Previous studies on open innovation and strategic management have emphasized the positive impact of external knowledge on firms' innovation performance. However, given that external knowledge is widely distributed across a myriad of heterogeneous sources, it presents challenges for both the openness strategy and knowledge accessibility. When designing a firm's openness strategy, the heterogeneity of these external sources must be considered, choosing a form of openness that aligns with the attributes of the targeted sources. The question remains, which form of openness aligns best with which knowledge source and leads to improved innovation performance? Our regression analysis, based on a sample of 3294 German firms from the Mannheim Innovation Panel (MIP) in 2013 and 2017, reveals that utilizing a search strategy toward market sources of knowledge influences innovation performance more positively than a collaboration strategy. Conversely, only collaboration with science-based sources of knowledge has a significant positive impact on innovation performance. We further delve into the implications of these observed results and describe the practical implications for innovation managers.

While prior studies underscored the importance of drawing on external knowledge for innovation (Cheng & Huizingh, 2014; Mention, 2011; Vanhaverbeke et al., 2008), the accessibility of external knowledge is a major unaddressed challenge. In this regard, the seminal paper of Laursen and Salter (2006) suggested the degree of openness, defined as the number of external sources a firm uses broadly or deeply to draw knowledge for innovation (i.e., the breadth and depth), as an explanator of the firm's innovation performance. However, the breadth and depth constructs do not capture the heterogeneity between external sources of knowledge and how the firm's openness strategy should cope with that (Cruz-González et al., 2014). Prior studies addressed this concern by unpacking the concepts of breadth and depth of openness into their sub-elements and investigated the determinants of capturing the value of openness toward external sources of knowledge (Bernal et al., 2022; Enkel et al., 2009; Huang et al., 2015, 2018). In this line, studies highlighted many factors that explain the positive role of openness in improving firms’ innovation performance, such as the direction of openness, e.g., customer, supplier, or universities (Cruz-González et al., 2014, Cappelli et al., 2013), the existence of internal technological capabilities (Tsai & Hsieh, 2009), diversity of collaborative networks (Nieto & Santamaría, 2007), partners’ geographic proximity (Santamaría et al., 2021), the persistence of R&D collaboration (Belderbos et al., 2015) and sectoral effects (Köhler et al., 2012). However, the empirical literature paid scant attention to the heterogeneity of external knowledge sources regarding their knowledge novelty (Sofka & Grimpe, 2010; Cappelli et al., 2013) and accessibility (Philipson, 2020). Recognizing the significance of external knowledge for innovation and the heterogeneity of external sources/partners, reaping the potential value of openness might depend largely on how the focal firm addresses external sources. In other words, the impact of external sources of knowledge on the firm's innovation performance could be conditioned by the form of openness that a firm adopts to draw knowledge from them. Based on this gap, we argue that firms must recognize external sources' characteristics and dedicate the appropriate forms of openness to address external sources and capture their knowledge (Köhler et al., 2012).

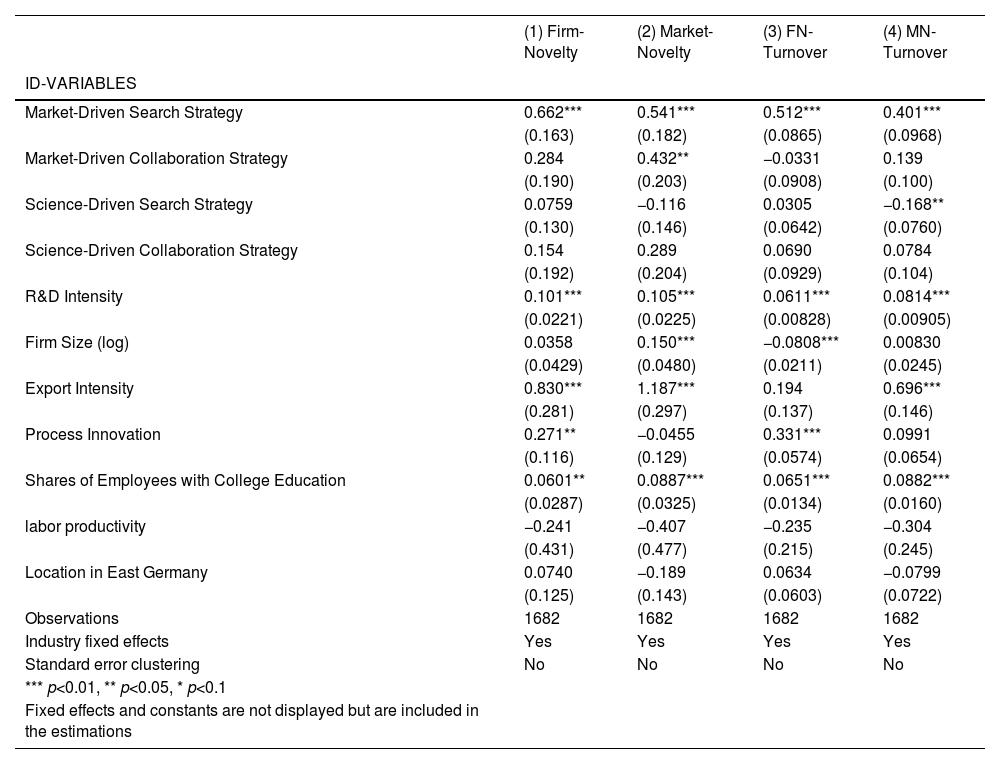

In this paper, we follow the open innovation literature and distinguish between two groups of external sources of knowledge, namely 1) market-based sources (i.e., customers, suppliers, and competitors)1 and 2) Science-based sources (i.e., commercial R&D consultants, universities, and public and private research institutes). These sources and their knowledge differ in their accessibility and potential impact on innovation performance in terms of innovations new to the firm (Firm Novelty) or to the market (Market Novelty). However, prior studies used different terminologies to describe how firms access external knowledge. In this line, various external forms of openness have been introduced, such as external search (Laursen & Salter, 2004), R&D cooperation (Belderbos et al., 2004; Mention, 2011), and R&D collaboration (Santamaría et al., 2021). As each paper uses its terminology to explain the linkages between the firm and external partners, the difference between those forms of openness is still ambiguous. We avoid this ambiguity by using two clear-cut forms of openness, “external search” and “external collaboration”. The former refers to an informal knowledge-sourcing strategy in which firms search for knowledge from multiple sources without any contractual obligations (Dahlander & Gann, 2010). The latter is mainly a formal openness strategy and requires more complicated institutional arrangements and contractual agreements with a few external innovation partners (Laursen & Salter, 2014). Our methodological approach adheres to these two constructs as they were used distinctly in the German innovation panel dataset, which we used for our econometric analysis. The survey differentiates between searching versus collaborating (excluding pure contracting out of work with no active collaboration) with external sources of knowledge. To test our hypotheses, we extracted data from the Mannheimer Innovation Panel (MIP), representing Germany's contribution to the European Community Innovation Survey (CIS). We constructed a pooled sample of 3294 innovative German firms from the MIP 2013 and MIP 2017, as these two waves include all our variables of interest.

