Life settlements (LSs) can be considered a novel and innovative financial asset in countries where they are not yet established. This paper aims to assess the attitude (ATT) of policyholders towards participating in LSs in such countries by evaluating various variables: performance expectancy (PE), expected easiness (EE), social influence (SI), perceived ethical problems (EP), and bad feelings (BF) that may arise from this type of transaction. To achieve this goal, a questionnaire was administered to 89 individuals in Spain who possessed extensive knowledge of financial and insurance matters. The data analysis employed fuzzy set qualitative comparative analysis (fsQCA) as the basis, supplemented by partial least squares-structural equation modelling (PLS-SEM). The fsQCA results enabled the identification of policyholder profiles associated with the acceptance or rejection of LSs. Meanwhile, PLS-SEM provided insights into the net strength and statistical significance of the impact of each variable on ATT. Methodologically, this study demonstrates that fsQCA is valuable in constructing a reliable and concise framework for subsequent PLS-SEM estimation. A significant practical implication of this research is the importance of the interaction between PE and SI in the successful development of LS markets. A positive perception of financial advisors regarding these agreements emerges as a crucial factor in market growth. Moreover, the study reveals that EP and BF may significantly influence resistance towards LSs.

A life settlement (LS) on a death benefit is an agreement whereby a policyholder sells their life insurance policy to an investor instead of surrendering it to the insurer (Braun et al., 2019). The LS market has undergone great development in the US. In this regard, some projections show market volume of LSs topping $60 billion by 2025 as the baby boomer generation reaches the usual age to sell life policies (Beleutz & García, 2021). Additionally, Harbor Life Settlement (2022) indicates that the US LS market registered a yearly growth of 31% during the last years of the 2010s and estimates that the annual gross market potential for LSs will be $212 billion from 2019 to 2028.

The academic literature on LSs has primarily focused on addressing four key questions. The first set of studies pertains to LS pricing, with researchers such as Brockett et al. (2013), Zhu and Bauer (2013), Braun and Xu (2020) and Andrés-Sánchez and González-Vila (2021) contributing to this area. The second topic can be categorized as empirical market studies, which encompass investigations into investor performance conducted by Braun et al. (2016), Giaccotto et al. (2017), MacMinn and Zhu (2017), and Bauer et al. (2020), as well as examinations of life expectancy providers by Bauer et al. (2017) and Xu (2020). Additionally, a substantial body of literature has emerged discussing the ethical concerns associated with LSs due to their nature as bets on the insured individual's lifespan. Scholars such as Leimberg (2005), Blake and Harrison (2009), Nurnberg and Lackey (2010), Glac et al. (2012) and Braun and Xu (2019) have contributed to this discourse. The last group of studies explores the theoretical advantages of an active secondary life insurance market facilitated by LSs for key industry stakeholders, including policyholders, investors, and insurers (Doherty & Singer, 2003; Rosenfeld, 2009; Gatzert et al., 2009; Gatzert, 2010; Mendoza & Monjas, 2011; Wang et al., 2011; Bajo et al., 2013; Fang & Wu, 2020). These advantages can be summarized as follows:

- •

The existence of an LS market increases the liquidity of policyholders' life contracts. In fact, this kind of transaction facilitates obtaining cash for people in situations of vulnerability due to their health. LSs are priced with mortality probabilities adjusted to the insured's health real situation, instead of the standard ones as insurers do. Thus, the amount obtained by the policyholder with the LS transaction is greater than its cash surrender value (Doherty & Singer, 2003). Before the development of this market, liquidity for a life insurance contract could only be gained by selling the policy back to the insurer, i.e., by surrendering it. The insurer was the only possible buyer and therefore set the price. The LS market avoids insurers’ monopsony in the repurchase of life policies. Additionally, given that the policies sold via LSs usually come from retired policyholders, an LS market increases the possibility of life policies being seen as pension investment assets.

- •

On the investor side, LS markets register returns that in many periods may be higher than those corresponding to the fixed income and equity markets. On the other hand, given the nature of the risks that affect this type of asset, basically that of longevity, its profitability is not related to economic cycles, political news or natural disasters, and it has a low correlation with conventional financial assets. Therefore, LSs create value in portfolio management. The exceptions to this claim are assets linked to biomedical firms.

- •

If life policies are seen as assets that can be turned into liquidity after retirement, LSs will lead to a growth in the demand for such policies in the primary market, which implies, per se, a great opportunity to expand the possibilities and penetration of the insurance business. In this way, since the mid-2000s, many life companies have been involved in the LS market because they understand that LSs add value to their customers. Likewise, insurance companies, due to their experience, have a competitive advantage when investing in LSs. In fact, insurance companies are currently one of the largest buyers of LSs that, in addition to being understood as an investment, can be part of a hedging strategy for their issued policies. Finally, when a policy is transferred to the LS market, the insurance company is assured that it will not be claimed before it expires. Therefore, LSs reduce the liquidity risk of life insurers.

Despite the significant development of LSs in the US, other countries, such as Spain, have not experienced similar levels of growth (Andrés-Sánchez & González-Vila, 2021). Mendoza and Monjas (2011) delve into the enablers and barriers within the Spanish insurance industry for the establishment of a secondary life insurance market based on LSs. Furthermore, even in the US, where institutional investors demonstrate a high demand for LSs and LS asset-backed securities (Beleutz & García, 2021), the growth of LSs remains constrained due to limited participation from policyholders in these transactions (Kampa & Siegert, 2010; Harbor Life Settlements, 2022). Paradoxically, the expansion of the LS market does not align with the development of the primary insurance market. Surprisingly, there is a scarcity of academic research examining the reasons behind eligible policyholders' decisions to engage in LS transactions. Andrés-Sánchez et al. (2021) address this gap by conducting an empirical study to identify the factors influencing policyholders' acceptance of LSs, which can be considered a novel financial service in Spain. Their analysis draws upon the Technology Acceptance Model (TAM) (Davis, 1989; Venkatesh & Davis, 2000) and the Unified Theory of Acceptance and Use of Technology (UTAUT) developed by Venkatesh et al. (2003) and Venkatesh et al. (2012), which have been successfully applied in the banking and insurance sectors. In this context, other examples of technology adoption within the insurance industry include the use of car telematics devices for insurance purposes (Milanović et al., 2020), innovative cashless payment systems for premiums and claims (Oktariyana et al., 2019), online insurance underwriting (Huang et al., 2019) and banking (Magotra et al., 2018) or novel policy processing systems (Legowo, 2018).

This paper aims to complement the results in Andrés-Sánchez et al. (2021) in two ways. First, it introduces a new explanatory variable related to the bad feelings that this type of agreement could produce for policyholders. Often, LSs are agreed upon under high emotional stress due to the insured's poor health status (Glac et al., 2012). Policyholders could also feel a loss of the insured's dignity since LSs may be understood as a bet on their date of death, and the linked life insurance policy is traded like any other financial asset in financial markets (Nurnberg & Lackey, 2010). Second, it combines configuration analysis provided by fuzzy set qualitative comparative analysis (fsQCA) along with partial least squares - structural equation modelling (PLS-SEM) to answer two research questions (RQ):

RQ1=How do explanatory factors combine to enable policyholders’ positive or negative attitude towards LSs?

RQ2=What is the net effect of every explanatory factor and its statistical significance on policyholders’ attitude towards LSs?

