Investment cash flow sensitivity constitutes one important block of the corporate financial literature. While it is well documented in standard corporate finance, it is still young under behavioral corporate finance. In this paper, we test the investment cash flow sensitivity among panel data of American industrial firms during 1999-2010. Using Q-model of investment (Tobin, 1969), we construct and introduce a proxy of managerial optimism following Malmendier and Tate (2005a) to show the impact of CEOs’ optimism in the relationship between investment and internal cash flow. Our results report a positive and significant coefficient of investment to cash flow for the full sample. While, on estimations of our model using sub-sample of more and less constrained firms, we find that the sensitivity exists stronger only for totally constrained group. We find also that board characteristics can reduce investment policy's distortions.

La sensibilidad de la inversión al flujo de caja constituye un bloque importante de la literatura financiera corporativa. Aunque está bien documentada en las finanzas corporativas estándar, aún es reciente en las conductuales. En este artículo investigamos la sensibilidad de la inversión al flujo de caja en los datos de panel de compañías industriales estadounidenses durante el período 1999-2010. Utilizando un modelo Q de inversión (Tobin, 1969), construimos e introducimos una representación de optimismo empresarial según Malmendier y Tate (2005a) para mostrar el impacto del optimismo del director ejecutivo en la relación entre inversión y flujo de caja interno. Nuestros resultados revelan un coeficiente de inversión al flujo de caja positivo y significativo en toda la muestra. Mientras, sobre las estimaciones de nuestro modelo utilizando submuestras de compañías más y menos limitadas, descubrimos que la sensibilidad es más fuerte solo para el grupo totalmente limitado. También detectamos que las características del consejo directivo pueden reducir las distorsiones de la política de inversión.

Standard corporate finance literature argues that corporate investment will be sensitive to internal cash flow availability. (Fazzari, Hubbard, & Petersen, 1988; Kaplan & Zingales, 1997, 2000; Harris & Raviv, 1990; Stulz, 1990; Hart & Moore, 1995; Zwiebel, 1996 and Cleary, 1999). In a rational framework, the causes of such sensitivity can be reduced to information asymmetry problems (Mayers & Majluf, 1984) and agency costs (Jensen & William, 1976, and Jensen, 1986).

Beyond the rational framework, a wave of research suggests that optimism or overconfidence biases play a central role in the investment and financing decisions making process (Kahneman & Lovallo, 1993; Shefrin, 2001; Goel & Thakor, 2000; Malmendier & Tate, 2001; Heaton, 2002, Gervais, Heaton & Odean, 2002; Hackbarth, 2008). In this behavioral framework, a new young approach commonly called “behavioral corporate finance” proposes managerial optimism as a factor that can cause corporate investment to be sensitive to internal cash flow.

The aim of this paper is to test the investment cash flow sensitivity under managerial optimism in a first time and we then introduce the effect of managerial optimism bias on investment cash-flow relationship when firm runs financial constraints. Hence, the paper contributes to the existing literature by (I) testing the validity of previous finding since there is a lack of empirical research in this fields. (II) Using new method based on dividend payout ratio to introduce the effect of financial constraint on the effect of optimism on investment-cash flow sensitivity in the American context.

The remainder of this paper is organized as follows. After this introduction, in Section 2, we present a literature review around the effect of managerial optimism on investment-cash flow relationship and we develop our hypothesis. In Section 3 we introduce our adjusted Q-investment model to test the effect of optimism on investment cash flow sensitivity and we offer a variables description and measurement. In this section we also provide a full description of managerial optimism measures. Section 4 provides that managerial optimism increase investment cash flow sensitivity and that this sensitivity will be intense when firms also run financial constraints. Section 5 offers discussions to our findings. Section 6 provides some empirical implications and Section 7 concludes.

2Literature review and hypothesis developmentDeparting from the hubris theory, Roll (1986) predicts that managerial overconfidence can affect corporate decisions. More recently, Heaton (2002) proposes a simple model of corporate finance with the introduction of managerial optimism. He predicts that CEOs’ optimism could have an explanatory power for firms’ decision making since it can cause investment cash flow sensitivity phenomena.

With optimistic managers, corporate investment should be interacted with firms’ internal financing sources. Heaton (2002) associates CEO's optimism to financing decision. Optimistic managers are assumed to be less rational from their portrait in traditional behavioral finance models. They believe that firm's projects under their control are better than they actually are. In such case, managers will attribute a higher expected return to these projects than their true value.

In Heaton's model (2002), managers with optimism bias are described as thinking that security issuing will be systematically under valuated by outside investors. Firms will use internal cash flow to finance their investment opportunities because internal financing seems to be costless with managerial optimism bias. This will lead to a cash flow investment phenomena.

Malmendier and Tate (2005a) propose a model where they introduce managerial overconfidence bias and they conclude that investment cash flow sensitivity exists and is robust among a sample of large American firms. They empirically demonstrate that managerial overconfidence increases the sensitivity of corporate investment to internal cash flow availability. Such conclusion may succeed to explain overinvestment and underinvestment problems. Corporate investment policies distortions can be influenced by managerial optimism that make it depended on internal cash flow. CEOs will intensively invest when cash flows are ample and we are facing an overinvestment friction and they will under invest when internal funds are insufficient. This will cause an under investment behavior which is a direct implication of overconfident mangers’ perception to the external sources of financing that seem having a high cost.

