Attaining competitive advantage is especially crucial for innovative firms. Due to increased competition, firms employ various types of innovation activities to position themselves against their competitors. Ambidexterity and strategic agility have been found to strengthen this position. Whereas scholars analyzed strategic agility’s and ambidexterity’s impact on organizational performance, ambidexterity’s impact on the competitive advantage of organizations remains largely unexplored. Tensions between exploration and exploitation within an ambidextrous strategy make it difficult to reap benefits in establishing competitive advantage. Contrary, strategic agility centers on organization’s capacities to quickly respond to shifting demand, hence, increasing its competitive advantage. Through a mixed-method approach, comprising of a literature review and quantitative analyses of 150 German mid-sized firms in the engineering industry, it is demonstrated how ambidexterity, exploration and exploitation, in conjunction with strategic agility, affect the competitive advantage of firms. In order to sustain, firms should either favor an exploration strategy of innovation processes to come up with radically new knowledge, products and services, or combine an exploitation strategy with strategic agility. A strategy of sole exploitation is not beneficial towards increased competitive advantage, while an ambidextrous strategy seems to even negatively influence the competitive advantage of a firm.

Lograr una ventaja competitiva es crucial para las empresas innovadoras. Como consecuencia del aumento de la competencia, las empresas utilizan diversos tipos de actividades innovadoras para posicionarse frente a sus competidores. Se ha descubierto que la ambidestreza y la agilidad estratégica fortalecen esta posición. Diversos estudios han analizado el impacto de la agilidad estratégica y la ambidestreza en el desempeño organizacional. Sin embargo, el impacto de la ambidestreza en la ventaja competitiva de las organizaciones permanece en gran parte inexplorado. Las tensiones entre la exploración y la explotación que definen una estrategia ambidiestra aumentan la dificultad de obtener beneficios al establecer una ventaja competitiva. Por el contrario, la agilidad estratégica se centra en las capacidades de la organización para responder rápidamente a la demanda cambiante y, por lo tanto, aumentar su ventaja competitiva. Mediante un enfoque de método mixto, que comprende tanto una revisión de la literatura como el análisis cuantitativos de 150 empresas medianas alemanas en la industria de la ingeniería, se demuestra cómo la ambidestreza, la exploración y la explotación, junto con la agilidad estratégica, afectan a la ventaja competitiva. Para ser sostenibles en el largo plazo, las empresas deben favorecer una estrategia de exploración de procesos de innovación para generar conocimientos, productos y servicios radicalmente nuevos, o combinar una estrategia de explotación con la agilidad estratégica. Una estrategia de explotación exclusiva no es beneficiosa para una mayor ventaja competitiva, mientras que una estrategia ambidiestra parece incluso influir negativamente en la ventaja competitiva.

Research on the innovation strategies of firms is of high topicality in today’s management literature (Hu & Chen, 2016). The fast development of new digital technologies has led to a situation in which firms are forced to continuously improve the efficiency of their existing business model and simultaneously develop radical new solutions and business models to cope with the potential threats of new market entrants (Bican & Brem, 2020; Khanagha, Volberda, & Oshri, 2014; Li, 2020). In light of these developments, the concept of ambidexterity has experienced increasing research interest (e.g., Cenamor, Parida, & Wincent, 2019; Markides, 2013; Montealegre, Iyengar, & Sweeney, 2019). Ambidexterity refers to the combination of both incremental, more efficiency-oriented innovation and radical, novelty-oriented innovation practices (e.g., exploitation and exploration) for short-term success and long-term survival (e.g., March, 1991; Jurksiene & Pundziene, 2016).

Despite the potential positive effects of implementing either an exploration or exploitation approach on the competitive advantage of firms (O’Cass, Heirati, & Ngo, 2014), those orientations are highly vulnerable to result in a trap (Liu, 2006). While scholars have analyzed ambidexterity’s impact on organizational performance (Menguc & Auh, 2008; Sarkees, Hulland, & Prescott, 2010; Severgnini, Vieira, & Galdamez, 2018) and competitive advantage (Jurksiene & Pundziene, 2016), the results vary significantly in size and direction (Junni, Sarala, Taras, & Tarba, 2013) and the question whether ambidexterity increases firms competitive advantage is still not resolved (O’Reilly & Tushman, 2013). Scholars emphasize issues related to an ambidextrous orientation as the inherently contradictory nature of exploration and exploitation poses considerable managerial problems (Lavie, Stettner, & Tushman, 2010; Raisch, Birkinshaw, Probst, & Tushman, 2009) which in turn negatively affect the organizational outcomes (Parida, Lahti, & Wincent, 2016; Vorhies, Orr, & Bush, 2011). This is especially important for startups, since entrepreneurs face this ambidexerity issue in an extreme setup (Brem, 2017).

Our study contributes to the ongoing discussion of organizational ambidexterity by introducing a new construct to the traditional model of exploration and exploitation. Strategic agility, which “is defined as a firm’s ability to renew itself continuously and to maintain flexibility without compromising efficiency” (Clauss, Abebe, Tangpong, & Hock, 2019, p. 3) could complement the traditional model as it adds a perspective on the relevant capabilities for organizational renewal instead of just focusing of the strategic orientation (Klammer, Gueldenberg, Kraus, & O’Dwyer, 2017). Strategic agility describes an organization’s capacity to quickly respond to shifting demand with the ultimate intent to increase competitive advantage (Brand, Tiberius, Bican, & Brem, 2019; Shin, Lee, Kim, & Rhim, 2015). Empirical research has shown that strategic agility improves incumbent firms’ capacity for business model innovation (Arbussa, Bikfalvi, & Marquès, 2017; Clauss et al., 2019; Doz & Kosonen, 2010; Hock, Clauss, & Schulz, 2016), and may therefore provide a mechanism that could facilitate greater novelty under an exploitation strategy. Based on the above, this study addressed the research question whether strategic agility together with exploitation and exploration orientation facilitates greater competitive advantages. It thereby makes a substantial contribution to the ongoing and diverse discourse on organizational ambidexterity and the overarching question how firms may improve efficiency while renewing the organization at the same time.

We address this research question based on empirical data of 150 firms in the German engineering industry. Our results suggest a unique solution to the exploitation-exploration paradox. Whereas ambidexterity reduces the firms competitive position, firms may utilize exploitative processes for high quality, productivity, incremental innovations and short-term, measurable success together with strategic agility to proactively address new environmental conditions (e.g. digital technologies) to ensure long-term prosperity. This provides a unique approach to resolve the problems inherent to ambidexterity and an exclusive exploration or exploitation approach.

Conceptual backgroundStrategic agilityStrategically agile firms have the capacity to stay competitive by focusing on their objectives while simultaneously being responsive to unforeseeable volatility within their business context. Thus, strategic agility describes a firm’s capability to rapidly change and rearrange the strategic orientation by adjusting quickly to shifting requirements, opportunities and trends (Battistella, De Toni, De Zan, & Pessot, 2017). Additionally, strategic agility also prevents a company’s stagnation (Arbussa et al., 2017), and it enables firms to react flexibly to developments that result from dynamic markets and shifting competition (Weber & Tarba, 2014). According to several studies (e.g., Doz & Kosonen, 2010; Lewis, Andriopoulos, & Smith, 2014; Clauss et al., 2019; Hock et al., 2016), strategic agility is based on a couple of organizational capabilities and dimensions. These basic underlying components of strategic agility described in the literature are strategic sensitivity, leadership unity and resource fluidity (Doz & Kosonen, 2010), which are described in more detail in the following sections.

