This study exposes relevant tensions between deep-tech startups’ sound technological solutions, confronted with lack of marketing skills to communicate their unique value proposition for targeted customers. Incorporating technological foresight as an essential component of strategic foresight, this study explores how the interplay between firm internal technological, environmental, and market features influences enhanced foresight capabilities. The model is tested with Partial Least Square-Structural Equation Modelling (PLS-SEM) and uses survey data from managers of European deep-tech companies. PLS-SEM findings reveal a significant correlation between market features, tech features and environmental features jointly influencing enhanced foresight capabilities. The strong correlation between tech features and enhanced foresight capabilities give promising insight for upgrading this managerial capability as it influences successful scaling from laboratory to pilot customers. In turn, the lack of correlation between firm internal features and enhanced foresight capabilities proves that rapid technological advances outpace market readiness or customer adoption, claiming to replace “learning from the past” with “learning from the future”. The findings enrich the current body of knowledge, while the practical implication highlights how enhanced foresight capabilities enable deep tech firms to leverage technology dominance with desirable business agility, in order to adopt a virtuous cycle of capturing-market maker opportunities towards a future shaping builder.

Deep tech firms are companies that develop and offer cutting-edge, technology-intensive products or services, often based on advanced research and development efforts. Deep tech firms spend a lot of time in innovation labs before being capable of bringing tech to market and achieving real market adoption (Tidd & Bessant, 2020). Deep tech firms are confronted with regular analyses of potential future market demands, emerging trends, and evolving consumer needs, to align their strong tech capabilities with the future market landscape. Deep tech firms often use scenario planning to address different time horizons, and envision various potential future scenarios (Amer et al., 2013). This approach involves configuring a myriad of plausible narratives for the future, considering specific market conditions, regulatory landscapes, and consumer preferences. Balancing strong tech capabilities with low market capabilities in the case of deep tech firms is a crucial challenge that can be addressed through effective communication of innovation (Elfring & Hulsink, 2003). The nature of deep tech startups consists of technological foresight capabilities, while the other components of strategic foresight are strong. Corporate foresight allows deep tech startups to recognize, track and analyse factors that lead to change, figuring out potential consequences and triggering the proper organizational reactions (Rohrbeck et al., 2015).

Evidence on addressing identified gaps related to firms featuring strong tech capabilities and low market capabilities is scarce, particularly in the context of technology-driven industries. The research gap addressed in this paper lies on understanding how the interplay between a firm's internal, market, environmental and tech features capabilities affect a deep tech firm's growth trajectory, conditioned by the maturity of a trend, along with its time horizon.

The objective of this research is to explore how foresight capabilities bridge the gap between deep tech firms’ strong tech capabilities and weak market capabilities to ensure product-market fit.

This research builds primarily on Technology Foresight theory, by assessing the combined internal and external influences affecting deep tech firms’ exposure to future trends: to balance technology with market foresight capabilities. Despite high levels of technological solutions delivered by deep-tech firms, market capabilities still determine their business performance.

The paper is structured as follows: the literature review highlights relevant information for building the conceptual model, which is further tested with PLS-SEM. Then, the findings are discussed with the existing ones from similar research. Conclusions, theoretical and practical contributions, limitations and future agenda are presented in the final section of this paper.

Theoretical backgroundDeep tech startups operate at the forefront of technological innovation, developing cutting-edge solutions that often address complex challenges and untapped market needs. However, their success hinges not only on their technological prowess but also on their ability to anticipate and navigate future trends and market dynamics (Romme et al., 2023).

Scenario-based foresight allows deep tech companies to navigate high degrees of uncertainty and complexity by developing strategies that are adaptable to multiple possible future states (Tiberius et al., 2020). Scenarios equip deep tech companies with a structured approach to anticipate and prepare for multiple potential futures, thereby enhancing their strategic flexibility and resilience (Jashari et al., 2022). Scenarios are vital for deep tech companies because they help align technological and market capabilities by exploring multiple potential futures. This alignment allows companies to anticipate market needs and technological advancements simultaneously (Tiberius, 2019).

Foresight capabilities, which encompass the ability to predict, plan, and prepare for future scenarios, are crucial for these startups. These capabilities allow deep tech firms to align their technological advancements with market readiness, regulatory landscapes, and emerging consumer demands. By systematically integrating foresight practices, such as scenario planning, trend analysis, and horizon scanning, deep tech startups can identify potential opportunities and threats early on, enabling them to adjust their strategies proactively and maintain a competitive edge (Wright et al., 2020). Deep tech startups are particularly interested in balancing the market readiness level with the technological readiness level, although they may also capture opportunities deriving from that misalignment. Engaging in scenario planning empowers deep tech companies to identify emerging trends, monitor key signposts, and adjust their strategies proactively, ensuring that their technological developments are market-relevant (Bezold, 2010).

Deep tech startups’ enhanced foresight capabilitiesForesight is a critical capability for deep tech companies operating in volatile, uncertain, complex, and ambiguous (VUCA) environments. By engaging in strategic foresight activities, these companies can anticipate and address the future technological and market changes better (Semke & Tiberius, 2020). By integrating foresight into their corporate strategies, deep tech firms identify new customer needs, emerging technologies, and innovative product concepts early on, effectively positioning themselves ahead of competitors (Gordon et al., 2020). The development of foresight capabilities in deep tech startups involves fostering a culture of continuous learning and adaptability. This strategic approach includes building internal processes for monitoring technological and market trends, engaging in active dialogue with stakeholders, and leveraging data analytics to inform decision-making. Deep tech startups must co-create strategic partnerships with their innovation networks to enhance their foresight activities. By doing so, they can tap into a wider pool of knowledge and resources, facilitating a more comprehensive understanding of the future landscape (Rhisiart et al., 2015). Furthermore, the ability to effectively anticipate and respond to future changes not only aids in mitigating risks, but also empowers deep tech startups to seize new market opportunities, drive sustainable growth, and shape the future of their respective industries (Xi et al., 2024). Strategic foresight creates value through a better ability to perceive change, an enhanced capability to understand and react to change, and by proactively influencing other actors in the deep tech market (Iden et al., 2017).

Central to building foresight capabilities in this framework is the emphasis on continuous cooperation and the long-term problem-solving capacity of the collaborative device. Weber and Khademian (2008) identify six essential commitments for Collaborative Capacity Building in Wicked Problems settings, starting with enhanced capacity and a commitment to governance in collaboration with government entities. This involves guiding network partners toward a shared understanding of problem definitions, program design, funding, and solution implementation. The second commitment focuses on balancing creativity and rule adoption to manage the complexities of wicked problems, enabling effective knowledge generation and control. Further, addressing unstructured wicked problems necessitates a mindset shift to build network capacity for performance and accountability. Lastly, active engagement and promotion of collaborative mechanisms are crucial to convincing partners to share knowledge and negotiate decisions on tools, strategies, and skill applications, thus enhancing the overall foresight capabilities within the network.

The study of Mostafiz et al. (2019) authors highlight that dynamic managerial capability enables deep tech entrepreneurs’ vigilance to strategic changes and strengthen the resource allocation models, while monitoring technological and market trends enhances business continuity with accumulating foreign business knowledge, foreign institution knowledge and internationalization knowledge. For early stages of market entry, or a turbulent environment, a valuable knowledge repository enables quick response to potential competitors, customer changing behavior, formal and informal rules, foreign cultures and international risk operation. The conceptual model aims at testing the relationship between dynamic managerial capabilities with managerial human capital, managerial social capital and managerial cognition positively related to foresight culture.

