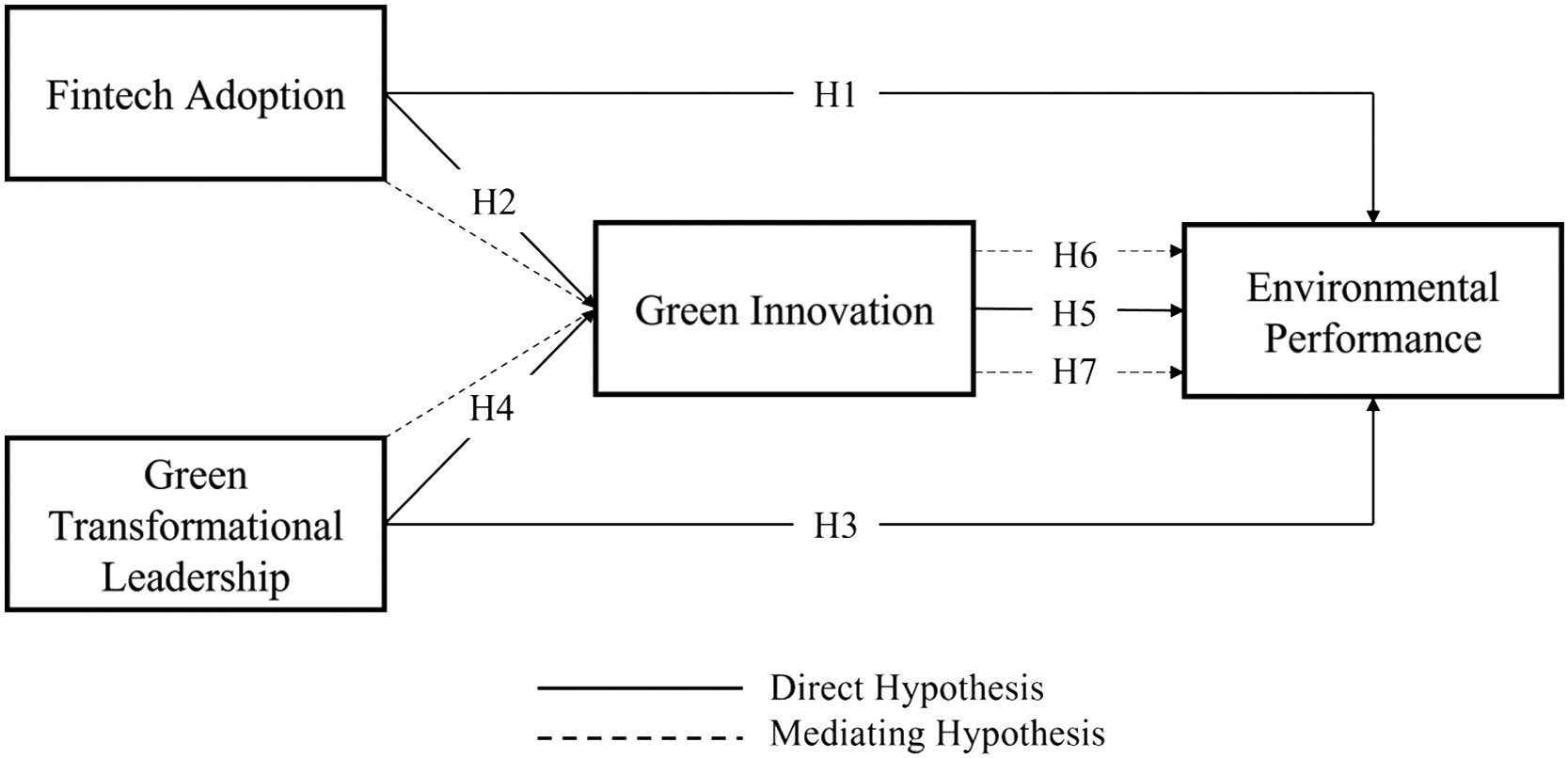

This study uses the ecological modernization theory (EMT) and ability-motivation-opportunity (AMO) perspectives to determine the roles of fintech innovation and green transformational leadership (GTL) in enhancing corporate environmental performance (ENP). Additionally, we explore the mediating role of firms’ green innovation among these associations. We analyze our conceptual model using survey data from 286 Bangladeshi manufacturing small and medium-sized enterprises (SME) managers. This study employs a two-staged hybrid structural equation modeling-artificial neural network (SEM–ANN) technique to assess the hypotheses. Our empirical findings suggest that fintech adoption has a positive linkage with SMEs’ green innovation and ENP. We also observe that GTL substantially affects organizations’ green innovation and ENP. Green innovation was found to enhance ENP in manufacturing SMEs. Our findings reveal that green innovation mediates the linkages between fintech adoption and ENP and between GTL and ENP. These novel findings contribute to fintech, GTL, and environmental literature and expand the scope of the EMT and AMO theory. Our research provides SME managers and policymakers with a constructive model for implementing fintech and managers’ GTL to enhance green innovation and performance. The results may assist manufacturing firms’ managers in integrating technological advancements and human capital to alleviate adverse environmental concerns.

Recent developments in financial technology (fintech) have garnered much interest from practitioners and academics (Croutzet & Dabbous, 2021; Khan et al., 2022; Najaf et al., 2022). Fintech is the most cutting-edge technology applied in innovative financial products and services and is considered one of the most creative and ground-breaking industries in recent times (Liu et al., 2021; Najaf et al., 2022). Financial institutions have begun innovating to remain competitive; instances include digitalization and automation in payments, investing, customer support, blockchain, artificial intelligence (AI), machine learning, cryptocurrency, peer-to-peer lending, and crowdfunding (Pizzi, Corbo & Caputo, 2021). Recent literature has explored the linkage between fintech and sustainability. For instance, Siddik, Yong and Rahman (2023) contend that firms’ fintech adoption drives their sustainability performance through improved circular economy practices; hence, we posit that firms adopting fintech may boost their environmental sustainability performance by raising environmental investments, lowering carbon emissions, driving green innovation, and optimizing resource efficiency (Muganyi, Yan & Sun, 2021; Yan et al., 2022).

Small and medium-sized enterprises (SMEs) in developing nations face substantial financial challenges, specifically when attempting to grow overseas. This funding gap is primarily attributable to “information friction” (Nassiry, 2018). SMEs with limited financial resources rely on external financing to continue expanding their companies; however, they are frequently denied trade credit. Information asymmetries between these companies and banking institutions are a significant factor in the rejection (Cosh, Cumming & Hughes, 2009). Fintech products can assist in bridging the financing gap caused by information friction. Emerging fintech can significantly enhance information processing and collection, notably through digitization and automation, biometrics and identity authentication, and blockchain, which will be beneficial for expanding access to financing among such businesses (Pizzi et al., 2021). Fintech advances can help mitigate environmental problems and enhance performance in industries with high pollution levels (Siddik et al., 2023). Moreover, fintech is a crucial source of green finance (Nassiry, 2018), enhancing SMEs’ ecological investments and environmental performance (ENP) (Guang-Wen & Siddik, 2022a).

In emerging economies, research has not extensively examined the relationship between fintech adoption (FA) and companies’ ENP. Many studies have examined customers’ acceptance and continuing of fintech (Ferdaous & Rahman, 2021; Ryu, 2018); however, the literature on the impact of FA on organizational ENP is scarce. Prior work on FA explores the influence of fintech on enterprises’ financial performance (Liu et al., 2021), renewable energy utilization (Croutzet & Dabbous, 2021), and access to credit (Abbasi, Alam, Brohi, Brohi & Nasim, 2021). There has been limited research on the function of fintech in enhancing organizations’ sustainability performance (Pizzi et al., 2021; Vergara & Agudo, 2021), with most papers focusing on literature reviews and case studies. Furthermore, most research has concentrated on the impact of financial technology on organizational sustainability (Rao, Pan, He & Shangguan, 2022). Pizzi et al. (2021) encourage scholars to explore the effect of FA on enterprises’ ENP through an empirical investigation of primary data. Most of the literature focused on the impact of different environmental and strategic factors on corporate ENP (Masud, Rashid, Khan, Bae & Kim, 2019), neglecting the technological drivers. Moreover, the researchers suggest investigating the involvement of different mediators in the link between FA and corporate ENP. This current study investigates how green innovation influences the link between SMEs’ FA and ENP to fill these gaps in the literature.

