This study conceptualizes the novel concept of generative capability, a unique capability by which firms organize experiential learning activities to achieve fast and iterative innovation. Employing a mixed-method research design, we first explored the theoretical framework of generative capabilities through an inductive case study to identify its dimensions. On this basis, we also developed measurement scales for generative capability. We then used survey data on a sample of 212 Chinese firms to test the construct and criterion validity of generative capability. Our findings show that generative capability can be captured by a second-order reflective construct with the three dimensions of knowledge acquisition, knowledge inheritance, and knowledge updating, and that capability is positively associated with firm innovation performance.

How can firms continuously and sustainably pursue innovation? The literature on product innovation has examined product innovation as a discrete event, focusing on the factors contributing to the development of a specific new product (Slater, Mohr & Sengupta, 2014; West & Bogers, 2014). Comparatively, less attention has been paid to continuous product innovations, which is defined as “the generation of multiple new products, as strategically necessary over time, with a reasonable rate of commercial success (Dougherty & Hardy, 1996, p. 1121)”. This temporal perspective of innovation is crucial for competing in an increasingly dynamic environment (Ancona, Okhuysen & Perlow, 2001).

While prior studies have found that discrete product innovation is associated with R&D resources (Song & Chen, 2014), R&D speed (Zhu, Xiao, Dong & Gu, 2019), market orientation (Joshi, 2016), and absorptive capacity (Santoro, Bresciani & Papa, 2020), it is unlikely that simply assembling these conditions is sufficient for firms to continuously introduce superior new products through successive innovation projects (Wang & Chen, 2018). Instead, other firm-level capabilities may drive the process and deliver the outcomes of continuous product innovation. This study proposes the concept of generative capability to incorporate key organizational routines that underlie continuous product innovation.

Specifically, this study conceptualizes, measures, and validates generative capability as an overarching capability that enables continuous product innovation. Scholars have considered innovation as the recombination of existing components (Schumpeter, 1939; Taylor, 2010) Fleming (2001). argued that the source of technological uncertainty is searching for processes with unfamiliar components and their combinations, which can result in both technological failure and breakthrough. Adopting a knowledge-based view, we propose that generative capability is manifested in a firm's high-level routines that reconfigure knowledge embodied within the product generation iteratively and re-bundle external and internal knowledge rapidly across product generations to develop the next-generation product. Generative capability enables firms to carry out cross-functional processes of redeploying internal and external competencies (Dougherty & Hardy, 1996; Garud, Gehman & Kumaraswamy, 2011; Soosay, Hyland & Ferrer, 2008), as well as the design processes of knowledge reconfiguration and design iteration (Eisenhardt & Bingham, 2017; Eisenhardt & Tabrizi, 1995; McKinley, Latham & Braun, 2014). Therefore, we believe that generative capability can enable firms to reduce technological uncertainty and the risk of R&D failure in the process of product development. This study aims to conceptually clarify the dimensions of generative capability as a driver of continuous product innovation and to empirically establish its construct and criterion validity.

To achieve this, we adopted a mixed-method design. We first conducted qualitative research to explore the theoretical framework of generative capability from in-depth interviews with eight high-tech companies in China. Findings from this qualitative phase allow us to establish the dimensions and structure of the construct of generative capability and propose measures for the dimensions. In the subsequent quantitative research phase, using survey data from a random sample of 212 Chinese high-tech companies, we empirically verified the proposed measurement and theoretical models to demonstrate the construct and criterion validities of generative capability. Our quantitative findings support generative capability as a second-order reflective construct, based on three key organizational routines: knowledge acquisition, knowledge inheritance, and knowledge updating.

The remainder of this paper is organized as follows. Following this introduction, we identify the literature gap in continuous product innovation and introduce the concept of generativity in different research fields. After linking generativity to product innovation literature, we develop an overarching framework for our theory development. Next, we proceed to the qualitative phase of this mixed-method research, where, through an inductive approach based on qualitative interviews, we elaborate on the conceptual structure and dimensions of generative capability. This is followed by the second phase, namely, a quantitative empirical study to validate the scale and test the hypotheses using survey data. We conclude the paper with a discussion of the main findings, theoretical contributions, implications for practice, limitations, and future research.

Literature reviewContinuous product innovationsDespite their different research contexts, scholars of continuous product innovations1 commonly emphasize its importance because of its function in coping with changing environments, seizing opportunities, and achieving sustained competitive advantage (Dougherty, 2001; Kim, Kim & Foss, 2016; Soosay et al., 2008). The central question in this research field is how firms can achieve continuous production innovation. The literature shows that achieving product innovation continuality is a complex process (Boer, Caffyn, Corso, Coughlan, Gieskes, & Magnusson, 2001; Dougherty & Hardy, 1996; Garud et al., 2011). Using qualitative data from 15 large organizations, Dougherty and Hardy (1996) found that large firms had difficulty achieving continuous innovation because they could not solve innovation-to-organization problems, such as the inability to connect new products with organizational resources, processes, and strategy Dougherty (2001). also articulated the image of work (in other words, an understanding of the work to be done) for sustained product innovation by comparing people's shared images of work in innovative and non-innovative organizations. His-findings showed that, in contrast to the image of work in non-innovative organizations, which is based on passive maintenance of the system, people in innovative organizations understand that value creation is achieved by the situated practice of problem solving with customers, which requires the development and maintenance of long-term working relationships with customers.

To explore how firms can achieve continuous production innovation, other scholars utilize longitudinal case evidence. For instance, Lazonick and Prencipe (2005) analyzed the development history of the Rolls-Royce Plc and found that strategic control and financial commitment play important roles in the process of continuous innovation. Top managers who make strategic decisions must have the capabilities and motivations to pour resources into innovation. Based on an in-depth study of innovation practices of 3 M Corporation, Garud et al. (2011): 760) identified how complexity arrangements, which they describe as “an intertwined set of arrangements capable of simultaneously addressing different complexities,” can facilitate sustained innovation. They found that through complex arrangements, 3 M can interweave actors, artifacts, and practices over time and enable productive nonlinear innovation.

In addition to the literature mentioned above, scholars also investigate continuous product innovations from different perspectives, such as organizational learning (Ballé, Morgan & Sobek, 2016), knowledge management (Kaminska & Borzillo, 2016; Kim et al., 2016), quality management (Cole, 2002), and supply chain management (Soosay et al., 2008). As such, existing insights into continuous product innovation are largely fragmented and primarily interpretative in nature. A clearly conceptualized and measurable construct pertaining to the core capability of enabling continuous product innovation is lacking. This hinders the bridging and synthesis of different research streams to better address the challenges of continuous product innovation. To address this knowledge gap, this study aims to explicate the conceptualization and operationalization of generative capability, which may serve as a foundation for further research to advance our understanding of continuous product innovation.

The notion of generativityThe concept of generative capability is centered on the notion of generativity, which has been introduced in multiple research fields. For instance, in linguistics, “generative grammar” has been developed as a theory that considers grammar as a system of basic rules that can generate infinite syntactical configurations (Chomsky, 2006). In the area of social policy research, Schön (1993) put forward the concept of “generative metaphor,” through which people's perspectives on the world can be changed, and new insights can be gained. Similarly, in the field of social psychology, Gergen (2012) proposed the notion of “generative capacity” to describe the ability of a theory or idea that challenges the status quo to enable out-of-the-box thinking Avital and Te'Eni (2009.: 349) also introduced the concept of “generative capacity” in the information systems field, by which they capture “one's ability to reframe reality and subsequently to produce something ingenious or at least new in a particular context”. Beyond the above-mentioned research fields, the notion of “generative” has also been applied in the areas of emergence (Lichtenstein, 2014), architecture (Alexander, 1999), computer design (Frazer, 2002), internet technology (Zittrain, 2008), and strategic partnerships (Remneland-Wikhamn, Ljungberg, Bergquist & Kuschel, 2011).

