The presence of the real estate investment trust in the Spanish real estate market since 2013 has led a significant number of the housing stock being offered for rent in the most popular cities around the country. In the specific case of the Costa del Sol, it is necessary to evaluate the participation of these companies in the establishment of a stable business fabric of housing for rent as well as in the development sector for home sales. In addition, its membership of international financial circuits means that the effect of financing the economy on urban environments has to be taken into account.

In order to assess the weight of the real estate investment trust in the development of the Costa del Sol, we turned to data on housing developments for sale provided by the main Internet real estate portals are used, comparing their market share with that of other national and local players The main conclusion is that this type of company has not opted for professional marketing of housing offered for residential rental in the province, but nevertheless, they have become the leading companies in the real estate development sector in the province by number of homes offered.

To achieve this objective, this document has first opted for a study of literature review that includes the contributions of Spanish and international social scientists on the processes of transmission of financial capital to the real estate sector, the characteristics of financial actors and their patterns of behavior, the factors that enable and facilitate their activity; as well as the transformations that have undergone today and that have allowed them to expand their investments, concluding with the economic and social consequences of all this.

Likewise, this analysis has also been deepened with the main characteristics of RETTs have, also attending the main magnitudes and figures related to it, provided by Spanish public institutions.

Finally, current data have been obtained on the new construction market of real estate of the Costa del Sol, using reports and statistics prepared by business study centers, and professional organizations in the sector. This information has allowed to know the number of homes built and put up for sale in recent years, as well as their geographical distribution or the nature of the real estate developer, which has allowed to show the main characteristics of this market.

These contributions and the data on the number, location and origin of the real estate developer of new construction homes, confirm the influence that the international financial agents have on the real estate sector of the province of Malaga, with an important participation in the tourist sector, focusing its activity on the real estate development of housing sales, while it has a marginal role in the supply of residential rental housing.

Taking advantage of the dynamics of the growth of the tourism sector, REITs have been the pioneers of the growth of the real estate sector in Malaga in the last four years, becoming the companies with the greatest market power and the greatest number of homes built in the sector, above those built by national and local housing developers. However, the goal set by the public sector for REITs to offer a professional rental housing stock has not been achieved.

Since 2014, we are seeing a growth in real estate development activity in Spain, especially in large urban centers and major resorts, attracting financial capital in search of returns not available in alternative investments. As a consequence, in 2018, real estate investment accounted for 5.5% of the GDP and 550,000 sales transactions, in spite of 500,000 unsold homes resulting from the geographical heterogeneity of the expansion of housing activity (Naredo, 2019). This heterogeneity is reflected in the existence of local markets with significant investment activity, rising prices and construction of homes, such as in Madrid, Barcelona, the Canary Islands and the Mediterranean area. In other areas, such as inland regions with smaller weights of housing activity in their economies and greater remoteness from large urban centers, these trends have been more moderate (Alves & Urtasun, 2019).

It should be borne in mind that the Spanish real estate sector has been a traditional privileged destination for financial investment flows. These flows reached their zenith in the period 1999–2007, when historical investment records were reached in terms of transactions, profits and number of homes built. After the 2008 housing bubble burst, the sector experienced a period of decline, with drops in all the parameters that serve to measure its activity and strength, such as employment, units sold, units built, price level, number of transactions, amount of investment, and number of companies, while increases were seen in less favorable parameters, such as the number of evictions and business closures, unemployment, and the number of unsold homes.

The state government was thus faced with three issues: paralysis of the real estate sector and recession of general economic activity; the absence of a business fabric specializing in offering rental housing and a low-presence regime throughout the country; and the need to address the stock of unsold housing, particularly that existing on the balance sheets of Spanish financial institutions, which were instructed by the European Central Bank to drastically reduce their housing exposure according to the conditions laid down in the bank restructuring process of 2012. In response, the government decided in the same year to amend “Ley 11/2009, de 26 de octubre, por la que se regulaban las Sociedades Anónimas Cotizadas de Inversión en el Mercado Inmobiliario” (Law 11/2009, of October 26, regulating Listed Anonymous Companies for Investment in the Real Estate Market) with “Ley 16/2012, de 27 de diciembre, por la que se adoptan diversas medidas tributarias dirigidas a la consolidación de las finanzas públicas y al impulso de la actividad económica” (Law 16/2012 of 27 December, adopting various tax measures aimed at consolidating public finances and boosting economic activity) (Boletín Oficial del Estado, 2012), with which they sought to address these issues by promoting the real estate investment trust (REIT) to attract financial capital to the Spanish real estate sector and to boost the country's overall economy.

This reform in 2012 sought to achieve what the measures contained in the 2009 Law had not achieved, which was the creation of a stable network of large companies that were dedicated to acquiring property for use under the rental formula. To accomplish this, he extended the regulatory and tax advantages available to those investors who wanted to opt for this type of business.

However, although the main activity of REITs is to make real estate available for rent, these companies, as well as the national and international investment funds that often contribute to their share capital, are engaged in the production and commercialization of homes through the establishment of and participation in companies that promote real estate projects. Such projects promote works in spaces that they consider capable of generating high profitability with the financial collaboration of national banks. Despite the large economic resources available to these companies, the existence of low interest rates on promoter loans granted by these entities, allows them to obtain a very favorable financial leverage, keeping their capital available for new land investments where future large capital gains can be obtained.

Therefore, these real estate investment companies and investment funds operating in the real estate market can make a profit in two possible ways: by operating real estate rentals, mainly in the form of housing, premises, offices and shopping centers; and from the benefits obtained from participation in developer companies that are dedicated to the construction and sale of housing.

Focusing on these two areas of practical action of these companies in the province of Malaga, this document attempts to measure the importance and weight of real estate investment trusts in the offer of housing for rental and, above all, in their participation in general real estate developer activity in terms of homes built, geographical location, and typology.

This will be possible to determine whether the objective set by the public authorities to provide the country with REITs, that offer a professionalized residential rental housing park, has met their expectations, or whether, on the contrary, the tax incentives of the public administrations have served to allow these companies to build homes in tourist areas of the country, with high expectations of benefits.

To achieve this objective, this document has first opted for a study of literature review that includes the contributions of Spanish and international social scientists on the processes of transmission of financial capital to the real estate sector, the characteristics of financial actors and their patterns of behavior, the factors that enable and facilitate their activity; as well as the transformations that they have undergone today and that have allowed them to expand their investments, concluding with the economic and social consequences of all this.

This analysis has also been deepened with the main characteristics of REITs, based on data on their main magnitudes provided by Spanish public institutions.

Finally, current data have been obtained on the new construction market of real estate of the Costa del Sol, going to reports and statistics prepared by business study centers, and professional bodies in the sector. This information has allowed to know the number of homes built and put up for sale over the last few years, as well as their geographical distribution or the nature of the real estate developer, which has allowed to show the main characteristics of this market.

