The introduction of digitalization and the promotion of eco-innovation, the move towards financial development, and the appearance of alternative financial practices such as crowdfunding as well as the adoption of freer economic systems represent plausible enablers of the sustainable transition and potentially help to increase nations’ sustainable competitiveness. However, knowledge is scarce about their contribution. The present study fills the gap in the sustainability literature by proposing a complexity theory lens to a dataset spanning four years from 2015 to 2018 for 18 countries which captures the possible configurations of the chosen factors that allow countries to achieve two outcomes: sustainability transitions and sustainable competitiveness. The findings show three configurations for each outcome. High levels of digitalization, crowdfunding, and financial development are present in all configurations showing their important contribution to sustainable competitiveness and sustainability transitions. High eco-innovation and economic freedom are present in four out of six solutions, while they are present in negation (low levels) in the remaining two solutions. Overall the results offer insights to policymakers, individuals, and businesses on how to use these findings to understand the complex interactions generating high sustainability transitions and sustainable competitiveness.

During the past couple of years, the world as a whole has had to face substantial challenges. Issues such as climate change, increased pollution, the energy crisis, social tensions, heightened inequalities, and economic disruptions together with unsustainable behaviors have led to growing threats (Djoundourian et al., 2022; Dibeh et al., 2021; Del Rio Castro et al., 2021; Kopnina, 2020) and pushed nations to question their current practices. Indeed, the world is at a pivotal turning point (Hof et al., 2020; WEF, 2020; UN, 2022), and the future of our planet relies heavily on our ability to secure both thriving communities and healthy natural ecosystems (Meng et al., 2023; Ki, 2018; WHO, 2015; UN, 2023a). This reality mandated the world leaders’ commitment to transform into a sustainable world by creating sustainable development pathways (UN, 2018). Nevertheless, the current political, societal, and economic choices are having an adverse effect as evidenced by social and environmental unsustainability indicators that have been on the rise (El-Kassar et al., 2023; Hallin et al., 2021; Djoundourian, 2011). Our activities have severely damaged the world's ecosystem (EEA, 2018;Zwartkruis et al., 2020;Odenweller, 2022; Hashem & Marrouch, 2023). According to United Nations reports on sustainable development, ‘around 40,000 species are at risk of extinction over the coming decades, 10 million hectares of forest are being destroyed each year (UN, 2023a), billions of people are struggling, and hundreds of millions face hunger and even famine (UN, 2023b). Such unsustainable activities undoubtedly risk the well-being of the current and future generations and hinder the successful implementation of the Paris Agreement (2015) and the attainment of the United Nations Sustainable Development Goals (UNSDGs) (UN, 2018). Therefore, sustainability is no longer a choice but rather a moral and economic imperative for countries all over the world, since society, nature, and business are intensely intertwined (Kiron & Unruh, 2018; Abdul Baki & Marrouch, 2022).

In this context, the multifaceted concept of sustainable competitiveness which encourages countries to provide the needs of the current generation without depleting social and natural capital appears as a suitable means of assessing the three dimensions of sustainable development - economic, social, and environmental (Dabbous et al., 2023; Popescu et al., 2017; SolAbility, 2017). Recently, sustainable competitiveness that combines sustainable development and competitiveness has gathered increasing attention. Yet this concept has not been extensively researched and few articles have addressed sustainable competitiveness on a country level (Dabbous et al., 2023; Doyle & Perez-Alaniz, 2017;Kirjavainen & Saukkonen, 2020; Thore & Tarverdyan, 2016), warranting the need for more research. Moreover, in light of the economic, environmental, and societal challenges the world is facing, fostering sustainable transitions has become a pressing global need (Delgosha et al., 2021). Nevertheless, transforming our world requires profound changes in governance and in the underlying core beliefs and value systems that led to past behaviors. Such transformations pass through sustainable transitions that require a deep knowledge of emerging technologies, the firm involvement of stakeholders, and awareness about eco-innovations. Furthermore, the multifaceted nature of these processes means that it is necessary to also analyze the pace of transitional changes across countries (Cheba et al., 2022). More research is therefore needed to understand the complexity of sustainable transitions as competing and complementary interactions between multiple emerging and existing technologies are on the rise (Köhler et al., 2019).

With the advent of the information age, digitalization is increasingly providing reliable infrastructures (Argyroudis et al., 2022) for trusted and safe communications (Reim et al., 2022; Alizadehsalehi & Yitmen, 2023). This offers the ability to reach a large audience with minimal effort and communicate more effectively and efficiently (Hadjielias et al., 2022) worldwide. Digitalization can also be considered as a connection between the different dimensions of the social, economic, and ecological systems (Liu et al., 2022; Satalkina & Steiner, 2020), and potentially make countries more competitive and innovative (Hung & Nham, 2023; Jovanović et al., 2018). While digitalization presents numerous opportunities to contribute to sustainable development, it comes with new risks and unforeseen consequences namely environmental (Chen et al., 2020). Hence, the need to further examine how it contributes to sustainable transitions and helps countries achieve sustainable competitiveness.

Existing studies have investigated the impact of technological innovation on renewable energy consumption (Ahmed et al., 2022; Sharma et al., 2021) and sustainable development (Omri, 2020), however, most studies did not define technological innovation in the context of eco-innovation. This study uses the concept of eco-innovation, which differs from technological innovations which in some cases can be non-environmentally friendly, given that they enhance production efficiency but generate higher carbon emissions and require increased energy demand (Khan et al., 2020). Eco-innovation on the contrary conveys eco-friendly characteristics to production processes and products. This ensures the presence of the necessary technological support needed to foster renewable energy use and optimize energy consumption, therefore, driving clean energy transitions efficiently (Zhongwei & Liu, 2022). Further, to date, no prior study conducted an empirical investigation assessing the role played by eco-innovation on sustainability transitions and sustainable competitiveness.

Funding remains the foundation of sustainable transitions (UN, 2021; Azarine & Songue, 2023). As reported in the International Monetary Fund report (IMF, 2021c), the sustainable investment fund sector is an important driver of the global sustainable transition but, currently, is ‘too limited in size and scope to have a major impact and faces challenges related to greenwashing’. According to the International Energy Agency (IEA) estimates, achieving net-zero carbon emissions by 2050 will require additional global investments in the range of $12 trillion to $20 trillion which cannot be funded by the current economic model (IEA, 2021; IMF, 2021a). This fact requires looking for sustainable investors from the crowd to bring financial stability and achieve a sustainable transition, hence the growing interest in crowdfunding (Kraus et al., 2016; Terri et al., 2017; Manoj Kumar, 2018;Shahin & El-Achkar, 2017; Shan et al., 2023). Indeed, in the past couple of years, the number of active crowdfunding platforms has grown from 1250 worldwide in 2015 (Massolution, 2015) to 1478 platforms in the United States alone in 2021. These figures reflect the reality that crowdfunding could be counted as a potential sustainable funding source and should be further investigated.

Previous literature has found strong relationships between financial development and the economy (Haseeb et al., 2018; Shahbaz et al., 2018; Zafar et al., 2019), as financial development drives growth and stability (Arayssi et al., 2019; Cao et al., 2022). However, its impact on the environment is questionable. Some researchers argue that by increasing productivity and financial gain, heightening energy demand, and encouraging the purchase of consumer goods and services (Shahbaz et al., 2018), financial development contributes to environmental degradation (Haseeb et al., 2018). Others consider that financial development nurtures the appearance of eco-friendly techniques that improve environmental quality (Usman & Makhdum, 2021). The mixed evidence within the financial development and environment nexus, therefore, warrants more investigation as to the contribution of the former to sustainability.

Economic freedom has been shown to have positive short and long-term effects on the economy (Haidar, 2012). It boosts capital and labor markets, increases investment potential, renders business markets more attractive, encourages entrepreneurship, and produces long-term GDP gains (Papageorgiou & Vourvachaki, 2017; Rapsikevicius et al., 2021). Researchers have also highlighted the importance of investigating economic freedom given the importance of government regulations in protecting the environment, providing incentives to invest in green technologies, and putting the economy on a greener pathway. However, the impact of economic freedom on countries’ environmental progress is debatable (Rapsikevicius et al., 2021) and its contribution to sustainability should be further examined.

The main objective of this study is therefore to explore when, if ever, digitalization, crowdfunding, eco-innovation, financial development, and economic freedom act as factors fostering sustainability transitions and sustainable competitiveness. Further, the analysis accounts for the influence of three other control variables namely, income, foreign direct investment, and education. Within the context of the study, the global sustainable competitiveness index is used as a measure of sustainable competitiveness and the transition performance index is used to measure sustainable transitions. The other variables are measured using data from the OECD, European Commission, World Development Indicators, UNESCO, and the International Monetary Fund. The study fills a gap in the literature as to date all existing works investigating the factors driving sustainability mostly rely on regression-based models which are based on the assumption of symmetric relationships between the dependent and independent variables. However, the relations observed in real life between the various factors considered are not necessarily symmetric and tend to be asymmetric and complex (Woodside, 2017). Further, countries with different characteristics cannot be presented by a unique model derived by using regression-based models that can fit all of them. Thus, this study builds on the complexity theory and uses the fuzzy-set Qualitative Comparative Analysis (fsQCA) to determine the factors generating high sustainability transitions and yielding high sustainable competitiveness (Woodside, 2017). The dataset used covers 18 countries over four years spanning from 2015 to 2018.

This study offers numerous theoretical contributions. First, this work empirically tested models helping to achieve sustainability transitions and sustainable competitiveness, by doing so, it addressed a gap in the existing sustainability literature. Second, it is considered among the first studies to empirically explore the interactions between crowdfunding, digitalization, eco-innovation, financial development, and the two outcomes of interest namely sustainability transitions and sustainable competitiveness. Third, the study is the first to use fsQCA to identify the necessary conditions and causal combinations of factors needed to achieve sustainability transitions and sustainable competitiveness, by doing so it provides a complete understanding of the asymmetric relationship that exists. Further, this study provides practical contributions for governments and policymakers, as it guides them in their quest for achieving sustainable transitions and offers them the tools for reaching a high level of sustainable competitiveness.

Literature reviewSustainable competitiveness and sustainable transitionsSustainable competitivenessSustainable competitiveness is defined as “the ability to generate and maintain wealth without diminishing the future capability of sustaining or increasing current wealth levels” (SolAbility, 2017). It aims to develop a set of mechanisms and policies that enable countries to achieve economic growth while taking into account environmental issues and the sustainability of society (Delgosha et al., 2021; Despotovic et al., 2016; Thore & Tarverdyan, 2016). Sustainable competitiveness involves a process of transformation whereby the use of resources, the orientation of investments, the development of technology, and institutional change are aligned and have the potential to meet current and future human needs and aspirations (Thore & Tarverdyan, 2016)

Previous studies highlight the complex interactions of factors that appear when studying sustainable competitiveness and emphasize the interrelationships of economic growth, sustainable development, and competitiveness (Balkyte & Tvaronavičiene, 2010; Delgosha et al., 2021; Doyle & Perez-Alaniz, 2017). In this sense, sustainable competitiveness appears as a complex construct within which the diverse elements of competitiveness play different roles as countries transition from basic requirements to reach sustainable development (Doyle & Perez-Alaniz, 2017; Popescu et al., 2017). Hence, the interest is in also studying the metrics that assist in steering the transition to sustainability.

