The purpose of this article is to analyze the evolution of the domestic market—recessive, stable, and expansive—on export volume in family firms. Although globalization has hastened family firms toward internationalization, little is known of the influence of market evolution on export strategies. We propose a theoretical model that evaluates the influence of domestic market evolution on the percentage of export sales and the mediating role of innovation in this relationship. This model views innovation as a process that may impact export propensity when influenced by the market situation.

We perform a study with panel data for a five-year period (2012–2016) from 788 family firms to identify family firms’ behavior in export volume and innovation under different market conditions.

The results reveal that family firms have significant results for export sales under recessive and expansive market situations. They are less prone, however, to export when markets are stable. Contrary to the predictions of the literature, our results indicate that innovation has little relevance to export volume in any of the market situations analyzed.

The literature has shown growing interest in family firms’ behavior regarding internationalization strategies (Fernández & Nieto, 2005). Since the inevitable globalization of markets, export has become a priority challenge for family firms (Graves & Thomas, 2008; Herrera-Echeverri et al., 2016), but research in this field is still in the early stages (De Massis et al., 2018). The family firm has been defined as a business in which a family or small number of families dominates or controls the business to make it sustainable and transfer it to subsequent generations (Chua et al., 1999). Export has been considered as a lower-risk expansion strategy for family firms than internationalization, since export uses fewer and more flexible resources (Kraus et al., 2017). There is no one way family firms execute export strategies (Herrera-Echeverri et al., 2016; Pukall & Calabrò, 2014).

Family firms constitute 60% of European firms and employ 40–50% of workers (European Commission, 2008). In Spain, family firms are even more important, as they constitute about 70% of the GDP and provide 75% of employment (Instituto de Empresa Familiar- IFM, 2007). Despite the significance of family firms, we find gaps in research on them. First, most studies of family firms in contexts of internationalization focus on the characteristics that distinguish family from nonfamily firms (Gomez-Mejia et al., 2011). In focusing on this segmentation, researchers have neglected the possibility of highlighting distinctive characteristics, such as flexibility (Broekaert et al., 2016; De Massis et al., 2018; Hatum & Pettigrew, 2004; Holt & Daspit, 2015) and entrepreneurship (Hitt et al., 2011; Mitter et al., 2014; Randolph et al., 2017; Sieger t al., 2011) inherent in family firms that can lead to better results in rapid, agile contexts.

Prior studies have, on the other hand, stressed the relevance of the international context for family firm export (Fernández & Nieto, 2005; Graves & Thomas, 2008). Yet research has not determined whether family firms strengthen or activate export (Pukall & Calabrò, 2014), perhaps because family firms handle export in very different ways (Herrera-Echeverri et al., 2016). In fact, the propensity to export depends on the situation in the environment in which the family firm finds itself. A study that incorporates the potential situation in the environment would thus explain the behavior that firms follow, because the environment is a factor that affects business decisions greatly. Our research question focuses precisely on analyzing market situations’ influence on export volume in family firms. More specifically, we wonder how cyclical fluctuation of the market or market evolution influences export volume.

In response to the demands of globalization, family firms must bid not only to innovate (Kellermanns & Eddleston, 2006), but also to open foreign markets (Herrera-Echeverri et al., 2016). The literature shows, however, that family firms respond ambiguously to this situation. Although they are prepared to be flexible (Holt & Daspit, 2015) and entrepreneurial (D. Miller, 1983; Sieger et al., 2011), they are more conservative (Belenzon et al., 2016; Le Breton-Miller et al., 2015) and thus usually innovate less (De Massis et al., 2015a) but better (Duran et al., 2016). To shed light on this ambiguous behavior, we analyze the effects of innovation in family firms relative to their export strategies. Although the literature has traditionally differentiated between process innovation (oriented to generation of novel elements of procedures and methods in the firm) and product innovation (oriented to generation of novel products on the market) (Alegre & Chiva, 2013), we find no studies that analyze the concepts of process and product innovation separately in family firms, much less in the presence of export strategies. This gap is an important issue, given that different resources are committed in each type of innovation. The market situation can thus lead to one type of innovation and not the other. Our study analyzes the influence of different contexts on the innovation strategies of family businesses.

This study uses two analytical perspectives: organizational and temporal. The organizational perspective enables us to analyze the behavior of family firms, and we aim to detect the influence of the changing market on family firms’ export volume. We also analyze the role of process and product innovations in the context of family firm export. The temporal perspective enables us to determine this trend over the 5 years of the study. We analyze panel data from 788 family firms for the years 2012–2016, and this longitudinal analysis shows the consistent behavior of family businesses over the years.

This study makes the following contributions to the literature.

First, our model analyzes the influence of the domestic market situation on family firms’ export, determining the effect of market evolution in three stages: recession, stability, and expansion. We see that family firms behave differently in stable markets than in receding and expanding ones. This finding indicates that export volume is sensitive to the situation in the domestic market.

Second, our study differentiates between process and product innovation. Given the intense differences in the ways family firms innovate (De Massis et al., 2015a; Duran et al., 2016), we believe that understanding their innovation requires determining how the firms’ behavior varies in these types of innovation and the effects of these differences on inclination to export. This study seeks to demonstrate the difference between the two types of innovation in family firms, due to their commitment of different resources within the firm.