These contributions and the data collected and systematized, confirm the influence that international REITs have on the real estate sector of the province of Malaga, Spanish province with a great importance of the tourism sector. These companies have fulfilled one of the objectives of their legislation in Spain, the sanitation of Spanish financial institutions, thanks to the purchases of urban land that they have made to them, and which have been aimed at the construction of new homes.

The structure of the analysis will begin in Section 2 with the relation of materials and methods used, which information has been obtained from the real estate portals by internet. In Section 3 it is included a review of the scientific contributions made to date relating to the financing of the real estate sector, and the economic and social implications of the presence of the international financial sector in the real estate sector and in the general economy.

This section will detail the main financial agents that participate in collective investment, devoting their resources to the real estate sector, with special attention to REITs. In Section 3, also the situation of the real estate developer sector in the Province of Malaga is described, including the evolution of the number of homes built in recent years, the geographical areas where they have grown the most, and finally the real estate developers who have participated in the same.

Finally, the main contributions of this work will be collected in the conclusions section. Specifically, it will be shown that real estate developers lead the market in the sale promotion of new construction in an area of great international tourist importance such as the Costa del Sol. This leadership is very prominent in front of local and national developers, which have been displaced by them. This shows that international financial investment channels have used the developer companies created by REIT as instruments to monetize their capital in the tourism and real estate market. However, RETS have a reduced presence in the residential rental market of the selected locations on the Costa del Sol, in such a way that the objective of the public authorities to create a stable sector of professionalized companies in this tourist area has not been achieved.

2Materials and methodsAs mentioned above, the main objective of this document is to know the participation of the developers belonging to REIT in the developer market of the Costa del Sol.

To this end, first of all, information has been obtained on the number of newly built homes placed on the real estate market during the period under study, provided in this case by the Official College of Architects of Malaga, with data on fixed and completed housing (http://coamalaga.es/estadisticas/).

Then it was necessary to know data on the homes promoted on the Costa del Sol, and the total housing built in the new construction developments that still have unsold homes as of August 2019, were obtained from real estate portals of Idealista, Fotocasa y Obranuevaenmalaga, leaders in the sale of real estate through the Internet.

This included all the offers available in the province. Specifically, this data can be found in the following locations: Fotocasa.com, real estate portal, houses and flats for sale of new construction in the province of Malaga. https://www.fotocasa.es/comprar/obra-nueva/malaga-provincia/listado; Idealista.com, real estate portal, listing of homes and flats for sale of new construction in the province of Malaga https://www.idealista.com/venta-obranueva/malaga-malaga/; and, Obranuevamalaga.com, listing of homes and flats for sale of new construction in the province of Malaga. https://obranuevaenmalaga.es/.

The information provided by these real estate included detailed data of real estate promotions by locality of the Costa del Sol, that, when collected and treated in an aggregated way, allowed to know the number of offered houses, the typology of these, their size and price per locality and by the nature of the real estate developer company.

There are several methodological options for an exploratory or descriptive study such as the one that this document performs.

Comparing it to other methods that also have extensive scientific support, such as interviews with experts in the real estate sector, or the Delphy method, it has been chosen to take advantage of the facilities and detail of the information obtained by previous sources through the Internet, together with the theoretical contributions made in scientific publications by renowned social academics.

3Financial market influence on housing: general characteristics of collective investorsSpanish housing has historically been a preferred destination for financial capital of all kinds and backgrounds. Both small and large investors, using domestic and international capital, have seen housing as a source of income and wealth, characterized by safety and stability (García Montalvo, 2007). Thus, at present, two types of major investors can be found: small investors, mainly national, who in view of the fall in the profitability of their assets deposited with financial institutions as a result of the drop in the official interest rates established by the European Central Bank, chose to devote part of their savings to the purchase of property by the European Central Bank; and, large international financial corporations, with large liquid financial resources in search of profitable investment destinations, employing filial in their destination countries, with a short-sighted view (Naredo, 2019).

The existence of companies of different natures and the facilities that allow the freedom of movement of global financial flows in recent decades has led to the importance of this type of global financial firm to the national real estate sector. The formation of a global financial market transformed housing economic policy, highlighted in 2000 by the reduction in official interest rates by the world's major central banks, which facilitated an increase in global liquidity partly targeted to the housing market (Stigliz 2010). Thereafter, expansion of local housing markets occurred in collaboration with regulations that reduced state protection of housing, thus expanding the business of large international financial companies, but at the cost of widening social inequality and gentrification (Hernández Pezzi, 2018).

This global financial market is mainly represented by investment banks, real estate investment companies and real estate investment funds, which manage private equity funds of institutional investors and capital from financial institutions raised from their retail clients investing in real estate directly, or indirectly, through the acquisition of shares of real estate companies (Fields & Uffer, 2014).

3.1Relationship between finance and real estateThe interrelationship between finance and real estate has been transformed in recent decades, thanks to the possibility of converting properties into liquid goods that allow the generation of income in the short term thanks to its easy transmission via the stock market. This process was facilitated by legislative and public policy measures that promoted the freedom of capital movement, and a decrease in the construction of social public housing (Rodríguez López & López Hernández, 2011). New financial products were subsequently developed by professional private institutions operating in the rental market, which created investments with great long-term security due to a stable institutional framework.

Traditionally, urban growth and finance have been closely related, but in recent decades this relationship has intensified, due to the high returns obtained in the development of urban environments (Sanfelici & Halbert, 2018). Thus, housing markets offer business opportunities to these companies through price increases, rental incomes and the sale of properties to new investors. In addition, they can maximize their capital returns through low interest rates, which make them less dependent on the benefit of a particular project thanks to low-cost leverage. Typically, these financial firms usually sell their investment, with positive returns within one to seven years (Fields & Uffer, 2014).

The financing of the economy and its relationship to the real estate market has even extended to aspects of the daily life of individuals and their assets, including the commodification of their way of living (Marazzi, 2009). This global commodification has led to real estate being a destination for capital surpluses, a development facilitated by the drop in profitability of productive activities and the consequent search for alternative forms of cost-effective investment, such as that offered by the real estate sector (De Mattos, 2007).

As a consequence, the real estate sector has become a destination for international investment that seeks to diversify its investment portfolio, with increasing demand in the main urban centers globally due to increases in population attracted to cities’ way of life and job opportunities. The resulting financial flows have had an unequal response in different countries. Thus, in Australia and Canada, possible restrictions on the influx of foreign capital are being explored because of its impact on access to housing. Since 2010, restrictions have already been implemented in Asian countries such as Singapore and Hong Kong. By contrast, in countries such as Spain, Greece or Turkey, this investment is promoted by their governments (Rogers & Yee Koh, 2017).