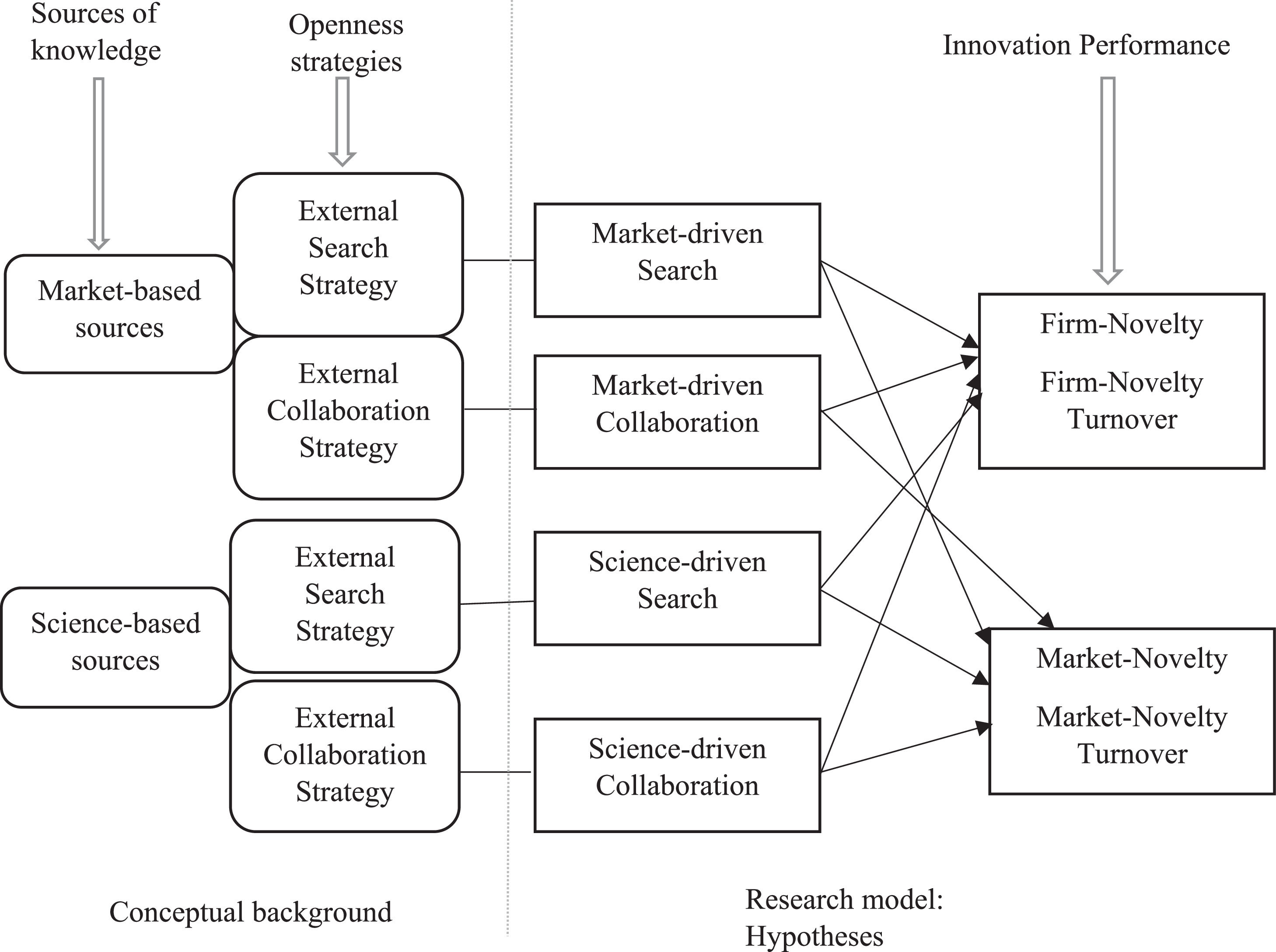

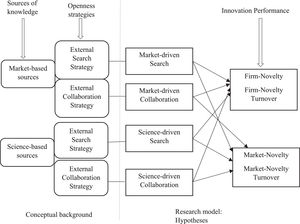

The main contribution of this paper is to define which forms of openness match better with the attributes of specific external knowledge sources to enhance innovation at the firm or on the market level. Answering this question could provide helpful guidance for innovation managers before investing in a particular form of openness that does not fit the targeted external knowledge sources. We combine the previously discussed aspects of openness (i.e., forms of openness and sources of knowledge) and construct four different openness strategies: market-driven search, market-driven collaboration, science-driven search, and science-driven collaboration (Fig. 1). We postulate that every strategy will generate different innovation performance, and deploying a collaboration strategy should generate better innovation performance than a using search strategy since it grants firms access to tacit and undisclosed knowledge of external sources (Sofka et al., 2018). For instance, industrial consortium members share knowledge but withhold their best research initially due to the perceived uncertainty of knowledge acquisition through the consortium, as seen in the case of Microelectronics and Computer Technology Corporation (MCC), a 1990s U.S. electronics consortium formed to compete with Japan (Gibson & Rogers, 1994; Gibson & Smilor, 1991). Concerning market-based sources of knowledge, the principal results show that adopting a search strategy positively correlates with innovation performance. Surprisingly, embracing a collaboration strategy with the same sources does not engender higher innovation performance. This means searching market-based sources is better for innovation than collaborating with them, despite the cost and difficulty of establishing external collaboration. On the contrary, regarding science-based sources, only a collaboration strategy positively affects innovation performance. Adopting an external search strategy toward the same sources shows no significant impact on innovation.

Given our results, we recommend that innovation managers adopt a soft external search strategy that is sufficient to capture the value from external market sources of knowledge, as embracing a costly formal collaboration strategy might be superfluous. However, deploying an external collaboration strategy is indispensable to capture the value of openness towards science-based sources.

We structure the rest of this paper as follows: the first section encompasses the theoretical background and hypotheses development. The second section includes our research method, the third section summarizes results, and the last two parts include a discussion, conclusion, and practical recommendation.

Theoretical backgroundOpenness strategies and innovation performanceFirms are encouraged to pursue innovation activities continuously as part of their new product development processes (Ferraris et al., 2017; Tsinopoulos et al., 2019). These innovation activities depend, to a large degree, on the amount of knowledge available for the organization (Rosenberg, 1990). Traditionally, this knowledge was generated inside the firm through investing in internal research and development (R&D) activities. However, firms increasingly recognize that internal R&D is expensive and often inadequate to cope with the dynamic changes in the market (Nelson & Winter, 1982). As no single firm can own all required resources for innovation (Chesbrough 2020), innovation becomes a result of interactive processes of knowledge generation and application that requires firms to open up their boundaries and absorb knowledge from external sources (Cohen & Levinthal, 1990; Teece, 2020; Tödtling et al., 2009). Therefore, building both in-house R&D capacity and openness capability turned out to have the same necessity for innovation (Bogers et al., 2019). In this regard, strategic management scholars stressed the importance of accessing knowledge outside the firm's boundaries (Cohen & Levinthal, 1990; Hippel, 1986; Rosenberg, 1990), as combining external knowledge with internally developed knowledge increases the firm's resources for innovation (Helfat & Peteraf, 2003).

In this light, the open innovation model promotes the advantages of the purposeful management of knowledge inflow and outflow between the focal firm and its surroundings in line with the firm's open business model (Henry W. Chesbrough, 2020; Saebi & Foss, 2015). The corresponding empirical studies underscored the importance of external knowledge sources in explaining firms' innovation performance in terms of introducing new or enhanced products and processes, cost efficiency, and sales/turnover from new products (Spithoven et al., 2012; Gesing et al., 2015). Accordingly, firms address many external sources of knowledge to try to fill the internal knowledge gap by acquiring knowledge beyond firm boundaries (Teece, 2020).

In particular, firms are integrating traditional market research strategies, business intelligence methods (Foley & Guillemette, 2010), and open innovation mechanisms, including boundary spanners, as well as formal and informal knowledge acquisition processes to propel their innovation initiatives. Moreover, recent advancements in artificial intelligence (AI) have enriched these open innovation practices significantly by utilizing deep learning within generative AI models. The latter, spearheaded prominently by OpenAI's GPT-3 Large Language Model, are able to produce content such as text or images. Such AI technologies facilitate the examination of expansive unstructured data sets, revealing obscured patterns, trends, and insights that might otherwise elude human scrutiny. As a result, AI can contribute to the discovery of new ideas and data-driven innovations. It can also optimize open innovation strategies by providing tools and methods that are more efficient and insightful than traditional approaches. For instance, AI-powered text analysis frameworks can reduce the cost of searching for knowledge in various sources such as patents, publications, and social media. These frameworks offer more in-depth insights compared to earlier models that were based on simple heuristics and machine-learning techniques. This demonstrates the potential of AI in not only enhancing our understanding of complex data but also in driving innovation and reducing operational costs (Bresciani et al., 2021; Bilgram & Laarmann, 2023).Top of Form

However, the necessity of complementarity between internal innovation activities and external knowledge acquisition as a determinant of openness' effectiveness is also highlighted (Cassiman & Veugelers, 2006). The notion that openness can improve innovation performance does not mean that the firm should search for knowledge through all possible external sources (Chen et al., 2011). In particular, searching many external sources of knowledge, i.e., over-searching, distracts managerial attention and causes misallocation of resources, such as time, effort, and money, which could generate a negative substitution effect with internal R&D (Laursen & Salter, 2006; Idrissia et al., 2012; Berchicci, 2013; Cassiman & Valentini, 2016). While some successful firms, such as Procter & Gamble (P&G), depend largely on openness toward customers and suppliers (Huston & Sakkab, 2007), other firms, such as Intel, innovate based on a closed collaboration with science-based partners, i.e., universities and research institutes (Chen et al., 2011). Notably, in the latter case, the firm must allocate more financial resources to establish collaboration projects and go through complex organizational arrangements that may increase innovation costs and slow down the whole innovation process instead of accelerating it (Berchicci, 2013; Masucci et al., 2020).

Prior empirical academic studies have stated multiple potential external sources of knowledge for innovation, such as clients and customers, suppliers, competitors, universities, research institutes, and commercial R&D consulting companies (see, for example, Laursen & Salter, 2004; Chen et al., 2011; Mention, 2011; Cruz-González et al., 2014). We focus on two distinctive groups: 1) market-based sources such as clients and customers, suppliers of equipment, materials, and software, and competitors or other enterprises in the sector (Rodriguez et al., 2017), and 2) science-based sources, such as consultants and commercial labs, universities or other higher education institutions, and government / public research institutes (Lhuillery & Pfister 2009; De Zubielqui et al. 2017). These sources are heterogenous regarding the novelty and accessibility of the knowledge they can provide for the innovation process of firms (more details will follow in the next section). Thus, the corresponding openness strategy of a firm should consider those characteristics to best capture the value of external knowledge.

