This manuscript examines the influence of some variables relating to boards of directors that we consider to be proxies for power (gender diversity, duality, board size and insider ownership). Their influence on firm debt is explored. The sample examined, Spanish non-financial SMEs, has some particular characteristics. Share ownership, which is usually highly concentrated in the Civil Law context, is even more concentrated when we focus on SMEs. As a consequence, there is little separation between ownership and control. We have employed a power perspective as the main theoretical framework. Data were obtained from the SABI database, and the methodology employed is a panel data, applying the System GMM technique. This methodology makes it possible to control for endogeneity and individual heterogeneity. The results show that a larger proportion of female directors, larger boards, the separation of the roles of CEO and Chairman, and more shares owned by directors and by the CEO stimulate a decrease in firm debt. This evidence supports the hypotheses tested.

There are many studies of the effect of corporate governance variables on firm outcomes (Valls Martínez et al., 2022). Many such studies have focused on the effect on firm performance and firm returns (García-Martín and Herrero, 2018), but there have been fewer studies of the effect on risk.

Corporate governance mechanisms of control are intended to align the interests of owners and executives of companies. These mechanisms can be external or internal to the business. Spain is considered a civil law country. In contrast, the American market, where most previous evidence comes from, is classified as a common law country. Countries with civil law systems have less investor protection and more concentrated ownership structures. Thus, internal control mechanisms, including the board of directors, are stronger (La Porta et al., 2002). As a consequence, board composition may be a more effective way to align the interests of shareholders and executives in these countries.

Most studies of corporate governance employ agency theory, or more specifically the principal-agent perspective. However, in Spain, as a Civil Law country, the conflict usually occurs between majority and minority shareholders (tunneling effect, Johnson et al., 2000). Although the majority shareholders in Spain are motivated to monitor the actions of executives, they themselves also usually serve as executive directors, thereby gaining the opportunity to negotiate agreements with the other members of the board, making decisions that will benefit themselves regardless of the interests of the minority shareholders (Sánchez-Marín et al., 2022).

This study adopts the power perspective as its main theoretical framework. We argue that some characteristics of the board (and the CEO) may be considered proxies for power, and that the firm will assume more financial risk in proportion to the power of the board (and the CEO).

Because of the possibility of bankruptcy and financial distress, and the cost that these situations provoke (Baxter, 1967; Warner, 1977), we consider that firm debt is a proxy for firm (financial) risk. Thus, we hypothesize that companies in which the power of the board of directors is highly concentrated in a few people will incur higher levels of firm debt. The power variables that we employ are: Gender diversity (proportion of women directors), duality (the fact that different people assume the roles of chairman of the board and CEO), the size of the board, and the percentage of shares owned by the board and the CEO.

This manuscript is important as it makes several contributions to the literature. Many studies of corporate governance and corporate finance focus on the effect of some board characteristics on firm value, firm performance, firm returns and similar variables. In contrast, this manuscript focuses on the effect on a proxy for firm financial risk, namely, the level of debt of the firm. Most evidence that has been related to similar topics has been collected about large firms and not SMEs. Given the characteristics of the sample examined, SMEs, we have decided to adopt a power perspective as the main theoretical approach. As far as we know, no previous study has followed this approach for a similar analysis. These two particularities, the focus on firms’ debt and the theoretical approach employed, fill a gap in the literature. In addition, from the methodological point of view, we employ a panel data methodology, applying the System GMM technique. This is a powerful methodology that makes it possible to control for endogeneity, individual heterogeneity and autocorrelation.

The results show, first of all, a negative effect on indebtedness of the presence of women on boards of directors, the separation of positions of chairman of the board and CEO and the size of the board. However, when directors and CEO own more shares, corporate debt increases. The interrelation between the percentage of women on the board and the share ownership of the directors and CEO reduces the company's debt. This does not occur when the separation of positions and board size are combined with ownership variables. Finally, it is not found that the interrelation between the presence of female directors and the separation of positions, on the one hand, and board size, on the other, have a positive effect on corporate debt.

The rest of the manuscript is structured as follows. Section 2 presents the theory and the hypotheses. Section 3 describes the data and the methodology. Section 4 presents the results. Finally, Section 5 presents the conclusions.

2Theory and hypothesesBoard of directors is the main body that exercises corporate control on behalf of shareholders. Board effectiveness depends on many variables, such as its composition, size, and so on (John & Senbet, 1998; Mínguez-Vera & Martín-Ugedo, 2010).

Several theories, such as agency theory, resource dependency and stewardship have been used to explain the development of the board of directors (de Enrique Arnau & Pinillos-Costa, 2023) but, as Banerjee et al. (2020) show, agency is the most frequently employed.

There are at least two reasons why literature pays most attention to the board. First, the great responsibility adopted by this body and, second, the fact that shareholders are demanding more of board members. Board members are assuming the more and more responsibilities and risks that were traditionally considered to be the CEO's, who was held to account in case of corporate difficulty (Banerjee et al., 2020).