Sustainable transitionsSustainable transitions consist of engaging in “radical transformations towards a sustainable society” (Grin et al., 2010). They aim to address grand challenges in a way that countries meet the needs of the present generation without compromising the ability of future generations to meet their own needs, and thus represent a pathway towards achieving sustainability (Voulvoulis et al., 2022). Sustainable transitions are an over-arching theme as they involve complex interactions between technology, policy, economics, and markets (Geels, 2011). In recent years, researchers have shown a growing interest in studying large-scale societal transformations that move toward sustainability (Loorbach et al., 2017; Voulvoulis et al., 2022) and have used different frameworks to conceptualize, understand, and support these transitions (Lachman, 2013; Markard et al., 2012). Within the context of this study, Geels’ (2002) Multi-Level Perspective (MLP) is adopted to explain how different factors contribute to sustainable transitions. The theory argues that interactions between and within three analytical levels (micro‑meso-macro) influence sustainability transitions and determine their scope and impact (El-Bilali, 2019). The first level, niches, are protected spaces and the locus for radical innovation as they allow individuals and groups to experiment with new technologies, social arrangements, and consumption routines (Cohen et al., 2017). The second level, socio-technical regimes, represents the institutional structuring of existing systems leading to path dependence and incremental change. The third level, exogenous socio-technical landscape developments, provides a macro-level structuring context (Köhler et al., 2019). According to the MLP, regimes are likely to produce conventional innovation patterns, whereas niches yield radical change (Smith et al., 2010). Hence, within this study, crowdfunding and eco-innovation are considered as niches, digitalization, economic freedom, and financial development as regimes and income and, foreign direct investment and education as landscape.

DigitalizationDigitalization is considered as the ways in which different areas of enterprise, government, and social life are generally restructured around digital technologies (Brennen & Kreiss, 2016). In recent years, it has been heralded as one of the most promising transformations for sustainability (Gouvea et al., 2018; Hung, 2023). While the majority of research points to the positive impact of digital technologies on economic growth albeit to varying degrees across countries (Bahrini & Qaffas, 2019; Hung, 2023; Niebel, 2018; Stanley et al., 2018), controversies exist concerning their social and environmental sustainability (Akande et al., 2019; Del Rio Castro et al., 2021; Kuntsman & Rattle, 2019). On one hand, the digital technology industry is considered one of the most environmentally damaging industrial sectors in the world (Junior et al., 2018), it generates high electricity demand and has given rise to the problem of e-waste (Dwivedi et al., 2022). On the other hand, digital technologies can help monitor climatic conditions and change, moderate natural disasters, lead to more efficient and sustainable energy consumption by the use of smart grids (Dwivedi et al., 2022) as well as generate mechanisms to maintain and stimulate natural resources, national wealth, and well-being (Akande et al., 2019). The contradictory results in the literature regarding the role of digitalization in driving sustainable competitiveness warrant further investigation.

Eco-innovationThe term eco-innovation was defined by the European Commission as, “the production, assimilation or exploitation of a novelty in products, production processes, services or in management and business methods, which aims, throughout its lifecycle, to prevent or substantially reduce environmental risk, pollution and other negative impacts of resource use, and enhance resilience to environmental pressures.”(Carrillo-Hermosilla et al., 2010; EC, 2011). Eco-innovation has been linked to sustainability as it reduces the impact of human activity on the environment by helping to achieve more efficient and responsible use of natural resources (Boons et al., 2013). Eco-innovation also creates value by addressing environmental concerns of markets, companies, and consumers through the creation of environmentally friendly products and processes (Padilla-Lozano & Collazzo, 2022), and as such provides environmentally sustainable advantages that actively contribute to sustainable development (Wu et al., 2022). Furthermore, eco-innovation has been identified as a key driver for change in the transition toward sustainability as it allows the development of competitive technologies that hold great environmental benefits (Kemp, 2010). Cainelli et al. (2020) emphasized the significance of eco-innovation in the European Union's strategy for fostering open economic systems. Gente and Pattanaro (2019) supported this view, establishing a connection between the circular economy and eco-innovation. Expanding on this notion, Kiefer et al. (2021) argued that systemic eco-innovations play a pivotal role in advancing a highly eco-friendly economy. Nonetheless, despite these insights, there remains a need for stronger theoretical underpinnings that clearly define the role of eco-innovation as a catalyst for an eco-friendly economy (Vence & Pereira, 2019).

CrowdfundingCrowdfunding includes “the efforts exerted by entrepreneurial individuals and groups to fund their ventures by relying on fairly small contributions made from a large number of individuals gathered through the internet” (Mollick, 2014). It covers numerous approaches such as equity crowdfunding, reward-based crowdfunding, donation crowdfunding, and crowdlending (Ribeiro-Navarrete et al., 2021). In recent years, it has been used as an alternative mode of financing for a variety of for-profit and non-profit projects (Testa et al., 2019). Crowdfunding holds great potential for successfully addressing sustainability problems that require large financial means (Böckel et al., 2021), and appears to be a catalyst for encouraging innovation and sustainable development (Siebeneicher & Bock, 2022). For instance, crowdfunding provides financial support to ventures that focus on sustainability issues, such as projects that create environmentally friendly solutions and pursue environmental goals (Petruzzelli et al., 2019), and contributes to the financing of renewable energies (Lam & Law, 2016). Furthermore, crowdfunding increases the availability of funding for social projects and sustainability-oriented initiatives that face obstacles in raising funds from conventional channels (Calic & Mosakowski, 2016). Crowdfunding also enables the democratization of investments and, leads to an increase in social justice and a fairer distribution of financial prosperity (Siebeneicher & Bock, 2022). Additionally, crowdfunding can potentially increase the public's awareness regarding sustainability issues and thus contribute to the dissemination of more sustainable behaviors among individuals (Petruzzelli et al., 2019). Although crowdfunding appears to support sustainability, a study conducted by Motylska-Kuzma (2018) concludes that alternative financing is unlikely to promote the aims of sustainability even though it appears at first glance that these finance methods are directed toward responsible businesses, can reduce inequalities and represent one of the major concepts related to sustainable development. Further, most existing works have presented case studies (Lam & Law, 2016), investigated success factors (Bonzanini et al., 2016), used surveys on crowdfunding renewable energy ideas (Lu et al., 2018), or explored its impact on one aspect such as renewable energy (Appiah‐Otoo et al., 2022) or entrepreneurship (Cervantes-Zacarés et al., 2023) but none quantified the global influence of crowdfunding on sustainability transitions and sustainable competitiveness. It becomes therefore necessary to conduct an empirical investigation on whether crowdfunding explains sustainability transitions and sustainable competitiveness in general and not only explore its impact on one aspect such as renewable energy or inequality.

Financial developmentIn recent years, researchers have recognized the need to include financial development in the economy-environment nexus (Mills et al., 2021) and further investigate the role it plays in helping nations achieve sustainability goals. First, financial development can contribute to economic growth as it enables capital formation and accumulation, encourages foreign investments, and stimulates research and development (Hung, 2023; Rafindadi & Ozturk, 2016). Second, financial development increases the level of accessibility to wealth, advances overall living standards, and stimulates the resource efficiency of a country (Yahya et al., 2022). Third, financial development exerts an impact on the environment although findings vary as to whether this impact is positive or negative. On one hand, some argue that well-developed financial systems can curb CO2 emissions by optimizing and restraining energy consumption, attracting energy-efficient green technologies, and mitigating environmental degradation (Zafar et al., 2019; Zaidi et al., 2019; Yu et al., 2022). While others consider that financial development harms the environment as broader access to finance and credit increases consumption and industrial activity which leads to environmental degradation and an increase in energy demand and CO2 emissions (Shahbaz et al., 2015; Xu et al., 2022). Finally, recent studies in Asia Pacific Economic Cooperation countries (Khan et al., 2022) and in OECD countries (Khan et al., 2021) have revealed new insights into the interplay between financial development, and environmental sustainability. While previous research has examined the causes and impacts of environmental sustainability, it has not fully explored the components that contribute to sustainability transitions and competitiveness.

Economic freedomEconomic freedom is defined as government interventions through the implementation of structural reforms that are made to maintain equilibrium amidst the global changes that affect economic paradigms (Van Neuss, 2019). Past research has shown that economic freedom has a positive impact on capital inflows, which leads indirectly to sustainable economic growth (Arayssi & Fakih, 2017; Mushtaq & Ali Khan, 2018). Economic freedom also increases the competitiveness of countries, their resilience to shocks, and their flexibility (Bjørnskov, 2016). The impact of economic freedom on the environment is, however, more mitigated. In their study of European countries; Rapsikevicius et al. (2021) found that higher economic freedom corresponds to higher environmental progress, and Farzin and Bond (2006) as well as Zeaiter and Kassem (2017) established that politically free countries display better environmental quality, whereas Carlsson and Lundström (2001) determined that economic freedom increases CO2 emissions and Graafland (2019) concluded that freedom from regulation decreases corporate environmental responsibility. Furthermore, to date, researchers have failed to agree on the social impact of economic freedom as some argue that by creating frequent economic disruptions, economic freedom is harmful to human well-being, while others consider that extensive economic freedom protects societies from such damaging disruptions (Bjørnskov, 2016).

Control variables: foreign direct investment, education, incomeThis study also accounts for the impact of foreign direct investment, countries' income levels, and education as variables that possibly influence sustainable competitiveness and contribute to sustainable transitions. Prior works have shown that foreign direct investment, which represents the inflow of capital, creates an encouraging investment climate that increases sustainable development (Odugbesan et al., 2022). However, other works show that foreign direct investment has no, or even a negative impact on the sustainable productivity of firms (Liu et al., 2016; Feinberg & Majumdar, 2001; Chang & Xu, 2008). This study also includes income as a control variable as it assumes that sustainable competitiveness varies according to the development level of a country (Despotovic et al., 2016). Other researchers consider income level as one of the key factors explaining sustainable economic growth (Li et al., 2023; Balkyte & Tvaronavičiene, 2010) and a significant factor in measuring sustainable societies (Méndez-Picazo et al., 2021; Popescu et al., 2017). Further, while education is considered to enhance sustainable economic growth (Tsamadias & Prontzas, 2012) and exerts a significant positive influence on sustainable competitiveness (Dabbous et al., 2023), the study conducted by Range and Sandberg (2016) reveals that factors such as overall education levels do not significantly influence whether these organizations choose to innovate toward or away from sustainable competitiveness.

