In the 21st century, the growth of each country's economy is now mostly influenced by the assets based on physical or non-physical grounds. These invisible assets are, as explained by various studies, supporting that they are one of the most important driving forces in the country's economy to accelerate growth. However, there is still a need for a more detailed research regarding the emergence and the impetus of this subject. This study aims to measure the effect of the intentional invisible asset on the growth of a country's economy. The correlation between the growth rates of 38 countries between 2008 and 2017 and the Top 500 brand values was analyzed for short and long-term by using the ARDL co-integration analysis. The effect of investing in national brands and increasing brand values of the country was observed to be negative in the short-term, but positive on the long-term with regards to the country's economic growth.

In the new millennium, brand management has become a central construct that is not only debated in marketing field but also in the economy and other social disciplines (Ashworth & Kavaratzis, 2009; Kotler & Gertner, 2002). Although branding has been a valuable tool for merchants and traders for many years, it has become one of the major research areas in marketing discipline since the early 1980s. In general, many scholars concentrated on the role and importance of brands from the firm and consumer perspective and the critical importance of successful brand management (Aaker, 1992; Keller, 1998) to survive in today's fierce and competitive world. However, in recent years the one-dimensional description of branding which concentrates on marketing programs has been changed to a multidimensional and multidisciplinary view (Louro & Cunha, 2001). Many theories from different disciplines like macro-economy, sociology, anthropology, and even neurology are integrated into branding studies (Kozinets, 2010; Rapaille, 2006). In other words, the dominant logic in brand management area moved to a macro perspective parallel to changing trends in the global economy. This new perspective has led further research in understanding how brands as intangible resources contribute to increasing business value and performance (Nenonen & Storbacka, 2010).

There are a growing interest and recognition in the brand management area together with various requirements of international marketing strategies and conditions for changing dynamics of interrelated economies in the world (Kathman, 2002). Since this new form of economy is associated with globalization, the proliferation of services, fragmentation, the breakdown of boundaries, liberalization, and democratization based on the foremost result of digitalization, brands are becoming more important for all stakeholders and even for national economies of those brands. In this respect, with the higher level of competitiveness and inter-relations, businesses are in competition with the creation of more powerful brands to support their national economies in worldwide markets. Nevertheless, the growing national economies which have more valuable brands accepted by global consumers are powerful than others.

Within the scope of this new economy, there are several important observations: markets are dynamic, the competition area is global, the organization competes as a network, and more importantly the definition of value has changed. Classical economy defines “value” in relation with scarcity whereas “value” is now associated with numbers of users in the new economy. Thus, in today's world, the dissemination of goods and their introduction to the masses of consumers have changed and increased the importance of branding concept. For the survival in a complex and highly capitalist business world, economic, political, and military strengths are defined as vital differentiators of competitive advantage. In recent years the alteration in the growth and stability of national economies refer to a progressive perspective involving new dimensions like the significance of intangible assets for the growth of economies.

Dynamics of this new economy are depending heavily on creating “value”, based on primarily intangible assets. According to the recent studies, 80% of market capitalization of companies which do not have any physical or financial embodiment is intangible (Brand Finance, 2017). These are also referred to knowledge assets or intellectual capital defined by The Organization for Economic Co-operation and Development (OECD) at Oslo Manual (2005). According to OECD, intangible assets can be classified into three groups as “computerized information (such as software and databases), innovative property (such as scientific and nonscientific research and development, copyrights, designs, and trademarks), and economic competencies (including brand equity, firm-specific human capital, networks joining people and institutions, organizational know-how that increases enterprise efficiency, and aspects of advertising and marketing” (OECD, 2011).

Technological products and innovations are listed as important intangible assets for economic development. Nevertheless, it is known that innovative products can easily lose their competitive advantages due to rapid duplication or other counter innovations. Therefore, gaining a competitive advantage through creating strong brands is more sustainable in the long run (Shocker, Srivastava, & Ruekert, 1994). Although it is widely accepted that having strong brands help companies to gain a sustainable competitive advantage, there is still a need for further financial and numerical support since developing strong brands requires heavy investments. Besides the micro-firm perspective, Tahir Ali (2016) discusses a macro perspective and mentions the need to study the relationship between the economic development of countries and their brand development success. On this perspective, this paper includes a research, based on secondary data collected from “Brand Finance” where Top 500 valuable brands are listed between 2008 and 2017 as a total of ten consecutive years.