De Enrique Arnau and Pinillos-Costa (2023) observe the that literature on boards has changed its focus. Until 2007 the interrelations between board members and CEO and the roles of institutional investors where prevalent. But in more recent studies attention has moved to societal issues, such as sustainability, environmental aspects and diversity.

The risk accepted by the firm is among the responsibilities of the board. Risk is usually associated with the difficulty of estimating the exact value of a parameter. Measures of statistical dispersion are frequently employed as proxies for risk. Some characteristics of the board may be determinants of firm risk. The literature on group decision-making and the concept of power provide arguments to explain this relationship. Power is usually considered to be the ability to overcome resistance to attain a goal (Pfeffer, 1981). Thus, power is directly related to the possibility of influencing decisions. As a consequence, factors such as power distribution, which depends on variables such as managerial discretion, participation, and demographic and cultural diversity are central to this relationship.

Group members can disagree. The decisions adopted by a group require some sort of consensus. The final decision of a group involves differing opinions, representing an average, a compromise among individual positions (Moscovici & Zavalloni, 1969). As a consequence, decisions adopted by individuals are likely to be riskier than decisions adopted by a group (Halliday et al., 2021).

However, as previously mentioned, it is not only the size of the group that matters, but also the distribution of power among its members. When power is unevenly distributed, the opinions of the leading members, as well their errors of judgment, cannot be balanced by other members’ opinions, making it more likely that the group adopts riskier decisions.

Capital structure was a recurrent topic in the financial literature, until Modigliani and Miller (1958) demonstrated that the leverage adopted by a firm is irrelevant in perfect capital markets. After that, the literature focused on different market imperfections such as taxation, financial distress, agency costs and information asymmetry. As a consequence, there are two main, non-exclusive, theories to explain firms’ capital structures, the trade-off theory and pecking order theory (Myers & Majluf, 1984). Both theories take into consideration the risk level that underlies decisions about capital structure.

The trade-off theory considers that a firm has an optimal debt level that is reached by balancing the advantages and disadvantages of market imperfections. One of those disadvantages is the cost associated with financial distress.

The literature on capital structure states that high levels of debt lead to higher (financial) risk and to the possibility of financial distress (Baxter, 1967; Warner, 1977; Fasano et al., 2022). Therefore, we hypothesize that some governance variables, which may be considered proxies for power, may exert an influence on the debt level of firms. According to Sánchez-Vidal et al. (2020), corporate debt can cause negative effects such as reduced flexibility when obtaining future financing, lower growth and more job losses in the event of financial crises.

To develop the empirical analysis in this study, we focus on Spanish SMEs. According to the International Council of Small Business (ICSB), 2023, SMEs represent 90 % of the business sector worldwide, generate between 60 % and 70 % of employment and are key to achieving the Sustainable Development Goals (SDGs).

SMEs are the engine of the Spanish economy. According to the latest data from Ministerio de Industria, Comercio y Turismo (2023), they represent 99.8 % of Spanish firms and generate 66.4 % of employment. Furthermore, in the last economic crisis, they began a process of internationalization, seeking new markets, because of the weakness of domestic demand. According to Eurostat (2023) data, they are responsible for 53.3 % of Spain's imports and 51.1 % of the exports.

In Europe, small and medium-sized companies are especially important in job creation and they generate half of the intra-community trade in goods. They account for 51 % of the imports and 45 % of the exports within the EU.

Most previous evidence on corporate governance focuses on large and/or quoted firms. However, in recent years, interest in the boards and CEO of SMEs has increased. The boards of SMEs tend to be less formalized, less structurally complex, and more homogeneous (Forbes & Milliken, 1999). As a consequence, the range and depth of tasks developed by each member are more diverse, and the possibility of influencing decisions is greater (Judge & Zeithaml, 1992). In addition, the directors of SMEs usually have less experience, knowledge and skills, reducing the effectiveness of the board (Gorman & Sahlman, 1989).

On the other hand, share ownership, which is usually highly concentrated in the Civil Law context, is even more concentrated in SMEs. In addition, shareholders and management are frequently the same people, reducing the possibility of exercising effective control (Forbes & Milliken, 1999).

Next, we present the arguments and hypotheses relating to the influence that some variables that we consider proxies for power may exert on risk and, as a consequence, on firm debt. These are the proportion of women directors, CEO duality, the size of the board, and the percentage of shares owned by the board and the CEO.

2.1Gender diversity (proportion of women directors)Many different theoretical perspectives examine the relationship between board gender diversity and other firm variables (Valls Martínez et al., 2022). Terjesen et al. (2009) conducted a survey, and identified about twenty different theories on gender diversity and corporate governance. These theories included agency theory, institutional theory, resource dependency, human capital theory, and a range of social psychological theories. These theories usually overlap, meaning that most studies do not consider a single theory or approach.

From an institutional point of view, there are country-level differences in female representation on boards of directors. National culture, the legal factors and systems, and corporate ownership structures are among the most important factors determining such representation (Grosvold & Brammer, 2011; Halliday et al., 2021). Spain, as a civil law country, has high ownership concentration and its national culture has a relatively low level of masculinity (implying a disposition to seek consensus), especially in comparison with Anglo-Saxon countries, and a high level of uncertainty avoidance (Hofstede, 2021; La Porta et al., 1999).