Malmendier and Tate (2005a) empirically validate a Heaton (2002) prediction who predicts a sensitivity of corporate investment policies to internal funding sources. Such relationship is dependent on firms’ financial constraints. Using the Kaplan and Zingales (KZ) measure of financial constraints, Malmendier and Tate (2005a) find that CEOs’ overconfidence increases the sensitivity of investment to cash flow and this will be greater for more constrained firms. The intuition here is that these firms run big difficulties when they want to finance their investment projects by external funds. The cost of external financing will be higher than that of others less constrained firms. For this reason, optimistic managers should prefer internal funds and the sensitivity of their corporate investment to internal cash flow will be intense when firms also are financially constrained. According to Hovakimian and Hovakimian (2009), financial constrains are defined as firms having restrictive and costly access to external capital markets and so that financially constrained firms should rely more on internal funds to finance their investment policy.

Malmendier and Tate (2005b) propose a revisited managerial overconfidence measure and they come up with similar results. Investment cash flow sensitivity persists in the American context and this result is robust, even if measures of overconfidence were changed. All the reviewed studies in this field document a positive relationship between investment and corporate cash flow availability.

Campbell, Johnson, Rutherford, and Stanley (2011) with minor substitutions for the governance control variables, due to data availability problem, confirm the Malmendier and Tate's finding that firms with optimistic managers have significantly greater investment cash flow sensitivity in the American context.

In a first study out of the United States, Lin, Hu, and Chen (2005) investigate the impact of managerial optimism on firm's investing activities. Among the listed companies from Taiwan, they find a positive correlation between investment and internal cash flow.

On the contrary, existing literature has documented positive correlation between top executives’ overconfidence and investment-cash flow sensitivity without any assumptions about agency cost. Wei Huang et al. (2011) suppose that there is a misalignment of the managerial and shareholders interest investigating how agency cost can affect the relation between top executives’ overconfidence and investment cash flow sensitivity using the data on exchange listed companies in China during 2002-2005. In their work, the main objective was to explore whether investment cash flow sensitivity differs between state-controlled and non state- controlled companies whose agency costs show significant difference.

Wei Huang et al. (2011)’ results demonstrate that average top executives’ overconfidence leads to increased investment cash flow sensitivity. However, this relation holds only for companies with state owned entities as controlling shareholders and it is not significant for non state controlled firms. This is because state-controlled companies have significantly greater agency cost than non-state controlled companies when running a regression using a proxy of agency cost. Additional tests on sub-sample show that the positive effect of top executives’ overconfidence on investment cash flow sensitivity only holds for companies that exhibit high agency cost.

After a comprehensive literature review of investment cash flow sensitivity under behavioral corporate finance and empirical results of Malmendier and Tate (2005a, 2005b), Campbell et al. (2011), Lin et al. (2005), Wei Huang et al. (2011), Glaser and Schmitz (2007), we can conclude that managerial optimism bias leads to an investment cash flow sensitivity and this sensitivity will be greater in the case of constrained firms. We summarize the above predictions in the following hypothesis.

Our first hypothesis derives from the theoretical predictions of Heaton (2002) and a wave of empirical validations (Malmendier and Tate (2005a, 2005b), Campbell et al. (2011), Lin et al. (2005), Wei Huang et al. (2011)) that demonstrate that managerial optimism bias creates a sensitivity between corporate investment and internal cash flow. For this reason, our first hypothesis will be oriented to empirically test the validity and robustness of this prediction: Optimistic CEOs will perceive that their stocks are under valuated and the financing of an investment project with external financing sources will make it costly so he/she will return to internal liquidity source a thing that will cause an investment cash flow relationship.Hypothesis 1 Managerial optimism bias leads to investment cash flow sensitivity.

Our second hypothesis jointly analyzes the effect of managerial optimism bias and the firm financial constraint on investment cash flow relationship. Regarding the above theoretical and empirical findings around the effect of managerial optimism on investment cash flow sensitivity, we aim to empirically test the effect of managerial optimism bias on investment-liquidity relationship when firm is also financially constrained. The discussion above here reviews the published paper in this subject and concludes that the totality of studies converges to a unified empirical finding; the effect of optimism on corporate investment and cash flow is intense when firms also run a financial constraint.Hypothesis 2 The investment cash flow sensitivity due to managerial optimism bias is more intense in the case of financially constraint firms.

In this paper we follow a similar methodology applied by previous researches in investment cash flow sensitivity. We use Q-investment model as is well documented both in standard and behavioral corporate finance literature. (Fazzari et al., 1988; Chirinko & Schaller, 1995; Hubbard, Kashyap & Whited, 1995; Calomiris & Hubbard (1995), Hubbard (1998), Kaplan & Zingales, 1997; Kaplan & Zingales, 2000; Cleary, 1999; Allayannis & Mozumdar, 2004; Malmendier and Tate (2005a, 2005b), W. Huang et al., 2011; Campbell et al., 2011) although critics of the Tobin's Q-model is still dominated and it represents a common empirical model to test investment cash flow sensitivity. (For the discussion of limits of Q-investment model, we can refer to Allayannis and James (2001). They synthesis critics of the Tobin model and conclude that even these weaknesses this model still dominates the methodology of studying investment cash flow sensitivity).

