In the last five years, home rentals for tourists have generated significant media and social concern. Since the economic crisis of 2007–2008, online platforms have emerged that have boosted the collaborative economy and provided security and trust. There are two positions related to the impacts of peer-to-peer and intermediation platforms: some consider them to reflect the destruction of tourist destinations at the hands of international corporations, while others allege that they have helped improve the incomes of many families and meet demand. These positions raise doubts, and based on the descriptive analysis of secondary public data from Spain, this study makes a first approximation of the actual situation. The results indicate that the platforms have given online visibility to business that already existed, while tourist rentals cater to specific market niches and adjust hotel supply to tourist demand. The study concludes that tourist rentals have been confused with the real problem: large and rapid increases in demand that are difficult to manage, aggravating mismatches in the rental market that are the result of multiple factors.

Before the 2007–2008 economic crisis, the collaborative economy was a marginal concept and limited to small communities. However, the appearance of online intermediation platforms that minimise the uncertainty in peer-to-peer (P2P) commerce between strangers (Weber, 2014) and many families’ need for extra income (Gil, 2019; Sainaghi, 2020) have generated a large volume of P2P activity that is managed through specialised web pages (Tham, 2016). Since 2008, there has been a significant and growing increase in the activity managed by these platforms, which have reduced the impact of the crisis by generating new income for some individuals and lower costs for others. The growth of P2P, especially in urban transportation and tourist rentals (CNMC, 2016; Menor, 2019), has made it a subject of substantial media (Guizi, Breda, & Costa, 2020) and academic interest (Belarmino & Koh, 2020; Dolnicar, 2019; Pizam, 2014; Sainaghi, 2020).

This interest has led to the appearance of reports and studies by associations, consultants, and researchers that have attempted to measure the relevance and impacts of the collaborative economy in today's context (Dredge & Gyimóthy, 2015). Various doctoral theses have also analysed the collaborative economy or some of its specific aspects from different perspectives (e.g. Gervi, 2018; Gil, 2019; Menor, 2019; Ramos, 2020). However, since the related media reports have not been accompanied by data to inform possible future decisions (Avdimiotis & Poulaki, 2019), and the scientific literature on this topic is in its infancy (Tussyadiah & Pesonen, 2018), it may be the case that erroneous ‘solutions’ have been proposed for the wrong ‘problems’.

For example, though some hoteliers are concerned about the effect of P2P rentals on their business, existing studies have not shown any clear impact on hotels (e.g. Dogru et al., 2020a; Sainaghi, 2020; Sainaghi & Baggio, 2020), and it has been argued that they serve different market niches (Sainaghi, 2020). Consequently, a review of the available secondary data is required to determine if a problem exists and, if so, to measure its severity. The present study reviews publicly accessible, reliable secondary data from Spain, in particular, from Ibiza and Formentera. Specifically, surveys of foreign tourists (INE, 2020d), Spanish residents (INE, 2020c), and hospitality firms (INE, 2020, 2020ab), which are conducted by Spain's National Institute of Statistics (INE), were examined. The main conclusion of the analysis was that, in the Spanish context, there has been no significant change in the form of accommodation chosen by tourists, suggesting the appearance of a new tourist trend.

The results from Spain led to a further analysis of a specific destination, the islands of Ibiza and Formentera, which have generated particular controversy related to tourist rental accommodation. The case of Ibiza and Formentera was examined in more detail with data from previous surveys and other statistics available from the Statistical Institute of the Balearic Islands (IBESTAT) (2020). In Ibiza and Formentera, the impacts that have occurred are due to the rapid increase in residents, tourists, and seasonal workers, which, together with other elements (changes in the long-term rental market, restrictions on the increase of tourist offerings, etc.), have caused multiple inconveniences in terms of housing, transportation, natural areas, and prices. One of the elements affected by P2P hosting platforms is the long-term rental market (Horn & Merante, 2017; Smith et al., 2018); however, this type of tourist rental is only one of several aggravating factors that also include the rental of habitual residences, the rental of housing for seasonal workers, the demise of the construction sector, and owners’ distrust in the current regulations, amongst others.

This paper is divided into seven sections that follow the order in which the research questions and the consequent analysis were raised. The next section puts into context the controversy that has arisen in recent years in relation to tourist-use housing. This is followed by a methodology section in which the secondary data sources and types of analysis performed on these data are indicated. Subsequently, the data analysis is presented: first, the data for the whole of Spain are analysed, resulting in several potential conclusions; thereafter, the data for the specific case of Ibiza and Formentera are examined, allowing the ratification and deepening of the ideas and conclusions previously reached. In the sixth section, the specific situation of Ibiza and Formentera is discussed in greater detail. The last section presents the final conclusions, implications, future lines of research, and limitations of the research.

2Background and contextThe tourist product has two basic components: transportation and accommodation. In Spain, the main form of accommodation for foreign tourists is hotels, which is the option chosen in more than 60% of cases (INE, 2020d). However, other forms of accommodation should not be ignored, for example, staying with family and friends, rental homes, and holiday homes, amongst others. Staying in the homes of family or friends is the most popular option for domestic tourists (INE, 2020c). Rental accommodation includes both tourist apartment blocks and tourist-use dwellings, whether or not they are single-family houses. Holiday homes, meanwhile, have given rise to residential tourism in the form of summer vacations in second homes, which have been analysed from the social science perspective (e.g. Jurado, 1978; Miralles, 2004; Moreno, 2001). Other accommodation options (e.g. camping, timeshares, rural tourism, etc.) are much less popular.

In the last five years, there has been media controversy (Guizi et al., 2020) regarding P2P rentals that are offered to tourists for short periods (days or weeks) and managed through online platforms (Dolnicar, 2019) that put the parties in contact and guarantee a context of mutual trust (Weber, 2014). The two most important platforms are Vrbo (formerly HomeAway) and Airbnb, which account for 99% of the online accommodation offerings in tourist destinations such as the Balearic Islands (Falcón & Palma, 2018). This media controversy has generated discussion and confrontations between supporters and detractors of these tourist offerings, although relevant academic research is still in its infancy (Tussyadiah & Pesonen, 2018). To analyse the tourism sector, rental market, and tourist rentals in Spain, it is important to consider the various elements that may affect these areas (Ramón, 2018):

- •

Security, political and social stability, and a hospitable attitude towards tourists are basic needs for tourist destinations since the vast majority of people want to avoid risks when planning their vacations. However, in recent years, various events have caused serious problems in important tourist destinations in Europe and the Mediterranean, including the 2011 Arab Spring in North Africa and the Middle East; the 2015 terrorist attacks in Tunisia; the victory of the Radical Left Coalition (Sýriza) in the 2015 Greek elections; the 2015 Islamist attacks in Belgium, the United Kingdom, Germany, and France; terrorist attacks and an attempted coup in Turkey in 2016; and the massive waves of migrants fleeing the Syrian war to Greece in late 2015, amongst others. These destinations, all competitors of Spain, experienced reduced tourist arrivals for months or years (Groizard, Ismael, & Santana, 2017). In contrast, the number of international tourists visiting Spain rose from 64.9 million in 2014 to 81.8 million in 2017 (INE, 2020d). From 2018, this growth in international tourist arrivals was moderated, and the COVID-19 pandemic may completely eliminate the effect of the events of 2015 and 2016.

