Innovation and intangible asset (IA) management have not received adequate attention amongst labour- and capital-intensive sectors. This study investigates the effect of IAs on firms’ performance and the internal and external determinants of firms’ IA development amongst small- and medium-sized enterprises (SMEs) in the Vietnamese sectors of agriculture, forestry and fishery (AFF). The study adopts a stochastic frontier analysis to estimate firms’ performance and propensity score matching to examine the difference between firms with and without IAs. Ten hypotheses of innovation determinants including firms’ internal and external factors are also investigated. The results reveal three notable findings. (1) For Vietnamese AFF sectors, IAs diminish firms’ performance. (2) Internal factors such as age, size and financial robustness have positive effects on the formation of IAs, while investments in land, labour and research and development impose mixed effects. (3) External factors, such as regional and province-specific characteristics, have significant impacts on IAs. These results suggest a review of current policies on innovation and IA management amongst SMEs.

The agriculture, forestry and fishery (AFF) sectors have been the driving force of the Vietnamese economy since its establishment thanks to favourable climatic and geographic conditions. Diverse regional characteristics, such as vast deltas, large forests and a long coastline, allowed these sectors’ development to fulfil domestic demand as well as contribute to a sizeable proportion of Vietnam's total exports. AFF products are significant final goods for ensuring food security in the context of a growing population and as inputs for other production sectors. In terms of progressing towards sustainable development, particularly in rural areas, AFF development is an essential consideration (Hoang-Khac et al., 2021). However, this need faces challenges, as conventional practices in these sectors are fragmented amongst small households and businesses, lack connections, are substantially affected by climate change and are based on labour intensity with a low level of innovation and technology (Lampach et al., 2021). These challenges lead to low productivity and even the risk of capacity reduction, especially amongst small- and medium-sized enterprises (SMEs). Lack of innovation in the agricultural sector also impedes countries’ paths towards sustainable rural development (Romero-Castro et al., 2022). Subsequently, to address these problems, the Vietnamese government has called for the integration of high technology in AFF production as the development route for the future.

In the AFF sectors, innovation and technology can be in the form of new farming/cultivation techniques or new plant and animal varieties, which can be recorded as intangible assets (IAs) on firms’ financial statements. According to the International Financial Reporting Standards Foundation (IFRS, 2014), ‘An intangible asset is an identifiable non-monetary asset without physical substance […] Examples of intangible assets include computer software, licences, trademarks, patents, films, copyrights and import quotas’. Firms can establish and accumulate IAs by investing in research and development (R&D) activities or via intellectual capital (IC), including high-skilled labour. Previous literature has presented common findings that IAs can improve firm performance from both business and finance perspectives (Ferdaous & Rahman, 2019). Researchers determine these relationships based on one or a few performance indicators, such as return on sales (ROS) and return on assets (ROA) (Andonova & Ruíz-Pava, 2016), profitability and market-based ratios (Ferdaous & Rahman, 2019) or a composite Tobin's q (Wernerfelt & Montgomery, 1988). IAs are also considered to be a driver of firms’ sustainable competitive advantage (Clulow et al., 2003; Mathur et al., 2007). However, Ferdaous & Rahman (2019) asserted that the direct IA–firm performance nexus has not been fully investigated in the literature.

We argue that technical efficiency (TE) is an appropriate proxy for firm performance as it offers a mature and comprehensive calculation based on an established and validated set of inputs and outputs (Färe & Lovell, 1978). This approach will allow us to examine the relationship between IAs and firm performance in a broader context. Previous literature regarding the impact of IAs on TE presents contradictory results. While the majority of previous studies have indicated a positive relationship between IAs and TE (Belkaoui, 2003; Kapelko & Oude Lansink, 2014; Turovets, 2021), other studies, such as of Firer & Williams (2003), show IAs to have an insignificant effect on value-added efficiency in South Africa; similarly, Ruiwen & Honghui (2010) found a ‘very weak negative correlation’ between IAs and the business performance of listed social services companies in China. Villalonga (2004) found that across nine sectors in the US, IAs not only enhanced firms’ performance through profits but also maintained firms’ competitive advantage; however, this effect is inconsistent across all sectors. While most of the previous literature has suggested that IAs have positive effects on firm performance amongst manufacturing, knowledge-based or high-tech firms (Ferdaous & Rahman, 2019; Marrocu et al., 2012; Sporleder & Moss, 2004), very little is known about this nexus amongst lower-tech sectors like AFF. This leads us to postulate that IAs have less significant importance for lower-tech, labour- and capital-intensive sectors. Accordingly, this study aims to examine this effect via data from AFF sectors in Vietnam, a developing country with a development orientation towards industrialisation, modernisation and sustainable growth.

We found limited separate empirical studies regarding the IAs–performance linkage in AFF sectors, other than a few works examining various sectors that include AFF. Andonova & Ruíz-Pava (2016) examined 831 firms in AFF sectors in their analysis of IAs’ role, yet provided no sector-specific conclusions, despite suggesting that IAs are important for firm performance in a developing country context. Xu et al. (2020) asserted that IC, characterised as knowledge and other nonfinancial factors, is important for the overall long-term development of agricultural enterprises. The authors combined IC with IAs, finding that human capital is the critical component of IC in the sustainable growth of Chinese agriculture. Villalonga (2004) suggested that R&D and advertising investments were not sources of increased profits for the agriculture sector. Turovets (2021) determined that although IAs have been believed to increase productivity on the macroscale in past decades, minimal studies have examined IAs as determinants of firm efficiency.

To fill this gap, we use a combination of stochastic production frontier (SPF), propensity score matching (PSM) and probit regression. SPF and PSM help measure firms’ performance and compare the TE of two groups of firms with and without IAs. Normally, these types of comparisons are implemented via t-tests; however, since considerable differences exist in terms of IA formation between the haves and have-nots, a simple t-test cannot yield statistically significant results from the mean of two subsets. In contrast, PSM and other matching techniques can help match more similar pairs for TE comparison. We then apply probit regression to examine the determinants of IA formation regarding internal and external factors.

The remainder of this study is organised into five sections. Section "Literature review" reviews the literature related to the IAs–TE relationship and the determinants of IAs and TE. Section "Materials and methods" presents the materials and methods used in this study. We detail and discuss the regression results in Sections "Results and discussion" and "Discussion". Finally, Section 6 concludes the study and proposes implications for managers and policymakers.

Literature reviewOn IAs and TEIAs are crucial to firms’ behaviours and decisions and are believed to enhance firms’ competitive advantage (Andonova & Ruíz-Pava, 2016; Marrocu et al., 2012). Hall (1993) devised a framework for linking firm capabilities to intangible resources, including components of intellectual property (i.e. patents and trademarks), human capital, know-how, reputation and firms’ culture. Belkaoui (2003) referred to IAs as strategic assets that can drive firms’ competitive advantage and financial robustness. Given the development of innovative and intellectual products in developed countries, the literature on the relationship of IAs and firm performance has been well established, primarily from two directions. The first includes studies from a business management perspective in which IAs are argued to affect firms’ competitive advantage, using qualitative reasoning or simple regressions of IAs to one or more indicators of performance (Belkaoui, 2003; Clulow et al., 2003; Hall, 1993; Mathur et al., 2007). The second strand of literature approaches IAs and firm performance from a more economic perspective, incorporating IAs and other inputs with production functions (Kapelko & Oude Lansink, 2014; Marrocu et al., 2012; O'Mahony & Vecchi, 2009; Turovets, 2021). Most of such literature falls under contexts of developed countries.

Regarding the first strand, Hall (1993) examined the role of IAs in relation to sustainable competitive advantage of firms in the UK, finding that IAs can help firms secure advantages via capability differentials. In Australia, Clulow et al. (2003) studied the financial services sector, revealing a similar result that firms with IAs had a consistent probability of outperforming competitors. Other studies also determined a significant positive relationship between IAs and firms’ competitive advantage in North America (Mathur et al., 2007), inside the United States (Belkaoui, 2003) and in Europe (Todericiu & St˘ani¸t, 2015).