Investment cash flow sensitivity under managers irrationalities converge into the application of Q-investment model. This is because our aim in this new area of behavioral finance is to explain investment distortions and so it is crucial to apply the same methodology in order to compare empirical results (Malmendier & Tate, 2005a) and to strengthen conclusions and the possibility for generalizing.

The empirical model is a modified Q-investment model. We depart from the standard Q model of investment and we introduce the managerial optimism bias Optimismit. We obtain a novel model that should be able to detect the sensitivity of investment (I) to internal funds (CF). Our model can be generated by expression (1)

Following previous empirical research on investment cash flow sensitivity, we measure the corporate investment in fixed assets by (I). It represents the dependent variable and measured by capital expenditure (CAPEX). Cash flows (CF) are computed as earnings before interest, taxes, depreciation, and amortization (EBITDA). Q is a proxy for firms’ opportunity growth; it is obtained by the ratio of market value to book value.

Optimismit is our proxy of managerial optimism. It is a dichotomy variable that will be equal to one if CEOs are classified as optimistic and zero value otherwise. Our way for measuring managerial optimism is similar to Malmendier and Tate (2005a) and Lin et al. (2005). The Optimismit proxy is derived from CEOs’ internal transaction. As is initiated by Malmendier and Tate (2005a), we can use such information to classify managers as optimistic if they are net buyers of their firms’ stocks during their five years in tenure.

X is a vector that includes corporate governance variables. Previous researches on investment cash flow sensitivity show that internal mechanisms of corporate governance have an explanatory power to explain the sensitivity phenomena, namely the board of director, as a central internal mechanism of corporate finance (Jensen, 1993), this can affect the relationship between corporate investment and internal funds. Among a large sample of American firms, Malmendier and Tate (2005a) document that board independence can arrive at reducing the investment cash flow sensitivity phenomena. The board's independence is a sign of its effectiveness (Jensen, 1993). The board's size can be used to detect the effect of the size, measured by the number of their members on the corporate policy distortions. Finally, the X vector should include ownership structure variables. We concentrate on the study of the effect of the CEO's detention on his firms’ capital on investment cash flow sensitivity.

To make comparisons between our results and other previous results in both the standard literature of corporate investment and those from behavioral corporate finance, we keep the same common methodology in the study of interactions between firms’ investment and internal source of financing. We estimate a fixed effect panel data with OLS regressions. We run model (1) for the full sample. We then split out this sample to generate a sub-sample that will probably be less or more constrained.

In this study we use the dividend payout ratio as a strong criterion to classify firms into two groups. The first one includes the most constrained firms, while the second one includes the less constrained firms. Our aim in this second step is to test the investment cash flow relationship under firms’ financial constraints hypothesis. Are theoretical predictions that postulate that CEOs’ optimism increases the investment cash flow sensitivity and this sensitivity will be greater if the firm is running financial constraints?

The dividend payout ratio is one of the most criteria in financial literature that is used to detect if firms run financial constraints (Fazzari et al., 1988; Hubbard et al., 1995; Calomiris & Hubbard, 1995; Agung, 2000). The argument of the excessive use of this ratio is formulated by Fazzari et al. (1988). They argue that the dividend payout ratio is useful for identifying firms suffering from financing constraints. External financing is costly and the firm should retain its cash and so it will pay low cash dividends out. In other words, if a firm is in a financial distress, it is probably that it cut dividends and uses it for internal financing (Cleary, 1999). Lin et al. (2005) use dividend payout ratio to run Q-investmel model among two sub-samples, the first one are firms with high dividend payout ratio. The dividend payout ratio is equal to the number of years with non-zero cash dividend to that in our sample period (Lin et al., 2005). These firms are so unconstrained firms. However, the second group includes firms that are fully constrained and the value of the dividend payout ratio for this group is equal to zero. Previous researches use a similar formula to determinate firms’ financial constraints degree. They define they use the median of this ratio and define firms that have a dividend ratio bellow the median and less constrained firms with a dividend ratio above the median. Lin et al. (2005) split their full sample into more constrained and less constrained firms by ranking all firms from small to large, using the dividend payout ratio and they define the smaller 50% firms as more constrained while the larger 50% firms as less constrained.