Third, our study analyzes a five-year trend in behavior of family firms. We examine the influence of innovation as a process that would mediate between market evolution and export sales, because innovation can be affected by domestic market situation. This study analyzes whether innovation as a mediating force influences export, or whether market situation is more intense and family firms opt significantly for export rather than innovation.

2Theoretical frameworkFamily firms integrate two systems: the family system and the business system (Sharma, 2004). Family firms are also extremely heterogeneous (Chua et al., 2004) and have highly diverse behavior (Cigoli & Scabini, 2006). Although the literature has not agreed on a single definition of family business (Sharma, 2004), we propose the definition formulated by Chua et al. as “a business governed and/or managed with the intention to shape and pursue the vision of the business held by a dominant coalition controlled by members of the same family or a small number of families in a manner that is potentially sustainable across generations of the family or families” (1999, p. 25).

Family firms have distinctive characteristics that differentiate them from each other (Lumpkin et al., 2011) and strengthen the generation of unique resources and capabilities. Due to the interaction of members of the firm, the family, and the business (Habbershon & Williams, 1999), family firms generate idiosyncratic capabilities (Reisinger & Lehner, 2015). The resource-based view of the firm points not only to competitive advantage achieved through distinctive resources but also to the way in which these resources are used (Barney et al., 2011). Family firms have difficulty maintaining competitive advantage due to their conservatism, difficulty accessing financing and growth, and lack of professionalism (Le Breton-Miller et al., 2015). Other authors stress family firms’ skill in maintaining competitive advantage. Because family firms are good at using available resources, they have less structured, more flexible forms of organization (De Massis et al., 2015a). Further, the capabilities that family firms develop are oriented to the market (Mitter et al., 2014). As family firms’ resources and capabilities are driven by entrepreneurship (Sieger et al., 2011), entrepreneurship and family firms are also related (Goel & Jones, 2016). Entrepreneurship involves identification and implementation of opportunities (Hitt et al., 2011). Whereas some family firms settle into a limited mindset, others develop through entrepreneurship (Randolph et al., 2017). Entrepreneurial activity stimulates innovation and growth to promote the firm's survival (Sharma & Chrisman, 2007).

In the past decade, some of the greatest challenges for family firms’ survival have been globalization of markets and internationalization of businesses (Herrera-Echeverri et al., 2016). Lack of resources limits the growth of small and medium-sized firms and family firms, which have traditionally developed in local markets (Nieto et al., 2015). The literature has indicated that family firms prefer to be near cultural and economic markets (Chung & Dahms, 2016).

This article examines the paradox inherent in strategic behavior of family firms. On the one hand, family firms use more conservative strategies (Belenzon et al., 2016) and are oriented to long-term growth (Bjuggren et al., 2013). On the other, the substantial competences of family firms include entrepreneurship (Mitter et al., 2014) and organizational flexibility (Holt & Daspit, 2015). No consensus has been reached on how family firms implement their internationalization processes in the presence of these disparate behaviors (Herrera-Echeverri et al., 2016), and even less consensus exists on this behavior in different market situations.

2.1The effect of domestic market evolution on export results in family firmsMarkets have cycles that alternate between periods of economic recession and expansion (Xi et al., 2012). Markets can be evaluated according to degree of stability—vacillating between stable and dynamic; degree of complexity—ranging from simple to complex; degree of diversity—fluctuating from integrated to diverse; and degree of hostility—ranging from munificent to hostile (González-Benito et al., 2014). The moment in the market's cycle and evolution is a determining factor in the firm's source of competitive advantage (Agarwal et al., 2002). Market evolution is intimately related to speed of change (McCarthy et al., 2010), which can be classified as high (Stepanovich & Uhrig, 1999) or moderate (Judge & Miller, 1991). High-speed markets are highly uncertain Milliken (1987), and moderate-speed markets are munificent (Castrogiovanni, 1991).

In the global economy, opening new geographic markets is key to firms’ growth, and family firms are no exception (Minetti et al., 2015). Much of the literature demonstrates the negative relationship between the property of the family firm and opening to the foreign market (Fernández & Nieto, 2005). Among internationalization strategies, export is the least risky way to access a new market (Sánchez-Marín et al., 2020). Export does not involve agreements or contracts with additional organizations and thus uses fewer resources. The firm can export its current production and leave the market when conditions are unfavorable (Kraus et al., 2017). Although family firms are considered less willing to assume risk and abandon their geographic niche of origin Onida (2004), there is no clear consensus on whether family firms slow down or activate their export processes (Pukall & Calabrò, 2014). Some family members’ lack of expertise and insufficient competences for managing the external market influence firms’ decisions, hindering international expansion (Cerrato & Piva, 2012; Majocchi et al., 2018). Research also indicates that family firms have access to fewer resources (Merino et al., 2015).

