Foreign direct investment (FDI) is of great significance to the economic development of developing countries; it infuses capital into enterprises, while propeling both technological advancement and economic efficiency. We examine whether zombie enterprises crowd out FDI inflows and whether the institutional environment can alleviate this effect. Using the Chinese Industrial Enterprise Database from 2003 to 2013 to calculate zombie shares at the prefecture-level cities and applying the OLS and instrumental variable estimation, we find that the larger the zombie shares, the less FDI inflows. That is, zombies do crowd out FDI inflows—a finding robust to specifications. We also find that the geographical advantage and greater openness to the outside world can alleviate the crowding-out effect. Further, we investigate the moderating effect of the institutional environment on the crowding-out effect. We find that market segmentation and government corruption will aggravate the crowding-out effect while strengthening intellectual property protection, improving the trust environment, and factor market development will alleviate it. Overall, our study explains impediments to FDI inflows by accounting for zombie enterprises. It provides insights for local governments seeking to clean up zombies and strengthen the institutional environment to attract FDI inflows.

Since the Chinese Economic Reform that began in the 1970s, foreign direct investment (FDI) has driven the national economy. FDI from advanced economies improves technological innovation as well as organizational and managerial skills; these transformations stimulate domestic investment, and have guided China's economic construction (Cheung & Ping, 2004; Fernandes & Paunov, 2012; Fu, 2008; Lu et al., 2017). Attracting and utilizing foreign investment is now a basic state policy of China's economic liberalization; it forms the crucial content for building a new open economy. Attracting foreign capital inflows has long been an essential concern in academia and policymaking, especially since China's economic downturn, which has slowed the influx of foreign capital. In addition, there is also significant regional heterogeneity in the distribution of foreign investment; one argument is that the institutional environment, agglomeration effect, market scale, geographical location, and production cost are essential factors affecting the location choice of FDI (Belgibayeva & Plekhanov, 2019; Boermans et al., 2011; Fetscherin et al., 2010; Krifa-Schneider & Matei, 2010). In this study, we intend to explain the differences in the regional distribution of FDI by accounting for zombie enterprises.

Zombie enterprises, often characterized by their poor earnings, persist by relying on low-interest bank loans and government subsidies (Banerjee & Hofmann, 2022; Caballero et al., 2008; Nie et al., 2018). These entities are believed to have played a pivotal role in the protracted economic stagnation from the 1990s to the early 21st century—called The Lost Decades—in Japan (Caballero et al., 2008; Fukuda & Nakamura, 2011; Hoshi & Kashyap, 2010). In response to the COVID-19 pandemic, the government's large-scale stimulus plan further promoted the recovery of zombies—a contentious point of discourse in academia (Acharya et al., 2020; Banerjee & Hofmann, 2022; Hoshi et al., 2023).

Zombie enterprises occupy many scarce factors (i.e., resources), such as capital, land, and labor, which affects the functioning of the market mechanism, distorts the effective allocation of resources, and damages the business operations of normal enterprises (Acharya et al., 2020; Banerjee & Hofmann, 2022; Caballero et al., 2008; Li et al., 2018; McGowan et al., 2018; Ren et al., 2023a; Ren et al., 2023b; Shen & Chen, 2017). The persistent existence of these zombies is a symptom of a poor institutional environment and prognosticates a worsening business environment in the region (Ren et al., 2023b; Wang & Liu, 2018). We thus pose a simple question: Do zombie enterprises crowd out FDI inflows and does improving the institutional environment alleviate this crowding out?

FDI has high requirements on the operating environment of its target market, and a well-developed market environment can strengthen the protection of corporate property rights, reduce operating costs, and improve corporate operating efficiency, which, together, should attract more FDI inflows (Dikova & Van Witteloostuijn, 2007; Fetscherin et al., 2010; Paul & Feliciano-Cestero, 2021). However, zombies occupy scarce factor resources, distort resource allocation efficiency, damage normal business operations, and worsen the regional institutional environment, which may crowd out FDI inflows and cause differences in the regional distribution of FDI. In response, the Chinese government has repeatedly emphasized the need to "clean up" zombie enterprises to create a sound business investment environment that attracts FDI inflows.1

In this study, we extract data from the Chinese Industrial Enterprises Database (CIED) to identify and calculate the share of zombie enterprises from 2003 to 2013 at the prefectural city level. As noted earlier, we wish to answer whether zombie enterprises crowd out FDI inflows empirically. The results confirm that the greater the share of zombies at the prefectural city level, the lesser the FDI inflows. Our results suggest that the negative impact of zombie enterprises on normal business operations and the regional institutional environment will also hinder FDI from entering the local market. We also find that geographical advantages and increased openness to the outside world alleviate zombie enterprises' crowding-out effect.

Since zombie enterprises harm the regional operating environment and crowd out FDI inflows, a natural question is whether improving the regional institutional environment alleviates this effect. Our further research reveals that market segmentation and political corruption exacerbate the crowding-out effect of zombies, while enhanced intellectual property protection, improved trust environment, and factor market development alleviate it. Thus, improvements in the institutional environment can mitigate the negative effects of zombie enterprises.

Our research contributes to the literature as follows: First, most research on FDI and location selection theory mainly focuses on the economic environment, agglomeration effects, market size, geographic location, and labor costs (Belgibayeva & Plekhanov, 2019; Boermans et al., 2011; Fetscherin et al., 2010; Krifa-Schneider & Matei, 2010). We measure the regional business investment environment based on the share of zombies at the prefectural city level to study their negative effect on FDI. Our work thus complements the literature on factors affecting FDI. Second, extant research on the damaging effect of zombies focuses on enterprise investment and financing, technological innovation, and employment (Caballero et al., 2008; McGowan et al., 2018; Ren et al., 2023a; Tan et al., 2017; Wang et al., 2018). We argue that the negative effects of zombies on business operations and, in particular, the long-term existence of such enterprises on the business environment also crowd out FDI inflows. This result enriches the literature on the economy-comprising effects of zombies. Finally, we enrich the literature on institutional environment and enterprise development. Much of the extant research argues that strengthening the institutional environment can optimize the regional business environment and attract enterprises from other regions to enter the local market (Bhasin & Garg, 2020; Cai et al., 2019; Du et al., 2012; Zhang & Kim, 2022). We find that the regional institutional environment is essential in mitigating the negative impact of zombies on the one hand and allowing entry of foreign investments on the other. We thus confirm that the construction of the regional institutional environment is crucial to economic development, especially in a transition economy.

The remaining paper proceeds as follows. Section 2 presents the literature review and research hypotheses; section 3 presents the data and empirical model; section 4 reports the results and robustness tests; section 5 further analyzes the location advantage and the institutional environment on the crowding-out effect; section 6 concludes.

Literature review and hypotheses developmentZombie enterprises and economic damageZombie enterprises, defined as financially nonviable companies, heavily depend on preferential bank loans or government subsidies to sustain their existence (Banerjee & Hofmann, 2022; Caballero et al., 2008). They have been implicated in The Lost Decades in Japan (Caballero et al., 2008; Fukuda & Nakamura, 2011; Hoshi & Kashyap, 2010), Europe's slow recovery from the 2008 financial crisis (Acharya et al., 2020, 2019; Banerjee & Hofmann, 2022), and overcapacity issues in China (Nie et al., 2018; Shen & Chen, 2017). Their emergence is attributed to various factors, including large-scale stimulus packages (Acharya et al., 2019; Fukuda & Nakamura, 2011), incentives for banks to manage non-performing loans (Caballero et al., 2008; Fukuda & Nakamura, 2011), collusion between government and enterprises (Chang et al., 2021; Nie et al., 2018; Zhang et al., 2020), and lax regulatory policy (Acharya et al., 2019). The adverse impacts of zombie enterprises on business operations and economic development have garnered increasing attention from both academia and the general public.

Zombies persist in the state of being "stiff but not lifeless," seizing a substantial share of scarce resources, including capital, labor, and technology. This not only exacerbates the misallocation of resources but also reduces the overall efficiency of resource allocation, leading to increased financial burdens and tax costs for healthy enterprises. The long-term existence of zombies in the market further deteriorates the regional business environment, as shown by insufficient investment and low productivity of normal enterprises (Caballero et al., 2008; Li et al., 2018; McGowan et al., 2018; Tan et al., 2017; Wang et al., 2018)

Caballero et al. (2008) explain that, during The Lost Decades of the Japanese economy, zombies occupied a large number of scarce credit resources, which crowded out the investment of normal firms and damaged Japan's total factor productivity. Ren et al. (2023a) similarly argue that zombies in China occupy scarce resources and increase the financing costs and constraints of normal enterprises; their long-term existence ultimately damages the market competition environment, which crowds out fixed asset investments in normal enterprises. The existence of zombies also affects the flow of resources across regions. Caballero et al. (2008) and McGowan et al. (2018) explain that since zombies can obtain credit subsidies from banks or the government, their operating costs are relatively low, and they can increase industry thresholds by increasing employee wages and reducing product prices to prevent potential entrants. Ren et al. (2023b) further document that zombies inhibit off-site companies from setting up local subsidiaries, thereby hindering the cross-regional flow of resources; they confirm the role of the institutional environment in alleviating this hindering effect.

Factors affecting FDI location choiceFDI plays a pivotal role in China's economic development and growth, but its distribution is characterized by regional heterogeneity. Most studies on FDI location selection primarily take four perspectives: First, economic agglomeration and economic scale. The learning effect and knowledge spillover from economic agglomeration and economies of scale make it easier for enterprises to obtain knowledge at a lower cost, cultivate and attract a large professional labor force, reduce transaction costs, and thus attract FDI inflows (Boermans et al., 2011; Kim & Aguilera, 2016; Li & Park, 2006; Myles Shaver & Flyer, 2000). He (2002) argues that since foreign investors suffer from adverse information asymmetry and face internal and external uncertainties in host economies, they are inclined to favor such locations that minimize information costs and offer a variety of agglomeration economies.

Second, human resources and labor costs. Salike (2016) points out that foreign investors value the availability of human resources in terms of the health of the labor force and the quality of labor working in scientific and technical fields; these are considered critical factors in investment decision-making. There is no scholarly consensus on the impact of labor costs on FDI, given lower labor costs can reduce business operating costs and attract FDI inflows; however, higher wages may reflect stronger labor productivity and market potential and attract foreign enterprises that require high skills (Donaubauer & Dreger, 2018).

Third, geographic location. Geographic location can reduce transportation costs and increase the speed of information transmission; thus, foreign capital tends to flow into coastal port cities or special economic zones open to the outside world (Boermans et al., 2011; Cassidy & Andreosso-O'Callaghan, 2006; Dunning, 2009; Li & Park, 2006).