The existing literature emphasizes the critical role of developing foresight capabilities in deep tech firms, particularly when upgrading solutions are challenging to implement. Technological foresight and scenario planning are essential for navigating the divergent interests of stakeholders along the value chain, including deep-tech vendors, resellers/distributors, and end-user organizations. Johansson and Newman (2010) expand on the resource-based view of the firm by mapping stakeholder influences within the deep-tech value chain. This approach underscores the complexities of future deep-tech design and upgrading.

An interesting research paper introduces a novel device based on the combined Technology, Market, and Regulatory framework, termed the TRM readiness level. By integrating Technology, Regulatory, and Market Readiness Levels into a single system dynamics model, the study by Kobos et al. (2018) underscores the model's implications and applications in the energy system sector. Scenario planning plays a central role in this framework, addressing the critical challenge of technological readiness, particularly in reducing CO2 emissions. Research and development investments, being technology-specific, directly influence the achievement of new readiness levels for proposed technological solutions. Market Readiness Level assesses a tech solution's ability to gain market acceptance, from early adopters to large-scale deployment. It considers factors like market base access, financial capital security, manufacturability, market cost competitiveness, and consumer utility. The authors emphasize the importance of scenario planning in understanding resource limitations for technological development and recommend its application to specific energy technologies to leverage the combined insights from the Technology, Market, and Regulatory framework.

A study conducted by Andersen et al. (2014) explores the relationship between literature on foresight and the innovation system domain to balance context dependency, learning and user-producer interactions and the role of knowledge and knowledge production in a simple sectorial innovation system model. Building on prior argumentation, which recognizes innovation emerging from matching user needs and technological opportunities, the authors highlight the interactive learning crucial role, once complexity increases. The generic foresight process applied to deep tech firms consist of three phases in different time horizons; the planning phase includes preparation and organizing of foresight exercise, addressing the current trends; the main phase comprises mapping, fore-sighting, prioritizing and planning, which covers periods of time up to five years. Finally, the follow-up phase lies with disseminating and learning, with a time horizon more than 5 years.

A recent contribution to deep tech literature outlines a new perspective of digital entrepreneurship driven by the concepts of digital transformation and entrepreneurship by exploring relationships between three constructs: technological readiness, digital technology exploration and exploitation. Jafari-Sadeghi et al. (2021) build their case on rich argumentation regarding the emergence of digital entrepreneurship, digital technology readiness and digital technology exploration and exploitation. They use four databases, with data collection at country/national level, to test the relationship between key components of the digital technology readiness of a country conditioned by effective digital transformation strategy. The findings confirm that ICT investment and usage by businesses, and households’ internet access positively influence technology-driven entrepreneurship and technological market expansion, while they found no support for adult education level and technology-driven entrepreneurship, nor the technological market expansion within the country. Their plausible interpretation is coherent with previous research which outlines that higher levels of education enact as a deterrent for entrepreneurship. The confirmed R&D and related investments have a positive effect on technological entrepreneurship, and open new opportunities for digital transformation guidance to stimulate digital entrepreneurship engagement. Although a nonlinear dynamic behavior of R&D for short-term performance was also found, when it comes to long-run periods, technological diversification obtained by R&D enable firms to seek new directions of product/service development.

Scenario planning plays a pivotal role in the technological and strategic foresight of deep tech companies, enabling them to navigate the complexities and uncertainties inherent in their operating environments. By envisioning multiple future scenarios, deep tech firms can anticipate potential challenges and opportunities, allowing them to strategically position their technological advancements to align with future market needs and regulatory landscapes. This process involves systematically exploring various possible futures and their implications, which helps firms identify key drivers of change, such as emerging technologies, shifting consumer preferences, and evolving regulatory requirements (Kishita et al., 2020). Through scenario planning, deep tech companies can develop robust strategies that are resilient to a wide range of possible future conditions, thereby enhancing their ability to innovate and compete in rapidly changing markets.

A recent work by Blechschmidt (2022) emphasizes the pivotal role of scenario planning in deep-tech companies' trend analysis over a temporal focus of up to ten years, divided into four time horizons to understand the main drivers of change and associated risks of disruption. Scenario planning is crucial for making sense of these changes, particularly for periods extending beyond ten years, where unknown factors may drive significant disruptions. For the near future, up to 3 years, trend research sources include startups and innovation leaders, internet and classical media, and various events, all of which are essential for short-term scenario planning. For the medium to distant future, overlapping 6 to 10 years, deep-tech companies must employ scenario planning to interpret the implications of patent application results, scientific publications, and future conferences. This strategic approach ensures that firms remain vigilant and prepared for potential disruptions, enabling them to navigate uncertainties effectively.

Firm internal featuresThe following relevant literature supports the assertion that firm internal environment evolves from stable to unstable model transformation, forced to deal with the compound effects of cultural, technical, financial, and organizational tensions. Therefore, a realistic deep tech solution has to deliver unique commercialization skills at least as valuable as the disruptive technology itself.

Deep tech's main management difficulty lies in recognizing the difference between mastering a disruptive technology and marketplace success. Recent literature highlights relevant experiences of deep tech transformation frameworks to shape their foresight capability, able to educate both business leaders and customers about a solution space and not a unique recipe.

A very interesting approach to the role of foresight knowledge on reactions to VUCA conditions (Kaivo-oja & Lauraeus, 2018) highlights the importance of developing foresight tools to address VUCA challenges, with business leaders acquiring foresight skills. Turbulence induced by combined volatility, uncertainty, complexity and ambiguity is training managers to use foresight tools such as: anticipating, interpreting, challenging, decision making, aligning, learning, combination. Furthermore, the authors reflect on the importance of changing mindsets by upgrading a combination of global, virtual, innovative and collaborative features, capable of discerning their deep tech profile and making it a strong predictor for balancing technological disruption and the market's acceptance propensity.

Another relevant contribution brings to our attention the Fintech revolution struggling with market acceptance of technological innovation in the financial sector (Gomber et al., 2018). Considering Fintech innovation as an architectural type and a combination of new technical competence and a new business model, the authors focus on two kinds of effects: one on customer experience transformation, and the second with complementary or disruptive effects on marketplace competition. The Fintech Innovation Landscape provides insights about effective value appropriation with an innovative framework capable of leveraging customer experience with the new financial services to enhance market acceptance. The markets and competition dimension examines contrasts of disruptive and complementary effects of Fintech Innovation, while the customer experience view reflects on enhanced experience with new products services and functionality, compared with supplementing experience with improvements in existing functionality.

A well-known stream of research on corporate foresight (CF) focuses on how technological development enables creation of attractive new markets, while adopting CF practices often qualifies as a predictor for business success. The CF framework proposed by Højland and Rohrbeck (2018) consists of adopting a three-phase mechanism to translate signals - perceiving into insights-prospecting and action-probing. The BOP markets case is particularly challenging for deep tech building, balancing the capability of technological disruption and market acceptance, therefore the three individual paths for developing BOP business opportunities invite them to fructify similarities or to gain knowledge from dissimilarities. Co-creation and deep dialogue foster credibility and transparence, which in turn enhances market acceptance, while creating a sustainable value and distribution chain is long-term oriented, therefore taking action to test acceptance of technology and educate the market lies with probing phase. Finally, Create Tailored Product Offerings Profitably stands for active collaboration with consumers to gather insights for developing an adapted deep tech solution.

