There is a growing recognition that firms increase their collaboration breadth by opening their boundaries to more innovation partners, sourcing and integrating complementary knowledge, skills, and resources and, in turn, improving their innovation performance. However, not all firms benefit equally from collaboration breadth. We argue that the literature has not considered important contingency factors that can mitigate such benefits. This paper enhances understanding of the relationship between collaboration breadth and innovation performance by contending, and empirically confirming, that the magnitude and direction of this association depend on the type of constraints the firm faces. Drawing on organizational learning theory, it is argued that firms encountering financial, knowledge, and institutional innovation constraints will compromise the effects of their openness. The empirical findings suggest that innovative firms face challenges balancing trade-offs between a broad collaboration network and high financial, knowledge, and institutional constraints.

Firms are increasingly opening their boundaries to access resources and knowledge because they must possess all the information and skills required to develop their products and processes (Love et al., 2014; Naqshbandi & Jasimuddin, 2022). Accordingly, scholars have long assumed that openness to internal and external knowledge flows and ideas increases innovation performance (Chesbrough, 2017; Laursen & Salter, 2006; Parida et al., 2014). There are recent research calls (Chesbrough et al., 2018; Foss & Saebi, 2017; Stanko et al., 2017) to examine the contingent nature of the impact of openness on innovation performance. While openness can be achieved by increasing search breadth and depth, innovation constraints facing a firm (e.g., absorptive capacity, finance) may hamper innovation (Garriga et al., 2013). The study by Garriga et al. (2013) reveals negative effects of innovation constraints on innovation performance through decreasing search depth. However, less is known about whether these negative effects also apply to collaboration breadth.

This paper focuses on collaboration breadth, defined as the extent to which a firm purposively exchanges knowledge with its innovation collaborators (e.g., suppliers, customers, competitors, consultants, and research institutes) to jointly advance and commercialize innovations (Kobarg et al., 2019; Laursen & Salter, 2014) and develop new products and services (Laursen & Salter, 2006). Collaboration breadth differs from search breadth in its deliberate focus (e.g., investment, resourcing) on collaboration in a formal manner, which promotes a deeper search. Collaboration may increase the depth of learning from partners. Moreover, when firms engage in formal collaborations to speed up technology development or solve innovation problems (Hagedoorn et al., 2018; Kobarg et al., 2019; Simeth & Mohammadi, 2022), they alter their technological and resource limitations.

The assumption that the higher the number of collaborations a firm engages in, the greater the probability of useful knowledge recombinations and complementarities between internal and external skills and resources (Huang & Rice, 2012; Love et al., 2014; Markovic & Bagherzadeh, 2018) must be corrected by considering how collaboration interacts with different constraints. However, there is a lack of evidence whether the purported benefits of innovation from collaboration breadth (Faems et al., 2005; Huang & Rice, 2012; Love et al., 2014; Markovic & Bagherzadeh, 2018) can be altered by different innovation constraints, as in the case of search breadth/depth (Garriga et al., 2013).

The lack of internal resources (e.g., finance, skills) and absorptive capacity within a firm are major innovation constraints (Monteiro et al., 2017), as is the case with external market or institutional constraints (Garriga et al., 2013). There is abundant evidence that such innovation constraints limit innovation (e.g., Coad et al., 2016; Silva et al., 2008; Voss et al., 2008). However, contradicting this dominant argument, Asimakopoulos et al. (2020) contend that resource-constrained firms are generally attracted to opportunities in line with their existing resources, and that they leverage and stretch their available resources more efficiently, and mobilize external complementary resources in a more focused manner. While there is also evidence suggesting innovation constraints drive innovation (e.g., Katila & Shane, 2005; Keupp & Gassmann, 2013; Van Burg et al., 2012), the arguments advanced by Asimakopoulos et al. (2020) may not apply to collaboration breadth.

There are many ways to overcome innovation constraints, including collaboration with others. To fully capture the benefits of their wide collaborative networks, firms need first to ensure that they possess enough resources to allocate to the experimentation and exploration of novel and unique innovation ideas from their collaborators (De Araújo Burcharth et al., 2015; March, 1991). While absorptive capacity matters, it is not merely a passive outcome of R&D (de Araújo Burcharth et al., 2015). When firms collaborate, they learn from collaborators (increase absorptive capacity) and use (borrow) their resources to compensate for the firm's limitations. Moreover, the concern for secrecy (Monteiro et al., 2017) may well be reduced as collaborators may become more open. To understand the interaction effects between collaboration breadth and various constraints, this paper seeks to address the research question of how the relationship between collaboration breadth and innovation performance is influenced by the specific constraints of innovation.

Drawing from the relevant literature (Audretsch & Belitski, 2023; D'Este et al., 2012; Pellegrino & Savona, 2017), this paper distinguishes between three categories of innovation constraints, namely: (1) financial, which denote the organizational difficulties in financing innovation projects; (2) knowledge, which explain the difficulty in accessing information on technology, markets, and skilled labour; and (3) institutional, which explain the market structure and demand and the role of regulations and standards in mitigating innovativeness. This paper advances the organizational learning theory (OLT) (Fiol & Lyles, 1985; Levinthal & March, 1993; Levitt & March, 1988) by exploring whether the three categories of constraints impact the effectiveness of open, collaborative relationships for innovation purposes (De Araújo Burcharth et al., 2015; Levinthal & March, 1981; March, 1991). Although broad collaborations expose the focal firm to diverse knowledge and novel recombinations (Grimpe & Kaiser, 2010; Laursen & Salter, 2014), such benefits can be either compromised for constrained firms or enhanced through leveraging collaborative resources.

This paper contributes to the open innovation literature in various ways. First, it offers a more nuanced understanding of the benefits of openness by bringing to the fore the importance of contingency factors in defining the benefits of collaboration breadth for innovation outputs (Chesbrough et al., 2018). Second, it clarifies the direction of the effects of collaboration breadth on innovation (e.g., Keupp & Gassmann, 2013; Nohria & Gulati, 1996; Van Burg et al., 2012; Voss et al., 2008) given the presence of innovation constraints. Third, it distinguishes three distinct and meaningful categories of innovation constraints and, therefore, offers a deeper comprehension of both the relationship and the role that each type can play.

Literature reviewOpen innovation capability requires knowledge creation processes linked to knowledge, resources, and technological exchanges with external collaborative actors (Chiu & Lin, 2022). Thus, firms source knowledge from their innovation collaboration partners to upgrade their innovation activities (Donbesuur et al., 2022; Laursen & Salter, 2014; Roper et al., 2017). Yet, the organizational ability to fully capitalize on this breadth of new ideas and information depends on the presence or absence of organizational financial, knowledge, and institutional constraints of innovation (Garriga et al., 2013; Monteiro et al., 2017).

Innovation constraints are often treated as “issues that either prevent or hamper innovation activities in the firm” (Sandberg & Aarikka-Stenroos, 2014, p. 1294). Scholarly literature has recognized the significance of innovation constraints in defining innovation outputs. However, empirical results are conflicting, and there is still an ongoing discussion on their contributive (e.g., Baldwin & Lin, 2002; Katila & Shane, 2005; Keupp & Gassmann, 2013) or preventative (e.g., Canepa & Stoneman, 2008; Coad et al., 2016; Voss et al., 2008) role in the innovation process. Both views have valid reasons.

