This study explored the usefulness of market orientation in an agricultural value chain in an emerging economy: Vietnam. Drawing on data from 190 actors in a beef cattle value chain in Vietnam's Central Highlands, the study examined the relationship between market orientation and innovation. The findings indicate that there is no significant relationship between market orientation and performance. However, customer orientation and inter-functional coordination are positively related to innovation, and there is a positive relationship between innovation and financial performance. The findings provide insight into the relationships among market orientation, innovation, and performance in agricultural value chains in emerging economies.

Market orientation (MO) is the degree to which an organization applies the marketing concept in their strategic and tactical marketing decisions (Jaworski & Kohli, 1993, 1996; Kohli & Jaworski, 1990). MO has been found to be an antecedent in the creation of superior customer value, increasing competitive capacity, and enhancing financial performance (Kohli & Jaworski, 1990; Narver & Slater, 1990). While MO has typically been explored at the customer–marketer dyad unit of analysis; there has been increasing interest in exploring the efficacy of MO at the value chain level of analysis (Baker, Simpson, & Siguaw, 1999; Grunert et al., 2002; Langerak, 2001; Siguaw, Simpson, & Baker, 1998).

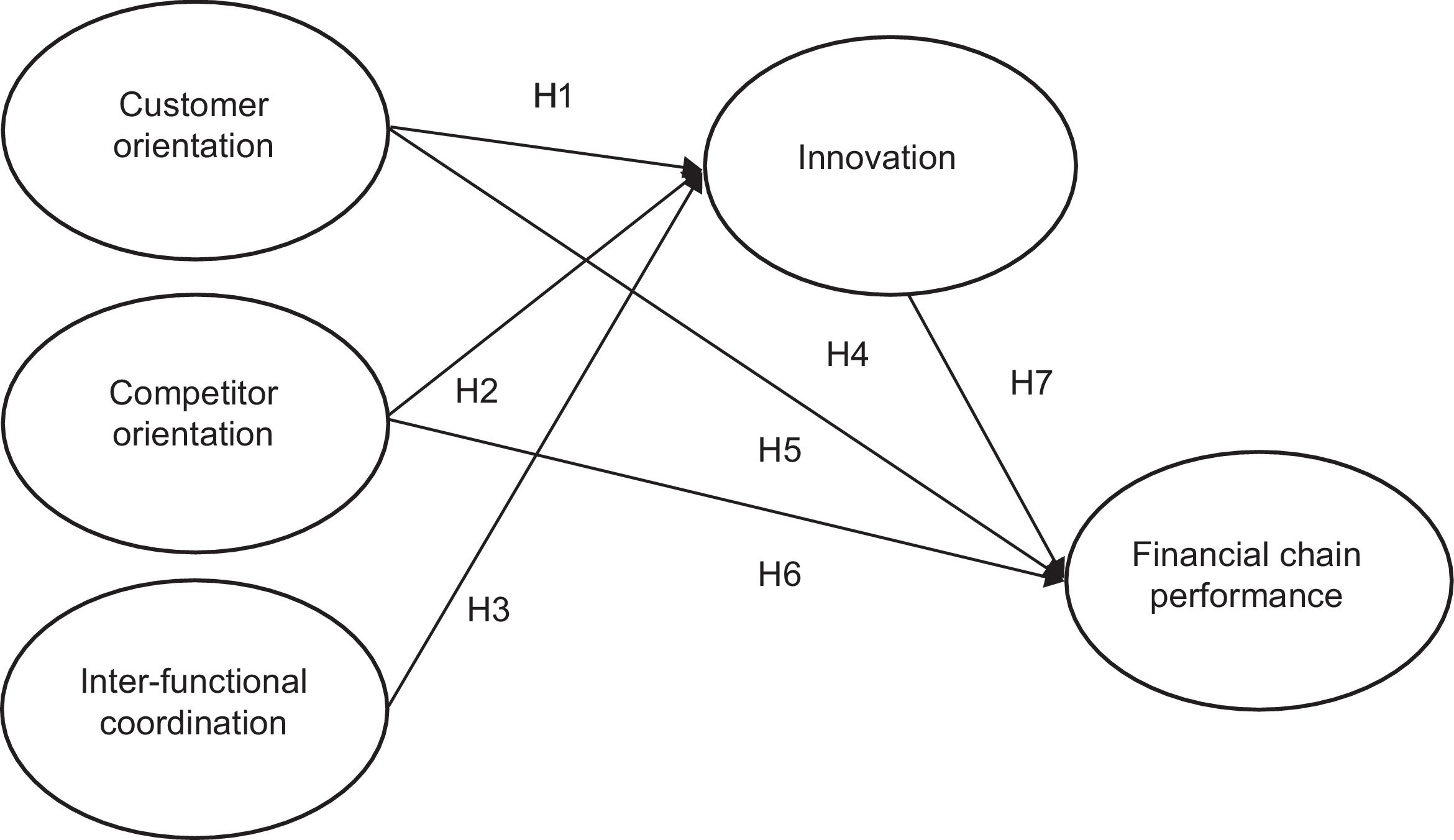

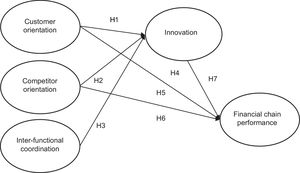

MO as a unifying business philosophy within a value chain suggests that actors in every segment of the value chain focus on serving the ultimate customers’ needs and strategically coordinate with all other chain members to create a superior value proposition in a vertically coordinated marketing system (Baker et al., 1999). In a value chain, the degree of MO of each actor is influenced by the other actors, and the competitiveness of the whole chain is influenced by the coordination of chain actors in generating, sharing and disseminating market intelligence throughout the chain (Fig. 1).

