As a vital component of entrepreneurship, innovation spirit is significant for innovation performance. Utilizing the 2015 China Micro and Small Enterprise Survey dataset, we used the Probit and Tobit micro-econometric models to study the relationship between the innovation spirit, research and development (R&D) investment, and innovation performance of micro and small enterprises (MSEs). Our research results show that the innovation spirit of MSEs has a significant promotional effect on innovation performance, and R&D investment is an important internal transmission mechanism for innovation spirit to affect innovation performance. We found that the business environment significantly moderates the impact of innovation spirit on R&D investment and innovation performance. Optimizing the business environment will suppress the impact of innovation spirit on R&D investment and enhance the promotion of innovation spirit on innovation performance. Our results have implications for policymakers about the cultivation of the innovation spirit of MSEs, the optimization of the business environment, and the improvement of the innovation ability of enterprises and the innovation vitality of the market.

Innovation in industry is widely regarded as the main stimulating factor in the national economic growth and international competitiveness of emerging market economic entities and newly industrialized countries (Guan & Chen, 2012) . Scholars have posited that enterprise innovation performance is a leading force in the improvement of the overall competitiveness of a country (Zhao et al., 2019) and plays a central role in boosting productivity and economic development (Amankwah-Amoah et al., 2018; Xie et al., 2022). However, as micro and small enterprises (MSEs) are not as proficient as large and medium-sized enterprises in terms of technology, capital, manpower, R&D investment, achievement transformation, and risk prevention, their innovation performance is seriously affected (Cong & Howell, 2018). According to the 2015 China Micro and Small Enterprise Survey (CMES), 64.37% of MSEs had no R&D investment, and only 23.34% had successfully applied for patents. This demonstrates that the innovation vitality and performance of MSEs are generally low. Whereas an earlier meta-analysis revealed inconclusive evidence of the role of R&D investment in start-ups’ success, Coad et al. (2016) argue that only high-growth start-ups can benefit from higher R&D investment, and García-Quevedo et al. (2014) posit that this investment is driven more by entrepreneurship—generally considered a basic component of production—than by the scale of R&D. As a vital component of entrepreneurship, innovation spirit has a profound impact on R&D investment, innovation performance, innovation promotion, and production. Therefore, studying the impact of MSEs’ innovation spirit on R&D investment and innovation performance from the micro level is conducive to understanding the impact mechanism of innovation spirit on innovation performance and has important practical significance for improving MSEs’ innovation vitality and innovation performance.

Innovation is characterized by high risk, high failure rate, unpredictability, and consuming long-time. Innovation performance is not achieved overnight but requires the long-term accumulation of a large amount of capital (Cong & Howell, 2018; Hottenrott & Peters, 2012). Researchers have found that external factors, such as firm competition (Tan et al., 2016), financing constraints (Guo et al., 2016; Szczygielski et al., 2017; Tse et al., 2021; Zhang et al., 2020; Zheng et al., 2021; Zhu et al., 2020), government subsidies (Coad et al., 2016; Cong & Howell, 2018; Kou et al., 2020; Kyung-Nam & Hayoung, 2011; Meuleman & De Maeseneire, 2012; Shinkle & Suchard, 2019; Wu, 2017; Zhao et al., 2019), foreign direct investment (Aitken & Harrison, 1999; García et al., 2013; Haddad & Harrison, 1993; Haskel et al., 2007; Keller & Yeaple, 2009), and the diversity of innovation R&D cooperation (Ahn et al., 2016; Cohen & Levinthal, 1990; Gkypali et al., 2017; Lin et al., 2012) have an impact on firms’ innovation performance.

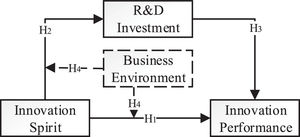

Schumpeter (1934) coined the term creative destruction to describe entrepreneurs' innovation spirit as the fundamental driving force of innovation performance, and thus innovation spirit is crucial for increasing productivity. On this basis, Baumol (1996) posited that entrepreneurship profoundly impacts technological innovation and innovation promotion. In the words of Mitchell et al. (2002), entrepreneurship constitutes “… the knowledge structures that people use to make assessments, judgments or decisions involving opportunity evaluation and venture creation and growth”. Under the hierarchical organization of enterprises in China, an enterprise's sustainable R&D investment reflects the will of senior managers, and their attitude toward innovation may impact the enterprise's investment performance (Carpenter et al., 2004). Innovation spirit is the core element of entrepreneurship, which refers to entrepreneurs' attention to innovation and willingness to innovate (Briones Peñalver et al., 2018; Huang et al., 2022). A high spirit of innovation means that enterprises attach immense importance to innovation and have a higher willingness to implement innovation activities. Scholars have found that entrepreneurship, characterized by innovation spirit, plays a significant role in promoting firm performance and economic development (Briones Peñalver et al., 2018; Ding et al., 2019; Elenkov et al., 2005; Li et al., 2009; Nonaka & Toyama, 2007; Pradhan et al., 2020; Tajeddini et al., 2020). Scholars have mainly studied the positive effects of external factors and entrepreneurship on promoting economic growth and regional innovation from a macro perspective, and few scholars have studied the impact of innovation spirit on R&D investment and innovation performance of MSEs from a micro perspective, especially the moderating role of the business environment. Utilizing the CMES database, we consider how innovation spirit impacts the R&D investment and innovation performance of MSEs. We also consider how the business environment—as an external condition of enterprise innovation decision-making—affects the relationship between the innovation spirit, R&D investment, and innovation performance of MSEs in this influencing process.

Our research results contribute to the innovation literature in three main ways. First, from the micro perspective, we demonstrate that innovation spirit significantly drives innovation performance. Second, we highlight the unique role of R&D investment and the business environment. Specifically, we show that innovation spirit can promote MSEs’ innovation performance by influencing R&D investment and that the business environment can moderate the relationship between innovation spirit, R&D investment, and innovation performance. Third, we make a unique empirical contribution by testing our model with data from the CMES.

Theoretical framework and hypothesesInnovation spirit and innovation performanceIdeology determines behavior (Loye, 1980). Thus, the stronger the innovation spirit of MSEs, the more actively they will perform R&D activities—such as researching and developing new products and services, introducing new technologies and production methods, exploring new markets, developing supply channels, committing to organizational innovation, and apply for patents to achieve higher innovation performance. Although MSEs owners do not need to manage all their enterprises’ affairs, Bel (2010) noted that innovative leaders balance innovation activities and the day-to-day activities of the enterprise and will effectively find and seize innovation opportunities. Managers’ strategic leadership and innovation spirit significantly promote enterprises' product and management innovation (Elenkov et al., 2005; Nonaka & Toyama, 2007). Ding et al. (2019) study of a sample of 144 managers in Chinese firms found that innovation spirit can improve innovation performance by improving knowledge management capability. Tajeddini et al. (2020) conducted a study of 201 tourism service enterprises in Japan and found that the key factor in realizing service innovation is the enhancement of the innovative spirit and ability of employees through the enterprises—that is, innovation must be embedded in the organization. Therefore, we propose the following hypothesis:

H1

: The innovation spirit of MSEs has a direct promoting effect on enterprise innovation performance.

Innovation spirit and R&D investmentEnterprise innovation can be funded by either internal or external sources of finance, according to capital sources. Internal sources of finance are the primary sources of R&D investment (Himmelberg & Petersen, 1994; Kamien & Schwartz, 1978). Bank loans and government funds mainly provide the external sources of finance. Entrepreneurship determines the allocation of enterprise funds to productive and innovative activities. Innovation spirit can promote the increase of entrepreneurs’ R&D investment from internal inputs—hence, MSEs with a stronger innovative spirit will invest resources in innovative activities and increase internal financing spontaneously and proactively. Enterprises with a stronger innovative spirit may also seek external sources of finance—such as government subsidies or bank loans—through rent-seeking or through corrupt means to increase R&D investment (Ahmad et al., 2021). However, enterprises’ innovation efforts are integrated with their risk management strategy, and MSEs usually avoid excessive external financing. Due to their lack of mortgage assets and higher risk-return profile, they are credit constrained and have difficulties accessing traditional lending, and thus their innovation activities are restricted. Because enterprises’ R&D investment generates a certain positive externality to society, governments may subsidize the innovation activities of enterprises, and these subsidies have a significant role in promoting the innovation of enterprises. As government subsidies for R&D are limited, governments identify recipients and grant subsidies based on a screening process, and the rent-seeking ability of enterprises replaces the market mechanism as a means to obtain these subsidies. Rent-seeking and corruption are illegal means to obtain influence and increase relational capital. Enterprises may establish relationships with bankers or policymakers using rent-seeking and corruption to obtain the capital and policy support needed for their R&D activities. A negative demonstration effect on enterprises can be observed as a consequence of innovation subsidies and benefits obtained by rent-seeking and corruption. Unlike large enterprises, MSEs often lack early-stage R&D investment (Howell, 2017), although Rossi (2015) reported that many governments now focus on subsidizing MSEs. Kou et al. (2020) found that MSE owners with a stronger innovative spirit are more likely to obtain government R&D subsidies through rent-seeking and corruption, thus increasing their R&D investment and facilitating their innovation activities. Therefore, we propose the following hypothesis:

H2

: The innovation spirit of MSEs has a promoting effect on enterprise R&D investment.

