Accounting information is used to evaluate the firm's financial performance. Although, firms may have incentives to engage in earnings management, misleading all stakeholders. This study aims to analyse earnings management behaviours of Portuguese listed firms. Both accrual-based and real activities of earnings management are analysed to draw an overall picture of earnings management’ strategies. Most studies focused only in discretionary accruals as a proxy for earnings management, since cash flow-based earnings management is more difficult to detect. Although both strategies can be complementary instead of substituting. Moreover, the impact of financial crisis, family control, and firm characteristics is taken into account. Previous literature found that 2008 crisis had impact on earnings management as firms want to meet debt covenants and investors’ expectations. Moreover, family firms also impact the magnitude of earnings management. While some researchers found a negative relationship since managers are highly controlled, others found the opposite relationship because the family may want to maximize their own wealth. Analysing 51 listed firms, from 2003 till 2015, results show that firms engage more in earnings management during crisis, when the firm's financial situation is less stable. In addition, accrual-based earnings management is higher in family firms than in non-family ones, suggesting less quality of information in the first group. Due to less control of family firms, the family may expropriate minority investors’ wealth to increase personal benefits. Finally, the impact of firms’ characteristics on earnings management depends on the proxy of earning management analysed, suggesting that firms use accrual or real-activities earnings management depending on its purposes.

La información contable se utiliza para determinar el desempeño financiero de la empresa. Sin embargo, las empresas pueden tener incentivos para la gestión de los resultados, engañando a todas las partes interesadas. Este estudio tiene por objeto analizar los comportamientos de manipulación de resultados de las empresas portuguesas cotizadas. Para conocer las estrategias de manipulación de resultados se analizan tanto la gestión de resultados a partir de los devengos como las resultantes de actividades reales. Así tenemos un panorama general de las estrategias de gestión de resultados. La mayoría de los estudios realizados en esta área se centran solo en la manipulación de resultados con base en devengados, ya que la gestión basada en el flujo de efectivo es más difícil de detectar. Pero, las dos estrategias pueden ser complementarias y no substitutas. Además, proporcionamos nuevas pruebas teniendo en cuenta el impacto de la crisis financiera, del control de la familia y de las características de la empresa. La literatura anterior sugiere que la crisis de 2008 tuvo impacto en la manipulación de resultados ya que las empresas se preocupan por cumplir los contratos de deuda y satisfacer las expectativas de los inversionistas. Por otra parte, el control familiar también afecta la magnitud de la gestión de los ingresos. Mientras que algunos investigadores encontraron impacto negativo en la gestión de resultados, otros encontraron la relación opuesta, ya que la familia puede maximizar su propia riqueza. Al analizar 51 firmas cotizadas, en el período de 2003 hasta 2015, los resultados obtenidos nos indican claramente que la crisis financiera tiene impacto en la manipulación de resultados porque la situación financiera de las empresas es más inestable. Además, la gestión de los ingresos en valores devengados es mayor en las empresas familiares que en las no familiares, lo que sugiere menor calidad de la información en el primer grupo. Debido a un menor control de las empresas familiares, la familia puede expropiar la riqueza a inversores minoritarios para tener beneficios personales. Por último, el impacto de las características de las empresas en la gestión de los ingresos depende de la proxy de gestión de resultados utilizada, lo que sugiere que las empresas utilizan devengos o actividades reales para gestionar los ingresos en función de sus propósitos.

Earning management is not a new theme. Healy (1985) and Lambert (1984) have been the first works to highlight the relevance of this issue. Since then diverse researchers have analysed this topic. Some aim to detect earnings management (Beneish, 1999; Dechow, Sloan, & Sweeney, 1995; Jones, 1991; Peasnell, Pope, & Young, 2000), others focus on the incentives of earnings management (Dechow, Sloan, & Sweeney, 1996; Healy & Wahlen, 1999; Roychowdhury, 2006), others analyse the effect of financial crisis, ownership structure, among others (Chen, Firth, Gao, & Rui, 2006; Dutzi & Rausch, 2016; Iatridis & Dimitras, 2013; Jiraporn & DeDalt, 2009). The main purpose of researchers is to understand if the firm's financial information is real since all stakeholders focus on accounting information to sustain their decision making.

This work aims to analyse earnings management of Portuguese listed firms. Available information of listed firms is higher compared to non-listed ones, which makes it easier to study this group of firms (Dutzi & Rausch, 2016). Alves (2012, 2014) and Kacharava (2016) also focused on Portuguese listed firms. Although, this work analyses a long period, from 2003 till 2015, with years with and without financial crisis. Therefore, it is possible to verify the impact of 2008 crisis on earnings management. Previous studies found that firms engage in earnings management in response to financial crisis to deal with the firm's poor financial condition (e.g. Chia, Lapsley, & Lee, 2007; Dutzi & Rausch, 2016; Xu & Ji, 2016). Managers want to meet debt covenant, decreasing the cost of debt, and in turn, maximizing the firm's performance (Moreira & Pope, 2007). Moreover, listed firms may also influence financial investors to increase the firm's stock price, and the firm's finance (Cheng, Johnson, & Liu, 2013).

The impact of family firms on earnings management is also analysed. Although family firms have been extensively analysed, studies focussing on the impact of the family on earnings management are few and the existing ones found mixed results (Cascino, Puguliese, Mussolino, & Sansone, 2010). Chen, Gu, Kubota, and Takehara (2015) argued that family firms have less motivation to manipulate earnings compared to non-family ones, since agency costs between the principal and manager are eliminated or at least reduced (Jensen & Meckling, 1976). The family manages the firm or actively controls the manager, avoiding earnings management to increase manager's bonus. Moreover, the family looks for reputation, brand name, and perpetuation of the dynasty. Likewise, the magnitude of earnings management may be smaller to avoid risk increasing, and instabilities. Although, Gomez-Mejia, Cruz, and Imperatore (2014) suggested that family firms are more willing to manipulate earnings, especially in recession periods to maximize socio-emotional wealth. The family not only look for the maximization of the firm's wealth, but also of the family personal one. Another agency cost appears: between family owners and minority investors. The family may maximize their own wealth at the expense of expropriation of minority investors’ wealth. Additionally, in periods of recession the family may manage earnings to conceal bad news.

Portugal is an interesting case study for three main reasons. First, Portugal is a small country almost unexplored. Studies focus mainly on major countries as US, and UK, or in groups of countries as Europe as a whole. The results of this study enlarge previous literature, and can be compared to studies analysing similar markets. Second, the 2008 financial crisis had greater impact in the country, not only due to firm's bankruptcy, but also because of the public deficit. Portugal asked for Troika's help in order to solve its deficit. Diverse measures were applied in the country to revitalize the economy. Finally, around 80% of the Portuguese firms and half of the Portuguese stock index (PSI 20) are family ones (Miralles-Marcelo, Miralles-Quirós, & Lisboa, 2014). Therefore, analysing the impact of these firms on earnings management is relevant, since they are prevalent in the country and around the world.

Earnings management is analysed in the perspective of both accruals and real activities. Few studies focused on both perspectives (Achleitner, Günther, Kaserer, & Siciliano, 2014). This allows to draw a great picture of earnings management in Portuguese listed firms, as firms can engage in more than one strategy of earnings management at the same time. First, models are used to detect earnings management. Diverse models can be used to estimate discretionary accruals, a proxy of earnings management. The Jones model (1991) is one of the most used by researchers. In this study, an adaptation of this model was selected, the Kothari, Leone, and Wasley model (2005). It adds the return on asset (ROA) variable to the Jones model to control the performance effect as it can influence earnings management, especially in recession periods. To estimate earnings management based on cash flows, the model of Roychowdhury (2006) was used due to its high awareness. Second, the mean and standard deviation values of discretionary accruals and abnormal cash-flow based indicators before and during crisis periods, and family and non-family firms are compared. Finally, it is analysed which firm's characteristics, namely operational cash flow, leverage, price-to-book value, return on assets, size and type of audit company, impact the firm's earnings management.

