Corporate involvement with social responsibility (CSR) is a voluntary practice. However, governments have recently adopted a more supportive stance by providing research and development support and tax exemptions. Therefore, this study examines the role of government subsidies (Sub) in CSR, considering the amount and number of subsidies and the type of industry in a competitive business environment. The paper establishes theoretical linkages through the construction of an oligopolistic market model of private enterprises based on industrial organisation theory's structure–conduct–performance (SCP) paradigm. Moreover, our study tests the empirical relationship using a dataset of 100 listed companies in Pakistan observed from 2011 to 2019 using robust standard error methodologies and a fixed effects IV estimator. The results show that government subsidies significantly promote private enterprises to actively fulfil their social responsibilities, and product market competition plays an intermediary role that endorses the theoretical proposition. This effect is visible at all stages of the enterprise's life cycle. Additionally, the relationship is more prominent in the case of low- and medium-sized government subsidies, competitive industries, and firms with no political connections. The results further reveal that product market competition is the primary channel through which government subsidies influence CSR. Concurrently, optimising the allocation of financial resources has specific significance.

Economic globalisation and development have resulted in social issues such as pollution, food safety, resource waste, and labour conflicts (Khurshid et al., 2020). Customers are increasingly avoiding goods produced by enterprises that lack human care and employee welfare, opting instead for environmentally responsible alternatives (Ageron, Gunasekaran & Spalanzani, 2012). Consequently, corporate social responsibility (CSR) has attracted significant attention from both business and academia. CSR, being self-regulating, can serve as a business model (Khurshid, Kedong, Calin & Khan, 2017), and is accountable to stakeholders, itself, and the public; all are therefore aware of its role (e.g. pollution control, disaster relief, social welfare programmes, charity) in society (Zhang, Khurshid, Wang & Băltăţeanu, 2021). CSR incorporates the values of enterprises and helps differentiate products in different ways (Zhang, Zhang, Fung, Rangaiah & Ng, 2018). Investors also value firms with high social responsibilities, which help achieve long-term growth objectives and lead to sustainable development (Besiou & Van Wassenhove, 2016). This social role of corporations puts extra pressure on them, as they gravitate between values and objectives specific to profit, the environment, human life, and well-being (Du, Bhattacharya & Sen, 2007). However, the social dimension and environmental performance help a firm attract investor interest and potentially enhance future financial benefits (Dyck, Lins, Roth & Wagner, 2019).

The significance of CSR in achieving sustainable development is now being recognised. However, sole reliance on enterprises may not be sufficient (Khurshid, Kedong, CĂLIN, Zhaosu & Nazir, 2018). In their capacity as regulators, governments can provide the necessary conditions that act as a catalyst for CSR, with the main channels of action being proper regulation and CSR incentives (Peters & Röß, 2010: 16).

Building a regulatory climate that incentivises, stimulates, and perhaps compels responsibility for corporate activity is critical for developing an equitable and sustainable economy (Qi, Chai & Jiang, 2021). Governments can influence firms and socially acceptable behaviours through mandating instruments such as awareness, partnering (public-private partnerships through technical assistance/subsidies), soft measures (codes of conduct, tax exemptions for charitable deeds, CSR reporting rules), and mandating laws (CSR reporting laws, stock exchange, pension regulations, and penalties on non-compliance), resulting in a combination of regulations and incentives (Peters & Röß, 2010: 19). These regulations can converge into rules and laws depending on socioeconomic conditions and drive business activities. Although CSR has traditionally been regarded as a voluntary practice, many governments presently require companies to disclose CSR-related actions. This can further translate into improved market recognition (Floridi, 2018), business reputation, and government subsidies.

In recent decades, the use of government incentives connected with market pricing to promote CSR has increased exponentially in developing countries (Jamali & Karam, 2018). Both direct and indirect subsidies (including tax exemptions/payments) and policy initiatives have recently gained considerable scholarly attention (Saha, Cerchione, Singh & Dahiya, 2020). Governments can motivate and encourage enterprises to engage in CSR activities to improve their social structure (Qi et al., 2021). The question is, who should be subsidised, whether producers or consumers? Both have an important role: producers help select environmentally friendly materials (Khurshid & Deng, 2021) and choose materials that help in energy saving, limiting gas emissions, and waste recycling (Qiang, Khurshid, Calin & Khan, 2019). Simultaneously, subsidies to consumers on product prices can help build savings, which can eventually be used for domestic and social welfare (Zhang et al., 2018). Furthermore, the subsidisation policy has both global and long-term effects. Once a producer is subsidised, the entity participates in CSR activities, and the product generated by the manufacturer comes to the suppliers for ultimate selling. If the retailer fails to recognise the manufacturer's efforts, the subsidisation policy of the government will be ineffective and vice versa. It would be interesting to investigate how subsidies affect market competition. The fact that subsidies provide certain firms with an advantage over others is a natural conclusion. Consequently, markets may become less efficient in price setting and product allocation as ‘privileged’ firms will have a far better market position than their competitors. This, in conjunction with greater obstacles to market entry, alters the normal dynamics of competition. In this context, this study examines the role of subsidies in CSR, employees, suppliers, shareholders, and environmental responsibility. We also examine the influence of subsidies on market competition and CSR.