Regarding the second strand, O'Mahony & Vecchi (2009) studied the impact of IAs as R&D or labour skills and knowledge on firm productivity in the context of the US, the UK, Japan, France and Germany. The results indicate that firms’ internal R&D activities in both manufacturing and non-manufacturing sectors have a significant influence on increasing productivity; however, the authors noted that firms operating in capital-intensive industries did not benefit from intellectual development as much as those involved in innovation/technology-intensive industries. Marrocu et al. (2012) examined IAs as a component of the Cobb–Douglas production function, finding that IAs have a higher impact on productivity growth than tangible assets in the service sector. Further aggregate results are difficult to conclude due to undiscussed cross-sector heterogeneity. The authors also highlighted the importance of favourable external circumstances on intangible capital accumulation. Kapelko & Oude Lansink (2014) have a slightly different approach on this issue, adopting data envelopment analysis to analyse the IAs–TE relationship, finding a positive correlation. Notably, this study only took IAs as a determinant of TE along with other factors, such as firm age or firm size, which is not ideal since these factors can be inter-correlated to certain extent. More recently, Turovets (2021) used a stochastic frontier model (SFM) to estimate the role of IAs in firms’ inefficiency, also finding firms in high-tech sectors to enjoy a stronger effect from IAs. This further implies that the business environment could be a robust factor affecting IAs and firm performance.

Several studies have been conducted in the context of developing countries. Firer & Williams (2003) studied four IC-intensive sectors of banking, electrical, information technology and services in South Africa from a business management perspective. The results indicated no robust association between IC and firm performance with a dataset of 75 publicly traded firms. Examining data from Columbia, Andonova & Ruíz-Pava (2016) used ROS and ROA to measure firms’ performance with cumulative IAs over time, concluding that IAs are an important determinant of firm performance in the context of developing countries. Ferdaous & Rahman (2019) studied manufacturing firms in Bangladesh from a similar angle, finding a mixed effect of IAs on firm performance that demonstrates positive effects on financial strength but negative effects on market-based performance. These results in developing countries reveal more inconsistency than those from studies in developed countries, suggesting that additional research using more robust methods and a larger data sample is necessary.

Due to the capital- and labour-intensive nature of AFF sectors, the impact of IAs on firm performance might be marginal compared to that of technology-intensive sectors (Marrocu et al., 2012; O'Mahony & Vecchi, 2009; Turovets, 2021; Villalonga, 2004). Consequently, previous studies have attempted to explore the impact of IAs on AFF firms’ performance in developing countries, where the level of technology advancement is lower and AFF sectors have a more prominent economic influence than in developed countries. Komnenic et al. (2010) adopted the value-added IC coefficient (VAIC), concluding that Serbian agricultural firms’ intellectual assets are important to performance; however, this study covers a considerably small group of public firms with a non-parameter approach, as VAIC acts only as an indicator of firms’ capital management capacity but is not a comprehensive measurement of efficiency. In Germany, Crass et al. (2015) found that IAs do not significantly affect the productivity of firms in the agriculture and mining sectors. This is similar to the results of Villalonga (2004) in the US, claiming that agricultural firms do not benefit from the R&D activities that form IAs.

Determinants of the formation of IAsInternal factorsFirm ageThe impact of company age on the IAs of SMEs is determined by the character of firms’ resources rather than their amount. According to one line of study, fledgling enterprises face the liability of newness (DeVaughn & Leary, 2018; Stinchcombe, 2000). New businesses are free to establish procedures and structures that generate distinctive, opportunity-related capabilities that are difficult to replicate or substitute and support the formation of competitive advantage. As a result, new entrants with strong entrepreneurial orientations frequently pioneer radical innovations in their surroundings, with technologically induced discontinuities (Christensen & Bower, 1996; Hill & Rothaermel, 2003). Another body of research indicates that older enterprises are prone to inertia and respond slowly to changing conditions (Daviy & Shakina, 2021; Kücher et al., 2020; Marshall, 2009). Firms that remain on existing paths and fail to adjust to environmental change hold a risk of falling behind competitors (DeCarolis & Deeds, 1999; Sull, 1999). As basic routines, processes and structures are reinforced, particularly in established SMEs, the original competitive advantage of nimbleness may be lost. As a result, we argue that firm age has a considerable impact on SMEs’ innovation and competitive edge, proposing the following hypothesis:

Hypothesis 1: Firms’ increasing age has a negative effect on the formation of IAs amongst AFF SMEs.

Firm sizeWhether organisational size affects innovation is a topic of considerable debate and enquiry (Bachmann et al., 2021; Stock et al., 2002; Haar et al., 2021). According to Robinson (1958), there are three explanations for the negative relationship between IAs and business size. (1) The substitution of labour division gains with routines as costs creating boredom and restricting technical creativity. (2) Lower decision-making speed and flexibility. (3) Higher coordination costs. In contrast, size has also been shown to improve firms’ potential to increase IAs (Penrose & Penrose, 2009). This concept is based on three key assertions. First, larger enterprises have better cash flow to hire more R&D personnel than small firms, allowing the development and accumulation of technological stock and human capital capabilities (O'Cass & Weerawardena, 2009). Second, a higher volume of sales could lower the average technology's fixed expenses. Third, larger firms may have better access to the resources required to implement new innovations. Lacking such resources, smaller firms are forced to compromise investment decisions and frequently forego the installation of costly innovation, maintaining less efficiency. We propose the following hypothesis:

Hypothesis 2: Firms’ increasing size has a positive effect on the formation of IAs amongst AFF SMEs.

Financial robustnessFinancial capital is a necessary resource for a corporation to start, function and develop (Xie et al., 2013). A sufficient amount of funding can also facilitate technological innovation and the accumulation of IAs. Tsai et al. (2012) emphasised the significance of financial factors, particularly firms’ solvency, to the formation of IAs, using two debt variables of debt ratio (i.e. firms’ ability to satisfy financial obligations and long-term debts, representing credit capability) and liquidity (firms’ ability to quickly and cheaply mobilise or convert cash, reflecting working capital capacity). According to Jensen (1986), a benefit of debt encourages firm managers to become more efficient in decision-making. Debt may be positively associated with SMEs’ performance if it reduces managers’ efforts to pursue firm goals (Jensen & Meckling, 1976). Furthermore, Huynh & Petrunia (2010) determined firm growth to be positively correlated with debt ratio for Canadian enterprises. When applied to the agricultural sector, free cash flow theory suggests that indebted SMEs are motivated to improve efficiency through innovation to meet repayment obligations. By contrast, according to Aras (2006), the relationship between the use of external funds and IAs is unclear; thus, we propose the following hypothesis:

Hypothesis 3: Firms’ increasing debt ratio has a positive effect on the formation of IAs amongst AFF SMEs.

Liquidity ratioLiquidity ratio, which measures firms’ capacity to satisfy the need for cash to sustain business activities or to payoff current debt commitments without generating external capital, is an essential financial indicator. Shortage in liquidity raises the cost of borrowing external funds, including the expenses of collateral appraisal and loan position monitoring. Another implication is that firms with limited cash are more exposed to unfavourable external shocks than others. When an economy is struck by a negative external shock, such as a drop in productivity or a rise in the interest rates, firms’ current net worth and internal resource value would decrease and the cost of borrowing external resources would rise (Nickell & Nicolitsas, 1999). In addition, investments in innovation and IAs are primarily long-term (Bruno et al., 2009; Le Van et al., 2010). Subsequently, for a firm to successfully develop IAs, it must have adequate internal resources to be resilient to external shocks. Empirically, liquidity is associated with the long- and short-term consequences of firms’ IA (Peters & Taylor, 2017); thus, we propose the following hypothesis:

Hypothesis 4: Firms’ increasing liquidity has a positive effect on the formation of IAs amongst AFF SMEs.

Investment in labour educationHuman capital resources, including workforce education, training and experience, have been observed as crucial for establishing firms’ competitiveness (Hoang-Khac et al., 2021; Saridakis et al., 2017). Human capital could be conceived as a profitable input, as it characterises firms’ ability to acquire new information, skills and technology (Konings & Vanormelingen, 2015; Reuber & Fischer, 1999). Firms place a premium on strategic human capital expenditure for training and engagement to encourage workers to participate in innovative activities (Damanpour & Aravind, 2012; Manafi & Subramaniam, 2015). Many businesses offer a range of training courses for employees to enhance their performance (Chen & Huang, 2009; Mumford, 2000; Saleem & Adeel, 2016). Staff expertise and competency can be improved by investing in education and training Sandybayev & Houjeir (2018). A previous study demonstrated that by investing in training, businesses build a stock of skills, knowledge and competency, which leads to IAs (Ployhart et al., 2009). Human capital in a company increases enterprise value and its capacity to preserve value while also generating innovation (Miles & Van Clieaf, 2017). Seo & Kim (2020) determined firm-provided training to have a direct influence on firms’ degree of efficiency and productivity, particularly technical and computer capabilities. Human capital investment helps personnel outperform adversaries, swiftly assume new tasks and accomplish different innovative jobs to enhance IAs; thus, investment in human capital is a vital resource for a firm's IAs, leading to the following proposed hypothesis:

Hypothesis 5: Firms that invest in labour education are more likely to acquire IAs.