Fourth, institutional environment. Improving the institutional environment can create a favorable investment environment, optimize resource allocation efficiency, reduce transaction costs, and protect property rights, all of which serve to attract FDI (Bhasin & Garg, 2020; Zhang & Kim, 2022). Du et al. (2012) find that foreign enterprises in regions that are culturally different from China often exhibit strong aversion toward regions with a weaker institutional environment. That is, the institutional environment is a critical factor affecting FDI inflows.

Clearly, the extant research on zombies focuses on their causes and impact on macroeconomic development and micro-business operations. Their effect on enterprise investment is limited to fixed asset investment, cross-regional investment, and enterprise innovation, while even fewer studies examine their crowding-out effect on FDI inflows. Multiple factors affect the location choice of FDI—a driving factor of China's economy—and these include market size, infrastructure development, and institutional factors of potential target markets. The negative impact of zombies on business operations and the regional institutional environment may also crowd out FDI inflows.

Hypothesis developmentIn China, administrative interventions by local governments have encouraged the emergence and long-term existence of zombie enterprises; the share of zombies at the prefectural city level represents the institutional environment of the region to a certain extent as well (Nie et al., 2018; Qiao & Fei, 2022; Shen & Chen, 2017; Wang & Liu, 2018). We argue that the negative effects of zombies on business operations and the damage they cause to the institutional environment will also crowd out FDI inflows.

Firstly, zombie enterprises' damage to normal enterprises may crowd out FDI inflows. The persistent presence of zombies in the marketplace not only allows them to seize a significant share of scarce resources, including capital, land, and labor, but also severely disrupts the proper operation of market mechanisms. This distortion disrupts the efficient allocation of resources, adversely affecting the productivity and performance of normal enterprises. For example, the monopolization of limited resources intensifies financial constraints and raises the costs of funding for normal enterprises, which, in turn, suppresses their investments, stifles their innovation, and hinders their growth and development (Caballero et al., 2008; Ren et al., 2023a; Shen & Chen, 2017; Tan et al., 2017; Wang et al., 2018). Liu et al. (2019) contend that the preferential loans acquired by zombies come at the expense of heightened financing costs, including tax burdens (Li et al., 2018), for normal enterprises. Zombies will also crowd out normal employment opportunities and obstruct the free flow of labor. McGowan et al. (2018) argue that zombies can reduce the employment opportunities of normal enterprises, reduce new job creation, obstruct the free flow of labor, and limit the expansion of normal enterprises. This negative impact of zombies on business operations, financing costs, and labor may crowd out FDI inflows.

Secondly, the long-term existence of zombie enterprises not only reflects the poor institutional environment but also worsens the business environment in the region, thus crowding out FDI inflows. Since the preferential loans and government subsidies obtained by zombies are at the cost of increased operating costs of normal enterprises, the former's existence disrupts the market order, damages industry competition, inhibits the emergence of new enterprises, and hinders foreign enterprises from entering the local market (McGowan et al., 2018; Ren et al., 2023b; Shen & Chen, 2017; Wang & Liu, 2018). McGowan et al. (2018) insist that the presence of zombies exacerbates the productivity gap between these entities and their non-zombie counterparts. This effect is more pronounced for young enterprises; that is, newcomers must clear higher productivity barriers to compensate for lower market profit margins. This situation inadvertently erects formidable entry barriers for non-local enterprises. Ren et al. (2023b) similarly observe a decline in the establishment of off-site subsidiaries in regions with a higher prevalence of zombies, confirming that zombies hinder foreign enterprises from entering the local market. The quality of a region's institutional environment is an essential factor affecting FDI inflows (Bhasin & Garg, 2020; Cai et al., 2019; Du et al., 2012; Zhang & Kim, 2022). Based on the above analysis, we argue that zombies damage the regional institutional environment, which crowds out FDI inflows.

H1. Under certain other conditions, prefectural cities with a higher proportion of zombie enterprises have lower FDI inflows.

The eclectic theory of international production proposed by Dunning (1977) points out that location advantage is an essential factor in promoting enterprises' cross-regional operations. FDI tends to flow into regions with geographical advantages and well-developed institutional environments. These advantages, such as proximity to ports, can reduce transportation costs, increase information transmission speed, improve the operating efficiency of the enterprise, and enhance return on investment (Boermans et al., 2011; Cassidy & Andreosso-O'Callaghan, 2006; Dunning, 2009; Li & Park, 2006). Indeed, China's miraculous liberalization began from its coasts; thus, policy preferences, advanced infrastructure, and cost-cutting information networks will also attract FDI to such regions(Li & Park, 2006). We argue that geographic advantages may reduce the negative impacts of zombies, and thus attract FDI inflows.

H2. Under certain other conditions, advantages of geographic location can alleviate the crowding-out effect of zombie enterprises.

The factor of institutional environment critically affects FDI location selection, and a well-developed market environment can attract FDI inflows (Dikova & Van Witteloostuijn, 2007; Fetscherin et al., 2010; Paul & Feliciano-Cestero, 2021). Blonigen (2005) asserts that the host country's institutional environment, which includes strong protection of property rights and intellectual property rights, reduces the risk of asset deprivation and infringement of intellectual property rights, which, in turn, attracts investments from high-tech foreign firms. A solid institutional environment will also reduce enterprises' transaction costs and the negative impacts of political corruption and rent-seeking issues. Krifa-Schneider and Matei (2010) and Belgibayeva and Plekhanov (2019) confirm that corruption inhibits FDI inflows but improves the political environment in the host country; the resulting environment is conducive to foreign capital. Awokuse and Yin (2010) and Hsu and Tiao (2015) argue that strengthening intellectual property rights also attracts more FDI, and improving the institutional environment can inhibit the emergence of zombies and reduce their negative impact on enterprise development and economic growth (Chang et al., 2021; He et al., 2020). Ren et al. (2023a) document that improving the institutional environment will alleviate the crowding-out effect of zombies on the fixed asset investment of normal enterprises. Moreover, Ren et al. (2023b) further argue that zombies create entry barriers for non-local enterprises and hinder the free flow of resources; however, a sound institutional environment and informal institutions can alleviate these entry barriers. Based on the above analysis, we propose hypotheses 3 and 4.

H3. A poor institutional environment will exacerbate the crowding-out effect of zombie enterprises.

H4. A well-developed institutional environment will alleviate the crowding-out effect of zombie enterprises.

Data, variables, and designDataWe use the CIED to identify zombies and calculate their share at the prefectural city level.2 This dataset is drawn from the National Bureau of Statistics Enterprise Data Set for 2002–2013,3 the annual survey of which comprehensively encompasses state-owned and large and medium-sized non-state enterprises, rendering the CIED highly representative. It has become a widely utilized basic microdata source for domestic and international scholars investigating China's various economic and financial aspects. The database has also been used to analyze China's zombification problem (Chang et al., 2021; Geng et al., 2021; Ren et al., 2023a; Ren et al., 2023b; Shen & Chen, 2017). We sorted the database following Brandt et al. (2012) and used this database to calculate the proportion of zombies at the prefectural city level.

The dependent variable, FDI, and the control variables were obtained from the CIED China Research Database. Since most of the data on the economic development of prefectural municipalities are published from 2003, our data period for empirical analysis is from 2003 to 2013. Importantly, owing to the errors in the CIED in 2010, we refer to the existing literature (Nie et al., 2018; Ren et al., 2023a; Ren et al., 2023b; Tan et al., 2017) and regard 2009 and 2011 as two consecutive years to identify zombies. If the data from 2010 are omitted from the empirical analysis, the sample may be missing, resulting in a biased estimation. To counter this, we used the average proportion of zombies in 2009 and 2011 to replace the missing sample in 2010. In the robustness test, we exclude the 2010 data and test the main regression results for robustness.

Variable descriptionZombie enterprise shares at the prefectural city levelWe adopt the methodologies employed by Caballero et al. (2008) and Fukuda and Nakamura (2011) to identify zombies. The identification process unfolds as follows: First, we compute the minimum annual interest payment for each enterprise annually following Caballero et al. (2008) (from here on, the "CHK method").4

Eq. (1) computes each enterprise's annual minimum interest payment (R*). We then compare the actual interest expense (R) and the calculated interest expense (R*) that the enterprise should pay based on the minimum interest threshold. If R is less than R*, the enterprise has obtained a credit subsidy from the bank, and we identify it as a zombie; otherwise, it is a normal enterprise.

Second, we calculate for the CHK method. Note that some scholars contend that the CHK method may erroneously categorize certain healthy businesses as zombies. To address this issue, Fukuda and Nakamura (2011) (from here on, "FN") introduce two critical adjustments—the "profitability criteria" and "continuous borrowing criteria"—which incorporate additional metrics, such as earnings before interest and taxes (EBIT) and liability ratios into their CHK–FN method for a more refined identification of zombies.5Tan et al. (2017) point out that, owing to the influence of government intervention and other factors, the EBIT of Chinese enterprises includes non-operating income and government subsidies, and the effect of this factor needs to be eliminated when calculating the actual profits. They propose using operating profit instead of EBIT. Following Tan et al. (2017), we use operating profit, but add the profitability and continuous borrowing criteria to modify the zombie enterprise identification index based on the CHK method. We record the zombies thus identified as zomtan.

Third, we calculate the proportion of zombies at the prefectural city level. To consider the impact of the scale of zombies, we calculate the share of zombies weighted by the assets and liabilities, which are recorded as zomtana and zomtanlev, respectively.