Valuable insights are provided from the community of practice struggling with integrating foresight knowledge into organizations’ decision-making process, concern which is common to the deep tech challenge to effectively anticipate and influence the future (Hines & Gold, 2015). The authors identify three main challenges to systematically adopting foresight in organizations: episodic use, cultural resistance, and low priority, while the barriers to foresight can be effectively addressed. One of the key internal barriers to overcome is cultural resistance to foresight integration. Therefore, the study proves that engaging in active dialogue with clients and employees helps them understand the main benefits of foresight tools: detecting ideas and signals from the periphery of the organizational mainstream and clients influencing the firm's future. Furthermore, they suggest that an organizational futurist audit can be employed to assess the foresight climate. The intangible nature of foresight capability also reduces the opportunities for successful adoption and institutionalization.

The project approach to foresight implementation (Sokolova, 2022) suggests that preliminary stages addressing barriers and challenges to integration enables the successful alignment to science, technology and innovation (STI) policy. The study addresses three types of gaps between foresight and STI policy and highlights the main barrier. The first gap lies with integration of foresight results into the political decision-making process, influenced by lack of decision makers’ interest in foresight results and what they might consider irrelevant foresight study goals. The second gap consists in the internal and external political integration of foresight processes, and results in other strategic documents and initiatives, while generating the challenges of coordinating various tools, policies, and socioeconomic objectives. The third gap type deals with implementing policies developed based on foresight outcomes, related to developing mechanisms for effective implementation of foresight projects results.

An interesting study (Coccia, 2020) applying the fishbone diagram provides a visual representation of general-purpose technologies (GPT) and highlights their distinctive features: pervasiveness, improvement and innovation spawning. The driving forces for GPT's are identified as follows: geographical factors, cultural and religious factors, democratization, high population and demographic change, relevant problems in society, major wars and environmental threats, purpose of global leadership in contestable environments, research policy, public research labs and national system of innovation. The study also underlines the advantages of fishbone diagrams for technological analysis and foresight: a cause-and-effect approach of complex and inter-related factors driving innovations, similarity and differences between sources of innovation.

Literature on a process approach to foresight implementation reveals the relevance of unanticipated impact in terms of knowledge gain, beyond direct and anticipated impact measurement (Amanatidou & Guy, 2008). The advanced conceptual framework aims at revealing the drivers and factors shaping participatory knowledge societies and contributes to identifying areas of influence of foresight systems adoption. Three foresight exercises reveal immediate, intermediate, and ultimate impact in three different countries and deepen our understanding of foresight design implementation and expected outcomes. Immediate impact lies with area recognition and expert–stakeholder collaboration, while intermediate relates to vision and action networks. The ultimate impact reveals how foresight capabilities influence research agendas and reshapes government policy, while the foresight culture becomes increasingly important in respect to participatory knowledge societies.

An influential work (Wayland, 2015) reveals strategic foresight community of practice view about approaching change in a highly uncertain and disruptive world. Applying the distinction between normal and extraordinary foresight, the author underlines the difficulty of anticipating the actual change overtime. Therefore, decision making must acquire anticipative capability in order to proactively detect an anomaly to exploit or to avoid. The author advocates for anomaly exploration and imagines plausible futures, while deploying extraordinary foresight activities: weak signals detection, scanning the periphery and reframing.

The limited capacity of the European economy to transform deep tech into new ventures capable of fulfilling societal needs has been addressed with a deep-tech Venture (DTV) builder designed to incorporate tools of entrepreneurship, and to guide the scale up process in a participative endeavor between universities and companies (Romme et al., 2023). The DTV approach includes tools for sourcing technology, talent acquisition strategy and scaling up within a local ecosystem of multinationals, tech institutes and relevant stakeholders. The DVT journey key components are: creating deep-tech ventures, assessing and monitoring progress, mentoring and supporting venture teams. The study advances a nine-scale maturity model of DVT journey, to exploit similarities of Technological Readiness Level, while is worth mentioning that the financial risk component has a huge influence because access to investment is only allowed for technology-driven ventures that have already reached a TRL of 8 or higher

A recently identified gap in the literature concerns the imprecise assignation of goals of deep tech startup to each of the life cycle stages, and a recent study advances a model to address the problem (Schuh et al., 2022). The study considers the following five key development fields for deep tech evolution: technological, product, market, business model and organizational, as compared with conventional startups - early stage, research and development, growth stage and late stage, each subdivided into various substages. Bearing in mind that technology and product development are crucial in early stages of deep tech ventures, the novelty comes with four superordinate and eleven sub-life cycle stages introduced to enable proactively integrating the constant need for reconfiguration and renewal as a result of changing parameters, problem-solving feedback and goal redefinition.

Moving from internal features to the broader environmental context, it is essential to consider how external factors shape and influence the strategic foresight capabilities of deep tech firms.

Environmental featuresDeep tech firms have to deploy scanning checks for regulatory issues in order to preserve their freedom to operate (Anouche & Boumaaz, 2019). Developing countries highly exposed to increasing administrative risks are seeking foresight support for decision making to reinforce tax compliance, and to improve their risk analysis capability. The authors propose a systemic foresight methodology with a learning approach to context, content and process of change. Engaging in the debate may also serve as a benchmark to enhance administration sensing capability when confronting risks in a complex environment.

A long-term debate among academia and practitioners in European forums addressing Foresight and Horizon Scanning concepts enriches deep tech startup's debate on their enhanced foresight capabilities with multiple routes of achievement (Cuhls, 2020). The authors highlight results about Horizon Scanning exercises in 27 international cases which are reported in terms of objectives, scopes, methods, formal /informal approach to processes. The authors argue that automated processes are acceptable for collecting and scanning, but human expertise is compulsory for filtering and sense making.

Technological and market risks faced by deep tech startups’ sensitivity to proprietary rights is long time subject of analysis and debate among various streams of literature (Casper & Whitley, 2004). Contrasting institutional frameworks in different countries may influence key management issues facing entrepreneurial technology firms. Organizational capabilities firms have to develop vary, with appropriability and competence destruction risks. Threats to proprietary technology rights are managed with patent and copyright protection or complementary assets controlling, while competence destruction, reflecting future uncertainty and high volatility, exposes deep tech sector both to technological and market acceptance risks. The comparative institutional advantage provided by Germany and Sweden reports about biotechnology and software sectors, where their institutional system fosters technological firms facing managerial dilemmas. The UK and US innovation institutional systems favor flexibility with disruptive innovation models, enabling risk-sharing related to competence destruction.

An evidence based cross-sectional study of 1042 CEOs interviewed by Bank of France (Coeurderoy & Durand, 2004) highlights the profiling of pioneers, early followers and late entrants to explore the leveraging effect of combined early movers and proprietary rights as predictors of market share. The contribution of the study goes beyond the early mover advantages exposing the market-maker characteristic of a pioneer if they are capable of protecting, key technology with a business model capable of leveraging safe technology diffusion.