A global real estate market is thus being created. Financial firms with real estate investments are becoming "global corporate owners" in states such as Spain, where the real estate crisis of 2007 resulted in an abundance of low-priced housing and many revaluation prospects that they acquired from financial institutions. In many cases, this housing belonged to families who lost their homes in foreclosures (Beswick & Penny, 2018).

The strategy that follows the investment policy of such investment funds is characterized by opportunism, high risk and high profit perspectives, counting on resources and power over the market that individual investors do not have, thanks to which they buy high volumes of housing (Wijburg, 2019).

With all these ingredients, traditional players participating in the real estate market, such as national developers, investors and financial institutions, are being replaced by large funds and foreign capital real estate investment companies. The latter carry out financing and promotion of real estate projects, but unlike in previous periods, focus on areas of high purchasing power or/and high yields, with less participation of national actors (Beswick et al., 2016).

In addition, within each economy, investment flows are directed to places with better prospects of revaluation and profitability, such as urban areas with some economic development, including tourism, or spaces with a recent experience of revaluation. Financial capital can thus connect these cities in an international network that modifies their existing economic base, with a focus on real estate investments (Wijburg, 2019).

However, within these selected cities, international investors have directed their attention in the form of real estate investments to areas in which the population has the greatest purchasing power and where tourists are located, paying reduced attention to the residential areas of the most disadvantaged population segments (Janoschka, 2018).

However, these more disadvantaged segments of society have also seen real estate investment trust direct attention to a type of housing of great importance to them: social housing. This interest was expressed through the acquisition in Spain, starting in 2013, of different packages of public social housing, at a time of reduced overall house prices and increased rental demand. These public housing units were officially protected housing in large cities, such as Madrid and Barcelona, where investment funds such as Goldman Sachs and Blackstone acquired 4860 flats in 2013. For large real estate investment companies, this represented an opportunity to purchase homes below their market value, many of which had option-to-buy rental contracts, for values that were twice as much as those disbursed to the administration (Vives-Miró & Rullan, 2014).

Therefore, the actions of companies investing in the housing market may have social consequences, contributed to by the action of state laws and executive powers facilitating the processes of urban financing by providing the REITs with the role of mediating the private flows of financial capital towards the urban environment, supporting the expansion of financial markets (Nappi-Choulet, 2013), and delegate the management and financing of urban space to capital markets and their financial intermediaries (Moreno, 2014). These innovations make housing one more instrument that is traded in global capital markets, an issue that has effects on everyday cultural and social life (Fields, 2018). These include the influence on rental prices of smallholders, which rise at a faster rate than before the actions of such societies, and the state regulations that promote them, such as has been demonstrated in other European countries (Wijburg, Aalbers, & Heeg, 2018).

In this way, the scientific studies carried out so far, have been able to detect and describe quite correctly the process of commodification of housing as a result of the investment activity of the financial sector, and the implications for urban environments and the social sectors that reside in them. But after this general analysis, it is appropriate to review the research work on the actors and instruments used by the international financial sector to invest and intervene in the real estate market.

3.2Collective investment in housingCollective investment in the real estate sector is highly developed in Anglo-Saxon, Asian, and European countries, although until 2009 it had not had acceptance in Spain, with its legislation currently being very similar to that of its neighbors. The most advanced regulatory development can be found in the US where the freedom to operate investment funds and companies is greater than that of other countries, although they are closely monitored by the regulators. (Rabadan Formies, 2009).

In Spain, channeling of savings into collective investment in the real estate sector is mainly done through real estate investment trusts, which have provided their owners with an average annualized average return of 9.9% in recent years, well above other stock market investments (Spanish Stock Exchanges and Markets, 2019), although there are also real estate investment funds. REITs combine real estate investment and portfolio investment, with worldwide market capitalization of USD 1.851 billion at the end of the first quarter of 2019 (EPRA Global REIT Survey, 2018), concentrated in America, Asia and Europe.

In Europe, financial development is less and varies between the Member States of the European Union, although regulatory convergence is taking place as a result of the transposition of Community directives. In addition, mortgage financing in the European Union has become more sophisticated, with specialization of financial intermediaries in the sector, and the development of the mortgage asset market and its connections (Newell & Marzuki, 2018).

In the Spanish case, legislation of real estate investment funds and real estate investment trusts is relatively recent, and subject to frequent changes to make this form of investment more attractive to institutional or individual investors. The intention is to collaborate in the creation of a professional rental market, a necessary condition for ensuring that these homes improve their competitiveness over property (Inurrieta Berruete, 2007).

As a consequence, the presence of foreign REITs dedicated to buying homes to rent has grown, professionalizing the business and sharing the market with traditional owners. However, the counterpart is an increase in rental prices to offset the costs of managing and maintaining homes, and the high rates of profits expected by their owners (Clark, Larsen, & Hansen, 2015).

Thus, in the face of modest amounts invested in real estate investment funds, real estate investment trusts have developed extensively in recent years. These companies are preferred for the international flows of real estate investment funds, as well as for financial flows in general, for allocation of their capital in search of high returns. The result has been an instrument used by Family Offices and large companies with important real estate packages to channel their real estate assets and improve taxation (Waldron, 2018).

Since 2014, assets managed by the real estate investment trusts, the recipient of the capital previously invested in real estate investment funds, have grown. By the end of 2018, there were 73 REITs in Spain with a capitalization of USD 26.7 billion, accounting for 3.8% of the Spanish stock market, less than in countries such as the Netherlands, Belgium or Greece, but greater than in the United Kingdom, France or Ireland (Bolsa y Mercados Españoles, 2019).

