A “race towards the bottom” in very poor countries is a policy that deliberately depresses wages to attain higher competitiveness in the global market. This policy distorts the comparative advantages that would emerge in the absence of such an economic policy and also induces lower purchasing power, leading to suboptimal consumption. There are barely any theoretical models (to our knowledge) showing the impact of a global minimum for minimum wages. We found that, under such circumstances, a global lower bound for minimum wages that re-establishes the competitive wage rate in very poor countries represents a Pareto improvement: It enhances the markets due to the expansion in sales caused by the increase in real wages of the vast majority (workers). One of the innovations of this primer is to apply a simple dsge model to the macroeconomic consequences of a global minimum for minimum wages.

Una carrera hacia la depauperación en países muy pobres es una política pública que busca reducir deliberadamente los salarios para tratar de alcanzar una competitividad mayor en el mercado global. Esta política desvirtúa las ventajas comparativas que emergerían en ausencia de ese tipo de política económica y también induce hacia un poder adquisitivo menor, llevando a un consumo subóptimo. En la actualidad no se ha modelado teóricamente (hasta donde sabemos) el impacto de un mínimo global para los salarios mínimos. Bajo estas circunstancias, encontramos que una cota inferior global para salarios mínimos que restablezca el salario competitivo en estos países muy pobres representa una mejora paretiana: magnifica los mercados gracias a las nuevas ventas que ocurren gracias al aumento en el salario real de la mayoría (trabajadores). Una de nuestras innovaciones es introducir un modelo dsge sencillo para modelar las consecuencias macroeconómicas de un mínimo global para los salarios mínimos; un tema poco estudiado en la literatura relacionada.

Mexico, once considered a powerhouse for low-wage jobs, allegedly has lost more than 500 maquiladoras following the admission of China to the World Trade Organization (wto) (Chan, 2003). China, on the other hand, has supposedly lost some ground in attracting multinationals corporations due to the lower labor cost of Vietnam (Kahle, Boush, and Phelps, 2000). Olney (2010) and Davies and Vadlamannati (2013) also have found evidence of a race towards the bottom in labor standards. That is, many countries, from Mexico to China, allegedly feel more pressure to reduce their wages and other labor standards (and thus the standard of living of the vast majority) to attain some comparative advantage in attracting firms.

Since the economic policy of defying comparative advantage by depressing wages (i.e., race towards the bottom) also induces a lower purchasing power, it represents a constraint for consumption, making the race towards the bottom a suboptimal scenario that lowers general welfare. We wonder if there is a Pareto improvement that addresses this suboptimality. We found that, under certain circumstances, setting a certain low global minimum for minimum wages that reduces the race towards the bottom can represent a Pareto improvement by reducing poverty, increasing purchasing power of poor (i.e., low-income) countries, increasing demand in poor countries, and creating a non-negative change in profits through the new expansion of goods markets.

To model the effects of a global lower bound for minimum wages, the consequences for goods markets should also be considered. In fact, it is well-known in the business literature that the low purchasing power of poor countries is a constraint on the sales growth of multinationals. Appiah-Adu (1999) reports the significant benefits of an increase in purchasing power for foreign businesses in Ghana. Schuster and Holtbrugge (2012) explain that the low purchasing power of poor countries represents a challenge to market entry for multinational companies. In India, Das, Mohanty, and Chandra Shil (2008) find that low purchasing power is one of the factors that limits the sales growth of televisions. In reference to China, Taylor (2003) reports: “During the early 1990s, especially, the rapid increase in retail outlets exceeded the growth in consumers’ purchasing power, and this reduced profit margins markedly, to the detriment of state enterprises (…)” (p. 196).

In other words, multinationals not only search for lower production costs, but for markets with a solid purchasing power: Low-income individuals are not only workers, in contrast to the underlying assumption in much of the literature on labor standards that is discussed in the next section.

To study the effects of a binding minimum wage on two markets, this paper innovates by expanding the usual static approach to a simple but reasonable dynamic stochastic general equilibrium for open economies that captures some macroeconomic consequences of enhancing the purchasing power of the poor. Here the authorities of each poor country can pursue only one policy: They can either seek to decrease wage level seven further so as to obtain greater competitiveness or agree to a binding global minimum wage for the entire group of countries. It is found that a small increase in the wages of the poor countries represents a Pareto improvement by stimulating demand. The growth in wages can also push up informal wages if the so-called “lighthouse effect” is assumed.

In the second section, we describe the model and show that there is a floor that can increase production and labor demand and produce a non-negative change in profits, even if prices might increase. In the third section, we discuss why this policy might benefit workers in the informal sector as well. In the fourth part, we state some conclusions.