Another part of the literature proposes, however, that family firms have specific inherent resources, as well as distinctive characteristics (Lumpkin et al., 2011) that can constitute an opportunity for export. Opening to the foreign market requires identifying opportunities, organizing the firm, and obtaining the resources needed for entrepreneurship (Kollmann & Christofor, 2014). Entrepreneurial capabilities have been viewed as key in high-speed environments (Reisinger & Lehner, 2015), and they are more characteristic of directors of family than of nonfamily firms (Kraus et al., 2017). Further, the decision to export involves a novelty that commits fewer resources and requires greater flexibility (Santulli et al., 2019). Rather than acting as a brake on export, the family firm's long-term orientation may thus facilitate greater resilience for internationalization and greater patience that performance will bring good returns (Kraus et al., 2017).

In low-speed environments (McCarthy et al., 2010), family firms do not feel pressured to perform newer and better actions than their competitors (Chirico & Bau, 2014), and innovative efforts decrease (Llach et al., 2012). Higher speed of the environment is a major cause of increased competitiveness (Pérez et al., 2019). In high-speed domestic markets (recessive or expansive), in contrast, family firms are in intense connection, acquiring information and adopting changes (Wang, 2016). Firms will choose to sell in foreign markets in two situations: conditions of bonanza and market opportunity, and unfavorable market conditions (Tatoglu et al., 2003). The most successful companies in more turbulent contexts are those that employ the most radical and disruptive strategies (Mason, 2007). Family firms may thus increase the business's orientation to export in expansive markets because there are more opportunities, but they may also increase their orientation to export due to the need to improve their position in recessive markets. Further, family firms detect opportunities in moments of expansion due to their entrepreneurial orientation (Goel & Jones, 2016). In competitive contexts, firms have the opportunity to be more entrepreneurial (Lumpkin et al., 2011). In recessive contexts, they may also opt to take a risk and start a new initiative. Market evolution thus shows significant fluctuations in which family firms are affected by periods of recession, stability, and expansion when they export and expand their initial geographic niche.

Following the arguments presented, we formulate:

H1 Family firms obtain greater export volume in recessive and expansive markets than in stable ones.

Many family firms participate in highly competitive sectors that require innovation (Miller et al., 2015). The family firm is intensely influenced by the family's social system (Wiklund et al., 2013), and innovation has been valued as crucial for survival over various family generations (Kellermanns & Eddleston, 2006). Innovation in family firms has a context and distinctive characteristics compared to other firms (Rondi et al., 2019). We define innovation as “a multi-phase process of generating and adopting new or improved products, services, processes, policies, structures, or administrative systems to meet the needs of a dynamic environment, to be effective, and to sustain a competitive advantage” (Holt & Daspit, 2015, p. 82). Traditionally, the literature on innovation differentiates between product and process innovation. Product innovation is oriented to the market, customers, and their needs; process innovation is oriented to improvement and development of internal processes (Alegre & Chiva, 2013).

Process innovation incorporates implementation of improvements in methods, procedures, and techniques (Orfila-Sintes & Mattsson, 2009), modifying productive routines to become efficient (Reichstein & Salter, 2006; Wallin et al., 2017). Process innovation improves the organization's internal innovative activities. Family firms innovate less but have more skills and capabilities to innovate (De Massis et al., 2015a). It is perhaps this development of idiosyncratic capabilities (Reisinger & Lehner, 2015)—whether or not the firm invests in innovation—that enables family firms to have good innovation results; that is, they innovate better (Duran et al., 2016).

Product innovation involves a novel advance that can improve the firm's market position (Bessant et al., 2005). Family firms must make long-term investments to guarantee survival for the following generations (Miller et al., 2015). As in other organizations, market-oriented innovation in family firms is viewed as critical to renewing competitive advantage (Rondi et al., 2019). The implementation of new actions in family firms will be affected by external factors, such as market speed and munificence (Kosmidou & Ahuja, 2019).

In uncertain markets, demand decreases (Miller, 1988), growth is limited, and firms tend to adopt conservative strategies (Shepherd & Zahra, 2003). Some research argues that high-speed markets have a positive influence on innovation in family firms (Cruz et al., 2012). Another stream of literature estimates that firms choose to innovate less in hostile economic environments (Llach et al., 2012). Some studies have noted that less-changeable markets have a negative effect on innovation in family firms. These studies argue that innovation decreases in highly munificent contexts and improves in less-munificent contexts (Casillas et al., 2011; Chirico & Bau, 2014).

Following the arguments presented, we formulate:

H2a Family firms perform more process innovations in recessive and expansive markets than in stable ones.

H2b Family firms perform more product innovations in recessive and expansive markets than in stable ones.

Research has stressed the importance of innovation for family firms (Rondi et al., 2019). Innovation and entrepreneurship are key tools for the survival of family firms (Miller, 1983). When deciding to apply innovation strategies, family firms seek to balance long-term orientation (Miller et al., 2015)—to remain loyal to ancestors and the dynastic succession of descendants—and organizational flexibility, stimulated across generations (Hatum & Pettigrew, 2004). Organizational flexibility is essential in family firms (Broekaert et al., 2016) and facilitates the combination of past and future (Adner & Snow, 2009). Family firms perform “innovation through tradition” (De Massis et al., 2015a). These conditioners can enable family firms to achieve better innovation results (Duran et al., 2016), making it crucial to describe the behavior family firms use to innovate (Rondi et al., 2019).