- •

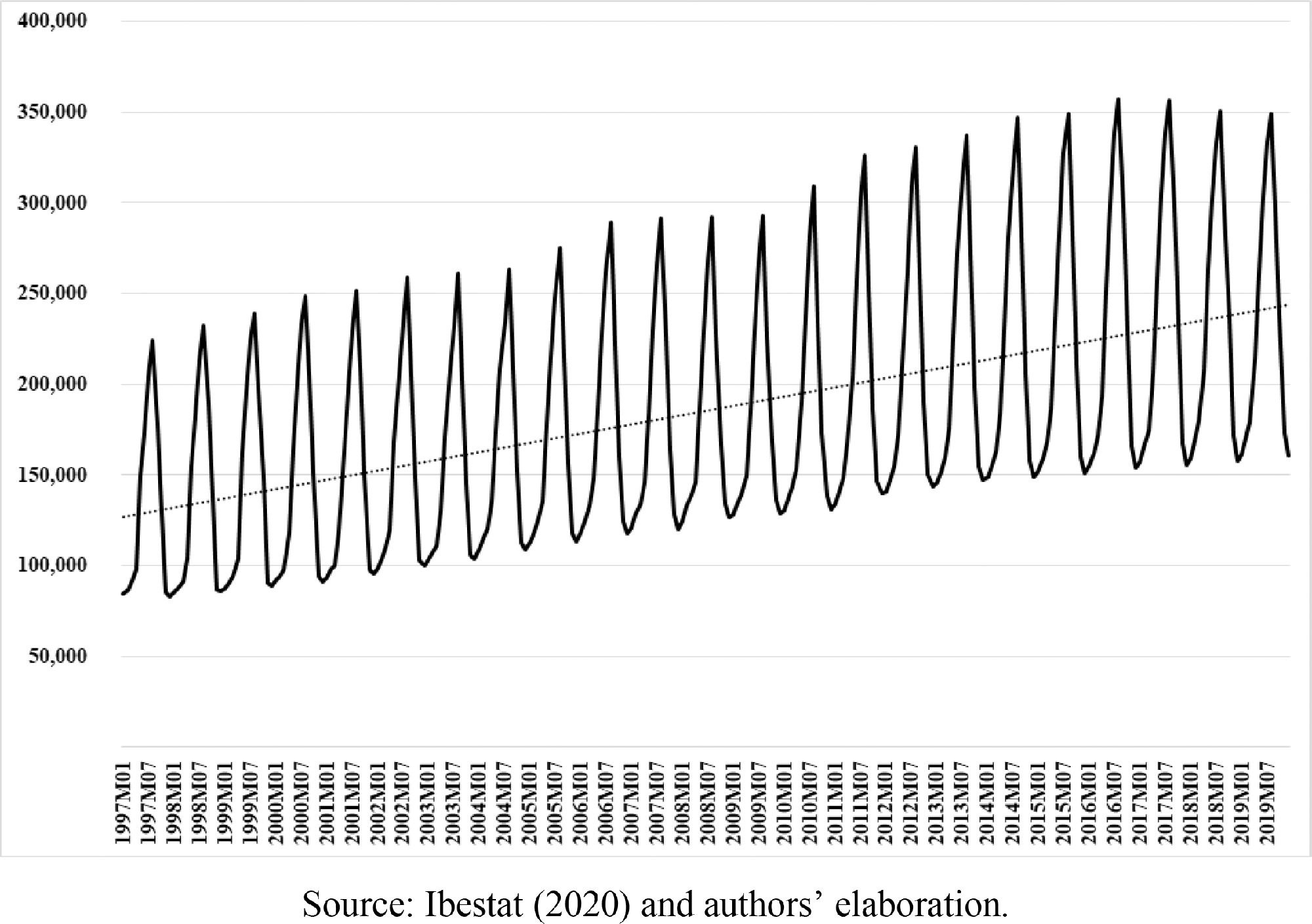

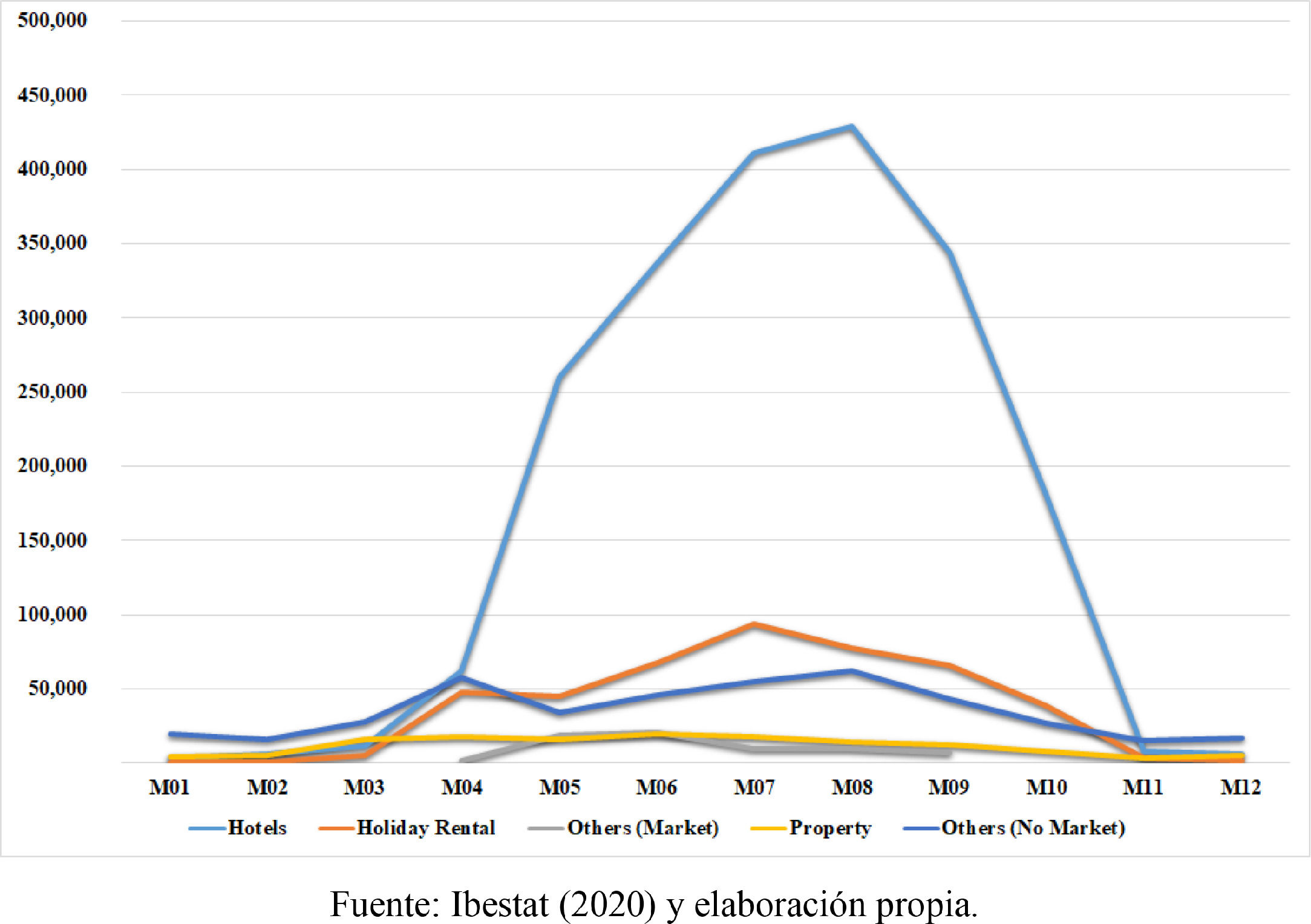

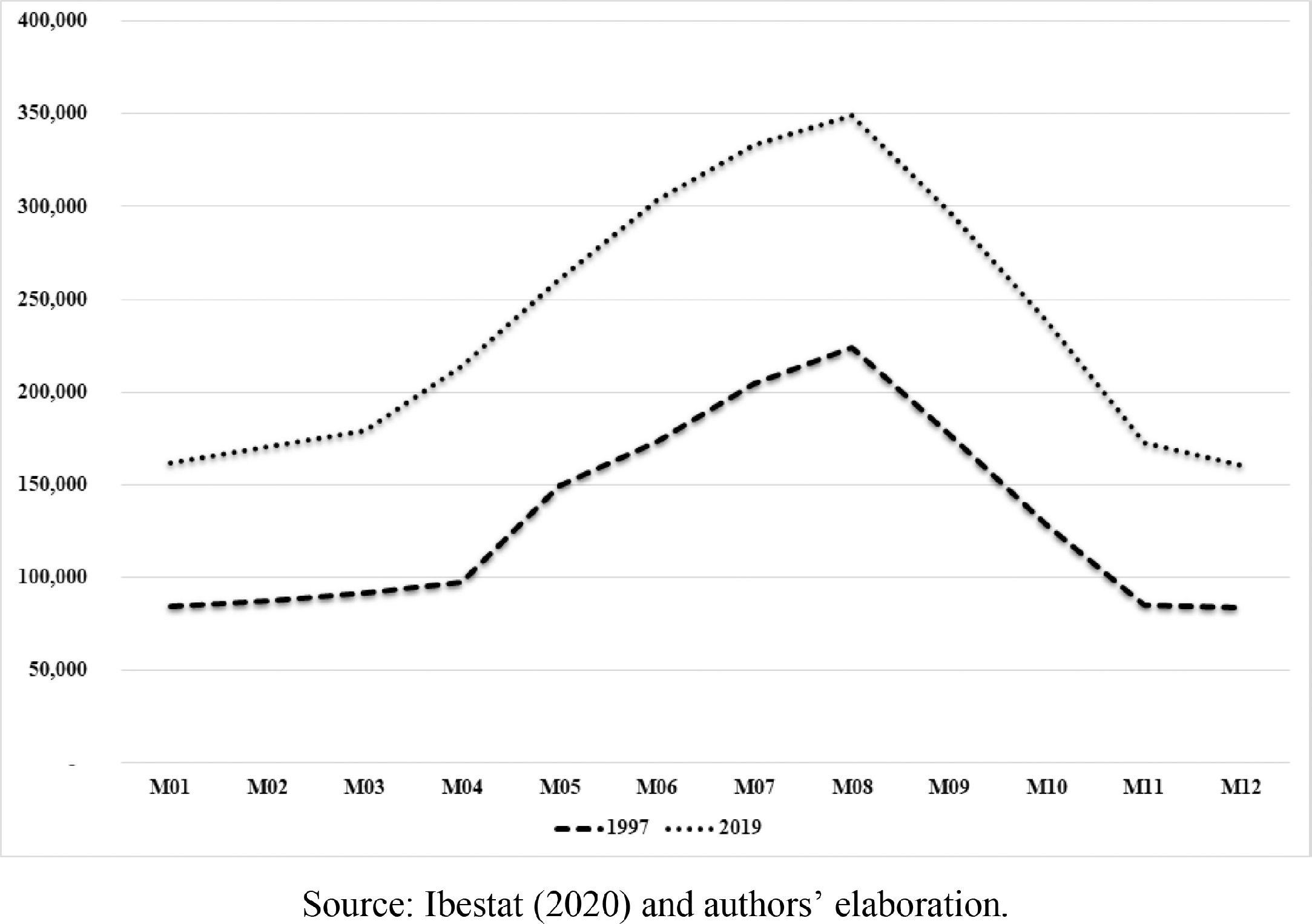

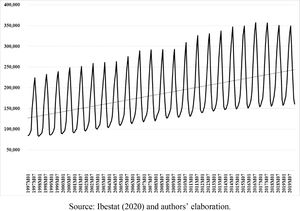

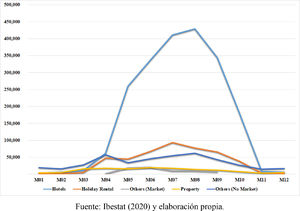

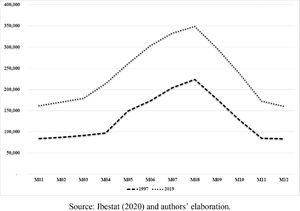

Seasonality has long been a problem for the tourism sector. This seasonality may be due to specific events (e.g. Easter) or weather characteristics (e.g. ski resorts). Sun and beach tourism is highly seasonal and significantly affects the entire Spanish coast, with the exception of the Canary Islands. This seasonality translates into a concentration of human pressure in the summer months (see Fig. 1) and generates various, mostly negative, effects (Ramón, 2014). Due to the seasonality of arrivals, hotel offerings in sun and beach destinations face very low levels of activity in winter and large volumes of tourists in summer, straining their capacity for a few months of the year (mainly July and August). In these central months of the season, hotels’ inability to meet demand generates an increase in tourists staying in other types of accommodation, including rental housing (Martín et al., Martín, Rodríguez, Zermeño, & Salinas, 2018.

Fig. 1.Monthly human pressure index in Ibiza and Formentera (1997 to 2019).

(0.22MB).Source: Ibestat (2020) and authors’ elaboration. - •

In the first decade of the 21st century, the behaviour of many tourists changed, particularly in Europe. Throughout the second half of the 20th century, 8-day or 15-day tour packages predominated (Ramón, 2001). The Internet emerged as a source of information in the late 1990s; however, almost a decade passed before a significant volume of tourists relied on the Internet to search, book, and buy flights, accommodation, and other tourist services. This scenario produced a disintermediation in the tourism sector and a new travel philosophy. Today, there are more trips of shorter duration, meaning that destinations receive more tourists but that these tourists stay for less time.

- •

The 2007–2008 economic crisis caused changes in consumer behaviour, including an increase in P2P exchanges. These types of exchanges grew rapidly because they allowed families to increase their income or reduce costs (Gil, 2019). The collaborative economy was defined by Felson and Spaeth (1978) more than 40 years ago; however, it has developed rapidly due to online platforms that put bidders in contact with offerings (Tham, 2016). These platforms have grown significantly since 2014 in sectors such as transportation and accommodation (CNMC, 2016), enhancing trust between the parties (Weber, 2014). In the case of accommodation, these platforms were initially linked to home-sharing but have now evolved towards a wider variety of offerings.

Airbnb and Vrbo have centralised and made visible (Ramón, 2018) a P2P activity that has existed since the origins of tourism (Ramón, 2001) but was formerly conducted in a discreet and discretionary manner. In recent years, the summer collapse and difficulties in renting long-term homes (due to shortages and high prices) have generated controversy amongst the supporters (Groizard & Nilsson, 2017) and detractors (Terraferida, 2017) of this type of platform and activity. There are significant discrepancies between the data provided by both parties, which has lead to doubts about its reliability.

The initial importance of reports, papers, and press articles on P2P hosting (Dredge & Gyimóthy, 2015) has promoted significant academic interest (Pizam, 2014), generating an exponential increase in scientific articles (Dolnicar, 2019), especially since 2015 (Sainaghi, 2020). According to Sainaghi (2020), the eight main areas of research are P2P platforms, demand studies (behaviour, satisfaction, and segmentation), supply studies (yields, prices, location, and motivation), host–guest relationships, economic impacts, social impacts, P2P regulation, and the collaborative economy in general. Other aspects should be added to these areas, such as the analysis of residents’ attitudes in areas where the greatest development of P2P accommodation is found (e.g. Garau, Gutiérrez, & Díaz, 2019; Richards, Brown, & Dilettuso, 2019; Suess, Woosnam, & Erul, 2020).