Related literatureLabor standards include heterogeneous aspects such as restrictions on child labor, safety measures in the workplace, health regulations, laws that seek to protect workers, work time regulations, and minimum wage rules, among others. This paper only models a floor on minimum wages, since a safer work environment may have different effects than a global minimum on minimum wages. However, analyses in the literature tend to encompass all sorts of labor standards.

In general, we identified two opposing blocs on the issue of labor standards. On one side, Bhagwati (1995) defends the current labor arrangements in poor countries and argues that if the rich (i.e., high-income) countries do not have the same standards there should not be equal standards in poor countries: In his view, labor standards are ‘culture-specific’. Chau and Kanbur (2006) analyze a unilateral increase in labor standards based on a partial-equilibrium model: Since workers do not consume in international markets, the feedback effect of an expansion in the Southern markets is not analyzed. The benefits of an increase in labor standards are evaluated in terms of utility and trade.

Another critique of proposals for international labor standards is provided by Brown, Deardorff, and Stern (2004), who refer to a study done in Asia: “Workers employed by multinationals are generally well paid, unionized, have legal protection of their rights, and receive mandated benefits, so that payment of a living wage to these workers may be redundant” (p. 285). However, it is not clearly shown why such “neutral” standards could create distortions.

In conclusion, Bhagwati (1995), Basu (2003), and Brown, Deardorff, and Stern (2004) could represent the bloc who argue that increasing labor standards is unnecessary and that imposing any sort of standards ultimately represents “disguised protectionism.” Ironically, the conception that a higher labor standard is “disguised protectionism” may stress the race-towards-the-bottom hypothesis: Multinational firms search for the lowest cost and if there is an increase in labor standards, multinationals will leave as a direct consequence.

That interpretation has been challenged. Freeman (1996) argues that “[t]he views that standards are disguised protectionism is erroneous (…). Adherence to core standards will not substantially affect the comparative advantage of developing countries nor have more than a minimal effect on trade” (p. 87).

Rodrik (1996), Busse (2003) and others have found that multinational firms tend to allocate their production to countries with higher labor standards. Carr, Markusen, and Maskus (2004) state in this regard: Overall, it is in the nature of what mnes (multinationals enterprises) produce that makes cheap labor not a strong attraction for production in developing countries. Our conclusion is that developing countries stand to gain little in terms of increasing fdi by artificially suppressing wages —for example, by limiting rights of workers to organize and bargain collectively. That strategy is likely to reduce productivity and investment, as noted by Martin and Maskus (2001, p. 384).

Singh and Zammit (2004) also argue that minimum labor standards can be beneficial for workers in both rich and poor countries. Miller, Hom, and Gómez-Mejía (2001) find that paying low wages can be costlier to firms since this increases turnover. Given the size of the markup, Pollin, Burns, and Heintz (2004) find that an increase in wages for the workers in the apparel industry in developing countries can be absorbed.

A few low-wage countries in South East Asia have agreed to increase some labor standards. Chan (2003) explains why it might be important for the standards to be supported by all countries at the bottom: The hukou pass system seems likely to remain in place for the foreseeable future, and China will continue to dominate the world's export market, to the point that the new initiatives taken by Vietnam, Cambodia and Thailand may possibly collapse under the weight of Chinese competition (p. 11).

The analysis of Chau and Kanbur (2006) also suggests that a unilateral increase in labor standards, in the absence of a minimum bound, may not be optimal. Likewise, Granger and Siroen (2006) contend that the inclusion of labor standards is common in preferential trade agreements but its exclusion from multilateral trade agreements may jeopardize such an initiative. In fact, this is the only consensus found in the literature: A unilateral increase in labor standards in poor countries, without a global minimum for all the poor countries, is not optimal.

Since a unilateral increase is not rational, we modeled the effects of a global minimum for minimum wages, not a partial-equilibrium analysis without a lower bound. By using a macro model to approach this topic, this study can capture some of the effects on both the goods and labor markets. As with any other model, simplifications were needed to set up this primer.

A MODELGiven that the proposal for a global minimum for minimum wages will be applied only in very poor countries (in practice it will be far below the minimum wages of middle- and high-income countries), in the following simple model there is a continuum of small open economies with similar endowments. The government plays a coordinating role by creating and removing wage laws, the sole economic policy that it is able to perform.