Although previous investigations have attempted to determine the effects of various policies on CSR activities (Arya & Mittendorf, 2015; Broman & Robèrt, 2017; Hafezalkotob, 2017), the literature on this topic predominantly examines developed economies. However, the general hypothesis has rarely been discussed in the case of developing economies, such as Pakistan. The current study is a valuable addition to the said hypothesis in a country-specific case by taking the government as a leading actor in motivating enterprises toward CSR activities. This study focuses on Pakistan, the fifth largest country in South Asia in terms of population and emerging economies. The country currently faces several social, political, and economic problems. Therefore, t clarifying the relevance of CSR in curbing these aspects is prudent. Currently, various firms in Pakistan engage in CSR policies (Ehsan et al., 2018; Khan, Lockhart & Bathurst, 2018). Nevertheless, due to several challenges, implementing these policies has become difficult (Majeed, Aziz & Saleem, 2015). During the last decade, progress has been made with regard to CSR practices, even though they are still in the nascent stage (Jariko, Børsen & Jhatial, 2016; Khan et al., 2018). Economic dynamics and socioeconomic issues in developing countries are similar. The results of this study provide insight into the effects of subsidisation policies. These effects are seen through the lens of higher productivity and the mitigation of negative externalities.

This study answers the following questions and contributes to the empirical literature.

- •

First, an oligopolistic market model of private enterprises is developed in a competitive environment to establish theoretical linkages between the variables. The mediating role of product market competition is also considered when examining empirical relationships.

- •

Second, we examine the impact of government subsidies and other determinants on CSR. In addition, we determine the influence of subsidies on shareholders, employees, suppliers, consumers, and environmental responsibility. This question has not been addressed, especially in the context of Pakistan.

- •

Third, we analyse the impact of government subsidies on the social responsibility of private enterprises from the perspective of the heterogeneity of government subsidies. This study examines the impact mechanism of market competition in the subsidies-CSR relationship. The additional clauses of subsidies provide new avenues for an in-depth understanding of the policy effects of government subsidies, and further broaden the research horizon.

- •

Fourth, we test the influence of the number and amount of subsidies, industrial preferences, and political connections on CSR in Pakistan. Robustness tests are conducted for different scenarios to validate the empirical outcomes. These relationships are tested using robust standard error methodologies and the fixed effects IV estimator (FE2SLS) to overcome unobserved exogenous effects, endogeneity, and selection bias.

Overall, this study implies that tax provisions, subsidies, and other mechanisms that match corporate and government objectives have a broader economic impact than previously believed. The findings also indicate that policymakers who evaluate legislative changes in incentive provisions should be aware that their effects extend beyond legislative objectives. Firms are immediately affected and can significantly affect other market players.

The remainder of this paper is organised as follows. The relevant literature is presented in Section 2. Section 3 elaborates on the theoretical linkages by constructing a mathematical model. In addition, this section explains the data and methodology used to answer the research questions. Section 4 explains the results and Section 5 concludes the paper.

Literature reviewThe empirical literature divides CSR responsibilities into economic, humanitarian, and legal categories (Carroll, 1991). The economic dimension, which serves as the basis for others, entails that a firm's production should match market needs while also following profit generation (Carroll, 2015). The legitimate duties of a firm are to perform its activities within the boundaries and limits drawn by law (Wood, 1991). The ethical imperative entails ensuring that its manufacturing process and commodities are eco-friendly, clean, and non-toxic (McWilliams & Siegel, 2001). Humanitarian aspects highlight how businesses should respond through philanthropic activities, such as donating and developing public amenities (Carroll, 2015). In summary, companies that practice CSR should balance their financial gains and social requirements. This study examines the influence of government subsidies on CSR and market competition.

CSR and private enterprisesCSR is a self-regulatory business model that enables a firm to be socially responsible to itself, shareholders, and the general public (Wang & Zhou, 2020). Companies become aware of their influence on all elements of society, including the economic, social, and environmental facets by adopting CSR (Chia, Kern & Neville, 2020). Zhang et al. (2021) argue that firm engagement in CSR allows companies to introduce and promote value and help maintain a good reputation in the market (Johnson, Lee & Ashoori, 2018). Yoon, Chastagner and Joo (2020) conclude that CSR helps firms have a strong connection with the customer, which increases firm market shares and customer willingness to pay, irrespective of the services and quality of the product (Du et al., 2007). Vuković, Miletić, Čurčić and Ničić (2020) believe that a firm's engagement in social responsibilities helps promote the product, as it positively affects consumers’ sentiments, and the firm/product can enjoy a good reputation in the market (Lerro, Raimondo, Stanco, Nazzaro & Marotta, 2019). Torelli, Monga and Kaikati (2012) remark that firms with CSR have more opportunities to extend their markets than those who do not engage in such activities. By contrast, Christensen, Morsing and Thyssen (2020), Zhang et al. (2018), and Qiang et al. (2019) suggest that performing CSR activities builds business reputation, but also puts extra pressure on firms to perform well to maintain position, which increases product costs.