Analysing 51 firms in a period of thirteen years (2003 till 2015), results show that financial crisis impacts earnings management. Earnings management is more prevalent during recession periods, when firms have more difficulties to reach a positive net profit, and to access to finance through loans or financial markets. In addition, family firms engage more in accrual-based earnings management than non-family ones. Financial information of family firms is less transparent and asymmetries of information are higher, decreasing the quality of their reports (Cascino et al., 2010). Consequently these firms can easily manage earnings to mislead stakeholders, and accomplish contracting aims, compared to non-family ones. Finally, the impact of firms’ characteristics on earnings management depends on the proxy used.

This study contributes to earnings management literature in three ways: (1) it sheds light on a relatively unexplored impact on earnings management: financial crisis and family control; (2) it analyses both accrual and real activities earnings management; (3) it studies a small country, almost unexplored, in which financial crisis had a great impact and the majority of the firms are family ones.

After the introduction chapter, where the aims of the study are presented, “Theoretical background and empirical hypotheses” section provides the theoretical background and the hypotheses of this study. “Data and empirical model” section describes the sample, models estimated and variables used. In “Empirical results and discussion” the empirical results are exhibited and discussed, and the conclusions are presented in “Conclusions” section.

Theoretical background and empirical hypothesesFirms follow the Generally Accepted Accounting Principles (GAAP) to produce financial information. Although managers have a variety of accruals options which can be used to reflect an ideal image of the firm, rather than its real value. Moreover, earnings can also be managed using real activities such as changing sales, production, inventories or policies about research and development, and advertising expenses. Likewise, can investors focus on firm's financial information to measure its performance and to sustain their decisions? (Schipper, 1989). To listed firms, stakeholders pay more attention to financial reports, but earnings management still prevail, being unusual to the interest of the users (Hu, Cao, & Zheng, 2015). Auditing could help to avoid its use, but Healy and Wahlen (1999) found that auditing is imperfect and so managers have the opportunity to manipulate results. But what is earnings management?

There are numerous definitions of earnings management showing the complexity of the issue (Beneish, 1999). For instance, Schipper (1989) focused on accounting numbers. Managers who have private information of the firm use it to choose the reporting rules more accurate to produce information to external share. Healy and Wahlen (1999) argued that managers use earnings management to show a different performance in financial statements than the reality to mislead stakeholders. Beneish (1999) stated that managers violate GAAP to present a higher financial performance. Earnings management is usually a strategy of managers to change the firm's report to reach a particular value, due to various reasons. Therefore, it has a negative impact on earnings quality (Kacharava, 2016).

According to Dutzi and Rausch (2016), earnings management can be beneficial, neutral or pernicious. It is beneficial when managers used the flexibility of GAAP to produce information about the firm's future cash flows and economic performance; neutral when it is efficient, but at the same time maximizes managers’ utility; and is pernicious when managers use accounting practice to reduce the transparency of financial statements. Some researchers (e.g. Dutzi & Rausch, 2016) argued that fraud actions are a part of earnings management, but usually researchers claimed that are two different things. The main problem is to distinguish between earnings management and illegality (Alves, 2014).

Managers can have different purposes to manage earnings. It can be used to influence contracting incentives, either managers or debt contracts. Managers, to increase their remuneration or bonus, may use specific accounting procedures to manage results (Healy, 1985; Healy & Wahlen, 1999; Schipper, 1989). In regards to debt hypothesis, managers want to avoid violations of the restrictive covenants which could increase financial costs (DeFond & Jiambalvo, 1994; Healy & Wahlen, 1999). Moreover, management of reports is also used to approve loans and benefit from a lower cost of debt (Kacharava, 2016). Moreira and Pope (2007) found that firms with negative net profit have higher incentive to manage earnings to avoid increasing of debt costs.

Another reason to engage in earnings management is to influence stock price, especially to increase market liquidity (Cheng et al., 2013; Erickson & Wang, 1999; Healy & Wahlen, 1999). The main tendency is to reduce fluctuations of net income or costs using earnings smoothing, a special case of earnings management, to show a normal growth (Alves, 2014). Stable earnings stream leads to firm's stock value increases, and in turn, the firm will have better conditions in loans, especially regarding the costs (Dechow et al., 1996), or will meet or beat analyst forecasts (Dutzi & Rausch, 2016). In addition, managers can use private information in their own interests, delaying the access of investors to the firm's information (Alves, 2014). Finally, Healy and Wahlen (1999) found that managers decrease results before management buyout and increase it after public offer.

Firms may also engage in earnings management to reduce income taxes, when there is a connection between financial statements and tax measurement (e.g. Healy & Wahlen, 1999). Managers may try to reduce results when they are high, to pay less income tax. In addition, earnings management can be used to avoid or reduce other consequences of violations of regulations from the government or the industry as costs for labour renegotiations (D'Souza, Jacob, & Ramesh, 2001 in Dutzi & Rausch, 2016), fulfil guidelines from the government (Dutzi & Rausch, 2016), answer to new environmental policies, influence external auditor, answer to legal protection of investors (Leuz, Nanda, & Wysocki, 2003), and others. Finally, earnings management can be used to increase some regulatory benefits, either from the government or the industry (Healy & Wahlen, 1999).

There are numerous ways to manipulate results, but it can be group into two groups: accruals and real activities. Accruals earnings management refers to change in accounting standards, while real activities earnings management are related to changing time and the structure of the business activity (Achleitner et al., 2014). Some researchers, as Peasnell et al. (2000) argued that accruals-based earnings management is more used because cash-flow management cannot only be managed at the end of the year. Others argued that they are complementary and not substitutes (Achleitner et al., 2014). Managers usually accelerate revenue recognition or defer expenses to influence income tax (Hu et al., 2015). They can change depreciation methods, or valorization method of inventories, reduce provision of bad debts and impairments, change assets’ life time or defer taxes in assets and liabilities (Healy & Wahlen, 1999). Accruals can be divided into non-discretionary accruals, which result from the normal activity of the firm's activity, and discretionary accruals, which are the ones artificial, that depend on manager's decision (Alves, 2014).

Real activities of earnings management are usually through increasing receivables through better conditions of sales or temporary discounts, deteriorating of gross margin, producing more than selling, decreasing R&D expenses and advertising costs (Beneish, 1999; Roychowdhury, 2006). Real activities are difficult to detect, and are usually confused with fraud (Alves, 2011).

HypothesisCrisis periods may influence the intention of changing results to lower or at least maintain the cost of debt, or to meet financial investors’ expectations (Chia et al., 2007; Kim & Yi, 2006). In fact, previous studies found evidence that firms manage earnings in periods of crisis. Persakis and Iatridis (2016) revealed that earnings quality decreases during recession periods, especially in countries with weak investor protection. La Porta, Lopez-de-Silanes, and Shleifer (1999) argued that in countries where shareholder protection is less efficient, the firm's ownership is more concentrate, as minority shareholders are afraid of wealth's expropriation. This ownership concentration makes it easy to managers to manage earnings, since firms are less controlled. This propensity of changing the firm's value may be enhanced in crisis periods, when firms have more difficulty to achieve good results.