As shown by Pappas and Woodside (2021), the use of fsQCA and PLS-SEM are complementary rather than competitive. Thus, whereas fsQCA responds to RQ1, PLS-SEM will be the key tool to answer RQ2. These two techniques allow data analysis from two nonexclusive points of view. While the configurational method will allow assessing available sample from a case-oriented perspective, the correlational method given by PLS-SEM will provide variable-centered findings.

- •

PLS-SEM enables the determination of the average influence and statistical significance of input factors on output factors, while fsQCA uncovers the combinatorial effects of these variables. Regression coefficients in PLS-SEM represent the overall impact of each input variable on the output variable, whereas fsQCA takes a case-oriented perspective (Ragin, 2008; Leischnig et al., 2016). Therefore, fsQCA does not quantify the influence of explanatory factors on the explained variable using coefficients but rather identifies multiple ways in which input variables combine to generate an output. These combinations are referred to as recipes, prime implicates, or configurations, and they can be interpreted as profiles that enable the occurrence of the output.

- •

In regression analysis, an input variable can only be linked with output with one sign (positive or negative). The significance of this relation is measured with the so-called p-value. On the other hand, fsQCA allows a different sign for the influence of an input factor on the output variable in two combinations of explanatory variables.

- •

Contrary to correlational methods, fsQCA does not assume symmetrical relationships between variables, despite its effectiveness in this case (Pappas & Woodside, 2021). This is relevant because combinations of factors that result in acceptance and rejection in complex phenomena are typically nonsymmetrical. For instance, Woodside (2014) indicates that the causes of an organization's success are always nonsymmetrical compared to those that lead to failure. Similarly, Gauttier (2019) suggests that there is no symmetry in the causes that contribute to the acceptance and rejection of new technologies. Similar findings are reported by Sendra-Pons et al. (2022), who analyze the influence of institutional factors on entrepreneurship development. In the context of LSs, perceiving ethical problems in these agreements may be sufficient grounds for rejection. However, simply lacking ethical concerns about LSs does not automatically lead to acceptance if this moral judgment is not accompanied by a positive assessment over the usefulness of the transaction.

- •

The utilization of SEM-PLS in the study conducted in this paper is highly suitable, as this technique enables the acquisition of reliable estimates even with limited statistical samples. SEM-PLS does not rely on assumptions of normality and can handle high complexity in estimation due to the inclusion of numerous variables and relationships in the model (Hair et al., 2019). Similarly, fsQCA also yields reliable results with small sample sizes and does not necessitate any statistical assumptions (Pappas & Woodside, 2021). Its primary objective is to capture the intricate nature of the phenomena under investigation.

These reasons have prompted several authors to combine fsQCA and PLS-SEM in business and market analysis. For instance, Leischnig et al. (2016) analyze the impact of variables such as firm size, firm age, and client orientation on business income, while Kaya et al. (2020) employ both methods to examine how organizational learning and interorganizational communication influence innovative performance. Similarly, Jichang et al. (2021) utilize a combination of both methodologies to elucidate the impact of business digital innovation on environmental adaptation. However, the approach taken in this paper differs slightly. Rather than implementing fsQCA and PLS-SEM separately to obtain complementary results, this article sequentially employs fsQCA and PLS-SEM, leveraging the configurations derived from fsQCA as a guide to construct the PLS-SEM architecture for adjustment.

The remainder of the paper is organized as follows. Section 2 outlines the theoretical framework and research hypotheses that underpin this study. Section 3 details the materials and methods employed in the study. Section 4 presents the obtained results. Finally, the paper concludes with a section summarizing the findings and providing suggestions for future research.

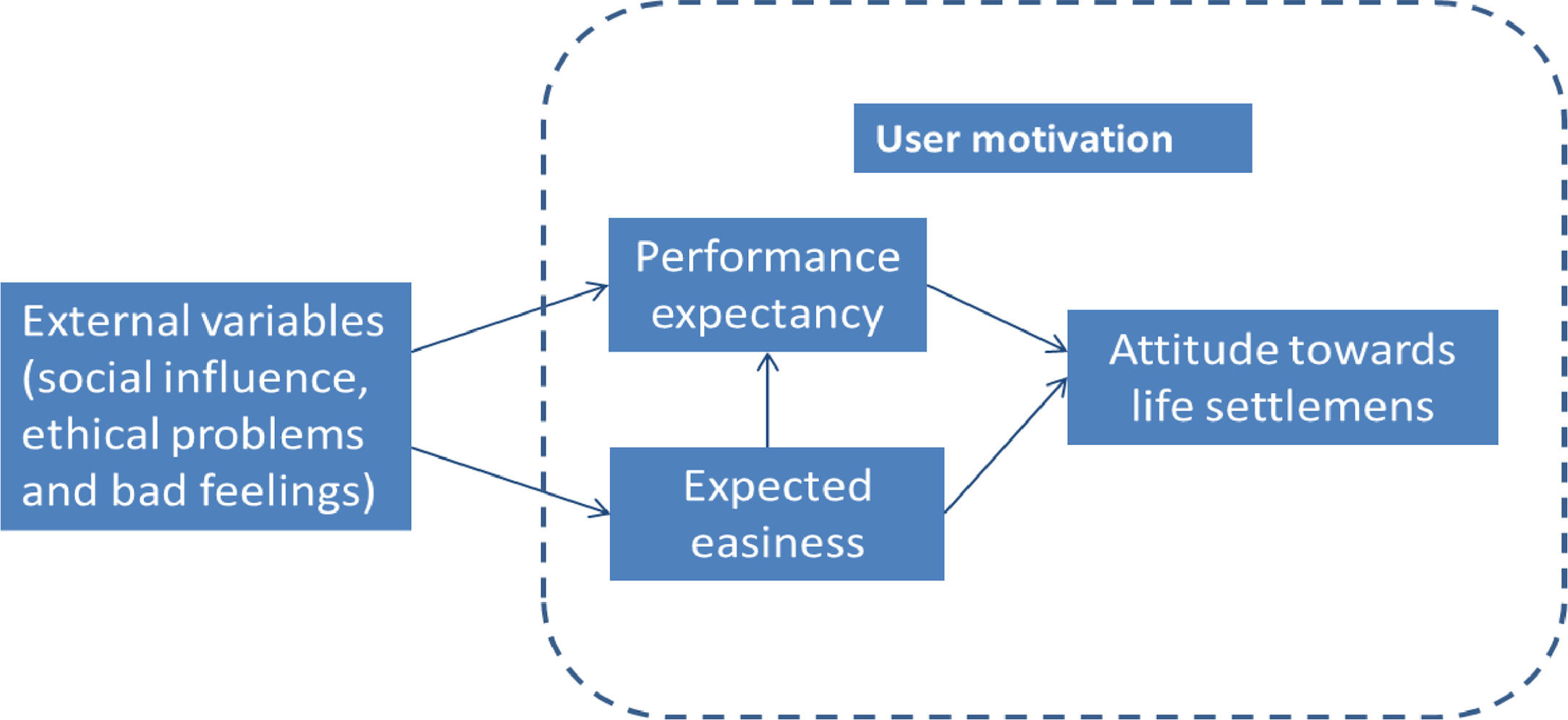

2Theoretical framework and research hypothesesPolicyholders are the supply side of the secondary life insurance market. To assess their attitude towards selling their policies via LSs (ATT), following Andrés-Sanchez et al. (2021), this analysis uses the TAM framework as a starting point (Davis, 1989). Thus, as this framework does, we initially consider that the pivotal variables to explain the motivation to agree on an LS are performance expectancy (PE) and expected easiness (EE). Additionally, we incorporate two traditional constructs from the UTAUT framework as external variables: social influence (SI) and perceived ethical problems (EP). Thus, the initial structure considered is illustrated in Fig. 1. In addition to the variables included by Andrés-Sanchez et al. (2021), this paper introduces the variable of bad feelings (BF) that may arise for policyholders and tests its impact on ATT.

