This paper examines the structure and dynamics of institutionalised flows of credit between economic sectors – with a distinct emphasis on industry – during the era of import-substitution industrialisation. Using the debate between “balanced vs. unbalanced growth” theories as prompting guide, the paper challenges conventional wisdom sustaining that the state supported industrialisation by providing ample/subsidised credit to industrialists. The argument in this article is that the relative share of institutionalised credit flowing to manufacturing was significantly lower than hitherto assumed, when the sectoral allocation considers the financial system as a whole. In fact, it is argued that industrialists were the losers in a financial system in which key players – the Central Bank (CB) – represented competing interests. This proposition is substantiated with a combination of newly constructed datasets integrating credit series for public and private banks, as well as data discriminating the sectoral allocation of resources originating in the CB.

Este documento examina la estructura y las dinámicas de los flujos de crédito institucionalizado entre sectores económicos —con particular énfasis en el industrial— durante la supuesta era de Industrialización por Sustitución de Importaciones. Utilizando como guía el debate entre las teorías del «crecimiento equilibrado y desequilibrado», el documento desafía la sabiduría convencional que sostiene que el Estado respaldó con crédito amplio/subsidiado a los industriales. El argumento asevera que la parte relativa del crédito institucionalizado que fluyó al sector manufacturero fue significativamente menor que al hasta ahora asumido cuando la asignación de todo el sistema financiero es tenida en cuenta. De hecho, se argumenta que los industriales fueron los perdedores en un sistema financiero en el que jugadores clave —como el Banco Central— representaban intereses de la competencia. Esta proposición se sustenta con una combinación de datos nuevos construidos para el crédito público y privado consolidado, así como de datos discriminados sobre la asignación de recursos originados en el Banco Central.

In the aftermath of the Second World War and the West's struggle against Communism prominent economists began to think, model, and prescribe recipes for the economic development of backward nations. A particularly contested debate emerged between proponents of what came to be known as “balanced” and “unbalanced” growth strategies. Although the key elements of the discussions centred around the identification of specific elements or “prerequisites” for economic take-off (such as capital and entrepreneurship) on the one hand; and the discovery of “hidden rationalities” and the mobilisation of potential or latent forces on the other; the issue of credit allocation – of both ordinary and subsidised resources – was part of the academic exchange. The implications for the distribution of financial resources originating in the banking sector – which at the time accounted for most of the assets of the financial systems of developing nations – are worthy of closer examination, for the differences in growth strategies entailed specific and distinct allocations of credit amongst economic activities. This paper establishes the distribution of banking-credit resources accorded to different economic sectors in Colombia during to so-called age of import-substitution industrialisation using as background the above-mentioned debate. It contributes to the literature in four concrete aspects. First, it presents data on new and outstanding loans from private and public banks in integrated fashion for a period for which consolidated numbers remained absent. Secondly, it offers newly constructed statistical series that discriminate the allocations of loans, discounts and rediscounted resources from the Central Bank. Thirdly, it presents primary evidence collected from archival research about the unsatisfactory conditions faced by national industrialists regarding credit sources from public and private banks. Lastly, and most importantly, the paper challenges conventional wisdom regarding the support that the state lent to the manufacturing sector during the ISI years.

The “balanced” and “unbalanced” growth strategies that emerged from the nascent sub-discipline of development economics were conceived of to lift backward countries out of poverty. At the heart of “balanced growth” proposals lay “investment criteria – coordinates for policy makers and lenders to allocate capital to pull societies out of their corner.” (Adelman, 2013, p. 329). To spring out of underdevelopment poor nations needed to mobilise and accumulate savings in order to attempt a “Big Push” in investment across sectors. As Nurkse, leading representative of this strategy, put it: “… it seems to me that the main point is to recognise how a frontal attack of this sort – a wave of capital investments in a number of different industries [italics added]–can economically succeed.” (Alacevich, 2007, pp. 69–70). Although it was clear to “balanced growth” advocates that the industrialisation of any economy was the certain road to riches, no overt bias in favour of one particular sector was stressed. Capital should flow where its shortage was greatest. Due to complementarities and coordination issues, the investment effort should be aimed at all fronts. Rosenstein-Rodan, foremost figure of this stream, illustrated the point between agrarian and industrial activities, for instance, noting: “One might consider the industrialisation of these countries [Eastern and Southern Europe] as one chapter of agrarian reconstruction, or one might treat the improvement of agrarian production as one chapter of industrialisation. What matters is to remember that the two tasks are interconnected parts of one problem.” (Rosenstein-Rodan, 1943, Fn, 2.) In practice, however, a certain preference evolved for social overheads, such as roads, ports and power grids (Adelman, 2013, p. 346). The role that “balanced growth” theories accorded to the state differed substantially from current neoliberal prescription: minimal intervention. State action was critical in order to sustain systemic transformation. Following on the above-cited authors, Chang argues: “the basic insight behind the Big Push theories was that people in developing countries do not invest in new industries because they do not know whether other, complimentary investments will come along; therefore there needs to be a centralised coordination of investment plans.” (Chang, 1999, p. 192). In short, for “balanced growth” strategists the road to development passed through outsized investment plans across economic sectors engineered, to a significant degree, by public authorities.

At the other end of the spectrum, “unbalanced growth” theorists, in particular its main exponent Albert Hirschman, considered development a process, and as such, sudden spurts of investment as one-off economic transforming formulas were viewed as misleading. His analyses of the weaknesses of poor nations differed significantly from “balanced growth” advocates. Therefore, his suggestions for action too. Rather than investing in social overheads, he proposed direct outlays in agriculture, industry and trade; letting the pressure exerted by the very growth in these activities to put pressure upon investments in infrastructure (Adelman, 2013, p. 346; Hirschman, 1955). In similar and complementing fashion, Amsden noted, that successful late-industrialisers benefitted handsomely from extensive allocation of intermediate assets (subsidies). Here the role of the state was paramount, for it befell to governments committed to industrialisation to create effective control mechanisms to discipline firms, extracting from the recipients of financial support the desired performances in terms of productivity, returns, local content, technological transfer, etc., that would benefit society at large (Amsden, 2001). It seems that in this respect, i.e. the role attached to the state, both “balanced” and “unbalanced” growth theories found common grounds.

Using the “balanced vs. unbalanced growth” framework as prompting guide and their hinted allocations of resources as background, this paper examines the dynamics of institutionalised, ordinary and subsidised, flows of credit between economic sectors in the Colombian context of the mid-twentieth-century; that is, amidst the era of import-substitution industrialisation. It is important to set the historical record straight. Colombia's industrialists are said to have enjoyed an ample and cheap supply of financing during the state-led and/or import-substitution industrialisation (ISI) era circa 1940–1967. Several assumptions underlie this view. First, that the Colombian state was deeply committed to industrialisation. Second, that the state was capable and willing of channelling ever increasing financial resources to manufacturing at the expense of other economic sectors. Third, that industrialists had the political clout and influence to force the financial system to lend to them at subsidised prices. These postulates are often supported with evidence leading one to believe that financing was not a real problem for manufacturers. This paper challenges the assumptions and evidence supporting this interpretation. It sustains that such view is misconstrued and the empirical evidence used to support it is only partial. The arguments goes as follows: the relative share of institutionalised credit flowing to manufacturing was significantly lower than assumed by proponents of the above view, when the sectoral allocation considers the financial system as a whole. In fact, it is argued that industrialists came to represent the losers in a financial system whose structure was bank-based and in which key players – the Central Bank (CB) and the biggest publicly owned bank – represented competing interests, those of agriculturalists in general and coffee growers and cattle farmers in particular. The state, contrary to what the literature claims, advocated chiefly for the financial interests of primary producers and only in a marginal sense catered to those of manufacturers, at least until 1967.

The paper divides in five sections. The first section reviews the current literature on the issue of industrial credit in Colombia. The second provides historical evidence by industrialists indicating that both short- and long-term credit availability were sources of concern for the sector – and deemed insufficient. This is validated by the display of further primary evidence from the CB, government sources and foreign experts coinciding with the assessments of industry. The next section characterises the Colombian financial system as a credit-based one, dominated by private commercial banks with an increasing role for public financial institutions. It also reviews and analyses the legislation shaping the flows of credit. The fourth part offers new calculations of the sectoral shares of credit by commercial banks, the CB, and public institutions, such as the Agrarian Bank, demonstrating that state support in financing matters was largely directed at agrarian, not industrial interests. The last section concludes.

1Credit to industry: the Colombia literatureMost of the literature dealing primarily (or marginally) with industrial credit has framed the issue on the basic assumption that the Colombian experience fits neatly in the context of import-substituting or state-led industrialisation. Berry and Thoumi outline the country's post-war economic policy as one following a “fairly standard import-substitution” strategy until the mid-1960s. Avella, Bernal and Ocampo characterise the deliberate development strategy that emerged after 1945 – that of ISI – as exhibiting three distinctive elements: the channelling of major resources to industry, direct state investments in the sector, and rising protectionism (Avella, Bernal, Errázuriz, & Ocampo, 1987, pp. 260–61). Misas, in a similar vein, narrows the bases of ISI in Colombia to two factors: high protectionism and promotional credit (Misas, 2002, pp. 72–76). Other authors, such as Rettberg (2001, p. 58) and Hallberg (1991, pp. 111–12) emphasise the role of subsidised industrial credit that originated in state institutions since the 1940s – also subscribing to the ISI account.1 So does the work by Muñoz and Bolívar who see the state as a new player in the financial markets acting with the aim of favouring the development of the productive sectors following CEPAL-inspired ideas at a time “when the problems of industrial financing were seen through structuralist lenses” and offered solutions accordingly (Muñoz & Bolívar, 2002, pp. 122–23). From a conceptually slightly different angle, Ocampo and Tovar stress governmental policies of the post-war period to redirect credit to strategic sectors, such as manufacturing, in a state-led or accelerated strategy of industrialisation (Ocampo & Tovar, 2000, p. 246). They illustrate their point by examining the evolution of industrial financing from the 1940s to the early 1970s. The emerging pattern, according to their study, is that of external financing or loans replacing new equity as the main source of funding, thanks largely to state policies of development credit (Ocampo & Tovar, 2000, p. 256). The underlying thread of this branch of the literature is the pro-active role they all assign to the state in supporting industrial development in the framework of an ISI or state-led strategy. The use of these concepts to understand the industrial trajectory of Colombia in the mid-twentieth century seems to put a straitjacket to these analyses forcing the authors to extend to the area of industrial credit insights and/or conclusions reached in other policy areas, i.e. trade policy. This paper argues that the utility of ISI premises in accounting for industrial credit policies is deceptive. State actions to support industry in the trade-policy field did not replicate in the financial arena. Below it will be shown that the empirical evidence regarding state policies and industrial credit makes the application of these frameworks inappropriate to explain the Colombian experience, at least in this specific policy field.

Another stream of authors that address the issue of industrial financing more directly also draw similar conclusions; namely, that industry received plentiful and increasing amounts of ordinary and subsidised resources from the financial system as industrialisation progressed during the post-war years. One of the most authoritative studies on the issue is that of Castro and Junguito. They argue that financial resources were not a constraint on industrial growth, neither in the 1940s nor especially the 1950s and 1960s, thanks to official policies that had started to direct credit towards industry (Castro & Junguito, 1979, pp. 12–16). The favourable evolution of institutionalised credit is reflected in the increasing share of loans allocated by the commercial banks to industry relative to other sectors; and through an upward trend identified in new loans to the sector measured against industrial GDP, which seems to confirm the new direction of financial resources (1977, p. 13). Ultimately, Castro and Junguito sustain that the rising levels of corporate indebtedness of the early 1970s and the recurrence of industrial firms to the curb and foreign markets for credit was the outcome of public policies that subsidised interest rates and led to credit rationing (Castro & Junguito, 1979, p. 68).

Fajardo and Rodríguez explore in more detail the ways by which state policies were designed to supply the industrialists’ rising demands for credit, as Colombia embarked upon the “industrialising strategy at any cost” (Fajardo & Rodríguez, 1980, pp. 29–30). They emphasise the new role of the CB as a key decision-maker regarding credit policy and the rediscounting mechanism as the preferred monetary instrument for preferential credit allocation (1980, p. 30). Others, like Salazar, highlight the adoption of forced investments upon commercial banks and the possibilities of manipulating their reserve requirements, as measures aimed at redirecting credit to priority sectors – of which industry was one (Salazar, 1996, p. 84). The common denominator in these interpretations is one that argues the existence and intensification of financial repression. State intervention in the financial system through the rediscounting mechanism, the manipulation of reserve requirements and the enactment of obligatory investments encouraged interest rates rigidities that distorted the markets for money and capital. Lower than market-determined interest rates led to excesses in the demand forcing the banks to ration credit. Ultimately, this prevented the financial system to operate at full capacity and the system remained shallow. The most important implication of that view to this study is that industry did not really seem to suffer from credit scarcity because industry was one of the sectors prioritised by government measures. Consequently, this was reflected in the portfolios of the commercial banks. From the empirical viewpoint these authors frequently show how changes in the structure of credit length terms from a predominantly short-term basis to a more medium- and long-term lending pattern indicate that industry was receiving ever larger shares of financial resources relative to other sectors. Also, reviews of the decrees, laws, and CB resolutions illustrating official policies along with industry's growing share of loans in the portfolios of private commercial banks suggest their interpretations match the evidence; hence their conclusions are definitive. This is not the case, however. This branch of the literature fails to grasp the issue of industrial credit on two accounts: first, by emphasising the portfolio of the private banks they leave out of the picture increasingly important players in the financial system: public lending institutions. Not only were official institutions expanding in size, but they were also specialising in meeting the financial needs of certain sectors, i.e. coffee growers, cattle farmers, agriculturalists, and housing – as will be discussed below. The obvious implication of this is that focusing on the private commercial banks introduces a bias towards industry and its share of credit. The way to rectify this is by examining the distribution of credits by sectors across of the entire financial system. Secondly, it is often assumed that the decrees and laws that favoured the allocation of credit to the so-called ‘productive’ sectors was symmetrical and did not discriminate between industry and agriculture. This, again, is not so clear. More often than not, as will be shown below, industry was a relative loser from such legislative acts.