As it is stated in Corrado and Hao's (2014) article whether the brand investment can be associated with the level of economic development deserves further research and attention. In the study, the focus is on the relation between brand development performance of economies and economic growth. The study aims to contribute to the limited literature on the accountability of brand management, the relation between brand value and growth of national economy, and enrichment of the explanation, and benefits of brand management for marketing science with its relation to economics. Meanwhile, the paper aims to indicate that brand development is not expenditure but a long-term investment. To realize this, longitudinal data is analyzed to show long-term and short-term relations between economic growth and brand value.

Furthermore, the purpose of the current study is to underline the rising importance of intangible assets, specifically brand in economic growth. Since the economic growth rates of the countries around the world are declining, every possible variable contributing to economic growth is worth to examine in detail.

The multi-disciplinary approach of the study which brings economic perspective to marketing and branding discipline is an important contribution to the existing literature. Also, this study is one of the earliest studies which take into account multi-country brand value analysis. Thus, this study will lead further studies since the intangible assets’ importance in economic growth will continue rising.

This paper continues with a literature study examining leading articles on brand value and economic growth. Besides academic studies, the authors mention actual economic and brand data collected by various third-party institutions like OECD reports. The literature review is followed by methodology section which explains the econometric method used, and data selected. Findings of the analysis are discussed in the last section of the paper. Conclusions, suggestions, and limitations of the study are summarized in the final part.

2Literature review about economic growth and brand developmentThere is a growing interest in the value and management of intangible assets, specifically in brands, since the business environment becomes more complex than ever. As the battle for customers intensifies every other day, companies are overly willing to have strong brands (M’zungu, Merrilees, & Miller, 2010). Brands are important and valuable assets not only for companies but also for national economies. From economic point of view, technological developments are incorporated in economic growth models whereas branding has been neglected are. Although scholars discuss that brand value is an important requirement for economic development, there is still lack of consensus on an economic growth model taking brand value into consideration.

In the 21st century the percentage of intangible assets compared with tangible assets in total firm value has increased considerably (Madhani, 2012, p. 9). Nordic countries attracted the attention of foreign investors since they positioned themselves in the Regional 2 European Growth index as one of Europe's fastest growing economic regions. Firms in Nordic countries are well known for investing in intangible assets more than any other European country (OECD, 1998).

According to OECD (1998, p. 36–38) report, research and development (R&D) investments increased in relation to Gross Domestic Product (GDP) resulting in a promising economic growth compared to other European countries, which supports the positive relation between economic growth and investments in intangible assets.

In today's world, it is important to produce value added products and services for sustainable economic growth. The share of brand value in Gross National Product (GNP) is high in developed countries’ economies. For example, the value of intangible assets between

1950 and 1959 increased from USD 19.4 million (period average) to USD 1226.2 million (period average) between 2000 and 2003 (Corrado, Hulten, & Sichel, 2009). Moreover, the value of brands has considerable importance in this trend, numerically brand value increased from 5.2 to 160.8 million USD, respectively (Corrado et al., 2009).

The importance of brands is undeniable since they are one major class of intangible assets. Globally, the value of intangible assets is rising from $19.8 trillion in 2001 to $47.6 trillion in 2016, despite a drop of over 50% during the financial crisis of 2008 (Brand Finance, 2017, p. 29). Although the rising importance of intangibles is also reflected in their contribution to GDP growth, classical growth theories still focus on tangible assets and ignore the critical value of intangible assets.