The first view is rooted in cognitive psychology (Durham et al., 2000), suggesting that individuals demonstrate greater creativity in constrained conditions. Here, resource-constrained firms are likely to actively seek new knowledge and opportunities and adopt more entrepreneurial innovation strategies (Keupp & Gassmann, 2013; Van Burg et al., 2012). In this context, Baldwin and Lin (2002)) proposed that innovation constraints act as stimuli for firms to advance solutions. Furthermore, in their seminal work, D'Este et al. (2012) suggested that innovation activities and performance do not necessarily have a slowdown effect under innovation constraints. Rather, they proposed two broad categories of innovation barriers: revealed barriers – those that firms can overcome based on their experience; and deterred barriers – those that are insurmountable. Moreover, they found that market and cost barriers can act as revealed constraints for some firms and as deterred for others (D'Este et al., 2012).

The second view draws primarily on the behavioural theory (Cyert & March, 1963) and the resource-based view of the firm (Barney, 1991). Scholars adopting this approach suggest that slack resources that are valuable, rare, non-imitable, and non-substitutable can more successfully innovate because they can diffuse resources to innovative projects that otherwise would not be supported. Yet, firms facing constraints will exhibit more reserved behaviours, focusing mainly on exploitation rather than exploration activities closer to resource availability (Pellegrino & Savona, 2017; Voss et al., 2008). Facing innovation constraints, firms often search less deeply, even though they may search more broadly (Garriga et al., 2013).

Furthermore, in a recent meta-analysis, Damadzic et al. (2022) concluded that constraints may not reduce creativity and may be less influential than we typically thought. The roles of constraints may also differ for different innovation types. For example, financial constraints appear to have insignificant results on radical innovation performance (Garriga et al., 2013; Keupp & Gassmann, 2013). Moreover, different constraints vary in their effects. Knowledge constraints can exercise a more prohibitive role on innovation outputs (Radicic, 2021). Indeed, there is a need to clarify whether constrained firms can really leverage complementary assets (Asimakopoulos et al., 2020) from collaborators.

Among other constraints, productive firms are more sensitive to the lack of qualified personnel (Coad et al., 2016). While the lack of qualified personnel matters (Monteiro et al., 2017), the effects of human capital quality and structure vary between technology-oriented and production-oriented firms in China (Zhang et al., 2018). The use of secrecy (Monteiro et al., 2017) may be reduced under collaborative settings. Furthermore, there is some uncertainty over financial resources – Sisodiya et al. (2013) found no evidence to empirically support the view that flexibility, in terms of financial slack, enhances the moderating role of relational capability in the relationship between open breadth and firm performance.

Theoretical backgroundFirms open their boundaries to their innovation collaboration networks to increase their learning opportunities and upgrade their innovation activities (Laursen & Salter, 2014; Roper et al., 2017). Yet, the organizational ability to effectively capitalize on the knowledge, resources, and skills sourced by the firm's collaborators on innovation depends on the presence or absence of organizational financial, knowledge, and institutional constraints on innovation (Garriga et al., 2013; Monteiro et al., 2017). OLT and the open innovation literature generally argue that innovation constraints may limit the effects of collaboration breadth on innovation performance because they may cause difficulties for firms to appropriately acquire, interpret, and internalize possible complementarities (Xie et al., 2022; Huber, 1991).

OLT suggests that innovation outputs depend on (a) the intensity of search, (b) the availability of slack, and (c) the absorptive capacity of the firm (Cohen & Levinthal, 1990; Cyert & March, 1963). The effective assimilation, internationalization, and exploitation of the newly acquired knowledge, skills, and resources might be impeded by limited financial, knowledge, and institutional constraints. In contrast, non-constrained firms have better opportunities to benefit from the newly sourced knowledge because they can allocate slack resources to further explore innovation opportunities, which otherwise could not have been supported (De Araújo Burcharth et al., 2015). Rather, OLT suggests that, when slack is limited, firms may focus on more familiar practices and less exploratory solutions (Dodgson, 1993, March, 1991) and, thus, limit their innovation outputs stemming from a wide collaborative network (Levitt & March, 1988).

In consequence, and in alignment with the second view above, the benefits of collaboration breadth may be compromised for firms with limited financial capacity because they can absorb less risk and failure, which are required for innovation (Iammarino et al., 2009; Dodgson, 1993). Instead, they may focus on short-term benefits, failing to acknowledge the benefits of collaboration (Levinthal & March, 1993). Furthermore, knowledge-constrained firms may limit the appropriateness of their collaboration breadth because they may need help identifying, incorporating, and commercializing new knowledge (Cohen & Levinthal, 1990; Lauritzen & Karafyllia, 2019). Moreover, under demand uncertainty, competitive intensity, and institutional challenges, firms may fail to benefit from collaboration breadth because they may opt for secrecy and opportunistic behaviours, which defeat the reasons they engaged in broad collaborations (Park et al., 2014; Williamson, 1975).

An increase in variance (breadth) of knowledge transfers and sourcing between innovation collaborators will lead to greater possibilities and learning opportunities for knowledge recombinations and successful innovation outputs for the focal firm (Jiménez-Jiménez & Sanz-Valle, 2011; Katila & Ahuja, 2002; Powell et al., 1996). Such benefits may have a “slowdown” effect when combined with high levels of specific innovation constraints. So, when firms face financial, knowledge, and institutional constraints while openly innovating, they are likely to shift their focus towards more familiar practices rather than capitalizing on new opportunities (De Araújo Burcharth et al., 2015; Levinthal & March, 1981; March, 1991) and compromise on the benefits of openness.

Rather than a firm-level perspective, we need to carefully consider the effects of collaboration between firms. Firms that intensively collaborate can upscale their innovation performance outputs by using resources from partners or resources jointly developed with them. Collaboration can change constraints or overcome them. From this perspective, even though constraints may still reduce the success of innovation projects, they may increase the utilization of partners’ resources to improve innovation performance. There is a counter perspective. Constraints promote creativity inside the firms (see first view above) and, therefore, increase the chances of innovation, although learning from partners is constrained. Relying on investing in collaboration (as this is perhaps too costly or risky), constrained firms may choose to use their creativity to solve innovation problems. Following this counter perspective, this paper contends that constraints are positively linked to innovation performance, although they negatively moderate the effects of collaboration breadth on innovation performance.

Hypotheses developmentFirms that collaborate in their innovation activities can access information on new products and technological developments from their collaboration partners (Laursen & Salter, 2014; Powell et al., 1996). High levels of collaboration breadth can lead to heterogeneous information received because different types of collaborators provide the focal firm with different knowledge and ideas (Markovic & Bagherzadeh, 2018). As a result, there is a greater possibility that the new and heterogeneous knowledge will complement the internal knowledge to produce successful innovation outputs. Moreover, more collaborators give the focal firm a greater probability of receiving valuable knowledge to fulfil its innovation goals (Leiponen & Helfat, 2010). Hence, diverse knowledge and resources enable the organization to obtain more learning opportunities and benefits (Huang et al., 2018). So, firms with high collaboration breadth may be better at sensing trends in the marketplace, more flexible and quicker in responding to new challenges and, thus, better able to develop products and services more relevant to their customers (Gimenez-Fernandez & Sandulli, 2017; Markovic & Bagherzadeh, 2018; Powell et al., 1996).