Government subsidies and competitivenessDespite Shepherd's (1972) declaration that political considerations with all types of subsidies are essential in determining firms' market positions, the question of whether subsidies improve enterprises' market power and affect competition remains debatable. Several factors may lead to a positive correlation between subsidies and firms' market power. First, as per Khurshid (2015), the number of subsidies reduces the firm's costs and uplifts the working capital, which provides a competitive edge and leads to unfair competition in the market. Similarly, Feldman and Kelley (2006) state that subsidies help firms secure loans and funding from financial institutions and banks and leads to other unseen benefits. Second, according to Aghion and Howitt (1992) and Klette and Griliches (2000), the beneficial effect of subsidies on innovation may result in a positive link between subsidies and market power given that innovation has been shown to be a key source of monopolistic power (Liu & Huang, 2016). In contrast, government-subsidised businesses have higher costs and less market influence. First, as (Zhao et al., 2015) note, firms in China seeking subsidies build and manage their relationship with officials, which increases firm costs and wastes resources that they can use to improve business performance. Yu, Hui and Pan (2010) demonstrate that financial subsidies to China's local government-owned firms will negatively impact its efficiency. Liang, Li and Lv (2012) note that subsidies in developing countries usually attract inefficient enterprises to participate in the marketplace. In addition, managers commit financial fraud and manipulate numbers linked to the labour force and productivity for more funds. Second, subsidies weaken the motivation for supported firms to increase efficiency since they may readily enjoy consistent and often considerable advantages. According to Lin (2012), from a viability perspective, large subsidy payments are made to businesses when the government wants these industries to grow, violating the factor endowment advantage. Businesses that lack viability will find it difficult to compete internationally if they lose the subsidy. Therefore, their market power and competition are linked to a continuous supply of government subsidies. Such cash flows in a market with a high degree of competition can diminish the responsiveness of businesses to the pressure of competition, which can lead to the so-called ‘producing just for subsidies’ practice and oversupply. Therefore, a company's market power and competition relations rely on the proportion of these two features when a subsidy increases or decreases.

Government subsidies and CSRFew studies focus on the relationship between CSR and government subsidies. According to one perspective, subsidies represent a tool to control environmental externalities which pave the way for CSR (Lu, Ren, Lin, He & Streimikis, 2019).

However, Li, Wu and Jiang (2018) and Khurshid et al. (2021) remark that subsidisation policies are a source of capital for private firms and help them finance their expenditures. As Guo, He and Xiao (2011) note, this also creates an opportunity for private firms to access banks and investment organisations for loans and investments. With the availability of cash, firms can contribute effectively by increasing their efficiency and initiating social responsibility. Second, this act of engagement in social activities strengthens the enterprise-government relationship. Jia and Liu (2014) argue that firms willingly engage in CSR after receiving subsidies. An interesting perspective is put forward by Li et al., who note that the government provides subsidies to achieve its political goals (Li et al., 2018). Donation is another way to strengthen the association between government and private firms (Xue & Xiao, 2011). In this regard, Lee, Walker and Zeng (2017) note that if firms do not engage in social responsibility, they bear high political costs, especially in the case of government enterprises. Therefore, private enterprises actively participate and perform social responsibility to repay the government.

Some studies argue that government subsidisation policies hinder CSR contributions. According to M. Shao and Bao (2012), the structural and institutional weakness on the government side puts a big question mark on allocating and utilising subsidy funds. These funds impact enterprises' operational performance, which further hinders their social responsibility. Moreover, Tzelepis and Skuras (2004) claim that subsidies are helpful for firms that run with a deficit, but this affects their performance because of extra pressure in the long run and decreases their profit. Firms' productivity can be enhanced by incorporating additional inputs; however, this increases the costs. Similarly, the orthodox mindset of firms motivates them to not perform social duties, as it will reduce revenue (Khurshid et al., 2020). Jia, Nam and Chun (2021) conclude that subsidisation policies increase firms’ dependence, as they do not use idle resources to maintain corporate social responsibly. This discussion shows that there is no clear consensus among scholars, which indicates the complexity of the relationship between the two concepts.

The research questions investigated in this study are novel relative to the recent literature. To the best of our knowledge, no study has considered market competition, the characteristics of the life cycle of firms, the number of subsidies, their volume, industrial preferences, and political connections. Unlike previous research, this study uses the FE2SLS method, which combines instrumental variables (IV) and fixed effects (FE). Therefore, both methods produce reliable results (Lin & Wooldridge, 2019: 24). It addresses multicollinearity, heteroskedasticity, unobserved exogenous effects, and selection bias problems and minimises the ambiguity of the outcome. This method is rarely used in empirical literature, especially in the CSR context. The ordinary least squares (OLS) method with robust standard error settings is applied for the robustness of the outcomes, as it helps minimise the error better than normal settings. The development of the model, selection of critical variables, and analysis of the relationships in different contexts differentiate this study different from the literature.

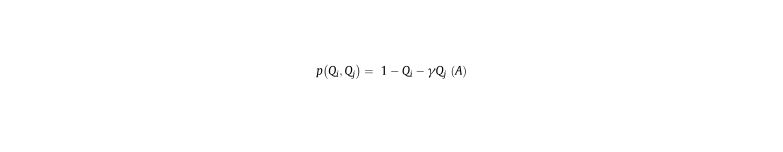

Theoretical and empirical modelsTheoretical modelThe theoretical model developed in this study is based on an oligopolistic, competitive market. We assume that two firms with similar products have imperfect substitutes. Both firms compete for market share and positions. Suppose Qi and Qj are the outputs produced by firms i and j, respectively. Thus, the total output in the market is Q=Qi+Qj. There are diminishing returns to scale as far as cost is concerned; therefore, the cost functions for both firms are C(Qi)=Qi2and C(Qj)=Qj2. Suppose that the market size is standardised to 1, and in such a situation, the market demand function is