In this light, the literature has underscored various pecuniary and non-pecuniary forms of openness that firms can use to access or acquire external knowledge. Pecuniary takes forms of IP in licensing R&D-services, supplier innovation awards, or specialized open innovation intermediaries (Dahlander & Gann, 2010). Non-pecuniary are mostly informal mechanisms such as crowd-sourcing, informal networking, publicly funded R&D-consortia, or customer-company co-creation (Chesbrough & Bogers, 2014). Internally, firms must decide which form of openness fits their financial resources, absorptive capacity, and appropriation capabilities (Abdelaty & Weiss, 2021). In other words, there is no blueprint for openness. Rather, the whole practice is contingent on certain key aspects: Who are the external sources of knowledge? What type of knowledge do they provide, and how accessible is it? And which forms of openness would match them and generate better innovation performance?

Before this background, our study follows Laursen and Salter (2014) and differentiates between external search and external collaboration regarding the forms of openness. External search refers to the number of external sources of knowledge that a firm utilizes to gain knowledge and information for its innovation activities. Firms that adopt this form of openness prefer to scout external sources and draw knowledge informally without establishing contractual collaborative innovation activities (West & Bogers, 2014). Firms might deploy this form of openness to acquire knowledge from a market or science-based source. We labeled these market-driven and science-driven search strategies (Fig. 1). External collaboration refers to actual collaborative innovation activities, such as R&D contracts or collaborative projects, with external sources of knowledge (Arora et al., 2001; van de Vrande et al., 2009). This form of openness is formal and requires establishing a contractual and institutional partnership with the innovation partners (Grimpe & Sofka, 2016). Similarly, firms might deploy this form of openness to acquire knowledge from a market or science-based source. Again, we labeled these as market-driven and science-driven collaboration strategies, respectively.

Hypotheses developmentFor our hypothesis development, we will delve into the essential characteristics of science and market-based sources in terms of their accessibility and novelty. We will also examine how these can be leveraged by a search or collaboration strategy for innovation at the firm or market level.

Market-Driven openness strategiesLiterature defined various market sources of knowledge, such as customers and clients, suppliers of materials and equipment, and competitors or other enterprises in the same sector (Mention, 2011). Verbano et al. (2015) surveyed a sample of 105 Italian manufacturing SMEs and underscored that all the firms had opened their innovation processes to at least one or two partners (96%). The most favored partners are suppliers (94% of firms), clients (88%), and firms from other sectors (51%). Customers have consistently been recognized as a significant source of knowledge about market trends and changes in market demand. Hippel (1986) identified a subgroup of customers, called lead users, who can precisely define their needs. Therefore, their demand is highly anticipatory for the broader market segment. Although customers' needs can be unarticulated, they can alert firms to new market and technology developments (Tsai & Hsieh, 2009). Competitors work in a similar market and technology context, making their impulses immediately relevant and more natural to absorb (Dussauge et al., 2000). However, the degree of novelty may be limited as opportunities for differentiation, based on shared knowledge among competitors, are likely to be restricted (Köhler et al., 2012). The significant role of suppliers in the innovation process has been frequently acknowledged as a crucial source for innovators (Pavitt, 1984; von Hippel, 1978). Un and Asakawa (2015) indicated that suppliers have the highest impact on process innovation due to their upstream position in the firm value-chain. Suppliers' knowledge boosts the creation of novel products, services, or processes, and ensures the quality of new products in the engineering process (Lhuillery & Pfister, 2009). It also helps shorten development times by providing compatible parts and components, which may seriously delay the development cycle (Tsai & Hsieh, 2009). Thus, we assume that market sources improve firms' innovation performance by providing contextual market knowledge for innovation (Wagner, 2013). Moreover, a relevant part of this knowledge is codified and accessible through a search form of openness, since customers are involved in a firm's daily business, while competitors' and suppliers' knowledge is mainly embedded in their products. In sum, a part of the knowledge from market sources is accessible, but comparatively less novel as it is also familiar knowledge to other actors (Grimpe & Sofka, 2010). Therefore, we expect that firms can capture market knowledge by using a soft search strategy. However, although this will enhance the overall innovation performance, we postulate that this will be driven by a positive effect on firm novelties rather than market novelties:

H1. A market-driven search strategy positively affects firms’ innovation performance, driven by Firm Novelty rather than Market Novelty.

While customers could be a source of novel ideas, they are often conservative in expressing their needs and more inclined to stick to the ‘status quo-bias.’ As long as they are satisfied with the current product performance, they do not think about improving the product (Talke & Heidenreich, 2014). Along the same line, Frosch (1996) points out that incorporating customers' impulses into innovation projects is generally risky. Customers' ideas can be myopic, narrow, and frequently wrong since they cannot articulate precisely how this product could be improved. We argue that the early inclusion of customers in the process, instead of dealing with them as passive recipients or evaluators of already developed products (Lettl et al., 2006), would motivate them to move beyond the satisfaction status quo and release their latent innovative ideas. Following this, we argue that customers' knowledge tends to be tacit, implying that it is not fully exploitable if the company uses only a search strategy (Tsai & Hsieh, 2009). Accordingly, customers could enhance a firm's innovation performance if they are properly included in the process through collaboration.

The same notion applies to suppliers. The old concept of handling suppliers as a hostage in a firm's supply chain is not applicable anymore (Brunswicker & Vanhaverbeke, 2015). For instance, continuous strategic alliances with suppliers and service providers are crucial determinants of the radical innovation performance of Flemish startup firms (Neyens et al., 2010). The COVID-19 crisis alerted manufacturers of the need to focus on their own problems and handle the issues of their suppliers to keep the supply chain functioning (Masucci et al., 2020). Hence, a close collaboration with suppliers would give the focal firm access to relevant tacit knowledge for innovation. By the same logic, despite the notion that competitors' knowledge is familiar and accessible as coded in their final products, we argue that some of their knowledge always remains tacit or hidden. Such specialized knowledge behind competitors' products cannot be accessed or copied through observation by applying a search form of openness, Rather, a closer collaboration is necessary (Tsai & Hsieh, 2009). We posit that a collaboration strategy towards market sources would give firms access to tacit and comparatively more novel knowledge that is unfamiliar or accessible to other actors. This will result in a better innovation performance than using a search strategy, and this will be driven by novelties on the market-level rather than on the firm-level.

H2. A market-driven collaboration strategy positively affects firms’ innovation performance, driven by Market Novelty rather than Firm Novelty.

Science-driven openness strategiesIn contrast to market sources of knowledge, science sources are primary producers of basic knowledge (Grimpe & Kaiser, 2010). The knowledge produced by universities, research institutes, and private R&D companies is always described by a high level of novelty that offers firms potential business opportunities (Perkmann and Walsh, 2007). However, knowledge generated from scientific sources may be far from application, requiring additional investment from the receiver to develop the final product (Siegel et al., 2004). Despite this, firms can easily access the coded knowledge of scientific sources using a search form of openness by reading periodical publications, examining patent databases, or sending their researchers to participate in international specialized conferences. Notably, this published and coded knowledge from science-based sources is accessible, but also familiar to other actors, which will not result in innovations new to the market but new to the firm. Thus, we assume this kind of knowledge can be accessed using a search strategy and will enhance innovation performance, although mostly driven by firm novelty.

H3. A science-driven search strategy positively affects firms’ innovation performance, driven by Firm Novelty rather than Market Novelty.

On the other hand, firms that deploy an external search strategy to draw knowledge from science-based sources must afford advanced, well-developed absorptive capacities to assess and transmit this type of knowledge (Köhler et al., 2012). There is a considerable novel part of the scientific knowledge produced, e.g., breakthrough discoveries, tacit experience, and heuristics of researchers, that firms cannot access through a search form of openness for many reasons. Firstly, published pieces of science are always written in an abstract technical language following the academic standards, targeting only the academic audience, not innovation practitioners. Secondly, not all science produced is published due to the difficulties of publishing in high-ranked peer-review journals (Laursen & Salter, 2006). Thirdly, universities encourage scientists to bring their ideas to the market, which inevitably requires them to keep them secret or unpublished. Researchers would like to keep their novel knowledge hidden to start their businesses or register a patent and sell licenses afterward. All these aspects hamper the accessibility of such scientific knowledge. Accordingly, seizing the value of such knowledge that is unfamiliar to other actors may only be achievable through adopting a collaboration form of openness as it enables researchers on both sides (i.e., universities and firms) to reach a mutual understanding and language over time. This leads us to our last hypothesis:

H4. A science-driven collaboration strategy positively affects firms’ innovation performance, driven by Market Novelty rather than Firm Novelty.

MethodDataWe extract data from the "Mannheim Innovation Panel" (MIP) to test our hypotheses. The MIP surveys German firms and has been conducted annually since 1993 by the center for European Economic Research (ZEW). MIP is a subject-oriented survey, as it focuses on firms' innovation activities by asking about their innovation expenditures on training or acquisition of external knowledge, the importance of information sources and cooperation for innovation activities, and factors hampering innovation and protection methods. The MIP targets decision-makers responsible for firms' innovation activities, such as CEOs and heads of innovation management units or R&D departments.