Furthermore, firms with collaboration breadth are likely to gain knowledge and experience in managing their partnerships and to maximize the benefits of knowledge, skills, and resource insourcing (Dodgson, 1993; Love et al., 2014). First, firms can accumulate diverse, novel knowledge and ideas for future use with innovations. Research suggests that the higher the collaboration breadth, the more varied knowledge interpretations are developed, which may change the range of potential innovation outputs (Argote & Miron-Spektor, 2011). Second, such firms learn over time how to manage existing and new collaborations to obtain better pay-offs from these partnerships (Powell et al., 1996). They learn how to develop the capabilities required to effectively manage high numbers of collaborators to achieve their innovation goals. Third, firms with broad collaboration networks are exposed to a learning process where previous experience in managing collaborations defines how the breadth of collaboration will be managed to achieve the desired innovation outcomes (Love et al., 2014). Thus,

H1 A firm's level of collaboration breadth is positively linked to its innovation performance.

Innovation is a costly process requiring ongoing resource commitments with safeguarded arrangements to ensure the effective management of collaborations (Pellegrino & Savona, 2017). Additionally, firms require funds to experiment with the new ideas their collaboration partners acquired and incorporate them into their innovation activities. Following our theoretical argument, financial constraints may hurt the external knowledge acquisition and distribution for firms with collaboration breadth (Huber, 1991). This is due to the possible lack of funding for an allocated team to work with different innovation partners, enabling the firm to transform the new knowledge into innovation. Yet, scholars have frequently argued for the importance of the allocation of internal R&D resources in exploring innovation possibilities and capitalizing on external knowledge to obtain innovation benefits (Grimpe & Kaiser, 2010; Hung & Chou, 2013; Van Burg et al., 2012). Therefore, financially constrained firms are less likely to fully reap the benefits from their broad collaboration activities (Monteiro et al., 2017). Instead, budget-restricted organizations have weakening learning effects because they tend to foster less innovative solutions with immediate results rather than explore the long-term advantages of their collaborations (Voss et al., 2008).

Furthermore, the breadth of collaboration provides access to diverse knowledge and new commercialization ideas, which can be easier to implement when financial resources are available (Lauritzen & Karafyllia, 2019). For example, firms might refrain from investing when jointly developed ideas require expensive new technologies. Likewise, if these newly developed ideas can be commercialized in new markets, firms may decide to hold back due to the costs associated with manufacturing, delivery, and market communication. Instead, they may exploit existing capabilities rather than experimenting with new ideas to ensure their current financial viability (Drechsler & Natter, 2012; Hoegl et al., 2008). So, a lack of financial tools may limit the transfer of knowledge between the organization and its context, and the learning effects of broad collaborations are likely to be compromised (Argote & Miron-Spektor, 2011).

From this perspective, it is expected that, when the organizational financial capacity is limited, management attention shifts from risky innovation projects to already-known technologies and processes to sustain efficiency (De Araújo Burcharth et al., 2015). Conversely, firms with collaboration breadth and financial slack can more easily absorb risk and failure and release funds to further explore innovative ideas, yielding more innovation and new product introduction (Bourgeois, 1981; Voss et al., 2008). Therefore,

H2 Financial constraints of innovation negatively moderate the effect of a firm's level of collaboration breadth on innovation performance.

The role of purposive knowledge inflows and outflows to allow for ideas and technology exploration to enhance the firm's innovation output is critically important in the literature on open innovation (Chesbrough, 2003, 2006; Audretsch & Belitski, 2023). Successful commercialization of an innovation requires that the know-how is linked to other internal assets and capabilities, such as qualified human capital, knowledge of technology, and knowledge of markets (Naqshbandi & Jasimuddin, 2022; Teece, 1986). Thus, although collaborating firms can access knowledge and resources from their partners unless they have adequate internal knowledge, they may not fully appreciate the newly developed ideas and opportunities.

From this standpoint, research has recognized the importance of internal human capital in effectively recognizing, assimilating, and commercializing external knowledge to create innovation outputs (Bogers et al., 2018; Cheng & Huizingh, 2014). Firms with superior in-house R&D resources and capabilities are usually better at exploring and capitalizing on external knowledge to achieve innovation benefits (Grimpe & Kaiser, 2010; Hung & Chou, 2013). From our perspective, this occurs because they can more effectively screen, internalize, and assimilate diverse, external collaborative knowledge and improve their absorptive capacity (Cohen & Levinthal, 1990). Although generally overlooked as a strategic asset in the literature of open innovation (Zhang et al., 2018), qualified human capital is crucial for building sufficient levels of absorptive capacity and influencing the effectiveness of collaboration breadth on innovation performance due to better cognitive skills and information processing abilities (Asimakopoulos et al., 2020).

Furthermore, knowledge-constrained firms may not be able to capture value from the external knowledge breadth (Simeth & Mohammadi, 2022) for two main reasons. First, the focal firm might hinder knowledge exchange with its collaborators owing to its finite knowledge of technologies and markets (Acar et al., 2019a). Because organizations have limited cognitive limits (Love et al., 2014), knowledge-constrained firms are likely to mobilize external complementarities within the scope of their existing knowledge and expertise (Teece, 1986). Therefore, they may choose assets based on their current knowledge and markets and ultimately compromise on the availability of assets offered by their broad collaboration network. For example, in manufacturing-intense markets, firms that need more knowledge of manufacturing processes and technologies cannot correctly specify the new product characteristics and the required procedures to develop their manufacturing processes (Katila & Shane, 2005). So, even if the knowledge is available within their collaborative network, firms might fail to suitably define the necessary technology to scale up their production to relevant products and processes.

Second, knowledge-constrained firms might lose control over operating decisions and outcomes in their collaborating network (Voss et al., 2008). To protect the organization's position, they will likely shift from novel and risky activities to improving the current productive efficiency with already-known technologies and processes (De Araújo Burcharth et al., 2015). Thus, they may adopt risk-averse strategies to ensure viability and overlook the long-term benefits of collaboration breadth (Levinthal & March 1993). This, again, will bear negative consequences for the collaboration breadth–innovation performance relationship. Accordingly, the following hypothesis is introduced:

H3 Knowledge constraints of innovation negatively moderate the effect of a firm's level of collaboration breadth on innovation performance.

The benefits of collaboration breadth on innovation performance are often reduced by institutional constraints for three reasons. First, collaborations under competitive and uncertain conditions may lead to overlap between technologies and resources (Mowery et al., 1996; Park et al., 2014). When many players are fighting for a few resources, different actors within the market can be approached for collaboration by different competitors. Thus, the opportunity to pair with the best collaborative partners is diminished, as is the opportunity to source the most appropriate knowledge to improve innovation outputs (Cyert & March 1963). This will be the case especially for potential partners who have catalytic knowledge of, or possess technology for, the desired innovations. Therefore, although firms may have a broad network of collaborations, they could need help in partnering with the most appropriate actors and improving their innovation activities with their knowledge and resources.