In Portugal 2008 crisis had a great impact. In 2004 the percentage of firms’ bankruptcy was 10.4%, and had increased to 16% in 2011 (Pordata, 2016). Due to this phenomenon, the country has asked Troika's for help in 2011, and in 2012 had created some policies and programmes to help the revitalization of firms and the economy. Likewise, it is expected that Portuguese firms increase accruals and cash flow-based earnings management during crisis to show solvency either to debt holders or financial investors. Similar results were found by Xu and Ji (2016) to China, where the government launched similar incentives to stimulate the economy.

Hu et al. (2015) also found that when companies have three consecutive losses, they will have a great incentive to manage earnings in order to turn losses into gains. This may also be the situation of some firms of the sample, because during recession periods is more difficult to achieve positive net profit. These arguments suggest the first hypothesis:Hypothesis 1 Portuguese listed firms increase accrual and cash flow based earnings management in response to financial crisis.

Previous researchers found that the disposition of earnings management depends on corporate ownership (Kacharava, 2016). Family firms present singular characteristics, such as concentration of ownership in the hands of the family, poorly diversified portfolios since all the family's wealth is invested in the firm, large presence on the boards that allows to guarantee the family identity in the firm, longer investment horizons because the main intention is to pass on the firm to future generations, sustain family reputation, among others (Anderson & Reeb, 2003; Cascino et al., 2010; Jiraporn & DeDalt, 2009; Schulze, Lubatkin, & Dino, 2003). Anderson and Reeb (2003, 2004) found that founding-family firms present superior performance and lower cost of debt than non-family firms. Therefore their intention to engage in earnings managements’ strategies can also be different compared to their counterparts. Previous empirical studies provide inconsistent results about the impact of family control on earnings management.

Jiraporn and DeDalt (2009), Cascino et al. (2010), and Achleitner et al. (2014) found that earnings management is lower in family firms. This result goes in line with the alignment hypothesis between the principal and manager. The agency costs are reduced or inexistent in these firms, as ownership and control belongs to the family, or manager is highly controlled (Jensen & Meckling, 1976). Likewise, the family discipline managers, limiting earnings management (Jiraporn & DeDalt, 2009). The main goal is the same: increase firm and family's wealth, and sustain the firm for future generations (Chen et al., 2015). Therefore, the family avoids to take risks to guarantee the preservation of the firm for future generations (Gomez-Mejia, Larraza-Kintana, & Makri, 2003). Moreover, due to the concentration of ownership, family firms are largely insulate from the financial market. As a consequence, managers may have less pressure to manage earnings to influence financial investors or beat analysis forecasts (Cascino et al., 2010).

For another side, Stockmans, Lybaert, and Voordeckers (2010), found that Finnish family firms have incentives to manage earnings. This result follows the entrenchment and expropriation hypothesis related with another agency costs, between the family and minority investors. As ownership is concentrated in the hands of the family, or at least there are no other individual or group with more ownership than the family, they may expropriate minority investors to maximize personal wealth (Miralles-Marcelo et al., 2014). Therefore, the family may have lower incentive to provide high quality of accounting benefits, because understand the benefits of private information (Cascino et al., 2010).

Gomez-Mejia et al. (2014) also argued that family firms may be willing to manage earnings to conceal bad news. The family looks both to firm and socio-emotional wealth, i.e., to net profit and also to the perpetuation of the family's identity and dynasty, to reputational concerns, to sustain control, among others (Gomez-Mejia, Haynes, Nuñez-Nickel, Jacobson, & Moyano-Fuentes, 2007). This double purpose: financial and non-financial private benefits, may lead the family to manage earnings.

In Portugal, the legal system to protect minority investors is insufficient (La Porta et al., 1999). Moreover, there are few transparency of information. This allows the family to manage earnings to change stakeholders’ perceptions, either to benefit in access to new equity, or to meet debt covenants. Therefore, the entrenchment hypothesis may be more relevant to explain Portuguese firms. In addition, the main period analysed is a financial crisis period, when firms’ net profit have decreased and diverse firms went to bankruptcy. Likewise, it is expected that family firms are more willing to earnings management to sustain the family socio-emotional wealth and reputation, than non-family ones. This leads to the following hypothesis:Hypothesis 2 Earnings management is higher in Portuguese family listed firms than in non-family firms ones.

Achleitner et al. (2014) and Chen et al. (2015) found that the impact of German and Japanese family control in earnings management, respectively, depends how it is measured: using accruals or cash flow based indicators of earnings management. Family firms use more accrual-based earnings management than real activities to avoid risks, to sustain the firm for future generations, and to allow the family to maintain control. Moreover, cash flow based earnings management can have negative impact in performance, which is disliked by the family (Achleitner et al., 2014). Contrary, managers of non-family firms, who usually are independent, prefer to engage in real activities earnings management, since it is difficult to be detected by the market. The next hypothesis naturally follows:Hypothesis 2a Portuguese family listed firms are more willing to accrual-based earnings management, than to cash flow based indicators.

Finally, the probability of earnings management may depend on the firm's characteristics and financial statement variables (Beneish, 1999). Firms with high operational cash flows have less tendency to manage earnings through accruals, since are more able to use real activities (Dechow et al., 1995; DeFond & Jiambalvo, 1994). Higher cash flow means the company is efficient in turning earnings into cash, so has more liquidity, and more opportunity to repay debt, distribute dividends or pay other expenses (Kacharava, 2016). This is also related with higher quality of management and reports. The next hypothesis is following:Hypothesis 3 Earnings management decreases with operational cash flow (OCF).

Leveraged firms usually try to increase income and use real-based earnings management to reduce the cost of debt, and meet debt covenants (DeFond & Jiambalvo, 1994). In case of default of debt contracts, the firm may have difficulties to access to new loans, and the interest expenses of the existent ones may increase. Therefore it is expected that earnings management increases with leverage (Alves, 2012). Although, indebted firms may have difficulties to manage results since are highly controlled by debt holders. Debt is an alternative way to control agency costs, because managers need to pay back loans, and thus have less opportunity to maximize private wealth (Jensen & Meckling, 1976). Peasnell et al. (2000) found a negative relation between earnings management and leverage. In this work, the firms analysed are listed firms, with access to both bank loans and new equity issue. Therefore, high levels of indebtedness are not expected, especially to avoid banks control on the firm. Thus, a positive relationship between earnings management and leverage is proposed.Hypothesis 4 Earnings management increases with leverage.

The firm's stock price may impact earnings management. When investors have positive expectations of the firm are willing to pay more for the stock price compared with the book value, since they expect that, in the future, the firms will grow and increase its value. Mature firms usually have a price-to-book value (PBV) near one, and investors are only disposal to pay the accounting value of the firm, or near that value, since are not expecting added value. Therefore, it is expected that these firms are more willing to earnings management to meet or beat investor's perception (Cheng et al., 2013; Healy & Wahlen, 1999). Hypothesis 5 is established:Hypothesis 5 Earnings management decreases with PBV.

The firm's return may also impact earnings management. One of the purposes of earnings management is to pay less taxes, when tax measurement is linked with the firm's financial statements. Firms with high net income may engage in earnings management to reduce tax net income (Healy & Wahlen, 1999). Although, firms with losses may want to turn it into gains to deal with stakeholders. Managers may employ earnings management strategies to increase net profit and then meet debt covenants and investors’ expectations. Chen et al. (2006) found that earnings management is negatively related with performance, measured by return on assets (ROA).

As the major period analysed is crisis period, high net income is not prevalent. Firms mainly present losses or small net profit, and so may be more willing to engage in earnings management strategies. The following hypothesis naturally comes up:Hypothesis 6 Earnings management is negatively related with ROA.

