This study examines whether auditors are innovating in their audit reports by incorporating material environmental, social, and governance (ESG) issues from companies' sustainability reports into the Key Audit Matters (KAMs) section. Additionally, it assesses whether ESG performance influences this inclusion. Content analysis was conducted on the materiality matrices of sustainability reports and KAMs disclosures for 20 Colombian companies listed on the COLCAP index during the period 2019–2021. Using logistic regression analysis, we examined relationships between ESG scores and KAMs disclosure of material ESG issues. The results obtained show that auditors strongly emphasise governance but tend to overlook social and environmental issues within their KAMs. Furthermore, higher governance scores increase the likelihood of ESG consideration in the KAMs, while lower profitability and leverage also lead to greater ESG inclusion in the KAMs. This pioneering study offers an initial analysis of whether material ESG issues arising from sustainability reports also appear in KAMs disclosures, thus addressing a significant literature gap. The study findings suggest that auditors need appropriate guidance and enhanced competencies to perform holistic ESG risk evaluation, as the acceptance of integrated sustainability reporting is gaining momentum globally.

In recent years, the world has had to face substantial new challenges, including climate change, pollution, energy crises, social tensions, rising inequalities and economic disruptions and unsustainable patterns of social and economic behaviour, all of which represent growing threats (Dabbous et al., 2024). In this context, environmental issues and resource limitations are of major importance, producing a direct impact on the business world (Xie et al., 2022). As a result, the question of corporate social responsibility (CSR) is now highly significant for companies, governments, regulators and stakeholders in general (Fiandrino et al., 2022; Henriques et al., 2022). Since 2015, the emphasis on CSR has become even stronger, following the approval of the United Nations 2030 Agenda for Sustainable Development, which established 17 Sustainable Development Goals (SDGs), in line with Elkington's triple-bottom-line approach, addressing not only profit but also social and environmental concerns. The ultimate aim of the SDGs is to protect the planet, eradicate poverty and ensure prosperity for all (Claro et al., 2021; Sierra García et al., 2022).

In the pursuit of sustainable development, companies and related organisations must play a fundamental role (Bebbington & Gray, 2001; Farooq & de Villiers, 2019). To demonstrate their commitment in this respect, many companies throughout the world are now incorporating CSR priorities into their business strategies and communications. According to stakeholder theory, companies provide information based on the needs of diverse groups that are affected by or have an interest in their actions (Freeman & Phillips, 2002). Consequently, companies prepare and publish sustainability reports (Jørgensen et al., 2022) documenting their results in the field of environmental, social and governance (ESG) issues, thus establishing an effective channel for communication with stakeholders (D'Adamo, 2022; Farooq et al., 2021; Torelli et al., 2020), who demand high-quality information to facilitate investment, financing and regulatory decisions, among others.

In this regard, the Integrated Reporting (IR) framework is presented as an innovative approach to corporate social responsibility (CSR) reporting, aiming to enhance the integration levels of CSR disclosures (Sun et al., 2022). Organisations, businesses and regulatory authorities are collaborating on the development and dissemination of non-financial information through the publication of sustainability reports and related information on areas such as sustainable investments, green banking, environmental issues, human rights and climate change (Gutiérrez‐Ponce & Wibowo, 2023).

The disclosure of this information has led to significant developments in accounting research. Among other findings, it has been shown that the provision of sustainability information impacts both on financial and on non-financial data, to varying degrees. Therefore, organisations must consider both types of information when commenting on ESG issues and obtain the necessary information to understand how sustainability issues affect their performance, results and financial situation.

In December 2022, the European Parliament issued Directive 2022/2464/EU (EU., 2022) recognising that many stakeholders consider the term "non-financial information" inaccurate as it implies that sustainability-related information lacks financial relevance. This Directive modifies Directive 2014/95/EU (EU., 2014) by changing the term "non-financial information" to "sustainability information". This change in terminology responds to increasing demands from companies and investors for sustainability information, considering the risks companies face and the growing awareness among investors about the financial implications of these risks, particularly climate-related financial risks (EU., 2022). However, it is not only climate-related issues that can financially affect organisations. The Directive also highlights a growing concern about the risks and opportunities for companies and investments arising from other environmental aspects, such as biodiversity loss and health and social issues, including child and forced labour (EU., 2022). All of these aspects can impact on financial statements. The Directive also introduces the concept of "double materiality," according to which companies must report not only information about their impact on ESG issues but also the information needed to understand how sustainability issues affect the firm's development, results and situation (EU., 2022). The Directive, thus, emphasises that ESG issues can impact on companies’ financial situation and on the information that must be provided.

In a related action, in November 2021, during the United Nations Climate Change Conference (COP26), Erkki Liikanen, the Chair of the International Financial Reporting Standards (IFRS) Foundation, announced the creation of the International Sustainability Standards Board (ISSB) as a new standard-setting board within the IFRS Foundation. The ISSB's objective is to "issue standards that provide a comprehensive global basis for sustainability-related information to be disclosed in financial reports for capital markets" (IFRS Foundation, 2022, p. 2). In June 2023, the ISSB issued its first two proposals for sustainability standards: IFRS S1 "General Requirements for Sustainability-Related Financial Disclosure" and IFRS S2 "Climate-Related Financial Disclosure." These standards respond to the global capital markets' demand for connectivity between sustainability information and financial information, enabling stakeholders to consider sustainability risks and opportunities when valuing companies. Moreover, shortly after the publication of the initial standards on sustainability and climate-related disclosures, in August 2023, the International Auditing and Assurance Standards Board (IAASB) released for discussion its ISSA 5000 - International Standard on Sustainability Assurance (ISSA) project.

In view of the above considerations, investors, regulators and other stakeholders are paying increasing attention to the potential impact of ESG matters on financial information. The above-mentioned standards will soon come into force, obliging companies to disclose sustainability-related information in their financial reporting. Therefore, it is crucial to examine whether those responsible for auditing financial information are considering ESG matters as new risks that need to be evaluated and included in Key Audit Matters (KAMs), which according to ISA 701 are “Those matters that, in the auditor's professional judgment, were of most significance in the audit of the financial statements of the current period users” (IASSB, 2016, p.3).

The purpose of an audit is to enhance users' confidence in financial statements. The inclusion of ESG aspects in the auditor's report can enhance stakeholders' understanding of the risks and opportunities associated with these matters, thereby increasing transparency and the quality of information provided. The importance of this question is heightened by the fact that many stakeholders lack awareness of the impact of ESG matters on financial statements. In this context, the question arises of how auditors seek to incorporate the most significant business risks identified in the materiality matrix, a tool that captures the company's and its stakeholders' perspectives on material risks in ESG dimensions (Geldres-Weiss et al., 2021), into the KAMs within their audit reports. Hence, the aim of our study is to investigate whether auditors include the ESG risks identified in the sustainability reports’ materiality matrix in the KAMs attached to their audit reports.

In this study, we employed content analysis methodology, a widely utilised approach in sustainability and KAM research. In particular, we examined the content of sustainability reports, concentrating on materiality matrices, to ascertain the ESG concerns disclosed by the reporting company. In addition, a content analysis was conducted on the KAMs detailed in the auditor's report. Finally, a logistic regression model was generated to ascertain whether the ESG pillar score correlated with a higher or lower incorporation of ESG matters into the KAM section of the audit report. The study sample consisted of 20 companies listed on the COLCAP index of the Colombian Stock Exchange during the period 2019–2021.

Colombia has a solid tradition in Corporate Social Responsibility (CSR) practices and voluntary sustainability reporting, despite the lack of regulation for these reports (Correa-Garcia et al., 2018). Indeed, in Latin America as a whole, there has been a significant increase in voluntary sustainability reporting. According to KPMG (2023), 60 % of companies in the region now generate sustainability reports, and in Brazil, Peru, Colombia and Panama the figures are above the regional average. Among these, Colombia has an 83 % sustainability reporting rate, which has remained consistent since 2020. Regarding ESG concerns, Colombian companies show greater interest than most; according to a study by EY (2023), 59 % of the companies surveyed claimed to include ESG-related information in their annual reports.

This context is reflected in the international recognition of its companies and their orientation towards sustainable practices. Furthermore, developing countries like Colombia present unique cultural, social, political, and economic aspects that make them interesting to study (Acosta & Pérezts, 2019). Although the literature on CSR in Colombia is underdeveloped, there is a long history of private sector contributions to social services and significant corporate commitment to development (Rojas & Morales, 2006). Additionally, the COLCAP index, which includes the most liquid and largest companies in the Colombian Stock Exchange, serves as a crucial indicator of corporate practices and economic health in the country. This environment, combined with the importance of the COLCAP index, makes Colombia an ideal setting to investigate the integration of ESG into audit reports.

