Extant literature recognizes both family business heterogeneity and the need to identify relevant definitional criteria to distinguish family firms, leading to the emergence of typologies, taxonomies and classification schemes. This paper presents a comprehensive review of existing classifications, which we the compare with the core conceptual elements embedded in 258 family business definitions. Our analyses enables an identification of the characteristics of the entities being classified, and then we proceed to reflect on their usefulness and effectiveness for classifying family firms. Based on the integrated analysis, we then propose some recommendations and future research lines in order to develop a workable classification of family firms.

La literatura sobre empresa familiar está poniendo un énfasis creciente en la heterogeneidad de las mismas y en la necesidad de identificar los criterios más adecuados para clasificarlas en tipologías o taxonomías. El presente artículo realiza una exhaustiva revisión de las clasificaciones identificadas en la literatura. Igualmente, analiza con métodos bibliométricos 258 definiciones de empresa familiar identificadas en la literatura para identificar las características más relevantes de una empresa para ser considerada familiar. La comparación de los criterios de clasificación empleados con los elementos más relevantes de las definiciones permite analizar la utilidad y efectividad de los sistemas de clasificación identificados. A partir de este análisis comparativo se proponen una serie de recomendaciones y futuras líneas de investigación que permitan avanzar en la elaboración de sistemas de clasificación de las empresas familiares relevantes y operativos.

Family firms as an area of research has been plagued by at least one nagging question hampering its growth – what really is a family business? For over half a century scholars have made numerous attempts to take up this conceptual challenge, with a majority establishing dichotomous definitions, by differentiating between family and non-family firms (e.g., Chua, Chrisman, and Sharma, 1999). While homogeneity among family businesses does not exist (Chua, Chrisman, Steier, and Rau, 2012; The Economist, 2015), there has been a tendency to downplay family firm heterogeneity (Nordqvist, Sharma, and Chirico, 2014), even though “a theory of the family firm must be able to differentiate family firms from nonfamily firms as well as explain variations among family businesses” (Chrisman, Chua, Pearson, and Barnett, 2012, p. 267). Responding to a recognition that family firms need to be compared with each other (Massis, Kotlar, Chua, and Chrisman, 2014), important contributions have been made over the last twenty years to establish categories or typologies of family business (e.g., Astrachan, Klein, and Smyrnios, 2002; Dyer, 2006; Shanker and Astrachan, 1996; Westhead and Howorth, 2007).

These classification systems have contributed to bringing greater clarity to the field, and have introduced greater nuances in our understanding of what a family business is. However, for researchers to tap accumulated knowledge and for practitioners to know which of the research findings most apply to them, it is necessary to reflect on the heterogeneity of the family business concept (Chrisman, Sharma, Steier, and Chua, 2013; Chua et al., 2012;). Similarly, it is necessary to identify essential definitional criteria that help scholars to find effective ways to classify these ubiquitous firms (Sharma and Nordqvist, 2008), which also would help theory to advance, by making both the necessary replications (Eden, 2002) and the comparisons among studies easier to perform.

Our research is a response to this growing chorus demanding to cover these needs, and consequently is born with a twofold objective. First, considering that an effective classification system must be based on the characteristics of the entities being classified (Darwin, 1859), our first objective is to identify and comprehensively review extant classification systems of family firms by analyzing whether such systems are based on the characteristics of this type of firms. Secondly, our objective is to study whether such classification systems have been later applied empirically, and to analyze whether they constitute operative and effective ways to classify family firms. To reach these research objectives, first we critically review classification systems found in the literature, and, then, we compare these classifications with major conceptual elements in family firm definition, identified by employing quantitative methods. Such methods enable the aggregation of large amounts of bibliographic data, and are deemed to be objective (Vogel and Güttel, 2013). Finally, considering the results of such comparisons, as well as characteristics and empirical replication of all classification systems identified, we propose that the main elements of the definitional network should be employed to build a family firm taxonomy.

This article makes at least three contributions to the literature. First, our integrative analysis permits a greater reflection on the debate between family business and non-family business, on the one hand, and the categorization of family businesses on the other hand. Second, we review classification systems of family firms as well as definitions which appear in the academic literature, by systematizing the more relevant publications dealing with classifications of family firms. That is, we provide an integrative guide, which may help scholars to quickly identify both the core elements required to define a family firm, and the literature relevant on the classifications of these type of firms. Third, we identify the key attributes or core conceptual elements for developing an optimal classification system and we propose future research lines that enable researchers to reconcile inconsistent and conflicting research findings.

This paper is structured as follows. After this introduction, we briefly explain the evolution of the family firm literature, from a dichotomist view, and we then move towards the recognition of the heterogeneity of family firm. We then proceed to explain the methodology used in selecting the classification systems analyzed, and for extracting the core conceptual elements from more than 250 definitions of family firm. Next, we discuss the main findings of our integrated analysis. The last section presents the main conclusions and summarizes the limitations as well as pointing towards future areas of work.

Family businesses: from dichotomy to categorizationSince its inception, scholars of the family business field have struggled to define its boundaries and lay out the source of the field's distinctiveness (Zahra and Sharma, 2004). A review of the literature reveals that the field has evolved from an earlier proclivity of comparing family versus non-family firms by emphasizing the commonalities, towards an acceptance that homogeneity among family firms does not exist (Chua et al., 2012). Consequently, we find two strands in the literature, one tending towards the comparison between family and non-family firms, and the other emphasizing the differentiation among types of family firms.

In the first strand, some scholars have defined family businesses based on a single criterion, while others employed two or more criteria. In the former, albeit with certain nuances, two main definitional dimensions emerge: “ownership” and “management”. Among scholars who have gone beyond the mono-criterion definitions, a number of them have also suggesting combining “ownership” and “management” dimensions (e.g., Choi, Zahra, Yoshikawa, and Han, 2015). However some have relied on, or added on to, other criteria, such as the number of generations of family owners (e.g., Kellermanns, Eddleston, Sarathy, and Murphy, 2012); intentions to transfer the business to the next generation (e.g., Miller and Le Breton-Miller, 2003); employment of family members in the business (e.g., Westhead and Howorth, 2006); or the self-perception of the company as a family business (Casillas, Moreno, and Barbero, 2010).

