With the increasing importance of services in the manufacturing industry, manufacturers have been providing customers with packages that combine products and services. Such a product–service combination trend is often referred to as “servitization” and/or “product–service system,” and its impact on firm performance has been studied over decades. Although firms can improve their performance through service and product innovation, uncertainty in services may cause them to experience potential risks. Notwithstanding the risk associated with undertaking both product and service innovation together vis-à-vis the increase in resource and effort utilization, several studies have focused on performance itself without considering the change in inputs. Thus, this study measures innovation efficiency, which represents the ratio of innovation outputs to inputs, and verifies the difference in innovation efficiency among three different innovation types: 1) both product and service innovation, 2) product innovation only, and 3) service innovation only. The differences in innovation performance, which is measured by the sales of innovative products and utilized as an output factor in estimating efficiency, are also verified to compare the results with the difference in innovation efficiency by innovation type, and the changes in inputs are inferred. This study demonstrates that firms performing both product and service innovation tend to achieve higher innovation performance than others, albeit lower innovation efficiency. Based on the results, this study suggests an appropriate innovation strategy for firm managers, depending on firms’ innovation objectives and input availability.

Although the value of the services provided by manufacturers has been unimportant in the past, firms now recognize that providing good quality services for products is a key success factor. Manufacturing firms also deliver an array of services, including the provision of spare parts and continuous support to customers (Kowalkowski & Kindström, 2013). Services can generate over 50% of the total revenue in many manufacturing firms (Doultsinou, Roy, Baxer, Gao & Mann, 2009), and the share of service sales has reached over 30% for manufacturing firms (Fang, Palmatier & Steenkamp, 2008).

Such an increasing importance trend of services in the sale of products is often referred to as “servitization” and/or “product–service system (PSS),” which refers to the process of adding service values to product offerings (Vandermerwe & Rada, 1989). Servitization (or PSS) is a new phenomenon in manufacturing firms whereby products and services are converged (Neely, 2008), and such product–service integration entails the reorganization of a firm's offerings from one-time product sales to continuous service provisions integrated with products (Baines, 2015). Integrating services into products is regarded as a form of innovation (Dachs et al., 2012), and firms can develop new or improved offerings through service and product innovation.

Several studies have proven that servitization is an effective way to strengthen a firm's competencies (Nudurupati, Lascelles, Wright & Yip, 2016). It is a strategic tool for capturing more customers and improving a firm's performance through such means as customer satisfaction (Bustinza, Bigdeli, Baines & Elliot, 2015). In addition, such a product–service integration enables firms to receive continuous feedback from customers, thereby maximizing the values that firms can bring to customers (Vargo & Lusch, 2008). As it is becoming increasingly difficult to segregate products from services integrated with products, manufacturing firms clearly understand the strong need to innovate services that are integrated with products (service innovation), as well as to innovate products themselves (product innovation). Thus, service innovation is no longer an agenda that manufacturing firms can overlook (Kindström & Kowalkowski, 2015; Shelton, 2009).

Notwithstanding the importance of services in the manufacturing industry, service innovation in manufacturing firms is not always advantageous. When a service is combined with a product, it is likely to cause numerous problems across the enterprise due to the natural characteristics of services, which include intangibility, inseparability, perishability, and non-transferable ownership (Baines et al., 2007; Barquet, De Oliveira, Amigo, Cunha & Rozenfeld, 2013; Mo, 2012; Ng & Nudurupati, 2010; Nudurupati et al., 2016; Zhang & Banerji, 2017). An increase in uncertainty due to the nature of services might lead to the poor integration of products and services (Parida, Sjödin, Wincent & Kohtamäki, 2014; Raddats & Easingwood, 2010), which increases costs and eventually negatively affects firm performance (Durugbo & Erkoyuncu, 2016; Li, Lin, Chen & Ma, 2015; Nordin, Kindström, Kowalkowski & Rehme, 2011; Reim, Parida & Örtqvist, 2015).

Although manufacturers can improve firm performance through service and product innovation, service innovation in manufacturing firms that basically deliver tangible products poses a potential risk of excessive costs and efforts. Research on service innovation in manufacturing firms has been discussed in terms of innovation outcomes without considering the required inputs, and the relationship between service innovation in manufacturing firms has yet to be fully uncovered. As innovation is not a linear process that guarantees a certain amount of output when a specific amount of input is utilized (Hollanders et al., 2007), innovation performance needs to be measured via efficiency, which considers both inputs and outputs.

By classifying innovation types into product and service innovation, this study aims to verify the differences in innovation efficiency among various innovation strategies that embrace 1) both product and service innovation, 2) product innovation only, and 3) service innovation only. This study is expected to not only extend the discussion on the relationship between innovation strategies and innovation performance to innovation efficiency but also suggest an appropriate innovation strategy for firm managers, depending on whether the purpose of innovation is to improve performance or efficiency.

The remainder of this paper is organized as follows: Section 2 reviews the theoretical background on the integration of product and service innovation, followed by Section 3, which explains the research methods, including the research model and data utilized with a detailed description of the variables. The results are presented in Section 4, while the implications, limitations, and suggestions for future research are discussed in Section 5.

Theoretical backgroundProduct and service innovationInnovation enables firms to generate higher revenue with differentiated products and services in the market (Nijssen, Hillebrand, Vermeulen & Kemp, 2006), as well as to satisfy the ever-changing needs and preferences of customers (Utterback & Abernathy, 1975). Manufacturing firms have traditionally focused on product innovation to achieve such benefits (Shelton, 2009; Shepherd & Ahmed, 2000). Product innovation has helped firms to extend their products’ life cycles and achieve economies of scale, along with continuous product improvement (Ulaga & Reinartz, 2011). Product innovation examples include mobile phones that have evolved from simple calling devices to being integrated with other complex electronics, such as cameras, and automobiles that have evolved from traditional fuel engines to electric vehicles with self-driving features.

However, product innovation alone does not guarantee sufficient and sustainable competitive advantages (Shelton, 2009). Leading companies in each sector complement product offerings through service innovation to enhance customer value, improve brand preferences, and develop integrated solutions that create greater cross-selling opportunities (Shelton, 2009). Such a form of service innovation is often referred to as “servitization” (Baines, 2015), which is defined as a manufacturer's ability to deliver customer- or industry-specific product–service solutions based on the close relationship between manufacturers and customers (Cusumano, Kahl & Suarez, 2015; Neely, 2008; Vargo & Lusch, 2008). Several examples describe the successful transformation of manufacturing firms toward servitization. BMW has enhanced its product offerings with certain services, such as leasing, car-sharing/pooling, and vehicle renting (Genzlinger, Zejnilovic & Bustinza, 2020), while Xerox is providing document publishing and management services, which is a shift from their traditional business as a photocopier seller (Emerald Publishing, 2020). IBM, Rolls-Royce, and Alstom are other examples of successful servitization-embracing manufacturing firms (Emerald publishing, 2020; Kowalkowski, Gebauer & Oliva, 2017).

Servitization is a strategic tool for promoting customer engagement and acquiring customers, thus contributing to firm performance through such avenues as customer satisfaction (Bustinza et al., 2015; Vandermerwe & Rada, 1989). This facilitates firms’ continuous conversations with customers to create a channel to enhance the value-of-use context (Bustinza, Parry & Vendrell-Herrero, 2013), and furthermore, firms can maximize value creation by utilizing their resources and knowledge based on customer engagement and service feedback (Vargo & Lusch, 2008). As innovation encompasses product and service innovation (OECD Eurostat, 2018), companies can benefit from innovation through both avenues.

Advantages of integrating product–service innovationThe persistent and consistent focus on product innovation has led to the conceptualization of similar large-scale investment and product development roadmaps for key industry participants, which has resulted in a similar range of new product options in the market; thus, product differentiation has decreased and no company has succeeded in market competition (Shelton, 2009). Naturally, firms consider the ambiguous boundaries between products and services and seek to deviate from the traditional product and service dichotomy (Drejer, 2004).