Our findings show that these auditors take governance concerns into account in their KAMs, but extend scant consideration to social and environmental issues. Accordingly, the Governance score was the most significant factor in the consideration of ESG matters in these KAMs.

To the best of our knowledge, no previous research has been conducted to determine whether the material ESG issues included in the materiality matrix are considered by auditors in the KAMs associated with audit reports. Therefore, this study is pioneering and makes a significant contribution to current research on sustainability and innovation issues in audit reporting. The study findings have significant implications for regulators, auditors, the accounting profession and other stakeholders.

The integration of environmental, social and governance (ESG) issues into Key Audit Matters (KAMs) offers a timely opportunity for innovation in corporate reporting and auditing practices. This study aims to provide a clearer rationale for examining this integration by highlighting its potential contributions to both theory and practice. By leveraging technologies like artificial intelligence and blockchain and data analytics, auditors can enhance the efficiency and reliability of ESG information collection and verification, driving innovation in assurance practices. However, challenges such as auditor skill gaps and resistance to change from traditional reporting frameworks require further exploration. This research addresses these gaps by examining the specific mechanisms through which integrating ESG issues into KAMs can drive innovation in corporate reporting, auditing and sustainability practices, ultimately providing valuable insights for stakeholders and laying the groundwork for future investigation in this emerging domain.

The remainder of this paper is structured as follows. Following this introduction, section 2 presents the theoretical framework. Section 3 describes the literature review performed. In section 4, the research methodology is presented. Section 5 explains the results obtained. In section 6 the robustness of this research is examined. Finally, we discuss the findings and summarise the main conclusions drawn.

Theoretical frameworkConsidering that organisations publish sustainability information in order to provide stakeholders with a comprehensive view of how they address challenges and opportunities in this field, and considering further that auditors assess and communicate significant financial risks in their audit reports, this research study is framed within stakeholder theory and the principle of the connectivity of information.

Stakeholder theory (Freeman & Phillips, 2002) emphasises the importance of considering the interests of different stakeholder groups in corporate decision-making. This involves engaging with and responding to stakeholders' expectations and needs, in the view that their support and collaboration are fundamental for long-term success and sustainability. This theory has been widely used to investigate how stakeholder interests are managed and addressed and is a significant aspect of accounting and auditing studies in general and of triple-bottom-line accounting in particular (Torelli et al., 2020).

Among various branches of stakeholder theory is that of managerial stakeholder theory, according to which companies use voluntary reporting to influence critical stakeholders to ensure the firm's survival and access to necessary resources (Mitchell et al., 1997). These reports enable organisations to communicate their performance in significant areas, such as sustainability, social responsibility and governance practices. Sustainability information allows stakeholders to assess whether the company is fulfilling its responsibilities and commitments, thereby strengthening their relationship with the firm.

The availability and communication of integrated corporate information is crucial for predicting risks and creating value over time, in the interests of all stakeholders (Kogdenko & Mel'Nik, 2014). Integrated reporting (IR) not only effectively includes the necessary element of CSR disclosure but also demonstrates the connection between different forms of information, something that is absent from traditional CSR reports. The IR approach enhances the value of CSR disclosure by emphasising the interconnectedness of different types of information (Sun et al., 2022)

Therefore, integrated reporting is the best way to enhance information interaction between companies and their stakeholder groups. Taking into account the principle of the connectivity of information, which has been defined as "the combination, interrelationship, and dependencies between components that are significant to an organisation's ability to create value over time" (World Intellectual Capital Initiative, 2013), it is apparent that the information supplied in financial statements should align with relevant sustainability information. Given this, the organisation concerned will be able to inform its stakeholders of the relationships between its financial and non-financial performance and the contribution made in each respect to value creation or destruction.

In the context of ESG matters and financial information, the principle of connectivity of information is especially relevant. Questions of ESG cannot be considered separately from financial information, as all these aspects are closely linked and may have a significant impact on a company's long-term value creation. When the company includes these matters in its financial reporting, this enables stakeholders to better understand the company's sustainability and corporate responsibility, and to evaluate its performance and associated risks. Furthermore, by considering ESG matters in financial information, the need for a holistic and connected view of the company is recognised. Financial and non-financial aspects are interrelated, and sustainability information provides an additional perspective on the risks, opportunities and challenges facing the company. A good understanding of the connection between ESG matters and financial information enables a correspondingly good understanding of long-term sustainability and contributes to a more accurate assessment of business performance.

The inclusion of ESG matters in financial information also enhances stakeholders' ability to make informed decisions. Investors, lenders, suppliers and other stakeholders require comprehensive and accurate information to evaluate a company's financial performance and sustainability. By acknowledging ESG matters in financial information, the evaluation of risk and decision-making based on a more comprehensive understanding of the company is facilitated.

Similarly, auditors, as independent actors assessing risks that may impact financial information and ultimately stakeholder interests, cannot view the audit report, particularly the KAM, as static. Instead, the auditor must innovate in the audit report to communicate ESG issues as business risks that can affect a company's financial performance and reputation (KPMG, 2023). For example, poor environmental management can lead to additional costs, regulatory fines and litigation that would impact on financial performance (Clarkson et al., 2011). Auditors should assess these risks and consider their potential impact on financial information in order to ensure the reliability and relevance of their reporting. By considering ESG matters in the Key Audit Matters (KAMs) of the auditor's report, auditors acknowledge the impact these risks can have on the company and its ability to generate sustainable long-term value.

The inclusion of ESG matters in the KAMs reflects a proactive and innovative assessment of these risks and allows stakeholders to make informed decisions. For example, if the auditors are of the opinion that climate-related risks may affect the client, they must consider whether the financial statements produced adequately reflect the impact of climate change. In other words, the KAMs should clearly identify climate-related issues considered in the audit and provide detailed information on how the issue was addressed. This may include a discussion on the work and tests performed, and the role played by an expert or specialist (CPA Australia, 2023).

Auditors must consider and understand how ESG matters can affect their work and procedures. Therefore, they should confer with management and corporate governance to determine whether ESG questions pose a significant risk to the company and how these questions should be managed, mitigated, monitored and reported. If these significant risks are accurately reflected in the company's financial statements, auditors must also consider the accounting estimates made, including the assumptions used to calculate fair value and potential losses or provisions. In this respect, Fig. 1 shows the basic relationship between KAMs and ESG matters, illustrating how these two concerns share a space in which information is interconnected.

Literature review and research questionsIn this research, we review the literature on the concept of sustainability materiality to understand how the materiality matrix can highlight relevant ESG issues for stakeholders and companies and show how these issues can impact on the financial information provided. This approach is also related to the details of the KAMs disclosed in the audit report regarding the impact of sustainability concerns on financial information, thus facilitating a better understanding of how the integration of ESG into KAMs enhances corporate reporting and auditing.

The concept of materiality in sustainabilityThe concept of materiality, which originally emerged in the context of financial reporting, has been widely debated in recent years. According to The Conceptual Framework for Financial Reporting:

"Information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general-purpose financial reports make on the basis of those reports, which provide financial information about a specific reporting entity" (IASB, 2018, p.14).

In the field of auditing, International Standard on Auditing (ISA) 320 states that the auditor must apply the concept of materiality or relative importance in both the planning and execution of the audit, defining the concept of materiality as follows:

"For purposes of the ISAs, performance materiality means the amount or amounts set by the auditor at less than materiality for the financial statements as a whole to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole. If applicable, performance materiality also refers to the amount or amounts set by the auditor at less than the materiality level or levels for particular classes of transactions, account balances or disclosures. " (IAASB, 2009, p. 4).

Subsequently, the concept of materiality was extended to sustainability information, and it became a crucial tool for assessing the relative importance of various sustainability issues, helping companies manage trade-offs among different sustainability areas (Jørgensen et al., 2022). Materiality is crucial in integrated and sustainability reporting, enabling companies to identify and prioritise relevant issues for stakeholders. Stakeholder involvement, guided by international standards, is essential for understanding and responding to their needs (Torelli et al., 2020). For a long time, both accounting organisations and the GRI have stressed the importance of the materiality principle in sustainability reporting. Nevertheless, some organisations have not disclosed comprehensive and detailed information on their approaches to identifying material issues (Machado et al., 2021).

