This study explores how entrepreneurial marketing can reduce the liability of poorness by enhancing the performance of smallholder agribusinesses in developing economies. Partial Least Squares Structural Equation Modeling (PLS-SEM) analyzed surveys from a judgment sample of 190 Vietnamese SME tea producers. Entrepreneurial marketing processes, including innovation, customer-linking, and reputational advantage, were positively related to cost advantage for the SME tea producers but not with differentiation advantage. This implies that SME agribusinesses in developing economies should focus on their cost-based advantage and leverage their customer-linking capacity to create premium-priced offerings. This could be enabled by participating in capacity-building opportunities such as Vietnam's One Commune One Product branding program. The OCOP program offers the opportunity to shift SME agribusiness from a substance orientation toward a more positive entrepreneurial mindset and develop entrepreneurial capabilities to facilitate a more prosperous future.

Small tea producers are essential sources of smallholder income for developing economies like China, India, Kenya, Sri Lanka, and Vietnam (FAOSTAT, 2020). This paper explores how entrepreneurial marketing processes can help substance tea producers differentiate their products to enhance their livelihoods. Raj's (2021) work on moving substance farmer-produced tea from a commodity to a differentiated product is one way to enhance their livelihoods and complements Morris et al. (2022) work on the commodity traps and poverty. The present study uses a survey of Vietnamese SME tea producers to determine if entrepreneurial marketing processes such as market innovation, customer-linking, and reputational advantage, are positively related to either a cost advantage are differentiation market advantage.

The paper contributes to entrepreneurial development theory and policy by considering how entrepreneurial marketing processes and capacity-building programs like Vietnam's One Commune, One Product (OCOP) may offer a way to break the cycle of the commodity trap. In this study, we discuss the liability of poorness, entrepreneurial marketing processes, development programs like OCOP, methods, findings, implications, and limitations in Vietnam's tea industry, which increasingly has a vital role in improving livelihoods and alleviating poverty in rural Vietnam.