ExplorationFirms follow exploration strategies in order to spot new opportunities in the market, identify the needs of customers or create new demand by anticipating potential desires. Exploration is oriented towards disruptive innovation practices, products and technologies (O’Cass et al., 2014). Exploration allows firms to acquire and create knowledge and information from any angle of the organization’s surroundings, thus it comprises undeveloped skills and the search for new information (Jurksiene & Pundziene, 2016). Through collaboration and interaction with various individuals, firms and partners, new information is acquired, which in turn facilitates creativity (Benitez, Castillo, Llorens, & Braojos, 2018; Bican, Guderian, & Ringbeck, 2017), and ultimately results in radical innovations.

These radical innovations can to interfere with established firm structures (Ireland & Webb, 2009) which makes it more likely that the firm discards radically differentiated products or new technologies that result from exploratory strategies. Nonetheless, exploration activities not only help to detect failure and deficits within current firm practices, but also allow the firm to develop new sources of competitive advantage (O’Cass et al., 2014). A major problem of exploratory activities is that it is never clear to what extent those activities will pay off. This is not the case with exploitation, as the likelihood to profit from incremental product innovation is quite high (March, 1991). Exploration activities are usually decentralized and the standardization and formalization of policies, practices and tasks is fairly low. Besides high uncertainty and risk, failure of some of the exploratory practices will happen and employees need to tolerate that (Ireland & Webb, 2009).

ExploitationContinuous improvement through incremental innovation of existing products and services is characterized as exploitation. Firms pursue exploitation activities in order to respond to market needs with minor modifications of existing routines, products and technologies (Kohtamäki, Kautonen, & Kraus, 2010). Exploitation allows firms to continue existing practices through incremental changes, while increasing resource efficiency and saving costs (March, 1991). This enables firms to stay competitive and continuously meet demands through updates of existing products and services, applying existing knowledge while increasing productivity, minimizing failure and continuously developing extant knowledge (O’Cass et al., 2014).

Unlike exploration, exploitation focuses on the creation of profound knowledge in a few domains, rather than establishing a broad set of knowledge in diverse fields. Through centralization and increasingly standardized as well as formalized processes and tasks, firms deploy their sharp and constantly refined knowledge within the market. Low levels of risk and high commitment of employees towards the attainment of short-term targets are organizational characteristics of exploitation (Ireland & Webb, 2009). While exploration aims for higher flexibility and discovery of new knowledge, exploitation facilitates improvement, summarization and efficiency in every area (Hu & Chen, 2016).

AmbidexterityAmbidexterity can be described as a firm’s capability to exploit current business operations with increasingly high levels of efficiency (i.e. exploitation) while seeking new opportunities and radical innovations (i.e. exploration) at the same time (Raisch et al., 2009), or, in other words, as the capability of a firm to simultaneously pursue competing strategic orientations (Hu & Chen, 2016; Zhang, Edgar, Geare, & O’Kane, 2016). It should ensure that organizations are able to carry out exploratory processes for sustainable growth while exploiting current business practices for maximizing returns (Stubner, Blarr, Brands, & Wulf, 2012). Balancing inherently different sets of activities for exploitation, which is characterized by attributes like “refinement, choice, production, efficiency, selection, implementation, execution” (March, 1991, p. 71) and exploration, comprising “search, variation, risk taking, experimentation, play, flexibility, discovery, innovation” (p. 71) are therefore at the heart of ambidexterity. Exploration and exploitation impede each other to a certain extent, as they are based on conflicting interests (Andriopoulos & Lewis, 2009). Finding a trade-off is inevitable. Sometimes, ambidexterity is also referred to as the general ongoing process of balancing trade-offs from different alternatives, like the parallel application of paradoxical strategies. The aim of ambidexterity is to secure an organization’s long as well as short-term competitiveness (Rosing & Zacher, 2016).

Literature reviewApproachWe conducted a structured literature review according to the procedure by Kraus, Breier, and Dasí-Rodríguez (2020)). Only peer-reviewed articles from academic journals with a publication after the seminal article of March, 1991 were included. We searched the databases Ebscohost Business Source Premier, Science Direct, Jstor and Emerald by searching for two types of keywords within the title and abstract. The first type includes “strat* agil*”, explorat*, exploit* and ambidext*, the second type includes “comp* adv*”, valu*, perform* and succ*. Each keyword of the first type was combined with each one of the second type.

This initial search resulted in 2.879 articles. We first eliminated duplicates from different databases. After that, the remaining articles were analyzed in order to find out whether they fall into the scope of research, which roughly encompasses the relationship between ambidexterity or strategic agility and performance. The articles that fell out of this scope of research were excluded. After this analysis the sample amounted to 156 articles. Then, a quality threshold was applied (Kraus et al., 2020) using the rankings VHB-Jourqual3 with the cut-off ≧C, the ABS Journal Rating 2018 with the cut-off ≧2 and the 2018 JCR impact factors with the cut-off ≧0.7, which resulted in 112 articles. The next step was a more detailed manual analysis of the articles which led to the exclusion of another 19 articles which were not relevant. Throughout the analysis of this literature base, 11 more relevant papers were discovered and included in the literature review leading to a final set of 104 articles for this structured literature review. These include 70 quantitative empirical studies, 7 qualitative empirical studies, 23 conceptual papers and 4 that applied a mixed method approach. 95 articles had a research focus on the impact of ambidexterity, exploration and exploitation on performance. 9 articles were identified with the core topic of strategic agility and its influence on performance. As the amount of literature that was found on the topic of strategic agility is quite low, research on in this area seems to be rather in the early stages. Even a reference analysis of the retrieved articles did not reveal more literature that would fit into the scope of analysis of this study.

Current state of researchLiterature on strategic agility analyzes its associated organizational capabilities, supply chain agility, measures to enhance strategic agility and its influence on performance. The capabilities that form strategic agility include leadership unity, strategic sensitivity, resource fluidity (Doz & Kosonen, 2010) as well as innovativeness, learning capability and transformation/reconfiguration capability (Battistella et al., 2017). Some factors that enhance strategic agility are a firm’s network structure (Yang & Liu, 2012), IT integration (Arnold, Benford, Canada, & Sutton, 2015) as well as strategic foresight (Doz & Kosonen, 2010). Regarding the outcomes of strategic agility, it was shown that strategic agility increases organizations’ ability to adapt their business model to environmental changes (Battistella et al., 2017) and to proactively renew the business model (Arbussa et al., 2017; Clauss et al., 2019; Hock et al., 2016). Strategic agility is significantly associated with financial performance, however positive (Hazen, Bradley, Bell, In, & Byrd, 2017) and negative (Shin et al., 2015) effects were found. Several studies show that strategic agility has a positive effect on performance in general (Chan, Ngai, & Moon, 2017; Yang & Liu, 2012). Furthermore, positive indirect effects of strategic agility on performance were found via operational responsiveness (Shin et al., 2015), enterprise risk management (Arnold et al., 2015) and network structure (Yang & Liu, 2012). In summary, strategic agility has an impact on the performance of a firm, even though the measures of performance and the specific connections analyzed within literature are diverse to a certain extent.