A wide range of studies have considered the concept of materiality in sustainability. Following the classification proposed by Sepúlveda-Alzate et al., (2021) and Torelli et al. (2020), we classify the research conducted into materiality in terms of four main groups. Firstly, studies on the definition of materiality (Fiandrino et al., 2022; Garst et al., 2022; Jørgensen et al., 2022); secondly, studies on the disclosure of ESG materiality issues in sustainability reports (Farooq & de Villiers, 2019; Farooq et al., 2021; Guix et al., 2019; Puroila & Mäkelä, 2019; Ruiz-Lozano et al., 2022); thirdly, considerations of methodologies for assessing materiality (Barcellos de Paula & Gil-Lafuente, 2018; Calabrese et al., 2016; Karagiannis et al., 2019; Sepúlveda-Alzate et al., 2021; Zeisel, 2020); and finally, research on topics that are material from the stakeholders' perspective (Beske et al., 2020; Guix & Font, 2020; Henriques et al., 2022; Torelli et al., 2020).

In this context, it is important to note what is being done in Europe, where the concept of "double materiality" has been incorporated into the debate (EU., 2022). This broader concept combines two perspectives of materiality: "impact materiality", which refers to external impacts such as those affecting the economy, environment and society, and also materiality assessments focusing on the internal impacts a company may experience, known as "financial materiality." Directive 2022/2464/EU requires all large listed companies to start reporting on two types of impact: those affecting the company's ESG performance and development (the "outside-in" perspective) and also the impacts generated by the companies themselves, affecting society and the environment (the "inside-out" perspective).

To our knowledge, the first empirical study to address the question of double materiality was conducted by De Cristofaro and Gulluscio (2023), in an exploratory analysis of non-financial reports from 58 companies operating in various industries, in the EU and elsewhere, for the period 2019–2022. These authors concluded that only a limited number of companies, mainly European and operating in service industries, demonstrated a proactive attitude towards double materiality.

In view of these considerations, it seems clear that materiality is a cornerstone of reporting and a highly effective tool for kick-starting sustainable management. An effective assessment of materiality requires the analyst to determine the probable impact of an ESG-related issue in a specific context. Success in this endeavour will provide a pivotal starting point on which to focus sustainable management. Additionally, accountability requires the information needs of management, investors, and other stakeholders to be considered in order to enhance the firm's long-term performance. A precise materiality analysis and a well-defined matrix are necessary to identify the most relevant issues. Stakeholder participation is vital for creating effective reports and providing pertinent information. This concept of materiality is also intertwined with stakeholder theory, whereby the concerns and interests of stakeholders shape the evaluation and prioritisation of ESG-related issues (Torelli et al., 2020).

Using the materiality matrix to identify and prioritise ESG issuesIn the field of sustainability, one of the biggest challenges for organisations is that of identifying the most important topics to be presented in sustainability reports, whilst considering the needs and requirements of stakeholders. In response, the concept of materiality has been used in sustainability reporting to help companies recognise the relevant issues to disclose (Hsu et al., 2013).

The materiality matrix is a tool for prioritising sustainability topics from the dual perspectives of companies and stakeholders, enabling all parties to identify present and emerging ESG issues (Garst et al., 2022). In this regard, the materiality matrix is often used to visualise materiality assessments (Ruiz-Lozano et al., 2022), revealing how stakeholders' perceptions of ESG issues may influence the value creation process (Geldres-Weiss et al., 2021).

To date, no specific stream of literature has emerged to focus on the materiality matrix in relation to ESG issues. However, the debate surrounding this question has become increasingly intense (Formisano et al., 2018), and several research studies have recently appeared. One notable example of this was conducted by De Cristofaro and Raucci (2022), who investigated approaches and arguments regarding the materiality matrix, analysing both supportive and opposing practices and opinions of this tool. In a related study, Torelli et al. (2020) examined how and when the materiality matrix is used.

Several authors have highlighted the strengths of the materiality matrix. Among them, D'Adamo (2022) showed that a sustainability materiality matrix can provide new and useful information for strategy and communication. Others (Kaffashi & Grayson, 2022; Longo et al., 2021;Calabrese et al., 2019; Puroila & Mäkelä, 2019; Santos et al., 2022) have concluded that the materiality matrix is an important tool for identifying and prioritising relevant sustainability issues in sustainability reports, making it an effective means of guiding corporate sustainability strategy. Similarly, Geldres-Weiss et al. (2021) suggested that the materiality matrix could be used to transform a company's existing traditional business model into a more sustainable one and to identify the most appropriate business model archetype to incorporate innovation into its sustainable business model.

In this context, too, studies have analysed the use of the materiality matrix in specific areas, such as industry (Rashed et al., 2022), finance (Campra et al., 2020; Formisano et al., 2018), mining (Saenz, 2019), sports (Barcellos de Paula & Gil-Lafuente, 2018) or textiles (Garcia-Torres et al., 2017), while Eccles and Krzus (2014) examined the use of materiality matrices in different industries and countries. The above studies reach the following general conclusions: 1) the materiality matrix, as an information tool, can be used to define and improve company reports by taking into consideration stakeholders' opinions, thus enhancing the quality of sustainability reporting; 2) the materiality matrix is likely to attract management attention and may therefore effectively expedite the integration of sustainability processes; 3) it enhances the use of materiality analysis, suggesting useful areas for future action; 4) by thus involving stakeholders in the decision-making process, the company generates greater trust and legitimacy.

The impact of ESG issues on financial informationThe consideration of ESG issues has transformed how companies manage their operations and business strategies (Kollat & Farache, 2017), as among other aspects, financial development has an impact on the environment, although findings vary as to whether this impact is positive or negative (Dabbous et al., 2024). Concerns related to climate change, social justice, gender equality and corporate ethics have led to increased demands for transparency and accountability. ESG issues, thus, constitute a valuable framework for evaluating the sustainable and ethical performance of organisations (Landi & Sciarelli, 2019) and their impact has extended to accounting and financial statements, driving greater transparency, comprehensive disclosures and the consideration of ESG issues in business valuation.

An outstanding aspect of the impact of ESG issues on accounting is the recognition and valuation of assets and liabilities related to environmental and social issues (Nicholls, 2020). For example, companies must now account for greenhouse gas emissions and the costs associated with climate change mitigation. Additionally, if the company conducts business practices that may negatively affect the environment or society, it is likely to face future costs, in the form of legal liabilities, fines or corrective actions, and these costs will require appropriate accounting provisions to be made. In short, climate-related risks cannot be treated merely as a matter of corporate social responsibility but must also be considered in the context of financial statements.

Audit firms have also reported on the impact of ESG issues on financial statements. Thus, KPMG (2023) published the handbook "Climate risk in the financial statements," which aims to help understand the potential effects of climate risk on financial statements, regarding possible errors, for example if items such as impairments and other write-downs, liabilities and contingent losses are not properly accounted for. In this regard, too, PwC have published two in-depth reports that address the impact of climate change on assets and liabilities in financial statements under IFRS (PwC, 2022, a, b). Moreover, Deloitte in their article "A close look at climate change" commented that all companies are likely to be affected, to a greater or lesser extent, by the risks and uncertainties arising from climate change (Deloitte, 2019) and that the magnitude of the impact of climate change on financial statements would depend on how effectively the company adapts to changing climate scenarios. This outlook underscores the importance of companies’ realising that these factors may alter cash flow projections and increase the risk associated in achieving those flows.

Empirical evidence reveals the impact of ESG issues on the information supplied by organisations regarding their financial situation. Chen et al., (2022) examined the influence of climate change risk disclosure on ESG performance and financial performance, concluding that when companies assign greater importance to climate change issues, the positive impact of environmental performance on financial performance gradually decreases until it produces a negative impact, thereby reducing operating profits. Liu et al., (2022) examined how different configurations of ESG pillars can impact on corporate financial performance, and concluded that the social pillar is of decisive importance in generating high levels of corporate financial performance. Bruna et al., (2022) found a positive and significant impact of ESG performance on financial performance. Yuan et al., (2022) showed that ESG disclosure reduced the risks of corporate financial irregularities and helped mitigate information asymmetry. The findings of Zhang et al., (2022) suggest that when publicly-traded corporations enjoy high ESG ratings this significantly weakens the positive correlation between political uncertainty and bond yield premiums. Rumyantseva and Tarutko (2022) concluded that considering ESG principles in developing a corporate financial strategy can generate significant benefits in terms of maintaining financial stability, ensuring a more stable cash flow, reducing risks, increasing commercial attractiveness for investors and consumers, and enhancing competitiveness and efficiency in obtaining financial resources.