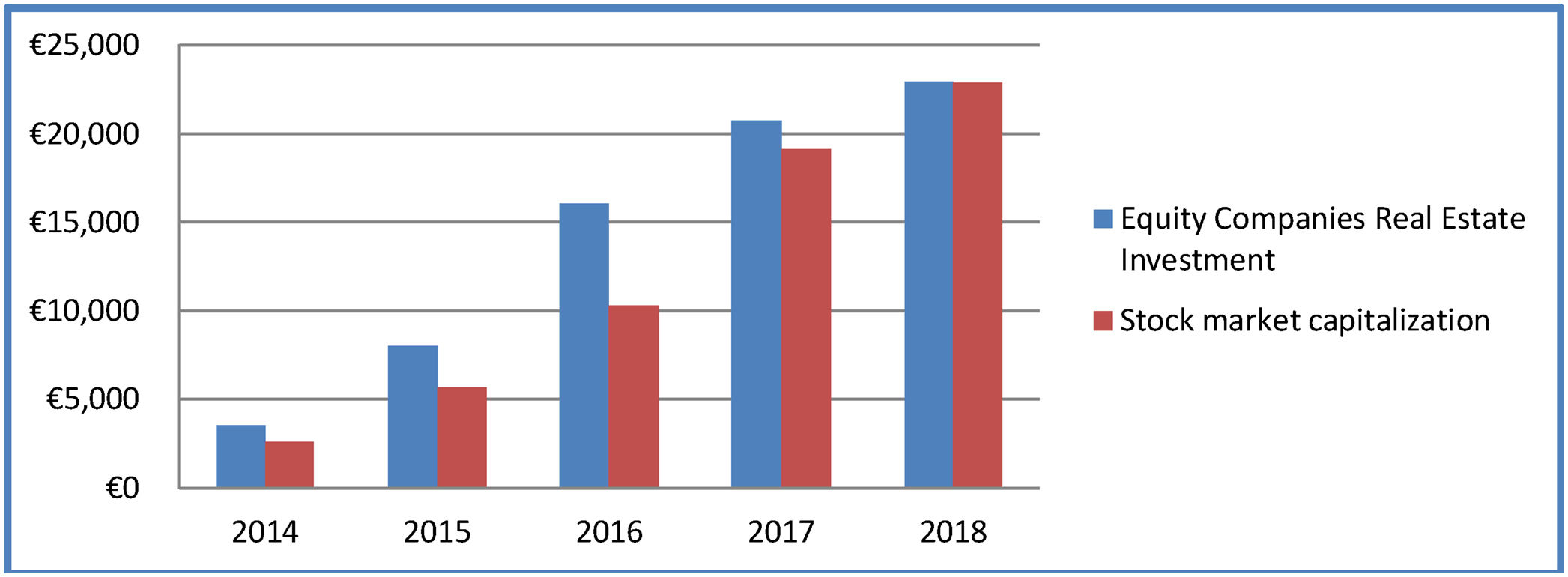

Fig. 1 shows the significant growth in the invested equity and market capitalization of these companies since 2014, just after the regulation reform of 2013; invested equity and market capitalization grew by 547% and 793%, respectively, in just five years.

Equity and stock market capitalization in thousands of euros of real estate investment trusts in Spain from 2014 to 2018.

The main agents and companies involved, as national and international investors and producers of real estate investment, will next be related and defined.

4Leading real estate finance agentsRegarding the type of agent that features in this sector, there is evidence of the role of home developers, financial institutions, small investors and housing claimants in the previous housing bubble of 1998–2007 (Etxezarreta Etxarri, 2010). However, it is of interest to determine if these agents are also leading the growth in house prices and level today, or if other actors, with a more discreet role in the past, are responsible for the current expansion.

Currently the relevant role lies in international capital, and to a lesser extent, when compared to the past, in national developers and financial institutions. Owners of international capital form partnerships with local developers, servicers and REITs, with large sums of capital to make real estate investments at times of liquidity restrictions and shortages, providing a high degree of professionalization and experience gathered in other countries (CBRE, 2016).

The large international investment societies and funds that turn their sights to the real estate sector around the world involve high-income people from traditionally rich countries, such as the United States, Japan and Western Europe, who have been joined in recent decades by the new fortunes of the so-called BRICS (Brazil, Russia, India, China and South African Republic). It is these high incomes that direct the policy and strategy of companies, even though they have the contributions of small investors who do not have decision-making power (Rogers, 2015).

These companies began to develop in the United States from 2008 and, as of 2015 they controlled 1% of tenants of 500,000 homes in the United States. For example, Blackstone, through its rental subsidiary Invitation Homes, controlled 50,000 rentals, American Homes 4 Rent controlled 38,000 homes, and Colony and Starwood Homes controlled 30,000 homes. In Spain, these companies have been active in the centers and areas with the greatest purchasing power of the country (Beswick et al., 2016).

Traditionally the supply of homes for rent in Spain was atomized and scarce, characterized by being mostly a market of private landlords (97% of the offer), with little presence of a professional offer only in recent years is beginning to change thanks to real estate investment funds and leasing companies (Inurrieta Berruete, 2007).

Thus, new companies have specialized in the professional management of housing blocks intended entirely for rent, producing a greater concentration of large owners of rental housing blocks (Observatorio Inmobiliario de la Construcción, 2017). The development of these real estate investment trusts, or real estate investment funds, is governed by the so-called principle of the "financial configuration" of the economy, according to which, the financial sectors predominate over the productive sectors. With an increase in connectivity and mobility, they have created a Global Urban Network formed by the large urban areas of the world which justifies the investments of large real estate investment companies in all these cities, which are seen as a single global market (Aalbers, 2008).

This financialization is intended to make a profit on its investments through a set of instruments, supported by state legislation: new financial products (swaps, derivatives, etc.); mechanisms for the functioning of financial markets on a global scale, whereby securitization enabled the transformation of real assets such as real estate into liquid, marketable financial assets in financial markets; and, finally, the introduction of new types of institutional investors such as investment funds, with advocacy capacity at national and global level, and which allow investors to diversify their risks by adding a new asset to their portfolios (De Mattos, 2016).

These financial instruments allow international capital to own real estate holdings through securities, rather than by direct and complete ownership of real estate, increasing leverage and volatility. Like any other type of financial secondary instrument that can be traded in the short term, such instruments fluctuate according to their own dynamics, which may be independent of those of the real asset. This situation allows the financial market to determine the real estate investment strategies of institutions and real estate developers, and to eliminate the link between the investor and the geographical location of the property (Van Loon, 2017).

This has two contradictory consequences. On the one hand, the real estate market is subject to greater uncertainty in the form of periods of growth and others of recession and decline. However, on the other hand, it is an incentive for the development of real estate projects that are necessary for productive economics. The financialization of real estate investment means that financial risk and benefit calculations prevail over the sense of geographical location and stability of the investment; the short-term outlook prevails over the long-term outlook; and real estate decisions are made from the financial hierarchies, and not from those of the real estate (Van Loon, Oosterlynck, & Aalbers, 2019).

These principles are present in the different types of companies in which national and foreign financial capital is invested in the real estate market, and particularly in the real estate investment trust.

4.1Real estate investment trusts in SpainReal estate investment trusts are real estate investment instruments whose objective is the acquisition, promotion and rehabilitation of urban assets for their lease, through shares of another REIT or other collective real estate investment institutions. From a tax perspective, they are taxed with a reduced corporation tax, with the obligation to share 80% of profits via dividends, which are also exempt. This tax treatment means that the holders of securities of these companies have very high prospects for fiscal economic benefits. In the 2017 tax year, tax benefits originating from these companies of EUR 260 million were accounted for by the Tax Agency, which implies a high reduction in tax collection (Estevez Torreblanca, 2018).

These companies allow participating investors to finance real estate projects in return for dividends sourced from the rents paid by the tenants of such properties enabling small investors to obtain returns on capital in sectors that needed large financial resources and limited liquidity before their appearance (Harris & Raviv, 1990).