Furthermore, to encourage green innovation and ENP in Bangladesh's manufacturing industry, leadership must reinforce comprehension, predict, and control staff behavior toward common goals (Northouse, 2015). To obtain ENP, we hypothesize that the senior executives of manufacturing SMEs must adopt green transformational leadership (GTL) and promote and maintain the internal capabilities required for green innovation (Zhou, Zhang, Lyu & Zhang, 2018). Existing research has focused chiefly on internal factors such as GTL, driving green innovation, and ENP in SMEs (Ahmad, Shafique, Qammar, Ercek & Kalyar, 2022; Sun, El Askary, Meo, Zafar & Hussain, 2022). Singh, Giudice, Chierici and Graziano (2020) suggest empirical studies to explore internal and external factors in SMEs’ implementation of environmental strategies to obtain a deeper comprehension of developing, implementing, and maintaining proactive environmental strategies. Camisón-Haba, Clemente-Almendros and Gonzalez-Cruz (2019) argue that technological adoption combined with managers’ capabilities facilitate superior innovation and performance for firms; thus, we examine the effect of external fintech and internal (GTL) factors on the ENP of Bangladeshi manufacturing SMEs. Our research aims to address three pertinent questions. (a) How does fintech affect SME green innovation and ENP? (b) Is GTL a catalyst for green innovation and ENP in SMEs? (c) Does green innovation mediate between FA, GTL, and ENP? We utilize the ecological modernization theory (EMT) and ability-motivation-opportunity theory (AMO) to further elucidate how fintech as a novel technology and GTL as strategic resources enable corporations to participate in green innovation for enhanced ENP.

Our research contributes to the technology adoption, green human resource management (GHRM), and environmental management literature in four ways. First, in response to the call of Pizzi et al. (2021) to conduct empirical research on firms’ FA and sustainability performance, we find that manufacturing firms can adopt fintech innovation to enhance their green innovation and ENP. Thus, given the paucity of literature on firm-level FA and ENP, our research addresses this gap by identifying fintech as a crucial driver of corporate ENP. Second, our research extends the scope of two crucial theories, EMT and AMO hypotheses. Considering EMT, we report that technological advances, such as fintech, facilitate ecological modernization, thus assisting firms in alleviating environmental consequences. Additionally, as posited by the AMO hypothesis, our structural equation modeling-artificial neural network (SEM–ANN) analysis presents evidence that GTL, as a critical strategic resource, produces superior capabilities, incentives, and scope for employees to facilitate green innovation and enhanced ENP. Third, our study adds to the green innovation literature by offering empirical evidence for the indirect impacts of fintech and GTL on increasing firms’ ENP and establishing the mediating role of green innovation in these linkages. Finally, by examining the manufacturing SMEs in Bangladesh, this research expands the current knowledge base on fintech and GTL in emerging economies. Using hybrid SEM–ANN analysis, we provide empirical support for the EMT and AMO hypotheses, providing insight into how fintech and GTL influence ENP through green innovation among SMEs in emerging economies.

Theoretical frameworks and hypothesesExperts from various fields have explored the standards for integrating environmental concerns into corporate strategies. These standards are based on theoretical paradigms such as ecological footprinting, triple-bottom-line, ecology in industry, environmental efficiency, and life cycle management (Tang, Chau, Fatima & Waqas, 2022). Nevertheless, the different conceptual models explain distinct facets of the same notion (Khan et al., 2021a); therefore, environmental and socioeconomic stewardship may be characterized by several theories instead of a single theory (Tang et al., 2022). Two unique theoretical frameworks lay the foundations of our research for examining the influence of fintech innovation and GTL on corporations’ green and ENP. The EMT contends that increasing resource efficiency through technological breakthroughs, such as fintech innovation, can eliminate environmental challenges arising from economic expansion (Khan et al., 2022). Once society no longer in the old-industrial phase, thus it must undergo environmental modernization or the re-adaptation of industrial society within the global geo and biosphere. This modernization uses contemporary methods, such as a scientific knowledge base and cutting-edge technology, to increase the earth's carrying capacity and make growth more sustainable (Huber, 2008). Ecological modernization minimizes raw material consumption and pollution while producing creative and competitive goods (Andersen & Massa, 2000). Thus, considering EMT, we postulate that advanced technologies, such as fintech, boost organizations’ green innovation and subsequent environmental sustainability.

AMO theory claims that GTL enables GHRM to enhance employees’ skills and motivation, providing opportunities for environmental management initiatives (Haddock-Millar, Sanyal & Müller-Camen, 2016) linked to green innovation and firms’ ENP. AMO theory is commonly applied in GHRM performance studies (Bos-Nehles, Van Riemsdijk & Kees Looise, 2013). When ensuring that employees have the information and skills required for a specific task, various methods are applied, including hiring, selection and development and training programs. Similarly, motivation is based on performance assessment and monetary and non-monetary incentives to inspire individuals to meet their objectives. Finally, opportunity refers to regulations that stimulate employee engagement in various activities via enhanced interaction, information sharing, and personal freedom (Sun et al., 2022). Drawing on the AMO perspective, we propose that GTL in organizations aims to recruit, motivate, promote, and sustain employee work behaviors toward environmental stewardship objectives and goals through green innovation to achieve superior ENP (Sun et al., 2022).

FA and ENPFintech is an emerging subject and an innovation that should stimulate studies in several areas, as digital connectivity is essential for sustainability performance and efficiency (Hammadi & Nobanee, 2019; Yan, Siddik, Akter & Dong, 2021). Leong and Sung (2018, p. 75) define fintech as “any innovative ideas that improve financial service processes by proposing technology solutions according to different business situations, while the ideas could also lead to new business models or even new businesses.” Literature argues that fintech, as an example of a sector emerging within Industry 4.0 (I4.0), can assist SMEs in transitioning to more viable business models (Pizzi et al., 2021), as fintech plays a critical role in credit supply to SMEs (Sheng, 2021). Financing is a critical facilitator of rapid business expansion, enabling SMEs to invest in physical and human capital, create new products/services, and penetrate new foreign markets; moreover, most high-growth SMEs depend heavily on debt-based financing instead of equity capital for funding (Giaretta & Chesini, 2021). Fintech has facilitated the adoption of supply chain financing by offering financial services, leveraging information technologies, and streamlining SMEs’ loan and transaction procedures (Soni et al., 2022). Existing research has demonstrated that access to finance is a crucial driver of corporate environmental sustainability (Anwar & Li, 2020); however, the effect of institutional FA on a company's ENP has not been explored. This study postulates that the adoption of fintech by enterprises can substantially improve their ENP by facilitating external financing.

We adopt the EMT perspective, which contends that enhancing resource efficiency through technological innovations, such as fintech, can alleviate environmental problems caused by economic growth (Khan et al., 2021b; Tang et al., 2022). Through extensive data analysis, fintech substantially solves modern environmental sustainability concerns, including circular procurements, recycling and reprocessing, the adaptation of sustainable production and customization (Jabbour, de, Jabbour, Foropon & Filho, 2018), resource preservation, renewable energy consumption, carbon emissions, shorter set-up periods, reduction of material and labor costs, and greater productivity (Liu & Chen, 2022). The immediate effect of fintech on corporations is that it may efficiently reduce the financial limitations of businesses in industries with high pollution levels (Xin, Yi & Du, 2022).

