This paper investigates how the time to a firm's first innovation affects the continued pace of innovation and how the networking behaviour of the firm moderates this relationship. In doing so, the paper develops a relationship among three constructs: time to innovation, pace of innovation, and networking. We draw on resource accumulation theory and network theories to develop our hypotheses, which are tested on a sample of 203 SMEs. The results indicate that the innovation pace of a firm depends on the capabilities developed. By developing innovation capabilities at an early age, firms are likely to drive market changes instead of being challenged by them. Firms that lag in the innovation process can compensate for this by actively networking for resources and capabilities.

Innovations and innovative behaviour have become increasingly important for firm survival, growth, and profitability in rapidly changing business environments (Taques, López, Basso, & Areal, in press). Shortened product life cycles, technological advances, and increased competition from globalization constitute major challenges for growth-aspiring firms (Baregheh, Rowley, & Hemsworth, 2016). The ability to innovate products, markets, organizations, processes, and business models is therefore crucial. Recent research (e.g., Kay, Youtie, & Shapira, 2014) suggests that managing innovations, especially in the form of patents, has become increasingly important to small and medium-sized technology companies for exploring and exploiting knowledge in the commercialization process. Even though start-ups tend to choose informal protective mechanisms due to a lack of resources (e.g., Block, De Vries, Schumann, & Sandner, 2014; Olander, Vanhala, & Hurmelinna-Laukkanen, 2014), it has been suggested (Bos, Broekhuizen, & Faria, 2015) that companies can achieve competitive advantages only by effectively appropriating value through protecting their innovation activities from use by competitors. Although the relationship between patents and innovations has been debated in the literature, patents are the protective mechanism that has attracted the most attention in management research to this point (Candelin-Palmqvist, Sandberg, & Mylly, 2012; Levitas & McFadyen, 2009; McGahan & Silverman, 2006). In this paper, we focus on the output of innovation efforts, using patents as a proxy along the lines suggested by Taques et al. (in press). We argue that patent data allows us to compare a broad sample of firms on a reliable basis, allow for replicability, and give us quantifiable longitudinal data.

In the current innovation debate, the speed and frequency of innovations have been described as critical (Langseth, O’Dwyer, & Arpa, 2016). Chen, Reilly, and Lynn (2012) argued that speed has become a magical word and that fast decision making, fast internationalization, and fast new product development are embraced as key to creating the competitive advantages of firms. The innovativeness, speed, and frequency of innovations are important success factors for small and medium-sized enterprises (SMEs) operating in changing business environments. To this point, research on the temporal aspects of firm innovations and innovativeness has focused on the speed of individual product innovation processes and the speed at which newly innovated products reach the market (Chen et al., 2012) – that is, the time it takes to innovate certain products – so researchers have a fairly well-developed understanding of the role of the speed of individual innovation processes.

As less is known about the pace of innovation by firms, i.e., the number of innovations developed over a certain period, we set out to develop the “pace of innovation” construct. Inspired by recent temporal construct developments in international business research (for an overview, see Hilmersson, Johanson, Lundberg, & Papaioannou, 2017), we suggest that the pace of innovation of a firm can be captured by dividing the number of patents controlled by the firm by the age of the firm, giving the average number of patents, or innovations, per year since firm inception. We acknowledge that individual product innovations are of utmost important for firm competitiveness, though this study argues that the innovative behaviour of the firm over time and the pace at which new firm innovations reach the market may well be important antecedents to SME growth and sustainability over time.