The literature on ambidexterity primarily considers various applications and conceptualizations of ambidexterity, factors that impact ambidexterity, tensions related to the concept and the balance between exploration and exploitation as well as its influence on performance, including mediating factors. Structural and contextual ambidexterity are the conceptualizations most often identified in extant literature (De Clercq, Thongpapanl, & Dimov, 2013; De Visser et al., 2010; Úbeda-García, Claver-Cortés, Marco-Lajara, Zaragoza Sáez, & García-Lillo, 2018). These were complemented by harmonic, partitional, cyclical and reciprocal ambidexterity (Simsek, Heavey, Veiga, & Souder, 2009). Furthermore, the literature investigated several antecedences of ambidexterity such as strategic foresight (Amniattalab & Ansari, 2016), entrepreneurial orientation (Lisboa, Skarmeas, & Lages, 2011), organizational learning (Ojha, Struckell, Acharya, & Patel, 2018), IT infrastructure (Benitez et al., 2018), organizational culture (Stubner et al., 2012, Lee, Woo, & Joshi, 2017; Matzler, Abfalter, Mooradian, & Bailom, 2013) and marketing and technological capabilities (Liu, Liao, & Li, 2018). Due to the contradictory nature of exploration and exploitation (Nielsen & Gudergan, 2012), paradoxical tensions in the organization regarding the strategic intend, the nature of customer orientation and the personal drivers arise (Andriopoulos & Lewis, 2009). Moreover, there are inconsistencies among studies whether there should be a balance between exploration and exploitation or not (Parida et al., 2016; Rosing & Zacher, 2016; Vorhies et al., 2011; Zhan & Chen, 2013). Another point of tension is also whether a balance of these two approaches should be integrated into each functional unit or across the different functions (Lavie, Kang, & Rosenkopf, 2011; Raisch et al., 2009). When and how to move on from explorative projects to exploitative ones poses difficulties as well (Ireland & Webb, 2009).

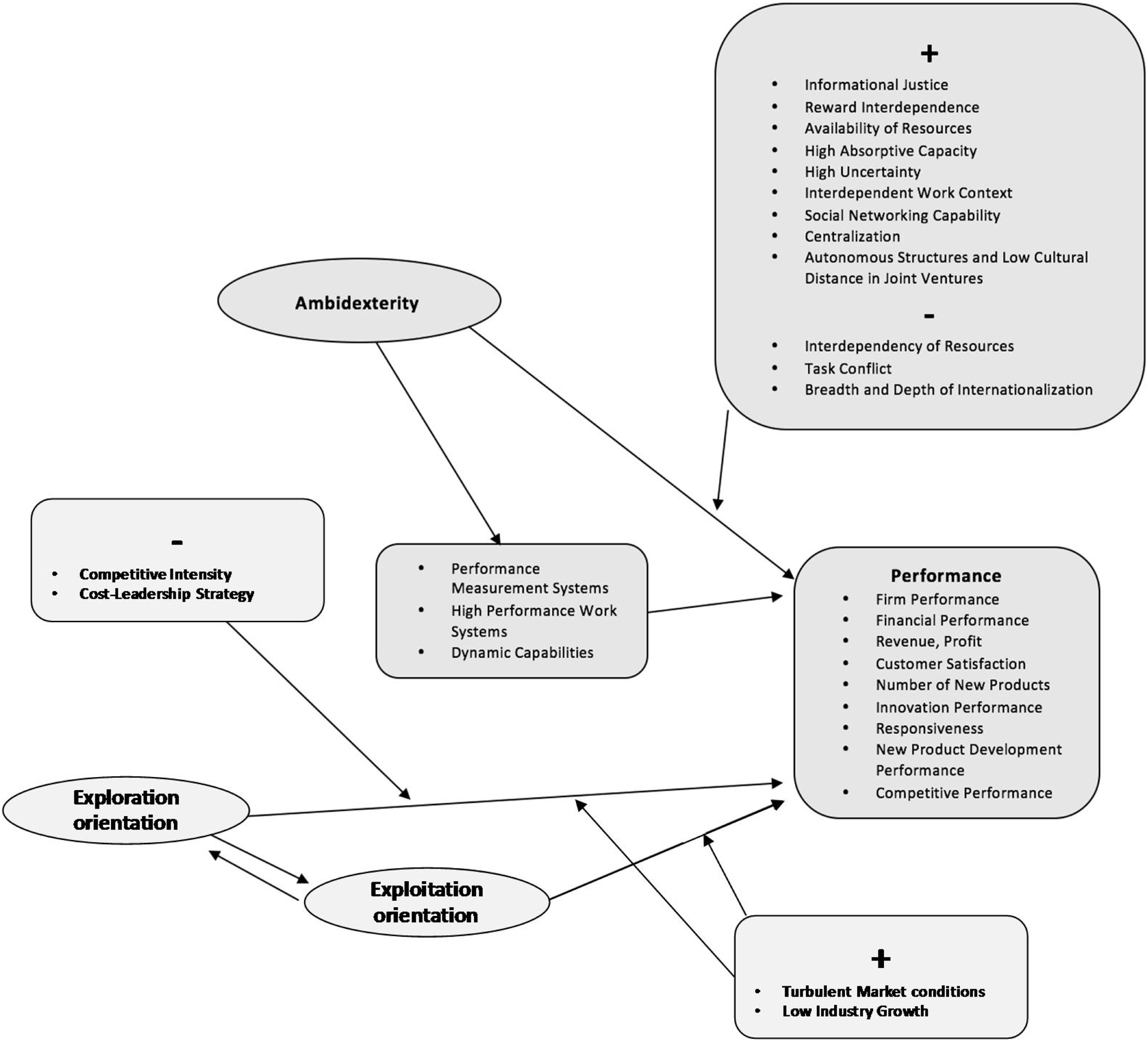

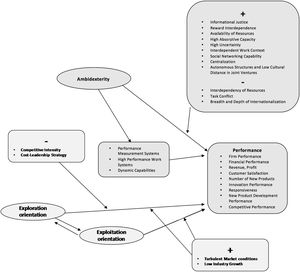

The performance effect received the most attention to throughout the retrieved articles (e.g., He & Wong, 2004; Yang & Liu, 2012; Shin et al., 2015). There is evidence that exploration (Lampert & Kim, 2018; Su, Guo, & Sun, 2017) as well as exploitation can positively (Hoang & Rothaermel, 2010; Yamakawa, Yang, & Lin, 2011) and negatively (Lin & Si, 2019; Menguc & Auh, 2008) influence performance in a firm, depending on the organizational context. Regarding the performance implications of ambidexterity, scholars analyzed this relationship from various angles. Several studies found that ambidexterity had both a direct (Hsu, Lien, & Chen, 2013; Sarkees et al., 2010; Severgnini et al., 2018) as well as indirect (Zhang et al., 2016) positive influence on the overall firm performance. Additionally, the conceptualization of ambidexterity (Simsek et al., 2009), absorptive capacity (Solís-Molina, Hernández-Espallardo, & Rodríguez-Orejuela, 2018), work context uncertainty (Mom, Fourné, & Jansen, 2015) and influences from the organizational structure (Jansen, Simsek, & Cao, 2012; Zhan & Chen, 2013) were found to be mediating factors in the ambidexterity-performance relationship. Fig. 1 shows a simplified visualization of the performance relationships with several mediating factors. The “+” indicates a positive mediating effect, the “−” a negative one. Not all of the indicated relationships have an impact on every performance measure listed in the model, as revealed by the literature review. The reason for the different outcomes in some studies probably lies in the diverse nature of the research settings, contextual conditions and contingent variables (Junni et al., 2013).

Integration of ambidexterity and strategic agilityOur literature review revealed that the two concepts of ambidexterity and strategic agility have been considered separately. Only Kortmann, Gelhard, Zimmermann, and Piller (2014) found evidence that ambidexterity has a positive influence on the relationship between strategic flexibility and operational efficiency. Following their argumentation, strategic flexibility enables fast and agile decision-making processes as well as the simultaneous pursuit of different strategic operations. As a result, strategic flexibility fosters the development of radical and incremental innovations which ultimately results in operational efficiency.