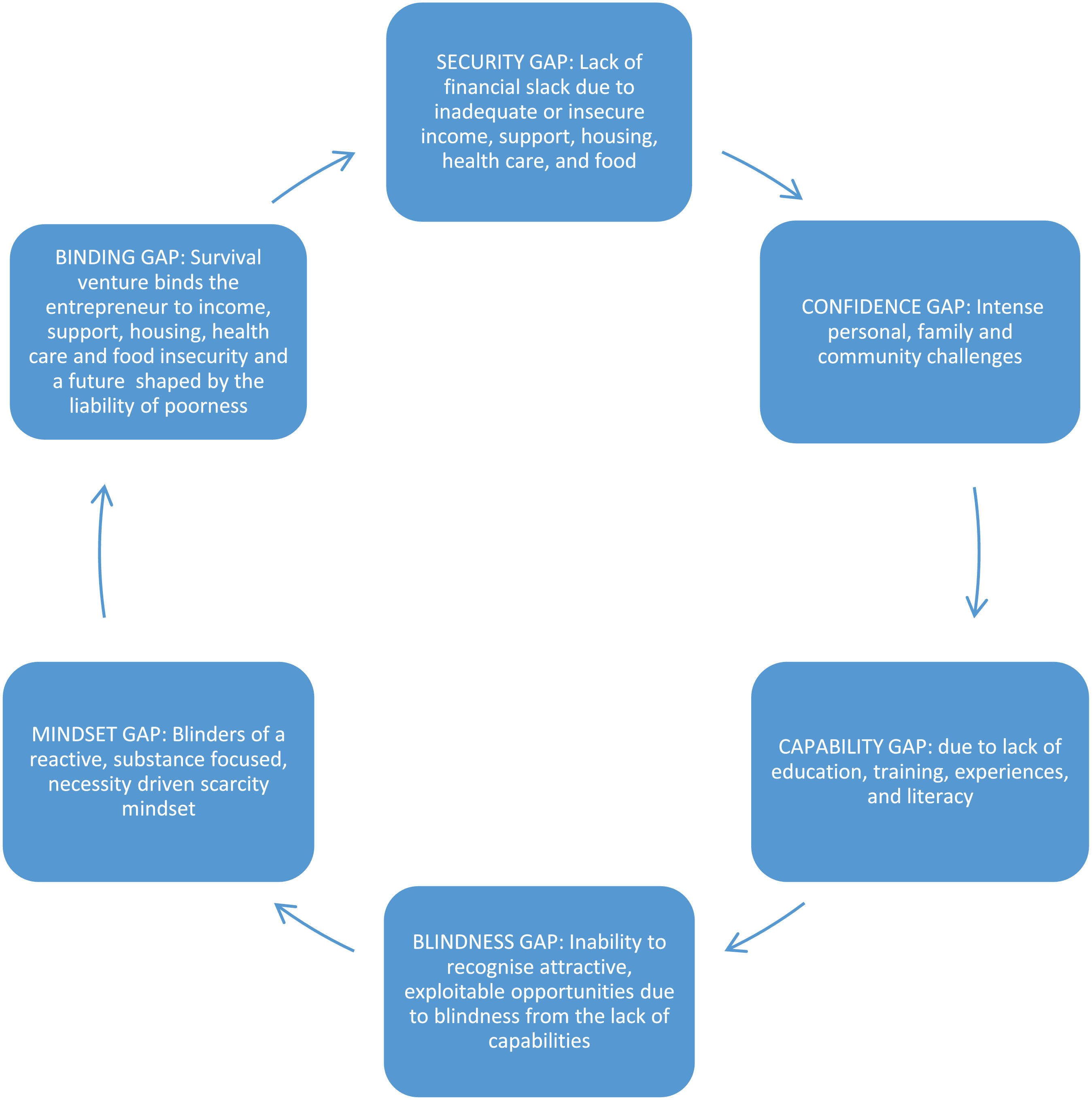

The liability of poornessSmall substance agribusinesses in developing economies often face what Morris et al. (2020) term the “liability of poorness.” It blinds them to the ability to recognize entrepreneurial opportunities and binds them to a substance necessity-driven venture. The liability of poorness is grounded on challenges that include (1) the lack of fundamental and business literacy, (2) a substance driven scarcity mindset, (3) “intense personal pressures,” and (4) the absence of savings and resources (Morris et al., 2020). The lack of literacy restricts the smallholder's ability to explore, recognize and evaluate potentially attractive market opportunities. Likewise, without literacy, the ability to recognize and successfully exploit attractive opportunities is diminished. As Morris (2020: 216) notes

“With entrepreneurial training and development, a different mix of tools and training approaches are necessary to reflect the unique developmental needs of the kinds of ventures started by those in poverty … The goal should instead be one of making survival and lifestyle businesses more economically viable and sustainable.”

The smallholder's scarcity mindset and family and personal pressures shape their decision to avoid incurring risks. Their scarcity mindset makes risk accepting, innovation-driven, proactive initiatives inconceivable, restricting their ability to explore opportunities while diminishing their capability to exploit them successfully. Likewise, the lack of “slack” resources often reinforces a low-risk, low-innovation, reactive approach to enterprise (Miles et al., 2013), resulting in a propensity to sell unbranded commodities. Fig. 1 illustrates the vicious cycle of the liability of poorness.

The blinding and binding cycle for entrepreneurs of the liability of poorness1

1: Adapted from Morris et al. (2015), Morris et al. (2020); Santos et al. (2019).

We propose that by adopting entrepreneurial marketing processes (EMPs), smallholders and SME agribusiness may enhance their livelihoods and reduce their liabilities of poorness. Work by Santos et al. (2019) and Dung et al. (2021) suggests that building entrepreneurial capabilities through entrepreneurial experiences may empower the poor by interacting with more entrepreneurial value chain partners that facilitate entrepreneurial learning and enhance livelihoods, and that is the motivation of our study.

EMPs are valuable resources that link SMEs to existing and potential customers to pursue a superior market position both in developed (Davick & Sharma, 2016; Lewis et al., 2014; Stokes, 2000a, 2000b) and developing economies (Bonney et al., 2013). Due to its potential to drive performance, entrepreneurship has emerged as a tool for rural development initiatives in developing economies when adapted to the context (Dung et al., 2020, 2021; Jack et al., 2013). This study adopts Miles and Darroch's (2006) EMP framework as one path toward ameliorating the liability of poorness.

Vietnamese tea is marketed domestically and internationally (Khoi et al., 2015). However, Vietnamese smallholder tea producers often have been constrained by traditional practices (San Le et al., 2021), fragmented SME producers (Khoi et al., 2015) with a lack of strong links to their suppliers and customers (Tru, 2020), and by marketing undifferentiated teas as a commodity and not a branded product. This resulted in the inability of SME tea producers to efficiently, effectively and profitably leverage their resources and competencies to create competitive advantages (Nguyen et al., 2019).

Work on the relationship between the resources of agrifood SMEs in developing economies and their ability to create an advantage in beef (Ho et al., 2018, 2019), shrimp (Kiet & Sumalde, 2008), rice (Loc, 2006), and coffee marketing (Juong, 2007) suggest that effective use of resources by enhances performance. However, there has been little published evidence on the role of SME resources and the competitiveness of tea producers.

Tea production is a cultural practice and a source of livelihood for many smallholders. Despite the comparative advantage of tea production in Central Vietnam, such as climate conditions and local experience, its production has faced numerous challenges resulting in a lack of advantage. Recently, the Vietnamese Government has prioritized improving the value of tea production by revitalizing the tea sector. Likewise, the acceleration of imported teas into Vietnam forces SME tea producers to seek competitive advantage through differentiation and cost reduction strategies.

Smallholder tea producers in Vietnam can use EMPs to enhance livelihoods by developing a marketing advantage. This study uses Hunt & Morgan's (1995, 1997) resource advantage theory (RA-T) to understand how small tea producers in central Vietnam leverage EMPs to create a marketing advantage. Resources help create superior value propositions offered in the market (Davcik & Sharma, 2016). RA-T considers resources, such as innovation, customer-linking, and reputational advantage, as inputs that combine to create superior value propositions for the customer (Hunt & Morgan, 1995, 1997). The resources of SME tea producers in Vietnam include both tangible assets (drying ovens, rolling machines) and intangibles (innovation, customer-linking and reputational capabilities) which contribute to creating an advantage and performance. RA-T explicitly considers a firm's resources, market position, and performance relative to its competition (Hunt & Morgan, 1995). In doing this, RA-T also accounts for demand, customer information, innovation, reputation, employee motivation, firm objectives, firm information, management's role, and competitive dynamics, among other tangible and intangible resources such as reputation, brand, and capabilities (Hunt & Morgan, 1997). RA-T is a robust framework that has been productively used to understand competitive performance by agrifood SMEs in developing economies such as Vietnam (Ho et al., 2018, 2019) and Uganda (Nakku et al., 2020).

