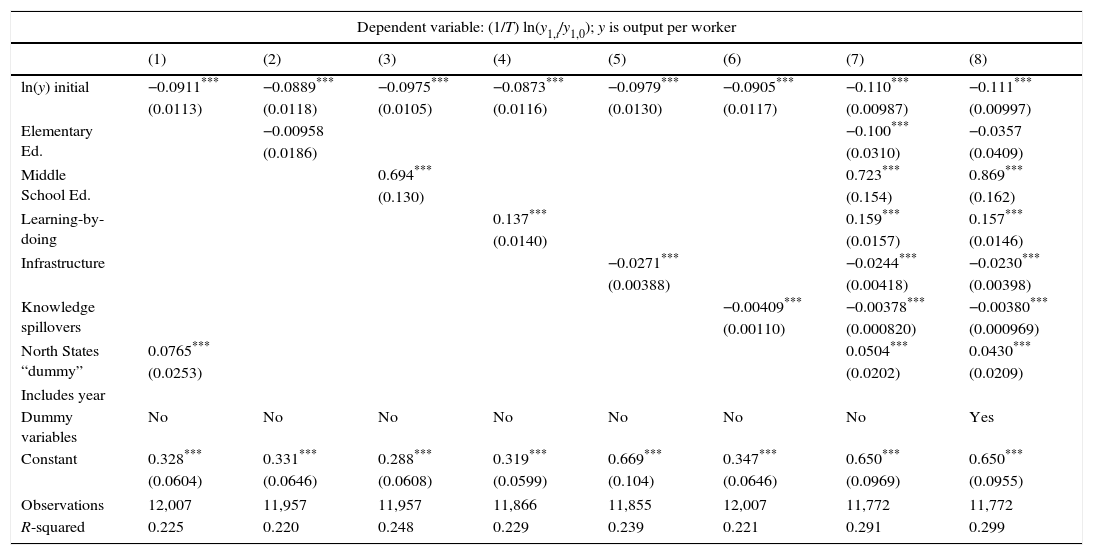

Regressions results on pooled OLS (1988–2013), corrected for heteroscedasticity.

| Dependent variable: (1/T) ln(y1,t/y1,0); y is output per worker | ||||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| ln(y) initial | −0.0911*** | −0.0889*** | −0.0975*** | −0.0873*** | −0.0979*** | −0.0905*** | −0.110*** | −0.111*** |

| (0.0113) | (0.0118) | (0.0105) | (0.0116) | (0.0130) | (0.0117) | (0.00987) | (0.00997) | |

| Elementary Ed. | −0.00958 | −0.100*** | −0.0357 | |||||

| (0.0186) | (0.0310) | (0.0409) | ||||||

| Middle School Ed. | 0.694*** | 0.723*** | 0.869*** | |||||

| (0.130) | (0.154) | (0.162) | ||||||

| Learning-by-doing | 0.137*** | 0.159*** | 0.157*** | |||||

| (0.0140) | (0.0157) | (0.0146) | ||||||

| Infrastructure | −0.0271*** | −0.0244*** | −0.0230*** | |||||

| (0.00388) | (0.00418) | (0.00398) | ||||||

| Knowledge spillovers | −0.00409*** | −0.00378*** | −0.00380*** | |||||

| (0.00110) | (0.000820) | (0.000969) | ||||||

| North States “dummy” | 0.0765*** | 0.0504*** | 0.0430*** | |||||

| (0.0253) | (0.0202) | (0.0209) | ||||||

| Includes year | ||||||||

| Dummy variables | No | No | No | No | No | No | No | Yes |

| Constant | 0.328*** | 0.331*** | 0.288*** | 0.319*** | 0.669*** | 0.347*** | 0.650*** | 0.650*** |

| (0.0604) | (0.0646) | (0.0608) | (0.0599) | (0.104) | (0.0646) | (0.0969) | (0.0955) | |

| Observations | 12,007 | 11,957 | 11,957 | 11,866 | 11,855 | 12,007 | 11,772 | 11,772 |

| R-squared | 0.225 | 0.220 | 0.248 | 0.229 | 0.239 | 0.221 | 0.291 | 0.299 |

Robust standard errors in parentheses.