Since 1986 Vietnam has experienced dramatic changes in socio-economic development which are based on market- oriented policy reform (Kien & Heo, 2008). While globally the livestock sector generally and beef cattle production particularly has become more efficient and effective through innovations in breeding stock, animal health, and technology these innovations have not yet been widely adopted throughout Vietnam (Ayele, Duncan, Larbi, & Khanh, 2012). Likewise, the linkages between a value chain's market orientation, innovation, and financial performance have not been explored in emerging economies such as Vietnam. The purpose of this paper is to examine theses interrelationships between MO, innovation, and financial performance within beef cattle agricultural value chains in the context of an emerging economy, Vietnam.

This study is motivated by two issues. First, the topics of MO, innovation, and performance in agriculture value chains are critically important to small cattle farmers attempting to increase their incomes in emerging economies such as Vietnam. Since the liberalization of Vietnamese economy agriculture has become much more market-orientated, with an increasing focus on efficiency, effectiveness, and economies of scale, resulting in smallholder cattle farmers directly competing with lower priced, high quality beef imports from Australia. Second, cooperation and coordination are becoming more important in agricultural value chains (Royer & Rogers, 1998). This trend requires both the dissemination of market intelligence through the chain and coordination of strategy among the chain actors to be responsive to customer's needs. The cooperation and coordination of Vietnamese smallholder cattle value chains are low due to a lack of communication between chain segments. The challenge for an emerging economy such as Vietnam's is to engage their small farm producers in the emerging modern retail economy thus avoiding locking them into subsistence production and poverty (Reardon, Barrett, Berdegué, & Swinnen, 2009). While the linkages between MO, innovation, and performance has begun to be explored in beef value chain actors in developed nations (Micheels & Gow, 2008, 2011, 2012) there is a gap in research on the MO, innovation and performance relationships in agricultural value chains within an emerging market context.

Literature reviewThe relationship between MO, innovation, and financial performance has been addressed by substantial research; however, to fix the context of agricultural production, the study applied framework produced by Johnson, Dibrell, and Hansen (2009) and Micheels and Gow (2008, p. 4). The framework was constructed by three sub-constructs: MO, innovation, and financial performance.

Market orientationMO has been defined by marketing researchers as the crucial framework to improve the sustainability of competitive advantage (Kumar, Jones, Venkatesan, & Leone, 2011). MO was early investigated by the pioneers such as Kohli and Jaworski (1990) and Narver and Slater (1990). According to Narver and Slater (1990), MO consists of the concentration on customers and competitors, and integrating of firms’ functions to create the superior value to customer. Delivering the superior value to customer is concerned as the key of long-time profit and competitive advantage (Kumar, Subramanian, & Yauger, 1998). Although MO has extensively considered in the literature since the last 20 years, the concept has received limited attention in field of natural resources (Hansen, Dibrell, & Down, 2006) and specifically in agricultural sector (Martino & Tregear, 2001; Micheels & Gow, 2008; Johnson et al., 2009). Hence, this study attempts to apply MO concept in agricultural production in an emerging country.

This study adopts Narver and Slater's (1990) conceptualization of MO which has been applied in agribusiness studies (Micheels & Gow, 2008, 2011, 2012), food industry (Aziz & Yassin, 2010, Johnson et al., 2009), and emerging countries (Hau, Evangelista, & Thuy, 2013). The concept includes: (1) customer orientation; (2) competitor orientation; and (3) inter-functional coordination. Many previous papers indicated that those three dimensions provide a holistic picture of collecting, disseminating and using market information in firms (Narver & Slater, 1990). The goal of MO is to deliver a superior value proposition to the customer based on the insights from customer and the analysis of competitors (Gounaris, Tanyeri, Avlonitis, & Giannopoulos, 2012). MO applied to value chains in this study is defined by measuring each value chain actor's customer orientation and competitor orientation, and then disseminating these customer and competitor insights throughout the value chain to create a superior value proposition for the customer (Baker et al., 1999).

InnovationInnovation can be conceptualized as the development of new products or services (Cumming, 1998; Covin & Miles, 1999); alternative business models and strategies (McAdam, Armstrong, & Kelly, 1998; Urabe, Child, & Kagono, 1988); new knowledge formation (Chaharbaghi & Newman, 1996); and/or an alternative delivery method (Knox, 2002). Damanpour (1991) considers organizational innovation as the practice of a new idea which comprises all activities of organizations: a new product, service or a new process. Innovation in this study focuses on three types: new products, new services, and new technology/process. Product and services innovation has been noted as the introduction of new product or services to meet the requirement of users and market needs (Damanpour, 1991), and is considered as the process of applying new technique into production process (Lukas & Ferrell, 2000) for the sake of increasing revenue (Johne, 1999). This innovation reveals the change in end product which has to be upgraded and renovated to maintain the market presence (Johne, 1999). Process innovation is the alteration of new items’ elements into the process and operation such as material, new equipment (Damanpour, 1991). This process changes the production methods of the firm's products and/or services (Cooper, 1998).

HypothesesMarket orientation and innovationThere are an increasing number of studies that focus on MO and its effect on innovation (Atuahene-Gima, 1995; Beck, Janssens, Debruyne, & Lommelen, 2011; Nasution, Mavondo, Matanda, & Ndubisi, 2011). Generally, these studies indicate a positive relation between customer and competitor orientations and influence on innovation. In particular, market orientation impacts the capability of innovation through an understanding of the customer increase production efficiencies and improves sales and profitability (Atuahene-Gima, 1996). A recent study by Grinstein (2008) found that the customer and competitor orientations positively affect innovation consequences. Likewise, Atuahene-Gima (2005) found that customer and competitor orientations enhance a firm's willingness to develop new products. Newman, Prajogo, and Atherton (2016) also found a strong relationship between customer and competitor orientations and incremental and radical innovation within a firm.