One consistency that emerges from this diverse literature suggests that generativity involves the transformation of patterns and the creation of new knowledge based on existing knowledge. In the product innovation context, the notion of “generativity” is particularly relevant because by reorganizing and upgrading the knowledge related to existing products, firms can continuously launch new-generation products, thus achieving continuous product innovation and gaining sustained competitive advantage. The new generation of products can be improved versions of the previous generation of products, or brand new products in a new market segment that spawned from the previous generation of products. In this regard, Ahuja, Lampert and Novelli (2013): 248) coined the concept of “generative appropriability,” which they define as “a firm's effectiveness in capturing the greatest share of future inventions spawned by its existing inventions”. An example of this concept is that Apple combined the innovative features of iPod and the functions of telecommunication to create the iPhone. Inspired by previous research (Ahuja et al., 2013; Sun & Zou, 2019) and our observations of many leading firms, we propose the concept of generative capability to examine the mechanism of firms’ continuous product innovation. From a knowledge-based perspective (Grant, 1996a, 1996b), we define generative capability as a firm's high-level routine that reconfigures knowledge embodied within the product generation iteratively, and that re-bundles external and internal knowledge rapidly across product generations to develop the next-generation product.

Generative capability is particularly relevant for multigenerational product development, which involves the evolution of firms’ knowledge and behaviors. Through this process, firms can accumulate knowledge and improve their product development procedures (Eisenhardt & Tabrizi, 1995). Similar to situated learning (Lave, Wenger & Wenger, 1991), learning by doing through multiple iterations is better than less participative learning. By developing multiple generation products, firms’ knowledge about the market, technology, and products can be enhanced because of the exploratory learning process (Krishnan & Ulrich, 2001; McGrath, 2001). For example, software companies add several new functions when they update their products to test customers’ demand, and there is evidence suggesting that frequent product updates can lead to better performance (Lee & Raghu, 2014; McIlroy, Ali & Hassan, 2016). By integrating external knowledge (such as customer knowledge and competitor knowledge) and internal knowledge, firms can develop superior next-generation products; thus, new market opportunities can be seized (Wang & Chen, 2018). It is conceivable that multi-generational product development involves the development and configuration of various firm capabilities. According to Collis (1994) and Zollo and Winter (2002), capabilities can exist on different levels, where first-order capabilities refer to routines that reconfigure the organizational resource base and second-order capabilities are routines that reconfigure first-order capabilities. To facilitate theoretical precision, we further treat generative capability as a second-order “learning-to-learn capability” (Schilke, 2014).

Although we have proposed the concept of generative capability based on the literature and our observation of leading firms’ practices, we still do not know what organizational routines substantiate a firm's generative capability. In other words, how is generative capability manifested in firms’ experiential learning? To answer this question, we use a mixed-method research design (e.g., Molina-Azorin, 2012) to first explore the conceptualization and operationalization of generative capability, and then empirically validate them. The following sections report the qualitative and quantitative phases of the study.

Conceptual development through qualitative case studyResearch setting and data collectionAs the purpose of this phase is to investigate how firms can build their capability for continuous product innovation and to explore firms’ behaviors that can reflect generative capability, theoretical sampling is employed to choose cases where the focal phenomenon is likely to occur. A valid case should meet the following criteria: (1) the firm has its own R&D department; (2) the firm has multigenerational product development experience and has launched at least two generations of products; and (3) the firm's products can be physical or software products. Following these criteria, we conducted 25 in-depth face-to-face semi-structured interviews with participants from eight leading Chinese high-technology companies, including Huawei, ZET, Tencent, and Baidu. (See Table 1) between June to August 2015. The interviews lasted for an average of 90 min each, and were audio recorded and later transcribed. Over 120,000 (Chinese) words of qualitative data consisting of interview transcripts and detailed notes were collected from the interviews.

Interview sources.

All interviewees were middle or senior managers in the R&D departments of the case firms. For each interviewee, after securing his or her agreement, we held a face-to-face meeting of about two hours with recording. In creating the protocol, we use Kvale (1996) framework of conversational, qualitative interviewing as a guide to ensure that our interviews elicit information relevant to our research questions. Based on these guidelines, we developed an open-ended interview protocol2 that focuses on (a) iterative product development, (b) knowledge iteration and integration mechanism, (c) internal factors related to generative capability, and (d) external factors affecting generative capability. During the interviews, we asked the interviewee questions such as “in the process of product development in your company, do you attach great importance to the multi-generational development of products, can you give an example?” and “how do you make sure the next generation of products is always better?”