One major gap for deep tech startups to overcome lies with limited capacity to understand how future trends influence their disruptive innovation. Literature contributes to deepening our understanding of how foresight skills gap of deep tech startups can be addressed (Si & Chen, 2020). A multilevel theoretical framework provides insights about the factors influencing disruptive innovation, but also addresses various misconceptions and misuse of the concept among academia and community of practice. Starting with Christiansen's Innovator's dilemma, disruptive technology evolved to disruptive innovation, including a business model. The authors highlight different perspectives of the disruption innovation definition: main characteristics, specific domain and effects, the evolving process approach. They also favor the process approach to disruptive innovation as compared to it as an outcome, because of the two phases considered; market entry with a disruptive technology followed by transformation with the outcome of market acceptance. The authors propose a multilevel theoretical framework to examine the internal and external influence factors over disruptive innovation. Internal factors distinguish between managerial perception of risk and opportunities, while firm level encompasses strategy, organization, marketing and resources. External factors expose a combination of industry and national level of conditions, such as: target market demand, technological and customer capabilities, regulators, legislation, embedded social impact etc.

An influential recent work (Schoemaker et al., 2013) underlines the risk of missing key signals from the periphery once an immediate business landscape indicates an early feasibility of a technological solution. The study is raising attention about managers admitting their lack of capability to adopt and use early warning systems efficiently, despite the risk management implemented. The study highlights the importance of purpose-built network contribution to deploying periphery extended vision with the following tasks: mobilize trend spotters for emerging technology and new business models, sharing intelligence with clients and suppliers, shifting to open innovation to refresh ideas and faster communication, and connecting to an ecosystem more supportive for business strategies. The research also advocates designing strategic radar to integrate scenario planning, business analytics and dashboard technology, by enabling quick reaction to unexpected signals from inside and outside the firm. The evidence-based research consists of a government agency scanning for weak new signals which could affect initial scenarios, while operating with potential disruptive meta-categories.

Another relevant stream of research calls our attention to resistance to including futures and foresight on mainstream literature (Fergnani & Chermack, 2021). The authors underline that the main arguments behind the motives for resistance are the results of misunderstandings and misbeliefs, which are addressed with three set of recommendations. The authors focus on theory building and testing practice to enhance the theoretical contribution. Shifting the lens when looking to foresight practice can also help refine the theoretical stream with identified causal relationships between constructs of interest. The authors suggest a rigorous research design within empirical boundaries for testing, which will enhance the theoretical relevance and further acceptance of the future and foresight cases in the mainstream literature. Among recommendations for practitioners, it is worth mentioning the facilitator observer collaboration with researchers approach to enhance the relevance of building and testing theory initiatives. The study also reports on responses to potential misunderstanding: the collaboration between practitioners and scholars enhances improvement societies with future and foresight studies both at an individual level and organizational one.

Strategic foresight literature considers vigilance as a managerial capability focused on guiding the organization through complex external environments which can affect the firm's performance (Sarpong & Maclean, 2014). However, vigilance to signal changes can be promoted at any level of the organization, mainly relevant for the deep tech startups, where ordinary employees can contribute to strategic foresight with quick responses to genuine uncertainties. The study adopts a qualitative case study research with product innovation teams of three organizations in the global software industry. The conceptualization for strategic foresight, as a dynamic and iterative process, generated new insights with the following key organizing practices: prospective sense-making, multi-lateral participation and the application of future techniques and methodologies.

Having explored the impact of environmental features, the next focus is on technological attributes and their critical role in advancing deep tech firms' strategic foresight.

Tech featuresTech foresight is crucial for deep tech companies as it allows them to proactively identify and prepare for emerging technological and market trends (Miles, 2010). Foresight is crucial for deep tech companies as it helps them break away from tech dependency and enables decision-makers to create compelling go-to-market strategies. Strategic foresight translates into superior firm performance, as evidenced by deep tech firms with high future preparedness exhibiting significantly better profitability and market capitalization growth (Rohrbeck & Kum, 2018).

An interesting line of research is seeking to highlight the user contribution to clarify the concerns about technological feasibility. A relevant study (Kristensson & Magnusson, 2010) argues that user's technological knowledge and perceptions about creating value influence their innovativeness, while deep tech companies mostly struggle to scale from laboratory to pilot customers. With an experimental design the research aims at proving how user involvement with non-voice wireless services are jointly affected by the technological restrictions awareness and the degree of use experience in their propensity to generate radical or incremental ideas. Authors challenge previous literature that regards a user's capability to influence technical feasibility lies with substantial knowledge about technology restrictions. The study proposes “tuning innovativeness” as a decisive managerial capability when providing pilot customers with a precise amount of technological guidance to preserve their genuine contribution in terms of creative thinking.

The customer value proposition is decisive for deep tech start-ups, while gaining pilot customers influences successful scaling. Addressing a literature gap, a recent study (Kirchberger et al., 2020) aims at delivering preliminary test results of the authors proposed model, capable of guiding tech start-ups to gain pilot customers with value proposition promotion. The authors argue that a customer value proposition is particularly difficult on B2B markets. Drawing on the literature and interviews with previous tech firms, the theoretical model delivers a start-up's interactive learning process with customers involved to jointly conceptualize and validate a value proposition.

Customer exigencies for technology intensive products depend on a sustainable value proposition and recent significant research, combining life cycle modelling and value demonstration with a process approach to technological solutions assessment. Deep tech customer sensitivity to economic, environmental and social effects raises significant pressure for technology providers to deliver a quick response when markets signal the need for sustainability–driven competitive advantages.

The research conducted by Patala et al. (2016) proposes a framework for sustainable value proposition development with an explorative study in the context of metallurgical and automotive manufacturing, two cases of special concern when confronting environmentally friendly requirements from their clients. Building on the main insights of the empirical analysis, two aspects of the customer value proposition development process are relevant. The first concerns the potential impact of tech solutions with trade-offs between economic, environmental and social benefits, while the second highlights monetization, certification and risk assessment as strategies capable of proving the benefit of sustainability as a customer value.

Another relevant approach to customer perspective regarding internet startups’ value proposition analyses changing trends in the last thirty years to guide future startups how to deliver a technological solution capable of coping with the combined effect of privacy protection, security services, legitimacy, community and emotions (Van Le & Suh, 2019). The authors dedicate efforts to observe and compare internet value propositions in each of the three decades in order to predict future changes on internet startups’ offerings matching customer exigencies. Considering efficiency, novelty, switching costs and the sources of value creation in e-business the study proposes a revision of the value proposition in internet startups from the perspective of the customer where economy, efficiency and speed are mostly expected to change. The research also considers estimating changes of community, emotion and trust as complex value constructs. Community construct measurement lies in deriving value proposition from a unique combination of the following three items: shared experiences and resources, emotional connection and ecosystem. Emotion lies with value deriving from the following: knowledge fulfilment, enjoyment and playfulness and transactional need satisfaction. Trust includes value deriving from quality assurance, security services, privacy protection, brand reputation and legitimacy. In the last two decades, the main trend for community gradually constructs people seeking shared experiences and resources toward emotional connections. In the last decade, emotion value constructs surprise with people looking primarily for enjoyment and playfulness, previously fulfilling knowledge and information needs prevailed. The main trend in trust value construct evolved from brand reputation and quality assurance to security service and legitimacy.