Customer and competitor orientations refer to the information acquisition process that creates knowledge about current and potential customers and competitors and then disseminate this information within the firm (Jaworski & Kohli, 1993; Narver & Slater, 1990). However, this construct is also affected by the inter-functional coordination among the firm's units (Jaworski & Kohli, 1993; Narver & Slater, 1990). First, inter-functional coordination enhances the flow of information and knowledge across the functional boundaries to help firms generate new insights from market knowledge (Hurley & Hult, 1998; Kohli & Jaworski, 1990). Second, inter-functional coordination establishes trust among different functional units as well as creates the conditions for applying market information to their business (Jaworski & Kohli, 1993; Narver & Slater, 1990).

Customer orientation and innovationThe relationship between customer orientation and innovation has yet to be fully explored and tested and remains ambiguous (Christensen, Cook, & Hall, 2005; Lukas & Ferrell, 2000). For example, studies by Tajeddini and Trueman (2008), Tajeddini (2010), and Voigt, Baccarella, Wassmus, and Meißner (2011) all failed to find a significant relationship correlation between customer orientation and innovativeness. Alternatively, work by Matsuo (2006) found that customer orientation positively affects innovation by the supporting positive conflict and solving the negative conflict. Customer oriented firms closely monitor and evaluate the tendency of customer needs, then innovate to improve their products, services to satisfy those needs (Micheels & Gow, 2008; Sadikoglu & Zehir, 2010). Others also found a positive relationship between customer orientation and innovation including Laforet's (2009) work on product innovation; Grawe, Chen, and Daugherty (2009) study on service innovation, and Fredberg and Piller (2011) findings related to the relationship of customer orientation and radical innovation and Newman et al. (2016) findings that customer orientation supports both exploratory and exploitative innovation. These suggest that: H1: Customer orientation is positively related to innovation.

Many studies have revealed the no significance and/or negative effect of competitor orientation on innovation. Frambach, Prabhu, and Verhallen (2003) found that competitor-oriented firms often require less engagement in new product development activities if they imitate their competitors’ product. A recent study by Lewrick, Williams, Maktoba, Tjandra, and Lee (2015) found that competitor orientation is counterproductive for radical innovation and has no significant relation with incremental in mature companies. Additionally, in the case where demand is uncertain competitor orientation tends to have a negative effect on innovation performance (Gatignon & Xuereb, 1997). Foreman, Donthu, Henson, and Poddar (2014) found that there is a negative relationship between competitor orientation and financial performance.

Alternatively, competitor orientation can also be found to positively relate to innovation. Competitor orientation is the ability of firms to determine, evaluate, and respond to weaknesses and strengths of competitors, and then improve their organizational intelligence (Day & Wensley, 1988; Kohli & Jaworski, 1990; Narver & Slater, 1990). Competitor orientation facilitates an evaluation of the progress of rival firms, stimulating a firm to be creative in differentiating its products or services from competitors thereby developing competitive advantage (Han, Kim, & Srivastava, 1998). Competitor orientation also appears to influence both incremental and radical innovation (Atuahene-Gima, 2005; Newman et al., 2016). Scholars have sometimes argued that competitor-oriented firms tracked the competitors’ actions, which leads to the imitation of their rival's product, then making an incremental innovation to their products and services (see, Lukas & Ferrell, 2000). However, others have suggested that focusing on competitors lead firms to develop different innovation from their competitors to obtain higher market share and that greater knowledge of competitors enhances firm investment in developing new competencies (Atuahene-Gima, 2005).

Grinstein (2008) found that when firms obtain a degree of customer orientation, competitor orientation reinforces innovativeness. This result supports Frambach et al. (2003) findings that competitor-oriented firms engage in a high degree of customer research to test “me-too” products on target customers. This leads to the hypothesis that: H2: Competitor orientation is positivity related to innovation.

The importance of inter-functional coordination to create superior value for customers has been mentioned in various studies which focus on the positive effect to new product development (Ayers, Dahlstrom, & Skinner, 1997; Griffin & Hauser, 1996). The concept of inter-functional coordination implies mutual sharing, dissemination, and involvement in conducting the launching and developing a new product (Song & Parry, 1997). In this paper, it is hypothesized that inter-functional coordination positively affects innovation because it supports the process of information acquisition, dissemination of market intelligence among the functional units, and hence facilitates creativity (Jaworski & Kohli, 1993). In particular, inter-functional coordination enables creativity because units in firms can generate and share new ideas, resolve difficulties, and mediate conflicts or disagreements (Andrews & Smith, 1996; Gatignon & Xuereb, 1997; Griffin & Hauser, 1996; Han et al., 1998; Micheels & Gow, 2008; Johnson et al., 2009). Thus, it is believed that inter-functional coordination facilitates the acquisition and dissemination of information and divergent ideas leading to innovation and so our hypothesis is that: H3: Inter-functional coordination is positively related to innovation.