Scholars employing multiple criteria for distinguishing family from non-family businesses, explicitly or implicitly acknowledge the existence of heterogeneity among family enterprises. Variety necessitates a way of classifying the objects of study (Davis, 2009) and finding ways to distinguish between different categories of family firms remains an important research gap (Chrisman and Patel, 2012; Chrisman, Sharma, and Taggar, 2007). It is precisely the need to embrace such heterogeneity that has led to the creation of different classification systems in the literature (e.g., Astrachan et al., 2002; Dyer, 2006; Shanker and Astrachan, 1996; Westhead and Howorth, 2007). Therefore, a review of the main findings of this research stream becomes necessary in order to answer the three research questions: Are the existing classification systems based on the main characteristics of the family firms? Have previous classification systems of family firms been replicated in order to accumulate evidence? Are the existing classification systems operative and effective ways to classify family firms? To be able to answer these research questions we first identify the main classification systems developed in academic literature, including not only taxonomies or classification schemes that categorize family firms in mutually exclusive and exhaustive sets (Chrisman, Hofer, and Boulton, 1988; Doty and Glick, 1994), but any typology or classification system developed for capturing the heterogeneity of family firms. Then we proceed to identify the conceptual elements in the family firm definition and we compare the classification systems identified with the conceptual element extracted. Finally we discuss the three questions above.

MethodsIdentification of classification systems of family firmsThe first step of our work involved the identification of the classification systems of family firms. We chose SSCI database as a starting point due to the reliability of its selections standards and its diffusion within the scientific community (Perri and Peruffo, 2016). From these results, in a second phase, we reviewed both the articles including any classification systems, as well as articles that cited these works. In a third phase, and considering that the two specific journals specialized in family business literature have been included in the SSCI database recently (Family Business Review in 2007 and Journal of Family Business Strategy in 2014), a complementary search in those journals was also performed. A similar process was carried out with the journal Entrepreneurship Theory and Practice, since it is the second journal after Family Business Review that has published the most papers related to family business, at a great distance from the third (Benavides-Velasco, Quintana-García, and Guzmán-Parra, 2013). In short, our work includes exclusively those classification systems that have been published in journals as the basis for analysis, since articles are the source of the most up-to-date knowledge (López-Fernández, Serrano-Bedia, and Pérez-Pérez, 2016). We identified 15 classification systems in family business literature that we will discuss later on this paper.

Identification of the core conceptual elements in family firm definitionsIn order to identify the core elements in the family firm concept, we based our study on a set of definitions employed by previous research (Hernández-Linares, Sarkar, and Cobo, 2014; Sarkar, Hernández-Linares, and Cobo, 2014). This definitional database included 258 definitions published between 1964 and 2014 with a citation frequency greater or equal to one citation by year. We proceeded to extract the conceptual elements from the definitions, using content analysis, a technique lying at the intersection of qualitative and quantitative traditions (Duriau, Reger, and Pfarrer, 2007). Content analysis permits the reduction of a large body of qualitative information to a smaller and more manageable form of representation (Smith, 2000). The underlying principle is that words of a text can be classified into fewer content categories, where each category consists of one or many similar words or word phrases, and that each word or phrase occurrence can be counted and the counts compared analytically (Kothari, Li, and Short, 2009). This process first involved breaking down the definitions into key terms, and then aggregating like terms to obtain the conceptual elements.

Deconstructing the definitionsWe broke down the 258 definitions according to the following process: (1) review of extracted definitions and then joining those words that appeared together to constitute a single concept, such as family-business, board-of-directors or chief-executive-officer etc.; (2) detection of duplicated and misspelled items, such as those representing the same object or concept but expressed differently, for instance, CEO and chief-executive-officer; (3) exclusion of words not to be taken into account in subsequent analyses, such as determinants, prepositions, conjunctions or words and groups of words that have no meaning in themselves or that contribute little or nothing to understanding of the family business concept, technically termed “stop words”; and (4) exclusion of the three groups of words: “family-business”, which constitutes the term defined; “family” and “company”, since these groups of words do not constitute definitional criteria as such.

Once our database was processed, definitions were loaded into an open source science mapping software tool called SciMAT (Science Mapping Analysis Software Tool), which incorporates algorithms and measures for all the processes involved in science mapping, and allows one to carry out studies based on several bibliometric networks, using different normalization and similarity measures with the data, or several clustering algorithms to cut up the data (Cobo, López-Herrera, Herrera-Viedma, and Herrera, 2012).

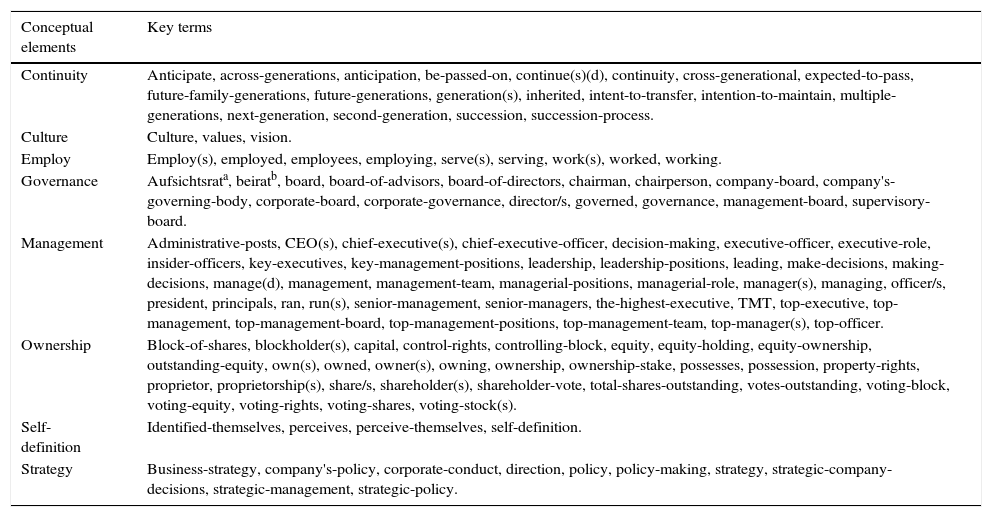

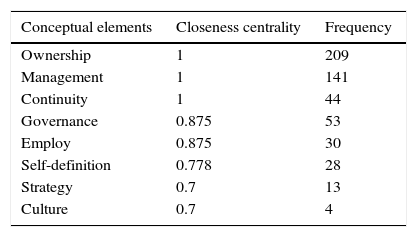

Extracting the conceptual elementsThe key terms that emerged from the deconstruction process were then grouped into conceptual elements (Nag, Hambrick, and Chen, 2007), the major concepts or dimensions underpinning the definitions. In creating the conceptual elements we took into account the following criteria – a search for words and terms which could clearly be grouped into one category (for instance, “employ”, “serve” or “work”), and the context in which these words were used. The latter was relevant since sometimes the context determines inclusion in one category or another (“anticipate” or “anticipation”, for instance, were included within the conceptual element “continuity” because these key terms referred to anticipation of which family would manage the company in the future, i.e., referring to the intra-family succession intention). This process was carried out by each of the three authors independently, after which the (three) classifications proposed were compared and in the cases of discrepancies, discussion followed, until consensus was reached. Based on these key terms, the consultation process yielded eight conceptual elements (Table 1) that we explain below following alphabetical order:

- -

Continuity: Refers to the successful transfer of a business across generations of the family (intra-family succession) or to transgenerational intentions for the future.

