Small- and medium-sized enterprises (SMEs) sometimes introduce different types of innovation simultaneously. However, the performance implications of simultaneous innovation practices remain under-researched in the literature. Therefore, this paper explores the combined use of six types of innovation and examines complementarity/substitutability in performance between these types of innovation. Data for the empirical analysis originates from a sample of 1,139 Chinese manufacturing SMEs. We identify two tendencies of simultaneous innovation by means of exploratory factor analysis (EFA), which are as follows: product-oriented and production-oriented. Using a conditional approach to supermodularity, we find no interplay between product-oriented types of innovation, but substitutability between production-oriented types of innovation. Based on organizational literature, we perform a supplementary test for the relationship between production-oriented types of innovation and organizational innovation. The result shows that substitutability between production-oriented types of innovation exists only in the absence of organizational innovation. These findings suggest that SMEs in China derive only additive benefits from a combination of product-oriented innovation, and gain no performance payoff from a combination of production-oriented innovation unless they introduce simultaneous organizational change.

Small- and medium-sized enterprises (SMEs) are generally considered to be the engines of innovation and technological change (Hall et al., 2009). In China, SMEs, accounting for 99% of total enterprises, have been extensively engaged in innovation, which is not only motivated by the increasing global competition (Cao et al., 2020) but also encouraged by Chinese government's innovation policies (Liu et al., 2017). There is evidence indicating that Chinese SMEs contribute to 70% of patents, 75% of technological innovation, and 80% of new products (Chen et al., 2017; Zhang & Merchant, 2020).

Despite their remarkable innovation success, SMEs in China still lag behind those in developed countries in terms of innovation capabilities and firm performance (Chen et al., 2020). This has spawned a vast amount of research that explores the determinants of innovation in Chinese SMEs (e.g., Gu et al., 2016; Mei et al., 2019; Xiang et al., 2019) and the impact of innovation on Chinese SMEs’ performance (e.g., Qiao et al., 2014; Zhang et al., 2018; Liu & Wang, 2022). These studies suffer from two main limitations. First, they concentrate on technology-based product and process innovation; in contrast, organizational innovation is under-researched empirically due to a lack of survey data, generic definitions, and measurement methods (Sapprasert & Clausen, 2012). Second, they consider innovation types as separate phenomena that drive firm performance individually, even though firms sometimes engage in different types of innovation simultaneously (Donbesuur et al., 2020). These two limitations constrain our understanding of the combined use of different innovation types in the context of China and the combinative effects of innovation types on Chinese firms’ performance.

Recent evidence from developed countries shows that firms introducing more than one type of innovation outperform those introducing only one type of innovation at a time. In fact, the simple introduction of technological innovation alone does not allow enhanced competitiveness (Battisti & Stoneman, 2010). Technological innovation (product and process innovation) provides more performance benefits if it is accompanied by organizational innovation (Arranz et al., 2019). Furthermore, firms are better off if they introduce process, product, marketing, and organizational innovation at the same time (Tavassoli & Karlsson, 2016). These studies show that firms can derive synergistic gains from simultaneous innovation, indicating the existence of complementarities between innovation types. However, the complementary effects of innovation types on firm performance are still poorly understood. First, little research has been carried out on innovation complementarities in SME performance. The costs of innovation are high, especially for SMEs that are always resource constrained; thus, it is important for them to know how to leverage complementarities between different types of innovation (Donbesuur et al., 2020). The significance of investigating this gap in the innovation literature is that performance differences between SMEs may result from the use and the effectiveness of simultaneous innovation practices. Furthermore, different sub-types of product and process innovation are bundled together in most studies. In analyzing innovation complementarities, it is important to recognize that different pairwise complementary relationships exist among different forms of product and process innovation (Doran, 2012).

The aim of this paper is to empirically analyze the existence of complementarities in use and in performance between six innovation types: product development, product improvement, quality innovation, efficiency innovation, flexibility innovation, and organizational innovation. Based on a sample of 1,139 Chinese manufacturing SMEs, we identify two tendencies of simultaneous innovation practices using factor analysis techniques. With reference to these two tendencies, we implement a new supermodularity approach developed by Ballot et al. (2015) to test for conditional complementarity/substitutability in performance between different types of innovation. We find that there is no interplay between product (measured by product development and product improvement), quality, and organizational innovation, but substitutability between efficiency and flexibility innovation that can be eliminated by organizational innovation. This study contributes to the micro-level evidence on innovation complementarities in three ways. First, we make an empirical and contextual contribution by using firm-level data from an emerging economy, China. To the best of our knowledge, this is the first work that addresses the complementarities between various types of innovation in the context of China. Second, we particularly focus on SMEs to enrich our knowledge about how they combine different innovation types and how their performance is shaped by such innovation combinations. Third, we use a broader range of innovation types, some of which are used for the first time in this area (e.g., efficiency and flexibility innovation), thus enabling us to explore more potential innovation combinations and their effects on firm performance.