Consequently, as a contemporary financial business model, the comprehensive functionality of fintech can offer financial services to more businesses, effectively extending the source of capital and the range of financial services (Xin et al., 2022). Second, fintech is an essential source of green finance (Nassiry, 2018), improving businesses’ environmental investments and performance (Guang-Wen & Siddik, 2022a). Fintech innovation facilitates the creation of green finance via green lending and investments, boosting green growth, and sustainability (Zhou, Zhu & Luo, 2022). Third, with the assistance of growing I4.0 technologies, such as big data, AI, and blockchain, financial technology, may effectively mitigate the informational asymmetries between borrowers and lenders in the financial market. Notably, financial constraints impede SMEs’ investment in environmental initiatives. Through peer-to-peer lending, investor pairing, microfinance, and crowdfunding, fintech may alleviate this barrier, resulting in superior ENP among SMEs (Siddik et al., 2023). Therefore, we posit the following:

H1

FA positively affects firms’ ENP.

FA and green innovationGreen innovation (GI) is the development of environmentally friendly products and processes, which involves using green raw materials and reducing emissions, water, electricity, and other raw material consumption. (Singh et al., 2020, p. 3). Businesses with green innovativeness are considerably successful (Albort-Morant, Henseler, Leal-Millán & Cepeda-Carrión, 2017) and have superior overall performance than their competitors. Such businesses utilize green resources and skills to promptly and effectively respond to consumers’ requirements (Allameh, 2018; Singh et al., 2020) and contribute intangible values and resources to the company. Previous studies indicate that FA significantly assists firms in innovating green products and processes (Liu & Chen, 2022; Rao et al., 2022); however, confronted with this massive information asymmetry, financial institutions can drastically lower their incentives to extend financing to businesses for GI initiatives (Yuan, Ye & Sun, 2021). Thus, to retain competitiveness, financial institutions are implementing innovations in the sector to improve the screening of businesses and minimize ineffective and low-end mismatches of financial resources (Laeven, Levine & Michalopoulos, 2015). Fintech enhances businesses’ transparency and stakeholders’ capacity to analyze information through digital technologies (Rao et al., 2022). This technology improves business capital flow efficiency and transfers funds to GI activities, consequently increases the positive ripple effect of GI by strengthening collaboration between firms and stakeholders (Liu & Chen, 2022), and facilitates the absorption and incorporation of GI's essential knowledge by enterprises (Rao et al., 2022).

Fintech may also promote GI by boosting research and development (R&D) spending (Liu, Jiang, Gan, He & Zhang, 2022). Prior studies have indicated that R&D investments for environmental innovation might impact GI (Lee & Min, 2015). A surge in R&D expenditures might encourage businesses to acquire new green technology gear, including software and hardware infrastructure, and replace old equipment (Liu et al., 2022). Yu, Zhao, Xue and Gao (2020) suggest that fintech greatly encourages family businesses to adopt green control technology by enhancing financing availability and social trust; thus, fintech substantially enhances the region's GI, according to Feng, Zhang and Li (2022). Additionally, Rao et al. (2022) contend that fintech can increase the amount and quality of green organizational innovation. As with blockchain technology, fintech features can be used to develop a green system and products that enable recycling, reusing, and circular production (Khan et al., 2021b; Saurabh & Dey, 2021). Therefore, we postulate:

H2

Fintech positively affects firms’ GI.

GTL and ENPOver the past quarter century, transformational leadership (TL) has emerged as a crucial model for scholars studying organizational leadership (Burawat, 2019). Burns (1978) noted that TL occurs when followers and leaders connect to motivate and inspire each other. In dynamic environments, a company's future and current action plans depend on TL's effect (Bass & Avolio, 1993). Chen and Chang (2013) define GTL as a leader who inspires their team to exceed environmental expectations. GTL is defined in this study as a leadership role that offers workers inspiration, vision, and motivation while supporting their learning and development needs (Kusi, Zhao & Sukamani, 2021). Previous studies have found that GTL can motivate and persuade people to engage in green employment behaviors (Singh et al., 2020; Sun et al., 2022).

Furthermore, Sun et al. (2022) contend that transformational leaders impact economic conditions, employee satisfaction, employee attitude, ENP (Ramus & Steger, 2000), and their organizations’ psychological performance. Çop, Olorunsola and Alola (2021) observe that managers’ GTL positively affects green work engagement, which impacts ENP. Drawing insights from the AMO theory, Singh et al. (2020) argue that managers’ GTL increases green capability, commitment, and potential, subsequently driving the ENP of manufacturing SMEs in the United Arab Emirates. Similarly, Sun et al. (2022) suggest that GTL ensures GHRM organization-wide to enhance SMEs’ ENP. Using a sample of manufacturing SME managers, Ahmad et al. (2022) conclude that the GTL of SME managers strongly influences enterprises’ green dynamic capacities and performance in developing countries. Awan, Arnold and Gölgeci (2021) further report that GTL is crucial for the ENP of Pakistani manufacturing SMEs. Consequently, we argue that:

H3

GTL positively affects firms’ ENP.

GTL and GILeadership is crucial to any organization (Leroy, Segers, van Dierendonck & den Hartog, 2018), and human capital is a company's most valuable asset (Singh et al., 2020). Leadership focuses on comprehending, forecasting, and regulating the social and interpersonal dynamics of how individuals influence one another in pursuit of common objectives (Northouse, 2015). Previous research indicates that TL substantially impacts organizational innovation (Mittal & Dhar, 2016; Zhao & Huang, 2022). Moreover, García-Morales, Jiménez-Barrionuevo and Gutiérrez-Gutiérrez (2012) report that TL leads to innovation by developing core competencies and capabilities. In TL, members are open to continuous learning and strive to understand and acknowledge the firm's purpose and goals (García-Morales et al., 2012). Transformational leaders who employ intellectual stimulation and motivate employees can foster innovation inside a company (Elkins & Keller, 2003).

Organizational innovation relies mainly on leaders and their traits because leaders are pivotal in boosting environmental sustainability (Andriopoulos & Lewis, 2010). Multiple studies have indicated that transformative leadership is crucial to achieving innovative results (Mittal & Dhar, 2016; Sun et al., 2022). This study endorses the idea of “green transformational leadership,” which Chen and Chang (2013) define as “leadership behaviors which motivate followers to achieve environmental goals and inspire followers to perform beyond expected levels of environmental performance” (p. 113). Chen and Chang (2013) argue that GTL is associated with GI. Furthermore, GTL allows its employees to learn creatively and analyze challenges from multiple perspectives (Chen & Chang, 2013). Another study indicated that GTL encourages GI and product development performance in the Taiwanese electronics sector (Chen & Chang, 2013). Several recent studies have drawn upon the AMO theory to demonstrate the role of GTL in enhancing firms’ GI (Chen, Chang & Lin, 2014; Singh et al., 2020; Sun et al., 2022). Based on the preceding discussion, we postulate that:

H4

GTL positively affects firms’ GI.

GI and ENPGI represents an attempt to reduce the negative impacts of production and activities on the environment, focusing on enhancing methods, techniques, structures, goods, and management approaches (Asadi et al., 2020; Huang, Li, Xiang, Bu & Guo, 2022). Utilizing these advances enables organizations to effectively promote green growth and resolve challenges linked with environmental protection. Regarding GI, three primary elements may be outlined: process, product, and organization (Lian, Xu & Zhu, 2022). The process and products emphasize the connection of environmental goals with the notions of process innovation or productive efficiency and product innovation or product excellence (Triguero, Moreno-Mondéjar & Davia, 2013; Xie, Hoang & Zhu, 2022). Recent research revealed a connection between GI and corporate ENP; furthermore, GI assists organizations in managing environmental problems and promoting environmental sustainability (Awan et al., 2021; Rehman, Kraus, Shah, Khanin & Mahto, 2021; Sun et al., 2022; Waqas, Honggang, Ahmad, Khan & Iqbal, 2021).