The firm’ size may also influence earnings management, since it affects the quality of reported information. For one side, larger firms usually have lower information asymmetry, and control system is more efficient, which may lead to reduction of earnings management (Watts & Zimmerman, 1986). For another side, larger firms have greater agency costs, due to the separation of the principal and manager, which can lead to opportunistic practices, especially with regards to managers’ bonus (Jensen & Meckling, 1976). Moreover, larger firms are more pressed by analysts to beat investors’ expectations. Some researchers (ex. Peasnell et al., 2000) found a negative relationship between firm size and earnings management not only because of the higher control of large firms, but also to maintain their reputation. As a result the following hypothesis appears:Hypothesis 7 Earnings management decreases with the firm’ size.

Finally, the quality of auditors may influence earnings management. Auditors control the firms’ report, and thus, the quality of financial reports is expected to be high, since they may detect errors and irregularities (Alves, 2014; Dechow et al., 1996). Previous studies found that companies audited by the big four firms (Deloitte, Ernest & Young, KPMG, PricewaterhouseCoopers) engage less in earnings management, since these auditors have a reputation that want to sustain to continue increasing the number of clients (Iatridis & Dimitras, 2013). Consequently, the following hypothesis is proposed:Hypothesis 8 Earnings management decreases when the firm is audited by one of the big-4 companies.

This study covers Portuguese listed firms over the period from 2002, the starting date of the circulation of euro (notes and coins) until 2015 (last year with available financial information). Portugal is a small-size country, with the predominance of small and medium enterprises (99%, Statistics of Portugal Portal – INE, 2016). Moreover, around 80% of the firms and half of the Portuguese stock indexes are family firms (Miralles-Marcelo et al., 2014). Firms usually use equity as a first choice to finance their activities, and then external loans as a second choice (Schmid, 2012). Issuing new equity is avoided to maintain the firm control. Moreover, In Portugal, the accounting is related with tax system (Alves, 2011). Finally, recent news estimated that the parallel economy in 2014 represented 26.81% of the gross domestic product. As a consequence the tendency to manage results may be related both to minimize income tax payment, and to have access to external capital at a low cost (Alves, 2014).

Data was obtained from SABI database of Bureau Van Dijk. Financial services and football clubs were excluded since these firms have different characteristics with regards to accounting standards. The final sample includes 51 listed firms with a total of 593 observations in a period of 13 years (2003–2015). Information about the year 2002 was also collected to calculate annual growths.

The financial crisis has started in September 2008 with the bankruptcy of Lehman Brothers in the USA. It was one of the major financial reporting fraud of this century (Koschtial & Franceschetti, 2013). In the same year two banks also collapsed in Portugal: Banco Português de Negócios in November, and Banco Privado Português, in December. As a consequence, Portugal suffered high public deficit in 2010, and in April of 2011 asked for Troika's help to surpass this problem. Although, the crisis did not end, and in 2014 another Portuguese bank have collapsed, Banco Espírito Santo. For this reason, the period from 2008 till 2015 was classified as a crisis period, while the years of 2003 until 2007 a pre-crisis period.

Firms were classified into family and non-family manually. The names of the firm’ owners and members of the board of directors were analysed to detect parental relations. Moreover, information on the firms’ website was also taken into account to confirm these relationships. There are numerous definitions of family firms. Miller, Breton-Milles, Lester, and Cannella (2007) presented in their research an extensive list of family firms’ definitions, explaining that due to different definitions, comparisons among studies can be biased. They define a family firm as one in which family members are involved as major owners, and at the same time, are present in the board of directors. This study employs the definition of family-controlled firm, i.e., a firm is classified as family firm whenever the family has fractional equity and family members are serving on the board of directors. This definition follows Anderson and Reeb (2003) and Miralles-Marcelo et al. (2014).

Analyzing the sample 55% of the firms are family firms (with 332 total observations), and 45% are non-family firms (with 261 total observations). This result is in line with the one found by Miralles-Marcelo et al. (2014).

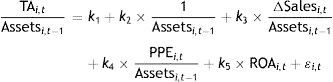

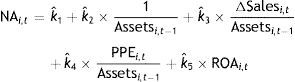

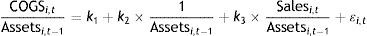

ModelsThere are various models to estimate discretionary accruals, as for example: Healy (1985), DeAngelo (1986), Jones (1991), Dechow et al. (1995), and Kothari et al. (2005). Following common practice the Kothari et al. (2005) model, which is a modification of the Jones model, was selected to estimate discretionary accruals for each financial year. This model considered changes in revenues and property plant and equipment as the primarily influenced dimension, and return on assets ratio to control the performance effect. The estimated model was the following:

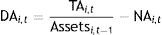

where TA: total accruals is the variation of non-cash current assets, less the variation of current liabilities, plus depreciations; Assets: total assets; ΔSales: annual change in sales; PPE: net amount of property, plant and equipment; ROA: return on assets; i: firm; t: fiscal year.The coefficients obtained in the aforementioned equation (kˆ) were used to estimate non-discretionary accruals (NA), using the following expression:

Finally, the difference between total accruals and estimated non-discretionary accruals is the discretionary accruals value (DA).

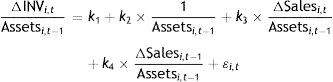

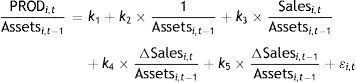

To analyse earnings management through real activities the model of Roychowdhury (2006) was estimated. He analysed patterns in operational cash flow, discretionary expenses (as the sum of advertising, research and development, and selling, administrative and general expenses), and production costs (as the sum of cost of gods sold and change in inventories), using linear functions of sales and changes in sales. Real activities cannot be manipulated at the end of the year (Roychowdhury, 2006). It results from increasing sales by giving better condition of payment or temporary discounts, decreasing operational cash flows, increasing production to report lower cost of goods sold, since unit fixed costs is reduced, and decreasing discretionary expenses.

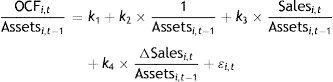

To estimate the normal level of operational cash flow (OCF) the following model was estimated:

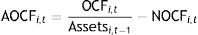

where OCF: operational cash flow is the net income plus depreciations, minus the variation of non-cash current assets, more the variation of current liabilities.The abnormal operational cash flow (AOCF) is the actual OCF minus the normal level of OCF (NOCF) calculated using the coefficients obtained in the previous equation.

The normal level of cost of goods sold (COGS) was estimated by:

The normal level of inventories change (ΔINV) was estimated using the following model:

As the production costs (PROD) are the sum of COGS and change in inventories, the normal level of production was estimated by:

In this study the discretionary expenses were not taken into account due to lack of information.

The abnormal cost of goods sold (ACOGS), abnormal level of inventories change (AΔINV), and abnormal production costs (APROD) are no actual value minus the normal level calculated using the coefficients obtained in the previous equations.

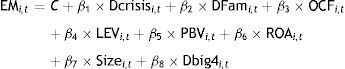

Finally, to analyse the impact of the firm characteristics on earnings management, previous studies suggested operational cash flow, leverage, price-to-book value, return on assets, size and audit by the big four companies (ex. Alves, 2012; Cascino et al., 2010; Dechow et al., 1995; DeFond & Jiambalvo, 1994; Xu & Ji, 2016).