Early work by Stokes (2000a,b) proposes that EMPs comprise the fundamental processes of market identification, interaction, and information gathering as innovation inputs. Miles & Darroch (2006) adapted work by Morris et al. (2002) and Shane and Venkataraman (2000), Stokes (2000a, b) to explore how EMPs can be leveraged in the recognition, assessment and exploitation of opportunities. Adhikar et al. (2018), Lewis et al. (2014), and Raj (2021) expanded both the applications of EMPs to agrifood SMEs. We draw from these studies a set of EMPs that reflect the context of agrifood SMEs in emerging economies by focusing on customer-linking processes, reputational processes, and innovation to understand how SMEs create superior value propositions relative to the competition.

Customer-linkingThere are many definitions of 'customer-linking,' including Hunt & Morgan's (1995) perspective of customer-linking as a marketing resource. Customer linking as an EMP emerged through the reconceptualization of marketing from a goods-dominant perspective toward a service-dominant paradigm (Gummesson, 1994). Marketing researchers recognized that the firm-customer relationship impacts the customer's perceived value of products and satisfaction. Moreover, long-lasting relationships with customers allow firms to systematically collect customer information to improve their products and service to meet customer needs (Mithas et al., 2005). Hooley et al. (2005) viewed customer-linking as the firm's capabilities to create, maintain, and enhance customer relationships.

Customer information is required to create a better link with customers. Customer linking consists of the skills and knowledge possessed by the SME that enable a comprehensive understanding of customers' needs, attitudes, behaviors, and desires (Varadarajan, 2020). Based on customer information, firms make decisions related to marketing. Leveraging the firm's marketing resources to establish a long-term relationship with customers is a marketing capability (Rapp et al.,2010). It often includes the capability to identify and anticipate customers' needs and requirements (Hooley et al., 2005). Customer-linking processes provide the requisite knowledge and create the vital relationship that supports SMEs in creating need-satisfying products and enhanced performance for firms (Cao & Tian, 2020). Day (1994) suggests that the capacity of customer-linking can create cost and differentiation advantages and ultimately improve financial performance. Formally:

H1

Effective customer-linking positively and directly impacts the SME tea producer's (a) cost advantage, (b) differentiation advantage, and (c) indirectly positively impacts financial performance.

ReputationA large body of research has identified that reputation is a driver of a firm's positional advantage in the marketplace (Flatt & Kowalczyk, 2008; Gao et al., 2017; Sheehan & Stabell, 2010). A firm's reputation is an intangible asset developed from past performance and prospects (Liu et al., 2019).

Studies have shown a positive reputation and financial performance relationship. Firms with superior reputations are rewarded when customers choose between competing products. In this case, reputation leads to a superior value proposition that impacts sales growth, price premiums, customer retention, and loyalty (Milan et al., 2015; Walsh et al., 2009). Additionally, reputation increases trust among the business partners, such as the firm's suppliers and buyers, reducing uncertainty and transaction costs (Bijman et al., 2020). In the agrifood sector, reputation increases sales due to customer loyalty and differentiates the firm's value proposition (Ivanov & Mayorova, 2015). A study by Song et al. (2017) also indicated that reputation mediates the supply chain management - firm's financial relationship by translating information about high-quality products to customers, reducing information asymmetry, and enhancing customers’ confidence in the product. Conveying a positive reputation to customers improves an agrifood SME's cost and differentiation advantage and, ultimately, its performance. Thus, the second hypothesis:

H2

A positive reputation positively and directly impacts the SME tea producer's (a) cost advantage, (b) differentiation advantage, and (c) indirectly positively impacts financial performance.

InnovationInnovation is a core dimension of EMPs as it enhances an SME's products, processes, marketing, and value propositions or value chains, thereby creating a relatively stronger position (Cappellesso & Thomé, 2019; Miles & Darroch, 2006). Morris et al. (2002) clearly articulate the central role of innovation as an entrepreneurial marketing process. Likewise, papers by Covin & Miles (1999), Darroch et al. (2005), and Miles & Darroch (2006) conclude that innovation creates advantage and performance.

While Vietnamese SME tea producers suffer from the liability of poorness and are very resource-constrained, three forms of innovation were found in the study. First, process innovations such as quality standards for product differentiation (Covin & Miles, 1999). A second form, supply or value chain coordination, allows vertical coordination where upstream tea producers can communicate the quality of their teas to downstream value chain actors such as distributors and retailers (Dung et al., 2020, 2021).

The third form of innovation, and a focus of this paper, is market innovations (Miles et al., 2003), such as Japan's One Village One Product program (Fujita, 2007). Natsuda et al. (2012, p. 370) note that the OVOP framework has been used successfully by emerging economies in Asia, Africa and South America to “enhance local communities’ entrepreneurial skills by utilizing local resources and knowledge, creating value-adding activities through branding of local products and building human resources in the local economy.” Vietnam has also adapted the OVOP framework as the foundation of its One Commune One Product (OCOP) rural development program (Thanh et al., 2018). Similar programs exist in India (Raj, 2021), where tea growers participate in capacity-building programs to brand their tea and enhance performance. In addition, Fujita (2007, pp. 210–211) noted the rural development outcomes associated with branding agricultural commodities through an OCOP program that:

“represents a general strategy for community-based rural development that successively identifies, cultivates, and fully utilizes local resources (including natural, historical, cultural, and human resources) for the continual development of an increasingly greater variety of unique local products and services (including local tourism). Through increasingly sophisticated marketing, these unique local products are sold in larger markets, gradually establishing local brands to identify them. The community accumulates technical skills, know-how, and practical knowledge learned by inference through experience (tacit knowledge) while developing the human resources essential for sustained or continual innovation of their unique local products and management system.”