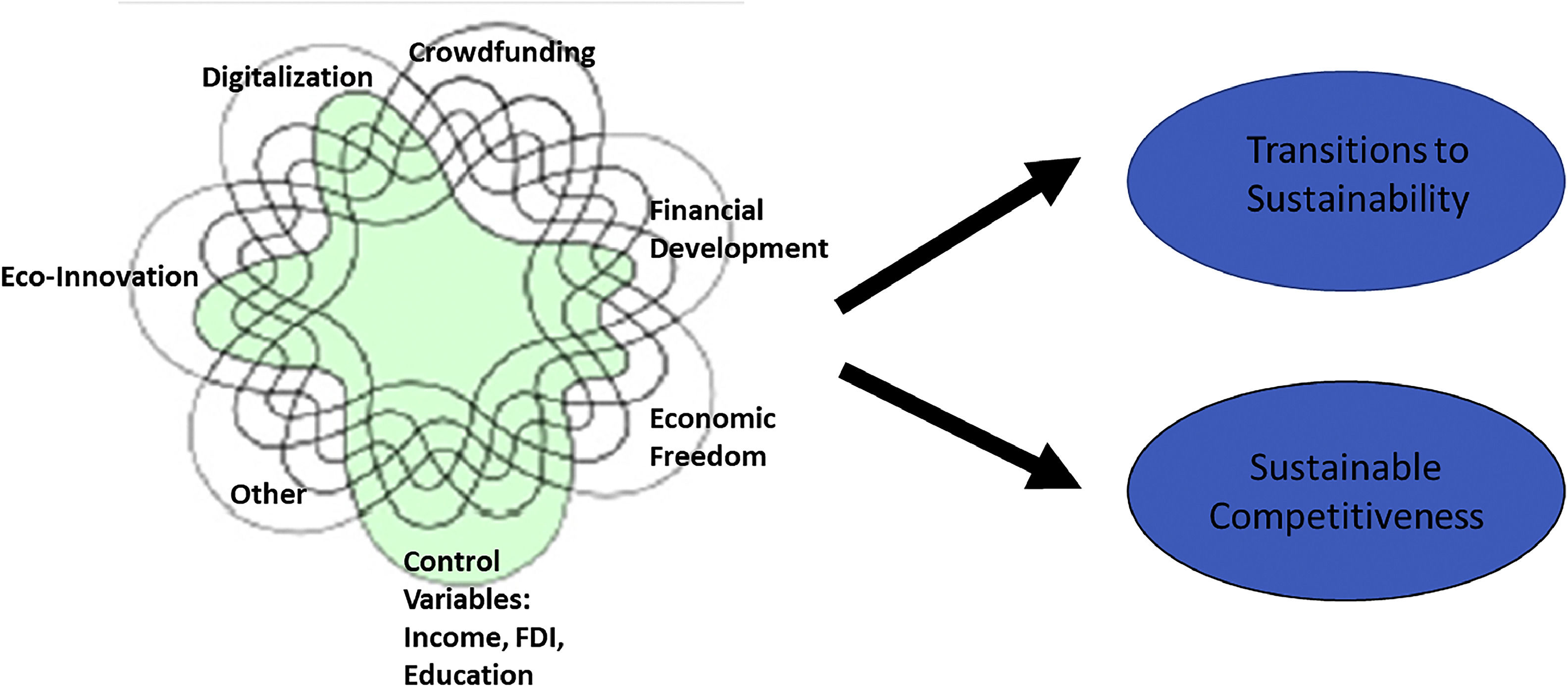

Proposed modelFig. 1 presents the proposed model forecasting sustainability transitions and sustainable competitiveness.

Methodology and data usedComplexity theory and configurational analysisThis study relies on the complexity theory and configurational analysis (Woodside, 2017), to determine the combinations of major factors that can achieve high sustainability transitions and sustainable competitiveness. According to complexity theory, the relationships among various variables are considered complex. Variables can interact and mix in different ways and can therefore yield differences in the observed outcomes. This theory relies on the equifinality principle, a particular desired outcome can be explained by several sets of causal conditions that are combined in sufficient configurations to present an explanation of this outcome (Woodside, 2014). Different configurations can generate either high or low levels of the outcome of interest. This is explained by the concept of causal asymmetry which represents the basis for the configuration. According to Fiss (2011), the presence or absence of a specific set of conditions generating a particular outcome of interest can be different from the ones yielding its absence. A variable can therefore present an asymmetric relationship with the outcome of interest. The same outcome can be influenced positively or negatively by the same factor depending on how this factor interacts with the others (Fiss, 2011). Within the context of this study, digitalization, crowdfunding, eco-innovation, financial development, and economic freedom are all considered important to achieve high sustainability transitions and sustainable competitiveness and they can interact with each other in different configurations to achieve the desired outcome. The use of complexity theory and configurational analysis allows us to explain and determine the complex phenomena of both sustainability transitions and sustainable competitiveness.

Advantages of using fuzzy-set qualitative comparative analysis (fsQCA)The use of fsQCA is adequate for research in business-related fields and presents several benefits (López-Cabarcos et al., 2021; Pineiro-Chousa et al., 2019). This technique allows to determine the configurations of conditions considered sufficient to realize the outcome of interest and studies the combined effect of the various variables rather than their independent effect (Carmona et al., 2023). FsQCA adopts quantitative and qualitative evaluations and calculates the level to which an individual case is associated with a set (Ragin, 2000; Rihoux and Ragin, 2008), therefore creating a link between both quantitative and qualitative analysis techniques (Pappas & Woodside, 2021). FsQCA can be also used with various sample sizes ranging from very small ones, less than 50 to very large samples, and can be used with different types of data (Pappas & Woodside, 2021). As explained by Fiss (2011), with fsQCA sample representativeness will no longer be an issue, since fcQCA is a case base analysis technique that uses calibration which reduces sample representativeness. Further, fsQCA is considered an appropriate technique to analyze country-level data (Misangyi et al., 2017; Orlandi et al., 2021) and is a useful method adopted when examining nonlinear or non-additive configurations at the country level (Furnari et al., 2021). Additionally, the use of fsQCA allows to overcome the various limitations of regression-based models. For instance, regression-based models make assumptions about the shape of probability distribution the data is assumed to be drawn from and examine relationships between the variables while presuming the presence of symmetric influences which may not be always true particularly since most real-life relationships tend to be asymmetric (Pappas et al., 2016; Woodside, 2014). According to Ragin and Fiss (2008), causal relations will be better explained in terms of a set of theoretical relationships as opposed to using correlations. Finally, fsQCA is not sensitive to outliers, it is therefore considered more robust than regression-based techniques particularly since outliers will not influence all configurations but only a limited number of them (Pappas et al., 2019).

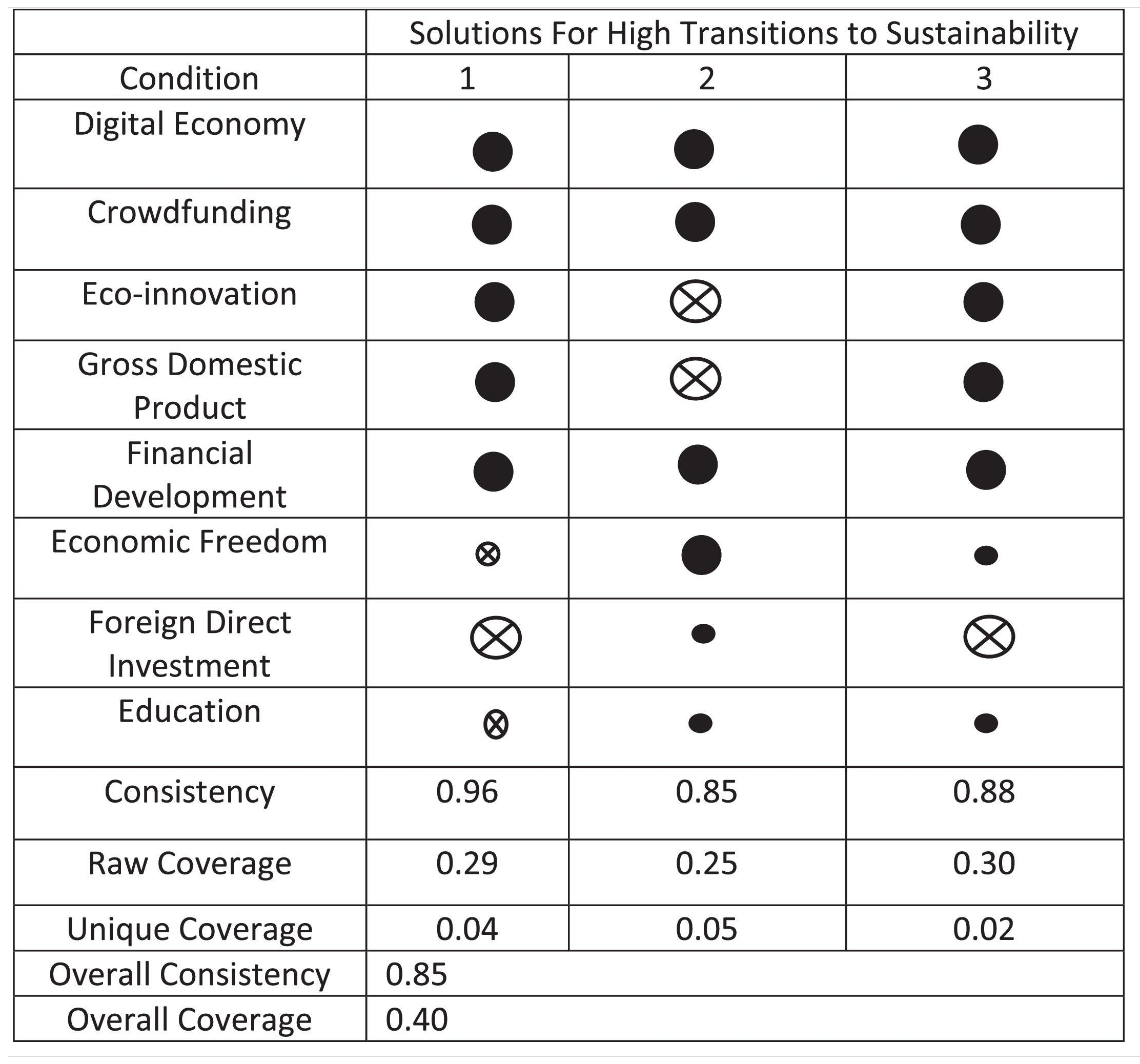

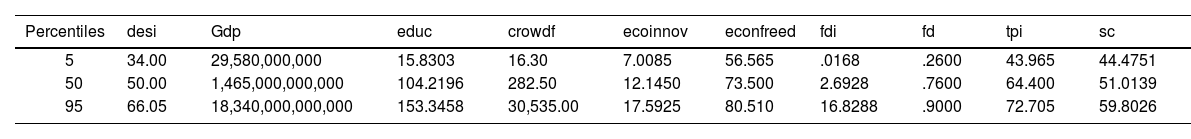

Data usedThe empirical analysis aims to determine possible configurations of crowdfunding, digitalization, financial development eco-innovation, and financial freedom that help nations realize high sustainability transitions and achieve sustainable competitiveness. Data from 2015 to 2018 for 18 countries (Australia, Brazil, Canada, Chile, Finland, France, Germany, Italy, Japan, Latvia, Mexico, Netherlands, Poland, Korea, Spain, Sweden, United Kingdom, and the United States) are used to conduct the analysis. The selected countries and the time period are dictated by the availability of both digitization and crowdfunding data available from 2015 to 2018 for selected countries. The study also accounts for other factors established in the literature to influence these two outcomes, such as Income assessed by the gross domestic product (gdp) in 2015 constant $, foreign direct investment (fdi) that measures the direct investment equity flows in a country and education (educ) measured as the gross enrollment ratio, for secondary education for both sexes. Transitions to sustainability are measured by the transition performance index (tpi). The index measures the ability of countries to successfully move to prosperous sustainability across four dimensions, economic, social, environmental, and governance transitions. Sustainable competitiveness (sc) is measured using the sustainable competitiveness index developed by SolAbility. The index covers key elements that interact and impact each other, natural, social, and intellectual capital, resource efficiency and intensity, and governance. Digitalization is measured using the International digital economy and society index (desi). The index includes five dimensions: communication, digital skills, individuals' use of the Internet, integration of business technologies, and digital public services. Crowdfunding (crowdf) data measures the volume in millions of dollars of various crowdfunding activities. The data is retrieved from the various reports of the Centre for Alternative Finance of the University of Cambridge and it covers data on 14 models that can be divided into Debt models (P2P/Marketplace Lending activities..), Equity models (Equity-based Crowdfunding, Real Estate Crowdfunding…) and non-investment models (Reward and Donation Crowdfunding…). Eco-innovation (ecoinnov) measures the share of environment-related technologies in all technologies. The financial development index developed by the International Monetary Fund (IMF) is used to measure financial development (fd) for a country. The index measures access, efficiency, and depth of traditional institutions and financial markets. The Heritage Foundation index of economic freedom (econfreed) is used to assess the country's level of economic freedom. The index covers four dimensions, economic freedom using 12 factors divided into 4 groups, rule of law that covers property rights, government integrity, government size (fiscal health, spending …), regulatory efficiency (monetary freedom, business freedom..,) and open markets (financial freedom, trade freedom…). Table 1 presents the variables’ descriptions and the corresponding data sources. Tables A1 and A2 in Appendix A present the descriptive statistics of all the variables and show the calibration values used in the analysis.