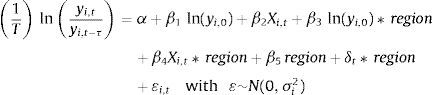

Following de León (2003), we propose the next equation:

where yi,t is the value added per worker in county i at year t, τ is the gap between the industrial census (usually 5 years); matrix X contains a collection of variables, related to LEGF that affects productivity growth. North is a dummy variable equal to one if the municipality is located in one of states close to Mexico-U.S. border3 and δt is a time-dummy variable that controls for year effects on the entire country. (See Table A.1 for definitions of variables.)Our first approach to Eq. (2) is to test the convergence model in a pooled OLS version adding only one variable at the time. Columns 1–6 in Table 9 shows the results for each of those variables,4 depicting a “strong” convergence among states around 9% on all the specifications. Only elementary education fails to reject a zero effect on productivity per worker, with all the rest showing positive impacts except the proxy of knowledge spillovers (industrial agglomeration) with similar results as the de León (2003) study among cities and infrastructure, measured by public investment in infrastructure by municipality.5

Column 7 and 8 test the overall model of Eq. (2), with column 8 adding time effects. In both columns we can see a positive relationship between learning-by-doing and productivity, whereas the rest of the variables depicts a no significant effect on the dependent variable. The North States dummy variable is positive and significant, in contrast with early results when this dummy shown negative and significant effect (de León, 2003) depicting a notable improvement on the initial results of poor performance of manufacturing in the Northern region.

In order to test carefully the hypothesis of the effects of trade liberalization and the performance of the Northern regions against the rest of the country (or even State of Mexico and Federal District), we tested a sensitivity analysis imposing some interactions on the equation.

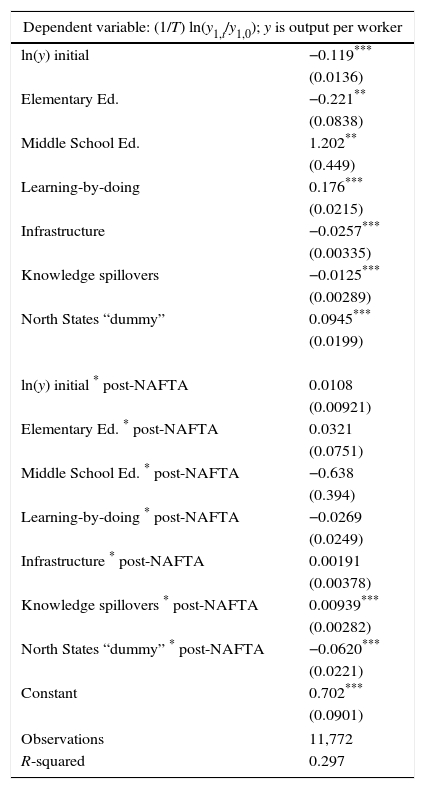

In Eq. (3), we included an interacting post-NAFTA time variable (equal to one if the year is greater than 1994, i.e. 1998, 2003, 2008 and 2013). Results are in Table 10 and shows a not significant (and positive) marginal effect on the convergence rate in the post-NAFTA era, showing a slower convergence rate.6 Also, elementary school shows a pre-NAFTA negative impact on productivity, and a not significant (and positive) marginal effect post-NAFTA (a negative contribution on total effect post-NAFTA), and middle school shows a not significant marginal effect of post-NAFTA era on productivity. The same goes to learning-by-doing, with a negative marginal effect (not significant) slowing down (or at least not improving) the contribution of this variable on the productivity per worker. Noteworthy is the spillovers effects coefficient, showing a drastic change from a negative to a positive post-NAFTA effect on productivity per worker.