Shelton (2009) categorized the integration of product and service innovation by manufacturers into four stages: “product-centric manufacturer,” “as-needed service provider,” “full-line service expert,” and “integrated solutions provider.” The enterprise adds higher levels of service and sophisticated solutions for customer problem solving as the stage moves to the next step, and customers perceive the products and services as an integrated solution that includes all the customer's needs rather than separated objects. For example, Apple has created a proprietary platform to expand its product offerings with solutions that allow customers to freely access and download applications for more services and problem-solving opportunities (Perona, Saccani & Bacchetti, 2017), while steadily launching new products with improved features. Consequently, Apple has successfully transformed into an integrated solution provider and achieved the convergence of product and service offerings (Perona et al., 2017). Because of the importance of integrating product and service innovation, several studies have been conducted on the impact of product–service integration on firm performance (Fang et al., 2008; Gebauer, Worch & Truffer, 2012; Malleret, 2006; Neely, 2008; Nijssen et al., 2006; Zhang & Banerji, 2017).

Some of the benefits of product–service innovation integration are presented as follows: first, the integration of product–service innovation proposes a value that extends beyond existing products based on a deep understanding of the customers through close contact with them (by performing consumer surveys, characterizing customer satisfaction, understanding how the product is used, identifying product-related requirements, developing product features to meet the requirements, etc.) (Shelton, 2009). Second, product–service integration ensures that a product is unseparated from certain additional and complementary services, such as maintenance, repair, and after-sales services (Lee, Yoo & Kim, 2016), and such strong interdependency phenomena bind consumers to product–service packages. Third, the increase in the types of product–service packages (bundles) facilitates more customer adaptation and engagement (Baines et al., 2017; Vandermerwe & Rada, 1989), which enables firms to achieve price differentiation, economies of scale and scope, reduction in complexity and transaction costs (Simon & Wuebker, 1999), as well as offset the costs of providing products to customers (Vandermerwe & Rada, 1989). Fourth, product–service integration could mitigate customers’ uncertainty regarding next-generation technologies, as it supports customers who are unsure about product complexity and reluctant to purchase the latest generation of products (Cusumano et al., 2015). Thus, the integration of product and service innovation could bring financial and strategic benefits to enterprises (Kinnunen & Turunen, 2012; Mathieu, 2001) and contribute to their growth (Baines et al., 2017).

Potential risks of integrating product–service innovationThe integration of product–service innovation is not always beneficial, and it entails potential risks. Purchasing a solution has been a relatively new concept for customers, and they may refuse to purchase non-transferable ownership because of concerns about the loss of control over the entire contract (Baines et al., 2007; Ng & Nudurupati, 2010). Owing to the nature of services jointly produced and delivered by customers and providers, integrated product–service solutions require significant changes and new capabilities and create numerous challenges across the enterprise, including organizational structure, business model, development process, customer management, as well as financial and operational risk management (Zhang & Banerji, 2017).

In particular, because of the intangible nature of services that cannot be stored, the integration of products and services can only be tested during consumption, thereby complicating receipt of immediate feedback during the development process (Demeter & Szász, 2013). As the intangibility of services entails great uncertainty and requires consensus on risk-sharing among supply chain partners, integrating product and service innovation is even more difficult (Parida et al., 2014; Raddats & Easingwood, 2010). Most importantly, providing services and products sometimes further increases firms’ costs (Barquet et al., 2013; Mo, 2012; Nudurupati et al., 2016).

Consequently, product–service innovation does not always yield expected returns (Gebauer, Fleisch & Friedli, 2005; Matthyssens & Vandenbempt, 2010; Neely, 2008), and it does not increase the probability of firms’ survival (Benedettini, Neely & Swink, 2015). Companies with product–service integration can easily lose any financial returns at an early stage because of increased investment in business transformation (Neely, 2008), and firms have to take significant operational risks with high uncertainty when establishing and expanding service portfolios to deliver value to customers (Durugbo & Erkoyuncu, 2016; Li et al., 2015; Nordin et al., 2011; Reim et al., 2015).

To enjoy the advantages of service innovation in manufacturing firms, it is necessary to cope with the risks of increasing costs and efforts. Consequently, firms without sufficient resources may not benefit from service innovation, and losses from increased inputs may be greater. However, studies on service innovation in manufacturing firms have focused on innovation performance without considering changes in innovation inputs; thus, the risk of increased inputs from undertaking service innovation remains unanswered. As innovation needs to be measured via innovation efficiency, which is the ability to transform innovation inputs into innovation outputs (Hollanders et al., 2007), this study aims to verify the differences in innovation efficiency among firms with various innovation strategies.

Servitization in KoreaAccording to an analysis conducted by the Korea International Trade Association in 2020, the servitization of Korean manufacturing firms is gradually progressing (Sim, 2020). However, many Korean firms still provide simple product-linked services, which are less competitive than firms in developed countries that have fully progressed in their servitization efforts and have built creative new business models. Lee et al. (2018) quantitatively measured the linkage between manufacturing and business services and found that the convergence of the manufacturing and services industries in Korea was not as mature as it was in Germany or Japan. Therefore, the Korean government has introduced several policies to promote servitization in Korean manufacturing firms (Lee et al., 2017).

Other studies have examined the dynamics of servitization in Korea. Hyun and Kim, (2021) conducted an in-depth case analysis of Korean tire manufacturers that started tire-rental businesses. Their study revealed that the new servitization business did not reduce the profitability of the traditional manufacturing business model. Ha, Lee and Kim (2016) examined the efficiency of small and medium-sized Korean manufacturing firms through data envelopment analysis (DEA). By comparing the efficiencies of servitized and non-servitized firms, this study shows that servitization is an effective way to improve the efficiency of manufacturing firms. The study also shares a proper servitization strategy for small and medium-sized Korean firms. Suh and Park (2019) conducted an empirical analysis on small and medium-sized Korean firms and demonstrated that servitization competency played a mediating role in the relationship between the driving factors of servitization and servitization performance.

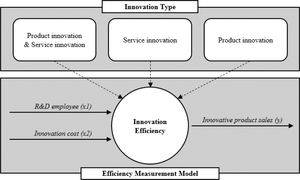

Research methodsModelThis study aims to verify the differences in innovation efficiency based on innovation type. Innovation efficiency refers to innovation output compared to innovation input, while innovation performance refers to the output itself. Thus, innovation performance becomes an output factor in calculating innovation efficiency. In this study, the output of innovation is measured by the sales of innovative products, that is, innovation performance, and innovation efficiency refers to the sales of innovative products compared to the resources invested in innovation.