The Vietnamese Government launched a national program similar to OPOV in 2018 called “one commune, one product” (OCOP) to build capabilities in SMEs. The OCOP brand certifies that the product meets product and marketing quality standards to downstream value chain actors and consumers and includes tea producers. Production and marketing capacity-building programs were developed and offered to the enterprises, allowing producers to develop the skills required to meet the OCOP standards (Thanh et al., 2018; Thanh et al., 2018). However, at the time of the study, none of the SME tea producers met the OCOP standards.

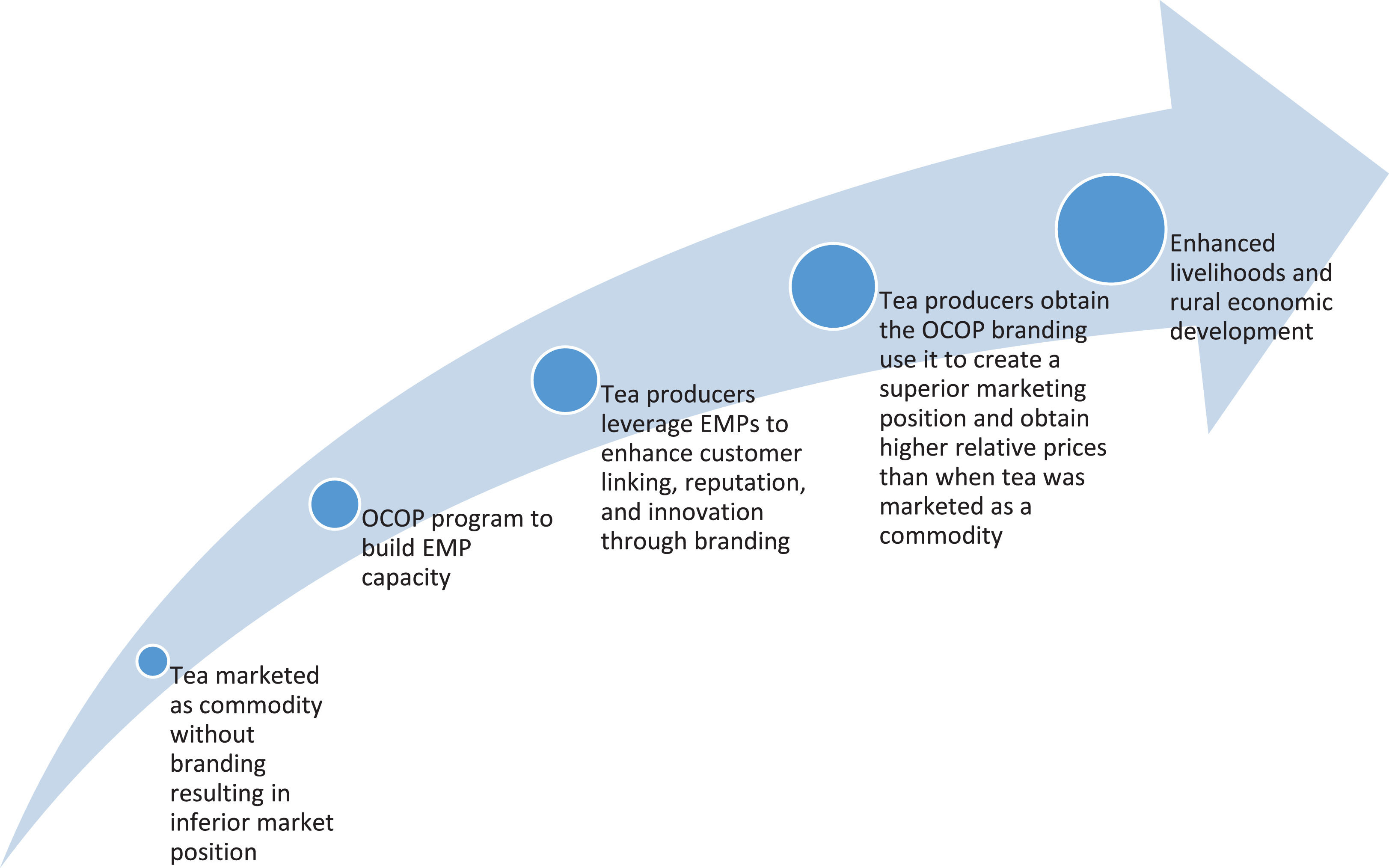

Recent OCOP initiatives focus on process innovations such as scaling out tea processing, improving horticultural techniques, and building managerial capacity for producers rather than marketing, branding and customer-linking innovation. Through capacity-building support programs, the SMEs should meet the OCOP branding program's requirements, allowing them to create an advantage by enhancing the credibility and reliability of the product's quality to downstream value chain distributors, retailers, and the ultimate customer, as illustrated in Fig. 2.

Transforming tea from a commodity to a brand1 through OCOP EMP development programs

1: Adapted from Fujita (2007).

The successful adoption of the OCOP program by tea producers would allow them to market the tea as a branded and differentiated product for a relatively higher price than selling tea as a commodity, thereby enhancing their livelihood. Thus:

H3

Innovation positively and directly impacts the SME tea producer's (a) cost advantage, (b) differentiation advantage, and (c) indirectly positively impacts financial performance.