- -

Culture: Reflects the concern for capturing the spirit of the family business, taking into account intrinsic factors such as the existence of a shared vision, or values that distinguish family firms from other forms of organizations.

- -

Employ: Refers to the employment of family members in the business and includes all words referring to employment, service or work.

- -

Governance: Refers to the processes of governing or the government bodies of the firm.

- -

Management: Refers to the family (members’) involvement as the person/s that adopt the decisions for accomplishing the firm's goals by using available resources.

- -

Ownership: Refers to the control of the company's capital by the family.

- -

Self-definition: Refers to businesses identifying themselves as family firms, which captures much of the “essence” of what it means to be a family business.

- -

Strategy: Refers to the influence of family on the policy or direction of the company.

(De)construction of the family business definition.

| Conceptual elements | Key terms |

|---|---|

| Continuity | Anticipate, across-generations, anticipation, be-passed-on, continue(s)(d), continuity, cross-generational, expected-to-pass, future-family-generations, future-generations, generation(s), inherited, intent-to-transfer, intention-to-maintain, multiple-generations, next-generation, second-generation, succession, succession-process. |

| Culture | Culture, values, vision. |

| Employ | Employ(s), employed, employees, employing, serve(s), serving, work(s), worked, working. |

| Governance | Aufsichtsrata, beiratb, board, board-of-advisors, board-of-directors, chairman, chairperson, company-board, company's-governing-body, corporate-board, corporate-governance, director/s, governed, governance, management-board, supervisory-board. |

| Management | Administrative-posts, CEO(s), chief-executive(s), chief-executive-officer, decision-making, executive-officer, executive-role, insider-officers, key-executives, key-management-positions, leadership, leadership-positions, leading, make-decisions, making-decisions, manage(d), management, management-team, managerial-positions, managerial-role, manager(s), managing, officer/s, president, principals, ran, run(s), senior-management, senior-managers, the-highest-executive, TMT, top-executive, top-management, top-management-board, top-management-positions, top-management-team, top-manager(s), top-officer. |

| Ownership | Block-of-shares, blockholder(s), capital, control-rights, controlling-block, equity, equity-holding, equity-ownership, outstanding-equity, own(s), owned, owner(s), owning, ownership, ownership-stake, possesses, possession, property-rights, proprietor, proprietorship(s), share/s, shareholder(s), shareholder-vote, total-shares-outstanding, votes-outstanding, voting-block, voting-equity, voting-rights, voting-shares, voting-stock(s). |

| Self-definition | Identified-themselves, perceives, perceive-themselves, self-definition. |

| Strategy | Business-strategy, company's-policy, corporate-conduct, direction, policy, policy-making, strategy, strategic-company-decisions, strategic-management, strategic-policy. |

Having obtained eight conceptual elements that underpin the field's definitions, and with the objective of analyzing what of these conceptual elements were key terms or core conceptual elements, we employed co-word and network analysis, two bibliometric methods that are explained below.

Co-word analysisCo-word analysis is an effective technique to map the strength of relationships among textual data (Ritzhaupt, Stewart, Smith, and Barron, 2010). Its methodological foundation rests on the idea that the co-occurrence of key words describes the contents of the documents in a file (Callon, Courtial, and Laville, 1991), or in our case, the co-occurrence of conceptual elements of the definitions.

Methodologically, we computed the co-occurrence matrix by assuming that the co-occurrence frequency of two conceptual elements is extracted from the corpus of definitions by counting the number of definitions in which two key-terms appear together. Based on frequencies of key-terms co-occurrences, we carried out the calculation of similarities between items. To do this, we proceeded to normalize the co-occurrence degree, relativizing the relationship by giving more importance to those terms with a lower frequency but a high co-occurrence value versus those terms with higher frequency and low co-occurrence value. Among the different similarity measures used in the literature, we opted for the equivalence index (Callon et al., 1991) for normalizing words’ co-occurrence frequencies. When the conceptual elements always appear together, the equivalence index equals unity, and when they are never associated, it equals zero. Once the equivalence index was calculated and the co-occurrence matrix built, we used social network analysis techniques.

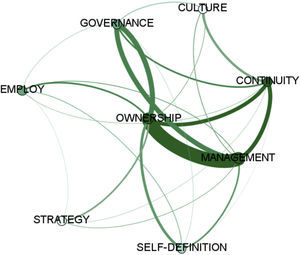

Social network analysisConsidering a network to be made of nodes and links that connect these nodes, we used social network analysis techniques to determine the degree of centrality of each key-term. Among the different types of centrality metrics that quantify the importance of the nodes in the network, and taking into account that our network is undirected, we employed the closeness centrality index. This focuses on how close a node is to all the other nodes in the network beyond the ones with which it is directly connected (Kim, Choi, Yan, & Dooley, 2011), and it is calculated as the inverse of the total distance. A node of high closeness centrality is considered structurally important, because it can easily reach or be reached by others (Brandes and Pich, 2007). Thus the closeness centrality can be considered a measure of the importance of the node (conceptual element) within the whole network (family business concept). In order to measure the closeness centrality and visualize the network, the open source software tool Gephi1 was used.