The remainder of this paper is structured as follows: Section 2 deals with the review of theoretical and empirical literature related to innovation complementarity; Section 3 presents our econometric framework; Section 4 shows the database, variables, and a preliminary analysis based on descriptive statistics; Section 5 reports on the econometric results; and finally, Section 6 concludes with a discussion of the results, implications, and limitations of our work.

Literature review on innovation complementarityOver the last several decades, many efforts have been made to measure the effects of innovation on firm performance. Substantial empirical evidence exists that strongly suggests that innovation plays a critical role in enhancing firm performance (Hall et al., 2009; Evangelista & Vezzani, 2010). Innovation, as an output, takes a multitude of types (OECD Oslo Manual, 2005), and thereby can be transformed into superior performance via different channels. Product innovation enables firms to gain a competitive advantage by developing new products to attract new customers or introducing significantly improved products to current markets (i.e., new product development and existing product improvement). Alternatively, process innovation provides firms with a competitive advantage by decreasing unit production costs or increasing market share associated with higher-quality products and flexible production (i.e., efficiency innovation, quality innovation, and flexibility innovation).

Most studies have focused on analyzing the adoption of single innovation types in isolation (e.g., Damanpour, 2010; Evangelista & Vezzani, 2010; Gunday et al., 2011). However, recent research has found that firms tend to simultaneously undertake certain innovation practices that are linked. A multiple case study of Chinese nanotechnology companies conducted by Zhang et al. (2017) demonstrates the simultaneous adoption of product and process innovation. They argue that nanotechnology is a process-based technology in which a significant change in manufacturing processes results in a simultaneous change in the products. Nahm and Steinfeld (2014) also observe the concurrence of product and process innovation based on case studies drawn from Chinese renewable energy sectors. They identify that new product development triggers cost-reducing process innovation. These instances exemplify complementarities in use between product and process innovation: the introduction of one creates possibilities for introducing the other (Ballot et al., 2015). Hullova et al. (2016) developed a classification that includes seven unique types of complementarities in use between product and process innovation. Wu et al. (2009) and Chen et al. (2020) further consider organizational innovation. They use many examples to show that organizational innovation is beneficial for technological innovation. In this paper, we explore complementarities in use employing possible innovation combinations generated by a wide range of innovation types.

The fact that firms combine different innovation types has further complicated the study of innovation and its impact on firm productivity. Complementarities in performance occur when the joint execution of innovation types produces greater economic effects than individual innovation types on their own (Ballot et al., 2015). Firms could derive synergistic gains from introducing different types of innovation in tandem (Hullova et al., 2019). This is theoretically supported by the resource-based view (RBV). The RBV uses firms’ internal characteristics to explain their differences in performance. According to the postulate of RBV, a firm's valuable, rare, inimitable, and non-substitutable (VRIN) resources contribute to competitive advantage and therefore lead to superior performance (Barney, 1991; Peteraf, 1993). A firm's capability of integrating resources further underlines the importance of its VRIN elements as the determinant of its competitiveness. Due to the characteristics of VRIN resources, well-integrated firms can be protected against imitation and achieve distinctive competencies by effectively extracting competitive combinations from their resources (Lin & Wu, 2014; Hervas-Oliver et al., 2015). Therefore, the notion of complementarity is in line with the main assumption of the RBV that competitive advantage is a function of the unique bundling of resources and capabilities that increases complexity and inimitability of organizational practices (Rivkin, 2000; Colbert, 2004; Sok et al., 2016). The importance of complementarity is also reflected in Teece's framework (1986), which argues that the commercial value of an innovation crucially depends on whether it is used in conjunction with complementary assets (Christmann, 2000). The implication of these theories for this study is that the simultaneous adoption of different types of innovation reflects the complexity of innovative resource and capability interactions where value exists in the interrelationships. From this perspective, complementarities between innovation types allow firms to achieve better performance outcomes. Although each type of innovation may be beneficial for firm performance in isolation, complementarities between innovation types provide extra benefits generating multiplier effects rather than simple additive effects. Therefore, complementarities-in-performance can be interpreted as firms combining innovation types to achieve superior performance.