Competitive advantage and financial performanceCompetitive advantage indirectly contributes to a firm's performance by satisfying customers (Anwar, 2018; Soltanizadeh et al., 2016). Firms leveraging EMP to create a differentiation advantage must use customer-linking to inform their reputation and innovation initiatives and offer unique products with superior value propositions that command premium prices and enhance margins (Brenes et al., 2014). Firms deploying EMP to create cost advantages must use customer-linking, reputation and innovation to drive down costs and improve profitability. Importantly, creating a cost advantage allows the marketer to lower the product's selling price and increase market share and profitability (Chauhan et al., 2021; Ho et al., 2019; Khan et al., 2019; Micheels & Gow, 2012; Soltanizadeh et al., 2016).

The domestic tea market in Vietnam is very competitive (Khoi et al., 2015), with firms applying both differentiation and or cost advantages to compete. Various alternative technologies have been used to improve materials for tea processing, product quality, and appearance to differentiate the tea product and/or reduce the cost to improve economic profitability (Bui & Nguyen, 2021; Wenner, 2011). Therefore, this paper hypothesizes that:

H4

Cost and differentiation advantages can increase the financial performance of SME tea producers.

Research design, data collection and measuresA pilot study was conducted with five tea producers and three academics to understand the marketing resources and the capabilities related to the competitive advantage of these producers in central Vietnam and test the hypothesis mentioned above. A draft questionnaire was developed to ensure that the scale items were suitable for SME tea producers, and three EMP resources were identified – customer linking, reputation, and innovation. Once completed, the questionnaire was finalized for data collection.

The sample of this study was randomly selected from a list of the population of 400 SME tea producers in central Vietnam. The first survey was mailed to 300 tea producers in December 2019, with a reminder call following one week later. One month after the initial survey, another survey was mailed to non-respondents resulting in an initial sample of 150. In February 2020, the survey was sent to the remaining 100 tea producers to increase the sample size, resulting in 40 responses. In total, 190 questionnaires were returned, resulting in a 47.5% response rate. Based on the “10-times rule” method – a widely accepted method to identify the sample size in PLS-SEM, the sample size employed to perform should be greater than ten times the number of inner or outer links at any latent variable (Kock & Hadaya, 2018) implying an adequate sample size (n = 190).

Respondents were asked to answer the questionnaire using a 5-point Likert scale. Data were then analyzed to identify the reliability, discriminant validity, and applied structural equation model using PLS-SEM. Scale items were adapted from previous studies, as shown in Table 1. The construct of customer-linking was measured using an instrument developed by Rapp et al. (2010). The original version of this instrument was employed to measure the effect of customer-linking and customer relationship performance in the IT industry. For this study, the scale items were modified to fit the context of SME tea producers in a developing country. Innovation, cost advantage, differentiation advantage, and financial performance were measured with scales developed by Ho et al. (2018); Hurley & Hult (1998), Micheels & Gow (2015), Ho et al. (2019), adapted to measure the positive relationship between innovation and financial performance of beef cattle enterprises (Ho et al., 2019; Micheels & Gow, 2015). Corporate reputation was measured by adopting work by El-Garaihy et al. (2014)). The respondents were asked to answer to what extent they agreed with the following: (1) the customers' sense of the total experience with the firm was excellent; (2) customers are optimistic about the long-term future of this firm; and (3) the firm is characterized by honesty and credibility.

Measures used in this study.

| Construct and Items | Cronbach's Alpha | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|---|

| Corporate reputation (El-Garaihy et al., 2014) | 0.859 | 0.914 | 0.781 | |

| REPUTA1 | Customers’ comprehensive sense of total experience in the corporate is excellent. | |||

| REPUTA3 | Customers are optimistic about the long-term future of this corporate. | |||

| REPUTA4 | The corporate is characterized by honesty and credibility. | |||

| Cost advantage (Hurley & Hult, 1998; Micheels & Gow, 2015; Ho et al., 2019, 2018) | 0.831 | 0.898 | 0.745 | |

| COS2 | We have a continuing overriding concern for operating cost reduction. | |||

| COS3 | Achievement of economies of scale or scope is an important element of our strategy. | |||

| COS4 | We closely monitor the effectiveness of key production processes. | |||

| Customer-linking (Rapp et al., 2010) | 0.753 | 0.856 | 0.665 | |

| CUSLINK1 | Our firm is good at understanding customer needs and requirements. | |||

| CUSLINK2 | Our firm is good at creating relationships with customers. | |||

| CUSLINK4 | Our firm is good at maintaining and enhancing relationships with customers. | |||

| Differentiation advantage (Hurley & Hult, 1998; Micheels & Gow, 2015; Ho et al., 2019, 2018) | 0.888 | 0.907 | 0.831 | |

| DIFF1 | I regularly introduce tea products to customers. | |||

| DIFF2 | We offer a broad range of tea products to meet the different customers’ requirements. | |||

| Financial performance (Hurley & Hult, 1998; Micheels & Gow, 2015; Ho et al., 2019, 2018) | 0.824 | 0.895 | 0.740 | |

| PERFOM1 | We were very satisfied with the overall performance of the firm last year. | |||

| PERFOM3 | The return on marketing investments met expectations last year. | |||

| PERFOM4 | The prices we receive for our product are higher than that of our competitors. | |||

| Innovation (Hurley & Hult, 1998; Micheels & Gow, 2015; Ho et al., 2019, 2018) | 0.838 | 0.892 | 0.673 | |

| INN1 | Technical innovation based on research results is readily accepted. | |||

| INN2 | We always seek innovative ideas which we can use in our tea production. | |||

| INN3 | Innovation is readily accepted on our tea production. | |||

| INN4 | We have enough resources to apply the innovation in tea processing. |

The reliability measurement was conducted by convergent, discriminant and composite validity for each indicator, as illustrated in Table 1. The convergent method was applied to validate the indicator, which was expressed by the value of the outer loading factor. In this paper, the outer loading value of each indicator was between 0.760 and 0.929, which confirms the requirement of convergent validity.