Deep tech startups are primarily concerned to confront critical challenges of sustainable innovation, when stakeholder exigencies influence the market success of a technologically viable solution. Relevant research (Ayuso et al., 2006) proves that firms’ ability to integrate stakeholder dialogue enables knowledge transfer to enhance trust and value creation. The qualitative research analysis of the dynamic capabilities of two Spanish companies promoting stakeholder dialogue to calibrate sustainable innovation solutions. The distribution group integrates customers and employees as pilot group partners to promote social and societal initiatives in accordance with its mission. The ability to adapt to market exigencies, and the commitment to foster the creative potential of the employees, are adopted with formally integrated procedures and practices for innovation and knowledge management. Furthermore, both companies delivered innovative solutions integrating stakeholder dialogue with organizational practice embedded to capture knowledge and translate it into innovative products and services. The last argument is particularly relevant for a deep tech solution, which has to be highly sensitive to stakeholder signals regarding sustainability goals. Deep technology solutions are increasingly aware of sustainability principles when designing a genuine value proposition. Valuable research (Baldassarre et al., 2017) combines sustainable business model innovation and user driven innovation to design user-centered sustainable value propositions. Drawing from the main principles of both approaches, the work proposes research through design methodology in the context of a climate change project to engage in active dialogue and test a problem solution-fit with relevant stakeholders, while enriching a sustainable value proposition. The study aims at addressing the missing guidance to support entrepreneurial practice in their attempt to design value proposition matching the sustainable business model innovation. The study delivers hands-on process for sustainable value proposition design, advances entrepreneurial practice with leveraging sustainable business model innovation and user-driven innovation principles, and delivers a methodology to design a sustainable value proposition. The empirical findings are reported to match the three steps of the user-driven design process talking, thinking, and testing. The talking phase focuses on co-creation with clients to identify corporate sustainability, entailing public image and employee engagement as core values. Thinking about the sustainability phase combines results from talking with market and research knowledge with problem reframing, knowledge brokering and brainstorming to check the core items of value proposition. The testing phase checks within the network of stakeholders their opinion about the Minimum Viable Product performance to validate the value proposition.

Even though supply chain disruptions have been associated with operational and financial risk, managerial solutions to address vulnerability, resilience and continuity are of limited transferability when firms confronted pandemic effects.

A relevant contribution to the literature (Craighead et al., 2007) informs the community of practice about valuable insights for firms coping with the unavoidable nature of disruptions to develop their mitigation capability influenced by crisis severity. The conceptual design focuses on mapping supply chain design characteristics (density, complexity, and node criticality) influencing disruption severity, while adopting recovery and warning capabilities enables firms to cope with negative consequences. The valuable insight of the study highlights that a supply chain has to develop the capability of disseminating and sharing critical information within the complex structure when confronted with an inevitable disruptive event. The authors develop six propositions as content guidance for supply chain partnerships to balance warning and recovery capabilities among members and to stimulate supply chain management in adopting crisis severity assessments.

To further understand the intricacies of foresight capabilities, it is necessary to delve into the market features that influence how deep tech companies navigate competitive landscapes.

Market featuresAligning technological features with market needs is crucial for deep tech companies to enhance their competitive edge and market acceptance. By tailoring technology roadmaps to fit specific market demands, deep tech firms ensure that their innovations are not only cutting-edge but also relevant and desirable to consumers (Linstone, 2011).

Deep tech markets are always seeking to explore business performance recipes for successful positioning. To deepen our understanding about the strategic learning behavior adopted by high tech firms to gain knowledge about markets, valuable research (Slater et al., 2007) compares 160 marketing managers responding to an established scale: customer, competitor and technological orientation. Drawing on salient literature, the study argues that the Slater and Olson typology is appropriate, highlighting prospectors, analyzers, low-cost defenders, differentiated defenders and reactors. Market targeting relates to addressing innovators, early adopters, early majority, late majority, and laggards. Because customer orientation for prospectors reveals no relationship between customer orientation and performance, and a negative relationship between targeting the early majority and performance, the authors performed a post hoc test and found that, when uncertainty is high, customer orientation appears to be positively related to performance. Furthermore, the negative relationship between targeting the early majority and performance is consistent with previous evidence of prospectors struggling with scaling from early adopters to early majority. Low price, intensive distribution, and less focus on product innovation are marketing capabilities of Analyser compared with prospectors. In turn, the prospector must adopt relational skill sets - an appropriate business alliance to defend its positions from its Analyzer rival, who in turn will pursue imitation instead of customer orientation. The differentiated defenders are worth mentioning for their skill sets: customer orientation, performing extensive market research to target customers who value innovative products, and ready to pay a high price.

Relevant research (McLean et al., 2020) reveals antecedents and outcomes of consumer attitudes with deep tech applications, examining differences or commonalities between variables influencing initial adoption and continuous use phases. Drawing on previous research on determinants of initial mobile app adoption and continuous use, the research focuses on managerial perspectives to understand and anticipate consumer changing behavior. The authors build on previous research which focuses on pre-adoption and initial adoption phases, longitudinal testing is used to examine consumer attitudes and behavioral evolution. The conceptual model supposes the differences between variables explaining adoption versus continuous usage with perceived ease of use, and perceived usefulness, combined jointly with enjoyment in using the app. Customization proved to have greater influence attitudes towards the app at the usage phase compared to initial adoption, while subjective norms will have a weaker influence. Positive customer attitudes towards the app will influence purchase frequency through the application on the usage phase, versus initial adoption. Findings indicate that a positive attitude towards the app signals loyalty towards the brand, not necessarily positive attitudes towards the brand or purchase.

Business model design for high tech firms must support knowledge translation for complex solutions to less qualified external audiences. A relevant study (Corbo et al., 2020) proposes a Continuous Validation Framework (CVF) to support the deep tech entrepreneurs’ need to align their goals and vision with external stakeholders to mitigate conflicting objectives. The authors address the challenge with a knowledge translation mechanism integrated into the business model, developing a common language with heterogeneous audiences acting as a common platform of matching outcomes. The CVF is conceived as a three-stage process. The first stage consists of problem discovery, valuable for a broad audience, and supposes active search for opportunity engaged with translational mechanisms targeting potential early adopters. The second stage refers to the value proposition design, tracking user interaction and solution, defining customer willingness to pay and go to market routes. The stage defines a list of priorities: value proposition, market segment, and investors to attract with a cost and revenue model. The third stage proposes delivery - with a translation- of a proof-of-concept product evolving toward a functional prototype.

Lupoae et al. (2023) provide extant evidence for corporate responsibility related to sustainability goals and exigencies. One relevant study (Ferro et al., 2019) provides a bottom-up multidimensional framework related to sustainable development goals to assist companies in their endeavor with business sustainability demands.

Entrepreneurship confronting uncertainty calls for developing and testing conceptual models of cognitive processes and communication in innovative organizations. Entrepreneurial organizations favor intuitive frameworks, using metaphors as guiding rules which enable flexibility to cope with ambiguity as opposed to mature companies with formalized configurations. The authors (Hill & Levenhagen, 1995) call on seminal previous research to reinterpret the use of metaphor in organizations to support entrepreneurial sensemaking and sense-giving. Drawing on entrepreneurial activity, the study highlights the main traits: focus on innovation, emphasis on growth. Entrepreneurial vision interprets future reality which has to be communicated to a specific audience, and metaphors enable an interpretive mode to cope with ambiguity and equivocality reduction. The real challenge with mental models and their metaphors is how to balance flexibility and adaptability with the lack of stability. The main characteristics of the metaphors are crucial in the emergent pre-organizational stage because they are valuable for aligning and attunement. The contradictions of metaphors are also capable of convincing internal and external audiences toward concerted actions with credible purpose, while fostering the flexibility, crucial for new ventures.