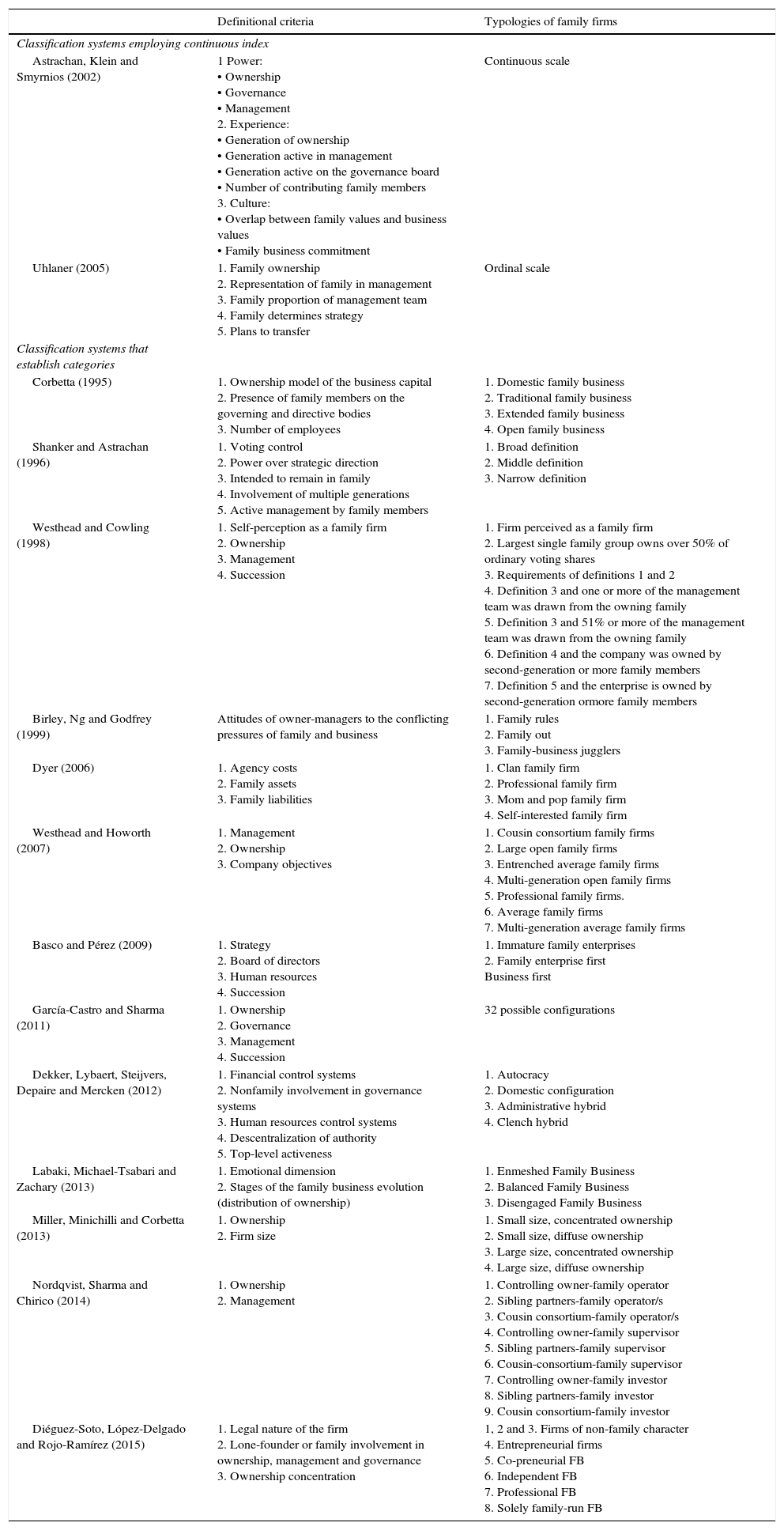

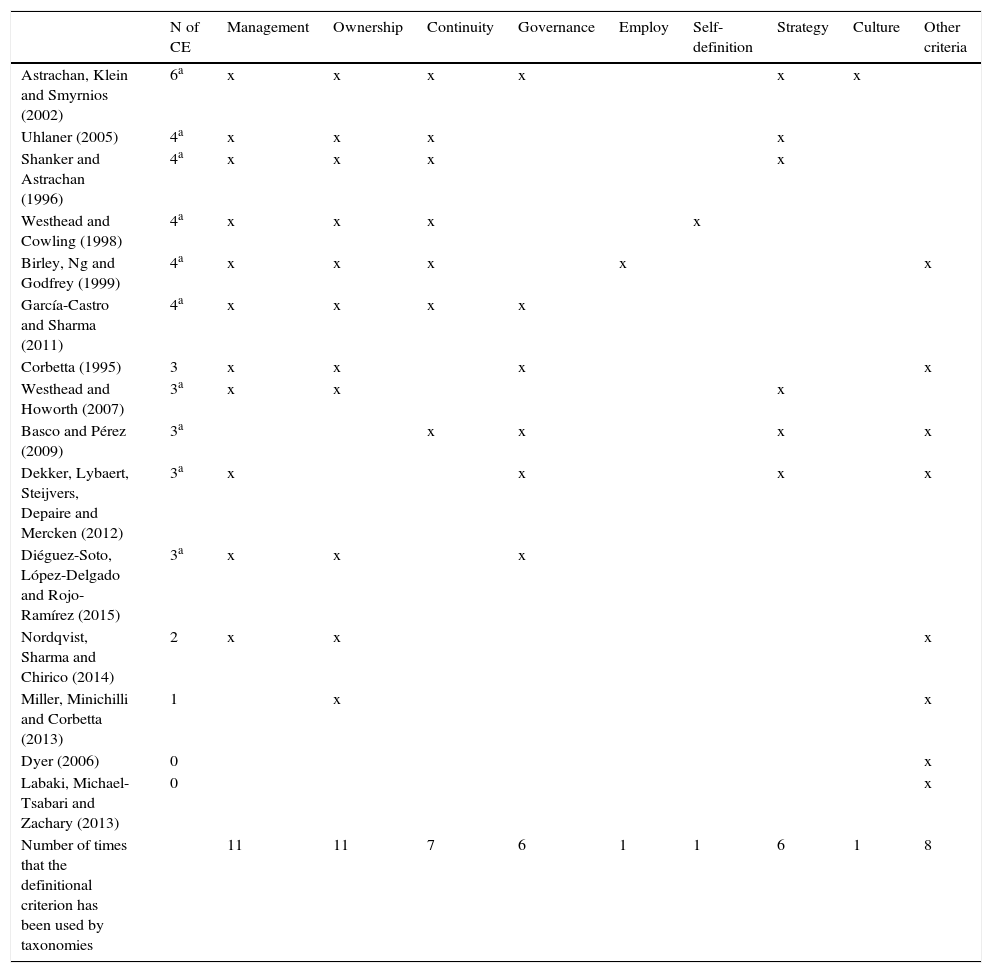

Results and discussionUsing the above multi-stage methodology, we finally identify 15 classifications systems (typologies, taxonomies, classification schemes or any other classification systems included), summarized in Table 2. These classifications have been grouped into two groups. The first includes those works that have proposed a continuous index for reflecting the heterogeneity of family firms (Astrachan et al., 2002; Uhlaner, 2005). These are multidimensional classifications that can be utilized without necessarily using an explicit definition of family firm, with the scale itself used to demonstrate the degree to which a family is involved in or influences the business. The second group comprises all classification systems that have categorized family firms, with the number of categories ranging from three (Basco and Pérez, 2009; Birley, Ng, and Godfrey, 1999; Labaki, Michael-Tsabari, and Zachary, 2013; Shanker and Astrachan, 1996) to thirty-two categories (García-Castro and Sharma, 2011).