Given that German firms participate voluntarily in the survey, the response rate is around 25%, slightly lower than in other CIS countries (Peters, 2009). In particular, about 5000 firms in manufacturing and services regularly respond to the German survey. Moreover, not all variables of interest are available annually and not all firms answer. This results in a considerably unbalanced panel dataset. Therefore, to make use of the largest amount of observations possible, we constructed a pooled sample using the MIP survey conducted in 2013 and 2017, both of which contain our variables of interest. The questionnaires refer to the three years before the survey year, i.e., 2010–2012 and 2014–2016. In total, our pooled sample comprises 3294 observations. The sample includes firms from different manufacturing and service industries, which are listed in Appendix A1.

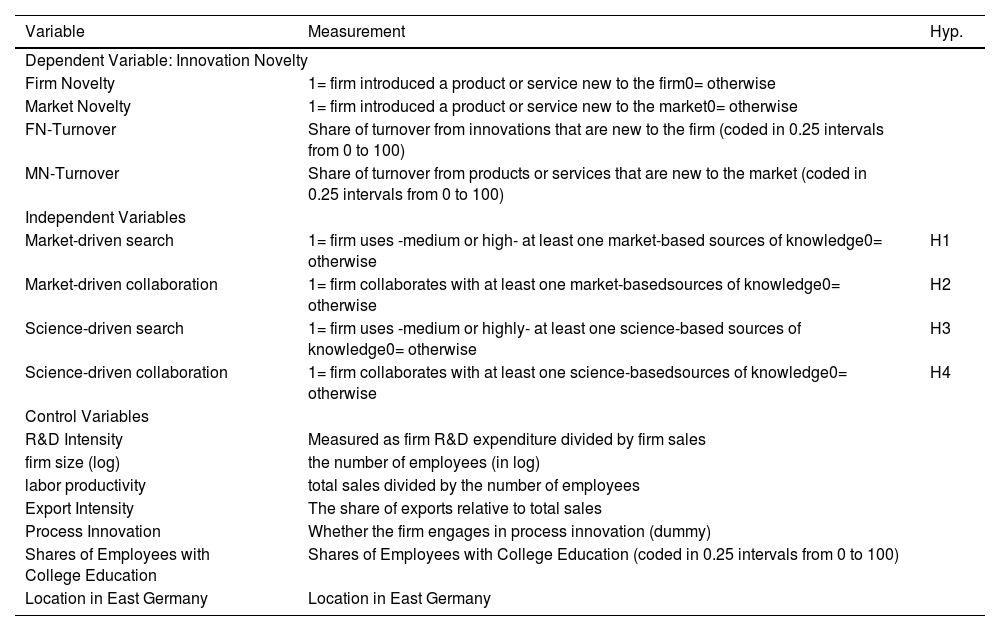

MeasuresDependent variable: innovation performanceTable 1 gives an overview of our regression variables. Firstly, we use a firm's innovation performance as our dependent variable. Prior literature features a variety of indicators to measure innovation performance (see, for instance, Moretti & Biancardi 2018; Praest Knudsen & Bøtker Mortensen 2011; Suh & Kim 2012). In this paper, we measure the innovation performance of a firm using two indicators of Innovation Novelty: Firm Novelty refers to newly introduced products or services that are new to the firm, while Market Novelty refers to newly introduced products that are new to the market (Köhler et al., 2012). Each variable takes a value of one if the firm introduces such a type of Innovation Novelty and zero if it does not. Since introducing a new product does not mean that product will be accepted in the market, we used the share of turnover generated from the newly introduced product as additional innovation performance indicators. Correspondingly, we use Firm-Novelty-Turnover (FN-Turnover) and Market-Novelty-Turnover (MN-Turnover).

Operationalization and measurements of all included variables.

| Variable | Measurement | Hyp. |

|---|---|---|

| Dependent Variable: Innovation Novelty | ||

| Firm Novelty | 1= firm introduced a product or service new to the firm0= otherwise | |

| Market Novelty | 1= firm introduced a product or service new to the market0= otherwise | |

| FN-Turnover | Share of turnover from innovations that are new to the firm (coded in 0.25 intervals from 0 to 100) | |

| MN-Turnover | Share of turnover from products or services that are new to the market (coded in 0.25 intervals from 0 to 100) | |

| Independent Variables | ||

| Market-driven search | 1= firm uses -medium or high- at least one market-based sources of knowledge0= otherwise | H1 |

| Market-driven collaboration | 1= firm collaborates with at least one market-basedsources of knowledge0= otherwise | H2 |

| Science-driven search | 1= firm uses -medium or highly- at least one science-based sources of knowledge0= otherwise | H3 |

| Science-driven collaboration | 1= firm collaborates with at least one science-basedsources of knowledge0= otherwise | H4 |

| Control Variables | ||

| R&D Intensity | Measured as firm R&D expenditure divided by firm sales | |

| firm size (log) | the number of employees (in log) | |

| labor productivity | total sales divided by the number of employees | |

| Export Intensity | The share of exports relative to total sales | |

| Process Innovation | Whether the firm engages in process innovation (dummy) | |

| Shares of Employees with College Education | Shares of Employees with College Education (coded in 0.25 intervals from 0 to 100) | |

| Location in East Germany | Location in East Germany | |

Secondly, to capture the effect of openness strategies on firms' innovation performance, we draw on the responses to two questions in the survey regarding firms' external search and collaboration activities. Ten possible external sources are listed in the survey. In particular, firms were asked to indicate every source's importance on a scale from 0 to 3 (0= not used, 1 = low used, 2= medium used, and 3 = highly used sources of knowledge). This list reflects the range of sources from the overall innovation system, including suppliers, clients, competitors, and public institutions, such as regulatory and standards bodies (Spithoven et al., 2012).

Following Laursen and Salter (2014), we use the seven external sources where interaction exists. These are market-based sources, including clients or customers, suppliers, competitors, and science-based sources, including consultants and private R&D institutes, universities, and public research institutes. Correspondingly, we excluded sources where no interaction occurs, such as scientific publications and technical standards. Using these seven sources, we created two variables to capture the external search strategies: market-driven search strategy and science-driven search strategy. The former takes the value one when at least one external market source of knowledge is used to a medium or high degree. The latter strategy takes the value of one if at least one external science-based source of knowledge is used to a high or medium degree and zero if no sources are used to a medium or high degree. Moreover, firms were asked whether they had collaborated in innovation activities with any of the seven types of organizations listed above for the external collaboration strategy. The external collaboration strategy variables were coded similarly to the external search strategies (Table 1).

Control variablesFinally, Table 1 also shows several control variables that capture factors that might influence a firm's innovation performance. In particular, we control for the importance of absorptive capacity by using R&D intensity (Braun & Bockelmann, 2016; Filho et al., 2021). Moreover, we include the firm size regarding the number of full-time employees (in log). Following Grimpe and Sofka (2016), we also control whether the firm engages in process innovation. Moreover, we use the labor productivity of the firm, defined as total sales divided by the number of employees, and the degree of internationalization, defined as the share of exports relative to total sales (Cassiman & Veugelers, 2006). The skills of the firm's employees are another facet of absorptive capacity captured by the share of employees with a college education (Bogers et al., 2018). Finally, we control for regional differences between East and West German firms. Regional control is necessary as most parts of East Germany are still lagging behind West Germany in terms of infrastructure and economic growth (Grimpe & Kaiser, 2010).

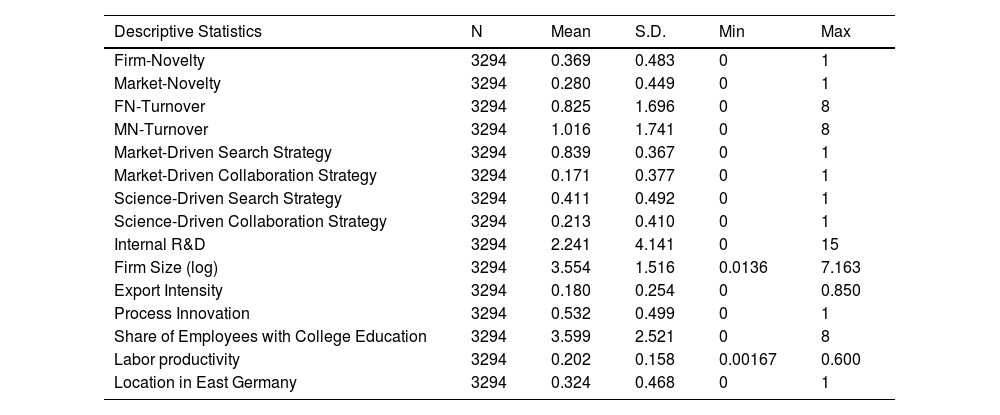

ResultsDescriptive resultsWe start with the descriptive statistics of our dependent and explanatory variables in Table 2. The table provides a summary of the whole sample. It turns out that 37% of the firms have introduced either a new or significantly improved good or service that is new to the market (i.e., market novelties). On the other hand, 28% of the firms introduced a new or significantly improved good or service that was new to the firm (i.e. firm novelties). For the two turnover variables, the mean indicates that, on average, the firms in our sample generate up to 25% of their revenue from either firm or market novelties.