However, in the United States of America (USA), Scandinavian countries, the United Kingdom (UK), Mexico, Ireland, France, and South Africa intangible asset investment is higher than tangible asset investment (Brand Finance GIFT Report, 2017). Moreover, the share of the intangible asset in Gross Domestic Product (GDP) in USA and EU14 are 8.8% and 7.2%, respectively. Within EU countries, the percentage of intangible assets in GDP differs among countries. As stated before, Scandinavian countries, UK, and France are known with high investment in intangible assets. Specifically, Sweden is the leading country with 10.4% intangible asset ratio in GDP, followed by UK (9.0%), Finland (8.8%), France (8.7%), Netherlands (8.5%), Ireland (8.5%), Belgium (8.1%), and Denmark (7.8%) (Corrado, Haskel, Jona-Lasinio, & Iommi, 2016).

Besides these countries, China has also become a well-known country with its investments in intangible assets after 2013. The ratio of intangible investments in GDP increased from 7% in 2013 to 8.5% in 4 years due to heavy investments in the software industry, R&D, and design (China Center for Economics & Business, 2012). The composition of intangible assets is different in China compared to the European Union (EU) and the USA. In EU and USA, innovative property and economic competencies are the main drivers of intangible capital accumulation while software plays a minor role compared to China. However, the percentage of software investments in GDP increased from 0.32% to 2.94% between 1995 and 2010 in China (Hulten & Hao, 2012). Table 1 shows the composition of several countries’ tangible and intangible investments in detail. Brands are considered as intangible assets which are part of economic compositions

Intangible/tangible investment and asset composition.

| Country | Intangibles (percent) | Tangibles (percent) | Asset composition of intangible investment (percent of GDP, average 2000–2013) | ||

|---|---|---|---|---|---|

| Software | Innovative | Economic | |||

| Sweden | 10.4 | 9.4 | 1.9 | 4.6 | 3.9 |

| UK | 9 | 7.5 | 1.6 | 2.9 | 4.6 |

| Finland | 8.8 | 6.9 | 1.1 | 4.3 | 3.3 |

| France | 8.7 | 7.4 | 2.2 | 2.9 | 3.7 |

| Belgium | 8.1 | 11.4 | 1.1 | 2.6 | 4.4 |

| Denmark | 7.8 | 9.9 | 1.4 | 3.6 | 2.9 |

| Germany | 5.9 | 9.7 | 0.7 | 2.9 | 2.3 |

| Austria | 6.7 | 11.4 | 1.5 | 2.2 | 3.0 |

| EU14 | 7.2 | 9.2 | 1.3 | 2.6 | 3.2 |

| United States | 8.8 | 7.2 | 1.6 | 3.5 | 3.7 |

On this perspective, USA had 199 brands in Top 500 at 2008 and 197 at 2017, France had 38 and 36, Canada had 13 and 14, Switzerland had 16 and 13, Sweden had 5 and 6, keeping similar numbers of brands in the Top 500, whereas China had 13 and 57, Korea had 8 and 14, India had 5 and 9, Brazil had 4 and 5, significantly increasing their worldwide top brands presence, respectively. On the other hand, UK had 44 brands at 2008 and 30 brands at 2017, Japan had 51 and 38, Germany had 31 and 26, Italy had 15 and 9, the Netherlands had 11 and 7, Belgium had 4 and 1, respectively. The results claim that the US is keeping its dominating position even if it had a decrease between 2008 to 2016, major Japanese and European originated brands are losing their places in the Top 500 and brands of emerging countries like China, India, Korea, and Brazil are taking their spots in the list.

Corrado et al. (2009) stated that the share of brand value in GDPs of developed countries increased from 5.3% during 1950–1959 to 160.8% at 2000–2003 (Corrado et al., 2009, p. 671). Thus, these figures support the need to scrutinize brand investments as part of business investments and need to be included in GDP. However, there is no consensus about how to or even whether to integrate brands in the balance sheets unless there is a transaction to support intangible asset values in the balance sheets. The debate on calculating intangible assets in existing accounting standards is going on as part of ‘undisclosed intangibles’ problem.

The gap between a company's market value and book value is increasing because of ignoring the brand value in the balance sheets. Since market value is strongly related to brand value, this gap creates an asymmetric lack of information about companies and decreases the efficiency of the market (Brand Finance Institute, 2017, p.1). There is limited research examining the impact of brand value on the stock performance of companies, one example is from Turkey by Başgöze, Yildiz, and Camoz (2016) who investigate Turkish market and another one from Scandinavia (Hinestroza, 2017).