Zumente and Bistrova (2021) examined the relation between shareholder value and ESG corporate awareness. Their analysis showed that companies with a higher level of sustainability awareness created greater value for their shareholders, through better financial performance, more effective management and reduced risk metrics. In this respect, too, Setyahuni (2020) showed that ESG disclosure had a significant impact on stock prices and returns, making this disclosure relevant both to pricing and to performance. Fedorova et al., Nersesyan and Ledyaeva (2020) examined the relationship between non-financial information and financial results, especially stock profitability and the weighted average cost of capital (WACC).

On the other hand, Gutiérrez-Ponce and Wibowo (2023) found that the relationship between the financial profitability of companies and the disclosure of Corporate Social Responsibility (CSR) and Sustainable Development Goals (SDGs) exhibits an inverse trend. This association can be interpreted in the sense that short-term sustainability initiatives require a significant investment of financial and organisational resources, which may negatively impact profits.

In a specific business sector, Gutiérrez‐Ponce and Wibowo (2023) analyse the relationship between ESG and financial performance in banks based in emerging economies in SE Asia. Their results suggest that ESG has a significant negative effect on financial performance. Ionescu et al., Pirvu and Vilag (2019) investigated the relationship between ESG factors and the market value of companies in the travel and tourism industry, concluding that among these factors, that of governance appeared to have the most significant influence on market value. Indeed, many studies have emphasised the influence of governance on a company's market value, suggesting there is a positive cause-and-effect relationship between strong corporate governance and market value (Bebchuk & Cohen, 2005; Brown & Caylor, 2006; Gompers et al., 2003).

The aforementioned studies provide strong evidence that ESG issues exert a significant influence on a company's financial standing, its financial statements and its overall valuation. These findings underscore the critical importance of incorporating ESG considerations into a comprehensive and precise evaluation of a company's financial position, particularly in the current landscape where sustainability and corporate responsibility considerations are of increasing significance for stakeholders.

The integration of ESG matters into financial statements is now a priority concern for companies wishing to provide stakeholders with an accurate, holistic description of their business situation. Financial reports can no longer be deemed complete if they fail to reflect the sustainability-related risks and opportunities faced. In this regard, auditors play a pivotal role in ensuring that financial statements offer a balanced and accurate view of the company, including the consideration of ESG issues. Auditors must meticulously weigh these factors when planning and executing an audit to assess the integrity of financial statements and to ensure they adequately capture the financial impacts of ESG matters.

In this context, the International Standards on Auditing (ISA) require auditors to assess and respond to audit risks, including the risks of material misstatement in financial statements due to fraud or error. Given that ESG matters can give rise to significant financial and legal risks, it is imperative for auditors to scrupulously consider these risks when planning and conducting audits. Neglecting these risks could lead to an inadequate evaluation of the risk of material misstatement.

In this respect, ISA 701, 'Communicating Key Audit Matters in the Independent Auditor's Report,' plays a notable role. This standard requires auditors to communicate KAMs in their report, addressing any matters relevant to stakeholders that were subjected to particularly significant audit scrutiny. Given that ESG issues can have a substantial impact on an entity's financial position and risks, it is essential for auditors to consider these issues and to incorporate them as applicable in the KAMs attached to their report (CAP Australia, 2023).

In this regard, the IAASB, in its document "The Consideration of Climate-Related Risks in an Audit of Financial Statements," states that while the phrase "climate change" does not appear in the ISA, the ISA requires the auditor to identify and assess the risks of material misstatement in the financial statements, whether due to fraud or error. The auditor is also required to design and perform audit procedures that respond to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for the auditor's opinion. If climate change affects the entity, the auditor should consider whether the financial statements adequately reflect this in accordance with the applicable financial reporting framework (i.e., in the context of risks of material misstatement related to amounts and disclosures that may be affected depending on the entity's facts and circumstances). Auditors must also understand how climate-related risks relate to their responsibilities under professional standards and applicable laws and regulations (IAASB, 2020).

Moreover, with the publication of the ISSA 5000 - International Standard on Sustainability Assurance project, the IAASB aims to address assurance engagements on sustainability information, in response to the increasing demand for transparent and verifiable sustainability reports. The primary objective of this standard is to establish a global baseline for sustainability assurance by enhancing the quality and reliability of sustainability information, thereby promoting greater accountability and transparency. This standard underscores the crucial role that auditors should play in assessing and reporting ESG risks, ensuring that these critical issues are appropriately evaluated and disclosed in corporate reporting.

ESG integration, KAMs and innovation in corporate reporting and auditingThe integration of ESG issues into KAMs can be a catalyst for innovation in corporate reporting and auditing. As companies face increasing pressure to address ESG risks and opportunities, the consideration of these issues in KAMs is spurring the development of new reporting frameworks, assurance practices and stakeholder engagement strategies (Smith et al., 2011). This integration can also foster innovation in sustainable business models, promoting the introduction of new products, services and processes that address ESG concerns (Geissdoerfer et al., 2018).

Innovation in corporate reporting and auditing practices is crucial in order to address the growing demand for ESG information from investors and other stakeholders. Moreover, the literature on auditing and CSR has paid little attention to the relationship between auditing and CSR disclosure (Pucheta-Martínez et al., 2019). Traditional financial reporting frameworks do not adequately capture the complex, interdependent nature of ESG risks and opportunities (Adams et al., 2021). By integrating ESG issues into KAMs, auditors can provide a more comprehensive and forward-looking assessment of a company's performance and prospects, driving innovation into how this information is communicated to stakeholders.

Moreover, the inclusion of ESG issues in KAMs can enhance stakeholder engagement and promote innovation in corporate sustainability practices. By highlighting the financial relevance of ESG factors, KAMs can encourage greater dialogue between companies and their stakeholders on sustainability issues (Patel et al., 2002). This engagement can facilitate the co-creation of sustainable solutions, as companies work with stakeholders to identify and address ESG risks and opportunities.

Innovation in ESG reporting and assurance can also be generated by technological advances, as digital transformations have become a vital means for companies to adapt to changes and strengthen their competitive advantage (Chen et al., 2024). The use of artificial intelligence, and blockchain and data analytics can improve the efficiency, accuracy and transparency of ESG information collection, analysis and verification (Mulligan et al., 2024). In recent years, big data has emerged as a frontier of efficiency and opportunity for transforming businesses (Khan & Tao, 2022) and the effective adoption of blockchain analytics is now one of the most potent tools for boosting sustainable organisational performance (Sun et al., 2022). These technologies can enable auditors to process large volumes of ESG data from multiple sources, identify patterns and anomalies and provide real-time assurance on the reliability of ESG disclosures (Singh et al., 2007).

However, the integration of ESG issues into KAMs also presents challenges for innovation in corporate reporting and auditing. Auditors may lack the necessary skills and knowledge to effectively assess and communicate ESG risks, requiring innovation in education and training programmes, and active engagement by higher education institutions, in both local and global contexts, to advance justice and sustainability (De Moraes Abrahão et al., 2024). There may also be resistance to change from companies and their stakeholders who are accustomed to traditional financial reporting frameworks and assurance practices (Patel et al., 2002).

Despite these challenges, the integration of ESG issues into KAMs represents a significant opportunity for innovation in corporate reporting and auditing. By embracing this integration, auditors and companies can drive the development of new reporting frameworks, assurance practices and stakeholder engagement strategies that better reflect the complex and interconnected nature of ESG risks and opportunities. This innovation can ultimately lead to more sustainable and resilient business models that create value for a broader range of stakeholders (Adams et al., 2021).

Research questionsIn view of the above-described theoretical framework and the literature review carried out, we address the following research questions:

RQ1

Do auditors consider the material ESG issues included in the company's materiality matrix in their KAMs?

RQ2

Does a company's ESG performance affect how auditors refer to ESG material issues in the KAMs presented in the audit report?

Research designSampleThe aim of this empirical research is to determine whether auditors include the material ESG issues identified in the sustainability report among the KAMs associated with the audit report. To do so, we considered a sample of companies listed on the COLCAP index of the Colombian Stock Exchange (BVC). This index, the primary stock market indicator of the BVC, provided us with a sample composed of the 20 most liquid and representative stocks of listed companies. Our research covers the period 2019–2021, which is very appropriate because KAMs began to be used in Colombia in 2019.