Investment in R&DR&D is a fundamental factor of corporate profitability and economic value. It is defined as a company's capacity to discover, produce new resources and provide goods and services that are superior to competitors (Dutta et al., 1999; Hunt & Robert, 1996). It enables businesses to expand their technological capabilities and improve IAs (Tseng, 2010). R&D may promote innovation as a phase that provides numerous benefits to development. Empirical studies, such as S¸erban (2014) and Lööf & Heshmati (2006), determined that R&D is a key contributor to improved business efficiency and productivity, with a favourable impact on both firms and national economies. According to Lee et al. (1996), measurement of R&D effectiveness is critical for identifying whether an investment improves firms’ efficiency and productivity. Gamayuni (2015) asserted that firms investing in research and innovation find ways to improve future earnings. As a result, R&D investment pushes enterprises to support efficient operations to acquire greater IAs. Based on the above analyses, this study hypothesises the following:

Hypothesis 6: Firms that invest in R&D are more likely to acquire IAs.

Land rentLand is one of the most crucial factors of agricultural production. Land rent has a beneficial impact on farms’ innovation and production, with the same effect as financial debt, as it incentivises firms to operate more effectively (Donkor & Owusu, 2014). In contrast, Jin & Deininger (2009) asserted that land held with a title has the highest degree of efficiency and productivity, whereas rented land has the lowest level of efficiency and productivity. Deininger & Jin (2006), Deininger et al. (2008) and Nguyen-Anh et al. (2022) demonstrated a significant correlation between land ownership and productivity; however, existing literature has not established the relationship between land rent and firms’ formation of IAs. Subsequently, our study proposes the following hypothesis:

Hypothesis 7: Land rent has a significant effect on the formation of IAs amongst AFF SMEs.

External factorsGeographical locationWe quantify geographical location using dummy variables of location and environmental characteristics indicating firms’ production location. Farm location and environmental characteristics can also explain differences in efficiency and productivity amongst SMEs (Nguyen-Anh et al., 2022). Firms must consider location, as they may operate in different climates or altitudes with variable soil quality. Morrison (2000) determined that the climatic zone has a powerful impact on the IAs of Slovakian agro-firms. As noted by Henderson (2015) and Sheng et al. (2019), land quality is also an essential component. There can also be regional differences in physical infrastructure. Munroe (2001) demonstrated that Polish enterprises with higher levels of modernity, measured by use of electricity and gas heating, are more innovative and productive. We propose the following hypothesis based on these findings:

Hypothesis 8: Location has a significant impact on the formation of IAs amongst AFF SMEs.

Provincial competitiveness indexIn addition to geographical location, we evaluate the impact of exogenous variables on Vietnamese AFF SMEs’ IAs using the provincial competitive index (PCI). Institutional variables are crucial for SMEs’ IAs because elements related to the institutional environment might impact their innovative performance. For example, in circumstances with inadequate institutional frameworks, performance may be jeopardised by infringement of intellectual property rights, inefficient contract enforcement and lack of political and economic stability (Volchek et al., 2013). Malesky & Taussig (2009) used the PCI and its sub-indices to analyse the effects of provincial institutions on company formalisation in Vietnam, determining that improvements in provincial institutions, particularly leaner and more predictable government policies, increase the likelihood of businesses choosing the higher growth-orientated route of formality. Furthermore, greater protection of property rights has a strong association with enterprise formalisation, as entrepreneurs are more confident when there is a lower probability of arising land difficulties that might endanger investment security. Some studies reveal significant results regarding the influence of institutional changes on the economic growth of the business sector at the micro-firm level. In particular, the labour and training sub-indices of PCI evaluate local governments’ efforts to strengthen vocation skills and knowledge development for local labour and enterprises. As a result, SMEs are responsible for a significant part of the innovation that leads to new higher-value goods and services (Karpak & Topcu, 2010), leading to our next hypothesis:

Hypothesis 9: A higher PCI in a firm's province has a positive effect on the formation of IAs amongst AFF SMEs.

We also investigate the impact of the ‘Labour and training’ index, one of 10 indices of the PCI that measures ‘the efforts by provincial authorities to promote vocational training and skills development for local industries and to assist in the placement of local labour’; thus, we postulate the following:

Hypothesis 10: A higher labour and training index in a firm's province has a positive effect on the formation of IAs amongst AFF SMEs.

Materials and methodsMethodologiesSPF approachFirms’ production transforms a set of inputs, such as labour and capital, into outputs. To maximise profit, firms must select the optimal combination of inputs; therefore, firms’ productivity is commonly measured using the ratio of actual output to maximum technologically feasible level of output given a particular set of inputs (i.e. TE). Researchers typically assess TE by estimating production functions and modelling the maximum level of outputs produced from a specific set of inputs for a given level of available technology (Battese et al., 2004; Battese & Coelli, 1988; Caudill et al., 1995). We apply the SPF approach to estimate firms’ TE, including different production inputs, their square terms and interaction terms as determinants. In addition to the classic linear variables, we account for the non-linear association of inputs to output via the square terms. We also consider the dependent effect of inputs on output, adding interaction terms to the model. Firm i’s TE can be estimated using the model introduced by Aigner et al. (1977) and Meeusen & van Den Broeck (1977) in which production is assumed to follow a Cobb–Douglas form:

where yi is the vector of output, xi is a K × 1 vector of production inputs and β is a K × 1 vector of parameters to be estimated. ωiexp(vi) is the stochastic combination of random shock vi and TE ωi.Let ωi = exp(−ui), (ui > 0) represent TE, which ranges from 0 to 1. Eq. (1) becomes

The intention of this model is to fit a line (production frontier) through all points of the inputs–output combination. Similar to the concept of error in ordinary least squares, SPF allows for random distributions of the distance between each data point to the frontier. We determine this distance using two values; vi corresponds to the regression error term (i.e. independently and identically distributed, vi ∼ N(0, σv2)), and the error term ui is assumed to be independently distributed, ui ∼ N+(µ, σu2), with a truncation point at 0. From Eq. (2), we can derive a log-transformation:

ui can be estimated by referencing Jondrow et al. (1982) and Nguyen-Van and To-The (2016):with μ~i=[−(vi−ui)σu2+μσv2]/σ2,σ~=σuσu/σ,σ=σv2+σu2; ϕ(.) and Φ(.) are the probability density functions and cumulative distribution functions of standard Gaussian distribution, respectively.PSMA propensity score (PS) is a statistical technique used to evaluate the treatment effects of observational study which could help reduce selection bias (Austin, 2011; Rosenbaum & Rubin, 1985). One of the advantages associated with using PS is the creation of adequate counterfactuals when random assignment is infeasible or unethical (Austin, 2011). The popular PS methods are PSM and inverse propensity score weighting (IPW).

PS is first estimated using a robust probit model:

where R represents the predictor variable (IAs availability), and X is set of explanatory variables (internal and external factors).The average treatment effects on the treated that represent the effects of potential outcomes are TE1 and TE0, where TE1 is the outcome with treatment (R = 1) and y0 is the outcome with control (R = 0). Note that unbiased estimates of E[TE0] and E[TE1] are required to determine the average effect. If the independence assumption (TE0; TE1) ⊥ R is applied to ensure that R is independent from TE0 and TE1, we then have E[TE0] = E[TE0|R = 0] and E[TE1] = E[TE1|R = 1].

We employ four types of PSM algorithms in this study, including doubly robust augmented inverse propensity weight (AIPW), IPW, nearest neighbour matching using Mahalanobis distance and PSM using a radius of 0.2.

For IPW, we adopt a weighted fractional regression model to deal with the dependent variable of firms’ IAs, defined as binary values TEi ∈ [0,1] (Papke & Wooldridge, 1996; Ramalho et al., 2011). The doubly robust AIPW fractional regression is also applied as a robustness test for conventional weighted fractional regression. Doubly robust estimation consists of a formula of predicted regression with another model for the exposure. Note that the differences between the results of the conventional and doubly robust models could be due to missing data or causal inference of population average treatment effects estimation (Funk et al., 2011; Schulz & Moodie, 2021).

The fractional regression model is generally described by Wooldridge (2009) as follows:

where Zi represents a set of regressors described in Eq. (4); namely, Xi and Ri. For the logistic link-function H(.) satisfying 0Our proposed estimator for β is the quasi-maximum likelihood estimator, which maximises the following Bernoulli log-likelihood function (McCullagh & Nelder, 2019):

To minimise the endogeneity of Ri, our weighted regression approach employs the squared root of propensity scores (1/PSi) as weights to estimate our models.