The positive relationship between brand investment and economic development is supported by the econometric analysis (Corrado & Hao, 2014; Dreger, Erber, & Weske, 2009; van Ark, Hao, Corrado, & Hulten, 2009) in the high-income economies like European countries, Japan, and the United States. According to these studies, brand equity contributes to the growth of output per hour by 0.04% per year in Japan and United States, and 12% in European countries (van Ark et al., 2009, p. 5)

More than half of the variations in GDP in European countries can be explained by the impact of intangible assets as Dreger et al. (2009) stated that intangible assets do have a significant influence on the growth rate of the GDP. Since strong brands can be sold worldwide to higher demand will induce higher production, which will lower the average costs and result in higher profit margins due to economies of scale. To penetrate wider geographic regions, manufacturers aim to create valuable brands which have high reputation recognized by global consumers. This scale effect is one of the major advantages of having strong brands.

Besides economies of scale advantage, investing in brands help companies to allocate resources more effectively and efficiently. Firms aiming to invest in developing brands become more innovative, more technology and quality oriented, more customer driving, and more quality oriented and achieve higher levels of economic development. In today's dynamic environment a continuous re-allocation of resources in the market is necessary for ensuring success in a well-functioning market economy (Erixon & Salfi, 2015, p. 7).

Marketing communication specifically advertising is indispensable for brand development. To create awareness, develop a brand image, and increase sales in a brand proliferated business world, companies need to invest more heavily in marketing communication. In several studies, advertising expenditures are considered as indicators to underline the relationship between brand value and economic growth (Sacha et al., 2013, p. 32). Sacha et al. (2013) state that economic growth leads companies to spend more on advertising and more advertising expenditure leads to higher economic growth.

The increasing competitive environment causes changes in the structure of production and consumption which in return encourages firms to focus on high total factor productivity. Total factor productivity can be attained by investing more in intangible assets. In brief, as economies become intangible asset intensive more, they enjoy higher growth performance.

Corrado, Haskel, Jona-Lasinio, and Iommi (2014) state that slowly growing economies like Spain and Italy have relatively high non-ICT capital growth but poor overall productivity growth due to their very low total factor productivity. Moreover, poor intangible capital growth and poor total factor productivity can be related to the service-dominant character of these countries.

The common characteristic of rapidly growing economies like UK, France, Germany, Austria, the Netherlands, and Finland is their above-average performance in the manufacturing sector. Among these economies, the UK and the Netherlands are better performers in service sectors than others especially Germany and France. Thus, the overall productivity of UK and Netherlands is above average. Decreasing productivity in the manufacturing sector caused a slowdown in overall productivity in Germany. Both German and French economy is dominated by service sectors with low total factor productivity (TFP) growth and relatively high non-ICT tangible investment (Corrado et al., 2016, p. 10).

Regarding building and management of brands beyond national borders, firms need to create global value chains (GVC). National economies can gain a competitive advantage by participating in GVCs since they can have a direct economic impact on income and build productive capacity by integration.

In the 21st century, smile curve concept is introduced to explain the increased importance of pre and post-manufacturing stages. The smile represents the growing importance of intangible capital (technology, design, brand value, workers’ skills, and managerial know-how) in competitive markets. Intangible assets add value that enables companies to gain a unique competitive advantage. From the consumer perspective, preferences moved from functional benefits to hedonic benefits which can be provided with differentiation and ensuring broader “brand experiences” (WIPO, 2017).

3MethodologyIn this section, the econometric methods used to analyze the data will be explained in detail.

3.1Cross-sectional dependenceThe second generation panel unit root and co-integration tests take into account cross-sectional dependency; however, they require balanced panel data sets (Demetriades & James, 2011). In the study, the data regarding some countries are missing, and the model used for this study is the unbalanced panel model. According to Nazlioğlu (2013, p. 1105), first generation panel methods are more appropriate than the second generation panel tests when the panel data set is unbalanced. It is important to note here that the first generation non-stationary panel methods are assumed as independent among cross-sectional units.