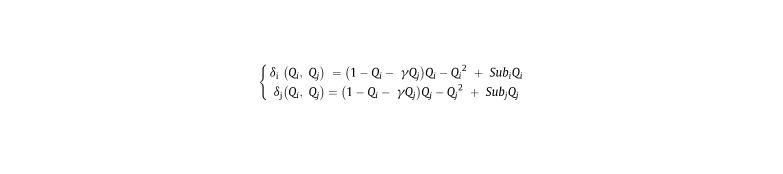

where i≠j and γ∈(0,1) are used for the substitution of a product, depending on the magnitude of the value. The larger the value, the stronger the substitution/competition.The relationship between the government and private firms has been established in the literature (Wang, Khurshid, Qayyum & Calin, 2022), which significantly impacts firms’ decision-making processes (Ahmed & Javed, 2017; Joshi & Rahman, 2015). The literature also supports the negative consequences of firm employees’ political connections on productivity (Abbas & Awan, 2017), which help firms gain government subsidies. Based on this discussion, the current study follows Tomaru and Saito (2010), who introduce an exogenous parameter Subi (0 < Subi < 1) to indicate the degree of government subsidies to enterprises. The higher the Subi, the larger the subsidy provided by the government (M. Shao & Bao, 2012). Thus, the profit earnings of firms i,j can be represented by Eq. (1) as follows:

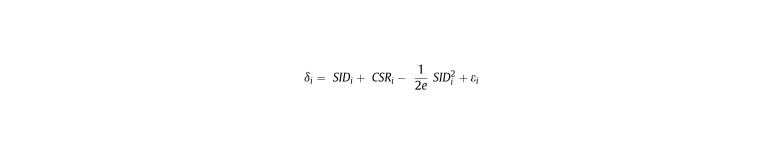

where Qi2 and Qj2are the costs of both firms and γ signifies product market competition. Moreover, SubiQi and SubjQj represent the total subsidies received by firms i and j, respectively.Furthermore, as Aggarwal and Samwick (2006) specify, each company has abundant resources to make independent decisions (SID) to maximise its profits, as shown below:

where SIDi in Eq. (2) indicates a series of investment decisions by the firm, such as production investment, R&D investment, external mergers, and procurements. Parameter e(e>0) represents the investment efficiency of these decisions. CSRi represents investment in CSR, which gives a firm some specific externalities (the firm's reputation). Moreover, εi is a random shock that obeys a normal distribution with a mean of 0 and variance of σ2.Any firm's primary objective is to maximise profits. The best-response function is estimated by partial differentiation of (1) for firms i and j and equating the system to zero (∂δi(Qi,Qj)∂Qi=∂δj(Qi,Qj)∂Qj=0) following the guidelines of Eaton and Grossman (1986) to obtain the equilibrium quantity (Qi and Qj). That is:

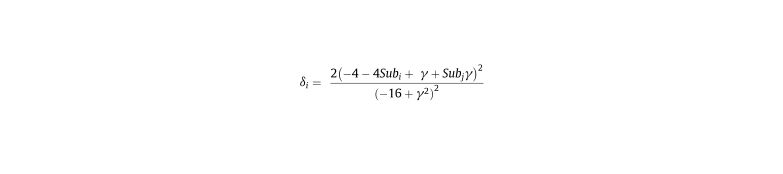

To obtain the equilibrium profit of the firms, we substitute Eq. (3) into Eq. (1), and after simplifying, we obtain Eq. (4):

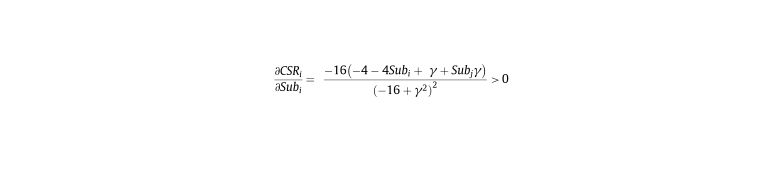

To obtain the CSR function, we merge Eqs. (4) and (2) and take the first derivative with respect to government subsidies to establish the relationship between the two variables, in line with the proposition introduced by Song, Yan and Yao (2020).

Eq. (5) shows the direct and positive relationship between government subsidisation policies and corporate social responsibilities. This also shows that firm investment decisions (SIDs) are not subject to changes in government subsidies. Therefore, we propose the following hypotheses:

H1: Keeping the other variables constant, government subsidisation policies help private enterprises accomplish their CSR goals.

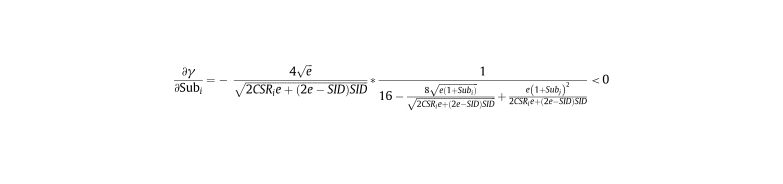

H2: Keeping the other variables constant, government subsidies discourage market competition.

By comparing Eqs. (2) and (4), we express the product market competition. We establish the association between product market competition and government subsidisation policies through a first-order partial derivative, as shown in Eq. (6).

