This paper aims to examine the adoption of electronic-invoicing (e-invoicing) technology using a Technological-Organisational-Environmental (TOE) framework, especially toward managing business information system transformation in emerging economies. A Partial Least Square (PLS) Structural Equation Modelling (SEM) was used for construct measurement, and logistic regression was used for model testing. We found compatibility, complexity, relative advantage, trialability, firm size, and competitive and regulatory pressure to act as determinants of e-invoicing technology adoption. This study contributes to the existing literature by providing theoretical underpinning to e-invoicing technology penetration literature and toward adopting this innovation in the business-to-business market context. It also offers insights into the implementation of e-invoicing from the perspective of emerging economies.

Managing information is crucial for the efficiency and competitiveness of the business supply chain. Structured strategic and transactional data of businesses must flow consistently among supply chain partners for a healthy and competent supply chain. Every supply chain needs to deploy functional information and document exchange systems. The information systems need to perform functions such as data capture and communication, data storage and retrieval, and data manipulation and reporting (Hugos, 2018). Electronic invoicing (e-invoicing) can perform these functions efficiently and thus benefit the focal firm and its supply chain partners. E-invoicing will play a key role in the digital transformation of the supply chain. Today, digital transformation in the supply chain is of paramount importance. To reap the benefits of the digital supply chain, it is essential to leverage novel approaches, including digital transformation with technologies (Nasiri et al., 2020). E-invoicing could also prove to be of immense value in enabling supply chain finance (SCF) which has gained significant attention in business-to-business (B2B) financing post-financial crisis of 2009 (Wuttke et al., 2013; Caniato et al., 2016; Marak & Pillai, 2018). SCF can greatly benefit from the implementation of digital technologies, such as e-invoicing, thereby making processes faster and cheaper (Caniato et al., 2016; Marak & Pillai, 2021; Moretto & Caniato, 2021). The implementation of new digital applications such as e-invoicing can increase the digitalised buyer-supplier relationships, thereby bringing new business-to-business (B2B) opportunities (Ivang et al., 2009).

B2B transactions play a crucial role in any economy, and it is of utmost importance that there should be a proper payment system to facilitate those B2B transactions. In 2021, the market size of the global B2B payments was valued at USD 1029 billion, and it is estimated to grow at a CAGR of 8.9% and thereby reach a market size of USD 2242 billion by 2030 (Straits research, n.d.). Though B2B payments are growing rapidly and have been found to outpace consumer payments, there are still issues that plague the way B2Bs make and accept payments. One of the major issues in B2B payments is the use of paper cheques which has many drawbacks compared to electronic payments. A recent study in the USA showed that though the paper cheque is one of the least preferred methods of payment, it still contributes to 42% of B2B payments. E-invoicing can immensely contribute to electronic payments and thus help improve the overall B2B payments ecosystem (Association for Finance Professionals, n.d.; Main, 2021).

Due to the significance e-invoicing holds for a supply chain, B2B payments, and the economy, the e-invoicing market has seen remarkable growth over the years in developed economies. Globally, it is expected to grow at a compounded annual growth rate of 20.4% for the period of 2019-2026 (Zion market research, 2019). The report further states that, by region, Asia Pacific is predicted to be one of the fastest-growing markets of e-invoicing within the forecast period, owing to the growing penetration of advancing technology support and rising automation trends, especially in emerging countries like China and India. E-invoicing in Asia and Latin America is expected to experience a tremendous growth rate which will further drive the overall e-invoicing market (Koch, 2017). The adoption of e-invoicing in the industrial market can make supply chains highly transparent and visible. It is expected that further adoption of e-invoicing will also further boost innovation in e-invoicing technology and the overall digital transformation of the supply chain (Martínez-Román et al., 2020).

Over the past few years, India has witnessed several initiatives and measures taken by the government. These initiatives could prove beneficial in creating a conducive ecosystem for the e-invoicing market. The Indian government replaced Value Added Tax (VAT) with Goods and Services Tax (GST), which has remained in effect since July 1, 2017 (Goods and Services Tax Council, n.d.). GST requires e-reporting in the form of an e-way bill to be generated by the consignor or consignee. It is a receipt or a document that offers details such as the Goods and Services Tax Identification Number (GSTIN) of the recipient, place of delivery, invoice or Goods Receipt Note (GRN) number and date, the value of the goods, reasons for transportation, transporter details, among others. As per the Central Goods and Services Tax (CGST) Rules, 2017, any consignment having a value of more than fifty thousand Indian Rupees (INR 50000) is compulsorily required to generate an e-way bill (Directorate General of Taxpayer Services Central Board of Excise and Customs, 2020). Such e-reporting is expected to aid in forming the necessary ecosystem for the practice of e-invoicing (Koch, 2017).

On the other hand, e-invoicing can help improve the ease of doing business and filing the e-way bill and thus GST. Further, e-invoicing is mandatory for enterprises in India with a turnover of INR 1 billion and above. For smaller enterprises, the use of electronic invoicing is still only voluntary (Prasad, 2020). Such measures taken by the government are expected to create a positive influence regarding the adoption and diffusion of e-invoicing.

This study aims to examine the adoption of e-invoicing in India, representing emerging economies, using a Technological, Organisational, and Environmental (TOE) framework. TOE broadly covers the factors from several dimensions that could influence the adoption decisions of a firm. This study will contribute to the existing literature on e-invoicing by providing a theoretical underpinning to e-invoicing literature. It will also offer insights into the implementation of e-invoicing in emerging economies.

Further, it will add to the literature on TOE in its application for a different technology from the previous ones. Testing an existing TOE model for a new technology application in the emerging market reveals newer aspects of the suitability of the theory. At the same time, this study also reflects propositions for supply chain finance and buyer-seller transparency as part of theoretical contributions.

The remainder of the paper is structured as follows. Section two is dedicated to the literature review. Section three is designed for the research methodology followed. Section four presents the results and findings of the study. Section five provides discussions, including the theoretical contributions, managerial implications, and directions for further research. Finally, section six offers the conclusion of the study.

Theoretical background and literature reviewE-invoicingE-invoicing may be defined as the dematerialised form of invoice having a structured and standardised format used among supply chain partners (Penttinen and Tuunainen, 2009, p1; Penttinen, 2008). Electronic invoicing is not entirely new. The transmission of invoices via an electronic format has existed for decades. Koch (2017) stated that the e-invoicing market has been around for longer than a few decades. As early as the 1970s, EDIFACT (Electronic Data Interchange for Administration, Commerce, and Transport) was used by large organisations as a mechanism for transmitting invoice data. However, these systems were point-to-point systems that required considerable investments in setting up connections between the parties involved (Penttinen and Hyytiainen, 2008). Earlier, the private industry acted as the major driver; however, at present, due to the push to have an efficient tax system, governments are taking measures to implement e-invoicing (Koch, 2017).

There are different ways in which an invoice may be transmitted between business partners: (a) paper-based invoice transmitted by post; (b) invoice exchanged as an electronic attachment (e.g., PDF) in an email; (c) invoice created by scanning a paper document by using optical character recognition; (d) invoice exchanged as structured XML or EDI; (e) using both paper invoice sent by post and duplicate electronic copy exchanged by other means mentioned earlier, i.e., (a) to (d); etc. (Keifer, 2011). It has been observed that invoice exchange using email is more popular than EDI, and small and medium-sized enterprises (SMEs) generally prefer email by comparison to their larger counterparts. It has also been observed that the combination of PDF and XML invoices is gradually increasing (Koch, 2017).

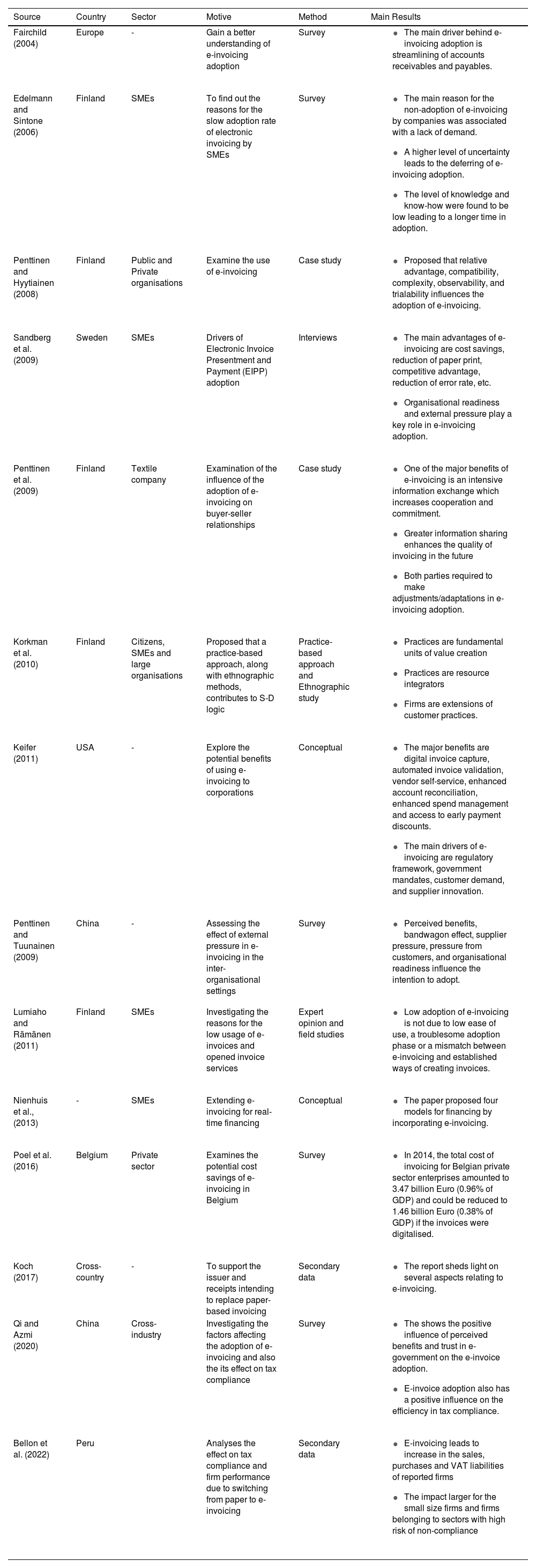

The use of electronic invoicing has gained attention over the last few years. A summary of extant research relating to e-invoicing is given in Appendix 1. Specifically, from Appendix 1, it can be observed that the majority of the studies are empirical, using a survey method followed by case studies, interviews, ethnographic studies, expert opinions, and secondary data. Most of these empirical studies have been primarily conducted in Europe, particularly Finland. These empirical studies have mainly highlighted the determinants, benefits, and challenges of e-invoicing.