3.2Unit root testIt is required to test the immobility of variables in order to apply co-integration of panel data. In this way, false regression problem, which is a consequence of time series analysis of unit root when panel data covers long-term, can be figured out (Granger & Newbold, 1974, p. 118). The immobility of variables is tested with different unit root tests such as augmented Dickey-Fuller (ADF) and Philips-Peron (PP). The results are presented in Table 2.

Results of panel unit root test.

| Variables | IPS W-stat | ADF – Fisher Chi-square | PP – Fisher Chi-square |

|---|---|---|---|

| Level | |||

| GDP | |||

| Intercept | −1.37948(0.9458) | 68.1235(0.85475) | 60.7701(0.8653) |

| Intercept and trend | 1.73844(0.9589) | 57.1857(0.9261 | 45.3115(0.9965) |

| None | – | 79.7947(0.3019 | 71.6743(0.5550) |

| Brand | |||

| Intercept | −2.48047(0.0066) | 110.434(0.0015) | 152.103(0.000) |

| Intercept and trend | −2.69051(0.0048) | 107.659(0.0041) | 197.840(0.0000) |

| None | – | 102.948(0.0063) | 138.997(0.0000) |

| Difference | |||

| D (GDP) | |||

| Intercept | −6.37948(0.000) | 199.972(0.0000) | 206.145(0.000) |

| Intercept and trend | −6.85745(0.000) | 196.854(0.0000) | 208.740(0.0000) |

| None | – | 169.777(0.0000) | 122.492(0.0003) |

Im, Pesaran, and Shin (2003) developed an alternative panel unit root test which takes the average of various individual root tests that is called IPS, which allows heterogeneous trend and intersection for each horizontal cross-section. The unit root test process is more flexible

and easier to calculate with IPS. Basically, it takes the average of ADF unit root test calculated for each unit in the panel. The IPS test is mostly used in unstable panels.H0: The hypothesis is ‘The series involve unit root.’

H1: The alternative hypothesis is ‘The series is immobile’.

Maddala and Wu (1999) and Choi (2001) proposed an alternative test which would eliminate the shortcomings of IPS. The proposed test, named ADF, would use Fisher test which

depends on the combination of individual test statistics (Baltagi, 2005, p. 244) and shows the values of unit root tests for each cross section. Fischer ADF and PP test statistics are shown in Eq. (2) and it shows an x2 distribution with two degrees of freedom.4Findings and discussionIn Table 2, unit root tests related to GDP and brand values are shown. In respect to IPS, ADF-Fisher, and PP Fisher root tests, GDP involves unit root while the brand is stationary at the level and when the first difference of GDP is taken, it becomes stationary.

4.1Co-integration analysisFollowing model is proposed for panel co-integration analysis. In this model, GDP represents the dependent variable, BRAND the independent and the error. In Eq. (3),

i=(1, …, N) shows the number of horizontal cross sections and t=(1, …, T) shows the time intervals.The results of co-integration are estimated by using Eq. (3) are explained in Table 3.

Results of co-integration analysis.

| Dependent variable: D (GDP)Method: ARDLMaximum dependent lags: 1 (automatic selection)Model selection method: Schwarz criterion (SIC)Model: ARDL(1, 1)Selected model: ARDL(1, 1) | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. error | t-statistic | Prob. |

| Long run equation | ||||

| Brand | 1.87E+11 | 1.69E+10 | 11.04370 | 0.0000 |

| Short run equation | ||||

| cointeq01 | −0.124387 | 0.032196 | −3.863421 | 0.0001 |

| D (brand) | −1.06E+10 | 3.27E+09 | −3.242100 | 0.0014 |

| C | 6.12E+10 | 1.12E+11 | 0.544953 | 0.5863 |

| Log likelihood | −7490.498 | |||

As a result, ARDL co-integration analysis is conducted to analyze the relationship between brand development and GDP. Findings support both long and short-term equilibrium relation between brand and GDP. The fact that the error correction term (cointeq01) is negative and meaningful in the ARDL model indicates that 12% of errors in the short-term are eliminated in the long-term. This implies that there is a long-run equilibrium relationship between the variables. Depending on the results at the long-term coefficient, the effect of BRAND on national income is positive and meaningful at 1% level. The long-term coefficient was calculated as 1.87. In the short-term relationship, the coefficient negatively (short-term coefficient −1.06) affects GDP and is found statistically significant.