Main typologies of family business.

| Definitional criteria | Typologies of family firms | |

|---|---|---|

| Classification systems employing continuous index | ||

| Astrachan, Klein and Smyrnios (2002) | 1 Power: • Ownership • Governance • Management 2. Experience: • Generation of ownership • Generation active in management • Generation active on the governance board • Number of contributing family members 3. Culture: • Overlap between family values and business values • Family business commitment | Continuous scale |

| Uhlaner (2005) | 1. Family ownership 2. Representation of family in management 3. Family proportion of management team 4. Family determines strategy 5. Plans to transfer | Ordinal scale |

| Classification systems that establish categories | ||

| Corbetta (1995) | 1. Ownership model of the business capital 2. Presence of family members on the governing and directive bodies 3. Number of employees | 1. Domestic family business 2. Traditional family business 3. Extended family business 4. Open family business |

| Shanker and Astrachan (1996) | 1. Voting control 2. Power over strategic direction 3. Intended to remain in family 4. Involvement of multiple generations 5. Active management by family members | 1. Broad definition 2. Middle definition 3. Narrow definition |

| Westhead and Cowling (1998) | 1. Self-perception as a family firm 2. Ownership 3. Management 4. Succession | 1. Firm perceived as a family firm 2. Largest single family group owns over 50% of ordinary voting shares 3. Requirements of definitions 1 and 2 4. Definition 3 and one or more of the management team was drawn from the owning family 5. Definition 3 and 51% or more of the management team was drawn from the owning family 6. Definition 4 and the company was owned by second-generation or more family members 7. Definition 5 and the enterprise is owned by second-generation ormore family members |

| Birley, Ng and Godfrey (1999) | Attitudes of owner-managers to the conflicting pressures of family and business | 1. Family rules 2. Family out 3. Family-business jugglers |

| Dyer (2006) | 1. Agency costs 2. Family assets 3. Family liabilities | 1. Clan family firm 2. Professional family firm 3. Mom and pop family firm 4. Self-interested family firm |

| Westhead and Howorth (2007) | 1. Management 2. Ownership 3. Company objectives | 1. Cousin consortium family firms 2. Large open family firms 3. Entrenched average family firms 4. Multi-generation open family firms 5. Professional family firms. 6. Average family firms 7. Multi-generation average family firms |

| Basco and Pérez (2009) | 1. Strategy 2. Board of directors 3. Human resources 4. Succession | 1. Immature family enterprises 2. Family enterprise first Business first |

| García-Castro and Sharma (2011) | 1. Ownership 2. Governance 3. Management 4. Succession | 32 possible configurations |

| Dekker, Lybaert, Steijvers, Depaire and Mercken (2012) | 1. Financial control systems 2. Nonfamily involvement in governance systems 3. Human resources control systems 4. Descentralization of authority 5. Top-level activeness | 1. Autocracy 2. Domestic configuration 3. Administrative hybrid 4. Clench hybrid |

| Labaki, Michael-Tsabari and Zachary (2013) | 1. Emotional dimension 2. Stages of the family business evolution (distribution of ownership) | 1. Enmeshed Family Business 2. Balanced Family Business 3. Disengaged Family Business |

| Miller, Minichilli and Corbetta (2013) | 1. Ownership 2. Firm size | 1. Small size, concentrated ownership 2. Small size, diffuse ownership 3. Large size, concentrated ownership 4. Large size, diffuse ownership |

| Nordqvist, Sharma and Chirico (2014) | 1. Ownership 2. Management | 1. Controlling owner-family operator 2. Sibling partners-family operator/s 3. Cousin consortium-family operator/s 4. Controlling owner-family supervisor 5. Sibling partners-family supervisor 6. Cousin-consortium-family supervisor 7. Controlling owner-family investor 8. Sibling partners-family investor 9. Cousin consortium-family investor |

| Diéguez-Soto, López-Delgado and Rojo-Ramírez (2015) | 1. Legal nature of the firm 2. Lone-founder or family involvement in ownership, management and governance 3. Ownership concentration | 1, 2 and 3. Firms of non-family character 4. Entrepreneurial firms 5. Co-preneurial FB 6. Independent FB 7. Professional FB 8. Solely family-run FB |

This second group adopted very different approaches. First, there are two works (Shanker and Astrachan, 1996; Westhead and Cowling, 1998) that, by employing different definitions of family business, empirically research the impact of different definitions employed by scholars on the statistics related to the family business contribution to economy, in turn leading towards the reflection of the heterogeneity of this type of firms. Second, considering that performance is a central theme in business and management studies (Kim and Gao, 2013), numerous scholars have researched if family firms and non-family firms perform differently, finding that there are no significant differences in business performance between both types of firms (Carney, Van Essen, Gedajlovic, and Heugens, 2015). Instead, this meta-analysis confirmed that family firms behave different from non-family firms in terms of fewer RandD investment, lower level of debt or less international diversification and they suggest that family firms are able to compensate these deficiencies by a more efficient transformation of inputs in outputs (Carney et al., 2015). In this line, Dyer (2006) had suggested that the question about whether family businesses perform better, must be replaced by another question: what type of family business leads to higher performance? To answer this question, different classification systems have been proposed in the literature (Basco and Pérez, 2009; Diéguez-Soto, López-Delgado, and Rojo-Ramírez, 2015; Dyer, 2006; García-Castro and Sharma, 2011; Miller, Minichilli, and Corbetta, 2013). Within this second approach, the pioneering work is that of Dyer (2006), who based his study on agency theories and a resource-based view to explore the relationships between family and firm performance. He concluded that there are several different types of family firms, and that some of them have unique assets that allow them to compete successfully, while others incur in significant agency cost, which may cause them to falter in the marketplace. Three of the five research outputs included in this second approach have classified family firms exclusively, whereas Diéguez-Soto, López-Delgado, and Rojo-Ramírez (2015), and García-Castro and Sharma (2011) classified both family and non-family firms. Third, we find a group of authors (Basco and Pérez, 2009; Birley et al., 1999; Labaki et al., 2013) that includes in their classification systems emotional or affective factors. Fourth, Dekker, Lybaert, Steijvers, Depaire and Mercken (2012), and Nordqvist et al. (2014) established their classification systems in order to study the professionalization construct, rendering its application difficult with other research aims. Finally, Corbetta (1995) employs his classification of Italian family firms to analyze its development.