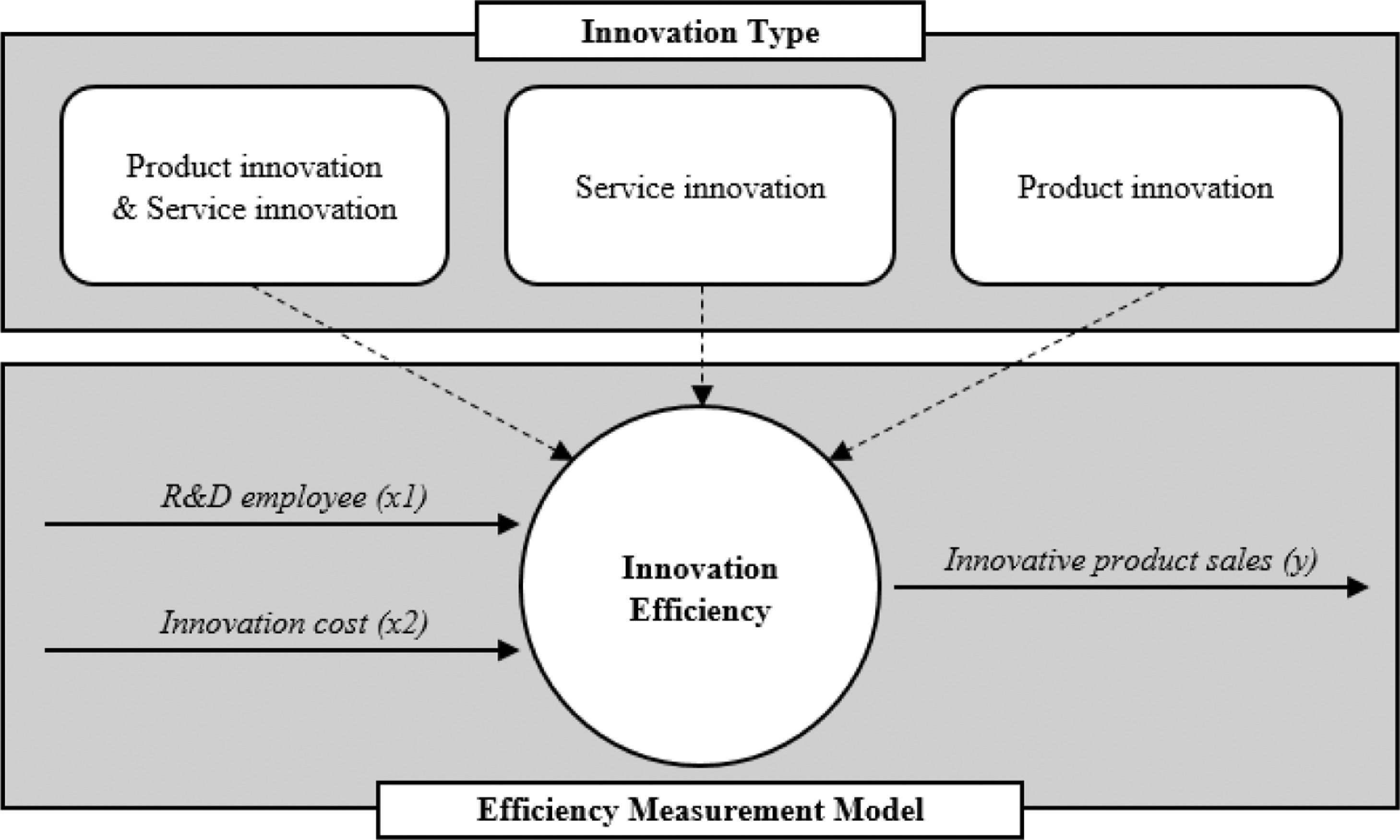

The research methods used in this study are presented as follows: DEA is adopted to measure the relative innovation efficiency of each firm in the first step, and then, Kruskal–Wallis one-way ANOVA is used to verify the difference in efficiency between innovation types. In addition, to compare the difference between innovation efficiency and innovation performance according to innovation type, the difference between innovation performance by innovation type is examined through ANOVA. The research model is established as shown in Fig. 1.

MethodologiesInput-Oriented BCC modelNotably, DEA is a typical method for measuring efficiency. It adopts linear programming to identify efficient frontiers and calculate the relative efficiency among decision-making units (DMUs). Furthermore, DEA is categorized into two different forms: the CCR and BCC models. While the CCR model assumes constant returns to scale and, thereby, cannot elaborate on technical efficiency, the BCC model assumes variable returns to scale, which enables a detailed distinction between the impact of pure technical efficiency and scale efficiency on technical efficiency (Banker, Charnes & Cooper, 1984; Charnes, Cooper & Rhodes, 1978).

Moreover, DEA models can also be categorized into input- and output-oriented models, depending on whether the controllable factors are inputs or outputs. Given that a specific amount of output is not guaranteed if a certain amount of input has been generated (Hollanders et al., 2007), it is reasonable to regard inputs as controllable factors for measuring innovation efficiency. Thus, this study adopts an input-oriented BCC model to calculate firms’ innovation efficiency. The formula for the input-oriented BCC model is presented as follows:

- •

θ0 = Efficiency of DMUj

- •

λi = The weight assigned to the ith input

- •

λr = The weight assigned to the rth output

- •

xij = The amount of ith input of DMUj

- •

λr = The amount of rth output of DMUj

- •

n = The number of DMUs

- •

m = The number of input factors

- •

s = The number of output factors

To measure innovation efficiency, this study utilizes two innovation inputs and a single output factor: the number of research and development (R&D) employees and innovation expenditures are utilized as input factors (Chen, Feng, Lin, Liao & Mei, 2021; Wang, Zhang, Xu & Wang, 2021), while innovative product sales is adopted as the output factor (Wang, Pan, Pei, Yi & Yang, 2020; Zeng, Li & Huang, 2021). Innovation expenditure includes not only R&D expenses but also expenses for innovation activities other than R&D (e.g., costs to purchase/lease R&D equipment). This is distinct from general R&D expenditure, which includes only the internal and external R&D expenses of a firm.

Kruskal–Wallis one-way ANOVA and bootstrap DEAThe Kruskal–Wallis one-way ANOVA, developed by Kruskal and Wallis (1952), is a non-parametric method used to conduct one-way ANOVA. It is an extension of the Mann–Whitney U test, which is used to compare two independent groups; therefore, it can be used to compare more than two groups (Xia, 2020). As with the Mann–Whitney U test, it ranks the observations across the groups in descending order and assigns the average of the ranks if the values are tied. After the observations have been ranked, the sum of the ranks and the mean rank (the average of the ranks of all observations) of each group are calculated, and the difference between groups is tested based on mean ranks (Hoffman, 2019). Therefore, the null hypothesis of the Kruskal–Wallis one-way ANOVA is that the mean ranks of the groups are equal.

Because DEA is a non-parametric method, it is limited in that the parametric statistical method cannot be applied for further analysis. Thus, this study adopts the Kruskal–Wallis one-way ANOVA to verify the differences in efficiency distributions among groups. The innovation strategies are divided into three groups according to the type of innovation that firms perform, namely, both product and service innovation, product innovation only, and service innovation only.

Owing to the non-parametric characteristics of DEA, in this study, we conduct an additional bootstrap DEA to suggest the descriptive statistics of each group, including the average and standard deviation. The bootstrap procedure is repeated 2000 times, and the bootstrap efficiency mean is calculated using the following equation (Kneip, Simar & Wilson, 2008; Simar & Wilson, 1998).

DataIn this study, we utilized data from the 2020 Korean Innovation Survey (KIS), which was conducted by the Science and Technology Policy Institute, Korea. The KIS data present compiled survey data on the overall innovation activities of manufacturing firms for the last three years (from 2017 to 2019), including whether firms engage in product and/or service innovation and the amount of inputs and outputs of innovation. This study excluded firm observations that neither perform product nor service innovation for the given periods, as they did not fall into any of the three groups categorized as innovation types. Out of 4000 observations, 951 are found to have performed product and/or service innovation, and 902 observations are used for the empirical analysis after excluding observations with incomplete data.

Summary of pros and cons of each innovation type.

| Type | Pros | Cons |

|---|---|---|

| Product innovation |

|

|

| Service innovation |

|

|

| Product and service innovation |

|

|

Definition of input and output factors.

| Factor | Factor name | Description |

|---|---|---|

| Input | R&D employee | The number of employees working in R&D (Unit: person)= The ratio of R&D personnel * The number of regular workers |

| Innovative cost | Total expenses spent for innovation activities (; internal R&D, external R&D, and innovation activities other than R&D). (Unit: million KRW) | |

| Output | Innovative product sales | Total sales of new innovated products (e.g. first product in the market or the firm's first product) (Unit: million KRW)= Sales * Sales contribution (%) of products launched through the firm's first product innovation or the market's first product innovation over the past three years. |

Firms are categorized into three groups depending on innovation type: Group 1 represents firms that have performed both product and service innovation, Group 2 represents firms that have performed product innovation only, and Group 3 represents firms that have performed service innovation only. The descriptive statistics of the overall inputs and outputs are presented in Table 3, and the detailed descriptive statistics by industry are summarized in Table 4.