Descriptive statistics.

| Descriptive Statistics | N | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| Firm-Novelty | 3294 | 0.369 | 0.483 | 0 | 1 |

| Market-Novelty | 3294 | 0.280 | 0.449 | 0 | 1 |

| FN-Turnover | 3294 | 0.825 | 1.696 | 0 | 8 |

| MN-Turnover | 3294 | 1.016 | 1.741 | 0 | 8 |

| Market-Driven Search Strategy | 3294 | 0.839 | 0.367 | 0 | 1 |

| Market-Driven Collaboration Strategy | 3294 | 0.171 | 0.377 | 0 | 1 |

| Science-Driven Search Strategy | 3294 | 0.411 | 0.492 | 0 | 1 |

| Science-Driven Collaboration Strategy | 3294 | 0.213 | 0.410 | 0 | 1 |

| Internal R&D | 3294 | 2.241 | 4.141 | 0 | 15 |

| Firm Size (log) | 3294 | 3.554 | 1.516 | 0.0136 | 7.163 |

| Export Intensity | 3294 | 0.180 | 0.254 | 0 | 0.850 |

| Process Innovation | 3294 | 0.532 | 0.499 | 0 | 1 |

| Share of Employees with College Education | 3294 | 3.599 | 2.521 | 0 | 8 |

| Labor productivity | 3294 | 0.202 | 0.158 | 0.00167 | 0.600 |

| Location in East Germany | 3294 | 0.324 | 0.468 | 0 | 1 |

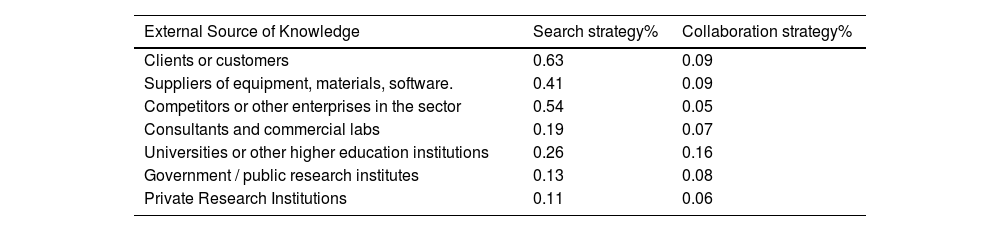

The table shows that the external search strategy is more widely adopted than the collaboration strategy. This behavior is understandable due to the cost of collaboration. We argue that it is not the most appropriate choice to capture the value of external sources of knowledge. Specifically, we find that firms largely adopt a search strategy toward market-based sources more than science-based sources, with 84% compared to 41%, respectively. Table 3 shows that clients and customers are the essential sources that firms search for knowledge, at 63%. In comparison, as seen in Table 2, the collaboration strategy is used more to draw knowledge from scientific sources than from market sources of knowledge, with 21% and 17%, respectively. As Table 3 shows, universities are the primary external innovation collaboration partners, at 16%. In sum, a search strategy is adopted more than a collaboration strategy. However, firms search market sources more than science sources and collaborate with science sources more than market sources of knowledge.

Knowledge sources and forms of openness.

| External Source of Knowledge | Search strategy% | Collaboration strategy% |

|---|---|---|

| Clients or customers | 0.63 | 0.09 |

| Suppliers of equipment, materials, software. | 0.41 | 0.09 |

| Competitors or other enterprises in the sector | 0.54 | 0.05 |

| Consultants and commercial labs | 0.19 | 0.07 |

| Universities or other higher education institutions | 0.26 | 0.16 |

| Government / public research institutes | 0.13 | 0.08 |

| Private Research Institutions | 0.11 | 0.06 |

We observe no indication of multicollinearity between our explanatory variables, as the variance inflation factor is below the recommended threshold of 4.0 (O'Brien, 2007).

Regression modelsWe use two different regression models for our main results. First, we use a logit model to estimate the effect of our selected independent variables on the binary Firm Novelty and Market Novelty dependent variables (models 1 and 2). In addition, we capture the impact of the openness strategies on FN-Turnover and MN-Turnover by estimating Poisson models (models 3 and 4), as these are count variables with an overrepresentation of zeros in their distribution, indicated by their low mean in Table 2 (Wooldridge, 2005).