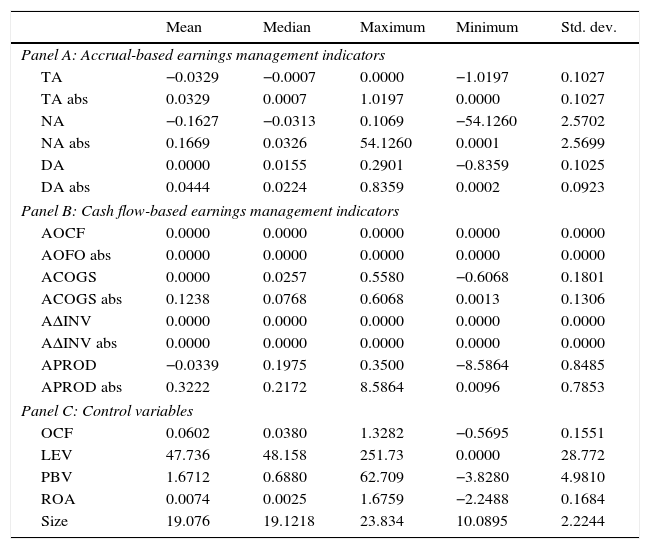

where EM: earnings management is the discretionary accruals, the abnormal cost of goods sold, or the abnormal change in inventories; Dcrisis: dummy variable that is one when the year is a period of financial crisis, and zero otherwise; Dfam: dummy variable that is one when the firm is a family firm, and zero otherwise. Family firms are the ones owned and controlled by a family. LEV: leverage ratio; PBV: price-to-book value; ROA: return on assets; Size: natural logarithmic of total assets; Dbig4: dummy variable that is one when the audit is a firm of the big four (Deloitte, Ernest & Young, KPMG, PricewaterhouseCoopers), and zero otherwise.Empirical results and discussionThe principal descriptive statistics, namely mean, medium, maximum, minimum, and standard deviation are presented in Table 1. Panel A presents accrual-based earnings management ratios; panel B the real-based earnings management indicators, and finally panel C the control variables in the regression models.

Descriptive statistics.

| Mean | Median | Maximum | Minimum | Std. dev. | |

|---|---|---|---|---|---|

| Panel A: Accrual-based earnings management indicators | |||||

| TA | −0.0329 | −0.0007 | 0.0000 | −1.0197 | 0.1027 |

| TA abs | 0.0329 | 0.0007 | 1.0197 | 0.0000 | 0.1027 |

| NA | −0.1627 | −0.0313 | 0.1069 | −54.1260 | 2.5702 |

| NA abs | 0.1669 | 0.0326 | 54.1260 | 0.0001 | 2.5699 |

| DA | 0.0000 | 0.0155 | 0.2901 | −0.8359 | 0.1025 |

| DA abs | 0.0444 | 0.0224 | 0.8359 | 0.0002 | 0.0923 |

| Panel B: Cash flow-based earnings management indicators | |||||

| AOCF | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| AOFO abs | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| ACOGS | 0.0000 | 0.0257 | 0.5580 | −0.6068 | 0.1801 |

| ACOGS abs | 0.1238 | 0.0768 | 0.6068 | 0.0013 | 0.1306 |

| AΔINV | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| AΔINV abs | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| APROD | −0.0339 | 0.1975 | 0.3500 | −8.5864 | 0.8485 |

| APROD abs | 0.3222 | 0.2172 | 8.5864 | 0.0096 | 0.7853 |

| Panel C: Control variables | |||||

| OCF | 0.0602 | 0.0380 | 1.3282 | −0.5695 | 0.1551 |

| LEV | 47.736 | 48.158 | 251.73 | 0.0000 | 28.772 |

| PBV | 1.6712 | 0.6880 | 62.709 | −3.8280 | 4.9810 |

| ROA | 0.0074 | 0.0025 | 1.6759 | −2.2488 | 0.1684 |

| Size | 19.076 | 19.1218 | 23.834 | 10.0895 | 2.2244 |

Descriptive statistics of TA (total accruals: accruals divided by total assets of previous year), NA (non-discretionary accruals), DA (discretionary accruals), AOCF (abnormal operational cash flow), ACOGS (abnormal cost of goods sold), AINV (abnormal change in inventories), APROD (abnormal production), OCF (operational cash flow divided by total assets of previous year), LEV (leverage), PBV (price-to-book value), ROA (return on assets), Size (natural logarithm of total assets). Abs mean absolute values.

The mean values of discretionary accruals (DA) and cash-low based earnings management indicators (AOCF, ACOGS, AΔINV, except APROD) are all zero. This result suggests that while some firms use income-increasing earnings management, others engage in income-decreasing earnings management. Similar values were found by Alves (2014) and Xu and Ji (2016). The absolute values of indicators were calculated to combine both the effect of earnings-increasing and earnings-decreasing management, as Jiraporn and DeDalt (2009) and Xu and Ji (2016). Absolute value of abnormal operational cash flow and abnormal change in inventory are still zero, in mean. The absolute value of discretionary accruals is around 4%, and absolute value of abnormal cost of goods sold is around 12%. Both are also volatile suggesting that Portuguese firms may engage in earnings management strategies, through accruals and gross margin.

Analyzing the control variables it can be drawn that, in mean, the operational cash flow is 6% of total assets of the previous period. Although, while some firms show high and positive values (maximum value is 133%), others exhibit negative ones (minimum value is −57%). This result can be influenced by both the industry and financial crisis. Leverage is 47.7% of the firms’ assets. Some firms are too indebted while others no, and the dispersion among the sample is high. The price-to-book value is higher than one, meaning that investors are able to pay more than the accounting value of the company due to future expectations. Return on assets is almost 0% (0.74%), and some firms even exhibit negative values, which can be inferred by the financial crisis. The firms’ size, measured by the logarithm of assets, is in mean 19. Alves (2012) found similar values to ROA and size when analyzing Portuguese listed firms in a different period.

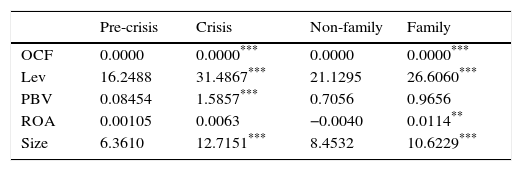

Table 2 exhibit the mean values of the control measures included in the analysis to periods before and with crisis, and to family and non-family firms.

Comparison of control variables of pre-crisis vs crisis period, family vs non-family firms.

| Pre-crisis | Crisis | Non-family | Family | |

|---|---|---|---|---|

| OCF | 0.0000 | 0.0000*** | 0.0000 | 0.0000*** |

| Lev | 16.2488 | 31.4867*** | 21.1295 | 26.6060*** |

| PBV | 0.08454 | 1.5857*** | 0.7056 | 0.9656 |

| ROA | 0.00105 | 0.0063 | −0.0040 | 0.0114** |

| Size | 6.3610 | 12.7151*** | 8.4532 | 10.6229*** |

Mean values of OCF (operational cash flow divided by total assets of previous year), LEV (leverage), PBV (price-to-book value), ROA (return on assets), Size (natural logarithm of total assets).

Analyzing Table 2 the following facts emerge. With crisis Portuguese listed firms have increased their indebtedness. In fact, many companies have delayed their payments, increasing the credit of suppliers, which in turn increased liabilities. Moreover, due to the country instability, diverse firms decided to internationalize to maintain their activity. Likewise, new investments were made, and the companies looked for new loans to finance these investments, explaining also the increase of debt levels. The firm’ size also increased with crisis, as a result of the situation explained before. Finally, the price-to book value also increased with crisis. This conclusion was unexpected, since during crisis financial investors may have few expectations about the firm's performance. This increase in price-to-book value could be a result of earnings management: the firms exhibit higher results than the ones financial investors were expecting, and in turn the stock price increase.