The complementary role that innovation types play in improving firm performance has opened a new sub-field of empirical research on innovation. Complementarities in performance have been examined using either interaction terms or the supermodularity approach. The analysis of interaction terms in a performance equation is a common practice in the literature. Lee et al. (2019) explore the combinative effects of product, process, marketing, and organizational innovation for a sample of Korean firms. They find that organizational and process innovation and marketing and product innovation have a synergistic effect on firm performance, but that the effect is contingent on industrial categories. Chen et al. (2020) investigate Chinese manufacturing firms and find that organizational innovation enables firms to better leverage technological innovation capabilities to increase firm performance, indicating the existence of complementarity between organizational and technological innovation. Donbesuur et al. (2020) focus on international performance of SMEs in Ghana and also find a significant complementary relationship between organizational and technological innovation. In order to avoid severe multicollinearity problems, the supermodularity approach is an alternative methodology frequently used to analyze complementarities between more than two innovation types. Doran (2012), using Irish firm-level data, tests for strict complementarities between new-to-firm product, new-to-market product, process, and organizational innovation within the supermodularity framework. The study shows a strong complementary relationship between organizational and technological innovation, at least one complementary relationship exhibited by each type of innovation, and no evidence for substitutability. The strict supermodularity test used in Doran's (2012) research is based on critical values for the Wald test and is often inconclusive. Ballot et al. (2015) propose a conditional approach to supermodularity that tests for pairwise innovation complementarities conditional on the presence/absence of a third type of innovation. They use two samples of French and UK manufacturing firms to capture their differences in the complementarities between product, process, and organizational innovation. Their study suggests that the existence of innovation complementarities depends on the national context and firm characteristics. Guisado-González et al. (2017) apply the new supermodularity method proposed by Ballot et al. (2015) to test for complementarities in performance between product, process, and organizational innovation for a set of Spanish firms. They find stable complementarity between product and process innovation, and conditional substitutability between process and organizational innovation in the absence of product innovation.

The aforementioned empirical studies have generated mixed results about complementarities in performance and have limited our understanding for two reasons. First, complementarity appears to be a contingent relationship between different innovation types in shaping firm performance, which may depend on the technological capabilities of firms (Doran, 2012) and the technological complexity of a national production structure (Guisado-González et al., 2017). The distinct characteristics of SMEs (e.g., restricted access to resources) and the specific context of China (e.g., labor intensive and low-end production) raises the question of whether SMEs in China can obtain economies of scope across innovation types (Laforet & Tann, 2006; Li, 2018). Second, the existence of complementarity may be dependent on the types of innovation investigated. For example, Doran (2012) distinguishes new-to-firm and new-to-market product innovations, which exhibit different pairwise complementary relationships. This suggests the need to disentangle different forms of the same typology of innovation in order to facilitate a more comprehensive analysis of the relationship between some sub-types of innovation (e.g., efficiency and flexibility innovation are the sub-types of process innovation). Therefore, to further explore innovation complementarity, we attempt to provide evidence from Chinese SMEs to verify the theoretical arguments and existing findings, which have generated much empirical ambiguity.

Econometric methodologyIn order to overcome multicollinearity problems of the interaction approach and inconclusive interpretations of unconditional supermodularity tests, we decide to implement Ballot et al.’s (2015) conditional supermodularity procedure. We need to pool exclusive innovation combinations and then regress firm performance on them. Before estimating the final regression model, we are aware of the potential endogeneity of innovation. Unobservable factors (e.g., management quality and entrepreneurship) that have an influence on innovation could impact firm performance (Chudnovsky et al., 2006). Following the approach by Fu et al. (2018), access to external finance can be used as an exclusion restriction in the innovation equation. The variable is believed to affect firm performance only through innovation. Therefore, we apply a two-step estimation procedure that corrects the endogeneity of exclusive innovation combinations.