Slater and Narver (1994, 1999), found a significant relationship between market orientation and performance through the improvement of sale growth and new product success. Likewise, Kumar, Subramanian, and Strandholm (2011) findings provide additional support for the positive relationship between MO and performance found by Slater and Naver (1994) and Slater and Naver (1999). While the market orientation–performance relationship is still debated (e.g. Harris, 2001; Johnson et al., 2009; Ottesen & Grønhaug, 2005); in a study based in the agricultural sector, Micheels and Gow (2008) found that MO has a positive effect on performance both directly and indirectly through innovation. Given the debate: H4: Customer orientation has a positive relationship with financial performance of beef cattle value chain H5: Competitor orientation has a positive relationship with financial performance of beef cattle value chain H6: Inter-functional coordination has a positive relationship with financial performance of beef cattle value chain

The effect of innovation on business performance remains a matter of debate. Schumpeter (1934) argued that innovation is a chance for firms to pursue economic rent in the short-term through the establishing of a monopoly and continuous innovation activities (Porter, 1980). Covin and Miles (1999) suggest that firms innovate and engage in entrepreneurship to pursue competitive advantage. By offering innovative products/services firms sometimes can avoid price competition, access new marketing and create new demand, and enhance the firm's business performance as indicated by financial metrics such as turnover, profit, and stock price; and/or develop strength in strategic metrics such as reputation, loyalty, and satisfaction (Gupta & Zeithaml, 2006). Through successful innovation, customers will pay a premium price and purchase more frequently enhancing customer loyalty when the purchased products/services meet their particular requirements (Anderson, Fornell, & Lehmann, 1994; Moreau & Herd, 2010). Moreover, innovation supports a firm's efforts to prevent competitors from entering markets, strengthen their positional advantage thus improving their resilience (Porter, 1980). More recent studies that indicate a positive relationship between innovation and business performance include Cheng, Yang, and Sheu (2014), Grissemann, Plank, and Brunner-Sperdin (2013), and Rosenbusch, Brinckmann, and Bausch (2011).

However, the literature also points out the negative effects of innovation. Rogers (2003) suggested that these include greater expenditure, greater resource consumption, and less equitable distribution of resources. Further, innovation is also a risk undertaking because it requires substantial resources (Li & Atuahene-Gima, 2001). These considerations suggest that innovation could negatively and positively impact financial performance. Notwithstanding this, the weight of the literature suggests: H7: Innovation is positively related to value chain financial performance.

A questionnaire was designed to ask beef value chain actors (such as farmers, collectors, distributors, slaughterhouses, retailers) for their perceptions on a range of variables including customer orientation, competitor orientation, inter-functional coordination, and innovation. The design of survey instrument comprises two areas: (1) general information, perception of interviewees about customer focus, competitor focus, inter-functional coordination, innovation and chain performance; (2) measurement of items using the five-point Likert scales ranging from 1=“Not at all”, 2=“A little bit”, 3=“Somewhat”, 4=“Quite well”, and 5=“Very well”. Local experts in beef cattle production include successful smallholders, local extension agents, beef cattle ‘collectors’ (sometimes also called ‘aggregators’ or ‘traders’). A pre-test of the survey by researchers from the Faculty of Animal Science at Tay Nguyen University, Dak Lak province, assessed the items in the questionnaire. After incorporating their suggestions, a second pre-test was carried out with ten farmers, and two collectors (aggregators or traders), to make sure that all the questions were relevant for respondents. Based on their feedback the items were modified.

To maximize responses, the survey strategies included four days’ training for the survey enumerators, modifying the length and the form of the survey to enhance clarity, improving arrangements for data collection and the provision of feedback. Data were acquired through face-to-face interviews, by meeting with each value chain actor. The enumerators were trained to provide information about respondent confidentiality and the project's potential benefits and implications. Generally, data were collected at a convenient time for the respondent. In this process, 190 value chain actors were interviewed including 134 small farmers, and 4 collectors, 2 slaughterhouses, 20 wholesalers, and 30 retailers.

Sampling design and frameThe unit of analysis for this study is a single value chain system in a developing country context. At some levels in single traditional smallholder value chain there are very few actors (e.g. collectors or traders) and there is a paucity of formal information available on chain participants to assist research design, hence ‘non-probability’ or ‘purposeful’ sampling is the most appropriate sampling technique to employ in order to collect the richness of the information needed to illuminate the phenomenon being studied. Thus, the frame was ‘stratified’ by the structure of the chain and its various levels of chain actors, farmers, collectors, slaughterhouses, and retailers, with a purposeful sample being selected from each stratum (Onwuegbuzie & Leech, 2007).

Surveys were administered to a non-random purposeful sample of 190 actors including 134 smallholders, 4 collectors, 2 slaughterhouses, 20 wholesalers, and 30 retailers who involve beef cattle value chain the Centre Highland of Vietnam. By using a snowball process, the respondents were requested to forward the survey. There are five collectors at the district level, and four are small collectors that mainly supply beef cattle for the district's slaughterhouse and one collector who supplies beef cattle to the city. The district collector was requested to identify the collection areas which daily provide a high percentage of beef cattle. Based on a list of 250 smallholders provided by the commune authority, 180 smallholders, who sell beef cattle to the commune collectors, were selected. However, 30 smallholders were removed from this list because of reasons that included: (1) they had migrated to the city; (2) they changed their production model to a cow–calf raising operation; or (3) they were not of sufficient scale of production. Within 150 selected smallholders, 16 smallholders were not available at the time of survey; therefore, only 134 smallholders involved in this process. The survey with the district collectors also helps to identify two slaughterhouses, then 20 wholesalers, who buy beef from these slaughterhouses was identified. The wholesalers helped to identify the markets where they supply retailers. A list of 60 retailers at two central markets in the city was provided by the government's Market Management Board. However, 20 retailers were removed from this list as they had not bought beef from these wholesalers; therefore 40 retailers at the two central markets in the city were selected to conduct the survey. During the survey, 10 out of 40 retailers were not involved in this process because they did not have the time to answer the questions in the survey.

MeasuresAll items to measure market orientation and innovation were adopted from previous research. MO was measured using the Narver and Slater (1990) scale. The concept comprises three dimensions: customer and competitor focus as well as the coordination among the firm's units. Items were adapted for agricultural production in developing country. The MKTOR measurement scale developed by Narver and Slater (1990) initially focused on three dimensions: customer orientation, competitor orientation, and inter-functional coordination which have been adopted in numerous research studies to date (Farrell & Oczkowski, 2002; Greenley, 1995; Hult & Ketchen, 2001). In the context of agricultural production in developing countries, a large portion of the innovation has usually been done to increase the productivity and the value of the product. Innovation is generally seen as the adoption and implementation of new technologies or production practices. In this paper, innovation was measured through two items adapted from Hurley and Hult (1998) to the study's context, small-scale cattle producers in a traditional and rural area of a developing country.