Performance expectancy (PE) can be defined as the extent to which the utilization of a new product benefits consumers in performing specific activities (Venkatesh et al., 2012). The literature suggests that PE exerts the greatest influence on attitudes towards new financial and insurance services (Legowo, 2018; Warsame & Ireri, 2018; Huang et al., 2019; Hussain et al., 2019; Oktariyana et al., 2019). In the context of LSs, this construct can be understood as the degree to which policyholders perceive that engaging in LSs will enhance their well-being and quality of life. This perception stems from the fact that policyholders can obtain a better price for their policy through LSs compared to surrendering it. Moreover, LSs enhance the flexibility of life insurance policies and, therefore, their utility. Initially, life insurance policies are acquired to provide financial security to beneficiaries in the event of the policyholder's death, which is particularly important when the policyholder is of working age and has dependents, such as children. Selling an in-force policy can be driven by various reasons, and LSs often offer a higher price than policy surrender in many cases. Some of these reasons may include the following (Rosenfeld, 2009):

- •

The policy is no longer needed, as the risk that motivated its purchase does not exist. It is usual to contract life insurance to provide economic protection to the family in the event of the death of the person who contributes a greater level of resources. This protection may be unnecessary when the family has reached a level of wealth that is not endangered by the death of that person, the children become self-sufficient, and/or the mortgage of the principal residence has been paid off.

- •

The policyholder urgently needs liquidity to finance or improve the medical assistance of the insured, who is in poor health. If the insured's health is severely impaired, an LS can provide more than three times the surrender value.

- •

Due to a personal financial planning decision.

- •

Some arbitrage benefits can be obtained by selling an in-force policy and acquiring new life insurance with lower premiums/greater facial value.

Some of these reasons elucidate why LSs are commonly favoured by older individuals whose children have likely become independent, rendering the need for coverage of the "breadwinner's" mortality unnecessary. Furthermore, advanced healthcare is often required during these stages of life (Doherty & Singer, 2003). Consequently, LSs offer the opportunity to enhance policyholders' retirement income in cases of impaired health. Additionally, addressing longevity concerns is undoubtedly significant for policyholders approaching retirement age. Therefore, the value of LSs is augmented by the fact that policy prices substantially increase in circumstances that may involve a state of dependence (Andrés-Sánchez & González-Vila, 2021). These aspects directly impact PE and are anticipated to positively influence ATT. Therefore:

It is expected that greater (lower) levels of performance expectancy of life settlements are linked with a positive (negative) perception of these agreements by policyholders.

Expected easiness (EE) is the belief that using a concrete innovative product is effortless (Davis, 1989), and it often positively impacts the acceptance of financial innovations (Legowo, 2018; Warsame & Ireri, 2018 and Huang et al., 2019). In an LS context, EE is the perception of the absence of difficulties in carrying out this type of agreement. LSs possess a complex structure due to the multitude of agents and processes involved (Braun et al., 2016). While obtaining the surrender value of a life insurance policy can typically be accomplished within a week, an LS entails a lengthier process that usually takes months to complete (Life Insurance Settlement Association, 2022). The procedure leading to an LS agreement is intricate due to the nature of life insurance policies, which are non-standardized assets usually with substantial face values. The LS agreement encompasses various steps, including a formal application and the submission of extensive medical documentation to the broker and LS provider. Careful review of this documentation is necessary to avoid false information from the insured, the omission of crucial details, or the inclusion of irrelevant and imprecise data (Xu & Hoesch, 2018). Even when the available information is honest and accurate, accurately estimating the insured's life expectancy is challenging. Medical advancements, new drugs and therapies, and the trend towards healthier lifestyles are often not adequately accounted for in models. Similarly, individual psychological profiles and resilience factors are not considered in traditional medical underwriting (Xu & Hoesch, 2018). This explains why insured mortality rates are typically adjusted using the assessments of at least two life expectancy providers (Xu, 2020), making the preservation of the insured's medical confidentiality particularly challenging (Rosenfeld, 2009).

Finally, it is essential to establish the price of the LS, which necessitates a meticulous quantification of numerous risk factors (such as longevity risk, rescission risk, default risk, or liquidity risk) to meet the requirements of investors (Braun & Xu, 2020). This extensive process can create the perception that claiming the surrender value of the policy is much easier than engaging in an LS. Consequently, even if policyholders perceive LSs as useful, they may prefer policy surrender, as it represents a more agile arrangement. Furthermore, some of the PE associated with an LS may diminish if the income from the transaction is delayed. In summary, it is assumed that EE has a positive influence on ATT. Thus:

It is expected that greater (lower) levels of expected easiness of life settlements are linked with a positive (negative) perception of these agreements by policyholders.

Social influence (SI) refers to the extent to which an individual perceives that significant others believe they should adopt a new technology or service (Venkatesh et al., 2003). In the context of LSs, the inclusion of SI pertains to the impact that individuals close to the policyholder, such as family members, friends, trusted financial advisors, or regular insurance brokers, may have on the intention to engage in LSs. On the one hand, selling a life insurance policy through an LS often entails a challenging decision, not only because it is associated with a situation involving a shortened life expectancy for the insured but also because it ultimately results in the forfeit of financial coverage for their loved ones after the insured's demise. Therefore, the positive influence of these individuals can be significant (Andrés-Sánchez et al., 2021). On the other hand, due to the complexity of LSs, guidance from financial advisors or insurance brokers regarding these transactions is typically required (Kampa & Siegert, 2010; Harbor Life Settlements, 2022). In fact, the expert opinions of professionals can hold value for the policyholder. Favourable assessments of financial advisors regarding these agreements serve as a foundation for inducing a positive attitude and favourable perceptions of their usefulness among policyholders (Kampa & Siegert, 2010), as well as for promoting innovation within the insurance industry in general (Legowo, 2018). Indeed, a crucial factor in the development of such transactions is the widespread perception among financial advisors regarding the social utility of LSs in the economy. This social utility can be viewed from various perspectives. LSs not only offer a return to policyholders but also generate attractive returns for investors in secondary life insurance markets, which can often surpass those associated with fixed-income and equity markets during many periods (Giaccotto et al., 2017). Furthermore, due to the nature of risks affecting LSs, their returns exhibit low correlation with those of conventional assets (Bajo et al., 2013; Rosenfeld, 2009). Additionally, investors in LSs typically include pension funds that hold retirement savings for workers. Hence, considering the influence that individuals close to the policyholder may exert:

It is expected that a favourable (unfavorable) social influence is linked with a positive (negative) perception of life settlements by policyholders.