GI is a crucial strategic stimulus for achieving sustainable development (Shahzad, Qu, Rehman & Zafar, 2022), encompassing technical innovation addressing energy conservation, pollution avoidance, and resource efficiency (Chang, 2011). Additionally, GI may be subdivided into green products and processes meant to reduce energy and carbon emissions, recycle waste, and use renewable sources (Asadi et al., 2020). GI, according to, involves reducing energy and pollutant emissions, pursuing circular economies, managing resources sustainably, and designing green products. Investment in green products, processes, and managers can increase productivity, cost savings, and higher product quality for firms (Porter & Linde, 1995). Furthermore, GI can reduce pollution, toxic waste, and waste disposal expenses while responding to external environmental concerns (Chiou, Chan, Lettice & Chung, 2011). Thus, we posit the following:

H5

GI positively affects firms’ ENP.

The mediating role of GIThe I4.0 technologies, such as fintech, are critical drivers of organizational ENP; however, this impact is not always direct. FA may not directly affect an organization's ENP, but it may be utilized to reorganize existing business models to enhance environmental performance (Pizzi et al., 2021). Cao, Nie, Sun, Sun and Taghizadeh-Hesary (2021) contend that GI is the channel through which fintech impacts environmental performance; thus, we propose that fintech innovation facilitates superior ENP through GI. By adopting fintech solutions, firms can obtain better access to finance and invest in green products and process innovation (Rao et al., 2022), leading to greater ENP (Singh et al., 2020). Furthermore, fintech encourages GI by increasing R&D investment (Liu et al., 2022). Existing literature suggests that funding in R&D for ecological sustainability may affect GI (Lee & Min, 2015). Moreover, literature has confirmed that GI significantly mediates the link between FA and sustainability performance (Yan et al., 2022) and FA and ENP in the context of financial institutions (Guang-Wen & Siddik, 2022b).

Fintech can substantially enhance GI by eliminating financial restrictions and maximizing information effects internally and externally (Liu & Chen, 2022). Moreover, fintech helps businesses to adopt green control technology by increasing funding availability and social trust (Yu et al., 2020). Nonetheless, several studies indicate that GI predicts organizational ENP; thus, we argue that GI, such as products, processes, and managerial innovation, mediate the linkage between corporate FA and ENP. Hence, we posit the following:

H6

GI mediates the association between FA and firms’ ENP.

Previous results on GTL and ENP outcomes revealed positive, neutral, and negative relationships. Some researchers have clarified the relationship between GTL and ENP, whereas others have used mediation theory. Furthermore, the GHRM literature does not explore intervening factors in GTL–ENP associations. Sun et al. (2022) demonstrate that GTL stimulates employees’ environmental consciousness, GI, and sustainable organization presentation. Prior studies suggest that GTL stimulates GI and ENP; however, examining how organizations engage their critical stakeholders in eco-friendly management practices requires a comprehensive and practical method (Tang, Chen, Jiang, Paillé & Jia, 2018). To demonstrate effective ENP, companies hire individuals with TL, environmental views and values and use assessment, green training, development, and green remuneration as fundamental motivators (Sun et al., 2022). Green processes and product innovations counteract negative firm impacts by reducing costs, waste resources, and other assets (Del Giudice, Rappuoli & Didierlaurent, 2018). Thus, using the AMO theory, we predict that GI acts as a crucial mediator in the GTL–ENP linkage of firms.

H7

GI mediates the association between GTL and firms’ ENP.

Fig. 1 presents this study's conceptual framework.

Research methodsSampling and data collectionThe authors surveyed Bangladeshi manufacturing SMEs to evaluate the stated hypotheses. The selected SMEs function in a competitive environment where strategic approaches, such as technology adoption and dynamic TL, are crucial for boosting innovation and performance (Gao et al., 2023; Tan, Siddik, Sobhani, Hamayun & Masukujjaman, 2022). The data were collected from the three largest divisions of Bangladesh: Dhaka, Chittagong, and Rajshahi. These three regions include 71% of the total SME population of Bangladesh: Dhaka (38%), Rajshahi (18%), and Chittagong (15%) (Hossain, San, Ling & Said, 2020). Furthermore, Bangladesh was chosen for the empirical study due to several reasons (Holgersson, 2013). First, SMEs constitute an essential part of Bangladesh's economy, employing 7.8 million people directly and assisting 31.2 million others (LightCastle Analytics Wing, 2020). These SMEs account for approximately 25% of the nation's GDP and can contribute significantly more (Siddik et al., 2023).

As an emerging economy, Bangladesh is also making great strides toward attaining the United Nation's Sustainable Development Goals (Dai, Siddik & Tian, 2022; Guang-Wen & Siddik, 2022a; Zheng, Siddik, Masukujjaman, Fatema & Alam, 2021), which has fostered the creation of several businesses, especially SMEs. Nonetheless, the vulnerable SMEs in Bangladesh underwent a period of hardship during the COVID pandemic (Rahman, Azma, Masud & Ismail, 2020); moreover, numerous companies terminated business indefinitely and others sustained significant losses. Investigating how Bangladeshi SMEs may implement I4.0 technologies and sustainable business practices to maintain a vibrant business climate at home and abroad is critical. Furthermore, Bangladeshi SMEs resist adopting environmentally friendly practices and complying with environmental regulations; however, this situation is gradually improving as international organizations finance SMEs to follow environmental standards. Several international development organizations have financed investments in worker safety, green manufacturing practices, and environmental considerations in Bangladesh's large garment manufacturing industry (Islam, 2021). International organizations now assist Bangladeshi SMEs in pursuing green and inclusive business practices. For example, Agence Française de Développement has granted 50 million EUR for green SME investment in Bangladesh (Islam, 2021). The Sustainable Enterprise Project of the World Bank is directly aiding 40,000 Bangladeshi SMEs in promoting green growth initiatives and diversifying their portfolios to include environmental stewardship, waste and emissions control, and enhanced workplace safety (Yoshijima, Sharmin & Paul, 2020). These firms are constantly adopting technological advancements (The Financial Express, 2022) and developing green leadership (Muhammad & Al-Amin, 2022) to ensure environmental sustainability. Hence, assessing how FA and GTL can improve Bangladeshi manufacturing firms’ GI and performance is essential.

We devised a self-administered questionnaire to collect data on the influence of FA and GTL on the GI and ENP of Bangladeshi manufacturing SMEs. Two academics and ten manufacturing SME managers pre-tested the survey questionnaires to confirm their validity. The authors made minor modifications to the questionnaire items based on the findings of the pilot survey. The survey data were collected from SME managers with in-depth knowledge of their companies’ processes and performances. The survey was distributed to 450 SMEs along with a cover letter describing the study's objectives, emphasizing that participation was voluntary. Furthermore, we assured the participants that their replies would be kept anonymous and used only for academic research. Subsequently, 286 complete and valid surveys were returned, indicating a response rate of 63.5%. The data for this study were obtained between August 2021 and January 2022; moreover, 81.7% of the responders were men and 18.3% were women. Most respondents had at least one year of experience in their current/most recent managerial position (67%). Most managers (82%) were between the ages of 25 and 50 and possessed a postsecondary degree (73%). Furthermore, 52% of firms directly served customers, 21% directly served other businesses, and 27% directly served customers and enterprises. The inquiry covered four firm age categories: 3 years (14%), 3–5 years (31%), 6–10 years (37%), and >10 years (18%). Apart from these attributes, 28% of enterprises employ fewer than 50 workers, 59% employ between 51 and 100 workers, and 13% employ more than 100 employees.