Innovation is an entrepreneurial task (Cassia et al., 2012). It happens when the generation of an idea is combined with implementation of that idea (Anderson et al., 2014). Process innovation develops through activities in the firm oriented to improving its activity (Orfila-Sintes & Mattsson, 2009). Product innovation involves the production or adoption of a novelty and renewal of products or services (Crossan & Apaydin, 2010) to increase sales and access the market (Classen et al., 2014). Some authors believe that innovations based on new methods and practices are more important in family firms than product innovations (Nieto et al., 2015). Family firms are usually viewed as needing both kinds of innovation (product and process), however, since both types influence the firm's productivity directly or indirectly (Classen et al., 2014).

Flexibility in family firms (Holt & Daspit, 2015) facilitates the introduction of more new products on the market than in nonfamily firms (Ayyagari et al., 2011). Further, because family firms have less formalized processes (De Massis et al., 2015b) and more flexible structures (Craig & Dibrell, 2006), they may be more prepared to perform innovations. It has been shown that family firms are sensitive and adaptable to environmental change (Craig & Dibrell, 2006).

The literature has also shown that innovation is necessary for the firm's survival in today's unstable markets (Slavec Gomezel & Aleksić, 2020). Research confirms that family firms acting in uncertain but generous markets—that is, in environments that generate opportunities—innovate more than in stable environments with fewer opportunities (Blake & Saleh, 1995).

In addition to innovation, international expansion of family firms—expansion of the market beyond local boundaries—involves expanding the firm's competitive advantage (Fernández & Nieto, 2005) and developing unique skills and competences (Reisinger & Lehner, 2015). Internationalization challenges family firms to grow (Graves & Thomas, 2008), and family firms’ flexibility enables them to respond quickly and agilely to new market opportunities (Kontinen & Ojala, 2010). Both process innovations, which encourage the absorption of distinctive capabilities, and product innovations, which involve the introduction of new products or services on the market, change firms’ adaptation in markets. We can thus expect family firms to achieve better export results.

Following the arguments presented, we formulate:

H3a Process innovations mediate the positive and significant relationship between domestic market evolution and export results in family firms.

H3b Product innovations mediate the positive and significant relationship between domestic market evolution and export results in family firms.