Innovations are dependent on firm capabilities, and to develop our arguments, we build on extant research on capability development. Whereas the related theories of firm growth, resource accumulation (Dierickx & Cool, 1989), and the resource-based view (Barney, 1991) consider firms in isolation, alternative perspectives assume that firms can exploit resources located outside their boundaries (Dyer, 1996; Gulati, 1999; Zaheer & Bell, 2005). Relevant and important resources may be found in the inter-firm routines and processes of a firm's network (Dyer & Singh, 1998) – a central idea of the industrial marketing and purchasing (IMP) perspective. This perspective builds on the idea that in business markets, both buyers and sellers play active roles (Håkansson, 1982), as the resource constellation between firms in a network is heterogeneous (Håkansson & Johanson, 1993). In a business network, constituted by a web of interconnected business relationships, the behaviour of an individual firm is unlikely to be understood without taking its network into account (Öberg, 2019). The firm's network relationships are expected to facilitate or impede its strategic moves (Axelsson & Easton, 1992). Research following this perspective (e.g., Axelsson, 1995; Ritvala & Salmi, 2010) has shown that actively networking firms may be able to mobilize resources from their external networks to compensate for internal shortcomings (Jin & Jung, 2016). It is likely valid to assume that resource accumulation is not necessarily an internal process undertaken by the individual firm (Rennemo, Widding, & Bogren, 2017). Instead, there are reasons to believe that the temporal aspects of innovation processes are influenced by the networking behaviour of the firm. Departing from this assumption, this study seeks to advance our knowledge of the temporal dimension of innovation processes by integrating theories of (internal) resource accumulation with theories of (external) resource mobilization. We do so by studying SME growth processes and examining the role of firm networking in the innovation capabilities of the firm over time. We seek to answer the following research questions: How does the time to the first innovation of a firm affect the continued pace of innovation? How does the networking behaviour of the firm influence this relationship?

By answering this research question, our intention is to make two contributions to the literature: first, to examine whether the concept of the learning advantage of newness can help us understand firm innovativeness over time; and, second, by considering external networking a means to alleviate time compression diseconomies, the aim is to integrate network theory and resource accumulation theory. Our ambition is to provide managerial insights into how to manage innovation processes in rapidly changing environments.

The rest of the paper is structured as follows. First, the theoretical background to the study is presented, followed by the hypothesis development. The methodology is described, after which the results are discussed and the analysis is presented. The paper ends by discussing the research implications and limitations and finally the suggestions for further research condensed from the study.

Theoretical backgroundInnovation and innovation performance as resource drivenA firm's ability to innovate products, markets, organizations, processes, and business models is a central capability in changing business environments. Recent research has described the speed and frequency of innovations as critical to smaller firms (Langseth et al., 2016). The literature has studied and measured innovations in various ways (see Katila, 2002, for an overview) and there does not seem to be consensus as to how to define and/or measure innovations and innovation performance. An underlying challenge concerns the fact that innovations and their outcomes are studied at different levels of analysis. For example, we find studies of the role of innovations and innovative activities on the national level trying to explain the economic development of societies. We also find studies on the individual product or service level explaining the performance of particular innovations. Here, we analyze innovations from a firm perspective, examining the innovation activities of the firm over time along the lines suggested by Zahra (2019). We are not focusing on individual innovations, but instead pay attention to the innovative pace of the firm, that is, how many innovations the firm can create over a certain period.

Despite relatively intense debate about how to conceptualize and measure innovations (see Katila, 2002), we argue that the use of patents as a proxy for innovations entails several benefits that help us develop the concept of pace of innovation. First, patents constitute a relatively objective measure of something new since, to be patented, “an invention must be something not already known from prior publication, or not a part of the experience of those skilled in the art” (Walker, 1995, p. 83). We also know that several significant studies advancing the innovation literature are anchored in patent-based research (e.g., Dutta & Weiss, 1997; Henderson & Cockburn, 1994) and, as suggested by Katila (2002), patents, as a measure, provide the benefits of availability and objectivity. Although there are shortcomings to using patents as a proxy for innovation, we argue that it is the best current objective measure available for the individual firm if one wants to study a broader sample. Since Hagedoorn and Cloodt (2003, p. 1375) found “no major systematic disparity amongst R&D inputs, patent counts, patent citations and new product announcements”, they concluded that “future research might also consider using any of these indicators to measure innovation performance of companies in high-tech industries”. Accordingly, we argue that the benefits of using patent data outweigh their shortcomings as a proxy of innovation.

Resources and resource-accumulation theoryFrom research in strategic management we know that firm growth and competitiveness depend on firm resources. Firm resources are defined as “all assets, capabilities, organizational processes, firm attributes, information, knowledge etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness” (Barney, 1991, p. 101). Resources that are valuable, rare, inimitable, and non-substitutable constitute the foundation of a sustainable competitive advantage. Efficient combinations of such resources constitute the core capabilities of competitive firms. A firm is said to possess a sustained competitive advantage “when it is implementing a value creating strategy not simultaneously being implemented by any current or potential competitors and when these other firms are unable to duplicate the benefits of this strategy” (Barney, 1991, p. 102). Such competitive advantages arise when a firm can produce its products at a lower cost than can the competition or when the firm produces a product that generates a superior willingness-to-pay among its customers. The sustainability of the competitive advantage concerns whether it persists over time.