In the first step, we conduct a multinomial logistic regression to estimate the innovation Eq. (1).

where Pij is the probability that firm i adopts innovation combination j. X1i is a vector of firm characteristics, including access to external finance, and α1j is the corresponding vector of parameters relating to innovation combination j.In the second step, the performance Eq. (2) is specified as a Cobb-Douglas function with constant returns to scale. The equation is estimated using a two-stage least squares (2SLS) regression approach, where the predicted probabilities from Eq. (1) are used as the instruments of exclusive innovation combinations wk(k=1,…,j).

where yi is the indicator of firm performance. X2i denotes a vector of firm characteristics and εi is an error term. Estimated coefficients of exclusive innovation combinations, βk(k=1,…,j), are used to test for complementarity/substitutability between different types of innovation based on the conditional supermodularity method.Beginning with a simple example to illustrate supermodularity tests, suppose there are two dichotomous choices of innovation, which implies that a vector of innovation combinations, W, consists of four elements that are as follows: W=[w00,w10,w01,w11]1. An objective function is given by Eq. (2), where [β00,β10,β01,β11] is a vector of estimated coefficients corresponding to W. Then, the objective function is supermodular and the two types of innovation are complementary if:

Alternatively, the objective function is submodular and the two types of innovation are substitutes if:

Ballot et al.’s (2015) conditional approach to supermodularity is applied when there are more than two dichotomous choices of innovation. For example, we focus on three innovation types that are INNO1, INNO2, and INNO3. The conditional supermodularity test implies examining separately pairwise complementarities conditional on the absence of the third innovation type and then on the presence of the third type. The restriction constraints to be tested for complementarity between INNO1 and INNO2 are as follows:

For complementarity between INNO1 and INNO3, the tests are as follows:

For complementarity between INNO2 and INNO3, the tests are as follows:

Following Guisado-González et al. (2017) and Serrano-Bedia et al. (2018), for each pair of restrictions we begin by performing the Wald test for the first one to test if a significant relationship exists between two types of innovation. If the test indicates that the relationship is statistically significant, then we perform a test for inequality to determine whether the two types of innovation are complements or substitutes.

Data, variables, and descriptive analysisSample and dataOur empirical analysis is based on firm data from the Chinese Manufacturing Enterprise Survey (ES) collected by the World Bank between November 2011 and March 2013. The ES captures information on multiple aspects of a firm (e.g., sales, employees, and industry sector) as well as its innovation behavior (e.g., R&D, technology acquisition, and innovation outputs). This allows us to consider various innovation types and ascertain firm performance. Despite the cross-sectional nature of ES dataset, some data (e.g., sales) shows a partial view of firm dynamics during a three-year period.

The sample is representative of the population of manufacturing firms in China, which is randomly selected based on three levels of stratification: firm size, industrial sector, and regional location. According to the definition of manufacturing SMEs in China, we restrict our focus to firms with less than 1,000 employees. The ES database containing a total of 2,848 firms is skewed toward manufacturing SMEs and 1,619 firms (56.85% of the total sample) are SMEs operating in 25 Chinese cities and 19 manufacturing sectors. After excluding firms with missing values, the number of manufacturing SMEs available for further analysis reduces to 1,139.

Variables and measuresThe dependent variable is firm performance. In order to mitigate simultaneity problems, we use the natural logarithm of total sales per employee in the last year covered by the ES to measure productivity as the proxy for firm performance. This measure of performance is widely used in research studying the effects of innovation on firm performance (Ballot et al., 2015; Fu et al., 2018).

We select six innovation types according to the OECD Oslo Manual (2005), some of which are new for the literature as previously mentioned. These innovation types are measured on a dichotomous scale (0 = No, 1 = Yes) and are listed as follows: (1) Quality innovation is the use of new quality control procedures in production or operation; (2) Organizational innovation is the use of new management/administrative procedures; (3) Product development is the introduction of new products or services; (4) Product improvement is the addition of new features to existing products or services; (5) Efficiency innovation is the use of new or significantly improved methods to reduce unit production costs; and (6) Flexibility innovation is the use of new or significantly improved methods to increase production flexibility. The independent variables include individual innovation types and their exclusive combinations.

Following prior literature (Hall et al., 2009; Baumann & Kritikos, 2016), we include a set of control variables for other production inputs. Specifically, we set controls for firm size, physical investment, and human capital. As Hsieh and Klenow's (2014) research shows a significant effect of firms’ life-cycle dynamics on productivity, we include firm age to control life-cycle effects. We also set controls for government and foreign ownership. In transitional economies like China, private-owned, government-owned, and foreign-invested firms coexist, and they differ in terms of their resource endowments, technological opportunities, and business environment, which lead to variations in their performance (Jiang et al., 2013). Finally, we use industry dummies and city dummies to capture unobservable differences across industries and cities.