An analysis from the definitions retrieved from the literature yields eight conceptual elements, which help in defining a firm as being family: continuity, culture, employ, governance, management, ownership, self-definition, and strategy. Given that any workable taxonomy or classification system should be built with the fewest number of taxa without sacrificing the essential classification attributes (Chrisman et al., 1988), and that most scholars have to work with surveys, we consider that the inclusion of eight conceptual elements would imply inclusion of a significant number of items in the questionnaire to classify family firms, requiring the inclusion of many firms in the sample. That is, the inclusion of these eight conceptual elements would add an unnecessary complexity, rendering any taxonomy difficult to apply.

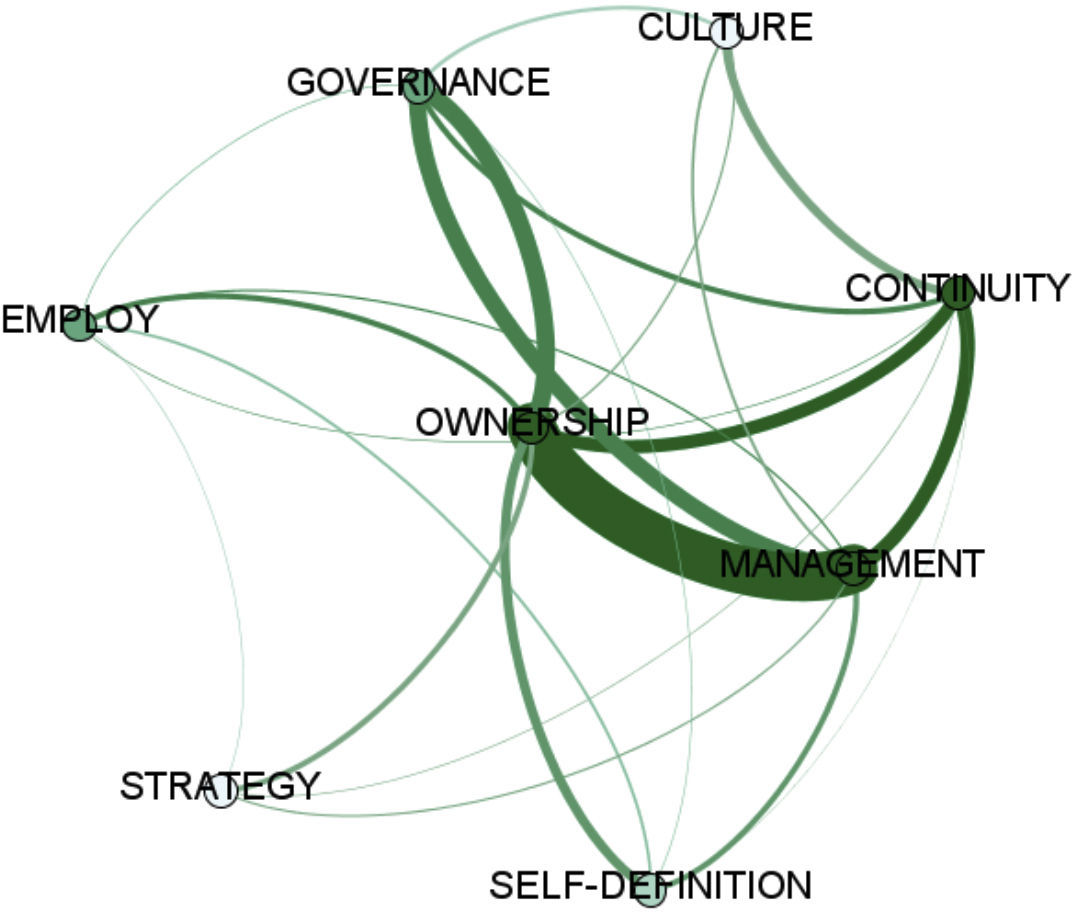

Fig. 1 reveals the network structure of the definition of the family business concept and Table 3 orders all conceptual elements according to their centrality index. Considering that in Fig. 1, the size and variation in the vertex colour are related to the position in the network (darker colours imply a higher degree of centrality), we identify three conceptual elements that can be considered as the basis for the creation and the rise of the theoretical corpus of the family business field or as core conceptual elements, namely “ownership”, “management”, and “continuity”. In addition, these core conceptual elements have the maximum centrality within the network (Table 3), confirming that, overall, researchers consider these three core conceptual elements as necessary conditions to define a business as family. To employ “ownership”, “management”, and “continuity” to distinguish between family and non-family firms allows scholars to include in their family firm definition elements of both the involvement approach and the essence approach (Chrisman, Chua, & Sharma, 2005).

Comparing these core conceptual elements with the extant typologies (see Table 4), we can answer our first question: Are the existing classification systems based on the main characteristics of the family firms? Six of the fifteen classification systems (Astrachan et al., 2002; Birley et al., 1999; García-Castro and Sharma, 2011; Shanker and Astrachan, 1996; Uhlaner, 2005; Westhead and Cowling, 1998) jointly included, at least, the three core conceptual elements that have maximum centrality in the definitional network (“ownership”, “management” and “continuity”). But in all these cases, authors include more criteria for establishing their classifications systems, adding complexity For instance, Astrachan et al. (2002) and Uhlaner (2005) added to the three central core conceptual elements, “strategy” as a fourth definitional criteria. Furthermore, “ownership” and “management” were the only two central core conceptual elements included in other four works (Corbetta, 1995; Diéguez-Soto et al., 2015; Nordqvist et al., 2014; Westhead and Howorth, 2007). While Dekker and colleagues’ classification (2012), and Basco and Perez’ (2009) study employ only a central core conceptual element: “management” and “continuity” respectively.