From the more recent strategic management literature we also know that the sustained competitive advantage of the firm requires that the firm be able to adapt its resource base to changes in the external environment. The original resource-based view (RBV) was static in nature, providing a strong framework for predicting competitiveness in stable market environments. In changing environments, however, it has been criticized for falling short. To sustain a competitive advantage in changing market environments, the firm must develop a dynamic capability, defined by Teece, Pisano, and Shuen (1997, p. 516) as “the firm's ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments”.

Contributions from RBV research on strategy have led to two major conclusions. First, the competitive advantages of firms depend on the resources they possess, and to evaluate the contribution of resources to sustained competitive advantages we must understand whether the resources are valuable, rare, inimitable, and non-substitutable. Second, the RBV framework assumes market stability, so if the firm is operating in a changing market environment, the sustainability of its competitive advantage also depends on its dynamic capabilities. The ability of the firm to integrate, reconfigure, gain, and deploy resources are important in order to address or even create market change. Conjointly, these findings indicate that the competitiveness and success of the firm depends on its resource base and on how these resources form a capability of the firm.

Whereas the capability-based view of competitiveness illuminates the role of resources and capabilities as sources of firm competitiveness, less is known about the capability development process. The literature on the characteristics and efficiency of the capability development process is scarce. In particular, researchers have limited knowledge of the consequences of time for the capability development process. Regarding resource accumulation, two streams of research have advanced our knowledge. First, research on resource accumulation suggests that the faster the needed resources or capabilities are developed, the higher the cost of this process. Dierickx and Cool (1989) argued that inefficiencies arise when things are done faster, so when the capability development process is accelerated, its costs increase disproportionally. Research on time compression diseconomies holds that individuals and organizations will be subject to diminishing rates of return when subjected to time compression. When all inputs to a process except time are held constant, the output will be weaker. Two easily digested examples from the discussion of time compression diseconomies serve as good illustrations. First, in their seminal paper, Dierickx and Cool (1989) cited the example of MBA students who cannot accumulate the same amount of knowledge in a one-year programme as in a two-year programme. Second, research on the resource accumulation of internationalizing firms has established the idea of the learning advantage of newness (LAN). Research on LAN (e.g., Autio, Sapienza, & Almedia, 2000; Prashantham & Young, 2011; Sapienza, Autio, George, & Zahra, 2006) has argued that young firms are less constrained by their pasts and therefore can more effectively develop new capabilities. They are not as limited by their routines and are therefore better equipped to promote the transformation of their experience into experiential knowledge, which is at the core of capability development.

Networks and resource accumulationWhereas resource accumulation theory studies firms in isolation, alternative research streams have shown that firms do not necessarily need to develop or accumulate resources internally. Instead, it has been argued that firms can exploit resources beyond their boundaries (Dyer, 1996; Gulati, 1999; Zaheer & Bell, 2005), making the firm's network an important resource pool (Dyer & Singh, 1998). Research has shown that networks may be a key for resource-constrained SMEs suffering from the liability of smallness. Small firms have difficulties developing scale and scope advantages and may therefore experience hampered innovative capacities. A means of circumventing these disadvantages is to develop relationships in networks. A firm that manages to develop an insidership position (Johanson & Vahlne, 2009) can tap its network for resources and access the capabilities of other firms. Consequently, in the resource development process, a strong network position can enable the firm to compensate for internal shortcomings. Instead of developing all resources and capabilities internally, the firm can seek to access the resources or capabilities of other actors in its network. This kind of strategic behaviour requires commitment by the firm and can be seen as a networking process.