Table A1 in Appendix A shows a detailed description and the measurement of all variables. Table 1 contains the summary statistics of these variables. In terms of our performance measure, its mean value is 12.444 and standard deviation is 1.042, suggesting interfirm differences in performance. When looking at the occurrence of the six types of innovation, we observe that efficiency innovation is the most frequent innovation type, followed by flexibility innovation. This reflects the fact that Chinese SMEs primarily leverage cost advantage to compete on price to build market share (Tang & Hull, 2012; Chen et al., 2017). In contrast, product-related types of innovation and organizational innovation occur less often in our sample.

Descriptive statistics.

N = 1,139

The main interest of our research is the extent to which the sample firms introduced different innovation types simultaneously. We report the tetrachoric correlation matrix for the six innovation types in Table 2. For all the variables, the pairwise correlation coefficient is positive and higher than 0.4, showing that the adoption of one innovation type is correlated with the adoption of another innovation type and that the correlation exists between all innovation types. However, correlation coefficients differ from pair to pair of innovation types. The positive correlation is strongest between quality and organizational innovation. Strong correlations (coefficient value > 0.8) can also be found between product development and product improvement as well as between efficiency and flexibility innovation. These findings reflect the actual practices of firms where they adopt innovation types simultaneously, and there is the possibility that firms use multiple innovation types to gain higher performance.

Matrix of tetrachoric correlations.

N = 1,139

The complementarity testing procedure is overly tedious if all the six innovation types are included within a supermodularity framework.2 Exploratory factor analysis (EFA) can provide analytical advantages by reducing a set of innovation types to a smaller number of uncorrelated factors. Each factor is represented by variables that are strongly correlated with each other and that are weakly correlated with variables representing other factors. Therefore, we concentrate on the analysis of complementarity between the innovation types that define each factor.

Bartlett's test of sphericity (χ2(15) = 6510.798, significant at p < 0.001 level) and the Kaiser-Meyer-Olkin test (overall measure of sampling adequacy = 0.76) indicate the suitability of our data for EFA. To determine the number of factors to retain, we use parallel analysis, resulting in a two-factor solution. Varimax rotation is performed to make the structure simpler to interpret. The two retained factors explain 80.6% of the total variance in the six innovation variables and the communalities are all higher than 0.5, indicating that the two-factor EFA model is desirable (see Table 3).

VARIMAX rotated loadings of innovation variables on two factors.

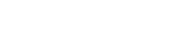

Table 3 shows the factor structure matrix, where loading values higher than 0.7 are in bold. Factor 1 contains mainly quality innovation, organizational innovation, product development, and product improvement, which are labeled as product-oriented innovation. Factor 2 focuses mainly on efficiency innovation and flexibility innovation, which are labeled as production-oriented innovation. The first factor reflects the propensity to adopt product-oriented types of innovation simultaneously. The second factor captures the propensity to adopt production-oriented types of innovation simultaneously. This is a particularly relevant insight, considering that firms tend to introduce different types of innovation simultaneously. The exclusive combinations of innovation types are visualized using alluvial diagrams, as shown in Fig. 1.3 These exclusive innovation combinations suggest complementarities in use between innovation types to some extent. In terms of the firms introducing at least one type of product-oriented innovation, the majority of them adopt all four innovation types simultaneously (see Fig. 1(a)). The most frequent exclusive combination in production-oriented innovation types is the simultaneous adoption of both efficiency and flexibility innovation (see Fig. 1(b)). Thus, we distinguish between the two groups of innovation types that are combined most frequently and attempt to test for pairwise complementarities by groups.

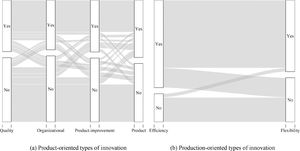

The two factors can be interpreted as the extent of adopting multiple product-oriented/production-oriented innovation types. To substantiate our interpretation of the factors, we investigate how the predicted factor scores correspond with the number of innovation types. Fig. A1 in Appendix A shows that Factor 1 is positively correlated with the number of product-oriented types of innovation introduced, and Factor 2 is positively correlated with the number of production-oriented types of innovation introduced. Hence, we use the factors to measure the usage intensity of both product-oriented and production-oriented innovation types. Fig. 2 presents the kernel density of productivity, our performance measure, at low and high levels of each factor. One standard deviation below/above the mean represents a low/high level. The distribution for high-level Factor 1 is skewed toward the right as shown in Fig. 2(a). Thus, firms introducing more product-oriented innovation types experience greater productivity. Moreover, only these firms have the highest productivity and can be found at the upper end of the spectrum. Since Fig. 2(b) shows near perfect overlapping distributions, the joint adoption of production-oriented innovation types may not allow firms to achieve higher productivity. These preliminary results provide suggestive evidence for the combinative effects of product-oriented innovation types, but no evidence for production-oriented innovation types. A strict econometric analysis is needed to verify the existence of complementarity/substitutability in performance between innovation types.