The nearest neighbour matching methodology is a common algorithm in which each treated unit searches for the control unit with the closest PS (to minimise the distance between all treated and control matches) at a ratio of 1:1 to minimise bias because the matching algorithm simultaneously seeks the smallest gap between two matching units (Caliendo & Kopeinig, 2008). When the PS of the i th unit, π(ρi), is estimated above the probit model, given a firm with IAs i, the distance from the firm with IAs j to the firm without IAs i is determined as dij = |π(ρi) − π(ρj)|.

Rosenbaum & Rubin (1985) proposed another method for matching the PS π(ρi) to minimise the effects of sampling variation and greedy matching, matching individual covariates by minimising the Mahalanobis distance of treated and control units to obtain balanced matching. PS is initially estimated, then matching is achieved based on Mahalanobis distance within PS stratification. Applying the theory of Mahalanobis distance to PSM is

where [π(ρi)−π(ρj)]τ denotes the related transposition of [π(ρi)−π(ρj)].Our dataset was obtained from the Vietnamese General Statistics Office (GSO) 2020 survey, which covers the annual financial statements of more than 600,000 firms from all sectors in Vietnam. Although this survey has been conducted annually since 2010, only the newly designed GSO survey 2020 offers adequate detail regarding firms’ cost structures, allowing us to calculate TE using a cost function approach rather than nominal inputs such as the number of labours or areas of land. After filtering out unqualified data from the dataset, 1045 AFF firms were retained for TE calculation.