Variables’ description and data sources.

| Variables Used | Symbol | Description | Data Source |

|---|---|---|---|

| The Transition Performance Index | tpi | The index monitors and measures the ability of countries to move to prosperous sustainability using 4 dimensions for measuring transitions, economic, social, environmental and governance transitions. | European Commissionhttps://research-and-innovation.ec.europa.eu/strategy/support-policy-making/support-national-research-and-innovation-policy-making/transitions-performance-index-tpi_en |

| The Global Sustainable Competitiveness Index | sc | This index measures the nations’ competitiveness by making use of 131 indicators. The indicators are organized in 5 sub-groups or sub-indices, namely, Natural Capital, Resource Efficiency and Intensity, Intellectual Capital and Innovation, Governance Efficiency and Social Cohesion. | Created by SolAbilityhttps://solability.com/the-global-sustainable-competitiveness-index/the-index |

| International Digital Economy and Society Index | desi | The International Digital Economy and Society Index monitors and assesses the evolution of the Digital Economy across the European Union and 15 other countries. The Index is based on five dimensions reflecting different policy areas. The dimensions are: connectivity which measures and evaluates the quality of broadband infrastructure, human capital which measures the availability of skills needed for people to profit from the various possibilities offered by the digital economy, use of the internet which takes into account the different activities conducted by individuals already online, integration of digital technology which evaluates the digitization of businesses and their corresponding use of the online channel for sales, and the digital public services dimension which measures the level of digitization of public services and eGovernment. | European Commission Directorate General for Communications Networks, Content and Technology.The index data are available starting the year 2015. |

| Crowdfunding | crowdf | Crowdfunding data covers data on 14models that can be divided into Debtmodels (P2P/Marketplace Lending activities..), Equity models (Equity-based Crowdfunding, Real EstateCrowdfunding…) and non-investmentmodels (Reward and Donation Crowdfunding…) | Data are retrieved form the various reports of the Centre for Alternative Finance of the University of Cambridge. |

| Eco Innovation | ecoinnov | Measures the share of environment-related technologies in total technologies. Calculated as the percentage of patents in environment-related technologies relative the total number of technology patents. | OECD statistics database |

| Gross Domestic Product (constant 2015 US$) | gdp | GDP is gross domestic product divided by midyear population. | World Development Indicators(WDI) |

| Financial Development | fd | Measures the relative ranking of nations on access, efficiency and depth of their traditional institutions and financial markets | International Monetary Fund (IMF) |

| Economic Freedom Index | econfreed | The index measures economic freedom using 12 factors divided into 4 groups, rule of law that covers property rights, government integrity, government size (fiscal health, spending …), regulatory efficiency (monetary freedom, business freedom..,) and open markets (financial freedom, trade freedom…) | Data retrieved from heritage foundation websitehttps://www.heritage.org/index |

| Education | educ | Gross enrollment ratio, secondary, both sexes (%) | UNESCO Institute for Statistics |

| Foreign Direct Investment | fdi | Measures the direct investment equity flows in a country. It is calculated as the sum of equity capital, reinvestment of earnings, and other capital. | World Development Indicators(WDI) |

The study adopts the fuzzy-set Qualitative Comparative Analysis (fsQCA) method, it associates the Qualitative Comparative Analysis (QCA) with fuzzy sets and logic principles (Ragin, 2000). The fuzzy-set Qualitative Comparative Analysis (fsQCA) software is used to conduct the analysis. FsQCA allows to depict the combinations or configurations of factors that are sufficient for realizing a particular outcome. According to Fiss (2011), this set-theoretic technique does not divide cases into individual observations but rather groups these cases to determine several possible causal configurations that allow the realization of a particular outcome. To date, no previous work investigated the impact of crowdfunding, digitization, eco-innovation, financial development, and economic freedom on sustainability transitions and sustainable competitiveness using the fsQCA software. By applying this technique, this study will help scholars to go beyond the traditional regression-based techniques which suffer from several limitations. Further, the analysis will allow us to determine the various configurations of factors that help to achieve both high levels of sustainability transitions and sustainable competitiveness. Finally, as Woodside (2014) argues, even though the configurations able to predict the outcome of interest might be depicted only in a small number of cases, they are still considered important.

The fsQCA method allows the identification of causal configurations that include sufficient and necessary conditions. According to Ragin (2008), a necessary condition represents a superset of the desired outcome. If the consistency score exceeds 0.9, the condition will be considered a necessary one (Schneider & Wagemann, 2010). Consistency refers to the degree to which cases exhibiting the same causal condition match in generating a particular outcome (Ragin, 2008). In each causal configuration yielding the desired outcome, conditions could be absent or present as core or peripheral components. When the relationship with the outcome of interest is strong, the component is considered a core one while peripheral components exhibit a weaker relationship (Fiss, 2011). To determine if any of the causal configurations is considered a necessary condition to achieve high sustainability transitions and high sustainable competitiveness, this study conducts a necessity analysis.

Data calibrationThe first step in conducting a fsQCA analysis consists of calibrating the data. All the factors used will be calibrated into fuzzy sets with values ranging between 0 and 1 (Ragin, 2008). A case with a value of 1 shows that this case represents a full member, while a score of 0 represents a full non-membership score. When using the fsQCA software, a logarithmic transformation is performed for all membership scores. Therefore, the values obtained range from 0.05 (full non-membership) to 0.95 (full membership), (Ragin, 2008).

Both indirect and direct data calibration methods are used depending on the type of data and the theory chosen (Ragin, 2008). This study uses the direct method and selects three anchors to conduct the calibration (Pappas et al., 2016, 2020). The 5th, 50th, and 95th percentiles depicted using the probability density function will be used as the three values for the full non-membership, cases with 0.5 fuzzy set scores (crossover points), and cases with full membership (Delgosha et al., 2021). Finally, the fsQCA algorithm will remove the cases exhibiting an exact score of 0.5, to resolve this issue, this study adds the value of 0.001 to all causal conditions that have a score below 1 after calibration (Fiss, 2011; Pappas et al., 2020).

Identification of the combinations generating the desired outcomeAfter completing the calibrations of all factors, the fuzzy set algorithm is run to generate the truth table. The truth table presents all possible combinations of causal conditions that can lead to the outcome of interest. If the number of conditions or factors is n, the truth table will consist of a total of 2n rows. Since we have 8 conditions included in the analysis, the total number of possible combinations that could generate the desired outcome will be 256. To evaluate the strength of these identified combinations, two indicators are used, consistency and frequency (Fiss, 2011). Consistency presents the extent to which the cases are associated with the relationships indicated in a particular combination (Ragin, 2008). The table also indicates for each combination the frequency which reveals the number of cases for each causal relationship. The selection of the final solutions is based on frequency and consistency, threshold values are selected to identify the combinations that explain the outcome of interest. The threshold values are set to 3 for frequency and 0.83 for consistency (Fiss, 2011). The fsQCA algorithm generates complex, parsimonious, and intermediate solutions. The complex configurations display all possible causal combinations of conditions if the logical operations are used, while the intermediate and parsimonious solutions represent the simplified version (Mendel & Korjani, 2012). This study presents the intermediate solutions which incorporate the parsimonious ones and at the same time are considered as part of the complex solutions (Pappas et al., 2020). Finally, the obtained conditions will be divided into core and peripheral ones. A peripheral condition is only present in the intermediate solution while a core condition appears in both the parsimonious and intermediate solutions (Fiss, 2011).

Robustness check: predictive validity analysisAs a robustness check, this study conducts a predictive validity analysis to assess and evaluate the strength of the selected solutions to predict the outcomes of interest (Pappas et al., 2016; Woodside, 2014). Therefore, the sample will be randomly divided into two subgroups. The same fsQCA analysis conducted on the whole sample will be performed on the first subsample. The solutions obtained will then be modeled as variables. The next step consists of testing the results against the second subgroup of data. As such, the variables obtained from subgroup 1 will be plotted against the outcomes of interest from subgroup 2. The models are considered with high predictive validity if the consistency and coverage achieved in the plots do not contract those of the solutions obtained from subgroup one of the data (Pappas et al., 2019).