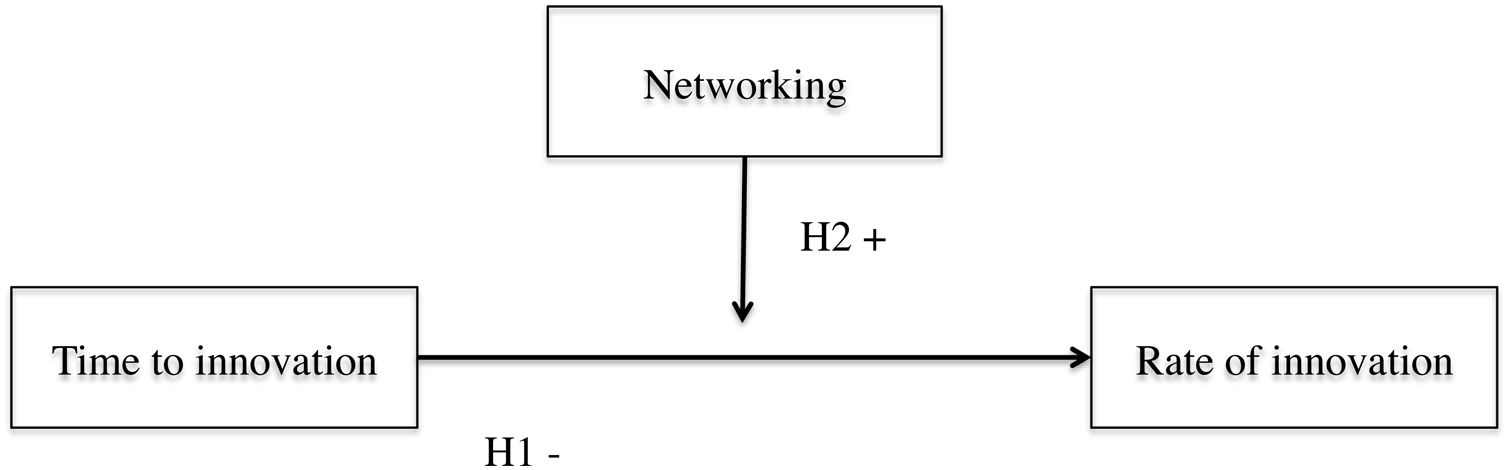

Conceptualization and hypothesesKey constructsThis study considers three constructs: time to innovation, pace of innovation, and networking. Time to innovation concerns the time elapsed from a firm's inception to its first innovation. To capture the firm's first innovation, the first patent registered by the firm is used. Pace of innovation, in turn, concerns how innovative the firm has been over time since inception; to capture this, the average number of patents the firm has registered per year since inception is used. Networking concerns the market behaviour of the firm and how actively the firm seeks to access or tap resources from its external network (Fig. 1).

Firm innovations and innovativeness depend on the relevant capabilities possessed by the firm. Innovation capabilities that contribute to firm competitiveness build on resources that are valuable, rare, inimitable, and non-substitutable (Grant, 1991). These capabilities are assumed to develop through learning from experience and R&D investments by the firm. Research on organizational learning shows that a firm's asset accumulation results from its dynamic capabilities (Teece et al., 1997) and absorptive capacity (Cohen & Levinthal, 1990).

The learning advantage of newness (LAN) concept captures the notion that young firms are less constrained by institutionalized routines and past experience than are old firms (Autio et al., 2000). Accordingly, firms that start investing in R&D activities at a young age are expected to develop and institutionalize routines that support innovation from an early age. In contrast, firms that do not make such investments are likely to develop routines and processes that do not support exploration of the new, but instead can be expected to develop routines for exploiting existing products and processes. This study argues that LAN plays an important role in the SME innovation process. Specifically, LAN fosters an innovative and open-minded mindset within the firm that supports future innovation. Consequently, the first hypothesis is:

H1: The more time elapsed between a firm's inception and its first innovation, the slower the pace of continued innovation.

Time to innovation, networking, and pace of innovationResource accumulation theory holds that resources and capabilities are controlled and developed internally by the firm, but the network perspective holds that resources and capabilities reside in networks. It has been argued that we cannot understand a firm's strategic behaviour without taking its network relationships into account. Firms are embedded in networks in which activities, actors, and resources create power dependency between network members. Insider firms in business networks (Johanson & Vahlne, 2009) can tap network relationships for resources and capabilities possessed by other firms. A firm that cannot develop resources and capabilities internally may very well be able to benefit from tapping its network for resources and capabilities. For small firms, the importance of networks for innovative behaviour is well documented (Ahuja, 2000; Lee, Park, & Yoon, 2010; Rogers, 2004; Zeng, Xie, & Tam, 2010). Both intra-firm (Tsai & Ghoshal, 1998) and inter-firm (Molina-Morales & Martinez-Fernandez, 2010) networks have been found to contribute to both process and product innovation. By tapping their networks for resources, SMEs can compensate for their liability of smallness and lack of economies of scale (Mohannak, 2007). It can be expected that a firm that actively seeks resources in its network can compensate for a longer time to innovation. By tapping its network for resources, the late-starting firm can compensate for its late start and catch up in its innovation rate. It is therefore hypothesized that:

H2: Active networking by the firm moderates the negative relationship between time elapsed between firm inception and first innovation and pace of continued innovation.