Descriptive statistics by industry type.

| Industry type | # of firms | # of product & service innovation(Group 1) | # of product innovation(Group 2) | # of service innovation(Group 3) | Ave. R&D employee | Ave. innovation cost | Ave. innovative product sales |

|---|---|---|---|---|---|---|---|

| Manufacture of food products | 63 | 2 | 19 | 42 | 20.44 | 1568.73 | 55,612.87 |

| Manufacture of beverages | 11 | 2 | 7 | 2 | 45.95 | 2652.73 | 77,219.95 |

| Manufacture of textiles, except apparel | 25 | 2 | 23 | 0 | 14.27 | 879.20 | 26,504.58 |

| Manufacture of wearing apparel, clothing accessories and fur articles | 30 | 5 | 23 | 2 | 38.22 | 3862.33 | 81,866.90 |

| Manufacture of leather, luggage and footwear | 11 | 5 | 5 | 1 | 12.49 | 1780.45 | 45,375.23 |

| Manufacture of wood and of products of wood and cork; except furniture | 1 | 1 | 0 | 0 | 28.96 | 2000.00 | 107,610.75 |

| Manufacture of pulp, paper and paper products | 4 | 3 | 1 | 0 | 27.28 | 3475.00 | 154,137.73 |

| Printing and reproduction of recorded media | 1 | 0 | 0 | 1 | 9.00 | 1180.00 | 5476.50 |

| Manufacture of coke, briquettes and refined petroleum products | 1 | 0 | 1 | 0 | 27.63 | 5000.00 | 108,408.00 |

| Manufacture of chemicals and chemical products; except pharmaceuticals and medicinal chemicals | 165 | 84 | 38 | 43 | 46.62 | 2325.19 | 61,921.62 |

| Manufacture of pharmaceuticals, medicinal chemical and botanical products | 31 | 26 | 1 | 4 | 110.94 | 30,003.16 | 105,284.10 |

| Manufacture of rubber and plastics products | 47 | 7 | 39 | 1 | 37.07 | 6139.60 | 60,129.60 |

| Manufacture of other non-metallic mineral products | 12 | 4 | 3 | 5 | 11.75 | 2547.50 | 23,816.13 |

| Manufacture of basic metals | 48 | 24 | 15 | 9 | 22.02 | 4342.92 | 79,402.03 |

| Manufacture of fabricated metal products, except machinery and furniture | 41 | 5 | 31 | 5 | 14.34 | 1594.59 | 14,393.03 |

| Manufacture of electronic components, computer; visual, sounding and communication equipment | 86 | 36 | 27 | 23 | 47.07 | 5144.50 | 85,611.25 |

| Manufacture of medical, precision and optical instruments, watches and clocks | 28 | 10 | 14 | 4 | 20.41 | 1069.29 | 37,372.79 |

| Manufacture of electrical equipment | 58 | 20 | 34 | 4 | 19.91 | 1427.17 | 68,977.08 |

| Manufacture of other machinery and equipment | 129 | 19 | 96 | 14 | 26.50 | 2953.50 | 43,075.65 |

| Manufacture of motor vehicles, trailers and semitrailers | 91 | 27 | 34 | 30 | 294.19 | 15,617.80 | 358,433.85 |

| Manufacture of other transport equipment | 8 | 7 | 1 | 0 | 233.43 | 25,473.38 | 430,678.53 |