Drivers of E-invoicingThe literature discussed several drivers of e-invoicing that prompt organisations to adopt e-invoicing. Some of these are the streamlining of accounts receivables (AR) and accounts payables (AP); reduction of costs in general (Fairchild, 2004); reduction of printing costs (Poel et al., 2016); working capital optimisation (Fairchild, 2004); increased efficiency in terms of storage, time savings, an increased control of processes, improved administration, increased safety, fewer errors, etc. (Poel et al., 2016); supply chain partner pressure (Fairchild, 2004; Keifer, 2011); regulatory pressure (Keifer, 2011; Koch, 2017); supplier innovation (Keifer, 2011), amongst others.

BenefitsThe use of e-invoicing is expected to offer several benefits not only to the immediate implementer but also to the supply chain partners. E-invoicing can substantially decrease costs, e.g., reduced clerical work and printing costs (Edelman & Sintomen, 2006; Penttinen & Tuunainen, 2009). It offers enhancement in delivery time, a reduction in payment delays, and greater reliability by lowering the error rate (Edelman and Sintomen, 2006; Lumiaho and Rämänen, 2011; Poel et al., 2016). It can additionally lead to process efficiency for the organisation (Fairchild, 2004; Sandberg et al., 2009). Another significant benefit is that it offers convenience to the supply chain partners involved and better service delivery to customers (Fairchild, 2004; Sandberg et al., 2009; Poel et al., 2016). E-invoicing can greatly help in firm tax compliance and increase the tax collection by the government, particularly from the high risks of non-compliance groups (Krysovatyy et al., 2021; Olaleye et al., 2023; Skare et al., 2023). Further, e-invoicing provides several environmental benefits, such as reduced paper usage and increased energy efficiency (Poel et al., 2016).

ChallengesDespite the several benefits provided by e-invoicing, the adoption rate has been slow due to the challenges faced by adopters. Though large enterprises may find it easy to implement an e-invoicing system, their smaller counterparts face difficulties in adopting it due to high investment and integration costs (Sandberg et al., 2009). Fairchild (2004) highlighted limited capital allocation and lack of internal sponsorship as the main hindrances to the use of e-invoicing. Edelman and Sintonen (2006) highlighted several reasons for the non-adoption of e-invoicing among SMEs. These reasons were a lack of demand in the environment, perceived uncertainty, and a low level of awareness. Buyer fragmentation could be another reason for the difficulty in adopting such technology. The challenges may also stem from the service provider side, e.g., fragmentation of service providers can significantly hinder the implementation amongst the supply chain partners (Keifer, 2011).

From the past literature on e-invoicing, it can be observed that most of the studies have focused on the paybacks and challenges of e-invoicing, while a few concentrated on the determinants of e-invoicing adoption. However, e-invoicing literature still lacks theoretical underpinning. Further, most of the prior studies have originated from developed countries, while the contribution to emerging economies is scarce.

Technological, organisational, and environmental (TOE) frameworkFor the present study, we have used the TOE framework by Tornatzky and Fleischer (1990). TOE serves as a vital theoretical perspective for examining the contextual factors in technology adoption (Tornatzky and Fleischer, 1990; Lin, 2014). It serves as a useful perspective to look at innovation adoptions (Chau and Tam, 1997). According to TOE, three elements influence the way that innovation or technology is adopted. These are the technological, organisational, and environmental contexts. The technological context refers to the adopter's perception of technological attributes or characteristics. The organisational context refers to the descriptive characteristics of the organisation, which may include the size and scope of the firm size, the firm's managerial structure and complexity, and the quality and degree of its human resources. The external environmental context refers to the arena wherein the organisation operates its business, including the industry and relationships with trading partners, competitors, regulations, and the government (Chau and Tam, 1997; Lin, 2014).

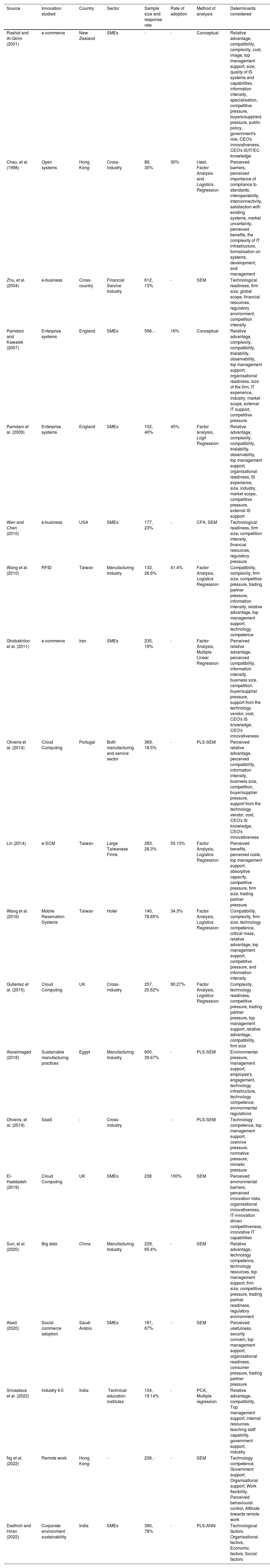

Many of the previous studies on technology adoption have used the TOE framework, and thus it possesses robust empirical support. Some of these studies are presented in Appendix 2.

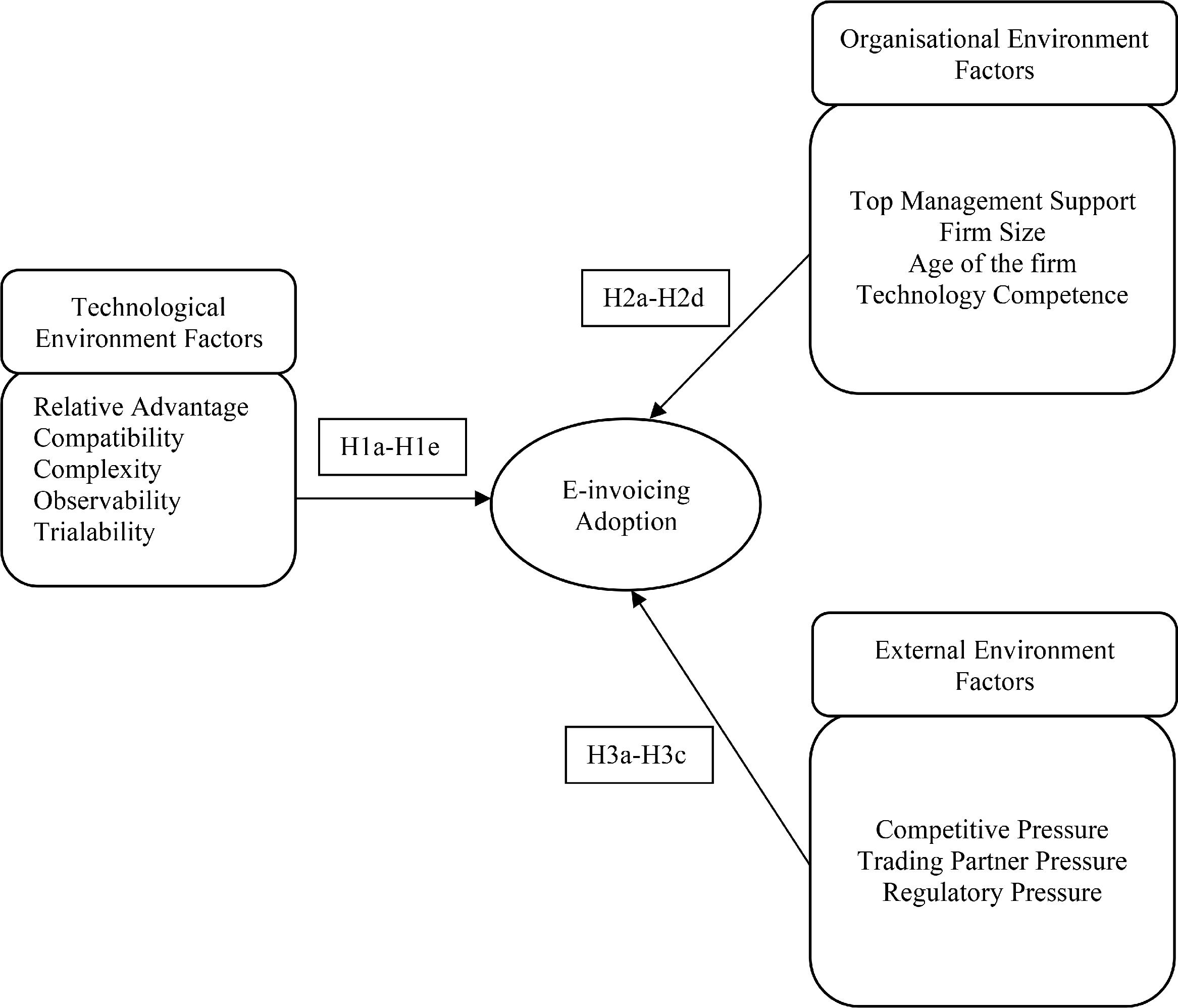

Research model hypotheses developmentWe propose our research model applying the TOE framework, as shown in Fig. 1.