Different arguments point to a reduced level of firm financial risk when there is a larger proportion of women directors (López-Delgado & Diéguez-Soto, 2020). Women seem to be more risk averse that men. This evidence comes not only from the finance and strategy fields, but also from fields such as professional work in health and physical safety (Maxfield et al., 2010). In addition, it is important to consider how people interact in a group, and therefore the importance of gender diversity.

Several theories of social groups examine how people with similar/different values and profiles interact. These theories include social network theory and social cohesion theories, as well as theories of ingratiation and social identity. Social identity theory (Tajfel & Turner, 2004) posits that individuals divide members of their organization into members of their group (in-groups), or individuals similar to themselves, and members from outside their group (out-groups), or individuals different from themselves. They tend to perceive the former positively, and the latter negatively (Nielsen & Huse, 2010). As a consequence, individuals seek to surround themselves with people who share similar profiles. Homogeneous groups tend to adopt riskier decisions (Roberson, 2019; Watson et al., 1993). Thus, having more women directors should lead to less risky decisions.

There is much previous evidence that shows that women are more risk averse that men (Chaganti, 1986; Khan & Vieito, 2013). This risk aversion on the part of women has also been observed in the arena examined in this manuscript, as Carter and Shaw (2006), among others, have found lower debt levels in firms managed by women. García and Herrero (2021) found that gender diversity of the board is negatively related to leverage and the cost of debt.

Related to agency theory, Carter et al. (2003) suggest that more diverse boards increase board independence. This is why increasing gender diversity could improve monitoring and control of management. They comment that women are more inclined to ask questions that would not be asked by male directors. Supporting these arguments, Adams and Ferreira (2009) found evidence suggesting that female directors provide greater insight and closer monitoring. This circumstance can increase risky decisions because the board of directors will be more aligned with the interests of external shareholders, who are less risk averse than insiders.

On the other hand, numerous studies affirm that women exercise power differently. Kelly et al. (2008) suggest that men use more domination and intimidation, while women tend to be more affectionate. Female leaders are seen to adopt a more democratic and participative style than their male counterparts and prefer consensus (Merchant, 2012). Rosener (1990) argues that female leadership tends to encourage participation, promote sharing power and information, favor general good over self-interest, and relate power to interpersonal skills. As a result, women may be more participatory in decision-making, which could mean less risky decisions.

In line with most of the previous arguments, we propose the following hypothesis:

Hypothesis 1 A larger proportion of women on the board will lead to less risky decisions, and thus lower levels of debt.

CEO duality, CEO-Chairman duality, or just duality, refer to the practice of different persons holding the positions of chairman of the board and CEO. It is one of the most frequently recurring topics in the literature on corporate governance.

There are two main theories that are used to explain the effect of duality-non duality on firm performance: agency theory and stewardship theory. Both theories agree that duality implies higher board control and weaker CEO power (Finkelstein, 1992). Moreover, appointing one person to both posts sends a clear message of leadership (Donaldson & Davis, 1991). This could skew the distribution of power.

Studies focusing on the influence of duality or non-duality on risk are scarce. Agency theory points to a conflict, in terms of the optimal level of firm risk, between the external shareholders and insiders. External shareholders can diversify their investments, reducing their risk, but insiders suffer the consequences of firm risk taking more directly (Jensen & Meckling, 1976). Combining the posts of CEO and chairman reduce supervision of the insiders and this can reduce firm risk. Daily and Dalton (1994a, 1994b) examined the relationship between non-duality and firm bankruptcy. They hypothesized that non-duality would imply a larger concentration of power, and that this would increase the likelihood of bankruptcy. The results are mixed as Daily and Dalton (1994a) found that duality increased the likelihood of bankruptcy, but Daily and Dalton (1994b) found no significant effect.

In contrast with this, the power perspective assumes that duality increases the power of the person who holds both posts, making it possible for them to take more risk on behalf of the firm (Halliday et al., 2021; Mínguez-Vera & Martín-Ugedo, 2010).

According to the previous arguments, we propose the following hypothesis:

Hypothesis 2 If a single person holds both positions (CEO and chairman), this will lead to riskier decisions being adopted and thus higher levels of debt.

Size is another variable that determines board effectiveness in its monitoring function. Even if managers have the right incentives, they can make mistakes (Sah & Stiglitz, 1986, 1991). Given that group members can disagree, group decisions imply differing opinions, requiring some sort of consensus on decisions. There should be less risk in decisions made by group consensus than in decisions made by individuals.

Sah and Stiglitz (1986) developed a model in which the larger the group of decision-makers, the less likely they were to accept a bad investment project. And Sah and Stiglitz (1991) found that highly variable returns, implying higher levels of risk, are less likely in firms with many managers. The larger the size of the decision group, and less power for individual decision-makers, reduce firm risk (Mínguez-Vera & Martín-Ugedo, 2010).