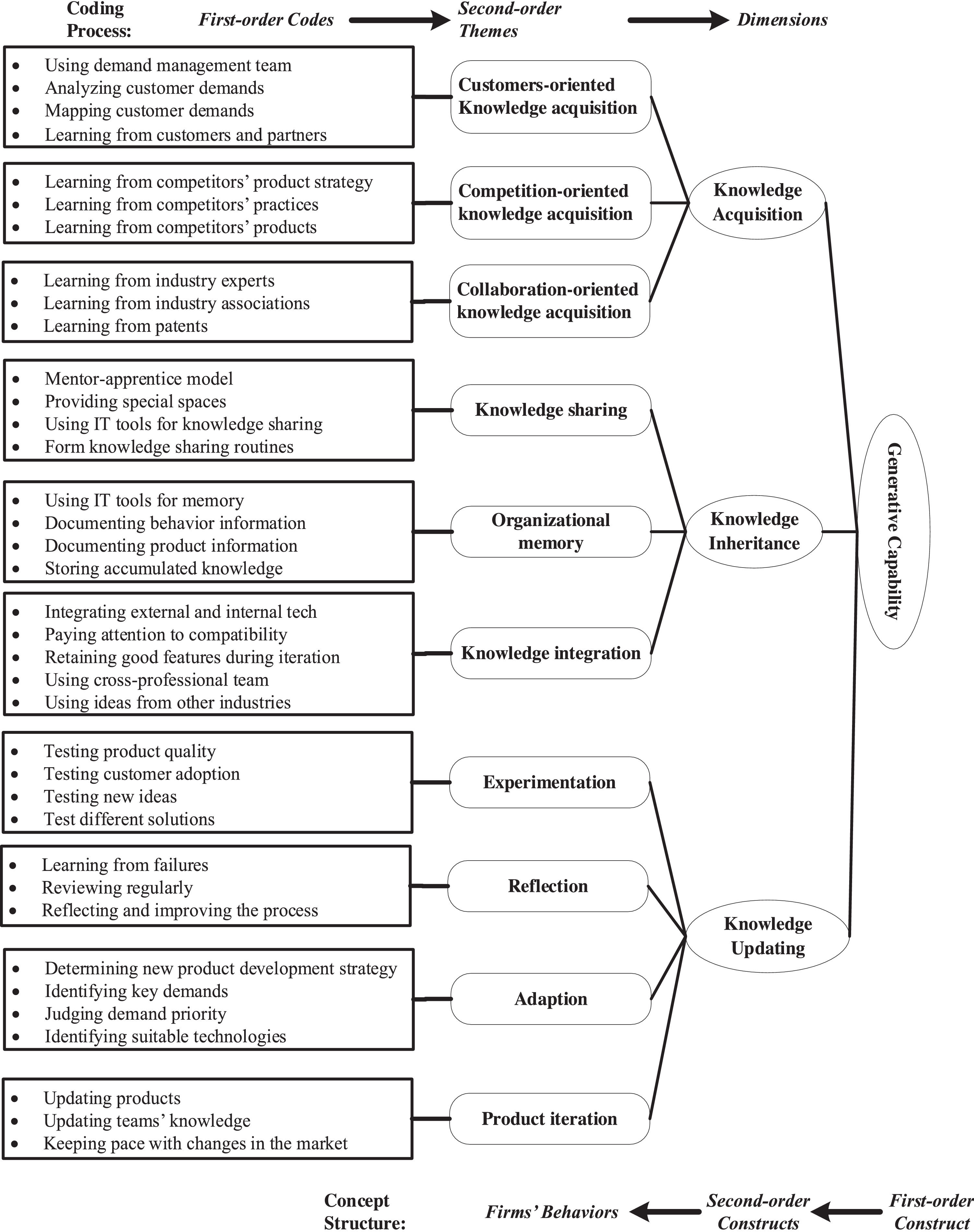

Data analysisThe data is analyzed through an abductive process in which “empirical observations and surprises are connected to extant theoretical ideas to generate novel conceptual insight and distinctions (Langley, Smallman, Tsoukas & Van de Ven, 2013, p. 11).” Using NVivo 11, three coders of our research team coded the data independently to ensure the reliability of the data analysis. We began with open coding through which first-order codes are generated. We then conducted axial coding to structure first-order codes into second-order themes and higher-level aggregate dimensions (Gioia, Corley & Hamilton, 2013). Once the coding process was completed, the three coders extensively compared and discussed any discrepancies in the coding structure, shifting back to data coding whenever necessary until we reached a consensus on the final data structure Fig. 1. presents the final data structure resulting from the data analysis.3

Conceptual development – structure and dimensions of generative capabilityUsing an abductive approach that involves taking iterative steps between the data, literature, and a developing set of theoretical ideas (Miles, Huberman, Huberman & Huberman, 1994), we identify three dimensions of generative capability, namely “knowledge acquisition,” “knowledge inheritance,” and “knowledge updating”.

Knowledge acquisitionKnowledge acquisition refers to the process through which firms obtain different types of knowledge from external sources. Exploitation of external knowledge is a critical component of a firms’ innovation (Cohen & Levinthal, 1990; Jaziri, 2019). Knowledge acquisition has been studied extensively in the literature on absorptive capacity (Cohen & Levinthal, 1990; Zahra & George, 2002) and market orientation (Jaworski & Kohli, 1993; Morgan, Vorhies & Mason, 2009; Narver & Slater, 1990). The difference is that the absorptive capacity literature emphasizes the absorption of a wide range of external knowledge related to technology and firms’ operations (Zahra & George, 2002) while the market orientation literature focuses on the transformation of customer and competitor knowledge into superior products and services (Atuahene-Gima, 2005; Johansson, Raddats & Witell, 2019). Firms’ knowledge acquisition not only depends on the individual behaviors of its members, but also requires firm-level routines to identify and synthesize information from different sources and fields (Cohen & Levinthal, 1990). For start-up firms, knowledge acquisition through high-intensity R&D activities or merging is difficult because, at the early stage of development, their available resources and technological bases are limited. Under these circumstances, gaining knowledge from customers and competitors to develop multiple generations of products is a favorable strategy because through this process firms can gradually accumulate resources and improve their technological bases. Forming routines to acquire customer knowledge can help firms iteratively improve their products (Philipson, 2020). As a manager stated: After we have made a product prototype, we go to various regions to test and communicate with users, operators, and partners. They give us feedback, and we continue to adjust and optimize our products.

Through the utilization of customer knowledge, the product can gain an accurate market positioning and better meet customer needs (Alshanty & Emeagwali, 2019).

Firms can also benefit from their competitors’ knowledge. First, firms can conduct competition-oriented knowledge acquisition by learning from their competitors’ practices and products. A competitor's knowledge may spill out after the competitor exploits the first-mover advantage in the marketplace (Cohen & Levinthal, 1990). Other firms can benefit from knowledge spillover (Operti & Carnabuci, 2014). As one interviewee said: We also learn from our peer companies; for example, one of our competitors has a number of product lines. We analyzed their practices, and then some practices were used in our product lines after adjustment.

Forming routines to acquire competitors’ knowledge can also help firms introduce superior products (Morgan et al., 2009). As a product manager put it, We will thoroughly experience our products… Of course, we will also experience competitors' products to find out their advantages and disadvantages, which requires a proactive approach, that is, to pay close attention to the dynamics of the industry in addition to our work, and we must take the initiative to experience new products in the industry.

This kind of competitor knowledge will help firms set a clear target to surpass. With a deep understanding of rivals’ strengths and weaknesses, firms can develop superior products more easily. Second, competitors can also facilitate peers’ knowledge transfers. Firms can also conduct collaboration-oriented knowledge acquisition by learning from industry experts, associations, and authorized patents. As a manager stated: We invite industry experts, sometimes even competitors to train us.

Another technical director also said: To acquire external knowledge, we go to technical exchanges and training programs organized by the government or associations.

Such routines can help firms keep pace with industry technology trends and make better decisions regarding the direction of technology pre-research.

Knowledge inheritanceKnowledge inheritance refers to routinized organizational processes that facilitate the transfer of knowledge embodied within products across generations. Previous researches on knowledge inheritance are mainly focused on the phenomena of “spin-outs” (entrepreneurial ventures of ex-employees) (Argyres & Mostafa, 2016; Berry, 2015; Furlan & Grandinetti, 2016), that is the knowledge inheritance between incumbents and their spin-outs, while limited attention has been paid to the knowledge inheritance across different product generations within firms. From our in-depth interviews, we find that knowledge inheritance is a key mechanism for product innovation. This enables firms to roll out new products continually. As a software architect articulated: Some product features slowly become the advantages of the product; these advantages are often the label of this product, and [these features] will continue to be used in the subsequent product development.

Knowledge inheritance involves firms’ learning behaviors, such as knowledge sharing, organizational memory, and knowledge integration. According to the knowledge-based view, Grant (1996a) argues that if employees are mobile, firms’ capability depends more on its mechanisms of knowledge integration rather than the extent of employees’ specialized knowledge, and the higher the level of common knowledge among the team, the more efficient integration is likely to be. Knowledge sharing is a key mechanism that can increase the level of common knowledge and facilitate knowledge inheritance. Besides its function on promoting innovation (Lin, 2007), knowledge sharing can also help minimize the influence of turnover on product development (Parise, Cross & Davenport, 2006). A senior manager said: We often use the mentor-apprentice model to ensure that the old staff's experience and know-how knowledge can be inherited by new employees, so that some key technologies can be passed on.

Another programmer also put it as: The code written by each team member must be reviewed by others. This ensures that if someone leaves, the project can continue as expected.

In addition to individual-level knowledge sharing, firm-level organizational memory is another key mechanism that ensures knowledge inheritance. Organizational memory refers to “actions organizations take to encode, store, and retrieve the lessons they have learned (Flores, Zheng, Rau & Thomas, 2012, p. 644)”. It can also benefit knowledge inheritance across product generations (Argote & Ren, 2012; Ginja Antunes & Pinheiro, 2020). As a technical supervisor stated, We have a technology library that stores all relatively mature technologies that we previously accumulated. They can be obtained at any time if required.

Knowledge in a library is no longer subject to personnel turnover; thus, it can promote the efficiency of knowledge integration Grant (1996a). uses the notion of “knowledge integration” to depict the source of organizational capability. He defines “knowledge” in this notion as “broadly to include both ‘explicit’ knowledge which can be written down, and ‘tacit’ knowledge which cannot” (Grant, 1996a, p. 377). The “knowledge integration” in this study mainly refers to the integration of internal knowledge that is already embodied within the existing product and the new externally acquired knowledge used to develop the next-generation product. Knowledge inheritance is also a process of knowledge integration.

An interviewee explained that: When we plan products, we consider the technologies we have accumulated internally and externally. We gradually integrate external and internal technologies through product planning.