The academic research has mostly been conducted by taking the Airbnb offerings in certain countries or regions as the focus of study (e.g., Baute, Gutiérrez, & Díaz, 2019; Caldicott, von der Heidt, Scherrer, Muschter, & Canosa, 2020; Cheng & Foley, 2019; Dogru, Mody, et al., 2020; Farmaki & Kaniadakis, 2020; Gunter, Önder, & Zekan, 2020; Leoni, 2020). There are also literature reviews that have focused on Airbnb (e.g. Andreu, Bigne, Amaro, & Palomo, 2020; Dann, Teubner, & Weinhardt, 2019; Medina, Marine, & Ferrer, 2020). Some of the results of this research have indicated that the increase of P2P rentals relates to the improvement of macroeconomic variables (for example, levels of employment, unemployment, or GDP), which are a clear indication of economic growth (Dogru et al., 2020c; Falcón & Palma, 2018). At the microeconomic level, the geographical location of tourist housing is essential for its economic success (Chica, González, & Zafra, 2020; Leoni, Figini, & Nilsson, 2020; Önder, Weismayer, & Gunter, 2019; Xu, Hu, La, Wang, & Huang, 2020; Yang & Mao, 2020), with offerings that are located in important tourist areas or close to prominent tourist attractions experiencing the best results.

The effect of P2P accommodation platforms on the hotel sector is another topic featured in the growing literature; however, the investigations (e.g., Dogru et al., 2020a, 2020b; Dogru, Hanks, Mody, Suess, & Sirakaya-Turk, 2020; Dogru, Mody, et al., 2020) have not yet allowed for clear conclusions (Dogru et al., 2020a; Sainaghi, 2020; Sainaghi & Baggio, 2020). Nevertheless, most studies have considered P2P accommodation to have had a small impact (Bashir & Verma, 2016; Guttentag, 2015; Kannisto, 2017; Sainaghi, 2020). A possible proposed explanation for the results is that rental homes serve different market niches than hotels (Sainaghi, 2020), although there could be other, complementary explanations. The impact of these offerings on the rental market has been much less well analysed (Sainaghi, 2020); however, it is believed to generate pressure on the rental of long-term housing (Horn & Merante, 2017; Smith et al., 2018).

The disparity of data between detractors and supporters of this activity, together with the provisional nature of the conclusions reached, emphasise the need for multiple analyses, beginning with an overview of what is truly happening in the rental of tourist-use housing in Spain. This article, thus, aims to determine if there is a ‘problem’ with tourist rentals and, if so, what it consists of and what its importance is.

3MethodsThis descriptive research used data from Spain's main national and regional databases regarding the type of accommodation used by both domestic and international tourists. In the first phase of analysis, data from the whole of Spain were reviewed to obtain a national overview. The main sources were as follows.

- •

The Survey of Tourist Movements on Borders (Frontur) includes data on the behaviour of foreign tourists arriving in Spain (INE, 2020d). Frontur asks foreigners, upon entering Spain, about various aspects of their stay in the country and is the main source of international tourism data in Spain.

- •

The Survey of Spanish Tourist Movements (Familitur), which is currently known as the Tourism Survey of Residents, gathers data on the behaviour of Spanish tourists travelling within Spain (INE, 2020c). Familitur is a survey of Spanish households on their travels in and out of the country. It is less well known than Frontur but provides information on domestic tourism (analysed in the present study) and international tourism carried out by Spaniards.

- •

The Hotel Occupancy Survey (HOS) was used to determine the evolution of clients and overnight stays in hotels in Spain (INE, 2020a). The HOS surveys hotels in the country about their activity levels (guests, overnight stays, occupancy, etc.) and is the main reference tool employed to assess the economic health of these establishments. The HOS does not differentiate between domestic and international guests.

- •

The Tourist Apartments Occupancy Survey (TAOS) gathers data on tourist apartments in Spain (INE, 2020b). The TAOS is similar to the HOS but is applied to tourist apartments. This database does not include data on the tourist'use housing that is the object of the present study but contributed to the analysis by comparison with airport arrivals figures.

Using these four surveys, an annual data series for a period of 15 years (2005 to 2019) was created to examine the housing situation from the perspectives of demand (Frontur and Familitur) and the main accommodation offerings (HOS and TAOS). To analyse these data, percentages, ratios, and trend lines were used. Trend lines are linear regressions that consider all the data of a time series, rather than just two points as occurs with ratios and percentages. A t-test was used to determine the level of significance of the β coefficients of the trend lines.

In view of the data obtained from the whole of Spain, a further, second-phase analysis was undertaken using the islands of Ibiza and Formentera as a case study, which represent a region that receives extensive media attention due to its problems with housing. For this analysis, the IBESTAT statistics (2020), which provide more disaggregated data than Frontur, Familitur, the HOS, and the TAOS, were consulted. Other data were also included, such as figures from the official regional register of tourist establishments and the daily demographic load statistics. The Human Pressure Index (HPI) is an estimate of the number of people on the islands on a specific day and is calculated by IBESTAT based on the entries and exits of people registered at ports and airports. Finally, information from AirDNA (2020) was used to estimate the volume of housing available for tourist use in Ibiza and Formentera to supplement the data on tourist accommodation published by IBESTAT (2020). AirDNA collects information from Airbnb and has been used in previous studies (e.g., Gunter et al., 2020; Ioannides, Röslmaier, & van der Zee, 2019), although this data should be used with caution (Agarwal, Koch, & McNab, 2019).

Analyses similar to those performed for the whole of Spain were conducted on the data from Ibiza and Formentera, which were later supplemented with other data and graphic representations that aimed to determine the situation on these two islands in recent years.