Ethical problems (EP) can be characterized as conflicts and choices between values, beliefs, and action options, and they are often significant explanatory variables for attitudes towards new technologies and services (Olarte-Pascual et al., 2021). LSs embed several ethical concerns from various perspectives, including suppliers, investors, and the primary market (Leimberg, 2005; Blake & Harrison, 2009; Gatzert, 2010; Nurnberg & Lackey, 2010; Glac et al., 2012; Braun & Xu, 2019; Bauer et al., 2020). The fundamental reason behind these ethical issues is the loss of insurable interest on the part of the new policyholder, as the original objective of providing financial protection for the insured's loved ones is lost (Blake & Harrison, 2009). While investing in conventional assets generates “good wishes”, purchasing LSs can evoke "bad wishes" among investors. Investments in assets such as bonds or stocks benefit from the success of the issuer's business. However, investors in LSs obtain higher returns in the event of the insured's early death (Andrés-Sánchez & González-Vila, 2021). Consequently, the LS industry has been described by various authors as an industry associated with negative wishes, often referred to as the "death wish" (e.g., Martin, 2014), leading some authors such as Glac et al. (2012) to propose the prohibition of such transactions.

News that may be considered positive, such as medical advancements, always represents negative news for LS investors. In fact, although LS profits are not correlated with bonds and stocks, they exhibit a highly negative correlation with assets issued by pharmaceutical or biotech companies (MacMinn & Zhu, 2017). Furthermore, the development of secondary life insurance markets exacerbates common issues in the insurance industry, such as asymmetric information and moral hazard (Bauer et al., 2020). Glac et al. (2012) documented cases in which AIDS patients attempted to artificially lower their T-cell counts to present a worse medical profile. In summary, LSs may create perverse incentives for the insured to neglect their health to obtain a higher price for their policy in LS transactions. Therefore, EP can have a negative impact on ATT.

However, LSs also mitigate certain ethical problems. The presence of LSs eliminates insurers' monopolistic control over the repurchase of life policies. The existence of insurance monopsony in secondary markets is deemed unfair and economically inefficient. Surrendering a life policy is unjust, as price policies rely on standard death probabilities rather than actual death probabilities. Consequently, this practice engenders a paradoxical situation. Insurers may experience losses when young individuals with above-average health receive the cash surrender value (due to the overpriced repurchase value), while gains from underpriced repurchases are derived from the surrender values obtained by senior insured individuals with below-average health. As a result, the group of insured individuals most in need of protection, such as seniors with impaired health status and vulnerable economic situations, effectively subsidizes the surrender values of insured individuals in very good health (Braun et al., 2019). Therefore:

It is expected that the presence (absence) of ethical problems in life settlements is linked with a negative (positive) perception of these agreements by policyholders.

Emotional factors, such as bad feelings (BF), play a significant role in explaining attitudes towards products and services (Pelegrín-Borondo et al., 2017). Therefore, in this study, in addition to considering the explanatory variables discussed in the preceding paragraphs, a variable associated with the potentially negative emotions arising from the sale of a life insurance policy through an LS is also taken into account. This variable is justified by the fact that LS transactions often occur under high emotional distress for the policyholder and in desperate circumstances (Nurnberg & Lackey, 2010). Furthermore, it can be argued that these transactions represent a loss of dignity for the insured, as the original policy transforms into a morbid speculation on their death date, reducing it to a mere financial asset like a stock or a bond (Nurnberg & Lackey, 2010; Glac et al., 2012). The perception of an LS as a bet on the insured's death date can be viewed as a macabre game of chance (Glac et al., 2012). It is discomforting for the insured to know that the new beneficiary of the life insurance policy wishes for their speedy death. Tracking agents play a significant role in the LS industry, as their responsibility is to constantly monitor the insured's death date. With the original life policy, the beneficiary, typically a loved one, desires the insured to live a long life, and the death benefit is often perceived as meager compensation for a profound loss. However, investors value the death benefit more than the life of the insured; thus, their continuous vigilance over the insured's decease is driven by the desire to receive the death benefit as quickly as possible.

Moreover, LSs necessitate that policyholders disclose extensive private information about their health and lifestyle, which is scrutinized by multiple agents (Xu & Hoesch, 2018), resulting in a significant loss of privacy for the insured (Glac et al., 2012). Consequently, it is logical to assume that experiencing BF towards LSs could exert a negative influence on ATT.

Thus: It is expected that the presence (absence) of bad feelings related to life settlements is linked with a negative (positive) perception of these agreements by policyholders.

It should be noted that both fsQCA and PLS-SEM are utilized in this study to assess the relationship between input variables and policyholders' attitude towards LSs. Based on the previous explanations, it is reasonable to assume that the influence of the explanatory variables PE, EE, SI (EP, BF) on ATT is positive (negative). However, the distinct mathematical foundations of each technique necessitate the formulation of hypotheses to be tested in a different manner. With fsQCA, the objective is to identify sufficient conditions, which involve combinations of input variables, that lead to a specific outcome. These outcomes can encompass acceptance attitude (ATT) towards LSs, as well as resistance or rejection (i.e., the negation of ATT, ∼ATT). Moreover, fsQCA does not assume symmetry in how the factors produce ATT and ∼ATT. Thus, on the basis of Moslehpour et al. (2022), we formulate the hypotheses to assess with fsQCA as follows:

Hypothesis 1a (H1a). The combination of high (low) perceptions about PE, EE, SI (EP, BF) produces sufficient conditions for an acceptance attitude on policyholders towards LSs.

Hypothesis 1b (H1b). The combination of low (high) perceptions about PE, EE, SI (EP, BF) produces sufficient conditions for a resistance attitude on policyholders towards LSs.

Hypothesis 1c (H1c). Causes for the acceptance and rejection of LSs by policyholders are different, i.e., recipes indicating negative attitudes are not mirror opposites of recipes of acceptance.

PLS-SEM enables the examination of the net effect of one variable on another by employing coefficients and determining statistical significance through p-values. Consequently, hypotheses regarding the influence of input factors on attitude towards LSs will be formulated in the following manner: "Variable X positively/negatively influences Y." The hypotheses to be tested using PLS-SEM are presented below:

Hypothesis 2a (H2a). PE positively influences policyholders’ attitude towards LSs.

Hypothesis 2b (H2b). EE positively influences policyholders’ attitude towards LSs.

Hypothesis 2c (H2c). SI positively influences policyholders’ attitude towards LSs.

Hypothesis 2d (H2d). EP negatively influences policyholders’ attitude towards LSs.

Hypothesis 2e (H2e). BF negatively influences policyholders’ attitude towards LSs.

It is important to note that the formulation of PLS-SEM in this paper may differ from that of Andrés-Sánchez et al. (2021). In their study, they formulated the model based on discourse arguments, which is a common procedure for constructing PLS-SEMs. In their model, the key variable for explaining the acceptance of LSs was PE, while the other variables (EE, SI, and EP) could directly impact ATT or indirectly through their influence on PE. However, the approach taken in this paper to construct the PLS-SEM is different. The implementation of fsQCA is used as a preliminary step to establish the relationships between the constructs of the PLS-SEM. By evaluating how the input variables combine in prime implicates to produce acceptance or rejection of LSs, we aim to construct the most parsimonious PLS-SEM possible.

3Materials and methods3.1Description of the surveyThis paper utilizes the survey conducted in Andrés-Sánchez et al. (2021), which was carried out in Spain between December 15, 2020, and April 20, 2021. The data collection process involved administering a structured questionnaire to individuals who hold a university degree in a social science discipline, such as Economics, Law, etc., and who are affiliated with the insurance or financial industry. The respondents encompassed both researchers specializing in financial and actuarial topics from Spanish universities and professionals working in these fields. The selection of a sample consisting of professionals from the insurance and financial industry, as well as individuals with comprehensive knowledge of the subject matter, is a common approach in studies focusing on technical issues like life insurance and LSs (Legowo, 2018; Oktariyana et al., 2019). The following steps were implemented in the survey development:

(1) The questionnaire was elaborated in Spanish and initially distributed to a panel of 25 scholars and professionals. The purpose of this preliminary distribution was to ensure that the questions were clear and easily understandable to respondents. Additionally, the explanatory text provided regarding LSs was carefully reviewed to ensure that it was informative and comprehensive enough for the intended audience.