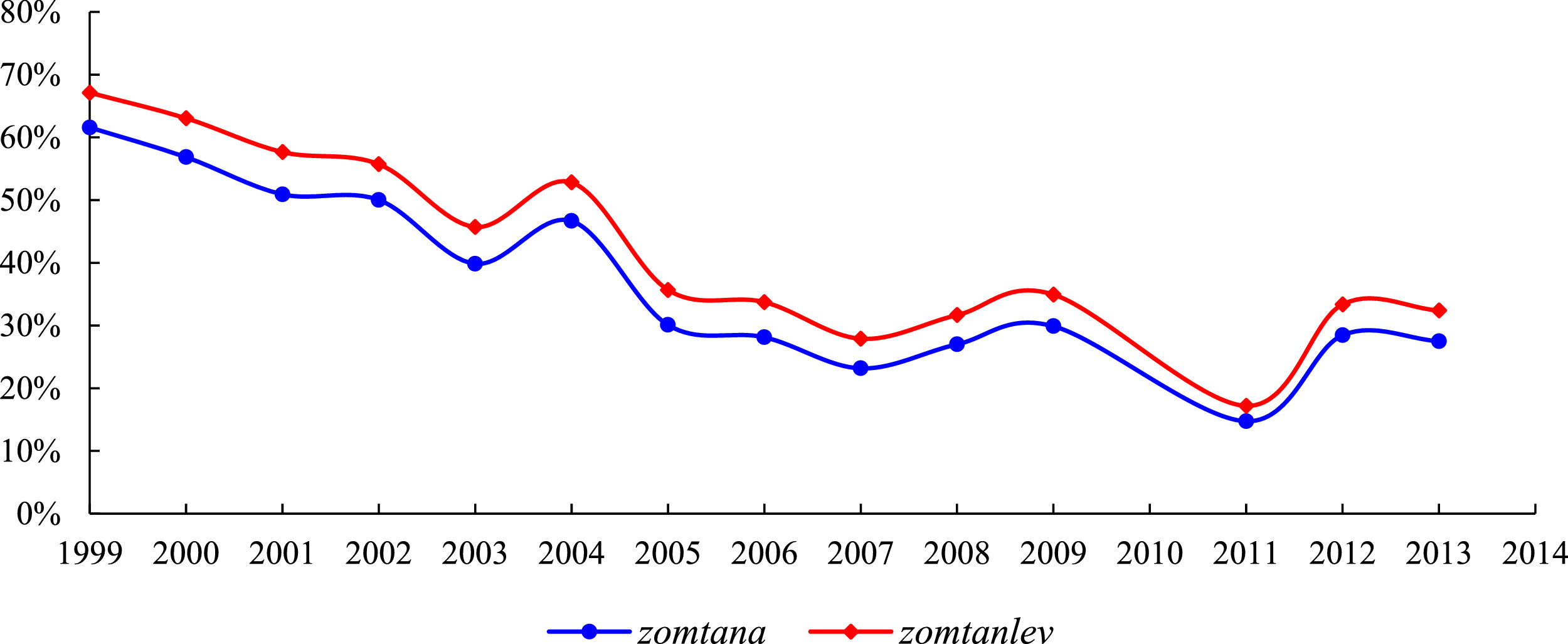

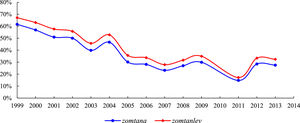

Distribution characteristics of zombie enterprisesAfter identifying the zombies, we calculate the distribution characteristics of the zombies by year, enterprise type, and industry, as shown in Figs. 1, 2, and 3, respectively. The curves of zomtana and zomtanlev in Fig. 1 denote the average proportion of zombies weighted by assets and liabilities at the prefectural city level, respectively.6 During the sample period, China faced severe zombification issue. Still, on the whole, Chinese zombies showed a downward trend from 2004 to 2007, mainly because of rapid economic development at the time. After 2007, the share of zombies increased as an effect of the 2008 financial crisis. After 2011, China's economic growth slowed, and the share of zombies increased again. This trend is consistent with the results of Ren et al. (2023a) and Nie et al. (2018). Thus, our method of identifying zombies is reasonable.

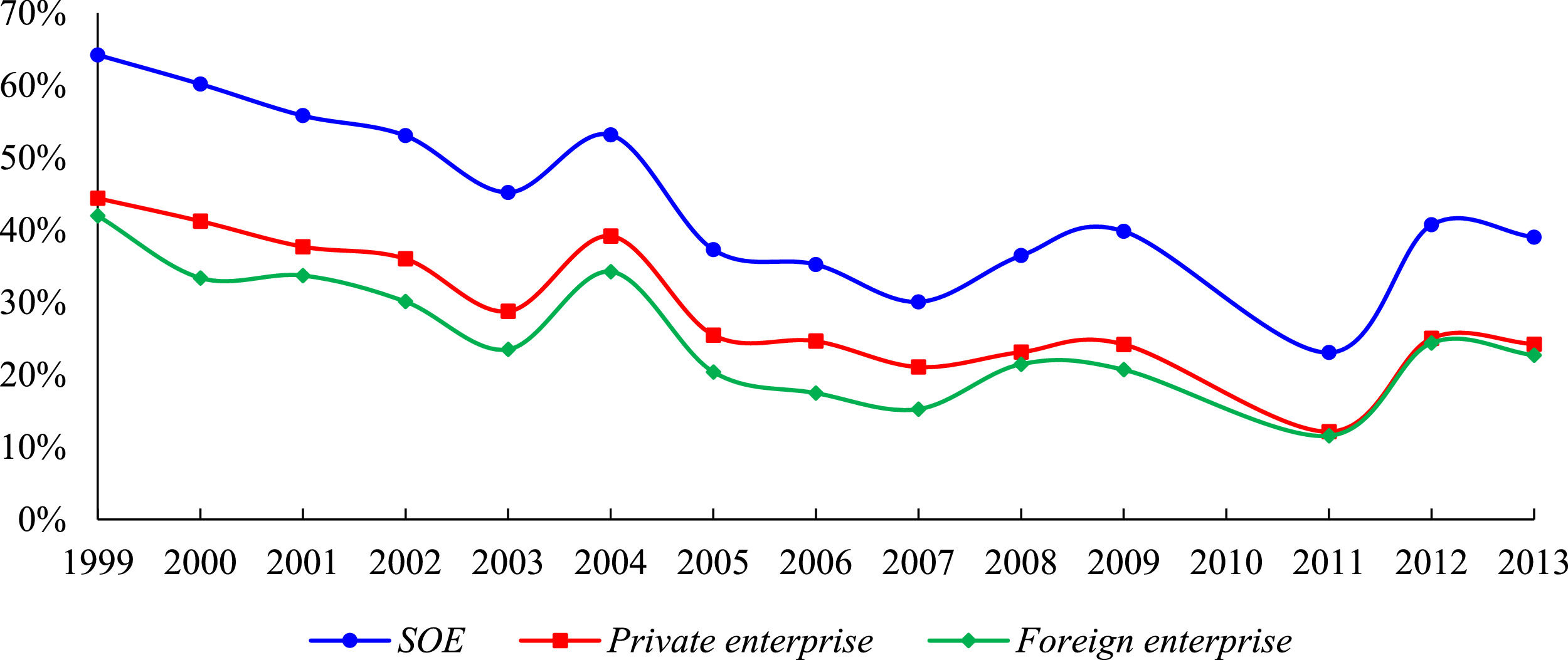

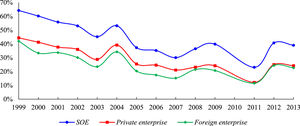

Fig. 2 shows the distribution of zombies by type of enterprise from 2003 to 2013. We divide the sample into three categories—state-owned enterprises, private enterprises, and foreign enterprises—based on the enterprises' registration type in the CIED. Their curves on the graph respectively represent the share of zombies of state-owned enterprises, private enterprises, and foreign enterprises weighted by assets each year. State-owned enterprises have the highest share of zombies, mainly because these enterprises are protected by the government and face a soft budget constraint, which allows them to maintain a "rigid but not dead" condition (Qiao & Fei, 2022; Shen & Chen, 2017). Before 2009, foreign enterprises' share of zombies was lower than that of private enterprises; after 2009, they were nearly the same.

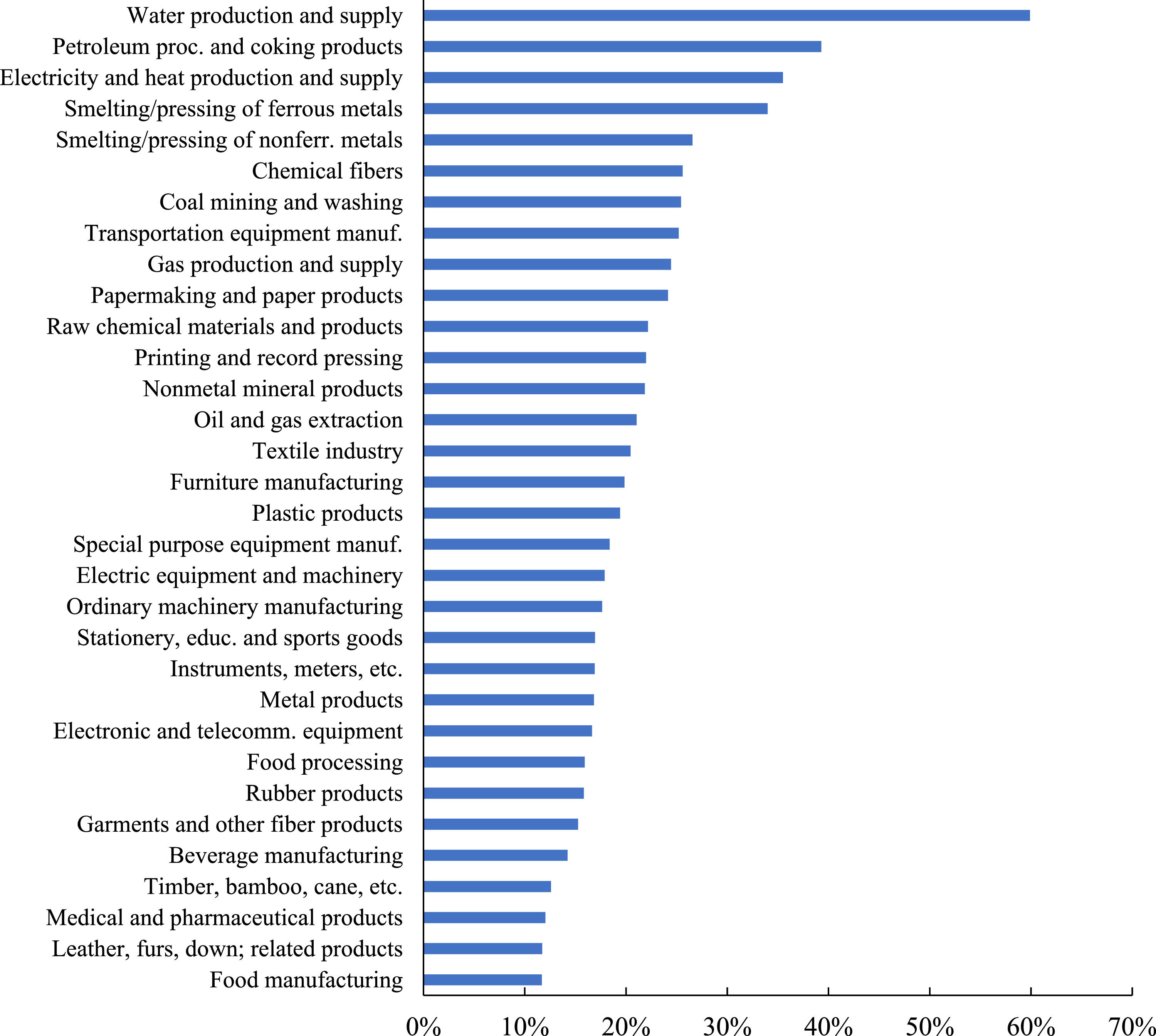

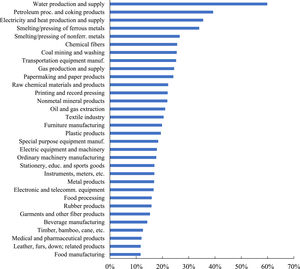

Fig. 3 further lists the distribution of zombies by industry from 2011 to 2013. The water production and supply (59.89 %), petroleum proc and coking products (39.29 %), electricity and heat production and supply (35.49 %), and smelting/pressing of ferrous metals (33.97 %) industries have more than 30 % share of zombies. The public utility industry (the water production and supply industry and the electricity and heat production and supply industry) aims to meet people's basic living needs. It has lower profitability and relies on subsidies from the government and banks to survive. However, some base industries, such as the petroleum proc and coking products industry and other top-ranked primary industries have strong cyclical characteristics and a high share of zombies from 2011 to 2013.