Second, under conditions of low predictability and high competition, firms may be less willing to disclose information to their innovation partners out of fear that they will put themselves at risk. For example, when a large number of firms are competing for the same market, firms may be reluctant to share critical information with their partners out of fear that knowledge created through a collaborative relationship might also be shared with other competing actors by their collaborator (Gnyawali & Park, 2009), thus negatively affecting the organizational intensity of complementary knowledge search (Cyert & March 1963). This fear might be magnified, especially for firms with collaboration breadth because they are exposed to more potential threats. It is therefore expected that firms with collaboration breadth will experience more significant tensions between learning and protecting because of a tendency to limit the otherwise diverse and unique knowledge flow (Park et al., 2014; Wu, 2012).

Third, for firms with collaboration breadth operating under institutional constraints, the likelihood of opportunistic behaviours by collaboration partners increases, as well as the potential for conflict between collaborators (Park et al., 2014; Wu, 2012). In information asymmetry and competition cases, firms might disclose incomplete or distorted information to their partners (Williamson, 1975). Therefore, they may display opportunistic behaviours to pursue their own competitive goals over the collective goals of the collaboration (Park & Russo, 1996). Such behaviours will reduce trust and possible tensions between the partners (Barnes et al., 2010). Yet, within collaboration breadth, knowledge can flow more effectively when high trust, commitment, and inter-organizational coordination mechanisms are present (McEvily & Marcus, 2005). Therefore, it is hypothesized that:

H4 Institutional constraints of innovation negatively moderate the effect of a firm's level of collaboration breadth on innovation performance.

Our study focuses on the UK context for three main reasons: (1) the UK is traditionally a country with a developed innovation system; (2) there is central acknowledgment and effort to identify and overcome innovation constraints and further support innovation; and (3) innovation constraints have been examined to a much less extent by scholars in the UK (Coad et al., 2016; UK Innovation Strategy, 2021). Therefore, the UK experience offers interesting insights for comparability and generalizability reasons. The data have been collected by the European Community Innovation Survey (CIS) (CIS6, CIS7, CIS8, CIS9, and CIS10) (UK Innovation Survey, 2017, 2018), administered by the UK Office of National Statistics (ONS) and provided by the Department for Business, Innovation and Skills (2018) every two years. We employ an unbalanced panel dataset of 18,039 firm-year observations over the 2006–2016 period. Based on the criteria of the study and the variables included in the statistical models, we finished with a final baseline sample of 11,581 firm-year observations. The survey's method and the types of question are drawn from the OECD/Eurostat (2005) Oslo Manual. The survey sample is derived from a stratified sample of the ONS Inter-Departmental Business Register (IDBR), including all the main sectors of the UK economy. Our analysis focuses on firms with ten or more employees and includes manufacturing and services firms to provide sample variability and generalizability.

The survey was addressed to the person officially responsible for reporting to ONS regarding the firm's activities, such as the managing director, the chief financial officer, or the R&D manager (Laursen & Salter, 2006, 2014). All responses were confidential. Response rates fluctuated between 43 % to 51.1 %, which is high, given that, in the UK, completion of the survey is voluntary (CIS6: 49 %; CIS7: 51.1 %; CIS8: 51.1 %; CIS9: 50.8 %; CIS10: 43 %). Each stratum was weighted back to the population, using the inverse sampling proportion based on industry sectors provided by CIS (Tsinopoulos et al., 2018). Thus, the sampling process ensures the representativeness of the populations of UK firms.1

CIS has been widely used in the literature on open innovation (e.g., Grimpe & Kaiser, 2010; Laursen & Salter, 2006; Tsinopoulos et al., 2018) and constitutes an appropriate, reliable, and valid data source for our analysis. Furthermore, it is well suited to account for the complex nature of the innovation process as it asks firms about knowledge sourced by collaboration partners and factor-inhibiting innovation activities. Moreover, CIS data is highly reliable and provides direct and importance-weighted measures (Grimpe & Kaiser, 2010).

To establish the survey's interpretability, reliability, and validity, it was piloted, tested, and pre-tested extensively in European countries and across different firms and industries (Grimpe & Kaiser, 2010; Laursen & Salter, 2006). Since the variables are extracted from five consecutive survey waves, although anonymous, it is highly unlikely that questionnaires across the five waves have been answered by the same respondents, thus reducing the probability of common method variance issues (Leiponen & Helfat, 2010). Furthermore, to reduce common method bias, the survey questionnaire is designed to include different types of response (e.g., importance indicator scales, yes/no answers, indications of percentages, and questions with absolute numbers introduced) (Laursen & Salter, 2014). Moreover, the questions on the independent variables refer to the entire survey period (e.g., 2014–2016 for CIS10). In contrast, the dependent variables indicator is evaluated only for the last year of the three-year period (e.g., 2016 for CIS10). Therefore, there is an inherent time lag in the survey between the dependent variable and the independent and moderating effects, in line with previous studies (Cassiman & Veugelers, 2006; Laursen & Salter, 2006; Tsinopoulos et al., 2019), which also helps to overcome potential common method bias (Rothaermel & Alexandre, 2009). The high response rates reduce non-response bias in the survey (Armstrong & Overton, 1977).