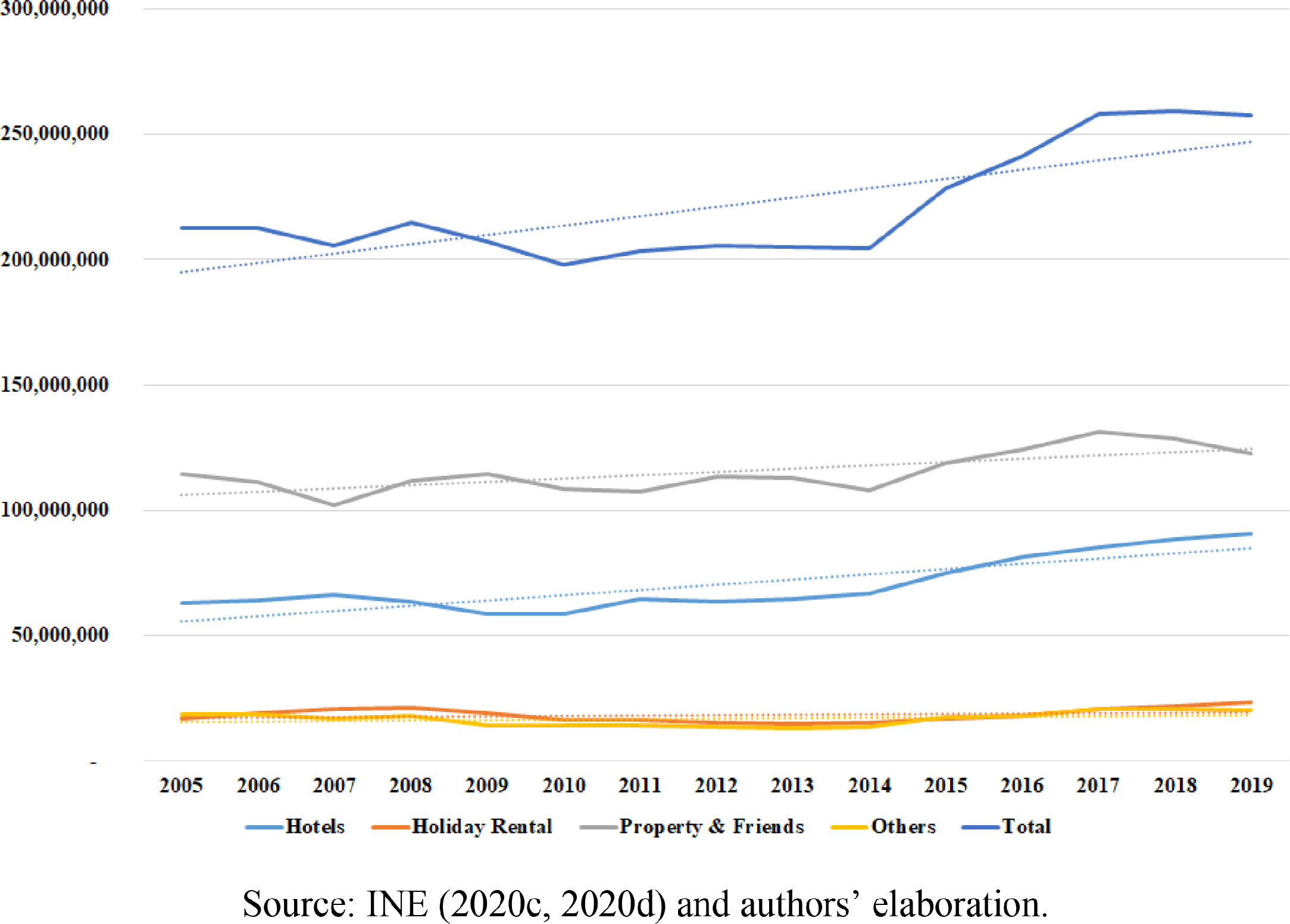

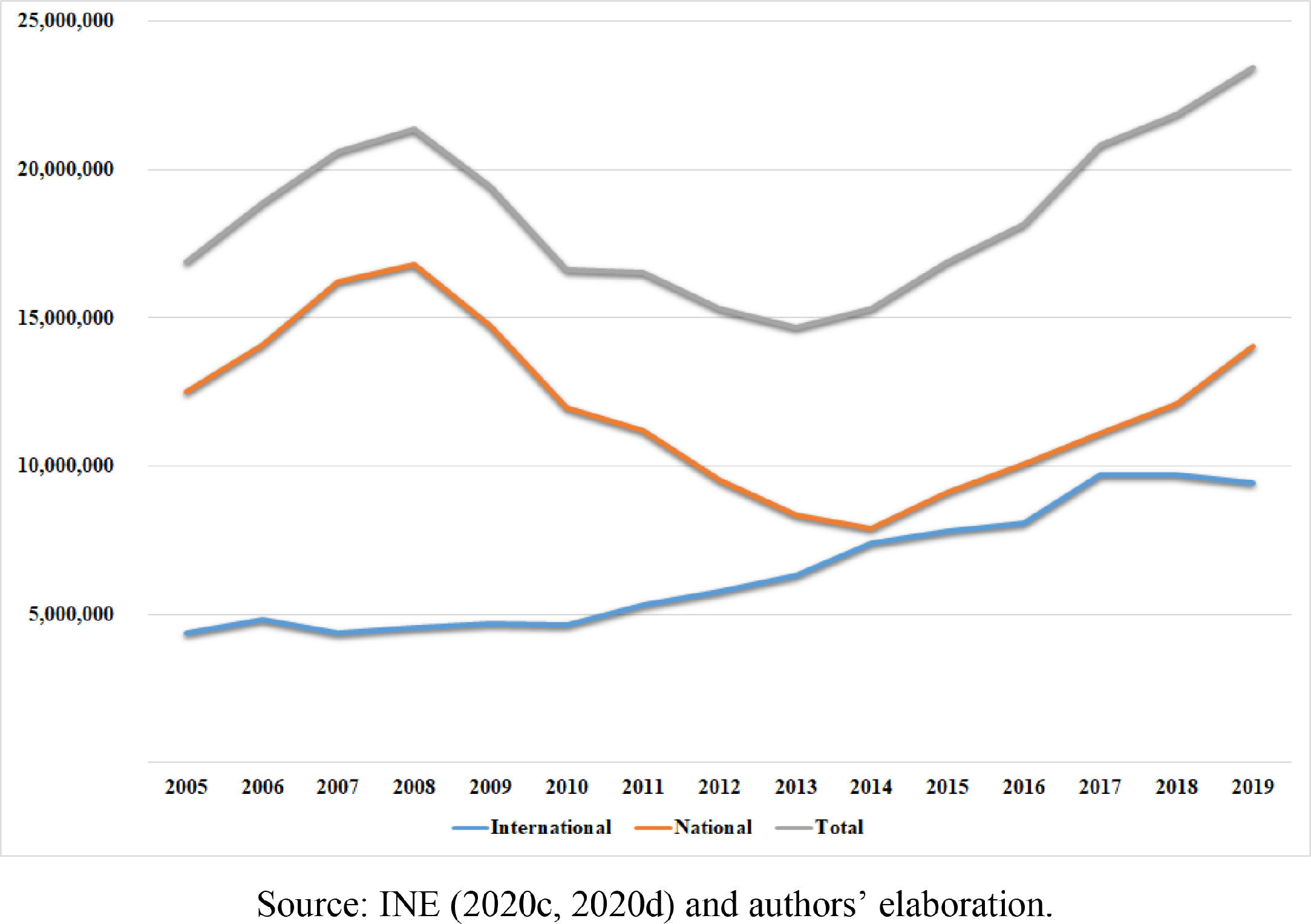

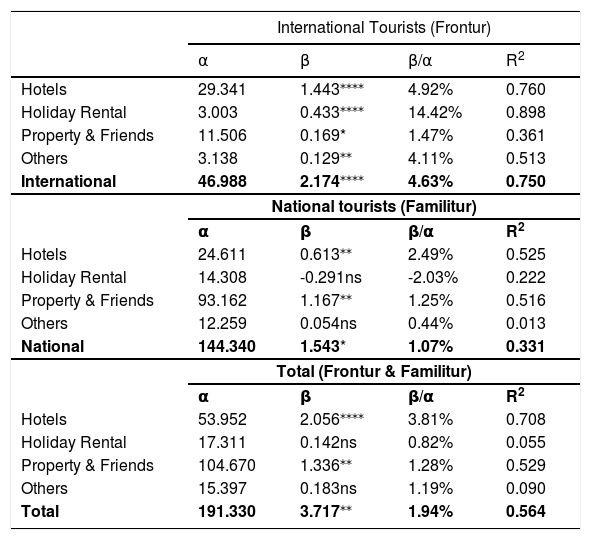

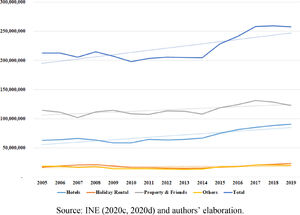

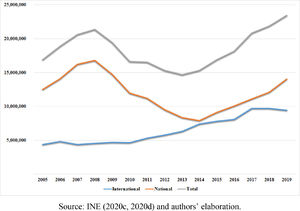

4Trends in tourist accommodation in SpainIn the first phase of the analysis, the existing databases for the whole of Spain, which mainly include supply and demand surveys, were reviewed. First, the data from the surveys applied to international (INE, 2020d) and domestic (INE, 2020c) tourists were analysed. From the Frontur and Familitur data, it was possible to prepare a time series with annual data for the period from 2005 to 2019. During this period, more than two hundred million international and domestic tourists travelled through the national territory each year, totalling 3.315 billion tourists over 15 years (Fig. 2).

Total tourists and trend lines (2005–2019).

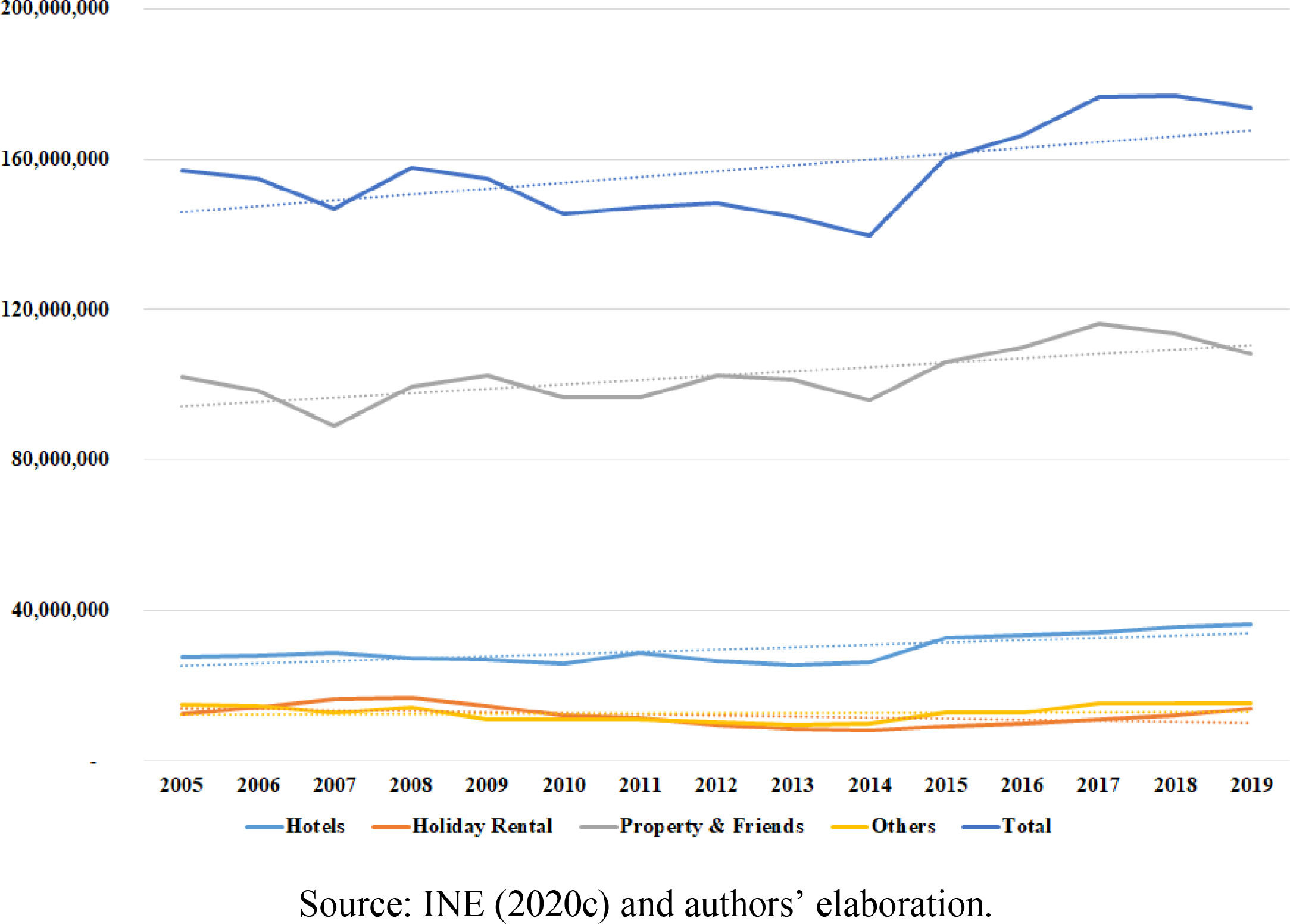

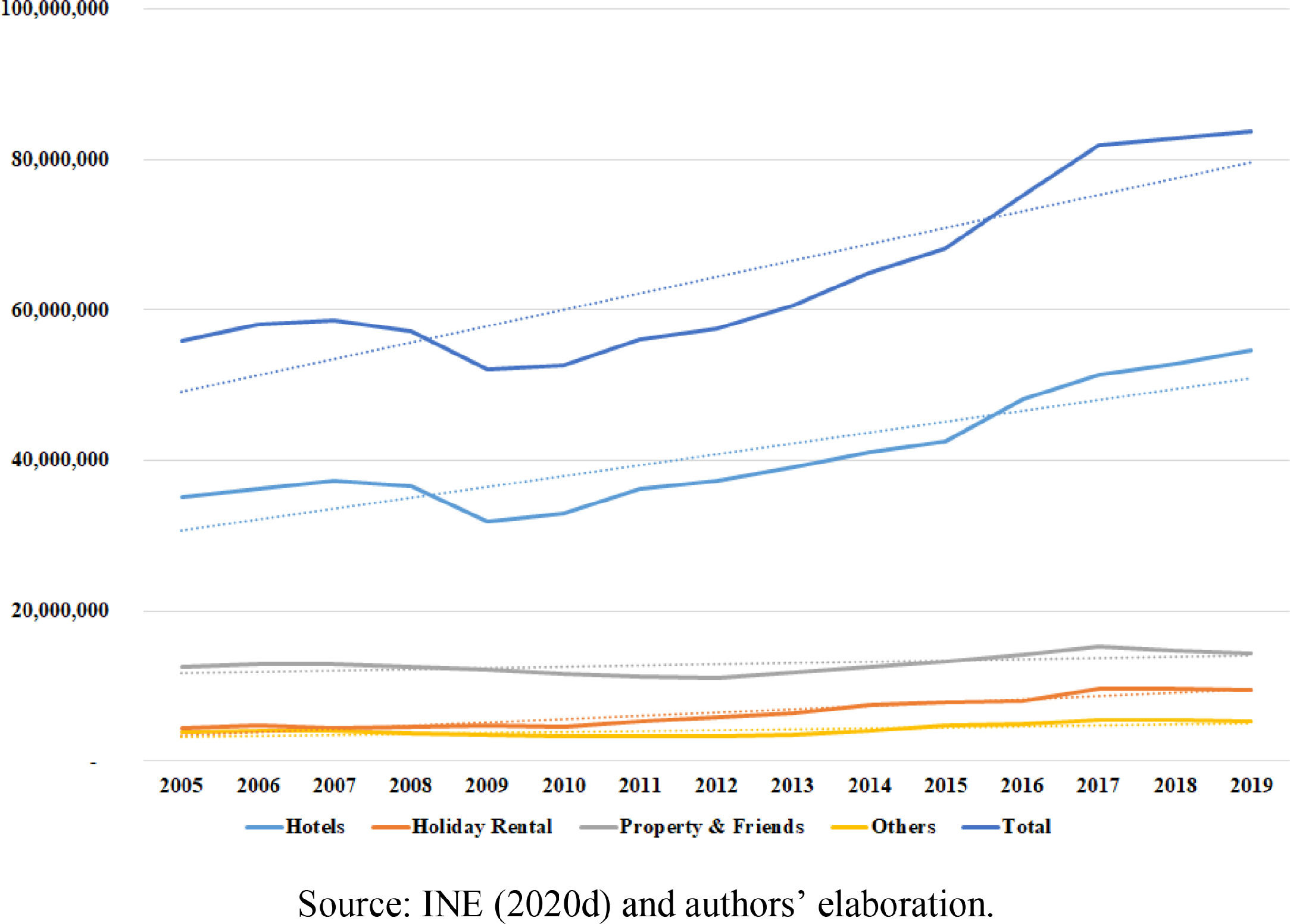

Tourists were categorised according to the accommodation used: hotel (hotels and similar), rental (tourist apartments and dwellings for tourist uses), property and friends (second residences or houses of family and friends), or other (camping, rural tourism, timeshares, etc.). The data series of total tourists showed a positive evolution until 2007 and 2008 and a collapse in 2009 and 2010 due to the economic crisis, followed by rapid growth until 2017 and 2018 (Fig. 2). However, each type of accommodation evolved differently. While the total number of tourists grew by 21% over 15 years, the number staying in hotels grew by 45%, in rentals grew by 39%, in second homes or with family and friends grew by 7%, and in other forms of accommodation grew by 10%. As a result of these differences, the relative weight of the different types of accommodation varied slightly, and hotels’ share has rose from 30% to 35%, with the rest of the accommodation types decreasing in popularity. In 2019, rentals were used by 9.1% of the total number of tourists but still did not have the share they experienced in 2007 and 2008 (10%). Trend lines were used to determine the exact trends (Table 1 and Figs. 2-4):