Technological contextThe technological factors that are expected to influence technology adoption are based on Roger's Innovation Diffusion Theory. These factors are relative advantage, compatibility, complexity, observability, and trialability (Rogers, 2010).

Relative advantageRelative advantage refers to the “degree to which an innovation is perceived as being better than its precursor technology or idea” (Rogers, 2010; Moore and Benbasat, 1991). For innovation to have a higher likelihood of being adopted, it should demonstrate that it has an advantage over the technology it is superseding. Electronic invoicing will have several advantages over traditional paper-based invoicing (Edelman and Sintomen, 2006; Fairchild, 2004; Poel et al., 2016). Waarts et al. (2002) argued that at the early stages of the diffusion process, adoption tends to be especially driven by a combination of internal strategic drives and attitudes of the firm, together with external forces like industry competition and supplier activities. Later, they suggest that the mix of adoption-stimulating factors seems to focus more on implementation issues, such as the scalability of the system. E-invoicing is based on the principle of the exchange of information digitally and is, therefore, extremely scalable. Previous studies on other innovations have shown that relative advantage is positively associated with adopting that innovation (Ghobakhloo et al., 2011; Oliveira et al., 2014; Sun et al., 2020). Thus, we propose the following hypothesis:

H1a: Relative advantage positively influences the adoption of e-invoicing.

Compatibility refers to the “degree to which an innovation is perceived as being consistent with the existing values, needs, and past experiences of potential adopters” (Rogers, 2010; Moore and Benbasat, 1991). For e-invoicing to have a higher likelihood of being adopted, it must fit with existing values and requirements and the organisation's past experiences. Earlier studies on other technologies have shown the positive influence of compatibility on the adoption of those technologies (Ghobakhloo et al., 2011; Wang et al., 2016; Waarts et al., 2002). There needs to be an alignment in the mindset and capabilities within the firm and between the supply chain partners, as resistance to change and barriers to the adoption of a new innovation can emerge from it (Töytäri et al., 2018). Thus, we derive the following hypothesis:

H1b: Compatibility positively influences the adoption of e-invoicing.

Complexity refers to the “degree to which an innovation is perceived to be relatively difficult to understand and use” (Rogers, 2010). The innovation should be easy to integrate with the business organisation's operations to have a higher likelihood of being adopted. If the organisations perceive the technology to be difficult to understand and use, it will act as the inhibiting factor to adopting that technology. Complexity describes the model whose subsystem is intricate in many ways, which follows the local rule with many interactions (Mehra et al., 2020; Moore and Benbasat, 1991). Mehra et al. (2020) further mentioned that the chances of acceptance of technological innovation would increase naturally by reducing its complexity. The complexity of technology has been found to negatively influence the adoption of such technologies (Oliveira et al., 2014; Wang et al., 2016). Thus, we propose the following hypothesis:

H1c: Complexity negatively influences the adoption of e-invoicing.

Observability refers to the “degree to which the results of an innovation are observable to others” (Rogers, 2010). Technological innovations, the impacts of which are easily visible in the industry, will be viewed more favourably, thus, having higher prospects of adoption (Marak et al., 2019). Past studies on innovative technologies have shown observability in enhancing the user adoption of such innovations (Al-Jabri and Sohail, 2012; Teo et al., 1995). Thus, we propose the following hypothesis:

H1d: Observability positively influences the adoption of e-invoicing.

Trialability refers to the “degree to which an innovation may be experimented with before adoption” (Rogers, 2010). Firms and users, in general, would prefer to have a trial of a new technology before making a decision and committing the resources to implement such technologies (Marak et al., 2019). Trialability can lead to a better understanding of new technology, such as capabilities, benefits, and difficulties. It can help the firm increase familiarity with the new technology (Agarwal & Prasad, 1998; Rogers, 2010; Al-Jabri and Sohail, 2012). Thus, we propose the following hypothesis:

H1e: Trialability positively influences the adoption of e-invoicing.

Top management support is considered an essential factor in the adoption of innovation. It represents the key decision-makers in the organisation. They can create an appealing vision of the benefits of the new technology and mobilise resources and tackle resistance to change, thus, leading to the creation of a positive ecosystem to facilitate the implementation of technology (Premkumar and Roberts, 1999; Wang et al., 2016). Prior studies have shown a positive influence of management support on adopting new technologies (Ramdani and Kawalek, 2007; Lin, 2014; Abed, 2020). Thus, we propose the following hypothesis:

H2a: Top management support positively influences the adoption of e-invoicing.

The firm's size has been found to play a key role in the implementation and use of technologies. In general, larger firms have more resources and skills at their disposal, and as such, they are associated with the adoption of new technologies (Frambach and Schillewaert, 2002; Wang et al., 2010; Ghobakhloo et al., 2011; Oliveira et al., 2014; Nurmilaakso, 2008). E-invoicing requires financial resources and considerable costs to be incurred in achieving integration with the supply chain partners (Sandberg et al., 2009). Thus, we propose the following hypothesis:

H2b: Firm size positively influences the adoption of e-invoicing.

The firm's age is often not taken into consideration for the type of studies we are undertaking. The firm's age may be considered the proxy for the firm's accumulation of experience and reduction in the perceived risk relating to technology investments. It is expected that older and more mature firms will implement more information technology than their younger counterparts (Giunta and Trivieri, 2007), though some studies have shown results contrary to this (Gambardella and Torrisi, 2001). Thus, we propose the following hypothesis:

H2c: The age of the firm positively influences the adoption of e-invoicing.

Technology competence refers to the firm's internal technological resources. Generally, a wide range of capabilities, activities, and processes related to identifying, assimilating, and exploiting existing knowledge, generating new knowledge, inventing new schemes and functions, and diffusing the acquired knowledge or invention may reflect the firm's technology competence (Giotopolous et al., 2017). Wang et al. (2016) stated that it might consist of information technology (IT) infrastructure and the professionals involved with these aspects of the firm. While IT infrastructure comprises the installed network technologies and enterprise systems, IT professionals comprise the knowledge and skills to implement the technology (Wang et al., 2010). Previous studies have shown that the level of technology competence of the organisation is positively associated with the implementation of technology in the organisation (Gutierrez et al., 2015; Wang et al., 2016; Oliveira et al., 2019). Thus, we propose the following hypothesis:

H2d: Technology competence positively influences the adoption of e-invoicing.

Gounaris and Koritos (2012) studied and found that the decision to adopt improves the understanding of the adopters regarding the benefits delivered by innovation. Competitive advantage is crucial for achieving superior performance and returns in the free market (Wernerfelt, 1984; Barney, 1991; Newbert, 2008). It drives the firm to achieve a competitive advantage by adopting new technology. It can be termed as the pressure resulting from a threat of losing competitive advantage, forcing firms to adopt and implement the respective technologies (Lin, 2014). Previous studies on various organisational technologies have shown the positive influence of competitive pressure in influencing organisations to adopt new technology (Wang et al., 2010; Ghobakhloo et al., 2011; Gutierrez et al., 2015; Abed, 2020; Sun, 2020). Therefore, we hypothesise that competitive pressure will lead the firm in implementing e-invoicing. Thus, we propose the following hypothesis:

H3a: Competitive pressure is positively associated with the adoption of e-invoicing.

Trading partners can influence an organisation's adoption of new technology. To display the fitness required to conduct business with a major trading partner, an organisation may be prompted to adopt a new technology that their trading partner has already implemented or is in the process of implementing. A request from a major trading partner can act as a critical factor in implementing a specific technology (To and Ngai, 2006; Wang et al., 2016). Enterprises of all sizes depend on their trading partners when deciding to adopt new technology. Further, the marketing activities, projects undertaken in the past, and targeted communications can have a significant bearing on the potential decision of an organisation to implement new technology (Gutierrez et al., 2015). Several empirical studies in the past have shown that trading partners play a crucial role in facilitating the implementation of new technology by an organisation (Teo et al., 2003; Pan and Jang, 2008). Thus, we propose the following hypothesis:

H3b: Trading partner pressure positively influences the adoption of e-invoicing.

Government laws and regulations can be very influential in the adoption and diffusion of technology. These can encourage or discourage organisations from adopting technologies (Oliveira et al., 2014). Previous works on electronic invoicing have stated regulatory pressure from the government as one of the key drivers in the implementation of e-invoicing (Keifer, 2011; Koch, 2017). The empirical research on other technologies has shown a positive association between the regulatory environment and the firm's intention to implement the technology (Kuan and Chau, 2001; Sun et al., 2020). Thus, we propose the following hypothesis:

H3c: Regulatory pressure is positively associated with the adoption of e-invoicing.