Econometric resultsComplementarities in performance between product-oriented innovation typesIn a broad sense, product innovation includes new product development and existing product improvement (OECD Oslo Manual, 2005). In order to reduce the computational burden, a single variable (product innovation) is used in the following analysis, which takes 1 if product development and/or product improvement takes 1.

Model Ⅰ in Table 4 is estimated using the 2SLS method,4 where the dependent variable is firm performance proxied by productivity, and exclusive innovation combinations are instrumented by their predicted probabilities from a multinomial logit model.5

Performance regression: determinants of firm performance by exclusive combinations of product-oriented innovation types.

(i, j, k) denotes the exclusive innovation combinations, where i, j, and k represent product innovation, quality innovation, and organizational innovation, respectively.

⁎, ⁎⁎and ⁎⁎⁎ indicate significance at the 10%, 5% and 1% levels.

Compared with the base combination (0,0,0), introducing product innovation only (1,0,0) and combining product innovation with any other innovation types, (1,1,0), (1,0,1), and (1,1,1), lead to higher performance. In contrast, introducing quality and/or organizational innovation in the absence of product innovation, (0,1,0), (0,0,1), and (0,1,1), does not make firms more productive. The individual coefficients of these exclusive combinations cannot directly reveal whether interaction relationships exist, but they are needed for the complementarity/substitutability tests (Mohnen & Röller, 2005).

Conditional supermodularity tests are based on the estimated coefficients of exclusive innovation combinations and the results are summarized in Table 5. We do not find any significant relationships between product, quality, and organizational innovation. However, these types of innovation individually have a significantly positive effect on firm performance (see Models 2, 3, 4, and 5 in Table A2 in Appendix A). Further, in Model 1 in Table A2, a positive and statistically significant coefficient of Factor 1 indicates that firms introducing more product-oriented innovation types have higher performance, which is consistent with our previous finding shown in Fig. 2(a). In summary, our results suggest that the simultaneous introduction of product-oriented innovation types favors firm performance merely by generating additive effects.

Testing complementarity/substitutability in performance between product-oriented innovation types.

(i, j, k) denotes the exclusive innovation combinations, where i, j, and k represent product innovation, quality innovation, and organizational innovation, respectively.

The exclusive combinations of efficiency and flexibility innovation are used to estimate the performance function. The results are shown in Model Ⅱ in Table 6. Firm performance increases due to the introduction of flexibility innovation (0,1), and subsequently decreases due to the addition of efficiency innovation (1,1).

Performance regression: determinants of firm performance by exclusive combinations of production-oriented innovation types.

(i, j) denotes the exclusive innovation combinations, where i and j represent efficiency innovation and flexibility innovation, respectively. (i, j, k) denotes the exclusive innovation combinations, where i, j, and k represent efficiency innovation, flexibility innovation, and organizational innovation, respectively.

⁎, ⁎⁎ and ⁎⁎⁎ indicate significance at the 10%, 5% and 1% levels.

Based on the estimates of Model Ⅱ, the results in Table 7 show evidence of substitutability between efficiency and flexibility innovation. It appears that better performing firms tend to focus on flexibility innovation rather than introducing efficiency and flexibility innovation together. This could be explained by a flexibility-efficiency tradeoff. Efficiency innovation results in a more bureaucratic form of organization with improvements in standardization, formalization and specialization, which has a greater detrimental effect on the more fluid process of mutual adjustment achieved by flexibility innovation (Adler et al., 1999). SMEs pursuing both efficiency and flexibility innovation experience difficulties in achieving consistent organizational attributes due to “the liability of smallness” and thus suffer inferior performance (Ebben & Johnson, 2005).

Testing complementarity/substitutability in performance between production-oriented innovation types.

(i, j) denotes the exclusive innovation combinations, where i and j represent efficiency innovation and flexibility innovation, respectively. (i, j, k) denotes the exclusive innovation combinations, where i, j, and k represent efficiency innovation, flexibility innovation, and organizational innovation, respectively.