Method and dataSample and data collectionThe theoretical model in this study is tested on a sample of 203 SMEs. Since we were interested in internationally competitive SMEs, we first used a sampling criterion related to international sales, namely, annual exports of at least EUR 1 million. Second, since we were interested in the innovative behaviour of SMEs, we used the EU definition of SMEs (based on an employee headcount <250).1 Third, to reduce contextual biases and industry differences in innovation patenting, we decided to only include manufacturing firms. For the project, relatively labour-intensive on-site data collection was performed. The study was conducted in southern Sweden, a geographical area known for its entrepreneurial SMEs. To identify the sample, data were ordered from Statistics Sweden covering all firms in southern Sweden matching the sampling criteria. Two steps were then taken: first, the secondary data were evaluated in relation to the criteria; second, all firms were contacted by phone. At this stage, the researcher confirmed that the firms met the sampling criteria. After these two steps, the sample comprised 277 firms, 203 of which invited researchers to their facilities resulting in a response rate of 73%. The 74 firms that did not participate in the study were either unreachable after four attempts, declined to participate, said that they did not have time, or were uninterested. Post hoc, several non-response tests were conducted without revealing any significant differences or patterns when comparing responding and non-responding firms. The on-site data collection strategy was rather labour and cost intensive, but it provided the researcher with several advantages: it ensured respondent commitment, standardized the data collection procedure, and allowed the researcher to help respondents understand the questions. On each site visit, which lasted an average of 1.5h, a semi-structured interview and a standardized questionnaire were conducted. A template was developed for the visits to standardize the interview situation. To identify the respondents, an intra-firm snowball sampling process was followed. Although several meetings were conducted with two or three persons, the data are compiled and treated so that one person represents each firm. As this creates a risk of potential biases related to single respondents, the suggestions of Podsakoff, MacKenzie, Lee, and Podsakoff (2003) were carefully followed to avoid method biases common in behavioural research.

After the on-site data collection, we used objectively available register data on all 203 SMEs. From patent data registers in Sweden, we downloaded patent information for each firm. In addition, we downloaded data on each firm from official sources regarding firm age, ownership, growth, turnover, and profitability, so the dataset integrates survey data with data from secondary sources for each firm. Below is an account of how the individual constructs were measured and how the data for each variable were accessed.

MeasuresAs outlined above, measuring innovations is challenging, and the literature has suggested several approaches for doing so (see Taques et al., in press, for an overview). As we are mainly interested in the innovation output or performance of the firm, input-related measures such as R&D investment were not chosen. Instead, we followed the suggestions of Hagedoorn and Cloodt (2003) and Blomkvist, Kappen, and Zander (2017) and used patent data as a proxy for innovation. Since patent data enable us to create a reliable, replicable, and comparable dataset covering developments over time, we decided to download patent data for all sampled firms.

The independent variable of the model, time to innovation, is intended to capture the time elapsed from a firm's inception to its first innovation. Data were collected from Swedish patent registers on the first patent registered by each sampled firm. The year of firm foundation was then subtracted from the year of the firm's first patent; for example, a firm founded in 1993 with its first patent in 1998 has a time to innovation of five years.

The dependent variable of the model, pace of innovation, is intended to capture the innovativeness by the firm over time. For this purpose, data were collected from Swedish patent registers regarding the number of patents registered by each firm, which was divided by firm age. This measure indicates the average number of patents per year since firm inception; for example, a 10-year-old firm with eight patents has a value of 0.8.

The interacting variable of the model, networking, is intended to capture whether the firm actively seeks to tap its external network for capabilities to advance the innovation process. To capture this aspect, membership data were collected from the Swedish Chamber of Commerce. A dummy variable was created giving members a value of 1 and non-members a value of 0. The Swedish Chamber of Commerce has regional chapters in all counties of Sweden and actively strives to improve business conditions for its members, create networking opportunities among its members, and be a business hub in the regions where the chapters are located.