R&D investment and innovation performanceAccording to the theory of traditional innovation economics, there is a significant positive correlation between R&D investment and innovation performance (Xu et al., 2021). Increasing R&D investment is an enterprise's basic path to improving innovation performance and is the internal driving force for sustainable, healthy growth. Scholars have studied the impact of R&D investment on innovation performance. At the industrial level, increasing scientific research input can improve regional innovation output performance (Gulbrandsen & Smeby, 2005). At the enterprise level, Artz et al. (2010) suggested that R&D expenditure is positively related to the number of a firm's patents. Yildiz et al. (2013) found that investment in science and technology significantly promotes innovation performance in their investigation of enterprises in the Middle East. Hall et al. (2013) posited that the R&D input of the Italian manufacturing industry is positively correlated with the innovation output of its enterprises. Andries and Hünermund (2020) found that resource-rich enterprises initiated more innovation projects and thus had higher innovation performance through their study of 2790 German enterprises. Through theoretical model and numerical simulation analysis, Kou et al. (2020) found that both government expenditure on technological innovation and enterprise input in technological innovation significantly promoted enterprise innovation.

The literature includes numerous studies of the relationship between R&D investment and innovation performance, and most scholars believe that R&D investment has a significant promoting effect on innovation performance. Therefore, we propose the following hypothesis:

H3

: The R&D investment of MSEs can promote enterprise innovation performance.

The moderating effect of the business environmentInnovation spirit is the subjective element determining whether MSEs conduct innovation activities and obtain results. The objective business environment restricts its influence on the innovation activities of MSEs. The business environment refers to the external institutions, factors, and conditions that affect the performance of business enterprises—a favorable business environment is conducive to sustaining economic growth and has an impact on the relationship between innovation spirit, R&D investment, and innovation performance of MSEs. In Baumol (1996) study of entrepreneurship, he posited that the roles of entrepreneurial talents in different entrepreneurial activities are determined by the enterprise's institutional structure, indicating that institutions play a moderating role in the process of innovation spirit influencing innovation activities. In China, financial subsidies are a major form of government support for enterprise innovation (Tse et al., 2021). Scholars argue that the government, as a so-called invisible hand, can not only prevent market failure by regulating policies but can also have a positive impact on enterprise innovation by subsidizing enterprise innovation (Szczygielski et al., 2017; Zheng et al., 2021; Zhu et al., 2020). Firms supported by government R&D subsidies increase their expenditure on innovation technology and produce significantly higher technological and business innovation outputs, thus promoting innovation performance (Guo et al., 2016; Zhang et al., 2020).

The impact of innovation spirit on innovation performance varies with the turbulence and competitiveness of the business environment—that is, dynamic and competitive environments impact an enterprise's innovation performance and production capabilities (Kerin et al., 1992; Prajogo, 2016). The performance effect of firm innovation is most positive in an environment of high market turbulence and competitive intensity (Tsai & Yang, 2013). A favorable business environment promotes the innovation performance of enterprises (Zheng et al., 2021). Conversely, an unfavorable business environment induces poor innovation performance of enterprises and the market. In China, some regions are still in the transition economy with imperfect market mechanisms. To bring new products to the market quickly, some micro and small enterprises with no obvious competitive advantage will obtain government R&D subsidies through rent-seeking and corruption, which has a negative impact on the fair business environment. When speculators deliberately charge high rents or delay the issuance of product licenses, it is also difficult for micro and small enterprises to make up for their losses by obtaining innovation performance gains through rent-seeking (Qian & Xu, 1998). With the continuous improvement of the business environment, the impact of the business environment on the relationship between innovation spirit, R&D investment, and innovation performance of MSEs can be considered from two aspects. First, the optimization of the business environment can help enterprises reduce the cost of institutional trading, obtain fair and equitable treatment from the government, and minimize channels for rent-seeking and corruption—hence, even those enterprises with a strong innovation spirit cannot receive government R&D subsidies by rent-seeking and corruption. Second, optimizing the business environment could help simplify the government's administrative examination and approval processes, facilitate patent applications, and improve the efficiency of the trademark registration and patent examination processes, enabling enterprises to obtain patents and product licenses, thus improving their innovation performance. Therefore, we propose the following hypothesis:

H4

: The business environment moderates the relationships between innovation spirit, R&D investment, and innovation performance. In an unfavorable business environment, the innovation spirit of MSEs influences innovation performance mainly through R&D investment. In a favorable business environment, the innovation spirit of MSEs directly impacts innovation performance but weakens the R&D investment.

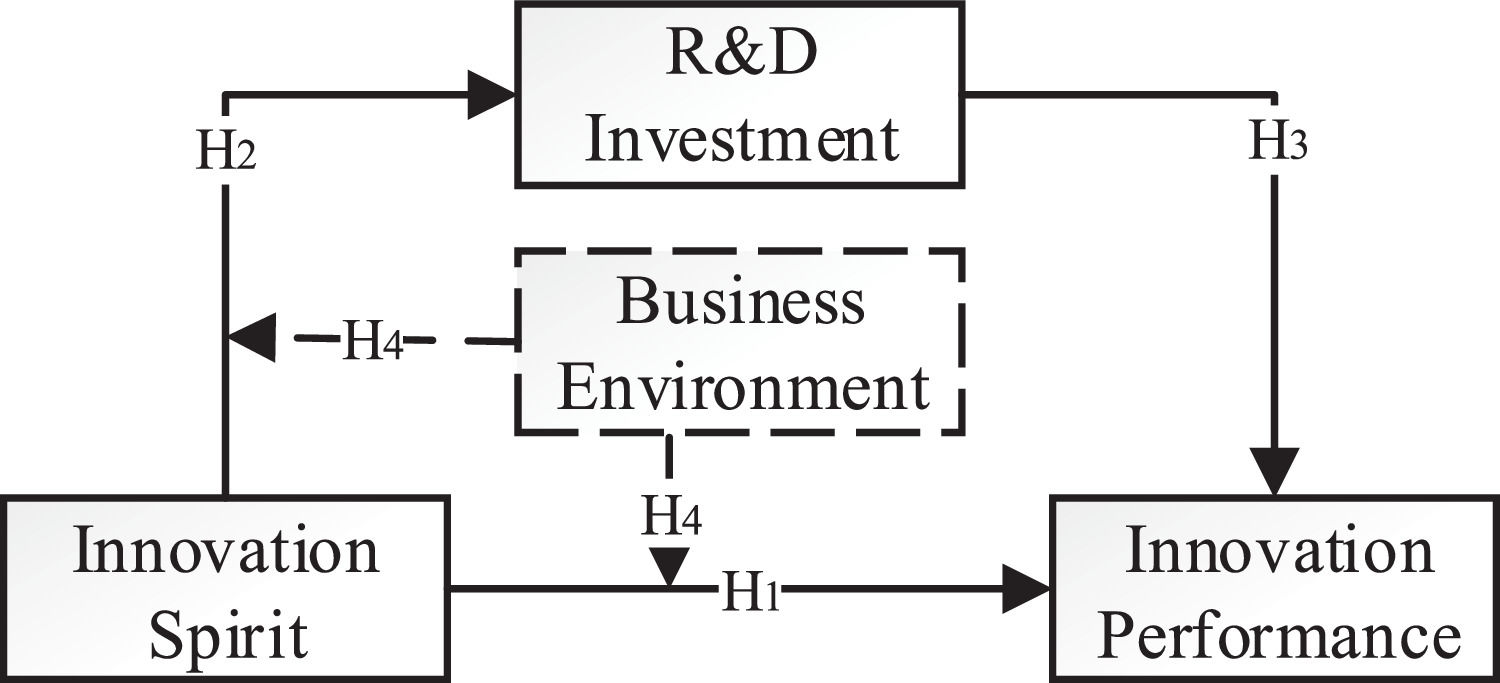

Based on hypotheses H1, H2, H3, and H4, the theoretical framework of this paper is shown in Fig. 1.

MethodsData collection and samplingOur study's dataset was from the 2015 CMES, conducted by the China Household Finance Survey and Research Center, which was established by the Southwestern University of Finance and Economics. The survey subjects were 5601 micro and small companies with independent legal personnel in 28 provinces (autonomous regions and municipalities directly under the Chinese central government, except the Xinjiang, Tibet, Qinghai, Hong Kong, Macao, and Taiwan regions). The survey focused on retail, wholesale, manufacturing, transportation, catering, software and information technology services, accommodation, construction, and agriculture. The survey questionnaire included basic information about the enterprises, including their R&D capabilities, innovation, operating environment, policy support, financial information, and other aspects. The three-stage sampling method used the probability proportional to size measurement to ensure that the sample was nationally representative and random. Based on this data, we eliminated the respondents with outliers, missing values of relevant variables, and those enterprises founded in 2015, and finally obtained the sample of 905 enterprises. Data processing was realized by Stata™ Statistical Software Release 15.