Comparing family and non-family firms, the first group is more indebted. In fact, family members prefer to use, first internal capital, then external loans, and lastly issuing new equity because it leads to loss of the firm’ control and to increase the risk taking (Schmid, 2012). Non-family firms may prefer to issue new equity, and finance their activity through financial markets to avoid banks control. The price-to-book value is slightly high to family firms, but the difference is not statistically significant. The long-term perspective of family firms may be seen as a positive sign, especially in periods of recession, and thus the stock price increases. While family firms exhibit, in mean, a positive return on assets, non-family firms show a negative one. This may suggest that or family firms engage more in earnings management, especially because their high levels of indebtedness, or that are more able to manage their income and costs. Finally, the dimension of family firms is larger than that of their counterparts. This result can be inferred by the financial crisis, because as it was shown before, with crisis firms increased their dimension, especially because of new investments to achieve new markets.

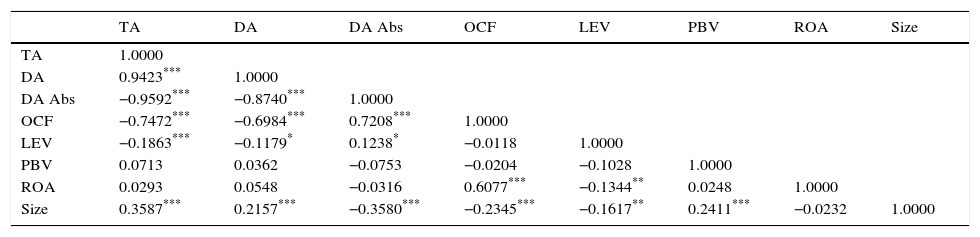

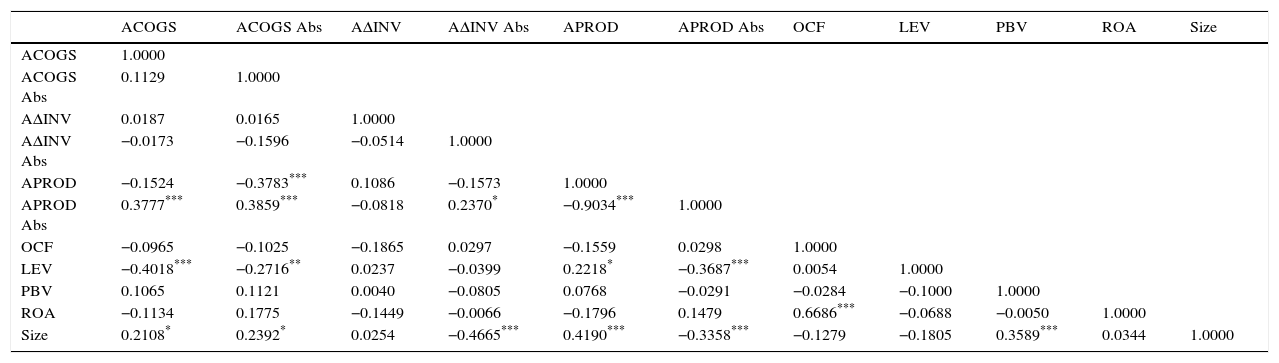

The correlation matrix is present in Tables 3 and 4, to accruals and cash flow based earnings management, respectively.

Correlation matrix – accruals variables.

| TA | DA | DA Abs | OCF | LEV | PBV | ROA | Size | |

|---|---|---|---|---|---|---|---|---|

| TA | 1.0000 | |||||||

| DA | 0.9423*** | 1.0000 | ||||||

| DA Abs | −0.9592*** | −0.8740*** | 1.0000 | |||||

| OCF | −0.7472*** | −0.6984*** | 0.7208*** | 1.0000 | ||||

| LEV | −0.1863*** | −0.1179* | 0.1238* | −0.0118 | 1.0000 | |||

| PBV | 0.0713 | 0.0362 | −0.0753 | −0.0204 | −0.1028 | 1.0000 | ||

| ROA | 0.0293 | 0.0548 | −0.0316 | 0.6077*** | −0.1344** | 0.0248 | 1.0000 | |

| Size | 0.3587*** | 0.2157*** | −0.3580*** | −0.2345*** | −0.1617** | 0.2411*** | −0.0232 | 1.0000 |

Correlation matrix of TA (total accruals: accruals divided by total assets of previous year), DA/DA abs (discretionary accruals/absolute value), OCF (operational cash flow divided by total assets of previous year), LEV (leverage), PBV (price-to-book value), ROA (return on assets), Size (natural logarithm of total assets).

Correlation matrix – cash-flow based variables.

| ACOGS | ACOGS Abs | AΔINV | AΔINV Abs | APROD | APROD Abs | OCF | LEV | PBV | ROA | Size | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACOGS | 1.0000 | ||||||||||

| ACOGS Abs | 0.1129 | 1.0000 | |||||||||

| AΔINV | 0.0187 | 0.0165 | 1.0000 | ||||||||

| AΔINV Abs | −0.0173 | −0.1596 | −0.0514 | 1.0000 | |||||||

| APROD | −0.1524 | −0.3783*** | 0.1086 | −0.1573 | 1.0000 | ||||||

| APROD Abs | 0.3777*** | 0.3859*** | −0.0818 | 0.2370* | −0.9034*** | 1.0000 | |||||

| OCF | −0.0965 | −0.1025 | −0.1865 | 0.0297 | −0.1559 | 0.0298 | 1.0000 | ||||

| LEV | −0.4018*** | −0.2716** | 0.0237 | −0.0399 | 0.2218* | −0.3687*** | 0.0054 | 1.0000 | |||

| PBV | 0.1065 | 0.1121 | 0.0040 | −0.0805 | 0.0768 | −0.0291 | −0.0284 | −0.1000 | 1.0000 | ||

| ROA | −0.1134 | 0.1775 | −0.1449 | −0.0066 | −0.1796 | 0.1479 | 0.6686*** | −0.0688 | −0.0050 | 1.0000 | |

| Size | 0.2108* | 0.2392* | 0.0254 | −0.4665*** | 0.4190*** | −0.3358*** | −0.1279 | −0.1805 | 0.3589*** | 0.0344 | 1.0000 |

Correlation matrix of ACOGS (abnormal cost of goods sold), AINV (abnormal change in inventories), APROD (abnormal production), OCF (operational cash flow divided by total assets of previous year), LEV (leverage), PBV (price-to-book value), ROA (return on assets), Size (natural logarithm of total assets).

Table 3 shows that only operational cash flow, leverage and size are relevant variables to explain discretionary accruals. There is a negative correlation between operational cash flow/leverage and discretionary accruals. This suggests that firms with lower operational cash are more willing to earnings management as expected. Regarding indebtedness, the relation found is contrary to the expected one, but results can be influenced by crisis periods, since in recession periods firms have more difficulties in access to loans, and the ones with this opportunity may use it to maximize personal wealth, as managers’ bonus for instance. Finally there is also a positive correlation between size and discretionary accruals proposing that large firms engage in accruals management. This is contrary to Hypothesis 7 since small firms usually have less transparency of information, and then can engage in earnings management strategy. Although, Portuguese firms have, in mean, small dimension compared with the ones of the U.S. or other major country. Moreover, total accruals and discretionary accruals are highly correlated which is explained because discretionary accrual is part of total accruals.

Table 4 presents the correlation matrix between the abnormal values of cash flow based earnings management and control variables. Leverage is negatively correlated with abnormal cost of goods sold, but positively correlated with abnormal production. More indebted firms increase production, decreasing cost of goods sold to manage earnings. This relation follows the expectation. Size is positively correlated with abnormal cost of goods sold, and abnormal production. This result suggests that larger firms manage results more than smaller firms may be because they are listed firms and want to meet investor's perceptions, especially in crisis periods. Finally, none of the variables included in the models are highly correlated, at least not to a significant extent.