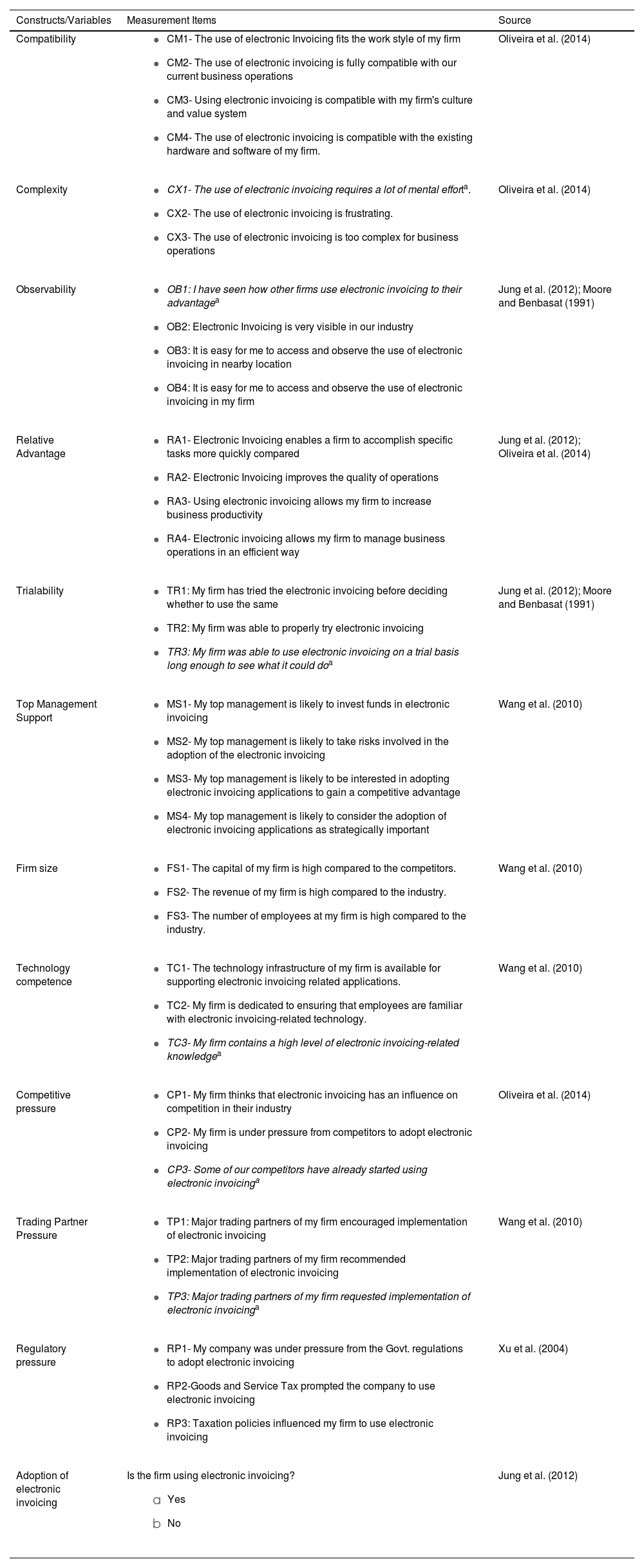

The constructs were measured by reviewing the extant literature, and modifications were made to suit the context of e-invoicing. All independent variables except the age of the firm were measured using the five-point Likert scale, ranging from 1 to 5, where “1” is “strongly disagree” and “5” is “strongly agree.” The age of the firm was measured using the actual age (i.e., ratio scale). The dependent variable was measured in a dichotomous manner, i.e., yes or no. The details of the constructs and the relevant references are shown in , Appendix 3.

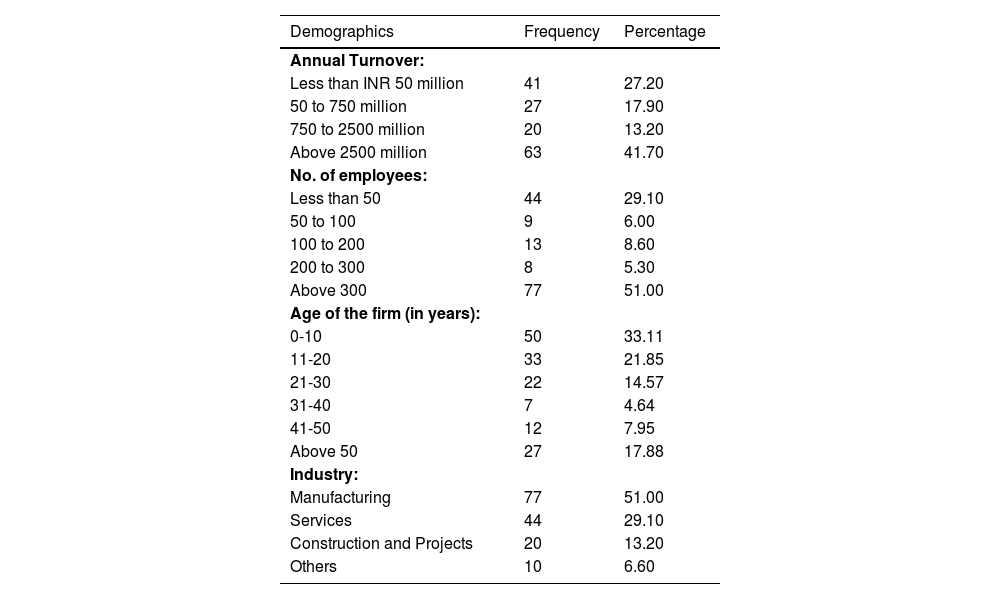

SampleData was collected using an electronic survey, and the questionnaire was sent to firms in India. These firms were involved in both the manufacturing and service sectors. Respondents were majorly in interface roles w.r.t. business transactions, such as sales, purchasing, finance, and accounts, as well as the decision-making roles, such as top management or senior management. Interface roles ensured the relevance of respondents in the context of the study. Overall, the questionnaire was sent to 600 individuals, and we received 151 valid responses, thus achieving a response rate of 25%. This can be considered acceptable given the previous studies on innovation adoption (see Appendix 2). The details of the respondents are shown in Appendix 4.

Results and findingsThe partial least square (PLS) approach was applied for empirically validating the research model. We applied SmartPLS 3.2.8 for estimating the PLS-SEM (Structural Equation Modelling). The sensitivity of PLS to the sample size is less; as such, the assumption of the normality of the data is not required (Dash & Paul, 2021). In PLS, the minimum sample size could be determined by using the criteria of the “10 times” rule, i.e. (1) ten times the largest number of formative indicators used to measure one construct; or (2) ten times the largest number of structural paths directed at a particular latent construct in the structural model (Hair et al., 2011). Kwong-Kay Wong (2013) suggested that a sample size of 100 to 200 is a good starting point for performing path modelling.

However, as the PLS-SEM has a problem dealing with binary outcome-dependent variables, we applied PLS-SEM for model measurement only as Bodoff and Ho (2016) recommended. In the first step, the PLS-SEM estimates latent values by assigning weights to its manifest variables while considering the latent values of directly linked variables in the structural model. In the second stage, it performs Ordinary Least Squares (OLS) regressions using the latent values found in the first step. As the PLS-SEM performs OLS regressions, it can prove to be problematic in approximations when the dependent variable is binary in nature (Hair et al., 2012; Bodoff & Ho, 2016). As such, for the second step, i.e., estimation of the path coefficients, we applied binary logistic regression as we measured the dependent variable in the binary outcome (i.e., adopters and non-adopters). Hair et al. (2010) stated that logistic regression is useful when the main purpose of the study is modelling predictors of a binary dependent variable. This statistical technique is widely used in enterprise technology or systems/e-business adoption studies (Gutierrez et al., 2015; Lin, 2014; Wang et al., 2016).

Logistic regression is useful when the purpose of a study is to model the predictors of a binary (two-group) dependent variable (Hair et al., 2010). This statistical technique has been adopted by previous organisational technology/e-business adoption studies, such as those focusing on firms’ adoption of e-business (Oliveira & Martins, 2010), enterprise resource planning systems (Pan and Jang, 2008), electronic supply chain management systems (Lin, 2014), and e-procurement systems (Teo et al., 2009).