Empirical designWe apply the regression below to explore whether zombies crowd out FDI inflows. In model (2), i, j, and t represent the city, province, and year, respectively. To reduce the endogenous impact, we lag the share of zombies at the prefectural city level and the control variables by one period. The dependent variable is FDI, obtained from the CIED China Economic Research Database for 2003 to 2013. We take the logarithm of the actual amount of FDI inflows at the prefectural city level to measure the amount of FDI (FDI) in that year. The independent variable zomtan is the proportion of zombies at the prefectural city level. CityCtrl and InsCtrl represent control variables at the prefectural and institutional levels.

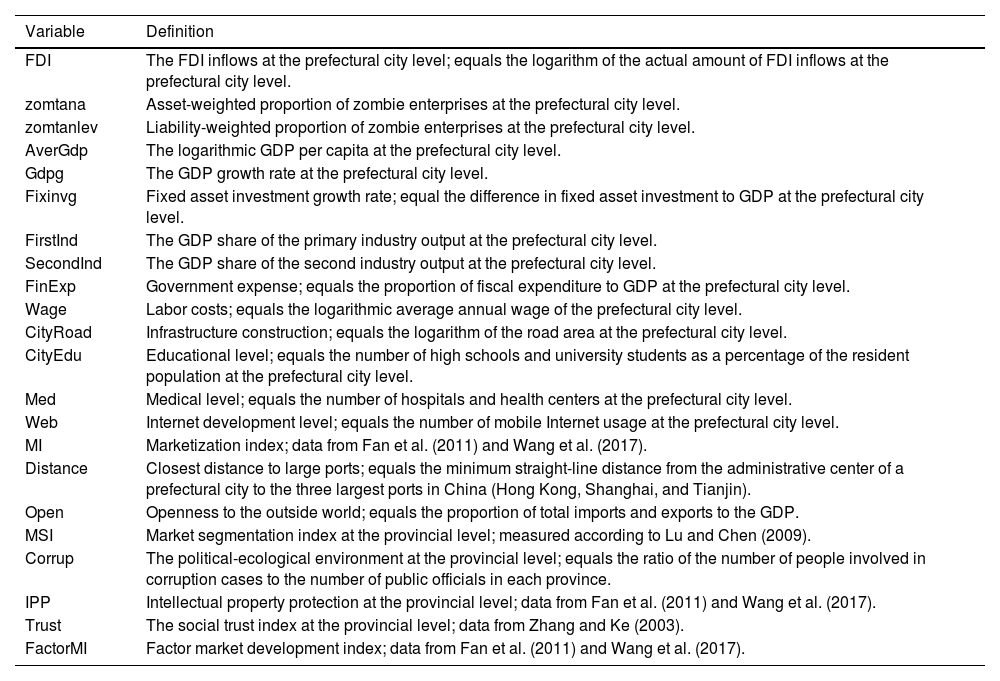

Following Fetscherin et al. (2010) and Blonigen and Piger (2014), we choose the following control variables that may influence FDI: market size (AverGdp) and market potential (Gdpg), fixed asset investment growth rate (Fixinvg), industrial structure (FirstInd and SeondInd), and government expense (FinExp). We also include the average wage (Wage) and education level (CityEdu) at the prefectural level to control for labor force effects (Donaubauer & Dreger, 2018). Infrastructure construction is also the main factor affecting FDI inflows (Dunning, 1977; Gong, 1995). We control for road area (CityRoad), medical care (Med), and Internet penetration level (Web) in model (2). We also control for the impact of the institutional environment on FDI inflows, and we use the marketization index (MI) proposed by Fan et al. (2011) and Wang et al. (2017) as a proxy. Finally, we include the year (ϕt) and province fixed effect (μj) in model (2). Appendix 1 (Table A1) lists the main variables and their descriptions.

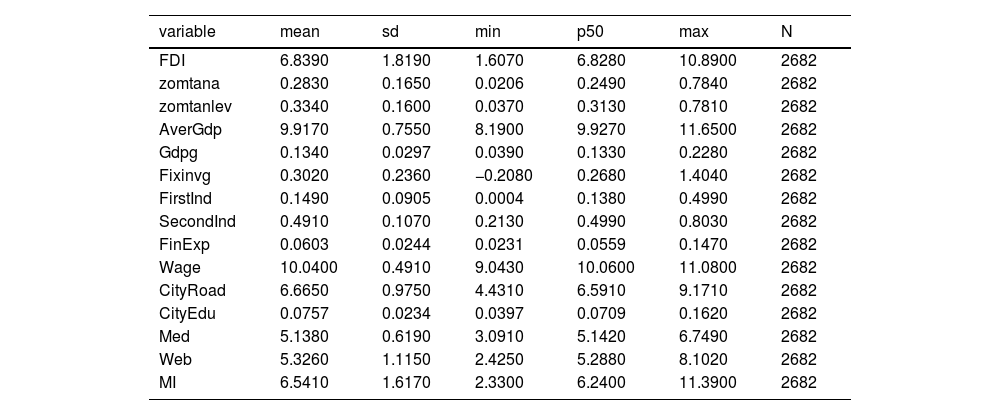

Summary statisticsTable 1 presents the descriptive statistical results of the main variables. All continuous variables are winsorized at the 1 % and 99 % levels to avoid the influence of extreme values. The mean value of FDI is 6.84, the minimum value is only 1.61, and the maximum value reaches 10.89, indicating that the difference in FDI inflows is noticeable and the difference in the ability of different regions to attract foreign capital is significant. The average ratio of zombies (zomtana) is 28.30 %, which is relatively high. The average GDP growth rate (Gdpg) is 13.40 %, which aligns with the degree of economic growth at the prefectural city level in China during the sample period. The average growth rate of fixed asset investment (Fixinvg) reaches 30.20 % and the maximum value reaches 140.40 %, indicating the fast growth rate of local investment and that investment is an essential driving force of regional economic growth. The output value of the primary industry (FirstInd) accounts for a relatively small proportion, while the secondary industry accounts for nearly 50 % of the GDP (SecondInd); that is, the secondary industry still occupies a dominant position in the economy of prefectural cities. The education level (CityEdu) has an average value of 7.57 % and the minimum value is only 3.97 %. Thus, the education level of some regions is relatively poor, with obvious gaps between different regions.

Summary statistics.

Notes: This table reports summary statistics for the variables used in our baseline model. Appendix 1 presents the variable definitions.

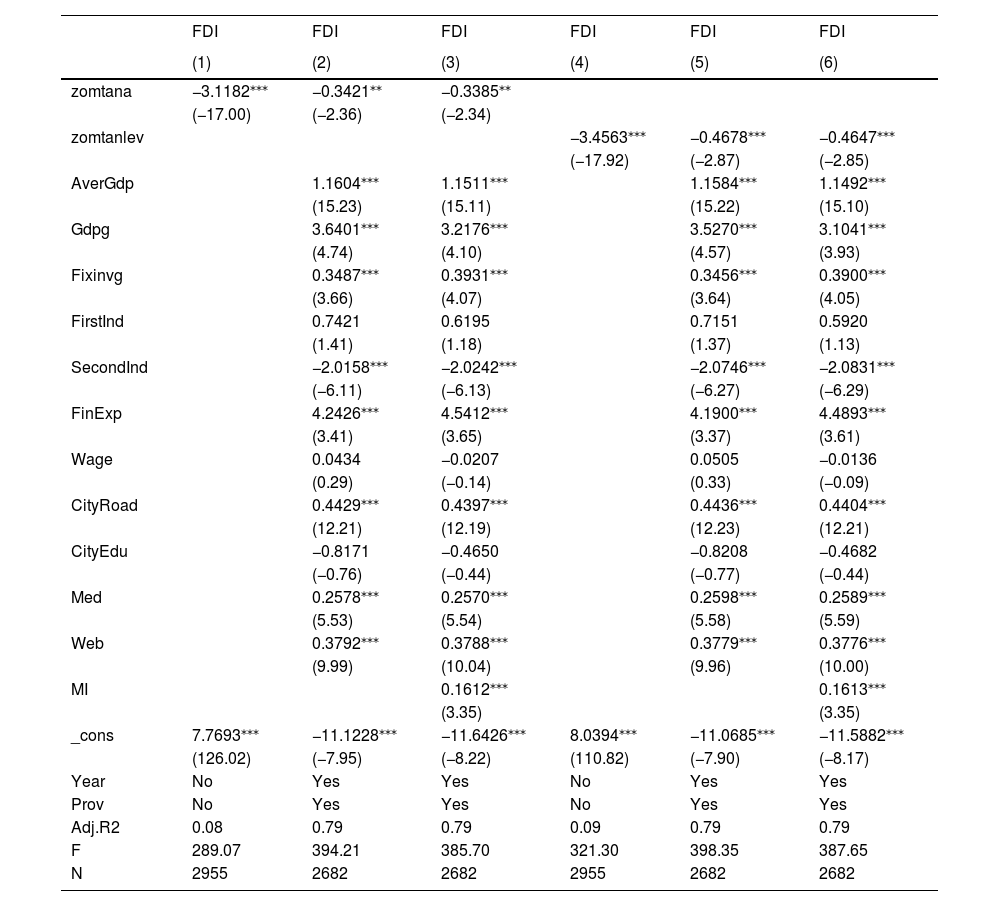

We use model (2) to study the crowding-out effect of zombies on FDI inflows (see Table 2). The independent variables in columns (1) to (3) are asset-weighted share of zombies at the prefectural city level (zomtana) and in columns (4) to (6) are liability-weighted share of zombies (zomtanlev). Columns (1) and (4) show the univariate analyses, columns (2) and (5) include prefecture-level control variables, and columns (3) and (6) include institutional-level control variables. The results in columns (1) to (3) show that the coefficients of zombies (zomtana) are negative and significant at least at the 5 % level, indicating that the larger the share of zombies in prefectural cities, the less the FDI inflows, that is, a crowding-out effect. In columns (4) to (6), we replace the independent variable, and the results remain stable, which confirms H1. Thus, the negative impact of zombies on normal business operations and the regional institutional environment hinders FDI from flowing into the local market.