Discriminant validityThe discriminant validity was tested among the different constructs to confirm that the items for measuring a construct are not highly correlated with others designed to measure the model by comparing the square root coefficient of variance extracted (AVE) from each latent factor with the correlation coefficient between others in the model. The AVE is required to be above 0.5.

The AVE value for corporate reputation was 0.884, greater than the correlation coefficient between other variables, namely, 0.567; 0.489; 0.05; 0.574, and 0.562, as shown in Table 2. The AVE value for cost advantage (0.863) was greater than the correlation coefficient between other variables, namely, 0.575, 0.093, 0.82 and 0.73. Similarly, the AVE values for customer linking, differentiation, innovation, and financial performance were greater than the correlation coefficient between other variables. These confirmed that the square root of the AVE of each latent variable is greater than the correlation between the latent variable and others, which suggests a good discriminant validity of the dimensions of variables (Fornell & Larcker, 1981; Ngo & O'Cass, 2012).

In the third step, composite reliability was used to measure the value between indicators of the variable. The results indicated that the composite reliability and Cronbach's alpha were above 0.70, which confirmed the reliability of the variable's dimensions and that it is free from the problem of random error (MacKenzie et al., 2011; Singleton and Straits, 2010).

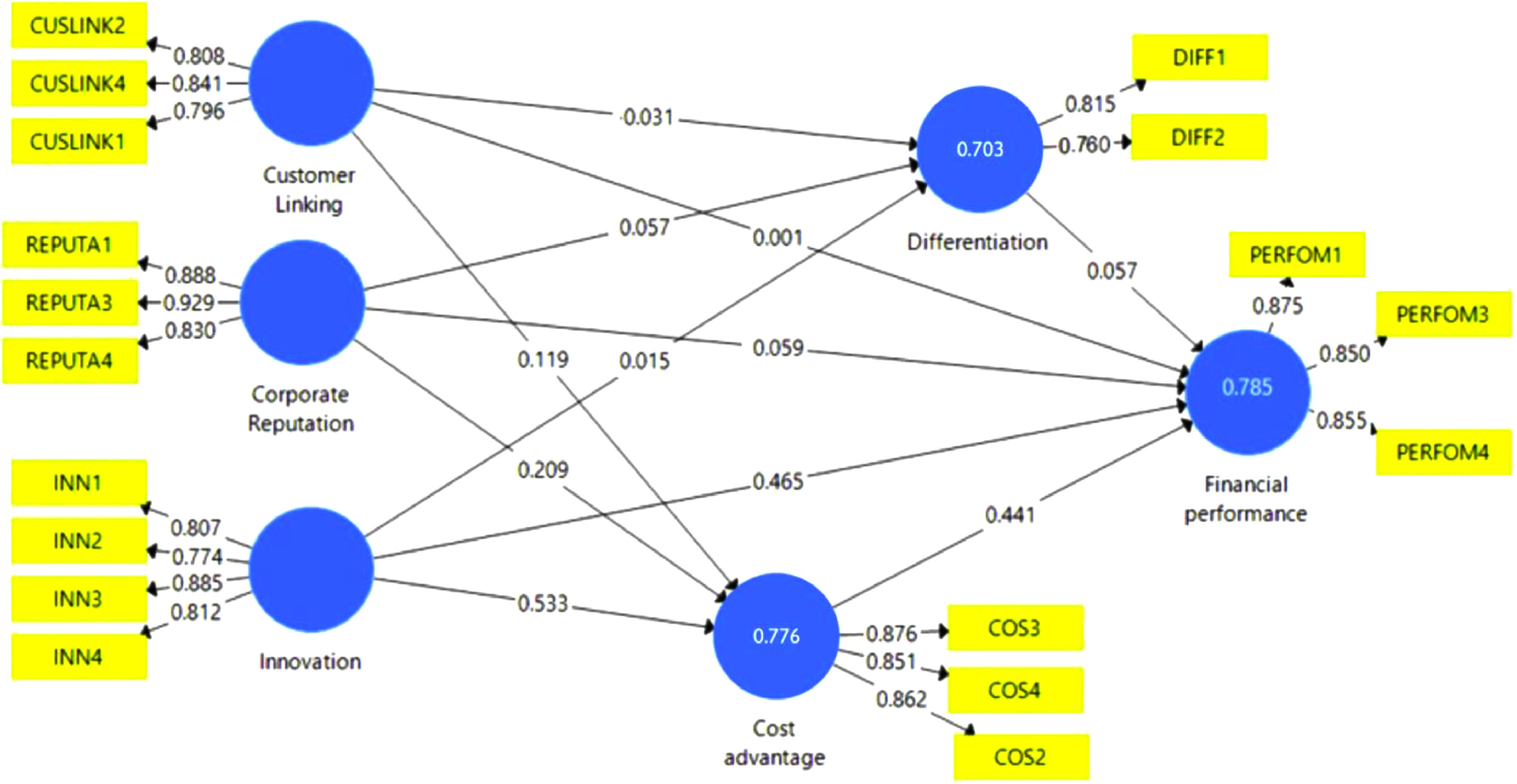

Inner model measurementThe inner measurement was conducted to address the feasibility of the model by (1) confirming the results of the R2 analysis, (2) testing the model holistically using the predict relevance method, and (3) calculating its goodness of fit (GoF). As shown in Table 3, the R2 of differentiation, cost advantage, and financial performance is 0.703; 0.776; and 0.785, respectively. The result confirmed that the model was robust as R2 was greater than 0.67 (Chin, 2001). The average value of R2 was 0.751, meaning that the relationship between the constructs in the model explained 75.1% of the variance. Table 3 also indicates that R2 values were greater than the distribution of adjusted R2 values, confirming that expansion of this model by adding other latent variables was still possible (Hair et al., 2014)

The Q square predictive relevance (Q2) was examined to evaluate if the model produced good observations. According to Stone (1974), the value of Q2 ranged from 0 to 1. The closer to 1 confirms the better prediction of the model. The calculation of the Q2 value was based on the following formula:

The value of Q2 was 0.985, with 98.5% of the variance in the relationship between variables in the model explained. The calculation of GoF is 0.66, which was close to 1, confirming a predictive model.

The effect size (f2) was also tested to obtain more detail about the variance in the dependent and independent variables in the model. According to Cohen et al. (1998) and Chin (2010), the effect size (f2) is from 0.02–0.15 or 0.15–0.35, reflecting the weak or medium effect, respectively. The effect size (f2) is greater than 0.35, confirming a strong effect. In this paper, the effect size (f2) is 0.18, indicating the variables' mediation relationship.

The study also explores the multicollinearity of the model by identifying the Variance inflation factor (VIF). The result indicated that VIF is smaller than 4, which confirmed no problematic issues with multicollinearity in the estimated model (Dakduk et al., 2019).

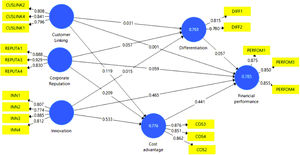