(2) The suggestions provided by the scholars and professionals were valuable in enhancing the readability of the text and questions in the questionnaire. These improvements ensured that the survey was clear and easily understandable to the target respondents. However, it is important to note that no items were removed or significantly altered based on their feedback. Furthermore, the responses obtained from this reduced sample were utilized to preverify the consistency of the scales used in the questionnaire. This process helped to assess the reliability and validity of the measurement scales, ensuring that they effectively captured the intended constructs and provided meaningful data for analysis.

(3) The output, ATT, was evaluated with a single question: “I may be interested in selling my life insurance through an LS if the conditions to carry it out are met”. As far as the input variables are concerned, three (PE, EE and SI) are based on constructs that were built using the scales in Venkatesh et al. (2012). EP is quantified by the two questions in Andrés-Sánchez et al. (2021). Finally, BF is assessed with the question “Selling my life insurance through an LS would make me feel at unease”. All the items used in this paper were answered on an eleven-point Likert scale. These items and their descriptive statistics can be found in Table 1.

Descriptive statistics of items.

Notes: (1) N = 89 (2) Answers scale ranks from 0 to 10.

(4) Subsequently, we proceeded to distribute the questionnaire via email to various university departments associated with financial and actuarial studies and professional associations of financial advisors and insurance brokers.

(5) Recognizing the targeted nature of our survey, specifically focusing on individuals with extensive knowledge of financial and insurance issues, we acknowledged that the final number of responses might be relatively small. However, it is important to note that both fsQCA and PLS-SEM are well suited for analysing data from smaller sample sizes (Pappas &Woodside, 2021; Hair et al., 2019). To ensure an acceptable sample size, we set a minimum threshold of 80 responses. This criterion was established based on considerations derived from the PLS-SEM literature:

(5.1) The first criterion is the so-called 10 times rule, which establishes that the minimum acceptable sample size is 10 times the maximum number of inner or outer model links pointing at any variable in the model (Kock & Hadaya, 2018). Consequently, if we assume that the maximum number of links in the PLS-SEM could be 5, the minimum sample required is 50 observations.

(5.2) The second criterion is the so-called minimum R2 method. The first element of the minimum R-squared method is the maximum number of links pointing to a construct in the proposed model (in this paper, they have been set to 5). The second is the significance level and the power of contrast used, which are usually set at 0.05 and 0.8, respectively. The third is the minimum R2 of the model, which, if set to approximately 25%, requires 70 observations (Kock & Hadaya, 2018).

(6) Out of the initial distribution of the questionnaire, we received a total of 102 responses, resulting in a success rate of approximately 15%. After removing surveys with incomplete or blank responses, we obtained a final sample size of 89 fully answered questionnaires for analysis. In terms of the respondents' profiles, the sample consisted of 43 male and 46 female participants. It is worth noting that all participants in the sample were over 35 years old. Furthermore, the majority of respondents reported a monthly income of €2000 or more.

3.2Data analysisThe empirical analysis is carried out by using fsQCA and PLS-SEM. The use of fsQCA allows us to answer RQ1, which inquires how the combination of explanatory variables influences ATT, and is also used to assess the architecture of the PLS-SEM fitted to answer RQ2.

3.2.1Data analysis with fsQCAFsQCA is a case-oriented technique that aims to capture how the combination of assessed variables, either present or absent, contributes to a specific output (Ragin, 2008). In complex phenomena, multiple combinations of explanatory factors can lead to the same outcomes (Woodside, 2014). The solution provided by fsQCA fits these combinations by means of so-called recipes/prime implicates/configurations (Ragin, 2008). Additionally, the causes of the presence and absence of an output are not necessarily exact opposites (Woodside, 2014). In the context of LSs, having bad feelings towards LSs might act as a barrier to acceptance, while positive feelings alone may not facilitate adoption. FsQCA allows for the fitting of nonsymmetrical solutions separately for the affirmation and negation of an explained variable, offering a natural approach. Furthermore, fsQCA has shown effectiveness even with small sample sizes (Pappas & Woodside, 2021).

To conduct the fsQCA analysis, we utilized fsQCA 3.1 software (Ragin, 2017) and followed the steps proposed by Pappas and Woodside (2021):

Step 3.2.1.1. By running a factor analysis, check the internal consistency of scales (Cronbach's alpha and composite reliability) and the convergence validity (average variance extracted, AVE).

Step 3.2.1.2. Test the discriminant validity of explanatory variables by using the Fornell-Larker criterion (Fornell & Larker, 1981) and the value of heterotrait-monotrait ratios (HTMT) by Henseler et al. (2015).

Step 3.2.1.3. Run a contrarian case analysis by applying the methodology suggested in Pappas and Woodside (2021). In this step, not only the standardized factor loadings of the input variables but also the direct observations of responses on ATT and BF are used. Crosstabs quantify the sign of the association between the output variable and the input variables, its significance and the existence of cases outside the main effect that justify a configurational analysis. To evaluate this last fact, it is very useful to take into account the value of the Phi statistic. We also calculate Kendall's tau-b correlation between ATT and the input variables. This value provides a preliminary measure of the sign of the relationship between the variables and its statistical significance.

Step 3.2.1.4. Calibrate the membership score of observations on each variable. In all cases, we use the function “calibrate” in fsQCA 3.1 software by Ragin (2017)). For ATT and BF, we fix the thresholds at 2, 5, and 8. For the rest of the variables, we transform factor loadings in membership scores by using 5%, 50% and 95% percentiles as thresholds.

Step 3.2.1.5. Implement fsQCA with fsQCA 3.1 software. It enables finding logical implicates that fit output results by running the Quine-McCluskey Boolean minimization algorithm described in McCluskey (1956). If we symbolize the negation of a variable as “∼”, we independently adjust the Boolean functions f(·):

Therefore, (1) explains a positive attitude towards LSs, whereas (2) explains resistance.

In a fsQCA, there are three possible solutions: complex, intermediate and parsimonious. They are nothing but a set of essential prime implicates, also known as recipes (Ragin, 2017), that are fitted with the Quine-McCluskey algorithm. The complex solution (CS) is fitted with no more assumptions than data. The parsimonious solution (PS) is fitted by using any hypothesis on the unobserved configuration of variables and discovers the “easiest” solution, although some of them might suppose “difficult counterfactuals” (Ragin, 2017). The intermediate solution (IS) is developed from theoretical hypotheses about unobserved configurations (Ragin, 2008).

Solutions and their recipes have associated measures of consistency (cons) and coverage (cov) that state their explanatory power. Consistency quantifies the membership degree of a combination of causes (a recipe) within the outcome set. It is similar to a statistical measure of significance (Thiem, 2010). There is broad consensus that to consider an essential prime implicate as a sufficient condition, cons > 0.75 (or better, cons > 0.8). Coverage measures the proportion of the outcome explained by a recipe, i.e., that measure is similar to a determination coefficient.