This liquidity capacity in assets as liquid as real estate is one of the main attractions for investors: investments in REIT can be converted into cash in a similar way to stock market securities. Even for small investors, however, it offers the possibility of obtaining a steady return on leases that come from stable and durable contracts, with very high annual profit prospects as a result of the legally mandatory distribution of the same after-tax profit (Deloitte et al., 2015).

For the companies that own these real estate investments, this power gives them access to liquidity by selling some of their market shares. In practice, REITs have better access to credit compared to other types of real estate companies, which have been disappearing from the market (Roig Hernando & Soriano Llobera, 2015).

Tax cuts made in the 2012 reform of the legislation of these companies increased the profitability of the sector to attract investment flows to Spain, aimed at the mass purchase of housing packages owned by the Spanish financial sector. In addition, this reform introduced the possibility of maintaining real estate assets in property for a minimum of three years, compared to the seven-year period of the previous 2009 legislation. This facilitated the liquidity of the sector (Gil García, 2018), thus achieving increases in sales revenue from EUR 1.325 million in 2016 to 2117 in 2018, and net profit from EUR 1.882 million in 2016 to EUR 2376 million in 2018, representing increases of 59.77 % and 26.24 %, respectively, in just three years (Spanish Exchanges and Markets 2019).

This meant a profitability above most of the returns offered in the rest of the market by other sectors, specifically in 2017, they had a growth that doubled that of the IBEX (Estevez Torreblanca, 2018) and (Bolsas y Mercados Españoles, 2019).

In recent years, REITs have increased investment in the real estate sector by more than 40% (CBRE, 2017), developing its activity in the full range of possible real estate segments, including: mixed, (investments in three or more segments), offices, retail (shopping malls), hotels (hotel establishments, hostels or student residences), residential (rental of housing by entire buildings or individual homes), high Street (commercial premises such as banking branches), and logistics, a series of properties that are acquired in large volumes to be competitive through synergies and efficiency (Bolsas y Mercados Españoles, 2019).

In addition, REITs have acquired properties in the center of cities because of the higher income they generate, as a result of the increased economic activity existing in these centers. It can be seen how managed assets are concentrated in economic activities that show significant growth, such as commercial buildings and hotel properties in city centers, which have ultimately been influenced by tourism activity. The latter development reflects the latest trends in the hotel business, in which the chains of the sector have increasingly decided to manage establishments without owning the buildings. In 2016, investments of around EUR 2125 million were made for this purpose, representing an increase of 261.42% in the preceding three years. This was highlighted by purchases of the American company, Blackstone, worth EUR 631 million (Gil García, 2018). As a result, they obtain rents, and have expectations of revaluation of the property that is the main part of their business, as is also the case with homes, offices, hospitals or shopping centers (Gil García, 2018).

Finally, investment in housing has received growing interest by these companies, justified in the growth of demand and house prices. This has even attracted large international investment funds such as Blackstone, which have acquired properties such as social housing of the City of Madrid or homes awarded to the former Banco Popular, under the REIT Fidere Patrimonio (Garijo, 2017).

One of the main risks of the great prominence of REITs in the global housing market is the threat of a contagious effect that may cause a decline in some of the markets where these companies invest, relative to the rest of the markets. There is evidence that international geographical diversification produces benefits to investors as a result of the reduction in risks involved in investing in several housing markets at the same time (Fernández Gimeno, 2012). However, these benefits are less evident in periods of economic crisis, as was the case in the 1997 Asian crisis, where there was strong contagion of the declines in international REITs (Bond, Mardi, & Renée, 2006). Thus, there is greater evidence of correlations between the REIT markets of various states as a result of increases in the disparities of national inflation rates, with greater uncertainty of the stock market globally, or in periods of economic crisis such as in 2007 (Joyeux & Milunovich, 2015).

As can be seen in Fig. 2, investments in offices and residential housing experienced significant growth in 2018 of more than EUR 4.8 billion, in the context of increased investment in the sector as a whole of more than EUR 5.6 billion.

Destination for real estate segments of REITs in Spain in 2017 and 2018, according to the type of property invested, in millions of euros.

This increase in total annual investment was 70% financed by borrowing, with the remaining 30% sourced from own resources. As a consequence, debt of REITs as a whole increased by EUR 4 billion, of which EUR 2.4 billion corresponded to the residential segment. This need for financing of real estate development and construction of homes for sale or rent justifies that of the total debt of this type of companies, 65% of it is contracted with national financial institutions, while the remaining 35% is in corporate bonds (Bolsas y Mercados Españoles, 2019).

In practice, REITs have become a key element of the restructuring of Spain's financial system, by acquiring large housing packages from financial institutions. This process began with Blackstone's acquisition of the financial mortgage defaulter of Cataluña Caixa at a discount of 40% (Vives-Míro, 2018). Financial institutions in turn participate in REITs, attracted by their growing profits (Gil García, 2018).

The most representative REITs in terms of net worth and financial results are those listed in the continuous market, where they have foreign capital participation in companies such as Merlin, Colonial, Hispania, Axiare and LAR Spain. For the purpose of this study, however, the investment companies that are listed on the Alternative Stock Market (MAB) deserve special attention, since it accounts for most of these companies, particularly those involved with residential real estate, providing them with favorable conditions of access. In the case of the former, the value of the real estate properties of these companies in 2018 amounted to EUR 16,483 million, compared to EUR 12,221 million in 2017, with a foreign capital stake of 55% (Simón Ruiz, 2019; Bolsas y Mercados Españoles, 2019). REITs listed on the Alternative Stock Market have a tendency to invest in homes (21.9% versus 14.5% overall) and shopping centers (14.2% versus 8.8% overall), as shown in Fig. 3.

Percentage distribution of total REITs by asset type invested in 2018, and of those listed on the Mercado Alternativo Bursatil (MAB).

This analysis of the scientific contributions made to the description of the main characteristics of real estate investment trust in Spain, and their role as an investment instrument of national and international financial capital, confirms, the role of public administrations to facilitate their activity; the participation of these REITs in the consolidation of Spanish financial institutions; the real estate segments in which they invest; and its role as promoters of the real estate sector when they were in a phase of depression, currently having a great role and leadership in the market.

But it can be said that there are areas of study that can be further developed, as they are studied in a less exhaustive manner. In the first place, their performance in the tourism sector, and secondly the participation of REITs as real estate developers, and not only as owners of rental properties. This is the intention of this document, which aims to be a starting point for other future analyzes, in which the participation of REITs as suppliers of homes for sale in tourist activity locations can be evaluated. This is a line of research that has been little studied at present.