Variable definition and descriptionDependent variable: Innovation performance. Intellectual assets such as patents are part of an enterprise's intangible assets, and the number of patents reflects the enterprise's market value. Scholars have commonly used the patent data of an enterprise to measure innovation performance (Abraham & Moitra, 2001; Brouwer & Kleinknecht, 1999; Sun et al., 2008; Trappey et al., 2011) . In this study, we used the survey question “Whether an enterprise has successfully applied for a patent” from the CMES to measure the innovation performance of MSEs. However, enterprises' innovation is reflected in patent applications, grants, and the launch of new products or services (Xie et al., 2019). Therefore, we adopted the following survey questions from the CMES: “Whether R&D activities lead to new products” “Whether R&D activities lead to new technology/new processes”, and “Whether there is innovation in the organization's service, marketing, culture, and other aspects” as the substitution variables of innovation performance of MSEs from the aspects of product, technology, and service.

Independent variable: Innovation spirit. Scholars have adopted different indicators to measure innovation spirit, including the rate of self-employment (Beugelsdijk & Noorderhaven, 2004); the number of small businesses (Glaeser, 2007). Li et al. (2009) used the number of patent applications to measure the innovation spirit of entrepreneurs. However, the number of patent applications is also affected by factors other than the spirit of innovation, and therefore it is not completely accurate to use the number of patent applications as a measure of the innovation spirit. Considering that the stronger the innovation spirit of MSEs, the higher the importance they attached to innovation, we used the importance of enterprise owners attached to innovation to measure the innovation spirit of MSEs. The CMES specified the evaluation of the degree of the MSE's attention to innovation into “very seriously,” “value,” “general,” “not very seriously,” and “no need.” In this paper, the values of the above options are between 5 and 0— the larger the value, the higher the importance the enterprise attaches to the innovation of employees, and the stronger the enterprise innovation spirit. At the same time, we used “innovation necessity” and “whether there is full-time R&D personnel” as the substitution variables of innovation spirit. The CMES investigated factors constraining innovation in MSEs, including “there is no need to innovate, and the innovation spirit is not strong enough” as the first substitute variable to measure innovation spirit. The more innovative the enterprise, the more inclined it is to employ full-time R&D personnel, and thus we took “whether there is full-time R&D personnel” as the second substitution variable to measure innovation spirit.

Mediating variable: R&D investment. The 2015 CMES investigated the total expenditure of R&D and innovation activities of MSEs in 2015. Since some enterprises had no R&D activities, we took the total expenditure of R&D activities +1 and then took the natural logarithm to measure the R&D investment of MSEs.

Moderating variable: The business environment. Chinese society is based on human relationships, and the higher the travel and entertainment expenses of enterprises, the more they participate in rent-seeking and corrupt activities and the less favorable their business environment is (Cai et al., 2011). We used the 2015 entertainment expenses of MSEs to measure their business environment from the corruption perspective. Since some MSEs did not have entertainment expenses, we took the entertainment expenses +1 and then took the natural logarithm.

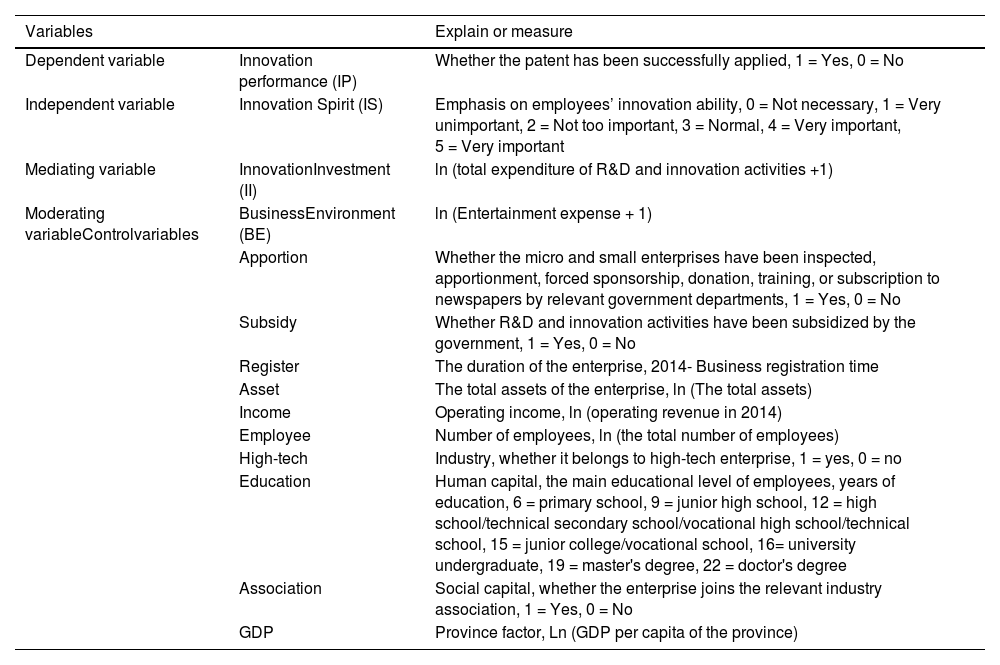

Control variables. The innovation spirit is the subjective element that determines whether MSEs conduct innovation activities, while the objective element is the crucial condition of MSEs' innovation. Based on existing studies, the control variables we selected are shown in Table 1 and include the following:

- •

Mandatory actions such as government apportionment of enterprises may hinder the innovation process of enterprises. In this study, we measured government apportionment behavior according to “whether the MSEs have been inspected, apportionment, forced sponsorship, donation, training, or subscription to newspapers by relevant government departments,” surveyed by the CMES.

- •

Government subsidies have a significant promoting effect on the innovation incentive of enterprises. We measured the government subsidies according to “whether the R&D and innovation activities of MSEs have received government subsidies,” surveyed by the CMES.

- •

The duration of the existence of an enterprise, measured by business registration of the establishment of the enterprise.

- •

Total assets are measured by the natural logarithm of the enterprise's total assets.

- •

The business income of the enterprise, measured by the natural logarithm of the business income in 2014.

- •

The number of enterprise employees, measured by the natural logarithm of the total number of enterprise employees.

- •

The enterprise's industry is 1 if the enterprise belongs to a high-tech enterprise and 0 otherwise.

- •

The human capital of the enterprise, measured by the number of years of education converted from the main educational level of the employee.

- •

The firm's social capital and relational capital significantly promote the firm's R&D investment propensity, 1 if the firm joins an industry-related association, and 0 if not.

- •

Provincial factors. To avoid reducing the degree of freedom owing to the introduction of too many dummy variables, we used the natural logarithm of per capita gross domestic product (GDP) of the province where the enterprise is located to control the province's influence on enterprise innovation.

Description of variables.

| Variables | Explain or measure | |

|---|---|---|

| Dependent variable | Innovation performance (IP) | Whether the patent has been successfully applied, 1 = Yes, 0 = No |

| Independent variable | Innovation Spirit (IS) | Emphasis on employees’ innovation ability, 0 = Not necessary, 1 = Very unimportant, 2 = Not too important, 3 = Normal, 4 = Very important, 5 = Very important |

| Mediating variable | InnovationInvestment (II) | ln (total expenditure of R&D and innovation activities +1) |

| Moderating variableControlvariables | BusinessEnvironment (BE) | ln (Entertainment expense + 1) |

| Apportion | Whether the micro and small enterprises have been inspected, apportionment, forced sponsorship, donation, training, or subscription to newspapers by relevant government departments, 1 = Yes, 0 = No | |

| Subsidy | Whether R&D and innovation activities have been subsidized by the government, 1 = Yes, 0 = No | |

| Register | The duration of the enterprise, 2014- Business registration time | |

| Asset | The total assets of the enterprise, ln (The total assets) | |

| Income | Operating income, ln (operating revenue in 2014) | |

| Employee | Number of employees, ln (the total number of employees) | |

| High-tech | Industry, whether it belongs to high-tech enterprise, 1 = yes, 0 = no | |

| Education | Human capital, the main educational level of employees, years of education, 6 = primary school, 9 = junior high school, 12 = high school/technical secondary school/vocational high school/technical school, 15 = junior college/vocational school, 16= university undergraduate, 19 = master's degree, 22 = doctor's degree | |

| Association | Social capital, whether the enterprise joins the relevant industry association, 1 = Yes, 0 = No | |