Main regression results of zombie enterprises and FDI.

Notes: This table presents the baseline regression of zombie enterprises on FDI inflows. The dependent variable is FDI inflows at the prefecture-level cities (FDI). Control variables include AverGdp, Gdpg, Fixinvg, FirstInd, SecondInd, FinExp, Wage, CityRoad, CityEdu, Med, Web, and MI. Variable definitions are presented in Appendix 1. Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively.

As for control variables, the larger the GDP per capita (AverGdp) and GDP growth rate (Gdpg), the greater the FDI inflows; that is, the market size and market potential are essential factors in attracting FDI. The coefficients of fixed asset growth rate (Fixinvg) are positive and significant at the 1 % level, meaning that fixed asset investment can attract foreign capital inflows. The coefficients of labor cost (Wage) are negative but not significant, meaning that the increase in labor cost will inhibit FDI inflows. Since labor quality is also an essential factor that foreign investors consider, FDI may allow a trade-off between labor quality and cost, thus making the effect of labor cost on FDI not significant enough. The coefficients of road area (CityRoad), medical level (Med), and Internet level (Web) are positive, indicating that foreign investment will flow more to areas with sound urban infrastructure and better health care. Regarding the institutional-level control variable, regions with better marketization development attract more FDI inflows.

Endogenous analysisFactors such as the political-ecological environment and regional institutional environment will promote the emergence of zombies and inhibit FDI inflows. We risk biased estimation results if these factors are omitted from the regression. FDI inflows may also impact zombies, and Jiang et al. (2018) argue that deregulation of foreign investment can inhibit zombies from emerging. As such, our findings may be compromised by endogeneity issues, including omitted variables and reverse causality.

We use the instrumental variable to solve any potential endogeneity in our analysis. Following Tan et al. (2017) and Ren et al. (2023a), we use the product of the state-owned enterprise shares at the prefectural city level at the beginning of the period and the average debt-to-asset ratio of state-owned enterprises at the prefectural city level as the instrumental variable (SOER_Lev). We justify this approach as follows: First, the share of state-owned zombies at the beginning of the sample period in a region has a high positive correlation with the share of zombies in subsequent years; that is, the more state-owned zombies at the beginning of the sample period, the higher the share maintained later. Second, the debt-to-asset ratio of state-owned enterprises reflects their ability to absorb credit resources, and zombies usually have a higher debt-to-asset ratio. Third, the share of state-owned zombies at the beginning of the sample period does not affect the subsequent FDI inflows. Therefore, the instrumental variable satisfies the correlation and exclusivity assumptions. We thus use the CIED to calculate the share of state-owned enterprises and the average state-owned enterprise debt-to-asset ratio at the prefectural city level.

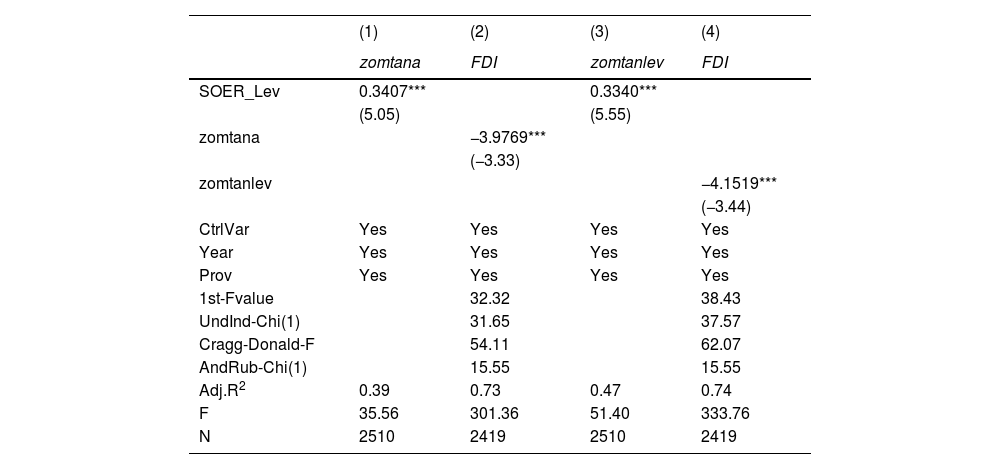

Table 3 shows the results of the instrumental variable regression. Columns (1) and (3) report the first-stage regression results and columns (2) and (4) report the second-stage regression results. The coefficients of SOER_Lev are significant and positive in columns (1) and (3), indicating that the instrument variable does influence the share of zombies at the prefectural city level. After considering the endogeneity problem, the coefficients of zombies are still negative and significant, as shown in columns (2) and (4), confirming the robustness of our main findings.

Endogenous analysis: instrument variable.

Notes: This table presents the 2SLS regression results. The control variables were replaced by CtrlVar. The instrumental variable is the product of the state-owned enterprise shares in prefecture-level cities at the beginning of the period and the average debt-to-asset ratio of state-owned enterprises in prefecture-level cities (SOER_Lev). We verify the validity of the instrumental variables in four ways. First, the first-stage F-value (1st-Fvalue). The first-stage F-value is greater than 10, indicating that the instrumental variables satisfy the correlation hypothesis (Stock & Yogo, 2005). Second, the Kleibergen-Paap LM test (UndInd-Chi(1)) for the under-identification test. In Table 3, the chi-square values of the tests are accompanied by probabilities of 0, which pass the under-identification test. Finally, We use the Cragg-Donald-Wald test (Cragg-Donald-F) and the Anderson-Rubin-Wald test (AndRub-Chi(1)) to test the weak instrumental variable problem. The results indicate that the instrumental variables have strong explanatory power. Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. In the following analysis, we present the results of both OLS and 2SLS analyses and statistical tests of the validity of the instrumental variables.

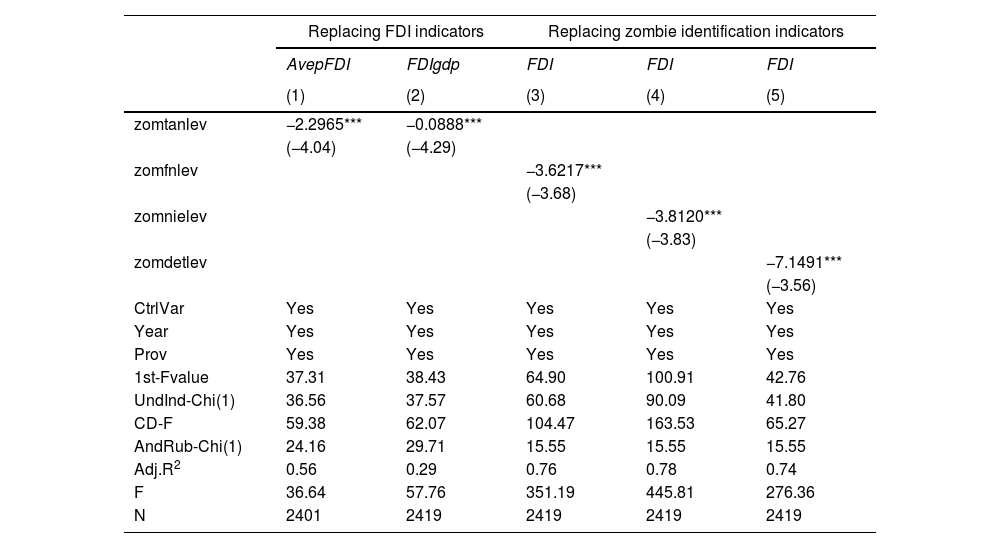

In the main analysis, we measure FDI inflows using the absolute amount of FDI. In Table 4, we measure FDI inflows by per capita FDI at the prefectural city level (AvepFDI) and FDI as a percentage of GDP (FDIgdp). Columns (3) and (4) are the estimation results using two-stage least squares (2SLS). The coefficients of the share of zombies (zomtanlev) are all negative, confirming the robustness of our findings even after replacing the dependent variable.

Robustness tests of replacing basic variables.

Notes: This table presents the robustness tests of replacing basic variables, and we mainly list the 2SLS regression results. The control variables were replaced by CtrlVar. In Columns (1)-(5), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

We use three methods to replace the zombie identification indicators. First, we follow Fukuda and Nakamura (2011) and add the profitability criterion and continuous borrowing criterion to modify the identification method based on Caballero et al. (2008). The zombie enterprise is recorded as zomfn.

Second, Nie et al. (2018) point out that short-term shocks may affect some companies that are only identified as zombies by the CHK–FN method in a certain year. To avoid such accidental factors, they propose using three consecutive years of financial data to identify zombies; that is, if an enterprise is identified as a zombie by the CHK–FN method in two successive years, then the enterprise is recognized as a zombie in year t. We modify the identification method based on CHK–FN and record zombies as zomnie.

Third, Zhu et al. (2019) state that the dependence of Chinese enterprises on various government subsidies and tax reductions weakens enterprises' competitiveness and viability, leading to the emergence of zombies. Therefore, zombies should be determined according to real profits and liabilities. They propose the "real profit criterion," which excludes government subsidies and tax breaks, and the "excessive borrowing criterion" to identify a zombie.7 We follow Zhu et al. (2019) and use three consecutive years of financial data to identify zombies and record them as zomdet.

After identifying zombies using these three methods, we calculate the proportion of zombies weighted by the assets and liabilities at the prefectural city level. Columns (3) to (5) of Table 4 report the 2SLS estimation results. The coefficients are all negative and significant at the 1 % level, confirming the robustness of the findings even after replacing the indicators for zombie identification.