Regressions results on pooled OLS (1988–2008), corrected for heteroscedasticity. Including an Interacting post-NAFTA.

| Dependent variable: (1/T) ln(y1,t/y1,0); y is output per worker | |

|---|---|

| ln(y) initial | −0.119*** |

| (0.0136) | |

| Elementary Ed. | −0.221** |

| (0.0838) | |

| Middle School Ed. | 1.202** |

| (0.449) | |

| Learning-by-doing | 0.176*** |

| (0.0215) | |

| Infrastructure | −0.0257*** |

| (0.00335) | |

| Knowledge spillovers | −0.0125*** |

| (0.00289) | |

| North States “dummy” | 0.0945*** |

| (0.0199) | |

| ln(y) initial * post-NAFTA | 0.0108 |

| (0.00921) | |

| Elementary Ed. * post-NAFTA | 0.0321 |

| (0.0751) | |

| Middle School Ed. * post-NAFTA | −0.638 |

| (0.394) | |

| Learning-by-doing * post-NAFTA | −0.0269 |

| (0.0249) | |

| Infrastructure * post-NAFTA | 0.00191 |

| (0.00378) | |

| Knowledge spillovers * post-NAFTA | 0.00939*** |

| (0.00282) | |

| North States “dummy” * post-NAFTA | −0.0620*** |

| (0.0221) | |

| Constant | 0.702*** |

| (0.0901) | |

| Observations | 11,772 |

| R-squared | 0.297 |

Robust standard errors in parentheses.

Also, North States dummy post-NAFTA shows a negative and significant coefficient, suggesting that North States municipalities diminished their participation to global municipalities growth, in other words, North municipalities have a smaller impact on growth, in line with the data in Table 3, where labor productivity shows a steady behavior for Mexico City regions, a constant growth for the Rest of the country and a reduction for Northern states. Also, in Table 2, Northern states show a decrease in their participation on the output share in relation to the national level during the post-NAFTA period.

In order to disentangle the reasons behind this “slowdown” on the convergence and the impact of the learning-by-doing and education variables, we tested the following equation.