Measurement instrumentsWe assessed the hypotheses using several questionnaire items, and all indicators were derived from previous studies except FA items; the research setting also required several adjustments. The variables in Table 1 were derived from prior research, comprising 23 items measuring FA, GTL, GI, and firms’ ENP. The questionnaire items reflect the FA, GTL, GI, and ENP constructs. The authors developed eight questionnaire items for measuring firms’ FA. A pre-test and standard construct reliability and validity metrics were used to assess reliability and validity (see Table 2). Even though numerous fintech services are available worldwide (i.e., digital wallets, blockchain, cryptocurrency, Robo-advisors, crowdfunding services, RegTechs, and InsurTechs), mobile financial service (MFS) providers, payment system operators, and payment service providers make up the majority of the fintech business in Bangladesh (Islam, 2022). MFS services are increasingly used for business-to-business (B2B) transactions, banking payments, salary payments, and utility payments. FA in Bangladesh is mainly related to payment mechanisms (Siddik et al., 2023). The GTL of managers was measured using six items from Chen and Chang (2013). We adopted six items from Singh et al. (2020) to measure the GI construct. Finally, we measured the ENP with four items adapted from Sajan, Shalij, Ramesh and Biju Augustine (2017). We asked the respondents to rate their company's ENP during the previous three years against that of their major competitor on a five-point scale from “much worse” (1) to “much better” (5). Excluding the demographic section, all survey items were scored on a 5-point Likert scale, with one representing “strongly disagree” and five representing “strongly agree.” Participants provided details about their gender, age, degree of education, and years of experience, among other demographic characteristics.

Descriptive statistics and correlation analysis.

| Mean | SD | Skewness | Kurtosis | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|---|---|---|

| 1. Fintech Adoption | 3.497 | 0.683 | 0.677 | −0.352 | 1 | |||

| 2. Green Transformational Leadership | 3.435 | 0.707 | 0.439 | −0.716 | 0.552 | 1 | ||

| 3. Green Innovation | 3.667 | 0.783 | 0.194 | −1.041 | 0.723 | 0.63 | 1 | |

| 4. Environmental Performance | 3.793 | 0.883 | −0.091 | −1.342 | 0.635 | 0.601 | 0.744 | 1 |

Source: Authors’ calculation.

Construct validity and reliability.

| Items | Factor Loadings | Alpha | CR | AVE | |

|---|---|---|---|---|---|

| Fintech Adoption (FA) | |||||

| We use fintech at our organization regularly | FA1 | 0.723 | 0.883 | 0.907 | 0.550 |

| We use fintech for merchant payments | FA2 | 0.759 | |||

| We use fintech for the salary payments of employees | FA3 | 0.743 | |||

| We use fintech for government payments | FA4 | 0.748 | |||

| We use fintech for p2p transactions | FA5 | 0.778 | |||

| We use fintech for microfinance and crowdfundin | FA6 | 0.739 | |||

| We use fintech for loan payments | FA7 | 0.724 | |||

| We use fintech for insurance payments | FA8 | 0.714 | |||

| Green Transformational Leadership (GTL) | |||||

| I inspire subordinates with environmental plans | GTL1 | 0.611 | 0.766 | 0.836 | 0.510 |

| I provide subordinates with a clear environmental vision. | GTL2 | 0.830 | |||

| I encourage subordinates to work on an environmental plan | GTL3 | 0.776 | |||

| I encourage employees to attain environmental goals | GTL4 | 0.641 | |||

| I consider the environmental beliefs of my subordinates. | GTL5 | 0.680 | |||

| Green Innovation (GI) | |||||

| Our company uses materials that produce the least pollution. | GI1 | 0.817 | 0.884 | 0.912 | 0.630 |

| Our company uses materials that consume less energy and resources. | GI2 | 0.811 | |||

| Our company uses materials that to design environment-friendly products | GI3 | 0.759 | |||

| The manufacturing processes of our company effectively reduces hazardous substance or waste | GI4 | 0.811 | |||

| Our company's manufacturing processes effectively reduce coal, oil, electricity, or water consumption | GI5 | 0.803 | |||

| The manufacturing processes of our company effectively reduce the use of raw materials | GI6 | 0.773 | |||

| Environmental Performance (ENP) | |||||

| Reduction in environmental business wastage | ENP1 | 0.772 | 0.864 | 0.908 | 0.710 |

| Reduction in emission/unit of production | ENP2 | 0.852 | |||

| Reduction in material usage | ENP3 | 0.881 | |||

| Reduction in energy/ fuel usage | ENP4 | 0.866 |

Note (s): Alpha = Cronbach's Alpha, CR = Composite reliability, AVE = Average variance extracted.

Source: Authors’ calculation.

We used procedural adjustments during the data collection process to prevent common method bias (CMB) during the understanding phase of the survey questionnaire (Podsakoff, MacKenzie, Lee & Podsakoff, 2003). The survey comprised guidelines on how to respond to these questions. We guaranteed confidentiality, anonymity, and voluntary nature, and we urged the respondents to answer the questions as truthfully as possible. Furthermore, we advised them that there was no correct or incorrect response. Subsequently, we rigorously checked the composition of each item to verify that there were no obscure, misleading, or uncommon terms and that the wording was as straightforward as possible. Additionally, the sequence of the statements was adjusted to limit the likelihood that respondents would “guess” (Malhotra, Kim & Patil, 2006); thus, we ensured that our measuring items were concise and straightforward.

Furthermore, we conducted a post-hoc assessment using Harman's (1976) single-factor test and Lindell and Whitney's (2001) marker variable technique. Before examining the hypothesized research model, Harman's one-factor test determined if CMB was present. The contribution of a single component was 37.82% (less than 50%), indicating the absence of CMB. Next, Lindell and Whitney's (2001) method was used to determine if CMB affected the reliability of the findings using an item that was not conceptually connected to either of our constructs (marker variable). This research used a measuring item as the marker variable to gage participants’ level of agreement on their interpersonal style (“I am occasionally bothered by individuals who seek favors of me”). Lindell and Whitney's (2001) analysis revealed minimal and nonsignificant correlations (ρ = −0.01 to 0.04), implying that our data lack CMB.

Data analysis techniquesWe analyzed cross-sectional data of manufacturing SMEs in Bangladesh using partial least squares structural equation modeling (PLS-SEM). SmartPLS software is used to evaluate our model's hypotheses. Unlike basic regression, the SEM has multiple independent variables and predictors; thus, it is more comprehensive. Khan et al. (2022) argue that SEMs require at least 100 input data to provide accurate and reliable estimations; our data set contains 286 records. The SEM concurrently examines the mean, variance, and covariance characteristics for each item under consideration. PLS-SEM generates composite frameworks without sacrificing prediction accuracy (Khan & Yu, 2021). Using PLS-SEM, Astrachan, Patel and Wanzenried (2014) reported that it handles complex model distributions and numerous indicator variables. We assessed the validity of SEM-derived structural model parameters using divergent and convergent validity measures.

Moreover, the PLS literature strongly advises using G*power analysis to determine the appropriate sample size (Hair, Hult, Ringle & Sarstedt, 2016); therefore, the sample size was analyzed using the G*Power 3.1.9.7 software. Our sample size of 286 exceeded the minimal sample size of 80 required by G*power, with a power level of 0.80, three predictors, an alpha value of 0.05, and an effect size of 0.15. The investigation of non-response bias followed the approaches outlined by past research (Rogelberg & Stanton, 2007). We used Pearson's chi-square test for discrete variables to compare the early and late responders’ firm age, firm size, education, and experience (Greenwood & Nikulin, 1996). The results show no difference between early and late responders; hence, non-response bias was not an issue in this research. ANN is also used to supplement PLS-SEM findings because it captures non-linear linkages in our model, which is helpful in decision-making (Lee, Hew, Leong, Tan & Ooi, 2020; Wong, Tan, Ooi, Lin & Dwivedi, 2022) due to the limitations of PLS-SEM, which can only identify corrective and linear investigations (Lim, Lee, Foo, Ooi & Wei–Han Tan, 2021). Based on the results of the SEM analysis, we used the significant predictors to rank the normalized importance of their significant predictors (Yan et al., 2022). The graphical representation of the research methodology is illustrated in Fig. 2.