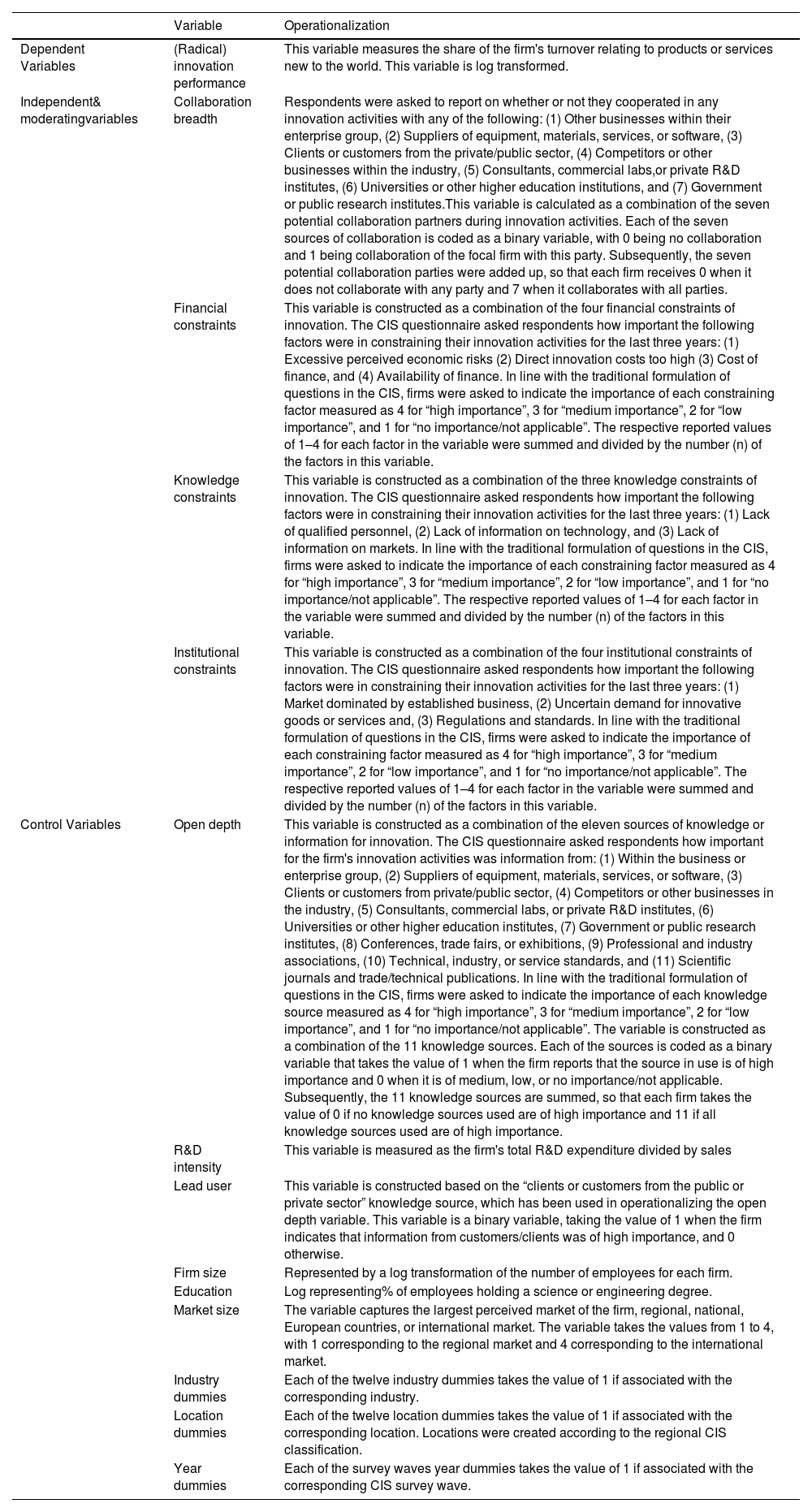

Dependent variableTo measure the dependent variable, a proxy is used to reflect radical innovation performance (Garriga et al., 2013; Laursen & Salter, 2006; Monteiro et al., 2017). The questionnaire asks firms to report the fraction of the firm's turnover from products and services that are new to the world (i.e., innovations that the firm was first to introduce to the market) is used. Then, given that innovation performance can take values from 0 to 100, a logarithmic transformation is not feasible (Kafouros et al., 2021). Hence, to improve the dependent variable normality and treat possible skewness pertinent to the zero reported values, the inverse hyperbolic sine (HIS) logarithmic transformation was employed2 (Burbidge et al., 1988). The HIS transformation provides an effective method to interpret percentage changes, address any issues with extreme values, and deal with the zero reported values of the dependent variable (Pence, 2006). This practice is consistent with research in business and management (Kafouros & Aliyev, 2016; Kafouros et al., 2021; Nyberg et al., 2010). In addition, following standard practice, the IHS transformation was applied to all independent variables (Kafouros et al., 2021).

Independent variableThe development of the measurement of collaboration breadth is analogous to the dominant approach used in the literature (e.g., Laursen & Salter, 2014; Roper et al., 2017; Tsinopoulos et al., 2018). In the questionnaire, respondents were asked to select which parties they collaborated with in their innovation activities during the three years of each survey wave. The actual wording of the question was: “Did your business cooperate on any innovation activities with any of the following? (a) Other businesses within their enterprise group; (b) Suppliers of equipment, materials, services, or software; (c) Clients or customers from the private/public sector; (d) Competitors or other businesses within the industry; (e) Consultants, commercial labs, or private R&D institutes; (f) Universities or other higher education institutions; and (g) Government or public research institutes”. The variable of collaboration breadth is calculated by combining the seven potential collaboration partners during innovation activities. Each of the seven sources of collaboration is coded as a binary variable, with 0 being no collaboration and 1 being a collaboration of the focal firm with this party. Subsequently, the seven potential collaboration parties were added so that each firm received 0 when it did not collaborate with any party and 7 when it collaborated with all parties. The assumption is that firms that use more collaboration partners have a higher level of collaboration breadth than firms that use fewer partners (Grimpe & Kaiser, 2010; Laursen & Salter, 2006; Tsinopoulos et al., 2018).

Moderating variablesThe moderating variables of this study are created by extending and adopting those from previous research (e.g., D'Este et al., 2012; Drechsler & Natter, 2012; Keupp & Gassmann, 2013; Monteiro et al., 2017; Pellegrino & Savona, 2017; Van de Vrande et al., 2009). The UK CIS asks respondents to indicate for the three years of the survey, “How important were the following factors in constraining your innovation activities? (a) Excessive perceived economic risks, (b) Direct innovation cost too high, (c) Cost of finance, (d) Availability of finance, (e) Lack of qualified personnel, (f) Lack of information on technology, (g) Lack of information on markets, (h) Market dominated by established business, (i) Uncertain demand for innovative goods or services, and (j) UK/EU regulations (including standards)”. In line with the traditional formulation of questions in the CIS, firms were asked to indicate the importance of each constraining factor measured as 4 for “high importance”, 3 for “medium importance”, 2 for “low importance”, and 1 for “no importance/not applicable”. Each factor's reported values (1–4) were summed and divided by the number of factors.

The first four constraining factors are used to construct the financial constraints of the innovation variable and are combined in one variable with Cronbach's alpha of 0.90. The knowledge constraints variable is constructed as a combination of the following three knowledge constraints of innovation, combined in one variable with Cronbach's alpha of 0.89. The last three factors are used to construct the institutional constraints variable, combined in one variable with Cronbach's alpha of 0.85.

Control variablesTo account for knowledge sourced from external knowledge sources in non-collaborative ways and to provide comparable results with previous literature (e.g., Cruz- González et al., 2015; Garriga et al., 2013; Laursen & Salter, 2006; Terjesen & Patel, 2017), we employ the open depth control variable. In addition, to account for the firm's intensity of innovation activities and its efforts to build capabilities required for developing new technologies, products, and processes, we captured each firm's R&D intensity measured as the firm's total R&D expenditure divided by sales (Kobarg et al., 2019; Laursen & Salter, 2006; Markovic & Bagherzadeh, 2018). Moreover, in line with Laursen and Salter (2006) and Garriga et al. (2013), the variable lead user is constructed based on the knowledge source of clients or customers from the public or private sector and is used in operationalizing the open-depth variable. Previous studies on innovation have shown that an innovation's lead users are a key source of innovation (Geilinger et al., 2020; Urban & Von Hippel, 1988). Moreover, prior research suggests that the quality of human capital, in terms of education, can affect the “openness” of the firm and produce performance benefits (Bogers et al., 2018; Zhang et al., 2018). Accordingly, an education variable reflecting the percentage of employees in each firm holding a science or engineering degree is included as a control variable, presented by its logarithmic value (Leiponen & Helfat, 2010; Love et al., 2014). To account for the size of the perceived product market, we employ a variable to capture how large the market is, as perceived by the firm, in terms of regional, national, European, and international markets (Laursen & Salter, 2006; Terjesen & Patel, 2017). Finally, our analysis controls for industry, location, and year dummies. However, their coefficients are omitted from the regression tables (for a list of all the variables in the study, see Appendix 1).