Conceptual elements employed by family businesses taxonomies.

| N of CE | Management | Ownership | Continuity | Governance | Employ | Self-definition | Strategy | Culture | Other criteria | |

|---|---|---|---|---|---|---|---|---|---|---|

| Astrachan, Klein and Smyrnios (2002) | 6a | x | x | x | x | x | x | |||

| Uhlaner (2005) | 4a | x | x | x | x | |||||

| Shanker and Astrachan (1996) | 4a | x | x | x | x | |||||

| Westhead and Cowling (1998) | 4a | x | x | x | x | |||||

| Birley, Ng and Godfrey (1999) | 4a | x | x | x | x | x | ||||

| García-Castro and Sharma (2011) | 4a | x | x | x | x | |||||

| Corbetta (1995) | 3 | x | x | x | x | |||||

| Westhead and Howorth (2007) | 3a | x | x | x | ||||||

| Basco and Pérez (2009) | 3a | x | x | x | x | |||||

| Dekker, Lybaert, Steijvers, Depaire and Mercken (2012) | 3a | x | x | x | x | |||||

| Diéguez-Soto, López-Delgado and Rojo-Ramírez (2015) | 3a | x | x | x | ||||||

| Nordqvist, Sharma and Chirico (2014) | 2 | x | x | x | ||||||

| Miller, Minichilli and Corbetta (2013) | 1 | x | x | |||||||

| Dyer (2006) | 0 | x | ||||||||

| Labaki, Michael-Tsabari and Zachary (2013) | 0 | x | ||||||||

| Number of times that the definitional criterion has been used by taxonomies | 11 | 11 | 7 | 6 | 1 | 1 | 6 | 1 | 8 |

N of CE=number of conceptual elements employed in the classification system.

Others conceptual elements broadly considered by the classification systems of family firms are “strategy” (Basco and Pérez, 2009; Dekker, Lybaert, Steijvers, Depaire, and Mercken, 2012; Shanker and Astrachan, 1996; Uhlaner, 2005; Westhead and Howorth, 2007) and “governance” (Astrachan et al., 2002; Basco and Pérez, 2009; Corbetta, 1995; Dekker et al., 2012; García-Castro and Sharma, 2011), two elements that can be considered as expression of the family control on the company. The rest of the elements included in the network (Fig. 1) have only been included or considered in a testimonial way. In fact, we find two taxonomies that do not employ any of the eight conceptual elements identified from the analyses of definitions, and instead focus on emotional aspects linked to the family (Dyer, 2006; Labaki et al., 2013), components of the tandem “family-firm” that have been scantly researched, perhaps due to many scholars of the field having a background in business or management.

In short, the three core conceptual elements with a higher degree of centrality within the definitional network have been the more used criteria for classifying family firms. However, there are two highly used criteria with a lower level of centrality, (“governance” and “strategy”), which means that researchers proposing classification systems have decided that they are relevant for many reasons that range from the availability of data to relevance as long as they reflect effective power/control of the company. The three remaining conceptual elements (“employ”, “self-definition, and “culture”) have been only residually employed by the classifications reviewed. The scant presence of “self-definition” is especially curious since this criterion has an important role in definitions as long as it reflects the heterogeneity of feelings, vision, or familiness of family firms collected by the “essence approach” in defining family firms. The scant presence of “self-definition” (only a 10% of classification systems identified have taken into account this criteria), a criterion with an important role in definitions as long as it reflects the heterogeneity of feelings, vision, or familiness of family firms collected by the “essence approach” may be explained because is more oriented towards the identification of family firms vs non-family firms, but it is considered less appropriate for addressing its heterogeneity.

Once we have studied the criteria or dimensions considered by the extant classification systems and considering that “replication is a key criterion by which to judge the robustness of an instrument” (Klein, Astrachan, and Smyrnios, 2005, p. 323), we investigated which of the extant classification systems have been applied by other scholars, thus, addressing our second question. After a review of those articles that cited each taxonomy, it seems clear that the classification system most employed by scholars is the F-PEC scale (Astrachan et al., 2002), which has been validated by several researchers (e.g., Holt, Rutherford, and Kuratko, 2010; Klein et al., 2005; Rutherford, Kuratko, and Holt, 2008), but mostly with the main purpose of examining the validity and reliability of the F-PEC scale, and not for analyzing other issues. The F-PEC scale is a multidimensional construct that has been validated and used in studies, allowing “the establishment of more nuanced differences at the cost of added complexity” (Wright and Kellermanns, 2011, p. 188). It also avoids the use of a Boolean yes/no type definition of the family firm by developing a series of instruments allowing researchers to position firms according to three key variables: power, experience and culture (Anderson, Jack, and Dood, 2005). However, the F-PEC scale also has some weaknesses. On the one hand, there appear to be ambiguous items in the culture subscale that could be omitted (Cliff and Jennings, 2005). On the other hand, the F-PEC scale fails to capture the essence of family businesses (Rutherford et al., 2008). Finally, while some scholars (Anderson et al., 2005) affirm that the F-PEC scale permits robust comparisons across studies and samples. In contrast to these scholars, we consider, in line with Chrisman et al. (1988, p. 417), that one guiding principle that has to follow any typology to become a good classification is parsimony, where “researchers are able to group similar entities and differentiate them from dissimilar entities with the fewest number of taxa possible without undue sacrifice of other essential classification attributes”. Therefore, we consider that the F-PEC scale, as well as the other continuous scale (Uhlaner, 2005), does not respect the parsimony principle, rendering comparisons across studies difficult.

Others scales have been empirically used, but only in limited contexts and intermittently (Diéguez-Soto et al., 2015; García-Castro and Sharma, 2011). The Diéguez-Soto et al.’s (2015) classification was empirically validated by their authors, and later was slightly modified and applied by López-Delgado and Diéguez-Soto (2015), in both cases with Spanish firms. The first of these scales (Diéguez-Soto et al., 2015) takes advantage of the Spanish custom of giving children two surnames, one from each parent; but since this custom is not followed in other countries (for example in English-speaking countries), there is a limitation for its applications in other contexts. Consequently it also constitutes a handicap for the replication of the scale, because common factors emerging when heterogeneous samples (for example, from different regions) are used to develop measures tend to provide a more complete understanding of any phenomenon (Sutton, 1987). The García-Castro and Sharma's (2011) classification was later applied by García-Castro and Aguilera (2014). Although this scale (García-Castro and Sharma, 2011) proposed 32 possible configurations of family firms, both García-Castro and Sharma (2011), and García-Castro and Aguilera (2014) used a dataset of 6611 publicly listed and major unlisted companies from 46 countries, and they only found 24 of these configurations with at least one observation, while the number of combinations found with at least 1% of cases in the sample (66 firms) decreases to 11. In our view, and in line with the idea of parsimony expressed by Chrisman et al. (1988), the definitions or categories differing only slightly make it difficult not only to compare across research, but also to integrate theory (Astrachan et al., 2002). Hence we consider that the taxonomy of García-Castro and Sharma (2011) is difficult to apply and replicate, and therefore, makes knowledge accumulation difficult.