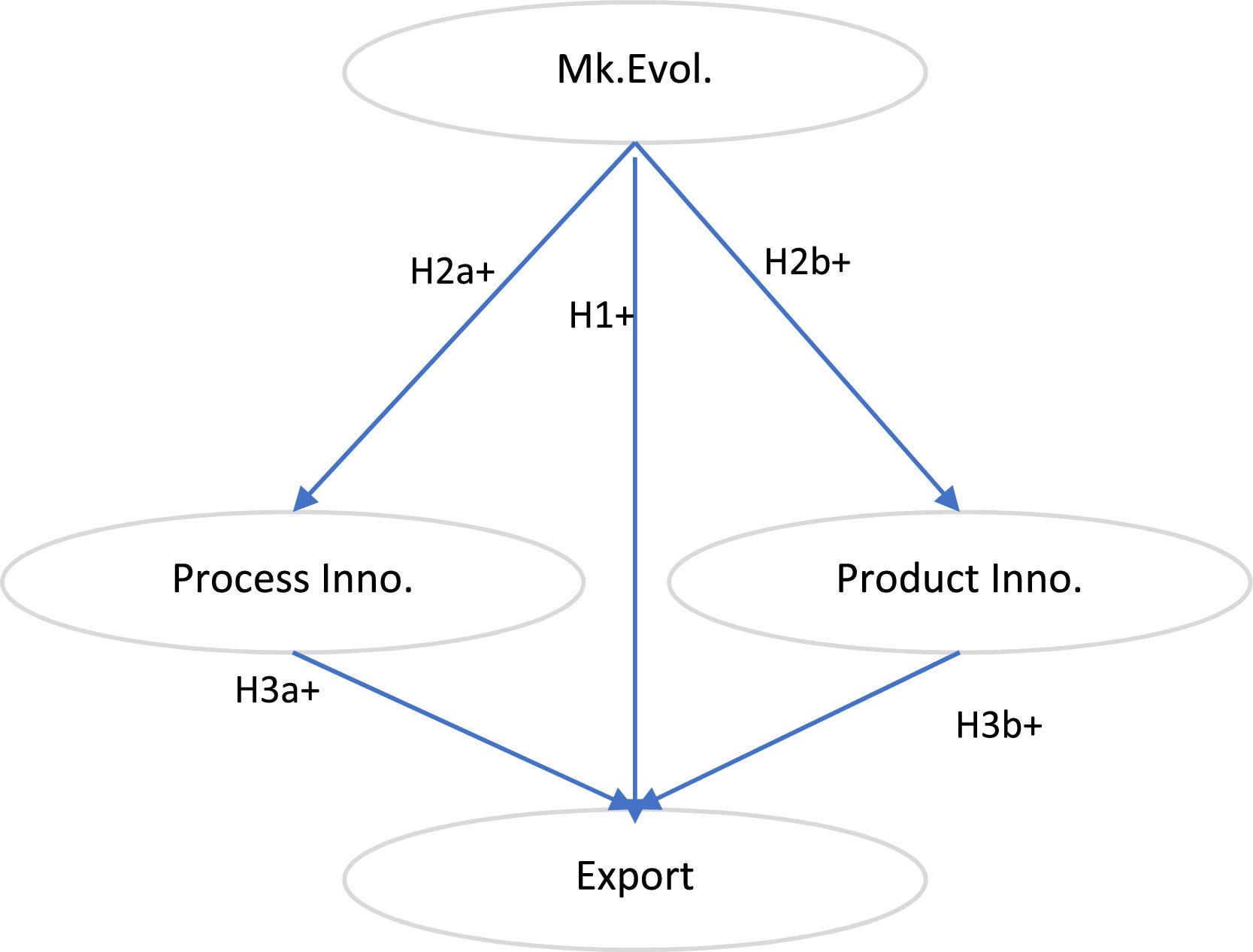

Fig. 1 represents the theoretical model.

3Research methodologyThis study analyzes data from the Survey of Business Strategies (SBS) performed by the SEPI Foundation, which collaborates with the Spanish Ministry of Industry to design, control, and administer the survey. The SBS is a panel database that has been gathering data since 1990. Its main goal is to generate information with a panel structure to enable analysis of changes and incidents, and evaluation of organizations’ strategic decisions. This study uses data on 788 family firms for 2012–2016. The longitudinal data in the SBS enable us to analyze the influence of process and product innovation on how export results progress over time in family firms.

To design the theoretical model, we used Partial Least Square (PLS) and SmartPLS software (Ringle et al., 2014). The use of PLS-SEM has increased significantly in social science fields and firm management (Hair et al., 2019). We use variance-based PLS-SEM because this method is recommended for exploratory studies (Hair, 2017). PLS-SEM also enables estimation of models with nonlinear and quadratic interactions (Ahrholdt et al., 2019). Because the PLS-SEM technique is more flexible, it permits measurement of constructs with one or more items (Henseler et al., 2015), as well as use of formative and reflective variables. Our model includes variables measured as a composite construct by various items (Benitez-Amado & Walczuch, 2012; Hair et al., 2019). Further, PLS-SEM enables us to analyze different weightings (Hair et al., 2012) of two variables in our study: process innovation and product innovation. PLS-SEM is also considered as a good method for analysis of secondary data (Benitez-Amado & Walczuch, 2012), which enables us to explore causal relationships that the literature has not defined theoretically (Hair et al., 2019). Finally, PLS-SEM has been used in other prior studies that analyze panel data (Alos-Simo et al., 2020; Benitez-Amado & Walczuch, 2012; Johnson et al., 2006).

Our model uses the following variables:

Domestic market evolution. This variable provides information about the moment in which the family firm finds itself relative to its domestic market. It asks firms to respond to questionnaire items about how they perceive the market. The variable was made operational through the distinction between levels ranging from market recession to market expansion and therefore identifying an intermediate level such as stability. This categorization is based on the distinction between turbulent and stable market environments used by Pérez et al. (2019), but we add recessive markets. The response options for this variable are 1="recessive," 2="stable," and 3="expansive." We use data for the years 2012–2016.

Process innovation. The questionnaire provides 3 variables that gather information on whether the firm has incorporated any significant change(s) in the production and/or distribution process. Specifically, it asks about the introduction of new techniques and/or methods, new machinery and equipment, and new computer programs linked to industrial processes (Díaz-Díaz et al., 2008; Fossas-Olalla et al., 2015). We measure the variable process innovation as a composite construct—as an aggregate of ingredients (Benitez et al., 2020), using the data for the 5 years analyzed.

Product innovation. We use 3 variables that ask whether the firm has performed innovations in completely new products or modifications that are very different than those the firm was previously producing. The questionnaire asks whether the firm has incorporated new materials, new components, or new intermediate products; and whether the product fulfills new functions (Díaz-Díaz et al., 2008; Fossas-Olalla et al., 2015). This variable is analyzed as a construct composed of 3 items (Benitez et al., 2020). We use the data for the 5 years analyzed.

Percentage of sales from export. For this variable, we use the percentage of exports that the firm made over its total sales in monetary units (Vissak et al., 2018). The results of the variable thus analyze the weighting of export sales relative to the organization's total sales.

The average number of employees does not change drastically in the 5 years of the study: The average in 2012=144.36, in 2013=132.72, in 2014=136.47, in 2015=141.87, and in 2016=130.46 employees. The average age of the 788 family firms in the study was 38.03 in 2016.

4Analysis and resultsWe construct the measurement model (external model) and analyze the CFA to determine the model's fit. As our model uses formative measures that do not require the variables observed to correlate for each construct and assumes that they are free of error, it is unnecessary to test for reliability and validity (Bagozzi & Yi, 1988). Following the analytical procedure described by Hair et al. (2017), we first examine the convergent validity of the formative constructs by performing a redundancy analysis for each construct (Hair et al., 2019). Table 1 presents the results of the redundancy analysis. We detect no problems of convergent validity, since all of the path coefficients are above 0.70 (Hair, 2017). We then analyze the multicollinearity of the measurement model indicators using the variance inflation factor (VIF). Table 2 shows that no value is greater than or equal to 3.0 (Hair et al., 2019).