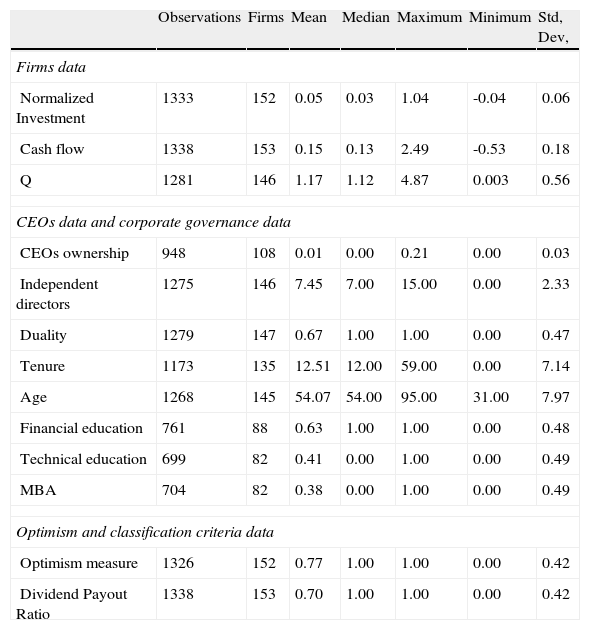

4Data descriptionOur dataset consists of 1 338 annual observations among the majority of NYSE industrial firms (see Table 1). We use the Thomson Financial data base to extract insider transaction for these firms. Firms with no insider transaction availability are excluded. We also exclude firms that have less than five years1. Finally, we exclude firms with missing data. We use unbalanced panel data with 153 manufacturing firms between 1999 and 2010. Bond and Meghir (1994)2 use similar methodology to test the impact of financial constraint on investment cash flow sensitivity.

Full sample: Summary of descriptive statistics.

| Observations | Firms | Mean | Median | Maximum | Minimum | Std, Dev, | |

| Firms data | |||||||

| Normalized Investment | 1333 | 152 | 0.05 | 0.03 | 1.04 | -0.04 | 0.06 |

| Cash flow | 1338 | 153 | 0.15 | 0.13 | 2.49 | -0.53 | 0.18 |

| Q | 1281 | 146 | 1.17 | 1.12 | 4.87 | 0.003 | 0.56 |

| CEOs data and corporate governance data | |||||||

| CEOs ownership | 948 | 108 | 0.01 | 0.00 | 0.21 | 0.00 | 0.03 |

| Independent directors | 1275 | 146 | 7.45 | 7.00 | 15.00 | 0.00 | 2.33 |

| Duality | 1279 | 147 | 0.67 | 1.00 | 1.00 | 0.00 | 0.47 |

| Tenure | 1173 | 135 | 12.51 | 12.00 | 59.00 | 0.00 | 7.14 |

| Age | 1268 | 145 | 54.07 | 54.00 | 95.00 | 31.00 | 7.97 |

| Financial education | 761 | 88 | 0.63 | 1.00 | 1.00 | 0.00 | 0.48 |

| Technical education | 699 | 82 | 0.41 | 0.00 | 1.00 | 0.00 | 0.49 |

| MBA | 704 | 82 | 0.38 | 0.00 | 1.00 | 0.00 | 0.49 |

| Optimism and classification criteria data | |||||||

| Optimism measure | 1326 | 152 | 0.77 | 1.00 | 1.00 | 0.00 | 0.42 |

| Dividend Payout Ratio | 1338 | 153 | 0.70 | 1.00 | 1.00 | 0.00 | 0.42 |

Author

We use world-scope data base to compute firms’ investment, cash flow and others information, such as the dividend paid, that we need to estimate our empirical model. Data concerning the CEOs’ optimism measurement derive from Thomson Financial data base. We use exactly insiders transactions data base; CEOs transactions. This data base offers details for CEOs’ internal transactions that can be used as a strong measure of managerial optimism. The CEOs internal transactions are largely used in the investment cash flow sensitivity under managerial irrationality (Malmendier & Tate, 2005), Lin et al. (2005) and Campbell (2011). Campbell (2011) uses the same data base to construct a proxy for managerial optimism in the study of CEOs’ forced turnover. Campbell et al. (2011) give more details in their paper). Only CEOs with a minimum of five years in their actual post are included. This criterion is imposed by previous literature in this field.

Additional data bases are implied here, SEC (Security Exchange Commission). Thomson officers and directors data are used in order to handily collect information about corporate governance mechanisms. They represent a practical tool to construct proxy for board of directors’ efficiency, namely we use information about the number of independent directors and the board size. CEOs’ ownership is generated by Thomson Financial Data base.