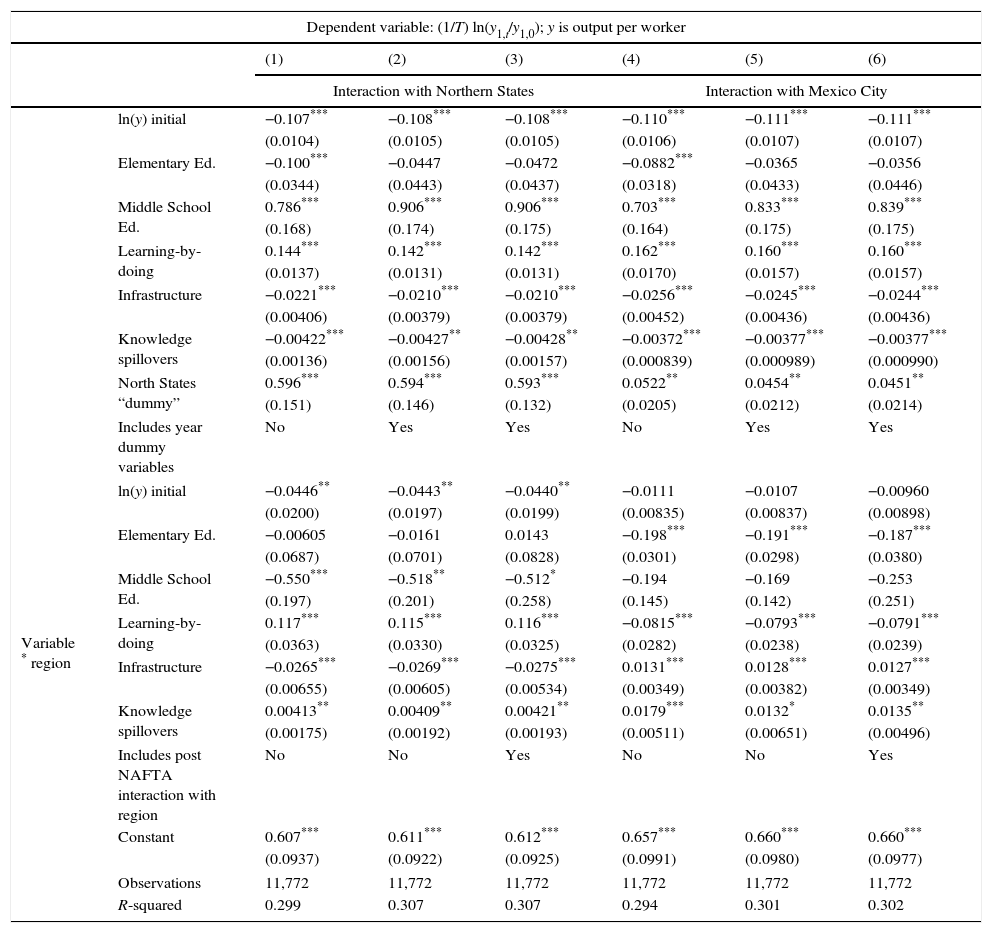

We included the region interaction “North” within the explanatory variables in order to capture the marginal effect of the Northern states, the time-dummy year effects and an interaction of the time-dummy post-NAFTA and the region. Also we included the State of Mexico and Federal District in order to make comparisons, all this is shown in Table 11.

Regressions results on pooled OLS (1988–2008), corrected for heteroscedasticity.

| Dependent variable: (1/T) ln(y1,t/y1,0); y is output per worker | |||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | ||

| Interaction with Northern States | Interaction with Mexico City | ||||||

| ln(y) initial | −0.107*** | −0.108*** | −0.108*** | −0.110*** | −0.111*** | −0.111*** | |

| (0.0104) | (0.0105) | (0.0105) | (0.0106) | (0.0107) | (0.0107) | ||

| Elementary Ed. | −0.100*** | −0.0447 | −0.0472 | −0.0882*** | −0.0365 | −0.0356 | |

| (0.0344) | (0.0443) | (0.0437) | (0.0318) | (0.0433) | (0.0446) | ||

| Middle School Ed. | 0.786*** | 0.906*** | 0.906*** | 0.703*** | 0.833*** | 0.839*** | |

| (0.168) | (0.174) | (0.175) | (0.164) | (0.175) | (0.175) | ||

| Learning-by-doing | 0.144*** | 0.142*** | 0.142*** | 0.162*** | 0.160*** | 0.160*** | |

| (0.0137) | (0.0131) | (0.0131) | (0.0170) | (0.0157) | (0.0157) | ||

| Infrastructure | −0.0221*** | −0.0210*** | −0.0210*** | −0.0256*** | −0.0245*** | −0.0244*** | |

| (0.00406) | (0.00379) | (0.00379) | (0.00452) | (0.00436) | (0.00436) | ||

| Knowledge spillovers | −0.00422*** | −0.00427** | −0.00428** | −0.00372*** | −0.00377*** | −0.00377*** | |

| (0.00136) | (0.00156) | (0.00157) | (0.000839) | (0.000989) | (0.000990) | ||

| North States “dummy” | 0.596*** | 0.594*** | 0.593*** | 0.0522** | 0.0454** | 0.0451** | |

| (0.151) | (0.146) | (0.132) | (0.0205) | (0.0212) | (0.0214) | ||

| Includes year dummy variables | No | Yes | Yes | No | Yes | Yes | |

| Variable * region | ln(y) initial | −0.0446** | −0.0443** | −0.0440** | −0.0111 | −0.0107 | −0.00960 |

| (0.0200) | (0.0197) | (0.0199) | (0.00835) | (0.00837) | (0.00898) | ||

| Elementary Ed. | −0.00605 | −0.0161 | 0.0143 | −0.198*** | −0.191*** | −0.187*** | |

| (0.0687) | (0.0701) | (0.0828) | (0.0301) | (0.0298) | (0.0380) | ||

| Middle School Ed. | −0.550*** | −0.518** | −0.512* | −0.194 | −0.169 | −0.253 | |

| (0.197) | (0.201) | (0.258) | (0.145) | (0.142) | (0.251) | ||

| Learning-by-doing | 0.117*** | 0.115*** | 0.116*** | −0.0815*** | −0.0793*** | −0.0791*** | |

| (0.0363) | (0.0330) | (0.0325) | (0.0282) | (0.0238) | (0.0239) | ||

| Infrastructure | −0.0265*** | −0.0269*** | −0.0275*** | 0.0131*** | 0.0128*** | 0.0127*** | |

| (0.00655) | (0.00605) | (0.00534) | (0.00349) | (0.00382) | (0.00349) | ||

| Knowledge spillovers | 0.00413** | 0.00409** | 0.00421** | 0.0179*** | 0.0132* | 0.0135** | |

| (0.00175) | (0.00192) | (0.00193) | (0.00511) | (0.00651) | (0.00496) | ||

| Includes post NAFTA interaction with region | No | No | Yes | No | No | Yes | |

| Constant | 0.607*** | 0.611*** | 0.612*** | 0.657*** | 0.660*** | 0.660*** | |

| (0.0937) | (0.0922) | (0.0925) | (0.0991) | (0.0980) | (0.0977) | ||

| Observations | 11,772 | 11,772 | 11,772 | 11,772 | 11,772 | 11,772 | |

| R-squared | 0.299 | 0.307 | 0.307 | 0.294 | 0.301 | 0.302 | |

Robust standard errors in parentheses.