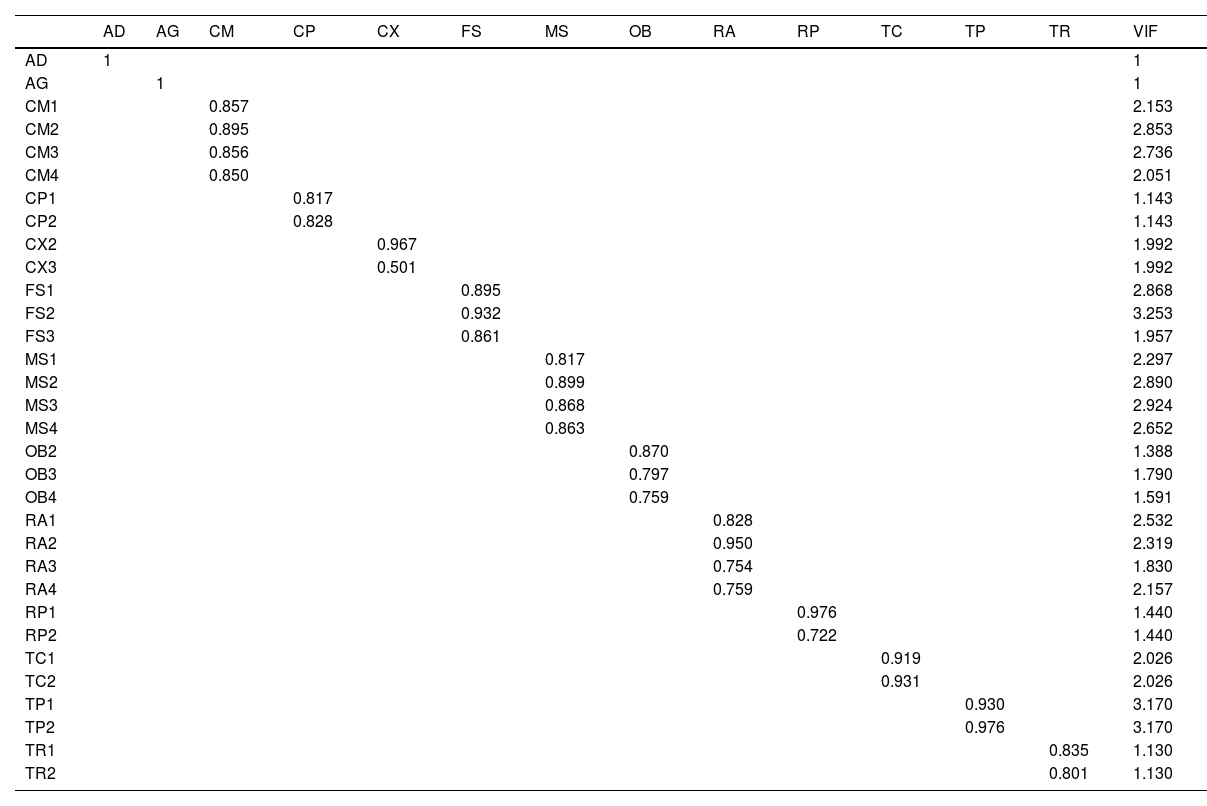

Model measurementTable 1 shows the factor loadings and multicollinearity test. The standardised outer loadings are found to be highly satisfactory as all the variables of the constructs except for one are greater than the threshold level value of 0.701 (Hair et al., 2011; Hair, 2016). One variable of outer loading less than 0.7 (CX3) is retained to avoid a single-item scale (Sarstedt et al., 2014).

Standardised outer loading.

| AD | AG | CM | CP | CX | FS | MS | OB | RA | RP | TC | TP | TR | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AD | 1 | 1 | ||||||||||||

| AG | 1 | 1 | ||||||||||||

| CM1 | 0.857 | 2.153 | ||||||||||||

| CM2 | 0.895 | 2.853 | ||||||||||||

| CM3 | 0.856 | 2.736 | ||||||||||||

| CM4 | 0.850 | 2.051 | ||||||||||||

| CP1 | 0.817 | 1.143 | ||||||||||||

| CP2 | 0.828 | 1.143 | ||||||||||||

| CX2 | 0.967 | 1.992 | ||||||||||||

| CX3 | 0.501 | 1.992 | ||||||||||||

| FS1 | 0.895 | 2.868 | ||||||||||||

| FS2 | 0.932 | 3.253 | ||||||||||||

| FS3 | 0.861 | 1.957 | ||||||||||||

| MS1 | 0.817 | 2.297 | ||||||||||||

| MS2 | 0.899 | 2.890 | ||||||||||||

| MS3 | 0.868 | 2.924 | ||||||||||||

| MS4 | 0.863 | 2.652 | ||||||||||||

| OB2 | 0.870 | 1.388 | ||||||||||||

| OB3 | 0.797 | 1.790 | ||||||||||||

| OB4 | 0.759 | 1.591 | ||||||||||||

| RA1 | 0.828 | 2.532 | ||||||||||||

| RA2 | 0.950 | 2.319 | ||||||||||||

| RA3 | 0.754 | 1.830 | ||||||||||||

| RA4 | 0.759 | 2.157 | ||||||||||||

| RP1 | 0.976 | 1.440 | ||||||||||||

| RP2 | 0.722 | 1.440 | ||||||||||||

| TC1 | 0.919 | 2.026 | ||||||||||||

| TC2 | 0.931 | 2.026 | ||||||||||||

| TP1 | 0.930 | 3.170 | ||||||||||||

| TP2 | 0.976 | 3.170 | ||||||||||||

| TR1 | 0.835 | 1.130 | ||||||||||||

| TR2 | 0.801 | 1.130 |

Note: AD- Adoption of e-invoicing, AG- Age of the firm, CM-Compatibility, CP-Competitive pressure, CX-Complexity, FS-Firm Size, MS-Top Management Support, OB- Observability, RA- Relative Advantage, RP- Regulatory Pressure, TC- Technology Competence, TP- Trading Partner Pressure, TR- Trialability.

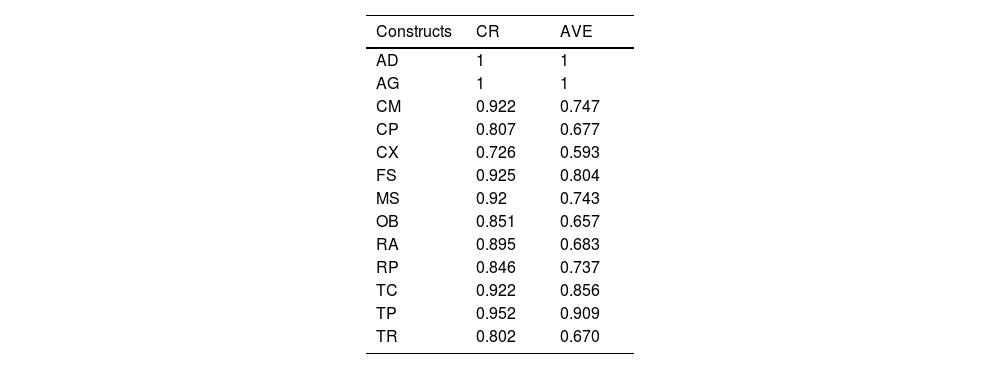

Table 2 shows the measurement of internal consistency. Traditionally, Cronbach's alpha has been used to measure the internal consistency reliability; however, it comes with a set of limitations, such as the assumption of equal outer loadings of all constructs, sensitivity to the number of items in the scale, and underestimation of the internal consistency reliability. As such, it is suggested to apply ‘composite reliability’ to measure internal reliability as a replacement for Cronbach's alpha (Bagozzi and Yi, 1988; Hair, 2016). The composite reliability of all the constructs is greater than 0.70, thus indicating the acceptable internal consistency of the variables forming the constructs (Straub et al., 2004; Hair et al., 2016).

Reliability and validity measures.

| Constructs | CR | AVE |

|---|---|---|

| AD | 1 | 1 |

| AG | 1 | 1 |

| CM | 0.922 | 0.747 |

| CP | 0.807 | 0.677 |

| CX | 0.726 | 0.593 |

| FS | 0.925 | 0.804 |

| MS | 0.92 | 0.743 |

| OB | 0.851 | 0.657 |

| RA | 0.895 | 0.683 |

| RP | 0.846 | 0.737 |

| TC | 0.922 | 0.856 |

| TP | 0.952 | 0.909 |

| TR | 0.802 | 0.670 |

Note: CR- Composite reliability, and AVE- Average variance extracted.

Convergent validity refers to the extent to which a measure correlates positively with the alternative measures of the same construct. A common measure to examine convergent validity is average variance extracted (AVE), and the AVE value of 0.50 or greater is considered acceptable as it shows that the constructs explain more than 50 per cent of the variations of its indicators (Hair, 2016). Table 2 shows the AVE for all the constructs to be greater than 0.5, thus showing the convergent validity of all the constructs.