A third stream of authors, converging somewhat with the previous literatures, centres on the rent-seeking capabilities of industrialists to benefit from credit allocation. This gradually started to take place, according to Avella and Kalmanovitz, after the reform of the CB in 1951, which centralised financial decision-making and strengthened promotional credit policies. They argue that both industrialists and agrarians managed to advance their corporative interests in capturing the rents originating in the seignorage of the CB (Avella & Kalmanovitz, 1998, pp. 2–4). An active and direct policy of promotion to industry and agriculture materialised through differential rediscounting rates, the creation of bancos del gremio – producer-association banks – during the 1950s, and the operation of rediscounting funds administered by the CB since the mid-1960s (Avella & Kalmanovitz, 1998, pp. 23–27). An identical claim emerges from the study by Armenta, Fernández and Sánchez (2007). They assert from an analysis of the CB's minutes of the board that: “it is visible how much terrain developmental credit has gained on the industrial and agricultural sectors, especially during the 1950s, with such an intensity that in occasions control of the monetary expansion is sacrificed at the expense of this type of credit” (Armenta, Fernández, & Sánchez, 2007, p. 339). Following the same line of thought are Revéiz and Pérez, 1984, who advance a hypothesis arguing that it was the capacity of industrial leaders to successfully influence the state in general aspects of economic policy and in particular in the growing control over credit between 1950 and 1974, which permitted them to flourish (Revéiz & Pérez, 1984, p. 42). It is critical to note here that the stress in these accounts is placed upon the ability of industry as a sector or industrialists as key agents to capture the state (or part of it) to extract rents that facilitated their survival or development. The initiative rests with the economic group demanding credit and not so much with the preferences of the state. Thus, although the direction of the impulse for industrial credit from this branch of the literature is the reverse from that of the previous two, the outcome is the same: an ample supply of subsidised and ordinary credit flowing to the industrial sector. This study partially agrees with the statements of Avella and Kalmanovitz and Armenta et al. to the extent that agricultural interests successfully captured rents from the financial system thanks to their powerful influence on different governments well before 1950. However, it rejects the part of the thesis in which industrialists too seemed to have participated in this process. The nature of the aggregated indicators they used as evidence to prove their point, such as changes in total internal credit as percentage of GDP, makes it very difficult to establish the relative share allocated or captured by each sector, and especially so for industry since it lacks the kind of sector-specific banco gremial from which other economic groups benefitted.

Few clarifications need to be made. First, the vast majority of the above-reviewed literature does not deal directly with the issue of industrial credit. The subject often simply falls within broader works tracing the evolution of the financial system, the trajectory of industrial development, the forms of state intervention in the economy, and particularly, the contradictions between price stability and economic growth as well as long-term monetary-history reviews.2 Secondly, several of these studies focus on a period that does not fully match the one examined here. Whilst this author draws special attention to the period from 1940 to 1967 most of the cited works concentrate on the 1960s and even more so on the 1970s. Frequently, their focus on the earlier decades is a rapid flypast setting the stage for the full development of their arguments about a later historical time. This acknowledgement has an important implication: that this investigation does not necessarily disagree with the broad arguments and theses of the above-cited literature. In a sense, the disagreements and challenges posed by this paper refer to general assumptions and statements about industrial credit. Historiographically, the problem is one of a near-void of literature on the topic of industrial financing rather than one of a hotly contested debate with a myriad of interpretations in which another competing explanation is offered.3 Thus, the purpose of this paper insofar as the literature on Colombian industrial financing is concerned is threefold. First, to set the record straight that credit to industry was neither substantial nor largely subsidised when the financial system as a whole is considered. Secondly, that the timing of significant state support to industry from the financial point of view is misplaced when located in the 1940s or 1950s. This only starts to materialise in the following decade. Thirdly, to note that extending notions and assumptions based on ISI and state-led industrialisation frameworks to the Colombian experience may obscure rather than better our understanding of industrialisation and the role of the state in it.

The prevailing literature has unapologetically failed on two important fronts. One is that of providing primary evidence on the situation of industrialists regarding credit shortages (or lack of it). Financial repression, rent-seeking and ISI-centred accounts all neglect the actual evidence of industrialists and other contemporary sources, placing financing difficulties as regular, serious and unsolved problems affecting the performance of the sector. The other relates to the absence in these studies of aggregate data on sectoral credit from the financial system as a whole.4 Castro and Junguito, like Fajardo and Rodríguez, and Salazar, refer strictly to the evolution of industrial credit and its generally growing share in the total of loans advanced by the private commercial banks to support the view that financial resources available to the sector are on the rise as the mid-twentieth century unfolds. From a different angle, Ocampo and Tovar, like Sándoval, Kalmanovitz and Avella, focus on the behaviour of publicly limited manufacturing corporations and the shift in their financing sources occurring between the mid-1940s and the 1960s: the displacement of equity issues for institutionalised banking loans (Sándoval, 1983). The limitations in each of these approaches are evident. They are concerned only with private commercial banks and leave out of the picture increasingly important lending institutions in terms of their sheer size and sectoral preferences. The most important amongst these institutions being the Agrarian, Industrial & Mining Bank – henceforth Agrarian Bank – but also relevant, though smaller, the Central Mortgage Bank – BCH. Any complete examination of the allocation of resources of the Colombian financial system must take into account the operations of these two agencies. A third, if less evident component, are the loans facilitated by the CB to the public without the intermediation of any other financial institution. In other words, direct operations of the CB with private economic agents and organisations, such as the National Federation of Coffee growers (FNC) and the provincial Cattle Funds, which also involve significant amounts of resources, and perhaps more critically, were subject to under preferential terms and conditions, need be included in a more comprehensive exercise.

Those addressing the issue of funding sources have different problems. Their accounts relate exclusively to publicly limited manufacturing corporations, which depending on the year, may account for up to two thirds of the sector's total output, but still leave out the majority of firms whose legal form is different. Although the literature has routinely made recourse to data that does not discriminate between the categories of ‘credit’ or ‘external sources’ (beyond paid up capital), they assume that the largest share of this financing was shouldered by banks. This was not the case. Moreover, the share of output accounted for by industrial publicly limited corporations shows an ever-increasing trend as we near the mid-1960s. However when the focus is on the 1940s they explain far less limiting their relative weight in the aggregate exercise. Lastly, these approaches fail to put the changes in the relative shares of funding sources in the wider context of financing needs of industry as a whole. It is unknown if the shares are changing in a context of shrinking or of growing lending activities. These shortcomings of the prevailing literature justify a study of industrial credit and its share in the financial system as a whole on the following grounds. First, amidst a supposed strategy of ISI, the economic effort of the nation in general and of the state in particular in regards to such a process is best tested and illustrated when the trends in lending practices from both private commercial banks and state financial institutions are examined. Secondly, because both private and official lending entities competed for resources (rediscount) in the CB, it is reasonable to include the latter in the analysis. An economic group or agency's gains are the other's losses, whether private or public. Finally, because the credit activities of both sets of institutions can ultimately affect the growth and stability of domestic prices, or merely the government's perception of it. The state's measures reacting to inflationary pressures or threats of it can trigger actions and policies that affect all financial intermediaries independently of ownership and purpose. In other words, tight monetary policies deployed to fight off inflation may affect financial institutions indiscriminately and independently of which type of entities are responsible for being too aggressive in their credit expansion. Now is the turn to examine the actual situation of industrial credit in the mid-twentieth century.

2Credit to industry: the voice of the sectorThe ANDI (National Association of Industrialists) was the largest and most important association of the sector. Its membership, a mixture of individuals, associations and firms stood at 540 by 1963 and reached 600 in 1967 (Schneider, 2004, p. 270). At first, representing large textile, beer, cement, tobacco, food and beverage producers from the Antioquia region, it gradually became more encompassing and geographically diverse to include entrepreneurship from Bogota, Cali and Barranquilla (Schneider, 2004, pp. 139–45). By some accounts ANDI is said to have represented between 65% and 90% of industrial output, others put estimations significantly lower (Osterling, 1989, p. 209). Regardless of the exact figures it is well accepted that ANDI was the chief organisation of the country's industrial interests5 (especially of large size manufacturers), and therefore the concerns regarding their demands for industrial financing can be taken to be representative of the sector.6

Difficulties in industrial financing from the 1940s until the mid-1960s referred mainly to: first, long-term capital investment and short-term working capital needs; secondly, contractionary monetary policies; lastly, the operation of a financial system whose inadequate institutional structure made it harder to meet industry's demands. For the early 1940s there is no lasting ANDI-equivalent organisation to resort to in order to display evidence about industrial financing problems and to assess their demands. Other sources need be used. A government publication, Anales de Economía y Estadística, stressed in its 1940 editorial the first of these problems by pointing at “the insufficiency of private resources to cope with the requirements of both industry and agriculture and the central function of appropriate credit flows to these sectors, so as to meet national necessities…” (Departamento Nacional de Estadística, 1940, p. 1). A study by the International Bank for Reconstruction and Development (IBRD), carried out in 1950 by Lauchlin Currie, also highlighted capital scarcity as a barrier to industrial development. Currie stated: “It is very likely that difficulties in mobilising capital funds has more than retarded initiatives in new [industrial] sectors” (Currie, 1951, p. 143). These timely perceptions of government officials and outsiders at the time coincide with the wider views of the secondary literature. Chu sustains that: “the real value of commercial bank loans to the private sector remained depressed throughout the period 1930–1945, and loans to industry seemed to conform to this general pattern. Moreover, the marginal share of industrial loans was relatively stable” (Chu, 1983, p. 118). Urdinola explains that the closure of private mortgage banks in the 1930s in addition to the non-operative scheme of credit directed to industry by the BCH “had brought industry to the point of asphyxiation owing to the lack of working capital” (1976, p. 470). For the 1950s the evidence came directly form industrialists themselves.

Long-term capital funding however was not the only type of financial difficulty faced by industry in the late 1940s and following years. ANDI's Assembly in 1951 reported a list of the factors affecting the sector and among them short-term credit seemed to top their concerns. Their weekly bulletin stated: “purchase of equipment and raw materials, delays in the absorption of new products, and above all and with worrying justification, the scarcity of working capital, is one of the most salient deficiencies in our economic organisation.”7 A few months later the association stressed the combination of both working and fixed capital requirements of industry and the insufficient supply of resources from the banks for these purposes, resulting in a concomitantly tight financial position of the productive enterprises it represented.8 Similar statements regarding industry's financial shortages and demands from the sector and the association directed at government and the CB to act upon them are regularly found in the minutes of CB, the minutes of ANDI's annual assemblies, and its internal weekly, all reporting on the credit shortages that industrialists from different regions, such as Santander,9 and industrial cities like Bogota, Medellin, Cali and Manizales suffered throughout the 1950s and early 1960s.10 The severity and unremitting shortage of industrial credit of the 1950s led ANDI's president to address a letter to the president of the Republic, Alberto Lleras – and his cabinet ministers – which, if well dramatised the situation also signalled the significance of the issue for contemporary manufacturers.11

Short-term financing was identified as a barrier to domestic investment in industry and was closely linked to the underutilisation of plant capacity. A 1959 study by the Centre for Economic Development from the University of the Andes found that in a sample of incorporated companies, restrictions of credit, in relation to their increasing working capital needs, were a problem for 29.6% of manufacturing firms (Wiesner, 1959,p. 1066). That study also found that lack of medium- and long-term credit was a problem for 25.6% of firms. A larger study carried out two years later revealed that 187 firms declared financing difficulties amongst the causes that explained plant underutilisation. Of these, some 73 companies mentioned working-capital credit as the only cause (Thoumi, 1978,pp. 37–38).