Knowledge integration can help firms improve their next-generation products and, simultaneously, new knowledge can be generated and accumulated during the knowledge inheritance process. In turn, the accumulated knowledge can be used for the next round of product iterations.

Knowledge updatingKnowledge updating refers to a firm's efforts to continuously test, reflect, and adapt according to internal and external feedback, and to probe into the future (Brown & Eisenhardt, 1997; Miller & Shamsie, 2001; Yang, Sun & Zhao, 2019). Experimentation involves firm members retaining actions that produce desired results and discarding those that do not (Argyris, 1976; Thomke, 1998). The iterative nature of the experimentation process allows firms to gradually improve the quality of their products (Sosna, Trevinyo-Rodríguez & Velamuri, 2010). A manager from a mobile phone company said: Before the launch of the new mobile phone, we distributed it to every leader of our company. If there is any problem, they provide feedback immediately… This is a constant error correction process to ensure the final quality of the product.

Reflection allows firms to anticipate and exploit early information (Thomke, 2001) and implement continuous improvement through double-loop learning (Argyris & Schon, 1978; Knipfer, Kump, Wessel & Cress, 2013). As a senior manager stated: Our team recorded the mistakes made during the previous generation of product development. After the project was completed, everyone discussed why we had made these mistakes. Why could we not avoid these mistakes at that time?

Through reflection, firms can obtain knowledge about the cause (why) and process (how) that leads to the success or failure of a product. This knowledge can lead to the development of a better next-generation product.

Adaption is another important activity that helps firms deal with the increasing complexities of fragmenting markets and decide which solution to adopt (Day, 2011). For example, rapid prototyping can be a useful tool for adaptation (Kelly, 2001). It tests copy versions with controlled experiments and continuously asks the market for ideas, concepts, and formulations that are working or failing, which is often an inexpensive and fast way to accelerate product development and meet customer needs (Day, 2011; Jaziri, 2019; Thomke, 1998). For example, a product manager articulated the following. If there are too many options, such as customer needs, how to make a choice? Under these circumstances, the system engineer performs assessment and feasibility analysis, during which experiments are conducted to determine the feasible solution.

This idea is consistent with the classic evolutionary models of variation, selection, and retention. Using different variations of the product prototype, firms can conduct market testing on a small scale to weed out bad solutions and help them continuously adapt their solutions to find the optimal one. Essentially, trial and error is an important process for firms to “update” their knowledge stock. Adaption determines the direction of product innovation by reaching a decision about the priority of customer demands (Hoornaert, Ballings, Malthouse & Van den Poel, 2017), which is important because excessive unordered customer knowledge may cause cognitive overload and inhibit innovation performance (Tang & Marinova, 2019). The formation of a specific team or mechanism is helpful. As one interviewee stated: Taking software development as an example, after a version is introduced, there will be some changes in demands, such as adding or removing some functions. We have a change control committee that judges and verifies the demands and decides which demand should be integrated into the next version [of the software]. We follow this direction to develop the next version.

In summary, from the above qualitative case analysis, we find that firms’ generative capability can be reflected in three dimensions: “knowledge acquisition,” “knowledge inheritance,” and “knowledge updating.” Although we elaborate on the three dimensions separately, it should be noted that they are not independent of each other and there is no chronological order between the three dimensions. Knowledge acquisition provides an important knowledge base for knowledge inheritance and updating. During a firms’ multigenerational product development process, knowledge inheritance can occur simultaneously with knowledge acquisition and updating. These three dimensions represent three sets of routines for firms to conduct continuous product innovation.

Quantitative examination of construct validitiesEmpirical setting and data collectionThe goal of this phase is to develop measurement scales for generative capability and its components, and quantitatively verify the construct and criterion validity of this novel concept. For this purpose, we collect firm-level perceptual data from China, the world's largest emerging economy. The target population comprises firms with documented R&D activities from various industries. We used the industrial corporation database of the National Bureau of Statistics of China (NBS) to identify the target population. The NBS dataset contains in-depth information about the firm's characteristics and financial data (such as address, email, phone number, and R&D investment) with annual sales of over 5 million RMB, which has been previously utilized in strategic management research (Tan & Peng, 2003). We first eliminated firms with zero or missing R&D data from our sampling frame as well as those with incomplete or missing contact information. We then randomly selected 1000 firms as targets for our managerial survey following the procedures recommended by Dillman (2000).

Our survey questionnaire was developed in Chinese, which is the native language of the authors. In addition to the newly developed construct of generative capability, all other constructs included in our survey questionnaire were measured using existing scales validated in prior studies. To discriminate GC from other related measures, we collected data on incremental innovation capability (IIC), radical innovation capability (RIC), pure imitation (PI), creative imitation (CI), and organizational learning.4 Measurements of IIC and RIC were adopted from Subramaniam and Youndt (2005) and each construct had three items. Scales for PI and CI were derived from Lee and Zhou (2012) with three items for each scale. For organizational learning, we used the five-dimensional scale developed by Flores et al. (2012), which includes four items for information acquisition (IA), four items for information distribution (DT), four items for information interpretation (ITP), five items for information integration (ITG) and six items for organizational memory (MEMO). In cases where the existing scales are presented in English, we translate them into Chinese by following the procedures demonstrated by Brislin (1980) to preserve content validity. We pretested our questionnaire with a group of 24 executive MBA students whose feedback led us to adjust the wording of some questions. We conducted our survey through the internet during the period of January to August 2017. We targeted middle and senior managers of the R&D department as qualified respondents. Among the 1000 questionnaires delivered, 212 were completed and returned as usable responses, achieving an effective response rate of 21.2%. The firms included in our final research sample came from a wide range of industries, including equipment manufacturing, electronics, IT, new materials, and pharmacies. We perform non-response bias tests by comparing key attributes, such as size, age, and financial performance, between responding and non-responding firms, as obtained from the NBS database, as well as those between early respondents and late respondents. The t-tests showed that there are no significant differences between the groups regarding key attributes, such as age and industry. A summary of the sample firms’ information is presented in Table 2.

Sample firms.

We used 17 newly developed items to measure the dimensions of generative capability. The development of these items is informed by both relevant literature concerning innovation, such as organizational learning (Flores et al., 2012) and market orientation (Jaworski & Kohli, 1993), and the qualitative data collected from the qualitative phase of this research. Examples of qualitative data in scale development include: “We will thoroughly experience our products… of course, we will also experience competitors’ products to find out their advantages and disadvantages”; “[personnel] should be stable. Everyone likes to work with someone who has worked for years. There is a tacit understanding of each other… in comparison, if new members keep coming, you will have to continue tutoring so that they can adapt to the team. It can be annoying and affect work efficiency”; and “the initial idea was very rough…then you put it on the market and get recognized…the whole process is actually the course of trial and error.”

To ensure content validity, the initial measurement items of generative capability were first sent to a panel of academics and managers to check for representativeness, ease of use, identify unclear wording, question double-barreled descriptions, and ensure that the measurement items would be interpreted accurately. Based on their feedback, some items were removed and others were modified. After several rounds, a final version of the 17 items was generated and included in the questionnaire. Among the 17 items, five items were intended to measure knowledge acquisition, six for knowledge inheritance, and six for knowledge updating. The completed survey data allowed us to perform a range of analyses to further purify the measurement scales and examine the construct and criterion validities of generative capability.