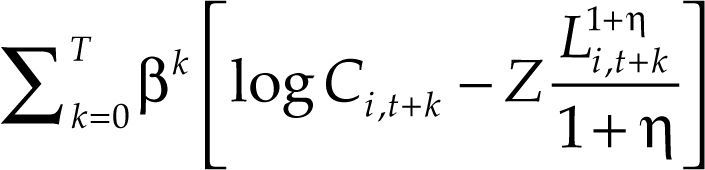

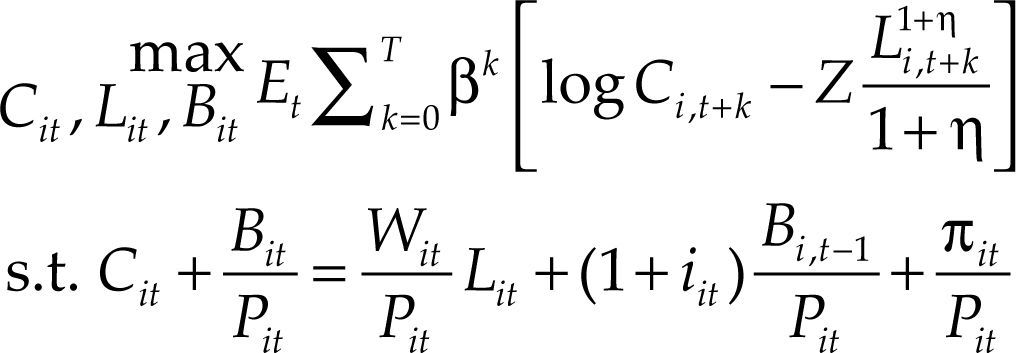

The household/consumer sectorThe household intertemporal utility function is given by:

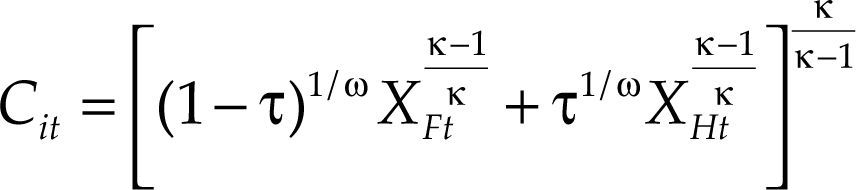

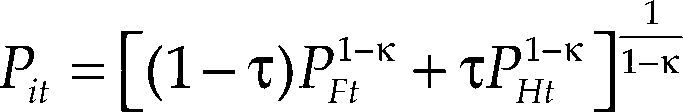

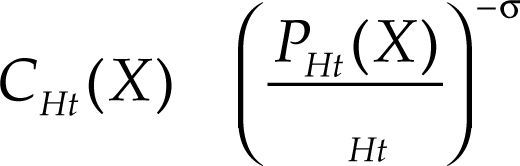

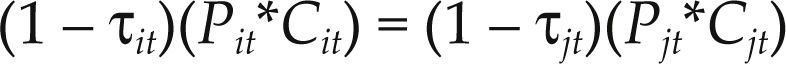

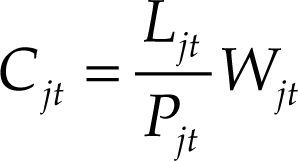

where Z is the parameter stating the magnitude of leisure, C is consumption, L is labor, and β is the discount rate. Each country has the same preferences and the composite consumption of goods for consumers of both countries follows Galí and Monacelli (2005):where X is the index of goods, H is the subscript for home goods, and F for foreign; κ > 0 and stands for elasticity of substitution between foreign and domestic goods, and τ is the share of import goods in consumption. The corresponding price of C is given by:where P is the price index.The demand function for domestic goods is given by:

where σ is the elasticity of substitution between goods produced within a country. An analogous demand corresponds to foreign goods. Notice that there are no problems of terms of trade since every country has the same preferences and faces the same level of prices. Consequently, in both steady states (before and after the introduction of a binding global minimum wage), trade is assumed to be balanced:Given the forward-looking optimization, we depart from the following assumption:

Assumption 1: An expectation of an increase in prices creates more elastic demand.

As such:

where e is the price elasticity of demand.In other words, consumers create expectations about future price movements and if they rationally expect an increase in prices in period t+1, the demand becomes more elastic in period t.