Industrialists were quick to identify the barriers preventing them to obtain the necessary financial resources they needed. These obstacles can be classified into two: government's search for macro-economic stability and the persistence of an inadequate financial-institutional framework. On the first issue, stability meant controlling the growth level of general prices. This often implied reining in the expansion of credit of the banks. A neat illustration of this situation is found in the above-cited letter of the ANDI to president Lleras: “Firms in financial distress are finding it ever more difficult to obtain funding due the harsh restrictions imposed on the lending capacities of banks in order to compensate for the growth in the means of payment generated by Banco de la República…”12 ANDI was not altogether indifferent to the stability of prices: “Industry recognises the government's efforts to ensure monetary stability and observes favourably the healthy expansion of credit…[] nevertheless, regarding manufacturing credit, it consider[ed] necessary a more generous flows in accordance with the growth of production and the financial requirements of development projects…”13 It also suggested to shift the burden of the squeeze more evenly, i.e. away from private commercial banks and into more specialised and possibly state-run development institutions. In this respect, at the 1958 Annual Assembly, ANDI issued the following statement: “considering the critical circumstances that have led to the current regime of restrictive credit…[ANDI] declares it essential to adopt measures aimed at a more uniformly distribution of the anti-inflationary controls, without these focusing uniquely and exclusively on the banking system.”14 Indeed, the CB was fully aware of the economic sectors that felt more the contraction of credit: “due to the curtailment of the means of payment, loans to finance manufacturers and merchants have reduced, at times when they must pay income taxes, advance sums for a priori import deposits, and sustain the movement of business in general.”15 Despite the fact that industrialists’ concern about credit being restricted due to monetary stability was not a permanent issue, it seemed to be one occasionally aggravating an already difficult situation.

On the second issue, awareness of the institutional shortfalls of the financial system in its ability to supply industry with the financial resources deemed essential for its growth and development came at early dates and are well documented. The fundamental concern lay in the lack of long-term credit for capital investments. Currie's analysis of the 1940s noticed the small contribution of commercial banks in this field and recommended the creation of an entity entrusted with supplying industrial credit (Perry, 1974, pp. 293, 311). He was not alone. The CB's board received requests from ANDI in 1947 and 1951 asking it to take actions to alleviate the problems of the sector regarding long-term borrowing. Specifically, ANDI appealed to the CB to act as guarantor of industrial companies taking on loans with the IBRD,16 and also asked for its support towards the creation of a financial corporation designed to fund investments geared to improve production capabilities.17 Petitions did not stop there. ANDI pleaded to promote the development of a larger capital market to facilitate the placement of industrial bonds and shares,18 to intensify credit to small industrialists through the Agrarian Bank, and to expand the issuing capacity of BCH's industrial debentures.19 The poor service that the Agrarian Bank provided to industrialists was perceived early on by government. A draft of the 1940 General Plan of Eduardo Santos stated: “Despite the full title of this entity, namely, Agrarian, Industrial & Mining Bank, and notwithstanding the creation of industrial bonds… credit for industrialists is poorly developed compared to that for agriculturalists.”20 The manufacturers’ association continued to demand the founding and operation of development banks throughout the 1950s,21 to increase the paid capital of IFI,22 and to arrange the setting up of mutual investment funds.23

ANDI was not alone in recognising the problem of long-term financing. An early yet comprehensive assessment of this issue was provided by Antonio Ordoñez Ceballos, fiscal auditor, who in 1947 sustained that the industrial loans from the Agrarian Bank were “practically stagnant”, that medium-sized firms, whose legal form was other than limited-liability, had been “abandoned from state tutelage” and that the industrial bonds issued by the BCH were “paralysed”.24 His successor echoed these views, declaring that the medium- and long-term credit for industry was practically non-existent and that this was especially problematic for small- and medium-sized firms.25 Similarly, a prominent Liberal politician and banker, Augusto Espinosa Valderrama, noted in 1948 that the current arrangements for industrial financing of 90-day loans were not suitable for investment purposes and advocated for the reform of the banking system.26 A consultative body, the Committee for Economic Development (Comité de Desarrollo Económico, 1951), put numbers to the investment deficit of the sector, claiming in its 1951 Final Report that the unsatisfied, long-term capital investments of industrial firms stood between 25 and 30 million pesos per year and that recent government measures to alleviate this situation had been ineffective.27 The development economist, then consultant for the government, Albert Hirschman, put it bluntly in 1955: “The most serious gap in the Colombian financial structure remains the lack of a sufficiently ample capital market to provide funds for industrial expansion.” (Hirschman, 1955, pp. 33–34). But the problem seemed to have been a protracted one. As late as 1966, a survey conducted by the National Planning Department showed that 51% of firms flagged the availability of domestic credit as a major problem in carrying out expansion plans (Billsborrow, 1977, p. 703). Alas, for industrialists, according to Poveda, the solution for the development of the sector came largely from non-institutionalised sources of financing, the curb market, and as expected, at high costs (Poveda, 1965, p. 15). Various solutions to the problem of long-term financing for investment were thought of at the time, however.

The Committee for Economic Development (Comité de Desarrollo Económico, 1951) suggested that to support industrial expansion, the creation of a credit institution with access to foreign funds was required.28 The organisation succeeding this committee, the National Planning Council, led the way for slightly more concrete actions, proposing in 1953 the “foundation of a financial institution, the Development Corporation or Bank, with a mission to supply financial assistance in the medium- and long-term to the most attractive of private initiatives in industry and agriculture.”29 The most detailed of schemes, however, originated in a study commissioned jointly by the Colombian government and the IBRD to a New York-based investment bank, Glore, Forgan & Co. Alfonso Manero, partner and author of the report concluded in his recommendations: “A Financial Society should be established to fund new or existing industrial firms with long-term financing… whose capital may be subscribed by commercial banks, insurance companies, private savings institutions and wherever possible with securities from private individuals and industrial companies. If necessary, government could supply 20 million pesos from the treasury… to manage total initial resources ranging from 50 to 70 million…”30 This proposal, however, failed to materialise.

But one idea that became law was that of Finance Minister Luis Morales. Morales, who had founded the Banco Popular in 1950, left the management of that bank to join Rojas Pinilla's cabinet in 1956, and in his new position he drafted the project that later became Decrees 3141 of 1956 and 739 of 1957, by which the National Production Corporation was created and its statutes conceived.31 The entity's authorised capital were a stunning 500 million pesos, to be subscribed by government and private sector for the development of basic industries, preferably, steel, metallurgy, textiles, sugar, oil and derivatives, electrical equipment, coal, drugs, and pulp and paper amongst others.32 Notwithstanding legal status, it did not materialise either. According to his creator, “the Corporation was killed off by political circumstance, neither the National Front nor Álvarez Restrepo [succeeding minister] showed interest in it.”33

The purpose of this section has been threefold. First, to present primary-based historical evidence to demonstrate, from the standpoint of industry, that industrial credit constituted a permanent source of preoccupation for the sector, since the resources made available to it were deemed insufficient to satisfy industrial demand. Secondly, to note the importance of the implications of these credit constraints. Shortages of credit to finance working capital affected negatively, according to manufacturers themselves, levels of industrial capacity utilisation. Difficulties in obtaining long-term capital could have hindered the development of new industrial sectors and the expansion of industrial capacity. Lastly, raising the question of the perception of industrialists on the institutional suitability of the financial system serves as a sound introduction to the next section.

3The institutional financial frameworkWhether financial systems should be market- or bank-based has been the subject of great debate in finance literature. The critical disagreements are over the respective effects that one system or the other had on economic growth. Advocates of bank-based systems stress information advantages, superior capital mobilisation for exploitation of scale economies and more effective debt repayments; whilst supporters of market-based systems highlight risk management facilities and the betterment of corporate governance amongst other merits.34 Levine settled the matter demonstrating that the most robust links to economic growth came from overall financial development, irrespective of its organisation or structure. Though this may suffice for a certain part of the literature it opens up another debate in political economy and development policy.

This is because financial system structures are critical determinants of the abilities states possess (or lack) to effect selective industrial policy. Zysman distinguishes three models of finance: first, capital market-based, in which bonds and stocks dominate long-term industrial funding, with central banks committed to controlling monetary aggregates and where prices are determined freely by competitive markets and financial are resources allocated accordingly. Secondly, credit-based models, in which few financial institutions dominate the system without being themselves dependent on the state, with market power translating directly into influence on clients, and where prices are also heavily influenced by these institutions. Lastly, government-administered credit-based ones, in which governments fix prices in several markets, leading to demand-supply disequilibria where financial resources are allocated through administrative discretion (1983). Each model entails distinctive political implications. In the first model, governments, banks and firms are in distinct spheres and meet as autonomous bargaining partners, concomitantly, the capacity of the state to direct financial flows is limited. In the second model, though governments lack the apparatus to dictate the direction of flows, they can build up alliances with the dominant financial institutions and negotiate the terms/recipients of lending, while in the third the distinctions between public and private spheres blurred: “the state's entanglement with industry becomes part and parcel of the financial system.” (1983, pp. 69–75). The key point, therefore, is that the structure of a financial system defines different ranges of state capacities, it endows or deprives the state of the capacity to intervene in credit markets, and in doing so, it also builds or denies states political capacity. Though Zysman's study deals with advanced economies his insights apply to late-developers. In fact, Woo has done just that, and pushing the argument further. She argues: “… financial structure can be used to test state efficacy because it is the overarching mechanism guiding the flow of savings and investment, delimiting the options of industrial policy… it is this that makes all states potentially ‘developmental’, whether they exist in Europe, Latin America or East Asia.” (Woo, 1991, p. 6). The need, then, to characterise and place the Colombian financial system in the above framework is apparent.