Formative vs reflectiveAccording to MacKenzie, Podsakoff and Podsakoff (2011), constructs are not inherently formative or reflective in nature and mostly depend on the researcher's theoretical expectations. Regarding multidimensional constructs, the main concern is the relationship between the sub-dimensions and the focal construct (Bollen & Lennox, 1991; Jarvis, MacKenzie & Podsakoff, 2003). Based on our conceptualization of generative capability, we propose that the empirical measurement of generative capability is best represented by a reflective first-order, reflective second-order model, whereby individual items (see Table 3) are reflective indicators of each dimension, and the dimensions are in turn reflective indicators of the latent second-order construct—generative capability (Jarvis et al., 2003; Zhang, Waldman, Han & Li, 2015). We arrive at this understanding for the following reasons. First, from an ontological perspective, “the realist interpretation of a latent variable implies a reflective model, whereas constructivist interpretations are more compatible with a formative model” (Borsboom, 2005, p. 63). We adopt the realist approach and view generative capability as existing at a deeper and more embedded level within organizations than its three subdimensions. These sub-dimensions are viewed as manifestations of generative capability. Second, when deciding the relationship between a construct and its sub-dimensions, scholars suggest that it is very helpful to ask, “Is it possible for a change in the focal construct to be associated with a change in only one of the sub-dimensions?” (Jarvis et al., 2003; MacKenzie et al., 2011; Wong, Law & Huang, 2008). If a change in only one of the sub-dimensions could be associated with a change in the focal construct, which means that each sub-dimension can independently influence the construct, then a formative structure is more appropriate (MacKenzie et al., 2011). If we look at the case of generative capability, we find that without the other two dimensions, changes in only one sub-dimension can hardly cause a change in generative capability. These three sub-dimensions must join forces to help firms roll out better products. In contrast, if we view the three sub-dimensions as manifestations of generative capability, which means that a change in generative capability would produce a change in all three sub-dimensions, then a reflective structure is more appropriate. In other words, the shared variance of the three sub-dimensions defines the variance in generative capability (Bollen, 1989). From the above, we believe that a reflective structure is more suitable for the relationship between generative capability and its three sub-dimensions.

Exploratory and confirmatory factor analyses of generative capability.

Note: The extraction method for EFA is principal component analysis. Varimax was used as the rotation method. The bold figures represent the highest factor loadings of indicators on factors from the EFA.

Using the SPSS random sample program, we separated the sample into two equal parts (N = 106). We used one subsample to conduct exploratory factor analysis (EFA) and another for confirmative factor analysis (CFA). We first conducted an EFA procedure in SPSS, through which we removed three items with cross-loadings greater than 0.4. This procedure resulted in a 14-item solution: four for knowledge acquisition, four for knowledge inheritance, and six for knowledge updating. The association between the items and dimensions is consistent with our findings from the qualitative phase. The eigenvalues of the three factors range from 1.01 to 8.07, with 75.2% of the total variance explained. Then, we conducted CFA using Mplus software Table 3. shows the items, EFA factor loadings, and percentages of the variance explained.

We subject this proposed measurement model to confirmatory factor analysis using structural equation modeling (SEM), using the other subsample (N = 106), as well as the full sample (N = 212). This proposed measurement model achieves sufficient fitness to the data, as evidenced by the non-significant model chi-square and CFI/TLI above 0.95 (see Table 4). Construct consistency validity is illustrated by the significant factor loadings between items and their respective dimensions as well as between dimensions and generative capability.

Comparison of alternative measurement models of generative capability.

| Model | χ2 | df | p-value | Δχ2 | CFI | TLI | RMSEA | SRMR |

|---|---|---|---|---|---|---|---|---|

| Subsample for CFA (N = 106) | ||||||||

| Second-order model (proposed) | 74.39 | 65 | 0.199 | 0.99 | 0.98 | 0.04 | 0.06 | |

| First-order, three-factor model | 74.39 | 65 | 0.199 | 0.99 | 0.98 | 0.04 | 0.06 | |

| One-factor model | 205.46 | 68 | 0.000 | 131.07⁎⁎⁎(3) | 0.79 | 0.71 | 0.14 | 0.10 |

| First-order, two-factor model (KA+KI, KU) | 140.19 | 67 | 0.000 | 65.80⁎⁎⁎ (2) | 0.89 | 0.85 | 0.10 | 0.08 |

| First-order, two-factor model (KA+KU, KI) | 125.87 | 67 | 0.000 | 51.48⁎⁎⁎ (2) | 0.91 | 0.88 | 0.09 | 0.08 |

| First-order, two-factor model (KA, KI+KU) | 157.42 | 67 | 0.000 | 83.03⁎⁎⁎ (2) | 0.86 | 0.81 | 0.11 | 0.09 |

| Full sample (N = 212) | ||||||||

| Second-order model (proposed) | 77.19 | 65 | 0.140 | 0.99 | 0.99 | 0.03 | 0.03 | |

| First-order, three-factor model | 77.19 | 65 | 0.140 | 0.99 | 0.99 | 0.03 | 0.03 | |

| One-factor model | 302.21 | 68 | 0.000 | 225.02⁎⁎⁎ (3) | 0.86 | 0.82 | 0.13 | 0.07 |

| First-order, two-factor model (KA+KI, KU) | 202.15 | 67 | 0.000 | 124.96⁎⁎⁎ (2) | 0.92 | 0.89 | 0.10 | 0.08 |

| First-order, two-factor model (KA+KU, KI) | 142.82 | 67 | 0.000 | 65.63⁎⁎⁎ (2) | 0.96 | 0.94 | 0.07 | 0.05 |

| First-order, two-factor model (KA, KI+KU) | 236.79 | 67 | 0.000 | 159.60⁎⁎⁎ (2) | 0.9 | 0.87 | 0.11 | 0.06 |

Note: KA = knowledge acquisition; KI = knowledge inheritance; KU= knowledge updating.

To assess the discriminant validity of the dimensions, we compared our proposed measurement model with a number of alternatives. The first alternative is a first-order three-factor model, which is mathematically equivalent to a second-order three-factor model (Bollen, 1989). We used it as a basis to compare the fit of the other alternative models, thus illustrating the discriminant validity of the dimensions. The second alternative is a first-order one-factor model, in which all 14 items are associated with the generative capability factor, equivalent to Harman's one-factor test of common method variance. The other alternatives are first-order two-factor models, in which the three dimensions are combined two at a time. If the one- and two-factor alternatives show significantly worse model fit than the three-factor model, we can conclude that there is evidence of discriminant validity for the three dimensions of generative capability.

Table 4 reports the results of the tests on these alternative measurement models. The best-fitting models are the proposed measurement model and its first-order equivalent (χ2= 74.39/77.19, df = 65, CFI = 0.99/0.98, TLI = 0.99/0.99 and RMSEA = 0.04/0.03). The one-factor model shows the worst fit to the data (χ2=205.46/302.21, df = 68, CFI = 0.79/0.86, TLI = 0.71/0.82 and RMSEA = 0.14/0.13). The two-factor models achieve poor model fit as well, evidenced by significant model chi-squares and other indicators. Moreover, chi-square difference tests show that the alternative models had model fit significantly inferior to the proposed three-factor model. In the full sample, the Cronbach's alphas for knowledge acquisition, knowledge inheritance, and knowledge updating are 0.81, 0.87, and 0.91 respectively. The three dimensions’ average variances extracted (AVE) are all above 0.5 (0.62, 0.59, and 0.62 respectively), indicating that the variances in these dimensions account for the majority of variance in the indicators. The square roots of AVE (from 0.77 to 0.79) are larger than the correlation coefficients among the three factors (maximum 0.66), demonstrating the discriminant validity of the three-factor structure.

Following Zhang et al. (2015), to validate the overall construct, we used the dimensional scores of GC and item scores of IIC, RIC, PI, and CI to discriminate GC from the four measures in factor analyses. We ran two three-factor, two one-factor, and six two-factor models (Table 5). The comparison results showed that the GC differs from the four measures. The square root of GC's AVE (0.73) is greater than the correlations between GC and the other four measures (maximum 0.67), further demonstrating its high discriminant validity. Five dimensions of organizational learning were used to test the discriminant validity of the GC dimensions. As shown in Table 5, the KA dimension differs from IA; the KI dimension differs from DT, ITG, and MEMO; and the KU dimension differs from ITP. All results suggest that GC can be discriminated from other related measures and has high discriminant validity.