Furthermore, we analyzed the model for both developing and developed countries specifically and reached following results which support the general model proposed above.

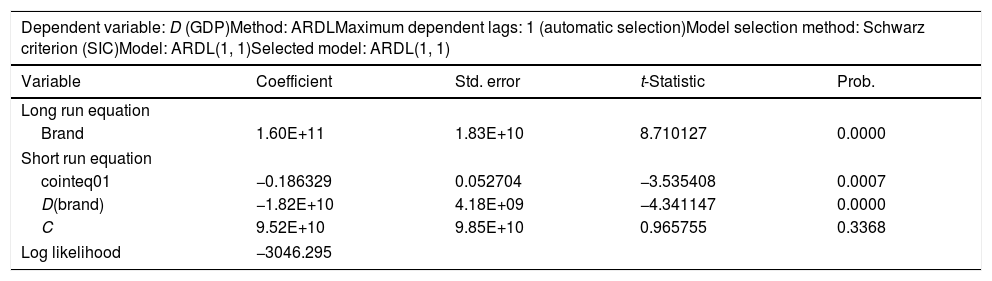

An extension of ARDL co-integration analysis which is conducted to analyze the relationship between brand development and GDP, developing counties including China, Chile, Colombia, Indonesia, Korea, Qatar, Russia, Saudi Arabia, Singapore, South Africa, Turkey, Unites Arab Emirates, and Thailand are analyzed with the same model, specifically. Findings presented in Table 4, support both long and short-term equilibrium relation between brand and GDP. The fact that the error correction term (cointeq01) is negative and meaningful in the ARDL model indicates that 18% of errors in the short term are eliminated in the long term. This implies that there is a long-run equilibrium relationship between the variables.

Results of co-integration analysis for developing countries.

| Dependent variable: D (GDP)Method: ARDLMaximum dependent lags: 1 (automatic selection)Model selection method: Schwarz criterion (SIC)Model: ARDL(1, 1)Selected model: ARDL(1, 1) | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. error | t-Statistic | Prob. |

| Long run equation | ||||

| Brand | 1.60E+11 | 1.83E+10 | 8.710127 | 0.0000 |

| Short run equation | ||||

| cointeq01 | −0.186329 | 0.052704 | −3.535408 | 0.0007 |

| D(brand) | −1.82E+10 | 4.18E+09 | −4.341147 | 0.0000 |

| C | 9.52E+10 | 9.85E+10 | 0.965755 | 0.3368 |

| Log likelihood | −3046.295 | |||

Depending of the results at the long-term coefficient, the effect of BRAND on national income is positive and meaningful at 1% level. Long term coefficient was calculated as 1.60. In the short-term relationship, the coefficient negatively (short term coefficient −1.82) affects GDP, is found statistically significant.

Table 5 below explains another extension of ARDL co-integration analysis which is conducted to analyze the relationship between brand developed and GDP, developing counties including Australia, Austria, Belgium, Canada, Czechia, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Netherlands, Norway, Portugal, Spain, Switzerland, UK, and USA are also analyzed with the same model. Findings support both long and short-term equilibrium relation between brand and GDP.

Results of co-integration analysis for developed countries.

| Dependent variable: D (GDP)Method: ARDLMaximum dependent lags: 1 (automatic selection)Model selection method: Schwarz criterion (SIC)Model: ARDL(1, 1)Selected model: ARDL(1, 1) | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. error | t-statistic | Prob. |

| Long run equation | ||||

| Brand | 6.01E+10 | 1.03E+10 | 5.810951 | 0.0000 |

| Short run equation | ||||

| cointeq01 | −0.153527 | 0.053284 | −2.881302 | 0.0047 |

| D(brand) | −3.20E+09 | 2.87E+09 | −1.114087 | 0.2674 |

| C | 1.44E+11 | 8.17E+10 | 1.763635 | 0.0802 |

| Log likelihood | −4232.727 | |||

The fact that the error correction term (cointeq01) is negative and meaningful in the ARDL model indicates that 15% of errors in the short term are eliminated in the long term.