Eq. (6) shows that government subsidies discourage competition.

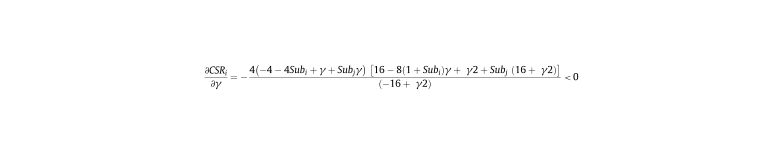

H3: Keeping the other variables constant, growing market competition negatively affects private firms’ CSR.

To prove this proposition, we take the first-order partial derivative of our equation of CSRi of a private firm to γ. This leads to an association between CSRi and product market competition, that is,

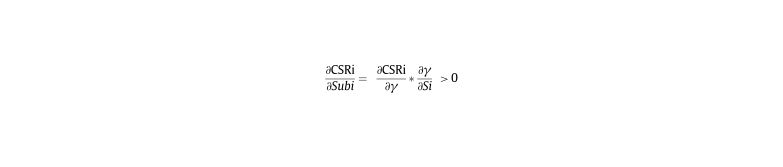

In the next stage, to establish the relationship between CSR and government subsidies, we follow Tomaru and Saito (2010) and combine Eqs. (5), (6), and (7), as represented in (8), in the following manner:

Eq. (8) shows that government subsidies use product market competition as a transmission channel to minimise competition and provide an environment in which firms can perform CSR effectively.

Empirical methodologySample selection and data sourcesThe Karachi Stock Exchange is the largest market in Pakistan, with 552 registered companies in 36 different sectors. The listed companies engage in various actions oriented toward health, education, environment, and national disaster relief under the slogan of a sustainable living plan. In 2019, 57 companies were honoured by international CSR awards.1 This study selects the top 100 companies due to data availability constraints. These companies are from the manufacturing, services, financial, hospitality, real estate, and information technology sectors. The heterogeneous influence of the industry attributes of enterprises is tested by dividing the sample into two sub-samples: competitive (manufacturing) and non-competitive industries (others). The sample ranges from 2011 2019. The data on these firms are taken from OpenDoor.pk (https://opendoors.pk/premium-data/corporate-social-responsibility-csr-data-of-pakistan-psx-listed-firms/) and the Corporate Social Responsibility Centre Pakistan (https://csrcp.com/). Data on government subsidies to private firms are taken from various issues of the Economic Survey of Pakistan (https://www.finance.gov.pk) and firms' financial reports.

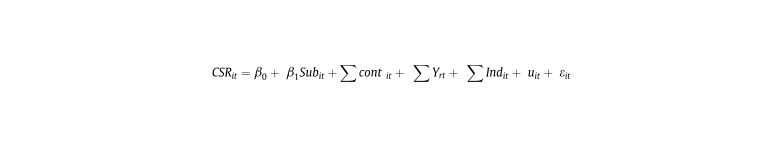

Model design and variable descriptionThe following econometric model is used to examine the impact of government subsidies on private firms’ CSR activities. This relationship is tested using the OLS method with a robust standard error setting. The ‘demean technique’ is used to estimate the fixed effects IV regression (FE2SLS), and the estimator is referred to as a ‘within estimator.’ It also presumes that the relationship between the independent parameters and an individual's effect is known.

CSR denotes corporate social responsibility, Sub is the subsidy, cont is the control variable, Y represents the year, and Ind denotes the industry. Here, uit represents the time-invariant unobservable effects that can influence our dependent variables and εit represents the error term.

By government subsidy, we imply any policy form, either in cash or tax reduction, announced by the government that helps firms reduce their economic burden and promote social welfare. In this paper, we obtain our specific data for the measure of government subsidy by consulting the detailed item ‘government subsidy’ of ‘non-operating income’ in the notes to the financial statements of listed companies, manually collecting the amount, and taking the natural logarithm of the amount.

The selection of the control variables is based on previous studies (Khurshid et al., 2020; Zhang et al., 2021). Most studies considered equity, internal control quality index, size of the board of directors, size of the supervisory board, and corporate retained earnings to total assets. Other variables include growth opportunity (ratio between the market value of the firm and its total assets), total cost (internal), total size of the firm (total assets), age of the firm (years in business), and ratio between assets and liabilities. We also focus on measuring and controlling year FE to avoid any ambiguity. A winsorisation procedure is adopted to reduce the error caused by extreme values at the 1% and 99% quantiles. The descriptions of the variables are summarised in Table 1.

Variable description.

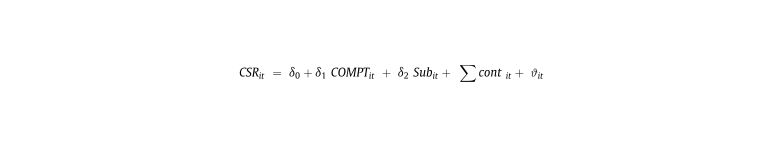

The theoretical derivation indicates that government subsidies mainly reduce the intensity of product market competition and ultimately encourage enterprises to actively perform social responsibility. Therefore, while keeping this in mind, this study constructs the following equations to empirically test the effect of government subsidies on the social responsibility of private enterprises.