Data analysisThe quantitative analysis in this paper was conducted using SPSS 23. All data were analysed using exploratory data analysis (EDA) to determine the out-of-range values, missing values, outliers, and normality. Reliability analysis was conducted by employing Cronbach's alpha. Confirmatory Factor Analysis (CFA) using AMOS 2.3 was used to measure the convergent proportion of variance (Hair, Anderson, Babin, & Black, 2010). The convergent validity is accepted when loadings of items are significant (Anderson & Gerbing, 1988) and the minimum value of factor loadings is 0.5 (Hair et al., 2010). Finally, the structural equation model was applied to test the whole hypothesized model by examining the relations between constructs and scale items. Additionally, to measure the fitness between data and the hypothesized model, some indexes were also calculated such as: χ2/df<2 (Tabachnick & Fidell, 2007), the comparative fit index (CFI), the normed fit index (NNFI) above 0.9 (Ullman & Bentler, 2003), and the root mean square error approximation (RMSEA) below 0.08 (Browne & Cudeck, 1993).

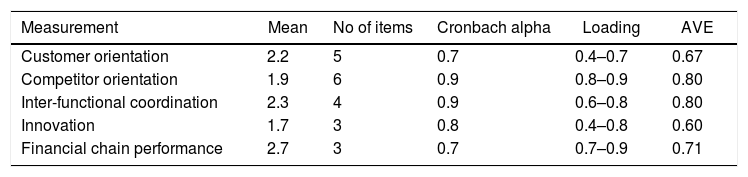

ResultsReliabilityTo measure the internal consistency among the items, reliability analysis was employed as illustrated in Table 1. The findings indicate that most of the Cronbach's alpha values are greater than 0.70 indicating the outstanding the consistency among items (Nunnally, 1978). The construct of customer orientation and financial chain performance is 0.7; acceptable for the context and nature of this exploratory study (Nunnally, 1978). During the reliability analysis, items that had item-to-total correlations below 0.35 were removed from further analysis Delgado-Ballester (2004). For this reason, two out of five items of financial performance construct were removed from this process (Table 2).

Reliability and validity of scale items.

| Measurement | Mean | No of items | Cronbach alpha | Loading | AVE |

|---|---|---|---|---|---|

| Customer orientation | 2.2 | 5 | 0.7 | 0.4–0.7 | 0.67 |

| Competitor orientation | 1.9 | 6 | 0.9 | 0.8–0.9 | 0.80 |

| Inter-functional coordination | 2.3 | 4 | 0.9 | 0.6–0.8 | 0.80 |

| Innovation | 1.7 | 3 | 0.8 | 0.4–0.8 | 0.60 |

| Financial chain performance | 2.7 | 3 | 0.7 | 0.7–0.9 | 0.71 |

Confirmatory factor analysis (CFA) was used to test the full measurement model. Model fit was analysed using the goodness of fit index (GFI), the incremental fit index (IFI), and the Tucker-Lewis index (TLI) along with the root mean squared error of approximation (RMSEA) and the chi-square index divided by degrees of freedom (df). The data seem to fit the model reasonably well as the GFI=0.84, IFI=0.93, TLI=0.90, RMSEA=0.08, and CMIN/df=2.3, all indicating an acceptable fit. The convergent validity was examined by the Average Variance Extracted (AVE), which is from 0.60 to 0.80 greater than the cut-off at 0.5; hence all items in measurement model are statistically significant.

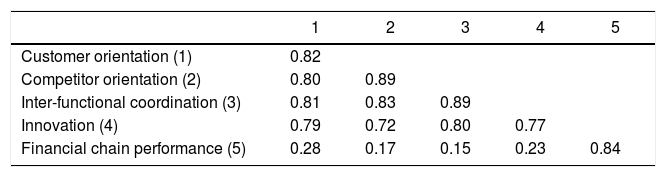

Discriminant validity was used to measure the extent to which latent factors are distinct and uncorrelated to ensure that one latent variable is not highly correlated with others. When a high correlation between two latent variables means that this latent variable is explained better by another variable from a different factor than its observed variables. According to Fornell and Larcker (1981), discriminant validity is observed through the comparison between the square roots of the average variance extracted and the correlation between latent variables. The result indicates that the square root of average variance extracted of all latent variables is greater than the correlation between latent variables; hence the discriminant validity is achieved.