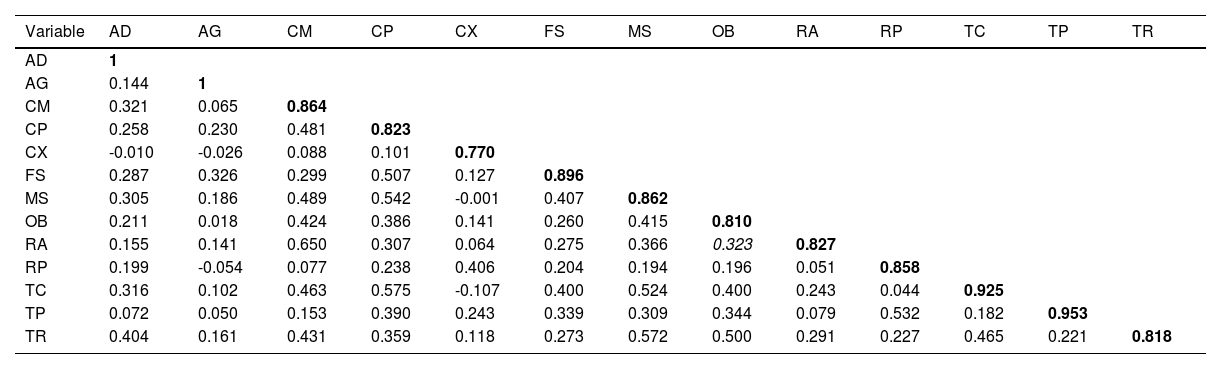

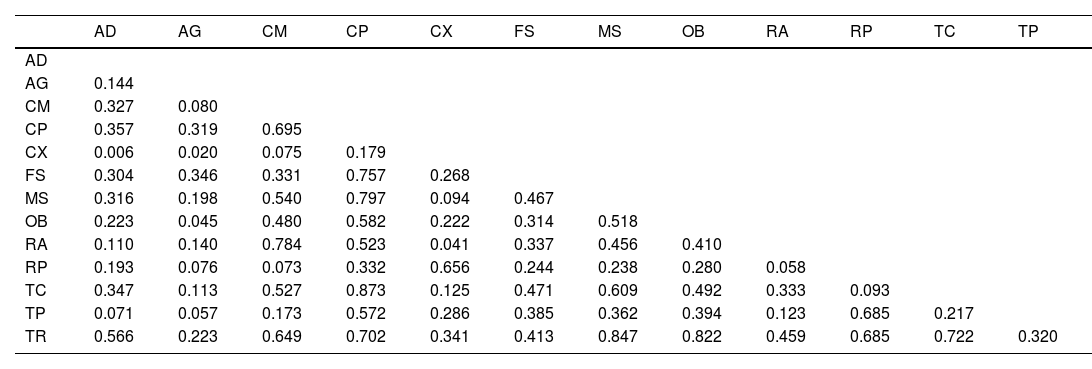

Discriminant validity is the extent to which the construct is truly unique from others in terms of empirical standards. We use the Fornell-Larcker criterion to measure the constructs’ discriminant validity, which compares the square root of AVE values with the latent variable correlations. When the square root of each construct's AVE is greater than its highest correlations with all other constructs, discriminant validity is confirmed (Hair, 2016). Table 3 shows that the square root of AVE (diagonal elements in bold) of each construct is greater than the highest correlation with all the other constructs. Besides, we also use another measure of discriminant validity, i.e., the Hetrotrait-Monotrait (HTMT) ratio, the ratio of correlations in which a value less than 0.90 is considered acceptable (Henseler et al., 2015; Aboelmaged, 2018). Table 4 shows 0.873 is the highest HTMT ratio, thus establishing an acceptable discriminant validity of the constructs. Table 1 shows the Variance Inflation Factor (VIF) of all constructs is found to be within the acceptable threshold value of 5, which shows there is no cause for concern for multicollinearity (Sarstedt et al., 2017).

Fornell-Larcker criterion.

| Variable | AD | AG | CM | CP | CX | FS | MS | OB | RA | RP | TC | TP | TR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AD | 1 | ||||||||||||

| AG | 0.144 | 1 | |||||||||||

| CM | 0.321 | 0.065 | 0.864 | ||||||||||

| CP | 0.258 | 0.230 | 0.481 | 0.823 | |||||||||

| CX | -0.010 | -0.026 | 0.088 | 0.101 | 0.770 | ||||||||

| FS | 0.287 | 0.326 | 0.299 | 0.507 | 0.127 | 0.896 | |||||||

| MS | 0.305 | 0.186 | 0.489 | 0.542 | -0.001 | 0.407 | 0.862 | ||||||

| OB | 0.211 | 0.018 | 0.424 | 0.386 | 0.141 | 0.260 | 0.415 | 0.810 | |||||

| RA | 0.155 | 0.141 | 0.650 | 0.307 | 0.064 | 0.275 | 0.366 | 0.323 | 0.827 | ||||

| RP | 0.199 | -0.054 | 0.077 | 0.238 | 0.406 | 0.204 | 0.194 | 0.196 | 0.051 | 0.858 | |||

| TC | 0.316 | 0.102 | 0.463 | 0.575 | -0.107 | 0.400 | 0.524 | 0.400 | 0.243 | 0.044 | 0.925 | ||

| TP | 0.072 | 0.050 | 0.153 | 0.390 | 0.243 | 0.339 | 0.309 | 0.344 | 0.079 | 0.532 | 0.182 | 0.953 | |

| TR | 0.404 | 0.161 | 0.431 | 0.359 | 0.118 | 0.273 | 0.572 | 0.500 | 0.291 | 0.227 | 0.465 | 0.221 | 0.818 |

Note: The diagonal elements represent the square root of AVE. Whereas, other elements indicate correlations between the constructs.

Heterotrait-monotrait ratio (HTMT)

| AD | AG | CM | CP | CX | FS | MS | OB | RA | RP | TC | TP | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AD | ||||||||||||

| AG | 0.144 | |||||||||||

| CM | 0.327 | 0.080 | ||||||||||

| CP | 0.357 | 0.319 | 0.695 | |||||||||

| CX | 0.006 | 0.020 | 0.075 | 0.179 | ||||||||

| FS | 0.304 | 0.346 | 0.331 | 0.757 | 0.268 | |||||||

| MS | 0.316 | 0.198 | 0.540 | 0.797 | 0.094 | 0.467 | ||||||

| OB | 0.223 | 0.045 | 0.480 | 0.582 | 0.222 | 0.314 | 0.518 | |||||

| RA | 0.110 | 0.140 | 0.784 | 0.523 | 0.041 | 0.337 | 0.456 | 0.410 | ||||

| RP | 0.193 | 0.076 | 0.073 | 0.332 | 0.656 | 0.244 | 0.238 | 0.280 | 0.058 | |||

| TC | 0.347 | 0.113 | 0.527 | 0.873 | 0.125 | 0.471 | 0.609 | 0.492 | 0.333 | 0.093 | ||

| TP | 0.071 | 0.057 | 0.173 | 0.572 | 0.286 | 0.385 | 0.362 | 0.394 | 0.123 | 0.685 | 0.217 | |

| TR | 0.566 | 0.223 | 0.649 | 0.702 | 0.341 | 0.413 | 0.847 | 0.822 | 0.459 | 0.685 | 0.722 | 0.320 |

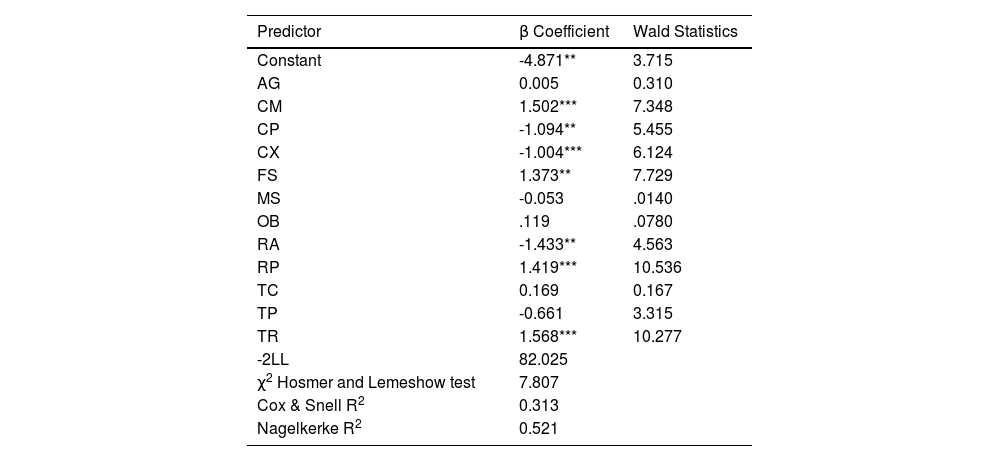

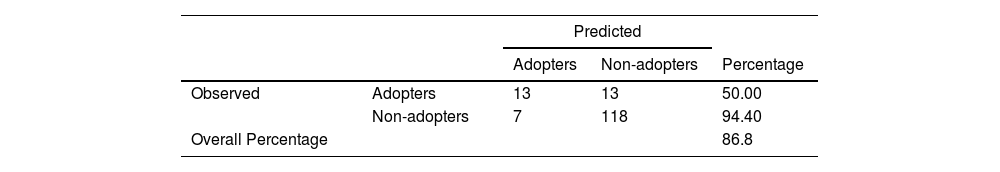

The path coefficient is estimated using logistic regression. Table 5 shows the results of logistic regression. The 2-log likelihood of the model is 82.025. The model generates the Hosmer Lemeshow measure of the goodness of fit of 7.807 and is insignificant at a 5% level of significance, thus indicating no presence of differences between observed and predicted classification, i.e., the overall fitness of the model. The two pseudo R2, Cox and Snell R2 and Negelkerke R2, are 0.313 and 0.521, indicating a satisfactory explanatory capability of the model. Table 6 presents the classification table, and it shows the overall predictive power of the model. The model's predictive accuracy is 86.8%, further confirming the goodness of fit of the model as satisfactory.

Logistic regression.

| Predictor | β Coefficient | Wald Statistics |

|---|---|---|

| Constant | -4.871** | 3.715 |

| AG | 0.005 | 0.310 |

| CM | 1.502*** | 7.348 |

| CP | -1.094** | 5.455 |

| CX | -1.004*** | 6.124 |

| FS | 1.373** | 7.729 |

| MS | -0.053 | .0140 |

| OB | .119 | .0780 |

| RA | -1.433** | 4.563 |

| RP | 1.419*** | 10.536 |

| TC | 0.169 | 0.167 |

| TP | -0.661 | 3.315 |

| TR | 1.568*** | 10.277 |

| -2LL | 82.025 | |

| χ2 Hosmer and Lemeshow test | 7.807 | |

| Cox & Snell R2 | 0.313 | |

| Nagelkerke R2 | 0.521 | |

Regarding the technology environment drivers, our findings support hypotheses H1b, H1c, and H1e. While observability is insignificant, we found a negative influence of relative advantage on the adoption of e-invoicing. From the organisational environment factors, only firm size influences the adoption of e-invoicing, thus supporting hypothesis H2b. Finally, among the external environment factors, competitive pressure and regulatory pressure were found to be significant. Competitive pressure is found to negatively influence adoption and is contrary to hypothesis H3a. Regulatory pressure positively influences adoption and supports hypothesis H3c.