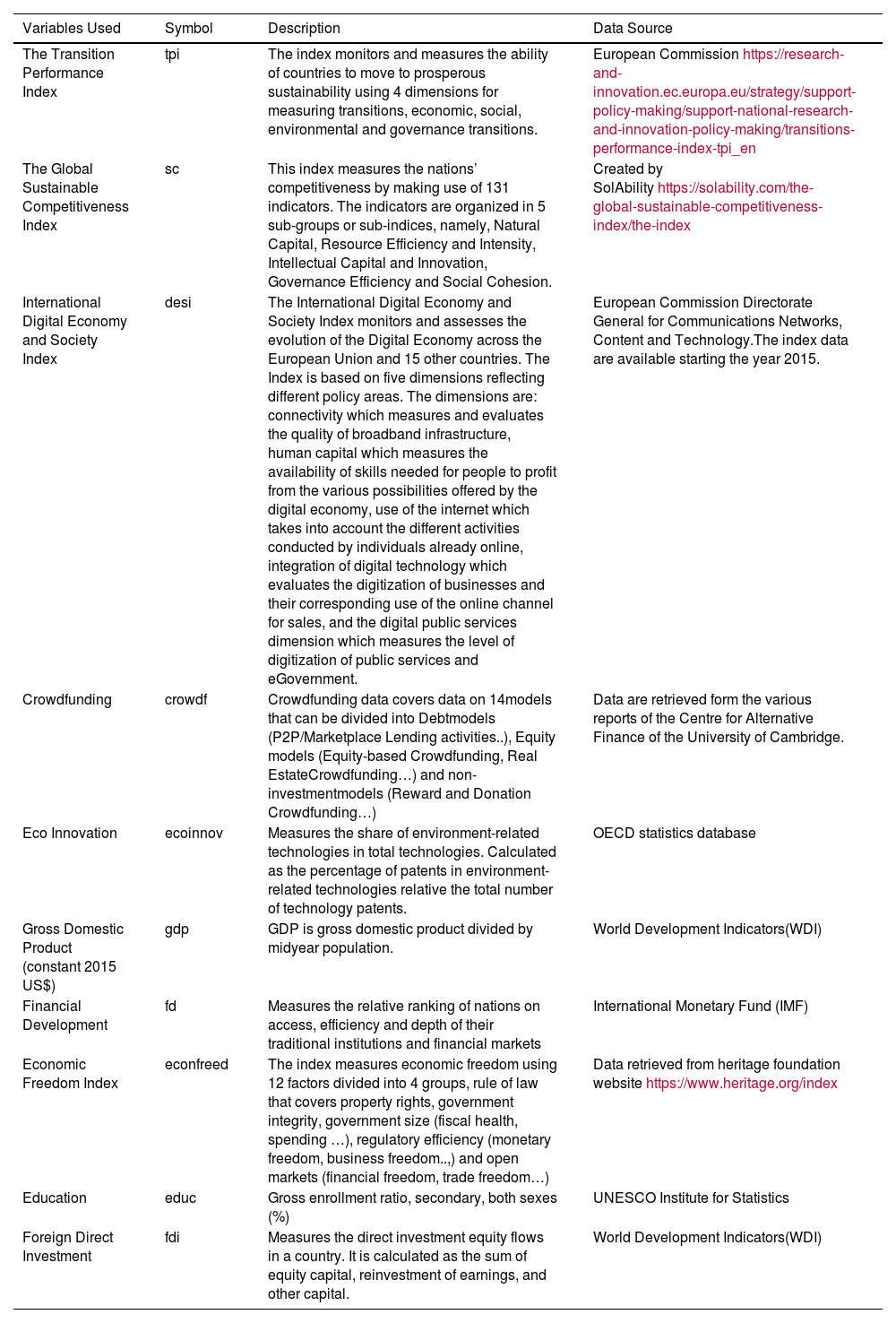

Results and discussionNecessity analysis for sustainability transitions and sustainable competitivenessThe findings of the necessity analyses conducted for both sustainability transitions and sustainable competitiveness are presented in Table 2. Both the presence and negation of the desired outcomes are considered in the analysis. As shown in Table 2, the results reveal that no single condition has a consistency value exceeding 0.9. All consistency values range between 0.52 and 0.83. A necessary condition will exhibit a consistency value of 0.9 and above (Schneider & Wagemann, 2010). Thus, individual conditions are not considered necessary to realize the presence or negation of both sustainability transitions and sustainable competitiveness.

Necessity analysis for the presence and negation of transitions to sustainability and sustainable competitiveness.

| Transitions to Sustainability | ∼ Transitions to Sustainability | Sustainable Competitiveness | ∼ Sustainable Competitiveness | |||||

|---|---|---|---|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | Consistency | Coverage | Consistency | Coverage | |