Analysis of convergent validity.

Note: n = 788.

Values of loadings and weights for the model.

Note: n = 788; ***p < .001; **p < .01; *p < .05; t<0.1.

Next, we evaluate the significance and relevance of the formative indicators (Hair et al., 2019). As the values for the external weights are standardized, we can compare them to each other. The results show the relative contribution of each weight to the construct (Hair, 2017). We estimate the weights and loadings for the variables process and product innovation (Table 2) and confirm their significance (Hair, 2017).

To evaluate the structural model, we calculate the model's overall goodness of fit (Benitez et al., 2020; Henseler et al., 2016). We confirm good fit of our data to the model through the standardized root squared residual (SRMR)=0.058, unweighted least squares discrepancy (d_ULS)=1.797, geodesic discrepancy (d_G)=0.756, Chi-square=2042.338, and normed fit index (NFI)=0.781.

We perform a bootstrapping procedure with 5000 resamplings. Following the procedure described by Hair (2017), we evaluate collinearity of the structural model (data available from the authors) and confirm that none of the collinearities of the relationships between variables exceeds 3.0 (Hair et al., 2019). We then evaluate the significance and relevance of the structural model. Table 3 presents the path coefficients and confirms the sign. Next, we evaluate R2, which represents the amount of variance of an endogenous construct explained by the predictive variables. For Chin (1998), levels of 0.67 indicate substantial scope of explanatory power (0.33 substantial, 0.19 weak). The value of R2 is related to context, and some disciplines consider values of 0.10 as good (Hair et al., 2019). We also evaluate the effect size, f2, which indicates the ability of an exogenous construct to explain an endogenous construct (Hair et al., 2019). Cohen (1988) suggests that 0.15 is a small effect, 0.15–0.35 a moderate effect, and greater than or equal to 0.35 a large effect. We then evaluate predictive relevance, Q2, a measure confirming that the variables shown in the table take values greater than 0.

Direct effects, f2, variance explained, R2, and Q2 test for endogenous variables.

Note: n = 788; ***p < .001; **p < .01; *p < .05; t<0.1. For n = 5000 subsamples: * p < .05; ** p < .01; ***p < .001 (based on a Student's t distribution t(4999), one-tailed); t(0.05; 4999) = 1.645; t(0.01; 4999) = 2.327; t(0.001; 4999) = 3.092.