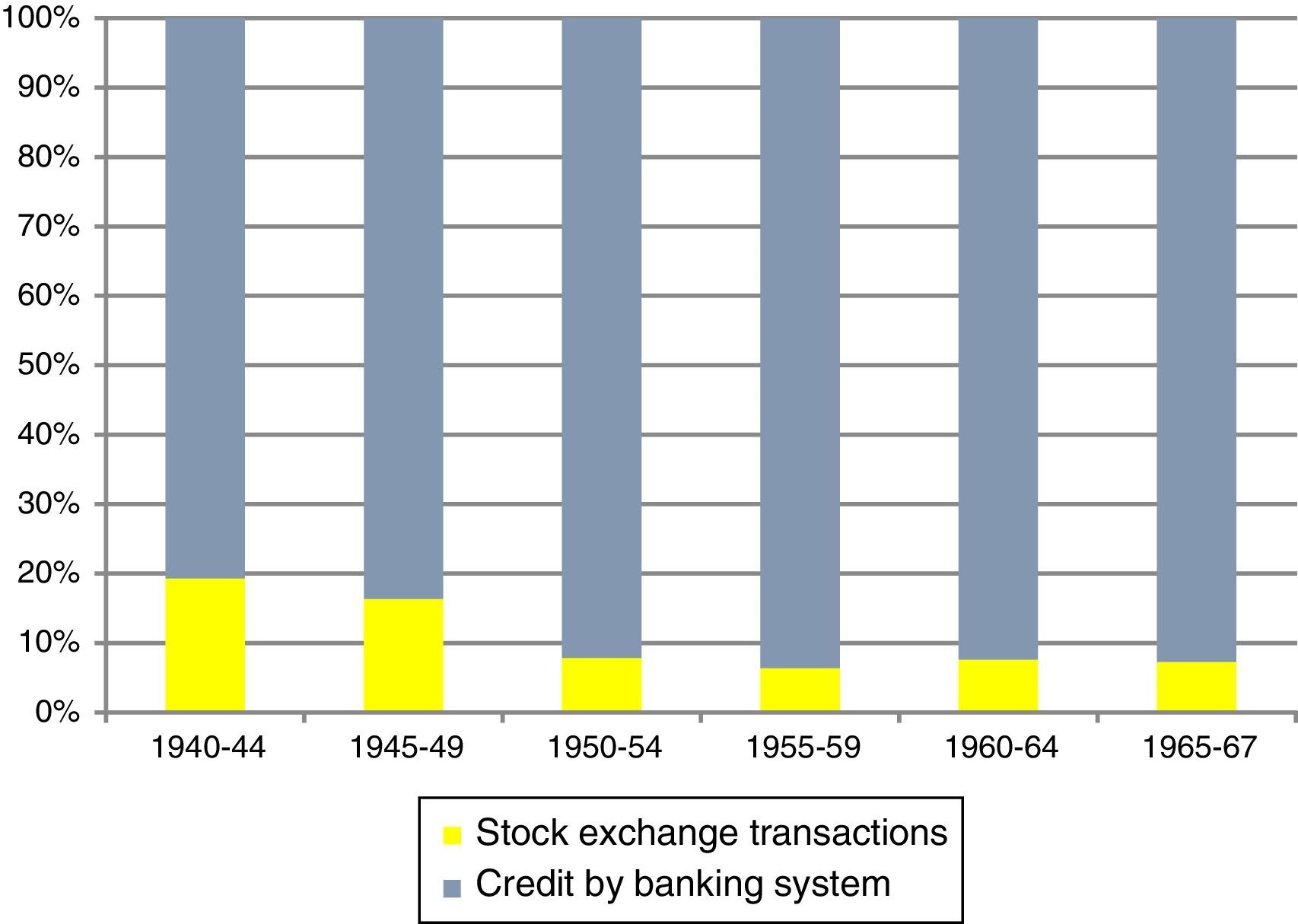

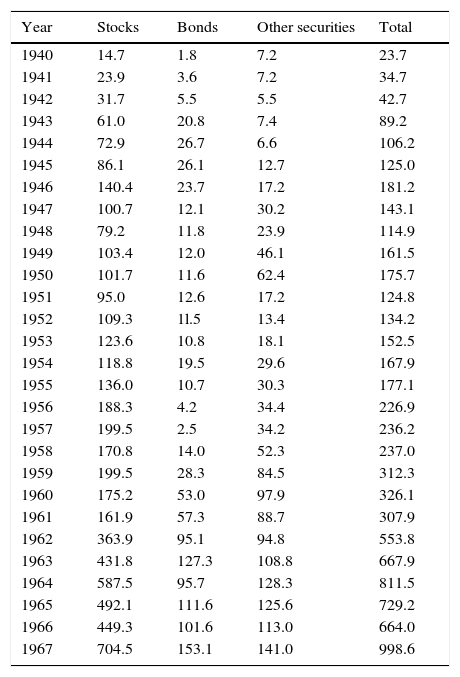

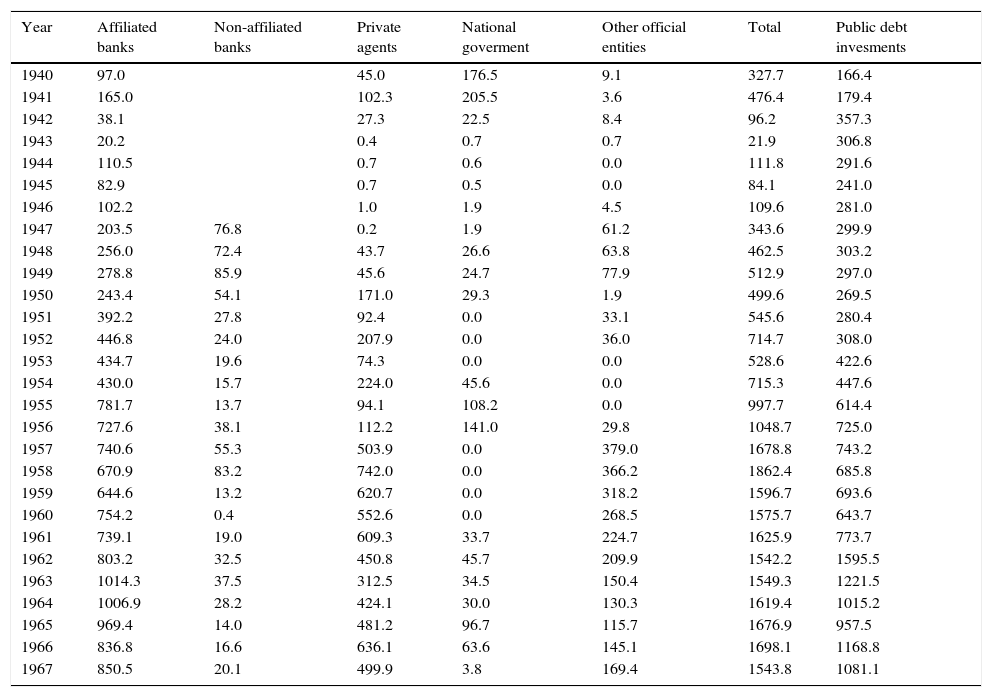

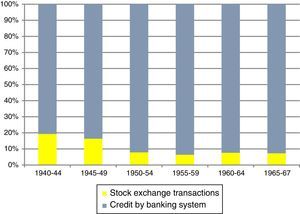

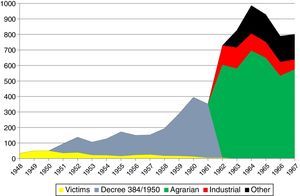

As seen from Fig. 1, throughout the period the financial system was credit-based. From 1940 to 1961 only Bogota had a stock exchange, then Medellin, an industrial centre, opened another. Relative to banking, credit exchange transactions peaked during WWII thanks to a combined hike in government bonds, which quadrupled between 1942 and 1943 and the more sustained increase in stock issuances of private companies.35 The decade-long decline that ensued is partly explained, according to Manero (1952), by inflationary pressures that put investors off fixed-income securities, and more probably, by the return of economic normality and the preferences for real estate investments in expanding cities and in land and farms in the countryside.36 Rapid growth in the financial assets of private banks also played a role. Relative stagnation during the 1950s and 1960s is said to have been the result of ‘double-taxation’ introduced by the government of Rojas, by which profits as well as shareholders’ dividends were subjected to taxation (Sáenz Rovner, 2002, p. 144). Government policies aimed at directing credit to targeted sectors, have been another oft-cited factor to account for the underdevelopment of the country's capital markets (Urdinola, 1976, p. 465). Finally, it is worth noting that within these modest markets, concentration amongst a handful of companies was high. For instance, in 1951, Bavaria and Coltejer accounted for two thirds of all the volume of stocks traded; and out of 17 bond emissions carried out 13 corresponded to government securities and only two were industry issuances – the other two obligations emitted by the Country Club of Bogota.37

Financial system structure: credit-based, 1940–1967 (5-year averages).

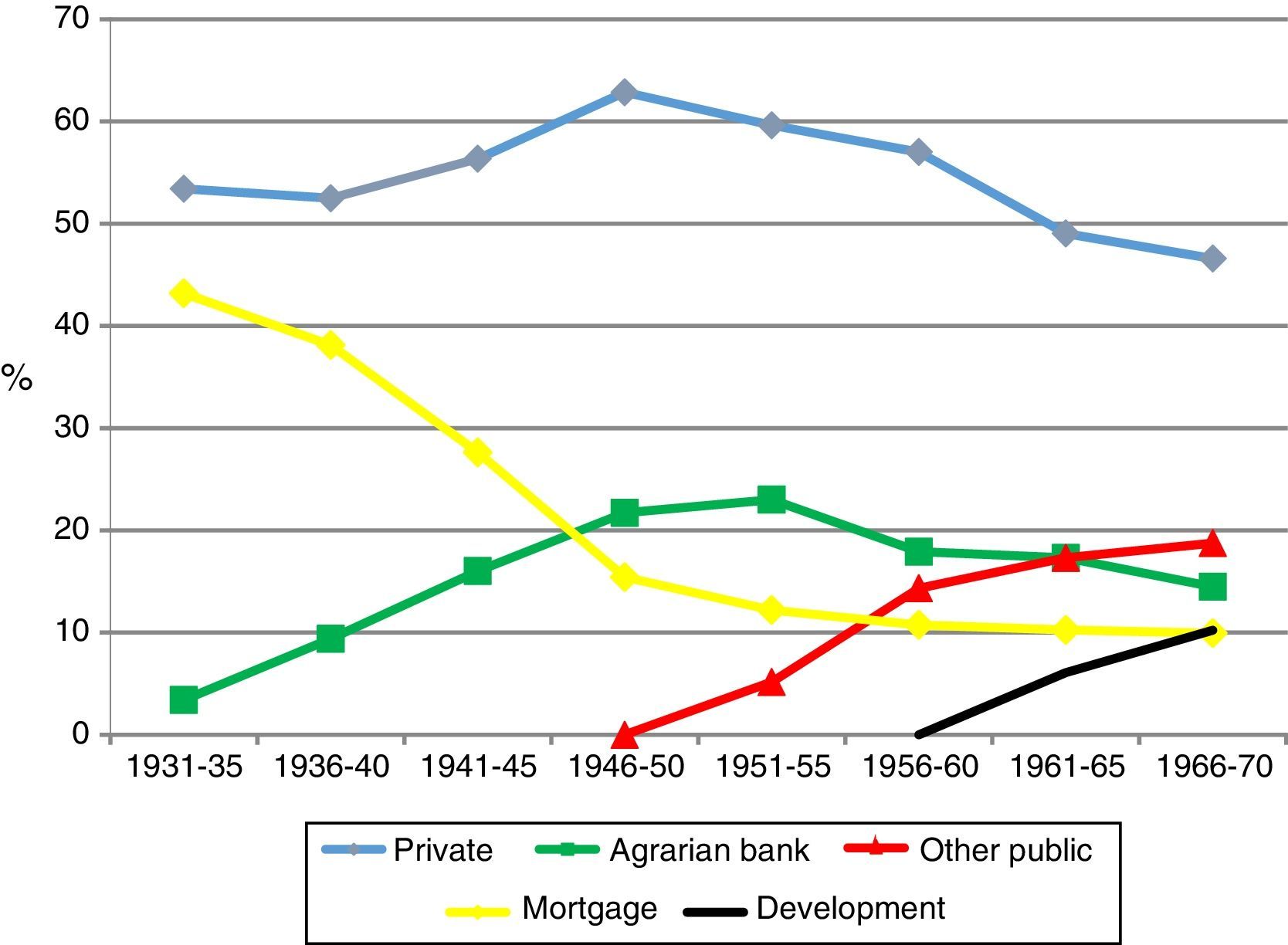

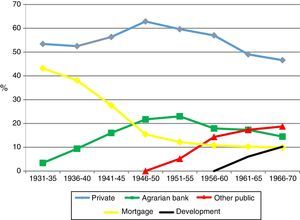

The credit-based financial system was not static, however. Two aspects are central in accounting for the transformations of the financial structure and how these influenced industrial credit availability: the rise and decline of different types of financial institutions and a long sequence of legal dispositions affecting the terms, conditions, and balance sheets of both public and private commercial lending entities. These institutional changes in the financial system dating from the 1930s determined, to a significant extent, the patterns of industrial credit. On the first aspect, as illustrated in Fig. 2, the most important shift at the organisational level during the 1930s and 1940s was the collapse of private mortgage banks, whose share of assets in the total of the financial system reduced by a factor of three from 45% in 1931 to 15% in the mid-1940s. This was the result of the Great Depression, which on the one hand had cut the sources of foreign credit – on which mortgage banks relied heavily; and on the other, worsened the capacities of payment of mortgage debtors, which in turn translated into ever-growing levels of bad debts in these banks’ portfolios (Muñoz and Bolívar, 2002, pp. 81–84; Urdinola, 1976, pp. 466–70). To compensate for the losses made by these institutions, Olaya Herrera's government reacted with legislation creating new official agencies: the Agrarian Bank in 1931, and the BCH, a year later. Both became important agents in the financial structure, the first one turning into the single largest provider of finance to agriculturalists, saw its share of assets rise from zero in 1931 to more than 20% by the late 1940s. Meanwhile, BCH became one of the largest players in the mortgage sector; supplying resources mainly to construction and agriculture, the joint assets of mortgage banks fluctuated moderately from 1940 onwards around 11% of the total of the financial sector. In stark contrast to what occurred with the mortgage sector, private commercial banks suffered moderately during the crisis and recovered swiftly during the 1940s to become the dominant agents in the financial business representing over 60% of all assets.

Credit-based financial system by types of banks (percentage of total assets).

This wave of institutional rearrangements left industry a net loser. Private commercial banks whose mortgage sections had been supplying medium and long-term capital to manufacturers stopped this line of business because of legislation that made this a privilege of mortgage banks. Agrarian Bank's rise served well the short-term needs of coffee growers, cattle farmers and other agriculturalists. Mortgage banks, as said above, satisfied the requirements of construction and agriculture, specialising on gradual amortisations. Requests from commerce, mainly of short-term nature, were well catered-for by the private banks. Industrialists’ short-term loans were supplied by commercial banks but no lending institution catered for their medium- and long-term needs. In the words of Urdinola: “industry was orphan” (Urdinola, 1976, p. 468). For industrialists this situation did not change for the better in the 1950s.

A second round of institutional innovations in the early and mid-1950s marked decisively the growing pattern of sector-orientated credit initiated in the previous decade. The lead was, again, taken by the state through the creation of the so-called bancos gremiales: sector-targeted institutions with promotional purposes. This trend towards ‘developmental’ banking started in 1950 with the foundation of the Popular Bank, aimed at advancing the twin-goals of credit democratisation and support of small urban artisans (Muñoz and Bolívar, 2002, pp. 112–13). Three years later, another intermediary arrived with the creation of the Coffee Bank, designed to finance the production, transportation, and exporting of coffee and other agricultural products (Franco, 1966, p. 206). In 1956 the turn was for the Livestock Bank to serve the needs of that sector. The promotional nature of these institutions meant they frequently enjoyed various types of privileged treatment, be it access to CB's funding without being a shareholder, preferential rediscounting facilities, relaxation of reserve requirements, and/or lower interest rates (Muñoz & Bolívar, 2002, p. 112).