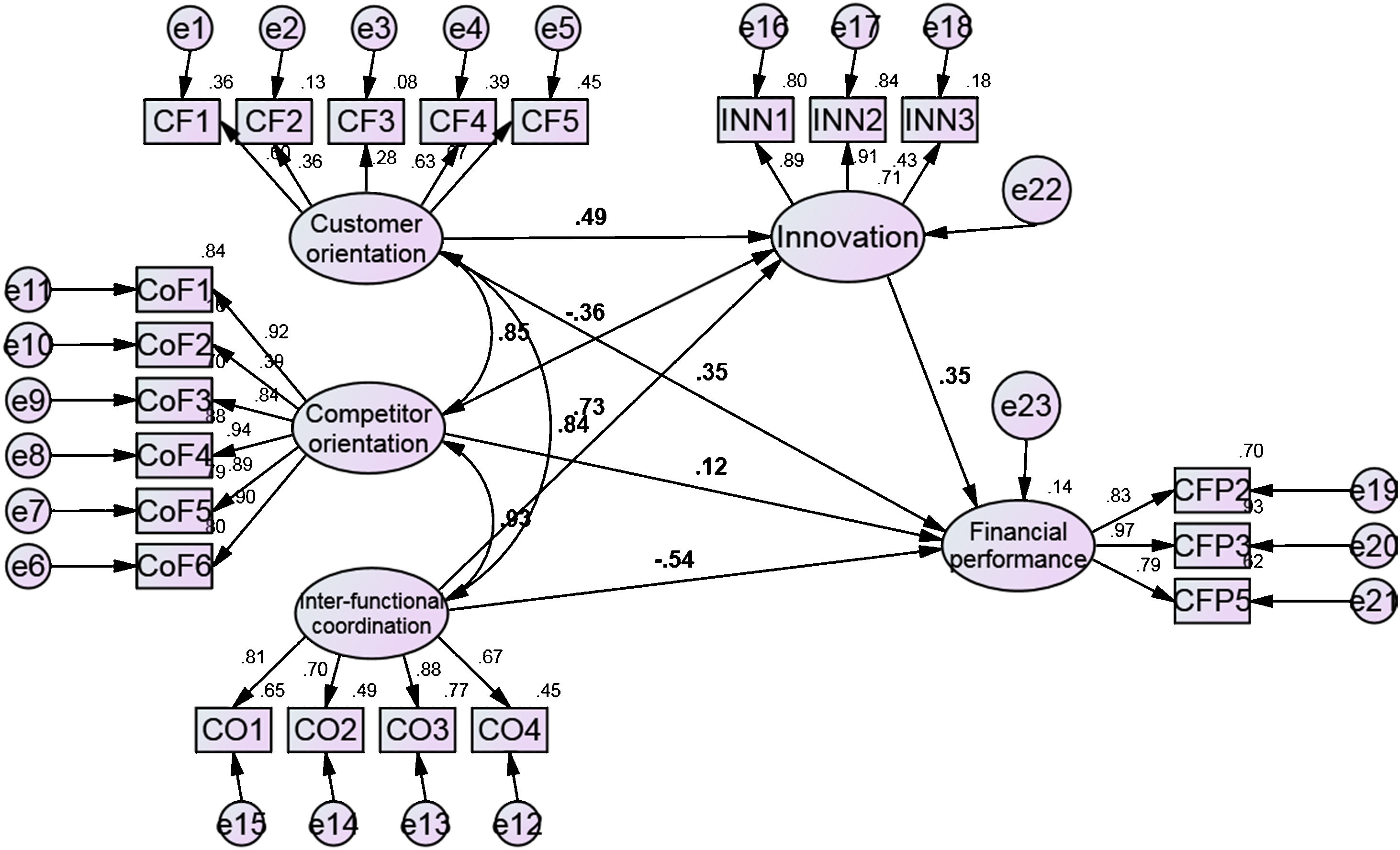

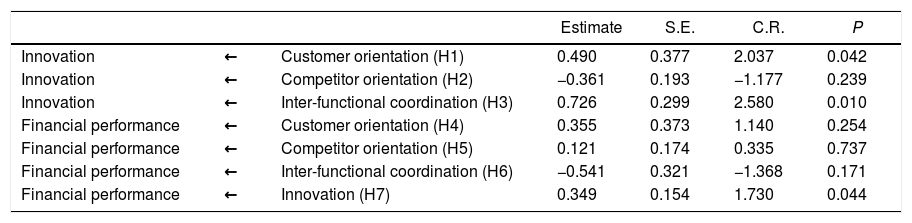

Testing hypothesesTesting of the hypotheses was conducted through structural equation model (Table 3). Model fit was analysed using the Goodness of Fit Index (GFI), the Incremental Fit Index (IFI), and the Tucker-Lewis Index (TLI) along with the root mean squared error of approximation (RMSEA) and the CMIN (χ2) divided by degrees of freedom (df). The data seem to fit the model reasonably well as the, GFI=0.84, IFI=0.93, TLI=0.90, RMSEA=0.08, and CMIN/df=2.3, all indicating the model fits the data well. Unfortunately, the RMSEA of 0.08 did not meet the requirement of RMSEA cut-off point of less than 0.08. However, other previous studies confirmed that when the sample size is small, the RMSEA does not perfectly fit due to the effect of the level of power or the Type I error rate (Nevitt & Hancock, 2004).

Regression weights.

| Estimate | S.E. | C.R. | P | |||

|---|---|---|---|---|---|---|

| Innovation | ← | Customer orientation (H1) | 0.490 | 0.377 | 2.037 | 0.042 |

| Innovation | ← | Competitor orientation (H2) | −0.361 | 0.193 | −1.177 | 0.239 |

| Innovation | ← | Inter-functional coordination (H3) | 0.726 | 0.299 | 2.580 | 0.010 |

| Financial performance | ← | Customer orientation (H4) | 0.355 | 0.373 | 1.140 | 0.254 |

| Financial performance | ← | Competitor orientation (H5) | 0.121 | 0.174 | 0.335 | 0.737 |

| Financial performance | ← | Inter-functional coordination (H6) | −0.541 | 0.321 | −1.368 | 0.171 |

| Financial performance | ← | Innovation (H7) | 0.349 | 0.154 | 1.730 | 0.044 |

The analysis shows there is a positive relationship between customer orientation, inter-functional coordination and innovation. A one-unit increase in customer orientation and inter-functional coordination will result in a 0.49 and 0.73 unit increase in innovation, respectively; therefore the hypothesis H1 and H3 are supported. The hypothesis H7 was also supported (P=0.04) when a one unit increase in innovation leads to a 0.35 unit increase in financial chain performance. Conversely, the result shows an insignificant relationship between competitor orientation and innovation and there are no relationship between customer orientation, competitor orientation, and inter-functional coordination with financial performance of value chain (Fig. 2).