α indicates the starting point of the series in millions of tourists;

β indicates the slope of the line or the average annual increase in millions of tourists;

β/α relativises the growth of the series;

R2 indicates the degree of the fit of the line to the actual data.

Demand trend (years 2005–2019).

| International Tourists (Frontur) | ||||

|---|---|---|---|---|

| α | β | β/α | R2 | |

| Hotels | 29.341 | 1.443⁎⁎⁎⁎ | 4.92% | 0.760 |

| Holiday Rental | 3.003 | 0.433⁎⁎⁎⁎ | 14.42% | 0.898 |

| Property & Friends | 11.506 | 0.169* | 1.47% | 0.361 |

| Others | 3.138 | 0.129⁎⁎ | 4.11% | 0.513 |

| International | 46.988 | 2.174⁎⁎⁎⁎ | 4.63% | 0.750 |

| National tourists (Familitur) | ||||

| α | β | β/α | R2 | |

| Hotels | 24.611 | 0.613⁎⁎ | 2.49% | 0.525 |

| Holiday Rental | 14.308 | -0.291ns | -2.03% | 0.222 |

| Property & Friends | 93.162 | 1.167⁎⁎ | 1.25% | 0.516 |

| Others | 12.259 | 0.054ns | 0.44% | 0.013 |

| National | 144.340 | 1.543* | 1.07% | 0.331 |

| Total (Frontur & Familitur) | ||||

| α | β | β/α | R2 | |

| Hotels | 53.952 | 2.056⁎⁎⁎⁎ | 3.81% | 0.708 |

| Holiday Rental | 17.311 | 0.142ns | 0.82% | 0.055 |

| Property & Friends | 104.670 | 1.336⁎⁎ | 1.28% | 0.529 |

| Others | 15.397 | 0.183ns | 1.19% | 0.090 |

| Total | 191.330 | 3.717⁎⁎ | 1.94% | 0.564 |

Note:

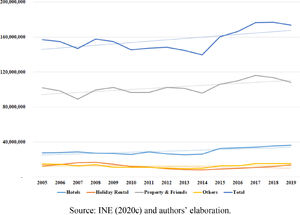

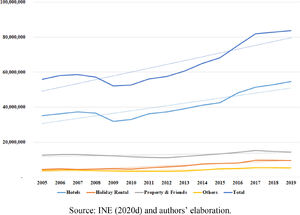

Hotels were the leading type of accommodation in terms of absolute and relative growth (Table 1). They also demonstrated the highest R2, indicating that their growth was the result of constant and regular evolution. The next highest option in terms of absolute and relative growth was holiday homes or staying in those owned by friends, which was the option used by the majority of domestic tourists (Fig. 3). Rental homes had the lowest values of the four types and only showed a clear and outstanding evolution in the case of international tourism (Table 1). In general, hotels largely absorbed the increase in tourists.

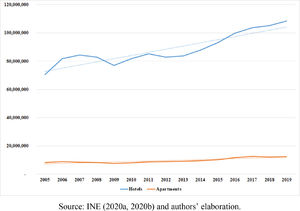

National tourists and trend lines (2005–2019).

International tourists and trend lines (2005–2019).

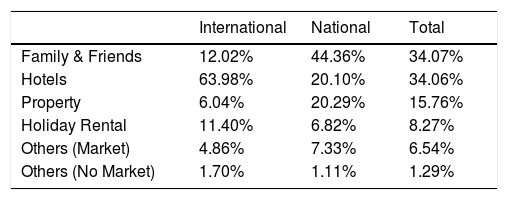

From 2017, the data for the series varied little, and the average of the last four years gave an overview of the current relative weights of each type of offering (Table 2). Hotels currently house just over a third of tourists, who are mostly foreigners, while the homes of friends and family provide accommodation for another third of tourists.

Demand distribution (years 2016–2019).

| International | National | Total | |

|---|---|---|---|

| Family & Friends | 12.02% | 44.36% | 34.07% |

| Hotels | 63.98% | 20.10% | 34.06% |

| Property | 6.04% | 20.29% | 15.76% |

| Holiday Rental | 11.40% | 6.82% | 8.27% |

| Others (Market) | 4.86% | 7.33% | 6.54% |

| Others (No Market) | 1.70% | 1.11% | 1.29% |

The use of rentals as a form of tourist accommodation (including tourist apartments and tourist-use homes) grew only 10% from the pre-crisis levels and decreased in terms of relative percentage (from 10% to 9%). These data do not match the media perception, possibly because after reaching a minimum in 2013, this use has grown 60% in six years (Fig. 5). However, it must be noted that the 2013 minimum was the result of a 31% drop caused by the crisis that began in 2008. Therefore, social concern regarding tourist rentals would be reasonable if it only considered data from recent years; data prior to the crisis show there has simply been a recovery in the sector.

Evolution of tourists (by origin) who chose to rent.

Trends in tourist rentals differed depending on whether the tourists were foreign or domestic (Fig. 5). After a small decrease in 2007, there was a moderate but continuous increase in foreign tourists who opted for rentals, which reached a maximum in 2017. Between 2008 and 2014, there was a significant decrease in domestic tourists who opted for rentals; from 2014, the national figures started to rise, although the 2008 level has not yet been reached. In the total balance, the 2008 figures were not exceeded until a decade later.