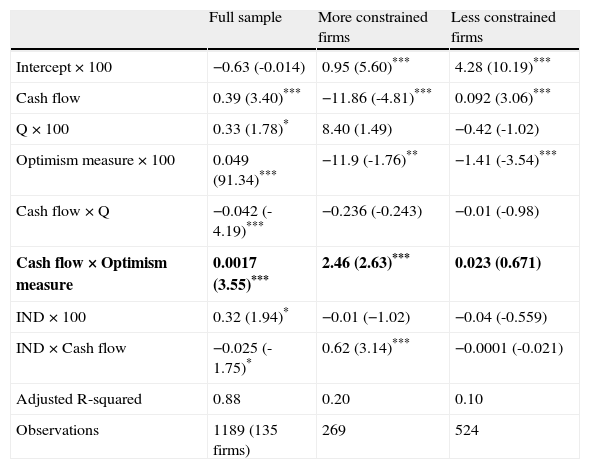

5Empirical resultsTable 3 gives details of estimation of our empirical model. Following previous literature in investment cash flow sensitivity (Fazzari et al., 1988)3 and recent literature provided by behavioral corporate finance (Malmendier & Tate, 2005a; Malmendier & Tate, 2005b; Lin et al., 2005) we use a fixed effect panel technique with OLS regression. Column one of Table 3 reports estimation results of model (1) for the full sample. The cash flow has a strong explanatory power. Our empirical finding insists on the existence of a positive and a significant correlation between corporate investment and internal funds availability. The coefficient between investment and cash flow is (0.39) at the one percent level (t=3.40). Previous literature comes up with similar results as is pioneered by Fazzari et al. (1988). For the full sample, corporate investment is sensitive to cash flow. This means that the corporate investment policy will depend on internal funds availability and levels. Beyond the perfect world of Modigliani and Miller (1958), firms’ financial situation can affect its investment policy and the investment-financing decision should be jointly discussed.

OLS regression of investment on cash flow and optimism measure.

| Full sample | More constrained firms | Less constrained firms | |

| Intercept×100 | −0.63 (-0.014) | 0.95 (5.60)*** | 4.28 (10.19)*** |

| Cash flow | 0.39 (3.40)*** | −11.86 (-4.81)*** | 0.092 (3.06)*** |

| Q×100 | 0.33 (1.78)* | 8.40 (1.49) | −0.42 (-1.02) |

| Optimism measure×100 | 0.049 (91.34)*** | −11.9 (-1.76)** | −1.41 (-3.54)*** |

| Cash flow×Q | −0.042 (-4.19)*** | −0.236 (-0.243) | −0.01 (-0.98) |

| Cash flow × Optimism measure | 0.0017 (3.55)*** | 2.46 (2.63)*** | 0.023 (0.671) |

| IND×100 | 0.32 (1.94)* | −0.01 (−1.02) | −0.04 (-0.559) |

| IND×Cash flow | −0.025 (-1.75)* | 0.62 (3.14)*** | −0.0001 (-0.021) |

| Adjusted R-squared | 0.88 | 0.20 | 0.10 |

| Observations | 1189 (135 firms) | 269 | 524 |

Author

***,** and * denote that results are significant at the 1%, 5% and 10% level

As is predicted by the standard Q-model of investment, investment and opportunity growth are positively significant at the ten percent level (β1=0.33 and t=1.78). Corporate investment depends on the existence of growth opportunity. Optimism has a positive effect on corporate investment level. CEOs’ optimism can increase investment level (β3=0.049 and t = 91.34). Firm investment and managerial optimism have a high student-t, a thing that means that the correlation is highly significant. However, this coefficient that relays on firms’ investment to the CEOs’ optimism should be carefully interpreted. Optimism’ effect may be depended on other unobservable factors. Firstly, the optimism can have an asymmetric effect for equity-dependent firms (Malmendier & Tate, 2005a). They developed a simple model of corporate financing-investment where managers are assumed to be irrational since they are frapped by their overconfidence bias. According to their second predictions, investment of equity-dependent firms can especially be affected by managerial optimism. They adopted a logic that stipulates that if a firm has sufficient amount of cash or untapped debt capacity to finance all their investment projects, internal cash flow may not affect the investment level. Secondly, optimism can have different effects on corporate investment with a joint presence of CEOs’ optimism and agency costs (Huang et al., 2011). So, the effect of optimism is governed by agency costs existence and level. In their paper, Huang et al. (2011) document that average top executives’ overconfidence affects corporate investment since it contributes to the emergence of an investment cash flow sensitivity phenomena. However, this relationship is pronounced only for companies with state owned entities as controlling shareholders. They construct a proxy for agency costs and show that the effect of managerial optimism holds only for companies that exhibit high agency costs. Finally, the relationship between corporate investment policy and managerial irrationality can be influenced by firms’ financial situation (Heaton, 2002; Lin et al., 2005; Malmendier & Tate 2005).

Investment cash flow sensitivity in the presence of managerial optimism is the central question of our research paper. Our results show that coefficient of investment to cash flow in the presence of optimistic managers (β5) is positive and significant at the one percent level (t=3.55).This finding supports previous results theoretically spawned by Heaton (2002) and empirically initiated by Malmendier & Tate (2005a). It also corroborates empirical findings of Malmendier & Tate (2005b), Lin et al. (2005), Huang et al. (2011) and Campbell et al. (2011).

Corporate investment can be explained by CEOs irrationality. Personal characteristics and psychological biases of managers are an important factor that may explain corporate policies (Hackbarth, 2002). Heaton (2002) theoretically predicts that CEOs will overinvest with sufficient internal funds and under invest if internal cash is limited. Optimistic managers are assumed to have their own perception about stock markets; they always perceive that market under valuates their share value. Departing from this hypothesis, external finance will be seen as highly costly compared with internal financing source. In real world, this will lead to investment cash flow sensitivity.

Corporate governance can also explain firms’ investment distortions (Hadlock, 1998, Malmendier & Tate (2005a), Huang et al., 2011). In this study we just introduce the board characteristics as a power internal mechanism that can be representative of corporate governance effectiveness. We use the board independence as an explicative variable. Jensen (1993) shows that when the board of director is dominated by independent members, it will act with efficiency. Among a large sample of industrial American firms, Malmendier and Tate (2005a) report a negative correlation between corporate investment and internal funds in the special case where a firm has an independent board. Our result indicates that (β6 = -0.025) is negative and significant at the ten percent level (t = -1.75).