Despite vocal opposition from private bankers against ‘unfair’ public competition the new banks had come to stay.38 As Fig. 2 shows, in relative terms, public banks’ assets grew in sustained manner and by the end of the 1960s accounted for about a fifth of the total assets of the financial system. Whether the rise of these banks reflected of the power of coffee growers, agriculturalists and cattle farmers and their ability to capture rents or whether it was a more state-led initiative is unclear. 39 Official documents, such as the Memorias de Hacienda, suggest that at least there was a confluence of interests and offer insights into the process dynamics. On the one hand, Finance Minister, Carlos Villaveces, announced in 1954 (Ministerio de Hacienda, 1954) that government intended to continue the strengthening of credit institutions facilitating resources for the expansion of both agriculture and cattle farming.40 On the other, he acknowledged “that on several occasions distinguished cattle ranchers and cattle-raising assemblies had requested from the government the establishment of a bank that met their needs and that government pay due attention to these recurring demands which had stipulated the formation of the Livestock Bank”.41 Luis Morales, who succeeded Villaveces in the ministry, recalls the creation of the Livestock Bank emerging from a conversation sustained with President Rojas in the context of the II International Fair of Bogota, in which the former proposed the idea to Rojas, knowing all too well about the General's “certain inclinations for cattle-ranching”.42 The president is said to have thought of it as “excellent” and prompted Morales to consult the president of that association to materialise it. At first, the Livestock Bank's management was entrusted to the Popular Bank, but in 1959 was re-fashioned as an autonomous incorporated company. The foundation of two public banks in addition to the growth of the Popular Bank and the relative stagnation of the Agrarian Bank, all during the Rojas’ administration suggest the consideration of a hypothesis: whether the financial rearrangements carried out under Rojas were conceived of to build new constituencies or clienteles – independent of those already associated with the state prior to his government. Testing this claim is beyond the scope of this paper, but considering the facts discussed above it seems plausible.

The salient fact is that neither the first wave nor the second round of financial-institutional rearrangements that took place circa 1930s-50s favoured manufacturing with the creation of a sector-targeted institution – public, mixed or private.43 Broadly speaking, during the late 1950s coffee growers and other agriculturalists were served by the Agrarian Bank and the Coffee Bank; cattle farmers by the former and the Livestock Bank; construction by BCH; and artisans and consumers by the Popular Bank. Commerce was the natural main client of private commercial banks, but all sectors, except for construction, also competed for the resources of the remainder of the private-banks’ portfolios. To sum up, official attention was being directed at the rural sector but not manufacturing. Industry was the only economic sector lacking a bank of its own and industrialists had to compete with all other sectors for a residual share of the credit that commercial banks could supply. This situation seemed to change in the next decade with the creation of the corporaciones financieras or development banks, however.

Legal regulations authorising the formation of a new kind of financial intermediaries, the development banks long-awaited by the industry, came in 1957. These were designed to promote through medium- and long-term credit facilities the creation and expansion of manufacturing industries, preferably, but not exclusively (Urdinola, 1976, pp. 473–74). However, a proper statutory framework defining their modus operandi was only streamlined in 1960. Further, great difficulties in raising funds via deposits from the public and unsuccessful placements of bonds in the capital markets made them largely inoperative until the CB started to provide them with growing resources in the early 1960s, as it opened lines of credit for them and began buying their bonds (Muñoz and Bolívar, 2002, pp. 120–32; Urdinola, 1976, p. 474). Only when development banks enjoyed the full support of the CB was their importance as both direct investor and creditor of industry realised fully. Sustained growth in their assets from the mid-1960s turned them into an important type of institution in the financial system, but it is necessary to note that the timing of this take-off of development banks meant manufacturing was the last economic sector to find a specialised type of financial intermediary that supplied it with resources it needed, especially for medium- and long-term investment purposes.

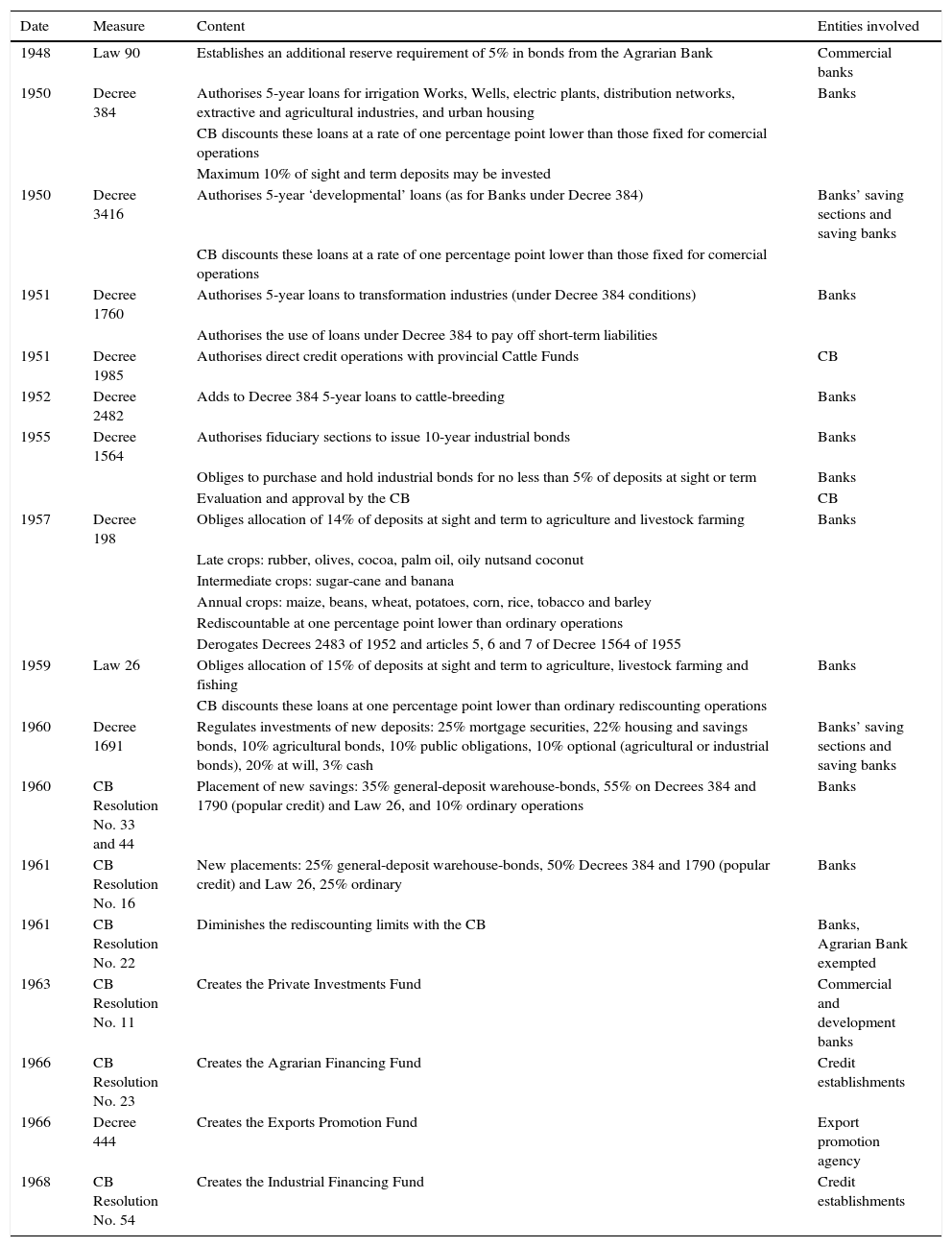

The second aspect in the transformation of the financial structure was that relating to the laws, decrees, and resolutions from the legislature, the executive, and the CB that incentivised, and/or imposed measures on, the financial agents to allocate a portion of their resources to economic sectors prioritised by government. It has become a commonplace in the literature to depict the 1940s as the prelude that lay the basis for the repressed financial system that emerged in the 1950s and consolidated in the next decade. That is, a banking system in which government affected financial intermediaries’ balance sheets directly through legislation that obliged them to invest in, and lend to, economic sectors deemed to be a priority. Or one in which the government influenced them indirectly via access to rediscount, attractive rediscounting conditions, and/or the manipulation of banks’ reserve requirements. The literature has rightly described the period as one of ‘centralised’ (Avella & Kalmanovitz, 1998, pp. 21–30), ‘directed’ (Urdinola, 1976, p. 465), or ‘selective’ (Salazar, 1996, p. 86) promotional credit, but has failed in identifying industry as one of the main sectors supposedly benefiting from it. For instance, Fajardo and Rodríguez, argue that: “obviously, banking and credit policies were part of the strategy of import substitution industrialisation…[] as this required a consequential financial effort, and one in which the Central Bank was essential” (Fajardo & Rodríguez, 1980, p. 30) For their part, Avella and Kalmanovitz, state: “the reform of 1950 signalled the turn towards a more active monetary policy, one of direct promotion of industry and agriculture” (Avella & Kalmanovitz, 1998, p. 2). Lastly, Urdinola claims that “the truth behind the surge in the new monetary theory [promotional credit] was that productive sectors, mainly industry, wanted cheap medium- and long-term credi7” (Urdinola, 1976, p. 471). But did the legislative and executive decrees of the 1950s and early 1960s actually prioritise credit to industry? Did industrialists really become recipients of subsidised credit? A closer look at the most important decrees, often cited to support the above claims reveals this was simply not the case; at least not until 1967.

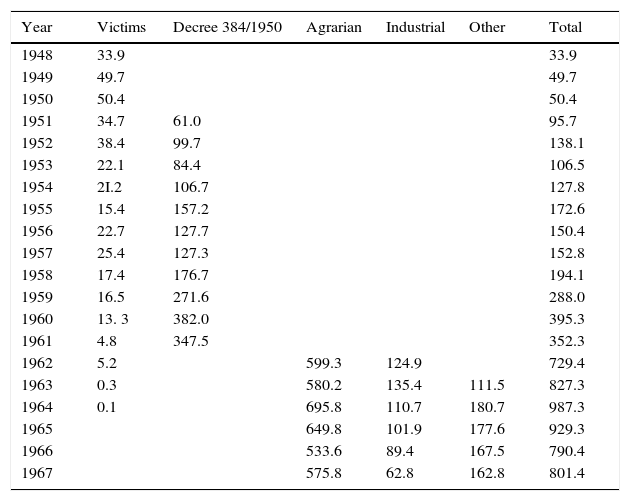

Pro-ISI or developmentalist policies in the financial field are often said to have started with legislation that in 1950 authorised private commercial banks to lend for developmental purposes for periods of over one year, thus eliminating the ‘self-liquidating principle’ – a practice that tied terms of deposits to those of loans to guarantee the liquidity of the system – which had regulated the way banks had organised their lending terms since 1923 (Avella & Caballero, 1994, p. 125). Decree 384 of 1950 also served to mark the beginning of an era of legislation that “classified as productive certain economic activities and made credit available to these sectors rediscountable at preferential interest rates” (Hernández, 1976, p. 325). For industry, however, the decree was not as beneficial as has been suggested.

First, and as seen in Table A.2, Decree 384 of 1950 did not single out manufacturing as recipient. Agribusinesses were listed along with irrigation works, deep wells and other similar works for water provision, electrical pants, distribution networks, extractive industries and urban construction – types of investment closely linked to “balanced growth” theories. Other transformative industries only came to be added 18 months later.44 Secondly, industrialists regarded the measure as being largely unsuccessful. ANDI's IX Assembly issued the following statement in April 1952: “Government's sanction concerning medium- and long-term credit at the hands of commercial banks has been insufficient, not only because of its theoretical quantities, but also because some banks did not make the measure effective…”45 The reason why bankers did so was simple, as the Finance Minister explained the scope of decrees 384 and 3416 of 1950 to the board of directors of the CB: “the measure[s] are purely discretionary, thus do not oblige saving sections or banks to make those investments nor to concede the developmental loans referred to in the decree…46 To repeat, banks did not make the measure fully effective because they did not have to. Thirdly, the regulation of the decree that came in 1952 (see Table A.2, Decree 2482) rendered the potentially favourable effects it had on industrialists ineffective. On the one hand, its bylaws included cattle farmers in the list of economic sectors benefiting from the decree – a sector also granted with direct access to CB funds in the same year – consequently reducing the relative share of the promotional loans of all other groups, industry included; and on the other, the provision that allowed for transformation industries to obtain credit to pay off immediate liabilities was abolished.

If there ever was a piece of legislation that forced banks to lend specifically and exclusively to industry it was the Decree 1564 of 1955 (see Table A.2). The decree authorised the fiduciary sections of commercial banks to issue industrial bonds with maturation of up to 5 years and most crucially obliged the banks to buy and hold the bonds in proportion of 5% of their deposits at sight or at term. The literature rightly portrays this measure as the first law by which banks were obliged to allocate a certain percentage of their deposits to an economic activity previously determined by government (Fajardo & Rodríguez, 1980, p. 31; Muñoz and Bolívar, 2002, pp. 118–19; Salazar, 1996, p. 82; Urdinola, 1976, p. 472). In a way, this signalled, in addition to initiatives put in place to incentivise banks to lend to certain sectors, the arrival of measures that forced financial intermediaries to lend to government-targeted activities. However, the literature has exaggerated the impact of this decree upon industrial financing for three reasons. First, the measure was short-lived. Passed in June 1955 and derogated by August 1957 it had a lifetime of about two years only. This rather important fact has not been noticed by the same authors that flag it as a landmark in the history of industrial credit nor for those stressing it as the emergence of forced-investment practices in the financial system. Secondly, the quantities involved were relatively small compared to measures that followed for other targeted sectors. Unlike the measure of 1955 that forced banks to allocate 5% of either their term or at sight deposits to industry, Decree 198 of 1957 obliged banks to dedicate 14% of both at sight and term liabilities to cattle farming and agriculture. Law 26 of 1959 increased this requirement by another percentage point making it three times as large as that made for industry and including both and not only one type of the banks’ deposits. Thirdly, a difference between the resources made available to industry and those to agriculture was that only the latter were rediscountable in the CB and at preferential interest rates, so as to encourage banks to lend more freely to these activities. Summarising, up to 1960 – and contrary to what the conventional literature sustains, legislation tailored to meet the credit demands of industry has been scarce and short-lived. Moreover, and as will be shown below, only a small portion of it was subsidised, especially when compared to other activities, such as cattle farming and other agricultural sectors.