Regarding the classification of Shanker and Astrachan (1996), called the “bull's eye model” and using demographic parameters, we have only found one particular development of this classification system (Anderson et al., 2005), that consisted in extending the bull's-eye model to incorporate Birley et al.’s typology (1999). None of the remaining scales identified has been employed in later studies rendering the accumulation of knowledge a very challenging task. In summary, most of the scales have been never employed by other scholars, while the remaining one has been only scarcely replicated preventing the accumulation of knowledge.

For accumulating knowledge it is important to find effective ways to classify family firms (Sharma and Nordqvist, 2008) and in addressing the third research question, our review shows that, hitherto none of the extant classification systems appearing in the literature has been accepted or used by the scientific community, with the only exception being F-PEC (Astrachan et al., 2002). However, our research reflects that family firm scholars have not found an optimal classification system yet, despite the fact that such a system seems to be more and more necessary, since some of inconsistencies found in the family firm research could be justified by its heterogeneity. Therefore, with a mind towards aiding researchers it is necessary to simplify the number of types of family firms (Davis, 2009; Dekker et al., 2012) in order to harness the main strength of the categorization: its simplicity (Snyder, Witell, Gustafsson, Fombelle, and Kristensson, 2016). Given that the existing classification systems do not seem to be operative and effective ways to classify family firms, we encourage scholars to undertake further research along these lines because developing and using categorizations allow for useful heuristics and provide a systematic basis for comparison and operationalization (Smith, 2002; Snyder et al., 2016).

Conclusions and future directionsSince its inception, the family business field has tried to arrive at some sort of consensus on what defines or characterizes a family firm, by comparing family businesses with non-family businesses. However, in recent years, the academic community has increasingly moved from viewing family firms as homogeneous entities to considering them as heterogeneous (e.g., Dekker et al., 2012; Westhead and Howorth, 2007). This heterogeneity of family businesses (e.g., Chua et al., 2012; Nordqvist et al., 2014) has rendered it necessary to compare family firms among themselves (Westhead and Howorth, 2007). Consequently, researchers have tried to identify different categories or types of family firms (De Massis, Kotlar, Chua, and Chrisman, 2014; Westhead and Howorth, 2007).

It has been held that the recognition and utilization of the types of family firms provides fresh and contextualized insights into the multi-faceted family firm phenomenon (Howorth, Rose, Hamilton, and Westhead, 2010), requiring an identification of all the important dimensions by which they may vary from each other (Chrisman, Chua, and Sharma, 2003). What emerges from our analysis of 258 definitions appearing in the literature (Hernández-Linares et al., 2014; Sarkar et al., 2014), is a necessary condition for distinguishing a family from a non-family business implied by the triad “ownership”, “management”, and “continuity”. However, if we compare this result with existing typologies, we find that while six classifications systems included these three core conceptual elements, none have taken into account this triad for establishing the difference between family firms and non-family firms. In this sense, Dyer (2003) argued that regardless of which definition is chosen, researchers should clearly set up what a family firm is and use multiple definitions to determine varying degrees of familiness. In line with him, we encourage scholars to establish a clear definition of the family firm as the first step for an optimal and useful classification system, and more concretely to establish this definition over the basis of the core conceptual elements “ownership”, “management” and “continuity”.

From our analysis eight conceptual elements emerged, but not all of them need to be considered for developing an optimal classification system along the lines suggested by Chrisman et al. (1988). Yet, while Dekker et al. (2012) stated that it is not possible to encompass all family firm-related dimensions into a single and workable typology, we believe that is possible to encompass all main dimensions (in the form of the three core conceptual elements that our analysis identified: “ownership”, “management”, and “continuity”) into a workable taxonomy, and that this should be based on the key characteristics captured by the field's definitions.

We also consider, along the lines of Bock (1973, p. 379), that any classification system has to provide the foundation for all comparative studies, with “the best classification being the one that permits the most useful comparative investigation”. Thus one guiding principle for any taxonomy to become a useful classification is parsimony (Chrisman et al., 1988), and definitions or categories that differ only slightly make it difficult to integrate theory (Astrachan et al., 2002). Therefore, to get a useful classification, we would recommend future taxonomies establish a reduced number of categories by using a hierarchical structure, since this type of taxonomy facilitates information retrieval, making the classifications system easy to use, facilitating comparative research because generalization can be developed about each categorical level (Chrisman et al., 1988).

Finally, we consider that a useful classification system of family firms should be established with a general purpose, oriented to the study of a specific topic within of the field (e.g., professionalization), in order to make comparison among studies easier. With the purpose of finding a general classification of family firms that can be applied to all contexts, we encourage future classification systems to advance the inclusion of the missing variable of the tandem “family firm” (Dyer, 2003): the family; opting for an inclusive definition, applicable to any national or cultural context. Specifically, we suggest that the definition of family be adopted from the self-perception perspective, considering as “family” the group of people that perceives itself as a family, instead as “a group linked by blood or marriage” (Chrisman and Patel, 2012; Villalonga and Amit, 2006). Additionally, considering that the scarcity of investigation on the family side of the family-firm may be due to the fact that most of the researchers of this field have a business or management background, we call for increasing multi-disciplinary studies in this area, as well as for including in family firm research more scholars with different backgrounds, such as psychology or sociology, among others.

Our work is not exempt from some limitations. First, we have selected definitions included in this analysis based to the relevance of the studies in which definitions appeared, which was measured by the citation index per year. However, this quantitative approach does not capture the intention the authors had in referring to other works and, hence, citation cannot be considered a synonym for importance or relevance (Vogel and Güttel, 2013). Second, our study allows the inspection of the nature and structure of relationships among the conceptual elements, but it is difficult to make detailed inferences from it.

Despite these limitations, our investigation provides opportunities for future research. Studies comparing results of the use of different categories of family firms will help transform research results into tangible and directly applicable practices for policy-makers and professional dealing with these firms. Therefore, we encourage scholars to build a taxonomy or classification of family business based on the key characteristics of the entities classified, creating a general, parsimonious and hierarchical classification, and not specific to any certain time period. For that, we firstly propose establishing a clear distinction between family businesses and non-family business, and then to classify family firms in a reduced number of categories, considering all definitional criteria identified in this research.

Conflicts of interestThe authors have no conflicts of interest to declare.

We express our gratitude to the support provided by the Banco Santander Chair in Family Firm (University of Cantabria), and we also express our thanks to Franz W. Kellermanns for his careful review of an earlier version of this paper.