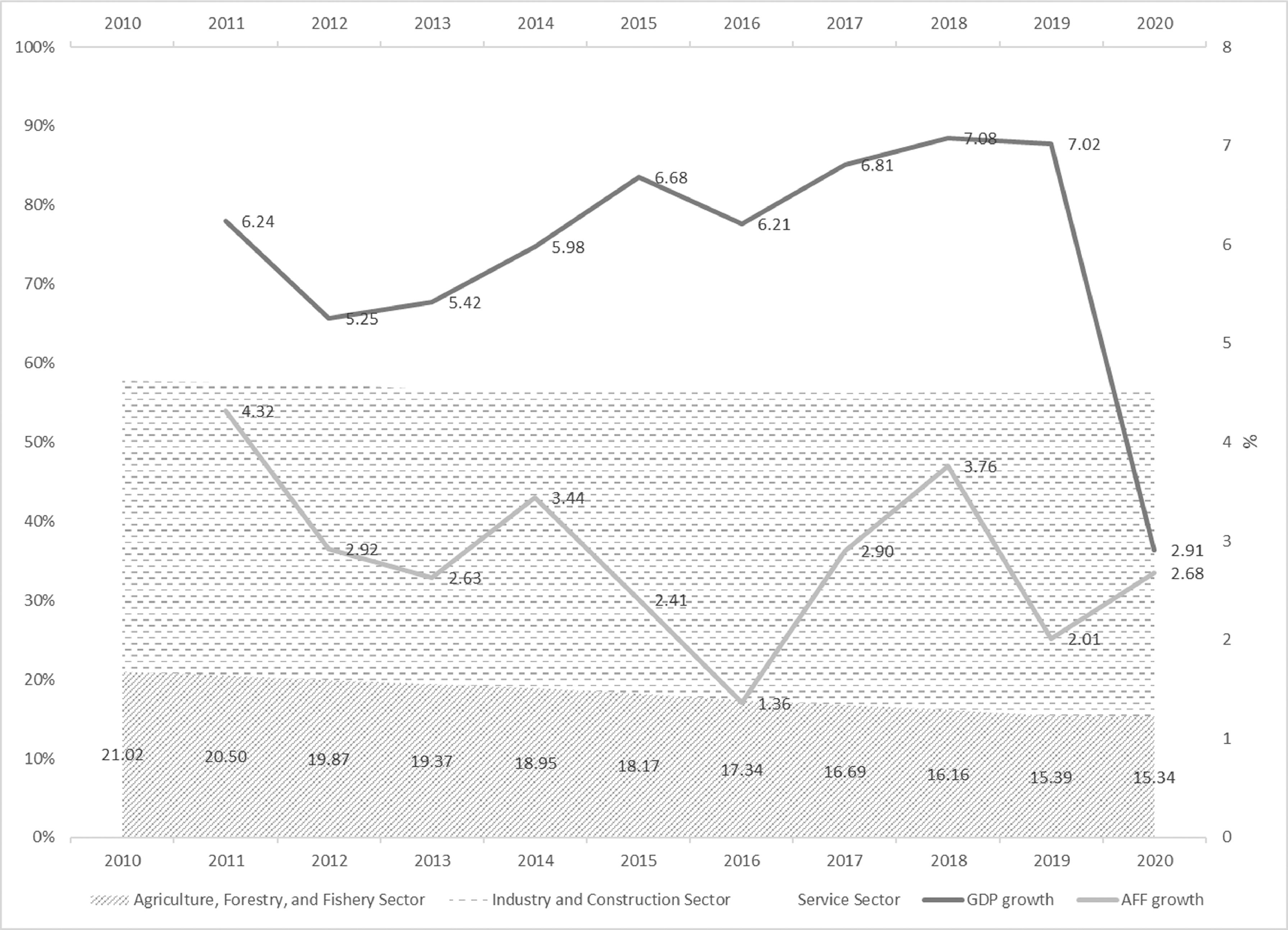

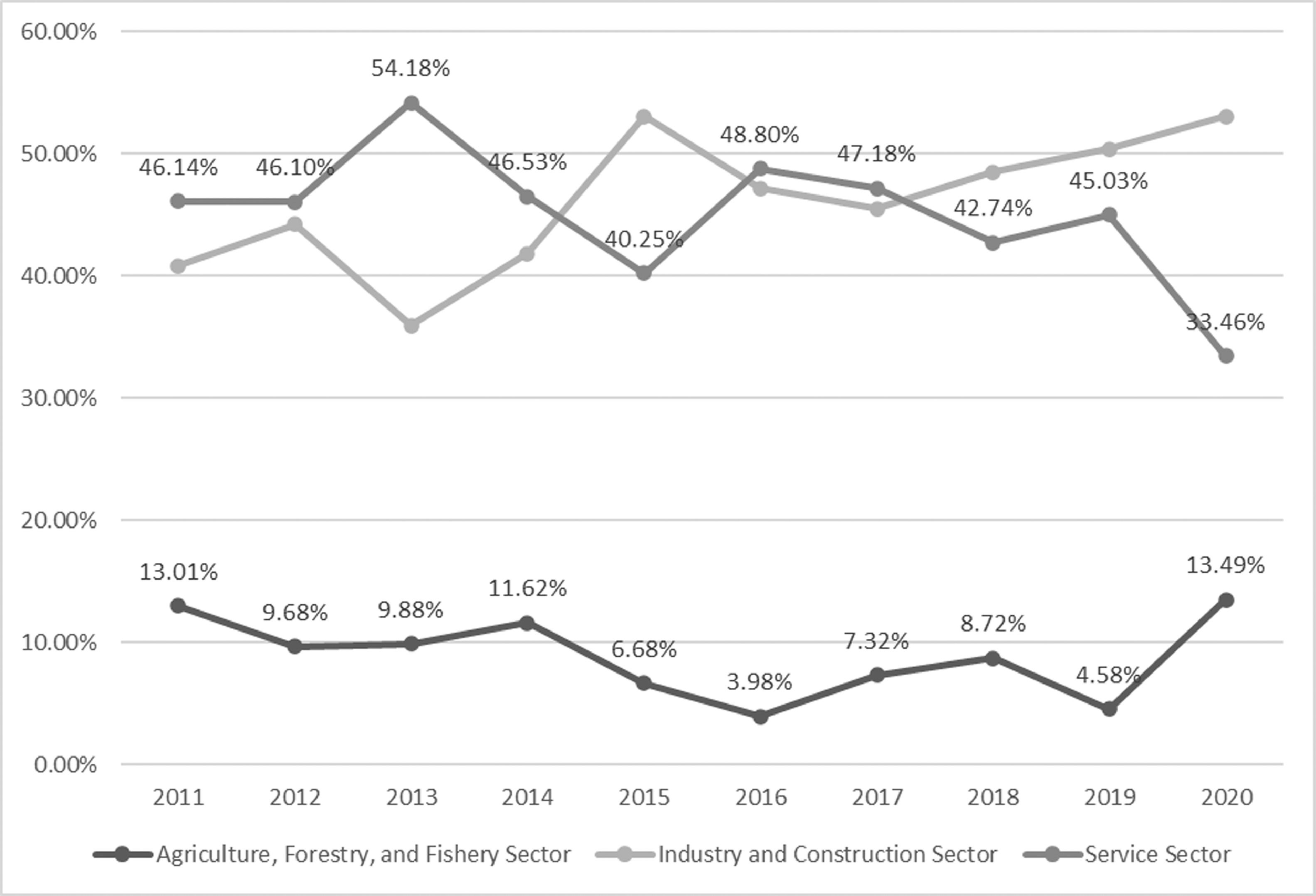

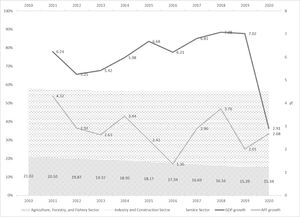

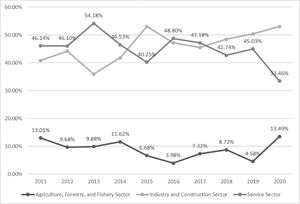

According the GSO (2021), Vietnamese AFF sectors have been reducing their share in the economy for the last decade. Fig. 1 shows that in 2020, the AFF sectors contributed 15.34% of the total Vietnamese GDP, with the sectoral growth of 2.68%; however, due to the COVID-19 pandemic causing a major slowdown in the service sector, in 2020, the contribution-to-growth rate of the AFF sectors rose to 13.49% from 4.58% in 2019 (Fig. 3). Regardless of its smaller contribution to economic growth compared to the other two major sectors, the AFF sectors are essential to meeting Vietnamese sustainable development goals, particularly in rural areas (Hoang-Khac et al., 2021; Romero-Castro et al., 2022). For a developing country with more than 65% of the total population living in rural areas (GSO, 2021), agriculture production is an essential source of people's livelihoods.

Our data include two groups of variables to serve our two-step model. The first part conducts TE calculation, using firms’ gross profit as output and cost structures as input, including labour costs, management costs, total debt, total investments and total foreign import value (Table 1). According to Aigner et al. (1977), to estimate the production function, rather than profitability indicators, such as ROA and ROE, the output of the model should be gross profit, which is the profit a firm makes after deducting the costs associated with making and selling products. Thus, we exclude input variables in the value of the output variable to minimise endogeneity.

The second part of the dataset includes the hypothesised determinants of IA accumulation and TE divided into internal and external factors. The former includes firm age, firm size, debt ratio, liquidity, investment in labour education, investment in R&D and land rent; the latter includes geographical location (northern, central or southern Vietnam), PCI and a provincial labour education composite index (Table 2). Geographical location refers to where firms exert major production, rather than headquarters, as these are usually separated in Vietnamese AFF sectors. We account for firms’ production location relying on the surrounding environment, climate and land quality. The two other provincial factors are from the Vietnamese PCI database (see Malesky, 2010; VCCI, 2019).

Description of variables.

We recorded IAs as a binary variable, implying firms’ decision to develop IAs. These data are obtained from firms’ financial statements from the GSO 2020. Of the 1045 firms examined, 88 firms report positive IA values, 73 of which are in the agriculture sector, nine firms are in forestry, and the remaining six are in the fishery sector (Table 6). Fourteen of the 88 firms do not record IA amortisation, which, based on the IFRS (2014), means these IAs are registered certificates of land use rights conversion. These are firms that have land for other uses (i.e. commercial or non-production, non-agricultural lands) converted to agricultural lands, or agricultural lands to infrastructure lands, such as firms providing irrigation services, which indicates firms’ redirecting or restructuring business models to improve the efficiency of business activities. The remaining 74 firms with amortised IAs indicate the possession of patents or other types of IAs such as software, licences or trademarks.

Results and discussionDecomposition of SPFTable 3 presents the log-transformation (translog) SPF results with output as firms’ gross profit.1 The main purpose of SPF in this study is not only to examine which factor contributes to firms’ output but also to estimate firms’ TE; therefore, we analyse these inputs to determine their relevance to firms’ production functions. In addition to the normal individual terms reported in the first section of Table 3, we also examine inputs’ squared terms and cross-interactions, which allows us to reach beyond linearity to consider firms’ production functions. Amongst the five individual inputs of the translog production function, only labour cost exhibits no significant correlation to firms’ output, despite its positive coefficient. This is seemingly contradictory since AFF sectors are widely conceived to be labour-intensive and AFF outputs are highly dependent on labour inputs. One explanation for the insignificant correlation of labour in our production model is that seasonal employment amongst AFF SMEs in Vietnam means that labour alone does not reflect firms’ efficiency. Nevertheless, the interaction terms of labour cost and other variables still indicate statistical significance. The interaction term of labour and management costs reveals a significant positive relationship, indicating that the simultaneous increase of labour and management costs helps raise firms’ output. This implies that expansion in labourers requires a more complicated and expensive management structure, but in return, raises firms’ productivity. Similar interpretations can be drawn from the interaction of labour costs and firms’ total debt, with a significance level at 10%.

Stochastic frontier model results.

The independent total debt variable and its squared term have positive coefficients, indicating that firms’ total debt forms a convex, upward-curved relationship with outcomes; for the current dataset, the higher firms’ total debt is, the higher the output increase is. For AFF sectors in Vietnam, firms usually borrow under three forms: (1) production materials and equipment in the short term, usually a year or less; (2) owed employees’ salary or bonuses in the short term, under one fiscal year or (3) long-term borrowing for production expansion via land acquisition or other investment. Therefore, the presence of debt in AFF firms usually means that the firms are functioning normally, with consistent cash and capital flows.

Regarding firms’ total investment, the significant negative coefficient implies that AFF firms’ current investments are not efficient to their outputs. This means that either the investment was ineffective or one year of observation is not enough time to capture the transfer of investment into firms’ output. Moreover, the coefficient of the squared term of investment is positive, revealing a non-linear relationship between this factor and outputs, which implies that current firms have not experienced positive effects from investment in general. Subsequently, from these two coefficients, we can predict that a rise of investment in AFF sectors would initially reduce TE to a turning point prior to its increase. In contrast, international business activities have a positive correlation with firms’ increased gross profit, with a 5% significance level. International trade can be used as a proxy for firms’ expenditure to merchandise products via logistics and advertisements, since labelling, packaging and shipping impose costs on each product unit.