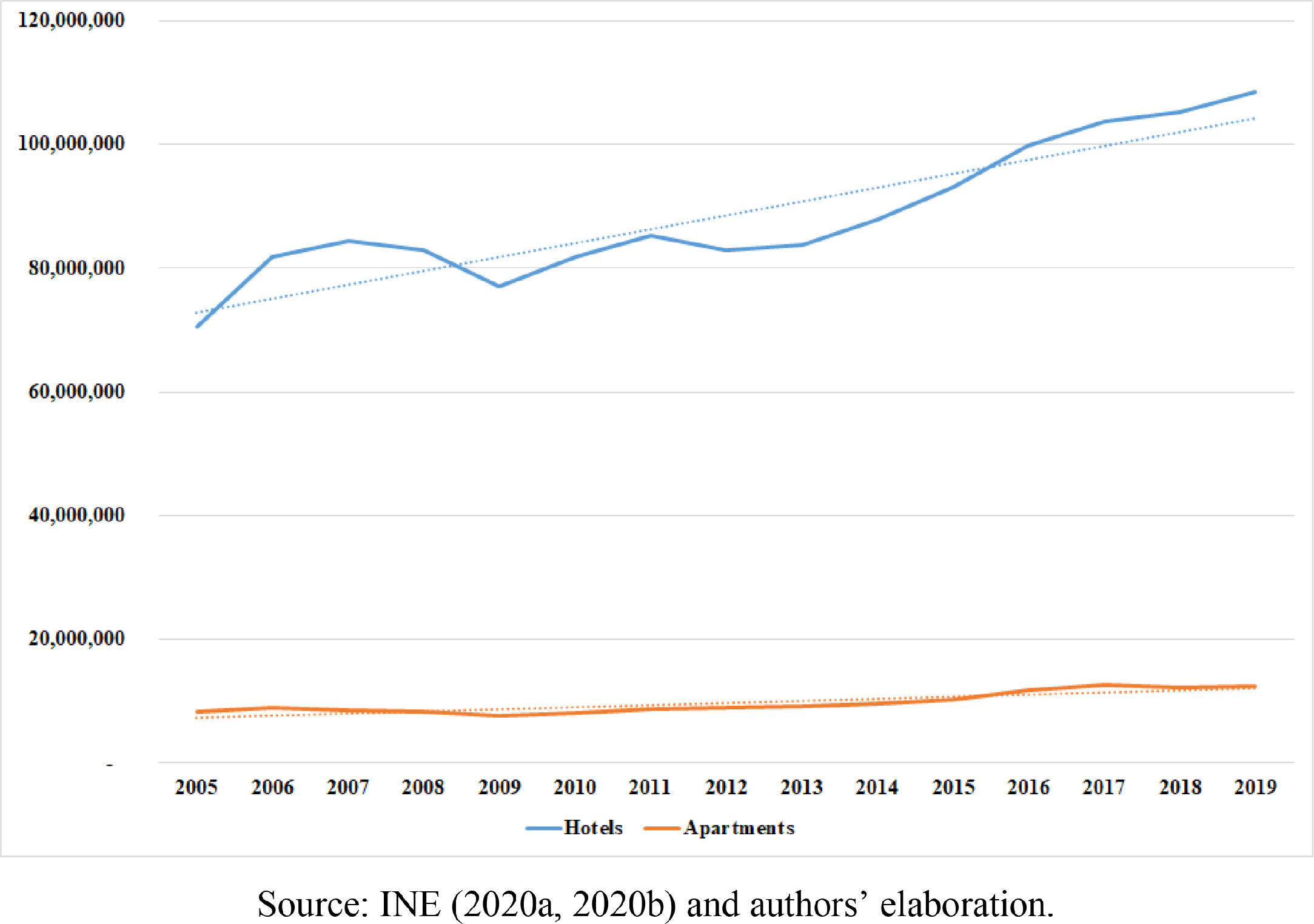

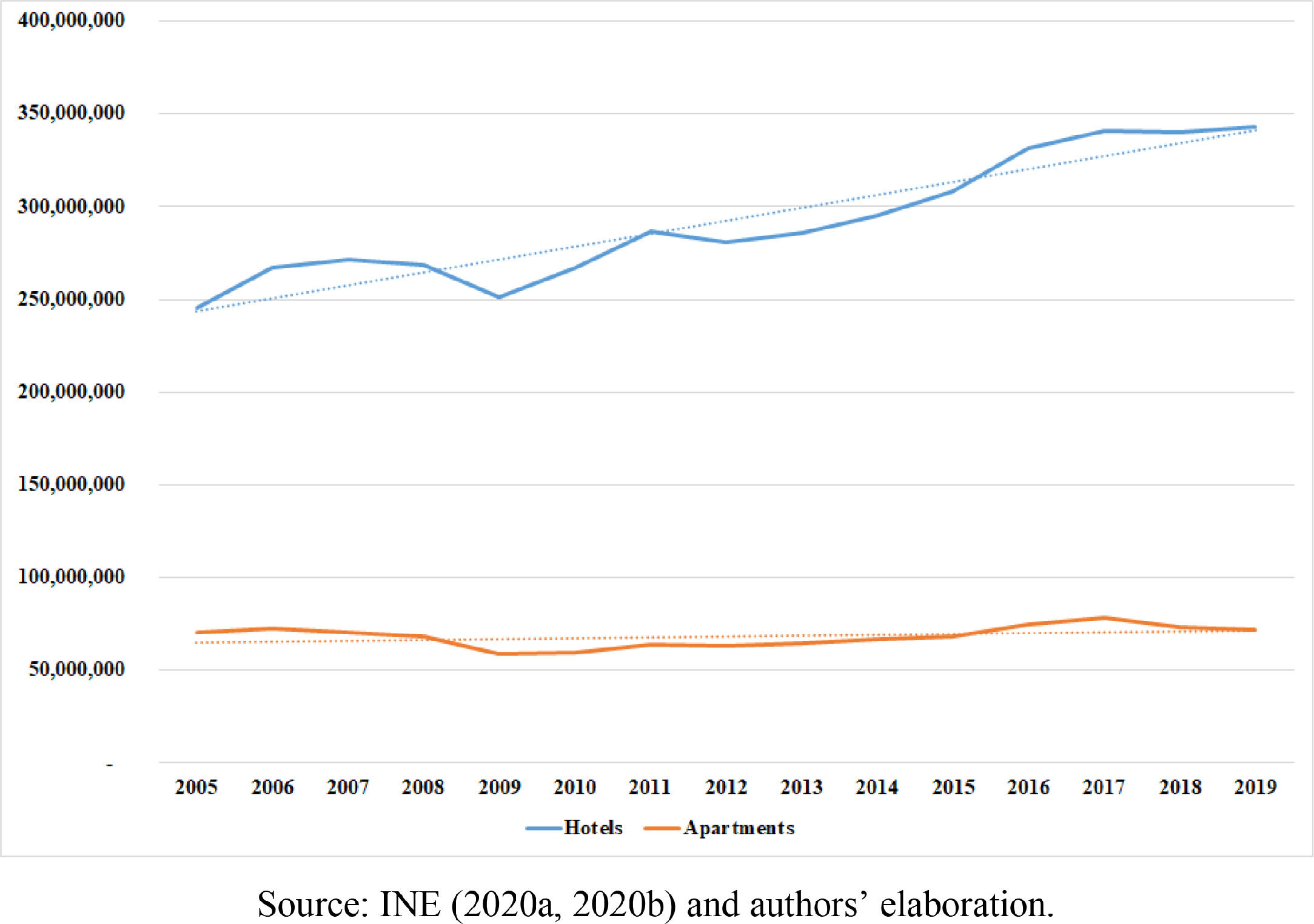

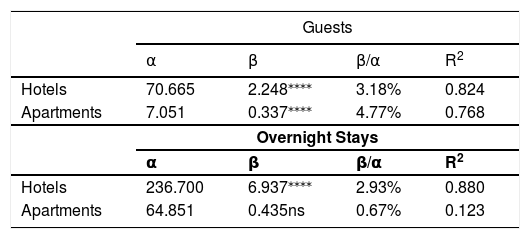

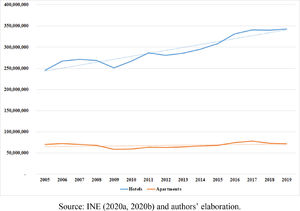

To complete the analysis, data from the Hotel Occupancy Survey (INE 2020a) and the Tourist Apartment Occupancy Survey (INE, 2020b) were reviewed. The maximum annual supply of hotels increased by 23% from 2005 to 2019. In the same period, travellers staying in hotels increased by 54%, and overnight stays increased by 40%. Meanwhile, the maximum annual supply of tourist apartments increased by 13% from 2005 to 2019. In the same period, the number of travellers staying in tourist apartments increased by 49%, and overnight stays increased by 2%. The trend lines for guests and overnight stays (Table 3) demonstrated that both formats experienced a fairly linear and positive trend in terms of guest numbers (Table 3 and Fig. 6); however, only hotels maintained this trend in overnight stays (Table 3 and Fig. 7).

Guests tendency according to the offering (2005–2019).

Overnight stays tendency according to the offering (2005–2019).

Based on the supply surveys, hotels showed a positive trend in guests, overnight stays, and average occupancy. Conversely, the growth in the number of guests in apartments did not translate into a clear increase in overnight stays due to a decrease in the average length of stay. The result is that hotels improved their occupancy levels, while tourist apartments saw a decrease in their occupancies. While tourist apartments met approximately half of the rental demand, the other half was met by tourist-use housing; however, it is not unreasonable to think that this housing may have been used similarly to tourist apartments.

Secondary data for both demand and supply did not show an explosion in tourist rentals; in fact, hotels were the type of accommodation that experienced the highest and most regular growth over the past 15 years. Other forms of accommodation, especially rentals, experienced more irregular trends because they act as an adjustment tool between hotel supply and demand; that is, when it is difficult to find a hotel room, some tourists choose to rent a tourist apartment or house instead.

It should also be borne in mind that the controversy over tourist rentals has focused only on some areas of Spain; for example, the central neighbourhoods of cities such as Barcelona (Benítez, 2019; Sales, 2019) and very popular tourist areas, such as Ibiza and Formentera. To identify the trends in such areas, the specific case of Ibiza and Formentera is analysed in the following section.

5Trends in tourist accommodation in Ibiza and FormenteraIbiza and Formentera were selected as a specific case study due to the ease of obtaining disaggregated information on the area, specifically from IBESTAT (2020), and because there is a clear social concern about the tourist industry and the rental of housing for tourist use there (Garau, 2016). This social concern is supported by the Airbnb data for the Balearic Islands, which show that Ibiza and Formentera are the islands with the highest supply and demand (Groizard & Nilsson, 2017; Nilsson, Leoni, & Figini, 2016).

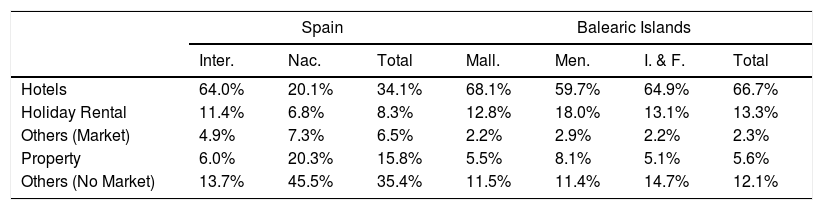

Data from the same surveys consulted for Spain were reviewed and supplemented with other data for the Ibiza and Formentera region. The distribution of tourists by type of accommodation, based on demand surveys, was similar to that of the Balearic Islands and of foreign tourists arriving in Spain (Table 4). This can be explained by the nationalities of tourists, with foreign tourism representing 33% of national tourism but 79% in Ibiza and Formentera. Tourist rentals were more frequent in Ibiza and Formentera than in the rest of Spain but did not differ from the Balearic average: rentals were chosen by 13% of tourists in Ibiza and Formentera, which is lower than the 18% rate in Menorca. Therefore, the distribution of tourists did not explain the differences between Ibiza and Formentera and the rest of the archipelago or the country.

Distribution of demand (years 2016–2019).

| Spain | Balearic Islands | ||||||

|---|---|---|---|---|---|---|---|

| Inter. | Nac. | Total | Mall. | Men. | I. & F. | Total | |

| Hotels | 64.0% | 20.1% | 34.1% | 68.1% | 59.7% | 64.9% | 66.7% |

| Holiday Rental | 11.4% | 6.8% | 8.3% | 12.8% | 18.0% | 13.1% | 13.3% |

| Others (Market) | 4.9% | 7.3% | 6.5% | 2.2% | 2.9% | 2.2% | 2.3% |

| Property | 6.0% | 20.3% | 15.8% | 5.5% | 8.1% | 5.1% | 5.6% |

| Others (No Market) | 13.7% | 45.5% | 35.4% | 11.5% | 11.4% | 14.7% | 12.1% |

In terms of the monthly distribution of tourist arrivals (Fig. 8), tourists mostly chose hotels, while tourist rentals and staying in the houses of friends and family were complementary options. Therefore, analysing the evolution of hotel offerings may provide important indications of the supply and demand in Ibiza and Formentera.

Distribution of tourist arrivals to Ibiza and Formentera (year 2019).

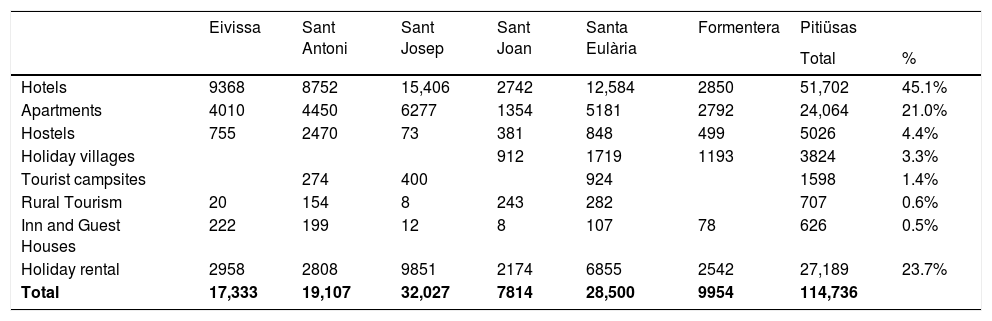

The Law 7/1988 of 1 June on the Transitional Measures for the Management of Hotel Establishments and Tourist Accommodations, which continued the policy set forth in two previous decrees (30/1984, 10 May and 103/1987, 22 October), limits the offering of tourist accommodation in the Balearic Islands. The regulation was designed to address an excess supply that did not disappear until the end of the 1990s. The result of this regulation is that the number of legal tourist accommodations on the islands has not changed significantly since the mid-1990s (IBESTAT, 2020) as there are few exceptions that allow such an increase. In Ibiza and Formentera, there are approximately 87,000 tourist accommodations (80,000 in Ibiza and 7000 in Formentera) (IBESTAT, 2020). Tourist-use homes should be added to this total, which, according to AirDNA (2020), represent slightly more than 27,000 spaces in Ibiza and Formentera (Table 5).