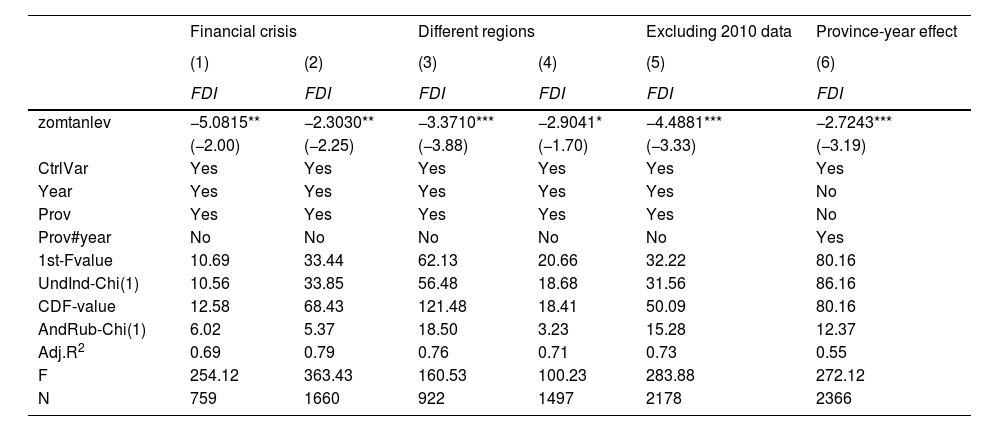

Considering the impact of the 2008 financial crisisAfter the 2008 financial crisis, the world's major economies experienced slower growth and lower effective demand. Concerns about economic development prospects and uncertainty of economic policies inhibited corporate investment and FDI inflows. During the financial crisis, the "Four Trillion Plan" launched by the Chinese government also promoted the emergence of zombies (Nie et al., 2018). To reduce the possible impact of the financial crisis on the results, we divide the sample into two groups: pre-financial crisis (before 2007) and post-financial crisis (after 2007). The results are listed in columns (1) and (2) of Table 5: The coefficients of the share of zombies are both negative, indicating that our results remain robust before and after accounting for the 2008 financial crisis.

Other robustness tests.

Notes: This table presents the robustness tests of other robustness tests, and we mainly list the 2SLS regression results. The control variables were replaced by CtrlVar. In Columns (1)-(6), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

We now consider the robustness of the crowding-out effect in different regions based on a sub-sample regression. We divide the sample into eastern (column 3) and central-western regions (column 4) in Table 5. The main findings remain stable across regions.

Excluding 2010 data from the sampleIn the primary regression analysis, we replace the missing data for 2010 with the average values of the share of zombies in 2009 and 2011 for each prefectural city. To ensure the robustness of our findings, we remove the 2010 data and re-estimate the model; the results are presented in column (5) of Table 5. The coefficient of the share of zombies is negative, indicating that the main regression results remain robust after excluding the 2010 sample.

Considering the province-year effectOur results may also be affected by the policy factors of different provinces in different years. In further robustness analysis, we control the province-year fixed effect; the results are presented in column (6) of Table 5. The coefficient of the share of zombies is negative, indicating that the main results remain robust after considering the province-time effect.

Further analysisIn the above analysis, we find that zombies will crowd out FDI inflows, and this effect remains stable after many robustness tests. In the theoretical analysis, we argue that the share of zombies in a region represents the pros and cons of the regional institutional environment to a certain extent, and the long-term existence of zombies further deteriorates this institutional environment. We thus pose the next question: Do advantages of geographic location and improvements to the institutional environment mitigate the negative effects of zombies? We will now investigate the effects of geographical location advantage and institutional environment improvement on the crowding-out effect of zombies in order to verify H2-H4.

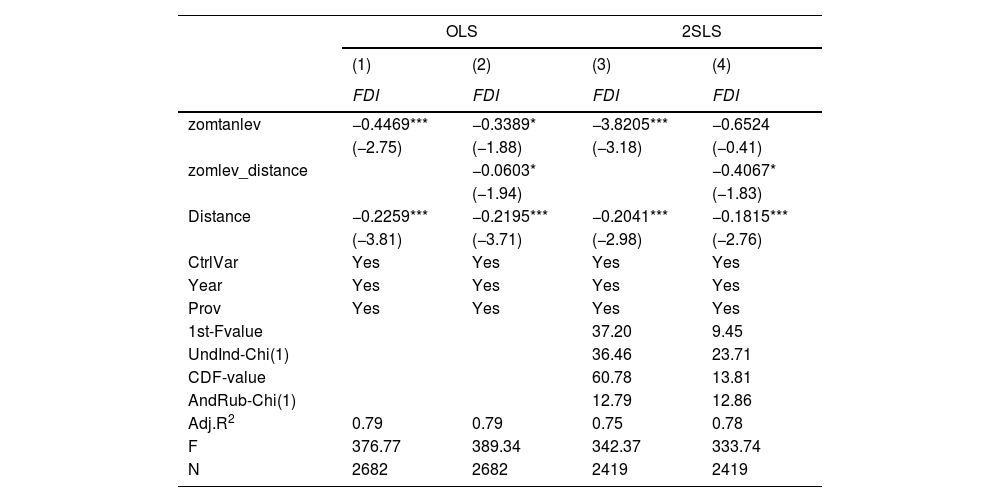

Geographical advantagesGeographical location and the crowding-out effectGeographical location is one of the main factors affecting the inflow of FDI. We know that foreign capital tends to flow into coastal port cities or special economic zones that are open to the outside world (Head & Ries, 1996). These regions can reduce trade costs and receive preferential policies, such as in taxation, from the state. We use the minimum straight-line distance from the administrative center of a prefectural city to the three largest ports in China (Hong Kong, Shanghai, and Tianjin) to measure the geographical advantage of a city; the nearest distance is recorded as Distance. Table 6 reports the regression results.

Geographical location, zombie enterprises, and FDI.

Notes: This table presents the mitigating effect of geographic location on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with Distance as instrumental variables for the endogenous variables zomtanlev and zomlev_distance. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

Columns (1) and (2) present the results obtained from the ordinary least squares estimation. Columns (3) and (4) present the results of the 2SLS estimation. We mainly present the results of the second-stage regression. Column (1) shows that the coefficient of distance (Distance) is negative, indicating that geographical location will influence FDI inflows. In column (2), the coefficient of the interaction term between the share of zombies and distance (zomlev_distance) is negative and significant at the 10 % level. That is, the farther the distance, the stronger the crowding-out effect; moreover, geographical location advantage can effectively alleviate the crowding-out effect. Columns (3) and (4) suggest the results remain robust after using the instrumental variable. Thus, the results in Table 6 indicate that the location advantage may help alleviate the crowding-out effect of zombies on FDI, which verifies H2.

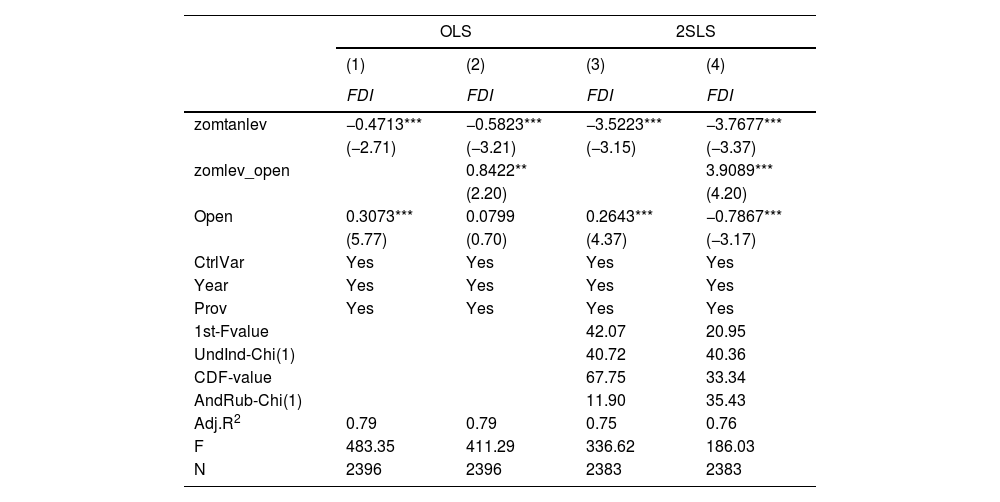

Openness to the outside world and the crowding-out effectRegional openness reflects the location advantage and represents the local government's attitudes toward international investment.8 In short, greater openness attracts more FDI inflow. We measure prefectural cities' openness by the proportion of total imports and exports to the GDP (Open) to determine if greater openness alleviates the crowding-out effect. The results are presented in Table 7. Columns (1) and (3) show that the greater the openness, the greater the FDI inflows. The coefficients of the interaction (zomlev_open) in columns (2) and (4) are positive and significant, indicating that greater openness can alleviate the crowding-out effect. On the one hand, openness reflects a geographical location advantage, and we know that cities near ports may be more open. On the other hand, increased openness requires local governments to improve infrastructure construction and the institutional environment. We believe that these combined effects alleviate the negative effects of zombies. Thus, the results in Tables 6 and 7 verify H2.

Degree of openness, zombie enterprises, and FDI.

Notes: This table presents the mitigating effect of openness to the outside world on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with Open as instrumental variables for the endogenous variables zomtanlev and zomlev_open. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

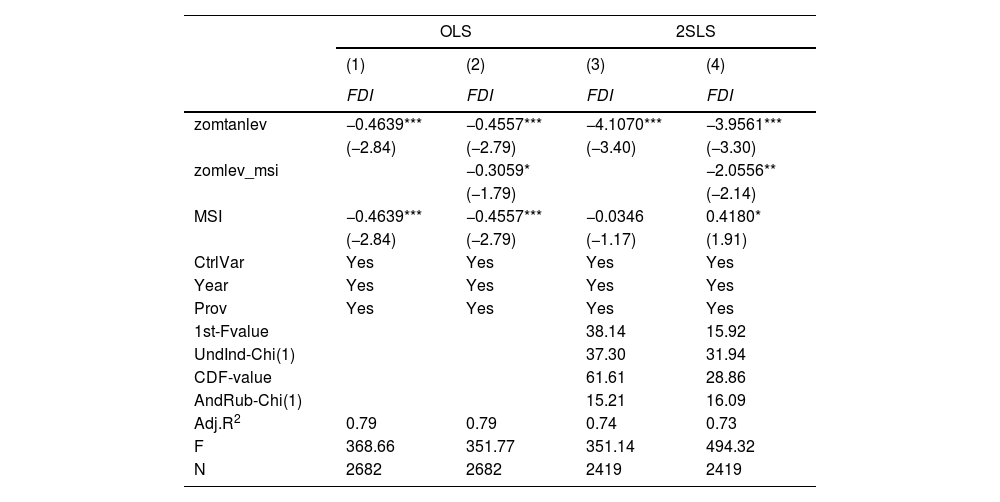

In transition economies, the government will intervene in market operation and resource allocation, and local governments will often adopt market segmentation strategies to protect local enterprises and promote economic development. This strategy intensifies market segmentation in different regions of China (Bian et al., 2019; Lu & Chen, 2009) and inhibits FDI inflows. Following Lu and Chen (2009), we construct the market segmentation index (MSI) at the provincial level.9 The results are presented in Table 8. Column (1) and (3) show that market segmentation (MSI) will inhibit FDI inflows. The coefficients of interaction terms (zomlev_msi) in columns (2) and (4) are negative and significant, indicating that, in areas with severe market segmentation, the crowding-out effect is more obvious. Thus, the market segmentation strategy implemented by local governments to protect local firms exacerbates crowding out by zombies, which verifies H3.