The regression model includes four control variables. First, firm size was controlled for by including the number of employees in the equation. Second, the international reach of the firm was controlled for by including a control for the number of markets to which the firm exports. Third, firm turnover was controlled for. Fourth, the share of the firms’ sales to foreign relative to domestic customers was controlled for.

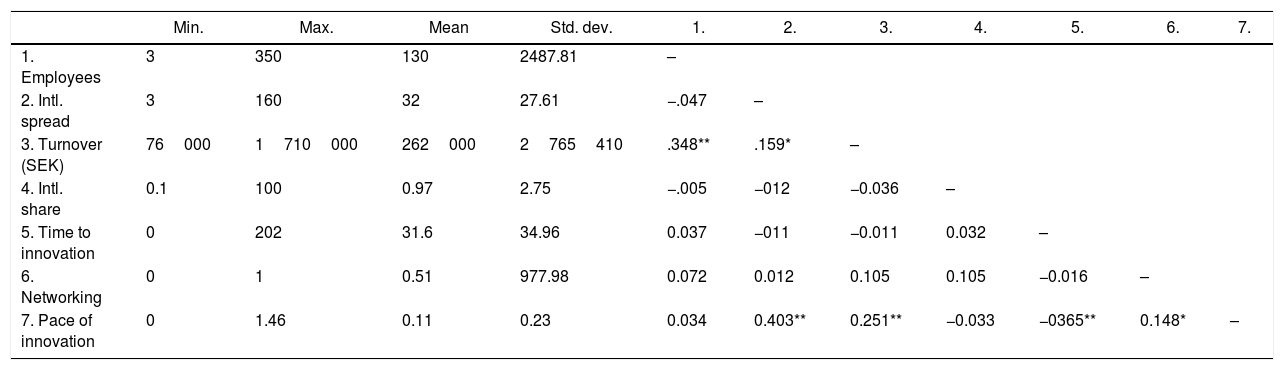

Descriptive dataTable 1 presents the descriptive data and the correlations between the variables of the model.

Descriptive statistics and correlations.

| Min. | Max. | Mean | Std. dev. | 1. | 2. | 3. | 4. | 5. | 6. | 7. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Employees | 3 | 350 | 130 | 2487.81 | – | ||||||

| 2. Intl. spread | 3 | 160 | 32 | 27.61 | −.047 | – | |||||

| 3. Turnover (SEK) | 76000 | 1710000 | 262000 | 2765410 | .348** | .159* | – | ||||

| 4. Intl. share | 0.1 | 100 | 0.97 | 2.75 | −.005 | −012 | −0.036 | – | |||

| 5. Time to innovation | 0 | 202 | 31.6 | 34.96 | 0.037 | −011 | −0.011 | 0.032 | – | ||

| 6. Networking | 0 | 1 | 0.51 | 977.98 | 0.072 | 0.012 | 0.105 | 0.105 | −0.016 | – | |

| 7. Pace of innovation | 0 | 1.46 | 0.11 | 0.23 | 0.034 | 0.403** | 0.251** | −0.033 | −0365** | 0.148* | – |

*,** indicates significance (2-tailed) at the 5 and 1% level respectively.