Our results corroborate previous empirical finding in the field of investment cash flow sensitivity under behavioral corporate finance. Managerial optimism can be considered as one of the determinant of corporate investment policy distortions, and our first hypothesis is verified.

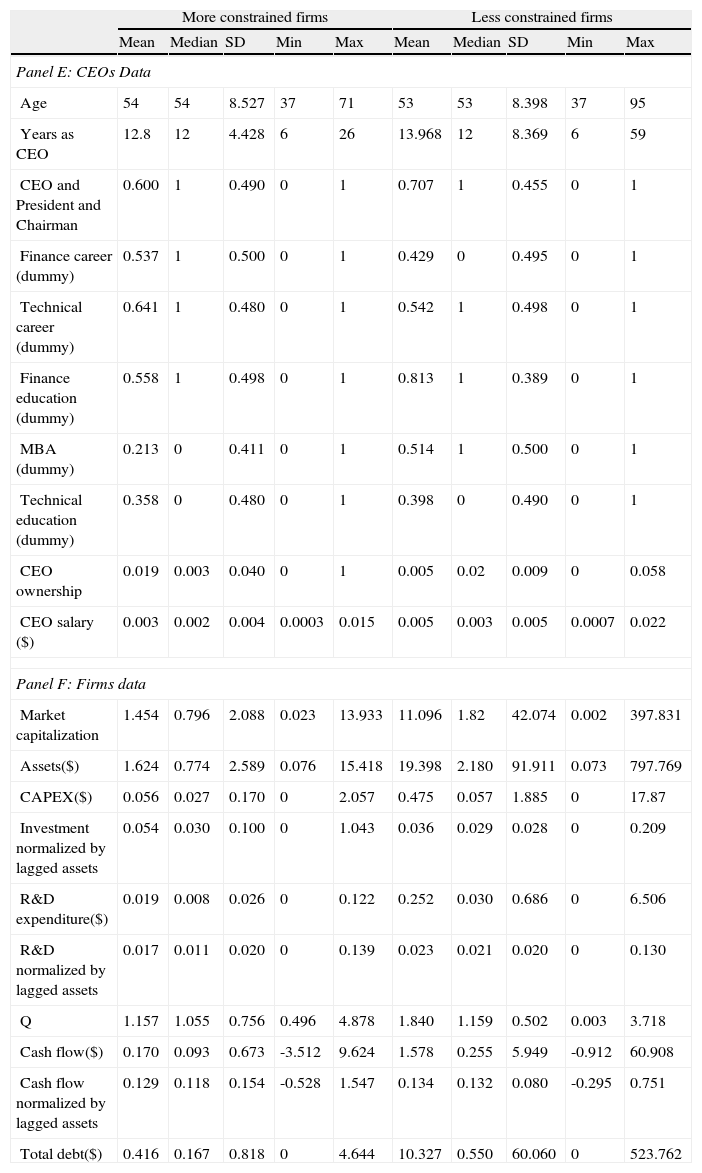

As is mentioned before, we run our empirical model (1) to sub-sample where we evoke the possible effect of financial constraints to investment cash flow sensitivity. Table 3, column B details estimations’ result of model (1) for more constrained firms while column C shows estimations’ results of the same model for a sub-sample that is classified as less constrained.

The more constrained firms here are defined as firms with exactly zero value of the dividends payout ratio (see Table 2). In our study, more constrained firms are really totally constrained. This sub-sample includes firms that do not distribute dividend during our period of this study. A surprising result is that cash flow is negatively associated with corporate investment and this correlation is intensive (β2 = -11.86). This result is highly significant (t=-4.81). The same coefficient is equal to (0.092) for less constrained firms and significant at the one percent level (t=3.06). Investment cash flow sensitivity is more pronounced for less constrained firms. This finding is coherent with Kaplan and Zingales (1997) and Cleary (1999). This result does not necessarily put into question previous theoretical development. According to them, more constrained firms are more exposed to an investment cash flow sensitivity phenomenon. Our result also opposes previous result by Fazzari et al. (1988). Such finding does not put into question our previous theoretical development. Gilchrist and Himmelberg (1995) and Erickson and Whited (2000) argue that measurement problems associated with Tobin's Q have an effect on investment cash flow sensitivity. Other explanations are provided by Allayannis and Mozumdar (2004). They demonstrate that the addition of firms with negative cash flows can lead to such findings; these firms are financially distressed and so their investments are not sensitive to their internal cash flows. One other potential possible justification of our result comes from Moyen (1999). He finds that classifications criteria used to distinguish between financially constrained and constrained firms can lead to results consistent both with empirical findings of Fazzari et al. (1988) and those of Kaplan and Zingales (1997), especially the dividend payout ratio applied by Moyen (1999); then his results also support Fazzari et al. (1988) results.