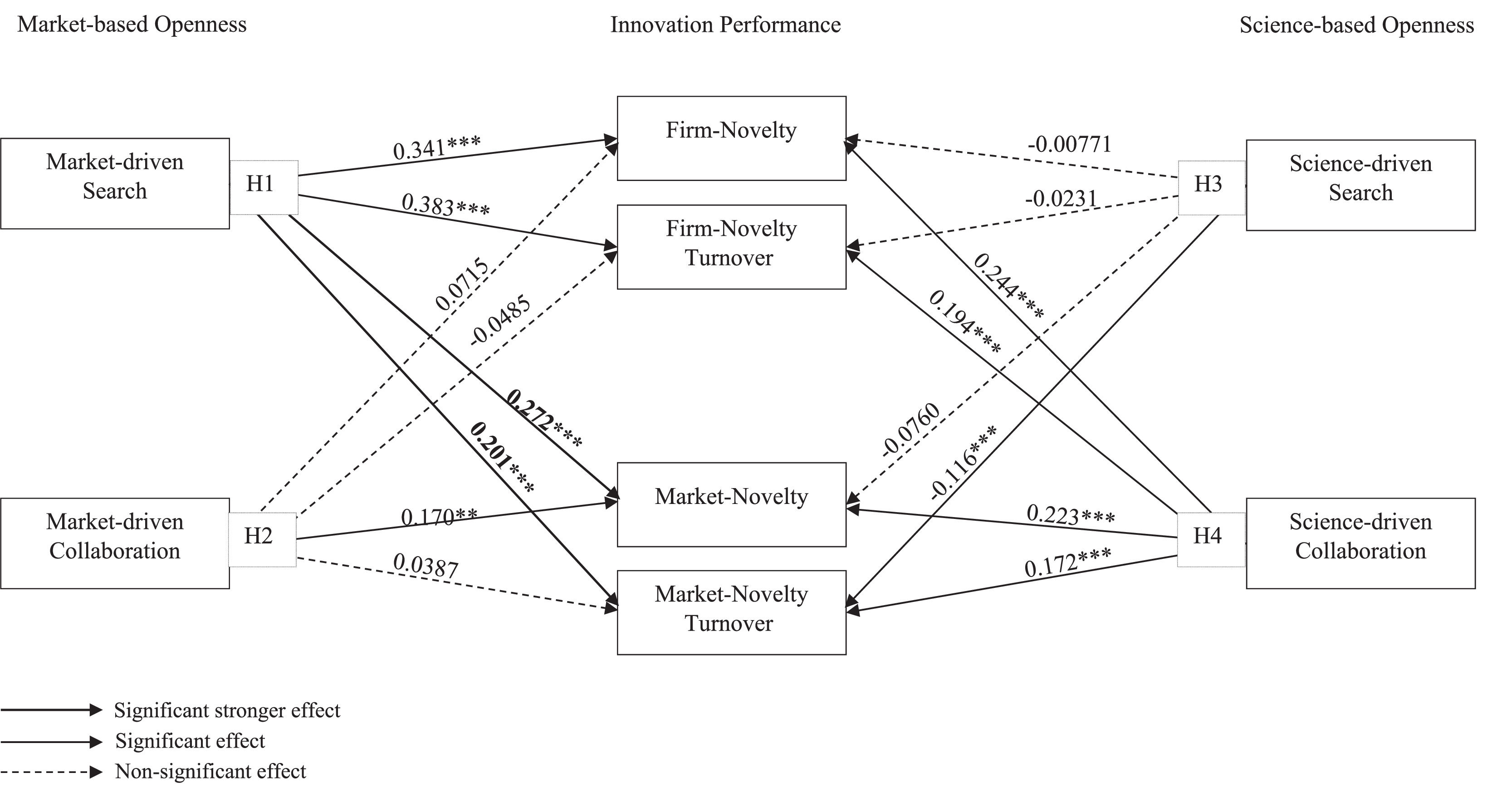

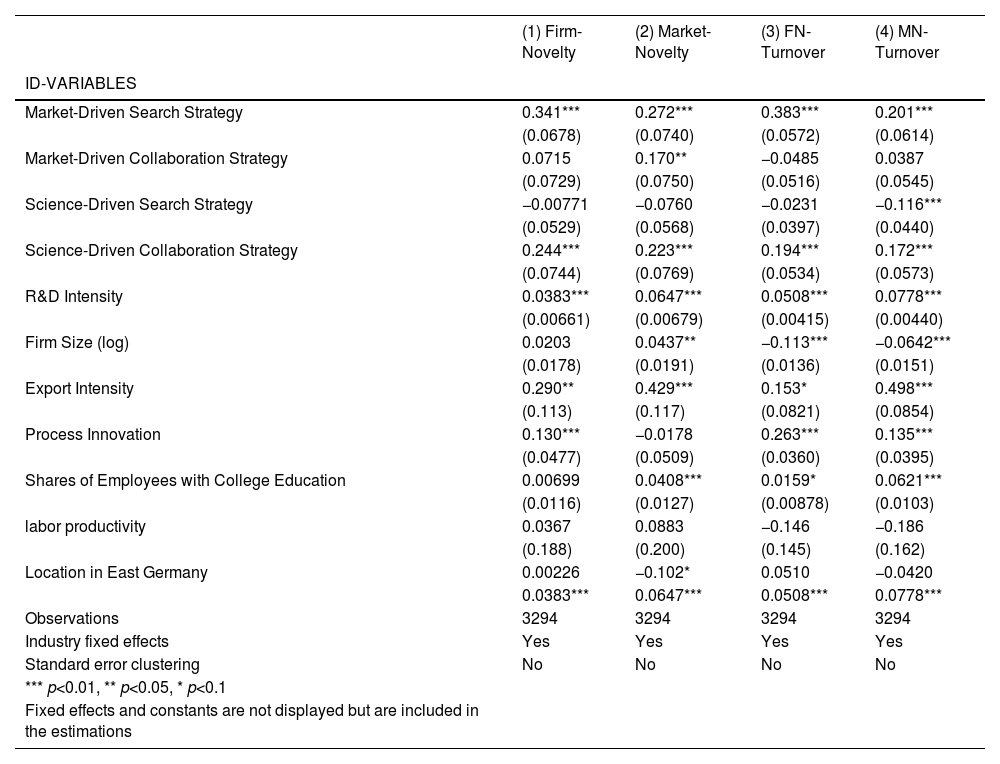

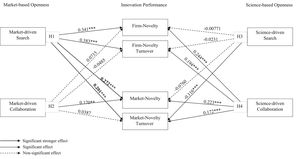

Regression resultsTable 4 and Fig. 2 present the results of our regression models. Firstly, regarding openness towards market sources of knowledge, i.e., market-driven search strategy and market-driven collaboration strategy, the results show a significant positive relationship between Market-Driven Search Strategy and all innovation performance indicators (models 1, 2, 3, and 4). It is also clear that this improved innovation performance is strongly driven by novelty on the firm level than on the market level. Hence, we have the full support of H1, suggesting that searching market sources of knowledge improves innovation performance and newly introduced products and services translated into sales on the market. In comparison, Market-Driven Collaboration Strategy has only a significantly positive impact on market novelties (model 2). However, this positive impact is not stable and loses significance when using the corresponding MN-Turnover (model 4). This means that products developed as new to the market did not translate into sales. Therefore, we have no support for H2, which states that adopting a collaboration strategy with market-based sources can improve firms' innovation performance compared to the search form of openness. Accordingly, adopting an external search strategy is more effective with market-based sources than deploying a collaboration strategy with the same sources.

Results of probit and Poisson estimation for the full sample.

| (1) Firm-Novelty | (2) Market-Novelty | (3) FN-Turnover | (4) MN-Turnover | |

|---|---|---|---|---|

| ID-VARIABLES | ||||

| Market-Driven Search Strategy | 0.341*** | 0.272*** | 0.383*** | 0.201*** |

| (0.0678) | (0.0740) | (0.0572) | (0.0614) | |

| Market-Driven Collaboration Strategy | 0.0715 | 0.170** | −0.0485 | 0.0387 |

| (0.0729) | (0.0750) | (0.0516) | (0.0545) | |

| Science-Driven Search Strategy | −0.00771 | −0.0760 | −0.0231 | −0.116*** |

| (0.0529) | (0.0568) | (0.0397) | (0.0440) | |

| Science-Driven Collaboration Strategy | 0.244*** | 0.223*** | 0.194*** | 0.172*** |

| (0.0744) | (0.0769) | (0.0534) | (0.0573) | |

| R&D Intensity | 0.0383*** | 0.0647*** | 0.0508*** | 0.0778*** |

| (0.00661) | (0.00679) | (0.00415) | (0.00440) | |

| Firm Size (log) | 0.0203 | 0.0437** | −0.113*** | −0.0642*** |

| (0.0178) | (0.0191) | (0.0136) | (0.0151) | |

| Export Intensity | 0.290** | 0.429*** | 0.153* | 0.498*** |

| (0.113) | (0.117) | (0.0821) | (0.0854) | |

| Process Innovation | 0.130*** | −0.0178 | 0.263*** | 0.135*** |

| (0.0477) | (0.0509) | (0.0360) | (0.0395) | |

| Shares of Employees with College Education | 0.00699 | 0.0408*** | 0.0159* | 0.0621*** |

| (0.0116) | (0.0127) | (0.00878) | (0.0103) | |

| labor productivity | 0.0367 | 0.0883 | −0.146 | −0.186 |

| (0.188) | (0.200) | (0.145) | (0.162) | |

| Location in East Germany | 0.00226 | −0.102* | 0.0510 | −0.0420 |

| 0.0383*** | 0.0647*** | 0.0508*** | 0.0778*** | |

| Observations | 3294 | 3294 | 3294 | 3294 |

| Industry fixed effects | Yes | Yes | Yes | Yes |

| Standard error clustering | No | No | No | No |

| *** p<0.01, ** p<0.05, * p<0.1 | ||||

| Fixed effects and constants are not displayed but are included in the estimations |

Secondly, regarding openness toward scientific sources of knowledge, our results reveal a negative influence of the Science-Driven Search Strategy for all innovation indicators, although only significant for MN-Turnover (model 4). Thus, we have no support for H3, which states that a science-driven search strategy could positively impact firms' innovation performance. In contrast, a significant positive relationship exists between science-driven collaboration strategy and all innovation performance indicators (models 1, 2, 3, and 4), which supports the first part of H4. However, it is not clear whether the improved innovation performance is driven by novelty on the firm level or on the market level, which does not support the second part of H4. This suggests that collaborating with science-based partners is more beneficial for the firm's innovation performance than just searching for information and trying to absorb knowledge for innovation without collaborating with them.

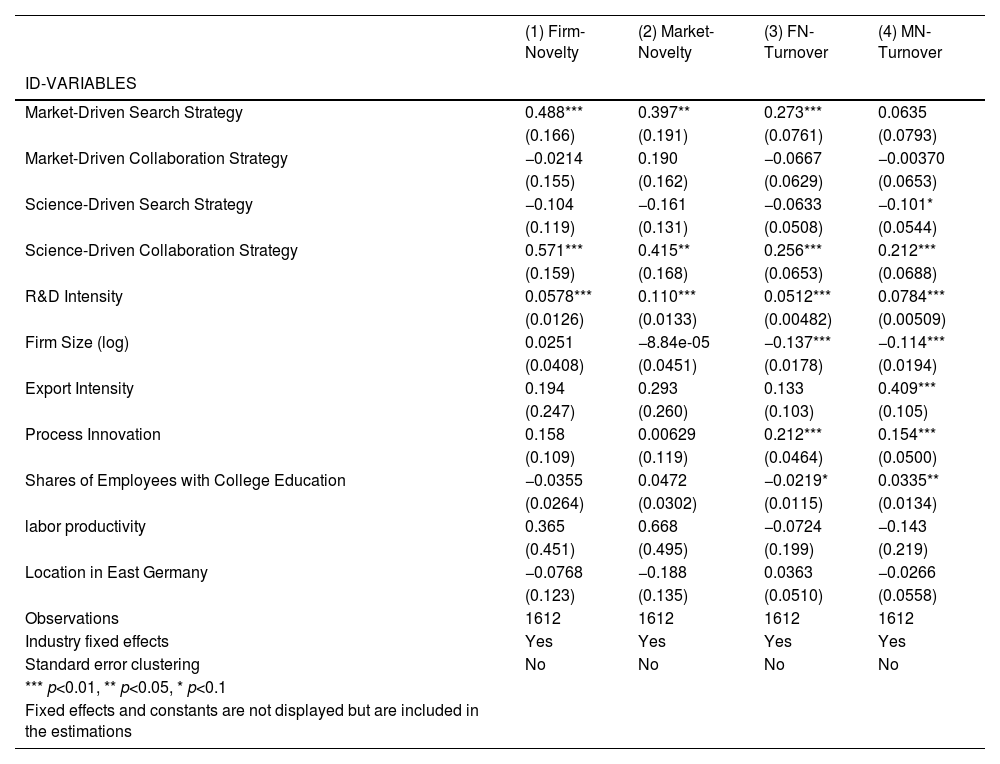

In addition to our main results, we conducted several robustness checks. Firstly, we use the labeling of the MIP to split the sample into research-intensive industries and industries not considered research-intensive. The former comprises chemical, electrical equipment, machinery, retail / automobile, media services, IT/telecommunications, banking/insurance, technical services/R&D services, and consulting/advertisement, as depicted in A1. This accounts for the possibility that the observed impacts of the openness strategies on innovation performance are influenced by the characteristics of high and low-tech sectors (Asimakopoulos et al., 2020). The robustness checks show that most of the results remain stable for research-intensive sectors. Market-based collaboration and market-based search lose their significance in models 2 and 4, respectively (see Appendix A2 and A3).