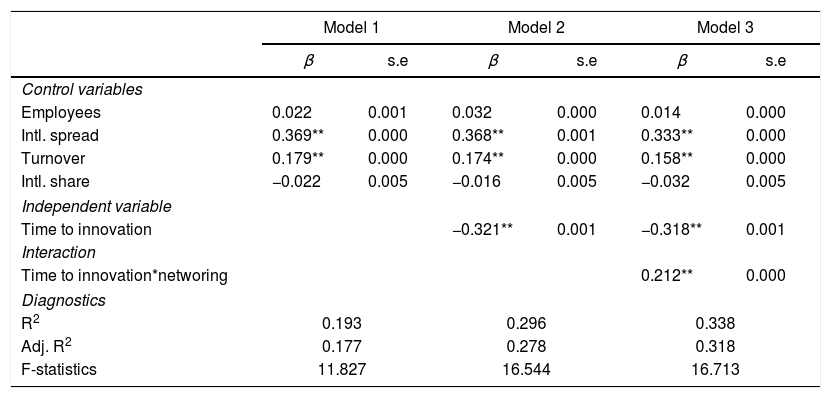

Ordinary least squares regression models were used to test the hypotheses, and Table 2 presents their results. Model 1 presents the results of the control variables, while model 2 adds time to innovation to the equation. Model 2 results indicate support for the first hypothesis, positing that the longer the time before first innovation, the slower the pace of innovation. This result is highly significant, with the adjusted R2 value indicating a predictive power of 27.8%. In model 3, the networking behaviour of the firm is added. The second hypothesis, positing that active networking by the firm moderates the negative relationship between time elapsed between firm inception and pace of innovation, is tested in model 3, which indicates significant support. The significant beta value changes from negative to positive, indicating that the networking effect can compensate for a late innovation start. The predictive power of model 3 is shown by the adjusted R2 value of 31.8%. These results are discussed in the next section.

Regression results.

| Model 1 | Model 2 | Model 3 | ||||

|---|---|---|---|---|---|---|

| β | s.e | β | s.e | β | s.e | |

| Control variables | ||||||

| Employees | 0.022 | 0.001 | 0.032 | 0.000 | 0.014 | 0.000 |

| Intl. spread | 0.369** | 0.000 | 0.368** | 0.001 | 0.333** | 0.000 |

| Turnover | 0.179** | 0.000 | 0.174** | 0.000 | 0.158** | 0.000 |

| Intl. share | −0.022 | 0.005 | −0.016 | 0.005 | −0.032 | 0.005 |

| Independent variable | ||||||

| Time to innovation | −0.321** | 0.001 | −0.318** | 0.001 | ||

| Interaction | ||||||

| Time to innovation*networing | 0.212** | 0.000 | ||||

| Diagnostics | ||||||

| R2 | 0.193 | 0.296 | 0.338 | |||

| Adj. R2 | 0.177 | 0.278 | 0.318 | |||

| F-statistics | 11.827 | 16.544 | 16.713 | |||

Standardized estimate parameters reported. *, **, show significance at 5 and 1% level respectively.

This study has shown that the longer the time elapsed between a firm's inception and its first innovation, the slower the pace of innovation in the later development of the firm, emphasizing that timing matters for firm innovativeness. We argue that this finding indicates a liability of lateness in the innovative development of SMEs. By starting to develop innovations late, an SME will lag in building flexible and creative capabilities. This finding is supported by recent developments in international entrepreneurship research suggesting that firms that internationalize – which can be seen as an act of market innovation – can draw on the learning advantages of newness (Autio et al., 2000). It seems as though firms that are innovative at a younger age foster a culture and strategy that are open to exploring new ideas and to continuously developing new products in their growth efforts. Firms with a longer elapsed time between inception and first innovation, in contrast, display a slower pace of innovation in their continued development process. It seems as though they are hampered by the routines and structures developed during the period that elapsed before their first innovation. By looking at the underlying mechanisms of the relationships between the time when first innovations are registered and the continued innovations of the firm, we understand that the time taken to develop routines and capabilities matters. If technological capabilities are developed relatively late, the firm will have difficulties adapting these capabilities to changing market environments. Consequently, resource accumulation theory can help us understand the dynamics of innovation processes at the firm level. As shown, the negative effects of a late innovation start indicate that the development of innovation capabilities is hampered. The late start leads to a situation in which these firms fall behind the more active early innovators. In a rapidly changing business environment, this situation is arguably challenging for the late-starting firm. These firms risk losing market shares and competitiveness as the needs and wants of customers are likely to change before they begin innovating. In contrast, by starting the innovation process at a young age, SMEs can foster an innovative and open-minded organizational culture that constantly develops new ideas and products. A rapid pace of innovation will likely enable the firm to meet challenges arising in rapidly changing environments. A rapid pace of innovation also means that the firm will likely participate in changing the market environment, meaning that the firm is less reactive and is instead a proactive actor. By developing innovation capabilities at an early age, the firm is likely to drive market changes instead of being challenged by them.