Confirmatory factor analysis results for scale validation of generative capability.

| Model | χ2 | df | p-value | Δχ2 | CFI | TLI | RMSEA | SRMR | AVEs |

|---|---|---|---|---|---|---|---|---|---|

| Models used to discriminate GC from alternative measures | |||||||||

| Three-factor model: GC and Subramaniam and Youndt (2005)’s incremental (IIC) and radical innovation capability (RIC) | 35.41 | 24 | 0.060 | 0.99 | 0.98 | 0.05 | 0.03 | AVEGC=0.53 | |

| One-factor model: GC, IIC and RIC merged | 97.79 | 27 | 0.000 | 62.38*** (3) | 0.91 | 0.89 | 0.11 | 0.05 | AVEIIC=0.59 |

| Two-factor model (IIC+RIC, GC) | 60.50 | 26 | 0.000 | 25.09*** (2) | 0.96 | 0.94 | 0.08 | 0.04 | AVERIC=0.55 |

| Two-factor model (IIC+GC, RIC) | 63.89 | 26 | 0.000 | 28.48*** (2) | 0.95 | 0.94 | 0.08 | 0.04 | |

| Two-factor model (RIC+GC, IIC) | 94.17 | 26 | 0.000 | 58.76*** (2) | 0.92 | 0.89 | 0.11 | 0.05 | |

| Three-factor model: GC and Lee and Zhou (2012) 's pure (PI) and creative imitation (CI) | 31.06 | 24 | 0.150 | 0.99 | 0.99 | 0.04 | 0.04 | AVEGC=0.53 | |

| One-factor model: GC, PI and CI merged | 433.03 | 27 | 0.000 | 401.97*** (3) | 0.41 | 0.21 | 0.27 | 0.21 | AVEPI=0.59 |

| Two-factor model (PI+CI, GC) | 176.72 | 26 | 0.000 | 145.66*** (2) | 0.78 | 0.70 | 0.17 | 0.15 | AVECI=0.53 |

| Two-factor model (PI+GC, CI) | 409.78 | 26 | 0.000 | 378.76*** (2) | 0.44 | 0.23 | 0.26 | 0.21 | |

| Two-factor model (CI+GC, PI) | 73.21 | 26 | 0.000 | 42.15*** (2) | 0.93 | 0.91 | 0.09 | 0.08 | |

| Models used to validate GC dimensions | |||||||||

| Two-factor model: KA dimension and information acquisition (IA) | 23.73 | 10 | 0.008 | 0.98 | 0.95 | 0.08 | 0.03 | AVEKA=0.53 | |

| One-factor model: KA and IA merged | 37.27 | 11 | 0.000 | 13.54*** (1) | 0.95 | 0.91 | 0.11 | 0.04 | AVEIA=0.47 |

| Four-factor model: KI, information distribution (DT), information integration (ITG) and organizational memory (MEMO) | 250.37 | 144 | 0.000 | 0.95 | 0.94 | 0.06 | 0.05 | AVEKI=0.50 | |

| One-factor model: KI, DT, ITG and MEMO merged | 539.81 | 150 | 0.000 | 289.44*** (6) | 0.82 | 0.79 | 0.11 | 0.08 | AVEDT=0.57 |

| Three-factor model: (KI+DT, ITG, MEMO) | 428.54 | 147 | 0.000 | 178.17*** (3) | 0.87 | 0.85 | 0.10 | 0.07 | AVEITG=0.51 |

| Three-factor model: (KI+ITG,DT, MEMO) | 399.11 | 147 | 0.000 | 148.74*** (3) | 0.88 | 0.86 | 0.09 | 0.07 | AVEMEMO=0.56 |

| Three-factor model: (KI+MEMO, DT, ITG) | 417.82 | 147 | 0.000 | 167.45*** (3) | 0.87 | 0.85 | 0.09 | 0.07 | |

| Two-factor model: KU dimension and information interpretation (ITP) | 37.99 | 32 | 0.215 | 0.99 | 0.99 | 0.03 | 0.03 | AVEKU=0.57 | |

| One-factor model: KU and ITP merged | 78.79 | 33 | 0.000 | 40.8*** (1) | 0.96 | 0.94 | 0.08 | 0.04 | AVEITP=0.54 |

Note: ***p < 0.001 (two-tailed).

We verify the criterion validity of generative capability by testing its association with expected outcomes, namely product innovation performance. If our conceptualization of generative capability captures the higher-level capability of firms to succeed in continuous product innovation, we expect a strong positive association between generative capability and product innovation performance after controlling for other potential explanations of firm’ innovation outcomes.

Theoretically, generative capability can foster innovation performance for two reasons: First, through the knowledge acquisition, inheritance, and updating processes, firms can gain a thorough understanding on the key market demand and available technology they can use (Van Oorschot, Eling & Langerak, 2018). Along this process, firms can build a close relationship with customers and foster customer engagement, which is beneficial for relevant marketing communication(Alvarez-Milán, Felix, Rauschnabel & Hinsch, 2018; Lee, Naylor & Chen, 2011). Using an iterative product development approach, the product team can learn thoroughly from concrete experimental results and customer feedback (Cui & Wu, 2017). Generative capability can enable firms to integrate key customer demands and suitable technological knowledge to produce better next-generation products. Therefore, generative capability can help firms improve their products incrementally and create higher innovation performance.

Second, the relationship between technological innovation and time is a series of stair-stepping S-curves (Foster, 1986; Utterback, 1994). An existing technology (Tl) initially promotes benefits rapidly when the technology is new and then slows as the technology matures. At a certain point in the history of T1, a new technology, T2, emerges. Initially, the benefits of T2 are inferior to those of T1. However, with the development of T2, its benefits increase rapidly and will surpass those of T1 at a point where the product based on T2 becomes a radical product innovation (Chandy & Tellis, 1998). Having experienced several product generations’ development, the knowledge updating process would gradually help the R&D team gain a deep understanding on the utmost of the technology currently in use and the potential of new technology emerging in the industry (Dattée, Alexy & Autio, 2018). This prompts the R&D team to reserve promising technologies in advance. During the multi-generational product development process, listening to customers and learning from the past can help firms continually check and update their knowledge of customer needs and the technologies used to fulfill these needs. This knowledge provides the foundation for firms to break existing frames of understanding regarding customer needs and technology when a new technology emerges (Joshi, 2016). In other words, generative capability enables the search for a deeper understanding of customer needs and alternative technologies that can better address these needs. Thus, generative capability can improve innovation performance by stimulating radical innovation.