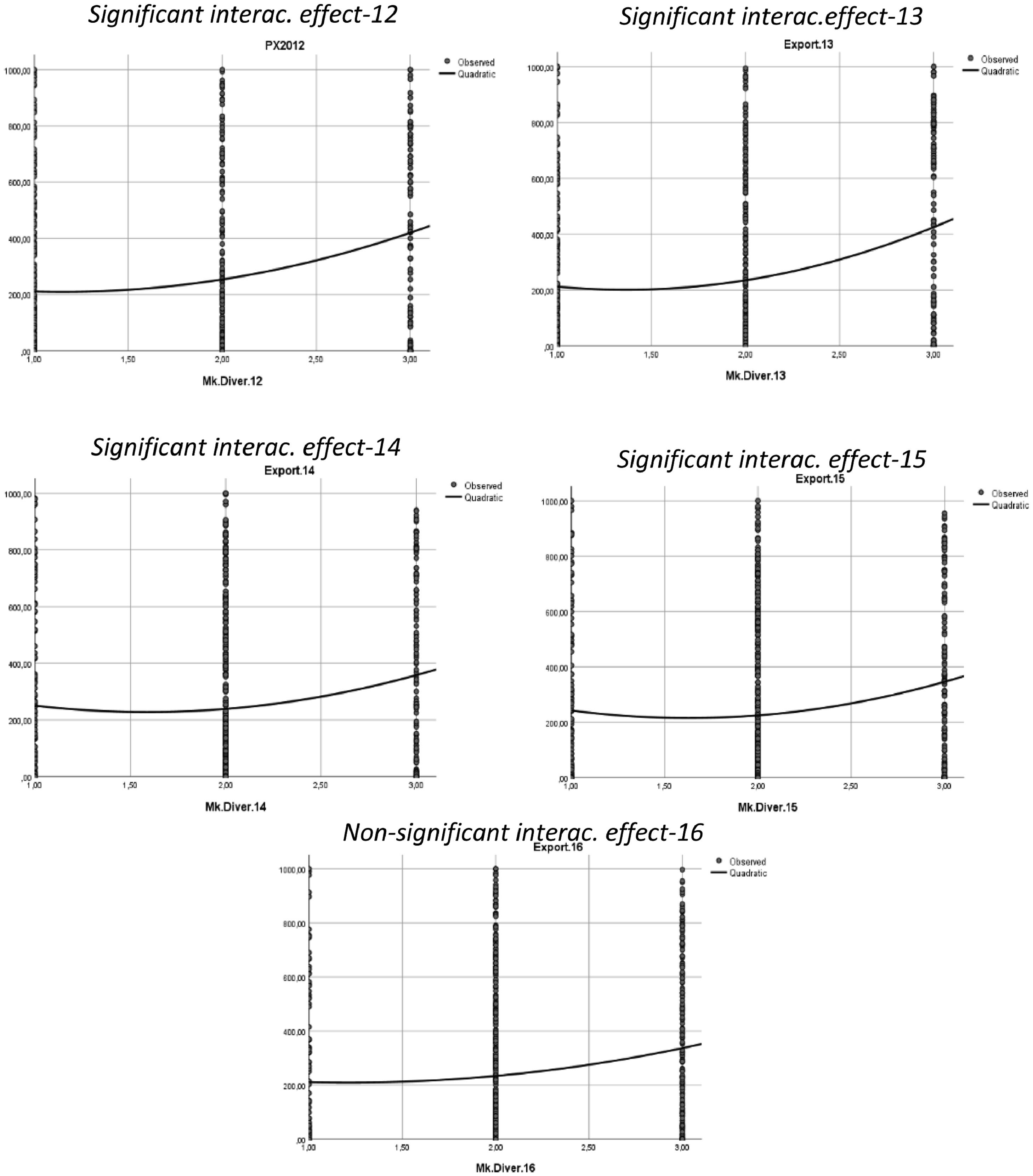

Fig. 2 presents the graphs from the slope analyses of the quadratic effect of the variable market evolution on export results. Not all variables maintain a straight-line linear relationship (Eisenbeiss et al., 2014). We observe the trend to analyze whether the dependent and independent variables decrease to a minimum, after which both variables increase (Haans et al., 2016). We estimate the quadratic effect of the predictive variable on a dependent variable, according to two-stage route choice modeling. First, we use the point values of the latent and predictive variables without the quadratic effect. Second, we include the quadratic effect and predictive variable (Henseler et al., 2012).

We also analyze the size of f2, the interaction term. The effect of the size f2 shows how much the interaction contributes to explaining the dependent variable in the context of the interaction. It does so by comparing the results when it is included in or excluded from the PLS (Kenny, 2015). Ahrholdt et al. (2019) argue that effect sizes can be more realistic and classify them as 0.005, 0.010, and 0.025 for small, medium, and large effects. We determine the size of the interaction effect by calculating R2 for the model with and without the interaction and analyze R2 for the model with and without interaction. We confirm that f2 (year 2012)=0.006, f2 (year 2013)=0.012, f2 (year 2014)=0.007, f2 (year 2015)=0.010, and f2 (year 2016)=0.003.

Analysis of the hypothesized mediations in the model demonstrates the indirect effects and significance of these effects in Table 4. In the mediations, one variable influences the relationship between two constructs, causing intensification of the relationship.

Indirect mediation effects.

Note: n = 788; ***p<.001; **p<.01; *p<.05; t<0.1. For n = 5000 subsamples: * p < .05; ** p < .01; ***p < .001 (based on a Student's t distribution t(4999) one-tailed); t(0.05; 4999) = 1.645; t(0.01; 4999) = 2.327; t(0.001; 4999) = 3.092.

The results of the hypotheses proposed in our model show that H1, which studies the effect of market evolution on export results, is positive and significant for four of the five years analyzed. This result demonstrates a market tendency to influence export results that continues over time, as predicted. Thus, family firms have better export results in recessive and expansive markets and worse results in stable environments.

This study does not support Hypotheses H2a and H2b, which analyze the influence of the market on innovation in family businesses. H2a is positive and significant in only two of the five years studied, and H2b is not significant in any of the five years. These results suggest that, while process innovation is more relevant than product innovation, innovation in family businesses is not influenced by domestic market evolution.

H3a, which examines the mediation of process innovation in the relationship between market evolution and export, is not supported. Nor do we obtain significant results for H3b, which analyzes the mediation of product innovation in the relationship of market evolution to export. Although the previous literature considers innovation as a necessary strategy to ensure the future of family businesses, our results do not indicate that this strategy influences their propensity to export.

5DiscussionAlthough globalization and the opening of markets has been confirmed as a challenge for family firms, little literature illuminates internationalization processes in these firms (De Massis et al., 2018) and insufficient research has been performed on the reasons family firms engage in export (Sánchez-Marín et al., 2020).

Our study focuses on the influence of market evolution on export sales in family firms. To analyze the evolution of our theoretical model over time, we use panel data from 788 family firms for a 5-year period, 2012–2016.

This study demonstrates that: (1) for family firms, recessive and expansive markets have a stronger influence on export sales than do stable environments; (2) market evolution does not influence either process innovation or product innovation in their relationship to export propensity; and (3) innovation does not mediate in the relationship between market evolution and export. That is, family firms are not influenced by either product or process innovation when implementing export strategies.

The first and most significant finding of our study involves the relationship between the domestic market situation and propensity to export. Much of the literature has argued that family firms do not bid for export (Fernández & Nieto, 2005; Onida, 2004) and that directors of family firms resist exporting (Majocchi et al., 2018) because managers from the family often lack related experience and competences (Cerrato & Piva, 2012). Some authors also believe that family firms have fewer resources (Merino et al., 2015). Other studies indicate that family firms are more likely to export, however, since export uses fewer resources due to the export market's lower risk (Santulli et al., 2019). Export is a very flexible internationalization strategy (Klaus et al., 2007), and specific idiosyncratic characteristics of family firms can push them to open markets far from their geographic niche of origin (Sánchez-Marín et al., 2020). Our study provides a possible explanation for this controversy. We suggest that family businesses, which are flexible and adaptable, are intensely affected by the evolution of the domestic market. These opposing perspectives are possible depending on the characteristics of the domestic market family businesses face when exporting.