Columns 1–3 shows Northern States interactions, column 1 without year dummy variables and without post-NAFTA interaction with Northern States, column 2 with year dummy variables and without post-NAFTA interactions and column 3 with year dummy variables and interactions post-NAFTA and Northern regions. Columns 4–6 show Mexico City interactions in the same way as columns 1–3 on Northern States. Results shows that marginal contribution toward convergence is higher among Northern Border Municipalities, showing a negative and significant coefficient in contrast with Mexico City region, with a not significant contribution toward convergence.

We need to pay extra attention on the learning by doing variable (investment growth), since in the Mexico City case, their marginal effect is negative and significant at 1% implying that the region is “wasting” this factor in order to promote productivity. In Northern Borders States case, shows a positive marginal coefficient, suggesting that positive investment growth have larger effects on productivity per worker in this region, compared with the rest of Mexico.

Noteworthy is the case of human capital, and shows the dynamics of the employment in these two parts of the country. Mexico City shows a negative coefficient on elementary education, and a not significant coefficient in middle school, implying that further increases on productivity needs more qualified human capital (since elementary school participation hurts productivity per worker in this region). Northern States shows the opposite effect, with no marginal contribution on elementary education and negative in middle school (not enough to make total contribution of Northern States negative), this implies that middle school in the rest of the country promotes growth in productivity at higher proportions than in Northern States.7

5ConclusionsIn this article, we explore the relevant case study of Mexico's Northern Border states and municipalities after 20 years of trade integration with the United States in order to contribute to the analysis of the impact of trade integration on regional economic growth while the combination of main themes of new geographical economics and endogenous growth theory is a task in progress. While, according to the new economic geography, the reallocation of economic activity due to trade integration of Mexico with the U.S. encouraged agglomeration of firms close to the new market, the U.S., and discouraged historical agglomeration in Central Mexico, its effect on economic growth was less clear. Previous studies showed that while endogenous growth factor, such as human capital, infrastructure, learning by doing and specialization were localized in Central Mexico, productivity growth was higher in that region rather than Northern Border region. Recent studies have shown significant faster productivity growth in Norther Border states. In this article, we found evidence for explaining this change in productivity performance as related to the recent accumulation of endogenous growth factor in Northern Border states. However, we also found the Northern Border states are still less efficient than other regions in embodying these factors into sustainable economic growth. Some possible explanations for this fact may be related to absence of economic activities with few forward and backward linkages or not related to innovative activities.

We think the approach developed in this article present potential to be extended in several ways, such as, using data on total factor productivity, control for spatial integration with the U.S. Southern Border states, and the role of institutions as suggested in the recent literature on economic growth.

Conflict of interestsThe authors declare no conflict of interest.