In models (10) and (11), the meaning and measurement methods of variables such as CSRit, subsidy (Subit), and control (contit) are consistent with those in Model (9). However, COMPTit represents the product market competition. The Lerner index is more in line with the market concept for measurement, and is a reverse competition index. Therefore, this study uses its reciprocal as a proxy variable for product market competition, as suggested by Iqbal, Tauni and Jebran (2017). The specific calculation method is COMPTit which is as under.

where Pit*Qit represents the total revenue and AVCit*Qit represents the total cost. This study uses business revenue and operating costs instead of total output and total cost for calculation.In Model (9), β1 is the total effect of government subsidies on CSR without considering product market competition. In Model (10), α1 is the impact of government subsidies on product market competition. In Model (11), δ1is the impact of product market competition on CSR, and δ2 is the direct effect of government subsidies on CSR. After controlling for the degree of product market competition, α1δ1 is the mediating effect of government subsidies that affect CSR through the mediation variable of product market competition.

Specifically, the test procedure for the mediation effect is as follows: First, test Model (9). If β1 is not significant, the mediation effect test is terminated. However, if β1 is significant, the test models (10) and (11) are in sequence. Second, if both α1 and δ1 are significant, then the mediation effect (α1δ1) is significant. Under this condition, if δ2is significant, then there is a partial mediation effect. In addition, if at least one of α1 and δ1 are not significant, a Sobel test is required. If the test result is significant, it indicates a mediating effect; otherwise, it indicates no mediating effect. The Sobel (1982) effect is estimated using Z=α^1δ^1/Sα1δ1. where, α^1,δ^1are the estimated values for α1 and δ1. Sα1δ1=α^12Sδ12+δ^12Sα12, where Sα1, and Sδ1are the robust standard errors of α^1 and δ^1 respectively.

Estimation outcomesData descriptionDescriptive statistical analyses of the main variables used in this study are summarised in Table 2. The results show that the company's overall social responsibility performance is 22.31. The standard deviation is 19.72, the minimum value is −3.58, and the maximum value is 61.63, indicating considerable differences in the level of fulfilment of social responsibilities among the sample companies. The government subsidies received by the companies appear unevenly distributed, and the average value after taking the logarithm is 18. We also observe a significant difference between the maximum and minimum values. The figure shows the differences in the quality of internal controls and retained earnings among companies. However, there are large differences in the internal costs. The largest shareholder holds more than 35% of the shares and the proportion of independent directors is approximately one-third. The average age of the company's listing is approximately six years, and the average asset-liability ratio is 36.2%.

Descriptive statistics.

Columns (1) and (2) in Table 3 report the test results of not adding and adding control variables, respectively. The results indicate that the two regressions' estimated coefficients for government subsidies are significant at the 1% and 5% levels. The positive coefficient values indicate that government subsidies can actively encourage private enterprises to perform their social responsibilities, verifying Proposition 1.

Government subsidies and corporate social responsibility.

Note: *** p<0.01, ** p<0.05, * p<0.1. Standard errors in parentheses.

Robustness Test.

Further, this study subdivides private enterprises' general social responsibility indicators into shareholder responsibilities, employee responsibilities, supplier and customer responsibilities, and environmental responsibilities. These relationships are tested by reshaping Model (9). The results in columns (3)–(6) of Table 3 show that the regression coefficients of government subsidies are all significantly positive, which further verifies the basic conclusions of this study.

The conclusion is attributed to the fact that government subsidies are the company's most common recurring profit and loss, which will directly increase the company's distributable funds, enabling it to conduct a broader range of socially responsible investments in addition to R&D investment. From an entrenched position, obtaining government subsidies enhances the confidence and sense of security of private entrepreneurs. CSR is a long run strategy that may cut profits in the short run; otherwise, it is compensated for by government subsidies.

Further, a firm's involvement in CSR activities occurs in two ways. Before receiving government support, CSR helps the company improve its brand image, which in turn enhances the consumer base and helps attract investors' attention which leads to business expansion and, as a result, raises revenues. CSR activities help attract government attention, which translates into economic and policy benefits. The subsidies increase the firm's market power through government support and, second, goodwill created due to its CSR activities, which further increase after obtaining government resources. This drives the company to become a significant stakeholder in the market. It not only lowers the burden from revenue but also presents the company as responsible corporate citizens. Subsidies help private companies connect with the community and increase their involvement, which eventually raises individuals' incomes and uplifts the conceptual image that later translates into sales and revenues.

In developing countries, governments lack resources, so they usually support companies through tax relaxation, which lowers costs and helps maximise profits. Lower prices give companies a comparative advantage both domestically and internationally. If the subsidy is for the industry, it will not affect each firm's market power; however, it will make a certain product range attractive in the international market. Eventually, it increases exports, attracting more investment and creating better employment opportunities. This reduces the community's economic problems, provides more resources to fund public goods, and helps fight against negative externalities.

Therefore, considering these results, we state that governments in developing countries can multiply CSR activities by providing subsidies to private firms, enhancing individual efforts that can be inhibited by a lack of resources.