Estimation methodTo empirically examine the conceptual model, censored Tobit models are applied, following the established literature on open innovation (Hagedoorn et al., 2018; Laursen & Salter, 2006; Sofka & Grimpe, 2010). The Tobit estimation method can address issues relevant to the characteristics of the dependent variable, which is measured as a percentage of the firm's turnover from products and services that are new to the world, taking the value from 0 to 100 (Grimpe & Kaiser, 2010). Thus, Tobit regressions account for both right- and left-censored dependent variables (Kesidou et al., 2023; Laursen & Salter, 2006) and allow us to treat firms not reporting innovation turnover differently than those that do and assume they are normally distributed (Tobin, 1958; Grimpe & Kaiser, 2010). In addition, the IHS was employed to improve the normality of dependent variables, address any issues with extreme values, and accommodate the existence of zero (0) values (Burbidge et al., 1988). To address potential concerns about endogeneity issues, the lag inherent in the CIS is used to test the relationship among the dependent, independent, and moderating variables (Laursen & Salter, 2006; Tsinopoulos et al., 2019). This methodological remedy provides confidence in the robustness of the results presented herein.

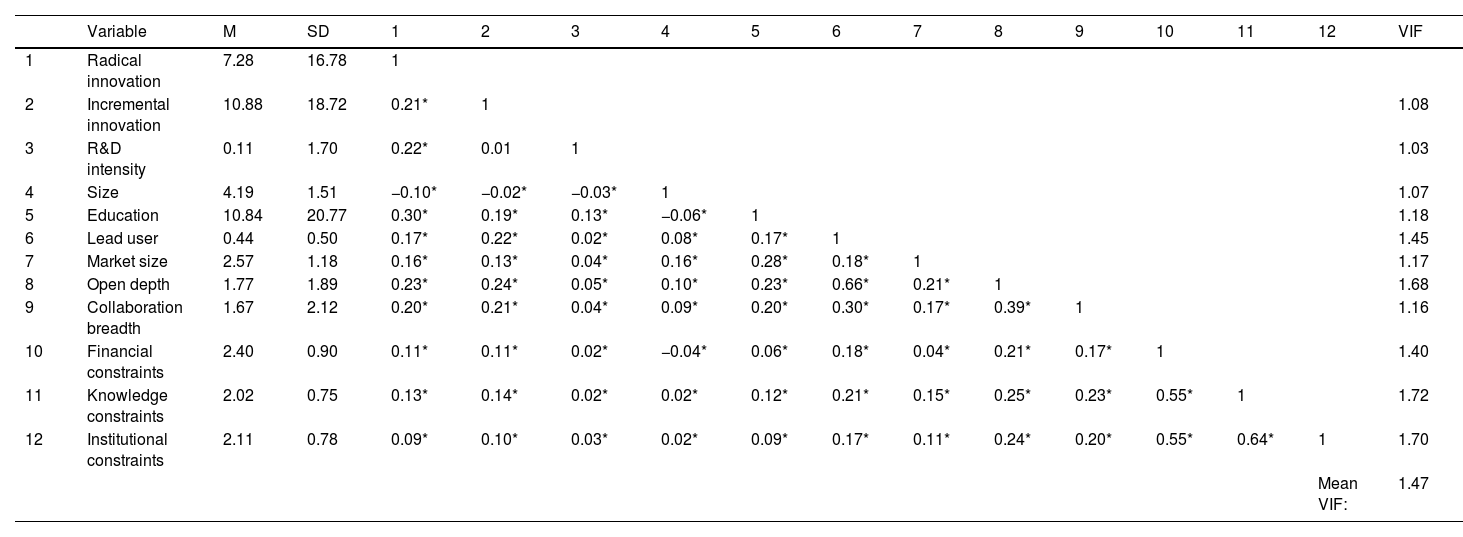

ResultsOur study developed and empirically tested a conceptual model examining the association between collaboration breadth and innovation performance and how the presence of financial, knowledge, and institutional constraints might negatively moderate this relationship. Table 1 presents the descriptive statistics and correlations. The table shows that the innovation constraint variables (financial, knowledge, institutional) correlate. To mitigate concerns that the results are affected by collinearity, the variance inflation factors (VIFs) were estimated. The VIF values range from 1.03 to 1.72 (see Table 1 for all VIF values), well below the commonly accepted threshold of 10 (Belsley et al., 2005), thus alleviating concerns about multicollinearity. However, to further mitigate collinearity concerns, the estimated models are added one at a time (Monteiro et al., 2017; Sofka & Grimpe, 2010; Tsinopoulos et al., 2019).

Correlation matrix.

* The correlation is significant at the 0.5 level. N = 18,039.