Sub-sample 1: Classification based on the dividend payout ratio.

| More constrained firms | Less constrained firms | |||||||||

| Mean | Median | SD | Min | Max | Mean | Median | SD | Min | Max | |

| Panel E: CEOs Data | ||||||||||

| Age | 54 | 54 | 8.527 | 37 | 71 | 53 | 53 | 8.398 | 37 | 95 |

| Years as CEO | 12.8 | 12 | 4.428 | 6 | 26 | 13.968 | 12 | 8.369 | 6 | 59 |

| CEO and President and Chairman | 0.600 | 1 | 0.490 | 0 | 1 | 0.707 | 1 | 0.455 | 0 | 1 |

| Finance career (dummy) | 0.537 | 1 | 0.500 | 0 | 1 | 0.429 | 0 | 0.495 | 0 | 1 |

| Technical career (dummy) | 0.641 | 1 | 0.480 | 0 | 1 | 0.542 | 1 | 0.498 | 0 | 1 |

| Finance education (dummy) | 0.558 | 1 | 0.498 | 0 | 1 | 0.813 | 1 | 0.389 | 0 | 1 |

| MBA (dummy) | 0.213 | 0 | 0.411 | 0 | 1 | 0.514 | 1 | 0.500 | 0 | 1 |

| Technical education (dummy) | 0.358 | 0 | 0.480 | 0 | 1 | 0.398 | 0 | 0.490 | 0 | 1 |

| CEO ownership | 0.019 | 0.003 | 0.040 | 0 | 1 | 0.005 | 0.02 | 0.009 | 0 | 0.058 |

| CEO salary ($) | 0.003 | 0.002 | 0.004 | 0.0003 | 0.015 | 0.005 | 0.003 | 0.005 | 0.0007 | 0.022 |

| Panel F: Firms data | ||||||||||

| Market capitalization | 1.454 | 0.796 | 2.088 | 0.023 | 13.933 | 11.096 | 1.82 | 42.074 | 0.002 | 397.831 |

| Assets($) | 1.624 | 0.774 | 2.589 | 0.076 | 15.418 | 19.398 | 2.180 | 91.911 | 0.073 | 797.769 |

| CAPEX($) | 0.056 | 0.027 | 0.170 | 0 | 2.057 | 0.475 | 0.057 | 1.885 | 0 | 17.87 |

| Investment normalized by lagged assets | 0.054 | 0.030 | 0.100 | 0 | 1.043 | 0.036 | 0.029 | 0.028 | 0 | 0.209 |

| R&D expenditure($) | 0.019 | 0.008 | 0.026 | 0 | 0.122 | 0.252 | 0.030 | 0.686 | 0 | 6.506 |

| R&D normalized by lagged assets | 0.017 | 0.011 | 0.020 | 0 | 0.139 | 0.023 | 0.021 | 0.020 | 0 | 0.130 |

| Q | 1.157 | 1.055 | 0.756 | 0.496 | 4.878 | 1.840 | 1.159 | 0.502 | 0.003 | 3.718 |

| Cash flow($) | 0.170 | 0.093 | 0.673 | -3.512 | 9.624 | 1.578 | 0.255 | 5.949 | -0.912 | 60.908 |

| Cash flow normalized by lagged assets | 0.129 | 0.118 | 0.154 | -0.528 | 1.547 | 0.134 | 0.132 | 0.080 | -0.295 | 0.751 |

| Total debt($) | 0.416 | 0.167 | 0.818 | 0 | 4.644 | 10.327 | 0.550 | 60.060 | 0 | 523.762 |

Summary of descriptive statistics

Author

Optimism measure is highly negative and significant for the more constrained firms. (β3=-11.9, t=-1.76). As is already mentioned before, one should be conscious when interpreting such coefficient. Here, a plausible reason for this negative relationship between corporate investment and managerial optimism is that these firms are financially distressed. For the least constrained firms, negative and significant at the one percent level as well. Here, we can adopt a similar logic to interpret. Since these firms are less constrained, it is logical that the correlation between CEOs’ optimism and firms’ investment is greater than those with high financial distress probability and then more financial constraints. Optimistic CEOs as well described by Heaton (2002) always perceive external financing as costly and the stock market under valuates its stocks. Therefore, optimism should not be directly implicating an increase in corporate investment. One important factor that derives this correlation is firms’ financial situation. Even for unconstrained firms, the coefficient can be negative because these firms are only classified as less constrained only during the study period.

In this study, we document for an original empirical finding. The coefficient between investment and internal funds becomes positive and significant at the one percent level (β5=2.46; t=2.63). This coefficient is positive and weak but insignificant for less constrained firms. Managerial optimism has a large effect on corporate investment, especially in the case of constrained firms. It increases the investment cash flow sensitivity when firms are financially distressed. Even if the correlation between investment and cash flow is negative and highly significant, with the introduction of optimism bias we observe a positive interaction between firms’ investment and internal financing source availability. Firms with optimistic managers are exposed to investment distortions problems; this is because they expose their investment projects to an investment cash flow phenomena. They will intensively invest when internal financing is available and they may refuse good investment projects with positive NPV in the case of short cash.