One notable commonality between ambidexterity and strategic agility refers to their antecedents. As can be seen throughout the literature review, strategic agility arises out of the interplay between certain organizational capabilities (Battistella et al., 2017; Doz & Kosonen, 2010; Fourné, Jansen, & Mom, 2014) – the same can be said for exploration and exploitation where capabilities play a vital role in balancing the two (Amniattalab & Ansari, 2016; Liu et al., 2018). Some researchers even mention both ambidexterity (Jurksiene & Pundziene, 2016; O’Reilly & Tushman, 2008) and strategic agility (Hazen et al., 2017) in the context of dynamic capabilities. Special attention should be devoted to strategic foresight, as this capability reportedly influences both ambidexterity (Amniattalab & Ansari, 2016) and strategic agility (Doz & Kosonen, 2010). Thus, fostering strategic foresight would enable firms to be strategically agile and support their ambidextrous strategy.

Firms conduct exploratory processes in their search for radically new product-market combinations which enables them to stay competitive in the long run (O’Cass et al., 2014) as environmental shifts and changes in demand are likely to occur over time (Parida et al., 2016). This implies that firms conduct exploration in order to stay responsive to unpredictable shifts. According to Shin et al. (2015), responsiveness is also the foundation for creating strategic agility. Moreover, exploration is a strategy for staying competitive in the long run (Molina-Castillo, Jimenez-Jimenez, & Munuera-Aleman, 2011). Strategic agility ensures a better responsiveness to unforeseeable changes in the business context (Chan et al., 2017), which is a capability that contributes to long-term survival as well.

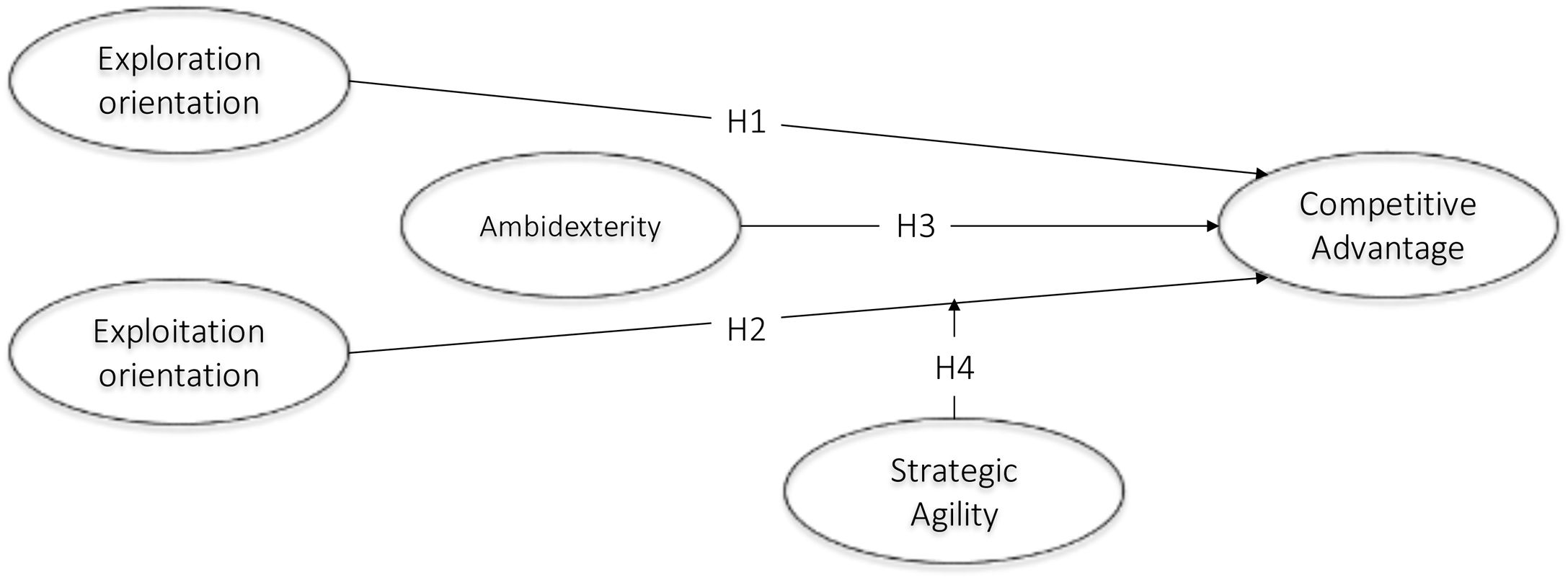

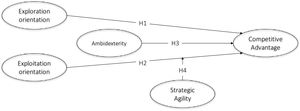

HypothesesExploration allows firms to come up with differentiated products and services that seize emerging opportunities on the market by providing unique resource combinations. It also helps firms to improve shortcomings of extant processes (O’Cass et al., 2014). The acquisition and creation of new knowledge through explorative activities increases firms’ innovative potential (Benitez et al., 2018; Bouncken, Fredrich, Ritala, & Kraus, 2018). Although explorative activities involve high risk and many times may result in failure, successful outcomes are likely to be characterized as radical innovations (Molina-Castillo et al., 2011). The nature of a radical innovation implies that a firm is ahead of its competitors and they have the potential to seize new product-market opportunities, fulfilling the criteria of value and rareness for competitive advantage (Barney, 1991). As such explorative innovations were potentially developed over a long time and underwent considerable research and development activities (Ireland & Webb, 2009; March, 1991), they are likely to fit the inimitability and non-substitutability criteria for competitive advantage as prolonged development creates entry barriers for competitors (Barney, 1991). Based on these arguments, it can be hypothesized that:H1 A separate exploration orientation increases the competitive advantage of firms.

Exploitation, on the other hand, refers to increasingly efficient processes within firms that lower the costs and maximize output (Liu et al., 2018). It encompasses the predictable, incremental refinement of extant products and competences and a perpetuation and further development of already successful product-market combinations (Molina-Castillo et al., 2011; O’Cass et al., 2014). Exploitative processes lead to measurable results much quicker than explorative activities (March, 1991). Evidence shows that exploitation is a performance driver (Hughes et al., 2018; Ojha et al., 2018), as it allows firms to create products with a higher perceived quality (Molina-Castillo et al., 2011) at lower prices compared to their competitors due to increased cost-efficiency (O’Cass et al., 2014). Exploitation also enables firms to implement a cost-leadership strategy (Yamakawa et al., 2011). These findings imply that a steady improvement of existing routines, facilitated by exploitation, increases the competitive advantage of a firm as the ongoing process of long-term exploitation and incremental improvement also involves developing a considerable knowledge-base over time which is difficult to copy. Thus:H2 A separate exploitation orientation increases the competitive advantage of firms.

The impact of ambidexterity on performance is variable. While some studies found a positive relationship (Hsu et al., 2013; Severgnini et al., 2018), others identified a negative connection (Menguc & Auh, 2008). The results of the literature review suggest that the performance outcomes of ambidexterity largely depend on contextual conditions and variables (O’Reilly & Tushman, 2013). Even though the connection between ambidexterity and competitive advantage remains largely unexplored, Amniattalab and Ansari (2016) found that the anticipatory capability of strategic foresight enables firms to employ their ambidextrous innovation practices to come up with unique resource combinations before competitors do, thus driving competitive advantage, as proposed by Jurksiene and Pundziene (2016).

What those studies fail to address are the inherent, considerable tensions of ambidextrous strategies that firms need to deal with (Andriopoulos & Lewis, 2009). The respective part of the previous literature review clearly outlines those contradictions inherent to ambidexterity, which demand considerable managerial attention (Lavie et al., 2010). The reviewed papers address issues like how to arrange the organizational structure to enable successful ambidexterity (Lavie et al., 2010; Raisch et al., 2009), how to divide resources (Parida et al., 2016) and whether and how to balance exploration and exploitation (Rosing & Zacher, 2016; Vorhies et al., 2011). Thus, firms have considerable difficulties in following explorative and exploitative strategies simultaneously. This could lead to negative effects on the competitiveness of firms (Levinthal & March, 1993).