The initial analysis was based on 60 observations (20 companies for each of the three years considered). However, this number was reduced to 54 after excluding two companies that provided incomplete information. The final sample, therefore, consisted of 18 companies, operating in various business sectors as shown in Table 1.

RQ1 was addressed using content analysis. The KAMs were obtained from the audit reports, and the ESG issues were extracted from the materiality matrices reported in the sustainability reports of the companies. Audit report and sustainability report data were collected directly from the companies' websites.

To conduct the content analysis, specific categories were developed based on the materiality matrices found in the sustainability reports, and following the approaches of Berelson (1984) and Krippendorff (1997). The categories for ESG issues included: (1) Environmental, covering factors such as carbon emissions, use of natural resources, and sustainable practices; (2) Social, involving issues such as labour rights, community impact, and diversity and inclusion; and (3) Governance, considering aspects such as corporate governance structure, economic performance, business ethics and regulatory compliance.

A search was conducted in the sustainability reports for the materiality matrices and material issues, which were subsequently classified into the three aforementioned categories. For the KAMs, the audit reports were reviewed, and the title of the KAM, its description and the auditor's response were extracted. The content of each KAM was manually analysed to determine whether its description related to the issues listed by the companies as material within the materiality matrices of the sustainability reports. The KAMs were identified with numbers, and subsequently, any coincidence between a KAM and a material issue was termed a "match", as shown in Fig. 2.

ModelRQ2 was addressed by means of a logistic regression model that related the ESG performance of the company (ESG scores) with the inclusion of significant ESG issues (included in the materiality matrix) in the KAMs (Match). Financial information and ESG scores were obtained from the Thomson Reuters Eikon Database1:

VariablesDependent variableIn this analysis, the dependent variable is Match, which represents the relationship between an ESG issue and a KAM. A match occurs when an ESG issue identified within the company through the materiality matrix disclosed in the sustainability report is acknowledged by the auditor in the KAM section of the audit report. In our main model, the variable 'Match' takes the value of 1 when there is a relationship between an ESG issue and a KAM, and 0 otherwise.

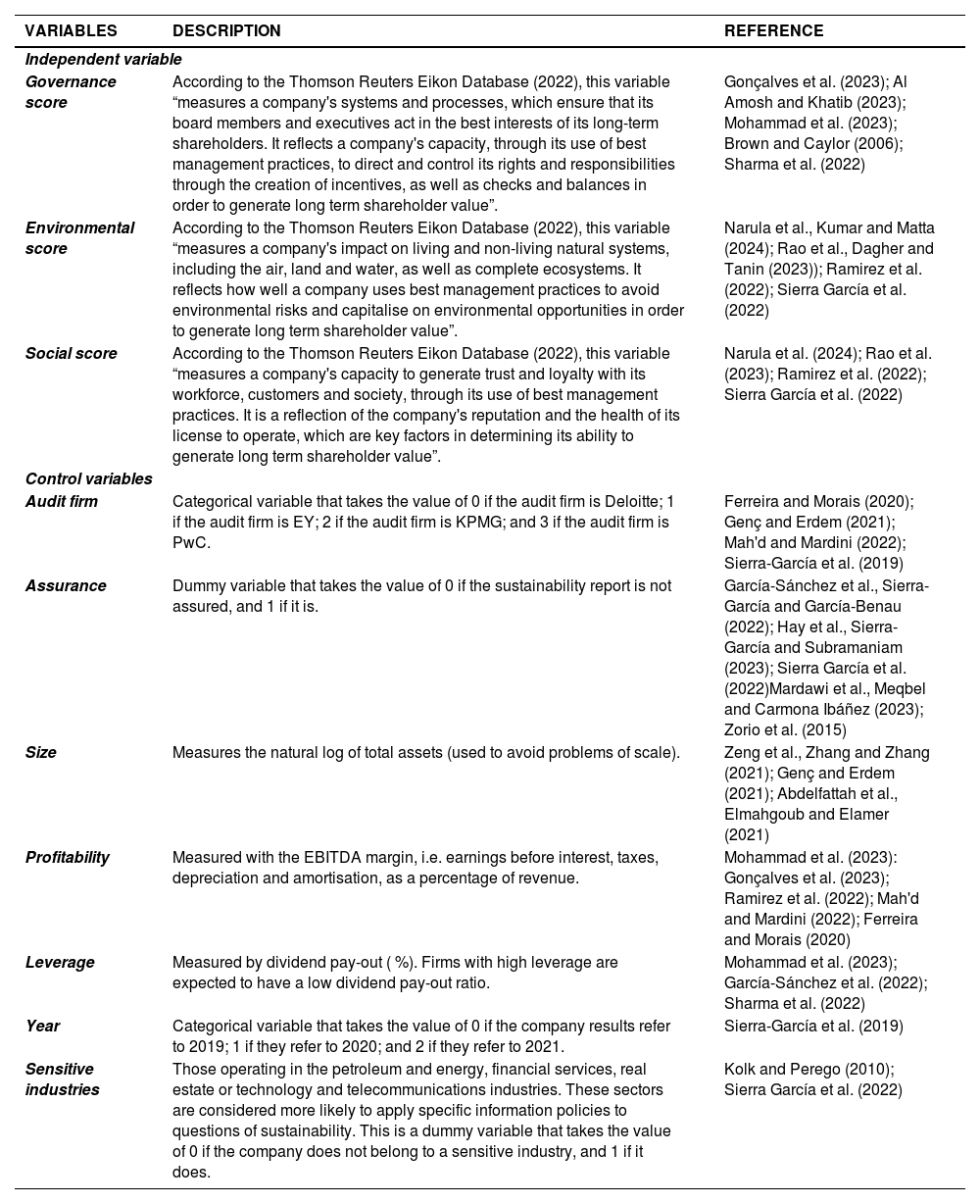

Independent and control variablesThe scores related to ESG performance were taken as independent variables, to determine whether these matters impacted on how auditors referred to ESG material issues in the KAMs presented in the audit report. In accordance with prior studies in the field of ESG matters and the disclosure of KAMs in the audit report, we considered the six control variables that are summarised in Table 2.

Study variables.

| VARIABLES | DESCRIPTION | REFERENCE |

|---|---|---|

| Independent variable | ||

| Governance score | According to the Thomson Reuters Eikon Database (2022), this variable “measures a company's systems and processes, which ensure that its board members and executives act in the best interests of its long-term shareholders. It reflects a company's capacity, through its use of best management practices, to direct and control its rights and responsibilities through the creation of incentives, as well as checks and balances in order to generate long term shareholder value”. | Gonçalves et al. (2023); Al Amosh and Khatib (2023); Mohammad et al. (2023); Brown and Caylor (2006); Sharma et al. (2022) |

| Environmental score | According to the Thomson Reuters Eikon Database (2022), this variable “measures a company's impact on living and non-living natural systems, including the air, land and water, as well as complete ecosystems. It reflects how well a company uses best management practices to avoid environmental risks and capitalise on environmental opportunities in order to generate long term shareholder value”. | Narula et al., Kumar and Matta (2024); Rao et al., Dagher and Tanin (2023)); Ramirez et al. (2022); Sierra García et al. (2022) |

| Social score | According to the Thomson Reuters Eikon Database (2022), this variable “measures a company's capacity to generate trust and loyalty with its workforce, customers and society, through its use of best management practices. It is a reflection of the company's reputation and the health of its license to operate, which are key factors in determining its ability to generate long term shareholder value”. | Narula et al. (2024); Rao et al. (2023); Ramirez et al. (2022); Sierra García et al. (2022) |

| Control variables | ||

| Audit firm | Categorical variable that takes the value of 0 if the audit firm is Deloitte; 1 if the audit firm is EY; 2 if the audit firm is KPMG; and 3 if the audit firm is PwC. | Ferreira and Morais (2020); Genç and Erdem (2021); Mah'd and Mardini (2022); Sierra-García et al. (2019) |

| Assurance | Dummy variable that takes the value of 0 if the sustainability report is not assured, and 1 if it is. | García-Sánchez et al., Sierra-García and García-Benau (2022); Hay et al., Sierra-García and Subramaniam (2023); Sierra García et al. (2022)Mardawi et al., Meqbel and Carmona Ibáñez (2023); Zorio et al. (2015) |

| Size | Measures the natural log of total assets (used to avoid problems of scale). | Zeng et al., Zhang and Zhang (2021); Genç and Erdem (2021); Abdelfattah et al., Elmahgoub and Elamer (2021) |

| Profitability | Measured with the EBITDA margin, i.e. earnings before interest, taxes, depreciation and amortisation, as a percentage of revenue. | Mohammad et al. (2023): Gonçalves et al. (2023); Ramirez et al. (2022); Mah'd and Mardini (2022); Ferreira and Morais (2020) |

| Leverage | Measured by dividend pay-out ( %). Firms with high leverage are expected to have a low dividend pay-out ratio. | Mohammad et al. (2023); García-Sánchez et al. (2022); Sharma et al. (2022) |

| Year | Categorical variable that takes the value of 0 if the company results refer to 2019; 1 if they refer to 2020; and 2 if they refer to 2021. | Sierra-García et al. (2019) |

| Sensitive industries | Those operating in the petroleum and energy, financial services, real estate or technology and telecommunications industries. These sectors are considered more likely to apply specific information policies to questions of sustainability. This is a dummy variable that takes the value of 0 if the company does not belong to a sensitive industry, and 1 if it does. | Kolk and Perego (2010); Sierra García et al. (2022) |