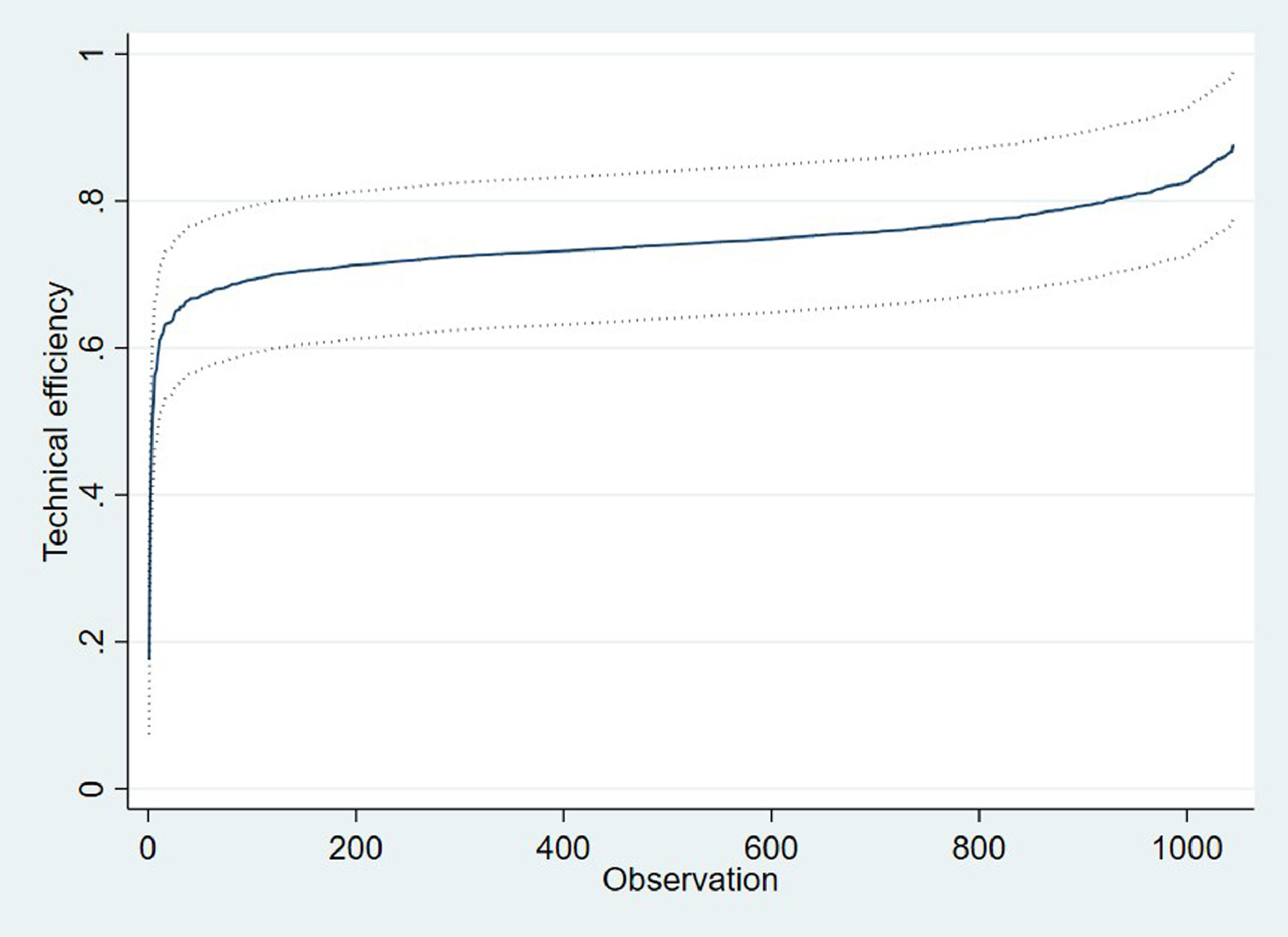

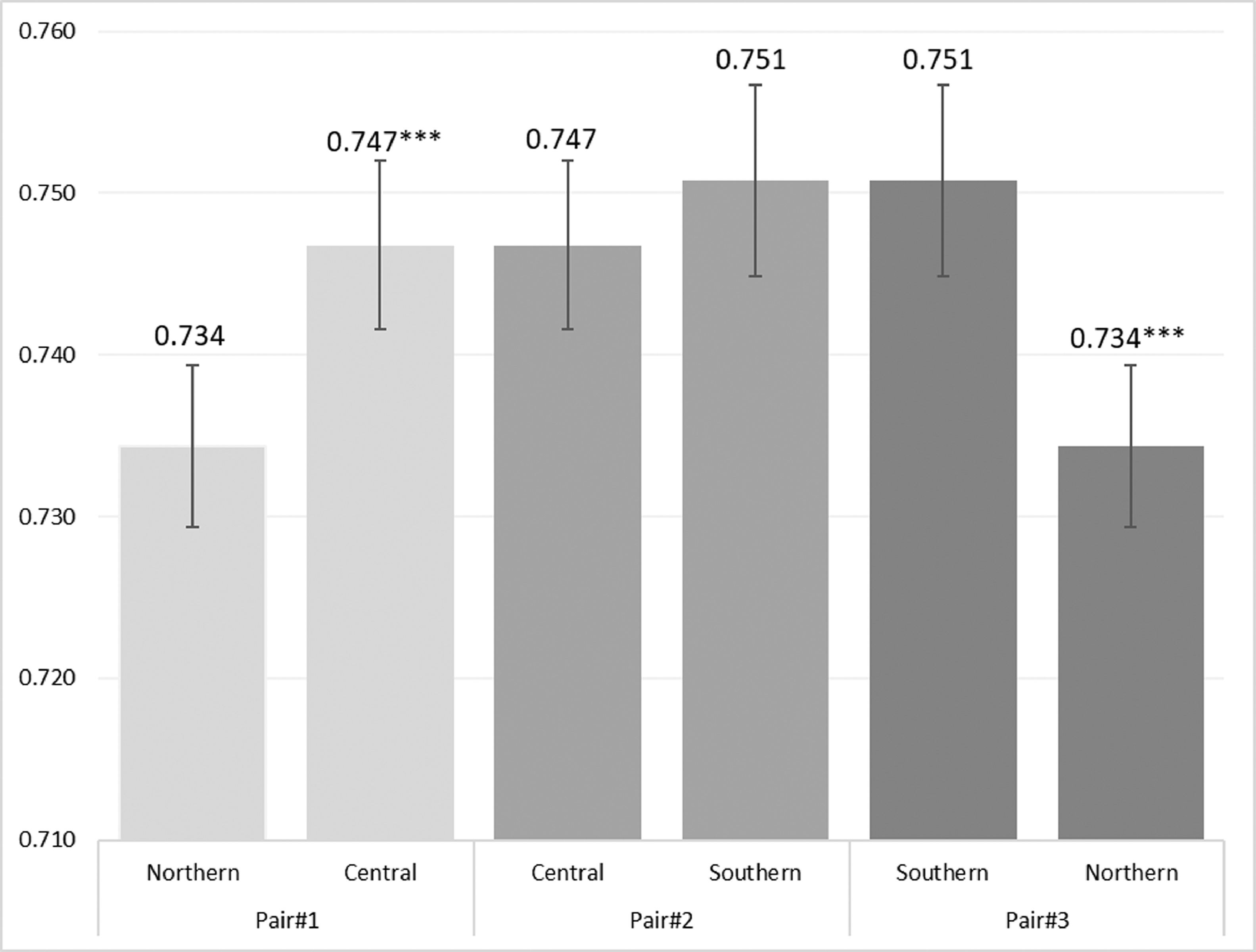

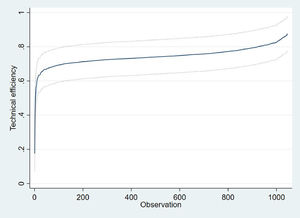

We estimate AFF firms’ TE from this production function, and our results are reported in Table 2 and Fig. 4. On average, firms in the Vietnamese AFF sectors are producing at 74.4% efficiency, with the majority of firms at more than 65% efficiency. At this level of TE, Vietnamese AFF firms have plenty of room for improvement.

Impacts of IAs on TE and determinants of IAsFirst, as we used the PSM method to sort the dataset into treatment and control groups of firms with and without IAs, respectively, we can compare the effect of IAs on firms’ TE using different matching techniques. Table 4 demonstrates, via four types of matching, that AFF firms with IAs are less efficient than firms without IAs. Specifically, at significance level of 5% and 10%, respective to models, firms with IAs are about 3.32% to 3.98% less efficient. In comparison, the non-weighted t-test in Table 8 indicates that we cannot draw a significant conclusion regarding the difference between firms with and without IAs for all three alternative hypotheses, although the simple mean TE of firms with IAs is higher than those without IAs for about 0.5%.

TE comparison between matched firms with and without IAs.