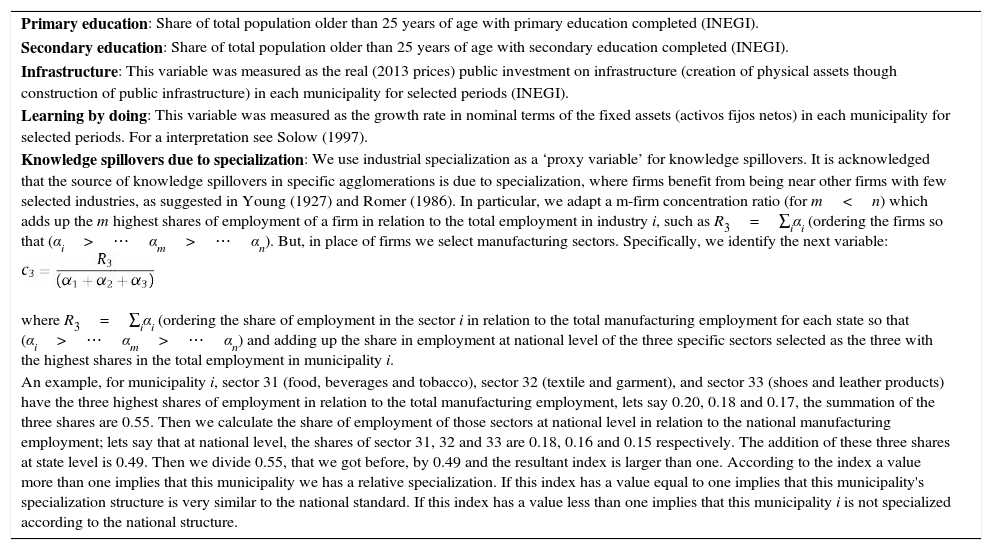

Definition of the explanatory variables.

| Primary education: Share of total population older than 25 years of age with primary education completed (INEGI). |

| Secondary education: Share of total population older than 25 years of age with secondary education completed (INEGI). |

| Infrastructure: This variable was measured as the real (2013 prices) public investment on infrastructure (creation of physical assets though construction of public infrastructure) in each municipality for selected periods (INEGI). |

| Learning by doing: This variable was measured as the growth rate in nominal terms of the fixed assets (activos fijos netos) in each municipality for selected periods. For a interpretation see Solow (1997). |

| Knowledge spillovers due to specialization: We use industrial specialization as a ‘proxy variable’ for knowledge spillovers. It is acknowledged that the source of knowledge spillovers in specific agglomerations is due to specialization, where firms benefit from being near other firms with few selected industries, as suggested in Young (1927) and Romer (1986). In particular, we adapt a m-firm concentration ratio (for m<n) which adds up the m highest shares of employment of a firm in relation to the total employment in industry i, such as R3=∑iαi (ordering the firms so that (αi>⋯αm>⋯αn). But, in place of firms we select manufacturing sectors. Specifically, we identify the next variable: |

| where R3=∑iαi (ordering the share of employment in the sector i in relation to the total manufacturing employment for each state so that (αi>⋯αm>⋯αn) and adding up the share in employment at national level of the three specific sectors selected as the three with the highest shares in the total employment in municipality i. |

| An example, for municipality i, sector 31 (food, beverages and tobacco), sector 32 (textile and garment), and sector 33 (shoes and leather products) have the three highest shares of employment in relation to the total manufacturing employment, lets say 0.20, 0.18 and 0.17, the summation of the three shares are 0.55. Then we calculate the share of employment of those sectors at national level in relation to the national manufacturing employment; lets say that at national level, the shares of sector 31, 32 and 33 are 0.18, 0.16 and 0.15 respectively. The addition of these three shares at state level is 0.49. Then we divide 0.55, that we got before, by 0.49 and the resultant index is larger than one. According to the index a value more than one implies that this municipality we has a relative specialization. If this index has a value equal to one implies that this municipality's specialization structure is very similar to the national standard. If this index has a value less than one implies that this municipality i is not specialized according to the national structure. |