To enhance the persuasiveness of the research results, we conduct the following robustness tests:

Sample self-selection problemThe receipt of government subsidies may not be random for companies. For instance, government subsidies and their volumes may be based on a company's characteristics or industry. We directly select a sample of companies that have received government subsidies for estimation, which may cause a sample selectivity bias. In this regard, we use the Heckman two-stage model to make corrections. First, we construct dummy variables based on the strength of government subsidies and use the probit method in the first stage to estimate the probability of private enterprises receiving high-intensity government subsidies, that is, the inverse Mills ratio (IMR). Later, we add this as a control variable to the first stage in the two-stage regression. Column (1) of Table 4 summarises the results. The results show that subsidies contribute positively to CSR. In addition, the IMR is highly significant, indicating that the basic conclusions of this study are still valid after controlling for the sample self-selection problem. These results are consistent with those obtained using the OLS regression method.

Robustness outcomes.

Note: *** p<0.01, ** p<0.05, * p<0.1. The standard errors in parentheses and robust in OLS case.

Enterprises’ active charitable donations are a representative way for enterprises to fulfil their social responsibilities. Therefore, for the robustness of the results, we replace CSR with the natural log values of ‘public welfare donation expenditures’ under the label of ‘Non-operating Expenses’ – financial statements of listed companies. Similarly, to examine its nexus with CSR, we replace subsidy with its intensity (government subsidy amount/total corporate assets × 100). Column (2) of Table 4 presents the empirical relationship between these two variables. The outcomes show that, even after adjusting the measurement methods of the key variables, the overall regression results did not substantially change.

Consider the life cycle characteristics of the enterpriseFrom a static perspective, the results show that government subsidies promote CSR significantly. Does this conclusion hold for companies with different life cycles? In this regard, this study divides the entire sample into three life stages–growth, maturity, and decline–and tests the benchmark model in dynamic settings. First, the top 50% of companies with positive operating income growth rates are classified as a growth period, and the last 50% are incorporated as the mature period. In contrast, companies with negative operating income growth rates were categorised as in the decline period. The results are shown in columns (3) – (5) of Table 5. The outcomes are consistent in both cases. The results show that, regardless of whether the sample enterprises are in the growth, maturity, or decline periods, there is a significant positive correlation between government subsidies and CSR.

Impact mechanism results.

Note: *** p<0.01, ** p<0.05, * p<0.1. The standard errors in parentheses and robust in OLS case.

The critical value of Sobel's test statistic at the 5% significance level is approximately 0.97. The regression results in Table 3 show that β1 in Model (9) is significantly positive; therefore, only the estimated coefficients of Models (10) and (11) need to be tested in turn. Table 6 lists the relevant test results.

Influence of subsidies on CSR under different conditions.

Note: *** p<0.01, ** p<0.05, * p<0.1. The standard errors are in parentheses and robust in the OLS case.

The results in Column (1) show that government subsidies are negatively correlated with product market competition. The regression coefficient is −0.13, significant at the 1% level, indicating that government subsidies significantly reduced the intensity of product market competition. These results support the theoretical framework of this study. The results further reveal a significantly negative correlation between product market competition and CSR. A coefficient value of −0.21 indicates that product market competition reduces CSR. The regression coefficient of government subsidies in Column (2) is 0.49, which is significant at the 5% level. In summary, subsidies weaken the impact on CSR by reducing competition. The empirical results are in line with the theoretical framework developed in this study.

Further analysisConsidering that the government has considerable corporate heterogeneity in the number of subsidies, industry preferences for subsidies, political connections, and additional subsidies, this may affect the relationship between government subsidies and the social responsibility of private enterprises. In this regard, this section focuses on further analysis of the benchmark Model (9) from the perspective of the heterogeneity of government subsidies.

Impact of the number of subsidiesFinancial subsidies provided by the government are not random. Corporate subsidies are typically based on the characteristics of enterprises or industries. Therefore, the number of subsidies received by different types of enterprises can vary significantly. In this regard, this study uses detailed information on government subsidies disclosed in the ‘non-operating income’ item in the notes to the annual statements of listed companies. The dataset is manually collected, the number of government subsidies obtained by enterprises is sorted, and the full sample is divided into averages according to government subsidies. The companies are divided into three main groups. The lowest frequency is defined as low-frequency arrays, the middle as medium-frequency arrays, and the highest groups are defined as high-frequency arrays and regressed as per our benchmark model. The test results are listed in Table 6 (rows 1–3). The effect of government subsidies on the social responsibility of private enterprises is only established in the low and middle-frequency sample group. Essentially, higher government subsidies do not play a role in fulfilling social responsibilities.

Impact of subsidy amountMao and Xu (2018) argue that there should be a moderate range of government subsidies in which companies can be more productive. This division is based on the average values of company size and subsidies received. The lowest rage is the low-quota group, while the other two are the medium and high quota groups. Model 9 is tested in a new setting, and the outcomes are summarised in rows 4–6 of Table 6. The results show that medium-sized subsidies have a more significant and positive impact on CSR. In summary, the optimal range of government subsidies can only promote the CSR of enterprises.