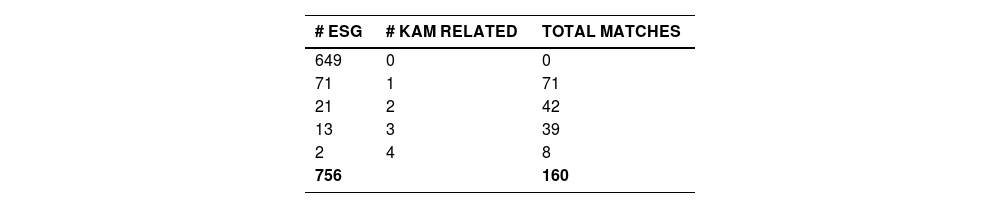

During the study period, the companies included in our analysis generated 103 KAMs and reported 756 ESG issues (see Tables 3 and 4). Specifically, 244 ESG issues were reported in 2019, 247 in 2020 and 265 in 2021, demonstrating the increasing importance assigned to sustainability topics in Latin American business reporting (Da Silva et al., 2009). Of the 756 ESG issues, 124 corresponded to environmental questions, 330 to social ones, and 302 to governance. Social and governance issues were more prevalent than environmental issues, which is consistent with the findings of Sepúlveda-Alzate et al. (2021).

Of these 756 ESG issues, 649 had no relation to any KAM, while 92 KAMs were associated with 107 ESG issues, resulting in 160 matches: 71 issues matched with 1 KAM, 21 with 2 KAMs, 13 with 3 KAMs, and 2 with 4 KAMs (see Table 5).

Of the 160 identified matches, 152 were related to governance issues and 8 to social issues. No matches were found for environmental issues, as shown in Table 6.

The content analysis enabled us to identify relevant patterns and themes, facilitating a deeper understanding of how auditors address ESG issues in their audit reports. The findings suggest there is a need for greater integration of ESG issues, particularly environmental and social ones, into current auditing practices. The prevalence of matches between KAMs and governance issues highlights the significant attention auditors are currently paying to governance aspects compared to environmental and social issues. This trend suggests that, although governance matters are well represented, there is considerable opportunity to improve the integration of environmental and social issues in audit reports. This finding underscores the importance of fostering a greater consideration of all ESG aspects to achieve a more holistic and accurate view of organisations' sustainability and performance.

Table 7 shows the number of matches between Key Audit Matters (KAM) and Environmental, Social, and Governance (ESG) issues across various industrial sectors. Identified sensitive sectors, such as oil and energy, financial services, real estate and technology and telecommunications, present significant variations in their outcomes. Specifically, the oil and energy sector has a relatively low average of matches per audit report (2.2), especially with respect to social and governance issues, suggesting a need to enhance environmental practices for better alignment with ESG standards. In contrast, financial services and real estate have high numbers of governance matches (71 matches, with an average of 3.4), indicating robust alignment with corporate practices and ESG regulations. Finally, the technology and telecommunications sector, while displaying a lower total number of matches, has a high average per audit report (3.7), implying an effective focus on ESG criteria despite there being fewer audit reports. This analysis underscores the importance of continually assessing and improving ESG practices in sensitive sectors in order to bolster sustainability and corporate responsibility.

Number of ESG issues matching with KAMs per sector.

| SECTOR | E | S | G | Total matches | Matches/ Audit reports per sector |

|---|---|---|---|---|---|

| Consumer goods | 0 | 0 | 11 | 11 | 3.7 |

| Basic materials, industry and construction | 0 | 0 | 21 | 21 | 3.5 |

| Oil and energy | 0 | 6 | 40 | 46 | 2.2 |

| Financial and real estate services | 0 | 0 | 71 | 71 | 3.4 |

| Technology and telecommunications | 0 | 2 | 9 | 11 | 3.7 |

| Total matches | 0 | 8 | 152 | 160 | 3.0 |

In this context, it is important to note that Latin America is becoming increasingly integrated into organisational strategies, particularly in large companies within sensitive industries (Da Silva et al., 2009). However, the region faces unique challenges such as limited access to healthcare and education, corruption, human rights violations, social unrest and inequality. As a result, environmental issues are addressed differently compared to the situation in developed economies, which have better institutional conditions and where basic needs are met to a higher degree (Hossain, Islam, Momin, Nahar, & Alam, 2019).

The analysis of ESG issues matching with KAMs per auditor revealed the following insights (see Table 8). Governance issues were the most frequently matched, with a total of 152 matches across Deloitte (16), EY (30), KPMG (87), and PwC (19). Social issues had only 8 matches (Deloitte: 2, EY: 6, KPMG and PwC: 0), and there were no matches for environmental issues. The total matches were 160, averaging 3.0 matches per audit report.

Deloitte had the highest average with 4.5 matches per report, followed closely by EY with 4.0 matches per report. PwC had an average of 3.2 matches per report, while KPMG had the lowest average with 2.4 matches per report. Deloitte and EY demonstrate a higher level of integration of ESG considerations into their audit reports, while KPMG shows the lowest level of integration.

These findings illustrate the significant role that large audit firms play in corporate governance and their impact on CSR disclosure practices. The varying averages of matches per report among the audit firms suggest differing levels of integration of ESG considerations, underscoring the need for auditors to enhance their focus on environmental and social issues to provide a more comprehensive view of ESG risks and opportunities in their reports.

Descriptive analysisTable 9 summarises the key features of the study variables. Corroborating previous research by Gonçalves et al., (2023) and Al Amosh and Khatib (2023), the Social score obtained a higher rating than the Governance and Environmental scores. The mean and standard deviation values of 67.57 and 11.55, respectively, for the Social score indicate an upward trend and relative consistency. The corresponding values for the Environmental score are 54.94 and 20.72, indicative of somewhat broader variability in this area. The Governance score, with a mean value of 50.64 and a standard deviation of 23.04 (the highest of the three considered), exhibits a wide range of values, from a minimum of 6.36 to a maximum of 89.24, highlighting the significance of governance in the Colombian context. These ratios suggest the performance metrics are reasonable and are in line with many previous research findings (Al Amosh & Khatib, 2023; Gonçalves et al., 2023; Mohammad et al., 2023; Sharma et al., 2022).

Descriptive statistics. Continuous variables.

| Variables | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|

| Governance Score | 50.63 | 23.04 | 6.36 | 89.24 |

| Environmental Score | 54.94 | 20.72 | 14.28 | 91.14 |

| Social Score | 67.57 | 11.55 | 31.61 | 92.63 |

| Size (m. Colombian pesos) | 345,917,400.49 | 1246,034,780.93 | 632,243.5 | 6660,634,456.34 |

| Profitability | 29.99 % | 17.64 % | 1.32 % | 65.45 % |

| Leverage | 66.81 % | 96.48 % | 0 | 549.90 % |

The average size of the companies in our sample is 345,917,400.49 million Colombian pesos, with a standard deviation of 1246,034,780.93, implying a relatively concentrated distribution around the mean. Company size ranges from a minimum of 632,243.5 Colombian pesos to a maximum of 6660,634,456.34 million Colombian pesos.

The mean value for profitability is 29.99, with a standard deviation of 17.65. Profitability scores range from a minimum of 1.3 to a maximum of 65.4, indicating the presence of considerable variation. The mean value for financial leverage is 66.82, with a notably high standard deviation of 96.48. Scores in this respect range from a minimum of 0, signifying the absence of debt (Sharma et al., 2022), to a maximum of 549.9. The financial leverage and profitability values present the highest coefficients of variation, implying significant differences within companies according to the period or economic sector considered (Ramirez et al., 2022).