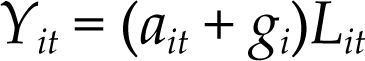

The private sectorLabor is the only factor, a common simplification of these models, and is immobile between countries but mobile within them. For the sake of simplicity, countries have the following production technology governed by labor, technology and productivity shocks:

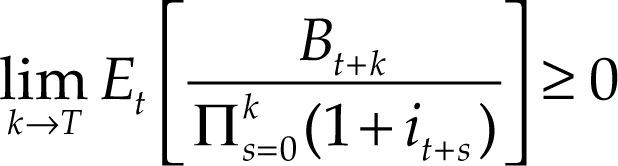

where Y is output, a is the productivity shock, and g is the technology level. The g is greater than 0.5, representing the barrier to entry (employment is less than full). The technology levels in the period t–1 work as a barrier to entry in period t and enable the markup price below. This follows related theories, where the differences in productivity levels allow firms to be competitive (Aw, Chung, and Roberts, 2003; Melitz, 2003). In other words, firms need a certain level of technology to enter and stay in the market. A finite number of firms make the race towards the bottom understandable (if there are an infinite number of firms, why would a country depress its wage rate to attract more firms?)1. Thus, employment is less than full2.Each country is engaged in free trade, producing goods for foreign and local demand. Countries share the same currency, a common assumption in this type of model (Rabanal, 2009). It is assumed that firms issue the same riskless bonds B with a nominal rate i, such that 1∼ B(1 + i*). Bonds are traded only within borders and the agents face the terminal borrowing constraint:

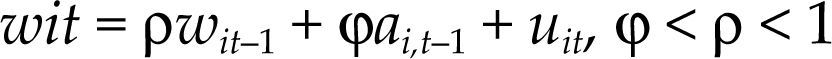

Given the race towards the bottom in these economies (i.e., depressing wages to attain competitiveness), the wage rate is assumed to be lower than the competitive level ex ante. Based on rational expectations (that are implied in Dynamic Stochastic General Equilibrium models, dsge), in period t–1 agents know the corresponding wage rate of the steady state that emerges from their optimization. Thus, the wage rate follows the following law of motion:

where u is the exogenous shock affected by minimum wage laws3. Moving the wage rates by changing wage laws is the only economic policy that the authorities are able to perform. Given the absence of a global floor on minimum wage in period t–1, authorities in each country can seek to decrease the wage rate to attain greater competitiveness through lower cost (i.e., race towards the bottom) or agree on a binding global floor on wages. However, if the authorities in country i decide to decrease the wage rate in period t–1, all the countries will decrease it as well to avoid a loss in competitiveness.On the other hand, in this model nominal wages and productivity have a relatively small feedback effect given that productivity should, in principle, increase nominal wages, and an increase in nominal wages should also increase productivity (e.g., according to the efficiency wages theory). The other law of motion is given by:

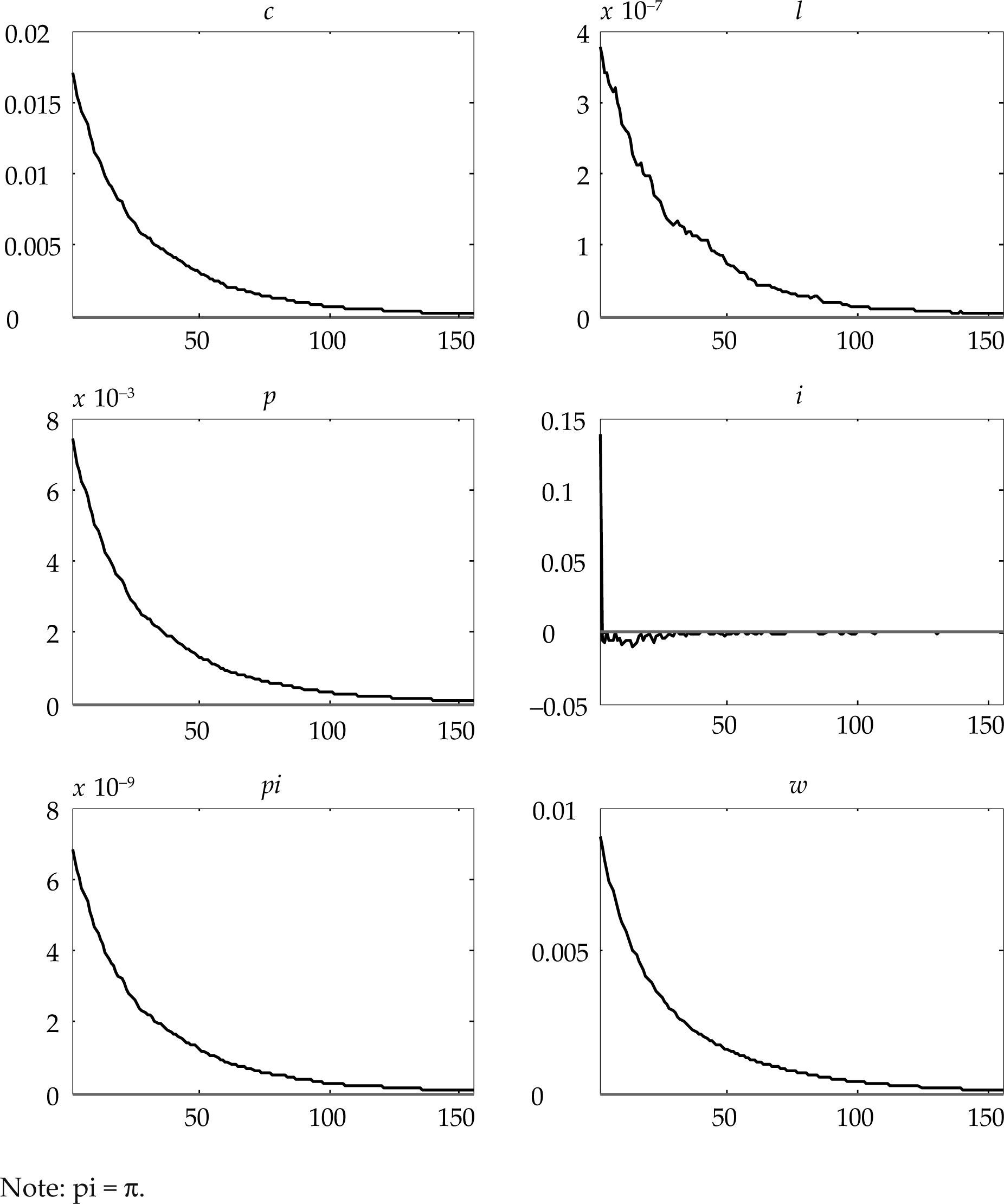

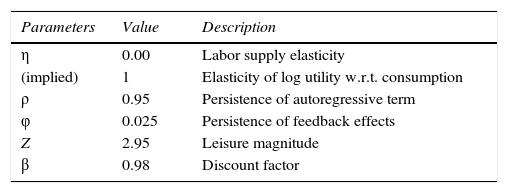

where Eait=1 and ∈it∼N0,σa2.Given that this is a hypothetical global scenario, we used somewhat conventional parameters values applied in other dsges to calibrate the model. For example, the parameters Z and β were set following the papers of Davig (2004) and Schmitt-Grohé and Uribe (2001), respectively. The ρ and φ are parameters fixed at 0.95 and 0.025, respectively. Since φ is relatively small, the findings below do not depend on the feedback effects between wages and productivity. Other parameters and values are illustrated in Table 1.

The effect of a wage bound on the good marketsAs shown in the business literature discussed above, the conditions that are depressing the wage rate are also limiting the sales level in the goods market. This will be shown in Proposition 1. A second best solution to correct the sub-optimality is provided by global minimum wages that re-establish the competitive wage rate. This global minimum wage law is gradually adjusted to reach the competitive wage rate in period T, such that E[wit] = 0.14 and E[wiT] = 0.1424.

Proposition 1: There is a global minimum wage that represents a Pareto improvement for this set of countries.

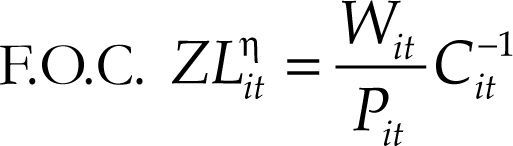

Proof: The utility maximization problem of the representative household in country i is given by:

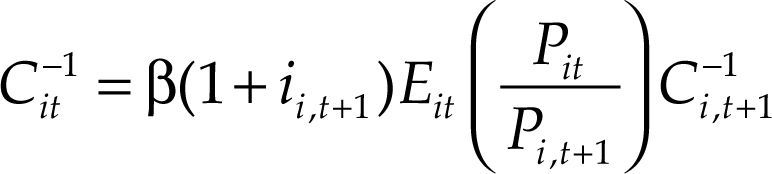

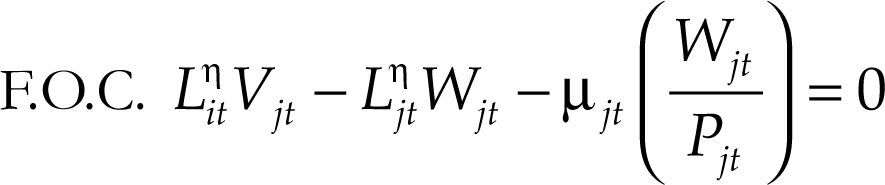

where π = nominal profits = PC – WL.On the other hand, the cost-minimization problem of the firms is given by:

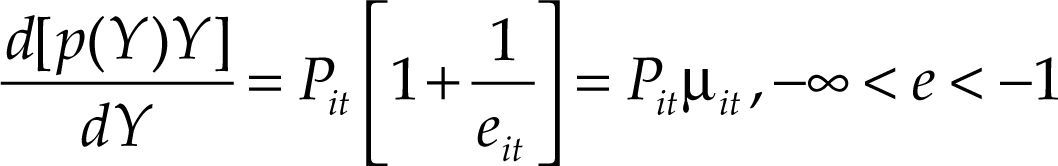

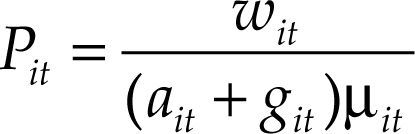

Letting the price at which the firms can sell their output be given by an inverse demand function of the sort Pit⋅≡Ci,t−1⋅, then let us define the marginal revenue by:

Thus, at the conventional optimal point, the price is:

If the nominal wage receives a permanent shock in period t+k → Pi,t+k < Wi,t+k. This follows from [1] and [10]5.

Hence, either Ct+k>Ct or Lt+kη>Ltη→ϒi,t+k>ϒit.

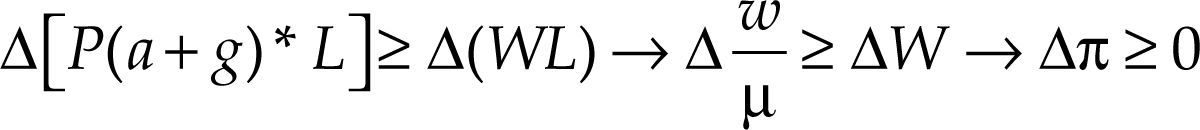

The Pareto improvement applies as long as π˙≥0, which is given by:

Thus, there is a Pareto improvement for both consumers and producers, as stated.

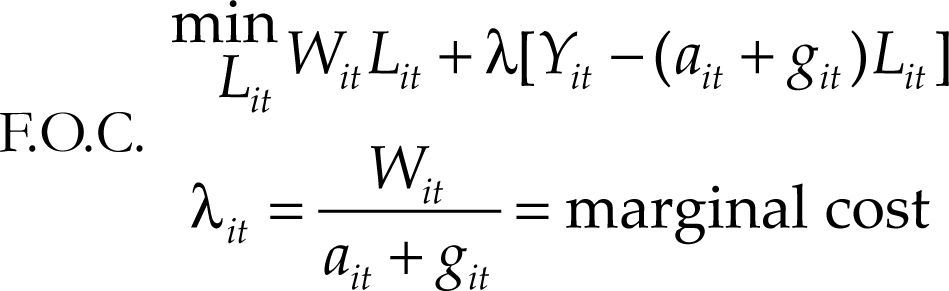

Figure 1 has the impulse-response function given an exogenous shock in wages. A net increase in real wages is found. There is also a Pareto improvement: Consumption, labor, and real profits have a non-negative change after the permanent shock on wages. Total output received the highest impact.

More complexities could be added to this simple model, such as heterogeneities in the markets or economic policies that help to ameliorate any perverse effects of a global minimum on minimum wages. However, to find conservative estimates, we keep this primer as simple as possible because adding fiscal or monetary policies could lead to overly optimistic results.

THE EFFECT ON THE LABOR MARKETProposition 2 shows that, in general, workers are not willing to work fora lower salary than the minimum wage established.

Proposition 2: Workers are not willing to work for a lower wage than the minimum established.

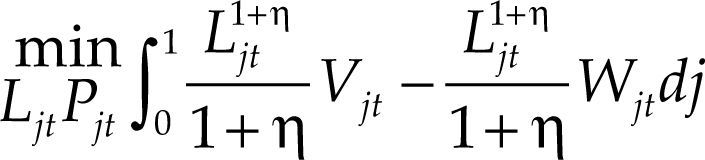

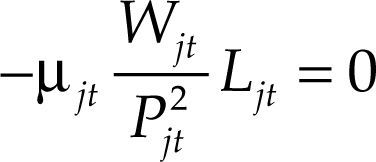

Proof: Workers attempt to minimize the following problem:

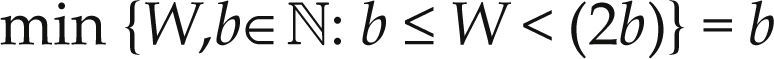

subject to:where V are the units of utility from leisure, j is the continuum of units of labor and Ljt1+η1+ηVjt is the opportunity cost of working in terms of leisure.Let b be the minimum wage set by law in the formal sector. Given that:

→ it follows by mathematical induction that: b = min V.

That is, the minimum reservation wage equals the binding minimum wage.