ResultsDescriptive analysisThe descriptive analysis of the latent constructs presented in Table 2 demonstrates that the mean scores for FA, GTL, GI, and ENP were 3.497, 3.435, 3.667, and 3.793, respectively. Following previous research (Kline, 2011), the skewness and kurtosis values were lower than the thresholds of ±3 and ±10, respectively. The correlation analysis revealed a maximum value of 0.74 between the latent constructs, indicating the lack of multicollinearity (Table 1). Consequently, the absence of multicollinearity implies that the model is appropriate for further statistical analysis.

Measurement modelFour tests were used to establish convergent validity, discriminant validity, item-level reliability, and internal consistency reliability. Table 1 demonstrates that the minimum factor loading is 0.611 and the maximum is 0.881, exceeding the suggested cutoff value of 0.50 (Hair et al., 2016). This result implies that this research has no issues with the reliability of individual items. If the value of the outer loading is more than 0.40 and less than 0.50, researchers may maintain the item if it does not affect the retrieved composite reliability (CR) and average variance (AVE). The CR and Cronbach's alpha for each variable should be used to determine the internal consistency reliability. Following Nunnally and Bernstein's (1994) suggestion, the derived Cronbach's alpha values, ranging from 0.766 to 0.884, surpassed the threshold value of 0.70, indicating strong internal consistency (Rahman et al., 2020). According to Hair et al. (2016), the CR value should be more than 0.60. In exploratory investigations, CR values between 0.60 and 0.70 are acceptable; values between 0.70 and 0.95 are deemed adequate to good, while values beyond 0.95 are considered troublesome. Table 1 shows that the CR value of all constructions greater than 0.60 indicates uniformity, internal consistency, and the reliability of all factors (Bagozzi, Yi & Phillips, 1991). This research demonstrates that the internal consistency criteria are met. Convergent validity refers to the extent to which elements of variables evaluate an identical construct. The lowest AVE value in Table 1 is 0.507 and the highest is 0.712; therefore, this study meets the convergent validity requirement established by Hair et al. (2016), which states that the AVE value must be at least 0.50.

Discriminant validity (DV) refers to a condition where researchers discover that two indicators must not be statistically identical (Islam et al., 2019). Fornell and Larcker (1981) provided a traditional metric for calculating DV in two distinct approaches. The first procedure is to compare the value of the AVE square root to correlational statistics; the AVE values can be compared to square correlation values. Recently, researchers have developed an innovation to compute DV, concluding that the old metric is inappropriate. Henseler, Ringle and Sarstedt (2016) introduced the heterotrait–monotrait ratio (HTMT) of correlation as a novel approach to computing DV. This paper applied both the standard Fornell–Larcker and the HTMT criterion. The conventional metric indicates that the square root of AVE for each construct is greater than the correlation coefficients for each row (Table 3); thus, the DV of the structures has been established. As Henseler et al. (2016) suggested, the threshold value of HTMT is 0.90 for theoretically identical constructs and 0.85 for conceptually distinct variables. Table 4 illustrates that the HTMT of all the structures is less than 0.85. Hair et al. (2016) indicated that the variance inflation factor (VIF) is used to determine multicollinearity and its value should be less than 5. This analysis revealed that the VIF value is less than 5, satisfying the DV criterion (see Table 4).

Fornell–Larcker criterion.

| Environmental Performance | Fintech Adoption | Green Innovation | Green Transformational Leadership | |

|---|---|---|---|---|

| Environmental performance | 0.844 | |||

| Fintech adoption | 0.635 | 0.741 | ||

| Green innovation | 0.744 | 0.723 | 0.796 | |

| Green transformational Leadership | 0.601 | 0.552 | 0.63 | 0.712 |

Note: Bold values on the correlation matrix's diagonal are AVE's square roots. Off-diagonal elements below the diagonal are correlations among the constructs.

Source: Authors’ calculation.

Table 5 presents the predictive relevance of the constructs, indicating the predictive ability of our model's predictors. R2 and Q2 are two predictive power measures; per Cohen (1988), R2 must be more than 0.26 to be substantial. The R2 values of ENP and GI are 0.595 and 0.599, respectively, indicating that both constructs have excellent predictive capacity. Furthermore, the Q2 value reveals the predictive relevance of the endogenous components, with a value larger than 0 indicating their predictive significance. The results also indicated that the factors in this study had predictive relevance (ENP Q2 = 0.413 and GI Q2 = 0.376). Moreover, the PLS-SEM SRMR was used to evaluate the model's fit. The model fits quite well, as indicated by the SRMR coefficient of 0.065, below the upper limit of 0.10.

Structural modelAfter executing the measurement model, we discuss how hypotheses can be validated. Using SmartPLS 3.3.3, hypotheses concerning the research model were tested. Following the measurement model, this part presents the structural or inner model. The inner model used to evaluate the presented hypotheses calculates the p-value and t-value. The proposed hypothesis is accepted if the t-value is more than 1.96 or the p-value is less than 0.05, and vice versa. This study utilized PLS-SEM, which included a bootstrapping resampling technique with 5000 subsamples. Fig. 3 and Table 6 depict the results of the hypothesis testing.

Results of hypothesis testing.

| Hypothesis | Structural Path | Coefficient | t-statistics | Remarks |

|---|---|---|---|---|

| Direct Effects | ||||

| H1 | FA → ENP | 0.163 ** | 2.865 | Supported |

| H2 | FA → FI | 0.540 *** | 13.387 | Supported |

| H3 | GTL → ENP | 0.195 *** | 3.513 | Supported |

| H4 | GTL → GI | 0.333 *** | 7.755 | Supported |

| H5 | GI → ENP | 0.505 *** | 8.281 | Supported |

| Mediating effects | ||||

| H6 | FA → GI → ENP | 0.273 *** | 6.915 | Supported |

| H7 | GTL → GI → ENP | 0.168 *** | 5.453 | Supported |

Notes: FA = Fintech adoption, GTL = Green transformational leadership, GI = Green innovation, ENP = Environmental performance; * = p < 0.05, ** = p < 0.01, and *** = p < 0.001.

Source: Authors’ calculation.

The results indicate that our model's seven hypothesized relationships are significant. Table 6 illustrates that the FA significantly impacts SMEs’ ENP (β = 0.163, t = 2.865, p = 0.004); thus, H1a is supported. The coefficients indicate that a 1% change in FA results in a 0.163% increase in ENP. Next, we note that FA substantially affects firms’ GI (β = 0.540, t = 13.387, and p = 0.000). The linkage between fintech and GI demonstrates the most substantial impact among all the hypothesized linkages, confirming that a 1% rise in FA would enhance the firms’ GI by 0.540%; thus, H2 is accepted.

Furthermore, the findings report that GTL positively influences firms’ ENP and GI. GTL strongly affects corporate environmental performance (β = 0.195, t = 3.513, and p = 0.000), indicating that a 1% change in GTL would lead to a 0.195% improvement in corporate ENP. Thus, H3 is confirmed. Moreover, GTL has a substantial positive effect on firms’ GI (β = 0.333, t = 7.755, and p = 0.000); hence, H4 is also supported. Next, firms’ GI substantially impacts their environmental performance (β = 0.505, t = 8.281, and p = 0.000), as a 1% improvement in GI can enhance firms’ ENP by 0.505%; therefore, H5 is confirmed.

A mediation analysis was conducted to assess the mediating effect of GI between FA, ENP, GTL, and ENP, revealing that firms’ GI strongly mediates the FA–ENP linkage (β = 0.273, t = 6.915, and p = 0.000), supporting H6. Next, we observe that firms’ GI also mediates the linkage between GTL and ENP (β = 0.168, t = 5.453, and p = 0.000); therefore, H7 is also confirmed.