Step 3.2.1.6. To evaluate H1a, H1b and H1c, fsQCA solutions must be assessed. There is no consensus on which solution (CS, PS or IS) should be considered. CS exclusively uses data without further assumptions. Therefore, it must be the only solution for any evaluation, and we restrict the analysis to that solution. Likewise, given that the prime implicates in CS are drawn exclusively from the available data, the examination of its recipes could be helpful for building up a PLS-SEM compatible with the sample. However, the recipes in the CS are sometimes difficult to interpret, which is why many practitioners tend to use IS to carry out this step. In addition, the IS allows a balance between the simplicity of the PS and the nuances of the CS (Ragin, 2008).

3.2.2Data analysis with PLS-SEMPLS-SEM, as a correlational method, enables the examination of the overall impact of explanatory factors on explained variables. Its primary purpose is to model complex relationships between variables, including mediation effects. Moreover, PLS-SEM is well-suited for analysing small sample sizes, and the assumption of data normality is not a requirement (Hair et al., 2019). These advantages have contributed to the widespread adoption of this statistical approach in various empirical studies within the field of management. For instance, PLS-SEM has been employed to assess export barriers (Mataveli et al., 2022), measure the impact of digitalization on firm performance (Fernández-Portillo et al., 2022), and investigate consumer motivation and behavior during the COVID-19 pandemic (Pelegrín-Borondo et al., 2021; Vázquez-Martínez et al., 2021). In our analysis, we utilized SmartPLS 4 software and followed the step-by-step procedures outlined in Hair et al. (2011) and Hair et al. (2019).

Step 3.2.2.1. Build a PLS-SEM to explain the acceptance of LSs. The final model to be estimated will be as parsimonious as possible and compatible with Fig. 1 and findings in configurational analysis in 3.2.1.

Step 3.2.2.2, checking internal consistencies of scales, and step 3.2.2.3, measuring the discriminant validity of variables (Hair et al., 2019), were already implemented when running fsQCA.

Step 3.2.2.4. Fit the paths of the model and their significance level. In this regard, it must be remarked that Hair et al. (2019) give an extended description of how the PLS-SEM algorithm works.

Step 3.2.2.5. Assess hypotheses H2a-H2e after fitting the PLS-SEM.

Step 3.2.2.6. The predictive capability of the model is examined by fitting Stone-Geisser's Q2 coefficient and running the cross-validated predictive ability test (CVPAT) explained in Liengaard et al. (2021) and Sharma et al. (2022). This last procedure compares out-of-sample predictions of the tested model with those by two simple benchmarks. The first alternative is known as the indicator average (IA) and predicts the explained variables as their average value, and the second alternative is a conservative linear model (LM).

4Results4.1Validity of scalesThe results of the validity of the scales are given in Tables 2 and 3.

Results of scale validation.

Notes: (1) N = 89.

Results of discriminant validity using Fornell-Larker criteria and HTMT ratios.

Note: Principal diagonal is the squared root of AVE. Below the principal diagonal are correlations between variables, and above the principal diagonal are HTMT ratios.

Table 2 shows that all the scales (PE, EE, SI and EP) are reliable since while Cronbach's alpha and convergent reliability are always >0.7, AVE>0.5 and factor loadings of all items are also >0.7.

Table 3 shows a matrix that allows affirming the discriminant capability of the proposed variables. Following the Fornell-Larker criteria, these factors have discriminant capability since their squared AVEs are always above the absolute correlations with the rest of the variables (Fornell & Larker, 1981). These results are reinforced by the fact that the HTMT ratios between variables are always below 0.7. Therefore, the criterion HTMT≤0.85 and its relaxed version HTMT≤0.90 by Henseler et al. (2015) are met.

4.2Results of fsQCATable 4 shows the basic results of the contrarian case study. Measures phi and Kendall's tau-b correlation inform about the existence of a statistically significant positive association between ATT, PE, EE and SI. On the other hand, the negative association of EP and BF with ATT does not seem statistically relevant. Likewise, it can be checked that in the case of EE, SI, EP and BF, 0.05< phi2 <0.5. Therefore, following Pappas and Woodside (2021), the use of fsQCA is fully justified to explain cases outside the main effect of these variables on ATT.

Results of crosstabs between attitude towards LSs and input factors.

Note: p-values are in parentheses.

Table 5 shows the CS of fsQCA for ATT and ∼ATT. We can verify that the consistency and coverage of the CS in ATT and ∼ATT is asymmetrical in these indicators. Whereas the overall solution for ATT attains cons=0.809 and cov=0.650, the consistency (coverage) attained by the CS in ∼ATT is slightly greater (substantially smaller) than that in ATT (cons=0.829, cov=0.461).

fsQCA complex solutions of ATT and ∼ATT.

Note: A full circle (•) indicates the affirmation of a variable, and circles with x (⊗) indicate its negation.

Regarding the explanatory recipes of ATT, Table 5 shows the following:

- (a)

The variables PE and SI come affirmed and EP comes negated (in the configurations where these variables are present, of course). Therefore, the sign of these variables is as we hypothesized in H1a. On the other hand, EE comes affirmed in two recipes, as we expected, but negated in another. We can make a similar appreciation with respect to BF: that variable is negated in recipe 1 but affirmed in recipe 3. Thus, H1a does not hold in relation to EE and BF.

- (b)

The most important variable to produce acceptance is PE, since it must be affirmed in all three prime implicates. EE is also present in all recipes but with contradictory signs. Note that the first recipe PE*∼EE*∼BF, where “*” stands for the Boolean product, includes people favourable to LSs despite their low evaluation of the ease of these trades.

Regarding the explanatory recipes of ∼ATT, the following can be observed:

- a)

All explanatory variables are present in at least one prime implicate with the expected sign. That is, hypothesis H1b is completely fulfilled.

- b)

It seems that the most important conditions to explain ∼ATT are the negation of both PE and SI since these constructs participate in all the recipes.

- c)

Likewise, to produce resistance to LSs, it is also necessary to combine the negation of PE and SI with the negation of EE and/or the affirmation of EP and BF.

By analysing how EE, SI and BF impact ATT and ∼ATT, it can be seen that recipes producing acceptance and resistance are not the mirror opposite. This leads us to conclude that there is a clear asymmetry in the way the input variables combine to produce acceptance and rejection of LSs. Therefore, we can accept hypothesis H1c.