Market segmentation, zombie enterprises, and FDI.

Notes: This table presents the moderating effect of market segmentation on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with MSI as instrumental variables for the endogenous variables zomtanlev and zomlev_msi. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

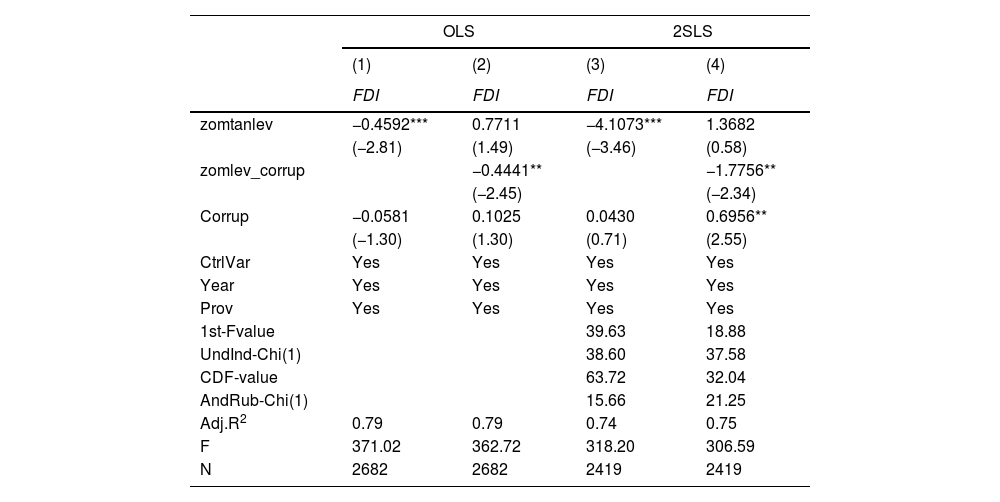

The political-ecological environment (e.g., political corruption) of a region is an important factor for measuring the quality of the regional government. Political corruption deteriorates the regional business environment, increases rent-seeking, creates unfair competition, and negatively impacts local enterprises and economic development (Cole et al., 2009; Gründler & Potrafke, 2019). Following Cole et al. (2009), we use the ratio of the number of people involved in corruption cases to the number of public officials in each province as a proxy variable to measure the degree of corruption in different regions (Corrup).10 Column (1) of Table 9 shows that corruption may inhibit FDI inflows. In contrast, the coefficients of the interaction term (zomlev_corrup) in columns (2) and (4) are negative and significant, indicating that the crowding-out effect of zombies on FDI is more pronounced in regions where political corruption is more serious. We confirm that political corruption exacerbates the crowding-out effect, which also verifies H3 that a poor institutional environment will exacerbate the crowding-out effect.

Political corruption, zombie enterprises, and FDI.

Notes: This table presents the moderating effect of the political environment on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with Corrup as instrumental variables for the endogenous variables zomtanlev and zomlev_open. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

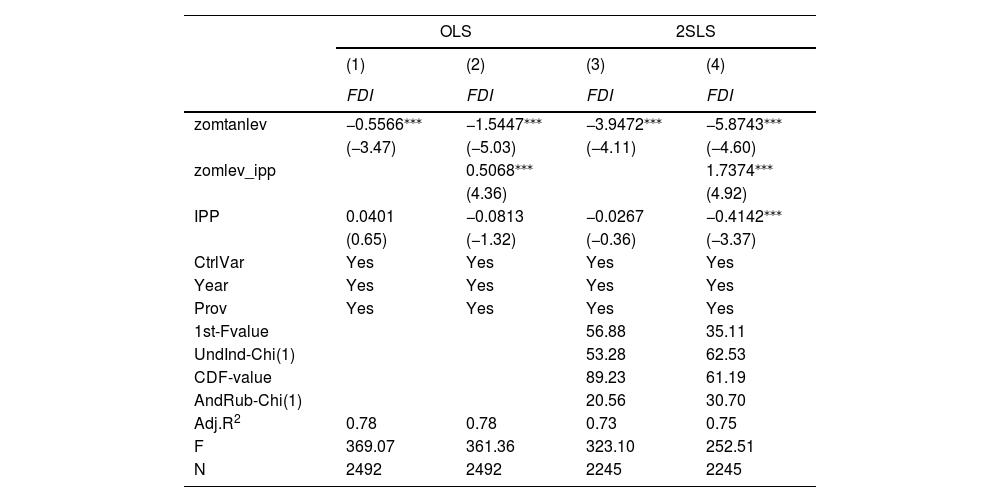

Strengthening the protection of intellectual property rights is of great significance for stimulating enterprises to innovate, safeguarding the legitimate rights and interests of companies, and attracting investment from other places. Intellectual property protection is also an essential factor affecting FDI inflows (Adams, 2010; Awokuse & Yin, 2010). We use the intellectual property protection index in the marketization index of Fan et al. (2011) and Wang et al. (2017) to measure this factor and its ability to alleviate the crowding-out effect. Columns (1) and (3) of Table 10 show that its effect is insignificant. In contrast, the interactions between the share of zombies and intellectual property protection (zomlev_ipp) are positive and significant in columns (2) and (4), indicating that strengthening intellectual property protection can effectively alleviate the adverse effects of zombies, which verifies H4 that a well-developed institutional environment will alleviate the crowding-out effect.

Intellectual property protection, zombie enterprises, and FDI.

Notes: This table presents the moderating effect of intellectual property protection on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with IPR as instrumental variables for the endogenous variables zomtanlev and zomlev_ipr. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

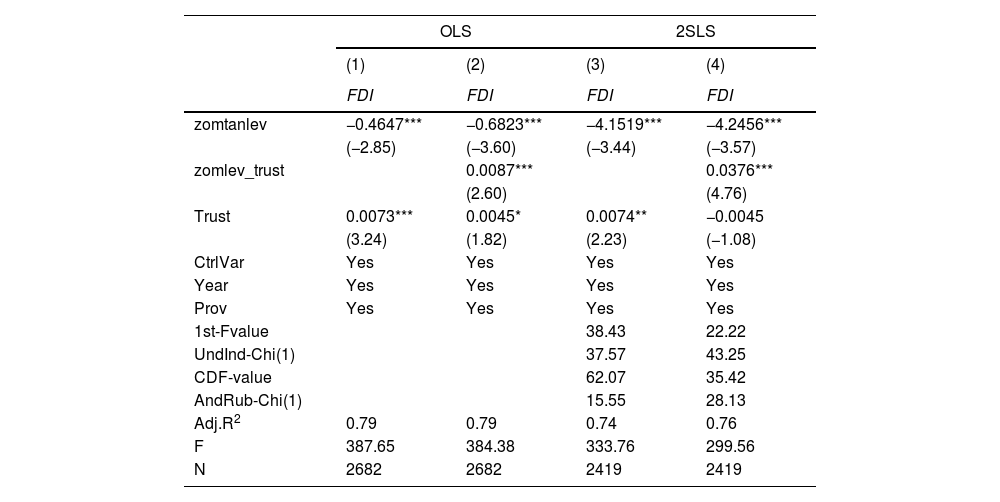

Trust is an essential social capital for economic growth and social progress. Improving inter-regional trust can reduce business transaction costs and increase labor productivity, thus attracting the inflow of FDI (Bhardwaj et al., 2007). We use the trust index (Trust) of each province in China, as surveyed by Zhang and Ke (2003), to study the mitigating effect of social trust on the crowding-out effect. Columns (1) and (3) of Table 11 show that social trust attracts FDI inflows. In columns (2) and (4), we add the interaction term (zomlev_trust) between zombies and the trust index. The coefficients of zomlev_trust are positive, indicating that improving the regional trust environment can effectively alleviate the crowding-out effect of zombies, which verifies H4.

Regional trust environment, zombie enterprises, and FDI.

Notes: This table presents the moderating effect of the regional trust environment on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with Trust as instrumental variables for the endogenous variables zomtanlev and zomlev_trust. We verify the validity of the instrumental variables in four ways (the first-stage F-value, the Kleibergen-Paap LM test, the Cragg-Donald-Wald test, and the Anderson-Rubin-Wald test). Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

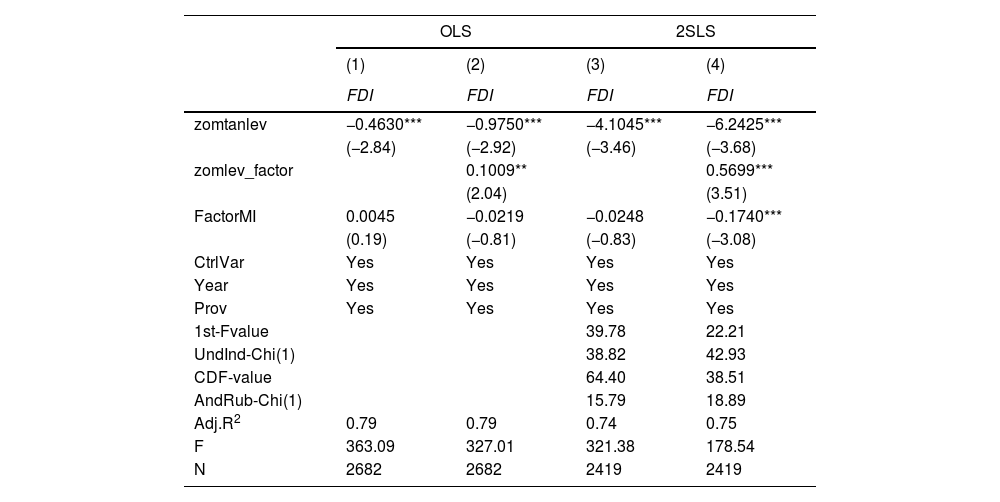

The factor endowments of a region are also essential factors that attract foreign investment. A well-developed factor market can optimize the market transaction mechanism, improve the efficiency of resource allocation, attract foreign investment, and stimulate the enthusiasm and creativity of market players (Brandt et al., 2013). We use the factor market development index from Fan et al. (2011) and Wang et al. (2017) to measure regional factor market development (FactorMI). Columns (1) and (3) of Table 12 show that the regional factor index has no evident impact on FDI, but the coefficients of interaction terms, as shown in columns (2) and (4), are positive and significant. Thus, under certain conditions, the development of factor markets can alleviate the negative effects of zombies and attract FDI inflows, which verifies H4 that a well-developed institutional environment will alleviate the crowding-out effect.