An issue for investigation is their possible activity on the Costa del Sol and its province, including its capital. Such a question arises since this is one of Spain’s areas of greatest economic dynamism, with coastal municipalities of great tourist and residential tradition and a capital that has been able to take advantage of new trends in urban and cultural tourism, and an excellent network of transport infrastructure.

This possible activity of REITs can be measured by the two areas of action that characterize their business management: the acquisition or construction of housing for rent, and the participation in large developer companies that market homes for later sale, like other companies in the sector.

In the first case it can be observed that the province of Malaga, despite all the above, is not an area in which this type of company has large real estate properties involved with residential rental, a circumstance that is simultaneous with a large presence of holiday tourist housing, which attracts local, national and international capital. At the national level, it highlights the percentages of total residential rental housing stock managed by REITs in certain provinces. Thus, the community of Madrid has 47% of the total, the province of Barcelona 22%, and Valencia 4%. By contrast, those existing in Malaga do not exceed 2% of the total, being ahead of it, provinces such as Alicante, Toledo, Guipúzcoa, Las Palmas, Tarragona or Valladolid (Larrouy, 2018).

Therefore, notwithstanding its pre-eminent characteristic as the driver of residential rental management activity in the Province of Malaga, it remains to be seen whether in the second activity, related to the housing development sector, the REITs are present as dynamic agents of the same in the province of Malaga.

5Results5.1Current situation of the real estate market on the Costa del SolThe activity of promotion and construction of new buildings is a great tradition on the Costa del Sol and the rest of the province of Malaga. Starting at the end of the 1950s, the economic takeoff of its tourism sector aroused, from the outset, the interest of domestic and international investors (Pellejero Martinez, 2005). This was encouraged by public authorities as a model of economic growth through the interrelationship of tourism and construction, and continued in the 1980s, and from the late 1990s to 2008 (López & Rodríguez, 2010).

In recent years, and more specifically since 2015, there has been growth in the construction of real estate in the province, in its price level and in business and profit prospects, particularly in the localities of the coast of the Costa del Sol and in Malaga’s capital. This concluded a period of more than seven years of stagnation in the construction of real estate as a result of the economic crisis initiated in 2008.

This increased dynamism has included all types of activities and segments of the real estate sector. Thus, for example, offices and commercial premises have seen their demand and rental rents increase in the historic center of the capital and its catchment since 2016. The important hotel market, where again the historic center of the city stands out, and shopping centers, have also increased their figures of growth of places and yields This is highlighted by two projects, the Intu Costa del Sol in Torremolinos and McArthurGlen in Plaza Mayor, both financed by British capital (Savills Aguirre Newman, 2019). Other examples include the shopping center "La Cañada" of Marbella, owned by General de Comerciales Galleries (the main REIT listed on the MAB with capitalization of EUR 2782 million in April 2019), and the shopping center "Larios", owned by the main national REIT, Merlin Properties, which has a capitalization value of EUR 5.708 million as of April 2019 (Bolsa y Mercados Españoles, 2019).

Student residences are another type of real estate leasing business that is arousing the attention of large investors, which until now has been managed mainly by small investors or Catholic religious congregations They have the advantage of being located in the third largest university city in Andalusia, and where the number of places offered at present is lower than the national and regional average, making up for this lack of supply with shared rented housing, which. Has allowed the design of six new student residence projects that will add 906 new places to the sector. The returns of this type of business are around 5.5%, higher than in other sectors, such as commercial premises (3.15%), offices (3.50%) and hotels (4%). As a consequence, there is already a REIT specializing in this type of business, Student Properties Spain, participated in by Altamar Capital Partners, Amira Real Estate and Elcano Patrimonial Services. (BNP Paribas Real Estate, 2019).

Despite the prospects of the real estate segments described above, it is the promotion and construction of newly constructed housing for sale where the highest percentage of economic and financial resources available in the province is to be found, and where it can be seen most clearly whether there is a relevant participation of these investment companies in the real estate market.

Thus, Fig. 4 shows the evolution of the promotion and construction of free-rental homes of new construction in the province of Malaga (officially protected homes have a marginal weight of only 290 homes, and have not been considered in this study). These have exhibited constant growth since 2015, reaching the highest figure in 2018 of a total of 7376 homes in the province, although with a very unequal geographical distribution.

Fig. 4 confirms that the growth in the number of housing project visa began barely four years ago, with the change of trend in 2015 compared to previous years, in correspondence with the evolution of the same phenomenon at the global level. But also, as noted above, its distribution is very uneven, since, as at the national level, the coastal areas and the capital are those with the highest growth rates, corresponding to greater economic activity linked mainly to tourism.

Thus, five main areas of real estate development activity can be distinguished in the province: the West Sun Coast that ranges from Benalmadena to Manilva; Malaga capital; the nearby municipalities that make up its metropolitan area, such as Torremolinos, Alhaurin de la Torre and Rincón de la Victoria; the East Sun Coast that ranges from Vélez Málaga to Nerja; and, finally, the remainder of the interior of the province. As shown in Fig. 5, new construction is especially relevant in the municipalities of the western Costa del Sol, which accounts for 53% of the total, and Malaga capital (27%), followed at a distance by the coastal municipalities of the Axarquia (8%) and those close to the capital (9%). Highlighting the existing activity of five municipalities, Malaga has 1982 homes, Estepona 1107, Mijas 763, Marbella 586 and Fuengirola 576, which together represent 68% of the new construction housing visa in the province. These towns also have the greater tourist activity. On the contrary, the municipalities in the interior of the province, with the largest territorial extension, present a situation of stagnation, representing the existing residential offer of new construction in these areas 3% of the total, with only 275 approved homes, mostly single-family homes (Colegio Oficial de Arquitectos de Málaga).

This unequal growth situation is repeated in the growth pattern of the Malaga capital, where most of the new-construction homes offered in 2019 were in three districts: Puerto de la Torre-Teatinos (1709 homes), Carretera de Cádiz (479omes), and Málaga East (285 homes). These have been urban expansion spaces of the city for almost two decades (Savills Aguirre Newman, 2019).

5.2The real estate developer sector on the Costa del SolFrom this data, it is worth knowing who is taking part in this apparent revival of the real estate sector in the areas of greatest tourist activity, i.e., which are the main developer companies that are developing new construction projects in the province of Malaga, and who are its owners, as well as the type of homes they build from the point of view of first or second residence. This is also a relevant fact, since on the one hand it will allow us to compare the current promoter fabric with respect to the existing fabric in the previous expansionary real estate cycle of the period 1999–2007, and also confirm the presence or otherwise of investment companies in the real estate market.

To this end, the promotions that currently have homes for sale will be analyzed with reference to the origin of their share capital, to distinguish between companies promoting international, national, local companies in the province, and those that are owned by real estate investment companies. We will also investigate the number of total homes that make up each promotion and their geographical locations, distinguishing five areas, namely, Malaga Capital, Metropolitan Area of Malaga, West Sun Coast, East Sun Coast and interior of the province.