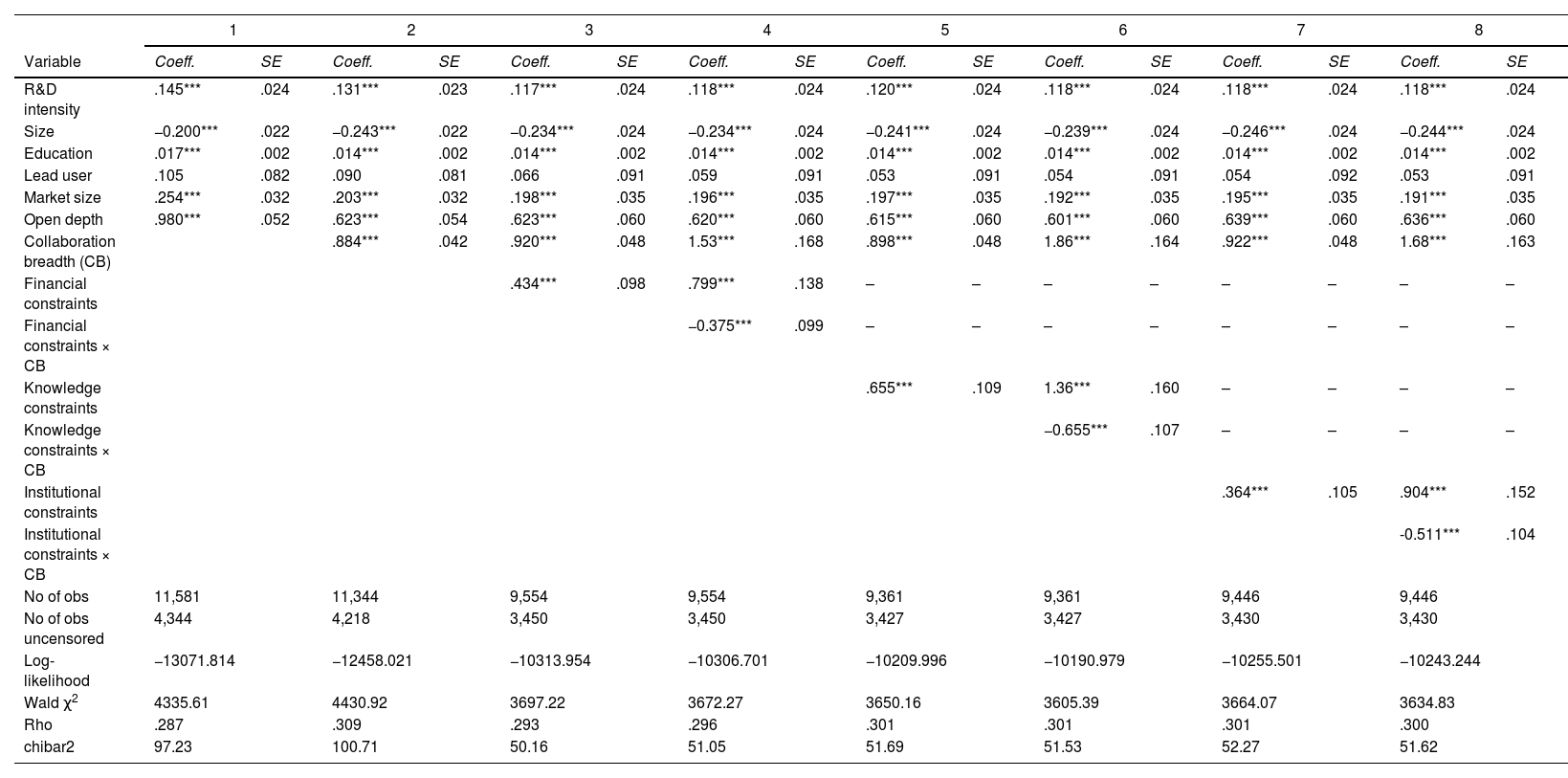

The empirical results of the Tobit regression models of the relationship between collaboration breadth and innovation performance and the interaction effects of financial, knowledge, and institutional constraints of innovation are presented in Table 2. Model 1 shows the basic model, including only the control variables. Variables pertaining to H1–H4 are subsequently added one by one to avoid multicollinearity issues. Likelihood ratio tests show that the extension models improve the statistical model fit. All Wald chi-square tests were significant at the 0.001 level.

Regression results radical innovation.

*p < 0.05; **p < 0.01; ***p < 0.001; † p < 0.10.

Industry, location, and year dummies are included. Probabilities of Wald χ2 test and chibar2 are significant at the 0.001 level.

H1 suggests that a firm's level of collaboration breadth is positively linked to its innovation performance. Model 2 shows that the coefficients of collaboration breadth are statistically significant at the 0.001 level (β = 0.884). These results provide full support for H1. Next, the interaction effects of financial, knowledge, and institutional constraints on the relationship between collaboration breadth and radical innovation are examined. H2 predicts that financial constraints have a negative moderation effect. Indeed, interaction coefficients are negative and significant at the 0.001 level (β = –.375) (model 4), providing full support for H2. With regard to knowledge constraints (model 6), the interaction coefficient is negative and significant (β = –.655, p < 0.001). Therefore, H3, which proposes that knowledge constraints of innovation negatively moderate the relationship between collaboration breadth and innovation performance, receives full statistical support. Finally, H4 is also fully supported, as the interaction coefficients for institutional constraints are negative and significant (β = –.511, p < 0.001; model 8), providing empirical support for their negative hypothesized moderation effect. Moreover, the results show positive effects of the three constraints on innovation performance, which align with our counter perspective.

Discussion and conclusionConclusions and theoretical contributionThis paper complements the literature on open innovation by providing a more holistic understanding of the conditions under which the benefits of openness, in terms of collaboration breadth, can be mitigated and lessened innovation performance effects are observed. By answering recent calls for further research on the contingencies affecting this relationship to develop a deeper understanding of how firms can benefit from openness (Chesbrough et al., 2018; Foss & Saebi, 2017; Stanko et al., 2017), we adopt an emerging contingency perspective on open innovation (Salge et al., 2012). Particularly, we explicate the role or constraints on the openness–innovation relationship (e.g., Damadzic et al., 2022; Keupp & Gassmann, 2013; Van Burg et al., 2012; Voss et al., 2008).

While search breadth and depth have been studied more frequently, this paper focuses on collaboration breadth because its effects on innovation could be altered by the presence of constraints in a different manner. We show that the distinct categories of innovation constraints – namely, financial, knowledge, and institutional – have the same effects. As expected, our theoretical arguments and empirical evidence suggest that collaboration breadth instigates improvements in innovation performance [H1]. Open innovation through collaboration provides access to heterogeneous information, skills, and resources, which can be reconfigured in valuable ways to develop new products and services (Grimpe & Kaiser, 2010). Yet, firms facing high levels of financial [H2], knowledge [H3], and institutional [H4] constraints will experience compromised collaboration breadth gains in their innovation activities, indicating that not all firms can equally benefit from openness. Despite this, these constraints should not be viewed negatively because the results show they could drive innovation through possibly promoting internal creativity (or internal R&D) as opposed to investing in collaboration. Not only we clarify innovation constraints as boundary conditions for capturing the value of collaboration breadth, but we also show there are solutions for addressing such constraints other than collaboration.

To better explain why innovation constraints appear to instigate both positive (D'Este et al., 2012; Van Burg et al., 2012) and negative (Coad et al., 2016; Pellegrino & Savona, 2017) effects on innovativeness, we add more nuanced knowledge on constraints to the literature. The pertinent literature claims that high levels of constraints will lead to a broader search (but shallower) for external knowledge (Garriga et al., 2013; Drechsler & Natter, 2012). A similar conclusion is reached when we examined collaboration breadth. We found that, in the collaboration setting, innovation constraints make it harder for firms to leverage the breadth of collaborators’ resources to improve innovation. However, innovation constraints may improve innovation performance (Damadzic et al., 2022; Katila & Shane, 2005; Van Burg et al., 2012) if firms utilize other mechanisms, such as internal R&D or creativity. Although innovation constraints cause ambiguity (Sandberg & Aarikka-Stenroos, 2014; Katila & Shane, 2005), they are not necessarily bad. Open innovation is not necessarily the only way to innovation, especially when firms are facing high levels of financial, knowledge, and institutional constraints.

Managerial implicationsOur study expands on the intricate relationship between open innovation, collaboration, and management practices, offering a multifaceted view that incorporates various crucial aspects. By integrating practical examples, we aim to illustrate both the successful and challenging instances of open innovation, providing a practical context. We explore the delicate balance between internal and external innovation efforts, offering insights into how resources can be effectively allocated and managed to harmonize in-house R&D with external collaborations. This is further enriched with quantitative data, where statistics quantify the impact of open innovation strategies, making the implications more tangible. Understanding that adopting open innovation requires a cultural shift, we address how to foster a culture that embraces these changes, including the necessary training programmes, leadership styles, and change management strategies. Additionally, we explore the risks associated with open innovation and call attention to risk mitigation strategies.