| Manufacture of furniture | 7 | 2 | 5 | 0 | 40.79 | 2500.00 | 196,341.49 |

| Other manufacturing | 4 | 1 | 3 | 0 | 18.50 | 950.00 | 17,243.50 |

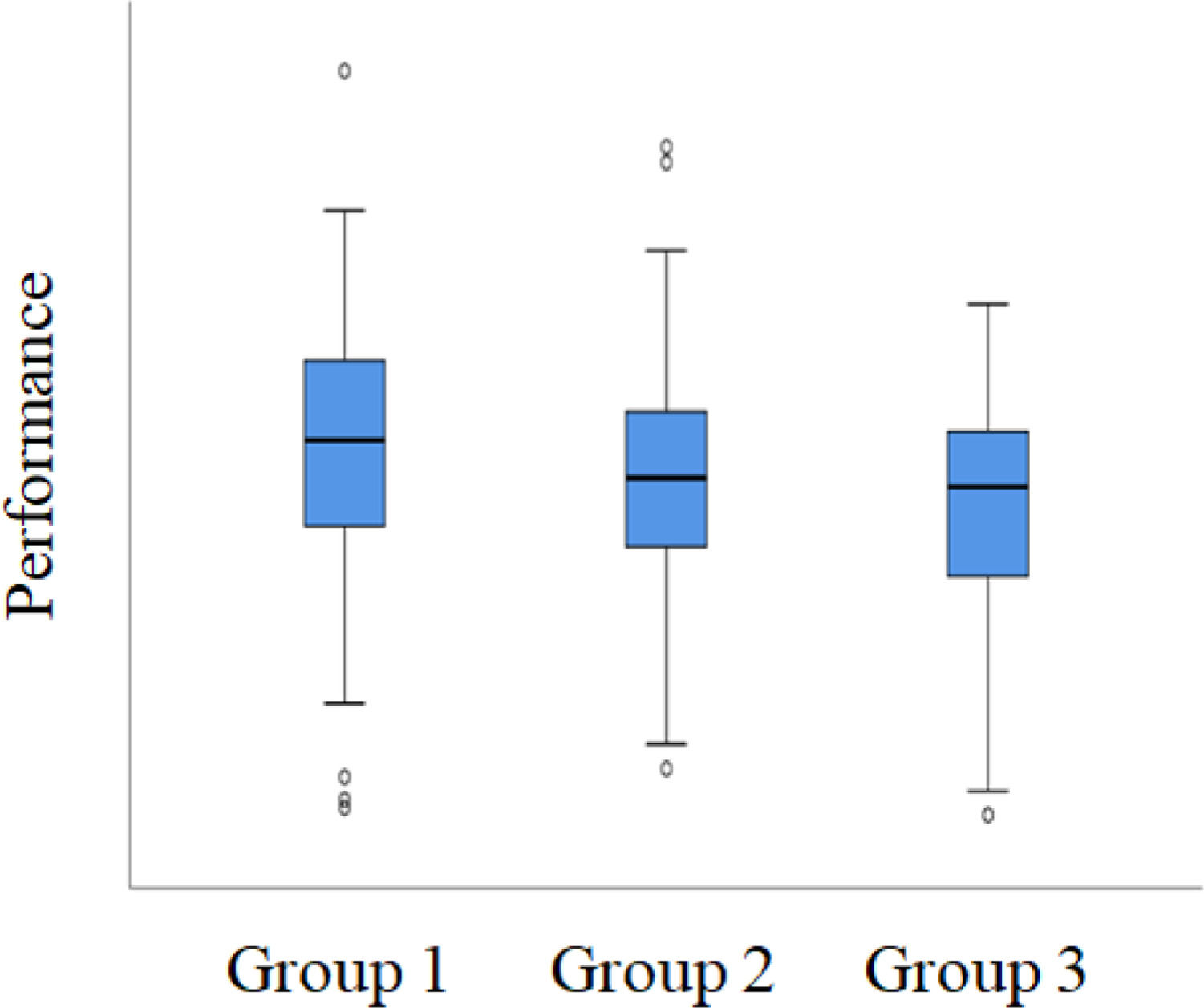

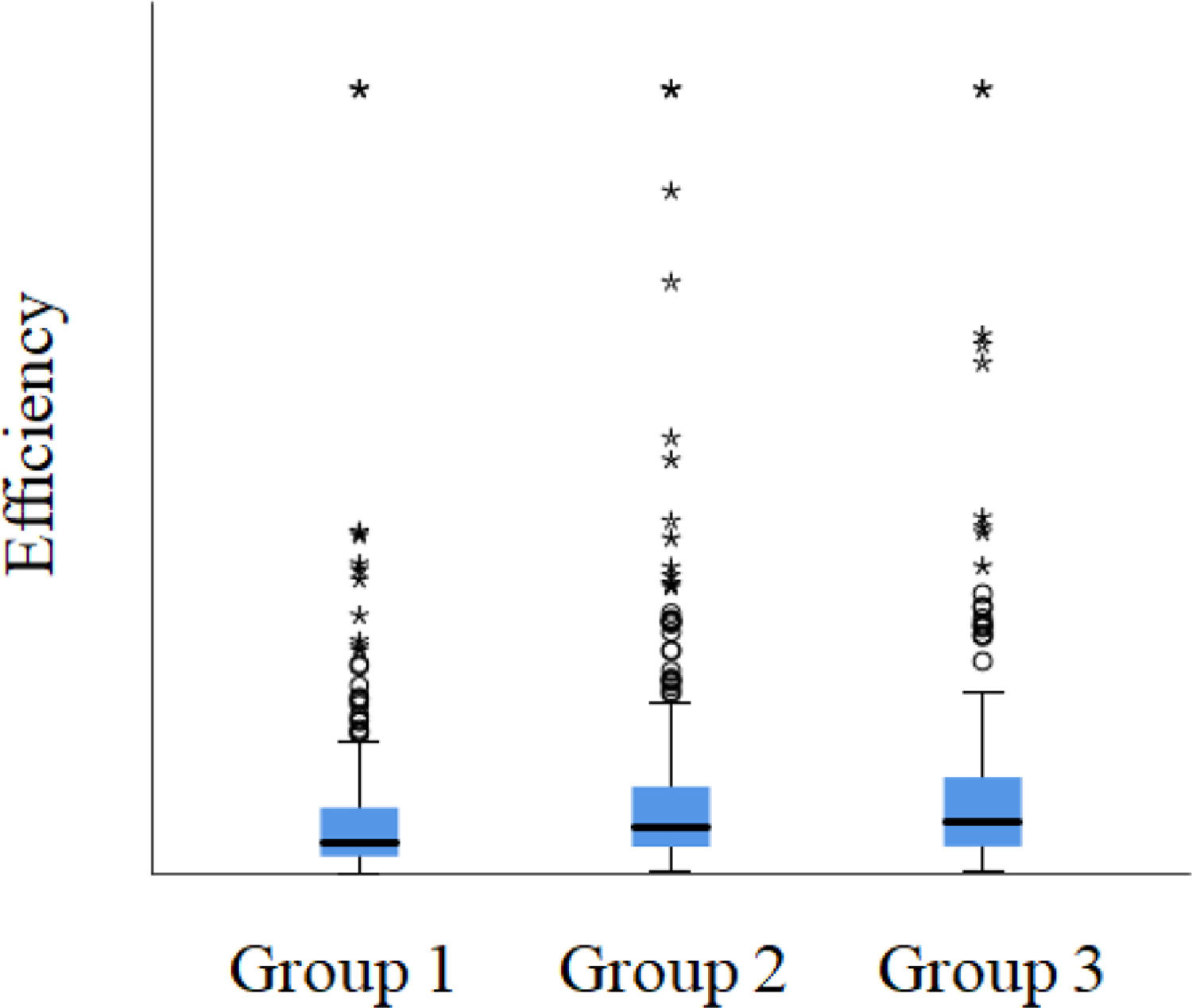

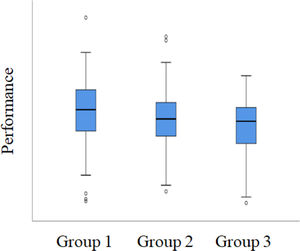

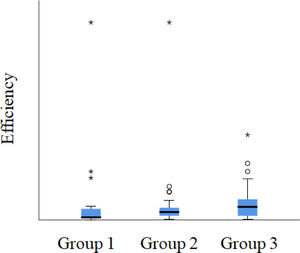

To further discuss the differences in innovation efficiency by innovation type, this study first analyzes the differences in innovation performance (the output factor used to measure efficiency). We perform ANOVA to verify the differences in innovation performance, as measured by innovative product sales between groups. The performance values are normalized using logarithmic transformation, and the results are presented in Table 5. Notably, Table 5 proves the existence of significant differences among groups; Group 1 shows the highest innovative product sales, followed by Groups 2 and 3. The box and whisker plots by group are shown in Fig. 2.

ANOVA results of log(innovation performance).

| Source of Variation | SS | df | MS | F | p-value | F Crit | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Between groups | 21.537 | 2 | 10.769 | 14.620 | 0.000 *** | 3.01 | ||||