Large boards may benefit from a greater variety of opinions and experiences and increased monitoring capacity. In contrast, coordination/communication problems are also more severe (Hermalin & Weisbach, 2003). These problems of communication and decline of individual responsibility are more pronounced in larger boards because the cost to any director of not exerting due diligence in monitoring falls in proportion to the total number of board members.

Considering these arguments, Yermack (1996) and Core et al. (1999) suggest a curvilinear relationship between board size and monitoring effectiveness, according to agency theory. In small boards, as the number of directors grows, supervision of top executives increase, resulting in an alignment of interests and riskier decisions. However, when an optimum number of directors is reached, the trend reverses. Jensen (1993) argues that when a board has more than seven or eight directors, it becomes more difficult to exert effective control over the CEO. So, the final effect it is not clear, according to this theory.

In addition, as previously mentioned, according to the power perspective, the final decision of a group represents an average among individual positions. Thus, decisions adopted by a group are, on average, less risky than those adopted by individuals (Moscovici & Zavalloni, 1969; Sah & Stiglitz, 1986). As a consequence, increasing the size of the board should reduce firm risk (Halliday et al., 2021).

Previous evidence on board size focuses mainly on its effect on firm value, and not on risk. However, most evidence indicates that board size has a negative impact on a firm's risk (Cheng, 2008; Nakano & Nguyen, 2012).

According to the power perspective, we propose the following hypothesis:

Hypothesis 3 A larger board will lead to less risky decisions adopted and thus lower levels of debt.

As in the case with the board size, the effect of insider ownership is not clear in the context of agency theory. Morck et al. (1988) argue that low levels of director ownership lead to more effective control (convergence hypothesis). This alignment of interests between shareholders and insiders can lead to riskier decisions being made (Mínguez-Vera & Martín-Ugedo, 2010). However, high levels of director ownership may lead directors to entrench themselves (entrenchment hypothesis) with the opposite effect.

In general, a large concentration of shares in the hands of a small number of shareholders will give those shareholders more power, and this power is increased when those shareholders are insiders. As a consequence, it is expected that when insiders have large holdings of shares they will be able to decide that the firm will take more risk, and incur more debt. In addition, large shareholders may be reluctant to engage in equity financing, as that would tend to dilute their ownership. To maintain the control of the firm, they prefer debt financing.

Unlike the American market, where more dispersed ownership structures have been observed, Spanish SMEs have highly concentrated ownership structures (La Porta et al., 1999; Leech & Manjón, 2002). Spanish companies are mainly controlled by internal, dominant shareholders, who frequently act simultaneously as directors and managers (Baixauli-Soler & Sanchez-Marin, 2015). In this scenario, controlling shareholders exercise considerable power.

According to previous arguments, we consider that larger insider ownership will lead to more concentrated power and thus we present the following hypothesis:

Hypothesis 4 More insider ownership will lead to riskier decisions adopted and thus higher levels of firm debt.

The sample includes Spanish non-financial SMEs, between 2014 and 2019, obtained from the SABI database. We use the size criterion proposed by the European Commission (2003), according to which SMEs employ fewer than 250 people and have either an annual turnover not exceeding €50 million, or an annual total balance sheet not exceeding €43 million. After selecting SMEs from the database, removing companies without data and with errors, we have an unbalanced panel of 2385 companies and 9715 observations.

We consider the firm's leverage (LEVER), computed as the ratio of total debt to total assets, as the dependent variable (Hernández-Cánovas et al., 2016; Hernández-Nicolás et al., 2019). Alternatively, and for robustness, the analyses have been repeated including the long-term and short-term debt ratio as dependent variables. The results do not differ significantly from those shown for total debt. The results for those two additional analyses have not been included for synthesis reasons. As independent variables, we measure the gender diversity or the proportion of women on the board, PWOMEN, as the number of female directors divided by the total number of directors (Valls Martínez et al., 2022). For duality, a dummy variable, DUAL, takes a value of 0 when the CEO and chairman of the board are the same person and 1 otherwise (Mishra & Mohanty, 2014). The board size, LNDIR, is computed as the logarithm of the number of directors on the board (Cashman et al., 2012). And insider ownership is calculated as the proportion of shares owned by the directors and CEO, DIROWN and CEOWN respectively (Fahlenbrach et al., 2010). We also include the squares of these two variables, DIROWN2 and CEOWN2, in order to account for a possible non-monotonic effect.

Finally, we consider the heterogeneity across firms by including several firm-specific control variables in the model. Variables generally used as determinants of leverage are (Brav, 2009; Gaud et al., 2005; Hall et al., 2004) the firm's size measured as the logarithm of total assets, FSIZE; the firm's age, approximated by the logarithm of the number of years the firm has been established, LFAGE; the ratio of intangible assets to total assets, INTAS; the debt cost, DEBCOS, measured as the ratio of financial expenses to total debt; the return on assets, ROA, calculated as the ratio of profits, before financial expenses and taxes, to total assets; and the interest coverage ratio, INCO, the number of times that net profit before interest and taxes related to a firm can cover interest payments.