ANN analysisANN is a “massively parallel distributed processor made up of simple processing units, which have a neural propensity for storing experimental knowledge and making it available for use” (Haykin, 2001, p. 2) and has been reported to outperform traditional regression techniques (Lo et al., 2022). We utilized the SPSS software to perform the ANN analysis. The significant variables from the PLS-SEM were included in the ANN analysis; thus, the FA, GTL, GI, and ENP variables are considered. Fig. 4 shows that the ANN model comprises one output neuron (e.g., ENP) and three input neurons (i.e., FA, GTL, and GI). We employed a deep ANN with one hidden layer for each output neuron node (Lee et al., 2020). The sigmoid function in our study stimulates both output and hidden neurons. Furthermore, we established the interval between input and output neurons as [0, 1] (Alhumaid, Habes & Salloum, 2021). To minimize over-fitting in the ANN, we employed cross-validation methods (ratio 90:10) for testing and training the collected data (Sharma & Sharma, 2019). The ANN model of the data yields mean-RMSE values of 0.116 and 0.105, respectively (see Table 7). The RMSE metric was used to evaluate the accuracy of neural network models (Liébana-Cabanillas, Marinković & Kalinić, 2017). RMSE is calculated by applying this formula: RMSE=√SSEN; where SSE is the sum of the square error of the training or testing data, and N is the sample size of the training or testing data. The RMSE values of testing and training data reported in the ANN analysis are relatively small; thus, we infer that our ANN model demonstrates high predictive accuracy (Lau et al., 2021; Leong, Hew, Ooi & Wei, 2020).

RMSE values.

| Network | Training | Testing | |||||

|---|---|---|---|---|---|---|---|

| N | SSE | RMSE | N | SSE | RMSE | Total Samples | |

| 1 | 261 | 3.239 | 0.111 | 25 | 0.204 | 0.090 | 286 |

| 2 | 260 | 3.466 | 0.115 | 26 | 0.303 | 0.108 | 286 |

| 3 | 255 | 3.995 | 0.125 | 31 | 0.383 | 0.111 | 286 |

| 4 | 247 | 3.048 | 0.111 | 39 | 0.465 | 0.109 | 286 |

| 5 | 256 | 3.668 | 0.120 | 30 | 0.269 | 0.095 | 286 |

| 6 | 251 | 2.907 | 0.108 | 35 | 0.672 | 0.139 | 286 |

| 7 | 259 | 3.273 | 0.112 | 27 | 0.138 | 0.071 | 286 |

| 8 | 256 | 3.008 | 0.108 | 30 | 0.445 | 0.122 | 286 |

| 9 | 259 | 5.009 | 0.139 | 27 | 0.308 | 0.107 | 286 |

| 10 | 257 | 3.270 | 0.113 | 29 | 0.260 | 0.095 | 286 |

| Mean | 3.488 | 0.116 | 0.345 | 0.105 | |||

| SD | 0.625 | 0.010 | 0.153 | 0.018 | |||

Note: SSE = Sum square of errors, RMSE = Root mean square of errors, and N = sample size.

Source: Authors’ calculation.

Next, we conducted a sensitivity analysis to rank the exogenous components based on their normalized relative significance to the endogenous construct, as shown in Table 8. We calculate the normalized importance of each neuron by dividing its relative importance by its maximal significance and reporting the outcome as a percentage (Leong, Hew, Tan & Ooi, 2013). GI is the most significant predictor of corporate ENP, followed by FA, which has a normalized value of 77.94%, and GTL (51.88%).

Sensitivity analysis.

| Neural Network (NN) | FA | GTL | FI |

|---|---|---|---|

| NN (i) | 0.346 | 0.192 | 0.462 |

| NN (ii) | 0.323 | 0.153 | 0.523 |

| NN (iii) | 0.348 | 0.323 | 0.328 |

| NN (iv) | 0.364 | 0.169 | 0.468 |

| NN (v) | 0.315 | 0.162 | 0.523 |

| NN (vi) | 0.366 | 0.214 | 0.421 |

| NN (vii) | 0.379 | 0.163 | 0.458 |

| NN (viii) | 0.320 | 0.246 | 0.434 |

| NN (ix) | 0.284 | 0.343 | 0.373 |

| NN (x) | 0.350 | 0.218 | 0.432 |

| Average importance | 0.339 | 0.218 | 0.442 |

| Normalized importance (%) | 77.94 | 51.88 | 100.00 |

Source: Authors’ calculation.

Our study assessed the role of FA and GTL in improving firms’ ENP through enhanced GI. Drawing on the EMT and AMO theories, this research empirically tested the linkages between fintech and GI, fintech and ENP, GTL and GI, and GTL and ENP. We also investigated the mediating impact of the GI of firms among these associations.

The study hypothesized (H1) that FA significantly affects environmental sustainability. The results of the hybrid SEM–ANN analysis demonstrate that FA favorably affects the ENP of Bangladeshi manufacturing SMEs, validating Hypothesis 1. Prior literature in the domains of fintech and sustainability corroborates this suggestion (Pizzi et al., 2021; Tang et al., 2022; Umar, Khan, Zia-ul-haq, Yusliza & Farooq, 2022). Recent studies have stated that fintech can efficiently alleviate the financial constraints of enterprises in industries with high pollution levels, representing its direct consequence on corporations (Xin et al., 2022). Additionally, environmental academics have demonstrated that fintech innovation enables the generation of green finance through green loans and investments, hence promoting green growth and environmental sustainability (Zhou et al., 2022). Furthermore, this study expands the EMT lens, positing that increasing resource efficiency via technological improvements, such as fintech, can address environmental challenges caused by economic growth (Khan et al., 2021b; Tang et al., 2022).

As posited in H2, FA positively affects firms’ GI. This result is in line with previous research examining the role of fintech in enhancing firms’ GI (Liu et al., 2022; Liu & Chen, 2022; Rao et al., 2022). The extant literature has substantiated that financial technology improves the efficiency of corporate capital flow and allocates cash to new GI endeavors (Liu & Chen, 2022). Furthermore, the rapid influx of financial resources enhances collaboration between firms and stakeholders, boosts the beneficial ripple effect of GI (Liu & Chen, 2022), and facilitates the absorption and assimilation of critical knowledge on GI by businesses (Rao et al., 2022). Our findings confirm the EMT proposition by providing empirical evidence on the role of technological innovations in enhancing firms’ green or environmental innovation performance (Gu, 2022).

Next, we observe that GTL is a crucial predictor of corporate ENP. This finding aligns with the stream of literature reporting a positive linkage between GTL and firms’ ENP (Çop et al., 2021; Singh et al., 2020; Sun et al., 2022). GTL enhances their businesses’ green capacity, dedication, and potential, generating ENP (Singh et al., 2020). The most recent empirical research also indicates that GTL enables organization-wide GHRM practice to improve the ENP of SMEs (Sun et al., 2022). Additionally, this finding supports the AMO perspective that organizations can confront environmental consequences through GTL.

Furthermore, GTL is a critical determinant of GI (H4). Previous literature confirmed GTL's significant impact on GI performance. For instance, Chen and Chang (2013) stated that GTL is linked to GI in the electronics industry. According to Mittal and Dhar (2016), GTL tends to increase the green creativity of tourism industry experts in India. Another study finds that GTL promotes GI and product development performance in the Taiwanese electronics industry (Chen & Chang, 2013). Additionally, some recent studies applied the AMO theory to highlight the significance of GTL in fostering GI in businesses (Chen et al., 2014; Singh et al., 2020; Sun et al., 2022).

Furthermore, the SEM–ANN analysis demonstrated that GI is the most significant predictor of corporate ENP. This outcome is consistent with several studies that established the critical role of GI in promoting firms’ ENP (Asadi et al., 2020; Kraus, Rehman & García, 2020; Seman et al., 2019). Environmental scholars argue that GI is a critical strategic stimulus for sustainable development, including technological innovation addressing energy reduction, pollution prevention, and resource efficiency (Chang, 2011). GI can minimize pollution, toxic waste, and waste disposal costs while meeting the external environmental concerns of other stakeholders on environmental legislation (Chiou et al., 2011; Porter & Linde, 1995). Dai et al. (2022) concluded that GI is intrinsically linked to corporate environmental management strategy and substantially improves ENP.