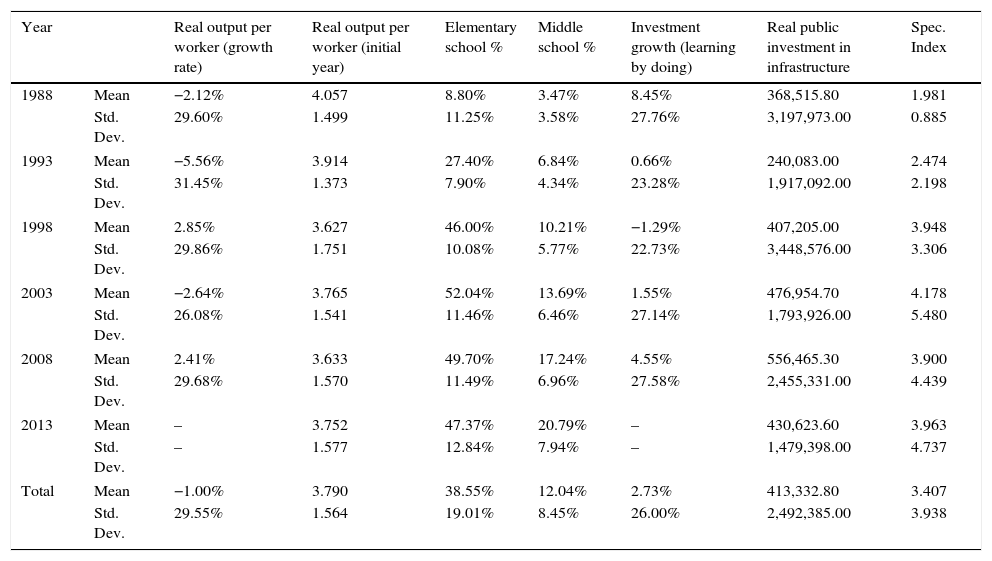

Variable means and standard errors.

| Year | Real output per worker (growth rate) | Real output per worker (initial year) | Elementary school % | Middle school % | Investment growth (learning by doing) | Real public investment in infrastructure | Spec. Index | |

|---|---|---|---|---|---|---|---|---|

| 1988 | Mean | −2.12% | 4.057 | 8.80% | 3.47% | 8.45% | 368,515.80 | 1.981 |

| Std. Dev. | 29.60% | 1.499 | 11.25% | 3.58% | 27.76% | 3,197,973.00 | 0.885 | |

| 1993 | Mean | −5.56% | 3.914 | 27.40% | 6.84% | 0.66% | 240,083.00 | 2.474 |

| Std. Dev. | 31.45% | 1.373 | 7.90% | 4.34% | 23.28% | 1,917,092.00 | 2.198 | |

| 1998 | Mean | 2.85% | 3.627 | 46.00% | 10.21% | −1.29% | 407,205.00 | 3.948 |

| Std. Dev. | 29.86% | 1.751 | 10.08% | 5.77% | 22.73% | 3,448,576.00 | 3.306 | |

| 2003 | Mean | −2.64% | 3.765 | 52.04% | 13.69% | 1.55% | 476,954.70 | 4.178 |

| Std. Dev. | 26.08% | 1.541 | 11.46% | 6.46% | 27.14% | 1,793,926.00 | 5.480 | |

| 2008 | Mean | 2.41% | 3.633 | 49.70% | 17.24% | 4.55% | 556,465.30 | 3.900 |

| Std. Dev. | 29.68% | 1.570 | 11.49% | 6.96% | 27.58% | 2,455,331.00 | 4.439 | |

| 2013 | Mean | – | 3.752 | 47.37% | 20.79% | – | 430,623.60 | 3.963 |

| Std. Dev. | – | 1.577 | 12.84% | 7.94% | – | 1,479,398.00 | 4.737 | |

| Total | Mean | −1.00% | 3.790 | 38.55% | 12.04% | 2.73% | 413,332.80 | 3.407 |

| Std. Dev. | 29.55% | 1.564 | 19.01% | 8.45% | 26.00% | 2,492,385.00 | 3.938 | |

Furthermore, these states are included in a special tariff structure that allows in-bound production free of tariffs from and to the United States. This structure created the maquiladora operation.

The authors acknowledge the valuable contribution of Monica S. Oyatomari in the development of this research, as well as L. Selene Vielmas Garcia and Alma A. Ruvalcaba Mendoza. We gratefully thank anonymous reviewers, and participants in seminars in Banco de la República, and Maestría en Economía, Universidad de Guadalajara for their comments that definitively contributed to the improvement of this article.

One period is lost due to growth rate calculation.

Mexico-U.S. border includes: Baja California, Chihuahua, Coahuila, Nuevo Leon, Sonora, and Tamaulipas.

The results were corrected for heteroscedasticity by clustering states, since original results rejected the null of homoscedastic errors.

These results may be driven by policy-oriented programs toward slow growth municipalities, so we are capturing the effect of the public policy.

The total effect post NAFTA is the sum of both coefficients, the interaction only shows the marginal effect.

Here, it is relevant to note that in order to control for endogeneity, we have tested the results including instrumental variables (IV), in general, results hold. Additional calculations are available upon request to the authors.