DiscussionsTechnological contextOf all the innovation characteristics, compatibility, complexity, relative advantage, and trialability are found to be significant in influencing the adoption of e-invoicing. For e-invoicing to be implemented, its compatibility with values, requirements, and experiences is important. Compatibility is an important determinant of innovation adoption. If e-invoicing matches the values, needs, and existing experiences of the firm's information technology, then the firm will have a positive perception and hence implement e-invoicing. As e-invoicing has implications for the supply chain, its compatibility with the technology and infrastructure of the supply chain partners will be crucial (Töytäri et al., 2018). Difficulty in technology integration with the supply chain partners could prove to be an inhibitor in the implementation of e-invoicing (Sandberg et al., 2009). However, the influence of compatibility may diminish along the adoption cycle due to increased compatibility of the innovation with all sorts of platforms and systems (Waarts et al., 2002). Similar to the previous findings on innovation adoption and diffusion (Oliveira et al., 2014; Wang et al., 2016), we found complexity to influence the adoption of e-invoicing negatively. The perception of difficulty in understanding and using e-invoicing proves to be an inhibiting factor in enterprises using the technology. Reducing the complexity and enhancing the ease of use can positively influence the implementation of the technology. Surprisingly, our results show the negative influence of relative advantage in e-invoicing adoption. Some of the earlier studies also found the negative influence of relative advantage on innovation adoption (Karahanna et al., 2002; Marak et al., 2019). Such negative influence could be due to perceptions that e-invoicing would be state-of-the-art and cutting-edge technology and the currently available product in the market not meeting such expectations (Karahanna et al., 2002). Trialability plays a key role in implementing new technology, as witnessed in several previous studies (Ramdani et al., 2009; Marak et al., 2019). Our study also supports those earlier findings. The ability to use new technology on a trial basis helps the enterprises to assess the capabilities, benefits, disadvantages, and other features of the technology, eventually leading to better implementation of such technologies. Our study also showed the influence of observability to be insignificant. The easy visibility of e-invoicing in the industry or market does not translate into an increase in its adoption. Several studies in the past have also shown the insignificant influence of observability characteristics of innovation on the adoption (Ramdani et al., 2009).

Organisational contextTop management support is not an influential factor in e-invoicing adoption. This result is consistent with the previous studies that have shown mixed results concerning the influence of top management support on adopting new technology. This may be because technology, such as e-invoicing, is of routine operational importance and can be comfortably driven by the operational management levels in a firm. While some studies showed the positive influence of top management support on the implementation of innovation (Lin, 2014; Oliveira et al., 2014; Oliveira et al., 2019), others have shown it to be insignificant (Kim and Lee, 2008, Wang et al., 2010; Gutierrez et al., 2015).

Our study shows the technology competence of the firm to be insignificant. This is similar to the prior studies that found the firm's technology competence to be a non-influential determinant in technology adoption (Wang et al., 2010). It may be so that the well-equipped firms with technological infrastructure may not feel the need to opt for e-invoicing, as is the case observed by earlier studies (Low et al., 2011; Wu et al., 2013). We also found the age of the firm to be an insignificant determinant in influencing the adoption of e-invoicing. Years of being in the business do not have a significant bearing on the implementation of e-invoicing. However, our results showed the positive influence of firm size on adoption. This shows that larger firms have a higher likelihood of implementing e-invoicing. This is in coherence with the previous studies, which showed size to be an essential determinant of e-invoicing. It may be because e-invoicing requires considerable investments, and integrating with the supply chain partners would be better (Sandberg et al., 2009). For this, larger firms will have more resources to cover the costs and risks associated with emerging technology (Crook et al., 1998; Nurmilaakso, 2008; Wang et al., 2010; Oliveira et al., 2014).

Environmental contextOur results showed a negative influence of competitive pressure on the adoption of e-invoicing. This is in coherence with the early theoretical contributions, which predicted a negative relationship between the intensity of competition and innovation (Schumpeter, 2013). In the influential analysis, Aghion et al. (2005) found an inverted-U-shaped relationship between the level of competition and innovation. The authors highlighted that the incentives for innovation decline with the increase in the level of intense competition in the industry.

We also found an insignificant influence of trading partner pressure on the adoption. This is similar to the earlier studies that found that trading or supply chain partners do not significantly influence the enterprise's adoption of new technology (e.g., Lin, 2014; Sener et al., 2016). One possible explanation could be that the likelihood of e-invoicing is affected more by other factors, technology-related factors, company-related factors, or other external factors (Lin, 2014).

We found regulatory pressure to be an influential factor in e-invoicing adoption. Previous studies have shown the significance of laws and regulations on technology adoption (Zhu et al., 2004; Abed, 2020; Sun, 2020). The literature on e-invoicing indicated that regulatory pressure is one of the major drivers of e-invoicing adoption in many parts of the world (Keifer, 2011; Koch, 2017). In India, the implementation of Goods and Services Tax (GST) must have played a crucial role in the adoption of e-invoicing (Goods and Services Tax Council, n.d.).

ConclusionTheoretical implicationsOur study contributes to the existing literature on e-invoicing by providing the context for the adoption of this concept to fill the gap of the need for a model to implement the transformation initiative. It also sheds light on the implementation of such technologies, especially from emerging economies’ perspectives. It could also be of interest to the literature on supply chain finance as it offers the determinants of automation/digitalisation of the trade process, which is considered one of the influential factors of supply chain finance. This research can also be instrumental in studying the buyer-seller relationship as it deals with one of the critical drivers of business relationship transparency while discussing the quality of information exchange. Adopting IT-enabled systems, such as e-invoicing, enhances the quality and speed of information exchange, improving the level of transparency in trade.

Managerial implicationsOur study has several managerial and academic implications. Compatibility emerged as one of the technology-related characteristics to have a positive influence on e-invoicing implementation. People in management should understand that the successful application of such technology will depend not only on the compatibility of the values, needs, and existing experiences with the firm's information technology systems but also on the supply chain partners. This is a rather important aspect for the technology service providers (TSPs) in managing their technology platforms’ offerings. From this study, TSPs can also focus on the age and firm size determinants in the product offering and can expect faster adoption. The study suggests that the older and larger the firm, the higher the chances of adopting electronic invoicing or similar technologies.

An organization should take the initiatives to implement technologies such as e-invoicing by knowing the benefits of it rather than being pressured to adopt them because of competition. Such initiatives can help organizations get and remain ahead of the competition.

Regulatory pressure/support can play a crucial role in the mass adoption and diffusion of such technologies. The policymakers should focus on preparing a conducive environment for the implementation and diffusion of such technologies. Research indicates the importance of new technology in an economy (Paul & Mas, 2016; 2020; George & Paul, 2020). As such, only internal and competitive business environments may not be sufficient; regulatory pressure/support can contribute to driving the adoption and diffusion of new technology. Other emerging countries can also learn from the Indian experience how regulatory push from the government authorities can act as a catalyst in e-invoicing adoption and diffusion.

Limitations and future researchThe explanatory power of our model is nominal. Future studies can incorporate other variables that can explain e-invoicing or similar technology adoption and improve the model's explanatory power. We could not accommodate different types of e-invoicing currently in use across industries and examine the determinants based on such types of invoices.

Future researchers can analyse the behaviour of individuals responsible for the adoption of such new technologies. This could throw light on aspects for service providers to specifically focus on other than the broader aspects of the internal and external environments of a buyer organisation. Further investigation can also focus on the impact of the adoption of newer technologies on the effectiveness and efficiency of an organisational business or individual performance. Studies can find out whether organisational learning has any mediating role in the rate and pace of adoption of new technologies.

FundingThe authors received no grant for this research.

Appendix 1, Appendix 2, Appendix 3, Appendix 4

Previous studies on e-invoicing.

| Source | Country | Sector | Motive | Method | Main Results |

|---|---|---|---|---|---|

| Fairchild (2004) | Europe | - | Gain a better understanding of e-invoicing adoption | Survey |

|

| Edelmann and Sintone (2006) | Finland | SMEs | To find out the reasons for the slow adoption rate of electronic invoicing by SMEs | Survey |

|

| Penttinen and Hyytiainen (2008) | Finland | Public and Private organisations | Examine the use of e-invoicing | Case study |

|

| Sandberg et al. (2009) | Sweden | SMEs | Drivers of Electronic Invoice Presentment and Payment (EIPP) adoption | Interviews |

|

| Penttinen et al. (2009) | Finland | Textile company | Examination of the influence of the adoption of e-invoicing on buyer-seller relationships | Case study |

|

| Korkman et al. (2010) | Finland | Citizens, SMEs and large organisations | Proposed that a practice-based approach, along with ethnographic methods, contributes to S-D logic | Practice-based approach and Ethnographic study |

|

| Keifer (2011) | USA | - | Explore the potential benefits of using e-invoicing to corporations | Conceptual |

|

| Penttinen and Tuunainen (2009) | China | - | Assessing the effect of external pressure in e-invoicing in the inter-organisational settings | Survey |

|

| Lumiaho and Rämänen (2011) | Finland | SMEs | Investigating the reasons for the low usage of e-invoices and opened invoice services | Expert opinion and field studies |

|

| Nienhuis et al., (2013) | - | SMEs | Extending e-invoicing for real-time financing | Conceptual |

|

| Poel et al. (2016) | Belgium | Private sector | Examines the potential cost savings of e-invoicing in Belgium | Survey |

|

| Koch (2017) | Cross-country | - | To support the issuer and receipts intending to replace paper-based invoicing | Secondary data |

|

| Qi and Azmi (2020) | China | Cross-industry | Investigating the factors affecting the adoption of e-invoicing and also the its effect on tax compliance | Survey |

|

| Bellon et al. (2022) | Peru | Analyses the effect on tax compliance and firm performance due to switching from paper to e-invoicing | Secondary data |

|

Previous studies using TOE for innovation adoption.