Influence of industry preferencesTo improve the general welfare of society, governments generally tend to provide more subsidies to enterprises with strong public attributes. Therefore, it is necessary to examine the heterogeneous influence of enterprise-industry attributes. This study divides the sample into two sub-samples of competitive industries (manufacturing) and non-competitive industries (others), and re-regresses the benchmark model. The results are summarised in rows 7–8 of Table 6. The findings reveal that government subsidies significantly impact CSR in competitive industry groups. Competition boosts the CSR activities.2

Impact of political connectionsThe connection between enterprises and government makes it easier for businesses to obtain government subsidies. However, this political connection can also lead to distortions in resource allocation and severe rent-seeking behaviour (Khurshid, Kedong, Calin & Popovici, 2016). For example, Faccio, Masulis and McConnell (2006) find that using political connections as an informal channel by enterprises to obtain government subsidies significantly reduces government subsidy resource efficiency. Fan, Wong and Zhang (2007) point out that securing government subsidies substantially improves operating efficiency and social contribution for enterprises that are not politically connected. Therefore, this study divides the companies in the sample into two sub-groups: with3 and without political connections. The test results are shown in rows (9) – (10) of Table 6. Non-political enterprises positively contribute to CSR. Enterprises that support political activities or are run and owned by politicians are not inclined toward CSR. The results of the FE2SLS and OLS analyses are consistent in both the intensity and direction of the relationship.

ConclusionThe CSR phenomenon is still new for developing economies and is not actively reported in many countries; however, subsidisation has a long history. Therefore, this study examines the influence of subsidies on CSR from different perspectives and shows the importance of the active use of subsidies and their role in enhancing CSR efforts, specifically from the private firm's perspective, which indulges in such practices for profit maximisation purposes. The relationship between variables in this context has not been discussed in the literature. To date, there is evidence in the case of developing economies. Pakistan and other developing economies have similar socioeconomic-political traits; therefore, countries with similar characteristics can benefit from these outcomes. The validity and robustness of the results were tested from different viewpoints, which increased the novelty of this study.

First, the SCP research paradigm of industrial organisation theory is used to construct an oligopoly market model to analyse the influence of government subsidies and product market competition in achieving CSR. The study tested theoretical propositions: i. government subsidies help private enterprises accomplish their social responsibilities, ii. government subsidies discourage competition in the market; and iii. growing competition in the market negatively affects the CSR of private firms using the empirical data of 100 private listed companies in Pakistan.

The results confirm these theoretical propositions and conclude that government subsidies actively encourage private businesses to meet their social obligations. This is because government subsidies or incentives, either in the form of tax relaxation or R&D funding, help increase the firm's profit and increase distributable cash, allowing the company to make more socially responsible expenditure. Moreover, subsidies provide a sense of security which increases firms confidence in enhancing output.

The results further reveal that product market competition negatively affects CSR activities. Competitiveness reduces CSR by driving enterprises to prioritise short-term viability and forego long-term investments, as in many CSR initiatives.

It is further revealed that the positive relationship between CSR and government subsidies is independent of the enterprises' growth stages. In comparison, the link was more robust for medium and low subsidies.

Finally, enterprises with non-political linkages participate actively in CSR activities. In the case of developing economies, such as Pakistan, firms are involved in CSR activities for brand image formation, which increases social acceptance for both products and firms.

CSR activities also help attract the attention of the political elite and government, who support firms with public funds and policies to build their reputation and position. In addition, in democratic environments, private firms finance political parties in elections to later obtain favours and subsidies in different forms in return. However, government subsidies can also help promote CSR activities.

Policy implicationsInvestigations of CSR focus mainly on advanced economies. CSR has rarely been discussed in developing countries such as Pakistan, as this phenomenon has recently been adopted. Pakistan shares similar socioeconomic problems and political characteristics with other developing economies. Therefore, the outcomes and implications can set a roadmap for researchers and policymakers in other developing economies to reconsider subsidisation policies and enhance their effectiveness.

Developing economies face financial constraints that hinder them from providing the necessary environment to boost individual existence. Therefore, they need an additional hand in the form of private firms to minimise these disparities. This study puts forth the following implications given the empirical results obtained for Pakistan.

The results indicate that government intervention through fiscal means (subsidies) and policies can help regulate market transaction orders and ease the intensity of market competition. Therefore, developing economies should consider this option and provide monetary benefits to emerging industries depending on the comparative advantage that the industry can provide. Subsidies provide endogenous motivation to private enterprises and assists in the fulfilment of their social responsibilities.

Private enterprises involve themselves in CSR mainly because of better brand imaging and to multiply their revenues which further motivates them toward social spending. Therefore, the government should actively perform strategic administrative functions. They should encourage and contribute to product R&D and innovation to enhance market position, instead of providing monetary benefits to enterprises that later help them achieve their political goals.

The results show that the number, amount, and type of subsidies also influence social spending. Therefore, countries should develop a criterion for awarding subsidies (amount and type) to make them public. This will standardise the opportunities for businesses to seek them, and they will actively work for it. Moreover, it will reduce the effect of political connections in gaining financial support which discourages other businesses.

In addition to this, governments should extend the supervision of financial resources, and at the same time, improve the regulations and systems of specific subsidies. This constitutes a great economic boost for private companies and motivates them to pursue their social responsibility agenda.

Future research direction and limitationData limitations restricted the study period as well as the examination of the role of government subsidies in the CSR for all private enterprises.

Another limitation is that the theoretical model constructed in this study focuses on a purely oligopolistic situation. Future research can analyse the influence of government subsidies on CSR in mixed oligopolies, monopolies, and perfect competition with a larger number of market players to obtain conclusions with a broader scope of application. Similarly, this study can be extended to compare SOEs and private enterprises. Lastly, future research can also focus on the heterogeneous characteristics of government subsidies, such as subsidies at different government levels, upsurges in subsidies, and their specific contents. Moreover, future studies could consider and examine the influence of subsidies on various types of industries and their role in CSR.