Table 10 shows the distribution of data across various key categories. The Audit Firm variable provides insights into preferences for audit firms within the dataset. Corroborating Sierra-García et al. (2019), our data show that KPMG is the most widely used firm, appearing in 53.98 % of cases, followed by EY at 23.58 %. With respect to the Assurance variable, the findings show that 75 % of firms obtained some form of assurance. This value is higher than that reported by Zorio Grima et al., (2015), and indicates increased interest by Colombian companies in recent years in assuring their reports. With respect to the year of publication, 34.66 % of the reports referred to 2019, 31.53 % to 2020 and 33.81 % to 2021. Finally, for the "Sensitive Industry" variable, 82.10 % of cases are categorised as corresponding to a sensitive industry, underscoring the prevalence of these industries within the dataset. These data offer a comprehensive view of the sample's composition and of relevant trends.

Table 11 presents the average governance scores, by key categories. The Audit Firm category reveals significant differences, with values of 44.20 for KPMG, 66.79 for EY, 38.28 for Deloitte and 57.81 for PwC. This variability suggests that the choice of audit firm may influence the governance scores reported. The firms that obtained assurance reported a mean governance score of 53.72, while those without assurance had a mean score of 41.32. This indicates that the presence of assurance is associated with higher governance scores, suggesting higher quality in the sustainability information published. For the Year variable, the mean governance scores were 47.65 for 2019, 51.48 for 2020 and 52.91 for 2021. This result indicates a rising trend in governance scores over time, reflecting a greater focus on sustainable practices. Finally, the mean governance scores for the Sensitive Industry variable differ significantly, between 47.88 for those companies operating within a sensitive industry sector and 63.27 for those operating elsewhere. This indicates that companies in sensitive industries may face additional governance challenges, resulting in lower scores. The above-described numerical values offer a detailed insight into trends and differences in governance scores based on key factors in this study.

Empirical resultsTable 12 shows the results of our logistic regression analysis, including the goodness of fit test, which show that the model performs well. The chi square test produced a value of 94.048 (p = .000) and the Cox-Snell R2 test indicates that 10.8 % of the variation of the dependent variable is explained by the variables included in our model. The Nagelkerke R2 test result shows that the proposed model is explained by 14.5 % of the variability. The robustness of the model was examined by the Hosmer-Lemeshow test, which showed there were no significant statistical differences. The overall classification obtained was 72.5 %.

Logit regression model.

| MATCH | Coef. | Std. Err. | z | P>z | [95 % C.I.] | |

|---|---|---|---|---|---|---|

| Governance Score | .0115917 | .0066932 | 1.73 | 0.083* | −0.0015268 | .0247102 |

| Environmental Score | .0090481 | .0098904 | 0.91 | 0.360 | −0.0103367 | .0284329 |

| Social Score | .0243309 | .0156768 | 1.55 | 0.121 | −0.006395 | .0550568 |

| Audit Firm (Reference: Deloitte) | ||||||

| EY | −1.851455 | .5909962 | −3.13 | 0.002*** | −3.009786 | −0.6931233 |

| KPMG | −0.3967381 | .4306074 | −0.92 | 0.357 | −1.240713 | .4472368 |

| PwC | −1.235822 | .6366503 | −1.94 | 0.052* | −2.483633 | .0119898 |

| Assurance | .1550995 | .3903134 | 0.40 | 0.691 | −0.6099007 | .9200997 |

| Size | .0679585 | .0857982 | 0.79 | 0.428 | −0.1002029 | .23612 |

| Profitability | −0.0330124 | .0086202 | −3.83 | 0.000*** | −0.0499078 | −0.0161171 |

| Leverage | −0.0033389 | .0014632 | −2.28 | 0.022** | −0.0062068 | −0.0004711 |

| Year (Reference: 2019) | ||||||

| 2020 | −0.4591665 | .3045999 | −1.51 | 0.132 | −1.056171 | .1378383 |

| 2021 | −0.4203646 | .2984299 | −1.41 | 0.159 | −1.005276 | .1645474 |

| Sensitive Industry | .5490203 | .4125851 | 1.33 | 0.183 | −0.2596316 | 1.357672 |

| _cons | −2.535598 | 1.536146 | −1.65 | 0.099 | −5.546389 | .4751929 |

*, ** and *** significant at 10%, 5 % and 1 %, respectively.

Goodness of fit test statistics:.

Χ2 (r- values) 94.048 (0.000).

2 log likelihood 90.329.

R2 Cox and Snell 0.108.

R2 Nagelkerke 0.145.

Hosmer and Lemeshow 8.042 (0.429).

Global Classification: 72.5 %.

N: 352.

The result for the Governance Score variable is positive and significant (Coef.=0.0115917, S.E.= 0.0066932, p = 0.083), meaning that companies with a higher governance score have a higher probability of obtaining a match. Since the Audit Firm variable was treated as categorical, with Deloitte as the reference category, although the coefficients for all three variables were negative, the results for both EY and PwC were significant (p = 0.0002 and p = 0.052, respectively). This result indicates that EY and PwC are less likely to obtain a match than Deloitte.

The results for the Profitability and Leverage variables were significant and negative. In the first case, the coefficient was significant and negative, at −0.0330, suggesting that as profitability decreases, the likelihood of obtaining a match tends to increase. This could mean that in less profitable companies, auditors pay more attention to ESG issues that may affect the company's financial information. The Leverage variable obtained a significant negative coefficient of −0.003, which also indicates that as leverage decreases, the likelihood of obtaining a match tends to increase.

ROBUSTNESSThe above-described analysis may have been subject to selection bias, and therefore a robustness test must be performed to assess the stability of the results under different conditions. To do so, we categorised Match into two types: negative Match, whereby ESG issues are included in a KAM because the auditor identifies a potential risk for the company; and positive Match, where there is a consideration of an ESG issue in a KAM because the auditor highlights the company's positive management of that risk. A negative Match takes the value of 1 and a positive Match takes a value of 2.

Table 13 shows the results of the logistic regression analysis, including the goodness of fit test, which confirmed that the model is adequate for purpose. The chi square test produced a value of 58.679 (p = .001) while the Cox-Snell R2 test results indicate that 15.4 % of the variation of the dependent variable is explained by the variables included in our model. The Nagelkerke R2 statistic shows that the proposed model is explained by 17.9 % of the variability. Furthermore, the robustness of the model was confirmed by the Hosmer-Lemeshow test, according to which there was no statistical difference. The overall classification obtained was 75.5 %.

Descriptive statistics: Test of robustness.

| MATCH 2 | Coef. | Std. Err. | z | P>z | [95 % C.I.] | |

|---|---|---|---|---|---|---|

| 0 (base outcome) No match | ||||||

| 1 Negative Risk: Concerns of Interest to the Auditor | ||||||

| Governance Score | .0210045 | .0084109 | 2.50 | 0.013** | .0045194 | .0374895 |

| Environmental Score | .0159572 | .0117675 | 1.36 | 0.175 | −0.0071067 | .0390211 |

| Social Score | .0188226 | .0187899 | 1.00 | 0.316 | −0.0180049 | .0556501 |

| Audit Firm (Reference: Deloitte) | ||||||

| EY | −2.33554 | .7972467 | −2.93 | 0.003*** | −3.898115 | −0.7729657 |

| KPMG | −0.211659 | .5252233 | −0.40 | 0.687 | −1.241078 | .8177598 |

| PwC | −1.395956 | .7799209 | −1.79 | 0.073* | −2.924572 | .1326612 |

| Assurance | .5493395 | .4866594 | 1.13 | 0.259 | −0.4044954 | 1.503174 |

| Size | .024223 | .1070951 | 0.23 | 0.821 | −0.1856795 | .2341255 |

| Profitability | −0.0263305 | .010983 | −2.40 | 0.017** | −0.0478567 | −0.0048043 |

| Leverage | −0.0030495 | .001788 | −1.71 | 0.088* | −0.0065538 | .0004548 |

| Year (Reference: 2019) | ||||||

| 2020 | −0.4246088 | .3631793 | −1.17 | 0.242 | −1.136427 | .2872096 |

| 2021 | −0.5104813 | .3528813 | −1.45 | 0.148 | −1.202116 | .1811533 |

| Sensitive Industry | .5145076 | .4758434 | 1.08 | 0.280 | −0.4181283 | 1.447144 |