| Source | Innovation studied | Country | Sector | Sample size and response rate | Rate of adoption | Method of analysis | Determinants considered |

|---|---|---|---|---|---|---|---|

| Rashid and Al-Qirim (2001) | e-commerce | New Zealand | SMEs | - | - | Conceptual | Relative advantage, compatibility, complexity, cost, image, top management support, size, quality of IS systems and capabilities, information intensity, specialisation, competitive pressure, buyers/suppliers pressure, public policy, government's role, CEO's innovativeness, CEO's IS/IT/EC knowledge |

| Chau, et al. (1998) | Open systems | Hong Kong | Cross-industry | 89, 30% | 30% | t-test, Factor Analysis and Logistics Regression | Perceived barriers, perceived importance of compliance to standards, interoperability, Interconnectivity, satisfaction with existing systems, market uncertainty, perceived benefits, the complexity of IT infrastructure, formalisation on systems, development, and management |

| Zhu, et al. (2004) | e-business | Cross-country | Financial Service Industry | 612, 13% | - | SEM | Technological readiness, firm size, global scope, financial resources, regulatory environment, competition intensity |

| Ramdani and Kawalek (2007) | Enterprise systems | England | SMEs | 598, - | 16% | Conceptual | Relative advantage, complexity, compatibility, trialability, observability, top management support, organisational readiness, size of the firm, IT experience, industry, market scope, external IT support, competitive pressure. |

| Ramdani et al. (2009) | Enterprise systems | England | SMEs | 102, 40% | 45% | Factor analysis, Logit Regression | Relative advantage, complexity, compatibility, trialability, observability, top management support, organisational readiness, IS experience, size, industry, market scope, competitive pressure, external IS support |

| Wen and Chen (2010) | e-business | USA | SMEs | 177, 23% | - | CFA, SEM | Technological readiness, firm size, competition intensity, financial resources, regulatory pressure |

| Wang et al. (2010) | RFID | Taiwan | Manufacturing Industry | 133, 26.6% | 41.4% | Factor Analysis, Logistics Regression | Compatibility, complexity, firm size, competitive pressure, trading partner pressure, information intensity, relative advantage, top management support, technology competence |

| Ghobakhloo et al. (2011) | e-commerce | Iran | SMEs | 235, 19% | - | Factor Analysis, Multiple Linear Regression | Perceived relative advantage, perceived compatibility, information intensity, business size, competition, buyer/supplier pressure, support from the technology vendor, cost, CEO's IS knowledge, CEO's innovativeness |

| Oliveira et al. (2014) | Cloud Computing | Portugal | Both manufacturing and service sector | 369, 18.5% | - | PLS-SEM | Perceived relative advantage, perceived compatibility, information intensity, business size, competition, buyer/supplier pressure, support from the technology vendor, cost, CEO's IS knowledge, CEO's innovativeness |

| Lin (2014) | e-SCM | Taiwan | Large Taiwanese Firms | 283, 28.3% | 55.13% | Factor Analysis, Logistics Regression | Perceived benefits, perceived costs, top management support, absorptive capacity, competitive pressure, firm size, trading partner pressure |

| Wang et al. (2016) | Mobile Reservation Systems | Taiwan | Hotel | 140, 78.65% | 34.3% | Factor Analysis, Logistics Regression | Compatibility, complexity, firm size, technology competence, critical mass, relative advantage, top management support, competitive pressure, and information intensity |

| Gutierrez et al. (2015) | Cloud Computing | UK | Cross-industry | 257, 25.62% | 90.27% | Factor Analysis, Logistics Regression | Complexity, technology readiness, competitive pressure, trading partner pressure, top management support, relative advantage, compatibility, firm size |

| Aboelmaged (2018) | Sustainable manufacturing practices | Egypt | Manufacturing Industry | 600, 39.67% | - | PLS-SEM | Environmental pressure, management support, employee's engagement, technology infrastructure, technology competence, environmental regulations |

| Oliveira, et al. (2019) | SaaS | - | Cross-industry | - | PLS-SEM | Technology competence, top management support, coercive pressure, normative pressure, mimetic pressure | |

| El-Haddadeh (2019) | Cloud Computing | UK | SMEs | 238 | 100% | SEM | Perceived environmental barriers, perceived innovation risks, organisational innovativeness, IT-innovation driven competitiveness, innovative IT capabilities |

| Sun, et al. (2020) | Big data | China | Manufacturing Industry | 229, 65.4% | - | SEM | Relative advantage, technology competence, technology resources, top management support, firm size, competitive pressure, trading partner readiness, regulatory environment |

| Abed (2020) | Social commerce adoption | Saudi Arabia | SMEs | 181, 67% | - | SEM | Perceived usefulness, security concern, top management support, organisational readiness, consumer pressure, trading partner pressure |

| Srivastava et al. (2022) | Industry 4.0 | India | Technical education institutes | 134, 19.14% | - | PCA, Multiple regression | Relative advantage, compatibility, Top management support, internal resources, teaching staff capability, government support, industry |

| Ng et al. (2022) | Remote work | Hong Kong | - | 238, - | - | SEM | Technology competence, Government support, Organisational support, Work flexibility, Perceived behavioural control, Attitude towards remote work |

| Dadhich and Hiran (2022) | Corporate environment sustainability | India | SMEs | 390, 78% | - | PLS-ANN | Technological factors, Organisational factors, Economic factors, Social factors |

Measurement items.

| Constructs/Variables | Measurement Items | Source |

|---|---|---|

| Compatibility |

| Oliveira et al. (2014) |

| Complexity |

| Oliveira et al. (2014) |

| Observability |

| Jung et al. (2012); Moore and Benbasat (1991) |

| Relative Advantage |

| Jung et al. (2012); Oliveira et al. (2014) |

| Trialability |

| Jung et al. (2012); Moore and Benbasat (1991) |

| Top Management Support |

| Wang et al. (2010) |

| Firm size |

| Wang et al. (2010) |

| Technology competence |

| Wang et al. (2010) |

| Competitive pressure |

| Oliveira et al. (2014) |

| Trading Partner Pressure |

| Wang et al. (2010) |

| Regulatory pressure |

| Xu et al. (2004) |

| Adoption of electronic invoicing | Is the firm using electronic invoicing?

| Jung et al. (2012) |

Profile of the respondents.

| Demographics | Frequency | Percentage |

|---|---|---|

| Annual Turnover: | ||

| Less than INR 50 million | 41 | 27.20 |

| 50 to 750 million | 27 | 17.90 |

| 750 to 2500 million | 20 | 13.20 |

| Above 2500 million | 63 | 41.70 |

| No. of employees: | ||

| Less than 50 | 44 | 29.10 |

| 50 to 100 | 9 | 6.00 |

| 100 to 200 | 13 | 8.60 |

| 200 to 300 | 8 | 5.30 |

| Above 300 | 77 | 51.00 |

| Age of the firm (in years): | ||

| 0-10 | 50 | 33.11 |

| 11-20 | 33 | 21.85 |

| 21-30 | 22 | 14.57 |

| 31-40 | 7 | 4.64 |

| 41-50 | 12 | 7.95 |

| Above 50 | 27 | 17.88 |

| Industry: | ||

| Manufacturing | 77 | 51.00 |

| Services | 44 | 29.10 |

| Construction and Projects | 20 | 13.20 |

| Others | 10 | 6.60 |

Ashish Kumar Tiwari is a Doctoral Research Scholar at Symbiosis International (Deemed University), Pune, India. An Engineering and Management graduate, Ashish is the CEO of ConChem Labs LLP, India. More than two and a half decades in the industry, he has majorly been in the areas of engineering and business management. His research and academic interests are adoption of new technologies, interpersonal trust & transparency, and competency building.

Zericho R. Marak has completed his Doctorate from Symbiosis International (Deemed University), Pune, India and is currently serving as Assistant Professor at the Symbiosis Centre for Management Studies Nagpur. Earlier, Postgraduate in Commerce from North Eastern Hill University, India, Zericho was a recipient of Junior and Senior Research Fellowship from University Grants Commission (UGC) during his doctoral study. His areas of research interest include Supply Chain Finance, Small & Medium Enterprises Financing, working capital financing and technology adoption.

Justin Paul is the current Editor-in-Chief of the International Journal of Consumer studies. He serves as Associate Editor (International Business) with the European Management Journal, the Journal of Strategic Marketing and The Services Industries Journal; he has been a Guest Editor for the Journal of Business Research. His publication record includes top-tier international journals such as Journal of World Business, California Management Review, Journal of Business Research, International Business Review, International Marketing Review etc.; he is a well-known author of several best-selling books, incl. “Business Environment” (McGraw-Hill, 4th edition), “International Marketing” (Pearson, 2nd edition), and “Export-Import Management” (Oxford University Press, 2nd edition).

Abhijit Prakash Deshpande is the Director, Board of University Development, and Associate Professor, Symbiosis International (Deemed University), India. He is doctorate in Human Resource Management (Application of the Competency Modeling Approach). He has authored a book, written various book chapters, and research publications in many national and international journals. He was a professional sportsman, especially a cricketer at national level in India.

Some of the items not meeting the threshold value of 0.70 are eliminated from the model, i.e. CP3, CX1, OB1, TC3, TP3, and TR3 (see Table 1 and Appendix 3).