In addition to the employment of incentives through the mechanism of rediscount and legally grounded obligations upon banks to advance credit to certain economic agents, rulings in the early 1960s, usually made by the board of directors of the CB, were designed to determine the sectoral allocation of new deposits entering the banking system. This was the case of Resolutions No. 34 and No. 44 of 1960, by which caps to the increases in the banks’ assets were accompanied with mandatory instructions as to how these new resources should be allocated. As with other schemes, industry did not emerge a distinct winner from this: for purchases of pledge bonds 30% (mostly agricultural), to satisfy demands from Decrees 385/50, 1790/60 and Law 26/59 went 50% (all agrarian), and the remaining 20% for ordinary operations. In other words, the bulk of new deposits was channelled to financing agriculture and facilitating ‘popular credit’. Subsequent modifications of the ways banks had to allocate incoming deposits, such as those dictated by Resolutions No. 9 and 16 of 1961, did not single out or earmark new resources for industry in any kind or form until 1963.

In this context of neglect of industrial credit, however, two measures could have had mild but positive effects on manufacturers; first, the above-mentioned ‘popular credit’, and; secondly, the creation of the Private Investments Fund (FIP). Following Law 49 of 1959 and Decree 1790 of 1960, the Popular Bank and the commercial banks were authorised to advance subsidised long-term credit to co-operative societies, mutual-aid funds, industrialists, artisans, workers and employees with modest liquid assets – hence ‘popular credit’. Similarly, the FIP was a fund ascribed to the CB that channelled credit through the banking system. At first endowed with external resources, later also resorting to primary emissions, the FIP was designed to foster sectors that could strengthen the nation's balance of payments account, and since this could be attained either through the exporting of new products or via the substitution of imports, industrial firms benefited from it.47 These arrangements represent two instances in which industrialists were indirectly favoured via preferential lending conditions, but in none of these arrangements had they been explicitly targeted; this was rather an indirect result or side-effect of broader policies. Industrialists benefited amongst various other economic groups or activities. Moreover, the Fund for Agrarian Financing (FAF) created in 1966, rapidly came to dwarf in resources the FIP.48 To examine the actual patterns of credit allocation from private banks and from public institutions the evident next step is to assess the impact of the credit legislation just revised.

4The sectoral allocation of creditThis section presents different data containing sectoral allocations of credit gathered from primary sources, such as the CB's annual reports and its monthly review; reports from the private association of commercial banks, ASOBANCARIA, reports from the Agrarian Bank and the BCH and data published monthly by the banking regulatory agency. It argues that in order to measure and assess the commitment of the state towards the industrialising project, efforts at examining the share of credit – both ordinary and subsidised – that flowed to industry, the activities of all lending institutions in the financial system need to be accounted for. As will be shown, the Colombian state, contrary to what the conventional literature sustains, did not prioritise industrial credit – at least not until 1967. Priority, instead, was given to coffee growers and cattle farmers. The first calculations exhibit the sectoral allocation of credit of commercial banks.49 The next integrates the resources advanced by the state-owned Agrarian Bank and BCH. Then all other financial institutions are included. Lastly, the credit advanced directly by the CB to the private sector, bypassing the financial intermediaries completes the wider picture. Efforts at estimating the subsidies entailed in CB's operations are also provided.

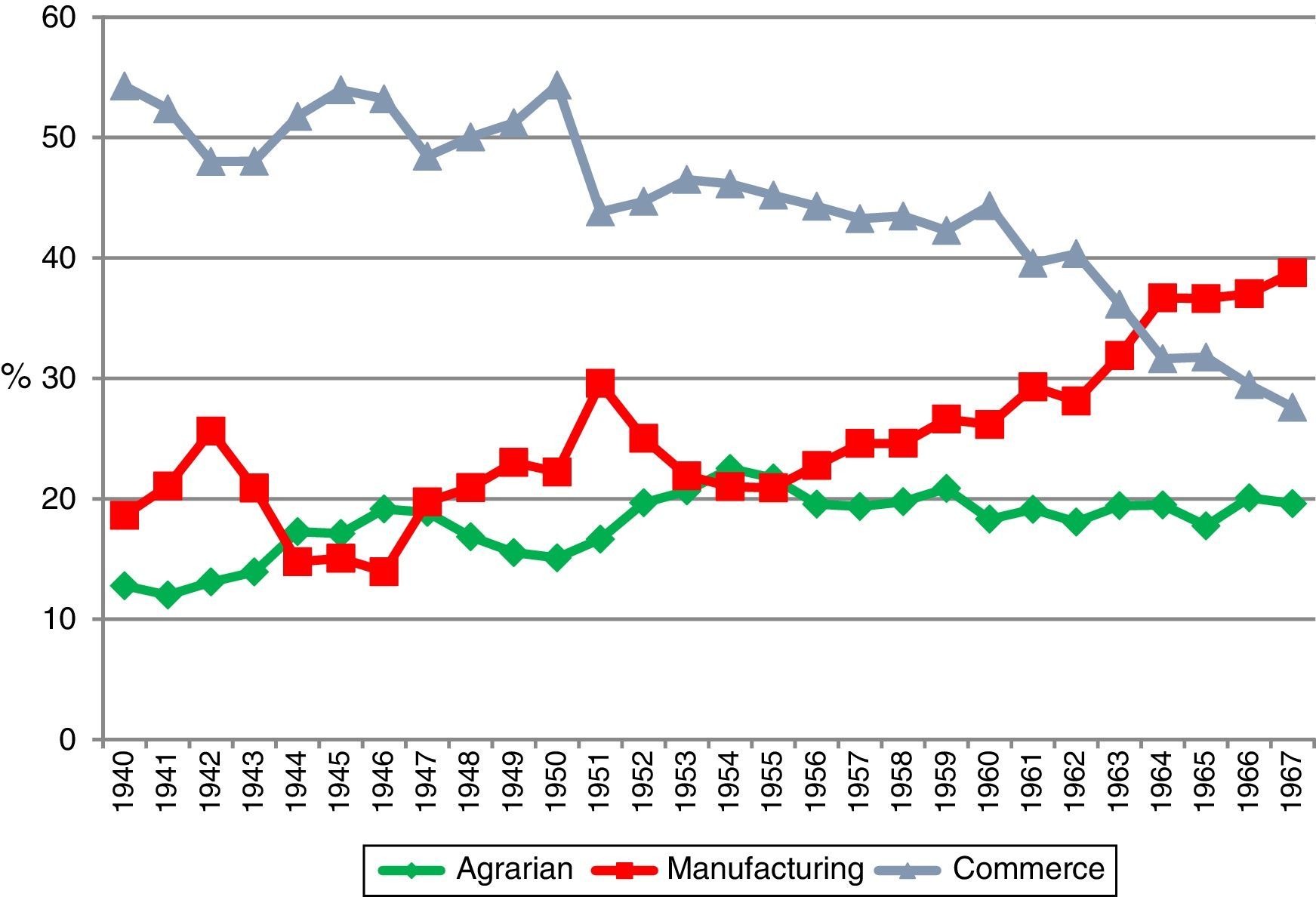

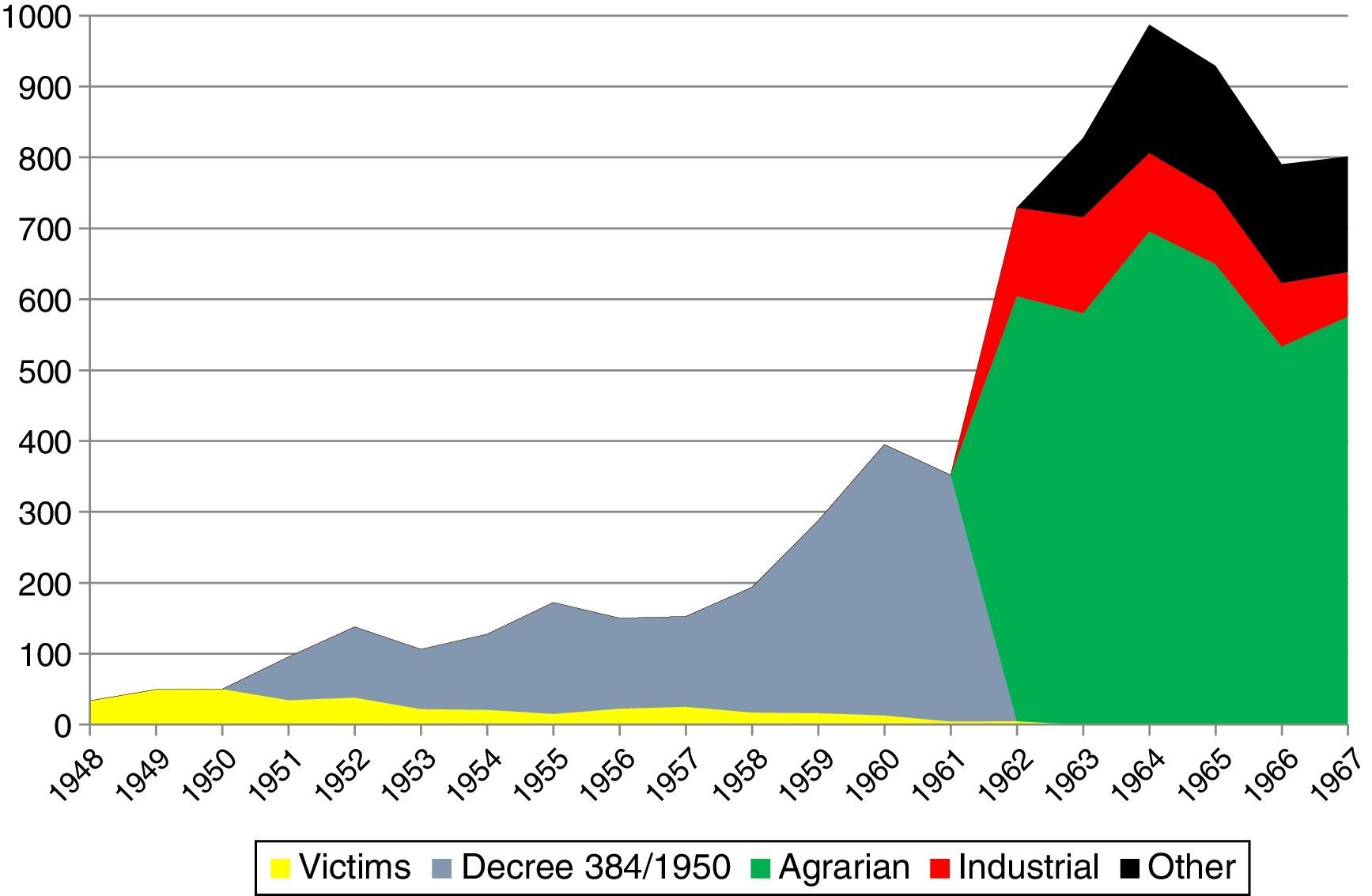

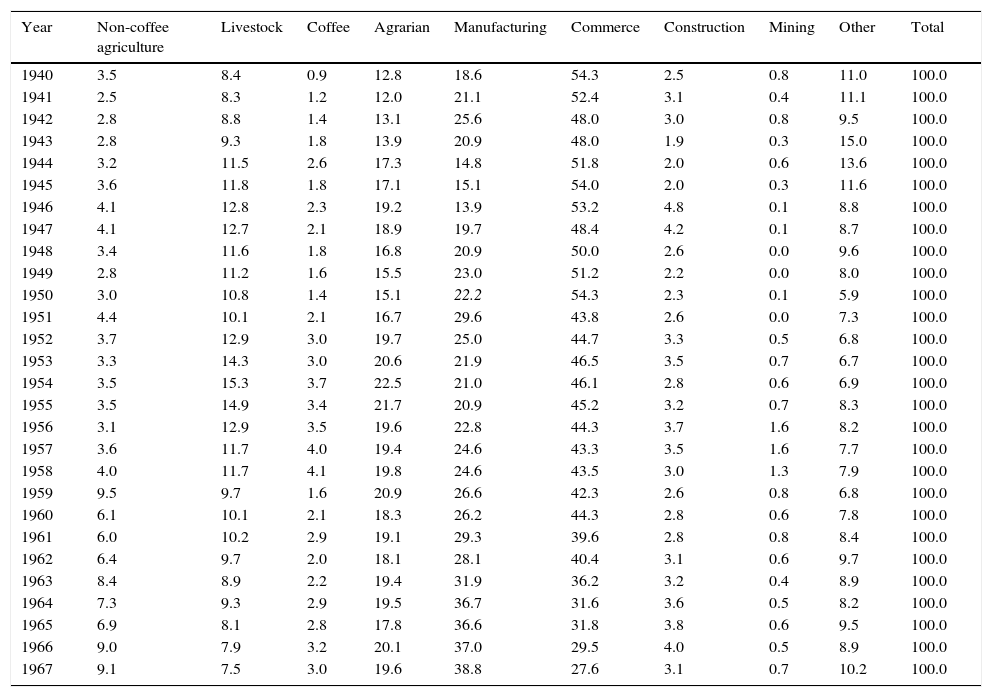

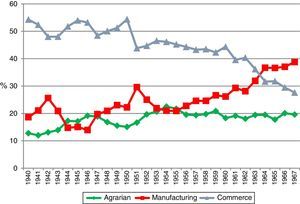

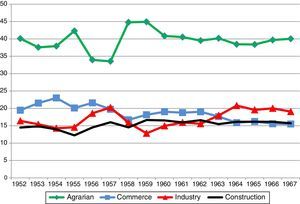

Fig. 3 exhibits a few important trends. First, commerce, which had been the leading sector in terms of shares of total credit allocation, declines markedly from more than half of the total new loans received in 1950 to less than 30% by 1967; losing its status to industry. For manufacturing the pattern is not so clear-cut at first. Its early 1940s level of 20% slumps to 13.9% in 1946 and only surpasses its 1942 peak of more than 25% in 1951 when it nears 30%. Then it drops and is overtaken by agrarian loans in 1954/55. From then on, however, industry's share grows gradually and widens the gap with agriculture decisively. Recalling the legislative acts of the previous section it is reasonable to argue that the initial impact of Decree 384 (on developmental 5-year loans) and its ensuing additions was noticeable. A drop of more than 10% is recorded in commerce and a hike of 7% occurs in industry in the following year (1951); however, industry's share then declines to its pre-decree level.