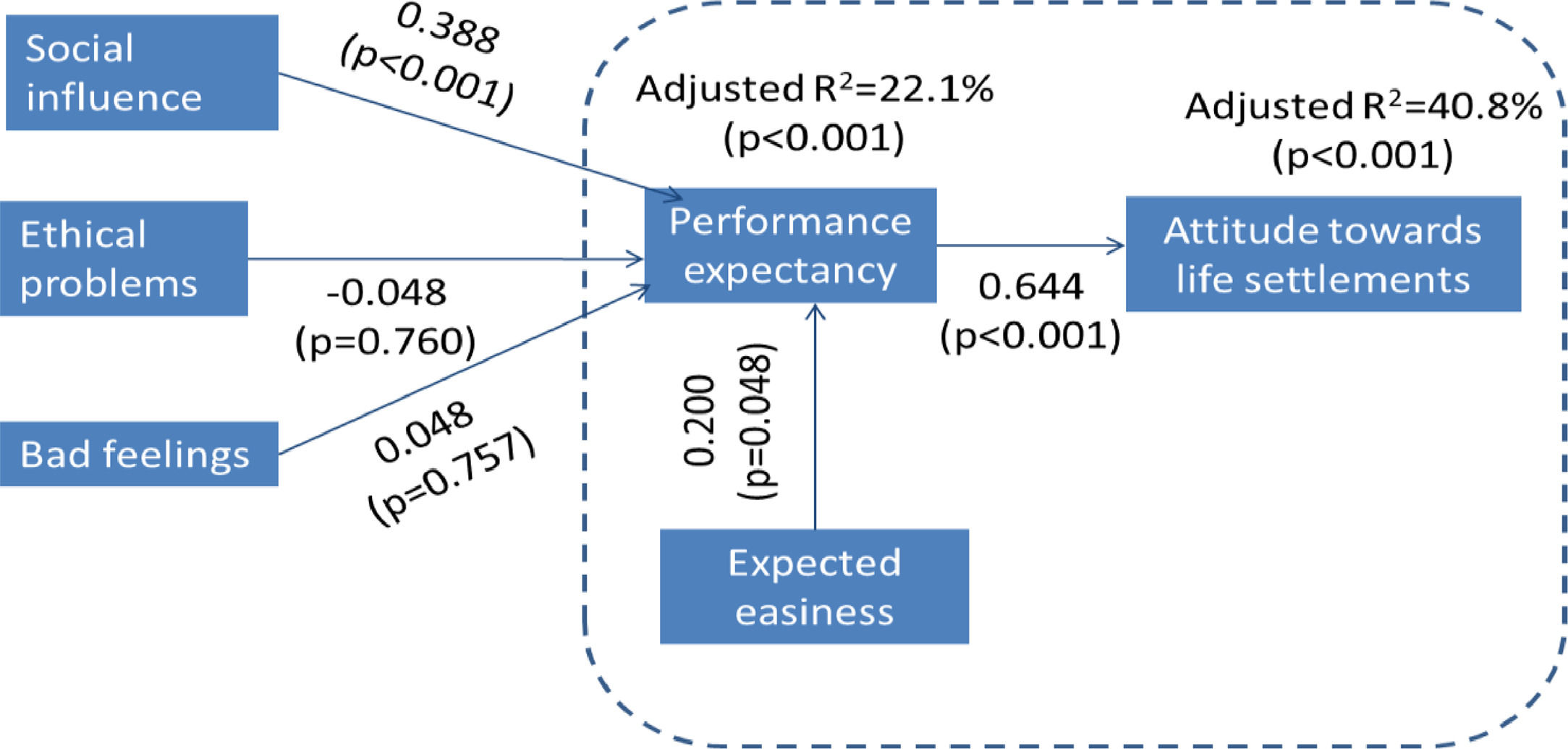

4.3Results of PLS-SEMThe results of CS in Table 5 suggest that the key variable to explain the attitude towards LSs is PE since it participates in all the explanatory recipes of ATT and ∼ATT. The other explanatory variables must always be combined with PE to produce a positive or negative response in ATT. Therefore, in the proposed PLS-SEM, which is shown in Fig. 2, only PE has direct effects on ATT. The other variables indirectly impact ATT by influencing PE.

By observing Fig. 2 and following the criteria in Hair et al. (2019), the adjusted R2=40.8% attained for ATT supposes a moderate accuracy. In the case of PE, R2=22.1%, i.e., that variable is fitted with a weak accuracy. However, the adjustment of both variables is significant (p<0.001).

As far as direct effects are concerned (see Fig. 2 and Table 6), the impact of PE on ATT is quantified by a significant path coefficient (pc) of 0.644 (p<0.001). We also found significant effects of SI (pc=0.388, p<0.001) and EE (pc=0.200, p = 0.048) on PE. The impacts of EP and BF on PE do not show statistical significance at standard levels.

Direct and indirect effects of input factors on attitude toward LSs.

Regarding the indirect effects of EE, SI, EP and BF on ATT, Table 6 shows that SI positively influences ATT with clear statistical significance (pc=0.250, p<0.001) and that EE shows a positive influence with moderate statistical significance (pc=0.129, p = 0.057). Moreover, EP and BF do not show a significant influence on ATT.

Therefore, it can be concluded that while H2a and H2c are strongly accepted and H2b has weaker acceptance, hypotheses H2d and H2e are rejected.

Table 7 shows that the proposed PLS-SEM has predictive capability. For both ATT and PE, Q2>0, so it can be considered that the model proposed in this paper allows significant predictions (Hair et al., 2019). CVPAT also suggests that PLS-SEM provides a good out-of-sample adjustment. Following Sharma et al. (2022), this ability exists because the model beats the IA benchmark (average loss difference=-1.164, p = 0.02), and it can be considered that it is strong since the proposed model gives better predictions than LM (average loss difference=-0.717, p = 0.008).

Results of PLS predictive analysis and cross-validated predictive ability test.

Note: RMSE stands for root-mean-square error, MAE for mean absolute error and ALD for average-loss difference.

This paper examines the factors influencing the acceptance of LSs on death benefits by policyholders in the Spanish life insurance market, where such agreements do not currently exist. The analytical framework and sample used in this study are based on Andrés-Sánchez et al. (2021). However, this paper expands the analysis by incorporating an explanatory factor that measures the bad feelings associated with selling a life insurance policy through an LS. While Andrés-Sánchez et al. (2021) employed a structural equation model fitted with partial least squares (PLS-SEM) to assess the relationships between variables, this paper applies fuzzy set comparative qualitative analysis (fsQCA) to extract complementary findings from the data. Furthermore, we demonstrate that performing fsQCA can be a valuable step in establishing a reasonable and concise fit for PLS-SEM.

The first research question (RQ1) aims to understand how explanatory factors combine to generate a positive attitude towards LSs for some policyholders and a negative attitude for others. Consistent with Andrés-Sánchez et al. (2021), we find that the key variable influencing policyholders' interest in LSs is performance expectancy (PE), and the relationship is positive. Affirmation (negation) of PE is a necessary condition for the acceptance (rejection) of LSs across all prime implicates. However, acceptance and resistance depend on the combination of PE with other factors. This finding aligns with the literature on the acceptance of innovations in finance (Veríssimo, 2016; Legowo, 2018; Warsame & Ireri, 2018; Huang et al., 2019; Hussain et al., 2019; Oktariyana et al., 2019).

Expected Easiness (EE) is a condition in all the recipes explaining positive attitude, but this variable has a different sign in its prime implicates. The affirmation of EE is required twice and therefore appears to confirm H1a, but its negation is a condition in one recipe, which contradicts H1a. On the other hand, the absence of EE is always a condition for a negative attitude towards LSs, which is in accordance with H1b. The finding that a lack of EE enables ∼ATT is in accordance with Legowo (2018); Warsame and Ireri (2018) and Huang et al. (2019), who show that the absence of EE could induce a negative perception of novel financial and insurance techs. Thus, the sign of the impact of EE on ATT is clearly defined to explain resistance, but this does not follow with respect to a positive attitude.

Although social influence (SI) and ethical problems (EP) seem to be the least important variables to explain acceptance, their impact has the sign hypothesized in H1a. Likewise, they also appear with the expected sign (negated SI and affirmed EP) to explain negative ATT towards LSs, as we hypothesize in H1b. The findings on the influence of SI on ATT and ∼ATT are in accordance with Andrés-Sánchez et al. (2021) and Legowo (2018) and fit the expectations that were grounded in Kampa and Siegert (2010) and Harbor Life Settlements (2022). On the other hand, the negative impact of EP on acceptance is in agreement with Olarte-Pascual et al. (2021) and with the fact that LSs embed several ethical concerns (Leimberg, 2005; Blake & Harrison, 2009; Gatzert, 2010; Nurnberg & Lackey, 2010; Glac et al., 2012; Braun & Xu, 2019; Bauer et al., 2020).