Thus, it is intended to determine the main REITs present in the province, their preferred geographical areas of action and, finally, the type of housing they promote, in order to try to discover different guidelines or behaviors compared to other companies.

The data obtained in Fig. 6 indicate that 27% of the homes built in current promotions are those of developer companies belonging to REITs or real estate investment funds. That is, these companies have played a special role in the Costa del Sol, promoting more than a quarter of the homes sold in the last two years. This figure is higher than that of local companies, whose presence is concentrated in the metropolitan area of Malaga, particularly Alhaurin de la Torre, and on the Costa del Sol Oriental, with the latter due to the outstanding presence of the company Salsa Inmobiliaria, with large plots of land owned in the area.

It can therefore be seen that the prominence of development activity in the province, especially in its areas of greater real estate dynamism, is due to nationally developing companies. These represent 51% in each of the western Costa del Sol and Malaga, followed by promoters linked to REIT and funds. If this data is added to the participation of international developers in the localities of the western Costa del Sol, it can be seen that 82% of the promoter investment capital in the province is held by external investors, and one-third is foreign capital.

If we take as a reference the ten development companies with the highest number of homes sold at present, it can be seen in graph 7 that of these four are from REIT, highlighting the first two developers in the province, Neinor Homes and Via Celere, five are from national capital companies outside the province and one is from foreign capital, highlighting the absence of local companies among these 10 main developers (Fig. 7).

In addition, if attention is paid to the characteristics of the promotions of each type of company, Table 1 shows that companies belonging to REITs have the highest ratio of housing per promotion in the province, i.e., 97.45 homes. The average number of homes built by local developers in each development is much higher than the next one, at 57.98, and a long way from the 37.31 homes built on average by local developers. Thus, 40 promotions of REITs have built 3898 homes in the province, while local developers in 83 promotions have built 3097 homes.

Number of homes built by promotion, depending on the nature of the developer and the geographical area in 2019.

| Capital principal developer | Total real estate promotions Province | Average Málaga Capital | Average Metropolitan Area | Average Costa del Sol Occidental | Average Costa del Sol Oriental | Average province |

|---|---|---|---|---|---|---|

| Local | 83 | 32,38 | 32,00 | 54,34 | 23,00 | 37,31 |

| National | 126 | 55,00 | 44,66 | 62,95 | 43,54 | 57,98 |

| REIT & investment funds | 40 | 134,00 | 69,50 | 91,88 | 91,00 | 97,45 |

| International | 11 | 54,63 | 54,63 | |||

| Total developer | 260 | 53,38 | 42,16 | 66,13 | 41,12 | 57,26 |

The greater the number of homes marketed by promotion, the greater the need for the economic resources needed to acquire urban land, start formalities and proceed to construction. This shows a greater availability of financial resources to acquire floorspace, and better options for obtaining bank financing by companies belonging to REITs and real estate investment funds which in many cases manage to access financing for the promotion of future homes offered by the financial institutions from which they buy the land.

5.3General characteristics of RETTs on the Costa del SolThe REITs promoting homes for sale in the province of Malaga display a series of general characteristics and specific objectives that should be highlighted, and that influence how they manage their activities. Most belong to foreign real estate investment funds, usually from North America, which acquire the land and own the resources required for real estate development. They can also offer foreign financing, providing billions of euros and dollars for the acquisition of large and numerous plots of urban land in tourist areas and large capitals of the country.

With this capital, they acquire these lands in cash, in many cases stocks of plots in the hands of Spanish financial institutions, acquired after the crisis of 2008 from developers who left unpaid credit operations, in large sales operations carried out mainly between 2015 and 2018, with 2017 standing out as the year that received the greatest volume of transactions, and which had very competitive discounts and sales prices as a result of the payments made in cash, and which allowed buyers great possibilities of revaluation.

To conclude the financing phase, REITs use Spanish financial institutions to finance the construction and marketing of the homes. Such institutions are located in the markets where they carry out the promotions, taking advantage of the excellent credit conditions for current developers, thanks to the low interest rates that currently exist. These companies take advantage of the low-cost situation of their financial leverage to borrow in the production and promotion phase, despite having significant own resources, and financing facilities in their home countries via entities’ foreign investment funds. The aim is to continue to leverage their resources to seek new investment opportunities for land or real estate at competitive prices.

Finally, REITs undertake the start-up of the promotion and construction of the houses in the shortest possible time. The goal is to take advantage of the high returns obtained in the residential real estate sector and the increase in demand for residential housing for purchase by small and medium-sized investors. In many cases, these investors acquire the housing for placement in the tourist and residential rental markets.

In terms of location, REITs concentrate mainly on coastal areas with the greatest tourist tradition, and the capital of the province and its metropolitan area, with a preference for the first two. The location of promotions determines the target audience. Promotions in Malaga capital and its metropolitan area are aimed at buyers of first homes, with medium-high and high purchasing power, for homes intended to be inhabited as habitual dwellings, and owned or put up for residential rental. In contrast, those marketed on the coast have a target audience of foreign or domestic investors seeking a second residence or housing to exploit as a tourist rental.

As for the production of homes by company, it can be seen in Table 2 that two stand out above the rest, namely, Neinor Homes and Via Celere, followed closely by Aq Acentor, Kronos Homes and Aedas.

Number of homes marketed by REIT developers in the province of Malaga in 2019.

| Total provincia | Málaga Capital | Área Metropolitana Málaga | Costa del Sol Occidental | Costa del Sol Oriental | |

|---|---|---|---|---|---|

| Neinor Homes | 1.315 | 572 | 748 | ||

| Via Celere | 962 | 195 | 548 | 219 | |

| Aq Acentor | 522 | 186 | 336 | ||

| Kronos Homes | 443 | 443 | |||

| Aedas Homes | 259 | 87 | 172 | ||

| Lar | 246 | 104 | 52 | 90 | |

| Osim | 78 | 78 | |||

| Aria | 39 | 39 | |||

| Dazia Capital | 36 | 36 |

Neinor Homes belongs to the American investment fund, Lone Star, which acquired the company from Kutxabank in 2015, and is currently the leader in the province, with a market capitalization of EUR 880 million (as of August 2019). From the financial institution Unicaja Banco, the company acquired six finalist lands in the Malaga Capital for EUR 68 million, with the capacity to promote more than 8000 homes. These plots are currently part of marketing promotions, located in resident areas with high purchasing power (El Limonar, in the east and Hacienda Cabello, in the north), all destined for first residences. In addition, there are 29 plots of land dedicated to second residences on the western Costa del Sol with capacity for more than 2300 properties. The capital required for this large land acquisition came from a financing line provided by US financial institution JP Morgan of EUR 150 million (La Vanguardia 2017).