Credit allocation by commercial banks, 1940–1967 (new loans – percentages).

The agrarian sector benefits in a more lasting fashion, with an increase of more than 7% spread over 4 years and stabilises since at around 20% of total allocated loans. This rise is largely driven by new loans advanced to livestock, though coffee also adds to it. It is difficult to discern from this figure any significant and lasting effects from the 1957 and 1959 legislation favouring agriculture and livestock, other than for maintaining its share relatively constant. As for the short-lived 1955 pro-industry decree, it is plausible that it accounted for a few percentage points in the early escalation of 1956–1957; yet despite the derogation of the law, industry's share kept on rising. The key points to take from here are: that as late as 1955 it was not clear at all that private commercial banks were directing ever-growing financial resources to industry. Secondly, it is only from 1956 onward that the share of industrial credit rises steadily. However, as noted in the previous section, this was not necessarily the result of legislation prioritising the channelling of financing to the sector. Lastly, given there was no equivalent of banco gremial for industrialists – along the lines of the Coffee Bank and the Livestock Bank for coffee growers and cattle farmers; commercial banks turned out to be the main providers of financing for industry. The critical question then arises: where did the state financial effort amidst a supposed ISI or state-led industrialisation strategy go to?

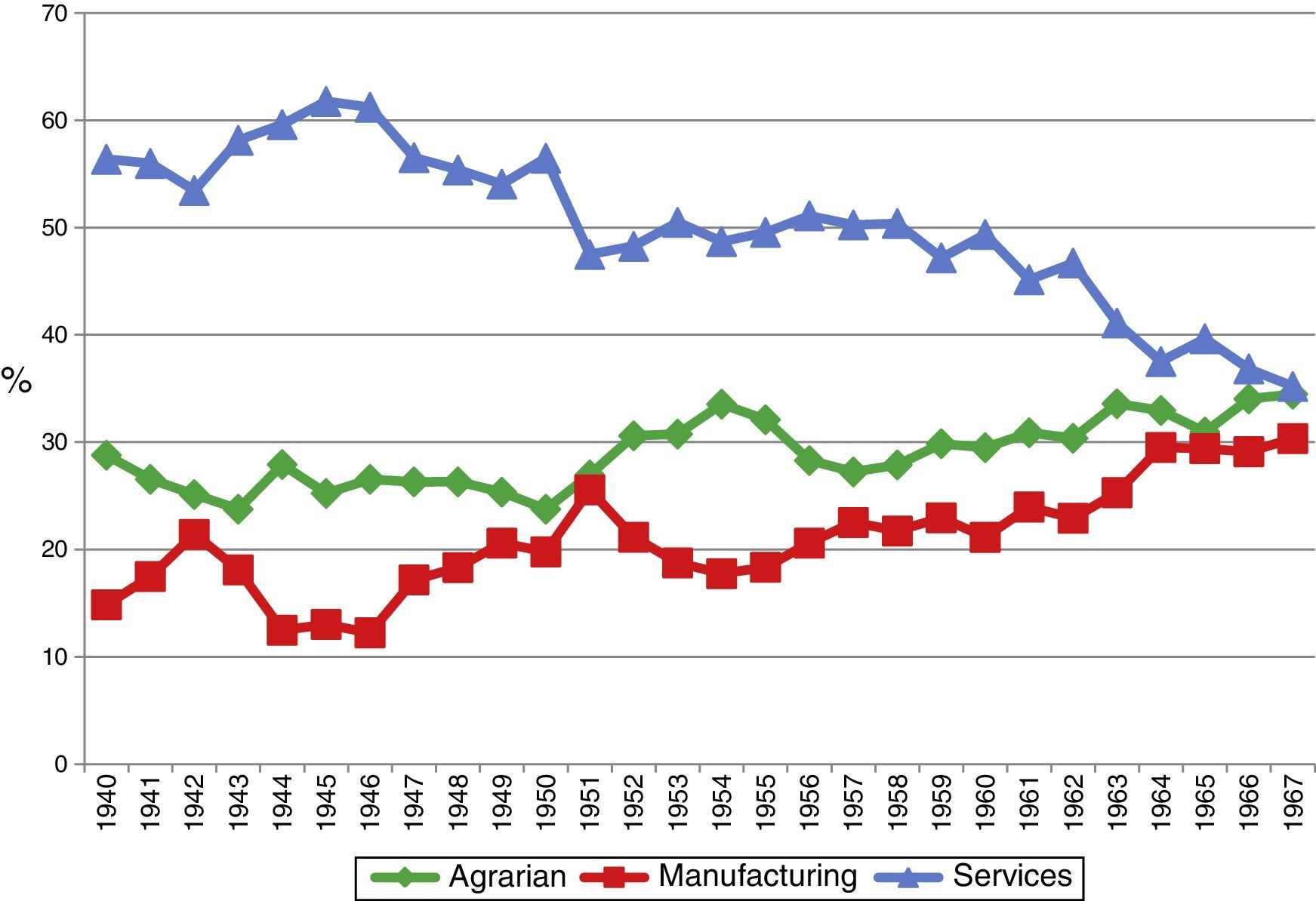

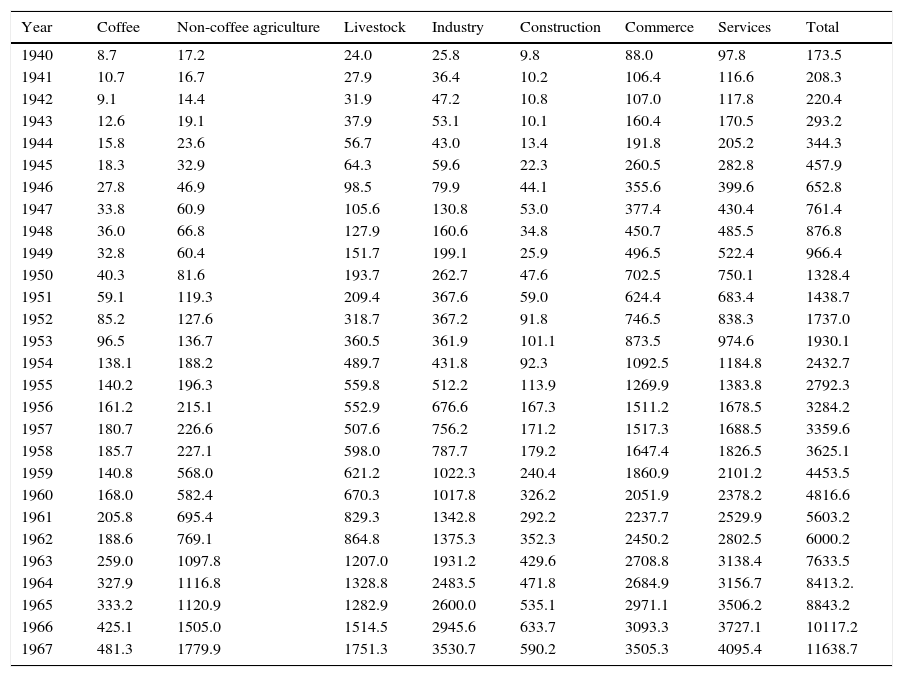

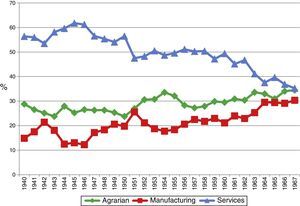

As said earlier, the financial system was by and large privately owned but since the 1930s a state-owned agency, the Agrarian Bank (full title: Agrarian, Mining & Industrial Bank), was becoming ever more important. Despite claims in its very title and mandate to serve the three sectors, this bank, for all practical purposes, lent primarily to crop growers and cattle farmers. In this respect, the official institution represented more accurately the economic interests and strategy of the state. The integration of the credit allocated by the Agrarian Bank and the BCH, which was the only entity authorised to issue industrial bonds until the early 1950s, to each economic activity alters the financial picture – when only the commercial banks are taken into account. Fig. 4 shows that the declining trend in commerce still holds, but it is now the agrarian sector which comes second opening a gap with industry of more than 10% in the mid-1950s and equalising the credit advanced to the services sector in 1967. The increase of agrarian credit from 1950 to 1955 – and consequent wedge created with industry – is explained chiefly by the joint-effects of a larger incidence of Agrarian Bank's new loans relative to commercial banks, and the drop in industrial loans facilitated by the these banks. As for industry, its share averages roughly 19% until 1955; then it catches up steadily and nearly closes the gap with agriculture and livestock, as it reaches 29% of new loans in 1964. Summarising, when the credit originated in state-owned financial institutions, such as the Agrarian Bank, is taken into account in the sectoral allocation of loans of the financial system, industrialists’ share reduces substantially and it becomes clear that it was not only far behind commerce but it also lagged behind agribusiness. It is also worth noting that there seems to be a direct inverse correlation between the industrial and agrarian credit shares, visualised in two marked ‘wedges’: the first one starting in 1943 and finishing in 1950; the second one opening up in 1950/51 and closing down again in 1957; suggesting that the losses of one sector represented the gains of the other. Returning to the question posed above, the bulk of the state's financial effort seemed to have been directed towards agriculture and livestock and not to industry.

Credit allocation: commercial banks, Agrarian Bank and BCH, 1940–1967 (new loans – percentages).