| desic | 0.77 | 0.73 | 0.52 | 0.56 | 0.65 | 0.72 | 0.65 | 0.61 |

| ∼desic | 0.58 | 0.54 | 0.71 | 0.75 | 0.57 | 0.62 | 0.74 | 0.68 |

| gdpc | 0.70 | 0.53 | 0.69 | 0.59 | 0.68 | 0.59 | 0.82 | 0.61 |

| ∼gdpc | 0.68 | 0.77 | 0.58 | 0.74 | 0.65 | 0.85 | 0.69 | 0.76 |

| crowdfc | 0.74 | 0.54 | 0.66 | 0.54 | 0.70 | 0.59 | 0.78 | 0.56 |

| ∼crowdfc | 0.65 | 0.75 | 0.60 | 0.79 | 0.61 | 0.82 | 0.69 | 0.79 |

| ecoinnovc | 0.72 | 0.68 | 0.59 | 0.63 | 0.70 | 0.76 | 0.68 | 0.63 |

| ∼ecoinnovc | 0.65 | 0.61 | 0.66 | 0.70 | 0.60 | 0.65 | 0.78 | 0.72 |

| econfreedc | 0.69 | 0.64 | 0.65 | 0.68 | 0.59 | 0.64 | 0.72 | 0.65 |

| ∼econfreedc | 0.71 | 0.68 | 0.62 | 0.68 | 0.63 | 0.70 | 0.67 | 0.63 |

| fdc | 0.66 | 0.70 | 0.54 | 0.65 | 0.55 | 0.67 | 0.67 | 0.70 |

| ∼fdc | 0.63 | 0.52 | 0.64 | 0.60 | 0.63 | 0.60 | 0.66 | 0.53 |

| fdic | 0.72 | 0.56 | 0.68 | 0.60 | 0.63 | 0.56 | 0.78 | 0.59 |

| ∼fdic | 0.68 | 0.75 | 0.60 | 0.75 | 0.63 | 0.80 | 0.66 | 0.71 |

| educc | 0.69 | 0.77 | 0.59 | 0.74 | 0.66 | 0.85 | 0.67 | 0.73 |

| ∼educc | 0.70 | 0.54 | 0.70 | 0.61 | 0.64 | 0.57 | 0.83 | 0.62 |

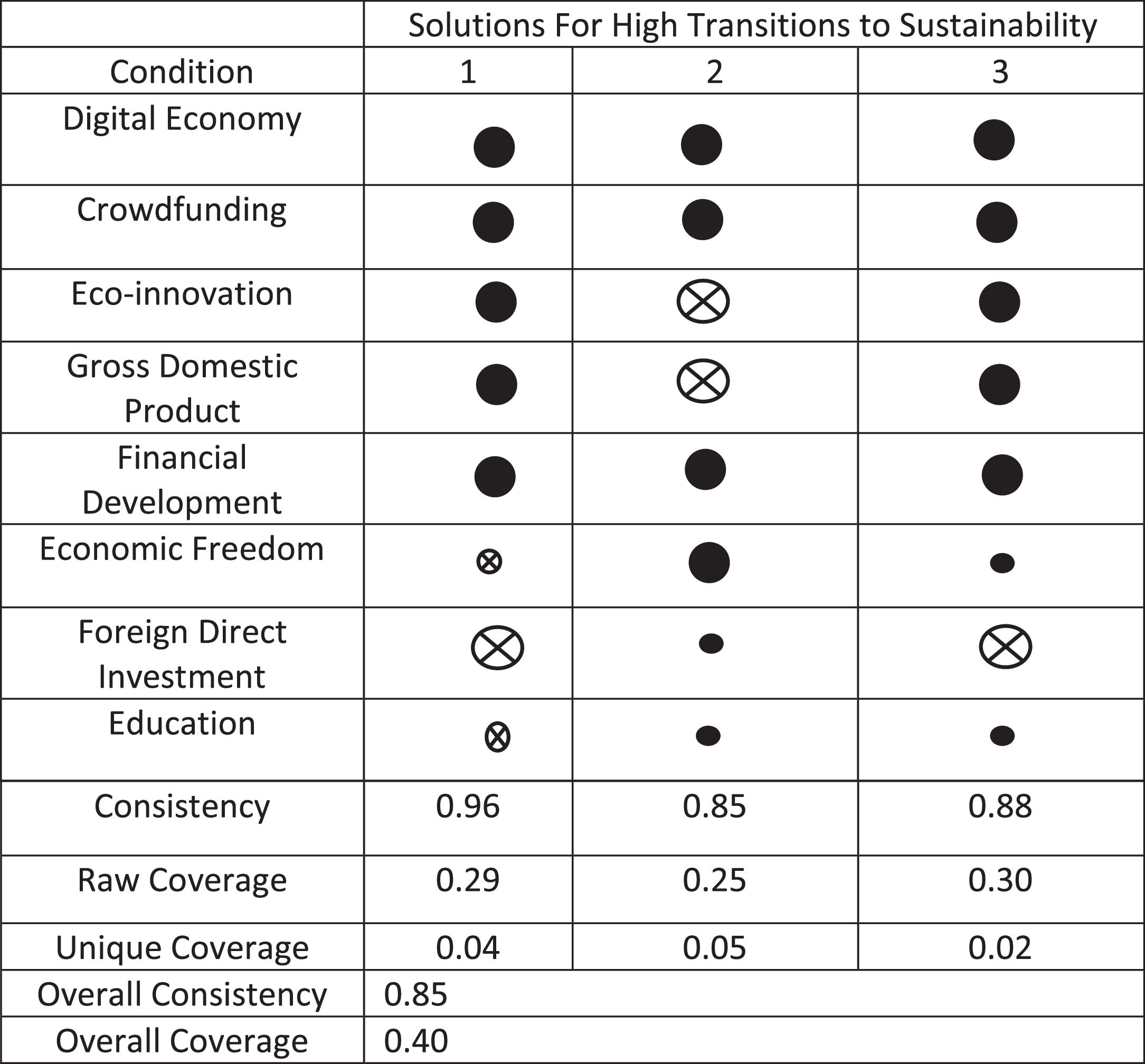

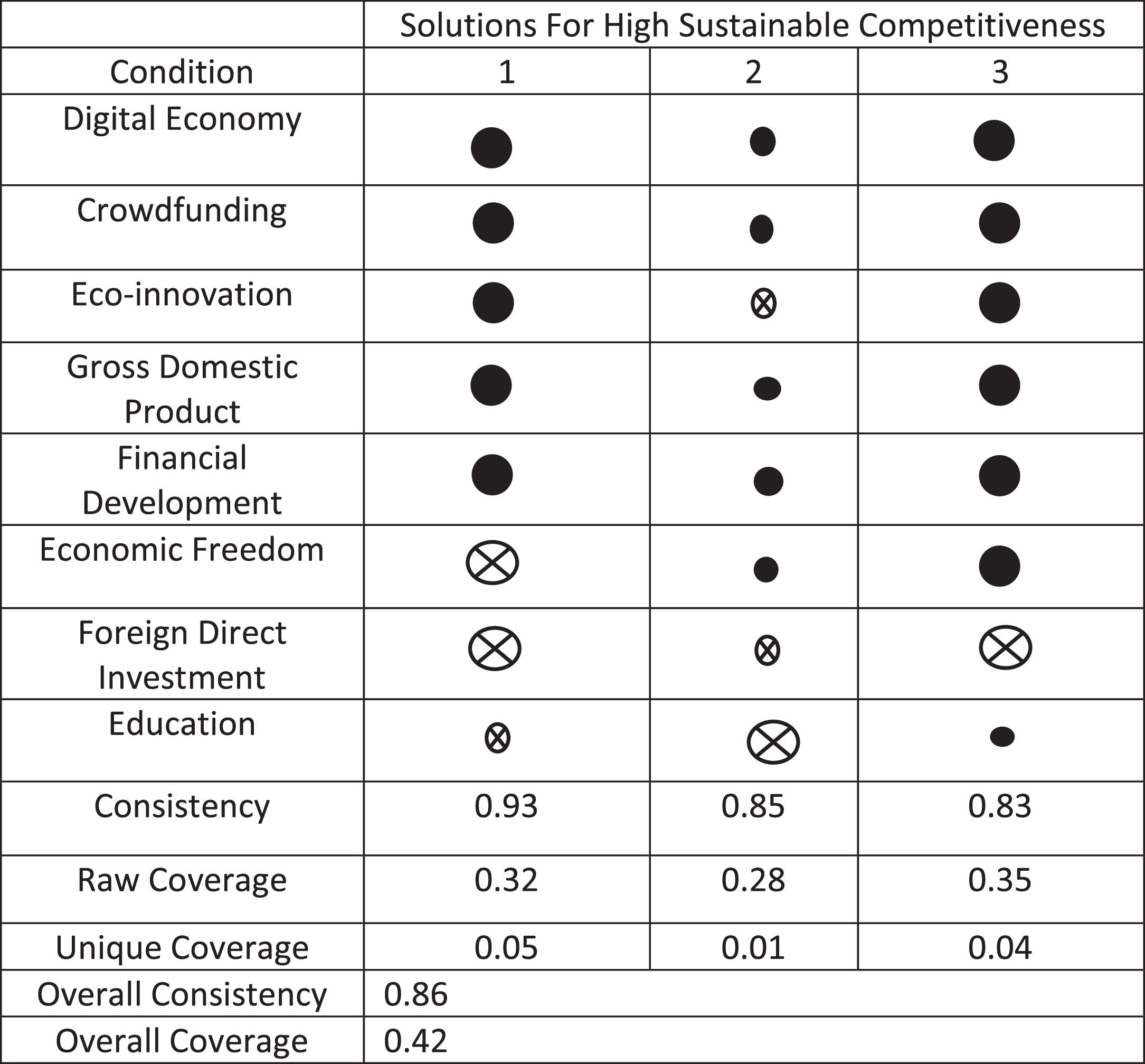

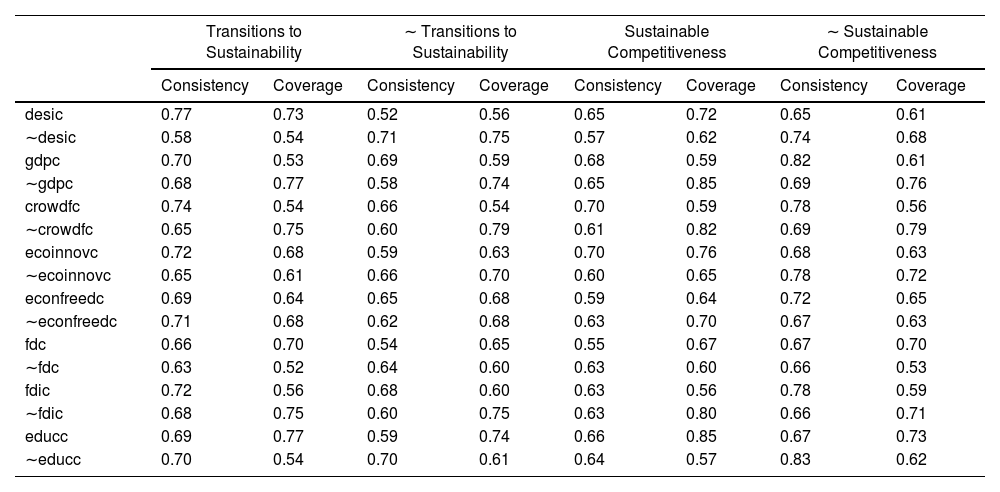

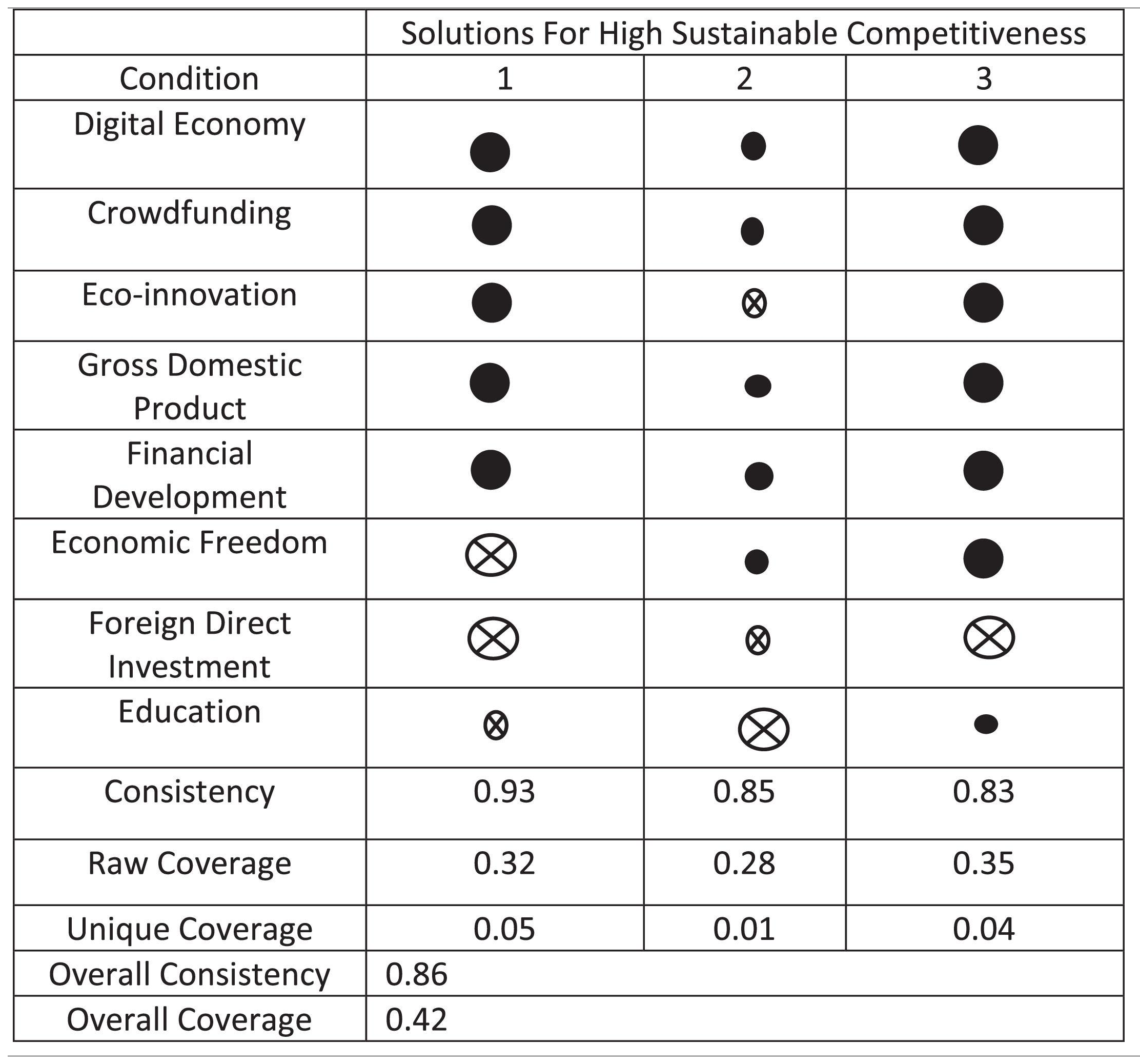

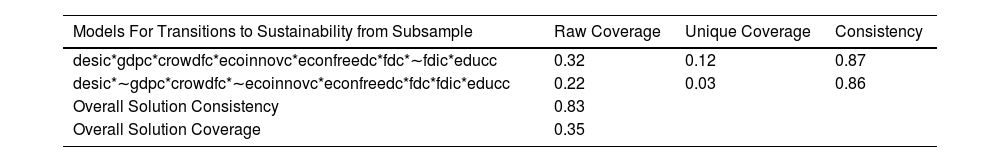

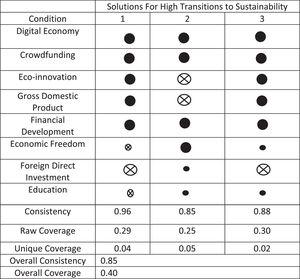

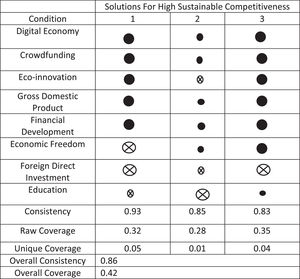

The results of the fsQCA analysis for the combinations generating high levels of transitions to sustainability and sustainable competitiveness are displayed in Tables 3 and 4. The solutions shown are the ones that have consistency values above 0.83 (Fiss, 2011). In each configuration, conditions could be present, present in negation form which indicates a low level, or absent, depending on how these conditions interact with each other. The relevance of each combination is depicted by the unique raw coverage, which reveals the proportion of the outcome of interest explained by a particular solution.

Solutions For High Transitions to Sustainability

Notes: The presence of a condition is presented by black circles, while the negation of a condition is denoted by circles with a cross sign (x). Core conditions and peripheral ones are indicated by large circles and small ones respectively. A blank space indicates that the condition can be either absent or present.

Solutions For High Sustainable Competitiveness

Notes: The presence of a condition is presented by black circles, while the negation of a condition is denoted by circles with a cross sign (x). Core conditions and peripheral ones are indicated by large circles and small ones respectively. A blank space indicates that the condition can be either absent or present.

Three combinations were determined to explain high sustainability transitions. The solutions presented in Table 3 have relatively high coverage with values ranging from 25 to 30 % and demonstrate a very good consistency with values exceeding 0.85. Further, three other combinations were depicted to explain high sustainable competitiveness. The solutions presented in Table 4 demonstrate also high coverage with values ranging between 28 and 35 % and high consistency with values above 0.85. Overall, the results displayed in Tables 3 and 4 indicate that all conditions are present or present in negation form in the 6 depicted solutions.

First, the results show that high digitalization is present in all combinations yielding high sustainability transitions and high sustainable competitiveness. These findings confirm that digitalization represents the most promising transformation for sustainability as argued by Gouvea et al. (2018), and align with the results of (Delgosha et al., 2021) who found that in order to reach moderate and high levels of sustainable competitiveness nations must have a high level of digitalization. Further, they advance previous studies by pointing to the major role played by digitalization in facilitating countries' sustainable economic, environmental, social, and governance transitions. They also help clarify the existing controversies concerning digitalization's social and environmental sustainability (Akande et al., 2019; Del Rio Castro et al., 2021; Kuntsman & Rattle, 2019), and support the twin transitions concept which considers that digital and green transitions go hand in hand (Dabbous et al., 2023).

Second, the findings indicate that high crowdfunding also appears in all configurations that explain high sustainability transitions and high sustainable competitiveness. Thus, the role of crowdfunding is not only limited to providing financing opportunities to individuals, small or innovative firms, entrepreneurs, or opportunities for open innovation (Testa et al., 2019), but it also helps in achieving higher and faster sustainability transitions and sustainable competitiveness. This result therefore, advances the argument of Petruzzelli et al. (2019) that crowdfunding can potentially increase the public's awareness regarding sustainability issues and lead to more sustainable behaviors among individuals, as it shows that crowdfunding actually contributes to sustainability transitions at all levels (economic, environmental, social and governance) and to sustainable competitiveness. Further, the study provides empirical evidence regarding the claim that crowdfunding supports the sustainability agenda that extends beyond encouraging renewable energy financing (Lam & Law, 2016).