O'Reilly III and Tushman (2008) argue that firms can benefit from the simultaneous adoption of efficiency and flexibility innovation as long as they construct an appropriate organizational context. Organizational innovation is intended to facilitate intra-organizational coordination and cooperation, which helps build organizational contexts conducive to the simultaneous pursuit of efficiency and flexibility innovation (Úbeda-García et al., 2020). Therefore, we conduct an additional analysis to determine whether organizational innovation plays a moderating role in the substitutability between efficiency and flexibility innovation. In Table 6, Model Ⅲ shows that firms introducing three types of innovation (1,1,1) outperform those merely introducing efficiency and flexibility innovation (1,1,0).

Table 7 reports the results of the complementarity/substitutability tests based on the estimates of Model Ⅲ. Efficiency and flexibility innovation are conditional substitutes if firms do not introduce organizational innovation. We find that the conditional substitutability disappears with the additional introduction of organizational innovation. These results suggest that the introduction of organizational innovation can defuse the conflict between efficiency and flexibility innovation. We also find conditional complementarity between efficiency and organizational innovation in the presence of flexibility innovation.

Model 6 in Table A2 shows that efficiency innovation has a significantly negative coefficient, which may be misleading due to its interaction with flexibility innovation. Model 1 in Table A2 shows an insignificant effect of Factor 2 on firm performance, which is in line with what was envisaged in Fig. 2(b). The positive effect of flexibility innovation (see Model 7 in Table A2) offsets the negative effect of the conflict between efficiency and flexibility innovation, thus leading to an insignificant combinative effect on firm performance. The majority of the sample firms tested in this research (58.56%) pursue both efficiency and flexibility innovation, but 37.93% of them without simultaneous organizational change are stuck in the middle and receive no performance payoff.

Discussion and conclusionsThere is very little micro-based literature on the relationship between different types of innovation in emerging economies. This paper presents one of the first attempts to investigate complementarities in use and in performance in the context of Chinese SMEs. It also extends previous literature about innovation complementarity by including a wider range of innovation types, some of which are scarcely used in the literature as stated earlier. A significant feature of this research is that our estimation procedure deals with problems of multicollinearity and endogeneity that are identified as important to consider in innovation studies. In order to simplify the analysis of the relationships between six types of innovation, we use EFA to delimit two important aspects of these innovation types: the first captures product-oriented types of innovation that are strongly intercorrelated, and the second captures production-oriented types of innovation. The resulting factors are used to estimate the effect of innovation intensity on firm performance. Moreover, the approach enables the complementarity/substitutability tests by two groups, thus, largely reducing the computational burden.

Our results reveal some important insights into innovation behavior in Chinese SMEs. First, in our special case of the relationship between product, process, and organizational innovation, there is no interplay between product, quality (a type of process innovation), and organizational innovation. This is inconsistent with the evidence from developed countries. Ballot et al. (2015) find one complementarity and two substitutions for SMEs in the UK, and two complementarities and one substitution for SMEs in France. Guisado-González et al. (2017) find two complementarities and one substitution for Spanish manufacturing firms. These results suggest that the existence of complementarity/substitutability depends on the firms’ national context. China has been dependent for a long time on the imitation and acquisition of existing technologies to rapidly promote technological progress and achieve economic growth (Hou & Mohnen, 2013; Liao et al., 2020). Chinese firms tend to directly exploit acquired knowledge with little internal effort, which in turn impedes the development of their own capabilities to absorb that knowledge (Petti et al., 2019). Internal innovation capability is key for the emergence of innovation complementarity because only firms that possess adequate capabilities can transfer knowledge and other resources from one innovation type to another, leading to economics of scope (Guisado-González et al., 2018, 2019). Therefore, a possible reason for different patterns of innovation complementarity between developed countries and China may be attributed to the varying levels of firms’ capabilities. Due to a lack of abilities to transfer and integrate knowledge, Chinese firms appear less able to profit from the combination of product, process, and organizational innovation than firms in developed countries. This may be particularly true for Chinese SMEs with weaker capabilities because these SMEs generally refrain from R&D activities and have difficulty recruiting qualified technical personnel (Chung & Tan, 2017). As a result, Chinese SMEs gain only cumulative benefits from the combination of product, process, and organizational innovation.