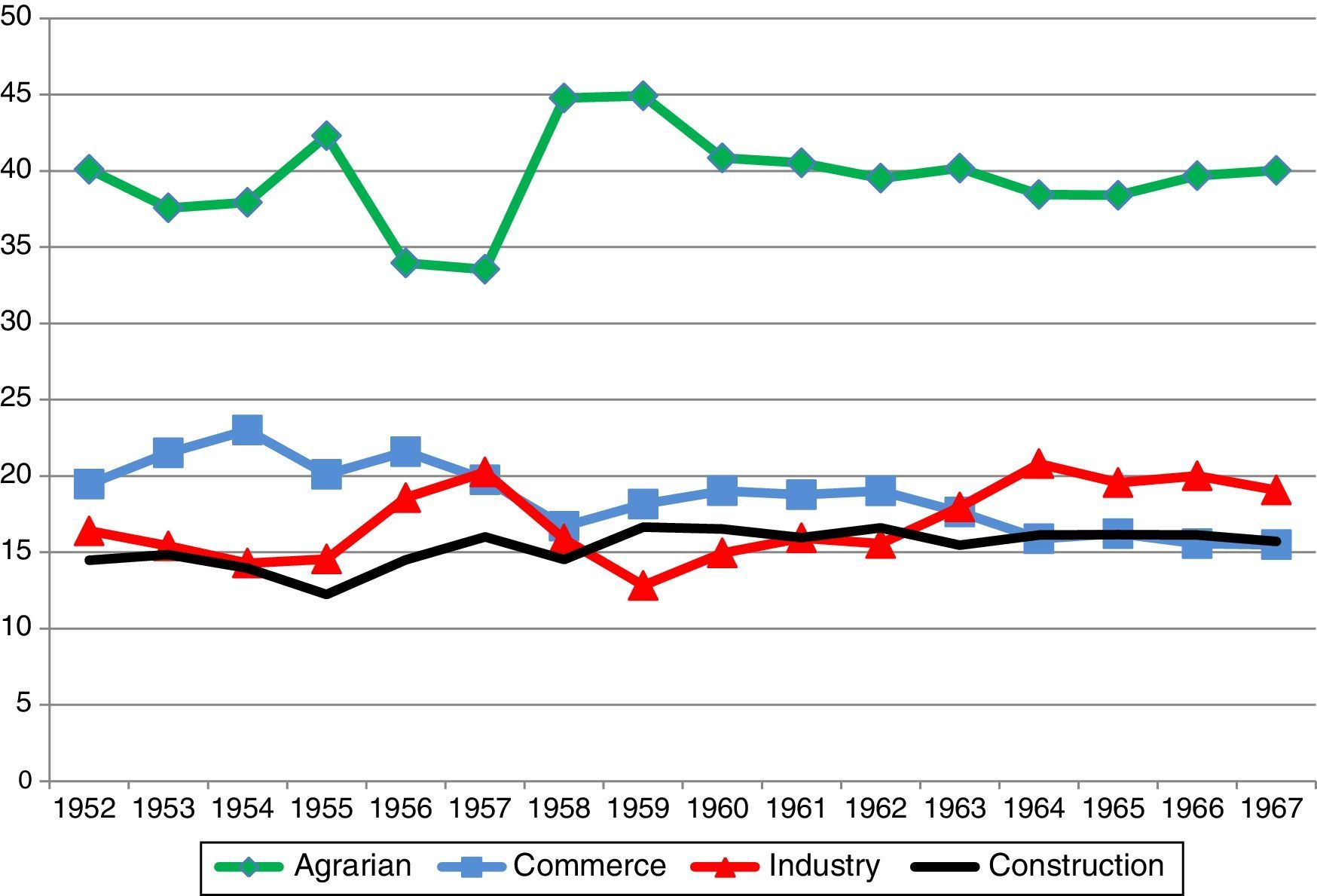

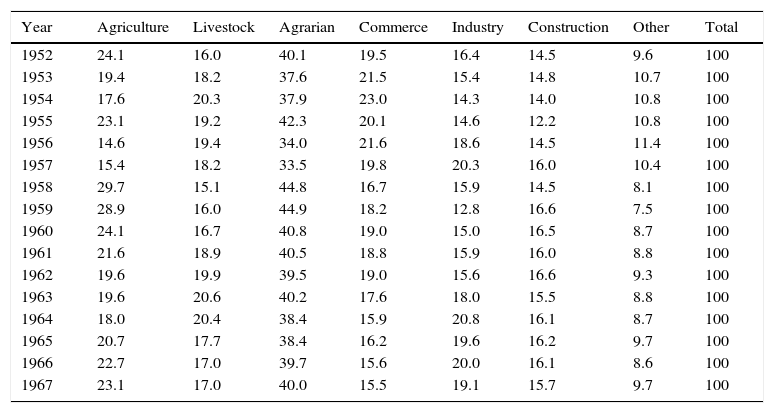

The sectoral allocation of credit changes even more when the entire banking system, i.e. commercial banks, bancos gremiales, the Agrarian Bank, mortgage banks, the CB and the bancos prendarios (pledging banks) are included. This paints an even bleaker picture of resources flowing to industry. From 1952, the year from which data for all agents are available, the largest receivers were agrarian interests with an average of 40% of all loans advanced by the financial system between 1952 and 1967 (see Fig. 5). Commerce followed with nearly 19%; even livestock, when considered as a sector on its own outdid industry taken 18.2% of the total.50 Industrialists obtained on average 17% of all outstanding loans facilitated by financial intermediaries, the smallest share of credit any sector received – safe for construction. Two important implications arise from these numbers on the sectoral allocation of credit; one empirical, the other interpretative. The first is that empirical evidence demonstrates that industry did not become a privileged receiver of credit in terms of having been allocated larger shares of it than other sectors. The erratic pattern or no pattern at all of industrial credit relative to other sectors confirms this. The second point is that interpretations that stress the role of the state in promoting and financing industrialisation via credit/financial policies, that is those of ISI and/or state-led industrialisation frameworks do not fit the empirical evidence. On the contrary, the state on the credit front promoted agriculture first and foremost and industry only marginally. This is illustrated further when an examination of the direct operations of discounts and loans from the CB is made.

Credit allocation by the entire banking system, 1952–1967 (outstanding loans – percentages).

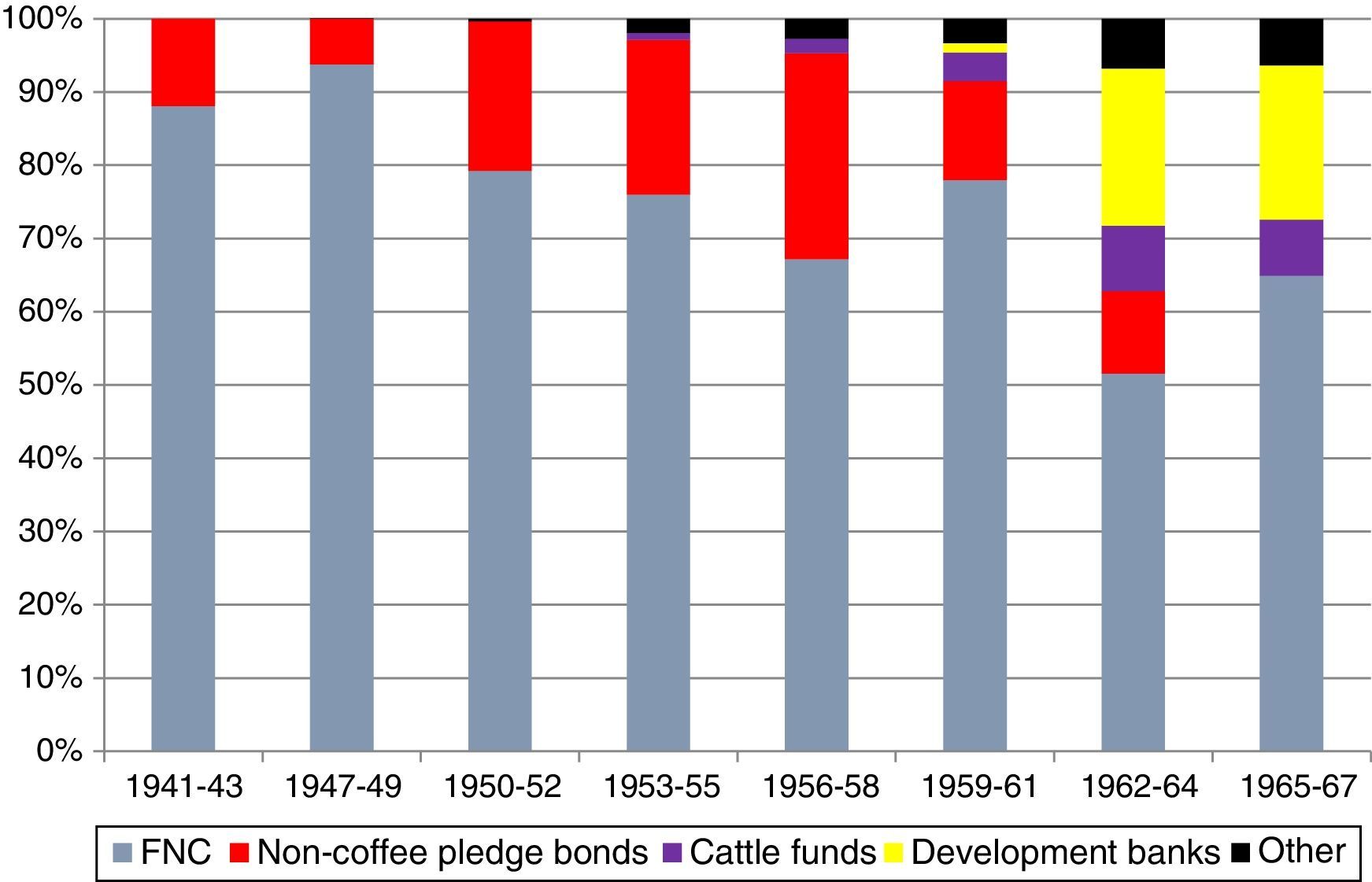

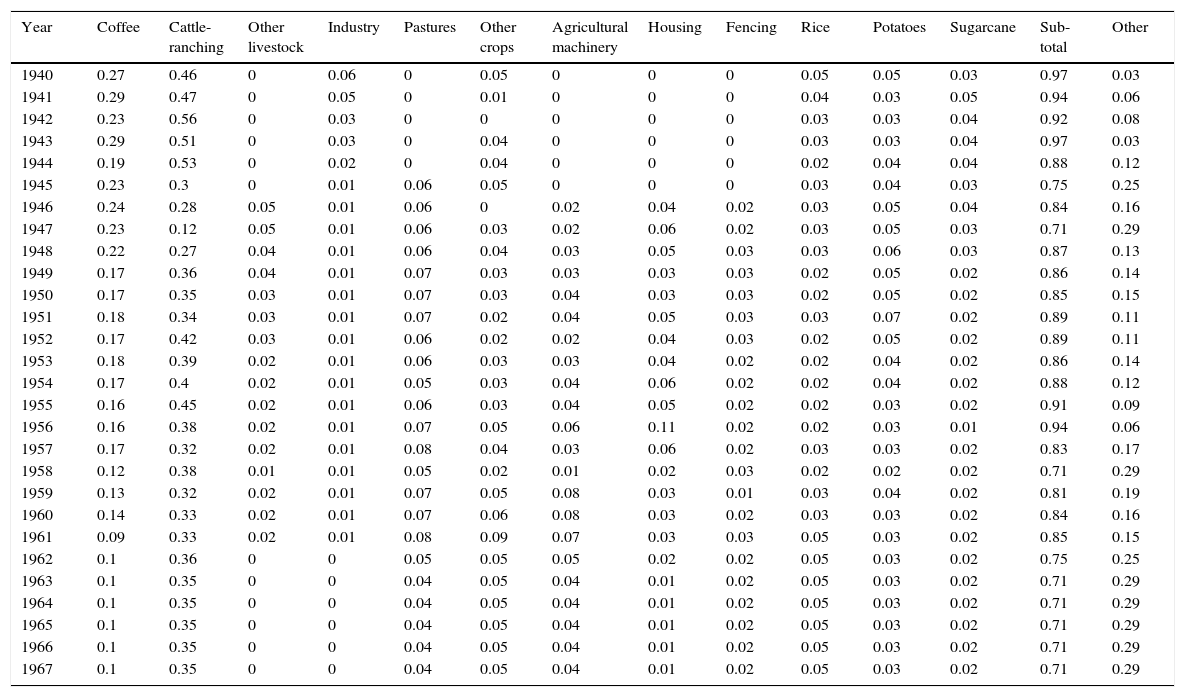

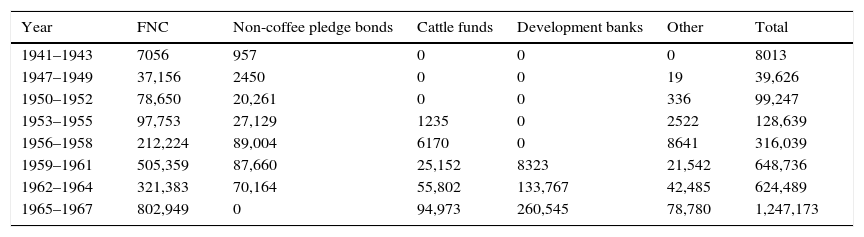

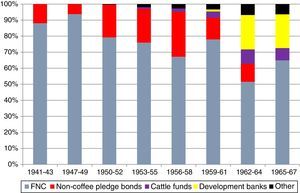

Further to the loans facilitated by public and private financial intermediaries, Banco de la República was authorised to carry direct transactions with the public, in addition to those it carried out with its main clients, affiliated banks and government. The extent of resources in question was not insignificant and once again, the share of these flowing to industry was rather modest. Relatively speaking, industry was a loser in the credit allocated directly by the CB to private agents. That this type of directly administered credits mattered was evident from the importance that CB directors assigned to it as a potential source of monetary expansion and instability. In October of 1958, as a response to claims that inflationary pressures originated in the CB's credit facilities to the coffee sector (via the FNC) and in the discounting operations it carried out with pledge bonds, the board of directors commissioned a study to look into the determinants of the country's economic instability and asked to examine carefully the role played by these elements in it.51 In various years, for instance, 1940, 1941, 1942, 1954, 1959, 1961, 1966 and 1967, the amounts received by so-called particulares – non-bank private agents – ranged between half and two thirds or more of the resources advanced to CB's most important clients, its affiliated banks.52 And in 1958, private agents received even more credit from the CB than its affiliated banks. In the early 1940s private agents received on average 33% of the loans and discounts advanced by Banco de la República.53 During the second part of WWII and in the immediate post-war years, credit to private agents was severely tightened, but relaxed again in the early 1950s to attain high levels in the late 1950s and 1960s when the international prices of coffee faltered and the CB provided sustained and generous financing support. Between 1957 and 1967 the proportion of relative credit advanced to private agents returned to its prewar levels. In other words, around a third of CB's lending facilities were directed to private non-financial agents. Given the visible importance of these resources it is crucial to examine which economic sectors benefit from these direct lines of credit.