Attaining a competitive advantage is a challenging undertaking which requires considerable skills and dedication of the organizational members (Barney, 1991). Some researchers found that striving for exploration and exploitation simultaneously does not deliver superior results (Boumgarden, Nickerson, & Zenger, 2012; Parida et al., 2016). Additionally, the contradictions and tensions between exploration and exploitation described before demand dedication and know-how of managers as well (Lavie et al., 2010). Even though Zhan and Chen (2013) state that there is an interactive connection between them, ambidexterity encompasses that firms simultaneously engage in two contradictory strategic orientations (Ireland & Webb, 2009), which also implies that they cannot fully focus on either one of the two strategies. This is a disadvantage, because creating competitive advantage would demand managers’ full attention (Barney, 1991). Kaiser (2016) states that the engineering industry is driven by innovativeness and thus faces continuous change, which is found to negatively affect ambidexterity’s relationship with performance (Luger, Raisch, & Schimmer, 2018). By combining these arguments, it can be hypothesized that firms striving for either exploration or exploitation are likely to outperform competitors who are trying to pursue an ambidextrous strategy, which implies that:H3 Ambidexterity negatively effects the competitive advantage of firms.

Even though, as outlined above, exploration is likely to increase a firm’s competitive advantage through radical differentiation that is facilitated by explorative activities (Yamakawa et al., 2011), exploitation is also meant to increase a firm’s competitive advantage through the continuous refinement of existing processes and products which enables firms to increase efficiency (O’Cass et al., 2014) and potentially develop a cost-leadership position (Yamakawa et al., 2011). Nonetheless, scholars repeatedly suggest that firms pursuing solely exploration or exploitation are likely to run into traps (Liu, 2006). Exploitation at the expense of exploration probably creates superior results in the short-term, while neglecting the search for long-term prosperity, which is called the competency trap (Sirén, Kohtamaki, & Kuckertz, 2012). Firms with solely explorative or exploitative strategies are in considerable risk of getting stuck in traps (Choi & Lee, 2015). Nonetheless, it was suggested that a combination of both throughout an ambidextrous solution is neither advisable, nor leads to competitive advantage.

Therefore, this study suggests an alternative solution to this paradigm. Although numerous studies suggest that an ambidextrous strategy is vital for an organization to thrive in the short as well as the long run by balancing exploration and exploitation (Hu & Chen, 2016; Junni et al., 2013; March, 1991), the potential positive impact of ambidexterity on firm’s competitive advantage was often neglected in these arguments. While exploitation is necessary for the firm to create vital profit, exploration ensures long-term survival (Stubner et al., 2012). However, this study would suggest instead that exploitation is the more important strategic orientation in the exploration-exploitation trade-off, as short-term returns are vital for organizations to survive. Exploitation’s returns are more predictable and probable in comparison and rapid gains from exploitation are even necessary to finance ongoing exploration activities and resulting failure (Lisboa et al., 2011; March, 1991). According to Molina-Castillo et al. (2011), exploitation clearly dominates over exploration in practice since firms are more likely to choose certain rewards and low risks which is usually the result of exploitative activities, but which conversely often results in a crowding out of explorative processes (March, 1991; Tushman & O’Reilly, 1996). Exploitation without the potential to adapt business processes flexibly to changes makes firms vulnerable to obsolescence, which is especially important in industries with technological dynamism (Uotila, Maula, Keil, & Zahra, 2009).

For issues like these, strategic agility offers the possibility to rearrange business processes in the face of unpredictable environmental changes (Battistella et al., 2017) and prevents stagnation (Arbussa et al., 2017). Strategic agility is a competence that results from the interplay between certain organizational capabilities. It considerably enhances an organization’s ability to catch up on newly emerging opportunities (Doz & Kosonen, 2010) and stay flexible which is even reported to have a positive effect on competitive advantage (Chan et al., 2017). Hence, a combination of exploitation for creating returns from the steady improvement of existing products and processes and incremental innovations of extant items (O’Cass et al., 2014) with strategic agility in order to stay responsive to dynamically changing circumstances (Shin et al., 2015) ought to resolve ambidexterity’s dilemma concerning its tensions (Raisch et al., 2009). This study therefore supports the assumption that exploitative processes with strategic agility would mediate the tensions between exploration and exploitation. The continuous search, experimentation and resulting failure of exploration (Lisboa et al., 2011), which stands in stark contrast to the characteristics of exploitation (Lavie et al., 2010), is exchanged for strategic agility. Since strategic agility arises from a certain configuration of organizational capabilities (Doz & Kosonen, 2010; Fourné et al., 2014), it should not be vulnerable to being undermined by exploitative processes. Consequently, firms should build and arrange their dynamic capabilities to reach strategic agility (Hazen et al., 2017) alongside their exploitative processes:H4 An exploitation orientation together with strategic agility increases the competitive advantage of firms.

Fig. 2 visualizes the hypothesized model of this study

MethodologySampleWe conducted our research in the German engineering industry. This industry is particularly suitable as it is typically characterized by a high level of innovation and competitive intensity and as it was recently affected by new technologies that enable substantial changes of established business models (e.g. Internet of Things, robot process automation, predictive maintenance etc.). Additionally, high innovativeness and increasingly faster innovation cycles that are facilitated by intelligent, interconnected systems determine the industry environment (Kaiser, 2016). On the other hand, international competitors (e.g. from China) put considerable pressure on firms to increase their quality and performance.

We collected the data via a mail survey which was send to 800 randomly selected firms that are members of the VDMA, the German association for the mechanical engineering industry. We received 157 responses (19.6% response rate). After the elimination of seven cases with incomplete responses in key variables, our final sample comprised 150 firms. Of these firms, 47.4% employed 50 or less people, 37% had 51–500 employees, and 15.6% employed 500 people or more. Key informants for the survey were 23.7% upper level managers (such as CEOs), 25% middle-level divisional or area managers, and 43.2% functional managers, and 8.1% others.