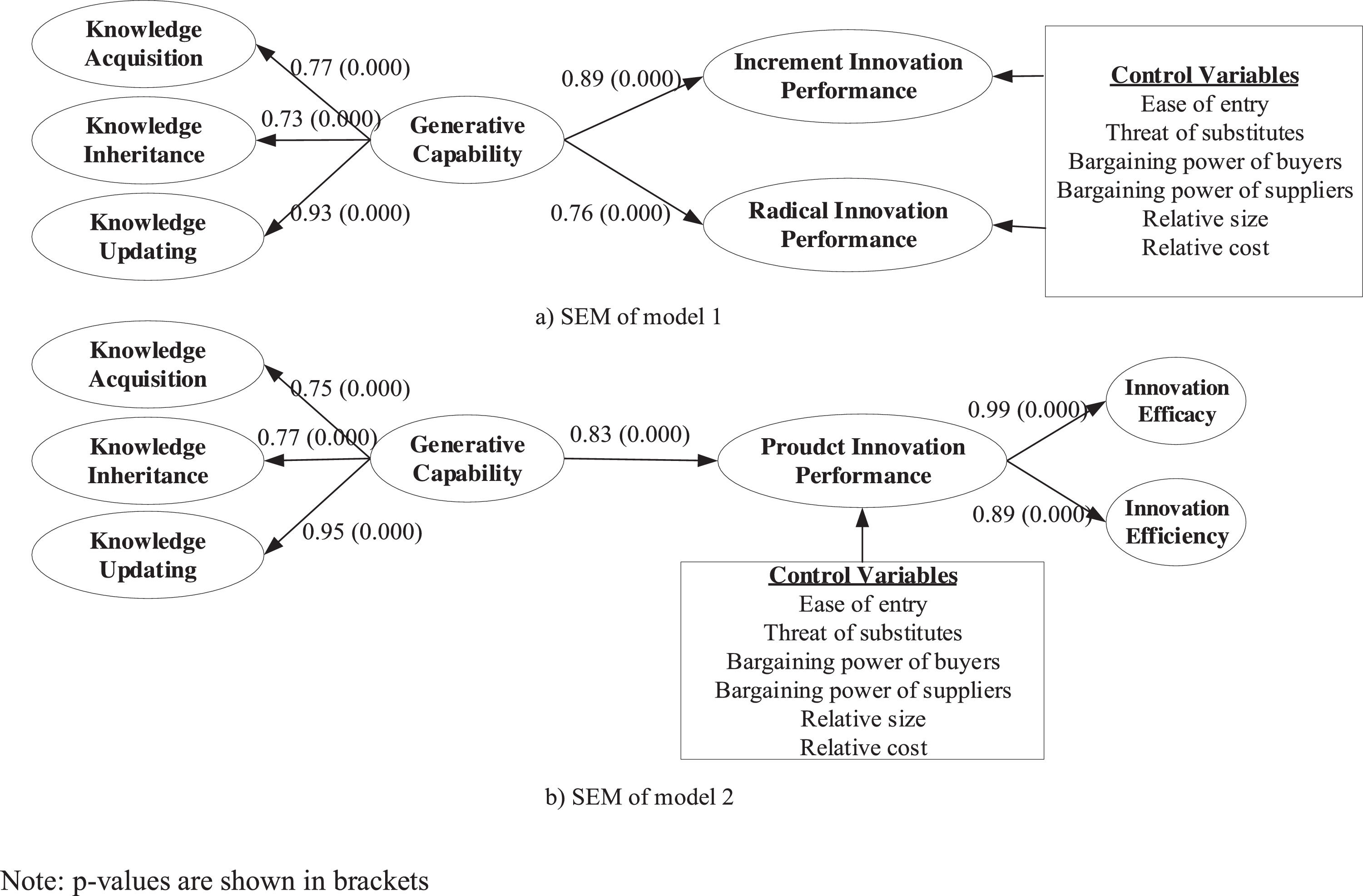

Given the above reasoning, to test this criterion validity, we constructed and tested a set of structural models linking generative capability to its expected outcomes. As Fig. 2 shows, we use two different sets of scales to measure firms’ innovation performance. The first set of scales differentiates between incremental and radical innovation performance, each measured by four items adopted from prior studies (Atuahene-Gima, 2005; Chandy & Tellis, 1998). The second set is a reflective first-order and reflective second-order measurement for product innovation performance, based on seven items measuring innovation efficacy and another four items measuring innovation efficiency adopted from prior studies (Alegre & Chiva, 2008; Alegre, Lapiedra & Chiva, 2006). We also included six control variables based on previous research on the factors influencing firm innovation outcomes (Narver & Slater, 1990). Ease of entry (ENTRY) assesses the degree of difficulty of new entry into the market. Threat of substitutes (SUBS) measures the difficulty of product substitution. Bargaining power of buyers (BPOW) assesses the extent to which customers are able to negotiate lower prices in the industry. Bargaining power of suppliers (SPOW) measures the extent to which the manufacturer is able to negotiate lower prices from its suppliers. Relative size (RSIZE) examines the annual sales revenue of a firm relative to its largest competitor. Relative cost (RCOST) assesses a firm's operating costs relative to those of its largest competitor.

Table 6 presents the results of SEM analysis. We tested two models using different sets of innovation measurements: Model 1 uses incremental innovation performance and radical innovation performance as dependent variables, returns a χ2 ratio of 1.46, a CFI of 0.96, a TLI of 0.95, an RMSEA of 0.05, and an SRMR of 0.07; Model 2 uses a second-order product innovation performance construct as the dependent variable, returns a χ2 ratio of 1.34, CFI of 0.96, TLI of 0.96, RMSEA of 0.04, and SRMR of 0.07. Both models showed a good model fit according to the cutoff criteria proposed by Hu and Bentler (1999). In Model 1, there was a positive and significant relationship between generative capability and IIP (b = 0.89, p < 0.001), and generative capability had a positive and significant association with RIP (b = 0.76, p < 0.001). In Model 4, the relationship between generative capability and PIP is positive and significant (b = 0.83, p < 0.001). Overall, we found a strong positive association between generative capability and innovation performance, indicating the criterion validity of this novel construct.

SEM analysis for criterion validity test.

| MODEL 1 | MODEL2 | ||

|---|---|---|---|

| IIP | RIP | PIP | |

| Generative capability | 0.89⁎⁎⁎ (0.04) | 0.76⁎⁎⁎ (0.04) | 0.83⁎⁎⁎ (0.04) |

| Ease of entry | 0.06 (0.06) | 0.01 (0.06) | −0.01 (0.05) |

| Threat of substitutes | −0.11 (0.06) | −0.06 (0.06) | 0.05 (0.05) |

| Bargaining power of buyers | 0.02 (0.06) | 0.05 (0.06) | 0.00 (0.05) |

| Bargaining power of suppliers | 0.06 (0.06) | 0.05 (0.06) | 0.16⁎⁎ (0.05) |

| Relative size | 0.14* (0.07) | 0.26⁎⁎⁎ (0.06) | 0.27⁎⁎⁎ (0.05) |

| Relative cost | 0.02 (0.06) | 0.06 (0.06) | 0.02 (0.05) |

| χ2 (df) | 313.96 (215) | 494.46 (368) | |

| CFI | 0.96 | 0.96 | |

| TLI | 0.95 | 0.96 | |

| RMSEA | 0.05 | 0.04 | |

| SRMR | 0.07 | 0.07 | |

Note: Standard errors are shown in parentheses; IIP = incremental innovation performance; RIP = radical innovation performance; PIP = product innovation performance.

This study makes three theoretical contributions to the literature: First, the literature on product innovation has focused on the factors contributing to the development a specific new product (Slater et al., 2014; West & Bogers, 2014). Comparatively less attention has been paid to continuous product innovation. From a knowledge-based perspective, we conceptualize a novel concept of generative capability, a unique capability by which firms organize experiential learning activities to achieve continuous product innovation. We elaborate on its three dimensions: “knowledge acquisition,” “knowledge inheritance,” and “knowledge updating.” Knowledge acquisition can create a knowledge base for product iteration, knowledge inheritance depicts the knowledge transformation and integration process across different product generations, and knowledge updating can ensure that the direction of product innovation is in line with key customer demands and appropriate technology. Thus, we extend the product innovation literature by exploring the sources and implementation of firms’ continuous product innovations. Simultaneously, this study enriches the literature on knowledge-based views.

Second, the conceptualization of generative capability contributes to resolving the paradox of organizational capability. Organizational capabilities are paradoxical because, on the one hand, they provide a reliable problem-solving architecture that can facilitate the formation of sustainable competitive advantages (Helfat & Peteraf, 2003). On the other hand, owing to path dependency and organizational inertia, capability-driven behaviors are likely to bind the organization to the past, which could be unfavorable in the face of a changing environment (Schreyögg & Kliesch‐Eberl, 2007). We believe that generative capability can resolve this paradox to a certain extent. As a high-order capability, generative capability emphasizes the reconfiguration and iteration of knowledge and processes. Along with the multi-generational product development journey, firms can continually upgrade and renew their knowledge and product development processes based on the information acquired and experimental results. Therefore, generative capability can relieve the capability paradox by reducing the influence of organizational inertia.