Relevant literature calls for reflection on experiential learning when business model innovation confronts market changing conditions. The study of Sosna et al. (2010) informs us about antecedents and drivers of business model innovation in a Spanish dietary firm confronted with recession and enhanced competition after liberalization. The report includes two phases: five years experiment and exploration followed by exploitation when it outperformed the competition. The exploration phase - initial business model design and testing involve experiential learning with an initial experiment as reaction to difficulties with internal and external stakeholders not approving the initiative. Business model development lies in testing the market acceptability of new products and services, matching target customer value.

Bridging the research studies on environmental uncertainty and strategic foresight, the study explores the “effect” uncertainty where drivers of change provide an appropriate analytical approach adopted to enhance the impact on industry structure and a firm's competitive position. To fill the gap in the literature, the study conducted by Vecchiato and Roveda (2010) enhances the value added of strategic foresight to strategy formulation, and delivers a useful framework for managers seeking guidance for handling the “effect and the response” uncertainty related to drivers of change recognition in their industry. The theoretical background lies with Technology Foresight, Social Foresight and Strategic Competition Analysis to distinguish the market forces from non-market drivers of change, with sources on business macro-environment. The authors provide a model of managing discontinuous drivers of change to bridge the gap between the sustaining and anticipatory approach to industry transformation.

Evolving from a product-centric to a service-centric business model is under scrutiny, with little guidance for developing new offerings and designing new business models. Tronvoll et al. (2020) has relevant research examining the link between digitalization and servitization, with interviews of senior executives of a market leading firm reporting that it had to shift from planning to discovery, from scarcity to abundance and from hierarchy to partnerships. Conceptual background recalls relevant contributions of critical success factors, which includes a decentralized service organization with profit-and-loss responsibility and creation of a culture favorable to manufacturing and service-oriented values. The study advances transformational shifts for digital servitization, including key mechanisms to identity, dematerialization and collaboration. A traditional firm identity lies with planning, while a digitally served firm's identity centers around discovery. Dematerialization supposes shifting from data scarcity to data abundance, while partnership replaces hierarchy, by leveraging external partnership for supplying expertise or fostering interdepartmental collaboration to refresh mindsets.

Research methodologyWe have used Partial Least Square-Structural Equation Modelling (PLS-SEM) to gain a more comprehensive understanding of how foresight will enhance deep-tech startups’ capability to bring tech to market faster, with smaller costs. PLS-SEM allows for the examination of causal relationships, and the testing of conceptual models using empirical data. This method provides a deeper understanding of the research problem, the foresight capabilities which mitigate deep-tech startups’ addiction to technology, and, implicitly, strategic myopia.

PLS-SEM is particularly advantageous when dealing with complex models that include multiple constructs and indicators, as is the case in our research. Deep-tech startups activate in multifaceted environments where firms’ internal features, environmental conditions, technological advancements, and market characteristics simultaneously influence their foresight capabilities. PLS-SEM's ability to handle such complex interdependencies and provide robust estimates for relationships among latent variables made it the optimal choice for our study.

Data collection and measurement modelWe used an online questionnaire-based survey to collect data reflecting the perceptions of deep tech companies’ representatives on specific items distributed over five strategic dimensions (firm's internal features, environmental features, market features, tech features and Deep-tech startups’ enhanced foresight capabilities).

Given that literature on foresight studies focused on deep-tech companies has no well-established sets of measurement items, we propose an original measurement scale, by using both adapted items from other research studies and expert opinions (managers of deep-tech companies) to review and integrate their feedback on the new measurement items we have co-developed.

We did a pretest of the items distributed in five latent variables previously mentioned to check the clarity of our measurement instrument. During the pre-test, the focus group provided valuable feedback on the clarity of the wording, the appropriateness of the scale, and the overall structure of the questionnaire. Their insights led to several revisions, including rephrasing ambiguous items, adjusting the Likert scale for better granularity, and ensuring that all questions were contextually relevant to deep-tech startups. The pilot study was conducted via a focus-group with five managers of deep-tech companies to evaluate the understandability of the items, assessed on a 7-point-Likert scale, ranging from 1 to 7: 1 – Not at all important; 2 – Low importance; 3 – Slightly important; 4 – Neutral; 5 – Moderately important; 6 – Very important; 7 – Extremely important. The purpose of the pilot study was to test the reliability and consistency of the revised survey items in a real-world setting.

The sampling strategy involved randomly finding managers of European deep-tech companies from a relevant target population (applicants and beneficiaries of funding within EIC Accelerator), who agreed to fill in the online questionnaire, based on the items revealed in Table 1.

Items integrated in the measurement model.

| Items included in the questionnaire | Source(s) |

|---|---|

| Firm internal features | |

| We balance the propensity to technological disruption and market acceptance. | Gomber et al., 2018;Højland and Rohrbeck (2018) |

| A key challenge is to overcome the compound effects of key internal barriers (cultural, technical, financial, organizational) by clarifying their growth drivers. | Coccia (2020), Hines and Gold (2015), Sokolova (2022) |

| We anticipate unexpected changes in technological developments to untap early customers’ needs. | Amanatidou and Guy (2008).Wayland (2015). |

| *(Economic): Our deep-tech solution can overcome the impact of economic factors on our business model. | Romme et al., 2023, Schuh et al., 2022 |

| Environmental features | |

| We deploy scanning checks for regulatory issues to enable our freedom to operate. | Anouche and Boumaaz (2019).Cuhls (2020). |

| We are prepared to cope with future opportunities and threats related to our proprietary technologies. | Casper and Whitley (2004).Coeurderoy and Durand (2004). |

| We are vigilant to trends influencing our disruptive innovations. | Schoemaker et al., 2013, Si and Chen (2020) |

| *(Environmental): We are accountable to comply with future environmental exigencies. | Fergnani and Chermack (2021).Sarpong and Maclean (2014). |

| Tech features | |

| We need to ensure technological feasibility to scale from laboratory to pilot customers. | Kristensson and Magnusson (2010).Kirchberger et al., 2020 |

| We enhance our customer value proposition through a promising technological solution. | Patala et al., 2016, Van Le and Suh (2019). |

| The broad marketability of our deep technology should be validated through active dialogue with relevant stakeholders. | Ayuso et al., 2006, Baldassarre et al., 2017 |

| *(Technological): We can deliver a quick response to disruptive market signals with our deep-tech solution. | Craighead et al., 2007 |

| Market features | |

| We adopt penetration strategies to make a smooth transition from beta customers to large scale early adopters. | McLean et al., 2020, Slater et al., 2007 |

| We are systematically assessing the problem/solution fit to validate the progress gain. | Corbo et al., 2020, Ferro et al., 2019 |

| We are aware that we need to deploy appropriate communication of innovation toolkits to evolve from scalability stage to market stability. | Hill and Levenhagen (1995).Sosna et al., 2010 |

| *(Social): We are committed to monitoring changes in customer needs to properly address social shifts. | Vecchiato and Roveda (2010).Tronvoll et al., 2020 |

| Deep-tech startups’ enhanced foresight capabilities | |

| We are engaged in a structured effort to anticipate future success to bridge the gap between tech and market capabilities. | Mostafiz et al., 2019 |

| We aim to influence the future value chain while consolidating our capability to cope with key trends in our niche market. | Johansson and Newman (2010). |

| We are actively looking for solutions able to match technological readiness level and market readiness levels. | Jafari-Sadeghi et al., 2021, Kobos et al., 2018 |

| *(Political): We are committed to collaborating with public authorities to prove the safety of our deep-tech solution. | Weber and Khademian (2008). |

Source: authors

More than 300 invitations to fill in the questionnaire were sent to managers of deep-tech start-ups, whose contact details have been retrieved from EIC Accelerator data hub, available at https://sme.easme-web.eu/ . The answers were collected in the period March 2023 – July 2023.