| GDP | Province factor, Ln (GDP per capita of the province) | |

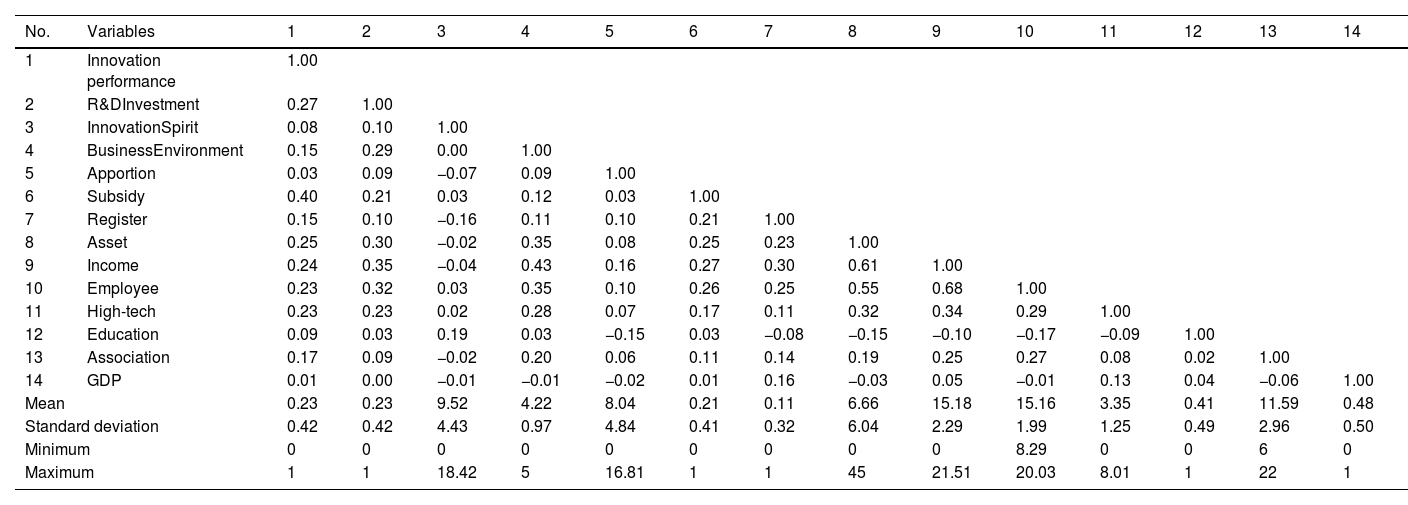

In Table 2, we present the descriptive statistics and correlation matrix for the sample of 905 MSEs. As expected, the correlations between the dependent and most independent variables are significant. The correlations for some independent variables are reasonably low, although some are significant. We checked the variance inflation factors (VIFs) for all independent variables and found that all VIFs were less than 2.5, far below the commonly used threshold of 10; this means that our results do not have multicollinearity problems. Among the 905 enterprises, the average value of innovation spirit is 4.221; 73.5% believe it is necessary to carry out innovation; and 62.8% have full-time R&D personnel—indicating that most MSEs attach importance to the innovation capabilities of their employees. Only 23.1% of the investigated enterprises successfully applied for patents in the categories of product innovation (58.5%), technology innovation (49.5%), and service innovation (37.3%)—indicating that the innovation performance of MSEs still needs to be improved.

Descriptive statistics and correlation matrix of the overall sample (905 firms).

| No. | Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Innovation performance | 1.00 | |||||||||||||

| 2 | R&DInvestment | 0.27 | 1.00 | ||||||||||||

| 3 | InnovationSpirit | 0.08 | 0.10 | 1.00 | |||||||||||

| 4 | BusinessEnvironment | 0.15 | 0.29 | 0.00 | 1.00 | ||||||||||

| 5 | Apportion | 0.03 | 0.09 | −0.07 | 0.09 | 1.00 | |||||||||

| 6 | Subsidy | 0.40 | 0.21 | 0.03 | 0.12 | 0.03 | 1.00 | ||||||||

| 7 | Register | 0.15 | 0.10 | −0.16 | 0.11 | 0.10 | 0.21 | 1.00 | |||||||

| 8 | Asset | 0.25 | 0.30 | −0.02 | 0.35 | 0.08 | 0.25 | 0.23 | 1.00 | ||||||

| 9 | Income | 0.24 | 0.35 | −0.04 | 0.43 | 0.16 | 0.27 | 0.30 | 0.61 | 1.00 | |||||

| 10 | Employee | 0.23 | 0.32 | 0.03 | 0.35 | 0.10 | 0.26 | 0.25 | 0.55 | 0.68 | 1.00 | ||||

| 11 | High-tech | 0.23 | 0.23 | 0.02 | 0.28 | 0.07 | 0.17 | 0.11 | 0.32 | 0.34 | 0.29 | 1.00 | |||

| 12 | Education | 0.09 | 0.03 | 0.19 | 0.03 | −0.15 | 0.03 | −0.08 | −0.15 | −0.10 | −0.17 | −0.09 | 1.00 | ||

| 13 | Association | 0.17 | 0.09 | −0.02 | 0.20 | 0.06 | 0.11 | 0.14 | 0.19 | 0.25 | 0.27 | 0.08 | 0.02 | 1.00 | |

| 14 | GDP | 0.01 | 0.00 | −0.01 | −0.01 | −0.02 | 0.01 | 0.16 | −0.03 | 0.05 | −0.01 | 0.13 | 0.04 | −0.06 | 1.00 |

| Mean | 0.23 | 0.23 | 9.52 | 4.22 | 8.04 | 0.21 | 0.11 | 6.66 | 15.18 | 15.16 | 3.35 | 0.41 | 11.59 | 0.48 | |

| Standard deviation | 0.42 | 0.42 | 4.43 | 0.97 | 4.84 | 0.41 | 0.32 | 6.04 | 2.29 | 1.99 | 1.25 | 0.49 | 2.96 | 0.50 | |

| Minimum | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8.29 | 0 | 0 | 6 | 0 | |

| Maximum | 1 | 1 | 18.42 | 5 | 16.81 | 1 | 1 | 45 | 21.51 | 20.03 | 8.01 | 1 | 22 | 1 | |

Note: Correlations above 0.055, 0.065, and 0.086 are significant at p < 0.1, p < 0.05, and p < 0.01, respectively.

Our model was set according to our theoretical assumptions. First, we measured the influence model of innovation spirit on innovation performance. Since innovation performance is a 0–1 variable, we adopted the Probit model:

InnovationPerformancei represents the innovation performance of firm i, InnovationSpiriti represents the innovation spirit of firm i, Xi is the control variable set, εi is the random error term.

Second, the mechanism model that the innovation spirit can promote innovation performance by increasing R&D investment was set. According to the survey sample, we found that 15.7% of the surveyed enterprises have no expenditure on R&D activities, indicating that the sample is truncated and the Tobit model should be adopted:

R&DInvestmenti represents the enterprise R&D investment of firm i. Based on Model (1), R&D investment is further added to obtain Model (3):