Tourist Offerings in Ibiza & Formentera (number of places).

| Eivissa | Sant Antoni | Sant Josep | Sant Joan | Santa Eulària | Formentera | Pitiüsas | ||

|---|---|---|---|---|---|---|---|---|

| Total | % | |||||||

| Hotels | 9368 | 8752 | 15,406 | 2742 | 12,584 | 2850 | 51,702 | 45.1% |

| Apartments | 4010 | 4450 | 6277 | 1354 | 5181 | 2792 | 24,064 | 21.0% |

| Hostels | 755 | 2470 | 73 | 381 | 848 | 499 | 5026 | 4.4% |

| Holiday villages | 912 | 1719 | 1193 | 3824 | 3.3% | |||

| Tourist campsites | 274 | 400 | 924 | 1598 | 1.4% | |||

| Rural Tourism | 20 | 154 | 8 | 243 | 282 | 707 | 0.6% | |

| Inn and Guest Houses | 222 | 199 | 12 | 8 | 107 | 78 | 626 | 0.5% |

| Holiday rental | 2958 | 2808 | 9851 | 2174 | 6855 | 2542 | 27,189 | 23.7% |

| Total | 17,333 | 19,107 | 32,027 | 7814 | 28,500 | 9954 | 114,736 | |

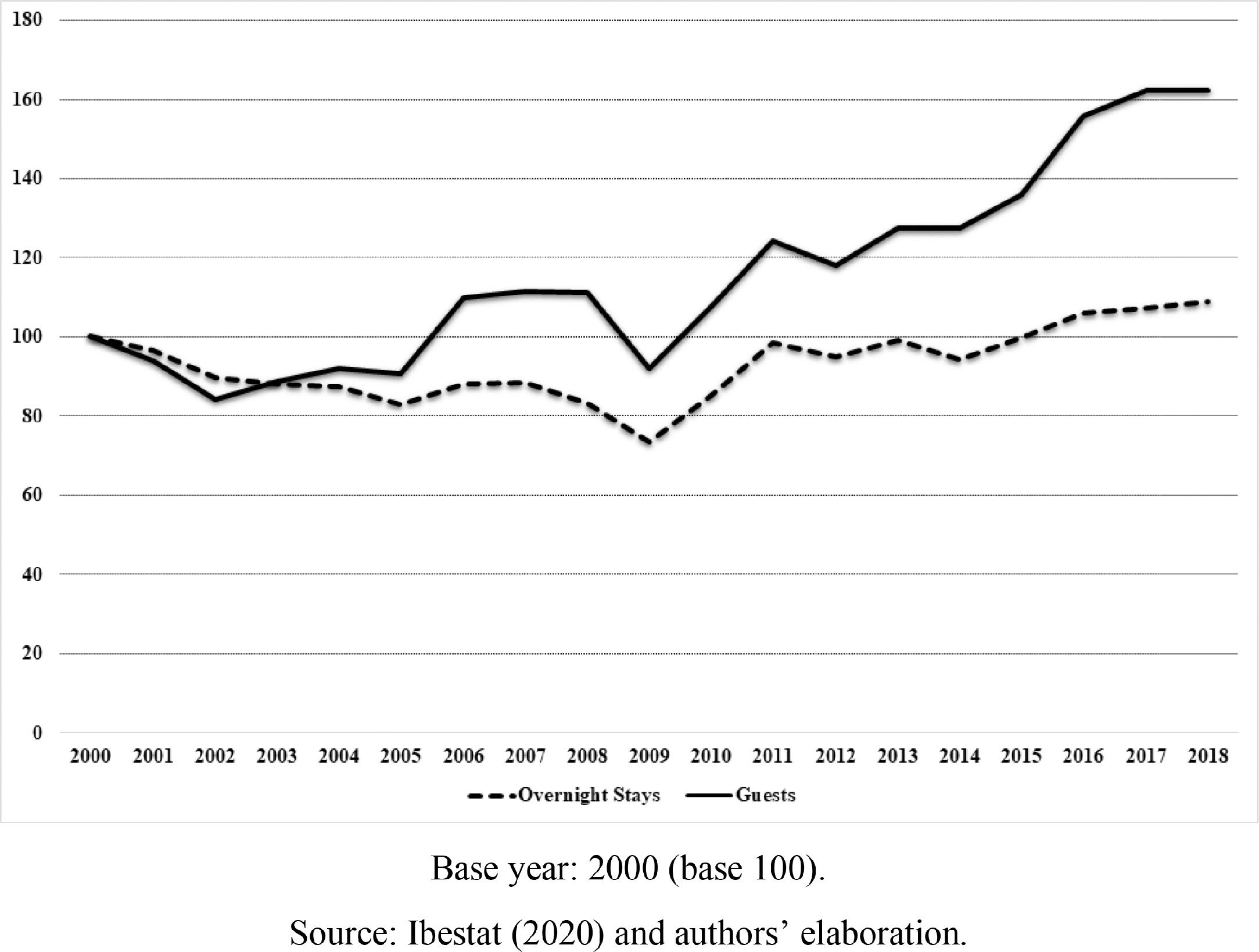

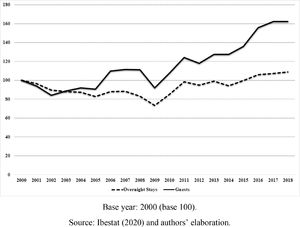

The Balearic Islands experienced maximum occupancy in 2000, which was considered historic by many professionals; however, the evolution of their hotel occupancy has been irregular since then. According to the Hotel Occupancy Survey (IBESTAT, 2020), between 2000 and 2018, hotel guests in Ibiza and Formentera increased by 62%, while overnight stays only increased by 9%. This was due to a 33% reduction in the average length of stay, unlike that observed in Spain as a whole, where the average stay remained very stable. However, the trend was not linear: between 2000 and 2009, the number of overnight stays decreased by 27%, while it increased by 49% between 2009 and 2018. Consequently, the number of overnight stays from 2000 to 2015 was unequal, and only in the period from 2016 to 2018 were there more overnight stays in hotels in Ibiza and Formentera than in 2000. These findings led to several preliminary conclusions.

- •

The data on tourist arrivals at the airport are no longer reliable for the analysis of the sector's evolution because the average stay has been greatly reduced in the last 20 years. As hotel guests grew, overnight stays stagnated or decreased (Fig. 9). Previously, these figures were reliable because the average length of stay remained very stable for more than 40 years. This change is due to a new way of travelling for many European tourists.

Fig. 9.Guests and overnight stays in hotels in Ibiza and Formentera. Base year: 2000 (base 100).

(0.17MB).Source: Ibestat (2020) and authors’ elaboration. - •

For a decade, hotels had a lower occupancy than in 2000, despite the increasing trend in tourist arrivals. Since 2015, occupancy has been equal to or greater than that of 2000. If we consider that hotel occupancy was close to its capacity limit in 2000, and that the number of tourist accommodations has not increased in this time, in recent years, the hotel's occupancy rates were close to capacity limits. For example, in August 2020, hotel occupations were greater than 90% (IBESTAT, 2020), which is technically full, while the start of the season has also been brought forward and the end of the season has been delayed. Other tourist offerings also had high levels of occupancy: tourist apartments were at over 70% occupancy in August 2020 (IBESTAT, 2020), and tourist houses had an 80% occupancy on some days in the same month (AirDNA, 2020).

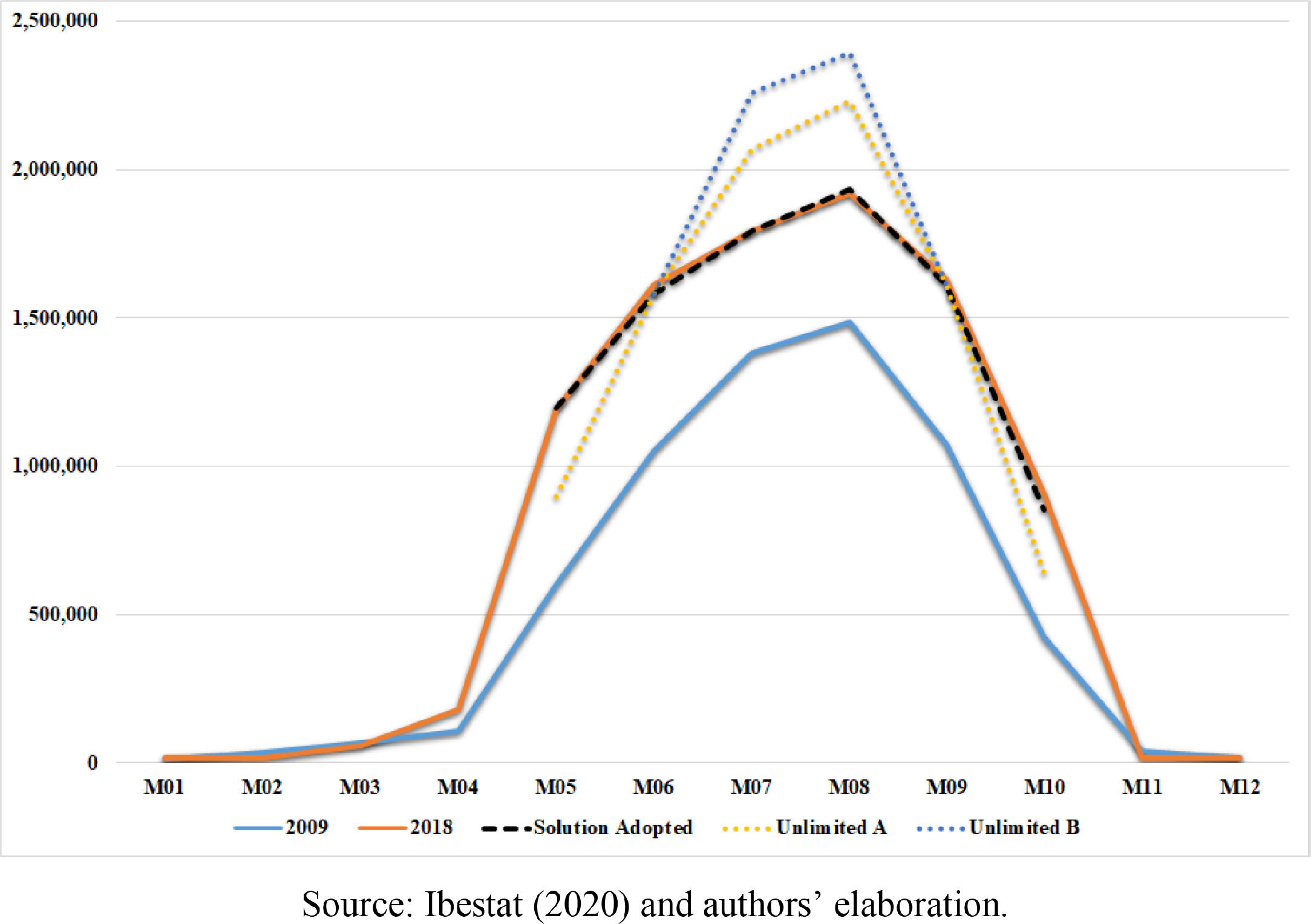

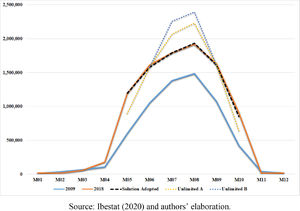

One important consideration is how to manage the recent volume of tourists; thus, the distribution of overnight hotel stays in the years with the lowest and highest figures in the statistical series were compared (Fig. 10). Given the limitation of hotel beds and the concentration of activity in the summer months, tourists have frequently been forced to choose between two options to stay on the islands:

- •

Choose another time to travel. Overnight stays in hotels increased by approximately 50% in 2018 compared to 2009 but only increased by 30% in July and August. If there was no limit on hotel beds, overnight stays would likely have followed the trend indicated by the ‘Unlimited A’ line (Fig. 10). However, since there was not as much growth capacity in July and August, tourists moved their visits to the beginning and end of the season. This is shown by the ‘Solution Adopted’ line (Fig. 10), which reveals a 30% increase in July and August; a 50% increase in June and September; and a 100% increase in May and October.