Nevertheless, the signs of the associated coefficients remain the same. More importantly, science collaboration loses significance across all models for the sectors that are not considered research-intensive. As expected, research-intensive industries are better equipped to benefit from openness toward science-based knowledge sources due to the absorptive capacity, which facilitates knowledge acquisition and transmission when working with universities or research institutes (Miozzo et al., 2016; Spithoven et al., 2011). Secondly, we confirm the robustness of our Poisson models by repeating the estimations with negative binomial and ordered probit regressions (Wooldridge, 2005).

DiscussionTheoretically, this study builds on previous works on open innovation strategies and innovation performance, such as Laursen and Salter (2006(and Köhler et al. (2012). The literature on open innovation, particularly quantitative studies, is mainly restricted to the breadth and depth of conceptualization of openness (Ahuja & Katila, 2001; Laursen & Salter, 2006). Both concepts focus on the number of external sources of knowledge that a firm uses for innovation. Despite the immense influence of this conceptualization, it does not consider the heterogeneity of external sources of knowledge (Köhler et al., 2012). We argue that external sources are heterogeneous regarding their knowledge novelty and accessibility, and firms must consider these aspects when organizing their openness strategy.

Empirically, we found strong support for our theoretical argument that the openness strategy should be aligned with the characteristics of external knowledge sources to enhance innovation performance (Köhler et al., 2012). The descriptive statistics indicate that external collaboration as a form of openness is much less common than external search strategy. This is in line with previous studies that argue that collaboration is more challenging, costly, and complicated than external search strategy (Cruz-González et al., 2015). Considering the difficulties in establishing collaboration linkage with external partners, it is rational that firms search a wide variety of knowledge sources but only collaborate with a few to access both codified and tacit knowledge at the lowest cost (Laursen & Salter, 2004).

Secondly, the main analysis of our paper focuses on exploring the relationship between strategies of openness and innovation performance. Our regression results indicate that a market-driven search strategy has a stronger association with innovation performance. The resulting positive performance is strongly influenced by novelty on the firm level due to the familiarity of the knowledge provided by market sources, as introduced in our theoretical background section. At the same time, in contrast to Tsai and Hsieh (2009), we find no evidence that adopting an external collaboration strategy with market sources improves innovation performance. This affirms that firms can mainly rely on a search form of openness to access market sources’ knowledge and capture the value of openness without getting into complicated contractual collaborations. Notably, this insight goes against our postulation that collaboration gives firms access to the tacit knowledge inherent to market sources. The regression results explain why firms prefer searching market sources rather than collaborating with them, as this choice gives them higher innovation performance. Our explanation for this result revolves around three factors:

(1) customers are part of a firm's daily business, making their impulses accessible. Likewise, the knowledge of suppliers' competitors can be captured by observing their business models and imitating or reverse-engineering their products. (2) the knowledge of market sources could be familiar or approachable enough to be exploited by a mere search strategy (Köhler et al., 2012). 3) the risk of knowledge leakage, which makes establishing collaboration with market sources risky as it would require the focal firm to disclose knowledge during collaboration, which will likely leak out to other market rivals through customers or suppliers in the value chain Miozzo et al. (2016). Different competitors may work with the same suppliers or customers, so a closer collaboration may increase the risk of unwanted knowledge spillover, as well as the costs related to protecting internal knowledge (Abdelaty & Weiss, 2021; Cruz-González et al., 2014). While a search strategy is beneficial towards market-based sources, our findings provide no evidence for a positive impact from a science-driven search strategy on firms' innovation performance (H3). This finding implies that despite the novelty of knowledge provided by science-based sources, such as universities, research institutes, and commercial R&D labs, this knowledge cannot be accessed through an external search strategy. Accordingly, our assumption that extracting knowledge from science-based sources by reading published work or investigating patent portfolios is beneficial for firms receives no support from our data. Nevertheless, our results suggest that persuing a collaboration strategy with the same science sources significantly improves innovation performance. This positive impact could be attributed to the notion that science-based sources provide novel knowledge beneficial to firms' innovation processes. However, this knowledge cannot be obtained by firms using a search strategy. We explain this as follows: (1) not all scientific output is published due to the challenges in the established publishing system (2) scientific knowledge tends to be complex, opaque, and far from technical language and applications needed in innovation processes (Laursen & Salter, 2014; Siegel et al., 2004) 3) because of the financial pressures and research valorization orientation in many countries, universities, and research institutes, individual scholars are encouraged to enhance their funding conditions by starting their own business or patenting their valuable knowledge to sell licenses afterwards (Bonaccorsi et al., 2021). Consequently, entrepreneurial interests have led researchers to monetize their new scientific discoveries over time rather than publish them in academia (Rothaermel et al., 2007). To apply these policies, universities have dedicated resources and facilities to valorize research (Bonaccorsi et al., 2021). Nowadays, almost all public universities have organizations such as Industrial Liaison Offices (ILOs), Technology Transfer Offices (TTOs), and science and technology parks for commercializing research outputs. Given these points, firms must delve into institutional relationships and initiate collaborative projects with science-based sources to utilize their knowledge for innovation performance. Notably, this is affirmed by our robustness test, which suggested that the impact of science-based collaboration is observed first and foremost in research-intensive industries.

Implications, limitations, and future researchAbove all, our study shows that researchers should go beyond the homogeneity assumption of openness and scrutinize the underlying practices of open innovation and how these affect firms' innovation performance. In this regard, while structural factors such as firm size, industry sector, or the existence of internal R&D infrastructure are important determinants of successful openness, managerial decisions and organizational behavior might play a crucial role. On the practical level, we have a specific recommendation for innovation managers. External sources can play an essential role in innovation, but not all sources of knowledge can or should be tapped with the same openness strategy. For instance, market-based sources of knowledge affect innovation performance positively, and using an informal and low-cost external search strategy is so far proper to capture its value. On the contrary, science-based sources substantially impact the firm's ability to innovate on the firm and the market levels. However, only by embracing a formal collaboration strategy can firms acquire such novel knowledge, while adopting a broad external search strategy does not fit with such inaccessible knowledge.

Last but not least, this study is not without limitations. Firstly, we introduced four different openness strategies and considered their respective influence on innovation performance, without examining the interaction effects between them. In reality, firms adopt a combination of these strategies to address external knowledge sources. Future research should come up with different combinations of external sources of knowledge and check which patterns result in better innovation performance, either with regression or cluster analysis. Furthermore, our modeling approach only focused on the effect of the different openness strategies on the innovation performance in the form of firm or market novelties and the applicable turnover, i.e., output innovation indicators. Our data was not applicable to further distinguishing the effects along different stages of the innovation process, e.g., ideation, prototyping, and commercialization. One can argue that the impact of external sources of knowledge on innovation performance would differ according to the stage of the innovation process. For instance, science sources would be influential in the ideation phase, while market sources are more impactful in the commercialization phase. Empirically, such a stage-based analysis could be addressed using a range of inputs, outputs, and throughput innovation indicators.

Secondly, more research is required to validate our empirical insights using datasets from different countries, as our results could be biased by the characteristics of the German innovation system and the composition of the MIP. For instance, we found that 16% of the firms in our sample are collaborating with universities, which is a remarkably high number compared to similar studies in the literature (Laursen & Salter, 2004). Moreover, we believe that a further sectoral analysis across industries would enrich our understanding of the underlying mechanisms. Likewise, future research could extend our analysis, including non-linear effects in terms of an inverted U-shaped relation between openness strategies and innovation performance (Laursen & Salter, 2006), or capture the independent openness strategy variables on a continuous scale, given better data availability. Finally, we explained the observed relationships between openness strategies, external knowledge sources, and innovation performance. However, in-depth qualitative research using interviews or dedicated case examples is needed to validate our thinking.

Finally, future research should explore the impact of recent advancements in generative AI technology, such as ChatGPT or Bard, on firms' collaboration activities and absorptive capacity. This includes examining how these innovations can potentially reduce the cost of tasks that can be easily replaced by these new AI applications. By the same token, it would be interesting to investigate how the integration of AI tools can streamline interorganizational communication, facilitating the sharing and co-creation of innovative ideas. This could also open up opportunities for firms to effectively leverage collective intelligence, pushing the boundaries of traditional knowledge management processes.

Finally, it is important to study how recent changes in foreign relations and the narrative of de-globalization impact the adoption of open innovation practices in Western countries. This research will provide valuable insights into the challenges and opportunities faced in implementing open innovation strategies in a shifting global landscape.