DiscussionThe literature does not adequately address the concept of the antecedents and consequences of innovation in agricultural value chains (McElwee, 2006), and specifically have failed to incorporate the context of an emerging nation such as Vietnam. This research addresses this gap by providing insights into the relationships between market orientation, innovation and chain performance in the context of cattle production in a developing country.

Market orientation and financial performanceThe study found that there are no significant relations between three dimensions of MO: customer orientation, competitor orientation, and inter-functional coordination and financial performance of beef cattle value chain, which was corroborated by Ottesen and Grønhaug (2005) and Johnson et al. (2009). The possible explanation is that beef cattle value chain actors believe they are market oriented, but in practice are not or they would be a shortage of the ability to perform the competitive advantage through market orientation. In this study, these value chain actors are at least aware of MO and perform these activities to some extent, but that is not enough to create a greater performance. It is also possible to explain that the insignificance in the relationship between MO and financial performance by the nature of relationships within the value chain. Obviously, the smallholders often sell cattle to collectors/traders. At the end, beef retailers who in turn sell to the end consumer.

Market orientation and innovationThe results consist with other previous studies to indicate that customer orientation is positively related to innovation (Sadikoglu & Zehir, 2010; Micheels & Gow, 2008, 2011; Newman et al., 2016) and coincides with arguments of others that customer orientation is an antecedent of innovation (Cheng & Krumwiede, 2012). Customer orientation asks the sellers to understand the buyer throughout the value chain (Day & Wensley, 1988), and then sellers can innovate their business to create value for buyers by increasing benefits or decreasing buyer's cost (Narver & Slater, 1990). However, the magnitude of customer orientation is relatively low indicating that the awareness of smallholders about understanding and collecting information from the target customer is still minimal and could be improved.

Findings also reveal that inter-functional coordination has a positive effect on innovation which is consistent with other similar studies (Micheels & Gow, 2008, 2011; Johnson et al., 2009). The existence of grass-root associations such as cattle clubs, animal associations, farmer unions, women unions, and youth unions at the study sites has enhanced the social capital among the smallholder farmers and reinforces the horizontal bonding and the vertical networking of the smallholders.

Findings also indicate that competitor orientation has an insignificant relationship with innovation which supports some previous studies (Gatignon & Xuereb, 1997; Lukas & Ferrell, 2000; Ottesen & Grønhaug, 2005; Johnson et al., 2009). In this study, competitor-oriented value chain actors imitate the competitor’ activity, and introduce me-too imitations, rather than produce line extensions or new-to-world products. Additionally, in this case of smallholder farmers in a developing country with little or no information, the farmer could not determine their competitors. In this Vietnamese province, most beef farmers are in collaborative relationships with fellow local producers rather than regarding them as competitors for the limited market opportunities offered by traders. Hence, it appears that the market orientation concept is unclear in the context of small farmers in an emerging economy.

Innovation and financial performanceWhile there is no evidence of the direct impacts upon performance via market orientation, the findings do reveal a positive influence on performance through innovation which supports previous studies such as Micheels and Gow (2008) and Johnson et al. (2009). The importance of innovativeness is not surprising in this highly competitive and heterogeneous marketplace. In this case, value chain actors employ their knowledge and understanding about the customer, which are then disseminated among the chain parties to innovate the beef cattle business. By doing that those innovations enhance the financial performance of beef cattle value chain

Managerial and policy implicationsThis paper is one of the first attempts to examine the concept of market orientation, innovation, and value chain performance within a developing country agricultural context, although these concepts have been widely applied in developed countries. Therefore, the application of these concepts to a developing country's agriculture where small farmer innovation is predominantly incremental and involving often complex socio-cultural and external factors contributes valuable insights to the literature on market orientation, innovation, and value chain performance.

The findings indicate that customer orientation and inter-functional coordination are antecedents to innovativeness, while competitor orientation has no significant relationship with innovation. This suggests that to improve beef cattle value chain financial performance, customer and inter-functional coordination should be encouraged by policy incentives and support initiatives amongst the value chain consisting of smallholders, collectors, slaughterhouse, wholesalers, and retailers; especially when innovativeness is defined in terms of openness to new ideas. To do that, development policies should encourage smallholders to engage in the coordinating supply and increase their capacity to access information on customers, competitors, and contact with other actors across the chain. The study also provides important strategic guidelines for agriculture generally and beef cattle production, particularly in developing countries.

To enhance the performance, smallholders should concentrate on understanding customers, pay attention to competitor behaviour to produce comparable products, and focus on inter-functional coordination to improve the product lines. The results of this study could offer policy makers’ guidelines regarding improving value chain performance in other agricultural sectors in developing economies. The lack of customer orientation and inter-functional coordination can restrict the development of innovation, and chain performance, therefore policy makers should increase smallholders’ awareness of customer expectation and requirements without ignoring strengths, weaknesses and the business performance of competitors.

Platforms to facilitate vertical coordination (such as on-line cattle markets and on-line access to market preferences and demand) should also be encouraged, developed and supported by policy makers so that smallholders and other chain actors can more effectively and efficiently share their resources, information, and knowledge about customers, and competitors. For example, Russell and Purcell (1980) suggested the market innovation for smallholders in rural Virginia (who faced thin markets with high price volatility) of electronic cattle auction markets to provide a more effective mechanism for price discovery (resulting in often higher prices to the small holders in narrow less competitive rural markets). This type of vertical market coordination is also suggested by Pica-Ciamarra and Otte (2008) to enhance the incomes of smallholders in developing nations.

Findings also reveal that market orientation is important if beef value chain actors are going to continue to develop value-added products; therefore, smallholders should contact and establish the linkage with consumers and downstream chain parties to accurately identify the possible sources to create the value, and gather information, which can be used to formulate and implement their beef cattle business (Micheels & Gow, 2011, 2012).