| Within groups | 662.183 | 899 | 0.737 | |||||||

| Total | 683.720 | 901 | ||||||||

| Comparison | Test statistics | Std. Error | p-value | Post-hoc | ||||||

| C1 (G1-G2) | 0.232 *** | 0.068 | 0.00 | G1>G2>G3 (Dunnett's T3) | ||||||

| C2 (G1-G3) | 0.423 *** | 0.080 | 0.00 | |||||||

| C3 (G2-G3) | 0.191 ** | 0.071 | 0.02 | |||||||

** p<0.05, *** p<0.01.

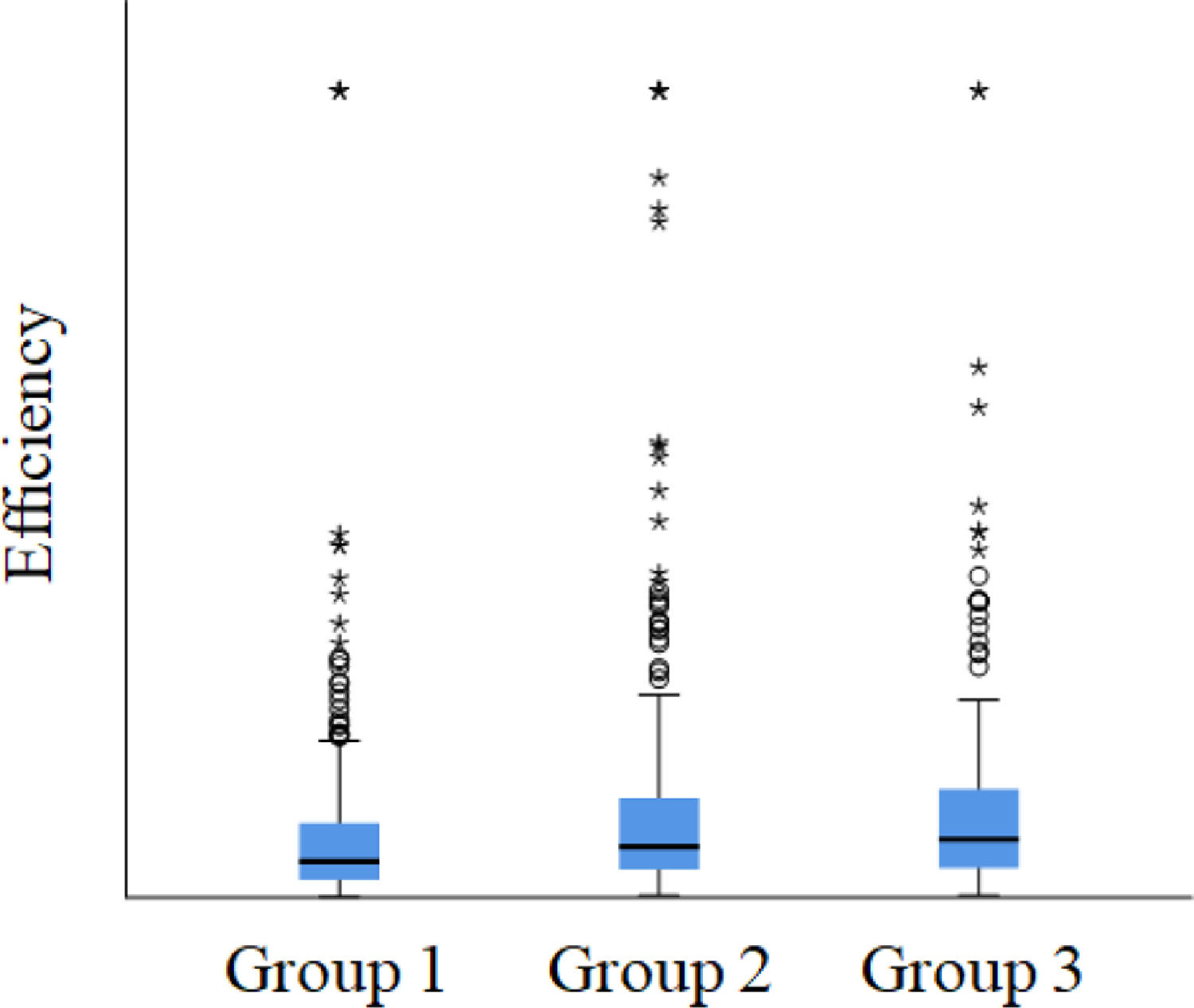

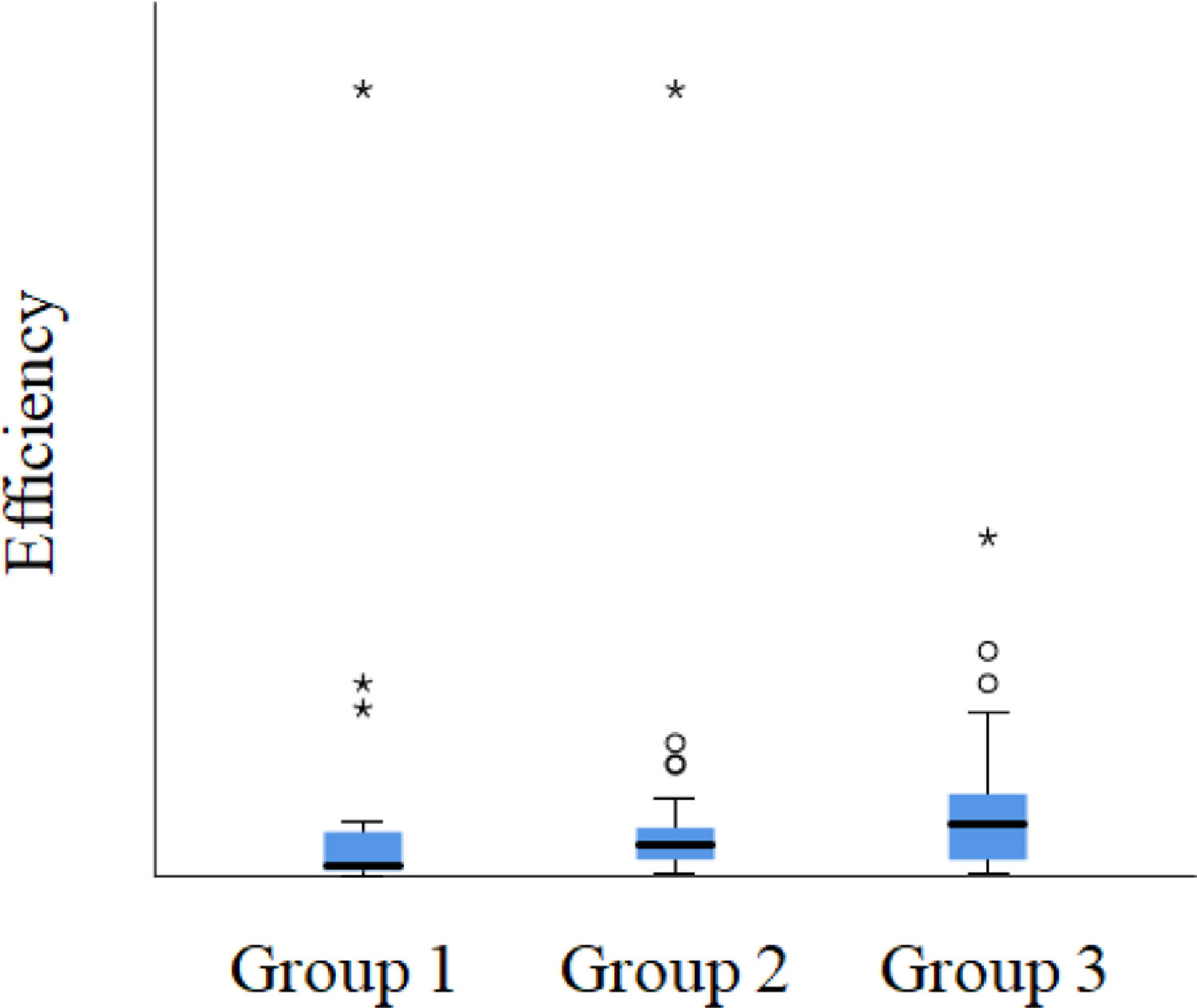

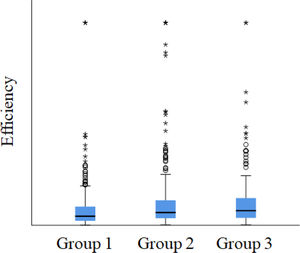

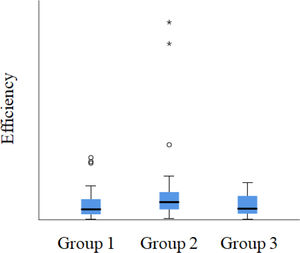

The results of the Kruskal–Wallis one-way ANOVA to verify the difference in the distribution of innovation efficiency are presented in Table 6. Contrary to the results of innovation performance, this proves that firms engaging in either product or service innovation tend to achieve higher efficiencies than those engaging in both types of innovation. This implies that the amount of input utilized is much greater than the increase in performance for firms performing both product and service innovation. However, there is no significant difference in efficiency between Group 2 (product innovation only) and Group 3 (service innovation only). The box and whisker plots of the efficiency among the groups are shown in Fig. 3.

Kruskal-Wallis one-way ANOVA results of BCC DEA.

| Mean Rank | Comparison | Test Statistics | Std. Error | Std. Test Statistics | p-value |

|---|---|---|---|---|---|

| G1: 383.93 | C1 (G1-G2) | −93.814 *** | 19.851 | −4.726 | 0.00 |

| G2: 477.75 | C2 (G1-G3) | −113.395 *** | 24.284 | −4.670 | 0.00 |

| G3: 497.33 | C3 (G2-G3) | −19.581 | 22.778 | −0.860 | 0.39 |

*** p<0.01.

Owing to the non-parametric characteristics of DEA, the efficiency score evaluated could be significantly changed when DMUs are added or deleted. Because the calculation of efficiency is determined by the input and output factors, the efficiency score may vary depending on the selection of input and output factors. Therefore, in this study, we perform further analysis to confirm the robustness of the empirical results: 1) analysis of the differences in efficiency among groups for industries with a sufficient number of samples only, 2) comparison of efficiency values calculated by different input factors by group, and 3) comparison of descriptive statistics after parameterization of the efficiency score by bootstrap DEA.