Networking to catch up in the pace of innovationBased on research into the development of innovation capabilities, one might assume that capability development is an internal process. However, by drawing on IMP research, we have shown that this is not necessarily the case. These findings are in line with recent suggestions that the relationship between technological capabilities and the internationalization performance of the firm is moderated by the social networks of managers (Zahra, 2019). Accordingly, we argue that there are problems with assuming that resource and capability development occurs within the firm. We have shown that firms that can access resources and capabilities in their external networks can compensate for the liability of a late innovation start. We further argue that accessing others’ resources and capabilities is a more sustainable strategy than seeking to develop them internally at high speed. Theoretically, we find clear explanations for this pattern in theories of time compression diseconomies (e.g., Dierickx & Cool, 1989; Hilmersson et al., 2017). Based on these findings, we question the importance of resource control and emphasize that critical resources may well reside in business networks. It can therefore be assumed that firms that cannot develop their own innovation capabilities, or that do so slowly, can compensate for their shortcomings by turning to their external networks. The network perspective is thus integrated with resource accumulation theory to advance our knowledge of the temporal aspect of innovation processes. Consequently, it was hypothesized that active networking by the firm moderates the negative relationship between time elapsed between firm inception and pace of innovation; the interaction test returned significant results, supporting the hypothesis. It can therefore be argued that resource accumulation theory falls short in explaining capability development processes in general and the innovation process in particular. The present findings reveal that resources and capabilities reside in business networks and that firms lacking certain resources and capabilities may well compensate for this lack by actively networking. This study therefore argues that networking is a means to accelerate the pace of firm innovation. These findings suggest that SMEs operating in rapidly changing environments where competitiveness is intense should seek to establish insidership positions (Johanson & Vahlne, 2009) in relevant business networks to accelerate their pace of innovation.

In light of Chen et al. (2012), who argued that the temporal aspect of innovation is understudied and deserves more explicit attention, this study has made an important contribution. First, the results contribute to the innovation literature by developing the concept of pace of innovation. Before this research, most literature on the temporal aspects of the innovation process focused on the innovation and development of certain products and their performance outcomes, using speed of innovation and time to market as concepts underlining the time it takes to develop certain products or services. Less was known about temporal innovation aspects from an SME management perspective. The present findings make a tentative contribution to the SME management literature by explicitly studying firm innovativeness and how to accelerate it over time. The measure developed captures the average number of innovations per year from firm inception instead of the time needed for certain innovations. Second, this study has made a tentative contribution to resource accumulation theory and, in particular, to innovation process theory by showing that resource accumulation is not necessarily an internal process. This research found that firms suffering from a late start in innovation capability development or that have underdeveloped innovation capabilities can alleviate such shortcomings by seeking resources and capabilities in their external networks. These findings validate research into the role of business networks in bolstering firm competitiveness (Dyer, 1996; Gulati, 1999; Zaheer & Bell, 2005). The present findings suggest that innovation research would benefit from further integrating the industrial marketing and purchasing perspective into its conceptualizations. This perspective builds on the idea that both buyers and sellers play active roles in business markets (Håkansson, 1982), as the resource constellation between firms is heterogeneous (Håkansson & Johanson, 1993). Firms can mobilize resources (Ritvala & Salmi, 2010) by actively networking with other business actors.

Implications and further researchThis study has several implications for managers. First, managers should be aware of the negative relationship between time to innovation and the continued pace of innovation. From a practical perspective, this means that firms that start innovating at an older age might face difficulties, as their institutionalized (non-innovative) routines and processes could hamper firm innovativeness. Managers are therefore advised to foster an innovative and entrepreneurial culture even at a young firm age. Second, for managers of firms interested in increasing or reactivating their innovativeness, this study has shown that networking is an important means of catching up in innovation processes. Managers should, based on these findings, focus on accessing resources and capabilities in their networks rather than on creating them internally if rapid innovation is sought.

The present findings suggest future avenues for research into the temporal aspects of innovation in SMEs. First, future research would benefit from taking a more nuanced view of innovation. This paper has focused on product innovation, and patent data were used as a proxy for innovation as suggested in earlier research (e.g., Katila, 2002). We believe that the objective nature and open availability of these data were crucial for our analysis. However, we might have missed important unpatented innovations as well as including patents that did not succeed in the market. Future research would probably benefit from studying organizational, process, and business model innovations for a more holistic understanding of the innovation phenomenon. Second, more qualitative research is needed into how firms network and mobilize resources over time to stimulate their innovativeness and pace of innovation.

After data collection, we evaluated the sample in terms of the turnover and balance sheet criteria of the EU definition, revealing that only four sampled firms exceeded any of these criteria. Since none of these four firms displayed any noteworthy differences in the studied variables compared with the rest of the sampled firms, they were included in the analysis.