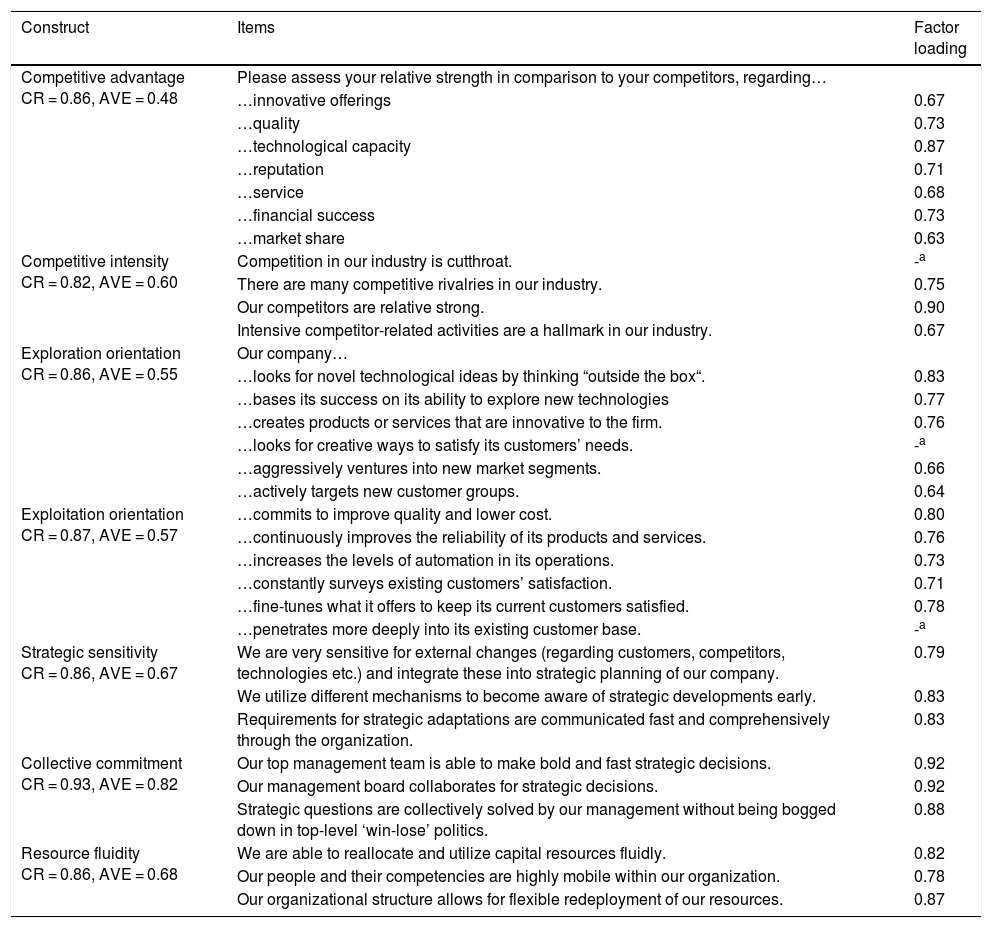

MeasuresThe measurement items applied in this survey are listed in Appendix A, which entail constructs and scales derived from previous studies. Strategic agility was measured as a type II second-order reflective-formative construct. The scales to measure strategic agility and its three underlying dimensions stem from Hock et al. (2016). Items for the measurement of exploration and exploitation are based on Sirén et al. (2012). To assess competitive advantage, seven pre-validated self-evaluation criteria to analyze a firm’s position relative to its competitors were used (Durand, 2003; Hooley, Greenley, Fahy, & Cadogan, 2001; Venkatraman & Ramanujam, 1986).

In addition to the key constructs used in our hypothesis model, we control for several variables that were previously shown to be related with firms’ competitive advantages: firm size as measured by the number of employees, industry, and the competitive intensity (measured by four items from Jaworski & Kohli, 1993).

MethodTo test our hypotheses, Partial Least Square-Structural Equation Modeling (PLS-SEM) with SmartPls 3.0 was applied (Ringle, Wende, & Becker, 2015), as has been done in comparable prior studies for quantification and testing of theories, especially in the field of marketing and management (Hair, Ringle, & Sarstedt, 2011). In order to obtain the standard errors, we applied non parametric bootstrapping with 1000 samples and pairwise deletion of missing values (Hair, Hult, Ringle, & Sarstedt, 2017). For the analysis of the second-order measurement model for strategic agility, we applied a repeated indicator approach (Becker, Klein, & Wetzels, 2012). The interaction terms are modeled via a two stage approach that uses the latent variable scores of the latent predictor and latent moderator variable from the main effects model (without the interaction term) for the calculation of the interaction model (Hair, Sarstedt et al., 2017).

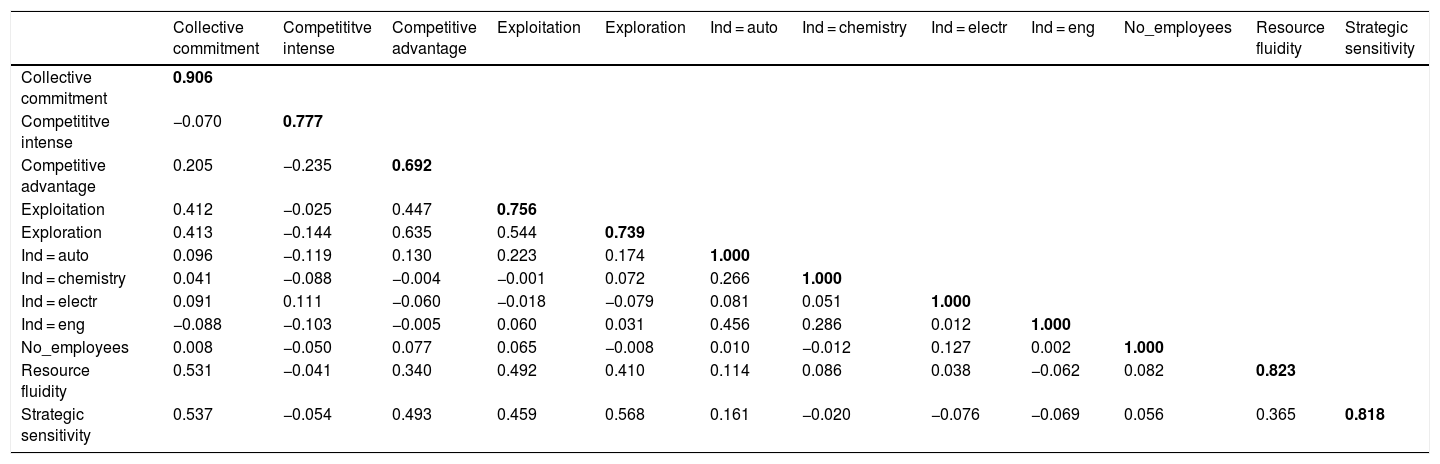

ResultsMeasurement model resultsReliability of the items was assessed by observing the respective factor loadings, which range from 0.46–0.92. We deleted three items that achieved factor loadings below the common threshold of 0.6. In order to assess the internal consistency of the constructs, composite reliability was calculated, which showed satisfactory values ranging from 0.82–0.93 (Hair et al., 2011). To assess the convergent validity of the measurement model, which analyzes whether the constructs measure what they ought to (Fornell & Larcker, 1981), average variance extracted (AVE) was calculated with values ranging from 0.48–0.83. AVE values, except the construct of competitive advantage (AVE: 0.47), were above the significance level of 0.5, indicating that 50% or more of the indicator’s variance are explained by the latent variables. Discriminant validity measures whether the constructs within the measurement model differ from each other and whether the items load on the constructs they ought to. As can be seen in Appendix B, each AVE is higher than its highest squared correlation with the remaining latent variables, which indicates discriminant validity (Hair et al., 2011), fulfilling the Fornell and Larcker (1981) criterion. In order to analyze potential redundancy between the first order constructs in the formative measurement model the variance inflation factors (VIF) were calculated. They all show values below 2, ranging from 1.41 to 1.72, which implies that there are no redundancy problems within the constructs (Hair et al., 2011). The weights of the first order measures on strategic agility range between 0.37 and 0.51 and are all significant (p < 0.001).