Data availabilityMannheimer Innovation Panel (MIP), ZEW, Mannheim doi: 10.7806/zew.mip.2013 and 2017.V1. suf; available at https://www.zew.de/en/research-at-zew/mannheim-innovation-panel-innovation-activities-of-german-enterprises.

We thank the center for European Economic Research (ZEW) in Mannheim, Germany, for making the data available for this research. We acknowledge support from the Open Access Publication Fund of the Freie Universität Berlin

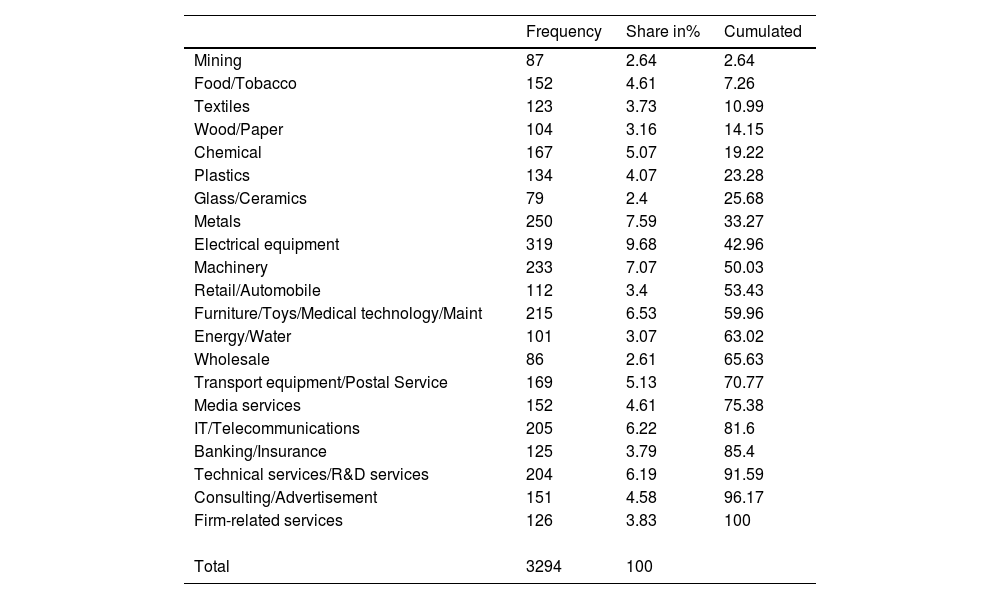

Sample breakdown according to industrial activities.

| Frequency | Share in% | Cumulated | |

|---|---|---|---|

| Mining | 87 | 2.64 | 2.64 |

| Food/Tobacco | 152 | 4.61 | 7.26 |

| Textiles | 123 | 3.73 | 10.99 |

| Wood/Paper | 104 | 3.16 | 14.15 |

| Chemical | 167 | 5.07 | 19.22 |

| Plastics | 134 | 4.07 | 23.28 |

| Glass/Ceramics | 79 | 2.4 | 25.68 |

| Metals | 250 | 7.59 | 33.27 |

| Electrical equipment | 319 | 9.68 | 42.96 |

| Machinery | 233 | 7.07 | 50.03 |

| Retail/Automobile | 112 | 3.4 | 53.43 |

| Furniture/Toys/Medical technology/Maint | 215 | 6.53 | 59.96 |

| Energy/Water | 101 | 3.07 | 63.02 |

| Wholesale | 86 | 2.61 | 65.63 |

| Transport equipment/Postal Service | 169 | 5.13 | 70.77 |

| Media services | 152 | 4.61 | 75.38 |

| IT/Telecommunications | 205 | 6.22 | 81.6 |

| Banking/Insurance | 125 | 3.79 | 85.4 |

| Technical services/R&D services | 204 | 6.19 | 91.59 |

| Consulting/Advertisement | 151 | 4.58 | 96.17 |

| Firm-related services | 126 | 3.83 | 100 |

| Total | 3294 | 100 |

Results of probit and Poisson estimation for research-intensive industries.

| (1) Firm-Novelty | (2) Market-Novelty | (3) FN-Turnover | (4) MN-Turnover | |

|---|---|---|---|---|

| ID-VARIABLES | ||||

| Market-Driven Search Strategy | 0.488*** | 0.397** | 0.273*** | 0.0635 |

| (0.166) | (0.191) | (0.0761) | (0.0793) | |

| Market-Driven Collaboration Strategy | −0.0214 | 0.190 | −0.0667 | −0.00370 |

| (0.155) | (0.162) | (0.0629) | (0.0653) | |

| Science-Driven Search Strategy | −0.104 | −0.161 | −0.0633 | −0.101* |

| (0.119) | (0.131) | (0.0508) | (0.0544) | |

| Science-Driven Collaboration Strategy | 0.571*** | 0.415** | 0.256*** | 0.212*** |

| (0.159) | (0.168) | (0.0653) | (0.0688) | |

| R&D Intensity | 0.0578*** | 0.110*** | 0.0512*** | 0.0784*** |

| (0.0126) | (0.0133) | (0.00482) | (0.00509) | |

| Firm Size (log) | 0.0251 | −8.84e-05 | −0.137*** | −0.114*** |

| (0.0408) | (0.0451) | (0.0178) | (0.0194) | |

| Export Intensity | 0.194 | 0.293 | 0.133 | 0.409*** |

| (0.247) | (0.260) | (0.103) | (0.105) | |

| Process Innovation | 0.158 | 0.00629 | 0.212*** | 0.154*** |

| (0.109) | (0.119) | (0.0464) | (0.0500) | |

| Shares of Employees with College Education | −0.0355 | 0.0472 | −0.0219* | 0.0335** |

| (0.0264) | (0.0302) | (0.0115) | (0.0134) | |

| labor productivity | 0.365 | 0.668 | −0.0724 | −0.143 |

| (0.451) | (0.495) | (0.199) | (0.219) | |

| Location in East Germany | −0.0768 | −0.188 | 0.0363 | −0.0266 |

| (0.123) | (0.135) | (0.0510) | (0.0558) | |

| Observations | 1612 | 1612 | 1612 | 1612 |

| Industry fixed effects | Yes | Yes | Yes | Yes |

| Standard error clustering | No | No | No | No |

| *** p<0.01, ** p<0.05, * p<0.1 | ||||

| Fixed effects and constants are not displayed but are included in the estimations |

Results of probit and Poisson estimation excluding research-intensive industries.

| (1) Firm-Novelty | (2) Market-Novelty | (3) FN-Turnover | (4) MN-Turnover | |

|---|---|---|---|---|

| ID-VARIABLES | ||||

| Market-Driven Search Strategy | 0.662*** | 0.541*** | 0.512*** | 0.401*** |

| (0.163) | (0.182) | (0.0865) | (0.0968) | |

| Market-Driven Collaboration Strategy | 0.284 | 0.432** | −0.0331 | 0.139 |

| (0.190) | (0.203) | (0.0908) | (0.100) | |

| Science-Driven Search Strategy | 0.0759 | −0.116 | 0.0305 | −0.168** |

| (0.130) | (0.146) | (0.0642) | (0.0760) | |

| Science-Driven Collaboration Strategy | 0.154 | 0.289 | 0.0690 | 0.0784 |

| (0.192) | (0.204) | (0.0929) | (0.104) | |

| R&D Intensity | 0.101*** | 0.105*** | 0.0611*** | 0.0814*** |

| (0.0221) | (0.0225) | (0.00828) | (0.00905) | |

| Firm Size (log) | 0.0358 | 0.150*** | −0.0808*** | 0.00830 |

| (0.0429) | (0.0480) | (0.0211) | (0.0245) | |

| Export Intensity | 0.830*** | 1.187*** | 0.194 | 0.696*** |

| (0.281) | (0.297) | (0.137) | (0.146) | |

| Process Innovation | 0.271** | −0.0455 | 0.331*** | 0.0991 |

| (0.116) | (0.129) | (0.0574) | (0.0654) | |

| Shares of Employees with College Education | 0.0601** | 0.0887*** | 0.0651*** | 0.0882*** |

| (0.0287) | (0.0325) | (0.0134) | (0.0160) | |

| labor productivity | −0.241 | −0.407 | −0.235 | −0.304 |

| (0.431) | (0.477) | (0.215) | (0.245) | |

| Location in East Germany | 0.0740 | −0.189 | 0.0634 | −0.0799 |

| (0.125) | (0.143) | (0.0603) | (0.0722) | |

| Observations | 1682 | 1682 | 1682 | 1682 |

| Industry fixed effects | Yes | Yes | Yes | Yes |

| Standard error clustering | No | No | No | No |

| *** p<0.01, ** p<0.05, * p<0.1 | ||||

| Fixed effects and constants are not displayed but are included in the estimations |

This is distinguished from 'business intelligence,' which refers to the analysis of internal and external data to guide the general decision-making within companies (Foley and Guilmette 2010). In contrast, the focus here is on search and collaboration activities specifically aimed at fostering innovation.