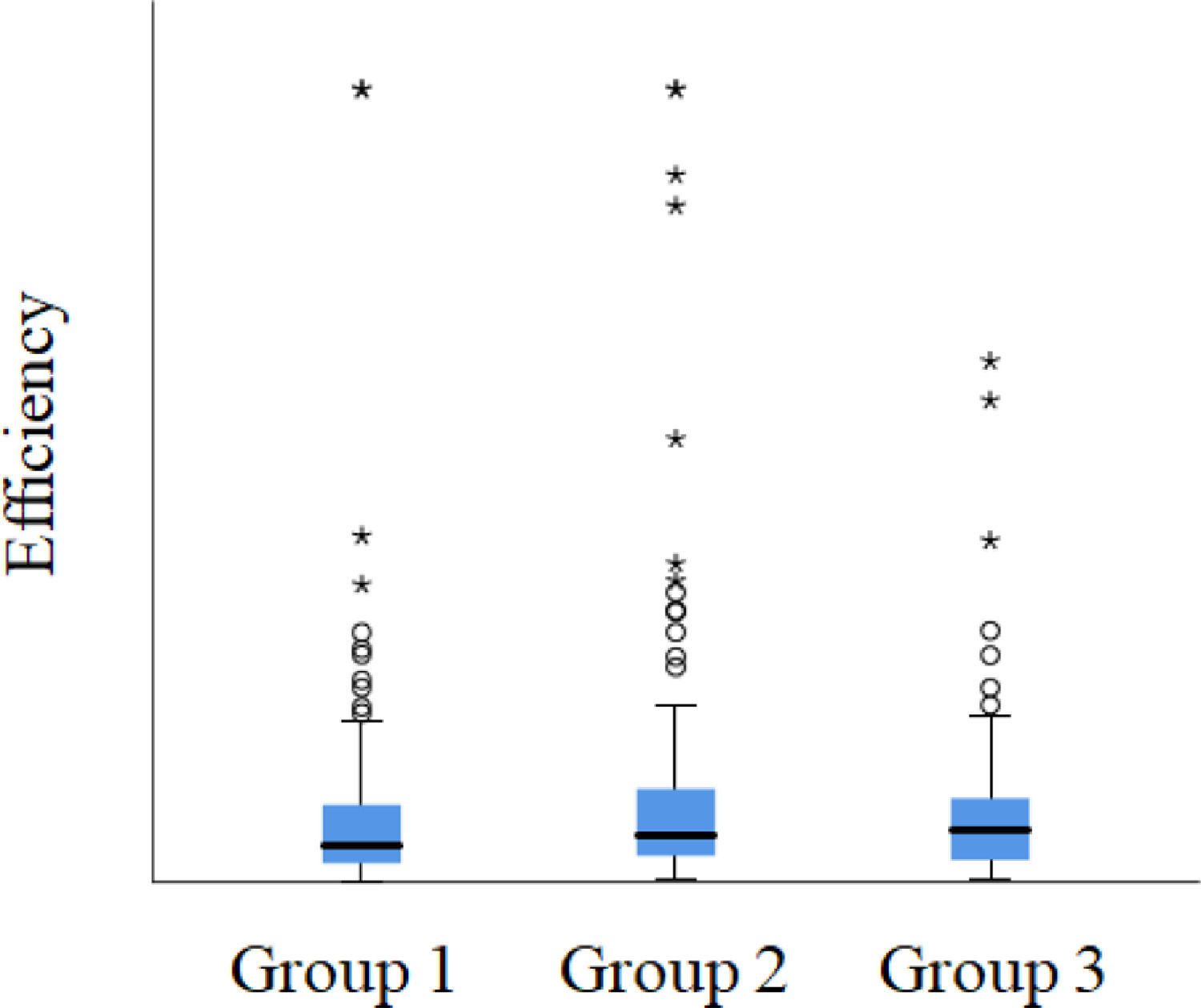

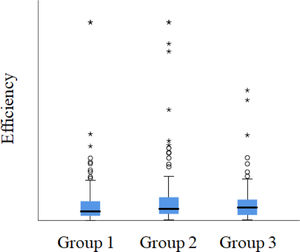

First, industries with more than 10 samples for each group are identified as 1) Manufacture of chemicals and chemical products, except pharmaceuticals and medicinal chemicals; 2) Manufacture of electronic components, computer, visual, sound, and communication equipment; 3) Manufacture of other machinery and equipment; and 4) Manufacture of motor vehicles, trailers, and semitrailers (see Table 4 above). Accordingly, the results of analyzing the differences in efficiency among groups with 471 firm samples belonging to the four industries are summarized in Table 7 and Fig. 4. This confirms the empirical results that firms belonging to Groups 2 and 3 tend to achieve higher innovation efficiency than those in Group 1, while the difference between Groups 2 and 3 is not verified.

Kruskal-Wallis one-way ANOVA results of BCC DEA (four industries).

| Mean Rank | Comparison | Test Statistics | Std. Error | Std. Test Statistics | p-value |

|---|---|---|---|---|---|

| G1: 214.42 | C1 (G1-G2) | −35.100 ** | 14.374 | −2.442 | 0.02 |

| G2: 249.52 | C2 (G1-G3) | −30.198 * | 16.734 | −1.805 | 0.07 |

| G3: 244.61 | C3 (G2-G3) | −4.902 | 16.230 | −0.302 | 0.76 |

* p<0.1; ** p<0.05.

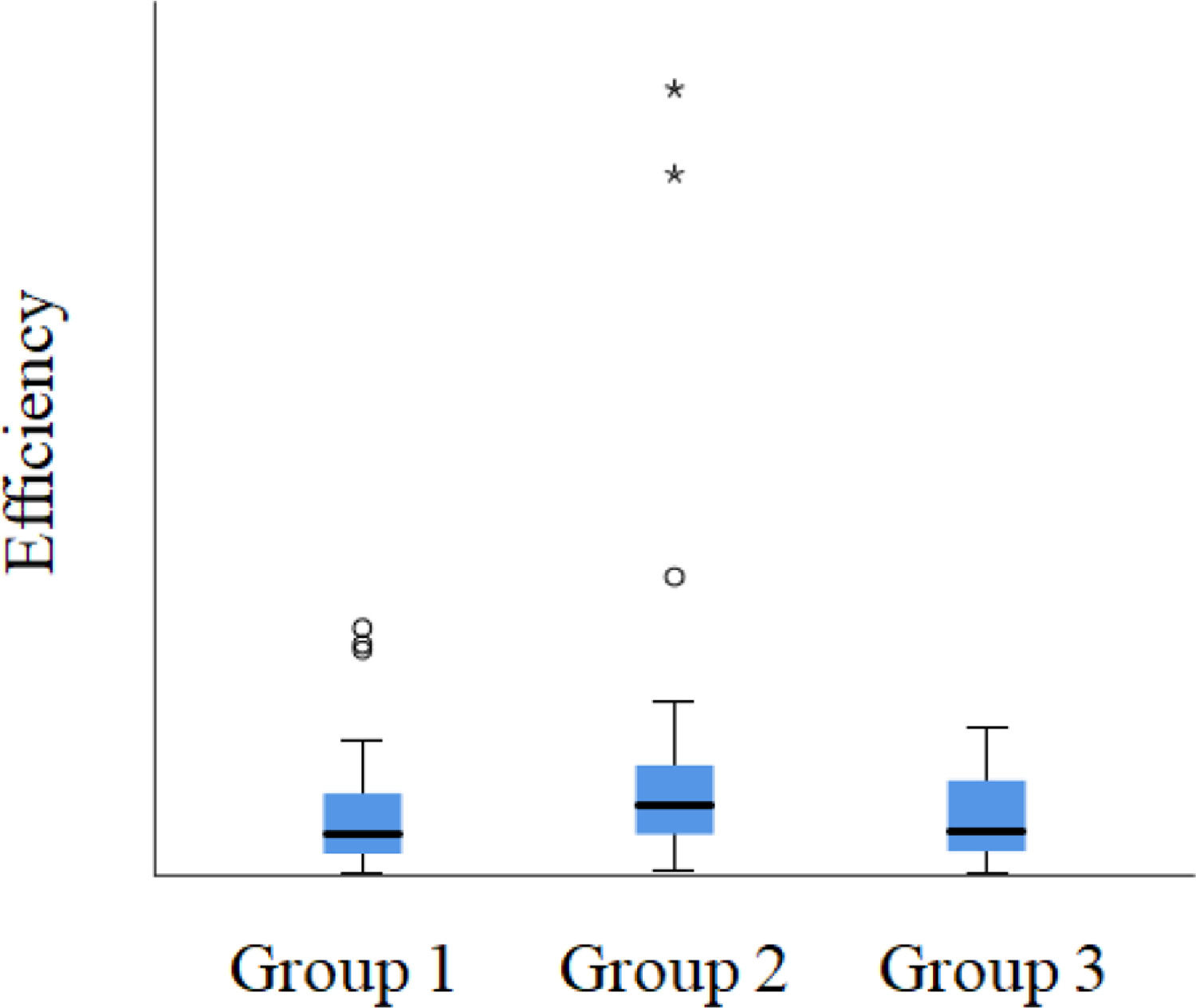

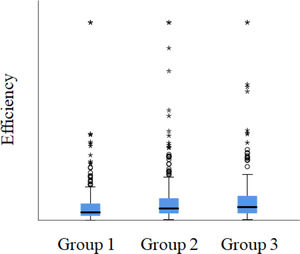

Second, the estimates and differences in efficiency scores among groups are analyzed by adopting R&D expenditure instead of innovation cost as an input variable. The same results as the empirical analysis are derived, which confirms that firms engaging in either product or service innovation are significantly more efficient than those performing both product and service innovation. The results are summarized in Table 8 and Fig. 5.

Kruskal-Wallis one-way ANOVA results of BCC DEA (input changed).

| Mean Rank | Comparison | Test Statistics | Std. Error | Std. Test Statistics | p-value |

|---|---|---|---|---|---|

| G1: 380.07 | C1 (G1-G2) | −101.653 *** | 19.851 | −5.121 | 0.00 |

| G2: 481.73 | C2 (G1-G3) | −114.389 *** | 24.284 | −4.711 | 0.00 |

| G3: 494.46 | C3 (G2-G3) | −12.736 | 22.778 | −0.559 | 0.58 |

*** p<0.01.

Lastly, we perform bootstrap DEA to eliminate the potential bias that occurs in traditional DEA, and the parameterized descriptive statistics for each group are summarized in Table 9. In line with the results from the Kruskal–Wallis one-way ANOVA, the difference in innovation performance efficiencies between groups is confirmed. Group 1 shows a significantly lower efficiency than Groups 2 and 3, while a significant difference in efficiency between Groups 2 and 3 is not verified.