Third, high financial development is present in all 6 solutions sufficient to achieve both high sustainability transitions and high sustainable competitiveness. This shows that a well-developed financial system appears as a major condition for sustainability. The result of the study aligns with the findings of Naqvi et al. (2023) who proved that financial development contributes to environmental sustainability as the financial sector can fund the production of energy from renewable sources, supports environmental initiatives, and grants credits that encourage green energy use among individuals. Moreover, these results align with Yu et al. (2023) who proved that financial development accelerates the flow of capital, promotes research and innovation and as such can support economic sustainability.

Fourth, high eco-innovation is present in two out of the three solutions explaining high sustainability transitions as shown in table 3, and also in two out of the three solutions explaining high sustainable competitiveness. While low eco-innovation is present in the remaining 2 combinations. This result confirms that eco-innovation does not only help to address environmental concerns through the creation of environmentally friendly products and processes (Padilla-Lozano & Collazzo, 2022), and contributes to sustainable development (Wu et al., 2022), but it is also becoming an inevitable factor to ensure sustainable social, economic and governance transitions. Further, despite the obstacles it faces notably in terms of regulatory frameworks and inadequate strategic orientation, eco-innovation contributes to sustainability as it helps in creating new market opportunities, especially in the field of renewable energy and the circular economy (Mady et al., 2023).

Fifth, high economic freedom is present in 4 out of the 6 solutions explaining high sustainability transitions and high sustainable competitiveness, and present in negation (low economic freedom) in 1 solution for high sustainability transitions and 1 solution for high sustainable competitiveness. This result aligns with the conclusions of Feruni et al. (2020) who found that economic freedom has a positive impact on economic development. The findings help to solve the controversies regarding the social impact of political freedom particularly since some advocate that economic freedom is harmful to human well-being, while others consider that extensive economic freedom protects societies from such damaging disruptions (Bjørnskov, 2016). Further, they support the argument advanced by Ofori et al. (2023) who considered that by encouraging entrepreneurship, private sector growth, and environmental consciousness, economic freedom positively contributes to environmental sustainability. Finally, they contradict Graafland (2019) who concluded that freedom from regulation decreases corporate environmental responsibility. These results highlight the importance of economic freedom to ensure sustainability transitions and sustainable competitiveness.

Sixth, high income is present in 5 out of the 6 solutions leading to high sustainability transitions and high sustainable competitiveness and present in negation (low income) only in 1 solution explaining high sustainability transitions. This result shows that countries with high income will have faster and higher sustainability transitions and will witness higher levels of sustainable competitiveness compared to those with lower income levels. This finding matches Despotovic et al. (2016) who found that sustainable competitiveness varies according to the development level of a country, and aligns with Hassan et al. (2020) who showed that countries with a higher income had lower levels of CO2 emissions over time.

Seventh, low foreign direct investment is present in 5 out of the 6 depicted solutions yielding high sustainability transitions and high sustainable competitiveness and present at high levels in 1 solution explaining high sustainability transitions. This result aligns with the strand of literature stating that the inflow of capital increases sustainable development (Odugbesan et al., 2022).

Finally, high education is present in 3 out of 6 solutions explaining high sustainability transitions and high sustainable competitiveness and present in negation (low education) in the remaining 3. It is therefore important to provide proper education for the population to ensure sustainability transitions and sustainable competitiveness. This result reveals that the significance of education extends beyond the mere conveyance of scientific information on environmental issues, rather it involves empowering learners (Howell, 2021). This will push them to adopt more environmentally friendly practices and will eventually lead to higher sustainable competitiveness and facilitate sustainability transitions.

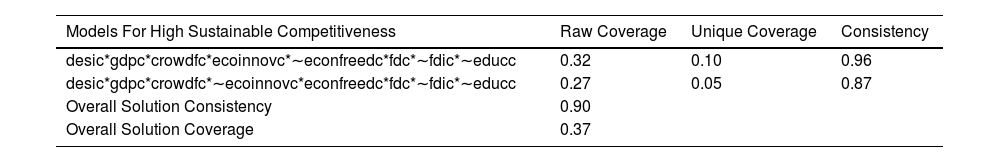

Predictive validity resultsPredictive validity analysis is conducted to assess if the models chosen can equally predict both high sustainability transitions and high sustainable competitiveness if another sample is taken (Pappas et al., 2016; Woodside, 2014). The results of the analysis conducted on subgroup 1 of the data are presented in Tables 5 and 6. The findings reveal that the pattern of the causal conditions obtained in the solutions depicted in subsample 1 is consistent. The overall solution consistency for configurations yielding high transitions to sustainability is 0.83 and the coverage is relatively high at 0.35. Further, the same result is indicated in Table 6 where the pattern of causal conditions explaining high sustainable competitiveness is also consistent for subgroup 1 of the data with an overall solution consistency of 0.9 and a relatively high coverage of 0.37. The results of the analysis conducted on subgroup 1 also match the ones obtained for the whole sample and exhibit the same patterns. For instance, for both sustainable competitiveness and sustainability transitions, high levels of digitalization, crowdfunding, and financial development are present in all 4 solutions presented in Tables 4 and 5, while eco-innovation is present in two out of four solutions, and present in negation in the remaining two.

Solutions for high transitions to sustainability for the subsample.

| Models For Transitions to Sustainability from Subsample | Raw Coverage | Unique Coverage | Consistency |

|---|---|---|---|

| desic*gdpc*crowdfc*ecoinnovc*econfreedc*fdc*∼fdic*educc | 0.32 | 0.12 | 0.87 |

| desic*∼gdpc*crowdfc*∼ecoinnovc*econfreedc*fdc*fdic*educc | 0.22 | 0.03 | 0.86 |