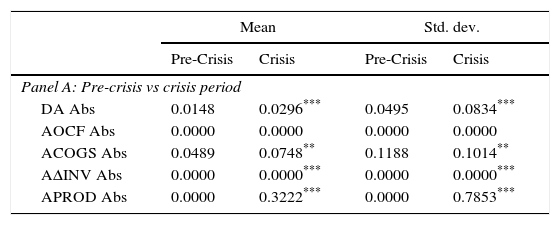

Table 5 shows the impact of financial crisis (panel A) and family control (panel B) on earnings management. As normal values of accrual and cash flow based indicators of earnings management are, in mean, zero, absolute values were used, as Xu and Ji (2016).

Comparison pre-crisis vs crisis period, family vs non-family firms.

| Mean | Std. dev. | |||

|---|---|---|---|---|

| Pre-Crisis | Crisis | Pre-Crisis | Crisis | |

| Panel A: Pre-crisis vs crisis period | ||||

| DA Abs | 0.0148 | 0.0296*** | 0.0495 | 0.0834*** |

| AOCF Abs | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| ACOGS Abs | 0.0489 | 0.0748** | 0.1188 | 0.1014** |

| AΔINV Abs | 0.0000 | 0.0000*** | 0.0000 | 0.0000*** |

| APROD Abs | 0.0000 | 0.3222*** | 0.0000 | 0.7853*** |

| Non-family | Family | Non-family | Family | |

|---|---|---|---|---|

| Panel B: Family vs non-family firms | ||||

| DA Abs | 0.0123 | 0.0321*** | 0.0251 | 0.0932*** |

| AOCF Abs | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| ACOGS Abs | 0.0597 | 0.0708 | 0.1211 | 0.1065* |

| AΔINV Abs | 0.0000 | 0.0000*** | 0.0000 | 0.0000*** |

| APROD Abs | 0.1209 | 0.1574 | 0.4946 | 0.2141*** |

Mean and standard deviation values of DA (discretionary accruals), AOCF (abnormal operational cash flow), ACOGS (abnormal cost of goods sold), AINV (abnormal change in inventories), and APROD (abnormal production). Abs mean absolute values.

As expected financial crisis impacts earnings management practices. Absolute values of discretionary accruals (mean values) have increased from 0.0148 to 0.0296 after 2008. This means that, to meat stakeholders’ expectations, especially during turbulent periods, Portuguese firms manage accruals. Moreover, the absolute value of cost of goods sold, change in inventories and production have also increased with financial crisis, and the difference between before and with crisis is statistically significant. Results suggest that firms also engage in real-based earnings management during turbulent periods. Therefore, Hypothesis 1 is validated, and results show that accruals and real activities earnings management are complementary strategies rather than alternative. Similar results were found by Kim and Yi (2006), Chia et al. (2007), and Xu and Ji (2016).

Differences between family and non-family firms are also significant with regards to accrual-based earnings management. Family firms’ absolute values of discretionary accruals are higher than those of non-family ones (in mean, 0.032 vs 0.012, respectively). The family may want to conceal real information, either to maintain reputation and other emotional wealth, or to meet stakeholders’ expectations, especially debt-holders and financial investors. Moreover, as these firms have ownership concentrate in the hand of the family, and less transparency of information, engage in earnings management may be easy than to non-family firms. This result confirms the entrenchment hypothesis, as expected in Hypothesis 2. With regard to real activities indicators of earnings management, only the absolute value of change in inventories is statistically significant, suggesting that family and non-family firms have similar strategies to production and operational cash flow. In fact the Portuguese tax authority (Autoridade Tributária) applied new rules with regards to inventories in 2015, because it was aware that firms used inventories to change earnings. Since 2015 Portuguese firms are obligated to communicate the list of inventories to tax authority every month or, if sales volume is less than €100000, at the end of the year. This also confirms different ways to manipulate earnings between family and non-family firms, as Jiraporn and DeDalt (2009). Comparing accruals and real-activities earnings management it can be drawn that the main differences between family and non-family firms are with regards to accruals, which is less risky and thus avoids firms’ instabilities and promote its sustainability in the future, as suggested by Achleitner et al. (2014). Hypothesis 2a is also validated.

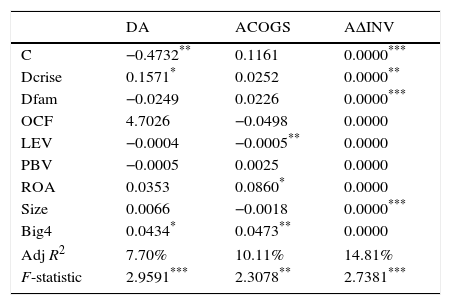

Finally Table 6 shows the impact of firm’ characteristics on earnings management.

Effects of firm characteristics on earnings management.

| DA | ACOGS | AΔINV | |

|---|---|---|---|

| C | −0.4732** | 0.1161 | 0.0000*** |

| Dcrise | 0.1571* | 0.0252 | 0.0000** |

| Dfam | −0.0249 | 0.0226 | 0.0000*** |

| OCF | 4.7026 | −0.0498 | 0.0000 |

| LEV | −0.0004 | −0.0005** | 0.0000 |

| PBV | −0.0005 | 0.0025 | 0.0000 |

| ROA | 0.0353 | 0.0860* | 0.0000 |

| Size | 0.0066 | −0.0018 | 0.0000*** |

| Big4 | 0.0434* | 0.0473** | 0.0000 |

| Adj R2 | 7.70% | 10.11% | 14.81% |

| F-statistic | 2.9591*** | 2.3078** | 2.7381*** |

Regression between DA (discretionary accruals), ACOGS (abnormal cost of goods sold), and AINV (abnormal change in inventories), and OCF (operational cash flow divided by total assets of previous year), LEV (leverage), PBV (price-to-book value), ROA (return on assets), Size (natural logarithm of total assets).

Analyzing the first column of Table 6, the impact of firm's characteristics on accrual-based earnings management, only financial crisis and audit from big four companies are statistically significant to explain discretionary accruals in a positive way. As expected, during crisis firms engage more in earnings management to meet debt covenants and financial investors’ expectations. 2008 financial crisis had great impact in Portugal. Many companies went to bankruptcy, the firm's financial performance has decreased, and unemployment rate has increased. This led to high public deficit. Banks had more difficulty to lend money. Therefore companies may have incentive to manage earnings to show a better performance than the real one, and in turn reduce cost of debt, and meet financial investors’ expectations. This result confirms the mean difference of accruals to periods before crisis and with crisis, and the expected in Hypothesis 1. Similar result was also found by Kim and Yi (2006), Chia et al. (2007), and Xu and Ji (2016).

Contrary to our expectation, audit from big four companies positively impacts earnings management. Roychowdhury (2006) suggested that accrual management is more easily detected by auditors. Although the result found contradicts it. It may be influenced by financial crisis because firms need to increase profitability and liquidity in recession periods. Similar results were found by Persakis and Iatridis (2016). In fact, in Portugal audit was questioned with crisis, suggesting that audit companies control the formal application of standards instead of detecting frauds. Banco Espírito Santo, that collapsed in November 2014, was a listed firm audit by a big four company. Similar case happened with Lehman and Brothers, the fourth-largest bank in the U.S, audit by a big four company (Kacharava, 2016).

All the other variables are not statistically significant to explain discretionary accruals. In a univariate analysis (mean and standard deviation differences), family control impacts discretionary accruals, but when other variables are included this effect disappears. Therefore, the family impact on earnings management may be related with the firm’ size or other characteristics now included in the model. Moreover, the variables included in the model explain around 7.7% of discretionary accruals.