- •

Choose another type of accommodation. The percentage of tourists staying in hotels decreased slightly in July and August, slightly increasing the percentages staying in other accommodation formats (rental, holiday homes, and friends’ properties). Hotels hosted 71% of tourists in the high season, except in the two central months of July and August, when they hosted 68% (three points less). This indicated that there are people who travelled in July and August and would have stayed in hotels but chose another form of accommodation rather than change the date or destination of their trip. If there had been space for these tourists in hotels, overnight hotel stays would have appeared in the ‘Unlimited B’ line (Fig. 10). It is in these two months that tourist-use houses have their highest levels of occupancy (AirDNA, 2020).

Comparison and solution to the increase in overnight stays.

Hotels in Ibiza and Formentera hosted a very high percentage of tourists and attempted to absorb the increase in tourists in the best possible way. The other accommodation formats, mainly rentals (half tourist apartments and half tourist-use homes) and friends’ houses, served small market niches (Sainaghi, 2020) and tourists who had difficulty booking hotels. The number of tourists staying in friends’ houses was very similar to the number of tourists who rented and, considering that almost half of the rentals were tourist apartments, it is most likely that a house accommodating tourists is not truly a rented house, i.e. a paid holiday stay.

Based on various data from IBESTAT (2020), the HPI that Ibiza and Formentera endured in 2019 was distributed amongst residents (67.5%), seasonal workers (10.8%), and tourists (21.8%). To produce this estimate, the municipal register was used for residents, Frontur data was used for tourists, and the HPI for the total number of people and, by difference, seasonal workers. In the month with the most tourists and human pressure (August), tourists accounted for 27.8% of the HPI, and tourist homes accounted for 6.2% according to data collected by AirDNA. The secondary data available suggested that the housing problems experienced by these two islands cannot be solely attributed to a small percentage of people who frequent the island for two to three months of the year. The causes of these problems should be sought amongst multiple sources, not only the tourist rental segment.

6Discussion of the case of Ibiza and FormenteraIbiza and Formentera have undergone important changes in recent decades owing to internal and external influences. These elements form the basis of the local population's criticism and are directly or indirectly related to the issue of housing and, in particular, tourist rentals:

- •

Human pressure on both islands increased by 79% between 1997 and 2019 (Fig. 11), and the resident population increased by 84%. Furthermore, there is an important oscillation between the minimum in January and the maximum in August, which increases the real and perceived impact of human pressure. This 79% more people must be accommodated; however, the number of available tourist accommodations has not changed or has even suffered a small decrease. Therefore, almost all of the pressure has been transferred to the housing market.

Fig. 11.Monthly Human Pressure Index in 1997 and 2019.

(0.11MB).Source: Ibestat (2020) and authors’ elaboration. - •

From the 1990s until the outbreak of the 2008 crisis, there was a great deal of activity in the construction sector that was clearly visible in the urban areas of Ibiza, especially in the capital. However, in 2009, the construction sector collapsed and has still not recovered (Figure 12). The island's economy has been perceived as unstable since 2008, especially in terms of employment, with banks and buyers opting for risk reduction: banks have increased the requirements to obtain mortgage loans, investment in housing has been reduced (some of this housing was dedicated for rental), and people who would have bought a residence now choose to rent to adjust their housing spending to their personal income. This implies that the new housing market is virtually stagnant, and the overall demand is currently comprised of the existing previous demand for rentals and a large number of formerly potential homebuyers now seeking to rent instead.

- •

The supply of tourist accommodation has been capped since the 1990s. Only through tourist-use housing has it been possible to increase accommodation capacity when there have been higher than usual arrival figures. However, these homes only have remarkable activity during the summer; the rest of the year, their occupancy is insignificant. Furthermore, in the month of maximum activity, these homes only house 6.2% of the human pressure that Ibiza and Formentera bear.

- •

Furthermore, homeowners have a perception of legal insecurity, preferring holiday-seasonal to long-term rental and the higher prices paid by tourists. This means that rented houses are primarily dedicated to tourist rentals and secondarily to seasonal rentals, with long-term renting being the most affected.

From 2015 to 2019, there were record arrivals of foreign tourists in Ibiza and Formentera, as well as the Balearic Islands and Spain as a whole. This was due to the insecurity seen in many of Spain's competitors, which has been resolved over the years. In fact, in 2018 and 2019, slight drops in demand were already detected in the central months of the season, which were offset by price drops in the most expensive accommodation offerings, especially five-star hotels (IBESTAT, 2020). Since 2017, the figures for the Balaeric islands and Spain have shown a moderation in such increases. Forecasts for 2020 indicated that this trend would continue due to macroeconomic data that suggested the start of a new economic crisis; however, the health crisis caused by the COVID-19 pandemic has further lowered these forecasts and generated great uncertainty about the forthcoming years. It is expected that if there is a significant future reduction in tourist arrivals, tourist rentals will have a greater reduction in occupancy than hotels and tourist apartments. However, it is also possible that they will initially maintain their current figures because they allow social distancing more easily and comfortably.

P2P hosting platforms have given visibility to a previously invisible offer; if something is not seen, it can seem as if it does not exist. Until the expansion of these platforms, P2P tourist rentals were conducted via offline routes that had less visibility but have been operating since before hotels appeared. In the Ibiza and Formentera case, there is evidence that this offering existed before the first hotels opened on the islands, and it is estimated that 50% of tourists stayed in such accommodation in the 1950s (Ramón, 2001). Since these platforms developed at the same time as the growth in tourist arrivals, after the 2009 low, public opinion has tended to conflate both aspects and accuse these platforms of causing the negative effects brought about by the recovery of the sector and, in particular, the exceptionally high peak of recent years.

7ConclusionsIn the discussion of the problems related to tourist rentals, a specific element is usually blamed, whereas these problems are, in reality, caused by a perfect storm of factors (increased demand for and a stagnant supply of housing and tourist accommodation) and effects (shortages of housing and tourist accommodation, very high prices, overcrowding, etc.), all of which are amplified by political causes and events (terrorism and political insecurity in competing destinations) and the perception of a lack of legal security for the owners in the case of renting residences (unpaid rents and occupations).

The psychological, social, and economic consequences of a decade of very rapid growth have caused the emergence of various critical positions, including, in some cases, anti-tourism and tourism-phobia (Ait-Yahia Ghidouche & Ghidouche, 2019; Gürsoy, 2019; Seraphin, Gowreesunkar, Zaman, & Bourliataux-Lajoinie, 2019). The faster the increase, the greater the criticism and contrary positions have been. In addition, the debate has been contaminated by political issues that are unrelated to the tourism sector.

In reality, much of the observed growth has been a recovery from previous figures, and the spectacular increase in tourist arrivals has been partially offset by the ongoing reduction in the length of the average stay. Only in the last five-year period have the overnight stay figures been higher than the figures of 15 years before, at least in the case of Ibiza and Formentera. Furthermore, these record figures have been due to exceptional events simultaneously occurring in competing destinations.

On the other hand, a large part of the growth in demand has been absorbed by the hotel sector, and tourist-use homes have acted as an adjustment tool between this rapidly growing demand and a hotel supply that is evolving more slowly. As the growth of arrivals moderates or stops, the hotel sector recovers its market share of tourists to the detriment of tourist rentals. Moreover, the situation of 2015 and 2016 had begun to disappear by 2018, and, with the crisis of 2020, its effect will possibly dissipate completely. This may have a greater effect on tourist rentals than on other types of accommodation. These rentals absorbed excess demand that hotels could not meet, and when this excess disappeared, their occupancy levels dropped greatly. Thus, the ‘problem’ will be greatly reduced if demand falls.

In view of the events of the crisis in the early 1990s (Ramón, 2001), it is possible that territories such as Ibiza and Formentera will lose their resident population for some years if the 2020 crisis has strong, longlasting effects. Much of the islands’ populations originated from mainland Spain or from abroad and travelled to the islands to work in the tourism sector; therefore, if tourism activity decreases significantly, it is expected that some residents will migrate to other regions with a better economic situation, lowering the demand for long-term rental housing.

Despite the very rapid growth in demand, rent regulation should not be directed at its prohibition or limitation. Tourist rentals and housing are an escape valve for situations in which hotels are not able to absorb increases in tourist demand, and their prohibition would aggravate this situation. Instead, regulation must consider this adjustment function between total demand and the supply of hotel beds.

The demand for tourist rental housing is due to very specific market niches (Sainaghi, 2020) and is a function of the adjustment between hotel supply and tourist demand. The mixed results found in some studies on the effects of P2P platforms on hotels (Dogru et al., 2020a; Sainaghi, 2020; Sainaghi & Baggio, 2020) have resulted from ignoring this double function of tourist rentals. The supply of tourist housing is much more flexible than the hotel supply; however, when performing adjustment functions, it can transmit part of the pressure from the tourist market to the housing rental market, reducing the supply for long-term rentals (Horn & Merante, 2017; Smith et al., 2018), although the real effect is likely low.

Vacation rentals are an indication of the real problem, implying that actions should be aimed at managing increases in tourist arrivals, taking into account the speed of such increases, the seasonality of arrivals, and whether they are conjunctural or structural increases. As much demand as possible should be shifted to the less crowded months, something that has already been undertaken in Ibiza and Formentera through moving part of the hotel occupancy to May and October and increasing the hotel offering only when it is expected that the new figures will be maintained in the long term. Tourists who cannot be served through these actions must be offered tourist rentals (tourist apartments and tourist-use houses).

Tourist accommodation and rental housing require further study that employs a higher level of detail in the analysis of the available secondary data. It is also necessary to carry out detailed analyses based on primary data to specify the real importance and impacts of tourist rentals. This would address the limitations of the present study, which are essentially its use of secondary sources. Secondary sources only provide certain data for certain aggregations and time periods, leaving other data and times to be examined. For example, overnight stay data are more useful than tourist figures due to the changes that have occurred in recent years; however, not all surveys provide this information. Moreover, the period from 2005 to 2019 was used in the present study because there were no previous data available in any of the surveys consulted. It should also be noted that these data are difficult to compare due to the different methodologies used in each survey, and discrepancies are likely between sources and time periods. For example, the following numbers of tourist-use dwellings were all found: 17,153 locations on Airbnb in 2016 (Groizard & Nilsson, 2017); 30,018 locations on Airbnb in 2017, 29,894, in 2018 (Terraferida, 2017), 42,670 in 2017 (Falcón & Palma, 2018); and 27,189 places on Airbnb in 2020 (AirDNA, 2020). Based on this finding and those of previous research (Agarwal et al., 2019), the data on available tourist-use housing should be interpreted with great caution.

With the financial support of Science, Innovation and Universities of the Ministry of the Government of Spain, within the State Program of R + D + i oriented to the Challenges of Society: “Soluciones jurídicas y económicas al problema inmobiliario turístico” (Agencia Estatal de Investigación/FEDER/DER2017 82705 R).

Declarations of interest: none.

Funding: This work was supported by the Ministry of Science, Innovation and Universities of the Government of Spain, State Bureau of Investigation/FEDER/UE [DER2017-82705-R].