The sample includes representatives from various sectors within deep-tech. This wide range ensures that the findings are comprehensive and applicable across different subdomains of deep-tech. The inclusion criteria focused on managers of European deep-tech companies who are beneficiaries or applicants of the EIC Accelerator, ensuring that participants have relevant experience, and insights into the challenges and opportunities within their industries.

By targeting a diverse group of deep-tech sectors, our study captures a broad spectrum of technological and market dynamics, enhancing the generalizability of the results. The demographic characteristics, such as the maturity of trends (ranging from currently mature to those maturing within 5 to 25 years), Technological Readiness Levels (TRL4 to TRL8), and Market Readiness Levels (MRL3 to MRL9), provide a comprehensive view of the current state and future potential of deep-tech startups. This diverse representation allows for a nuanced analysis of how different factors influence strategic foresight capabilities across various stages of technological and market development.

The control variables were considered: Time horizon from the perspective of trend maturity, Technological Readiness Level and Market Readiness Level, as well as market experience and the deep tech niche market. Table 2 reveals the demographics of the convenience sample. Most respondents signal that trend maturity allows a balanced approach to technological and market skills, with a business model which supports communication of innovation.

Study sample demographics.

Source: data retrieved from survey

Demographics analysis based on TRL and MRL reveals the profiling of the deep tech startups in our enquiry, confirming their strong tech capabilities and weak market capabilities to further balance with enhanced foresight capabilities (Fig. 1). Back-casting methodology reflects deep tech startups’ roadmap, which starts with a desired future state and then works backward to identify the steps needed to reach that future. The foresight journey will enhance deep-tech startups’ capability to bring tech to market faster, with lower costs.

The distribution of respondents according to the location of their head office is highlighted in the Appendix.

Conceptual framework and research hypothesesIn foresight research, there are often latent constructs (variables) that underlie future trends or scenarios. PLS-SEM is particularly well-suited to handle latent constructs, allowing the modelling and analysis of complex relationships between them. Furthermore, foresight research deals with multidimensional models, and PLS-SEM is more flexible than covariance-based SEM in handling complex models, being advantageous when studying multifaceted phenomena, and exploring multiple dimensions of future scenarios related to deep tech start-ups’ strategic behaviors.

PLS-SEM involves two steps: first, the assessment of the measurement model through the reliability and validity of the constructs; second, the assessment of the structural model (Fig. 2). We analyzed the data using SmartPLS software v. 4.0.9.2.

The latent constructs FIF (firm internal features) and TF (technological features) are approached through a formative measurement model, as their corresponding items are conceptually clear and distinct from each other, and contribute to these constructs. The latent constructs EF (environmental features), MF (market features) and enhanced foresight capabilities (EFC) are analyzed through a reflective measurement model, as their corresponding items are considered as indicators of the construct, reflecting different facets of the same underlying construct, and predicting future outcomes within this foresight study.

The reflective measurement model was assessed through Cronbach's Alpha, composite reliability, average variance extracted (AVE), Fornell-Larcker criterion, and Heterotrait-Monotrait ratio of correlations (HTMT), and the formative model through Variance Inflation Factor (Hair et al., 2021).

The structural model was assessed through the p-values and T-Statistics indicators, after running a bootstrap analysis with 5000 subsamples. The hypotheses obtained are listed below:

H1 Firm internal features (FIF) positively influence enhanced foresight capabilities (EFC).

H2 Environmental features (EF) positively influence enhanced foresight capabilities (EFC).

H3 Market features (MF) positively influence enhanced foresight capabilities (EFC).

H4 Technological features (TF) positively influence enhanced foresight capabilities (EFC).

H5 Environmental features (EF) positively influence firm internal features (FIF).

H6 Environmental features (EF) positively influence market features (MF).

H7 Technological features (TF) positively influence firm internal features (FIF).

H8 Technological features (TF) positively influence market features (MF).

The reliability and validity measurements of the reflective latent variables included in the structural model EF (environmental features), MF (market features) and enhanced foresight capabilities (EFC) are in line with the requirements of the threshold values. Cronbach's alpha and composite reliability (CR) values are above the recommended threshold of 0.70. All item loadings were above the 0.70 thresholds, while the average variance extracted (AVE) values are situated above the recommended threshold of 0.70. (Table 3).

Description of the reflective measurement model.

Legend: α = Cronbach's alpha, CR = composite reliability, AVE = average variance extracted; outer loadings are extracted from Fig. 2

The outer loading for each indicator is the regression weight or loading that quantifies the strength of the relationship between the indicator and the reflective latent construct. The deployment of scanning checks for regulatory issues, enabling deep tech firms’ freedom to operate (EF1: outer loading = 0.804) has the highest impact on environmental features (EF); the commitment to monitor changes in customer needs to properly address social shifts (MF4: outer loading = 0.781) has the highest impact on market features (MF); the capability to influence the future value chain while consolidating deep tech firms’ strength to cope with key trends in their niche market (EFC2: outer loading = 0.828) has the highest impact on enhanced foresight capabilities (EFC);

The structural model outlines that market features (MF) have the strongest impact enhanced foresight capabilities (EFC) (path coefficient = 0.514), followed by environmental features (EF) on firm's internal features (FIF) (path coefficient = 0.480). The lowest impact on enhanced foresight capabilities (EFC) corresponds to technological features (path coefficient = 0.046) – Fig. 3.

The variables FIF, EF, MF and TF explain 47 % of the variance in the case of EFC (R-square = 0.470), EF and TF explain 35.6 % of the variance in the case of FIF (R-square = 0.356), while EF and TF explain 40.7 % of the variance in the case of MF (R-square = 0.407).

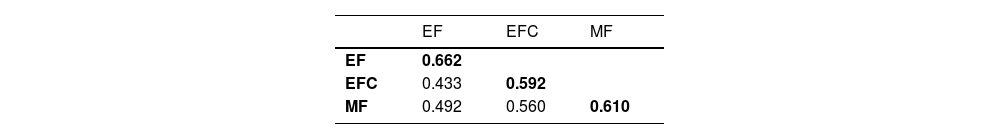

The square root of each construct's AVE is greater than its highest correlation with other constructs (observed under the main diagonal), demonstrating the discriminant validity of the latent variables based on the Fornell-Larcker criterion (Table 4).

The discriminant validity in the reflective measurement model is also demonstrated by the Heterotrait-Monotrait ratio of correlations (HTMT), as the pairs of latent variables are all below the threshold of 0.85 (Table 5).

Assessment of the formative measurement modelIn the formative measurement model, the capability of balancing the propensity to technological disruption and market acceptance (FIF1: outer weight = 0.577) has the highest contribution of firm internal features, while deep-tech startups’ need to ensure technological feasibility to scale from laboratory to pilot customers (TF1: outer weight = 0.894) has the highest contribution on tech features - Table 6.

Description of the formative measurement model.

Source: SmartPLS software output

The formative measurement model is analyzed through a Variance Inflation Factor (VIF), used to assess multicollinearity, which is the presence of high correlations among predictor variables (also known as independent variables) in the structural model. Table 7 emphasizes VIF values related to the formative constructs FIF and TF.