Managers are increasingly more interested in the open innovation paradigm (Chesbrough et al., 2018). The findings support managers in making informed decisions on managing broad collaboration networks and constraints in their firm's innovation processes. More particularly, it is shown that investing in collaborations to source external knowledge on innovation is rewarding because organizations can improve their problem-solving and learning abilities and identify innovation opportunities. However, managers need to recognize that depending heavily on external knowledge when facing constraints may cause adverse effects on innovation performance. Hence, they should seek the right balance between openly innovating and ensuring resource availability to manage the trade-offs of openness. Firms need to know when to increase the diversity of external knowledge sources. This point is reached when they increase collaboration breadth disproportionally to their internal organizational resources and fail to balance the trade-offs between new knowledge acquisition, distribution, and interpretation and the lack of internal resources (financial, knowledge, and institutional) (Jiménez-Jiménez & Sanz-Valle, 2011; Argote & Miron-Spektor, 2011).

The literature suggests that constraints can benefit innovation because they foster creativity (Damadzic et al., 2022; Keupp & Gassmann, 2013; Van Burg et al., 2012). For instance, GE company successfully set specific technological, cost, and time constraints for its engineers to develop GE Healthcare's MAC Electrocardiograph device (Acar et al., 2019b). Hence, practitioners encountering those constraints can overstretch their teams to display more creative and entrepreneurial behaviours and identify innovation opportunities. However, when resource-constrained firms develop innovations jointly with their collaboration partners, managerial practices will adjust accordingly to balance the trade-offs. Some firms have heavily invested in open innovation practices, failing to achieve innovation benefits due to financial, knowledge, or institutional constraints. For example, due to budgetary restrictions, Google abandoned its Project Tango after having devoted time and resources to engage in formal and informal collaborations (Tsinopoulos et al., 2019).

Therefore, managers should know their organizational constraints before investing in broad collaborations to advance their innovation outputs. This implication is of greater relevance for managers of smaller organizations because they are expected to face greater challenges in resource allocation than larger organizations, which could more easily absorb the limitations attributed to innovation constraints. Moreover, managers that are more innovation focused rather than operational focused shall ensure that they invest more in preparing their organizations internally to assimilate the benefits of external knowledge search. A further suggestion derived from the study is to create interactive tools, such as online assessments and innovation readiness calculators, which would offer managers tailored insights and recommendations for implementing open innovation strategies based on their organization's specific data. Furthermore, building a dynamic repository of case studies from various industries and regions would provide managers with real-time examples of successful and unsuccessful open innovation initiatives, fostering continuous learning.

Moreover, establishing a community of practice among managers and leaders engaged in open innovation would foster a collaborative environment for sharing experiences and best practices. Finally, integrating sustainability and social responsibility into the open innovation discussion would ensure these strategies align with broader societal and environmental goals. Through these interconnected suggestions, our study aims to become a practical, comprehensive, and dynamic guide, assisting managers and organizations in effectively embracing and implementing open innovation strategies.

Limitations and future research avenuesOur analysis comes with a number of limitations, some of which could open avenues for future research. First, the United Kingdom was selected as the study context, given its active innovation scene and wide coverage of companies and innovation strategies in the dataset. It would be interesting to engage in a cross-country comparison of the findings using datasets from the European Community Innovation Survey (e.g., Spain, Germany) or other data from contexts with different socio-economic conditions (e.g., developing economies), cultural (e.g., power distance) and country (e.g., welfare system) characteristics to see whether there are country-specific effects present in the results (e.g., Hajighasemi et al., 2022). Moreover, the authors suggest that future researchers expand collaborative research by partnering with academic institutions and industry experts worldwide to further enhance the study's depth. This would bring diverse perspectives, particularly from emerging markets or under-represented sectors, enriching the study with various insights. Implementing longitudinal studies to track the long-term effects of open innovation in different organizations is also crucial. This approach would yield valuable data on the sustained impact of these strategies, offering a comprehensive view of their long-term benefits and challenges.

Second, a deeper focus on specific sectors would allow for more granular insights. Developing detailed analyses of how open innovation functions uniquely in different industries, such as pharmaceuticals versus technology, could provide invaluable, sector-specific guidance. In addition, creating training programmes and educational modules, including webinars, workshops, and e-learning courses tailored to different managerial levels and organizational sizes, would facilitate the widespread understanding and adoption of open innovation concepts.

Third, while the use of the CIS survey has its advantages in terms of data quality, volume, and richness (Hagedoorn et al., 2018; Laursen & Salter, 2014; Tsinopoulos et al., 2018), it possesses several limitations – for example, single key informants and inconsistencies in the questions and format of answers. To enhance the validity and reliability of the results reported, future research should look into replicating some of the tests conducted in this study using a combination of secondary and primary data sources, employing multiple key informants. Studies could delve into collaboration breadth more closely by looking at and surveying the focal partners involved. Fourth, although we employed five waves from the CIS survey and used their inherent time lags to address potential endogeneity issues, future researchers should carefully design questionnaires to allow for time separation between the dependent and independent variables and include appropriate instrumental variables for endogeneity testing purposes. Fifth, a suitable avenue for future research would be to scrutinize the role of innovation constraints in hierarchical, substituting, and/or complementary ways (e.g., using fuzzy set qualitative comparative analysis - fsqca) to address possible trade-offs from the over-search for knowledge and the firm's ability to concentrate attention and manage resources.

Sixth, future research could benefit by concurrently examining the interplay between collaboration breadth and depth. While the breadth of openness refers to the extent to which firms engage in open innovation activities (Leiponen & Helfat, 2010), the depth of openness refers to how intensively firms draw information from their external partners (Garriga et al., 2013). It would, therefore, be interesting to identify the right balance between the two in maximizing innovation outputs and any possible trade-offs. Finally, we examined the possibility of non-linear effects by introducing the squared term of collaboration breadth in the robustness checks regressions. Empirical non-linear results are of the same magnitude and direction as in previous studies (Hagedoorn et al., 2018; Kobarg et al., 2019). Yet, the findings of this study pertaining to the moderating effects of innovation constraints remain in the same direction as in the main statistical models. Given the significant results of the non-linear collaboration breadth effects, researchers should theorize whether innovation constraints can exert flattening or steepening effects on the non-linear relationship between collaboration breadth and innovation performance.

CRediT authorship contribution statementAthanasia D. Nalmpanti: Conceptualization, Data curation, Formal analysis, Funding acquisition, Writing – original draft, Writing – review & editing. Chee Yew Wong: Conceptualization, Supervision, Writing – original draft, Writing – review & editing. Pejvak Oghazi: Methodology, Project administration, Supervision, Validation, Writing – original draft, Writing – review & editing.

The authors are thankful for the financial assistance from the University of Leeds for conducting this project. The authors thank Professor Mario Kafouros for his constructive and valuable feedback on previous drafts of this article. Professor Oghazi is also thankful for the recieved support from the AIDoaRt project. AIDOaRt project has recieved funding from the ECSEL Joint Undertaking (JU) under grantagreement NO 101007350. The JU recieved support from the European Union´s Horizon 2020 research and innovation programme (Sweden, Austria, Czech Republic, Finland, France, Italy and Spain).

More information about the data and sampling processes is available in the report of the UK's Department for Business Innovation & Skills (Robson & Achur, 2013).

The IHS (asinh) was used (Johnson, 1949) as an efficient way to log-transform data involving zeros and/or negative values.