Table 1 shows the descriptive statistics of all variables. The mean value of the proportion of women on the board is only 7.2 %. We also observe that only a third of the firms in our sample have a separate power structure relating to CEO and Chairman, although the Spanish Good Governance Code (2020) recommends the separation of those posts. The number of directors, NDIR, has a mean value of 5, just in the lower level of the recommendation of the Spanish Good Governance Code for listed firms: “The board of directors should have an optimal size to promote its efficient functioning and maximize participation. The recommended range is accordingly between five and fifteen members”. Finally, the ownership of directors has a value of 35.2% while the percentage of shares owned by the CEO is about 18.4 %. These values are higher than those reported by Mínguez-Vera and Martín-Ugedo (2010) for Spanish listed firm (3 % and 2 %, respectively).

Descriptive Statistics.

VARIABLES: LEVER (leverage ratio); PWOMEN (proportion of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); NDIR (board size); LNDIR (the logarithm of the number of directors on the board); DIROWN (proportion of shares owned by the directors); CEOWN (proportion of shares owned by the CEO); FSIZE (firm size, measured as the logarithm of total assets); LFAGE (logarithm of the firm age in years); INTAS (ratio of intangible assets to total assets); DEBCOS (debt cost, measured as the ratio of financial expenses to total debt); ROA (return on assets); INCO (interest coverage ratio).

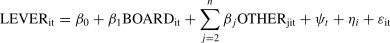

According to the theoretical arguments, the following model is proposed to capture the relationship between the characteristics of the board of directors and the debt ratio of the firm:

where LEVER refers to the debt ratio; BOARD includes the different characteristics of the board of directors (the proportion of female directors, PWOMEN; leadership structure, DUAL; the board size, LNDIR; and the proportion of shares owned by the board members, DIROWN and the CEO, CEOWN). OTHER refers to the control variables (firm size, FSIZE; the logarithm of the firm age, LAGE; the intangible assets to total assets ratio, INTAS; the debt cost; the return on assets, ROA; and the interest coverage ratio, INCO). Finally, ψt,ηiand εitare the time effects, the unobserved individual heterogeneity and the error term, respectively.Considering the hypotheses presented in Section 2, a negative sign is expected for the proportion of female directors, PWOMEN, the dummy that indicate the separation of the posts of CEO and Chairman, DUAL and for the board size, LNDIR, on debt ratio, LEVER. According to the power perspective, we expect a positive relationship between the proportion of shares owned by board members, DIROWN and the CEO, CEOWN and firm debt.

For the control variables, there are several arguments why firm size is related to capital structure (Kieschnick & Moussawi, 2018), including economies of scale in lowering information asymmetry, and scale in transaction costs, and market access. These reasons suggest that smaller firms should have lower debt levels. So a positive sign between firm size and debt ratio is expected.

A negative relationship between the age of the firm, LAGE and the leverage level is expected. Older firms have accumulated funds and, therefore, will probably require fewer external funds (Michaelas et al., 1999). With regard to the intangible assets to total assets, INTAS, a negative sign can be obtained as a consequence of the indirect correlation between the level of intangible assets and the debt structure of the firm (Parsons & Titman, 2009). The expected sign for the debt cost, DEBCOS is negative (firms with higher cost of debt will have a lower debt ratio) (Barry et al., 2008).

For Return on Assets, ROA, Modigliani and Miller (1963), argue that tax shielding would induce profitable companies to use more debt. In contrast, the pecking order theory (Myers & Majluf, 1984) concludes that profitable firms would primarily finance with retained earnings rather than external financing. Finally, the interest coverage ratio, INCO (Robinson et al., 2015), shows the ability of a firm to repay its debt (Zarebski & Dimovski, 2012) and it is a measure of the riskiness of a firm (Andrade & Kaplan, 1998). Risk of insolvency is higher when earnings are relatively low with respect to interest expenses. Consequently, a positive relationship is expected.

Equations are estimated using a panel data methodology, applying the System GMM technique (Arellano & Bover, 1995; Blundell and Bond, 1998). This methodology makes it possible to control for individual heterogeneity (Himmelberg et al., 1999). These are unobserved variables that affect each of the firms in the sample unequally, but which are constant over time and which directly affect the decisions made by these units. Descriptions of the kind of things usually considered under this heading are entrepreneurial capacity, operational efficiency, capitalization of experience, and access to technology. The methodology also controls for macroeconomic effects on the dependent variable (those factors that equally affect all the companies in the study). In addition, System GMM estimation solves the endogeneity problem that may appear when the independent variables and the dependent variable are determined simultaneously, as is the case in the present study (for example, women can choose to serve on board of firms with less debt because of their risk aversion). In order to remove any possible bias arising from simultaneous estimation, this methodology estimates a system of two simultaneous equations. The first equation uses variables in levels (first differences instruments) and the other uses variables in first differences (lagged with respect to instruments).