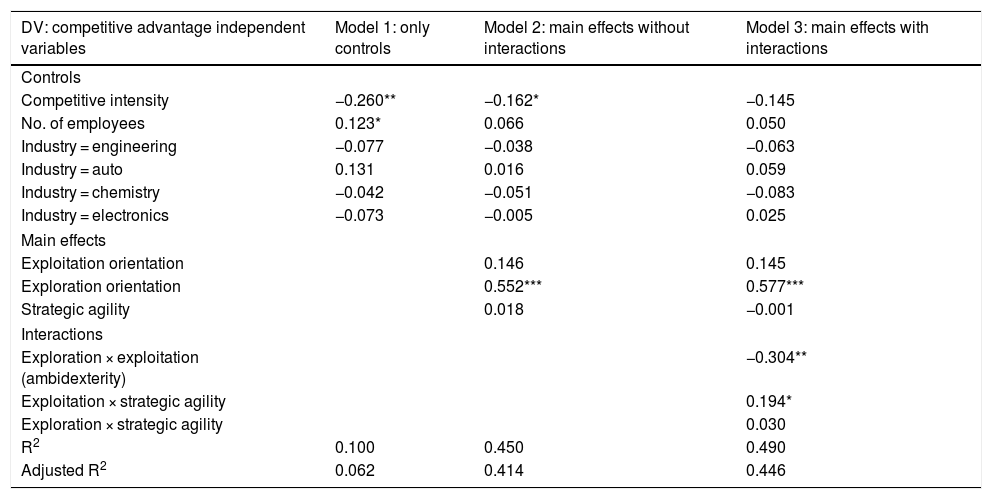

Structural model resultsWe compare three models in a successive way (Table 1). In Model 1 only the control variables were considered. This model achieves only an R2 of 0.1 and yields few significant effects. We then integrated the main effects in Model 2. This model shows that an exploration orientation has a significant effect on the competitive advantage of firms. The R2 in this model increases substantially to 0.45. Model 3 shows the highest R2 value of 0.49 and has been used as a basis for the hypothesis test.

Structural model results.

| DV: competitive advantage independent variables | Model 1: only controls | Model 2: main effects without interactions | Model 3: main effects with interactions |

|---|---|---|---|

| Controls | |||

| Competitive intensity | −0.260** | −0.162* | −0.145 |

| No. of employees | 0.123* | 0.066 | 0.050 |

| Industry = engineering | −0.077 | −0.038 | −0.063 |

| Industry = auto | 0.131 | 0.016 | 0.059 |

| Industry = chemistry | −0.042 | −0.051 | −0.083 |

| Industry = electronics | −0.073 | −0.005 | 0.025 |

| Main effects | |||

| Exploitation orientation | 0.146 | 0.145 | |

| Exploration orientation | 0.552*** | 0.577*** | |

| Strategic agility | 0.018 | −0.001 | |

| Interactions | |||

| Exploration × exploitation (ambidexterity) | −0.304** | ||

| Exploitation × strategic agility | 0.194* | ||

| Exploration × strategic agility | 0.030 | ||

| R2 | 0.100 | 0.450 | 0.490 |

| Adjusted R2 | 0.062 | 0.414 | 0.446 |

The positive hypothesized relationship between exploration orientation and competitive advantage was significant with a standardized β = 0.577 (p < 0.001), supporting H1. In contrast to our hypothesis, an exploitation orientation does not affect the competitive advantage (β = 0.145, p > 0.05), leading to a rejection of H2. The hypothesized negative effect of ambidexterity on a firm’s competitive advantage (H3) could be supported with a significant coefficient of β = −0.360 (p < 0.01). Eventually, as proposed by H4, we find a positive and significant interaction term of exploitation orientation and strategic agility on competitive advantage (β = 0.194, p < 0.05). Hence, H4 is supported. The results of the structural model are summarized in Table 1.

DiscussionTheoretical implicationsOur study provides results to the largely unexplored research streams of ambidexterity, exploration and exploitation, and their influence on the competitive advantage (Jurksiene & Pundziene, 2016) of firms operating in the German engineering industry. It has further analyzed how the established exploitation-exploration model is influenced by a firms’ strategic agility. The combination with exploitation as an innovation strategy in order to increase the competitive advantage of a firm is a unique insight into how firms can strategically position themselves to attain a competitive advantage. Our study therefore contributes to the literature on firms’ strategic orientations and ambidexterity theory (e.g., O’Reilly & Tushman, 2013) by providing an extended model for the context of the German engineering industry. Furthermore, we contribute to the literature on strategic agility (e.g., Doz & Kosonen, 2010) by demonstrating that strategic agility will be particularly beneficial for firms that follow an exploitation orientation.

The results show a significant positive effect of exploration orientation on the competitive advantage of a firm. Especially considering that exploration’s impact on performance is difficult to analyze, as it often is the preliminary stage of exploitation (Ojha et al., 2018), the results of this study is interesting. Our result supports previous research that show positive effects of exploration orientation such as innovation success (Matzler et al., 2013), the innovativeness of new products (Molina-Castillo et al., 2011) as well as the acquisition of valuable information and knowledge (Lisboa et al., 2011). However, our study strengthens the argument that exploration even increases the competitive advantage of a firm which is remarkably impressive new information. It is indeed the case that firms in the engineering industry have the potential to position themselves ahead of their competition with excessive, new technological knowledge, innovative products and services, entry into new market segments as well as new ways to acquire novel customers and increase the satisfaction of existing ones (Sirén et al., 2012), even though the exploration oriented activities take considerable amounts of time (Lin & Si, 2019).

Our results did not show a positive effect of exploitation on competitive advantage. This might be explained as intense competition, R&D intensity, and the requirement to create new knowledge and radical innovations to stay competitive, are typical of the German engineering industry (Kaiser, 2016). In light of these industry characteristics, it is possible that exploitation and the resulting efficiency increase are primarily hygiene factors that need to be in place to keep the market position but are not strategically suited to increase competitive advantage. Even though Molina-Castillo et al. (2011) argue that competition requires increased exploitation to reach more efficiency, Jansen, Van Den Bosch, and Volberda (2006) provide evidence that within such dynamic industry environments, exploration positively influences performance while exploitation does not. Even though exploitation allows firms to cut down on prices (Molina-Castillo et al., 2011; Yamakawa et al., 2011) and is associated with high performance in family businesses (Hughes et al., 2018), it is apparently not enough to increase the competitive advantage of a firm that operates in an industry that is driven by innovations and excessive R&D (Kaiser, 2016).

Ambidexterity was found to negatively affect the competitive advantage of a firm. This finding is in contrast to research that has found positive impacts of ambidexterity on performance (e.g., Hsu et al., 2013; Severgnini et al., 2018). Here, the results contrast with the findings of March (1991) who outlined that firms need to strive for both exploration and exploitation in a balanced manner in order to secure success and continuity. Even though firms might benefit from an ambidextrous strategy (Birkinshaw & Gibson, 2004; Lee & Huang, 2012), it is not the right strategic orientation for establishing a competitive advantage. Consistent with Boumgarden et al. (2012) and Parida et al. (2016), ambidexterity is not the strategy that yields superior firm benefits. One reason for these antithetic results may indeed be the issue that successfully pursuing an ambidextrous strategy demands considerable amounts of resources (Parida et al., 2016) and poses increased tensions and contradictions within organizations (Hu & Chen, 2016; Van Looy, Martens, & Debackere, 2005) which firms potentially are not able to resolve. Firms are likely to have their difficulties in coping with the considerable tensions that are inherent to an ambidextrous strategy (Hu & Chen, 2016; Ireland & Webb, 2009). In addition to that, increased environmental dynamics in the engineering industry might impair ambidexterity’s influence on performance (Luger et al., 2018). In line with O’Reilly and Tushman (2013) who suggested that the influence of ambidexterity depends on contextual factors, we therefore believe that structural ambidexterity, i.e. the simultaneous pursuit of the two orientations, should be avoided in rather turbulent environments, as the external conditions might be more favorable to exploratory organizations.