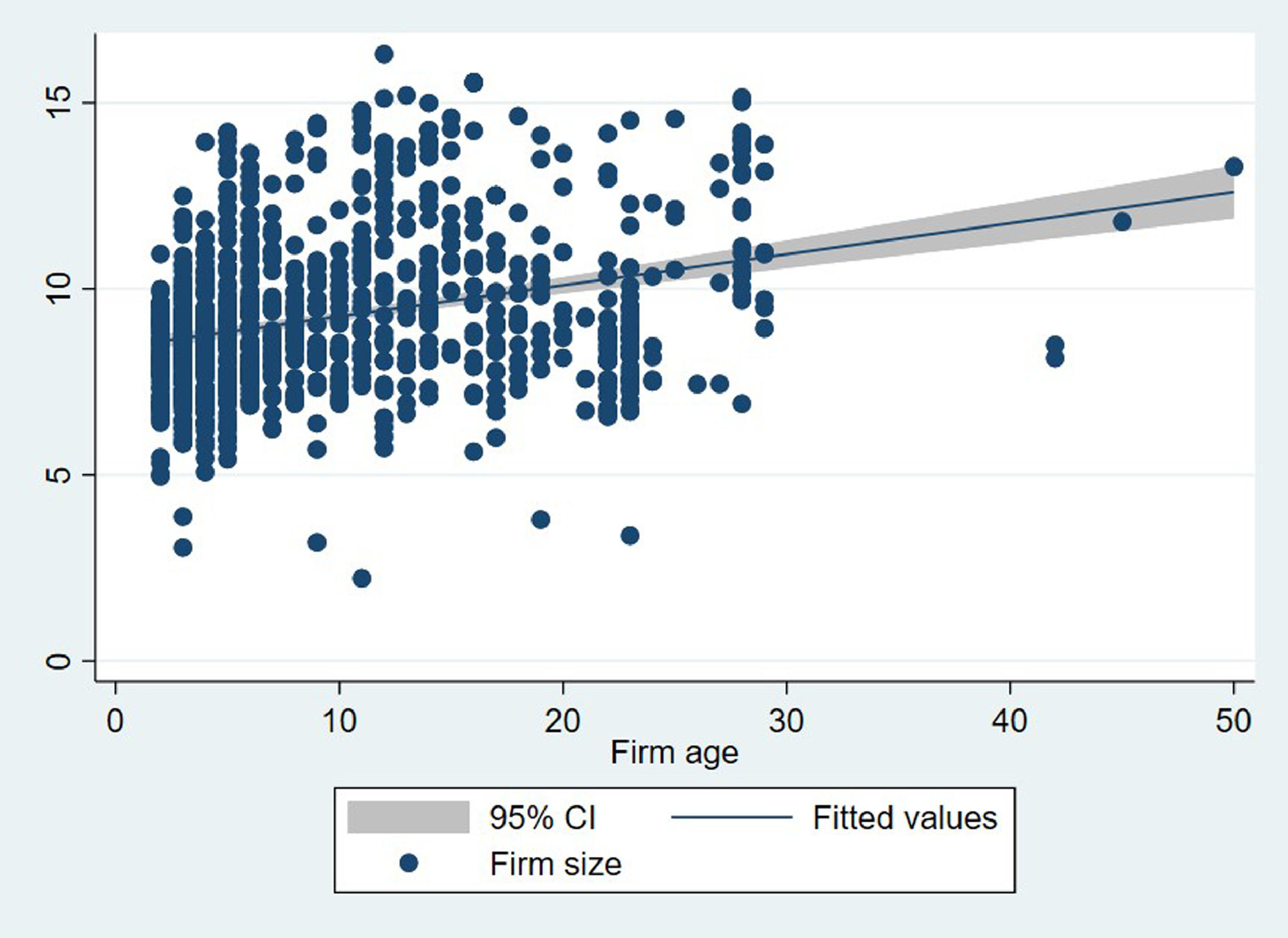

Second, we examine the drivers of firms’ formation of IAs regarding internal decisions (internal factors) and external environment (external factors) in Table 5. Regarding the former, all the proposed variables elicit significant coefficients. Except for firms’ land rent value and labour educational investment, the remaining internal factors issue positive coefficients to IA formation. Older and larger firms are more likely to have IAs reported with statistical significance at 1%. Firms with higher debt ratio and more liquidity present a similar tendency as well, but with the smaller magnitude to firm size. R&D investment has the largest impact on firms’ likelihood to have IAs, with the highest coefficient at a 1% significant level. Firms’ investment in labour education and land rent has a negative association with IA formation, also at a 1% significance.

Determinants of formation of IAs.

Regarding external factors, our first consideration is firms’ geographical location, which includes categories of northern, central and southern Vietnam. From Table 5, with northern Vietnam serving as the baseline for comparison, firms in the central region are less likely to obtain IAs. In contrast, southern firms have a higher probability of IAs than northern firms and with a greater magnitude. The PCI has a significant, positive correlation with firms’ IA formation tendency, signifying that firms located in an overall more competitive province are more likely to have IAs. However, the PCI labour education index has no significant correlation.

DiscussionFirst, our matching comparison result contradicts some previous studies that suggested a positive IAs–firm performance relationship. The results of our four different types of matching reveal consistent, reliable evidence that firms with IAs are less efficient with only a 6.6% variation amongst coefficients (Table 4). However, some authors did find less impact of IAs on TE or even insignificant correlation in the AFF sectors (O'Mahony & Vecchi, 2009; Villalonga, 2004). One possible explanation for this result is that current innovations do not lead to firms increasing profit, as they are either impractical or cannot be commercialised. Another explanation proposed by Martin (2019) suggests that innovations are less encouraged in a market that prioritises profit and power, which describes the market of the AFF sectors in which disruptive innovations require immense resources and have a high risk of failure.

Other than pure innovation, IAs also include licences, trademarks and commercial advantages which can yield revenue. Currently, there are many products with viable market applicability, helping to increase production efficiency amongst firms. In the AFF sectors, many farmers with seniority in farming are able to invent and improve labour tools at low cost, with better productivity than traditional counterparts, or to breed new plant and animal varieties with characteristics suitable for new farming circumstances. However, patenting, licensing and ultimately commercialising those improvements requires efficient synchronisation amongst different stakeholders, which is lacking in the Vietnamese context. Similar to other types of assets and capital, IAs have a time lag for concretisation and reflection in firms’ performance. For businesses, this equals risky investment in R&D, lobbying and education and training with uncertain prospective outcomes.

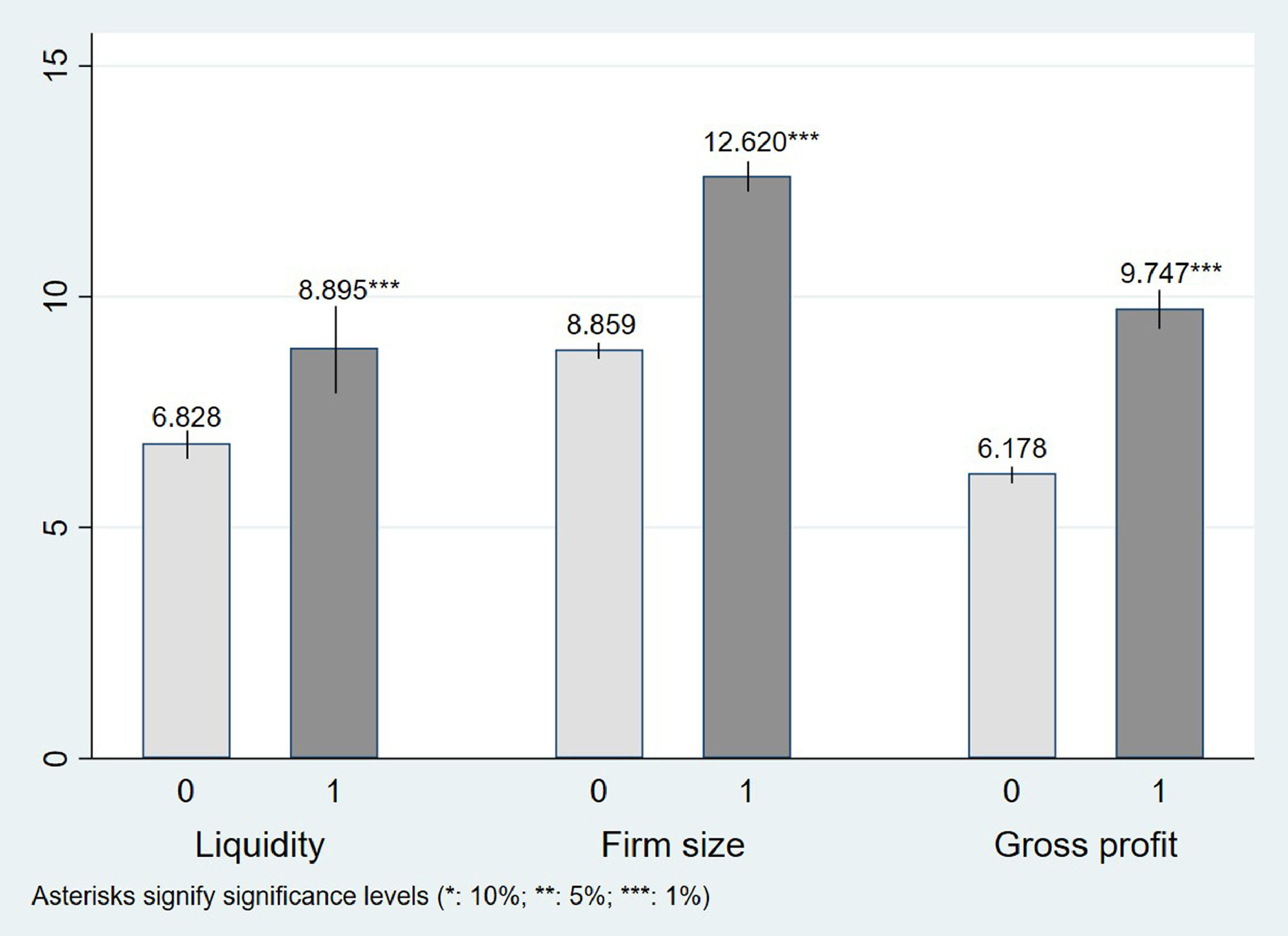

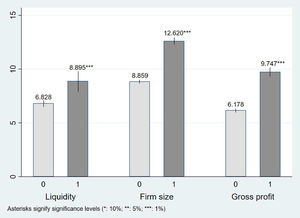

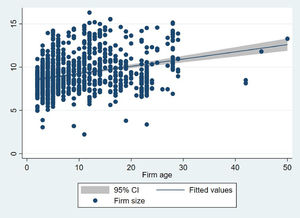

These investments can also be costly. Bruno et al. (2009) theoretically demonstrated that firms in developing countries need to accumulate enough resources for efficient technological investment, and human capital, technology productivity and technology costs affect the amount of resources requires. Time is another significant factor related to the threshold at which firms can advance to unbounded technology-induced development. This indicates that if firms are not wealthy enough, given their ability to maintain investments in technologies for a sufficiently long period, they would be unsuccessful or even worse off for initiating technologies. Le Van et al. (2010) extended this assertion, suggesting that advancement in developing countries follows three stages: (1) production of consumption goods; (2) production of both consumption goods and new technology from imports and (3) investment in education and training with only capital imports. Subsequently, after firms accumulate enough capital to effectively invest in new technology and not to fall into the poverty trap, they can transfer these technologies to more long-term capital and human capital investments. However, within the scope and data availability of this study, we are unable to ascertain the appropriate threshold amount for firms to successfully develop and realise the benefits of IAs. However, a statistically significant association is certain between indicators of firms’ wealth and IA formation (Fig. 2). Both Fig. 2 and Table 5 demonstrate that firms with better cash flow, represented by the three visualised indicators, are more likely to invest to obtain IAs.