Our result also implies that a governmental policy that aims to inject liquidity and facilitate the external financing by firms can appear as inefficient when firms are governed by irrational managers who are affected by their optimism bias. Firms are close to their internal funds and they can refuse to finance positive NPV project in the absence of sufficient internal financing funds. Such prediction should not only make it legitimate to revise corporate investment models but also economic theory is invited to take into consideration the effect of CEOs irrationalities.

6DiscussionsHow do managers’ psychological biases affect their corporate investment policy? This is the main question of this study. We adopt a modified Q-investment model which includes a proxy for managerial optimism constructed on the basis of Malmendier and Tate's (2005a) work. Our optimism measure is well documented in the majority of papers in this area of finance.

Running our model for the full sample, we support previous results by Malmendier and Tate (2005a), Malmendier and Tate (2005b), Lin et al. (2005), Huang et al. (2011) and Campbell et al. (2011). Optimism bias has a significant influence on firms’ investment policy. We demonstrate that optimistic managers, who are assumed to always perceive that market under valuate their firms’ value, apply an investment cash flow sensitivity phenomenon. Such result can be explored to advance an original explanation for corporate investment distortions.

We document that managerial optimism increases investment cash flow sensitivity. As is predicted by behavioral corporate finance literature, managers overinvest when internal funds are ample and they can show an underinvestment behavior in the case of short cash.

Another interesting thing in this paper is that it explores the investment cash flow sensitivity of optimistic managers when firms are totally financially constrained. We adopt the dividend payout ratio to classify firms and we define those with zero value of dividend payout ratio as totally distressed firms.

In contrast to Malmendier and Tate's results (2005a), managerial optimism can only increase investment cash flow sensitivity of totally constrained firms. Firms with high dividend payout ratio are less exposed to investment distortion problems caused by managerial optimism.

Such result can be interpreted in different ways: (I) Constrained firms can run higher financing costs if they have the possibility to access to external financing sources and they do it. They are motivated to excessively use their internal funds. This will not be the case of unconstrained firms that have better possibilities to engage in external funds. (II) Our result can be driven by agency cost degree. As is mentioned by Huang et al. (2011), firms with high level of agency costs are more influenced by CEOs’ optimism in terms of investment cash flow sensitivity. Firms with high level of dividend payout are assumed to run less agency costs. According to M. Rozeff (1982) and Easterbrook (1984) the payouts to shareholders reduce the resources under managers’ control, thereby reducing managers’ power and making it more likely to incur the monitoring of capital markets which occurs when the firm must obtain new capital. Adopting similar logic, firms with zero dividend payout ratios should have the greatest degree of agency problems and so they can probably be more exposed to investment cash flow sensitivity (Huang et al., 2011). (III) Finally, one should be aware that our result can be influenced by the sample size. We should include more firms or we should make a comparison between different contexts4 in the same period in order to generalize.

7Empirical implicationsBeyond the traditional explanation of firms’ investment distortions, behavioral corporate finance proposes a new original explanation. Managerial optimism bias has an explanatory power. Firms, namely shareholders are invited to be aware of the effect of CEOs’ behavioral biases in their investment policies.

Corporate governance mechanisms should be designed in an efficient structure in order to limit such problems. Referring to our empirical findings, firms should strengthen their boards by increasing their independence. This can be an easy task if a government also obliges a high number of independent directors in boards’ structure.

Decision makers are also invited to encourage CEOs’ ownerships in their firms. This can be an efficient instrument to discipline them and to align shareholders and managers interest and reduce managerial irrationality.

Finally, it is time to stop saying that investments’ distortions are due to market imperfections or flaws in corporate governance systems or mechanisms only. They should pay a great attention to CEOs’ psychological bias and traits of personality as a new factor that may cause frictions and may explain underinvestment or overinvestment problems.

8ConclusionThis study explores a fundamental question in behavioral corporate finance: how does managerial optimism affect firms’ investment policy? Adopting a modified Q-investment model we show evidence of the effect of optimism bias on investment cash flow sensitivity.

The coefficient of investment to cash flow increases with managerial optimism. Our study shows a weak positive and significant influence of optimism bias for the full sample. However, when classifying firms into two sub-samples: in contrast to Malmendier and Tate's results (2005a) and Lin et al. (2005), we find that managerial optimism increases investment cash flow sensitivity only for financially distressed firms.

Our results make challenge in generalizing the relationship between investment and managers optimism bias. We also offer an original explanation of how managerial ownership and personal characteristics affect their investment policy. Finally, this paper can be ameliorated by adopting a new measure of managerial optimism that can go away from the dichotomy measure. We can refer at this level to Campbell et al. (2011) who construct intervals of managerial optimism that classify CEOs into them having high, moderate or low optimism level.

This is because our managerial optimism is based on the first five years in tenure of a CEO.

In their work they use unbalanced panel but they use the Euler equation model of investment.

This literature is spawned by these authors but we can find a large empirical literature that uses the same technique. For more details, we can refer to these authors.

The idea here is that the study of managerial optimism and investment cash flow sensitivity may be affected by the context's specificity: market oriented economics or economy debt. Another interesting thing is to see the effect of corporate governance systems (Anglo-Saxon system versus German and Japan systems).