The current study’s most significant contribution is that exploitation together with strategic agility has a positive influence on competitive advantage. Various factors within an organizational environment influence the ecosystem in which businesses operate, thus making it necessary to stay responsive to changes (Weber & Tarba, 2014). The combination of strategic agility and exploitation allows firms to stay competitive in the short run through incremental innovations and increasing financial returns from efficiency (O’Cass et al., 2014), as well as seize emerging opportunities in the organizational environment through an increased responsiveness from strategic agility (Shin et al., 2015), and thus stay competitive also in the long-run. The combination of strategic agility with exploitation offers a unique solution to overcome the tensions and contradictions that are inherent to this paradigm. The reason for a greater compatibility of exploitation and strategic agility is that strategic agility bases on certain meta capabilities (i.e. strategic sensitivity, collective commitment and leadership unity) that can be utilized to innovate the business model in times of external changes (Clauss et al., 2019; Doz & Kosonen, 2010). As these capabilities enable firms to conduct significant changes to the organization if needed, based on strategic observations, specific decisions and dedicated resource allocations, it is not inherently conflicting with an exploitation orientation. Therefore, inherent tensions between radical innovation and continuous improvement may be overcome. As strategic agility as such does not show a direct effect on firms’ competitive advantage and does also not interact with exploration, these capabilities will particularly improve the competitive position of rather traditional, exploitative firms such as family firms (Hughes et al., 2018).

Managerial implicationsOur study provides some important implications for managers of firms in rather turbulent markets (e.g. engineering firms) who want to strategically manage short-term efficiency and long-term change. First, we find that an exploration orientation is beneficial to the firms’ competitive advantage. Therefore, managers may assess their exploratory capacity. In case they are primarily exploratory, this orientation may ensure competitive advantages without further strategic changes. If however a firm is primarily exploitation-oriented, considerations may be different. As it has been shown that changing a strategic orientation is difficult and time-consuming, as these are deeply rooted in the organizational mission and culture (Sidhu, Volberda, & Commandeur, 2004), changing to an exploration orientation might be difficult or even impossible. Therefore, those firms may be advised to build the necessary capabilities for achieving strategic agility (Doz & Kosonen, 2008, 2010), such as investing in market screening, utilizing experiments, intensive end empathic leadership dialogues and designing more modular and decoupled organizational structures. The achieved strategic agility together with the exploitation strategy will help to achieve a new form of strategic ambidexterity.

Limitations and outlookThis study is not without limitations that may be addressed when conducting future studies on the topic. First, our study bases on data from one industrial and cultural context, namely the German engineering industry. Although, this context is relevant from a managerial perspective and has been used for many other studies (e.g., Clauss & Tangpong, 2019), it may not be generalizable to other more or less dynamic industries. Therefore, future studies might replicate our analysis with data from other contexts. Second, we focus only on one particular form of ambidexterity―the simultaneous utilization of both exploration and exploitation at the same time. However, the literature has discussed that there might also be other forms of ambidexterity such as temporal or special ambidexterity (e.g., O’Reilly & Tushman, 2013). From our perspective, we gain no understanding how strategic agility may interact with these other – less paradoxical – types of ambidexterity. Finally, our study is based on cross-sectional data. We can therefore not draw any conclusions on how the effects of exploitation, exploration, ambidexterity and strategic agility may influence competitive advantages on a long-term base. Such an analysis may provide further insights into the intertemporal dynamics of these strategic constructs.

Participants of the survey were requested to respond to the items based on a 5-point Likert-type scale. Within the items of competitive advantage and competitive intensity, 1 equals “no advantage”, whereas 5 means “very high advantage”. Within the remaining items 1 is equal to “strongly disagree” and 5 means “strongly agree”.

| Construct | Items | Factor loading |

|---|---|---|

| Competitive advantage CR = 0.86, AVE = 0.48 | Please assess your relative strength in comparison to your competitors, regarding… | |

| …innovative offerings | 0.67 | |

| …quality | 0.73 | |

| …technological capacity | 0.87 | |

| …reputation | 0.71 | |

| …service | 0.68 | |

| …financial success | 0.73 | |

| …market share | 0.63 | |

| Competitive intensity CR = 0.82, AVE = 0.60 | Competition in our industry is cutthroat. | -a |

| There are many competitive rivalries in our industry. | 0.75 | |

| Our competitors are relative strong. | 0.90 | |

| Intensive competitor-related activities are a hallmark in our industry. | 0.67 | |

| Exploration orientation CR = 0.86, AVE = 0.55 | Our company… | |

| …looks for novel technological ideas by thinking “outside the box“. | 0.83 | |

| …bases its success on its ability to explore new technologies | 0.77 | |

| …creates products or services that are innovative to the firm. | 0.76 | |

| …looks for creative ways to satisfy its customers’ needs. | -a | |

| …aggressively ventures into new market segments. | 0.66 | |

| …actively targets new customer groups. | 0.64 | |

| Exploitation orientation CR = 0.87, AVE = 0.57 | …commits to improve quality and lower cost. | 0.80 |

| …continuously improves the reliability of its products and services. | 0.76 | |

| …increases the levels of automation in its operations. | 0.73 | |

| …constantly surveys existing customers’ satisfaction. | 0.71 | |

| …fine-tunes what it offers to keep its current customers satisfied. | 0.78 | |

| …penetrates more deeply into its existing customer base. | -a | |

| Strategic sensitivity CR = 0.86, AVE = 0.67 | We are very sensitive for external changes (regarding customers, competitors, technologies etc.) and integrate these into strategic planning of our company. | 0.79 |

| We utilize different mechanisms to become aware of strategic developments early. | 0.83 | |

| Requirements for strategic adaptations are communicated fast and comprehensively through the organization. | 0.83 | |

| Collective commitment CR = 0.93, AVE = 0.82 | Our top management team is able to make bold and fast strategic decisions. | 0.92 |

| Our management board collaborates for strategic decisions. | 0.92 | |

| Strategic questions are collectively solved by our management without being bogged down in top-level ‘win-lose’ politics. | 0.88 | |

| Resource fluidity CR = 0.86, AVE = 0.68 | We are able to reallocate and utilize capital resources fluidly. | 0.82 |

| Our people and their competencies are highly mobile within our organization. | 0.78 | |

| Our organizational structure allows for flexible redeployment of our resources. | 0.87 |

CR = Composite Reliability/AVE = average variance extracted, aItem was deleted due to low loading.

| Collective commitment | Competititve intense | Competitive advantage | Exploitation | Exploration | Ind = auto | Ind = chemistry | Ind = electr | Ind = eng | No_employees | Resource fluidity | Strategic sensitivity | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Collective commitment | 0.906 | |||||||||||

| Competititve intense | −0.070 | 0.777 | ||||||||||

| Competitive advantage | 0.205 | −0.235 | 0.692 | |||||||||

| Exploitation | 0.412 | −0.025 | 0.447 | 0.756 | ||||||||

| Exploration | 0.413 | −0.144 | 0.635 | 0.544 | 0.739 | |||||||

| Ind = auto | 0.096 | −0.119 | 0.130 | 0.223 | 0.174 | 1.000 | ||||||

| Ind = chemistry | 0.041 | −0.088 | −0.004 | −0.001 | 0.072 | 0.266 | 1.000 | |||||

| Ind = electr | 0.091 | 0.111 | −0.060 | −0.018 | −0.079 | 0.081 | 0.051 | 1.000 | ||||

| Ind = eng | −0.088 | −0.103 | −0.005 | 0.060 | 0.031 | 0.456 | 0.286 | 0.012 | 1.000 | |||

| No_employees | 0.008 | −0.050 | 0.077 | 0.065 | −0.008 | 0.010 | −0.012 | 0.127 | 0.002 | 1.000 | ||

| Resource fluidity | 0.531 | −0.041 | 0.340 | 0.492 | 0.410 | 0.114 | 0.086 | 0.038 | −0.062 | 0.082 | 0.823 | |

| Strategic sensitivity | 0.537 | −0.054 | 0.493 | 0.459 | 0.568 | 0.161 | −0.020 | −0.076 | −0.069 | 0.056 | 0.365 | 0.818 |

Bold numbers on the main diagonal show the square root of the AVE values; remaining numbers show construct correlations