In other words, a floor in wages implies a floor in reservation wages. Thus, it is difficult to observe unemployment effects under these circumstances.

Let us introduce Lemma1, which shows the impact of an increase in purchasing power on labor demand.

Lemma 1: A higher purchasing power (either from local consumers or from abroad) in period t increases the labor demand in the formal sector.

Proof: The effect of a real wage increase on labor was already presented in the impulse-response figure of Section 2. Thus, for Lemma 1 this paper presents a simple proof.

Let us define the increase in purchasing power as:

Proposition 1 showed that there is a global minimum wage that increases wages more than prices. It follows that Cˆl>0. Then, country 1, for instance, will have:

where * indicates the new level. L* > L in the formal sector given the assumptions over a and g.What if there is an informal labor market? There is no clear empirical evidence about the extent of the gap between the average salaries in the informal sector vis-à-vis the formal in developing countries (Yamada, 1996). Nonetheless, let us assume for the moment that the wage setting in the informal sector benchmarks the setting in the formal sector. This is sometimes called the lighthouse effect (Boeri, Garibaldi, and Ribeiro, 2011). That is:

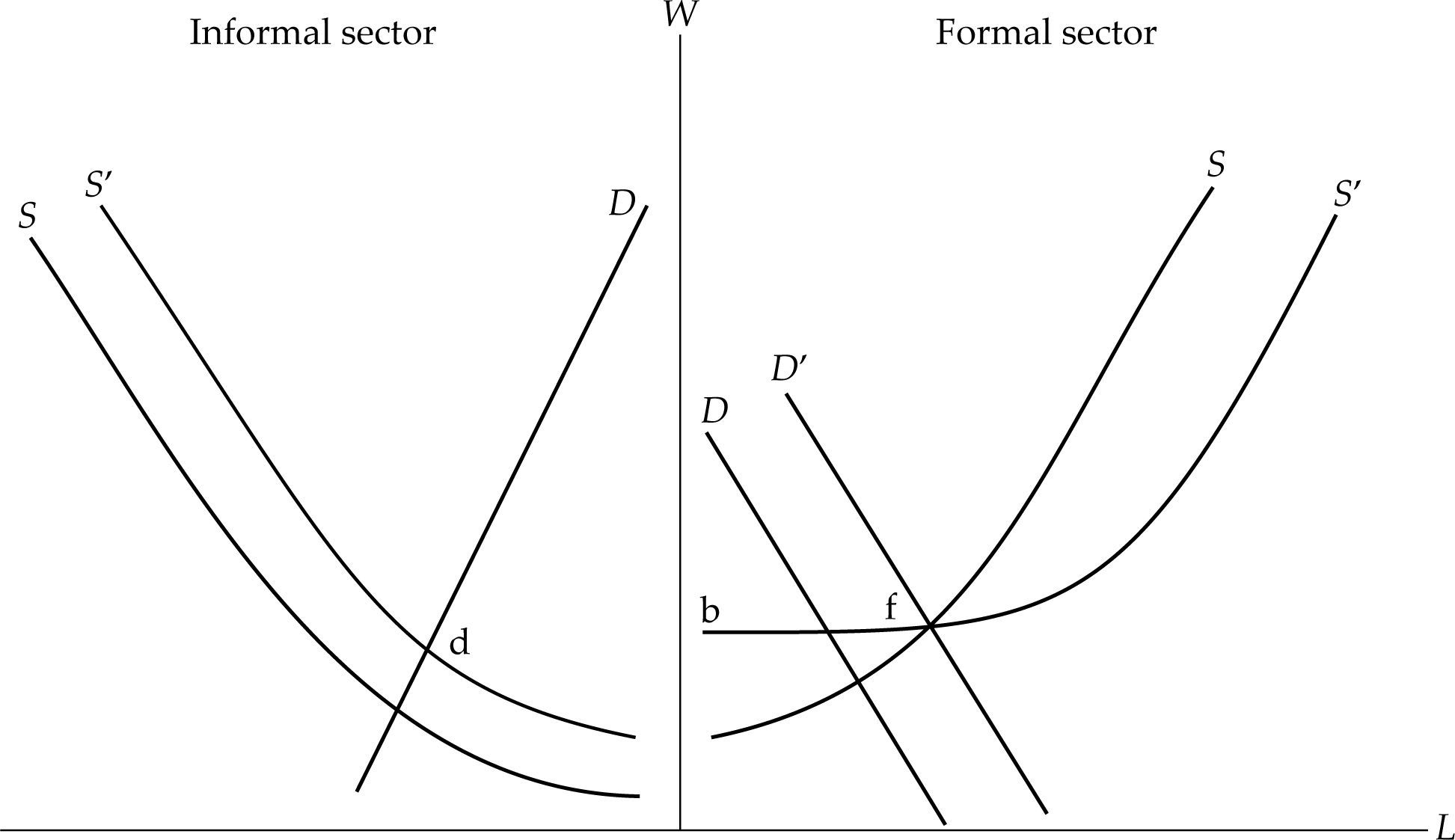

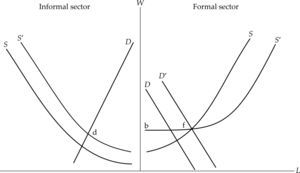

where n indicates informal and f formal.A similar representation of the effects on the labor market can be illustrated in Figure 2.6

Following Proposition 2, b is the new reservation wage of the workers in the formal sector given the new global minimum wage and f is the clearing level given the new law. Finally, in the informal sector the wage rate increases to point d by [12]. The labor demand in the informal sector remains constant because, by Lemma 1, only the formal sector was enhanced.

This characterization appears to be coherent with empirical studies. The positive effect of an increase in minimum wage on the wages of the informal Ribeiro, 2011). In addition, Lemma 1is consistent with the empirical findings of Galli and Kucera (2004), where countries with higher labor standards have higher shares of employment in the formal sector and lower shares in the informal sector.sector has been found empirically in many countries (Boeri, Garibaldi, and Ribeiro, 2011). In addition, Lemma 1is consistent with the empirical findings of Galli and Kucera (2004), where countries with higher labor standards have higher shares of employment in the formal sector and lower shares in the informal sector.

CONCLUSIONSThere is a considerable body of evidence suggesting a process that has been called the race towards the bottom, in which many developing countries face pressure to obtain competitiveness by depressing their labor standards. Since this race towards the bottom also keeps consumption at a suboptimal level, this process is not optimal or even rational from an economic point of view.

In addition, even when there are disagreements over the courses of action, the living conditions of the working poor in poor countries are generally not acceptable. Some firms may find it ethical to increase the level of wages for their workers (Chan, 2003), but there is a consensus that a unilateral action without a global lower bound may cause a loss in competitiveness. A binding global minimum on certain standards has been proposed to correct that suboptimality.