The literature has argued that the best markets for developing firms are expansive environments or growth markets (Proaño, 2017) because these markets generate more opportunities (Audretsch et al., 2002). This perspective does not explain the situation of markets with lower growth, however. Our study asks whether the market leads to changes in the behavior of family firms beyond the linear relationships of environments to growth and development of firms already examined in the literature (Sánchez-Marín et al., 2020).We analyze the relationship between evolution of the domestic market and the benefits of export for family firms. The academy has argued that the relationships analyzed sometimes diverge from a linear relationship (Ahrholdt et al., 2019), and our results indicate that the relationship between domestic market evolution (based on our proposed operationalization) and export volume is not linear. These results require further reflection and nuance. The literature has shown differences in the behavior of family firms. Whereas some family firms do not bid for strategic innovation, others commonly renew strategies and undertake new initiatives (Randolph et al., 2017). The literature has proposed that external contexts influence family firms’ innovations (Chirico & Bau, 2014) but has not clarified the influence of these contexts on exports.

Our study thus suggests that family firms implementing export strategies show one behavior during periods of recession and expansion and another than during times of stability. Firms opt to enter foreign markets for either passive-reactive reasons (driven by unfavorable conditions) or proactive motivations (influenced by internal factors) (Tatoglu et al., 2003). We propose that family firms bid for new, unknown geographic environments in times of market expansion. We also argue that family firms venture to export in times of recession. That is, family firms export, or start more initiatives, in times of expansion because the opportunities are clear and in times of recession as a reaction to need.

Second, although the literature has shown the importance of innovation for family businesses (Broekaert et al., 2016; et al., 2012), some studies indicate that innovation is difficult for them (De Massis et al., 2015b), a finding in line with ours. We found that market developments – recessive, stable, or expanding – do not contribute significantly to innovation in family businesses. Although the literature proposes that turbulent or stable environments enhance or limit innovations (Pérez et al., 2019), our data do not support either position for the family business. Despite the importance the literature attributes to innovation in family firms (Kraus et al., 2012) and to these firms’ preparation in entrepreneurship capabilities (Cassia et al., 2012), our results indicate that innovation does not influence export results. This finding may be explained by the fact that export is a more secure bid for family firms, as it involves less risk and fewer family resources (Kraus et al., 2017). Family firms probably consider export a faster, more agile option (Kontinen & Ojala, 2010).

Third, our research contributes to the study of process and product innovation by proposing a relationship between domestic market evolution and export results. Our work aims to analyze the two main innovations (process and product) to assess the idiosyncratic competences of family businesses (Reisinger & Lehner, 2015). Although the results indicate more influence of process innovation than of product innovation, neither type is significant. These results do not therefore support the hypothesis that innovation (process or product) influences the relationship between situation of the domestic market and export volume.

6ConclusionOur study contributes to the literature on the export strategies in family businesses. More specifically, it focuses on the influence of market evolution. We analyze the impact of market evolution—recessive, stable, and expansive—on the export results of family firms. We draw the following conclusions from this study.

First, some of the literature suggests that export is not a successful strategy for family businesses. Our results qualify these previous contributions, however, indicating that family businesses have different behaviors depending on the moment of market evolution. Our findings show that family firms have better export results in recessive and expansive markets than in stable ones.

Secondly, since little existing research is based on longitudinal data, this study attempts to determine whether the results obtained remain consistent over time. We used panel data from 788 family firms for the years 2012–2016. The results show that the behaviors analyzed do remain constant over time for family businesses. Using panel data over a five-year period helps to make the results more rigorous than they would be if only cross-sectional data studies were used.

Thirdly, this study reflects academia's concern for how family businesses perform innovation. Our results show that process innovation is more significant than product innovation. Furthermore, our examination of data on the influence of innovation on the relationship between market evolution and export indicates that innovation is not significant in this relationship. This finding suggests that family firms opt to export rather than innovate in agile and rapid markets.

This research also has some limitations and opportunities for future research. As our results come from secondary data, the researchers cannot determine the items analyzed. Future research should aim to determine and specify deeper differences between process innovation and product innovation in family businesses. Similarly, as this research has not identified differences between family businesses, given their heterogeneity, it would be interesting for future research to analyze whether behavioral differences exist between family businesses.

This study has significant implications for professionals and governments. The relationship identified in the results indicates that family businesses export more in recessive and expansive times. It would be interesting to determine whether family businesses also show better economic export data when the domestic market is stable. Furthermore, when family businesses export, they do not rely only on innovation to generate better export results. Managers of family businesses may find it difficult to focus available resources and must choose between increasing exports or investing in innovation. Managers could try to activate innovation and export strategies simultaneously to cope with globalization of markets. Governments and family managers must consider what contexts they should generate to enable family businesses that choose to export to implement innovation that obtains better economic results. Faced with this reality, governments should promote policies that help to combine innovation strategy and export strategy for family businesses.