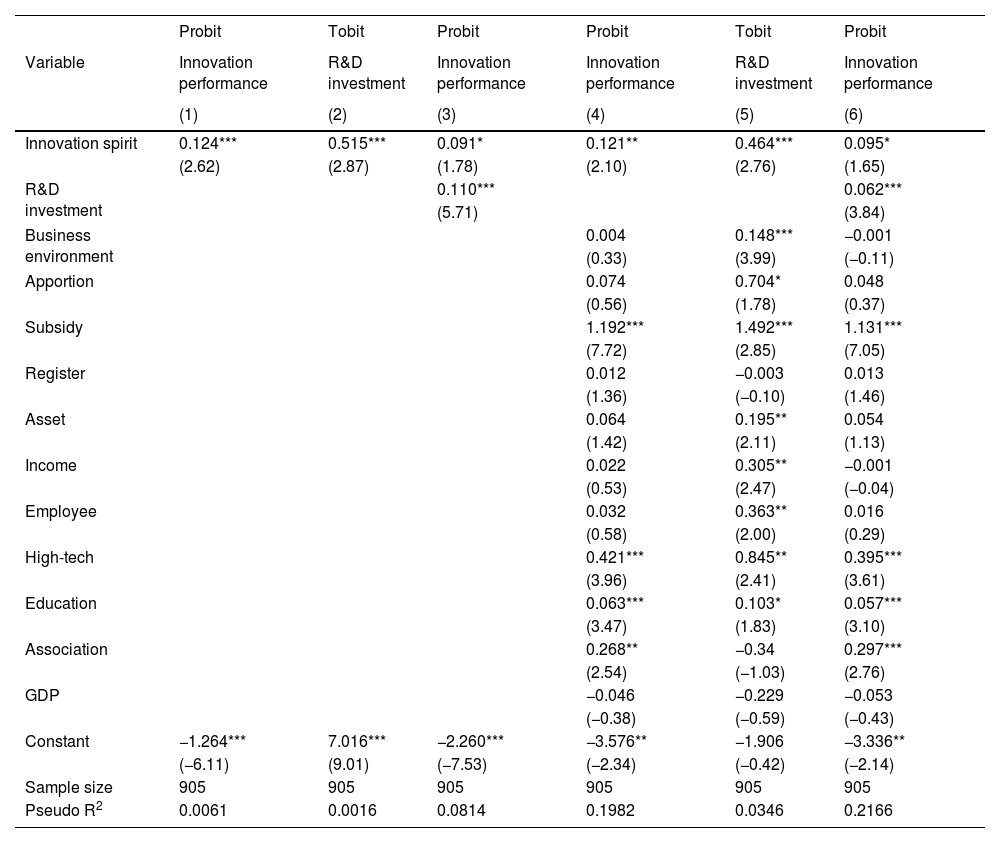

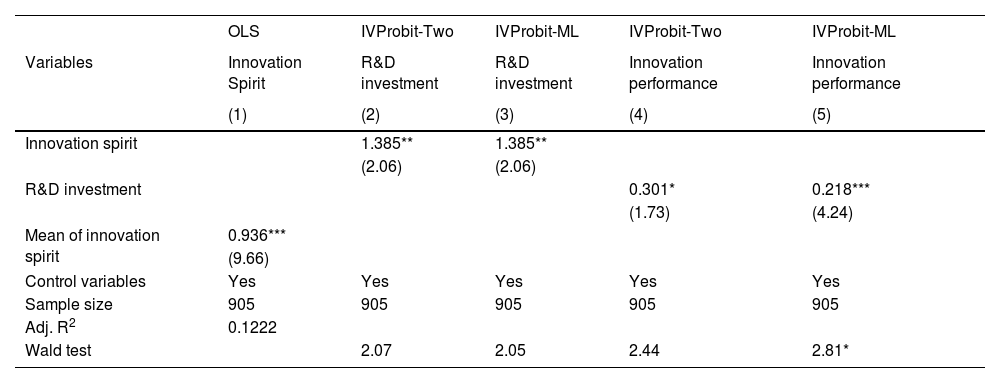

Analysis and resultsRegression resultsTable 3 demonstrates the relationship between innovation spirit, R&D investment, and innovation performance. First, the Probit model is used in column (1) to analyze the impact of innovation spirit on innovation performance. The results show that the impact of innovation spirit on innovation performance is significantly positive at 1%, and H1 is verified. In column (2), the Tobit model is used to analyze the impact of innovation spirit on R&D investment, and it shows that the impact is significantly positive at the level of 1%, and H2 is verified. In column (3), the influence of innovation spirit and R&D investment on innovation performance is analyzed simultaneously. The influence of innovation spirit on innovation performance is significantly positive at 10%, indicating that innovation spirit directly impacts innovation performance. The impact of R&D investment on innovation performance is significantly positive at the 1% level, and H3 is verified. According to the results of columns (2) and (3), innovation spirit has a direct impact on innovation performance, and meanwhile, it also has a significant promoting effect on innovation performance through R&D investment.

Innovation spirit, R&D investment, and innovation performance.

| Probit | Tobit | Probit | Probit | Tobit | Probit | |

|---|---|---|---|---|---|---|

| Variable | Innovation performance | R&D investment | Innovation performance | Innovation performance | R&D investment | Innovation performance |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Innovation spirit | 0.124*** | 0.515*** | 0.091* | 0.121** | 0.464*** | 0.095* |

| (2.62) | (2.87) | (1.78) | (2.10) | (2.76) | (1.65) | |

| R&D investment | 0.110*** | 0.062*** | ||||

| (5.71) | (3.84) | |||||

| Business environment | 0.004 | 0.148*** | −0.001 | |||

| (0.33) | (3.99) | (−0.11) | ||||

| Apportion | 0.074 | 0.704* | 0.048 | |||

| (0.56) | (1.78) | (0.37) | ||||

| Subsidy | 1.192*** | 1.492*** | 1.131*** | |||

| (7.72) | (2.85) | (7.05) | ||||

| Register | 0.012 | −0.003 | 0.013 | |||

| (1.36) | (−0.10) | (1.46) | ||||

| Asset | 0.064 | 0.195** | 0.054 | |||

| (1.42) | (2.11) | (1.13) | ||||

| Income | 0.022 | 0.305** | −0.001 | |||

| (0.53) | (2.47) | (−0.04) | ||||

| Employee | 0.032 | 0.363** | 0.016 | |||

| (0.58) | (2.00) | (0.29) | ||||

| High-tech | 0.421*** | 0.845** | 0.395*** | |||

| (3.96) | (2.41) | (3.61) | ||||

| Education | 0.063*** | 0.103* | 0.057*** | |||

| (3.47) | (1.83) | (3.10) | ||||

| Association | 0.268** | −0.34 | 0.297*** | |||

| (2.54) | (−1.03) | (2.76) | ||||

| GDP | −0.046 | −0.229 | −0.053 | |||

| (−0.38) | (−0.59) | (−0.43) | ||||

| Constant | −1.264*** | 7.016*** | −2.260*** | −3.576** | −1.906 | −3.336** |

| (−6.11) | (9.01) | (−7.53) | (−2.34) | (−0.42) | (−2.14) | |

| Sample size | 905 | 905 | 905 | 905 | 905 | 905 |

| Pseudo R2 | 0.0061 | 0.0016 | 0.0814 | 0.1982 | 0.0346 | 0.2166 |

Note. The value of t-statistics reported in parentheses; ***, **, * indicate that the bilateral test is significant at 1%, 5%, and 10%, respectively.

By adding the control variables of the business environment, enterprise level, and regional level based on columns (1), (2), and (3), the results of columns (4), (5), and (6) can be obtained. It can be found that the size, sign, and significance level of regression coefficients of innovation spirit and R&D investment are unchanged. It indicates that H1, H2, and H3 are verified after adding control variables.

As for the influence of control variables on R&D investment and innovation performance, we found a significant positive correlation between rent-seeking, corruption, and R&D investment. In China, the lack of a market system, rent-seeking, and corruption have distorted the positive effects on enterprise R&D investment, suggesting that China should improve its market system, optimize its business environment, and enhance the innovation vitality of enterprises. Government subsidies have a significant promoting effect on R&D investment and innovation performance. Firm assets, income, employee scale, and R&D investment correlate significantly. The high-tech industry's R&D investment and innovation performance are significantly higher than other industries. The higher the level of human capital, the higher the R&D investment and innovation performance. Social capital plays a significant role in improving innovation performance.

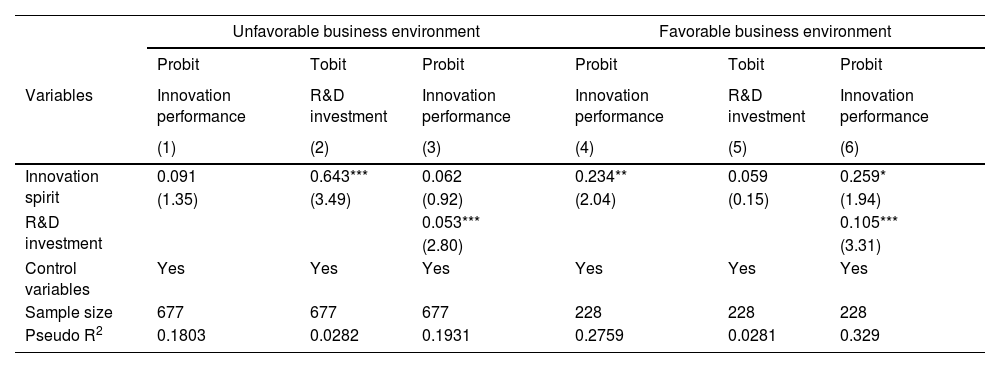

Mechanism analysis: the moderating role of the business environmentTo test the influence mechanism of the business environment on the relationship between innovation spirit and innovation performance of MSEs, we conducted sample regression according to the merits and demerits of the business environment and whether the enterprise has entertainment expenses (Table 4). According to the results in columns (1), (2), and (3), we found that in the regions with a less favorable business environment, the innovation spirit of MSEs only has a significant positive correlation with R&D investment and its influence on innovation performance is not significant, indicating that innovation spirit can only improve enterprise innovation performance by influencing R&D investment. This is due to an unfavorable business environment and the obstruction of formal financing channels. MSEs with a stronger innovative spirit are more likely to obtain external financial support from banks and governments through rent-seeking and corruption to increase enterprise R&D investment. However, the complexity of the administrative examination and approval system—such as in the patent application process—makes the direct impact of innovation spirit on innovation performance insignificant. With the optimization of the business environment, the impact of innovation spirit on innovation performance changes, as shown in columns (4), (5), and (6). Optimizing the business environment helps MSEs reduce institutional transaction costs and minimize the channels of rent-seeking and corruption, making it more difficult for enterprises to obtain financial support, such as government innovation subsidies through rent-seeking and corruption. Therefore, the relationship between innovation spirit and R&D investment is no longer significant. At the same time, the business environment is optimized to improve the efficiency of administrative examinations related to innovation—such as trademark registration and patent application—to facilitate processes. Therefore, a significant positive correlation exists between innovation spirit and enterprise innovation performance, and H4 is verified.

Mechanism analysis: The moderating effect of the business environment.

| Unfavorable business environment | Favorable business environment | |||||

|---|---|---|---|---|---|---|

| Probit | Tobit | Probit | Probit | Tobit | Probit | |

| Variables | Innovation performance | R&D investment | Innovation performance | Innovation performance | R&D investment | Innovation performance |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Innovation spirit | 0.091 | 0.643*** | 0.062 | 0.234** | 0.059 | 0.259* |

| (1.35) | (3.49) | (0.92) | (2.04) | (0.15) | (1.94) | |

| R&D investment | 0.053*** | 0.105*** | ||||

| (2.80) | (3.31) | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 677 | 677 | 677 | 228 | 228 | 228 |

| Pseudo R2 | 0.1803 | 0.0282 | 0.1931 | 0.2759 | 0.0281 | 0.329 |

Note. The control variables include all the control variables mentioned above. To save space, they are not listed.