Structural modelThe results of the PLS-SEM (Table 4) provide support for the relationship between customer-linking and cost advantage (P-value = 0.032), corporate reputation, and innovation and cost advantage (P-value = 0.000), supporting hypotheses H1a, H2a, and H3a. However, the relationship between differentiation advantage and reputation and innovation capacity is insignificant (P-value > 0.05), failing to support H1b, H2b, and H3b. There are no direct relationships between customer-linking, reputation, and financial performance (P-value > 0.05), failing to support H1c and H2c. However, innovation was found to have a strong positive relationship with financial performance (beta = 0.465, P-value = 0.000), supporting H3c. The result also found that differentiation advantage has no significant relationship with financial performance (P-value > 0.05). By contrast, the cost advantage – financial performance relationship is confirmed (beta = 0.441 and P-value = 0.000).

PLS path results.

| Paths | Original Sample (O) | P Values | Hypothesis |

|---|---|---|---|

| Direct paths | |||

| Corporate reputation -> Cost advantage | 0.209 | 0.000 | H2a |

| Corporate reputation -> Differentiation | 0.057 | 0.536 | H2b |

| Corporate reputation -> Financial performance | 0.059 | 0.271 | H2c |

| Customer-linking -> Cost advantage | 0.119 | 0.032 | H1a |

| Customer-linking -> Differentiation | 0.031 | 0.765 | H1b |

| Customer-linking -> Financial performance | 0.001 | 0.978 | H1c |

| Innovation -> Cost advantage | 0.533 | 0.000 | H3a |

| Innovation -> Differentiation | 0.015 | 0.895 | H3b |

| Innovation -> Financial performance | 0.465 | 0.000 | H3c |

| Cost advantage -> Financial performance | 0.441 | 0.000 | H4a |

| Differentiation -> Financial performance | 0.057 | 0.176 | H4b |

| Indirect paths | |||

| Customer-linking -> Cost advantage -> Financial performance | 0.053 | 0.042 | |

| Innovation -> Differentiation -> Financial performance | 0.001 | 0.894 | |

| Innovation -> Cost advantage -> Financial performance | 0.235 | 0.000 | |

| Corporate reputation -> Cost advantage -> Financial performance | 0.092 | 0.000 | |

| Corporate reputation -> Differentiation -> Financial performance | 0.003 | 0.567 | |

| Customer-linking -> Differentiation -> Financial performance | 0.002 | 0.783 |

The indirect analysis was also conducted to explore the properties of the structural model. As shown in Fig. 3, the indirect pathways were significant in this analysis. Innovation capacity via cost advantage had a strong significant effect on financial performance (beta = 0.235, P = 0.000), and as expected, customer-linking was found via cost advantage to have an indirect effect on financial performance (beta = 0.053, p < 0.05). Similarly, corporate reputation through cost advantage had a slight positive effect on financial performance (beta = 0.092, P = 0.000).

Discussion and contributionsThis study considers how EMP may improve livelihoods and reduce the liability of poorness that constrains SME agribusiness to entrepreneurially build a more prosperous future for themselves and their communities. It also adds to the body of knowledge on EMP by testing a theoretical model in which two forms of competitive advantage (cost and differentiation advantage) is proposed to mediate the relationship between marketing resources and performance. The results suggest that deploying the EMP resources of customer-linking, reputation, and innovation capability are critical for SME tea producers to achieve a relative cost advantage in the marketplace, enhancing their financial performance. To some extent, the findings support the theoretical framework that EMP resources enable SME tea producers' competitive advantage and financial performance.