Second, we find substitutability between efficiency and flexibility innovation. The simultaneous pursuit of efficiency and flexibility innovation reflects that Chinese SMEs relying on a low-cost strategy attempt to increase their competitiveness by providing customized products. However, firms introducing efficiency and flexibility innovation simultaneously suffer from two conflicting goals, which explains the absence of enhanced performance. This finding provides empirical support for prior research on the efficiency-flexibility tradeoff (Tan & Wang, 2010; Phillips et al., 2019) and on the innovation ambidexterity paradox (Ngo et al., 2019). Our work goes one step further by additionally investigating organizational innovation as a contingency of the relationship between efficiency and flexibility innovation. The result shows that substitutability between efficiency and flexibility innovation exists only in the absence of organizational innovation. In addition, the relationship between efficiency and organizational innovation is complementary in the presence of flexibility innovation. These results suggest that the addition of organizational innovation is beneficial for the firms that wish to excel in both efficiency and flexibility. We interpret our findings from a knowledge-based perspective. The tradeoff between efficiency and flexibility innovation arises largely from contradictory knowledge processes (Soto-Acosta et al., 2018). Efficiency innovation exploiting existing knowledge and flexibility innovation exploring new knowledge generate tensions within firms (Solís-Molina et al., 2018). Organizational innovation involves the use of new knowledge management systems to reconcile the inherent contradictions, which enables firms to maintain both efficiency and flexibility innovation (Simao & Franco, 2018).

Practical implicationsThe main implication of this study is that managers of Chinese SMEs can decide to introduce product, quality, and organizational innovation simultaneously, since these innovation types are neither complements nor substitutes, which means that their joint application does not additionally increase or decrease firm performance. It would be more appropriate to encourage managers to commit additional efforts to developing internal innovation capabilities. Such capabilities can improve firms’ potential to capture complementarities and thus reap the maximum economic benefits from simultaneous innovation practices. R&D activities are very important determinants of a firm's innovation capabilities. For SMEs struggling to conduct R&D in-house, a more plausible way to build up internal innovation capabilities is through informal modes of learning, such as learning by doing, using, and interacting (Lee & Walsh, 2016). It is also feasible to enhance innovation capabilities by implementing better recruitment, training, incentives, and compensation packages to attract, leverage, and retain a competent workforce (Petti et al., 2019).

Another important implication is that Chinese SMEs who combine efficiency and flexibility innovation have a wrong perception of the effectiveness of the efficiency-flexibility combinatorial strategy, since there is substitutability between efficiency and flexibility innovation. This is particularly striking considering the efficiency-flexibility innovation combination as the most frequently used one by Chinese SMEs (58.56% of our sample firms). The preferred efficiency-flexibility innovation combination has not generated the expected positive results in terms of firm performance. Instead, Chinese SMEs should consider simultaneous organizational change, as suggested by us, or avoid combining efficiency and flexibility innovation, as argued by Ebben and Johnson (2005).

Limitations and future researchOur study is subject to some limitations, which suggest possibilities for future research. First, although cross-sectional data is used in many studies of innovation complementarity (e.g., Ballot et al., 2015; Serrano-Bedia et al., 2018), future availability of panel data would allow us to capture unobserved individual heterogeneity, and thus help improve the econometric analysis. Second, firm performance is a multidimensional construct. Gunday et al. (2011) define firm performance as four dimensions: innovative performance, production performance, market performance, and financial performance. The complementarities between different innovation types could be prolifically examined by employing a wide range of firm performance measures. Finally, we tested for complementarities between product-oriented types of innovation and also between production-oriented types of innovation. Further efforts could be made to explore the relationship between product-oriented and production-oriented innovation.

This work was funded by the China Scholarship Council (201806330116). The author acknowledges support by the OpenAccess Publication Fund of Freie Universität Berlin. The author is grateful to the editors, the anonymous reviewers, and Dr. Hamdy Abdelaty for their useful comments on earlier versions of this paper.

Table A1, Table A2, and Fig. A1

Description of variables.

Performance regression: determinants of firm performance by factors or individual innovation types.

The conditional mixed process procedure is used to estimate innovation and productivity equations simultaneously. Robust standard errors are in parentheses. *, ⁎⁎ and ⁎⁎⁎ indicate significance at the 10%, 5% and 1% levels.

The subscripts denote exclusive innovation combinations. For example, w00 indicates that neither of the two types of innovation is introduced, and w11 indicates that both types of innovation are introduced together.

It can be shown that the number of constraints to be tested is equal to 2(k−2)∑(k−1)(i=1)i, where k is the number of innovation types. With six innovation types, there are a total of 240 constraints for the supermodularity test.