Vía Celere, the province's second largest developer by number of homes promoted, is controlled by an American investment fund, which has 75% of its share capital, with the remainder distributed among other US financial institutions. It is one of the largest REITs in the country, with a land portfolio with the capacity to build more than 26,000 homes. The province of Malaga is its second market, representing 20% of the total assets of the company, acquired mainly in 2017 (Arroyo, 2018). The type of housing offered is mostly second residences, in many cases aimed at investors in holiday tourist housing (Lospitao, 2019).

Kronos Homes is a company founded in 2015 with European and North American financial capital, including real estate investment funds and family offices, which have so far opted out of the company. It has a portfolio of land valued in the environment of EUR 1 billion, with capacity to build around 16,000 homes. Approximately 70% has been acquired with own resources, while construction and completion will be financed with bank funding. The focus is on second residences in towns such as Benalmadena and Estepona, being present in the province since 2016 (Simón Ruiz, 2019).

6DiscussionThe influx of international financial capital through investment companies into the Spanish real estate sector is making a decisive contribution to the patterns of development and evolution of the sector, with social and economic consequences.

From an economic point of view, such companies are helping to bring to the market properties that were stagnant as empty dwellings in the hands of private individuals and on the balance sheets of financial institutions, in addition to unproductive plots of land. Properties were acquired at low prices with great revaluation possibilities in the period before 2014, taking advantage of the favorable legislation and state taxation applicable to this type of companies. Thanks to this, they have become facilitators of the work of cleaning up the real estate assets in the hands of Spanish financial institutions, and at the same time they have been pioneers in the growth of development and construction activity of the last five years.

At a general level, they contribute to consolidating the role of the global financial sector as a predominant sector in the economy. In the real estate sector, this entails strengthening the process of commodification of housing, reducing its role as a necessary object for complying with the constitutional right to decent and adequate housing for all citizens, and making it an economic good subject to price variations and speculation, at the risk of hindering access to housing for disadvantaged and lower-income sectors.

In the specific case of the Costa del Sol and the province of Malaga, it can be seen that its presence as an agent that exploits and manages homes for rent is very small. The percentage weight of the Malaga market compared to the national market of homes offered for rent by REITs is less than the weight of the overall housing stock of the province. The existing offering in Malaga is below that of other provinces with a smaller housing stock and lower population.

Participation in real estate development in the province is a prominent facet in investment activity. Developer companies owned by REITs and real estate investment funds have had a very important weight with respect to the total number of homes marketed and built in the last two years in the province. This is an element that differentiates this period of growth of new construction activity from the period before 2008. Previously, promoter activity was predominantly undertaken by companies at the national and local level, while more recently that role it shared by national companies and the affiliate companies of REITs.

On the other hand, these companies do not differentiate their geographical preferences from other types of national or local societies, opting for the capital and its area of influence, and for coastal towns with great tourist activity. As in the 20th century, tourism and real estate sectors jointly boost the economic growth of the province.

The main difference from other types of developers is their greater capacity to simultaneously promote urbanization and housing blocks with the largest number of units built in several locations, which undoubtedly demonstrates their ability to access financing from Spanish financial institutions.

7ConclusionThis document has collaborated in showing the importance that REITs have in the real estate development sector in a tourist area of first international order such as the Costa del Sol, in such a way that it reflects how they invest in real estate markets with strong tourist activity, for residential housing or for their exploitation as a vacation rental on housing.

The development companies linked to the REITs on the Costa del Sol have become the market leaders in the number of homes marketed and in the volume of business generated, well above the traditional national development companies. However, it is necessary to warn of the risks involved in leaving companies with a short-sighted view of their investment objectives in the real estate sector. A stable and professionalized business fabric of residential housing is needed in public and private sectors, with social trading companies or cooperatives that allow a greater balance between the interests of their owners and tenants.

This leads to the possibility of expanding the subject of study of this document. In addition to studying other professionalized business options that offer citizens affordable housing, whether public or private, it is necessary to evaluate the costs and benefits that the activity of these real estate investment companies in the Spanish real estate sector have. In addition, the social consequences of consolidating the commodification of housing, leaving behind its social nature, should also be explored to extend this study to broader geographical areas. On the other hand, the influence that the activity of these companies has on the current cycle of growth in house prices in residential rent must also be studied.

It should also be taken into account what their methods of management, production and marketing of homes are for sale to end customers, since REITs may be contributing to improve the professionalization of the housing promoter market.

All these elements must be studied in the future with other methodologies, incorporating more extensive data on the physical characteristics of the homes and socioeconomic profiles of the buyers and the neighborhood where the real estate developments are located, among others, that can be treated using econometric techniques and that evaluate the weight that real estate development companies have in the sector, and their participation in the rise in the price of housing and the difficulty of their access to citizenship.

It will be of interest to study the specific activity of the main promoters involved by the RETTs, particularly their target markets, their geographical areas of influence, the type of housing offered, in order to obtain a better understanding of the phenomenon.

But in addition, the situation described regarding residential housing on the Costa del Sol, can be analyzed in other national and international tourist areas with similar characteristics, in addition to other real estate segments such as offices, shopping centers, student residences and hotel accommodation, and whose economic importance deserves the attention of social scientific research.

Ricardo Urrestarazu Capellán is the Doctor of Tourism from the University of Malaga. Comercial de Unicaja Banco S.A.U., an entity in which it has assumed functions of office management, submanagement, risk analysis and training monitor, participating in the integration process of Banco CEISS. Degree in Economic and Business Sciences from the University of Malaga and in Political Science from UNED, being Master in Business Administration and Management (MBA) by ESESA. Acting Substitute Professor in the Department of Economic Structure of the University of Malaga in the courses 2014/2015, 2015/2016 and 2016/2017, Department of Economics and Business Administration of the University of Málaga in course 2019/2020, and collaborating professor of Edufinet, Financial Education project of Unicaja Banco S.A.U. University of Málaga. Address: Avenida Brisa del Mar, 7. Vivienda 18. Chilches (Velez Málaga) 29790 Málaga, España.

José Luis Sánchez Ollero is the Doctor in Economic and Business Sciences from the University of Malaga, he is Professor of the University of Malaga in the Department of Applied Economics (Economic Structure). University of Málaga. Address: Calle León Tolstoi, s/n. Campus de Teatinos. Málaga 29,071 – Málaga.

Alejandro García Pozo is the Doctor of Economic and Business Sciences and Extraordinary Award by the University of Malaga in 2005, he is Professor of the University of Malaga in the Department of Applied Economics (Economic Structure) since 2008. University of Málaga. Address: Calle León Tolstoi, s/n. Campus de Teatinos. Málaga 29071 – Málaga.