Specification tests proposed by Arellano and Bover (1995) are applied to examine the validity of the instruments in System GMM estimation. First, the Arellano–Bond test for the serial correlation is adopted to test whether there is a second-order serial correlation in the first-differenced residuals. The null hypothesis is that the residuals are serially uncorrelated. If the null hypothesis cannot be rejected, it provides evidence that there is no second-order serial correlation and the System GMM estimator is consistent. Second, the Sargan test is applied to test the null hypothesis of instrument validity and the validity of the additional moment restriction necessary for system GMM, respectively. Failure to reject this null hypothesis means that the instruments are valid.

This methodology has important advantages over others. The OLS (Ordinary Least Squares) estimations do not consider the unobservable heterogeneity of firms, and considers the variables to be exogenous. Fixed Effects estimation addresses the problem of unobserved heterogeneity, but not the endogeneity. The 2SLS (Two Stage Least Squares) considers the endogeneity, but it is not efficient in samples with a large number of firms and small number of years and it also has the problem of the choice of instruments (Arellano & Bond, 1991).

4Results and discussionThe results are shown in Tables 2 to 5. In Model 1 of Table 2, we find a negative and significant effect of the proportion of female directors (PWOMEN) on firm debt ratio (LEVER). This finding supports Hypothesis 1 (A larger proportion of women on the board will lead to lower levels of debt) and is consistent with arguments from the power perspective and social identity theory (Tajfel & Turner, 2004; Roberson, 2019; and Watson et al., 1993). According to these authors, heterogeneous groups make less risky decisions. According to these arguments, decision making will be more complicated in a heterogeneous group. To decide, a consensus must be reached and the power of the male directors (with a riskier profile) can be diluted by the preferences of the female directors. Olsen and Cox (2001) found that women investors weight risk attributes, such as the possibility of loss, more than men. The World Bank (2012) report shows that women tend to be more cautious and have a lower level of ambition. Carter and Shaw (2006) also found that the presence of women in management is associated with lower levels of debt.

System GMM Estimation of the influence of female directors (PWOMEN), CEO duality (DUAL) and board size (LNDIR) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

This result is important since it shows how female directors influence financial decisions and the survival of the company, and it suggests an important contribution to the empirical findings.

Model 2 shows a negative relationship between the separation of responsibilities (DUAL) of CEO and Chairman and firm debt. This result supports Hypothesis 2 (If a single person holds both positions (CEO and chairman), this will lead to higher levels of debt). So, according to the power perspective, when the post of CEO and Chairman coincide in the same person the decision maker can accumulate more power, and so the firm will have a higher proportion of debt. This evidence contradicts the conclusion of Adams et al. (2005) who found no significant relationship between firm risk and duality. However, Daily and Dalton (1994a) found that duality increased the likelihood of bankruptcy. The findings of this research contribute to reducing the controversy surrounding CEO duality in leadership by furnishing empirical evidence of how CEO duality in corporate governance structures affects managerial behavior in corporate strategic management.

Finally, in Model 3, we observe a negative influence of board size (LNDIR) on firm leverage (LEVER) as anticipated in Hypothesis 3 (A larger board will lead to lower levels of debt). So, as the power perspective predicts, increasing the size of the decision-making group reduces the power of a specific decision-maker and, as a consequence, the firm risk.

In relation to the control variables, Table 2 shows a positive effect of firm size (FSIZE) on firm debt (LEVERAGE), in line with our expectations and the arguments of Kieschnick and Moussawi (2018) and Titman and Wessels (1988). The signs of the firm age, LFAGE, proportion of intangible assets, INTAS and debt cost, DEBCOS, are all as expected, and consistent with the arguments of Michaelas et al. (1999), Parsons and Titman (2009) and Barry et al. (2008), respectively. Supporting the pecking order theory (Myers & Majluf, 1984), we find that profitable firms tend to use less debt. Finally, firms with less risk, as indicated by the interest coverage ratio, INCO, have more debt in proportion (Andrade & Kaplan 1998).

Table 3 shows the effect of directors and CEO ownership, DIROWN and CEOWN, on firm leverage (LEVER).

System GMM Estimation of the influence of the percentage of shares owned by directors (DIROWN) and the percentage of shares owned by CEO (CEOWN) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: VARIABLES: LEVER (leverage ratio); DIROWN (percentage of shares owned by the directors);DIROWN2 (the square of the DIROWN variable); CEOWN (percentage of shares owned by the CEO); CEOWN2 (the square of the CEOWN variable); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

In Model 1, we find a positive and significant influence of the directors’ ownership on firm debt, in agreement Hypothesis 4 (More insider ownership will lead to higher levels of firm debt). It is possible that high share ownership of directors gives them more power, and thus makes the firm more likely to adopt risky policies. A similar result is observed in Model 3, focusing on CEOs’ ownership, supporting Hypothesis 4. We do not find a quadratic relationship (Models 2 and 4).