Analysis on individual industriesFurther analysis is conducted to verify the difference in efficiency by innovation type, even within individual industries. Four industries with more than 10 samples for each group are selected, and the results are as follows:

First, in the case of “Manufacture of motor vehicles, trailers, and semitrailers,” it is verified that Group 2 (product innovation only) and Group 3 (service innovation only) are significantly more efficient than Group 1 (both product and service innovation), while the difference in Group 2 and 3 is not significantly verified. This shows the same results as the previous outcomes when considering the overall industries (see Table 10 and Fig. 6).

Kruskal-Wallis one-way ANOVA results of BCC DEA(Manufacture of motor vehicles, trailers and semitrailers).

| Mean Rank | Comparison | Test Statistics | Std. Error | Std. Test Statistics | p-value |

|---|---|---|---|---|---|

| G1: 34.24 | C1 (G1-G2) | −12.156 * | 6.809 | −1.785 | 0.07 |

| G2: 46.4 | C2 (G1-G3) | −21.893 *** | 7.007 | −3.125 | 0.00 |

| G3: 56.13 | C3 (G2-G3) | −9.736 | 6.616 | −1.472 | 0.14 |

* p<0.1; *** p<0.01.

In the case of “Manufacture of chemicals and chemical products, except pharmaceuticals and medicinal chemicals,” it is significantly verified that Group 2 (product innovation only) is more efficient than Group 1 (both product and service innovation), and Group 3 (service innovation only) is more efficient than Group 2. It is noteworthy that the difference in efficiency between companies that perform product innovation only and service innovation only is verified. However, the difference in efficiency between Groups 1 and 3 is not verified (see Table 11 and Fig. 7).

Kruskal-Wallis one-way ANOVA results of BCC DEA (Manufacture of chemicals and chemical products; except pharmaceuticals and medicinal chemicals).

| Mean Rank | Comparison | Test Statistics | Std. Error | Std. Test Statistics | p-value |

|---|---|---|---|---|---|

| G1: 77.5 | C1 (G1-G2) | −22.605 ** | 9.340 | −2.420 | 0.02 |

| G2: 100.11 | C2 (G1-G3) | −1.128 | 8.958 | −0.126 | 0.90 |

| G3: 78.63 | C3 (G2-G3) | 21.477 ** | 10.637 | −2.019 | 0.04 |

** p<0.05.

Nonetheless, the null hypothesis that the distribution of efficiency among groups is the same could not be rejected for the other two industries; thus, the difference among groups in each industry could not be verified (p = 0.42 for “Manufacture of electronic components, computer, visual, sound, and communication equipment” and p = 0.34 for “Manufacture of other machinery and equipment”).

ConclusionDiscussionAs innovation efficiency is measured by the ratio of performance to inputs, these conflicting results indicate differences in the amount of inputs by innovation strategy. In other words, the amount of input increment to perform both types of innovation may exceed the increase in innovation outcome. In line with studies on the advantages and potential risks of product–service integration, inputs as well as outcomes tend to increase when both product and service innovation are performed.

However, in the analysis by industry, different results are derived, depending on the industry. The difference in the relationship between innovation types and their efficiencies between industries can be explained by the characteristics of the innovative services integrated into the product. Service innovation in the chemical industry usually involves maintenance/consulting services using high-tech technology that is provided to corporate customers (Jang, Lee & Lee, 2010). The provision of such services is likely to be included in sales other than innovative product sales; therefore, the positive effects of service innovation may not be accurately measured in this study.

Moreover, Ha et al. (2016) argue that the success of servitization can vary depending on the size of the company. As servitization requires a substantial amount of funds, large firms with sufficient capital can benefit from service offerings, whereas small firms with insufficient funds cannot enjoy the advantages of integrated services (Ha et al., 2016). Of the 165 firm samples belonging to the chemical industry in this study, 55.8% (92 firms) are small firms with less than 100 employees, and only 9.1% (15 firms) are large firms with 500 or more employees.

Regarding the automobile industry, the various successful examples of product–service integration practices undertaken by Hyundai motors are suggested, including financial services, vehicle maintenance services, system and solution services, rental car services, and so on, and such services are provided with affiliates related to the firm, including Hyundai Capital, Hyundai Card, Hyundai Glovis, and Haevichi Hotel & Resort (Lee & Kwon, 2016). This implies that the performance of servitization can be high when a firm is large enough, and can possibly be greater in a company that could cooperate with others that can provide related services.

The sizes of the firms in the motor vehicle, trailer, and semitrailer industry utilized in this study are comparatively larger than those in the chemical industry, with 17.6% (16 out of 91 firms) having less than 100 employees, while 36.3% (33 out of 91 firms) have 500 or more employees in the automobile industry. Therefore, the difference in the distribution of efficiency by innovation type depending on the industry may have originated from the characteristics of the services in each industry and/or the size of the firm. Although this study suggests a possible explanation for the difference in efficiency by industry, the exact reason could not be determined, and we leave this to future research.

In addition, large firms pursue economies of scale by hiring more R&D employees (Kamien & Schwartz, 1982) and investing more in R&D activities (Conte & Vivarelli, 2014; Rosen, 1991). However, the average number of R&D employees in small and medium-sized enterprises (SMEs) is less than that in large firms, and R&D organizations are usually unstructured (Santarelli & Sterlacchini, 1990). Moreover, it is difficult for SMEs to carry out innovation activities because of insufficient assets (Zeng, Xie & Tam, 2010). This indicates that the number of R&D employees and expenditures on innovation activities can represent the size of the firm.

Implication, limitation, and suggestion for future researchThis study has several academic implications. First, it extends the discussion of previous studies on the relationship between innovation strategies and their performance in terms of efficiency by measuring innovation efficiency, while considering both innovation inputs and outputs. Second, this study empirically verifies the advantages and potential risks of providing products and services together in the manufacturing industry. By comparing performance and efficiency according to innovation type, this study provides evidence of increased inputs and outputs when adopting both product and service innovation.

This study has several managerial implications. First, it proposes appropriate innovation strategies based on firms’ innovation objectives. As several studies have pointed out both the benefits and hazards of product–service innovation, firms may encounter challenges in deciding which innovation path to embrace. Firm managers can determine which innovation strategies they should perform, depending on whether the purpose of innovation is to maximize performance or efficiency. Most importantly, an appropriate innovation strategy is strongly related to a firm's resource availability. If resources are insufficient, firms might be better inclined to engage in either product or service innovation only to increase innovation efficiency and avoid resource shortage. Considering that many companies face difficulties in innovation due to a lack of financial and human resources (Galia & Legros, 2004; Savignac, 2006), performing a single type of innovation could also become a great innovation strategy.

Notwithstanding these implications, this study has several limitations. First, the study compares innovation performance and efficiency based solely on whether each type of innovation is performed without considering the extent whereto it is performed. Although product and service innovation may vary in degree by firm, this study is unable to measure the extent to which each innovation type is undertaken. Although the relationship between innovation types and their efficiency may differ by industry, the differences in efficiency by innovation type can only be examined for a few industries.

These limitations can be attributed to the characteristics of the data used in this study. As the study utilized secondary data, the amount of resources invested in product and service innovation could not be identified, and the obtained samples were insufficient to compare the differences in innovation efficiency by industry. To compare the differences between the four industries mentioned in this study, it is necessary to analyze subgroups by four industries. Thus, future research can overcome these limitations by adopting qualitative methods, such as interviews, or by conducting surveys containing additional information. Based on the distinction of the extent to which resources and efforts are allocated between product and service innovation by industry type, future studies are expected to provide detailed proposals for appropriate innovation strategies for firm managers. Furthermore, it could be robust to present the specific implications for each industry through a comparison of its innovation performance with innovation type.