Given changing consumer preferences, smallholders need the institutional framework support from governments to increase their capabilities in order to remain competitive with the larger more sophisticated competitors (Pica-Ciamarra & Otte, 2008). The institutional framework shapes and strengths the relationship among smallholders, traders, slaughterhouse, wholesaler, retailers, and final customer, which would enhance the information and product flow among chain parties.

LimitationsThe present study has some limitations. The research setting surveys a range of actors such as farmers, collectors, slaughterhouse, wholesalers, and retailers directly involved in the beef cattle value chain, while ignoring the effect of other stakeholders in farmers’ network (Lazzarini, Chaddad, & Cook, 2001). Those stakeholders include extension agents, local governmental staff, and policy makers who also may affect the market orientation and innovation of smallholders, consequently impacting business performance. Therefore, future studies should consider the effect of additional actors in supporting smallholders to improve their beef cattle value chain.

In this study, the scale and validation were specific to the context of a developing country; therefore the generalizability may be limited. It would be fruitful to be able to compare similar studies in other emerging economies to test cross-cultural validation of the measurement models and to confirm the scale development and its validity.

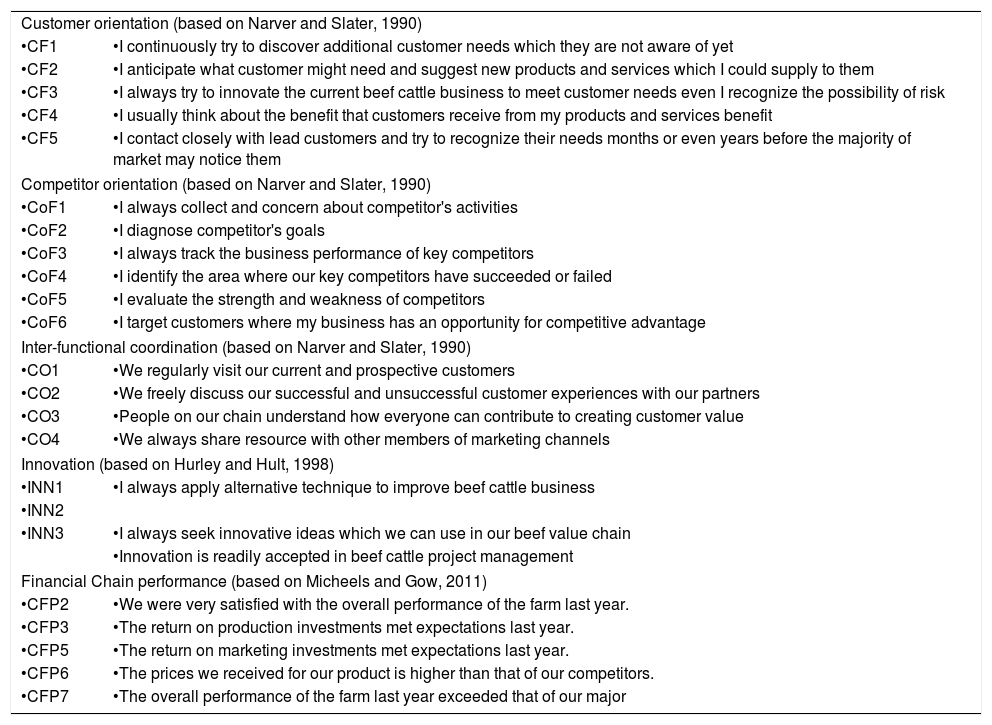

Scales

All measures were taken on a 1 (not at all) to 5 (very well) scale

| Customer orientation (based on Narver and Slater, 1990) | |

| •CF1 | •I continuously try to discover additional customer needs which they are not aware of yet |

| •CF2 | •I anticipate what customer might need and suggest new products and services which I could supply to them |

| •CF3 | •I always try to innovate the current beef cattle business to meet customer needs even I recognize the possibility of risk |

| •CF4 | •I usually think about the benefit that customers receive from my products and services benefit |

| •CF5 | •I contact closely with lead customers and try to recognize their needs months or even years before the majority of market may notice them |

| Competitor orientation (based on Narver and Slater, 1990) | |

| •CoF1 | •I always collect and concern about competitor's activities |

| •CoF2 | •I diagnose competitor's goals |

| •CoF3 | •I always track the business performance of key competitors |

| •CoF4 | •I identify the area where our key competitors have succeeded or failed |

| •CoF5 | •I evaluate the strength and weakness of competitors |

| •CoF6 | •I target customers where my business has an opportunity for competitive advantage |

| Inter-functional coordination (based on Narver and Slater, 1990) | |

| •CO1 | •We regularly visit our current and prospective customers |

| •CO2 | •We freely discuss our successful and unsuccessful customer experiences with our partners |

| •CO3 | •People on our chain understand how everyone can contribute to creating customer value |

| •CO4 | •We always share resource with other members of marketing channels |

| Innovation (based on Hurley and Hult, 1998) | |

| •INN1 | •I always apply alternative technique to improve beef cattle business |

| •INN2 | |

| •INN3 | •I always seek innovative ideas which we can use in our beef value chain |

| •Innovation is readily accepted in beef cattle project management | |

| Financial Chain performance (based on Micheels and Gow, 2011) | |

| •CFP2 | •We were very satisfied with the overall performance of the farm last year. |

| •CFP3 | •The return on production investments met expectations last year. |

| •CFP5 | •The return on marketing investments met expectations last year. |

| •CFP6 | •The prices we received for our product is higher than that of our competitors. |

| •CFP7 | •The overall performance of the farm last year exceeded that of our major |