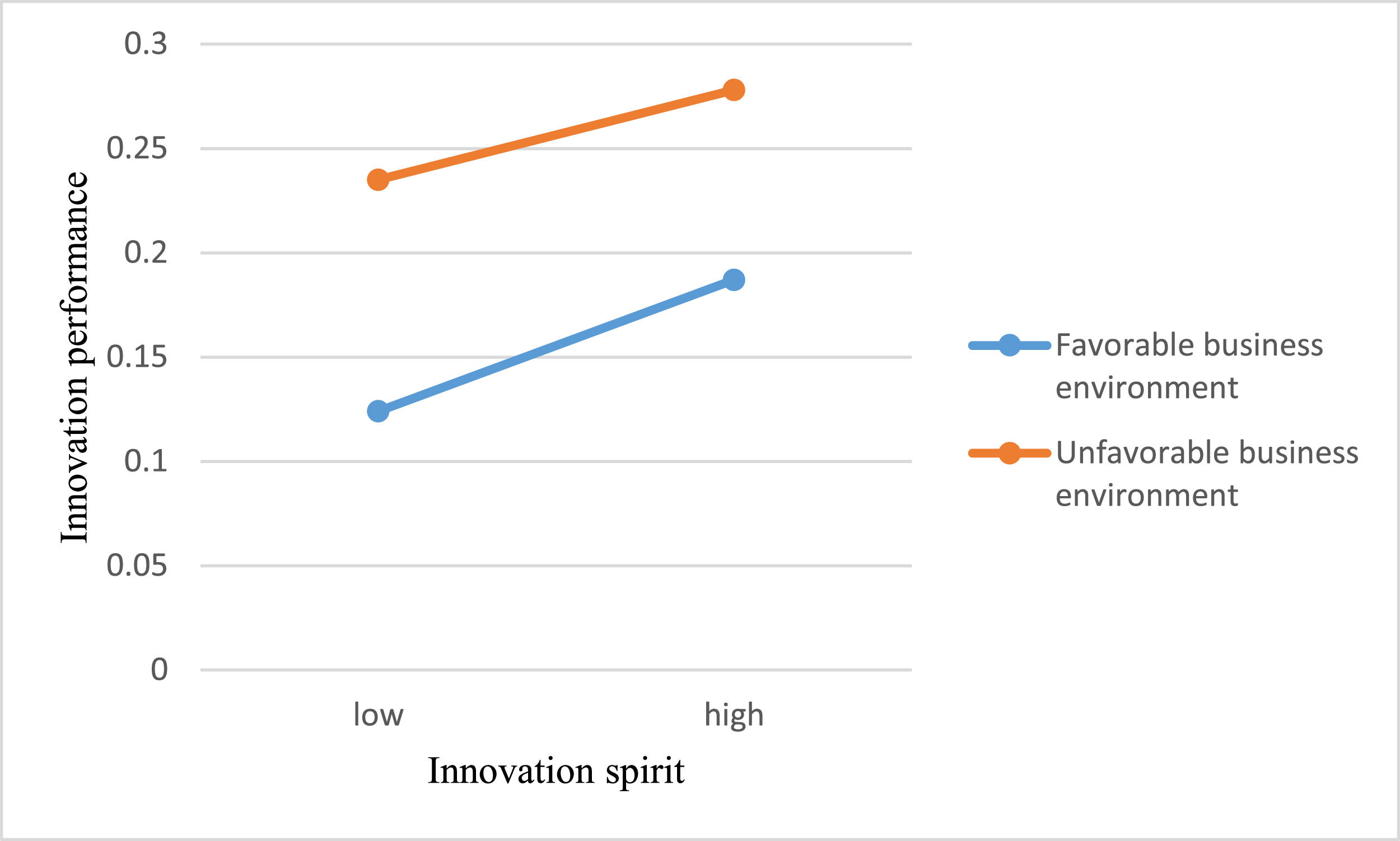

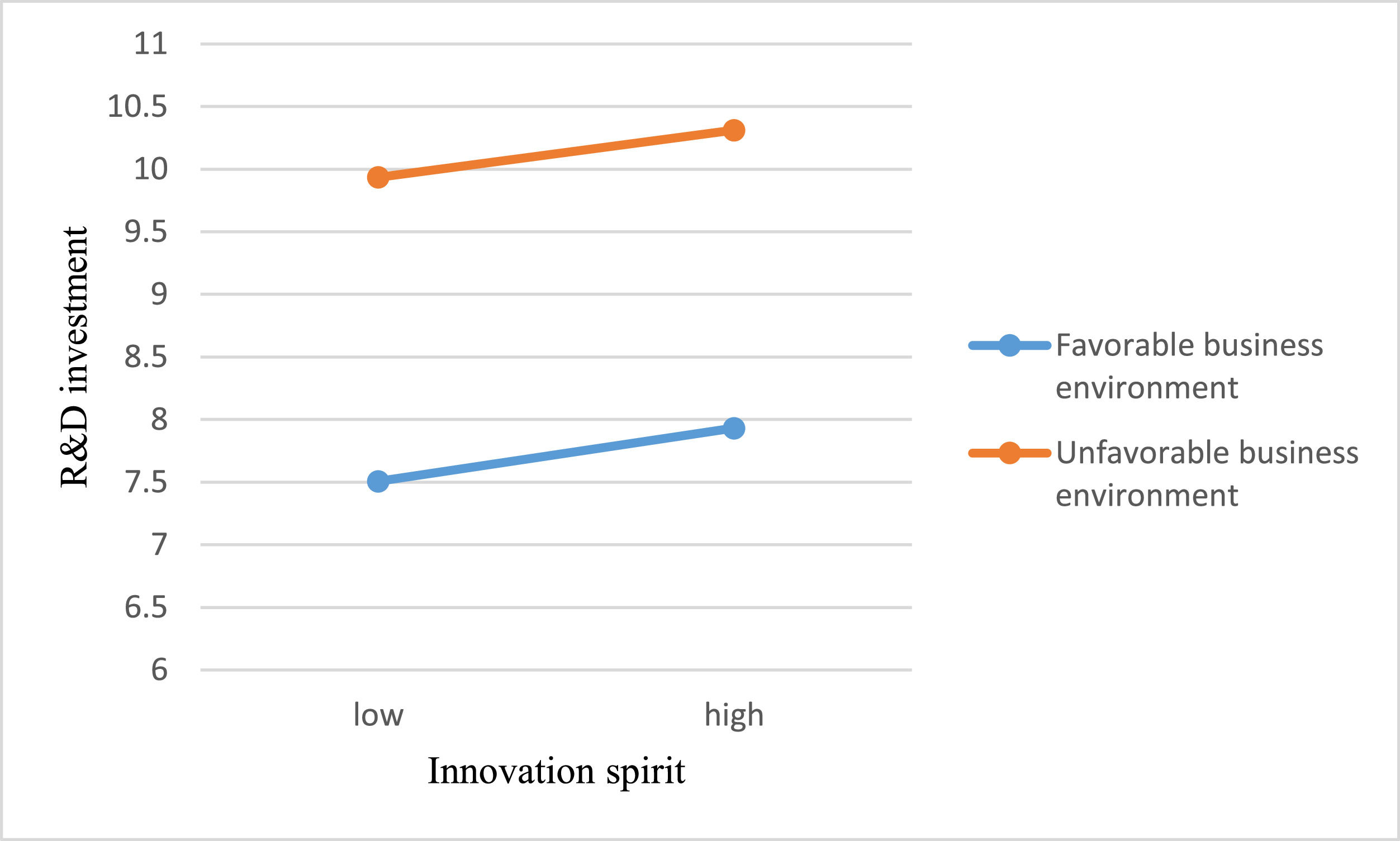

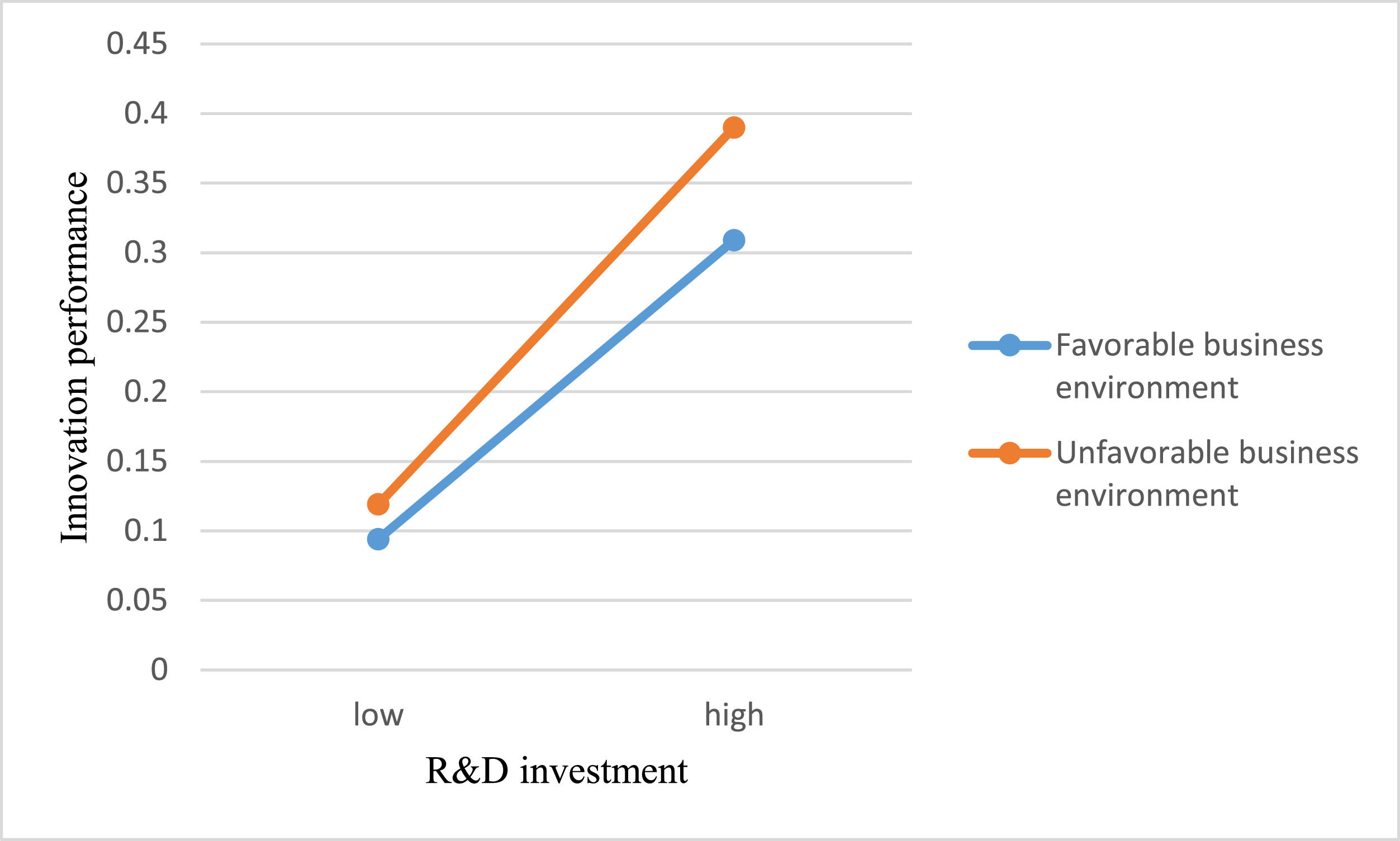

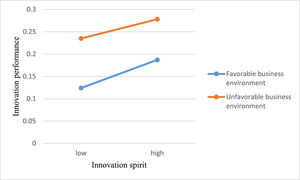

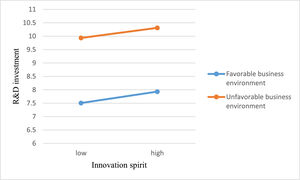

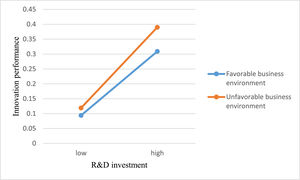

To interpret the significance of innovation spirit and business environment on R&D investment and performance, we followed recommended practices (Tse et al., 2021) to plot high versus low values using median splits. Figs. 2–4 show the analysis results graphically. In Fig. 2, the slope of the two lines is positive, which means that the effect of innovation spirit on innovation performance is positive, verifying H1. And the slope is larger for a favorable business environment than for an unfavorable business environment, which means that the effect of innovation spirit on innovation performance is stronger for a favorable business environment than for an unfavorable business environment, verifying H4. Similarly, in Fig. 3, the effect of innovation spirit on R&D investment is positive and stronger for an unfavorable business environment than for a favorable business environment, which is not significant, verifying H2 and H4. Finally, in Fig. 4, the effects of R&D investment on innovation performance are positive for both a favorable and an unfavorable business environment, verifying H3. All three graphs confirm our hypotheses.

Endogenous checks. In this paper, we studied the influence of enterprise innovation spirit on R&D investment and, thus, on enterprise innovation performance. However, owing to bidirectional causality, omission variables, and measurement errors, endogenous problems may exist. The greater MSEs’ investment in innovation, the more importance they attach to innovation, and the stronger their innovative spirit. Meanwhile, the higher a firm's innovation performance, the greater a firm's R&D investment. In addition, enterprises' R&D investment and innovation performance may be affected by customs, culture, history, society, and other factors. Innovation spirit is a relatively abstract concept, and there may be some measurement errors in the investigation and measurement. Therefore, the endogeneity of our model needs to be considered.

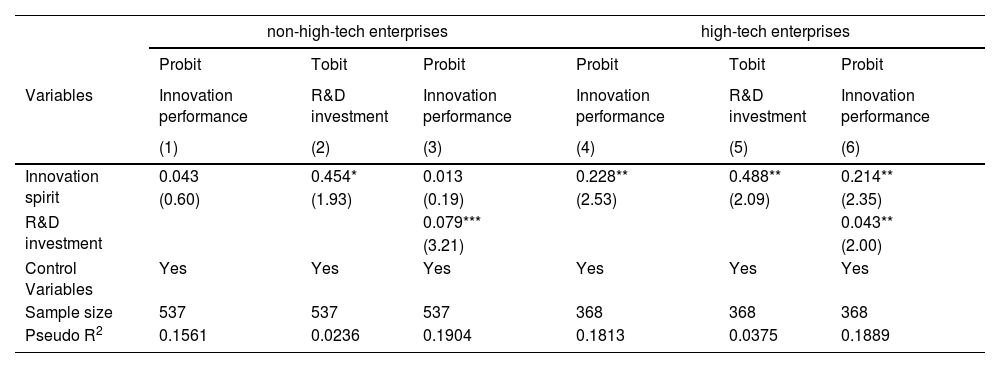

First, this paper used the average value of all enterprises' innovation spirit in the same city as the instrumental variable of enterprise innovation spirit. The innovation spirit of enterprises is closely related to the level of regional economic and social development and the innovation environment, so the innovation spirit of enterprises in the same region is highly correlated. Moreover, using the average value of the innovation spirit of all enterprises as the instrumental variable ensures the exogeneity of the instrumental variable. The regression results of instrumental variables are shown in Table 5. Column (1) used