Finally, corporate GI mediates the fintech-ENP and GTL–ENP relationships. Fintech boosts GI and improves ENP, according to the mediation study. The mediating role of GI in the association between fintech innovation and firms’ environmental sustainability performance has also been reported in a few recent studies (Guang-Wen & Siddik, 2022b; Yan et al., 2022). Guang-Wen and Siddik (2022b) reported that the impact of fintech on the ENP of firms can be partially mediated by its GI. Furthermore, GTL is a crucial driver of GI and the subsequent ENP of manufacturing firms. A few studies have explored the intervening role of GI in the association between GTL and ENP (Singh et al., 2020; Sun et al., 2022) and concluded that GI mediates this association. Singh et al. (2020) support our argument by highlighting that top management's GTL affects SMEs’ green product and process innovation, subsequently boosting ENP. This study confirms these limited studies’ findings in a different economy and industry context. The authors believe this is the first study to confirm how GI impacts enterprise ENP through FA.

Conclusions and implicationsThis study aimed to investigate the impact of fintech innovations and GTL on the ENP of Bangladeshi manufacturing SMEs. Our two-stage SEM–ANN analysis revealed that fintech and GTL positively affect enterprises’ ENP. Fintech advancements may assist in minimizing ecological issues and increasing the performance of enterprises with high pollution levels in several ways. Fintech innovation enables the creation of green financing through green loans and investments, therefore boosting green growth and ecological sustainability. However, managers with GTL motivate and persuade their employees to participate in green job practices that contribute to ENP achievements. Our ANN assessment's sensitivity analysis identified FA as the most critical predictor of enterprises’ ENP. Additionally, we have identified a significant role of GI as a mediator between FA and ENP and GTL and ENP. Fintech advances improve enterprises’ access to capital and enable them to invest in green products and process innovation, thereby improving ENP. Furthermore, GTL fosters corporate GI and subsequent ENP.

Theoretical implicationsEmerging environmental concerns need firms to consistently strengthen their GTL within their HRM and adopt novel financial technology to enhance their sustainability performance. This research has produced several theoretical implications. First, this paper expands the scope of two crucial theories: EMT and the AMO hypothesis. The EMT approach proposes that the environmental impacts of business operations may be mitigated by implementing new and integrated technologies. Our SEM–ANN findings demonstrate that businesses may improve their GI and ENP by adopting financial technology. As postulated by the AMO hypothesis, we also present evidence that GTL produces greater capacity, incentive, and opportunity for employees to drive GI and corporate ENP.

Second, our study suggests a framework for future studies on environmental management, especially those examining the role of FA, GTL, and GI in the manufacturing sector. This framework is based on the interaction between FA, GTL, GI, and organizational ENP. This research also offered empirical evidence for the indirect impacts of fintech and GTL on enhancing the ENP of organizations and established the mediating function of GI in these linkages. We expand the literature on green innovation by addressing the mediating effect of GI on the interaction between FA and ENP, as well as GTL and ENP. Existing research has primarily centered on the GI as an outcome of I4.0 technology adoption (Liu & Chen, 2022; Rao et al., 2022) and a facilitator of organizations’ ENP (Kraus et al., 2020; Yan et al., 2022), neglecting its mediating role. Our research concentrates on the role of GI as a mediator between FA and ENP and GTL and ENP. The empirical findings suggest that GI positively mediates the FA–ENP and GTL–ENP linkages. Thus, the findings imply that adopting fintech and developing GTL enable manufacturing SMEs to engage in green products and process innovation, which may substantially boost businesses’ ENP. Given the dearth of research examining the crucial mediating role of GI in the FA–ENP and GTL–ENP associations, our findings enrich the existing body of knowledge.

Third, a plethora of studies focus on consumers’ FA and continuation behavior; however, there is a scarcity of research on the influence of FA on organizational performance. Few studies have been undertaken regarding the use of fintech in businesses and its role in increasing sustainability performance; however, most of these investigations are grounded in case studies and literature reviews. In addition, most studies have concentrated on the function of digital finance in organizational sustainability rather than financial technology in general (Rao et al., 2022). Thus, recent studies have advocated for empirical studies on adopting fintech at the enterprise level and its relationship to corporate sustainability performance (Pizzi et al., 2021). Our research fills this gap by demonstrating the substantial beneficial impact of FA on enterprises’ GI and ENP.

Finally, this article expands the current knowledge base on fintech and GTL in the context of Bangladesh, which can symbolize emerging economies. As previously stated, research on fintech and GTL in emerging regions is limited, which prompted this study to evaluate the adoption of fintech and GTL in Bangladesh and the role of GI and its mediating impacts. Furthermore, there is a lack of evidence on the setting of manufacturing SMEs, which strengthens the value of our study to the extant research; therefore, this study expanded the exploration of fintech, GTL, GI, and ENP in Bangladesh's SME manufacturing industry.

Policy and managerial implicationsThis study has several policy implications for both the government and organizations. First, the laws and regulations should prioritize the localization of fintech and GI following the capabilities and objectives of particular countries. As each country's capability to prepare for and adopt fintech and GI practices varies, the national government must understand these notions and integrate them with national and local economic objectives. With a defined direction and guidelines, regulations may be designed and executed with greater flexibility, improving the possibility of successfully adopting fintech in the manufacturing industry and shifting to the nation's sustainability goals.

Second, to effectively leverage the advantages of technological innovation in minimizing negative environmental consequences, the government should prioritize the acceptability and participation of all stakeholders in adopting financial technology and GI practices. As an emerging economy, Bangladesh must establish national policies for FA and GI, and it must support these plans with legislation that stimulates these executions.

Firms have a crucial role in adopting fintech and GIs since they are accountable for integrating and advancing innovation and building an efficient business model according to government objectives. Firms should emphasize harmonizing innovation and industrial policy with the objectives and endeavors of other stakeholders. Therefore, with proper government–industry interactions, technological advancement and structural change produced by fintech solutions and GI may favorably affect sustainable development.

Moreover, manufacturing SME managers from emerging nations must develop GTL to motivate the staff to attain environmental goals and inspire them to perform beyond the expectations of standard ecological requirements. SME managers must motivate employees to acquire, exchange, and implement the knowledge and technological capabilities required to introduce GI and enhance businesses’ ENP.

Limitations and future research avenuesThis research contains several shortcomings; however, other untapped avenues remain to be investigated. Our study provided preliminary evidence that should only be used as a reference point for additional research into the link between FA, GTL, GI, and organizational ENP. Nonetheless, future research should investigate the various categories of GI, including product, process, and management innovation. Although this study seeks to incorporate the potential effects of fintech and GTL, further research is required to provide a deeper understanding of the different dimensions of fintech and GTL. Furthermore, this study focused primarily on Bangladeshi manufacturing SMEs; however, enterprises in other emerging economies and industries may have varied adoption patterns and technological capabilities, which must be investigated. Future research may employ a global comparison to expand the application of these results. In addition, this is one of the few empirical studies to explore the linkage between firm-level FA and the ENP of SMEs. To confirm our proposition, we call for further empirical investigation of the implications of FA on corporate green behavior and sustainability performance. Apart from FA and GTL, external factors, such as R&D expenditure, government support, environmental legislation, access to finance, and internal factors, such as managers’ dynamic capabilities, sustainability orientation, and green value co-creation, may influence GI and ENP. Future researchers might explore these determinants of GI and ENP in different contexts. Finally, since we adopted a cross-sectional research design, there is no information on longitudinal linkages between the constructs under investigation. Therefore, future research should employ different longitudinal studies to assess the long-term effects of fintech and GTL on GI and firms’ ENP. (Appendix A).