Multinationals need low production costs but also a high purchasing power to expand sales around the globe. A certain global floor for minimum wages (in practice this can be a salary slightly above the international poverty threshold), to be applied only in the very poor countries, can represent a Pareto improvement given the markets’ imperfections: Companies benefit because higher real wages imply more sales. Also, this paper shows that more sales may involve higher labor demand and may imply higher salaries in the informal sector.

A race towards the bottom distorts the comparative advantage that would arise in the absence of such economic policy (which deliberately depresses wages). In practice, this may have a direct effect on the very poor countries and an indirect effect on the rest of the world, where, in the absence of the pressure created by the global race to the bottom, higher wages can be established based on their comparative advantage. This could be applied even to countries that have multinational firms operating in Free Trade Zones because the sales of multinational firms depend on the global demand of goods, which can be stimulated by augmenting the purchasing power of poor countries.

Future extensions can consider the inclusion of heterogeneities in the labor market and across industries as well as the role of standard economic policies. This may lead to the discovery of new angles not considered in this introductory model.

Acknowledgements: I am grateful to Christian Proaño, Duncan Foley, Willi Semmler, Sanjay Reddy, and Marlio Paredes for their helpful feedback. However, the usual disclaimer applies.

This research assumes that the following circumstances described by Nolan (2003) in the 1990s have not been significantly altered:

Not only do six firms account for 68% of world auto sales, but two firms alone account for over half of total world brake systems sales and three firms account for over half of total global sales of tyres (sic). Not only do the top two carbonated soft drinks firms account for as much as three quarters of world sales, but the top two suppliers of aluminum, a key packaging material, account for around two fifths of global aluminum supplies. One firm alone accounts for over half of the world total of plastic bottle machinery (p. 310).

Further assumptions concerning the relation between formal and informal markets are found in the third section where labor markets are briefly discussed. Non-tradable goods are included in home goods.

A similar wage equation was given in Chang and Kim (2006), Escudé (2009), and Sin and Gaglianone (2006).

To find the competitive wage rate, we first run the model without frictions (in perfect competition) that would correspond to an economy not engaged in a race towards the bottom (i.e., that does not depress wages to attain competitiveness). This yields a rate of 0.142.

In practice, an increase in wages need not be completely mapped onto the level of prices because of many other factors: money, capacity utilization, and competition, among others. But, again, simplifications have to be made in any model. Counting the relevant equations, there are ten unknowns and ten equations.