ordinary least squares (OLS) regression to estimate the impact of regional enterprise average innovation spirit on enterprise innovation spirit. The influence coefficient is 0.936, which is significant at the 1% level, and the F statistic is 12.54, greater than 10, which proves the effectiveness of instrumental variables to a certain extent. Column (2) is listed as the estimation results of the two-stage Probit model of the instrumental variable method (IVProbit-Two), the enterprise innovation spirit and R&D investment are still significantly positively correlated, and the size and significance of the estimated coefficient of the control variable are essentially unchanged. The Wald exogenous test accepts the null hypothesis that innovation spirit is an exogenous variable at the significance level of 5%. It shows that the innovation spirit does not have an endogeneity problem. In a two-stage regression model, the first phase of the error could be into the second phase. Therefore, the two-phase model is less efficient than the maximum likelihood estimation method. We further used the maximum likelihood Probit model (IVProbit-ML) to estimate the instrumental variable model. As shown in column (3), enterprise innovation spirit is still significantly positively correlated with R&D investment, and innovation spirit is an exogenous variable.

Regression analysis results of endogeneity test.

| OLS | IVProbit-Two | IVProbit-ML | IVProbit-Two | IVProbit-ML | |

|---|---|---|---|---|---|

| Variables | Innovation Spirit | R&D investment | R&D investment | Innovation performance | Innovation performance |

| (1) | (2) | (3) | (4) | (5) | |

| Innovation spirit | 1.385** | 1.385** | |||

| (2.06) | (2.06) | ||||

| R&D investment | 0.301* | 0.218*** | |||

| (1.73) | (4.24) | ||||

| Mean of innovation spirit | 0.936*** | ||||

| (9.66) | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Sample size | 905 | 905 | 905 | 905 | 905 |

| Adj. R2 | 0.1222 | ||||

| Wald test | 2.07 | 2.05 | 2.44 | 2.81* |

Note. The control variables include all the control variables mentioned above. To save space, they are not listed.

Second, innovation spirit is used as the instrumental variable of R&D investment, and IVProbit-Two and IVProbit-ML are respectively used to estimate the impact of R&D investment on innovation performance. As shown in columns (4) and (5), we found that the positive influence of R&D investment on innovation spirit is still significant. The size and significance of the estimation coefficients of the control variables did not change. The Wald exogenous test accepted the null hypothesis that R&D investment was an exogenous variable at the significance level of 5%, indicating no serious endogeneity problem of R&D investment. To sum up, after considering the endogenous problem of innovation spirit and R&D investment, the conclusions of this paper are still robust.