Second, we next examine the determinants of IA formation in Vietnamese AFF sectors. From the results (Table 5), firm age has a positive relationship with IA formation, contrasting to our Hypothesis 1 and previous studies, such as Daviy & Shakina (2021) and Kücher et al. (2020), Marshall (2009). In Vietnamese AFF sectors, old companies are often large companies, meaning they accumulate resources over time and, thus, have more flexibility to afford longer-term investments (Fig. 5). Firm size contributes positively to IA formation at a 1% significance level. This result confirms Hypothesis 2, also providing empirical evidence for the assertions of Bruno et al. (2009) and Le Van et al. (2010) that firms need to have enough wealth and allow enough time for IAs to concretise. Regarding firms’ financial decisions, increases in firms’ liquidity and debt ratio also raise the probability of IA formation at a 10% significance level. This means that firms that know how to take advantage of financial leverage, with a good capacity to repay short-term debts, will be more likely to have IAs than those that do not. A reasonable structure of debt and liquid assets indicates firms’ ability to maximise both owned and mobilised capital, confirming Hypotheses 3 and 4. These results are similar to those of Peters & Taylor (2017) and Tsai et al. (2012), indicating that increases in debt and liquidity are associated with firms’ outstanding resources and ability to pay. The results of these four variables lead to our reasonable assertion that factors reflecting firms’ available long-term resources positively affect IA formation.

The three variables for firms’ investment decisions elicit interesting results, as land rent and investment in labour education appear to discourage firms from obtaining IAs rather than the common supposition of encouragement (Table 5). In fact, amongst the 1045 firms studied, 100 did pay for labour education programmes in 2020 (Table 2). These payments can be in the form of short-term training classes for single technical or managerial personnel or certified courses for all employees; however, the result suggests that these investments in labour training do not encourage firms’ establishment of IAs, contradicting the previous conclusions of Damanpour & Aravind (2012), Seo & Kim (2020) and Ployhart et al. (2009). Increasing land rent can be equivalent to firms either making new expansions or (with a much lower probability) production land price for rent increases. This negative correlation between land rent and labour education investment and firms’ IA formation implies two possibilities. (1) These investments are inefficient or accounting fraud to enjoy tax incentives for AFF production land and education could be at play. (2) Since investments in human capital and land have a long-term return, the impact of these new payments is not yet reflected in firms’ TE via gross profit. Thus, Hypotheses 5 and 7 are rejected. Conversely, investment in R&D activities has a strong effect on SMEs’ IA establishment, with a coefficient of 0.917, representing the largest magnitude amongst all variables (Table 5), confirming Hypothesis 6, in alignment with Tseng (2010) and Gamayuni (2015).

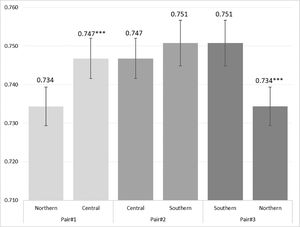

In terms of exogenous factors, we first examine the effect of geographic regions on firms’ TE, as the three regions have differing climates and topographies, which influences AFF business activities highly. In our model, northern Vietnam is used as the baseline for comparison to central and southern Vietnam. The results indicate that compared to the northern region, SMEs in central Vietnam are less likely to develop IAs, whereas SMEs in the south are more likely to, confirming Hypothesis 8 with a 1% significance level. The general economic development in central Vietnam faces various difficulties related to climate and topography. With a long coastal line and narrow, steep area, this region of the country must deal with natural disasters, such as tropical storms, flash floods and landslides, which are extremely detrimental to AFF activities. Accordingly, it is understandable for SMEs in this region to be deterred from developing IAs. In contrast, the southern region of Vietnam is considered to be the largest field in the country with favourable conditions, including wide, flat terrain, extensive natural irrigation systems and fertile soil. It is fair to conclude that southern SMEs are endowed with more resource endowments to succeed. Not only is the tendency of IA possession higher here, but firms’ TE in the southern region of Vietnam is also the highest (Fig. 6).

We also examine other province-specific indicators, such as the PCI and its labour and training sub-index. The results indicate that firms in a province with a higher PCI are more likely to develop IAs (Hypothesis 9). Since PCI is a comprehensive index composed of 10 component indices including market entry costs, transparency and access to information and fair competition, a province's higher PCI indicates higher competitiveness and a better environment for SMEs’ development. In contrast, we found no significant evidence for Hypothesis 10′s claim that the provincial labour and training environment has a positive effect on IA formation. Although this index includes firms’ investment in labour education (Hypothesis 5), other components cover the average level of labour skill and education in each province. It should be noted that, the AFF sectors in Vietnam primarily employ low-skilled labour, resulting in an insignificant level of education, yet our result still contradicts common intuition and previous studies in Vietnam, such as those of To-The and Nguyen-Anh (2021) and To-The and Nguyen-Anh (2019).

ConclusionsDespite efforts to increase firms’ productivity via IAs, innovations and technologies, an examination of this issue has not been prioritised in AFF sectors as much as others in previous literature. This study contributes to the literature by answering the following question: do IAs stimulate firm performance? We determine IAs via firms’ financial reports and calculate performance via TE, which is estimated using the SFM. Our primary result from four matching techniques indicates that firms with IAs are less efficient than those without IAs. Amongst AFF sectors in Vietnam, IAs are not encouraged, as market competition favours scale (size) and experience (age). Thus, for AFF sectors to sustainably develop, Vietnamese policymakers must strategically develop better incentives for adopting disruptive changes. The first viable solution is to reassess the effectiveness of rural development support policies in Vietnam. Synchronisation amongst stakeholders should be prioritised for firms with IAs to stand a better chance of merchandising products with greater efficiency. Moreover, based on our findings regarding the determinants of IA formation, firms must carefully consider short- and long-term resource allocations, including financial capital, physical capital and human capital respective to time investment before investing in any type of IAs or innovations. Specifically, we found that older and larger firms are more likely to develop IAs. The same implications are observed from firms’ financial robustness and investment in R&D. The two other types of investment, labour education and land rent, reduce firms’ IA formation. In terms of external factors, different regions have considerably different probabilities of developing IAs. A province-specific index is also a significant determinant of IA establishment, demonstrating that firms with a higher PCI are more likely to have IAs.

Based on these results, two considerations must be further studied. First, regarding the negative relationship between TE and IAs, it is tautological to conclude that improving TE requires firms to develop IAs. One limitation of this study is that we cannot ascertain if the IAs are effective. A panel dataset, rather than a cross-sectional one, would be better suited to such analyses. Given a time trend index, it would be more precise to conclude the effectiveness of IAs and its impact on firms’ TE. Second, as discussed in Section "Data", IAs do not only include innovations, as other types of rights and licences are also recorded as IAs; thus, this study has another limitation related to the measurement of innovation amongst firms. As a result, the determinants of IA formation might be subject to biases. In addition, as suggested by Romero-Castro et al. (2021), firms’ willingness to invest in technologies and other innovative assets must also be considered to assess IA formation. Extending the literature in this direction would also help validate Martin's (2019) claim regarding backward innovation development amongst profit- and power-induced markets.

To conclude, this study has solved the question posed, finding that for the current AFF sectors in Vietnam, IAs are not efficient for firms given the average TE of 74.4%. We also identified nine factors influencing firms’ decisions to develop IAs. From these results, we suggest that Vietnamese authorities implement initiatives to encourage a more favourable environment for AFF firms to develop and merchandise IAs to increase effectiveness.

Funding detailsThe authors received no funding for this study.

We thank the two anonymous reviewers for their constructive and positive suggestions.