In regards to abnormal cost of goods sold, column 2, leverage, return on assets and audit from the big four are statistically significant to explain it. The abnormal cost of goods sold increases in firms with less leverage, more performance and audited by one of the big four companies. These relations confirm Hypotheses 4, 6 and 8. Firms manipulate results increasing production to report lower cost of goods sold, and thus to increase results (Roychowdhury, 2006). Indebted firms engage more in real-based earnings management to reduce cost of debt and meet debt holders’ expectations. In case of default of debt contracts, indebted firms may have difficulties to access to new loans, which may make it difficult to sustain the firm's activity. Thus, indebted firms may have a higher incentive to use earnings management strategies, and meet debt covenants. Similar result was found by DeFond and Jiambalvo (1994) and Alves (2012). Moreover, firms with lower net profit may employ earnings management strategies to turn losses into gains. This result should be more relevant during crisis, when net profit is smaller and the need of debt is higher. Chen et al. (2006) found similar result. Finally, it seems that firms audit by big four companies engage less in real-based activities. This goes in line with expectations, but it contradicts results found previously, about discretionary accruals. This result is even more interesting as previous studies, as for example Peasnell et al. (2000) argue that accruals is more easily detected than real-activities earnings management. May be, audit firms are more concern with changings the structure of the business activity, which can increase the probability of the firm's bankruptcy, than changing in accounting standards. Finally, the variables included in the model explain 10.11% of the abnormal cost of goods sold.

Abnormal change in inventories is explained by crisis, family control and size of the firm as expected. Hypotheses 1, 2 and 7 are then validated. As explained before, management of inventories in Portugal was seemed as one of the main strategy to manage earnings through real activities, and for this reason, since 2015 Portuguese firms are obligated to communicate the list of inventories to tax authority every month (or in some cases only at the end of the year). As the sample period analysed is from 2003 till 2015, this result is the expected one. The family impact on inventories management was already detected in the mean difference analysis. The tendency to manage inventories to change the firm's real value is different between family and non-family firms. Moreover, this impact is also explained by the firm’ size. Smaller firms are usually less controlled by externals, and thus can easily increase the firm's results by changing inventories. The variables included in the model explain 14.81% of abnormal change in inventories.

DiscussionTaken together, the results of this paper contribute to the ongoing debate on earnings management. The financial crisis and family control impact on earnings management strategies is analysed together. Most studies analyse it in separate, but the differences between family and non-family firms may depend on the economic cycle. Consistent with the first hypothesis, financial crisis impact management's involvement in earnings management activities. During recession periods firms may have difficulties in meet debt covenants, which may influence the firm's cost of debt, and future access to new loans. Therefore, managers may try to turn losses into gains, changing the firm's value to assure the actual debt conditions. Moreover, listed firms also want to meet financial investor's expectation to access to new external capital, and to maintain the firm reputation.

Following Hypothesis 2, earnings management strategies are different across family and non-family firms. Results indicate that family firms engage more in earnings management relative to their non-family counterparts. This finding supports the entrenchment hypothesis: family managers may use private information for their own benefits, expropriating minority investors’ wealth. The family not only looks for financial performance maximization, but also to socio-emotional wealth, mainly to reputational concerns, and sustain the firm's for future generations. This second issue is highlight during recession periods, when firms way have losses instead of high profits.

Moreover, while several studies focus on accruals and real-activities earnings management in separate, this paper aims to understand them both, as complementary mechanisms. In fact, family firms tend to avoid risky strategies as it can question the firms’ perpetuation to future generations. Therefore family managers tend to engage more in earnings management through accruals than through real activities. Results corroborate this hypothesis.

Finally, the determinants of earnings management tend to be different depending on the proxy of earnings management used. Financial crisis impact both discretionary accruals and abnormal changing in inventories. Family impact is only relevant to explain abnormal changing in inventories. The family impact on the other proxies of earnings management may be inferred by some firm's characteristics. Indebted firms engage less in earnings management strategies. This result support the idea that debt holders are a complementary way to discipline managers, and thus to decrease discretion. The return on assets only impact the abnormal cost of goods sold, which is expectable since this ratio depends on the net profit which is the sum of profits less costs. The firm size, as well as family control impacts the abnormal change in inventories, showing that small firms as well as firms controlled by family members have different strategies regarding inventories compared with their counterparts. This result was expected in Portugal, because inventories were not controlled before 2015, and was one of the main items used to change results, especially to small firms to exhibit a positive net profit, and influence debt holders’ perceptions. Lastly, firms audited by big four companies show higher accruals earnings management, but less real-activities earnings management. This suggests that higher quality enhances a higher degree of compliance with regards to changes in the business structure, but not in following accounting standards.

ConclusionsEarnings management is not a new theme but is still an important issue of financial accounting literature. Diverse studies have analysed whether firms engaged in earnings management using accrual and cash-flow based models. In this study the impact of both financial crisis and family control on earnings management was analysed. There are few studies analyzing the impact of 2008 crisis, especially in countries, as Portugal, who asked Troika's help to solve public deficit. In addition, as family firms are predominant in Portugal, and previous studies found that ownership structure impacts earnings management, this impact was also examined. Others researchers found that family control influences earnings management, but while some suggest a positive relation, others found a negative one.

Both accruals and cash flow-based earnings management were used to draw a great picture of earnings management of Portuguese listed firms. Firms may use different earnings management strategies depending on the main purpose to change the real value of the firm. Management through real activities is more difficult to detect since it involves third parties. Therefore most studies focused only in accruals management. Finally, the impact of firm characteristics, namely operational cash flow, leverage, price-to-book value, return on assets, size, and audit by the big four, on earnings management was also examined.

Using a sample of 51 Portuguese listed firms from 2003 till 2015 results show that financial crisis impacts both accrual and real activities-based earnings management. During financial crisis firms manipulate earnings to meet debt covenants and analysts’ expectations. In addition, family firms also impact earnings management, especially with regards to accruals. In periods of recession family firms may engage in earnings management to hide bad news. Family firms’ concerns are not only with the firm's financial performance but also with family socio-emotional wealth. Therefore the family aims to hide the real situation either to sustain reputation and the firm's control, and to deal with debt holders and financial investors’ expectations. Finally with regards to firm characteristics the impact depends on earnings management proxy.

The main conclusions of this study are of great value to all users of financial statements in making decisions. Euronext Lisbon and other regulators may take it into account to improve the quality of financial reporting. Listed firms manage earnings, especially trough accruals, and the big 4 auditing firms are not sufficient to avoid and control it. Therefore new policies should be applied to auditing companies, and to all firms. Moreover, stakeholders may understand how and when firms manipulate earnings. Therefore, they may analyse better the firm's financial performance before taking decisions. Managers may know the benefits and limitations of managing earnings. Finally, this study also extends earnings management literature, analyzing a new market – Portugal, the impact of 2008 financial crisis, and considering accruals and cash flow indicators as complementary mechanisms of earnings management instead of substituting ones.

The purposed aims were accomplished, but as all studies, this one has some limitations. Portuguese market is small and the number of firms per industry is slight so the impact in each industry was not analysed. For future research it could be interesting to enlarge the sample, including other country or non-listed firms to generate a more comprehensive representation of earnings management strategies in response to financial crisis or family firms. Moreover, in this study the firms were separated into two groups: family and non-family. Although even family firms are not a homogeneous group, and the firm size and age, the type of manager or even the family ownership concentration may impact the results. Therefore, in an upcoming work these impacts should be taken into account.

Conflict of interestThe author declares no conflicts of interest.