Factor market development, zombie enterprises, and FDI.

Notes: This table presents the moderating effect of factor market development on zombie enterprises' crowding-out effect. We list the OLS and 2SLS regression results. The control variables were replaced by CtrlVar. In Column (3), we use SOER_Lev as the instrumental variable for the endogenous variable zomtanlev. In Column (4), we use SOER_Lev and its interaction term with FactorMI as instrumental variables for the endogenous variables zomtanlev and zomlev_factor. We verify the validity of the instrumental variables in four ways. Standard errors were clustered at the prefecture-level city. *, **, and *** represent the significance levels of 10 %, 5 %, and 1 % respectively. We only listed the results using zomtanlev as the independent variable, and the results remained robust when we replaced the independent variable.

On the one hand, attracting and utilizing foreign capital is an essential part of China's basic national policy of opening up. However, recent economic downturn has soured China's attractiveness to FDI. The uneven regional distribution of FDI has further exacerbated this situation. On the other hand, in the extant literature on FDI and location selection theory, most studies examine the economic environment, agglomeration effects, market size, geographic location, and labor costs (Belgibayeva & Plekhanov, 2019; Boermans et al., 2011; Fetscherin et al., 2010; Krifa-Schneider & Matei, 2010). Keeping these points in mind, we argue that the negative effects of zombies on normal business operations and the long-term existence of zombies damage the business environment and crowd out FDI inflows.

In this study, we measure the regional business investment environment by the share of zombies using the 2003–2013 CIED at the prefectural city level and accordingly study the negative effects of zombies on FDI. We summarize our results below. First, prefectural cities inundated with zombies will attract less FDI inflows. This relationship confirms the damage to business operations and the environment, which ultimately crowds out FDI inflows. Our results remain stable after robustness analyses using instrument variable estimation, replacing the zombie enterprise identification method, etc. Second, a prefectural city's geographical location and openness to the outside world will help alleviate the crowding out effect of zombies, making geographical advantage a critical driving force for FDI (Dunning, 1977, 2009). Third, making improvements to the regional institutional environment will optimize the regional business environment and attract foreign capital (Alguacil et al., 2011;Cai et al., 2019; Ren et al., 2023b). In particular, reducing market segmentation, bettering the political-ecological environment, strengthening intellectual property protection, enhancing social trust, and developing the factor market will alleviate the crowding-out effect. Overall, we offer an empirically sound explanation for the impeding FDI inflows by accounting for zombies. Our findings may serve as references for local governments seeking to conduct a timely cleaning up of zombies in order to strengthen the institutional environment and attract FDI inflows.

Policy implicationsOur research also has some policy implications: Firstly, clarifying the harm of zombie enterprises to business operations and economic development is the key to cleaning up zombies effectively. In recent years, affected by the COVID-19 epidemic, Chinese zombie enterprises have shown a recovery trend, increasing the burden of economic recovery and hindering FDI inflows. The Chinese government needs to take effective measures to eliminate zombie enterprises promptly and curb the formation of zombies. For example, the government should first improve the market exit system in which the good eliminates the bad and perfect the enterprise bankruptcy system. Then, it should reduce its intervention in the market, regulate the credit behavior of banks, and strengthen their budgetary constraints. In addition, it should also establish a regular zombie identity and early warning mechanism and minimize zombie enterprises' negative effects.

Secondly, the institutional environment, as our results show, is critical to attracting FDI inflows, but developing countries often face a poor institutional environment. This condition restricts the long-term development of the national economy. Nevertheless, our results confirm the role of the institutional environment in mitigating the crowding-out effect of zombies, where a poor environment exacerbates the crowding-out effect. The government should expand and intensify reforms of the institutional economic environment, improve the political-ecological environment, promote market integration, strengthen intellectual property protection, improve the regional trust environment, and create a good market environment to attract FDI inflows.

Limitations and future researchSimultaneously, there are some limitations in our research. First, we used the CIED from 2003 to 2013 to measure the share of zombies at the prefectural city level. Our study may not reflect the most recent distribution of zombies. More representative microdata may yield findings that better reflect actual economic situations. Second, we study the crowding-out effect of zombies from the total amount of regional FDI inflows. Microdata specific to FDI investment projects or enterprises would be more representative and allow us to account for the impact of zombies on FDI exit in particular. We leave these to future exploration.

The authors acknowledge financial support from the Major Humanities and Social Sciences Research Projects in Zhejiang higher education institutions(2018QN084), the Fundamental Research Funds for the Provincial Universities of Zhejiang (QR202305), and the Humanities and Social Sciences Research of Ministry of Education of China (No.18YJC790133).

Description of the main variables.

| Variable | Definition |

|---|---|

| FDI | The FDI inflows at the prefectural city level; equals the logarithm of the actual amount of FDI inflows at the prefectural city level. |

| zomtana | Asset-weighted proportion of zombie enterprises at the prefectural city level. |

| zomtanlev | Liability-weighted proportion of zombie enterprises at the prefectural city level. |

| AverGdp | The logarithmic GDP per capita at the prefectural city level. |

| Gdpg | The GDP growth rate at the prefectural city level. |

| Fixinvg | Fixed asset investment growth rate; equal the difference in fixed asset investment to GDP at the prefectural city level. |

| FirstInd | The GDP share of the primary industry output at the prefectural city level. |

| SecondInd | The GDP share of the second industry output at the prefectural city level. |

| FinExp | Government expense; equals the proportion of fiscal expenditure to GDP at the prefectural city level. |

| Wage | Labor costs; equals the logarithmic average annual wage of the prefectural city level. |

| CityRoad | Infrastructure construction; equals the logarithm of the road area at the prefectural city level. |

| CityEdu | Educational level; equals the number of high schools and university students as a percentage of the resident population at the prefectural city level. |

| Med | Medical level; equals the number of hospitals and health centers at the prefectural city level. |

| Web | Internet development level; equals the number of mobile Internet usage at the prefectural city level. |

| MI | Marketization index; data from Fan et al. (2011) and Wang et al. (2017). |

| Distance | Closest distance to large ports; equals the minimum straight-line distance from the administrative center of a prefectural city to the three largest ports in China (Hong Kong, Shanghai, and Tianjin). |

| Open | Openness to the outside world; equals the proportion of total imports and exports to the GDP. |

| MSI | Market segmentation index at the provincial level; measured according to Lu and Chen (2009). |

| Corrup | The political-ecological environment at the provincial level; equals the ratio of the number of people involved in corruption cases to the number of public officials in each province. |

| IPP | Intellectual property protection at the provincial level; data from Fan et al. (2011) and Wang et al. (2017). |

| Trust | The social trust index at the provincial level; data from Zhang and Ke (2003). |

| FactorMI | Factor market development index; data from Fan et al. (2011) and Wang et al. (2017). |

For example, in 2018, the Chinese State Council's Notice on Several Measures to Actively and Effectively Utilize Foreign Investment to Promote High Quality Economic Development states the need to create a more fair, transparent, convenient, and attractive investment environment, and further promotes stable growth of foreign investment. In 2019, the Chinese State Council issued the Opinions on Further Improving the Utilization of Foreign Investment, which proposes the national treatment of foreign-invested enterprises and creating an open, transparent, and predictable foreign investment environment to further improve the utilization of foreign investment.

The CIED is a representative micro-enterprise database of China. Although this database was only updated until 2013, it is currently the most widely used database for scholars to study the problems of Chinese zombies. Notable studies include those by Chang et al. (2021), Geng et al. (2021), Ren et al. (2023a), Ren et al. (2023b), and Shen and Chen (2017). Although some scholars have used data from Chinese listed enterprises to identify zombies, owing to the relatively high quality of listed enterprises, their representativeness does not match that of the CIED.

The sample interval of the CIED is from 1998 to 2013. However, owing to missing data at the prefectural city level before 2003, our sample interval is from 2003 to 2013. Therefore, we took 2002 as the initial time point and used two consecutive years of data to identify the share of zombies at the prefectural city level from 2003 to 2013.

BSi,t−1, BLi,t−1, and Bondsi,t−1 denote short-term bank loans (with maturities less than one year), long-term bank loans (with maturities exceeding one year), and the aggregate amount of outstanding bonds, respectively. Owing to the unavailability of corporate bond data in the database, we consider corporate bonds as non-existent (i.e., set to zero). Short-term loans (BS) and long-term loans (BL) are substituted by liquid liabilities and long-term liabilities, respectively. rs and rl denote the average market minimum interest rate for short-term and long-term loans, respectively.

The profitability criterion refers to the adjustment made to a company's EBIT after calculating the minimum interest payment using the CHK method. If the EBIT is higher than the minimum interest payment (R), the company should not be identified as a zombie company according to the CHK method. The continuous borrowing criterion indicates that, if a company's EBIT in year t is lower than the minimum interest payment calculated by Eq. (1), and the company's debt-to-equity ratio exceeds 50% for two consecutive years with an increase in the second year, then the company should be classified as a zombie company.

The share of zombies at the prefectural city level calculated herein reaches 28.3% (zomtana) and 33.4% (zomtanlev) on average, which are relatively high numbers. We explain this result as follows: First, during the sample period, China faced relatively serious zombification problems, and with the advancement of state-owned enterprise restructuring, the share of zombies have gradually decreased. The changing trend and share of zombies shown herein are also consistent with the results of Tan et al. (2017). Second, we use two consecutive years of financial data to identify zombies, so there may be some misjudgment (Nie et al., 2018). In the robustness tests, we use three consecutive years of financial data to identify zombies.

Real profit criterion: The real profit of the enterprise is determined by subtracting government subsidies from the total profit. If the resulting profit is negative, the enterprise meets the real profit criterion. Excessive borrowing criterion: This criterion is met if the company's debt ratio exceeds 50% and there is an increase in the debt ratio compared with the previous year.

We believe that the degree of openness to the outside world represents the location advantage to a certain extent because cities close to large ports have transportation advantages and more imports and exports. In addition, at the beginning of China's reform and opening up, the cities that initially opened up were located along the coast.

Referring to Lu and Chen (2009), we select the relative price change variance of the consumer price index, average real wages of employees, and fixed asset investment price index for each province from 2003 to 2013, and measure the market segmentation of the consumer goods market, labor market, and capital market, respectively. Finally, we use principal component analysis to construct a composite market index to measure the overall market segmentation (MSI).

The data on the number of people involved in corruption cases in each province come from the China Prosecutorial Yearbook, and the data on the number of provincial public officials come from the WIND database.