The paper's findings support the proposition of previous studies about customer-linking and competitive advantage (Hunt, 2013; Kamboj & Rahman, 2017). In this case, customer-linking is an essential resource that significantly affects the competitive advantage of tea producers in central Vietnam. SME tea producers connect with customers through experimental marketing tools such as sensory testing, promotional videos, and customer conferences to introduce the teas’ unique value proposition (Weber et al., 2021). However, reputation and innovation capacity positively affect only cost advantage and do not impact differentiation advantage. This suggests that the EMP resources of reputation and innovation can help SME tea producers achieve lower costs but not enable price premiums based on differentiation.

Critically, the findings of this study suggest that EMP resources of SME tea producers have no significant relationship with the ability to employ differentiation strategy, contradicting previous similar studies (Ho et al., 2019; Micheels & Gow, 2012). The ability to differentiate tea, similar to wine or olive oil, is a function of variety, terroir, appearance, branding, and packaging (Stanton & Herbst, 2005). Some studies have shown that differentiation strategies such as leveraging social networks (Dentoni & Reardon, 2010; Jackson et al., 2011) can help differentiate similar food products. However, differentiation is difficult for tea producers as they do not typically leverage customer information or production innovations effectively (Raj, 2021). It may be that the SME tea producers have not yet deployed sufficient EMP resources to create a differentiation advantage for their tea in either the competitive domestic market or export markets. However, it is likely also a function of the fact that the SMEs typically have not adopted tea growing and processing innovations but continue to use traditional tea growing and production methods learned from their family.

These findings suggest that by offering technical product innovation support programs to SME tea producers, they will be able to create a higher quality product that also leverages the unique traditional and cultural values of tea to create differentiation. Likewise, by participating in the marketing and management capacity-building programs, SMEs will learn the needed skills to obtain the OCOP brand, resulting in a stronger reputation grounded on product, process and marketing innovations.

The findings contribute to a better understanding of the relationship between EMP resources and competitive advantage, and the paper contributes to a clearer understanding of the complementarity between EMP resources and competitive advantage to improve financial performance. In particular, the study sheds light on how SME tea producers who possess superior marketing resources can achieve competitive advantage and enhanced performance. The paper shows that EMP resources provide the customer-linking, reputation, and innovation capability for firms to develop distinctive strategies in terms of cost leadership to outperform their rivals.

The paper further provides a new understanding of marketing theory by highlighting the relationships between EMP resources, competitive advantage, and their complementary effect on financial performance. The results show that EMP resources and competitive advantage complement and enhance a firm's financial performance. In addition, the findings are consistent with the growing body of work that suggests studying marketing resources within broader models rather than simply linking these resources directly with financial performance.

The findings indicate that SME EMP resources contribute to the superior financial performance of SMEs by creating a cost advantage. Notably, the findings confirmed that the complementarity between firms’ entrepreneurial marketing resources and competitive advantage provides a greater impact on the business performance of SMEs. The paper also contributes to the debate on the theory of competitive capability concerning whether market resources and competitive advantage are complementary in explaining the differential business performance between firms.

The paper provides insights on how to transition from a scarcity mindset shaped substance business orientation to leveraging EMPs to create marketing advantage using EMP resources such as customer-linking, reputation and innovation capability play an essential role in creating superior financial performance. It reinforces the need to manage agrifood SMEs' production costs effectively. By showing that customer-linking, reputation and innovation capability influence the tea producers’ cost leading strategy, the paper suggests that SMEs consider adopting innovative tea production methods and new alternative techniques in processing and packaging their tea products. SMEs can improve their product's value proposition for their customers and create a positional advantage. Managers should recognize that cost leadership strategy and innovation capability are of primary importance in improving the financial performance of the tea business. Likewise, their marketing resources such as customer-linking, innovation capability, and reputation should be improved to leverage cost leadership. Additionally, the findings show managers that financial performance can be enhanced through the complementarity between production innovations and EMPs. Accordingly, for managers who focus on synergistic performance, EMP resources can provide synergistic effects with a competitive advantage – the firm's capability to influence financial performance.

The OCOP program offers policymakers the opportunity to build smallholder entrepreneurial capabilities through EMP initiatives. These programs can shift SME agribusiness from a substance orientation towards a more positive entrepreneurial mindset and develop entrepreneurial capabilities to facilitate a more prosperous future.

Limitations and directions for further researchAdapting scales from developed economies and using them in an emerging economy with substance agriculture has many challenges. It studies one product in one developing economy using a judgment sample. This limits generalization to the sample. Items are drawn and adapted from previous studies. Future studies may benefit from using a mixed-method approach, where qualitative work provides the understanding and potential validation of scale items in measuring resources, competitive advantage, and financial performance. Since the study focused on tea producers, the results are limited to a single industry; however, the findings may apply to tea producers in other nations and agrifood producers in developing economies. The paper suggests that using qualitative data collection through multiple informant interviews might provide more qualitative insights on the causality between marketing resources and competitive advantage and the translation of these constructs into financial performance. This suggestion would increase the reliability and validation of data collection and facilitate the generalization of findings (Ngo & O'Cass, 2012; Ray et al., 2004).

The author(s) also acknowledge the partial support of Hue University under the Core Research Program, Grant No. NCM.DHH.2022.14.