This result is in the line with that of Palmer and Wiseman (1999). They showed that the stockholdings of senior management have a positive impact on managerial risk taking. Bajaj et al. (1998) suggest that in firms with low executive ownership, directors are incentivized to under-lever the firm to reduce bankruptcy risk. May (1995) also argues that CEOs with high ownership will display riskier behavior, such as selecting investments with more risk. We contribute by adding new evidence in a country with a high concentration of business ownership in small and medium-sized enterprises.

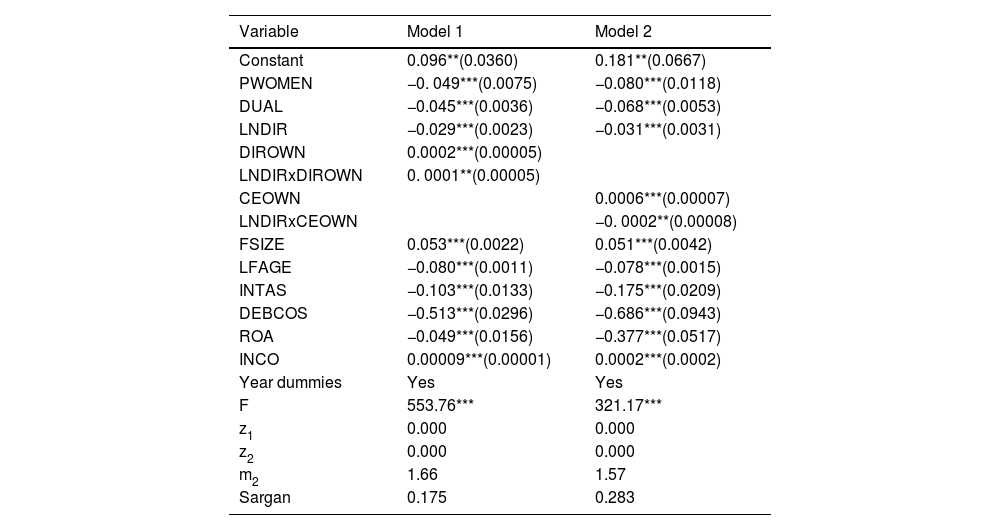

Table 4 presents all the variables together. This table confirms the previous results, namely a negative effect of the proportion of female directors (PWOMEN), duality (DUAL), and board size (LNDIR), on firm debt (LEVER), and a positive effect of director and CEO ownership (DIROWN and CEOWN). The sign of the control variables is the same as above.

System GMM Estimation of the influence of female directors (PWOMEN), CEO duality (DUAL), board size (LNDIR), the percentage of shares owned by directors (DIROWN) and the percentage of shares owned by CEO (CEOWN) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); DIROWN2 (the square of the DIROWN variable); CEOWN (percentage of shares owned by the CEO); CEOWN2 (the square of the CEOWN variable); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

Considering the results obtained in this study of the effect of the share ownership of directors and CEO on indebtedness, we set out to analyze whether the presence of female directors has a moderating effect (Baron & Kenny, 1986).

In this sense, the greater risk aversion that women can provide and the greater heterogeneity that they bring to the board of directors can cause even companies with the highest shareholding concentration to reduce their exposure to financial risk, limiting the power of those who own shares. In other words, we analyze whether the presence of women on boards of directors serves to offset the power of shareholder concentration and thus reduce the debt ratio.

Following the previous arguments, we study the moderating effect of adding women to the board on reducing the leverage of SMEs where more shares are in the hands of directors and the CEO. In Table 5, we observe that more female directors reduce the indebtedness of firms where directors (Model 1) and the CEO (Model 2) own more of the shares. So, women on the board help to reduce the level of firm debt.

System GMM Estimation of the interrelationship of the percentage of women on the board (PWOMEN) with the percentage of shares owned by directors (DIROWN) and the percentage of shares owned by CEO (CEOWN) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); CEOWN (percentage of shares owned by the CEO); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

The interactive term PWOMENxDIREOWN has significant and negative impact on debt ratio (β=−0.0007, p<0.01), meaning that if the percentage of female directors and directors’ ownership increase by 1 %, the firm financial risk in terms of debt ratio will decrease by 0.07 %. This can be interpreted as meaning that firms with high director ownership tend to have heterogeneous gender diverse boards which decrease the firms’ financial risk. Also, PWOMENxDIREOWN produces similar results.

So, women on the board can help to reduce the level of firm debt. This finding represents a contribution to the study of corporate governance. We are not aware of any similar analysis before. In contexts of high share ownership, such as the Spanish case, adding women to the board of directors can serve to reduce the financial risk, and therefore the bankruptcy, of companies. The presence of women directors is not only important for ethical reasons. There are also the economic reasons, that it can mitigate the devastating effects of financial crises.

In addition, in Tables 6 and 7, we analyze the interrelation of the proportion of women on boards (PDIR) with the separation of positions of CEO and Chairman, DUAL (Table 6) and the board size (Table 7).