All VIF values are below the threshold of 5.00 (Table 6) and we can conclude that collinearity does not reach critical levels for any of the formative constructs and implicitly does not create problems in the estimation of the analyzed structural model.

Bootstrapping procedure applicationPLS-SEM uses a nonparametric bootstrap procedure to test the significance of path coefficients estimated in the structural model. In the bootstrapping procedure, 5000 subsamples were drawn randomly from the original data set, based on replacements. Table 8 highlights the process of testing the hypotheses, considering the p-values and T Statistics of the relationships between all latent variables from the structural model.

– Hypotheses testing results.

| Hypothesis | Original sample (O) | Sample mean (M) | Standard deviation (STDEV) | T statistics (|O/STDEV|) | P values |

|---|---|---|---|---|---|

| EF -> EFC | 0.306 | 0.309 | 0.121 | 2.524 | 0.012 |

| EF -> FIF | 0.48 | 0.481 | 0.102 | 4.699 | 0* |

| EF -> MF | 0.31 | 0.308 | 0.127 | 2.439 | 0.015 |

| FIF -> EFC | 0.165 | 0.191 | 0.121 | 1.362 | 0.173 |

| MF -> EFC | 0.514 | 0.494 | 0.13 | 3.955 | 0* |

| TF -> EFC | 0.31 | 0.323 | 0.13 | 2.383 | 0.017 |

| TF -> FIF | 0.209 | 0.22 | 0.14 | 1.495 | 0.135 |

| TF -> MF | 0.445 | 0.438 | 0.152 | 2.923 | 0.003* |

Six hypotheses are supported, but two hypotheses were rejected, considering the 0.05 threshold for p values related to the relationships between the latent variables. T Statistics reveals the magnitude of the relationship. The findings indicate the highest magnitude of the relationship between EF and FIF.

The analysis indicates a strong correlation between market features and enhanced foresight capabilities. Similarly, environmental features significantly influence both firm internal features and enhanced foresight capabilities. These findings underscore the importance of accommodating to market dynamics and regulatory landscapes for developing strong foresight capabilities.

Technological features are found to have a significant impact on enhanced foresight capabilities. This suggests that technological advancements and the ability to scale from laboratory to pilot customers play a critical role in improving strategic foresight in the peculiar case of deep-tech firms.

Contrary to our expectations, there is no significant correlation between firm internal features and enhanced foresight capabilities. This finding highlights a potential disconnection between internal organizational factors and the ability to anticipate scenarios for future markets and technological changes.

DiscussionThe significant correlation between market features (MF), tech features (TF) and environmental features (EF), on the one hand, and enhanced foresight capabilities (EFC), on the other hand, illustrates the need of deep tech firms to stay updated on regulatory changes, competitors’ moves, and other factors that could impact their business.

The strong correlation between envirionmental features (EF) and enhanced foresight capabilities (EFC) is relevant for deep tech startups, because it provides signals about future environmental exigencies, as exposed by Weber and Khademian (2008) and Cuhls (2020), arguing that leadership recognition becomes critical for problem-solving efforts to manage horizon scanning and foresight process. This correlation also highlights the importance of regulatory compliance, and the ability to navigate political and social landscapes. Deep-tech startups should engage in proactive regulatory scanning and compliance strategies, ensuring they are ahead of regulatory changes and are able to adapt their operations accordingly. Our findings confirm the study conducted by Coeurderoy and Durand (2004), where deep tech firms, perceived as market creators, must balance technological dominancy with managerial capabilities. Therefore acquiring foresight skills enables market maker opportunities through efficient protection of key technologies, while threats can be addressed with network effect where risk sharing applies. The value added of the research framework on disruptive innovation, developed by Si and Chen (2020), combined with our findings, consists of the enhanced foresight capabilities contribution to nurture future self-exploration and development within communities of practice, and to consolidate deep tech firms’ market positioning.

The strong correlation between tech features (TF) and enhanced foresight capabilities (EFC) was introduced by Kristensson and Magnusson (2010), who argue that user experience is the key factor for enhancing technological feasibility, while less technological knowledge led to radical innovation, but difficult to implement. For the deep tech case, this managerial capability becomes crucial, as it influences successful scaling from laboratory to pilot customers. Deep-tech startups should focus on "tuning innovativeness," which means guiding pilot customers with just the right amount of technological information to harness their creative input, while ensuring feasibility, as mentioned by Kristensson and Magnusson (2010). This balance will lead to more user-centric innovations that meet actual market demands, and pave the way for smoother scaling and commercialization processes.

Moreover, one important contribution to technological foresight research (Kirchberger et al., 2020) proposes a model delivering valuable guidance for deep tech start-ups, when a promising technological solution will achieve market success, conditioned by learning and adjusting to pilot customer's exigencies, in line with our findings. The study of Patala et al. (2016) validates our results regarding the difficulties encountered by deep tech providers, confronted with a lack of marketing skills to communicate their unique value proposition for targeted customers.

The strong correlation between market features (MF) and enhanced foresight capabilities (EFC) suggests that deep-tech startups must prioritize understanding of and adapting to market dynamics. This includes staying informed about market trends, customer preferences, and competitive movements. For practical application, startups should invest in market research tools and techniques such as market segmentation, competitive analysis, and customer feedback systems. By considering these insights, they can better anticipate changes, and align their technological developments with market needs, ensuring greater relevance and adoption of their innovations. An early contribution underlines the importance of interpretation of trend maturity, which guides technological-intensive companies’ managers to quickly balance their tech performance with the commercial one by engaging in customer dialogue to address expressed needs, and to detect the latent ones (Slater et al., 2007). To ensure the alignment between between market features and enhanced foresight capabilities, Corbo et al. (2020) introduced the Continuous Validation Framework, which enacts as a learning device for deep tech firms confronted with various disruptions on market conditions and customer behavior, therefore they need quick progress in systemically assessing the problem solution fitness.

The lack of correlation between firm internal features (FIF) and enhanced foresight capabilities (EFC) can be explained by the fact that rapid technological advancements sometimes outpace market readiness or customer adoption. This lag in market validation can create a disconnect between technological development and market acceptance, hindering the anticipated correlation. The lack of a significant correlation between firm internal features and enhanced foresight capabilities indicates that internal organizational factors alone are insufficient to drive strategic foresight. This finding suggests that deep-tech startups need to go beyond internal improvements and focus on external engagements and market-driven strategies. While internal capabilities such as efficient processes, strong leadership, and a supportive culture are essential, they must be complemented by external market insights and adaptive strategies.

To address this disconnect, startups should consider integrating external perspectives into their strategic planning processes. This can be achieved by involving external consultants, participating in industry consortia, and leveraging open innovation platforms.

Our findings are consistent with Højland and Rohrbeck (2018), who prove that engaging in systematic corporate foresight practices of matching technology and market changes to explore new value propositions with new business is a valuable insight to exploit on the deep tech case. To overcome firm internal (FIF) barriers to foresight integration, other authors advance an integration foresight framework to enhance organizational responsiveness of deep tech firms, deploying the following activities: publicizing, introducing, doing the work, evaluating outcomes, positioning, institutionalizing (Hines & Gold, 2015).

Another study (Sokolova, 2022), which confirms the same concerns presented in our study, underlines the foresight functions that need to be integrated with firm internal features (FIF): informing policy about the future which ties in with identifying opportunities and threats, exploring trends and building scenarios; engaging and coordinating stakeholders, active debate about the future and facilitating cross-department knowledge sharing.