Bad feelings (BF) impact ATT in a similar way to EE. This variable is a condition in two prime implicates of ATT, but its influence is contradictory since in one recipe it needs to be affirmed and in the other one it is negated. Therefore, the net sign of BF on ATT may be null, and H1a is violated. On the other hand, BF is also a condition in two recipes explaining ∼ATT, and in both configurations, it must be affirmed. This finding agrees with H1b. This influence of BF on ∼ATT is in consonance with the relevance of feelings when explaining the attitude towards innovative products and services (Pelegrín-Borondo et al., 2017).

Therefore, whereas H1a is not fully accepted because of the contradictory sign of EE and BF on ATT, the negative (positive) sign of PE, EE, SI (EP, BF) leads us to a full acceptance of H1b.

Note that prime implicates explaining ATT are not mirror opposites of ∼ATT, so H1c is satisfied. The impact of PE on ATT and ∼ATT could be considered approximately symmetrical since it is a principal variable to explain acceptance and resistance towards LSs. EP also seems to have a fairly symmetrical impact on ATT and ∼ATT since it is negated to explain ATT, affirmed to explain ∼ATT and, in both cases, is not a principal variable. However, this fact does not follow in the case of EE, SI and BF.

The second research question (RQ2) focuses on assessing the net effect of each explanatory factor on ATT, and it has been addressed through the fitting of a PLS-SEM model. The findings reveal that PE is the most significant variable in explaining ATT. This result aligns with the outcomes of the proposed fsQCA model and the findings of Andrés-Sánchez et al. (2021). It is also consistent with empirical studies on insurance issues such as Legowo (2018), Huang et al. (2019), and Oktariyana et al. (2019).

Furthermore, it is important to note that EE and SI, particularly the latter, have a significant positive direct impact on PE and a substantial positive indirect influence on ATT. In the case of SI, it is reasonable to assume that the opinions of loved ones and trusted financial advisors can indirectly influence attitude by fostering a positive perception of the usefulness of engaging in LSs if necessary. This finding is consistent with Kampa and Siegert (2010) and Legowo (2018). Regarding EE, the sign of its indirect impact on ATT corresponds to the findings of Legowo (2018), Warsame and Ireri (2018), and Huang et al. (2019), while its positive influence on PE is in line with Huang et al. (2019).

The PLS-SEM analysis does not identify a significant impact of EP and BF on PE and ATT. It is worth noting that EP appears in fsQCA recipes with a contradictory sign, which suggests that, from a variable-oriented perspective, the average impact of BF on ATT is likely to be null. On the other hand, although the presence of BF in fsQCA recipes aligns with our assumed sign for its impact on ATT, it is the least influential explanatory factor. It is important to acknowledge that the sample size is not very large, which may limit the power of coefficient tests.

The findings of this paper have important implications for the development of a secondary life insurance market through LSs in Spain. The key factor in fostering a positive attitude towards LSs is PE. Therefore, for LSs to be attractive to policyholders, they must offer significantly higher amounts than simply surrendering the policy. Currently, in the US, these amounts are approximately six times the cash surrender value (Harbor Life Settlements, 2022).

Additionally, to create a perception of usefulness, it is essential to consider factors such as EE and SI. If a policyholder is in need of cash and, despite having a compromised health status, perceives the process of trading their life insurance through an LS as lengthy and complex, they are likely to choose surrendering the policy instead. Therefore, the successful implementation of LSs requires streamlined procedures that are agile and efficient. Moreover, the acceptance and utilization of LSs by policyholders also depend on the perception of financial advisors and insurance brokers. It is crucial that these professionals view LSs as a convenient option for their clients. Their support and positive perception of LSs can play a significant role in encouraging policyholders to consider this type of agreement. By addressing these factors, policymakers and industry stakeholders can work towards establishing a thriving secondary life insurance market through LSs in Spain, providing policyholders with viable options for maximizing the value of their life insurance policies when needed.

Let us note that currently, the emergence of new technologies in the insurance industry, such as artificial intelligence (AI) and blockchain technology, can have a positive impact on EE or SI towards LSs. There are several ways in which these technologies could facilitate transactions in secondary life insurance markets. For instance, one of the most challenging and contentious aspects of reaching an agreement on an LS is determining the insured individual's life expectancy, which is typically done by the medical underwriters (Bauer et al., 2020; Xu, 2020). Undoubtedly, the utilization of AI and big data could enhance the accuracy of such predictions. The application of these emerging technologies to other processes associated with the operations of secondary life insurance market participants (e.g., policyholders, investors, LS providers, LS brokers, tracking agents, etc.) will surely streamline administrative procedures and reduce costs. Consequently, this could potentially lead to higher profit margins for all participants or a decrease in the minimum face values required to negotiate life insurance policies through LSs. Additionally, the implementation of financial advice bots for addressing basic inquiries could enhance the work of brokers and LS providers.

This study has shown that the mixed method approach used to investigate the acceptance of LSs is highly suitable. The employment of fsQCA has facilitated the identification of profiles of policyholders with both positive and negative perspectives on LSs. The results obtained through fsQCA have proven valuable in guiding subsequent steps when formulating the model to align with PLS-SEM. Furthermore, PLS-SEM provided insights into the net strength of the impact of each input on the explained factor, as well as its statistical significance.

However, it is important to acknowledge that this paper has certain limitations that need further investigation. First, the empirical research conducted in this study was based on a survey conducted in a specific country, Spain. Additionally, the respondents were individuals with a high level of financial and insurance literacy. This aspect is significant, as it may influence the general attitude towards LSs in the sample, given that individuals with greater financial knowledge are generally more receptive to new financial products (Lusardi & Mitchell, 2014). Therefore, to obtain a broader perspective, future research should be conducted in alternative countries and with different profiles of policyholders.

Another limitation to consider is the small sample size. Although this limitation did not pose a problem in identifying profiles exhibiting a negative association between perceiving ethical issues, experiencing bad feelings, and the attitude towards LSs, this relationship may not have been adequately captured by the PLS-SEM estimation, possibly due to the size effect.

Furthermore, this article relies on a cross-sectional survey conducted at a specific point in time, reflecting the unique situation of the life insurance market in Spain. Consequently, the results derived from this study cannot be directly generalized to other countries or extrapolated to long-term trends. This aspect is particularly relevant considering the dynamic nature of secondary life insurance markets. In summary, conducting a longitudinal study to comprehend how perceptions of LSs evolve alongside the growth of LS markets would be of interest.

Finally, we believe that further exploration of fsQCA's application in actuarial and insurance contexts is warranted. This methodology has already proven valuable in identifying the combined effects of variables that influence the acceptance or rejection of new technologies and products within financial environments (Veríssimo, 2016; Arias-Oliva et al., 2021). Therefore, it would be worthwhile to utilize these frameworks to assess both positive and negative attitudes towards emerging technologies in the insurance industry, such as AI or smart contracts. Additionally, fsQCA could serve as an interesting complement to instruments such as Poisson regression in insurance rate making. For instance, in the field of automobile insurance, the factors that determine an insured individual's classification as a "good driver" may be entirely different from those that define a "bad driver", and fsQCA can potentially capture these asymmetries.