System GMM Estimation of the interrelationship of the percentage of women on the board (PWOMEN) with separation of charges of CEO and Chairman (DUAL) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); CEOWN (percentage of shares owned by the CEO); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

System GMM Estimation of the interrelationship of the percentage of women on the board (PWOMEN) with board size (LNDIR) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); CEOWN (percentage of shares owned by the CEO); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

Table 6 shows a non-significant interaction effect, which means that the presence of women on the boards of Spanish SMEs does not produce a positive effect of separation of positions on corporate debt. This occurs whether we include the CEO ownership (Model 1) or the percentage of shares of the members of the board of directors (Model 2) as the dependent variable. There are no changes in the significance or sign of the other variables.

The result is similar when the interaction between the percentage of women and the size of the board is included (Table 7). That is, there is no increase in debt as a consequence of the joint effect.

Finally, in Tables 8 and 9, we study whether the other characteristics of the board, the duality of positions (Table 8) and the board size (Table 9) serve to mitigate the positive effect of both directors’ ownership and CEO ownership.

System GMM Estimation of the interrelationship of the separation of charges of CEO and Chairman (DUAL) with the percentage of shares owned by directors (DIROWN) and the percentage of shares owned by CEO (CEOWN) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); CEOWN (percentage of shares owned by the CEO); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

System GMM Estimation of the interrelationship of the board size (LNDIR) with the percentage of shares owned by directors (DIROWN) and the percentage of shares owned by CEO (CEOWN) on leverage ratio (LEVER).

*, **, *** Significant at 10 %, 5 % and 1 %, respectively. Standard errors in brackets.

VARIABLES: LEVER (leverage ratio); PWOMEN (percentage of female directors on the board); DUAL (dummy variable that takes a value of 1 when the chairman of the board and CEO are not the same person, and zero otherwise); LNDIR (the logarithm of the number of directors on the board); DIROWN (percentage of shares owned by the directors); CEOWN (percentage of shares owned by the CEO); FSIZE (firm size); LFAGE (logarithm of the firm age); INTAS (intangible assets to total assets); DEBCOS (debt cost); ROA (return on assets); INCO (interest coverage ratio); F statistic (test of combined significance); Hausman (Hausman specification test), z1 and z2, are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses, probability is shown.

In Table 8 it can be seen that the interaction between the DUAL variable and the percentage of shares owned by members of the board of directors (Model 1) and the CEO ownership (Model 2) is positive and significant. Therefore, unlike the percentage of women on the board, the separation of positions of Chairman and CEO does not serve to offset the positive effect that ownership has on corporate debt.

The results are similar in Table 9. A positive interaction relationship is observed between the size of the board and the directors’ ownership (Model 1) and the percentage of shares owned by the CEO (Model 2). This result highlights the importance and effectiveness of female directors in reducing debt and, therefore, business risk.

For all the models, the z1 Wald Test shows the combined significance of the coefficients of the independent variables, while z2 reports the joint significance of the time dummies. The m2 statistic shows no second-order serial correlation in the first-difference residuals in all models. This means that the models are not mis-specified. Sargan's Test shows a lack of correlation between the error term and the instrument used.

5ConclusionsSmall and Medium Enterprises are extremely important in terms of number, employment and sales. As observed in periods of financial crisis, one of the factors positively influencing their survival is avoiding very high leverage. In this manuscript we examine, from the power perspective, how several board characteristics (gender diversity, duality, board size and insider ownership) influence the firm debt ratio for a sample of Spanish SMEs. Previous studies that have addressed this topic mainly focus on listed firms, and use agency theory in their analysis. However, in the Spanish context and SMEs, the power perspective is probably a more appropriate framework.

All the results obtained support our hypotheses. We find that more female directors, a lower proportion of shares owned by directors and by the CEO, larger boards and the separation of the roles of CEO and Chairman all lead to a decrease in firm debt. We also find that women directors reduce the level of debt in firms where more shares are in the hands of the CEO and directors. Focusing on this last finding, previous evidence has already indicated that women are more risk averse than men and they are more prone to share the power. However, to our knowledge, there is no previous evidence that shows so clearly how the presence of more women on the board can offset the negative effects of high levels of insider ownership. Furthermore, we find that the other board characteristics examined, separation of positions and size, do not exert a moderating effect on the share ownership of directors and CEOs to reduce corporate debt. Finally, the combination of the proportion of women with the separation of positions and size does not cause an increase in financial risk.

These results are important as they show that the characteristics of the boards of directors are important when it comes to reducing corporate debt and preventing financial crises. The proportion of women on boards of directors is especially decisive, since they not only reduce financial risk but have a moderating effect on insider ownership. Therefore, it is important that legislation is used to increase the proportion of female directors, not only in large companies, but also in SMEs, which are the vast majority of firms in the world economy.

The main limitation of this work is that it is focuses on a single country. Other relevant variables, such as the type of director, have not been included (due to lack of data). For future research, we will try to extend the sample to different countries and legal systems.

This work was supported by Spanish Ministry of Science, Innovation and Universities (Spain) under grant RTI2018–093884-B-I00; Fundación Séneca (Spain), under grant 21947/PI/22 and Fundación Cajamurcia. We wish to thank the editor and the anonymous reviewers for their constructive suggestions.