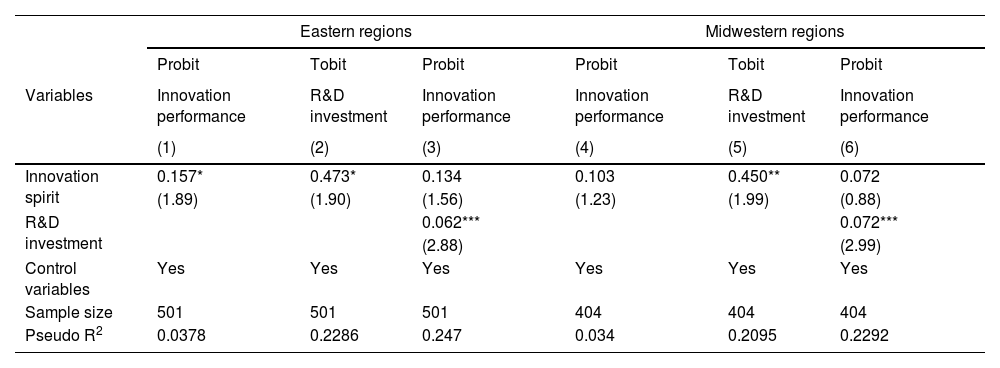

Subsample estimation. First, we used the subsample regression method according to whether the enterprise belongs to the high-tech category, and the estimated results are shown in Table 6. For non-high-tech enterprises, the intermediate effect of enterprise innovation spirit on improving innovation performance through influencing R&D investment is still held, but the direct effect of innovation spirit on innovation performance is not significant. The positive impact of innovation spirit on R&D investment and innovation performance of high-tech enterprises is significant at the level of 5%, which indicates that the impact of innovation spirit on R&D investment and innovation performance of high-tech enterprises is greater than that of non-high-tech enterprises. The high-tech enterprises have higher demand and spirit of innovation, so they can get more R&D investment and innovation performance, verifying H1, H2, and H3.

Grouping regression analysis results based on industry.

| non-high-tech enterprises | high-tech enterprises | |||||

|---|---|---|---|---|---|---|

| Probit | Tobit | Probit | Probit | Tobit | Probit | |

| Variables | Innovation performance | R&D investment | Innovation performance | Innovation performance | R&D investment | Innovation performance |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Innovation spirit | 0.043 | 0.454* | 0.013 | 0.228** | 0.488** | 0.214** |

| (0.60) | (1.93) | (0.19) | (2.53) | (2.09) | (2.35) | |

| R&D investment | 0.079*** | 0.043** | ||||

| (3.21) | (2.00) | |||||

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 537 | 537 | 537 | 368 | 368 | 368 |

| Pseudo R2 | 0.1561 | 0.0236 | 0.1904 | 0.1813 | 0.0375 | 0.1889 |

Note. The control variables include all the control variables mentioned above. To save space, they are not listed.

Second, we divided the sample into eastern and midwestern regions for estimation according to the enterprises’ location, and the results are shown in Table 7. It shows that the effect of innovation spirit on innovation performance is still positive and significant in eastern regions, and the effect of innovation spirit on R&D investment is more significant in midwestern regions than in eastern regions. It is because the business environment in eastern regions is more favorable than that in midwestern regions. In eastern regions with a favorable business environment, the innovation spirit of MSEs has a significant impact on innovation performance, but in midwestern regions with unfavorable business environment, the innovation spirit of MSEs influences innovation performance mainly through R&D investment, verifying H4.

Grouping regression analysis results based on region.

| Eastern regions | Midwestern regions | |||||

|---|---|---|---|---|---|---|

| Probit | Tobit | Probit | Probit | Tobit | Probit | |

| Variables | Innovation performance | R&D investment | Innovation performance | Innovation performance | R&D investment | Innovation performance |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Innovation spirit | 0.157* | 0.473* | 0.134 | 0.103 | 0.450** | 0.072 |

| (1.89) | (1.90) | (1.56) | (1.23) | (1.99) | (0.88) | |

| R&D investment | 0.062*** | 0.072*** | ||||

| (2.88) | (2.99) | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 501 | 501 | 501 | 404 | 404 | 404 |

| Pseudo R2 | 0.0378 | 0.2286 | 0.247 | 0.034 | 0.2095 | 0.2292 |

Note. The control variables include all the control variables mentioned above. To save space, they are not listed.

In addition, we checked the conclusion's robustness by replacing metrics and estimation methods. First, we changed the measurement index of innovation spirit and used "whether innovation is necessary" and "whether there is full-time R&D personnel" as the substitution variable of innovation spirit. Second, we changed the measurement index of innovation performance. This paper used product, technology, service, and other innovations as substitution variables for innovation performance. Third, we used OLS and logit models instead of Probit models for estimation. It shows that the conclusions are still reliable after robustness checks.

Discussion and implicationsDiscussion and conclusionsBased on the microdata of the 2015 CMES, we examined the influence mechanism of innovation spirit on R&D investment and innovation performance of MSEs, as well as the moderating effect of business environment. Innovation of MSEs, R&D expenditure, and several patent applications were used to measure innovation spirit, R&D investment, and innovation performance. Micro-econometric models such as Probit and Tobit were used for regression analysis. Through theoretical analysis and empirical testing, our research results enrich the literature on the mechanism of the impact of innovation spirit on innovation performance and provide a theoretical basis for promoting innovation development and optimizing the business environment of MSEs in China.

Our theoretical and empirical research results show that the innovation spirit of MSEs can directly promote improving enterprise innovation performance. The stronger the innovative spirit of MSEs, the higher the importance they attach to innovation, and the more actively they will perform R&D activities—such as researching and developing new products and introducing new technologies and production modes—explore new markets, develop supply channels, provide new services, commit to organizational innovation, actively apply for patents, and seize innovation opportunities, thus improving their innovation performance. This result is congruent with many similar empirical studies of Bel (2010) and Chaithanapat et al. (2022), who focused on leadership and innovation. This result also confirms Ding et al. (2019) finding that innovation spirit can improve innovation performance.

Second, innovation spirit is conducive to increasing the R&D investment of MSEs. Enterprises with a stronger innovation spirit will increase their R&D investment through internal finance sources, and they will also be more proactive in obtaining funding through external finance sources such as bank loans and government subsidies. The findings align with previous findings that claimed innovation spirit could enhance R&D investment (Ahmad et al., 2021; Kou et al., 2020).

Third, R&D investment is conducive to improving the innovation performance of MSEs. The greater their investment in innovation, the more likely they are to innovate in products, technologies, services, and systems, and the more likely they are to apply for patents. Therefore, R&D investment is an important internal transmission mechanism of innovation spirit affecting innovation performance. This study confirms prior studies (Andries & Hünermund, 2020; Hall et al., 2013; Kou et al., 2020; Shin et al., 2022; Xu et al., 2021; Yildiz et al., 2013) that found positive relationships of R&D investment with innovation performance.

Finally, the business environment impacts the relationship between the innovation spirit, R&D investment, and innovation performance of MSEs. This finding extends the literature on these variables (Chaithanapat et al., 2022; Prajogo, 2016; Tsai & Yang, 2013; Zheng et al., 2021; Zuo & Lin, 2022). In regions with an unfavorable business environment, MSEs may obtain bank loans and government subsidies through rent-seeking and corruption. Therefore, the innovation spirit of MSEs improves innovation performance by influencing enterprises to increase R&D investment. With the optimization of the business environment, the rent-seeking and corrupt activities of MSEs to obtain subsidies will be restricted, and the efficiency of governments’ innovation, administrative examination, and approval processes will be improved. Therefore, the innovation spirit of MSEs will directly affect innovation performance. Our research results are still robust after the endogeneity test, replacement of the measurement index, subsample estimation, and replacement of the estimation method.

ImplicationsOur research results have important theoretical and practical implications for implementing innovation-driven strategies and improving the business environment. As a vital component of entrepreneurship, innovation spirit plays a vital role in the R&D investment and innovation performance of enterprises and provides empirical support for realizing innovation at the micro level. Second, enterprises can improve their innovative spirit by conducting innovation training for their employees and thus achieve higher levels of innovation and development in their enterprises. Third, improving the business environment can reduce the institutional transaction costs of enterprises, eliminate the negative inductive effects caused by rent-seeking and corruption, and encourage enterprises to perform R&D activities through formal channels. The simplification of administrative approval processes and improvement of activities such as patent applications provide a basis for further optimizing and reforming the business environment in China.

Limitations and future directionsOur study has some limitations. First, sampling was limited by data collection—using cross-section data ignores the dynamic development and change of enterprise innovation activities over time. Second, some respondents did not answer the questions related to innovation, and those that did not answer were excluded; thus, our sample size was relatively small, and there may be a selective bias. In addition, we analyzed the moderating effect of the business environment on the relationship between innovation spirit and innovation performance but did not examine the business environment in detail. Different aspects of the business environment may affect enterprise innovation performance differently. Future researchers should use more detailed survey data to study the different effects of firm heterogeneity and institutional environment on firm innovation.

CRediT authorship contribution statementXingmin Yin: Conceptualization, Formal analysis, Funding acquisition, Methodology, Project administration, Resources, Writing – original draft. Luyao Qi: Writing – review & editing, Investigation, Software, Data curation. Jianyue Ji: Conceptualization, Funding acquisition, Supervision, Visualization, Writing – review & editing. Jinglin Zhou: Validation, Writing – review & editing.

This study was supported by the Soft Science Research Project of Shandong Province (Grant no. 2022RZB03023); the Fundamental Research Funds for the Central Universities (Grant no. 202113007); the National Social Science Fund of China (Grant no. 19VHQ007); the National Natural Science Foundation of China (Grant no. 71873127).