This implies that there is a long-run equilibrium relationship between the variables. Depending of the results at the long-term coefficient, the effect of BRAND on national income is positive and meaningful at 1% level. Long term coefficient was calculated as 6.01. In the short-term relationship, the coefficient negatively (short term coefficient −3.20) affects GDP, is found statistically insignificant.

Finally, Table 6 summarizes that the diagnostic test for ARDL in explanation of heteroscedasticity serial correlation normality. There was found no serial correlation from function's model, non-normality of the errors and heteroscedasticity. Tests with all P values larger than 0.05. The model passes all the reported diagnostic tests. The results of this research have economic significance and reasonable.

5ConclusionThere are many studies in the literature focusing on the importance of creating brand value for gaining competitive advantage and sustainable economic growth. However, there is still a lack of quantitative research on the relationship between brand value and economic growth. Since GDP is stated as the most popular tool for understanding the economic development of a country, this study also concentrates on the GDP as an indicator of economic growth.

The findings of the current study support the view that there is a relation between GDP and brand value. The positive relationship between brand value and GDP supports the general perception that advertising, marketing, and R&D investments take a long period of time to return. As Clary and Dyson (2014) discuss, many econometrics studies state that the short-term return on advertising can even be less than the investment itself. According to a popular belief among advertising practitioners who find difficult to prove that advertising pays off; “the long-term effect can be four times as much as the short-term effect”.

Besides the marketing and advertising investments, R&D, economies of scale, the increase in TFP and intense competition are the main reasons for brand values’ long-term impact on GDP. All customer-facing aspects of a company's performance – including product quality, production innovation and the underlying technology, product design, product cost, managerial know-how, human capital in the company, research, service, and other issues – have an impact on brand value, as well as on the company's image and reputation.

As a result of the analysis carried out in the current study, the allocation of production factors negatively affects the GDP due to the fact that the cost of creating a brand in the short-term is high and its positive impact can only be realized in the long run. Creating a brand is a long-term investment and it takes time to observe the positive impact of investment on GDP. The performance of the firm is closely related to customer loyalty which depends on product quality, product innovation and technology, product design, company's human capital, R&D, and management style. Short and long-term investment and dedication are a prerequisite for attaining high performance on all indicators. To observe the return on brand investment and also the contribution of the real economy to the national economy takes longer time than expected. In developed economies, the short-term negative effects can be more easily compensated than in emerging economies since the lower growth rates can be revitalized with creating strong brand values. However, developing countries do not prefer to engage in long-term investments rather they prefer to allocate their limited resources for short-term returns.

These drawbacks of developing countries with regards to long-term investments for brand development will result in a larger income gap between developed and developing economies. Understanding the importance of intangible assets, specifically brand development, creating new brands, and understanding the value of invisible assets is of much greater significance in terms of developing countries, such as China and India, which has caught up with high growth rates for years. The most valuable brands in the world league have captured the advantage of keeping growth in the economy at a high rate.

It is clear by the list of Top 500 brands that economies of the developed countries hold dominance in the brand league. They have discovered the positive effect of invisible assets on TVP and have concentrated their investments on these assets and have improved their economic power globally. Middle and low-income countries have to understand the importance of intangible assets, including brands, to produce high value-added products. However, the capability of emerging countries for building brands is the main driver to close the gap in income levels among countries. These countries have to consider investing in intangible assets by understanding the value of building them and the importance of creating new brands to gain a competitive advantage. The most significant example of this movement for the last decade is China. Its momentum of growth is in correlation with the number of brands coming out of its home market to global markets.

Finally, there are some limitations due to the constraints regarding Interbrand and Brand Finance datasets which could be accessed for only ten years. Another important remark would be based on this constraint, was the size of data that leaded researchers to work with only a limited set of methodological approaches. In the following studies, there might be additional methods to run with the analysis depending on the increasing size of the data. A potential development area could be constructing new measures and instruments for evaluation of brand value in comparison with growth in firms and countries.