| _cons | −3.350955 | 1.906624 | −1.76 | 0.079 | −7.08787 | .38596 |

| 2 Positive Risk: Auditor Highlights Company's Risk Management | ||||||

| Governance Score | −0.0007163 | .008895 | −0.08 | 0.936 | −0.0181502 | .0167176 |

| Environmental Score | .0003415 | .0137184 | 0.02 | 0.980 | −0.0265461 | .027229 |

| Social Score | .0316334 | .0225328 | 1.40 | 0.160 | −0.0125301 | .0757968 |

| Audit Firm (Reference: Deloitte) | ||||||

| EY | −1.320484 | .7505411 | −1.76 | 0.079* | −2.791517 | .1505496 |

| KPMG | −0.6861326 | .5775751 | −1.19 | 0.235 | −1.818159 | .4458938 |

| PwC | −0.954832 | .8454655 | −1.13 | 0.259 | −2.611914 | .7022499 |

| Assurance | −0.2386528 | .5121806 | −0.47 | 0.641 | −1.242508 | .7652026 |

| Size | .1567399 | .117529 | 1.33 | 0.182 | −0.0736127 | .3870925 |

| Profitability | −0.0433346 | .011237 | −3.86 | 0.000*** | −0.0653588 | −0.0213105 |

| Leverage | −0.0039463 | .0020576 | −1.92 | 0.055* | −0.007979 | .0000865 |

| Year (Reference: 2019) | ||||||

| 2020 | −0.5114256 | .3984359 | −1.28 | 0.199 | −1.292346 | .2694944 |

| 2021 | −0.3345669 | .3899866 | −0.86 | 0.391 | −1.098927 | .4297927 |

| Sensitive Industry | .6955597 | .5800787 | 1.20 | 0.230 | −0.4413738 | 1.832493 |

| _cons | −3.852642 | 2.11326 | −1.82 | 0.068 | −7.994555 | .2892711 |

*, ** and *** significant at 10 %, 5 % and 1 %, respectively

Goodness of fit test statistics:.

Χ2 (r- values) 58.679(0.001).

2 log likelihood: 90.329.

R2 Cox and Snell: 0.154.

R2 Nagelkerke: 0.179.

Hosmer-Lemeshow: 8.042 (0.429).

Overall classification: 75.5 %.

N: 352.

Table 13 presents the results of a logistic regression model in which two outcomes are associated with the Match variable. The first outcome, "Negative risk concerns of interest to the auditor," examines the negative risk linked to ESG issues that may concern the auditor.

The Governance Score variable was found to be positive and significant (Coef. = 0.0210, S.E.= 0.0084, p = 0.013). The regression results for Governance Score are interpreted as follows: for every unit increase in this variable, the logarithmic odds of a case falling into the category of "Negative Risk: Auditor's Concerns" (in comparison to the No Match category) are predicted to increase by 0.021 units. This result suggests that companies with a higher Governance Score have a higher negative risk (Auditor's Concerns) when there is no match.

Since Audit Firm was considered to be a categorical variable, each category shown represents a dummy variable, with a given category being compared with the reference category (Deloitte). Although the coefficients for the three dummy variables were all negative, only those for EY and PwC were significant (p = 0.0003 and p = 0.073, respectively). This result predicts that EY and PwC will present a lower "Negative Risk: Auditor's Concerns" and a higher risk when there is no match, compared to Deloitte.

The Profitability (p = 0.017) and Leverage (p = 0.088) variables were significant and negative. This suggests that companies with lower profitability or lower leverage have a higher negative risk (Auditor's Concerns) when there is no match.

The second outcome, referred to as "Positive risk: auditor highlights company's risk management," examines the positive risk where auditors emphasise the company's risk management. In this case, the Profitability variable is significant with a negative coefficient of −0.043 (p = 0.000), implying that lower profitability increases the likelihood of the auditor highlighting positive risk management. Leverage is also significant, with a negative coefficient of −0.0039 (p = 0.055), indicating that lower leverage increases the likelihood of the auditor emphasising positive risk management by the company.

For the Audit Firm variable, although the coefficients for the three dummy variables were all negative, only that for EY was significant (p = 0.079). This result predicts that EY is less likely to present "Positive risk: auditor highlights company's risk management" than Deloitte.

Conclusions and discussionIn this study, we examine whether auditors consider the material ESG (Environmental, Social and Governance) issues reported in companies' sustainability reports within the Key Audit Matters (KAMs) section of the audit report. Using content analysis, we analysed the materiality matrices in sustainability reports and KAM disclosures from the audit reports of 20 Colombian companies listed on the COLCAP index for the period 2019–2021. In addition, logistic regression analysis was used to determine whether the ESG scores impacted on the inclusion of ESG issues in the KAMs.

This content analysis revealed that auditors primarily focus on governance matters within the KAMs, with very limited consideration of social and none of environmental issues. Out of 160 identified matches between ESG issues and the KAMs, 152 pertained to governance matters and only eight corresponded to social issues. The regression analysis showed that higher governance scores were associated with a greater likelihood of ESG issues being included in the KAMs. Additionally, lower profitability and leverage resulted in a higher probability of ESG issues appearing in the KAMs. Our findings reveal that auditors strongly emphasise governance issues in the KAMs but largely overlook social and environmental matters. This aligns with prior research according to which governance issues tend to receive greater attention in emerging market contexts compared to other ESG dimensions (Mohammad et al., 2023; Sharma et al., 2022). However, sustainability risks extend beyond the context of governance, and failure to capture environmental and social factors may lead to the auditor presenting an incomplete picture of ESG risks and their financial impacts.

The absence of environmental issues from the ESG-KAMs matching is particularly concerning given the material financial risks posed by climate change, pollution and resource depletion (Deloitte, 2019; KPMG, 2023). Forthcoming sustainability standards will require double materiality assessments, encompassing both financial materiality and external impacts (EU., 2022). Our results show that auditors have significant room for improvement in addressing the breadth of material ESG factors within the KAMs. At the same time, higher governance scores increase ESG consideration within the KAMs, thus confirming that governance is a pivotal dimension to the integration of sustainability within business processes (Sharma et al., 2022). However, reversing the logic, our findings indicate that companies with poorer governance may receive inadequate ESG scrutiny in their audits. Additionally, lower profitability and leverage result in a greater emphasis on ESG factors in the KAMs. This suggests that auditors are more likely to perceive and respond to the ESG risks faced by financially weaker companies. Nevertheless, considerable risks may lurk beneath the financial surface even among profitable, leveraged entities. Therefore, limiting ESG emphasis based exclusively on financial criteria could overshadow the existence of real risks.

Our findings have significant implications for innovation in corporate reporting and auditing practices. The strong emphasis on governance issues in KAMs, along with the limited consideration of social and environmental factors, suggests that there is considerable room for innovation in how auditors assess and communicate ESG risks. As the demand for ESG information continues to grow, auditors will need to develop new methodologies and frameworks to effectively integrate a broader range of ESG issues into their risk assessments and reporting practices.

Moreover, our results highlight the potential for the inclusion of ESG issues in KAMs to drive innovation in sustainable business models. By highlighting the financial relevance of ESG factors, KAMs can encourage companies to develop innovative products, services and processes that address these risks and opportunities. This integration can also foster innovation in stakeholder engagement practices, as companies seek to co-create sustainable solutions with their stakeholders.

The integration of ESG issues into KAMs also presents opportunities for innovation through the use of technology. Artificial intelligence, and blockchain and data analytics can improve the efficiency, accuracy and transparency of ESG information collection, analysis and verification. By leveraging these technologies, auditors can provide more comprehensive and reliable assurance on ESG disclosures, driving innovation in corporate reporting and auditing practices.

However, our findings also highlight the challenges associated with integrating ESG issues into KAMs. The limited consideration of social and environmental factors suggests that auditors may lack the necessary skills and knowledge to effectively assess these risks, requiring innovation in education and training programmes. There may also be resistance to change from companies and other stakeholders who are accustomed to traditional financial reporting frameworks and assurance practices.

Future research should explore the specific mechanisms through which the inclusion of ESG issues in KAMs can drive innovation in corporate reporting, auditing and sustainability practices. Studies could investigate how different stakeholder groups perceive and respond to the integration of ESG factors in KAMs, and how this integration influences their decision-making and engagement with companies. Additionally, researchers could examine the role of technology in enabling innovation in ESG reporting and assurance, and the challenges and opportunities associated with its adoption.