Third, previous studies on continuous production innovation are primarily interpretative and qualitative studies that have been fragmented in different research fields. This might be partly due to the lack of core concepts and scales in relation to continuous product innovation. In this study, we conceptualized generative capability and developed its measurement scales. According to Collis (1994) and Zollo and Winter (2002), generative capability is conceptualized as a second-order “learning-to-learn capability” (Schilke, 2014). Corresponding to this conceptualization, we develop a “reflective first-order, reflective second-order” measurement model for generative capability and test its reliability and validity. These efforts lay a solid foundation for further research on continuous production innovation.

Managerial implicationsMany firms consider R&D to be a bottomless pit that can never be filled because of its high investment and failure rate. Generative capability can help firms design reliable long-term product and technology roadmaps based on customer needs, competitor information, and experimental results. Firms can continuously improve their products and roadmaps during the multi-generational product development process, which can lower the R&D cost and make the investment more efficient because they are more likely to address the right customer needs and use appropriate technology. Firms’ learning capabilities can also be simultaneously improved at the same time.

Our concept of generative capability can also guide managers in iterative product development. This means that in some cases, the quality of products can take a back seat. For example, a manager stated that: Sometimes, to capture the market quickly, we push out a relatively low-quality but usable product and then gradually improve it based on customers’ needs and rivals’ actions. If we continue to improve quality instead of launching the product, our rivals will take over the market.

Our concept also grounds the idea of a minimum viable product (MVP) in lean startups on a solid theoretical foundation (Ries, 2011; Yang et al., 2019). MVP refers to “an early version of a new product that allows a team to collect the maximum amount of validated learning (learning based on real data gathering rather than guesses about the future) about customers” (Ries, 2011, p. 83). Firms should take the initiative to focus on customers’ demands and rivals’ movements and build a specific team (such as a demand management team) to find the right target to surpass and meet the core needs. Compared to the traditional R&D model, which does not launch the product in the market until it reaches a relatively high degree of completion, the practice of a minimum viable product not only has the advantage of quickly seizing the market, but also can lower the risk/cost of R&D failure. Before launching the first version of the products, managers should set the criterion for “minimum viability.” Through market surveys or experiments, managers can determine which customer needs should be met and what functions should be achieved in an MVP. When launching early versions of products, it is important to let customers know the progress of product improvement and encourage them to keep using it and provide feedback. Managers can use incentive measures to promote the engagement of early users such as early bird discounts, rewards for reporting bugs, and special gifts.

Limitation and future researchAlthough this study has contributions and implications, it also has several limitations. First, in the generative process across multiple product generations, organizational semi-structures can support this continual change and a rhythm can be created (Brown & Eisenhardt, 1997). Future studies could explore which type of organizational structure provides better support for generative capability. Second, the sample survey was composed of samples from China, which constrains the generalization of the results to other countries. It would be interesting to see if the findings of this study can be extended to other countries. Although most quantitative studies collect data from surveys, the use of multiple data sources may enhance the validity of the outcomes, which is also an avenue for future research. Third, the results of this study were based on product-related interviews or quantitative measures. Future studies could consider other innovation contexts to determine whether generative capability can be applied to generic discussions of innovation. Finally, the study applies a cross-sectional design, which implies that causal relationships may not be robust. Future research could adopt a longitudinal design to test these results.

ConclusionHow can firms continuously and sustainably conduct product innovation? We conceptualize generative capability, which involves knowledge acquisition, knowledge inheritance, and knowledge updating. We believe that generative capability can be a path toward continual innovation. Firms can ultimately build their own core competencies and gain sustained competitiveness through the development of generative capabilities.

Bo Zou and Jinyu Guo are grateful to the support from the Ministry of Education of PRC(Grant No. 21YJA630129), Guangdong Planning Office of Philosophy and Social Science (Grant No. GD21YGL18) and National Natural Science Foundation of China (Grant No. 71672049).

Dependent variables:

Radical innovation performance

- 1

Compared to your major competitor, this firm introduced more radical new products in the last three years (1 = “strongly disagree,” 5 = “strongly agree”).

- 2

This firm frequently introduced radical new products into markets totally new to the firm in the last three years (1 = “strongly disagree,” 5 = “strongly agree”).

- 3

Number of radical products introduced by the firm in the last three years (converted into a five-point scale).*

- 4

% of total sales from radical product introduced by your firm in the last three years (less than 5%, 5%–10%, 11%–15%, 16%–20%, >20%).*

Incremental innovation performance

- 1

Compared to your major competitor, this firm introduced more incremental new products in the last three years (1 = “strongly disagree,” 5 = “strongly agree”).

- 2

This firm frequently introduced incremental new products into new markets in the last three years (1 = “strongly disagree,” 5 = “strongly agree”).

- 3

Number of incremental products introduced by the firm in the last three years (converted into five-point scale).*

- 4

% of total sales from incremental product introduced by your firm in the last three years (less than 5%, 5%–10%, 11%–15%, 16%–20%, >20%).*

Product innovation performance

Could you please state the performance of your company compared to your competitors with regard to the following items? 1 represented much worse performance than competitors and 5 represented much better performance.

Product innovation efficacy

- 1

Replacement of products being phased out.

- 2

Extension of product range within main product field through new products.

- 3

Extension of product range outside main product field.

- 4

Development of environment-friendly products.

- 5

Market share evolution.

- 6

Opening of new markets abroad.

- 7

Opening of new domestic target groups.

Product innovation efficiency

- 1

Average innovation project development time.

- 2

Average number of working hours on innovation projects.

- 3

Average cost per innovation project.

- 4

Global degree of satisfaction with innovation project efficiency.*

Control variables: Adopted from Narver and Slater (1990)

- 1

Ease of entry (ENTRY). How easy is it for new entrants to start competing in this industry? (1 very easy; 5=very difficult).

- 2

Threat of substitutes (SUBS). How easy can a product or service be substituted in this industry? (1 very easy; 5 = very difficult).

- 3

Bargaining power of buyers (BPOW). The extent to which our customers are able to negotiate lower prices in this industry is (1 very low; 5 = very high).

- 4

Bargaining power of suppliers (SPOW). The extent to which we are able to negotiate lower prices from our suppliers in this industry (1 very low; 5 = very high).

- 5

Relative size (RSIZE). The size of our annual sales revenues in the principal served market segment in relation to those of our largest competitor is: (1 = much smaller than the largest competitor; 5 = much larger than the largest competitor)

- 6

Relative costs (RCOST). Our average total operating costs (administrative, production, marketing/sales, etc.) in relation to those of largest competitor in its principal served market segment are: (1=much lower than the largest competitor; 5 = much higher than the largest competitor).

Notes: * indicated that the item was deleted based on item-to-total correlation and factor analysis

Also referred as sustained product innovation in some literature (e.g., Dougherty and Hardy, 1996; Dougherty and Deborah, 2001). Although both the terms continuous production innovation and sustainable production innovation share some kind of long-term innovation, they have different focal points. Sustainable product innovation is a research stem that emphasizes the sustainability of resource and environment during new product development process (Adams, Jeanrenaud, Bessant, Denyer & Overy, 2016; Varadarajan, 2017), while continuous production innovations focuses on the sustainability of firms’ innovation behavior itself. Nevertheless, the two terms are not mutual exclusive. Continuous production innovations can be sustainable and vice versa.

Interview protocol is available upon request to the authors.