| Overall Solution Consistency | 0.83 | ||

| Overall Solution Coverage | 0.35 |

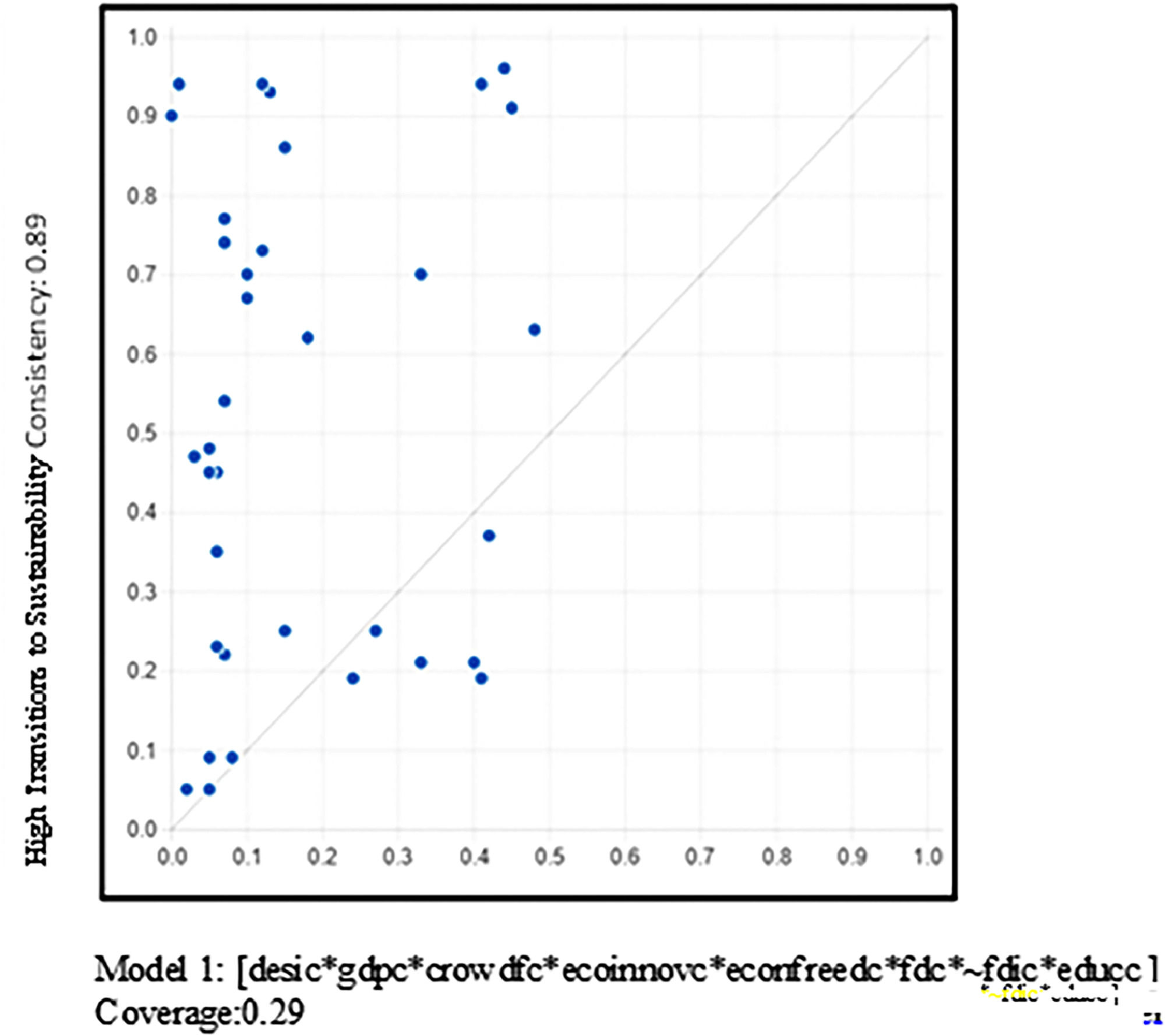

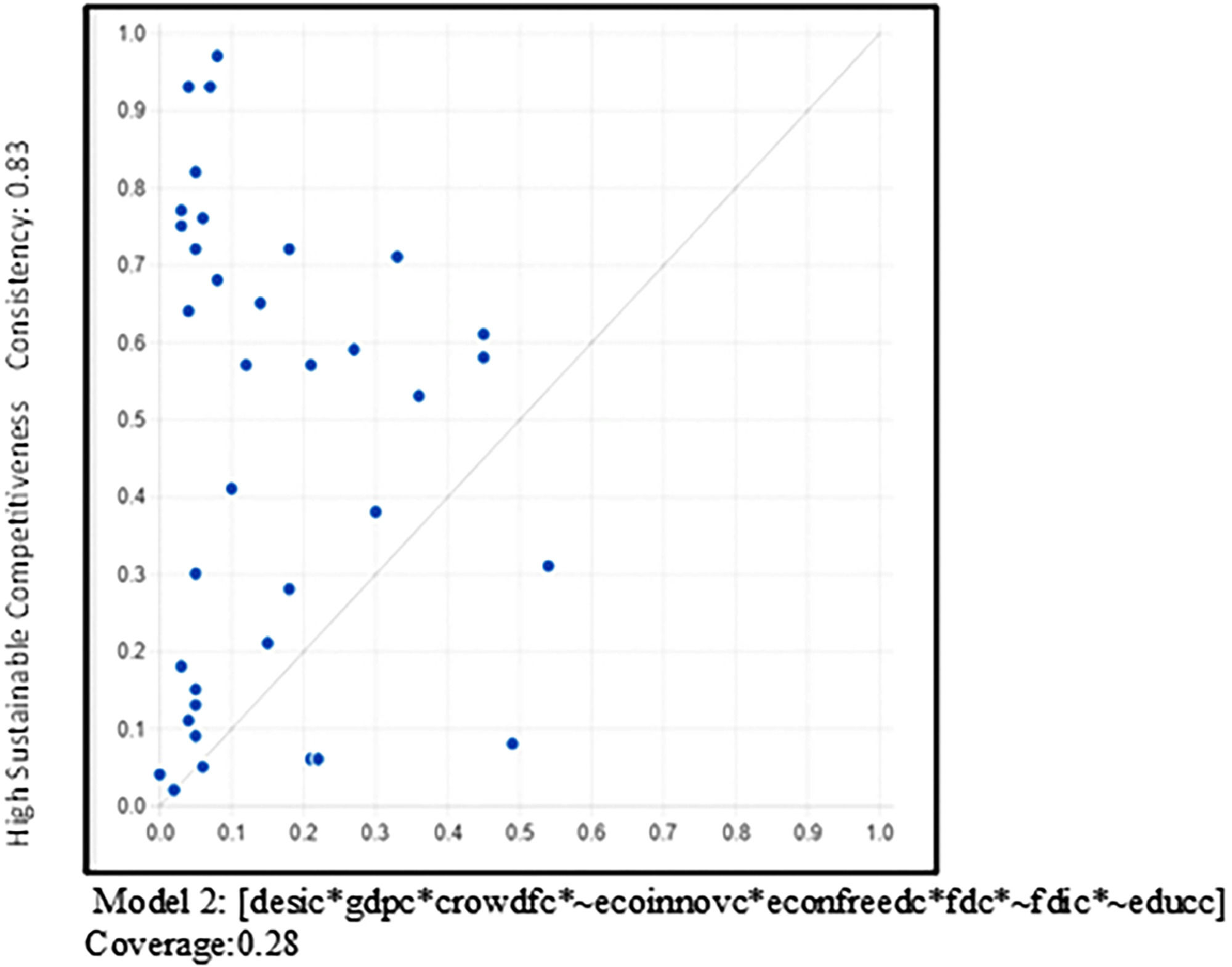

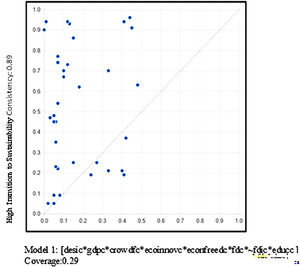

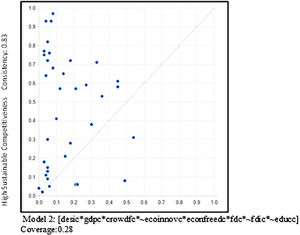

Each combination in Tables 4 and 5 represents a model that can be plotted against the outcome of interest in subsample 2 of the data. For brevity, the findings of model 1 in Table 5 and model 2 in Table 6 are tested again using data from subgroup 2. The results are presented in Fig. 2 for Model 1 [desic*gdpc*crowdfc*ecoinnovc*econfreedc*fdc*∼fdic*educc] and in Fig. 3 for Model 2

[desic*gdpc*crowdfc*∼ecoinnovc*econfreedc*fdc*∼fdic*∼educc]. The results show that both models demonstrate a high predictive ability for subgroup 2 of the data as evidenced by the values of consistency and coverage shown in Figs. 2 and 3.

Conclusion, implications, and limitations of the studyConclusionOver the years, sustainable competitiveness has been advocated as a means of achieving economic, environmental, and social changes that are necessary to maintain and generate wealth without diminishing natural and social capital. However, these changes require that countries move in a more sustainable direction, hence the need to also shed light on sustainability transitions. Within this study, a multi-level perspective was adopted to understand the complex micro, meso, and macro combinations that nurture sustainability transitions and lead to sustainable competitiveness. At the micro level, crowdfunding and eco-innovation are considered as disruptive practices that potentially contribute to sustainability. The former upscales and transforms financial regimes by enabling more user-led initiatives and supporting sustainability projects. While the latter promotes the development of new environmentally-friendly products and processes that efficiently drive energy transitions. At the meso level digitalization, financial development and economic freedom represent the existing systems that possibly nurture sustainability by promoting economic growth, advancing overall living standards, and improving the quality of the environment. At the macro level, income, education, and foreign direct investment are also investigated as probable contributors to sustainability as they elevate human capital, enhance economic activity, and increase investments. The study used the fsQCA approach to capture the possible configurations of the chosen factors that allow countries to achieve two outcomes: sustainability transitions and sustainable competitiveness. The findings show three configurations for each of the two outcomes. For both sustainable competitiveness and sustainability transitions, high levels of digitalization, crowdfunding, and financial development are present in all configurations. This shows their important contribution to sustainability as they appear essential for operating sustainability transitions and achieving sustainable competitiveness. Even though it is a novel concept, high eco-innovation is present in four out of six solutions, while it is present in negation (low levels) in the remaining two solutions. This points to the potential it holds in contributing to sustainability transitions and sustainable competitiveness.

Theoretical contributionsThe study offers several theoretical contributions. First, it adds to the literature tackling sustainability by adopting fsQCA which allows to identify both the necessary conditions and causal combinations needed to achieve high sustainability transitions and sustainable competitiveness. Second, it answers the call of Vial (2019) to develop new contributions aiming to explain the higher level influence of digital transformation by associating together the sustainability and digital transformation strands of literature. As such, this work contributes to analyzing this association at the macro level using an index of digitalization that covers several dimensions characterizing the digital economy and two indicators for sustainability that not only cover sustainable economic development but also show sustainable environmental, economic, social, and governance transitions. Additionally, the findings provide insights into the medium-term influence of digitalization on sustainability transitions and sustainable competitiveness by using data ranging from 2015 to 2018 and not cross-sectional data covering a single year. Third, this analysis opened a new line of research by offering the first empirical evidence on the influence of crowdfunding on sustainability transitions and sustainable competitiveness. It, therefore, adds to both the sustainability literature and links it to the alternative finance literature investigating the impact of crowdfunding on the economy, environment, and society and not only on one particular aspect such as renewable energy, entrepreneurship or inequality. Fourth, the results add to the literature investigating the influence of technological innovation on sustainability by showing that it is becoming necessary to differentiate between technological innovation in general and eco-innovation when exploring the influence of sustainability transitions and sustainable competitiveness.

Practical implicationsThe findings present policy implications for individuals, policymakers, and businesses. First, digitalization appears as the backbone for sustainability transitions and sustainable development. Policymakers and governments are urged to promote the development of the digital economy and to encourage businesses to adopt digital techniques for production, marketing, and sales. Second, regarding the crowdfunding results, they offer interesting insights. Over the years, most countries relied on traditional financial streams like capital markets or commercial banks to ensure the money needed to fund the development of clean technologies, foster governance, social equity, or the use of renewable energies. However, with the mounting challenges to ensure funds through traditional ways, crowdfunding appears as an alternate finance channel with a large potential to ensure high sustainability transitions and sustainable competitiveness. Thus, governments are advised to develop the necessary infrastructure and regulations needed to foster the use of crowdfunding. Third, recognizing the potential of crowdfunding for sustainability, policymakers should acknowledge its significance in facilitating sustainable projects and create a supportive environment for its widespread adoption. Essential measures include educating entrepreneurs on crowdfunding and guiding them on its effective utilization for financing their initiatives. Fourth, government and policymakers will have to continue their support for the traditional financial industry particularly since financial development is established as an important condition for promoting sustainability transitions and sustainable competitiveness. A well-developed financial system offers diverse financing methods as well as provides risk management tools for businesses and individuals to obtain their needed funds. Fourth, concerning eco-innovation policymakers are advised to design new strategies to foster eco-innovation and promote green technologies. Businesses can for instance diversify their use of technology by adding more eco-friendly technologies and channeling their money toward more investments in eco-innovation technological initiatives.

Limitations of the study and future research venuesThis research investigates the influence of digitalization, crowdfunding, eco-innovation, financial development, and economic freedom on sustainability transitions and sustainable competitiveness using a sample of 18 countries over a period of 4 years. The sample size is relatively small, however, the choice of countries and the time period was based on data available for digitalization and crowdfunding. Future studies can replicate this analysis by considering a larger number of countries and dividing the sample between developing and developed economies once data becomes available to check if the depicted solutions differ across countries with different income levels. Another limitation could be related to the use of fsQCA which does not allow the investigation of the influence of each factor individually but rather provides various combinations of causal conditions explaining the outcome of interest. Future studies can use different methods to explore the impact of the chosen factors on sustainability transitions and sustainable competitiveness thus complementing and extending the results of this work. Finally, One future line of research would be to explore the role of regulations concerning crowdfunding particularly since large differences are observed between several countries that applied specific regulations concerning equity crowdfunding (Hervé & Schwienbacher, 2019).

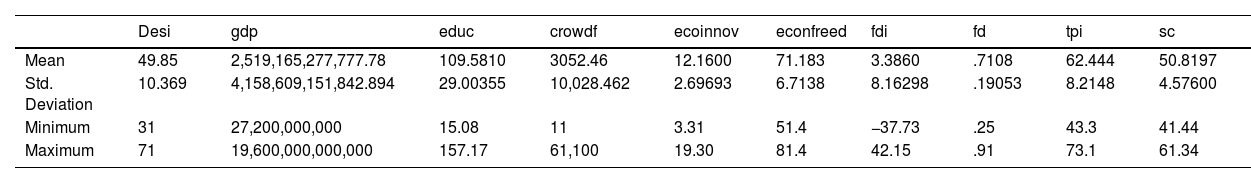

Descriptive statistics.

| Desi | gdp | educ | crowdf | ecoinnov | econfreed | fdi | fd | tpi | sc | |

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 49.85 | 2,519,165,277,777.78 | 109.5810 | 3052.46 | 12.1600 | 71.183 | 3.3860 | .7108 | 62.444 | 50.8197 |

| Std. Deviation | 10.369 | 4,158,609,151,842.894 | 29.00355 | 10,028.462 | 2.69693 | 6.7138 | 8.16298 | .19053 | 8.2148 | 4.57600 |

| Minimum | 31 | 27,200,000,000 | 15.08 | 11 | 3.31 | 51.4 | −37.73 | .25 | 43.3 | 41.44 |

| Maximum | 71 | 19,600,000,000,000 | 157.17 | 61,100 | 19.30 | 81.4 | 42.15 | .91 | 73.1 | 61.34 |

Values used in calibration.

| Percentiles | desi | Gdp | educ | crowdf | ecoinnov | econfreed | fdi | fd | tpi | sc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 5 | 34.00 | 29,580,000,000 | 15.8303 | 16.30 | 7.0085 | 56.565 | .0168 | .2600 | 43.965 | 44.4751 | |

| 50 | 50.00 | 1,465,000,000,000 | 104.2196 | 282.50 | 12.1450 | 73.500 | 2.6928 | .7600 | 64.400 | 51.0139 | |

| 95 | 66.05 | 18,340,000,000,000 | 153.3458 | 30,535.00 | 17.5925 | 80.510 | 16.8288 | .9000 | 72.705 | 59.8026 | |